1

INTEGRATED ANNUAL REPORT FOR THE 20-F 2025

2

Contents

Harmony | Page |

Delivering profitable ounces | |

Environment stewardship | |

Water stewardship | |

Social stewardship | |

Governance | |

3

About Harmony

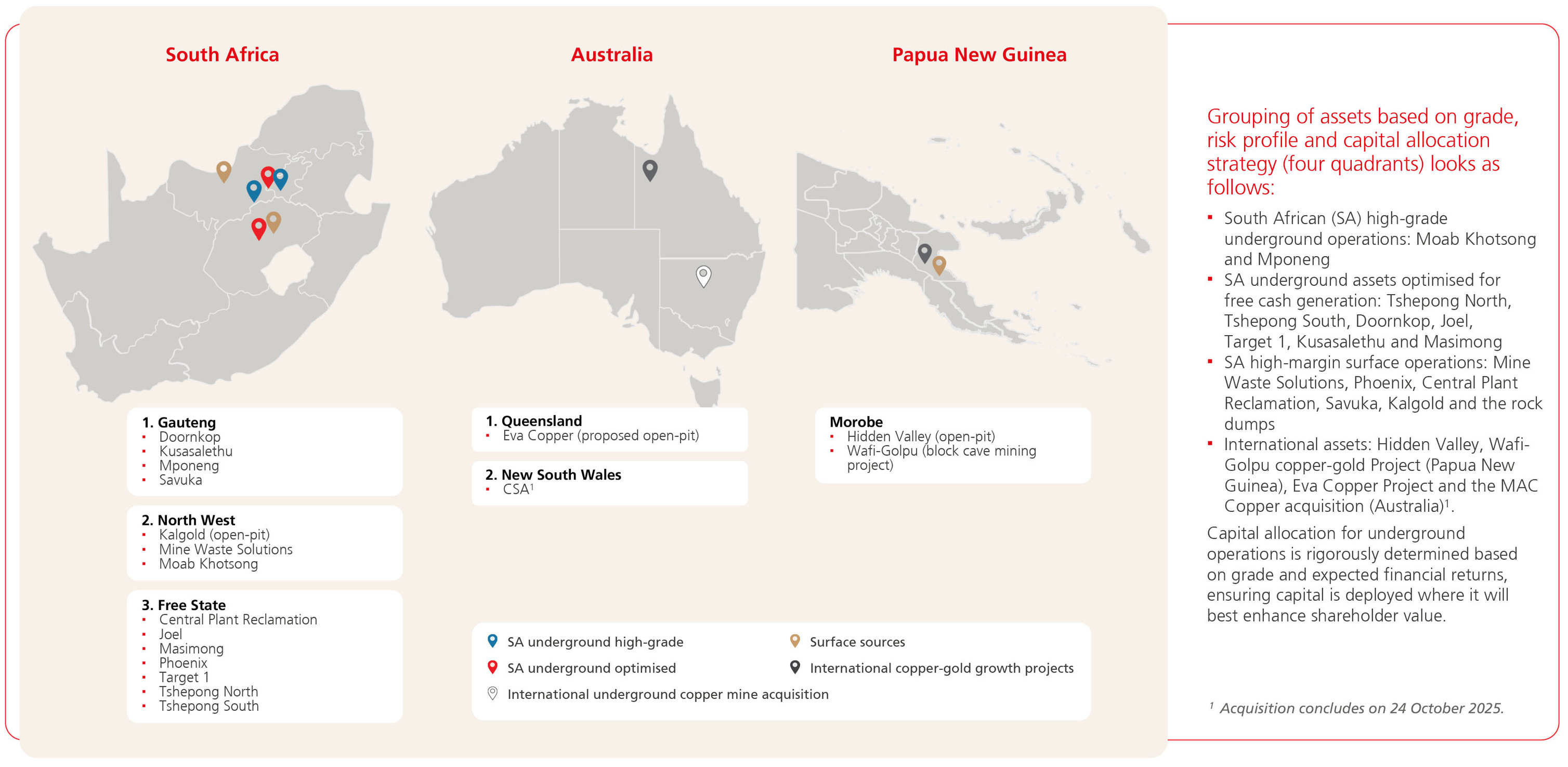

Harmony is a gold mining specialist with a growing international copper footprint. We are South Africa’s largest gold producer by volume and have

delivered safe, profitable ounces, shaped the mining landscape and supported communities for over 75 years. Today, we operate across South Africa,

Papua New Guinea and Australia. Our MAC Copper acquisition and Eva Copper Project alongside our Tier 1 Wafi-Golpu Project have positioned us to

become a significant gold-copper producer, ensuring long-term resilience and margin growth. We lead the world in gold tailings reclamation, unlocking

value from historic resources safely and responsibly. Sustainability is embedded in everything we do – driving operational excellence, community

development and environmental stewardship.

Headquartered in Randfontein, South Africa, Harmony has a primary listing on Johannesburg’s stock exchange,

the JSE Limited (HAR) and an American depositary receipt programme listed on the New York Stock Exchange

(HMY). Our shareholder base is geographically diverse and includes some of the largest fund managers

globally. The largest shareholder base is in South Africa (49%), followed by the United States (32%).

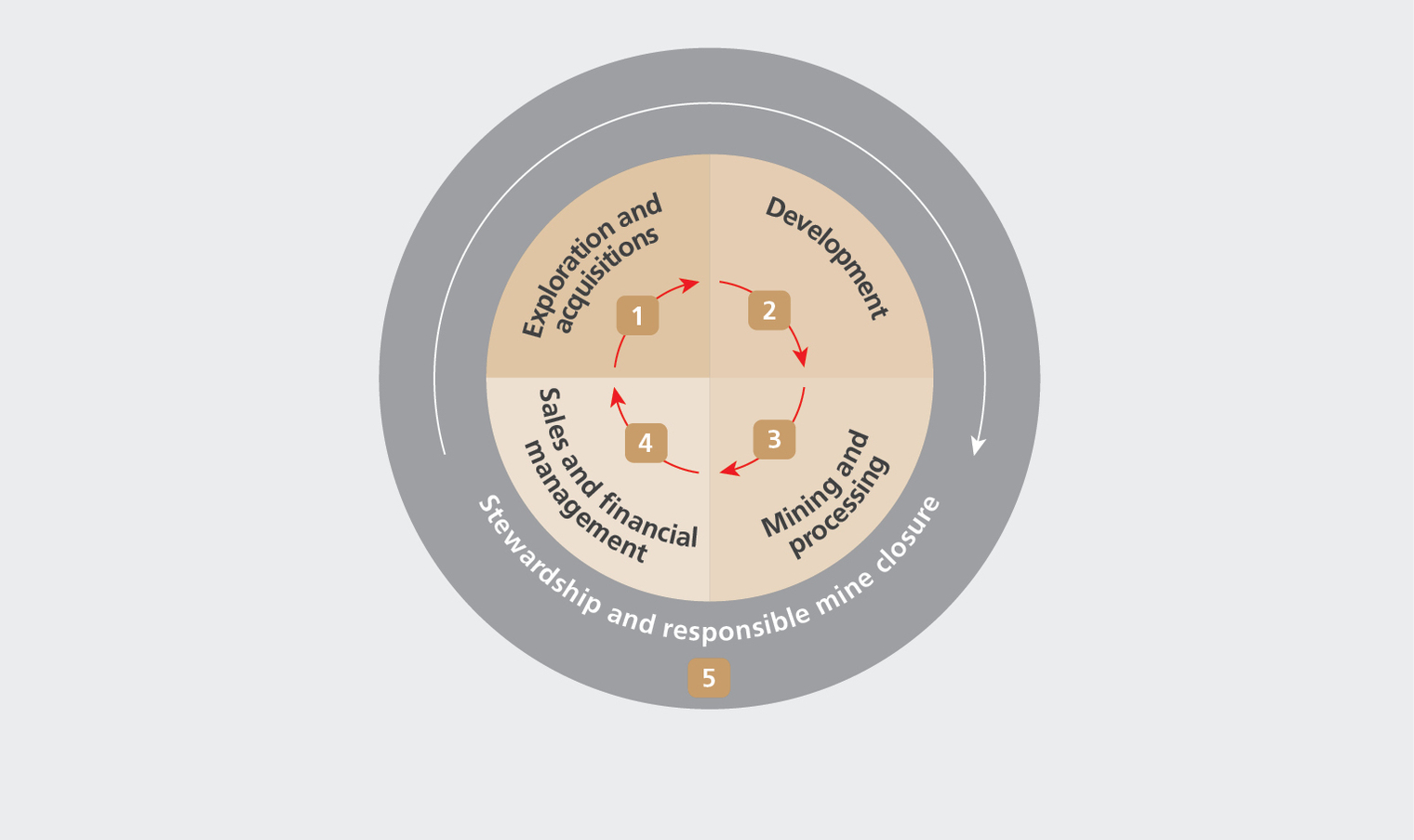

What we do

| Exploring for and evaluating economically viable gold-bearing orebodies and/or value- accretive acquisitions in gold and copper. |  | Evaluating development options to de-risk projects before major capital outlays, the design of efficient and sustainable operations and then the building of the necessary infrastructure, facilities and systems to enable mining operations. | ||||||||||||

| Generating revenue through the sale of gold, silver and uranium produced and optimising efficiencies to maximise financial returns. |  | Establishing, developing and operating mines, reclamation sites and related processing infrastructure. Ore mined is milled and processed by our gold plants to produce gold doré bar. | ||||||||||||

| Responsible for our environment during operations, committed to empowering communities and employees throughout and beyond the life of our mines and restoring mining-impacted land for alternative economic use post- mining, while adhering strictly to approved mine closure commitments. | ||||||||||||||

75 years’ gold mining experience in South Africa, a 25-year presence in Australia and over 20 years in Papua New Guinea. | 1.48Moz produced (FY24: 1.56Moz) with 11.2% (166 027oz) being from reclamation activities. | 36.82Moz gold and gold equivalent Mineral Reserves (FY24: 40.26Moz). | Market capitalisation of R155.4 billion (US$8.7 billion) at 30 June 2025 (FY24: R106.3 billion (US$5.8 billion)). | |||||||||||||

How we do it

Mining with purpose

Our integrated, stakeholder-inclusive and risk-based approach to sustainable mining practices, combined with

meaningful investments in organic and inorganic growth, continues to enable the long-term success of our

business, and ultimately, sustained value creation for our stakeholders.

Sustainability is embedded in all we do and are committed to safe, ethical, social and ecologically responsible

mining. We believe we can deliver long-term, consistent results thanks to disciplined capital allocation and

operational excellence, and are well positioned to make a meaningful contribution to a low-carbon future

through our copper footprint.

Our values

We refer to ourselves as Harmonites – a community united by the hope of a greater future for ourselves, each

other and our communities. Our values are principle-centred, serving as a guide for decision making,

behaviour and our culture.

| No matter the circumstances, safety is our main priority | Safety is our promise – not just compliance, but care. It is the foundation of our culture, where every person matters. | |||||

| Achievement is core to our success | Achievement is our fuel – driven by purpose, resilience and the courage to turn risk into opportunity. It is the spirit behind our empowerment programmes and performance culture. | |||||

| We are all accountable for delivering on our commitments | Accountability is our compass – owning our impact and modelling integrity. It is the backbone of our leadership development and risk propensity coaching. | |||||

| We are all connected as one team | Connectedness is our rhythm – bridging cultures, communities and conversations. It is the essence of Thibakotsi: Unity in diversity, inclusion in action. | |||||

| We uphold honesty in all our business dealings and communicate openly with stakeholders | Honesty is our voice – clear, courageous and authentic. It is how we build trust, foster psychological safety and lead with transparency. | |||||

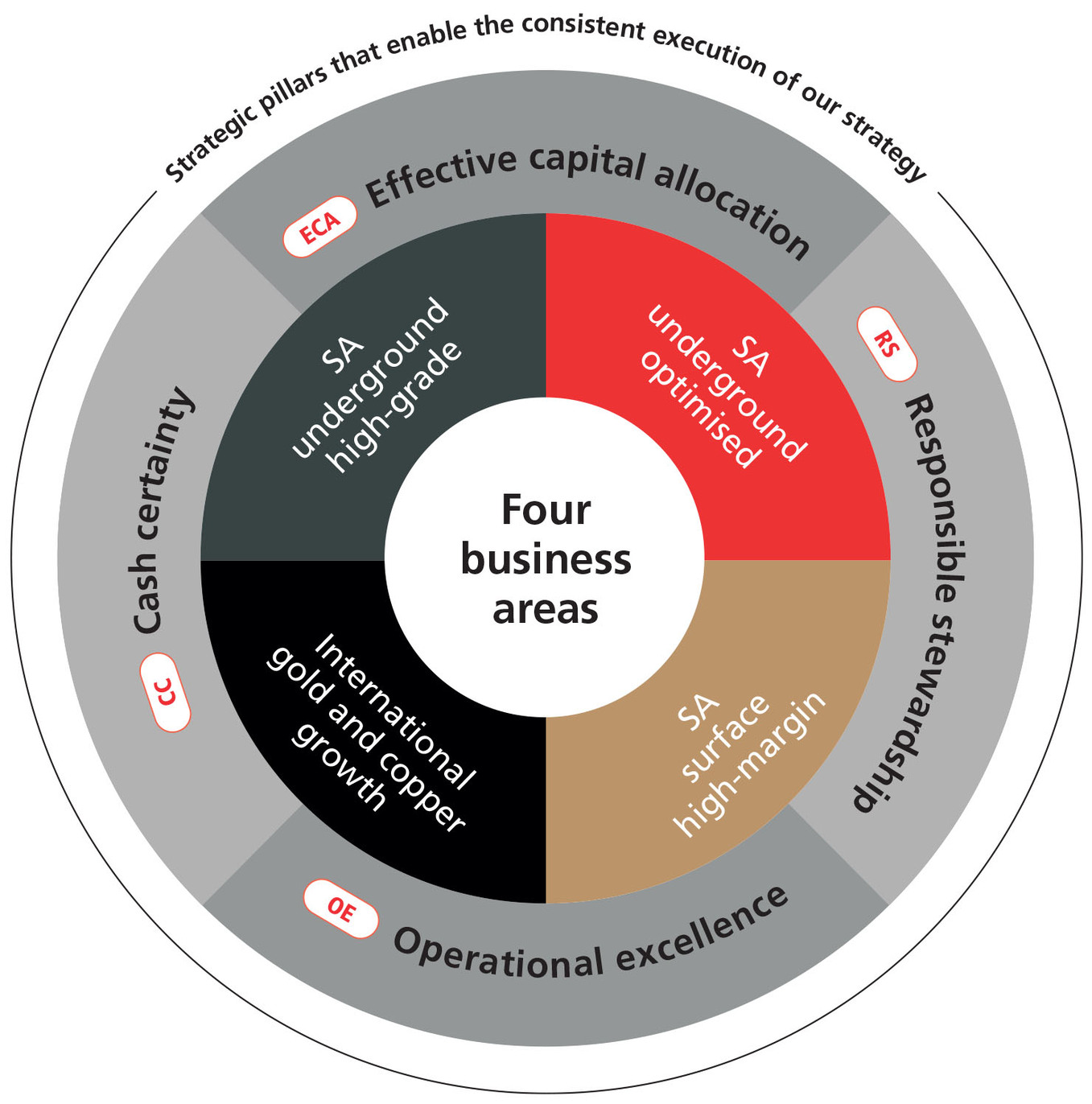

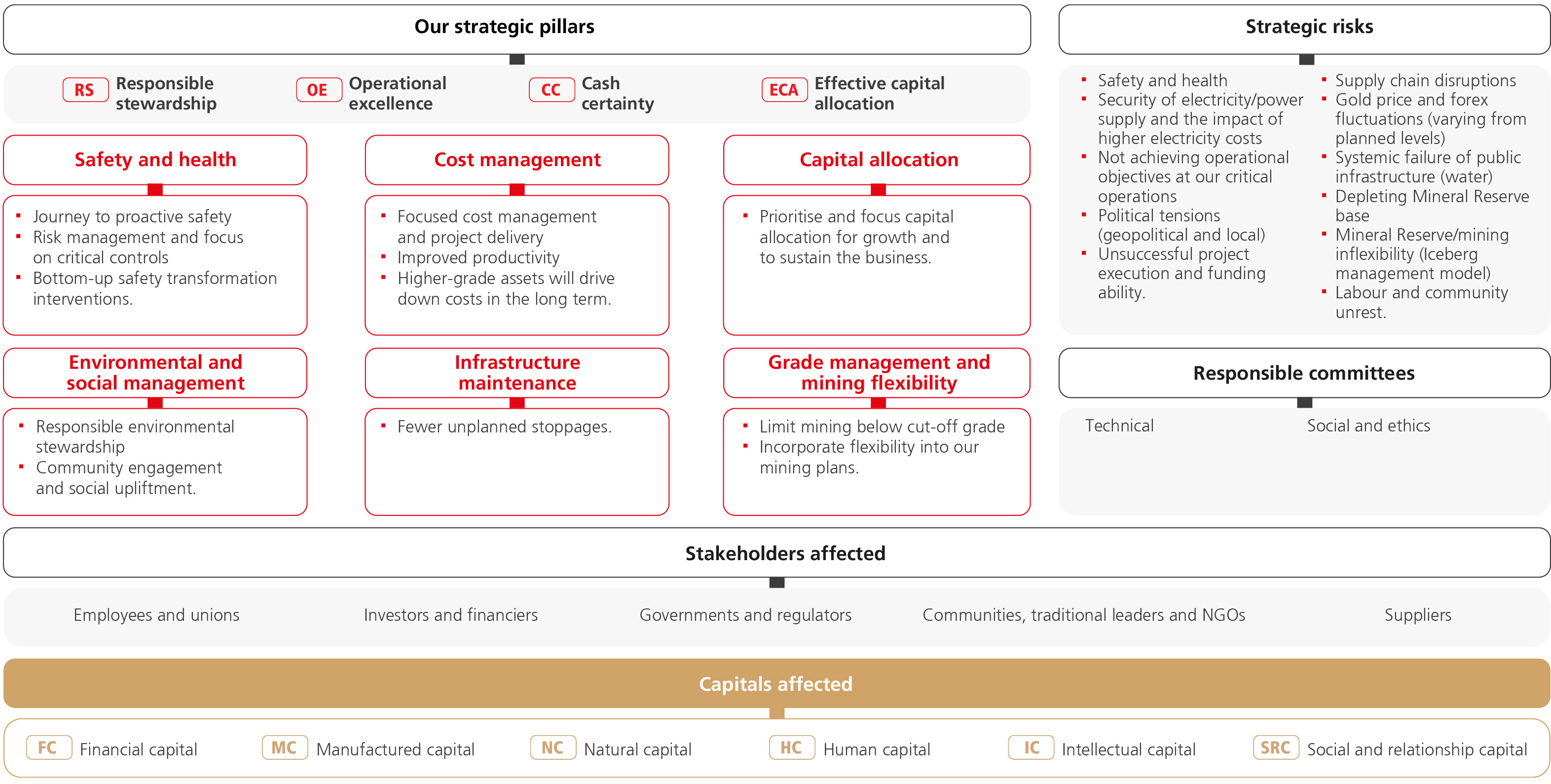

Our strategy

To produce safe, profitable ounces and improve margins through operational excellence and value-accretive

acquisitions. This is made up of four pillars, detailed in the Strategy section:

RS | Responsible stewardship | OE | Operational excellence | CC | Cash certainty | ECA | Effective capital allocation | |||||||||||||||

4

Mining with purpose

For 75 years, Harmony has mined with purpose – creating long-term value for shareholders while building a sustainable business that benefits society and the economy, and promotes

responsible resource management, while expanding into copper for future resilience.

