Dear 8x8 Stockholders, This quarter marked a big milestone. In Q1 2026, we returned to year-over-year growth for the first time in nine quarters. We exceeded the midpoint of our service revenue guidance by more than $3 million. That growth was fueled by strong demand for our CPaaS API solutions, continued momentum in platform adoption, and a steady shift toward usage-based consumption models, plus a small tailwind from FX. Additionally, the revenue headwinds from the transition of former Fuze customers to 8x8’s modern platform are starting to recede. Evolving CX Market Enterprises are shifting away from fixed seat licenses and toward usage-based, intelligent platforms. They are prioritizing solutions that are flexible, AI-enabled, and easy to integrate across their stack. We believe 8x8 is aligned with this market evolution. Metrigy’s research really tells the story: ● Over 50% of CX leaders now prefer consumption-based pricing. ● Average handle time in live contact center calls is increasing because automation is deflecting simpler requests, allowing agents to focus on higher-value conversations like upsells and account reviews. ● More than 50% of companies are using multiple AI tools, and over 70% expect to expand that use in the coming year. ● Despite macro-economic pressures, only 17% of enterprises plan to reduce customer engagement budgets. 8x8 1Q F26 1

It is clear the contact center is undergoing a foundational shift from cost center to customer experience engine. As enterprises embrace intelligent engagement models that combine AI-driven self service with seamless human interaction, they are learning to balance scale and efficiency with trust and empathy. Forward-looking organizations see the contact center not just as a place to reduce costs, but as a strategic lever for improving satisfaction, increasing retention, and driving upsell. In doing so, they’re redefining success, not by savings alone, but by the value delivered in every customer interaction. This is a massive shift for the industry. But change at this scale doesn’t happen quietly. Legacy vendors are responding with aggressive pricing and long-term lock-ins, trying to slow the pace of change and protect their installed base. That resistance introduces complexity, even when the direction of travel is clear. Customer Focused, Future-aligned For 8x8, the opportunity is significant and we are already aligning with where the market is headed. Organizations are rethinking how they build customer engagement, favoring platforms that are composable, intelligent, and adaptable. Our portfolio is purpose-built for this shift. At the core is our tightly integrated UCaaS and CCaaS platform, which continues to lead through innovation. It provides customers with the best of both worlds: a proven, award-winning foundation and the flexibility to tailor solutions to their needs without locking into a single vendor or rigid architecture. This adaptability is especially critical as the pace of change accelerates with AI. At the same time, our CPaaS API solutions are expanding rapidly directly in response to these evolving customer expectations. As more organizations look to embed programmable voice, video, messaging, authentication, and AI-driven workflows into their own applications and ecosystems, CPaaS is enabling that flexibility and scale. This trend is reshaping our revenue mix toward higher-growth offerings with different financial dynamics, specifically, lower gross margins in the near term. But it’s a deliberate and strategic tradeoff that allows us to scale faster, deliver more value to customers, and strengthen our long-term position. And that position starts with voice. There’s a perception that voice is in decline,but we see the opposite. It has always been the fastest, most trusted way to resolve complex issues and build relationships. And now, with AI transforming customer experience, high-fidelity voice is more essential than ever. It’s the primary way people communicate,whether with human agents or AI-powered systems, and it has to be crystal clear, intelligent, multilingual, and seamlessly integrated with digital agents to deliver real value. That’s why our world-class voice infrastructure, shaped by decades of expertise, global scale, and real-time precision, is such a strategic asset. Let’s talk about how we’re delivering on that today. In Q1, consumption-based revenue, which is primarily generated by our CPaaS API solutions, but also by usage related to our UCaaS and CCaaS subscriptions, grew more than 30% year-over-year. But it wasn’t just about volume. We saw growth from new use cases, new channels, and more diverse engagement models. We’re moving beyond SMS into programmable voice, alerts, authentication, and AI-driven workflows. And we’re seeing real customer success stories: ● A UK-based utility added video and messaging to their contact center using our CPaaS APIs to reduce on-site troubleshooting visits by 40%. That freed up their engineers to focus on more strategic work and saved them a meaningful amount of money. ● A Melbourne-based leader in hospitality technology started with a simple SMS implementation back in 2023. Today, they’ve expanded to include WhatsApp, Viber, programmable voice, authentication, and our identity platform through Descope. This is the power of our land-and-expand strategy. 1Q Fiscal 2026 2

