Please wait

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A

Proxy

Statement Pursuant to Section 14(a) of the

Securities

Exchange Act of 1934

(Amendment

No.

)

Filed by the

Registrant ☒

Filed by a Party

other than the Registrant ☐

Check the

appropriate box:

☐

Preliminary Proxy

Statement

☐

Confidential,

for Use of the Commission Only (as permitted by Rule

14a-6(e)(2))

☒

Definitive Proxy

Statement

☐

Definitive

Additional Materials

☐

Soliciting Material

Pursuant to § 240.14a-12

AutoWeb,

Inc.

(Name

of Registrant as Specified In Its Charter)

(Name

of Person(s) Filing Proxy Statement, if other than the

Registrant)

Payment of Filing

Fee (Check the appropriate box):

☐

Fee computed on

table below per Exchange Act Rules 14a-6(i)(1) and

0-11.

(1)

Title of each class

of securities to which transaction applies:

(2)

Aggregate number of

securities to which transaction applies:

(3)

Per unit price or

other underlying value of transaction computed pursuant to Exchange

Act Rule 0-11 (set forth the amount on which the filing fee is

calculated and state how it was determined):

(4)

Proposed maximum

aggregate value of transaction:

☐

Fee paid previously

with preliminary materials.

☐

Check box if any

part of the fee is offset as provided by Exchange Act Rule

0-11(a)(2) and identify the filing for which the offsetting fee was

paid previously. Identify the previous filing by registration

statement number, or the Form or Schedule and the date of its

filing.

(1)

Amount previously

paid:

(2)

Form, Schedule or

Registration Statement No.:

AUTOWEB, INC.

NOTICE

OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held on June 21, 2018

TO

OUR STOCKHOLDERS:

NOTICE

IS HEREBY GIVEN that the Annual Meeting of Stockholders

(“Annual

Meeting”) of AutoWeb, Inc., a Delaware corporation

(“AutoWeb” or

“Company”), will

be held at the Company’s offices at 18872 MacArthur

Boulevard, Suite 200, Irvine, California 92612-1400, on

Thursday, June 21, 2018, at 10:00 a.m. Pacific Time for

the following purposes:

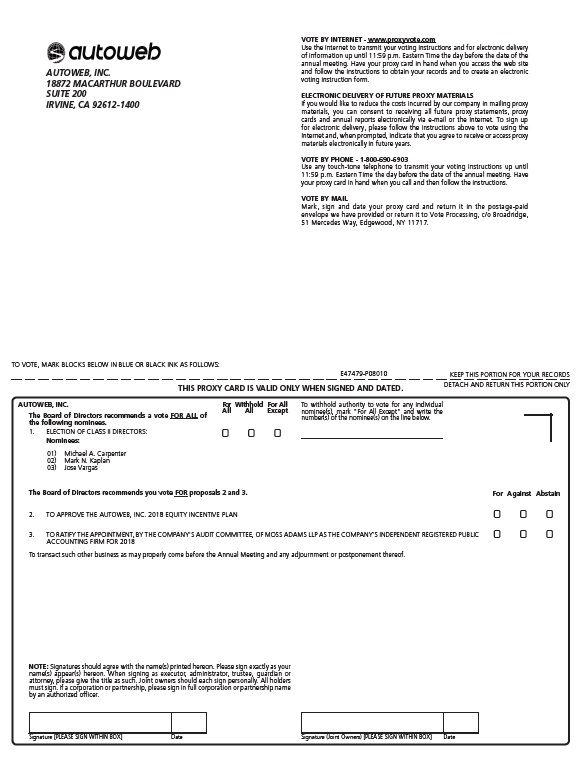

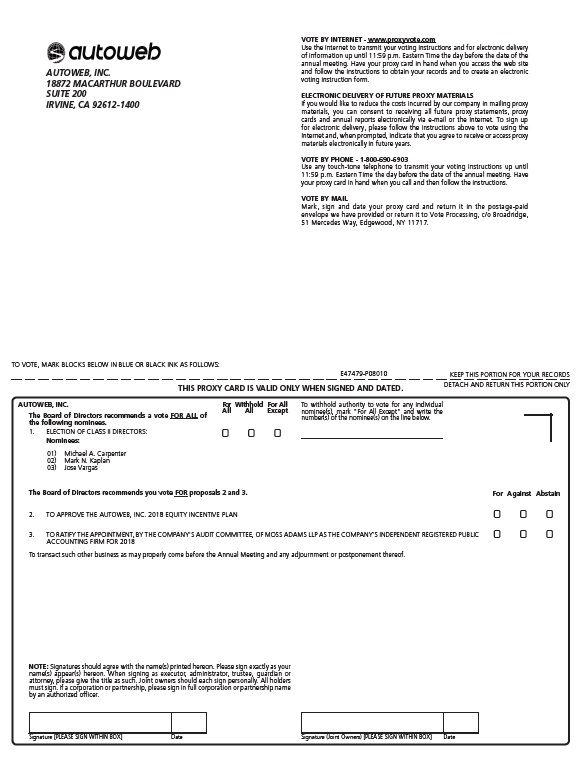

1.

To

elect three (3) Class II Directors (“Nomination and Election of Directors

Proposal”);

2.

To approve the

AutoWeb, Inc. 2018 Equity Incentive Plan (“2018 Equity Incentive Plan

Proposal”);

3.

To ratify the

appointment, by the Company’s Audit Committee, of Moss Adams

LLP as the Company’s independent registered public accounting

firm for 2018 (“Accounting

Firm Ratification Proposal”); and

4.

To transact such

other business as may properly come before the Annual Meeting and

any adjournment or postponement thereof.

At the Annual

Meeting, the Board of Directors (“Board”) intends to present Michael

A. Carpenter, Mark N. Kaplan, and Jose Vargas as nominees for

election to the Board.

The

Board has fixed the close of business on April 27, 2018, as

the record date for the determination of the holders of record of

the Company’s common stock entitled to notice of, and to vote

at, the Annual Meeting.

A list

of stockholders entitled to vote at the Annual Meeting will be open

for examination by any stockholder for any purpose germane to the

meeting during ordinary business hours for a period of 10 days

prior to the Annual Meeting at the offices of AutoWeb located at

18872 MacArthur Boulevard, Suite 200, Irvine, California

92612-1400, and will also be available for examination by any

stockholder present at the Annual Meeting until its

adjournment.

PLEASE READ CAREFULLY THE ACCOMPANYING PROXY STATEMENT. AUTOWEB

INVITES ALL STOCKHOLDERS TO ATTEND THE ANNUAL

MEETING. TO ENSURE THAT YOUR SHARES WILL BE VOTED AT THE

ANNUAL MEETING, PLEASE COMPLETE, DATE, AND SIGN THE ENCLOSED PROXY

CARD AND RETURN IT PROMPTLY IN THE ENCLOSED ENVELOPE.

|

|

By

Order of the Board of Directors

|

|

|

Glenn

E. Fuller

Executive Vice President, Chief Legal and Administrative Officer

and Secretary

|

Irvine,

California

April

27, 2018

IMPORTANT

YOUR VOTE IS IMPORTANT. WHETHER OR NOT YOU EXPECT TO

ATTEND THE ANNUAL MEETING, PLEASE COMPLETE, DATE, AND SIGN THE

ENCLOSED PROXY CARD AND PROMPTLY RETURN IT IN THE ENVELOPE PROVIDED

TO VOTE PROCESSING, C/O BROADRIDGE, 51 MERCEDES WAY, EDGEWOOD, NEW

YORK 11717, TO BE RECEIVED NO LATER THAN 11:59 P.M. EASTERN TIME ON

THE DAY BEFORE THE ANNUAL MEETING. IN ORDER TO AVOID THE

ADDITIONAL EXPENSE TO AUTOWEB OF FURTHER SOLICITATION, THE COMPANY

ASKS YOUR COOPERATION IN MAILING IN YOUR PROXY CARD PROMPTLY. PRIOR

TO THE ANNUAL MEETING, STOCKHOLDERS MAY ALSO PROVIDE VOTING

INSTRUCTIONS USING THE INTERNET AT WWW.PROXYVOTE.COM

OR BY CALLING 1.800.690.6903 AS DESCRIBED IN THE PROXY STATEMENT

AND ACCOMPANYING PROXY CARD. THE CUTOFF TIME FOR PROVIDING VOTING

INSTRUCTIONS USING THE INTERNET OR BY CALLING IS 11:59 P.M. EASTERN

TIME THE DAY BEFORE THE DATE OF THE ANNUAL MEETING.