Mining with purpose defined: We are a gold mining specialist with a growing international copper footprint with sustainability embedded in our business decisions. Building a lasting positive legacy involves creating shared value for our stakeholders. Caring for, protecting and empowering employees is a core commitment. Stewardship of the environment, mining with a social conscience and sharing value with host communities guide our actions. Significant contributions to the economic development of host countries remain a priority. A stakeholder-inclusive approach drives the delivery of our strategy while carefully managing the resources on which we rely. Efforts continue to enhance positive impacts and reduce negative ones. | ||

Mining with purpose informs and guides how we:

Build a profitable, sustainable company | Create and preserve value | Deliver on our sustainability commitments | ||||||||||||

With 75 years of operational experience in South Africa, 25 years’ presence in Australia and over 20 years in Papua New Guinea, we are a gold mining specialist with a growing international copper footprint. Our disciplined capital allocation approach includes the evaluating and prioritisation of safe, sustainable, organic growth opportunities and value-accretive acquisitions to deliver positive stakeholder returns and increased margins. Our operational excellence efforts improve the safety, productivity and efficiency of our operations while achieving operational plans. These outcomes enhance our margins and reduce overall risk. As a result, we generate long-term shared value, actively contributing to the economic and social progress of the countries where we operate. Over the past 10 years, we have met production guidance each year. | Engaging meaningfully with our stakeholders is essential to safeguard the value we create. To mine with purpose, we prioritise building trust, nurturing long-term relationships and working collaboratively with key stakeholders. This approach supports the delivery of our strategic objectives and ESG commitments, while carefully balancing stakeholder expectations with business priorities. Our pursuit of positive impact and shared value beyond compliance is affected by dynamic internal and external factors. Mining with purpose allows us to effectively navigate our complex operating environment and growing international footprint. By unlocking value from a finite resource, we are able to generate lasting benefits for our stakeholders and the business. Read about our engagement practices in the Stakeholder needs and expectations section. | Sustainability is embedded into our strategic and operational decision- making processes. Through ethical, transparent and responsible mining practices, we continue to contribute positively to local communities and societies and proactively manage our environmental footprint through considered upfront planning and ongoing efforts to optimise our resource use. This philosophy is central to our sustainability framework, which drives accountability and supports our evolution into a resilient, future-focused business. It also aligns with our contribution to the UN SDGs. To monitor our progress, we track performance against medium- and long-term KPIs. | ||||||||||||

Share value with all our stakeholders | ||||||||||||||

Investors and financiers Our investors and financial partners provide the capital that drives our growth. Their support enables our ongoing expansion, allowing us to maintain financial flexibility, deliver value to shareholders, and achieve consistent earnings and share price appreciation. | Employees, contractors and unions Our employees are our greatest strength, and we are committed to safeguarding and enabling their growth. Their expertise, insights and contributions within our host communities are essential to our success. We prioritise their wellbeing, professional development and empowerment – fostering a workplace that is safe, healthy and highly productive. | |||||||||||||

Communities, traditional authorities and NGOs To uphold our social licence to operate, we collaborate with our host communities and develop shared solutions to local challenges. Through these partnerships, we contribute to the long-term, socio-economic advancement of the regions where we are active. | Governments and regulators Our operations are conducted in accordance with the legal frameworks of the countries in which we operate, ensuring ethical and responsible mining practices. The taxes and royalties we pay support national development and help strengthen host country economies. | |||||||||||||

Suppliers Through procurement, job creation and enterprise development, we invest in strengthening supplier capabilities and drive meaningful transformation within our host communities and the wider economy. Our upstream value chain supplies the essential goods and services that enable us to run our operations. | ||||||||||||||

5

MAC Copper acquisition

Harmony announced the acquisition of MAC Copper Limited in May 2025. MAC Copper is the owner of

the CSA mine in Cobar, New South Wales, Australia. The transaction, for a consideration of

US$1.03 billion, signifies a landmark achievement in our transformation into a global gold and copper

producer, as it introduces a high-grade, underground, copper asset that produced approximately 41kt of

high-quality copper in calendar year 2024. This investment fully aligns with our investment criteria

focused on enhancing free cash flow and improving margin quality.

CSA mine is recognised as one of Australia’s highest-grade copper operations, offering long-life

production and low-cost operational advantages. This acquisition provides us with the opportunity

to optimise operational efficiencies and extend life-of-mine.

This transaction reinforces our strategic objective to build a resilient, low-cost, global gold and copper

mining company. CSA mine adds significant scale to our copper production, enhancing our commodity

diversification and reducing our reliance on gold price cyclicality. Copper’s strategic importance as a

critical metal for global decarbonisation and energy transition further underscores the value of this

acquisition.

Harmony is financing the acquisition through a balanced mix of available cash resources, debt facilities and

potential debt instruments, leveraging our strong balance sheet to maintain financial flexibility and protect

shareholder returns. This disciplined capital allocation approach demonstrates our commitment to value-

accretive investments that strengthen our operational, financial and strategic foundation.

We are confident that our underground mining expertise will unlock additional operational value, and

this transaction marks a meaningful advance in de-risking our asset base and growing our long-term

value proposition.

The acquisition positions Harmony to capitalise on copper’s rising demand in a Tier 1 mining jurisdiction.

It underscores our commitment to disciplined growth, operational excellence and long-term value

creation for all stakeholders. This acquisition marks a significant step in our transformation into a global

gold-copper producer.

The transaction concluded and took effect on 24 October 2025. While guidance on this acquisition will

be provided in H2 FY26, selected details on the CSA mine are included in this report.

6

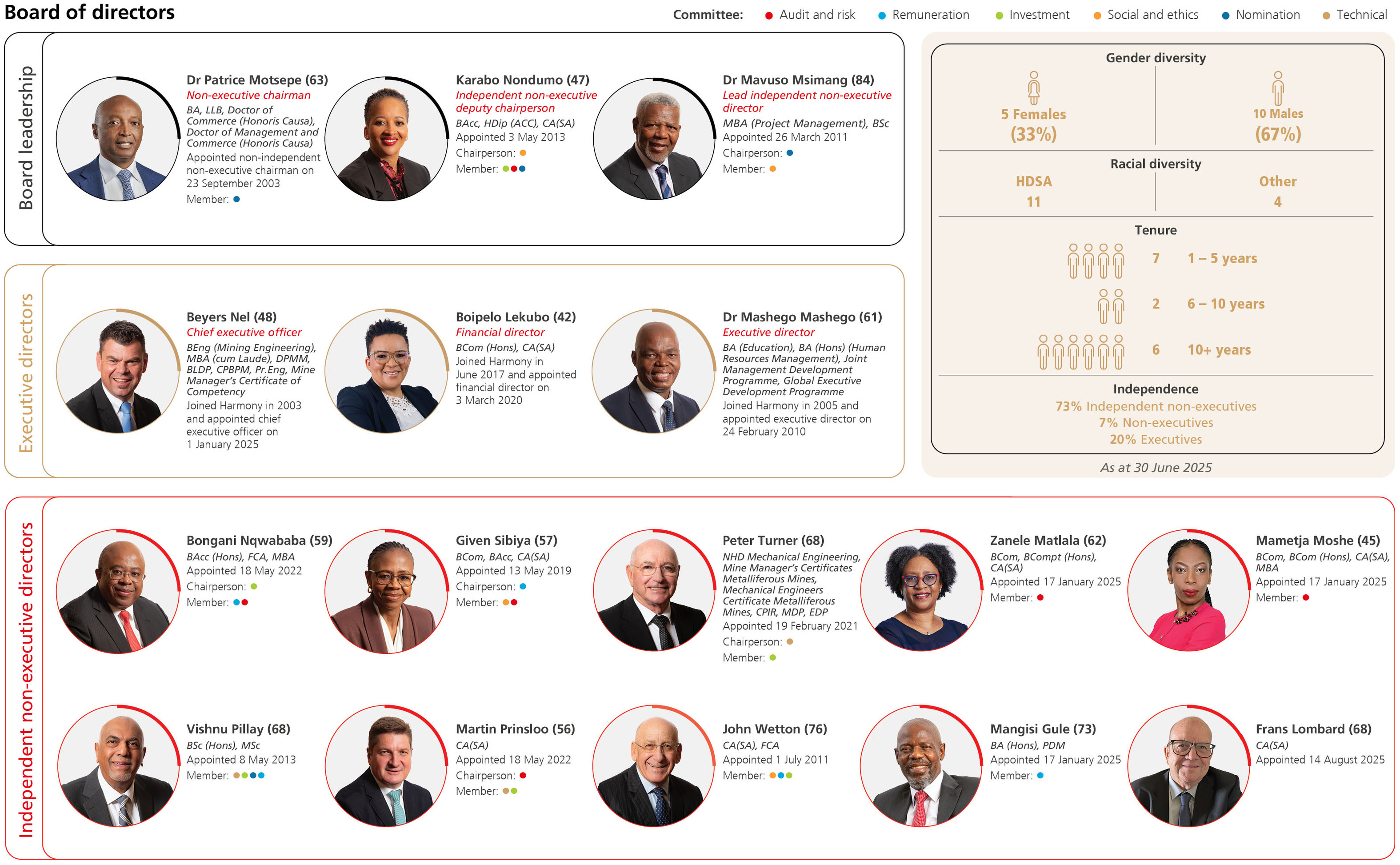

Our leadership

7

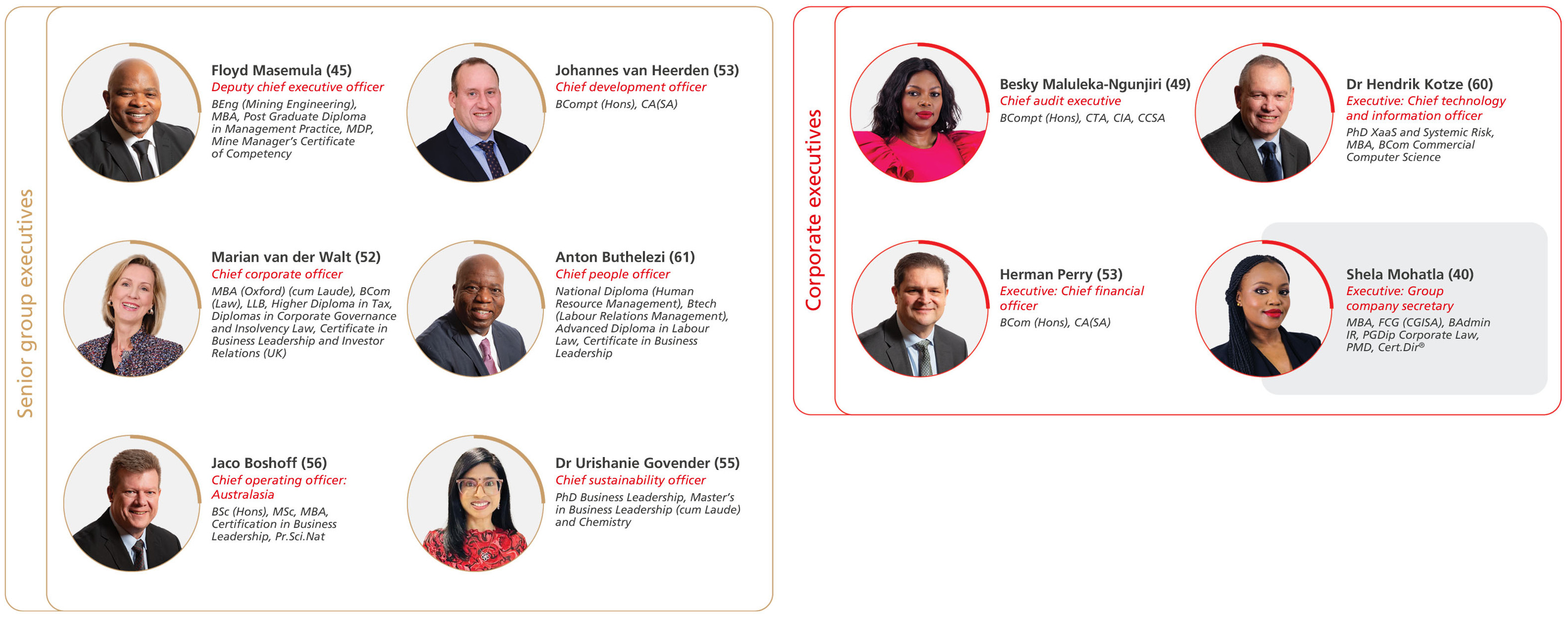

Executive management

Harmony’s executive management team comprises the chief executive officer, financial director and an executive director (see above). Together with six prescribed officers, they serve as the group executive committee.

This committee is supported by four corporate executives, who make up the group chief executive’s office.

There are also regional executive committees for South Africa and Australasia.

Detailed résumés of members of Harmony’s executive management are available at www.harmony.co.za/who-we-are/executive.

8

Chairman’s statement

Dear shareholders and

stakeholders

FY25 was a year of strong performance and

excellent execution by Harmony’s

management.

It also marked our 75th anniversary, a

milestone that celebrates our proud legacy as

a leading gold miner and our transformation

into a globally competitive gold-copper

producer.

This was also our 10th consecutive year of

meeting production guidance, an objective

that is seldom achieved in our sector. This is

testament to our operational excellence and

world class leadership.

These achievements illustrate the consistency

of our performance, and our continued

commitment to creating long-term value

through operational excellence and effective

capital allocation.

Performance and financial strength

Harmony once again delivered strong

operational and financial results in FY25,

despite persistent currency volatility,

macroeconomic complexity, and geopolitical

uncertainty.

Gold production reached 1.48Moz at an

underground recovered grade of 6.27g/t, with

all-in sustaining costs of R1 054 346/kg

(US$1,806/oz). Supported by unprecedented

gold prices, excellent operational

performances, Harmony generated record

adjusted free cash flows of R11.1 billion at a

15.1% margin.

Headline earnings grew by 26.6% with the

highest dividend payout of R2.4 billion

(US$133 million) for FY25.

Harmony ended the year with a net cash

position of R11.1 billion (US$628 million) and

liquidity of R20.9 billion (US$1.18 billion),

providing the flexibility to fund growth, sustain

competitive dividends and maintain a robust

and resilient balance sheet.

This strong financial position will enable

continued investment in our portfolio of high-

quality, long-life gold and copper assets,

ensuring enduring value creation for our

shareholders and stakeholders.

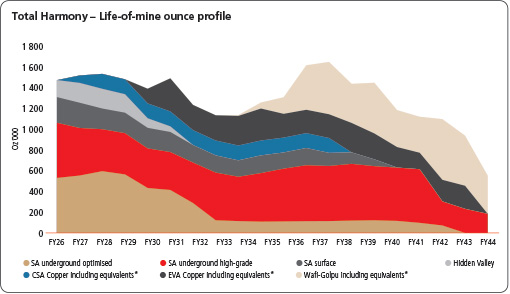

Strategic growth: gold and copper

Gold remains the cornerstone of Harmony’s

portfolio, underpinned by our world-class,

high-grade, long-life assets at Mponeng and

Moab Khotsong, which continue to generate

exceptional margins and cash flow.