● A Fortune 500 US specialty retailer is running an RCS pilot integrated out of the box with 8x8 Contact Centre. Initial use cases include order & delivery updates and appointment reminders, with suggested replies, SMS fallback, and seamless agent handoff aimed at improving CSAT. We’re also continuing to see strength in Microsoft Teams environments. Sales of 8x8 Voice for Teams licenses grew more than 30% year-over-year again this quarter. We’re now recognized as a top-5 Operator Connect partner worldwide by country reach, which gives us strong visibility in that ecosystem. Here’s a great example of what that looks like in practice: a professional membership organization in the UK, supporting thousands of engineers and technologists, needed to unify voice, contact center, and CRM within Microsoft Teams. With 8x8, they brought it all together into a single experience, streamlining agent workflows and improving service response times. Innovation and Go-to-Market Drives Momentum And these wins aren’t isolated. The momentum is clear: ● Adoption of our Intelligent Customer Assistant rose 75% year-over-year. ● Voice AI interactions grew more than 7x year-over-year, representing more than three quarters of all AI interactions in the quarter. ● 8x8 communication API messaging interactions, such as WhatsApp, RCS, Viber, Zalo, and LINE, increased more than 200% year-over-year and more than 50% quarter-over-quarter. We’re innovating rapidly, but more importantly, our customers are scaling with us. Let’s shift gears a bit and talk about go-to-market. We’re evolving how we show up. We’ve moved from SKU-based selling to outcome-based selling. We lead with solutions,such as 8x8 Ballot It!, our government voting information solution, Enhanced Security using 2FA, After Sale Assist and our automated self-service for Retailers, not a features list. And we’re investing in Customer Success. We know customers with active CSMs have higher NPS scores and gross retention above 90%. That’s why we’re doubling down on high-touch support and AI-powered tools that help our customers unlock more value from the platform. We’re also improving how we qualify and target accounts, focusing on those where our platform has the clearest fit and long-term upside. And this approach is working: ● We closed our first-ever 7-product customer. ● Revenue from customers using 3 or more products now accounts for about one-third of our annual revenue. ● Every single one of the top 10 new logo wins this quarter included multiple solutions. One example that really illustrates this evolution: a public university in the western U.S. ran an RFP for Contact Center with more than 15 vendors, including all the major players. Instead of a generic pitch, we built interactive proposals, used AI to personalize use cases for each department that aligned our solutions directly to their goals. They selected 8x8 for their contact center and told us our customer-first approach sealed the deal. 1Q Fiscal 2026 3

Another example: a global electrical systems manufacturer had been running a hybrid setup of unified communications with us and contact center with another provider. But over time, friction around analytics and reporting led them to standardize on 8x8 across the board. They needed to simplify operations and support their M&A strategy with a consistent, scalable platform and we delivered. Our channel partners continue to be a force multiplier as we make this transformation. Our largest UK-based partner increased bookings by more than 100% this quarter. That was the result of closer collaboration, co-selling from day one, and better alignment with our platform strategy. Looking Forward As we look ahead, our product roadmap is focused on continuing to enhance our platform with features and capabilities that add value and improve customer outcomes. That includes AI-enabled tools, but it also includes ongoing work to make the platform easier to use with a modern, intuitive interface; advanced data analytics that give our customers real-time visibility and actionable insights; and orchestration across bots, agents, and CX tools to create seamless experiences. We are investing in both internally developed innovations and deeper native integrations with technology partners from our ecosystem. Key areas of focus include predictive customer journey orchestration, real-time sentiment analysis with automated escalation, AI orchestration using internal and external tools, and AI summarization across the entire platform.These innovations will help differentiate our platform in competitive evaluations, but more importantly, they are grounded in real customer needs. We’re also expanding internationally with a focus on distributed businesses like retail and regulated industries like healthcare and government where our compliance posture, self-service capabilities, and global infrastructure present real advantages. And, on a final note, we’re wrapping up a key chapter in our transformation. We remain on track to fully sunset the Fuze platform by fiscal year-end as we upgrade customers to the 8x8 platform. These customers gain the benefits of a modern business communications platform designed for the era of AI. For 8x8, this will eliminate complexity, unlock margin leverage, and free up resources to focus on growth. The bottom line: The foundations are strong, the strategy is clear, and execution is accelerating. And with our foundational expertise in voice, a capability many underestimate, we have a lasting edge as customer engagement enters a smarter, more connected era. To the 8x8 team: your resilience is what made this return to growth possible. To our customers and partners: thank you for the trust and collaboration that guide us every day. And to our stockholders: thank you for believing in our long-term vision. Sincerely, Samuel C. Wilson Chief Executive Officer 1Q Fiscal 2026 4