PROXY

STATEMENT

AutoWeb,

Inc.

18872

MacArthur Boulevard, Suite 200

Irvine,

California 92612-1400

Annual

Meeting

To Be Held on

June 21, 2018

The Annual Meeting

The

enclosed proxy is solicited by and on behalf of the Board of

Directors (“Board”) of AutoWeb, Inc., a

Delaware corporation (“AutoWeb” or “Company”), for use at

AutoWeb’s 2018 Annual Meeting of Stockholders

(“Annual

Meeting”) to be held on Thursday, June 21, 2018 at

10:00 a.m. Pacific Time at the Company’s offices located

at 18872 MacArthur Boulevard, Suite 200, Irvine, California

92612-1400, and at any and all adjournments or postponements

thereof, for the purposes set forth in the accompanying Notice of

Annual Meeting of Stockholders.

This

Proxy Statement of AutoWeb is being mailed on or about May 4, 2018,

to each stockholder of record as of the close of business on

April 27, 2018.

Record Date and Outstanding Shares

The

Board has fixed the close of business on April 27, 2018, as

the record date for the Annual Meeting (“Record Date”). Only holders of record of

AutoWeb’s common

stock, $0.001 par value per share (“Common Stock”), at the close of business

on the Record Date are entitled to notice of, and to vote at, the

Annual Meeting. As of the close of business on the

Record Date, there were 12,896,225 shares of Common Stock

outstanding and entitled to vote.

Quorum and Voting

Quorum. The holders of record of a majority in

voting power of the shares of stock of the Company issued and

outstanding and entitled to be voted, present in person or by

proxy, will constitute a quorum for the transaction of business at

the Annual Meeting or any adjournment or postponement

thereof. Shares not present in person or by proxy at the

Annual Meeting will not be counted for purposes of determining a

quorum at the Annual Meeting. In the event there are not

sufficient shares present to establish a quorum or to approve

proposals at the time of the Annual Meeting, the Annual Meeting may

be adjourned in order to permit further solicitation of proxies by

the Company.

Vote

Required. Holders of Common Stock are entitled to

one vote for each share held as of the Record Date on all matters

to be voted on at the Annual Meeting. The Company’s

Bylaws, as amended (“Bylaws”), provide that, except as

otherwise provided in the Company’s Certificate of

Incorporation, as amended (“Certificate of Incorporation”),

the rules or regulations of any stock exchange applicable to the

Company or by applicable law or regulation, all matters will be

decided by the vote of a majority in voting power of the shares

present in person or by proxy and entitled to vote at the Annual

Meeting and on the matter. For Proposal 1 (Nomination and

Election of Directors Proposal), the Bylaws provide that the

persons receiving the greatest number of votes, up to the number of

directors then to be elected, will be the persons elected. The

affirmative vote of a majority in voting power of the shares

present in person or by proxy and entitled to vote at the Annual

Meeting and on such proposal is required to approve Proposal 2

(2018 Equity Incentive Plan Proposal) and Proposal 3 (Accounting

Firm Ratification Proposal). None of the proposals is

contingent upon the approval of any other proposal.

Abstentions. Abstentions will be counted for

purposes of determining a quorum at the Annual

Meeting. An abstention for any proposal, other than

Proposal 1 (Nomination and Election of Directors Proposal),

will have the same effect as a vote against such

proposal. As to Proposal 1, because the number of

nominees is equal to the number of directors being elected at the

Annual Meeting, abstentions will not affect the election of the

nominees to the Board as long as each nominee receives at least one

vote in favor of the nominee’s election.

Broker Discretionary Voting. If your shares are

held in a brokerage account, by a bank or other nominee, you are

considered the beneficial owner of shares held in “street

name,” and the proxy materials are being sent to you by your

broker, bank, or other nominee who is considered, with respect to

those shares, the stockholder of record. As the

beneficial owner, you have the right to direct your broker, bank,

or other nominee how to vote. If you do not give

instructions to your brokerage firm or bank, it will still be able

to vote your shares with respect to “discretionary”

proposals, but will not be allowed to vote your shares with respect

to “non-discretionary” proposals. The

Company expects that Proposal 3 (Accounting Firm Ratification

Proposal) will be considered to be a discretionary proposal on

which banks and brokerage firms may vote. The Company

expects that all other proposals being presented to stockholders at

the Annual Meeting will be considered to be non-discretionary items

on which banks and brokerage firms may not

vote. Therefore, if you do not instruct your broker or

bank regarding how you would like your shares to be voted, your

bank or brokerage firm will not be able to vote on your behalf with

respect to these proposals. In the case of these

non-discretionary items, the shares will be treated as

“broker non-votes.” Broker non-votes are shares that

are held in “street name” by a bank or brokerage firm

that indicates on its proxy that it does not have discretionary

authority to vote on a particular matter. Your failure

to give instructions to your bank or broker will not affect the

outcome of Proposal 1 as long as a nominee receives at least

one vote in favor of the nominee’s election, nor affect the

outcomes of Proposals 2 and 3 because these proposals require

the affirmative vote of a majority in voting power of the shares

present in person or by proxy and entitled to vote at the Annual

Meeting and on these proposals, and broker non-votes will not be

deemed “entitled to vote on the proposal” and therefore

are not counted in the vote for these proposals.

Expenses of Proxy Solicitation

This

solicitation is being made by the Company. Officers, directors, and

regular employees of AutoWeb may solicit proxies in person or by

regular mail, electronic mail, facsimile transmission, or personal

calls. These persons will receive no additional

compensation for solicitation of proxies but may be reimbursed for

reasonable out-of-pocket expenses. In addition, AutoWeb

has retained MacKenzie Partners, Inc. to act as a proxy solicitor

in conjunction with the Annual Meeting. The estimated

fees and costs for those proxy solicitation services are $6,500.00

plus reasonable disbursements.

AutoWeb

will pay all of the expenses of soliciting proxies to be voted at

the Annual Meeting. Banks, brokerage firms and other

custodians, nominees or fiduciaries will be requested to forward

soliciting material to their principals and to obtain authorization

for the execution of proxies, and will be reimbursed for their

reasonable out-of-pocket expenses incurred in that

regard.

Voting of Proxies

Shares

may be voted by completing, dating, and signing the accompanying

proxy card and promptly returning it in the enclosed envelope.

Stockholders may provide voting instructions for voting of their

proxies using the Internet at www.proxyvote.com

or by calling 1.800.690.6903. Providing voting instructions using

the Internet or by calling requires stockholders to input the

Control Number located on their proxy cards. The cutoff

time for providing voting instructions via the Internet or by

calling is 11:59 p.m. Eastern Time the day before the date of

the Annual Meeting (“Voting

Instructions Cutoff Time”).

All

properly signed proxies received prior to the vote at the Annual

Meeting that are not properly revoked prior to the vote will be

voted at the Annual Meeting according to the instructions indicated

on the proxies or, if no direction is indicated, such proxies will

be voted “FOR”

Proposal 1 (Nomination and Election of Directors Proposal);

“FOR”

Proposal 2 (2018 Equity Incentive Plan Proposal); and

“FOR”

Proposal 3 (Accounting Firm Ratification

Proposal). The Board does not presently intend to

present any other matter for action at the Annual Meeting and no

stockholder has given timely notice in accordance with the Bylaws

of any matter that it intends to be brought before the

meeting. If any other matters are properly brought

before the Annual Meeting, the persons named in the proxies will

have discretion to vote on those matters in accordance with their

best judgment.

