Q2 2026 CEO Letter & Financial Highlights .2

We believe the foundation we’re building today is what will drive long-term value tomorrow: a unified, intelligent communications platform that helps organizations connect, serve, and grow in entirely new ways. To our employees, thank you for your dedication and creativity. To our customers, thank you for your trust. And to our shareholders, thank you for your continued confidence in 8x8 as we move forward together. Samuel C. Wilson, Chief Executive Officer .2

Second Quarter Fiscal 2026 Dear Stockholders, Customers, and Employees, I’m pleased to share that the second quarter of fiscal 2026 was another strong step forward for 8x8. We delivered our second consecutive quarter of year-over-year revenue growth, marked meaningful progress against our strategic goals, and continued to strengthen the foundation for durable, profitable growth. Total revenue for the quarter was $184 million, and service revenue was $179 million, both above the high end of our guidance range. It was our best top-line performance in two years, driven by record usage of our communications platform, strong execution across our business, and continued momentum in AI-driven customer experience solutions. More importantly, this quarter reflected steady progress against our key objectives for the year: achieve year-over- year revenue growth, complete the Fuze platform transition, harness the power of AI internally and in our platform, drive higher net revenue retention through multi- product adoption and transform our go-to-market strategy. CEO Letter to Stockholders .2 Financial Newsletter 3

Returning to Growth We set out this year to return to growth through focus, execution, and a commitment to customer outcomes. Q2 2026 delivered on that plan. Excluding Fuze related revenue (both on the 8x8 or Fuze platforms), 8x8 service revenue grew nearly 6% year-over-year, our fourth consecutive quarter of accelerating growth. The drivers were clear: steady expansion in usage-based revenue, strong adoption of our AI-powered solutions, and continued cross-sell across our installed base. Our usage-based offerings, which include CPaaS APIs, intelligent voice automation, and AI solutions sold on an as-consumed basis, now represent nearly one-fifth of service revenue, up from 13% a year ago. This mix shift reflects our evolution into a platform company where customers engage with us more deeply and more frequently over time. CEO Letter to Stockholders .2 Financial Newsletter 4

Harnessing AI to Work Smarter and Serve Better At 8x8, we’re using artificial intelligence to make our business and our customers’ businesses smarter, faster, and more connected. AI is becoming part of how we work, helping our teams improve efficiency, accuracy, and decision-making, as well as part of what we deliver through intelligent capabilities embedded across our communications platform. Our goal is to use AI thoughtfully, as a tool that amplifies human performance and helps organizations deliver better customer outcomes with greater ease. This quarter, we expanded AI functionality across the 8x8 platform to improve both customer experience and team productivity. In 8x8 Contact Center, live summarization for voice now automates after-call updates and improves CRM accuracy in real time. In 8x8 Work, native transcription powered by our partnership with OpenAI enhances call documentation across more than 20 languages. We also saw a surge in adoption of 8x8 Intelligent Directory, our AI-based auto attendant that routes calls automatically and learns from every interaction. Usage grew more than 180% quarter-over-quarter from the first quarter of 2026, demonstrating customers’ appetite for solutions that simplify automation and improve employee and customer experiences. Across the business, AI-driven voice interactions increased nearly sixfold, now accounting for more than 80% of all AI-based interactions on our platform. This growth underscores how deeply voice remains at the center of modern customer engagement, even as digital channels expand. Inside 8x8, we’re applying the same approach and using AI to enhance the quality and efficiency of our work. Our internal teams are leveraging AI to streamline processes, accelerate deal approvals, improve forecasting, and deliver more consistent pre- and post-sales experiences. We view AI as enhancing and elevating human efforts. By embedding intelligence into everything we do, we’re building a company that operates more efficiently, serves customers more effectively, and delivers measurable outcomes that last. CEO Letter to Stockholders .2 Financial Newsletter 5