Concurrently, copper has emerged as a central

pillar of our growth strategy, a critical metal

for the global energy transition and a natural

strategic complement to our gold portfolio.

In FY25, the Eva Copper, copper Mineral

Resources increased by 31%, underscoring its

quality and scale. We also announced the MAC

Copper acquisition, adding the CSA Mine in

Australia, a high-grade, cash-generating asset.

This acquisition brings over 40kt per annum of

immediate copper production. Our copper

portfolio which includes, Eva Copper and Wafi-

Golpu, firmly positions Harmony as an

emerging, globally competitive gold and

copper producer.

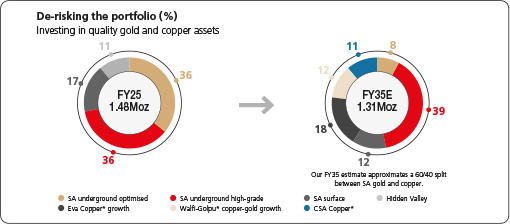

We expect copper to contribute around 40%

of group production by FY35, ensuring

structural resilience through commodity cycles

and aligning Harmony with global

decarbonisation trends.

Safety and sustainability

Safety remains our highest priority and a

fundamental pillar of our operational

philosophy. We are deeply saddened by the

loss of 11 colleagues during the year. We

extend our heartfelt condolences to their

families and loved ones. Every loss is one too

many.

Our commitment to zero harm remains

unwavering, supported by dedicated and

visible leadership, proactive risk management,

and technology-driven monitoring across all

operations. Our LTIFR improved to 5.39 in this

financial year.

Sustainability continues to underpin our long-

term competitiveness. In FY25, we advanced

our decarbonisation roadmap, targeting a 63%

reduction in Scope 1 and 2 emissions by 2036

and net zero by 2045. Nearly 600MW of

renewable energy projects are planned to be

commissioned by 2028, including a 100MW

solar plant under construction at Moab

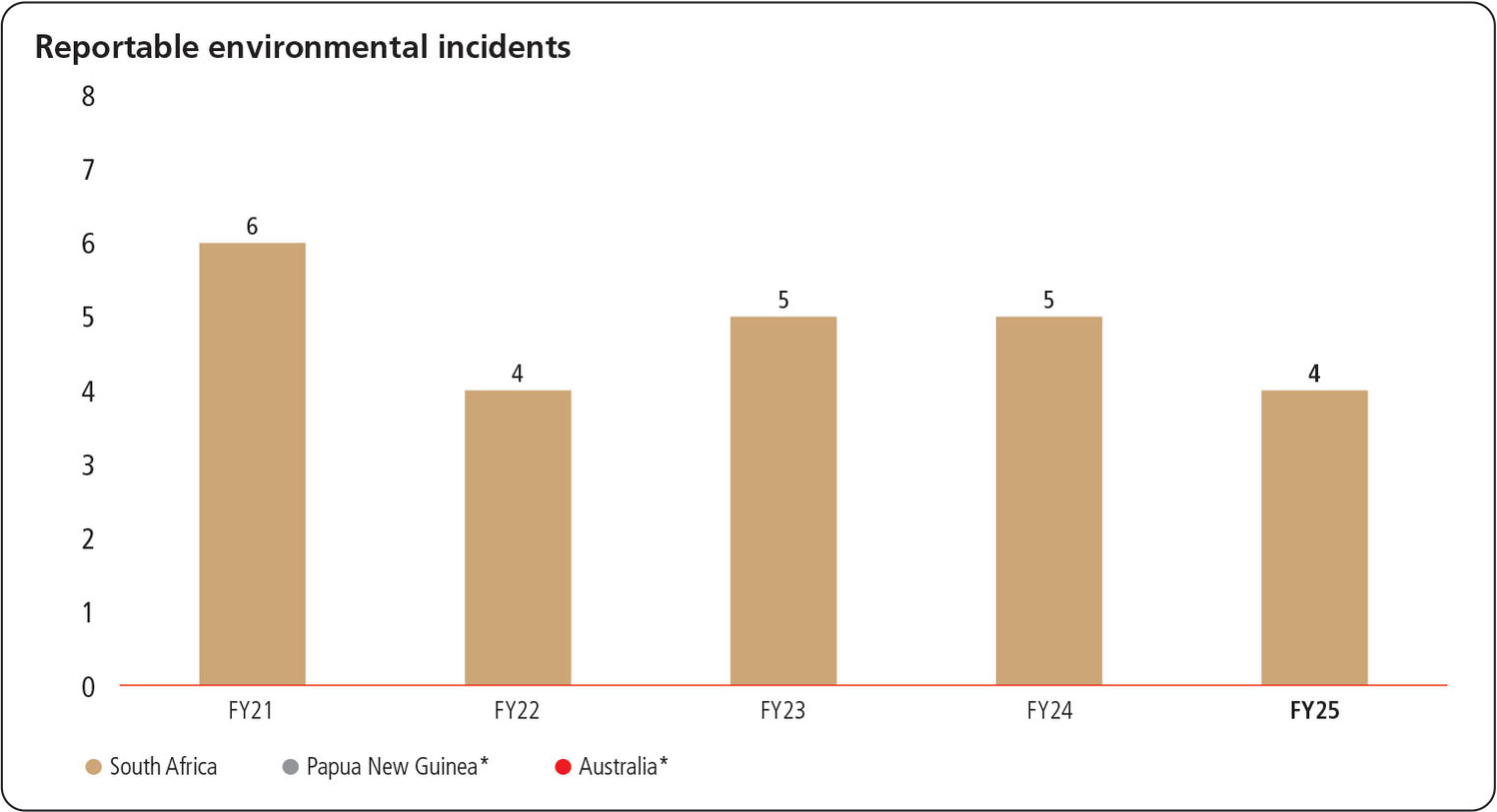

Khotsong. We recorded no environmental

incidents above level 3, a reflection of

disciplined environmental management.

Refer to social and ethics chairperson’s report.

Responsible mining and shared value

Harmony’s objectives and commitment

extends beyond mining ounces; it is about

creating lasting socio-economic impact. In

FY25, we contributed R6.0 billion (US$331

million) in taxes and royalties in South Africa

and R304 million (US$16.7 million) in Papua

New Guinea. We continue to be a trusted

partner in the communities and countries

where we operate.

Employee salaries and benefits totalled

R20.2 billion (US$1.1 billion), complemented

by significant investment in local procurement

and community development. The five-year

wage agreement concluded in FY24 continues

to provide stability and strengthen our

partnership with employees and unions,

reinforcing our commitment to shared

prosperity.

Governance and leadership

Harmony’s business is built on a strong ethical

foundation, underpinned by core values that

shape our organisational culture and guide

every decision we make.

We remain deeply committed to upholding

the highest standards of corporate

governance, transparency, integrity and

accountability across all aspects of our

business.

Our comprehensive governance framework

continues to guide strategic decision-making

and safeguards the long-term value we create

for all stakeholders.

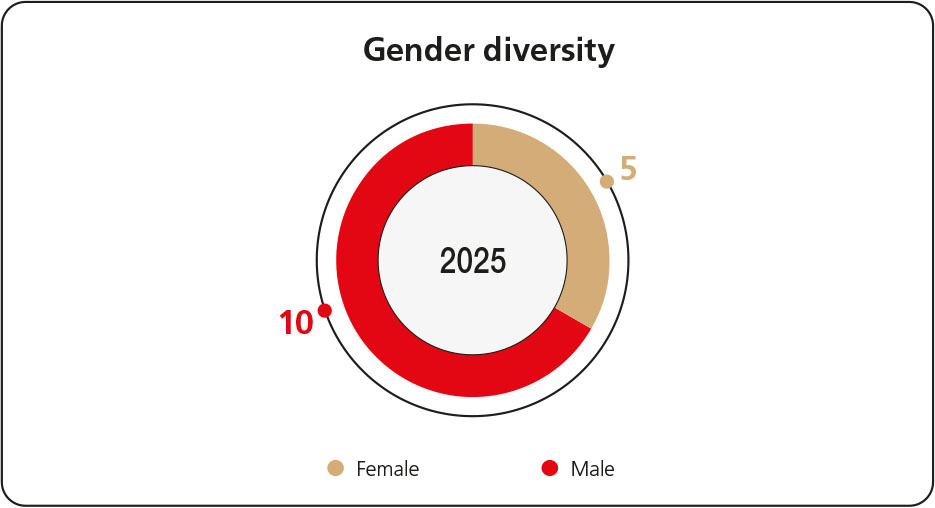

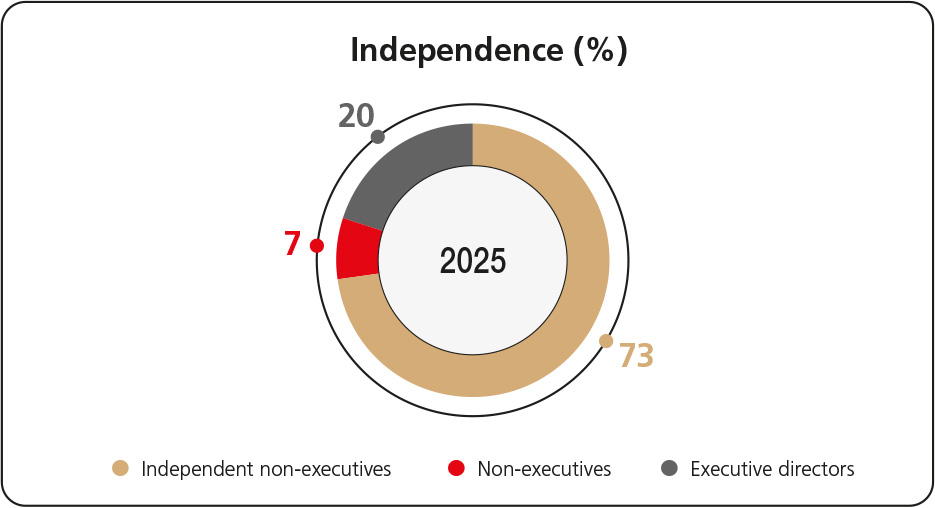

During the year, we welcomed Mametja

Moshe, Zanele Matlala, Mangisi Gule, and

Frans (“Faan”) Lombard to the Board. These

appointments strengthen the independence,

expertise and diversity necessary for robust,

well-informed decision-making and effective

oversight of strategy.

We also extend our sincere gratitude to John

Wetton, who retires by rotation this year.

After many years of dedicated service, John

will not be standing for re-election, though

eligible. This will be effective as of the

conclusion of the 2025 annual general

meeting.

The Board continues to review its composition

annually to ensure it retains the optimal

balance of skills, experience, and

independence required to support strategic

delivery.

As part of our ongoing transition plan, we are

aligning our governance practices with global

best standards to ensure accountability,

transparency, agility, and long-term

sustainability.

Looking ahead

As we mark 75 years of Harmony, our strategy

remains clear and focused and is to:

▪deliver safe, profitable ounces while

investing in value accretive growth;

▪generate strong cash flows and maintain a

robust balance sheet;

▪advance copper integration into our

portfolio, and thereby diversify earnings

▪support and benefit from the global energy

transition;

▪embed sustainability.

Acknowledgments

On behalf of the Board, I extend my heartfelt

gratitude to our employees, unions,

communities, partners, and shareholders for

their cooperation and continued support

throughout the year. Your dedication and

partnership are central to Harmony’s

sustained success.

9

I also wish to express my personal gratitude to

my fellow Board members for their advice,

insight and steadfast commitment to the

highest standards of governance and ethical

leadership. Their collective wisdom and

oversight continue to strengthen Harmony’s

strategic direction and resilience.

I would like to express our deep gratitude to

Peter Steenkamp for his outstanding

leadership and many years of success as CEO,

which have been pivotal to Harmony’s

transformation and growth.

We warmly welcome Beyers Nel, who

succeeded Peter as Group CEO on

1 January 2025. Beyers brings deep

operational expertise, technical insight, and a

strong understanding of Harmony’s strategic

priorities.

The Board has full confidence that, under

Beyers’ leadership, Harmony will continue to

create sustainable value, advance copper

integration, and strengthen its position as a

diversified and globally competitive company.

The board, management and staff are

committed to continue building on Harmony’s

proud legacy and to strengthen the company’s

position as a leader in gold production while

expanding our copper portfolio to ensure

Harmony’s global competitiveness.

Dr Patrice Motsepe

Chairman

24 October 2025

10

Chief executive officer’s review

FY25 marked another year of consistent

delivery for Harmony. We met our production

guidance for the 10th consecutive year,

generated record adjusted free cash flows and

delivered strong shareholder returns. As we

celebrate our 75th anniversary, we remain

rooted in gold while evolving into a global,

low-cost gold and copper producer.

Copper, a critical enabler of the energy

transition, strengthens our portfolio and

supports long-term value creation.

Our purpose – creating shared value through

responsible mining – continues to guide our

strategy. Safety, operational excellence and

disciplined capital allocation remain non-

negotiable. This approach has delivered a

decade of consistency and positioned us

for sustainable growth, robust cash flow

generation supported by quality orebodies,

expanding international assets and strong

stakeholder relationships.

Our progress over recent years owes much to

the vision and commitment of my

predecessor, Peter Steenkamp, whose

leadership laid a solid foundation for our

continued growth.