Financial Highlights 8x8 delivered solid first-quarter results, demonstrating the resilience of its financial model, the strength of its platform strategy, and continued operational discipline in a dynamic macroeconomic and competitive environment. Service revenue and total revenue increased year-over-year for the first time in 9 quarters as we began to realize the benefits of our investments in innovation and the transformation of our go-to-market strategies. Revenue & Business Performance ● Total Revenue reached $181.4 million, near the high end of guidance, driven by strong execution across the business. ● Service Revenue came in at $176.3 million, above the high end of guidance and up 2% year-over-year. ○ Excluding revenue from former Fuze customers, service revenue grew just over 5% year-over-year, marking the third consecutive quarter of acceleration. ● Platform usage revenue continued to expand rapidly, and represented approximately 17% of total service revenue, up from 12% in Q1 last year. This reflects growing customer demand for programmable, usage-based solutions and aligns with the broader market shift toward composable, AI-driven engagement models. Profitability & Margin ● GAAP Gross Margin was 66.4%. Non-GAAP Gross Margin of 67.8% and reflected a higher mix of usage-based platform revenue, primarily CPaaS APIs but also including usage revenue related to our UCaaS and CCaaS platform. ● GAAP Operating Income of $0.6 million, or 0.3% of revenue, was positive for the fourth consecutive quarter, signaling continued progress toward sustainable GAAP profitability. ● Non-GAAP Income of $16.3 million, or 9.0% of revenue, was within our guidance range. ● GAAP net loss per share (basic) was $.03. Non-GAAP earnings per share (diluted) was $.08.

Operating Cash Flow & Capital Allocation ● Cash Flow from Operations exceeded $11 million, marking the 18th consecutive quarter of positive cash flow. ● Ended the quarter with $82.2 million in cash, cash equivalents, and restricted cash. ● The ending balance reflected: ○ A $15 million debt prepayment in Q1 (followed by an additional $10 million post-quarter-end). ○ Repurchase of 1 million shares of common stock in open market transactions for an aggregate purchase price of $1.8 million Balance Sheet & Debt Management ● Amended the term loan agreement post-quarter and prepaid an additional $10 million. The Amendment modifies, among other things, the requirements to meet certain financial ratio tests in connection with permitted acquisitions and an adjustment to maintain the existing consolidated total net leverage ratio (a measure of total debt relative to Adjusted Cash EBITDA) at its current level for the duration of the 2024 Credit Agreement. While the Company has no acquisitions pending, the added flexibility positions it to respond efficiently should opportunities arise. The Amendment reflects the Company’s continued commitment to financial discipline as it executes on long-term growth priorities and shareholder return initiatives. ● Including the additional post-quarter $10 million pre-payment made with the Amendment, total debt outstanding has declined by $219 million (or ~40%) since the August 2022 peak of $548 million. ● Stockholders equity increased to $128.2 million, up 23% from the end of Q1 2025. Q2’26 and Updated Fiscal Year 2026 Guidance Management provides expected ranges for total revenue, service revenue, non-GAAP operating margin, non-GAAP net income per share, diluted, and cash flow from operations based on its evaluation of the current business environment. The Company emphasizes that these expectations are subject to various important cautionary factors referenced in the section entitled "Forward-Looking Statements" below. ● Q2 FY26: ○ Service Revenue: $170M–$175M ○ Total Revenue: $175M–$180M ○ Non-GAAP Gross Margin: 66%–68% ○ Non-GAAP Operating Margin: 8.0%–9.0% ○ Interest Expense: ~$4.4M ○ Cash Interest Paid: ~$6.4M ○ Non-GAAP Net Income per Share, diluted: $0.06–$0.08, based on a fully-diluted weighted average share count of ~142M shares ○ Cash Flow from Operations: $3M–$5M 1Q Fiscal 2026