Innovation as the Foundation for Growth At 8x8, innovation is what keeps us ahead. Recent product advancements reinforced our position as the industry’s most integrated platform for customer experience, combining communications, contact center, and CPaaS APIs into a single intelligent ecosystem. Our Customer JourneyAPI now gives companies a unified view of every customer interaction, connecting calls, chats, and digital engagements into one complete customer journey. With these insights, organizations can improve customer satisfaction and reduce handling time by understanding exactly where friction occurs. We also expanded Conversational Intelligence and Smart Assist to provide real-time sentiment insights and coaching suggestions for contact center agents. Our new Agentless Digital Payments feature enables secure, PCI-compliant payments directly through AI-powered voice or chat bots. No live agent required. On the platform side, 8x8 Work for Managed Devices was launched to help large retail and healthcare organizations manage shared devices with role-based access and built-in security. And with the addition of RCS and Viber support in 8x8 Engage, customer facing employees outside the contact center can now manage SMS, WhatsApp, Messenger, voice, and social media conversations seamlessly in one inbox. Each of these enhancements is designed to make communication simpler, smarter, and more integrated. That’s why we were again named a Leader in the IDC MarketScape for European Contact Center-as-a-Service, and recognized across multiple categories at the International Business Awards, including a Gold Stevie Award for Customer Service Executive of the Year. CEO Letter to Stockholders .2 Financial Newsletter 6

Completing the Fuze Platform Transition We’re now in the final phase of upgrading the customers remaining on the Fuze service platform, with only about 3% of service revenue remaining on that legacy system. All remaining customers are expected to transition to our modern 8x8 platform by year end, and we expect to complete the transition of Fuze legacy back-office systems by March 31, 2026. This has been a carefully managed process to ensure continuity and reliability while freeing us from the costs and inefficiencies of a redundant, legacy infrastructure. The result will be a simpler, more efficient operating model and an even stronger customer experience for these customers. Transforming Our Go-To-Market Strategy We’re also reshaping how we take our innovation to market. Over the past several quarters, we’ve taken a hard look at how our teams engage with customers, how we position our platform, and how we align sales, marketing, and channel activities to drive sustainable growth. Our go-to-market transformation is designed to make 8x8 simpler to do business with and faster to respond to customer needs. That means aligning sales resources around customer outcomes instead of products, building deeper relationships with our partners, and expanding our focus on consumption-based and multi-product sales. To lead this next phase, Stephen Hamill has assumed the role of Chief Revenue Officer, following his outstanding success driving adoption of our CPaaS communication APIs and growth in the Asia-Pacific region. Stephen brings a deep understanding of both our customers and our platform, and his leadership will be instrumental as we integrate our direct, channel, and partner motions into one unified go-to-market approach. We’ve already seen early signs of progress. Our pipeline quality has improved, partner engagement is strengthening, and our brand recognition continues to grow thanks to the success of our Power of You campaign, which saw a 47% increase in social engagement and strong market reception. These efforts are about focus. By combining disciplined execution with a more unified go-to- market model and a steady stream of new innovations, we’re positioning 8x8 to capture the next phase of growth and deliver even greater value for customers and shareholders. CEO Letter to Stockholders .2 Financial Newsletter 7

Increasing Multi-Product Adoption One of our most important growth levers continues to be expanding relationships with our existing customers. The number of customers using three or more 8x8 products grew double digits year over year and now represents more than one-third of total annual revenue excluding usage. A few customer stories from this quarter highlight how our unified platform strategy is resonating: • A US based network of healthcare providers expanded its 8x8 deployment with more than 3,000 UC seats and 100 Contact Center licenses to improve nurse communications and care coordination. • A regional bank selected 8x8 to unify customer engagement across its branch locations and digital channels. • And a UK-based healthcare provider became our largest customer to date for our AI- powered Intelligent Customer Assistant in a groundbreaking use of voice automation in healthcare. Each of these wins demonstrates how customers are developing deep partnerships with 8x8 to drive measurable outcomes in productivity, customer satisfaction, and cost efficiency. Financial Discipline and Strength Q2 also underscored our ongoing focus on financial discipline and operational efficiency. We delivered non-GAAP operating income of $17.3 million, representing a 9.4% operating margin, above the high end of our guidance. We also generated $8.8 million in operating cash flow, our 19th consecutive quarter of positive cash flow, and ended the quarter with $76.7 million in cash and equivalents. Since August 2022, we have reduced our total debt by more than 40%, reinforcing the strength of our balance sheet and increasing our flexibility to invest in growth. CEO Letter to Stockholders .2 Financial Newsletter 8