Revocability of Proxy

If you

are the holder of record for your shares, you may revoke your proxy

at any time before it is exercised at the Annual Meeting by taking

either of the following actions: (i) delivering to the

Company’s Secretary a revocation of the proxy or a proxy

relating to the same shares and bearing a later date prior to the

vote at the Annual Meeting; or (ii) attending the Annual

Meeting and voting in person, although attendance at the Annual

Meeting will not, by itself, revoke a proxy. Stockholders may also

revoke a prior proxy by providing later voting instructions for

voting of a later proxy prior to the Voting Instructions Cutoff

Time.

Recommendation of the Board of Directors

The

Board recommends that AutoWeb stockholders vote “FOR” the election of Messrs.

Michael A. Carpenter, Mark N. Kaplan, and Jose Vargas as Class II

Directors under Proposal 1 (Nomination and Election of Directors

Proposal); “FOR”

Proposal 2 (2018 Equity Incentive Plan Proposal); and

“FOR”

Proposal 3 (Accounting Firm Ratification

Proposal).

TO ENSURE THAT YOUR SHARES ARE REPRESENTED AT THE ANNUAL MEETING,

PLEASE COMPLETE, DATE, AND SIGN THE ENCLOSED PROXY CARD AND MAIL IT

PROMPTLY IN THE POSTAGE-PAID ENVELOPE PROVIDED, WHETHER OR NOT YOU

PLAN TO ATTEND THE ANNUAL MEETING. PRIOR TO THE VOTING

INSTRUCTIONS CUTOFF TIME, STOCKHOLDERS MAY ALSO PROVIDE VOTING

INSTRUCTIONS USING THE INTERNET AT WWW.PROXYVOTE.COM

OR BY CALLING 1.800.690.6903 AS DESCRIBED IN THIS PROXY STATEMENT

AND ACCOMPANYING PROXY CARD.

A copy

of the Company’s Annual Report on Form 10-K for the

fiscal year ended December 31, 2017, accompanies this Proxy

Statement. If requested, AutoWeb will furnish you with a

copy of any exhibit listed on the exhibit index to the

Company’s Annual Report on Form 10-K for the fiscal year

ended December 31, 2017, upon payment of a reasonable copy

fee.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR

THE ANNUAL MEETING TO BE HELD ON JUNE 21, 2018: Copies

of the Notice of Annual Meeting of Stockholders, this Proxy

Statement, the form of Proxy Card, and the Company’s Annual

Report on Form 10-K for the fiscal year ended December 31,

2017, are available online at http://www.autoweb.com/proxymaterials. Stockholders

wishing to attend the Annual Meeting may obtain directions by

calling the Company at 949.862.1393.

NOMINATION AND ELECTION OF DIRECTORS

Nominees for Class II Directors

Messrs.

Michael A. Carpenter, Mark N. Kaplan, and Jose Vargas are the

Board’s nominees as Class II Directors for election at

the Annual Meeting. The Board made these nominations at

the recommendation of the Board’s Corporate Governance and

Nominations Committee. A Class II Director will

hold office until the 2021 Annual Meeting of Stockholders and until

that director’s successor is duly qualified and

elected.

Michael A.

Carpenter. Mr. Carpenter has served as a director of AutoWeb

since September 2012. Mr. Carpenter served as the Chief Executive

Officer and as a director of Ally Financial Inc. from November 2009

until his retirement in February 2015. Ally Financial is one of the

nation’s largest financial services companies, with a

concentration in automotive lending. In 2007, he founded Southgate

Alternative Investments, Inc. From 2002 to 2006, he was Chairman

and Chief Executive Officer of Citigroup Alternative Investments,

overseeing proprietary capital and customer funds globally in

various alternative investment vehicles. From 1998 to 2002, Mr.

Carpenter was Chairman and Chief Executive Officer of

Citigroup’s Global Corporate & Investment Bank with

responsibility for Salomon Smith Barney Inc. and Citibank’s

corporate banking activities globally. Mr. Carpenter was named

Chairman and Chief Executive Officer of Salomon Smith Barney Inc.

in 1998, shortly after the merger that created Citigroup. Prior to

Citigroup, Mr. Carpenter was Chairman and Chief Executive Officer

of Travelers Life & Annuity and Vice Chairman of Travelers

Group Inc. responsible for strategy and business development. From

1989 to 1994, Mr. Carpenter was Chairman of the Board, President

and Chief Executive Officer of Kidder Peabody Group Inc., a wholly

owned subsidiary of General Electric Company. From 1986 to 1989,

Mr. Carpenter was Executive Vice President of GE Capital

Corporation. He first joined GE in 1983 as Vice President of

Corporate Business Development and Planning and was responsible for

strategic planning and development as well as mergers and

acquisitions. Earlier in his career, Mr. Carpenter spent nine years

as Vice President and Director of the Boston Consulting Group and

three years with Imperial Chemical Industries of the United

Kingdom. Mr. Carpenter was elected to the board of CIT, Inc., a

publicly held financial holding company, on May 1, 2016. He also

serves on the boards of Law Finance Group, US Retirement Partners,

the New York City Investment Fund, the Rewards Network, Inc., and

Client 4 Life Management Systems, and has been a board member of

the New York Stock Exchange, General Signal, Loews Cineplex and

various other private and public companies. Mr. Carpenter received

a B.S. Degree from the University of Nottingham, England, and a

M.B.A. from the Harvard Business School where he was a Baker

Scholar. Mr. Carpenter also holds an honorary degree of Doctor of

Laws from the University of Nottingham. Mr. Carpenter’s

experience in investment and commercial banking, executive

management and capital markets led the Board to conclude that Mr.

Carpenter should serve as one of the Company’s

directors.

Mark N.

Kaplan. Mr. Kaplan

has served as a director of AutoWeb since June 1998. Mr. Kaplan was

a member of the law firm of Skadden, Arps, Slate, Meagher &

Flom LLP from 1979 through 1998 and currently is of counsel to that

firm, Chairman of the Board and Chief Operating Officer of

Engelhard Minerals & Chemicals Corporation (mining and

chemicals) from 1977 to 1979, and President and Chief Executive

Officer of Drexel Burnham Lambert (investment banking) from 1970 to

1977. Mr. Kaplan serves as Chairman of the compensation committee

of the board of directors of American Biltrite Inc., a publicly

traded company. He is a Trustee of Bard College, the New York

Academy of Medicine, a member and former Chairman of the New York

City Audit Committee, a Trustee and Chairman of the Audit Committee

of WNET.org (provider of public media in the New York City

metropolitan area), a director of twenty investment funds managed

by Gresham Investment Management LLC, as well as an advisor to

fifteen additional private Gresham fund properties. Mr. Kaplan has

also served on the boards of Volt Information Services, Inc.,

Congoleum Corp., DRS Technologies Inc., and other privately held

entities or mutual funds. Mr. Kaplan was formerly the Chairman of

the Audit Advisory Committee of the Board of Education of The City

of New York, Vice-Chairman and Governor of the board of directors

of The American Stock Exchange, Inc., and a director of Security

Industry Automation Corporation. Mr. Kaplan holds an A.B. Degree

from Columbia College and a LL.B Degree from Columbia Law School.

Mr. Kaplan’s experience in securities and corporate laws,

mergers and acquisitions, investment banking and business

management, as well as his qualification as an audit committee

financial expert, led the Board to conclude that Mr. Kaplan should

serve as one of the Company’s directors.

Jose Vargas. Mr.

Vargas has served as a director of AutoWeb since October 1, 2015

and as the Company’s Chief Revenue Officer from October 1,

2015 to April 12, 2018. From September 18, 2013 to October 1, 2015,

Mr. Vargas was a director and president of a company that provided

an internet-based, pay-per-click advertising marketplace for the

automotive industry, which was acquired by the Company as of

October 1, 2015. Mr. Vargas is a co-founder, director and the

president of People F, Inc., a British Virgin Islands business

company (“PeopleFund”), a holding company

that is focused on investments in technology, internet and media,

and a co-founder of, and currently serves as a co-managing director

and president of PF Holding Inc., a British Virgin Islands business

company (“PF

Holding”), an entity affiliated with PeopleFund that

is focused on investments in technology, internet and media, as

well as vice president and a director of PF Auto, Inc., a British

Virgin Islands business company (“PF Auto”), an entity affiliated

with PeopleFund, and co-managing director, president and secretary

of Auto Holdings Ltd., a British Virgin Islands business company

(“Auto

Holdings”), also an entity affiliated with PeopleFund.