● Full-Year FY26: ○ Service Revenue: $685M–$700M ○ Total Revenue: $706M–$720M ○ Non-GAAP Gross Margin: 66%–68% ○ Non-GAAP Operating Margin: 8.5%– 9.5% ○ Non-GAAP Net Income per Share, diluted: $0.29–$0.33, based on a fully-diluted weighted average share count of ~143M shares ○ Cash Flow from Operations: $35M–$45M Forward-Looking Statements: This news release contains "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995 and Section 21E of the Securities Exchange Act of 1934. Any statements that are not statements of historical fact may be deemed to be forward-looking statements. For example, words such as "may," "will," "should," "estimates," "predicts," "potential," "continue," "strategy," "believes," "anticipates," "plans," "expects," "intends," and similar expressions are intended to identify forward-looking statements. These forward-looking statements include, but are not limited to: changing industry trends; market opportunities; our ability to leverage our existing voice infrastructure;the potential success and impact of our investments in artificial intelligence technologies; our ability to successfully upgrade former Fuze, Inc. customers to our 8x8 platform; our strategic transformation initiatives; our ability to drive increased platform and multi-product adoption; our ability to increase profitability and cash flow; our position in the market and pace of our innovation; the success of our go-to-market engine; our ability to enhance shareholder value; and our financial outlook, revenue growth, and profitability, including whether we will achieve sustainable growth and profitability. You should not place undue reliance on such forward-looking statements. Actual results could differ materially from those projected in forward-looking statements depending on a variety of factors, including, but not limited to: customer adoption and demand for our products may be lower than we anticipate; the impact of economic downturns on us and our customers; ongoing volatility and conflict in the political environment; general inflationary pressures; competitive dynamics of the cloud communication and collaboration markets, including voice, contact center, video, messaging, and communication application programming interfaces, as well as our competitors' use of AI, in which we compete, may change in ways we are not anticipating; third parties may assert ownership rights in our IP, which may limit or prevent our continued use of the core technologies behind our solutions; our customer churn rate may be higher than we anticipate; and our investments in marketing, channel and value-added resellers, new products, and our acquisition of Fuze, Inc. may not result in meeting our revenue or operating margin targets we forecast in our guidance, for a particular quarter or for the full fiscal year. Our increased emphasis on profitability and cash flow generation may not be successful; and the reduction in our total costs as a percentage of revenue may negatively impact our revenue and our business in ways we do not anticipate and may not achieve the desired outcome. For a discussion of such risks and uncertainties, which could cause actual results to differ from those contained in the forward-looking statements, see "Risk Factors" in the Company's reports on Forms 10-K and 10-Q, as well as other reports that 8x8, Inc. files from time to time with the Securities and Exchange Commission. All forward-looking statements are qualified in their entirety by this cautionary statement, and 8x8, Inc. undertakes no obligation to update publicly any forward-looking statement for any reason, except as required by law, even as new information becomes available or other events occur in the future. 1Q Fiscal 2026