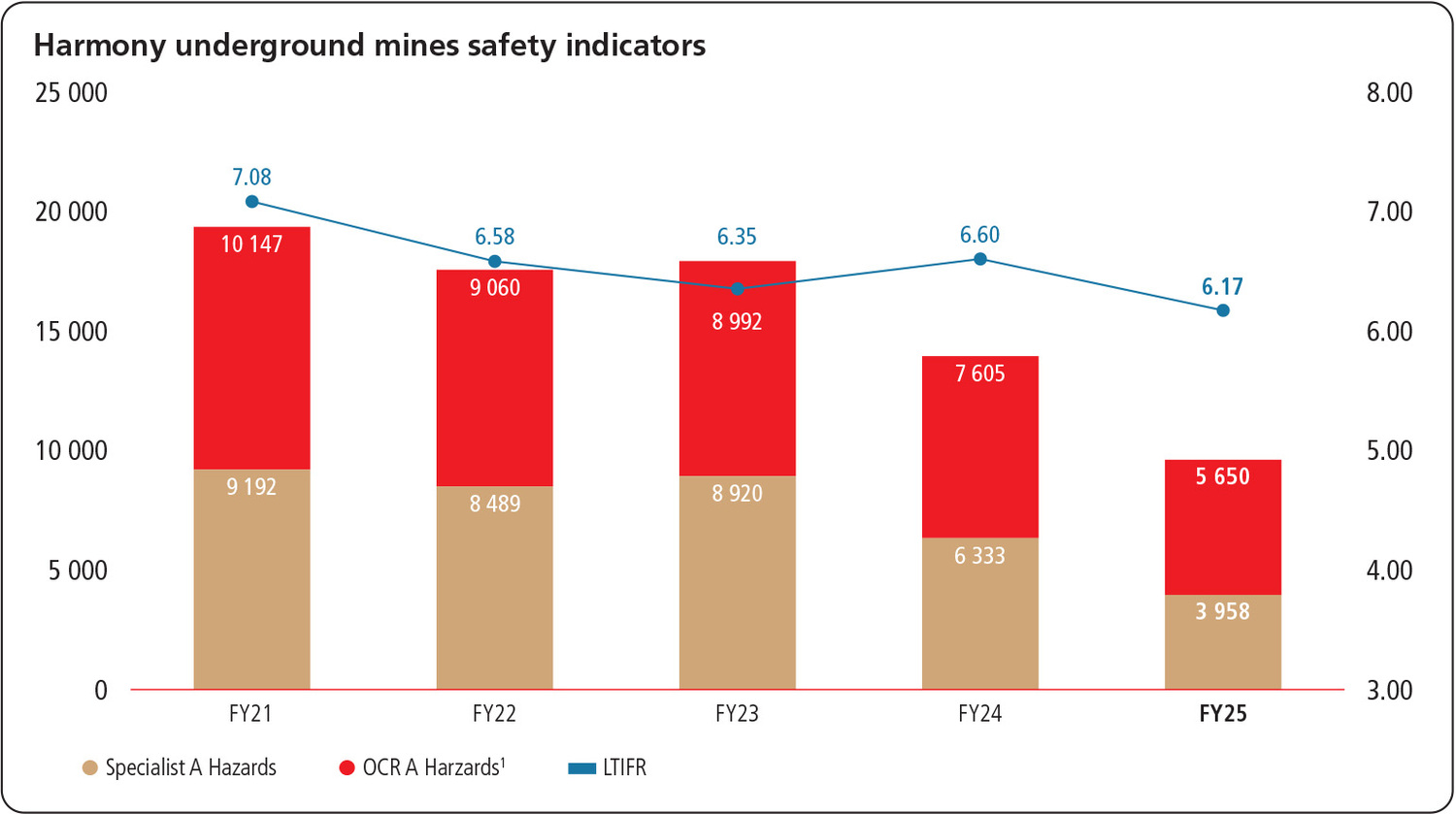

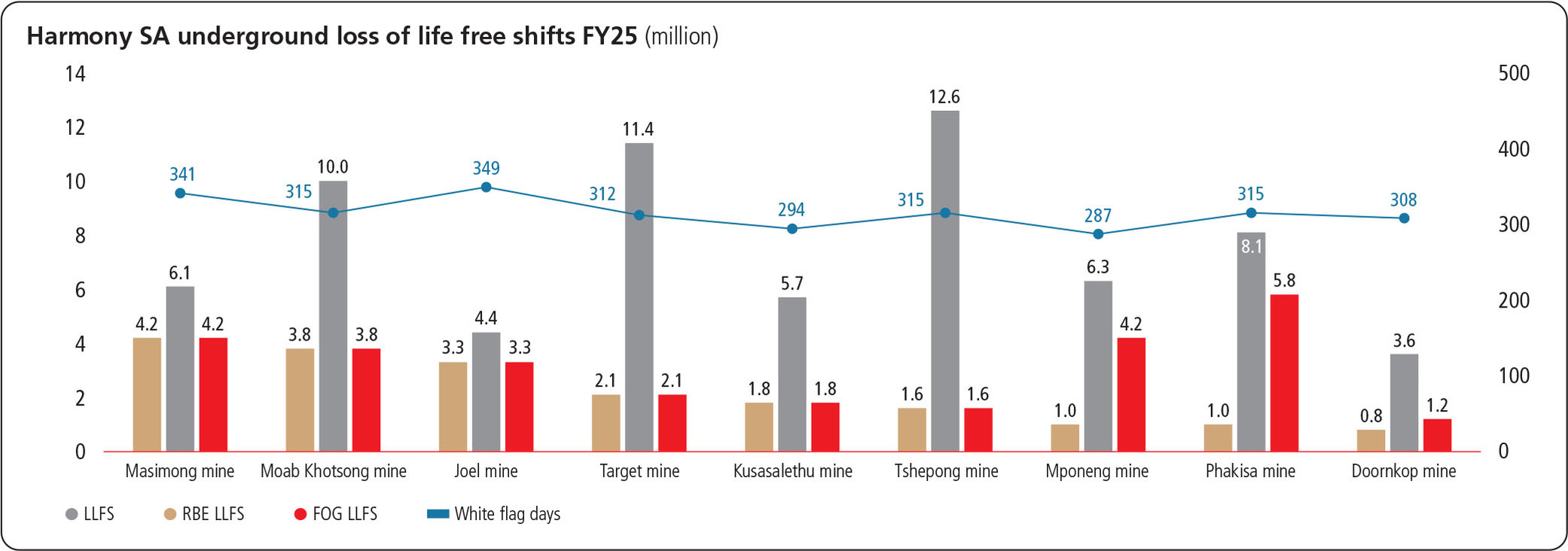

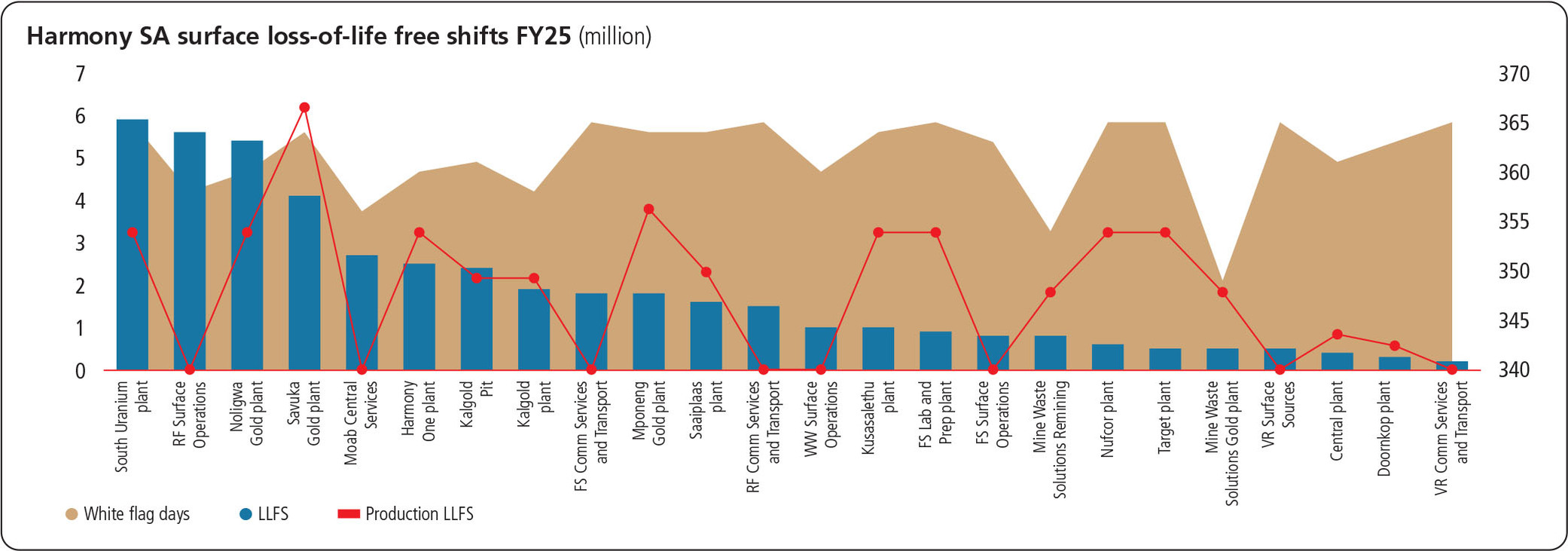

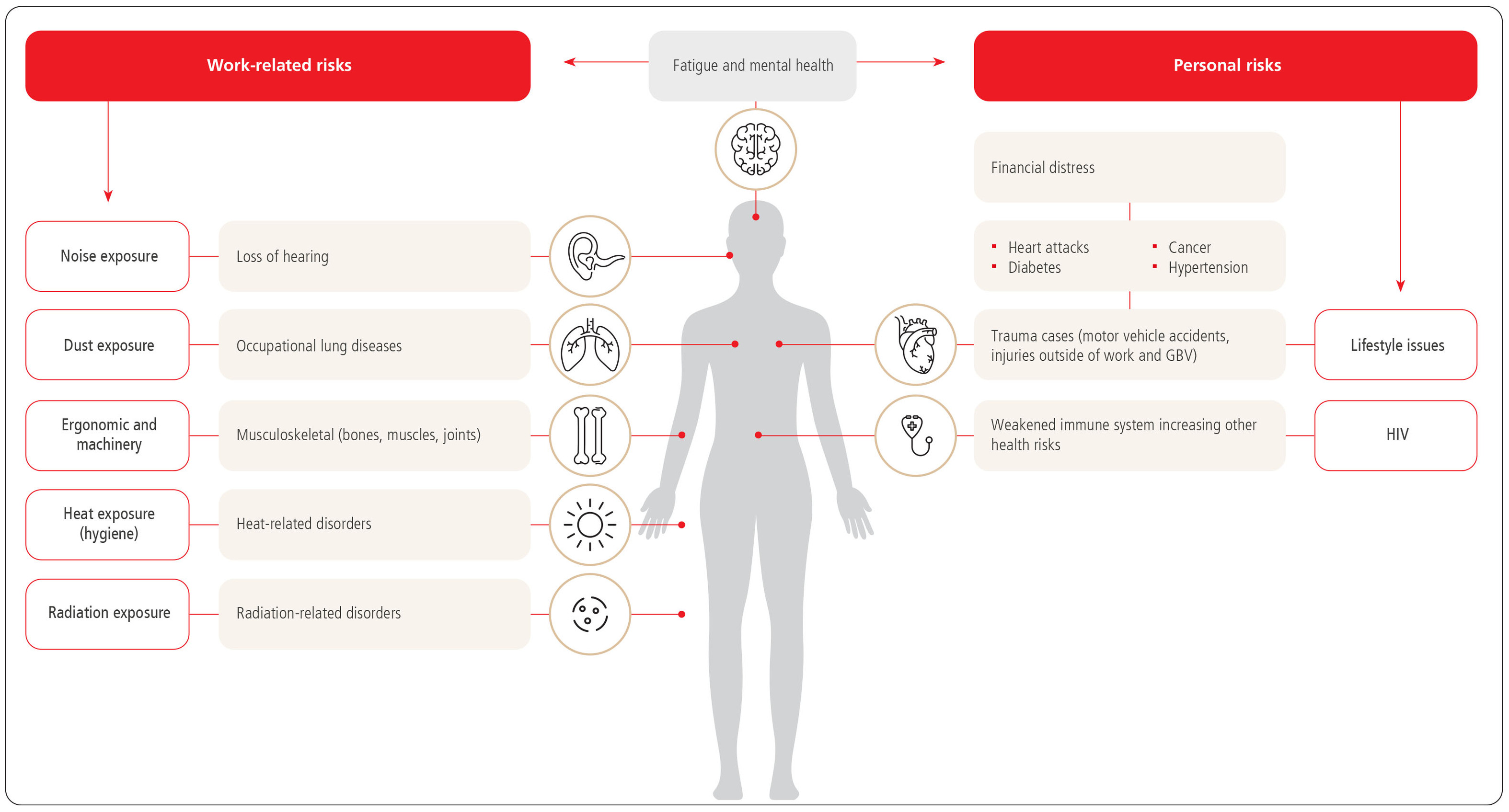

Safety and operational excellence

Safety remains our top priority. While our LTIFR

continues to trend lower and despite reaching

a record low of 5.39 per million hours worked,

we tragically lost 11 colleagues this year. We

continue to strengthen our safety culture,

guided by a robust strategy and proactive risk

management. Our humanistic transformation

journey is 79% complete, and we are investing

in relevant technologies, training and

leadership engagement to achieve zero harm.

Operationally, we met our production, cost

and grade guidance in FY25. Underground

recovered grades rose by 2.6% to 6.27g/t.

Although total production declined by 5.3% to

46 023kg (1 479 671oz) in line with plan, this

remained within guidance. Our high-grade

South African underground mines, particularly

Mponeng, alongside Hidden Valley in Papua

New Guinea, delivered exceptional results.

Higher grades and a 27.2% increase in the

average gold price to R1 529 358/kg

(US$2 620/oz) drove a 21.4% increase in gold

revenue. Headline earnings per share rose

by 26.2% to 2 337 SA cents, while basic

earnings per share increased by 66.9% to

2 313 SA cents.

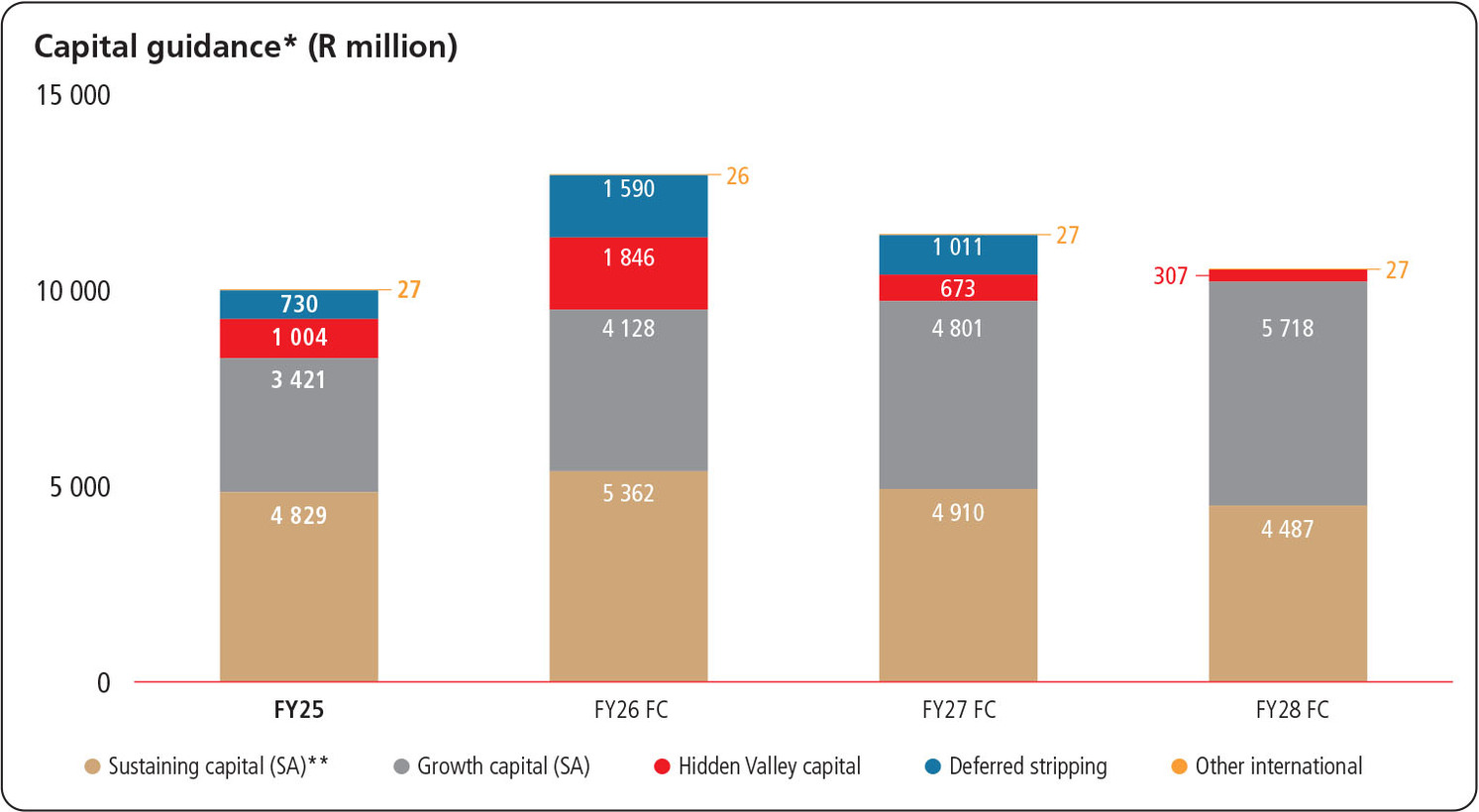

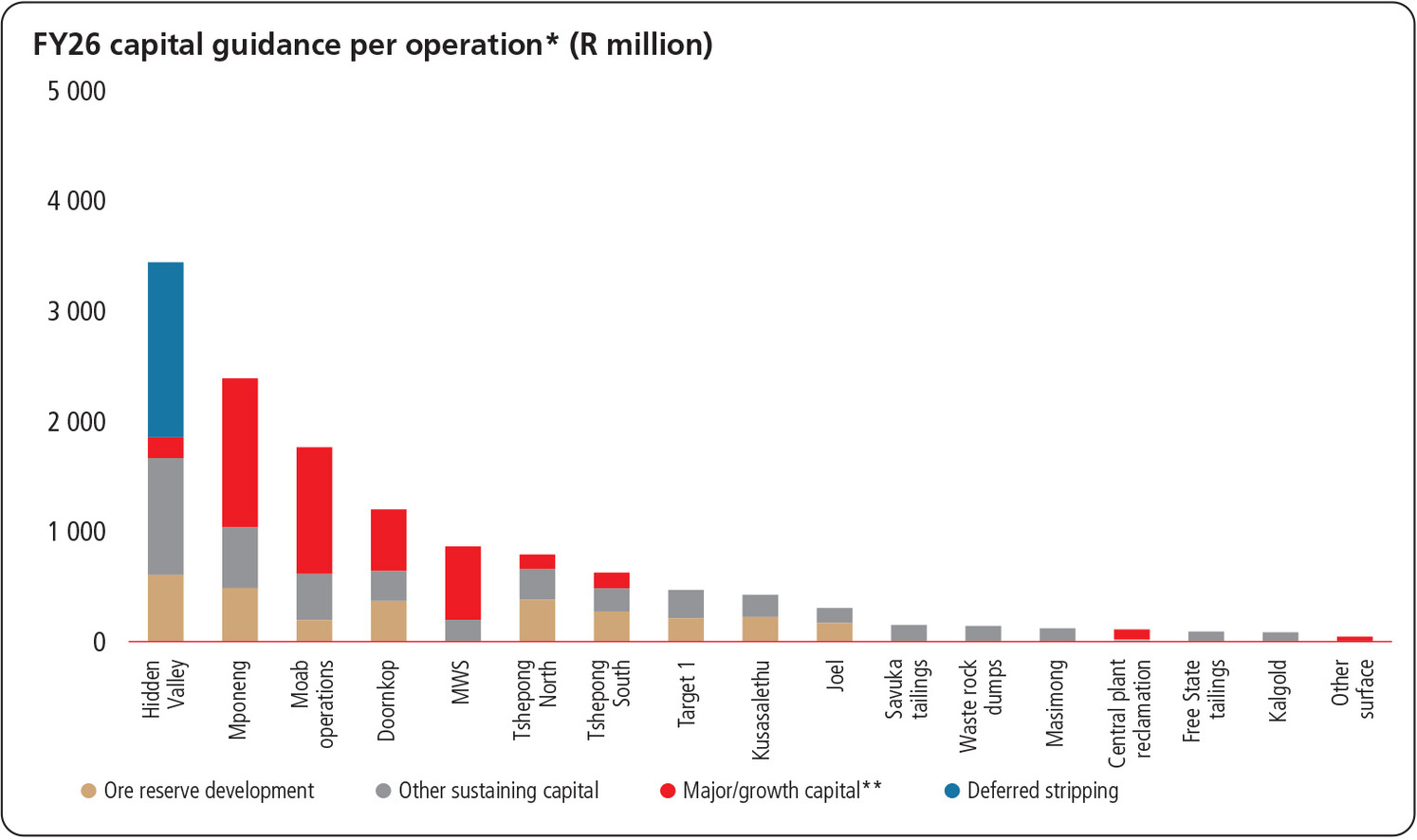

Capital expenditure reached R11.0 billion,

a function of directing capital to assets and

projects that will deliver the best possible

returns. Capital expenditure in the past

financial year was driven mainly by the

extension projects at Moab Khotsong and

Mponeng, the 100MW renewable energy

project at Moab Khotsong, early works at the

Eva Copper Project and the Kareerand TSF

extension, which is largely complete.