Mr. Vargas is also a director or officer of a number of

privately-held companies that include Healthcare, Inc., an online

search, comparison and recommendation tool for healthcare

consumers, Blue Mountain 17 Inc., Blue Mountain 18 Inc., Blue

Mountain 30 Inc., Blue Mountain 31 Inc., Blue Mountain 45 Inc.,

Blue Mountain 46 Inc., Blue Mountain 48 Inc., Blue Mountain 73

Inc., Classifieds Corp., Gray Mountain Inc., PeopleFund Inc.,

People Ventures Inc., Startups Holding, Inc.; MapFit Inc. (prior:

GeoFi, Inc.), PF Classifieds Inc., PF Healthcare Inc., Galeb3 Inc.,

Healthcare.com Insurance Services, LLC, Startups.com I, Limited,

Startups.com Inc., and Startups.com III, L.P. Mr. Vargas received a

B.S. Degree from Florida International University.

Mr.

Vargas was appointed to the Board pursuant to the Stockholder

Agreement described below under the section of this Proxy Statement

entitled “SECURITY OWNERSHIP

OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT” upon

AutoWeb’s acquisition of Autobytel, Inc. (formerly AutoWeb,

Inc.) as of October 1, 2015. Mr. Vargas serves as one of the two

representatives on the Board designated by the former owners of the

acquired company. Mr. Vargas’ experience in founding and

growing technology and online media companies led the Board to

conclude that Mr. Vargas should serve as one of the Company’s

directors.

Voting

for Election of Class II Directors

The

persons named in the enclosed proxy card will vote

“FOR” the

election of Michael A. Carpenter, Mark N. Kaplan, and Jose Vargas

as Class II Directors unless instructed otherwise in the

proxy. Because no other nominees have been properly and

timely nominated in accordance with the Bylaws, Messrs. Carpenter,

Kaplan, and Vargas will each be elected as Class II Directors

as long as they each receive at least one vote for the

nominee’s respective election. Holders of Common

Stock are not entitled to cumulate their votes in the election of

directors. Although Messrs. Carpenter, Kaplan, and

Vargas have each consented to serve as a director if elected, and

the Board has no reason to believe that any of them will be unable

to serve as a director, if Messrs. Carpenter, Kaplan, or

Vargas withdraws his nomination or otherwise becomes unavailable to

serve, the persons named as proxies will vote for any substitute

nominee designated by the Board. Abstentions and

“broker non-votes” will not have any effect on the

outcome of the voting for the election of Class II Directors

as long as a nominee receives at least one vote in favor of the

nominee’s election.

Recommendation of the Board of Directors

THE BOARD OF DIRECTORS RECOMMENDS THAT THE STOCKHOLDERS

VOTE “FOR” THE ELECTION

OF

MR. CARPENTER, MR. KAPLAN, AND MR. VARGAS.

PROPOSAL 2

APPROVAL OF AUTOWEB, INC.

2018 EQUITY INCENTIVE PLAN

Background and Reason for Proposal

On

April 12, 2018, upon recommendation of the Compensation Committee

of the Board (“Compensation Committee”), the Board approved

the adoption of the 2018 Equity Incentive Plan (“2018 Plan”) subject to the

approval of the stockholders at the Annual Meeting. If approved by

the stockholders, the 2018 Plan will replace the Company’s

2014 Equity Incentive Plan, as amended and restated in 2016

(“2014 Plan”).

The total number of shares available for awards under the 2018 Plan

will be 2,003,758 shares, less any awards made after December 31,

2017 under the 2014 Plan (counted at the Fungible Share Ratio

described below). If the stockholders approve the 2018 Plan at the

Annual Meeting, no new awards will be made under the 2014 Plan. All

awards under the 2018 Plan are approved by the Compensation

Committee or, subject to limited delegation of authority and

discretion to award up to 50,000 awards per year, by the

Board’s Non-Executive Stock Option Committee. The number of

awards that may be approved under the 2018 Plan is not known at

this time. The Compensation Committee’s determination to

recommend the adoption of the 2018 Plan to the Board was made after

the Compensation Committee’s consultation with Frederik W.

Cook & Co., the Compensation Committee's independent

compensation consultant.

The

Board believes a compensation policy that includes a balanced mix

of cash and equity is the most effective way to attract and retain

talented employees whose interests are aligned with AutoWeb

stockholders. The Board recommends stockholder approval of the 2018

Plan because it believes that equity-based

compensation:

●

Links the interests

of the Company’s employees and other plan participants with

the long-term interests of the Company’s

stockholders,

●

Supports a

pay-for-performance culture within the Company,

●

Fosters employee

stock ownership,

●

Focuses the

management team on increasing value for the

stockholders,

●

Encourages

employees to remain in the Company’s employ, and

●

Provides a

long-term balance to the Company’s overall compensation

program.

As of

December 31, 2017, a total of 603,758 shares of Common Stock

remained available for future awards under the 2014 Plan. If the

Company’s stockholders do not approve the 2018 Plan, the 2014

Plan, which was previously approved by the Company’s

stockholders, will continue in full force and effect. However, the

Board expects that no, or almost no, shares will be available for

future awards under the 2014 Plan by the Annual Meeting.

Consequently, the Board will be required to alter substantially the

Company’s compensation program, which includes equity as well

as cash compensation, if the stockholders do not approve the 2018

Plan at the Annual Meeting. The Board believes that approval of the

2018 Plan is important for the Company to continue to recruit and

retain talented directors, officers, employees, consultants and

advisors. Without approval of the proposed 2018 Plan, the Board

believes it will be severely limited in its ability to use equity

as a component of its compensation philosophy, a result that would

put AutoWeb at a considerable competitive disadvantage to its

direct and indirect competitors for high level

professionals.

It is

generally expected that the share reserve under the 2018 Plan, if

this Proposal 2 is approved by stockholders, will last AutoWeb for

a period of approximately two to three years based upon its average

burn rate for 2015-2017.

Burn Rate and Overhang

In

setting and recommending to stockholders the number of additional

shares to authorize under the 2018 Plan, the Compensation Committee

and the Board considered historical equity awards granted under the

2014 Plan, as well as the Company’s three-year average burn

rate for the preceding three fiscal years as follows:

|

Year

|

Time-Vested Stock Options Granted

|

Performance-Based Stock Options Earned

|

Time-Vested Stock Awards Granted

|

Performance-Based Stock Awards Earned

|

|

Weighted Average Common Shares Outstanding

|

|

|

2017

|

466,600

|

0

|

345,000

|

0

|

811,600

|

11,852,539(1)

|

6.8%

|

|

2016

|

833,900

|

0

|

0

|

0

|

833,900

|

10,673,015

|

7.8%

|

|

2015

|

606,750

|

2,955

|

25,000

|

0

|

634,705

|

9,907,066

|

6.4%

|

|

Three-Year Average

Burn Rate

|

|

|

|

|

|

|

7.0%

|

(1)

Represents

11,910,906 weighted average common shares outstanding minus 58,367

weighted average common shares repurchased during

2017.

The

burn rate is the ratio of the number of shares underlying awards

granted under the 2014 Plan during a fiscal year (except that the

Company identifies performance-based awards as earned) to the

number of the Company’s weighted average common shares

outstanding for the corresponding fiscal year.

The

Company calculates overhang as the sum of the total number of

shares subject to equity awards outstanding and the total number of

shares available for grant under the 2014 Plan (the only plan under

which the Company currently makes equity awards) divided by the sum

of the total number of shares of Common Stock outstanding, the

total number of shares subject to equity awards outstanding (which

are not already included in total Common Stock outstanding) and the

total number of shares available for grant under the 2014 Plan. The

Company’s overhang as of December 31, 2017, was 23.2%. If the

2018 Plan is approved, the additional 1.4 million shares available

for issuance would increase the overhang to approximately

29.2%.