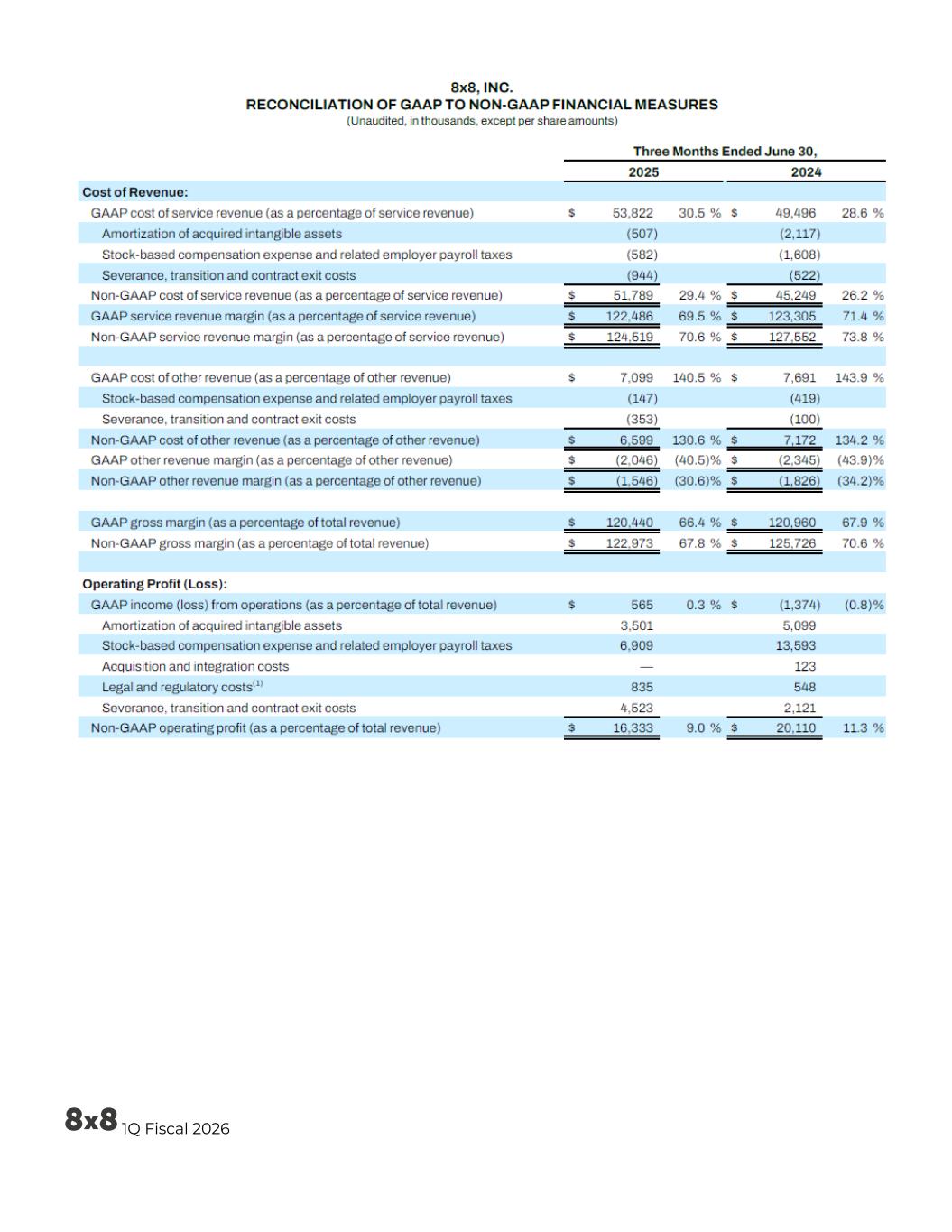

Explanation of GAAP to Non-GAAP Reconciliation Non-GAAP Service Revenue Gross Margin, Other Revenue Gross Margin, and Total Revenue Gross Margin Non-GAAP Service Revenue Gross Profit and Margin as a percentage of Service Revenue and Non-GAAP Other Revenue Gross Profit and Margin as a percentage of Other Revenue are computed as Service Revenue less Non-GAAP Cost of Service Revenue divided by Service Revenue and Other Revenue less Non-GAAP Cost of Other Revenue divided by Other Revenue, respectively. Non-GAAP Total Revenue Gross Profit and Margin as a percentage of Total Revenue is computed as Total Revenue less Non-GAAP Cost of Service Revenue and Non-GAAP Cost of Other Revenue divided by Total Revenue. Management believes the Company’s investors benefit from understanding these adjustments and from an alternative view of the Company’s Cost of Service Revenue and Cost of Other Revenue, as well as the Company's Service, Other and Total Revenue Gross Margin performance compared to prior periods and trends. Non-GAAP Operating Profit and Non-GAAP Operating Margin Non-GAAP Operating Profit excludes: amortization of acquired intangible assets, stock-based compensation expense and related employer payroll taxes, acquisition and integration expenses, certain legal and regulatory costs, certain severance, transition and contract exit costs, and impairment of long-lived assets from Operating Profit (Loss). Non-GAAP Operating Margin is Non-GAAP Operating Profit divided by Revenue. Management believes that these exclusions provide investors with a supplemental view of the Company’s ongoing operating performance. 1Q Fiscal 2026

1Q Fiscal 2026