In memoriam | ||

Mojalefa Segage Moab Khotsong mine – rock drill operator | ||

Phakamani Khiphezakho Gumbi Doornkop mine – machine rock driller | ||

Telang Nene Doornkop mine – machine rock driller | ||

Moloja Samuel Leteketa Joel mine – rock drill operator | ||

Morero Patric Taeli Joel mine – rock drill operator | ||

Themba Ephraim Maloka Joel mine – stope team member | ||

Fundile Mdungelwa Mponeng mine – scraper winch operator | ||

Andile Goodman Toko Mponeng mine – mining team member | ||

Joaquim Alfredo Chihobomo Cossa Moab Khotsong mine – loco operator | ||

Lebamang Senetane Saaiplaas plant – general worker | ||

Lebohang Mokiri Joel mine – stope team member | ||

Consistent safety improvements | Total gold produced | Growth capital spent | Adjusted free cash flow | |||||||||||

▪Group LTIFR1 at 5.39 from 5.53 in FY24 and 7.21 from FY17. | ▪46 023kg (1 479 671oz) ▪This is down 5.3%, but still within the FY25 production guidance. | ▪R11.0 billion (US$606 million) allocated towards projects. | ▪+53.6% to R11.1 billion (US$614 million) ▪15.8% margin. | |||||||||||

Underground recovered grades | AISC2 | Robust balance sheet | Final dividend | |||||||||||

▪+2.6% to 6.27g/t ▪Met our revised guidance of more than 6.00g/ t. | ▪R1 054 346/kg (US$1 806/oz) ▪Costs remain contained and within guidance. | ▪Net debt:EBITDA3 ratio of <1x. | ▪155 SA cents ▪9 US cents4. | |||||||||||

1 LTIFR: Lost-time injury frequency rate. 2 AISC: All-in sustaining cost. | 3 EBITDA: Earnings before interest, taxes, depreciation and amortisation. 4 Illustrative equivalent based on the closing exchange rate of R17.45/US$1 as at 22 August 2025. | |||||||||||||

11

Financial strength and cost discipline

Harmony maintained strong cost controls, with

AISC below guidance at R1 054 346/kg (US$1 806/

oz). Total labour costs, representing 51.6% of cash

operating costs, remained predictable due to our

five-year wage agreement. By investing in

renewable energy, the effects of escalating

electricity tariffs are being reduced and will

continue to be offset over time. Royalties increased

significantly as a result of higher revenue and

improved profitability, contributing 4.4% to SA cash

operating costs.

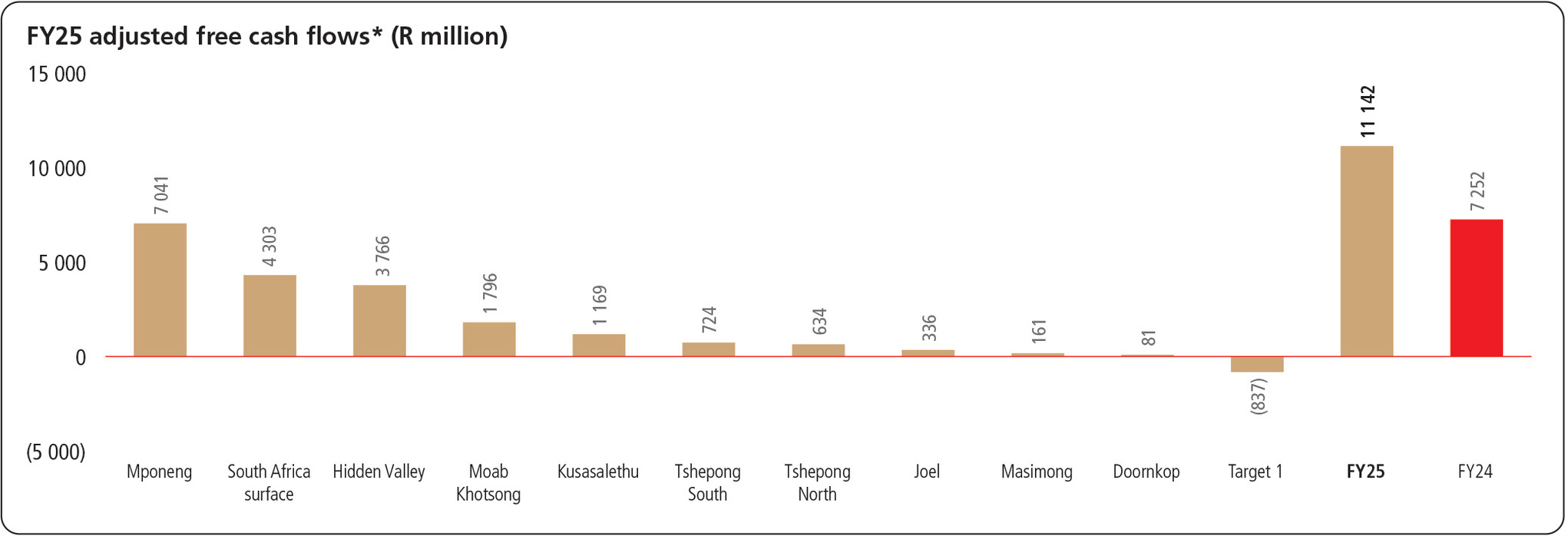

We ended FY25 with R20.9 billion (US$1.2 billion)

in available liquidity and net cash increased by

284.5% to R11.1 billion (US$628 million). Adjusted

free cash flow surged to a record level of

R11.1 billion (US$614 million), driven by higher

recovered grades, elevated gold prices and the

increased contributions from our high-margin

surface operations in South Africa and Papua New

Guinea as well as Mponeng. These strong cash

flows provide flexibility to fund growth, sustain

dividends, and pursue value-accretive acquisitions.

Sustainability embedded in strategy

Sustainability is central to our strategy and

decision making. Our framework addresses global

imperatives and local challenges, including safety,

reserve replacement, energy security, land

rehabilitation, water stewardship, and community

wellbeing.

We received external recognition for our

sustainability practices, including inclusion in

the FTSE4Good Index for the eighth consecutive

year, an A- rating for water management, and an

upgraded MSCI ESG rating to BB.

Our decarbonisation roadmap includes

investments in renewable energy and efficiency.

We have deployed 30MW of solar capacity, with a

further 100MW currently under construction. We

aim to install approximately 600MW of

renewables and an additional 200MW via short-

term power purchase agreements by FY28. These

investments will reduce scope 1 and 2 emissions

by 63% by FY36, lower our energy costs and

support our net-zero goal by FY45.

Tailings retreatment is a core part of our business

and offers attractive margins and ESG benefits. We

are advancing feasibility studies to convert 5.7Moz

of Mineral Resources in the Free State into

Reserves.

We invest significantly in community

development, benefiting thousands of people and

reinforcing our commitment to building trust and

lasting relationships.

Operational performance

Our operations are divided into four quadrants,

based on our capital allocation strategy: South

African underground high-grade, South African

underground optimised, South African surface,

and international gold and copper. Each plays a

vital role in generating cash, sustaining growth,

and diversifying risk ensuring we consistently

deliver to guidance. Importantly, in FY25, 64% of

our production, excluding SA optimised

underground business area, was at an AISC below

US$1 500/oz.

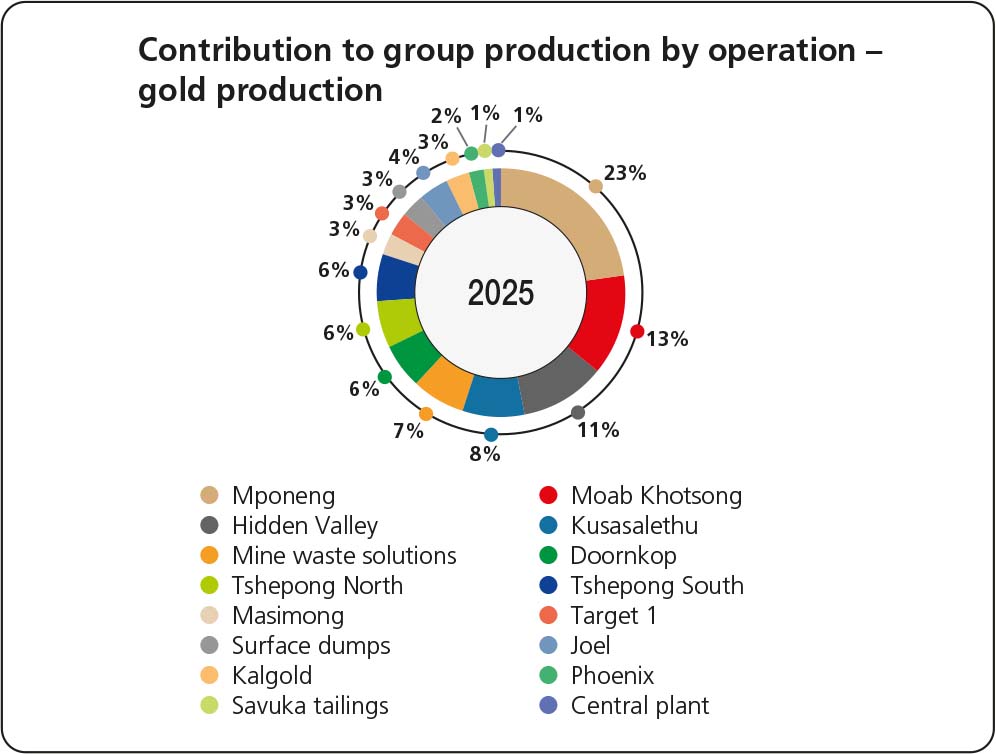

South African high-grade underground operations

(Mponeng and Moab Khotsong) delivered a 9.7%

improvement in recovered grades to 9.89g/t.

These assets contributed 36% of production and

generated 46.1% of our adjusted free cash flows at

a margin of 34.6%. Mponeng’s performance was

particularly strong, with a 13.4% increase in grade

to 11.27g/t. These long-life assets continue to

generate strong free cash flows and remain central

to our long-term strategy.

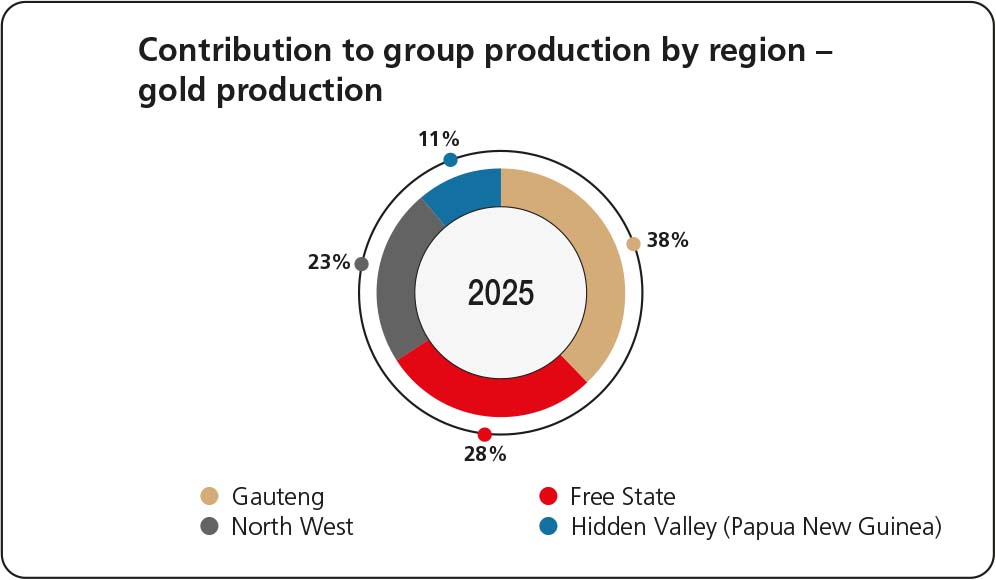

International operations at Hidden Valley

maintained gold production at 5 107kg

(164 193oz). This mine contributed 11.1% of total

production and generated 19.6% of total adjusted

free cash flows at a phenomenal 47.5% margin.

The life-of-mine was extended to March 2030 and

studies are underway to assess further extensions

beyond 2030.

SA surface operations performed in line with

expectations, though excessive rainfall impacted

production at Mine Waste Solutions. Despite

lower recovered grades, adjusted free cash flow

generation remained strong. These operations

contributed 17.1% of group production and

generated 22.4% of our adjusted cash flows

at a 36% margin.

South African optimised underground operations

(Doornkop, Tshepong North, Tshepong South, Joel,

Target 1, Kusasalethu and Masimong) contributed

35.8% to group production and generated 11.8%

of group adjusted free cash flows at a 9% margin.

Despite operational challenges and a 13.5%

decline in production, these assets delivered

positive adjusted free cash flows – supporting our

social licence and funding of our various projects.

International gold and copper projects

At Eva Copper in Australia, we have completed over

153 000 metres of drilling since acquisition,

increasing copper resources by 31% and gold by

11.8%. The feasibility study is in its final phase,

and we are exploring long-term power solutions.

Eva Copper was declared a prescribed project

by the Queensland Government, supporting our

environmental authority amendment application.

We are expecting to release the results of the

Feasibility Study update before the end of calendar

2025.

We continue negotiations to secure the mining

lease for Wafi-Golpu, a transformational and key

asset in our international growth strategy.

Strategic capital allocation

Our capital allocation framework ensures

disciplined investment aligned with our four

strategic pillars: Responsible stewardship,

operational excellence, cash certainty and

effective capital allocation.

Group capital expenditure remains focused

on delivering safe, profitable ounces and

maintaining flexibility at our mines. Most of our

major capital is directed towards our high-grade

underground, high-margin surface assets and

international copper-gold growth projects.

We have maintained a consistent and clear

hedging strategy to lock-in margins and protect

our balance sheet as we execute on our

comprehensive project pipeline. In line with our

policy, we hedge up to 30% of gold production

over a rolling period of 36 months to protect

margins and ensure operational and financial

stability. This supports consistent performance

during elevated capital investment periods.

A final dividend of 155 SA cents (9 US cents)

per share was declared, bringing total FY25

shareholder payout to a record R2.4 billion

(US$133 million).

Outlook and priorities

We remain committed to protecting our balance

sheet and cash flow, ensuring growth is affordable

and sequenced. Our focus is on safety, portfolio

quality, profitability, growth and sustainable

mining.

FY26 guidance includes production of 1.4Moz

to 1.5Moz at an AISC of R1 150 000/kg to

R1 220 000/kg. Underground recovered grade

is guided above 5.8g/t. Capital expenditure is

expected to rise to R13.0 billion (US$699 million),

reflecting strategic investments in high-quality

ounces and long-term growth. Included in this is the

once-off fleet replacement at Hidden Valley due to

the life-of-mine extension.

We will revisit guidance in February 2026,

contingent on the successful MAC Copper

transaction and the updated Feasibility Study

for Eva Copper.

MAC Copper acquisition

In May 2025, we announced the US$1.03 billion

acquisition of MAC Copper Limited, owner of CSA

mine in Cobar, New South Wales.

This acquisition marks a significant step in our

transformation into a global gold-copper producer.

Regulatory approvals have been received and the

transaction is concluding and takes effect on 24

October 2025.

A note of thanks

I extend my heartfelt thanks to every Harmonite

for their dedication and hard work in FY25. As

I reflect on my first 10 months as CEO, I am proud

of what has been achieved as a team. I encourage

all employees to embrace a leadership mindset –

proactively shaping our future and driving

progress.

Thank you to our board, unions, shareholders, and

stakeholders for your continued support. Special

thanks to our chairman and again my predecessor,

Peter Steenkamp, for their leadership and vision.

As we celebrate 75 years of Harmony, we do so

with pride in our legacy and confidence in our

future as we transform into a high-quality,

geographically diversified gold and copper

producer. This is mining with purpose.

Beyers Nel

CEO

24 October 2025

12

Business model

Our business model explains how we create value through our inputs, the business activities we undertake and the outcomes we achieve.

We draw on different resources and relationships (our capitals) as inputs, and through our business activities, transform them into outputs that, in turn, lead to broader outcomes that impact our capitals. We recognise

that our outcomes impact our future inputs across the capitals. Together with other stakeholders and elements that make up our external environment, our outcomes influence capital availability, quality and

affordability. This continuous interplay influences the efficacy of our business model. The details that follow highlight how we mine with purpose, managing our inputs, delivering on our strategy while we manage

related risks and leverage opportunities.