The

following table shows certain information about shares subject to

outstanding awards under our Prior Plans (as defined below) as of

December 31, 2017:

|

Number of shares

that will be authorized for future grant after stockholder approval

of the 2018 Plan (1)

|

2,003,758

|

|

Number of

restricted shares and performance-based restricted shares at

December 31, 2017

|

453,333

|

|

Number of shares

relating to outstanding stock options at December 31,

2017

|

2,745,284

|

|

Weighted average

remaining term of outstanding options

|

|

|

Weighted average

exercise price of outstanding options

|

$11.50

|

(1)

Grants of

awards, other than stock appreciation rights (“SARs”) or options,

(“Full Value

Awards”) will count against the authorization as 1.75

shares. The authorization will also be reduced by the number of

shares granted under the 2014 Plan between December 31, 2017, and

the date of stockholder approval at the Fungible Share Ratio

described below.

Section 162(m) of the IRC

Section

162(m) of the Internal Revenue Code (“IRC”) precludes a deduction for

compensation paid to certain employees to the extent that the

employee’s compensation for the taxable year exceeds $1

million. In December 2017, Congress enacted Public Law No. 115-97,

commonly referred to as the “Tax Cuts and Jobs Act.”

Among other things, Public Law No. 115-97 eliminated an exception

for performance-based compensation from the $1 million

deductibility cap and the definition of “outside

director” under Section 162(m) of the IRC. Because some

states, including California, have not conformed their tax laws to

these changes, the 2018 Plan provides that if the Committee

determines at the time a Restricted Stock Award, a Restricted Stock

Unit Award, a Performance Award or Other Share-Based Award is

granted to a participant who is, or is likely to be, as of the end

of the tax year in which the Company would claim a deduction under

applicable state law in connection with such Award, a

“covered employee” within the meaning of Section 162(m)

of the IRC as in effect immediately before the enactment of Public

Law No. 115-97, then the Committee may determine that lapsing of

restrictions thereon and the distribution of cash, shares or other

property pursuant thereto, as applicable will be subject to the

achievement of one or more objective performance goals established

by the Committee and set forth in the 2018 Plan. Approval of

Proposal 2 is intended to constitute stockholder approval of the

material terms of performance goals for purposes of Section 162(m)

of the IRC immediately prior to the enactment Public Law No.

115-97. Although the 2018 Plan includes provisions intended to

allow for continued deductibility of performance based compensation

under non-conforming state tax laws, there is no assurance that

such compensation will continue to be deductible. In addition, the

Board has not adopted a policy that all compensation must be

deductible under applicable tax laws or be intended to qualify as

performance-based compensation.

The

following description of the 2018 Plan is qualified in its entirety

by reference to, and should be read in conjunction with, the full

text of the 2018 Plan, a copy of which is attached to this Proxy

Statement as Appendix A.

Summary of the 2018 Plan

Purpose of the 2018

Plan. The purpose of the 2018 Plan is to assist AutoWeb

and its subsidiaries in attracting and retaining individuals who,

serving as employees, directors, officers, consultants and/or

advisors, are expected to contribute to its success and to achieve

long-term objectives that will benefit its stockholders through the

additional incentives inherent in the awards under the 2018

Plan.

Shares Available. As

of the date the stockholders approve this Proposal 2, the total

number of shares of Common Stock that may be issued under the 2018

Plan (subject to the adjustment provisions described under

“Adjustments upon Changes in

Capitalization or Changes in Control ” below)

will be 2,003,758 shares, less one share for every one share that

was subject to an option or SAR granted under the 2014 Plan after

December 31, 2017 and prior to the effective date of the 2018

Plan, and 1.75 shares for every one share that was subject to a

Full Value Award granted under the 2014 Plan after

December 31, 2017 and prior to the effective date of the 2018

Plan. Any shares that are subject to options or SARs will be

counted against this limit as one share for every one share

granted, and any shares that are subject to Full Value Awards will

be counted against this limit as 1.75 shares for every one share

granted. The rate at which Full Value Awards are counted is

referred to herein as the “Fungible Share

Ratio.”

As used

in this Proposal 2, “Prior

Plans” means, collectively, the Company’s 1998

Stock Option Plan, 2000 Stock Option Plan, Amended and Restated

2001 Restricted Stock and Option Plan, 2004 Restricted Stock and

Option Plan, 2010 Equity Incentive Plan, and 2014 Plan. If any

shares subject to an award under the 2018 Plan are forfeited, an

award expires or an award is settled for cash (in whole or in

part), or after December 31, 2017 any shares subject to

an award under the Prior Plans are forfeited, or an award under the

Prior Plans expires or is settled for cash (in whole or in part),

the shares subject to such award or award under the Prior Plans

will, to the extent of such forfeiture, expiration or cash

settlement, again be available for awards under the 2018 Plan. In

the event that withholding tax liabilities arising from an award

other than an option or SAR or, after December 31, 2017,

an award other than an option or SAR under any Prior Plan are

satisfied by the tendering of shares (either actually or by

attestation) or by the withholding of shares by the Company, the

shares so tendered or withheld shall be added to the shares

available for awards under the 2018 Plan. The following shares may

not be added to the shares authorized for grant:

(i) shares tendered by the participant or withheld by the

Company in payment of the exercise price of an option under the

2018 Plan or after December 31, 2017, an option granted

under the Prior Plans, or to satisfy any tax withholding obligation

with respect to options or SARs under the 2018 Plan, or after

December 31, 2017, options or SARs under the Prior Plans;

(ii) shares subject to an SAR under the 2018 Plan, or after

December 31, 2017, an SAR granted under the Prior Plans

that are not issued in connection with its stock settlement on

exercise thereof; and (iii) shares reacquired by the Company

on the open market or otherwise using cash proceeds from the

exercise of options under the 2018 Plan or after

December 31, 2017, options granted under the Prior

Plans.

Any

shares that again become available for grant as described in

preceding paragraph above must be added back as (i) one share if

such shares were subject to options or SARs granted under the 2018

Plan or options or SARs granted under the Prior Plans, and (ii) as

1.75 shares if such shares were subject to Full Value Awards

granted under the 2018 Plan or Full Value Awards granted under the

Prior Plans.

Shares

of Common Stock under awards made in substitution or exchange for

awards granted by a company acquired by the Company or a

subsidiary, or with which the Company or any subsidiary combine(s),

do not reduce the maximum number of shares that may be issued under

the 2018 Plan. In addition, if a company acquired by the Company or

a subsidiary, or with which the Company or any subsidiary

combine(s), has shares remaining available under a plan approved by

its stockholders, the available shares (adjusted to reflect the

exchange or valuation ratio in the acquisition or combination) may

be used for awards under the 2018 Plan and will not reduce the

maximum number of shares of Common Stock that may be issued under

the 2018 Plan; provided,

however, that awards using such available shares may not be

made after the date awards or grants could have been made under the

pre-existing plan, absent the acquisition or combination, and may

only be made to individuals who were not employees or directors of

AutoWeb or its subsidiaries prior to the acquisition or

combination.

The

maximum number of shares of Common Stock that may be issued under

the 2018 Plan pursuant to the exercise of incentive stock options

is 2,003,758 shares, subject to the adjustment provisions described

under “Adjustments Upon Changes in

Capitalization or Changes in Control ”

below.

Limitation on Awards to

Non-Employee Directors. Notwithstanding any other provision

of the 2018 Plan to the contrary, the aggregate of the following

during any single calendar year shall not exceed $750,000, and any

compensation that is deferred shall be counted toward this limit

for the year in which it was first earned, and not when paid or

settled if later: (i) the aggregate grant date fair value (as

calculated by the Company for financial accounting purposes) of all

awards granted to any non-employee Director for services during

such calendar year and (ii) the sum of all cash payments to any

non-employee Director made for services during such calendar

year.

Eligibility.

Options, SARs, restricted stock awards, restricted stock unit

awards and performance awards may be granted under the 2018 Plan.