Looking Ahead As we look ahead, our product roadmap is focused on continuing to enhance our platform with features and capabilities that add value and improve customer outcomes. That includes AI- enabled tools, but it also includes ongoing work to make the platform easier to use with a modern, intuitive interface; advanced data analytics that give our customers real-time visibility and actionable insights; and orchestration across bots, agents, and CX tools to create seamless experiences. We are investing in both internally developed innovations and deeper native integrations with technology partners from our ecosystem. Key areas of focus include predictive customer journey orchestration, real-time sentiment analysis with automated escalation, AI orchestration using internal and external tools, and AI summarization across the entire platform. These innovations will help differentiate our platform in competitive evaluations, but more importantly, they are grounded in real customer needs. We’re also expanding internationally with a focus on distributed businesses like retail and regulated industries like healthcare and government where our compliance posture, self-service capabilities, and global infrastructure present real advantages. And, on a final note, we’re wrapping up a key chapter in our transformation. We remain on track to fully sunset the Fuze platform by fiscal year-end as we upgrade customers to the 8x8 platform. These customers gain the benefits of a modern business communications platform designed for the era of AI. For 8x8, this will eliminate complexity, unlock margin leverage, and free up resources to focus on growth. The bottom line: The foundations are strong, the strategy is clear, and execution is accelerating. And with our foundational expertise in voice, a capability many underestimate, we have a lasting edge as customer engagement enters a smarter, more connected era. To the 8x8 team: your resilience is what made this return to growth possible. To our customers and partners: thank you for the trust and collaboration that guide us every day. And to our stockholders: thank you for believing in our long-term vision. Sincerely, Samuel C. Wilson Chief Executive Officer CEO Letter to Stockholders .2 Financial Newsletter 9

Q2 2026 marked our second consecutive quarter of year-over-year revenue growth, reflecting healthy usage trends and disciplined execution. Excluding revenue from Fuze customers, whether on the 8x8 platform or not, service revenue grew nearly 6% year-over-year, which is higher growth than we achieved in Q1 2026 and our fourth quarter of acceleration. Kevin Kraus, Chief Financial Officer CEO Letter to Stockholders .2 Financial Newsletter 10

Financial Highlights In Q2 2026, 8x8 once again demonstrated steady, disciplined execution and consistent financial performance. The company extended its long track record of delivering non-GAAP operating profit and positive cash flow from operations, underscoring the strength of its business model and focus on sustainable growth. These results reflect a balanced approach of investing in innovation and customer success while maintaining tight control over expenses and efficiency. Behind the numbers is a simple story of operational consistency: 8x8 continues to perform quarter after quarter, translating innovation and execution into measurable profitability. This consistency has also allowed 8x8 to keep strengthening its balance sheet and increasing financial agility. Through ongoing debt reduction and careful capital management, the company has built flexibility to invest where it matters most, advancing its AI-powered platform, expanding customer relationships, and driving durable growth. The outcome is a more resilient, adaptable 8x8, well positioned to navigate changing market conditions while continuing to deliver value for customers, partners, and shareholders alike. CEO Letter to Stockholders .2 Financial Newsletter 11