Harmony remains South Africa’s largest gold producer, mining with purpose while strategically diversifying into copper to enhance resilience, improve margins, align with global decarbonisation trends, and deliver enduring value for shareholders and stakeholders. | ||

13

Inputs | ||||||||||||||||||||||

Our diverse internal and external capitals both depend on and impact the geographical, geopolitical and regulatory environments in which we operate. They differentiate us from our peers, strengthening Harmony’s resilience in the short, medium and long term. We also manage the interdependencies between the capitals, considering how their affordability, quality and availability could impact Harmony’s long-term value creation. | ||||||||||||||||||||||

Financial capital | Manufactured capital | Intellectual capital | Human capital | Social and relationship capital | Natural capital | |||||||||||||||||

Our financial capital comprises funds sourced from investors, external financing and internally generated cash. These resources are strategically invested in high-quality assets and projects that drive Harmony’s sustainable growth. For the 10th consecutive year, we have met production and, this year, generated record free cash flows. With a strong cash position, prudent hedging and available facilities, we can fund capital projects while protecting profit margins and benefiting from gold price movements. | Our manufactured capital consists of the physical, material and technological infrastructure we own, lease or manage to support the production of gold, silver and uranium. We are diversifying into copper. With a strong presence across multiple geographies that includes a robust project pipeline, our goal is to reduce risk and improve margins. Our portfolio includes long-life assets with excellent resource-to-reserve conversion potential. | Our intellectual capital is the intangible value of our deep industry expertise and experience, including mining, the circular economy, leadership, acquisitions and project development capabilities. As a specialist gold mining company evolving into copper, we have the opportunity to transfer our deep underground mining expertise, safety systems and operational excellence programmes to our copper acquisitions. | Our human capital includes our employees and contractors who enable the delivery of our business activities through their collective knowledge, capabilities and experience that includes specialised underground and open-pit capabilities. Our human capital strength also lies in the scale and localisation of employment, robust health and safety programmes, commitment to gender equity and inclusivity, and seasoned leadership. | This capital includes the relationships and partnerships essential for our licence to operate and to create shared value. Our intent is to be a partner of choice by building durable, trust-based relationships with our employees, suppliers, host communities and governments. Through impactful community investments and inclusive socio- economic transformation we demonstrate our commitment to being a socially responsible and relationship-focused mining house. | Our natural capital includes the essential resources (water, land, minerals and energy) required for our operations with sustainability embedded into our strategy and business model. We have a significant and diversified Mineral Resource base, strengthened by our expansion into copper. Through acquisitions and portfolio optimisation, we have increased grade quality. We are the world’s largest tailings retreatment operator. | |||||||||||||||||

Interdependencies and resource constraints | Interdependencies and resource constraints | Interdependencies and resource constraints | Interdependencies and resource constraints | Interdependencies and resource constraints | Interdependencies and resource constraints | |||||||||||||||||

▪We invest a significant amount of financial capital into all other capitals to secure the long-term success of our business ▪Our financial capital is impacted by factors beyond our control, including gold price fluctuations, inflation and rising electricity tariffs ▪Our derivative and hedging strategies remain responsive to persistent macro-economic instability. | ▪The availability and quality of manufactured capital depend on a significant investment of financial, intellectual and natural capital ▪Maintaining and modernising our operations are necessary for us to operate safely, efficiently and profitably. | ▪Culture transformation to achieve zero harm takes time, and requires human, financial, manufactured and social and relationship capital ▪Securing mining rights and leases can be challenging in the face of an ever-changing political, social and environmental landscape ▪Leveraging technology and innovation to improve our systems and processes will consume other capitals and take time to coordinate across operations. | ▪Our employees’ safety, health and wellbeing remain a top priority and requires a significant investment of social and relationship and financial capital ▪Sound employee relations are critical for us to succeed as a business ▪General and specialised skills in the mining sector need to be developed continuously to adapt to changing business requirements ▪Diversifying our employee profile remains challenging due to the mining industry being male dominated with underrepresentation of women at some levels. | ▪Safeguarding our reputation as a responsible miner is inextricably linked to how we manage the resources on which we rely, requiring significant financial, intellectual and human capital investments ▪Building trust and credibility in the multi-cultural and diverse regions where we operate is critical to maintain our social licence to operate ▪Collaborating and partnering with our key stakeholders is a business and moral imperative. | ▪Protecting the natural resources on which we rely depends on the availability of financial capital and the quality of manufactured capital, and could affect our human and social and relationship capital ▪Mining is an inherently dangerous industry and has significant potential to impact the biophysical environment ▪Our operations heavily rely on water, a scarce resource ▪Limited life-of-mines (LoMs) and depleting Ore Reserves could jeopardise our ability to create value ▪We rely on fossil-fuel electricity, negatively impacting our environmental and increasing operational costs. | |||||||||||||||||

14

Business activities and outputs |

Business activities | ||

Our business activities, guided by our Strategy, are underpinned by an operational competency developed over the past 75 years. We have well-balanced production performance while amplifying efficiencies thanks to ongoing business improvement initiatives across our operations. |

Outputs | ||

Our primary product is the gold we produce and sell to the market, followed by silver and uranium. Our activities also result in by-products and waste that we aim to reduce and mitigate. |

Outputs: Products | ||||

Gold produced 1.48Moz (FY24: 1.56Moz) | ||||

Silver produced 3.14Moz (FY24: 3.67Moz) | ||||

Uranium produced 488.05klb (FY24: 590.10klb) | ||||

Renewable energy generated 64.3GWh (FY24: 65.4GWh) | ||||

Business activities | ||

For details on each of the business activities, refer back to About Harmony. For our locations refer back to Operations. | ||

Outputs: Other | |||

¢ By-products Tonnes processed 50.90Mt (FY24: 51.32Mt) | |||

¢ Waste Hazardous waste to landfill 558t (FY24: 1 261t) | |||

¢ Emissions Total CO2 emissions 5 482 478t (FY24: 5 255 534t) | |||

Each country we operate in has its unique geopolitical and socio-economic operating environment and a broad network of stakeholders with varying needs, interests and expectations. Stakeholder needs and expectations both significantly influence, and are impacted by, our business activities and its outputs. They play a key role in shaping the creation and preservation of value, significantly influencing Harmony’s social licence to operate, risk management and sustainability practices. We therefore strive to stay connected to our stakeholders to understand their different needs, expectations and perceptions of Harmony. For more details refer to Stakeholder engagement. | ||

15

| Value created (net increase in capital) |  | Value preserved |  | Value eroded (net decrease in capital) |

Outcomes for Harmony and our stakeholders | ||||||||||||||||||||||

Our four strategic pillars translate our purpose into outcomes, generating sustainable returns through our focus on value over volume. The outcomes across the six capitals follow, highlighting a company balancing financial growth with social and environmental responsibilities, while strengthening the resilience of its business model and long-term value creation through effective governance. Our Strategy section details our four pillars, key trade-offs, resources allocated and our focus going forward. | ||||||||||||||||||||||

Financial capital  | Manufactured capital  | Intellectual capital  | Human capital  | Social and relationship capital  | Natural capital  | |||||||||||||||||

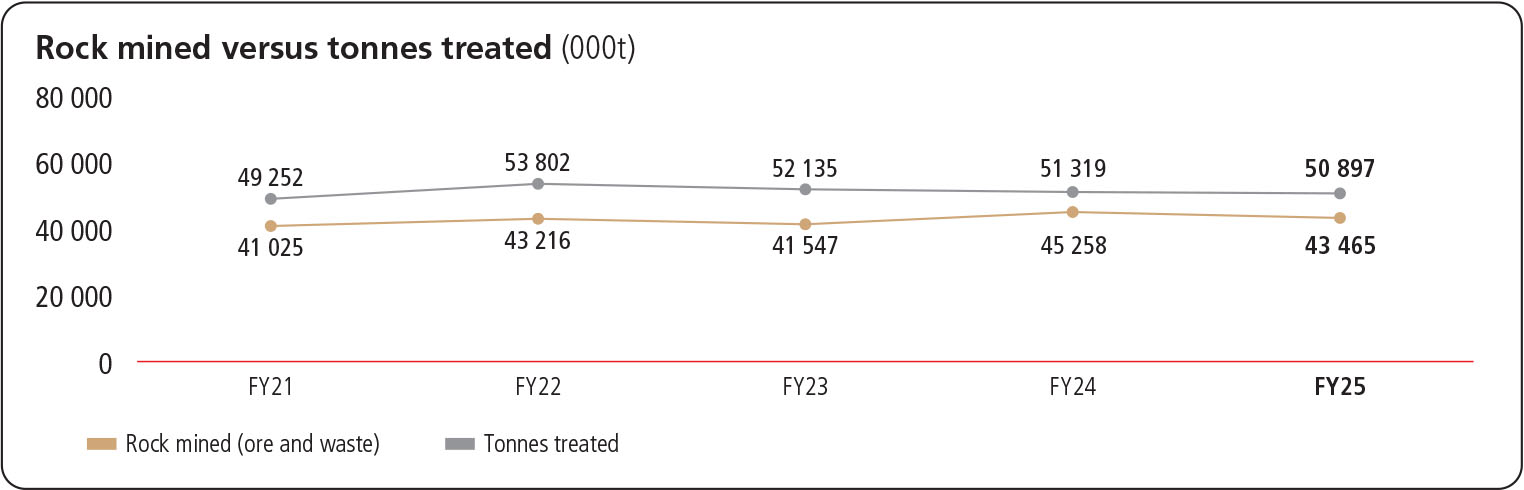

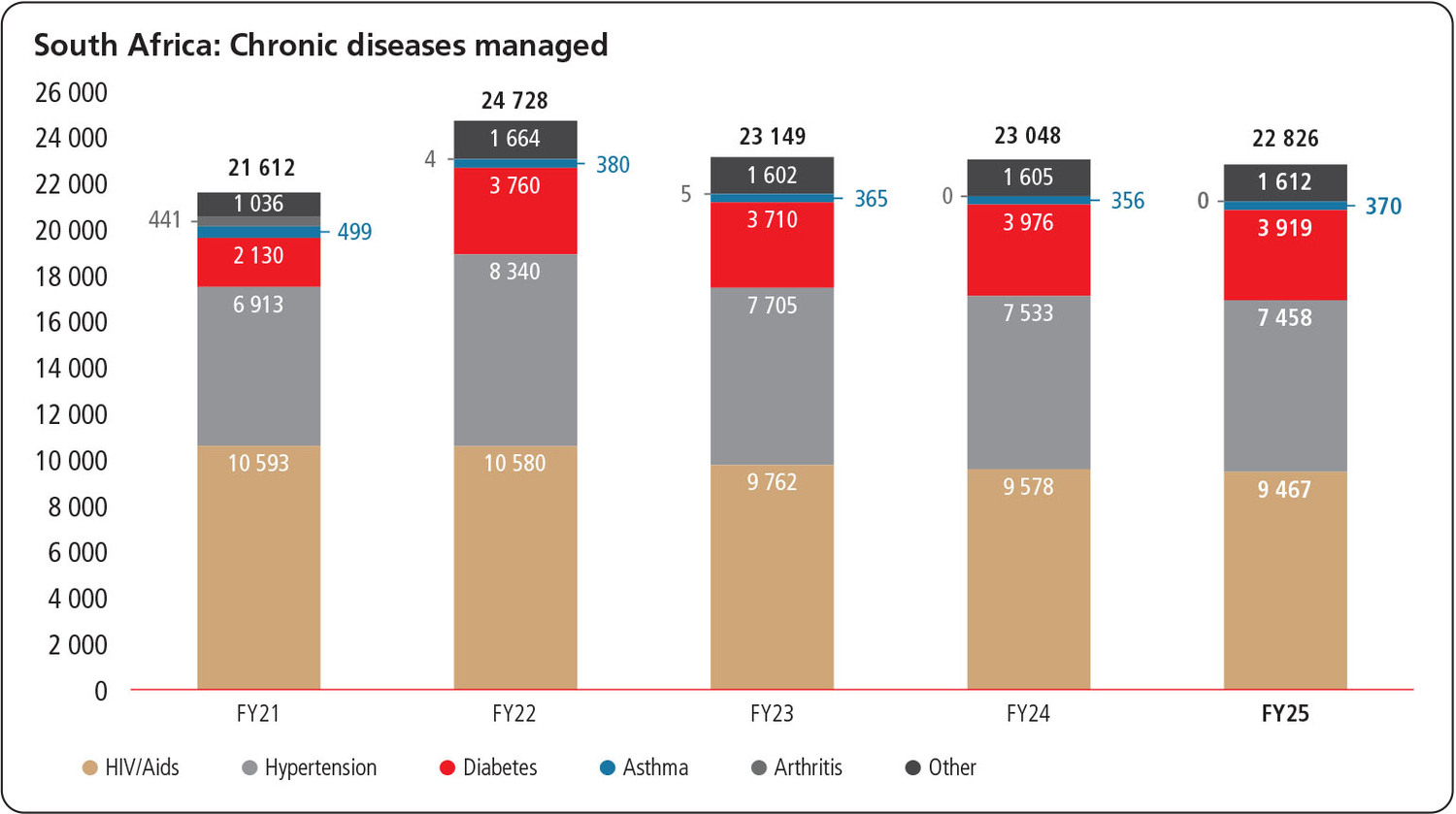

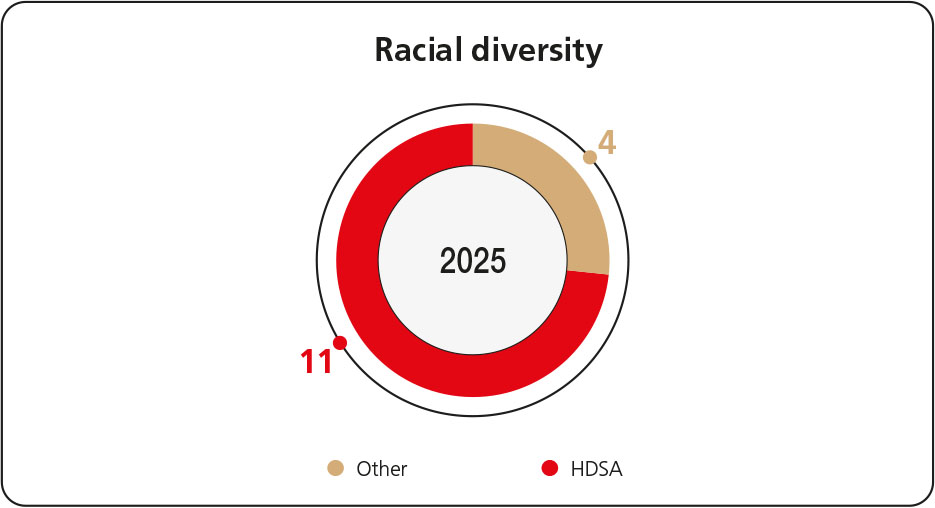

▪Over five years, with a favourable gold price, revenue has grown from R41.7 billion to R73.9 billion (US$4.1 billion) ▪In FY25, revenue was partially offset by a realised gold hedge book loss of R4.6 billion (US$253 million) ▪Production costs have risen from R29.8 billion to R43.2 billion (US$2.4 billion) over the past five years, showing inflationary pressures ▪Over five years, production profit has improved substantially from R12.0 billion to over R30.7 billion (US$1.8 billion), with the operating margin rising from 28.7% to 41.6% ▪Despite some variability over the past five years, net profit increased sharply in FY25 to R14.5 billion (US$802 million) compared to R5.1 billion in FY21 ▪Headline earnings per share is up 26.6% year on year to 2 337 SA cents (129 US cents) ▪A final dividend of 155 SA cents (9 US cents) has been declared, bringing the total FY25 payout to a record R2.4 billion (US$133 million) ▪Adjusted free cash flow is at a record high of R11.1 billion (US$614 million), up 53.6% compared to FY24, driven by a higher gold price and grades ▪Our net cash position has increased by 284.5% to R11.1 billion (US$628 million) while liquidity stands at R20.9 billion (US$1.2 billion) in cash and undrawn facilities. | ▪Ore milled has remained relatively stable, ranging between 49.25Mt and 53.80Mt over the past five years ▪Gold production has remained relatively stable over the five years, close to 1.50Moz (∼47 000kg) ▪Capital expenditure rose 32.1% year on year to R11.0 billion (US$606 million), driven mainly by the extension projects at Moab Khotsong and Mponeng, the 100 megawatts (MW) renewable energy project at Moab Khotsong, the Mine Waste Solutions Kareerand tailings storage facility (TSF) extension as well as the Eva Copper Project. . | ▪Exploration spend trends upwards, supporting the sustainability of our Mineral Reserves ▪Investment in training and development programmes trends upward, supporting our leadership and management capacity ▪Innovation in health and safety improvements, evidenced by lower lost-time injury frequency rates (LTIFR) and better health outcomes, reflect enhancement of intellectual capital ▪Investment in renewable energy projects and our digitalisation efforts, aimed to support operational efficiency and sustainability, continue ▪Eva Copper Project’s final Feasibility Study update is imminent with Mineral Resources up by 31% to 1.93Mt of contained copper, while gold is also up by 11.8% to 492koz. | ▪Our total workforce has stayed relatively stable at about 47 000 employees and contractors ▪We tragically lost 11 lives this year ▪We achieved an all-time low LTIFR of 5.39 for our South African region, versus 5.53 in FY24 ▪With a five-year wage agreement in its second year, no strike action took place in FY25, displaying a strong and mature relationship with unions ▪Voluntary turnover decreased to 1.9% from 2.3% in the prior year ▪Health-related absenteeism in SA improved to 7.3% from 7.5% in FY24. We continue to implement applicable best practice healthcare programmes to address occupational and non- occupational health risks ▪Employment equity showed positive trends, with representation of historically disadvantaged South Africans in management increasing from 65% to 72% over the past five years ▪Females in management has slowly edged forward over a five- year period, now at 23.3% ▪Training participation has increased, underscoring our focus on skills development. | ▪Community investment increased to R271 million (US$14.9 million) from R266 million (US$14.2 million) last year, contributing to local socio-economic development ▪Over 33 000 people benefited from our corporate social investment (CSI) projects in the current year, including women and youth ▪In SA, preferential procurement (BEE-compliant spend) has increased from R5.7 billion five years ago to a current spend of R16.3 billion (US$898 million) ▪In Papua New Guinea (PNG), total local procurement spend over the past five years trends upwards with a current spend this year of over R2.5 billion (US$138 million) ▪In SA, employees drawn from local communities sit at 85%, while in PNG, PNG nationals make up in excess of 96% of our permanent employees ▪We continue to maintain healthy relationships with unions and host communities, ensuring stability and mutual benefit ▪Paid R6.1 billion (US$336 million) in income taxes and royalties compared to a prior year payment of R3.7 billion. | ▪We have globally significant declared Mineral Resources of 135.5Moz with a declared Mineral Reserve of 36.8Moz in gold and gold equivalents ▪Underground recovered grades are up 2.6% to 6.27g/t from 6.11g/t in the prior year ▪We have been included in the FTSE4Good index for the 8th consecutive year ▪MSCI ESG rating upgraded to “BB” this year, performing better than the industry average ▪We received a CDP score of “A-” for our best practice water management strategy ▪Achieved three annual potable water consumption targets to FY25 reducing water usage from 20.0 to 19.3 to 18.4 million m3 over the past three years ▪We reduced our energy consumption through the energy efficiency programme by a cumulative 2.3TWh since 2016 ▪Our renewable energy programme is expected to generate close to 600MW by 2028 through solar and wheeled wind, with a potential of another 200MW in short-term PPA ▪Scope 1, 2 and 3 CO2 emissions relatively stable over the past five years. | |||||||||||||||||

16

Operating context

Influential economic, technological, political and sustainability factors at global and local levels directly and indirectly shape our operating context. The

interplay between our business model and operating context determine and shape our risks and opportunities. Strategic risk management aligned with our

business model and continuous assessment of our operating context allows us to mitigate threats effectively and capitalise on new growth possibilities.