Options may be either “incentive stock options,” as

defined in Section 422 of the IRC, or nonstatutory stock

options. Awards may be granted under the 2018 Plan to any employee

or officer of AutoWeb or its subsidiaries, non-employee member of

the Board and consultant or advisor (subject to meeting conditions

specified in the 2018 Plan) who is a natural person and provides

services to the Company or a subsidiary, except for incentive stock

options which may be granted only to the Company’s employees

or employees of a subsidiary. The 2018 Plan defines a

“subsidiary” as any corporation, limited liability

company, partnership, joint venture or similar entity in which the

Company owns, directly or indirectly, an equity interest possessing

more than 50% of the combined voting power of the total outstanding

equity interests of such entity; provided, however, in the case of an

incentive stock option, “subsidiary” is defined to mean

any corporation (other than the Company) in an unbroken chain of

corporations beginning with the Company if, at the relevant time

each of the corporations other than the last corporation in the

unbroken chain owns stock possessing 50% or more of the total

combined voting power of all classes of stock in one of the other

corporations in the chain.

Awards to be Granted to

Certain Individuals and Groups. As of the Record Date, approximately

235 employees and non-employee directors were eligible to

participate in the 2018 Plan. The Compensation Committee, in its

discretion, selects the persons to whom awards may be granted,

determines the type of awards, determines the times at which awards

will be made, determines the number of shares subject to each award

(or the dollar value of certain performance awards), and determines

the other terms and conditions relating to the awards. For this

reason, it is not possible to determine the benefits or amounts

that will be received by any particular person in the

future.

Limits on Awards to

Participants. The 2018 Plan provides that no participant may

(i) be granted options or SARs during any calendar year with

respect to more than 500,000 shares of Common Stock and (ii) be

granted restricted stock awards, restricted stock unit awards,

performance awards and/or Other Share-Based Awards (as defined

below) intended to comply with the qualified performance-based

exception under Section 162(m) of the IRC as in effect immediately

before enactment of Public Law No. 115-97 and applicable state tax

law and in any calendar year that are denominated in shares and

under which more than 500,000 shares may be earned for each 12

months in the performance period. In addition to the foregoing,

during any calendar year no participant may be granted performance

awards that are intended to comply with the qualified

performance-based exception under Section 162(m) of the IRC as in

effect immediately before enactment of Public Law No. 115-97 and

applicable state tax law and are denominated in cash under which

more than $2,500,000 may be earned for each 12 months in

the performance period (together, collectively with the limitations

in the preceding sentence, the “Limitations”). If an award is

cancelled, the cancelled award will continue to be counted toward

the applicable Limitation (or, if denominated in cash, toward the

dollar amount in the preceding sentence).

Administration. The

2018 Plan will be administered by the Compensation Committee (or a

subcommittee upon approval of the Board) which must consist of at

least two members of the Board, each of whom must qualify as a

“non-employee director” under Rule 16b-3 of the

Securities Exchange Act of 1934, as amended (“Securities Exchange Act”), to the

extent required, an “outside director” under

Section 162(m) of the IRC as in effect immediately before

enactment of Public Law No. 115-97 and an “independent

director” under the rules of the principal U.S. securities

exchange on which the Common Stock is traded. The Compensation

Committee has the authority to determine the terms and conditions

of awards, interpret and administer the 2018 Plan. The Compensation

Committee may (i) delegate to a committee of one or more

directors the right to make awards, cancel or suspend awards and

otherwise take action on its behalf under the 2018 Plan, and

(ii) to the extent permitted by law, delegate to an executive

officer or a committee of executive officers the right to designate

officers (other than those officers subject to Section 16 of the

Securities Exchange Act) and employees of the Company or any

subsidiary to be recipients of awards and determine the number of

awards to be received by those officers and

employees; provided that any resolution of

the Compensation Committee must comply with Sections 152 or 157 of

the Delaware General Corporation Law, as the case may be, and the

Compensation Committee may not authorize an officer to designate

himself or herself as a recipient of a stock option.

Stock Options. The

Compensation Committee may grant either non-qualified stock options

or incentive stock options. A stock option entitles the recipient

to purchase a specified number of shares of Common Stock at a fixed

price subject to terms and conditions set by the Compensation

Committee. The purchase price of shares of Common Stock covered by

a stock option cannot be less than 100% of the fair market value of

the Common Stock on the date the option is granted.

However, the

exercise price of an incentive stock option granted to any person,

who at the time of grant, owns (or is deemed to own) stock

possessing more than 10% of the total combined voting power of the

Company or any parent or subsidiary of the Company (a

“10%

Stockholder”), must be at least 110% of the fair

market value of the Common Stock on the date of grant. Fair market

value of the Common Stock is generally equal to the closing price

for the Common Stock on the principal securities exchange on which

the Common Stock is traded on the date the option is granted (or if

there was no closing price on that date, on the last preceding date

on which a closing price was reported). To the extent that the

aggregate fair market value, determined at the time of grant, of

shares of Common Stock with respect to incentive stock options that

are exercisable for the first time by a participant during any

calendar year (under all plans of the Company or parent or

subsidiary) exceed $100,000, the portion exceeding that amount will

be treated as non-statutory options.

The

2018 Plan permits payment of the purchase price of stock options to

be made by cash or cash equivalents, shares of Common Stock

previously acquired by the participant, any other form of

consideration approved by the Compensation Committee and permitted

by applicable law (including withholding of shares of Common Stock

that would otherwise be issued on exercise), or any combination

thereof. Options granted under the 2018 Plan must expire no later

than seven years from the date of grant; however, incentive stock

options granted to a 10% Stockholder must expire no later than five

years from the date of grant.

Stock Appreciation

Rights. The Compensation Committee is authorized to grant

SARs in conjunction with a stock option or other award granted

under the 2018 Plan and to grant SARs separately. The grant price

of a SAR may not be less than 100% of the fair market value of a

share of Common Stock on the date the SAR is granted. The term of a

SAR may be no more than seven years from the date of

grant.

Upon

exercise of a SAR, the participant will have the right to receive

the excess of the fair market value of the shares covered by the

SAR on the date of exercise over the grant price. Payment may be

made in cash, shares of Common Stock or other property, or any

combination thereof, as the Compensation Committee may determine.

Shares issued upon the exercise of SARs are valued at their fair

market value as of the date of exercise.

Restricted Stock

Awards. Restricted stock awards may be issued either alone

or in addition to other awards granted under the 2018 Plan, and are

also available as a form of payment of performance awards and other

earned cash-based incentive compensation. The Compensation

Committee determines the terms and conditions of restricted stock

awards, including the number of shares of Common Stock granted, and

any conditions for vesting that must be satisfied, which typically

will be based principally or solely on continued provision of

services, but may include a performance-based component. Unless

otherwise provided in, and subject to the execution of, the award

agreement, the holder of a restricted stock award will have the

rights of a stockholder from the date of grant of the award,

including the right to vote the shares of Common Stock and the

right to receive distributions on the shares; provided, however,

that any dividends, shares or other property distributed with

respect to the award will be subject to the same restrictions and

risk of forfeiture as the award.

Restricted Stock Unit

Awards. Awards of restricted stock units having a value

equal to an identical number of shares of Common Stock may be

granted either alone or in addition to other awards granted under

the 2018 Plan, and are also available as a form of payment of

performance awards granted under the 2018 Plan and other earned

cash-based incentive compensation. The Compensation Committee

determines the terms and conditions of restricted stock units. The

holder of a restricted stock unit award will not have voting rights

with respect to the award. Any dividend equivalents, shares or

other property distributed with respect to the award will be

subject to the same restrictions and risk of forfeiture as the

award.

Other Share-Based

Awards. The 2018 Plan also provides for the award of shares

of Common Stock and other awards that are valued in whole or in

part by reference to, or are otherwise based on, Common Stock or

other property (“Other

Share-Based Awards”). These awards may be granted

above, or in addition to, other awards under the 2018 Plan. Other

Share-Based Awards may be paid in cash, shares of Common Stock or

other property, or a combination thereof, as determined by the

Compensation Committee. The Compensation Committee determines the

terms and conditions of Other Share-Based Awards.