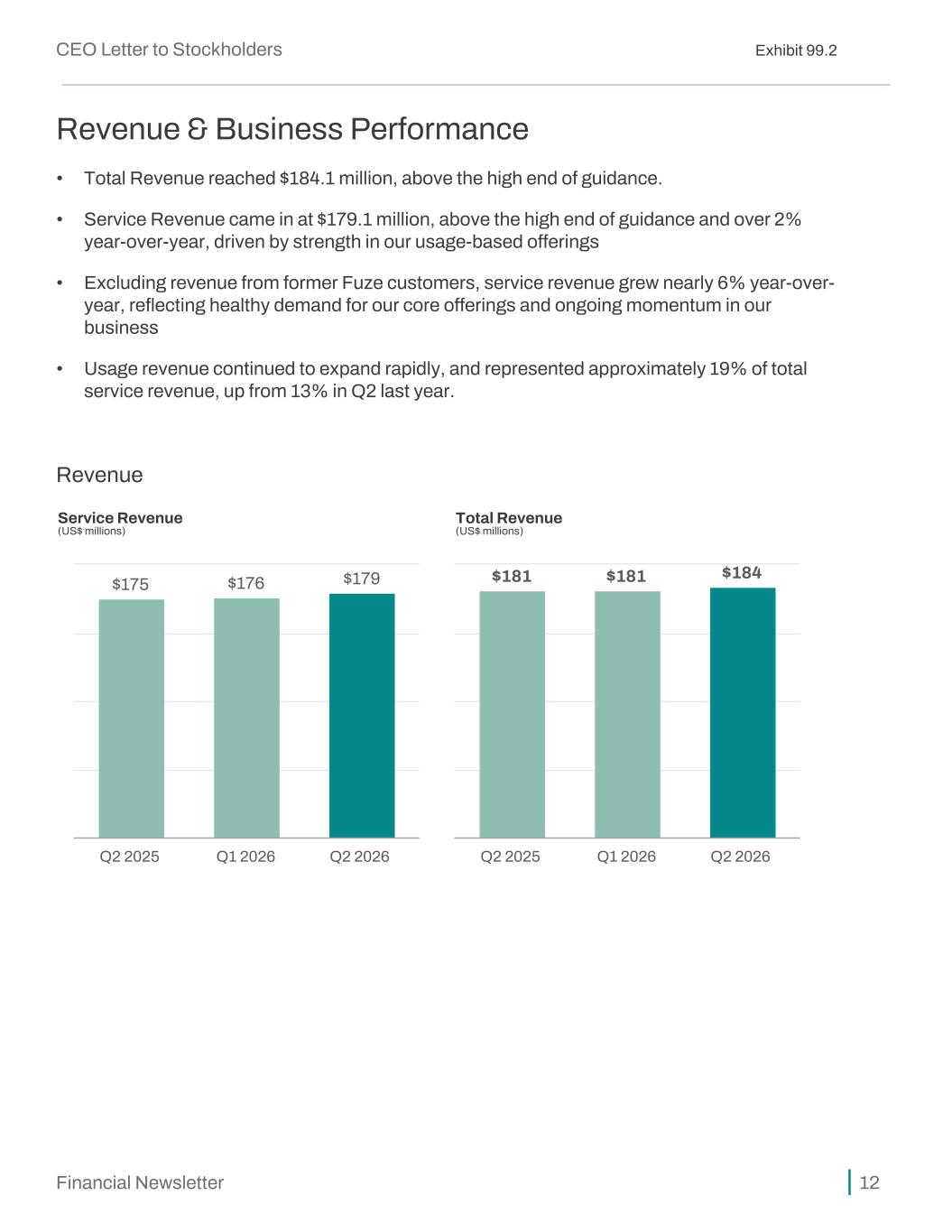

Revenue & Business Performance • Total Revenue reached $184.1 million, above the high end of guidance. • Service Revenue came in at $179.1 million, above the high end of guidance and over 2% year-over-year, driven by strength in our usage-based offerings • Excluding revenue from former Fuze customers, service revenue grew nearly 6% year-over- year, reflecting healthy demand for our core offerings and ongoing momentum in our business • Usage revenue continued to expand rapidly, and represented approximately 19% of total service revenue, up from 13% in Q2 last year. Revenue Service Revenue (US$ millions) Total Revenue (US$ millions) $175 $176 $179 Q2 2025 Q1 2026 Q2 2026 $181 $181 $184 Q2 2025 Q1 2026 Q2 2026 CEO Letter to Stockholders .2 Financial Newsletter 12