Our operating context is made up of the following external factors or issues that influence Stakeholder needs and expectations and impact our Material matters:

Sustainability factors and related business practices

Social impact | South Africa | Papua New Guinea | Australia | |||||||||||||

Maintaining a social licence to operate is widely recognised as a moral and business imperative for companies globally. Mining companies continue to face growing pressure to exceed regulatory requirements by operating sustainably, transparently and in ways that benefit society. This includes by contributing solutions to key challenges facing host communities. Businesses must also continuously navigate complex social, economic and political dynamics while sustaining strong and constructive stakeholder relationships. | South Africa faces many obstacles to social upliftment, including insufficient service delivery, poverty, inequality, widespread unemployment, illegal mining and high levels of crime. These issues, combined with the government's immense responsibility to provide infrastructure and essential services, highlight the urgent need for both private and public sector contributions to improve citizens’ quality of life. These challenges also contribute to a population of unskilled and unemployed individuals, reducing the available talent pool. | Papua New Guinea is rich in natural resources, but development has been uneven since gaining independence in 1975. Many people still face poverty, unemployment, limited access to services, and social challenges like crime, gender-based violence and inequality. Like other resource-rich countries, Papua New Guinea is working to overcome these barriers and move toward becoming a prosperous, middle-income nation. | By global standards, Australia ranks highly in literacy, numeracy, employment, income and wealth. However, challenges still remain. These challenges include rising inequality, the high cost of living (especially housing), discrimination, and domestic and gender- based violence. In rural and remote areas, poorer health outcomes are compounded by limited access to essential services such as education, transport and digital connectivity. People continue to expect real progress in tackling these issues. | |||||||||||||

Impact on Harmony | Our response | |||||||

▪Addressing systemic issues requires a collaboration between Harmony, government, civil society and other stakeholders ▪Harmony can positively contribute to the lives of employees and host communities by understanding their needs and implementing initiatives that contribute to community wellbeing ▪If we fail to respond constructively to societal expectations, we risk financial, reputational and operational challenges, including legal and strike action, reduced investment and a disengaged workforce. | ▪Our social stewardship initiatives are critical to our business success and sustainability ▪Harmony’s community development initiatives are guided by regulations and mining-related agreements, allowing us to collaborate with government departments to deliver shared benefits and value to our host communities, suppliers and landowners. This is supported by CSI initiatives, enterprise and supplier development, and procurement practices that support job creation and contribute to social development and economic empowerment with the SDGs in mind ▪As part of enterprise risk management (ERM), multiple organisational strategies enable us to care for, protect and empower our employees, fostering a conducive, safe and inclusive workplace and contributing to improved livelihoods. | |||||||

17

Environmental impact | South Africa | Papua New Guinea | Australia | |||||||||||||

Urgent action to combat climate change and its impact | ||||||||||||||||

Climate change’s prevailing and increasing effects, including extreme weather events, continue to impact businesses, people and the natural world. Climate change regulations are evolving rapidly, with new laws, expanded disclosure requirements and increased litigation driving accountability. | South Africa frequently experiences drought and floods, which significantly affect its environment, economy, infrastructure and people. Floods between February and March 2025 in KwaZulu-Natal, Free State, Gauteng and Eastern Cape underscore the severity of extreme climate-related events. New regulations, including the Climate Change Act 22 of 2024 that introduces binding carbon budget limits and the National Treasury’s August 2024 phase two carbon tax paper which signals higher tax rates from 2026. | Papua New Guinea is vulnerable to natural events. Some of these are expected to increase in frequency, magnitude and intensity due to climate change. High rainfall during the summer months of FY25 caused flooding, landslides, displacement of people and significant damage in Enga province. A brief period of La Niña conditions is predicted in the southern hemisphere FY26 summer. La Niña events can have the effect of bringing increased rainfall to south and south-eastern areas of the country, while the north-east and New Guinea islands region can experience lower rainfall and drier conditions. | Climate change poses a growing risk in Australia and is impacting communities, ecosystems and industry. This results in hotter temperatures, increased bushfires, prolonged droughts and floods, higher sea levels and erratic weather conditions. Tropical Cyclone Alfred's landfall in South East Queensland during March 2025 is consistent with predictions that climate change is expected to cause tropical cyclones to penetrate further south. Commencing from 1 July 2025, Australian- registered companies are now required to report on climate-related risks and opportunities that could reasonably affect their financial performance. | |||||||||||||

Threats to natural resources and biodiversity | ||||||||||||||||

Mismanagement, overexploitation and pollution-related degradation of critical natural resources such as food, minerals, air and water continue to drive environmental risk and contribute to severe global shortages in commodities and natural resource supplies. | Overwhelming development needs and society’s dependence on natural resources and ecosystems to survive exacerbates South Africa’s water scarcity and natural resource depletion. | Deforestation and forest degradation caused by agriculture expansion, including cash crops, authorised and unauthorised logging, artisanal and alluvial mining, and expanding settlement footprints pose a threat to the country’s significant natural resources and heritage. | Climate change, unsustainable use of natural resources, habitat loss, invasive species and problematic native species and pollution have been identified as driving a decline in the condition of Australia’s natural environment. The Australian Government has introduced Australia’s Strategy for Nature 2024 – 2030 in an effort to strengthen the country’s response to halt and reverse biodiversity loss. | |||||||||||||

18

Environmental impact continued | South Africa | Papua New Guinea | Australia | |||||||||||||

Responsible tailings management | ||||||||||||||||

TSF failure could cause loss of life and severe economic, environmental and societal damage, underscoring the importance of effectively managing risks associated with TSFs. Mining companies are also exploring innovative solutions to better manage these facilities. | Mining is a key economic sector in the country. As such, the high number of tailings dams presents a significant safety risk. The government has bolstered efforts to enforce stricter regulations, independent TSF audits and higher penalties, signalling tougher oversight. | Heavy rainfall and seismic activity heighten the risk of dam failure. Our TSFs are designed and operated per the Australian National Committee of Large Dams (ANCOLD) guidelines, with accepted risk-based deviations and conservative factors of safety for seismic and static conditions. | With mining as a major economic sector, Australia has a high number of tailings dams. The ANCOLD guidelines play a key role in setting standards for effective TSF design and management. | |||||||||||||

Impact on Harmony | Our response | |||||||

▪Harmony is susceptible to the physical and transitional impacts of climate change. Extreme weather events such as flooding could damage equipment and infrastructure, while water shortages and heatwaves present significant safety and health risk to our employees ▪Regulatory changes, along with market and technology shifts, influence the way we conduct our business ▪Resource depletion could increase operational costs, affect our stakeholder relationships and investor sentiment. Conversely, conserving natural resources drives sustainable mining practices across the business ▪TSF failure has the potential to impact the environment and communities surrounding our operations. Consequences may include loss of life, environmental fines due to non-compliance, rehabilitation and operational costs, decreased market value and reputational damage. | We are committed to environmentally responsible mining that respects natural ecosystems and supports long-term sustainability. We manage and mitigate environmental risks and, where appropriate, offset impacts by: ▪Decarbonising Harmony’s energy profile through energy efficiency initiatives and transition to lower‑carbon sources, which presently include solar energy and battery storage projects ▪Using natural resources efficiently and responsibly, while managing water quality and quantity, and monitoring impacts on waterways and the overall health of the watershed ecosystem ▪Reducing our environmental footprint by reclaiming legacy mining sites and lowering the risk of long-term physical and chemical impacts ▪Addressing biodiversity and ecosystem impacts through rehabilitation and other initiatives ▪Capturing environmental risks, including TSF management, as part of our ERM process. | |||||||

19

Governance impact | ||||

Growing regulatory and stakeholder scrutiny | ||||

Increasingly complex regulatory requirements and stakeholder expectations continue to put pressure on companies to reposition or accelerate their business strategies, take action to address a range of issues, and transparently report and substantiate their sustainability claims and progress against commitments. Sound corporate governance practices are driven by ethical business practices, regulatory compliance and best practice alignment, with increased scrutiny being placed on respecting and upholding human rights, preventing fraud and corruption and maintaining data integrity through robust assurance processes. | ||||

Impact on Harmony | Our response | |||||||

▪Our market capitalisation, reputation and credibility could be affected by non-compliance with regulatory and reporting requirements, failure to meet targets or address material stakeholder concerns, and inadequate preparation for new disclosures, safety governance and equity participation requirements in our key jurisdictions ▪Delivering responsible and sustainable business practices is fundamental to our ability to protect the shared value we create and prevent value erosion. Critical to this is engaging and collaborating effectively with our key stakeholders, maintaining their trust and preserving our social licence to operate. | ▪Harmony has adopted a Management Delegation of Authority and a comprehensive Compliance Programme to underpin regular engagement with government and regulators. The company responds to proposed legislative changes through the Minerals Council South Africa or direct submissions, following consultation with relevant executives. We also work directly with regulators and through Australian, Queensland, and Papua New Guinea industry bodies on policy matters ▪Our sustainability framework assists us to respond strategically to the sustainability issues facing our business and host communities. The framework outlines the actions we are taking to further embed sustainability in our business ▪We measure and track our progress against group-wide KPIs, and adopt regulatory and voluntary reporting frameworks and guidelines ▪To facilitate the integrity of our reporting, we conduct internal and external assurance on our reporting suite ▪Our employees, contractors and suppliers must adhere to our human rights policy and code of conduct ▪Our formal corporate governance and compliance policy and framework outline the principles of good corporate governance for the board and employees at all operational levels ▪The draft Mineral Resources Development Amendment Bill proposes several changes to South Africa's mining laws. Harmony is closely monitoring the progress of the draft bill and will develop an action plan to align our processes with the new regulations We are actively preparing for compliance with the Australian Sustainability Reporting Standards (ASRS) S2, which are new sustainability disclosures that largely align with IFRS S2. These requirements will encompass our Australasia region and took effect for Australian-registered companies from 1 July 2025. | |||||||

20

Governance impact continued | ||||

Cybercriminality | ||||

Cyberattacks continue to increase in frequency and severity, with the human, operational and financial impact of attacks rising in line with increasing infrastructure digitalisation. Similarly, the digitalisation of critical national and mining infrastructure increases the risk of cyberattacks. A successful cyberattack can have severe consequences, including safety and economic impacts. | ||||

Impact on Harmony | Our response | |||||||

▪Cybersecurity is a top strategic risk to our business. Digitalisation of technology exposes our systems and processes to information security compromises, which could lead to the accidental or unlawful use, destruction, loss, alteration or disclosure of data ▪In addition to the direct cost of an incident, regulatory fines under South Africa’s POPIA and the Critical Infrastructure Protection Act could reduce profitability, disrupt production and erode stakeholder trust ▪Australia’s Cyber Security Act 2024 introduces stricter obligations around incident reporting, ransomware disclosures and privacy protections. These changes heighten regulatory risk and demand stronger digital resilience across our operations. Non-compliance could lead to financial penalties, operational disruptions and erosion of stakeholder trust, particularly where data integrity and safety systems are critical to our licence to operate. | ▪Our cybersecurity strategy focuses on proactive risk identification, technological defences, governance oversight and workforce engagement. This approach aligns with the critical need for robust cybersecurity in mining operations within regions facing sophisticated cyberthreats ▪We continue enhancing our cybersecurity by implementing state-of-the-art technologies and processes to identify threats, protect our information and technology environment and respond to cyberincidents ▪We conduct cybersecurity awareness training interventions and regularly communicate with our employees about cyberthreats and how to prevent them. This year, we conducted focused cybersecurity training to 1 200 users identified as high-risk and maintained consistent communication on cybersecurity best practices across the organisation to strengthen our human security layer and reduce vulnerability exposure. We also significantly increased our investment in our cybersecurity software. | |||||||

21

Governance impact continued | ||||

Third-party risks | ||||

Harmony’s mining operations and growth projects are highly exposed to supply chain vulnerabilities, with shortages and extended lead times for strategic spares, critical consumables, mining equipment and reagents posing risks to operational continuity and project delivery. This is amplified by reliance on foreign-sourced components and single suppliers for key inputs, such as sulphuric acid, cyanide, oxygen and large-scale mining equipment, which limits alternative sourcing options. Geopolitical uncertainties and inflationary pressures have further increased consumable costs and logistical challenges, raising all-in sustaining costs and potentially impact the commercial feasibility of certain operations. | ||||

Impact on Harmony | Our response | |||||||

▪Financial difficulties faced by third-party contractors or suppliers can impair their ability to fulfil contracts, leading to project delays and increased costs ▪If a supplier or contractor fails to adhere to safety and health protocols while on-site at our operations, it could result in serious injuries and hinder our goal to achieve zero harm ▪Delays or shortages in critical consumables, reagents, strategic spares and equipment can disrupt production, reduce output, create maintenance backlogs and negatively impact capital projects – potentially threatening the financial viability of certain operations ▪Inflationary pressures, higher transport costs and supplier monopolies raise the cost of inputs, increasing all-in sustaining costs ▪Country-specific issues, such as foreign exchange shortages in Papua New Guinea, can lead to supply disruptions that may impact operational continuity. | ▪Harmony’s suppliers must adhere to our code of conduct, human rights policy, environmental management policies and standards and observe laws and regulations of the countries in which we operate ▪Supplier engagement helps us understand our suppliers’ needs and how we can improve our transactions for mutual benefit ▪Harmony has collaborative and transparent relationships with strategic suppliers to manage disruptions, particularly where sole supplier risks exist. The company seeks out multiple reliable suppliers for critical commodities and has strategic contracts with rise-and-fall mechanisms to manage market escalations ▪Reviews of critical commodities and stock holdings are conducted by regional teams in South Africa and Australasia ▪Efforts to engage local suppliers and integrate small, medium and micro-enterprises (SMMEs) into the supply chain are ongoing. Long-term contracts with strategic suppliers include mechanisms to secure supply and mitigate inflationary impacts. | |||||||

22

Macro-economic environment

Economic and geopolitical factors | South Africa | Papua New Guinea | Australia | |||||||||||||

Ongoing geopolitical uncertainty, trade tensions, subdued global growth and diverging monetary policy paths continue to disrupt supply chains, constrain capital access, undermine economic growth, financial planning in emerging markets, and the availability and affordability of materials and equipment. Trade disputes between major economies, notably the United States and China, and increasing export controls on critical minerals have fragmented mineral supply chains. This environment has resulted in more volatile input costs, supply-timing challenges and complicated project development for mining companies. | South Africa faces multiple economic and geopolitical challenges, including high interest rates, policy uncertainty, potential resource nationalisation, infrastructural constraints, and high borrowing costs that restrict investment and economic growth. | The region’s macro-environment continues to be impacted by political instability, regulatory uncertainty, access to foreign exchange and rising inflation. | Australia’s economy remains resilient and the political environment stable. However, the country is impacted by the volatile international context. | |||||||||||||