Performance Awards.

Performance awards provide participants with the opportunity to

receive shares of Common Stock, cash or other property based on

performance and other vesting conditions. Performance awards may be

granted from time to time and on such terms and conditions as

determined at the discretion of the Compensation Committee. Subject

to the share limit and maximum dollar value set forth above, the

Compensation Committee has the discretion to determine (i) the

number of shares of Common Stock under, or the dollar value of, a

performance award; and (ii) the conditions that must be

satisfied for grant or for vesting, which typically will be based

principally or solely on achievement of performance goals. The

performance period for performance awards may not be longer than

five years.

Performance

Criteria. If the

Compensation Committee determines at the time a restricted stock

award, a restricted stock unit award, a performance award, or Other

Share-Based Award is granted to a participant who is or is likely

to be, as of the end of the tax year in which the Company would

claim a deduction under applicable state law in connection with

such award, a “covered employee” within the meaning of

Section 162(m) of the IRC as in effect immediately before the

enactment of Public Law No. 115-97, then the Committee may

determine that the lapsing of restrictions thereon and the

distribution of cash, shares or other property pursuant thereto, as

applicable, will be based on the attainment of specified levels of

one or more of the following: net sales; revenue; revenue growth or

product revenue growth; operating income (before or after taxes);

pre- or after-tax income or loss (before or after allocation of

corporate overhead and bonus); earnings or loss per share; net

income or loss (before or after taxes); return on equity; total

stockholder return; return on assets or net assets; appreciation in

and/or maintenance of the price of the shares or any other

publicly-traded securities of the Company; market share; gross

profits; earnings or losses (including earnings or losses before

taxes, before interest and taxes, or before interest, taxes,

depreciation and amortization); economic value-added models or

equivalent metrics; comparisons with various stock market indices;

reductions in costs; cash flow or cash flow per share (before or

after dividends); return on capital (including return on total

capital or return on invested capital); cash flow return on

investment; improvement in or attainment of expense levels or

working capital levels, including cash, inventory and accounts

receivable; operating margin; gross margin; year-end cash; cash

margin; debt reduction; stockholders equity; operating

efficiencies; market share; customer satisfaction; customer growth;

employee satisfaction; regulatory achievements (including

submitting or filing applications or other documents with

regulatory authorities or receiving approval of any such

applications or other documents and passing pre-approval

inspections); strategic partnerships or transactions (including

in-licensing and out-licensing of intellectual property);

establishing relationships with commercial entities with respect to

the marketing, distribution and sale of the Company’s

products (including with group purchasing organizations,

distributors and other vendors); lead supply or other supply chain

achievements; co-development, co-marketing, profit sharing, joint

venture or other similar arrangements; financial ratios (including

those measuring liquidity, activity, profitability or leverage);

cost of capital or assets under management; financing and other

capital raising transactions (including sales of the

Company’s equity or debt securities); factoring transactions;

sales or licenses of the Company’s assets (including its

intellectual property, whether in a particular jurisdiction or

territory or globally; or through partnering transactions);

implementation, completion or attainment of measurable objectives

with respect to research, development, manufacturing,

commercialization, products or projects, production volume levels,

acquisitions and divestitures; factoring transactions; and

recruiting and maintaining personnel. These performance goals also

may be based solely by reference to the Company’s performance

or the performance of a subsidiary, division, business segment or

business unit of the Company, or based upon the relative

performance of other companies or upon comparisons of any of the

indicators of performance relative to other companies. Any

performance goals that are financial metrics, may be determined in

accordance with U.S. Generally Accepted Accounting Principles

(“GAAP”), in

accordance with accounting principles established by the

International Accounting Standards Board (“IASB Principles”), or may be adjusted

when established to include or exclude any items otherwise

includable or excludable under GAAP or under IASB Principles. The

Compensation Committee may also exclude the impact of an event or

occurrence which the Compensation Committee determines should

appropriately be excluded, including (i) restructurings,

discontinued operations, items of an unusual nature or infrequency

of occurrence or non-recurring items; (ii) an event either not

directly related to the operations of the Company, subsidiary,

division, business segment or business unit or not within the

reasonable control of management; (iii) the cumulative effects of

tax or accounting changes in accordance with U.S. generally

accepted accounting principles; (iv) asset write-downs, (v)

litigation or claim judgments or settlements; (vi) acquisitions or

divestitures; (vii) reorganization or change in the corporate

structure or capital structure of the Company; (viii) foreign

exchange gains and losses; (ix) a change in the fiscal year of the

Company; (x) the refinancing or repurchase of bank loans or debt

securities; (xi), unbudgeted capital expenditures; (xii) the

issuance or repurchase of equity securities and other changes in

the number of outstanding shares; (xiii) conversion of some or all

of convertible securities to common stock; (xiv) any business

interruption event; or (xv) the effect of changes in other laws or

regulatory rules affecting reported results. With respect to any

such restricted stock award, restricted stock unit award,

performance award, or Other Share-Based Award, the Compensation

Committee may adjust downwards, but not upwards, the amount payable

pursuant to such award, and the Compensation Committee may not

waive the achievement of the applicable performance goals except in

the case of the death or disability of the participant or a change

in control of the Company. The Compensation Committee has the power

to impose such other restrictions on such awards as it may deem

necessary or appropriate to ensure that such awards satisfy all

requirements for “qualified performance-based

compensation” within the meaning of Section 162(m) of the IRC

in effect immediately before enactment of Public Law No. 115-97 and

applicable state tax law. Notwithstanding the foregoing, the

Compensation Committee, in its sole discretion, may grant

performance-based awards that are based on other metrics, not

specifically set forth above.

Dividends; Dividend

Equivalents. The Committee is authorized to establish

procedures pursuant to which the payment of any award may be

deferred. Awards other than options and SARs may, if determined by

the Compensation Committee, provide that the participant will be

entitled to receive amounts equivalent to cash, stock or other

property dividends declared with respect to shares of Common Stock

covered by an award. The Compensation Committee may provide that

these amounts will be deemed to have been reinvested in additional

shares of Common Stock or otherwise reinvested; provided, however,

that in all cases such dividend equivalents shall be subject to the

same vesting or performance conditions and risks of forfeiture as

the underlying award and shall not be paid unless and until the

underlying award vests.

No Repricing. The

2018 Plan prohibits option and SAR repricings (other than to

reflect stock splits, spin-offs or other corporate events described

under “Adjustments upon Changes in

Capitalization or Changes in Control ” below)

unless stockholder approval is obtained. For purposes of the 2018

Plan, a “repricing” means a reduction in the exercise

price of an option or the grant price of a SAR, the cancellation of

an option or SAR in exchange for cash or another award (except in

connection with a change in control or for awards granted in

assumption of or in substitution for awards previously granted by a

company acquired by the Company or with which it combines) under

the 2018 Plan if the exercise price or grant price of the option or

SAR is greater than the fair market value of the Common Stock, or

any other action with respect to an option or SAR that would be

treated as a repricing under the rules of the principal U.S.

securities exchange on which the Common Stock is

traded.

Nontransferability of

Awards. In general, no award and no shares that have not

been issued or as to which any applicable restriction, performance

or deferral period has not lapsed, may be sold, assigned,

transferred, pledged or otherwise encumbered, other than by will or

the laws of descent and distribution, and such award may be

exercised during the life of the participant only by the

participant or the participant’s guardian, members of a

committee for incompetent former employees or similar persons duly

authorized by law to administer the estate or assets of former

employees. To the extent and under such terms and conditions as

determined by the Compensation Committee and except for incentive

stock options, options may be exercised and the shares acquired on

exercise may be resold by a participant’s family member who

has acquired the options from the participant through a gift or a

domestic relations order (a “Permitted Assignee”). A

“family member”

includes any child, stepchild, grandchild, parent, stepparent,

grandparent, spouse, former spouse, sibling, niece, nephew,

mother-in-law, father-in-law, son-in-law, daughter-in-law,

brother-in-law or sister-in-law, including adoptive relationships,

any person sharing the participant’s household (other than a

tenant or employee), a trust in which these persons have more than

50% of the beneficial interest, a foundation in which these persons

(or the participant) control the management of assets, and any

other entity in which these persons (or the participant) own more

than 50% of the voting interests; provided that such Permitted

Assignee will be bound by and subject to all of the terms and

conditions of the 2018 Plan and the award agreement relating to the

transferred award and must execute an agreement satisfactory to the

Company evidencing those obligations; and provided further that the

participant remains bound by the terms and conditions of the 2018

Plan. Awards may not be transferred to third party financial

institutions and may not be transferred for value. A transfer for

value does not include: (i) a transfer under a domestic

relations order in settlement of marital property rights; or

(ii) a transfer to an entity in which more than 50% of the

voting interests are owned by the family members (or the

participant) in exchange for an interest in that entity. An

incentive stock option is not transferable (other than by will or

by the laws of descent and distribution) by the participant and is

exercisable, during the lifetime of the participant, only by the

participant.