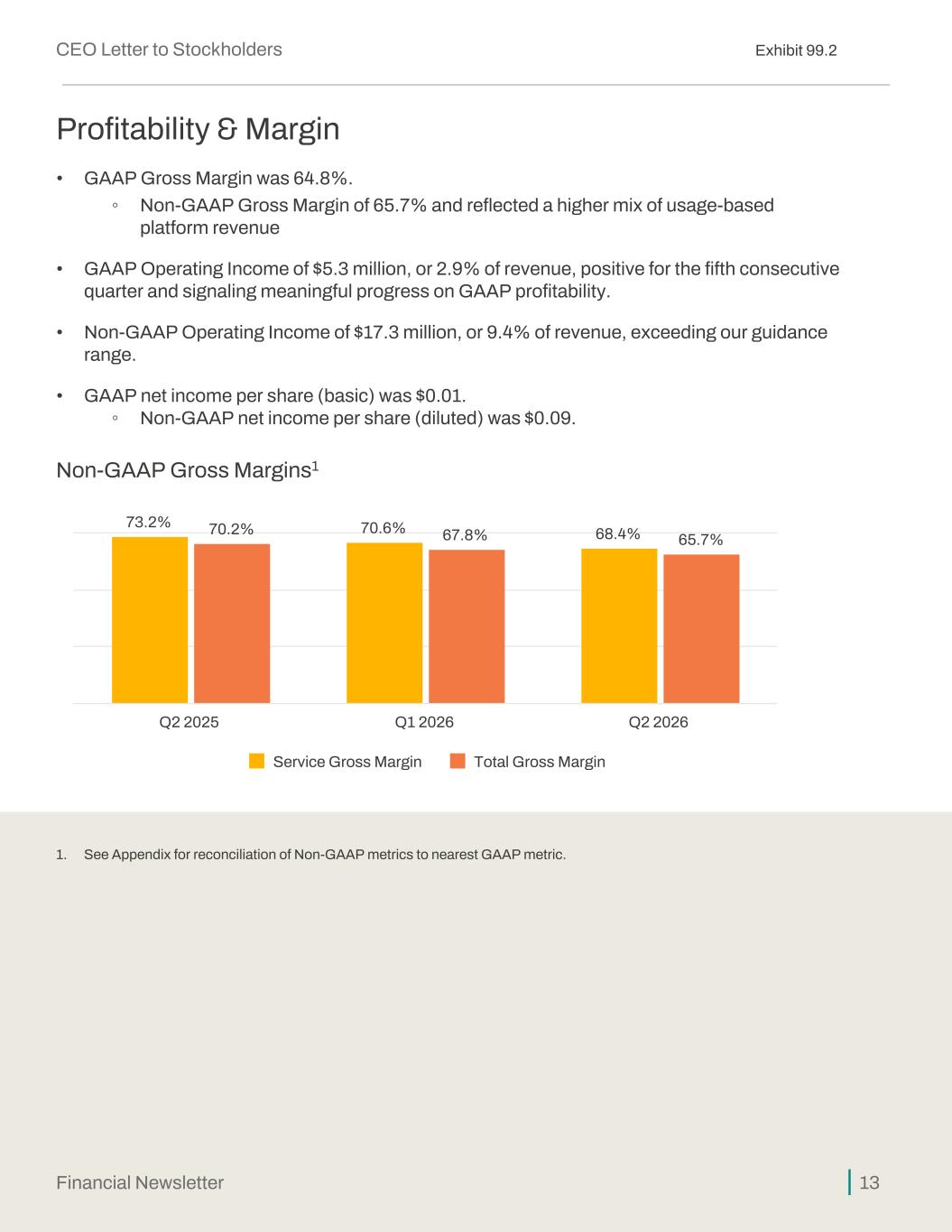

Profitability & Margin • GAAP Gross Margin was 64.8%. ◦ Non-GAAP Gross Margin of 65.7% and reflected a higher mix of usage-based platform revenue • GAAP Operating Income of $5.3 million, or 2.9% of revenue, positive for the fifth consecutive quarter and signaling meaningful progress on GAAP profitability. • Non-GAAP Operating Income of $17.3 million, or 9.4% of revenue, exceeding our guidance range. • GAAP net income per share (basic) was $0.01. ◦ Non-GAAP net income per share (diluted) was $0.09. Non-GAAP Gross Margins1 73.2% 70.6% 68.4%70.2% 67.8% 65.7% Service Gross Margin Total Gross Margin Q2 2025 Q1 2026 Q2 2026 1. See Appendix for reconciliation of Non-GAAP metrics to nearest GAAP metric. CEO Letter to Stockholders .2 Financial Newsletter 13

Non-GAAP Operating Income and Margin1 Non-GAAP Operating Income (US$ millions) Non-GAAP Operating Margin (% of revenue) $22 $16 $17 Q2 2025 Q1 2026 Q2 2026 11.9% 9.0% 9.4% Q2 2025 Q1 2026 Q2 2026 1. See Appendix for reconciliation of Non-GAAP metrics to nearest GAAP metric. CEO Letter to Stockholders .2 Financial Newsletter 14