Sovereign credit ratings | ||||||||||||||||

Sovereign credit ratings assess a government's ability and willingness to meet its debt obligations, reflecting economic fundamentals, including fiscal health, debt sustainability, political stability, institutional strength and external financing capacity. Rating agencies evaluate factors such as gross domestic product (GDP) growth prospects, government effectiveness, monetary policy credibility and structural economic resilience when determining sovereign ratings. These ratings directly influence country risk premiums embedded in equity valuations, corporate borrowing costs, and foreign investment flows. | South Africa’s credit rating outlook was re‑affirmed as stable with long-term foreign and local currency sovereign credit ratings of BB-. | Papua New Guinea’s credit rating outlook remains stable with long-term foreign (B-) and local currency (B) sovereign credit ratings. | Australia’s credit rating outlook was affirmed as stable with long-term foreign and local currency sovereign credit ratings of AAA. | |||||||||||||

23

Economic and geopolitical factors continued | South Africa | Papua New Guinea | Australia | |||||||||||||

Market volatility | ||||||||||||||||

Global financial markets experienced heightened volatility during FY25, reflecting divergent monetary policy approaches, persistent inflationary pressures and evolving geopolitical tensions across key economies. Market volatility manifests through fluctuations in commodity prices and foreign exchange rates, creating both operational challenges and strategic opportunities. Central bank policy divergence between developed and emerging market economies amplified currency volatility, while ongoing supply chain disruptions and energy security concerns contributed to commodity price volatility. The gold price achieved record highs during the second half of FY25. Prices peaked at US$3 432/ oz on 13 June 2025, significantly higher than the US$2 332/oz at the beginning of FY25, and ending at US$3 303⁄oz at 30 June 2025. Supply disruptions and strong demand kept copper prices elevated. Prices peaked at US$10 103/t on 2 October 2024, higher than the US$9 636/t at the beginning of FY25, and decreasing to US$9 878/t at year end. Based on trends in the market, our internal planning processes have determined a future copper price of US$9 367/t, which is in line with long-term market consensus. | The rand experienced significant volatility against major currencies, influenced by domestic political developments following the May 2024 elections, commodity price fluctuations and global risk sentiment. The currency strengthened following the formation of a Government of National Unity but remained vulnerable to external shocks, sovereign rating considerations and shifts in foreign investor confidence. | The kina demonstrated relative stability against the US dollar, supported by ongoing International Monetary Fund programme implementation and foreign exchange market reforms. However, the currency remained susceptible to commodity price movements and external financing conditions affecting the country's current account balance. | The Australian dollar fluctuated against major currencies, influenced by commodity price movements, domestic monetary policy settings and China's economic performance as a key trading partner. The currency's correlation with commodity prices provided both opportunities and challenges for mining operations. | |||||||||||||

24

Impact on Harmony | Our response | |||||||

▪Borrowing costs and economic growth were also affected by increased interest rates ▪Borrowing costs increase directly through higher credit spreads when sovereign ratings deteriorate ▪Investment returns on cash deposits and short-term investments fluctuate with sovereign risk-free rates, impacting treasury management returns ▪Equity valuations face material impact through elevated country risk premiums incorporated in discount rates used by investors. Research demonstrates that sovereign downgrades increase equity risk premiums demanded by investors, mechanically reducing share price valuations through higher required returns ▪Foreign investment flows respond asymmetrically to sovereign rating changes, with downgrades triggering capital outflows that disproportionately affect equity markets. Conversely, rating upgrades generate minimal positive flow effects, creating an asymmetric risk profile for share price performance ▪Currency fluctuations impact both revenue realisation from US dollar-denominated gold and copper sales and cost structures denominated in local currencies, creating natural hedging effects where operating costs decrease in dollar terms when local currencies weaken. ▪Commodity price volatility affects revenue streams, influences capital allocation priorities across our portfolio, and determines the economic viability of marginal ounces and development projects ▪The average level of the rand appreciated against the US dollar in FY25, with an average exchange rate of R18.15/US$1 (FY24: R18.70/US$1). Although the rand appreciated, the significant increase in the US$ gold price, positively impacted on revenue for the year as sales are US dollar-denominated. | ▪Our derisked and diversified portfolio continues to perform well ▪Expansion in Australia, together with focus on gold-copper assets, is part of Harmony’s deliberate strategy to diversify geopolitical exposure, reducing risk concentration in a single region and commodity ▪Through regular engagement with investors and financiers (a key stakeholder), we provide a realistic understanding of our potential operating and financial performance ▪We invest our funds in financial institutions that meet the group’s policy requirements for credit quality. The credit ratings are continuously monitored, with adjustments made where required ▪We apply conservative price assumptions in our business planning processes to maintain a reasonable margin and strong cash flow. Even at the relatively lower exchange rate, our South African operations are generating a positive margin and cash flows ▪We monitor market volatility through quarterly treasury committee assessments and employ targeted risk management strategies, where appropriate, to manage exposure to adverse movements while preserving upside participation in favourable market conditions ▪Our derivative and hedging strategies and capital allocation framework remain responsive to persistent macro-economic instability, enabling us to analyse and manage potential positive and negative impacts on our business proactively and appropriately ▪In response to high gold prices during the year, we continued to lock in more of the higher gold prices, supporting our future cash flows and ability to fund projects. | |||||||

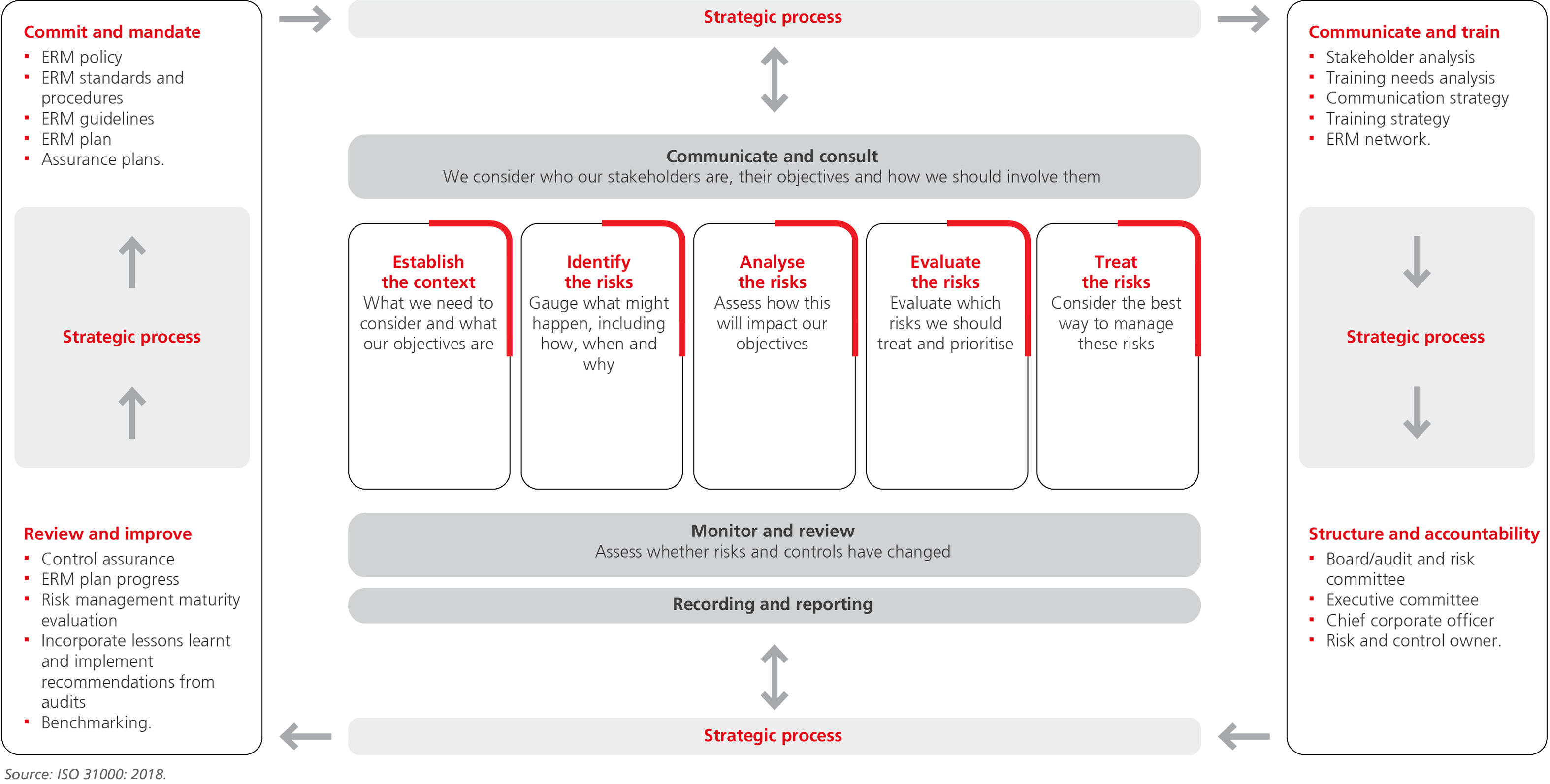

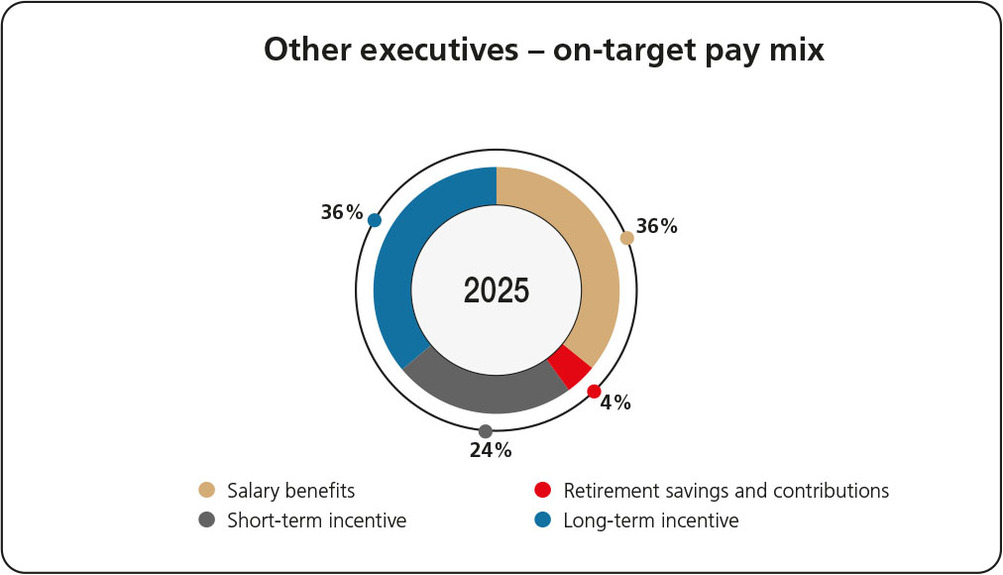

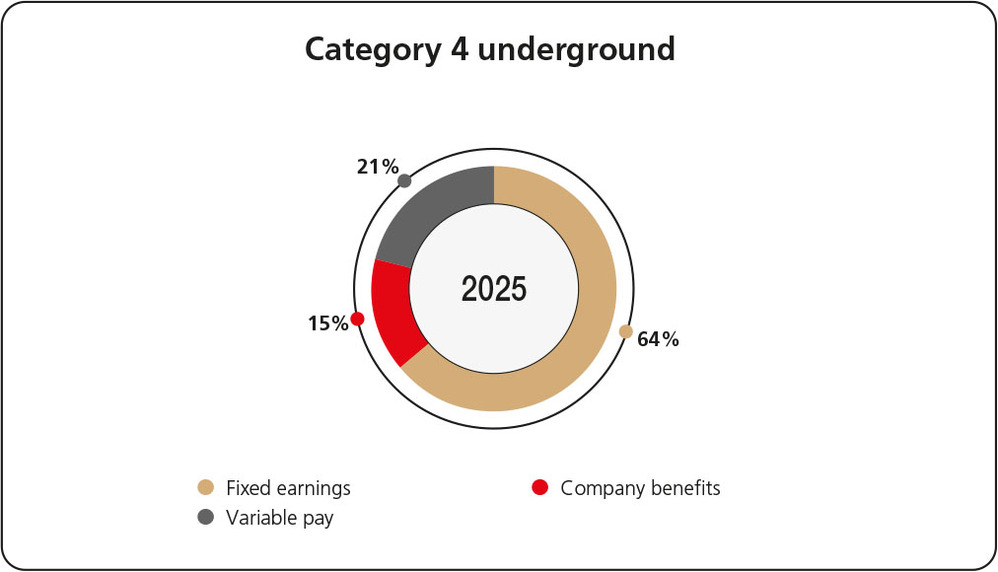

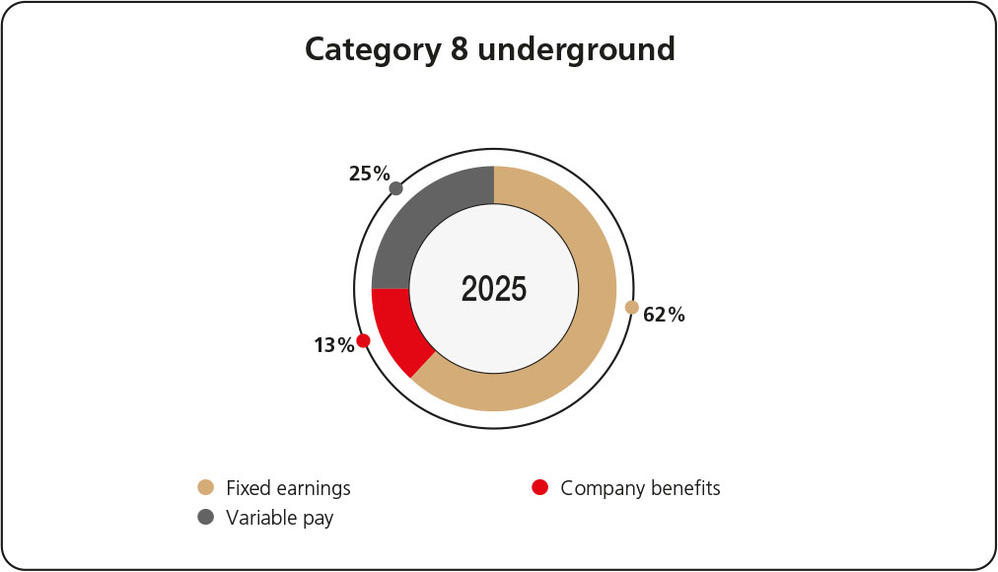

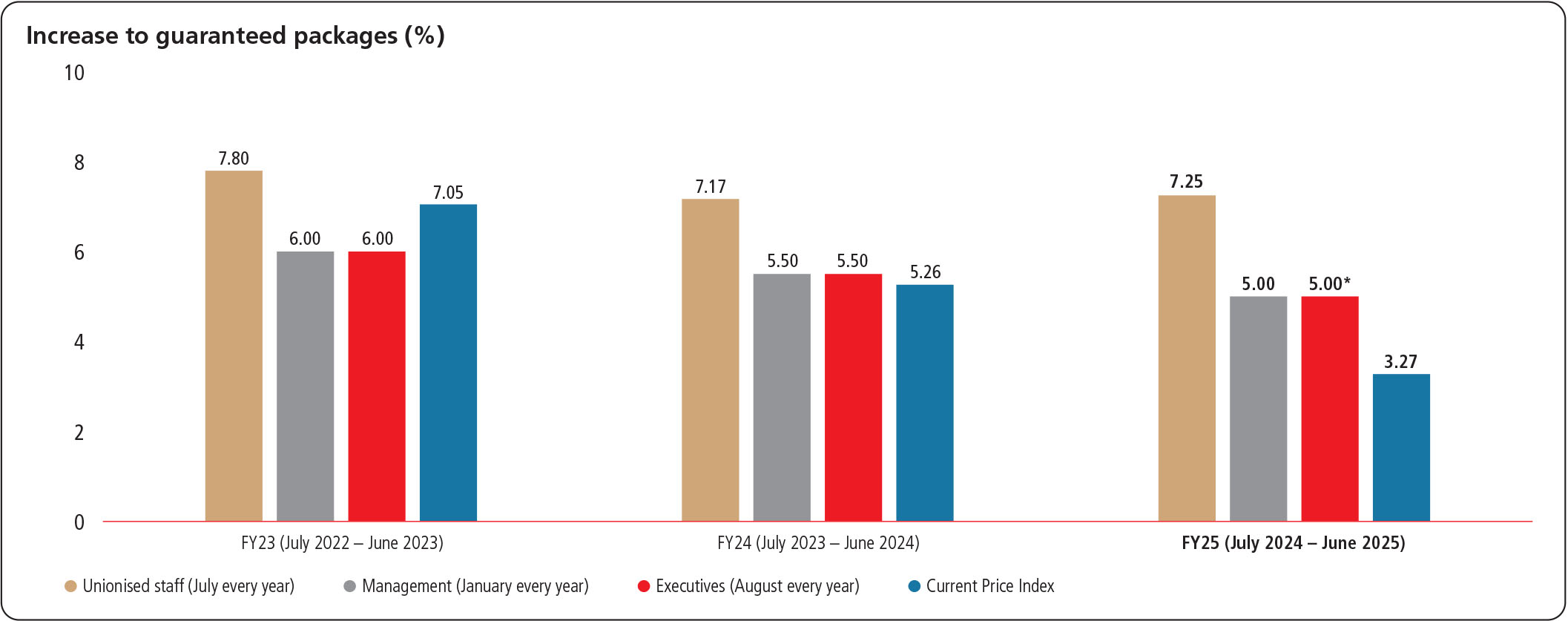

25