Adjustments upon Changes in

Capitalization or Changes in Control. In the event of any

merger, reorganization, consolidation, recapitalization, dividend

or distribution (whether in cash, shares or other property, other

than a regular cash dividend), stock split, reverse stock split,

spin-off or similar transaction or other change in the

Company’s corporate structure affecting its Common Stock or

the value thereof, appropriate adjustments to the 2018 Plan and

awards will be made as the Compensation Committee determines to be

equitable and appropriate, including adjustments in the number and

class of shares of stock subject to the 2018 Plan, the number,

class and option or exercise price of shares subject to awards

outstanding under the 2018 Plan, and the limits on the number of

awards that any person may receive.

Under

the 2018 Plan, award agreements may provide that (i) options

and SARs outstanding as of the date of the change in control (as

defined in the 2018 Plan attached hereto) will be cancelled and

terminated without payment therefor if the fair market value (as

defined in the 2018 Plan) of one share of the Common Stock as of

the date of the change in control is less than the per share option

exercise price or SAR grant price, and (ii) all performance

awards will be considered to be earned and payable (either in full

or pro rata based on the portion of the performance period

completed as of the date of the change in control), and any

limitations or other restrictions will lapse, and performance

awards will be immediately settled or distributed. In addition,

unless otherwise provided in an award agreement, in the event of a

change in control of the Company in which the successor company

assumes or substitutes for an option, SAR, restricted stock award,

restricted stock unit award or Other Share-Based Award (or in which

the Company is the ultimate parent corporation and continues the

award), if a participant’s employment with the successor

company (or the Company) or a subsidiary thereof, terminates within

24 months following such change in control (or such other period

set forth in the award agreement, including prior thereto, if

applicable) and under the circumstances specified in the award

agreement:

●

Options and SARs

outstanding as of the date of such termination of employment will

immediately vest, become fully exercisable and may thereafter be

exercised for 24 months (or the period of time set forth in the

award agreement), but in no event later than the earlier of (i) the

latest date on which the option or SAR would have expired by its

original terms or (ii) the date that is seven years after the

original date of grant of the option or SAR,

●

The

restrictions, limitations and other conditions applicable to

restricted stock and restricted stock units outstanding as of the

date of such termination of employment will lapse, and the

restricted stock and restricted stock units will become free of all

restrictions, limitations and conditions and become fully vested,

and

●

The

restrictions, limitations and other conditions applicable to any

Other Share-Based Awards or any other awards will lapse, and such

Other Share-Based Awards or such other awards will become free of

all restrictions, limitations and conditions and become fully

vested and transferable to the full extent of the original

grant.

Unless

otherwise provided in an award agreement, in the event of a change

in control of the Company to the extent the successor company does

not assume or substitute for an option, SAR, restricted stock

award, restricted stock unit award or Other Share-Based Award (or

in which the Company is the ultimate parent corporation and does

not continue the award), then immediately prior to the change in

control:

●

Those options

and SARs outstanding as of the date of the change in control that

are not assumed or substituted for (or continued) will immediately

vest and become fully exercisable,

●

Restrictions,

limitations and other conditions applicable to restricted stock and

restricted stock units that are not assumed or substituted for (or

continued) will lapse, and the restricted stock and restricted

stock units will become free of all restrictions, limitations and

conditions and become fully vested, and

●

The

restrictions, other limitations and other conditions applicable to

any Other Share-Based Awards or any other awards that are not

assumed or substituted for (or continued) will lapse, and such

Other Share-Based Awards or such other awards will become free of

all restrictions, limitations and conditions and become fully

vested and transferable to the full extent of the original

grant.

The

Compensation Committee, in its discretion, may determine that, upon

the occurrence of a change in control of the Company, each option

and SAR outstanding will terminate within a specified number of

days after notice to the participant, and/or that each participant

will receive, with respect to each share subject to such option or

SAR, an amount equal to the excess of the fair market value of such

share immediately prior to the occurrence of such change in control

over the exercise price per share of such option and/or SAR; such

amount to be payable in cash, in one or more kinds of stock or

property (including the stock or property, if any, payable in the

transaction) or in a combination thereof, as the Compensation

Committee, in its discretion, may determine.

Termination of

Employment. The

Compensation Committee will determine and set forth in the award

agreement whether any awards will continue to be exercisable, and

the terms of exercise, on and after the date the participant ceases

to be employed by, or to otherwise provide services to, the

Company, whether by reason of death, disability, voluntary or

involuntary termination of employment or service, or

otherwise.

Amendment and

Termination. The 2018 Plan may be amended or terminated by

the Board except that stockholder approval is required for any

amendment to the 2018 Plan which increases the number of shares of

Common Stock available for awards under the 2018 Plan (except for

adjustments described under “Adjustments Upon Changes of

Capitalization or Changes in Control ” above),

expands the types of awards available under the 2018 Plan, changes

the class of persons eligible to receive incentive stock options,

materially expands the class of persons eligible to participate in

the 2018 Plan, eliminates the requirements of the 2018 Plan with

respect to minimum exercise price, minimum grant price and

stockholder approval, or increases the maximum permissible term of

any option or SAR specified in the 2018 Plan. The 2018 Plan may be

amended without shareholder approval to provide for awards that do

not receive favorable tax treatment under Code Section 162(m) or

422 or otherwise. No amendment or termination of the 2018 Plan may

materially impair a participant’s rights under an award

previously granted under the 2018 Plan without the consent of the

participant.

The

2018 Plan will expire on June 19, 2028, except with respect to

awards then outstanding, and no further awards may be granted

thereafter.

Federal Income Tax Consequences

The

following discussion summarizes certain federal income tax

considerations of awards under the 2018 Plan; however, it does not

purport to be complete and does not describe the state, local or

foreign tax considerations or the consequences for any particular

individual. Tax consequences may vary depending on particular

circumstances, and the federal income tax laws are subject to

change, sometimes with retroactive effect. Participants in the 2018

Plan who are residents of or are employed in a country other than

the United States may be subject to taxation in accordance with the

tax laws of that particular country in addition to or in lieu of

United States federal income taxes.

Stock

Options. A

participant does not realize ordinary income on the grant of a

stock option. Upon exercise of a non-qualified stock option, the

participant will realize ordinary income equal to the excess of the

fair market value of the shares of Common Stock on the exercise

date over the option exercise price paid. The cost basis of the

shares acquired for capital gain purposes on the future sale of the

shares is the fair market value of the shares at the time of

exercise, and the holding period of the shares for capital gain

purposes begins on the date on which the option is exercised and

not the date on which the option was granted. Upon exercise of an

incentive stock option, the excess of the fair market value of the

shares of Common Stock acquired over the option exercise price will

be an item of tax preference to the participant, which may be

subject to an alternative minimum tax for the year of exercise. If

no disposition of the shares is made within two years from the date

of grant of the incentive stock option or within one year after the

transfer of the shares to the participant, the participant does not

realize taxable income for regular income tax purposes as a result

of exercising the incentive stock option; the tax basis of the

shares received for capital gain purposes is the option exercise

price paid; and any gain or loss realized on the sale of the shares

is long-term capital gain or loss. If the participant disposes of