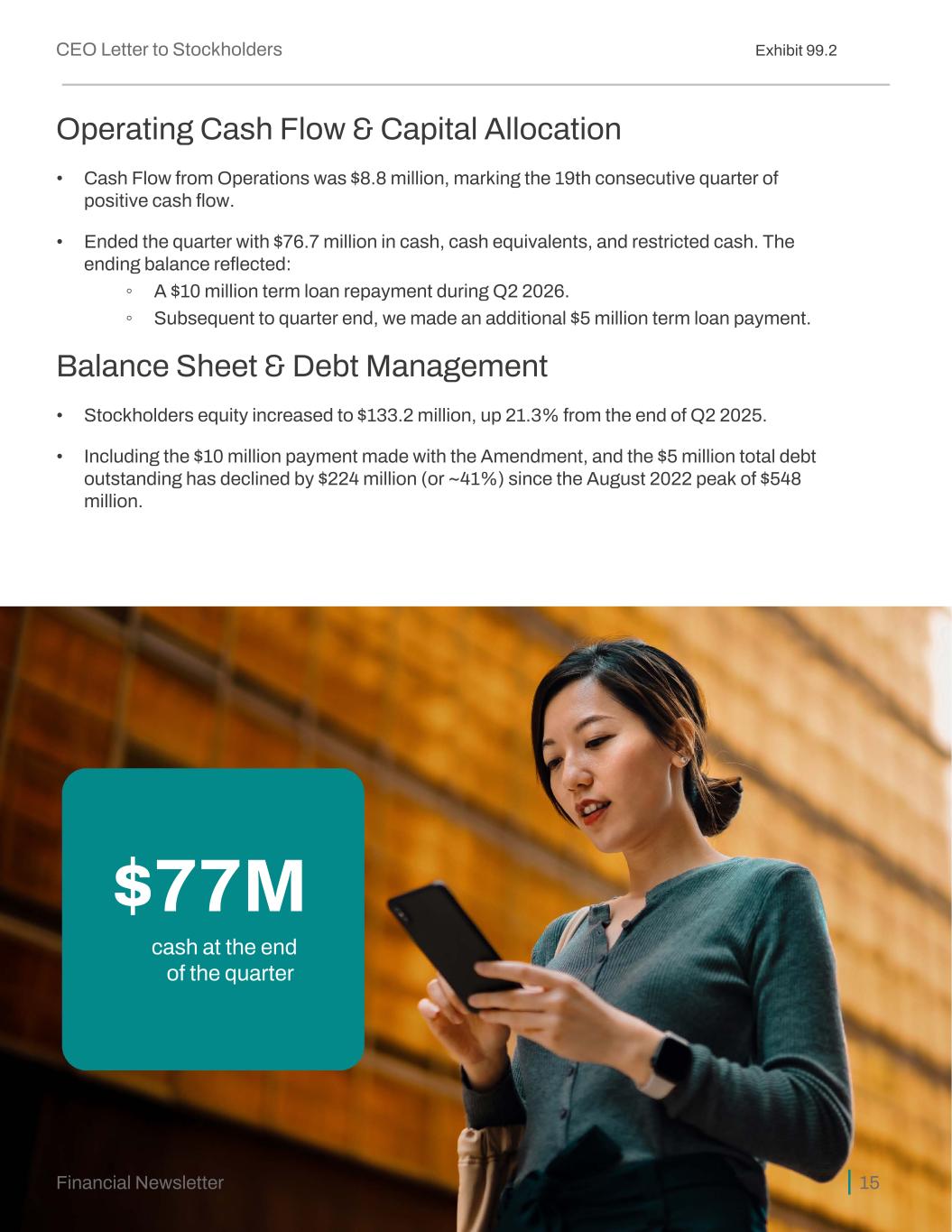

Operating Cash Flow & Capital Allocation • Cash Flow from Operations was $8.8 million, marking the 19th consecutive quarter of positive cash flow. • Ended the quarter with $76.7 million in cash, cash equivalents, and restricted cash. The ending balance reflected: ◦ A $10 million term loan repayment during Q2 2026. ◦ Subsequent to quarter end, we made an additional $5 million term loan payment. Balance Sheet & Debt Management • Stockholders equity increased to $133.2 million, up 21.3% from the end of Q2 2025. • Including the $10 million payment made with the Amendment, and the $5 million total debt outstanding has declined by $224 million (or ~41%) since the August 2022 peak of $548 million. $77M cash at the end of the quarter CEO Letter to Stockholders .2 Financial Newsletter 15

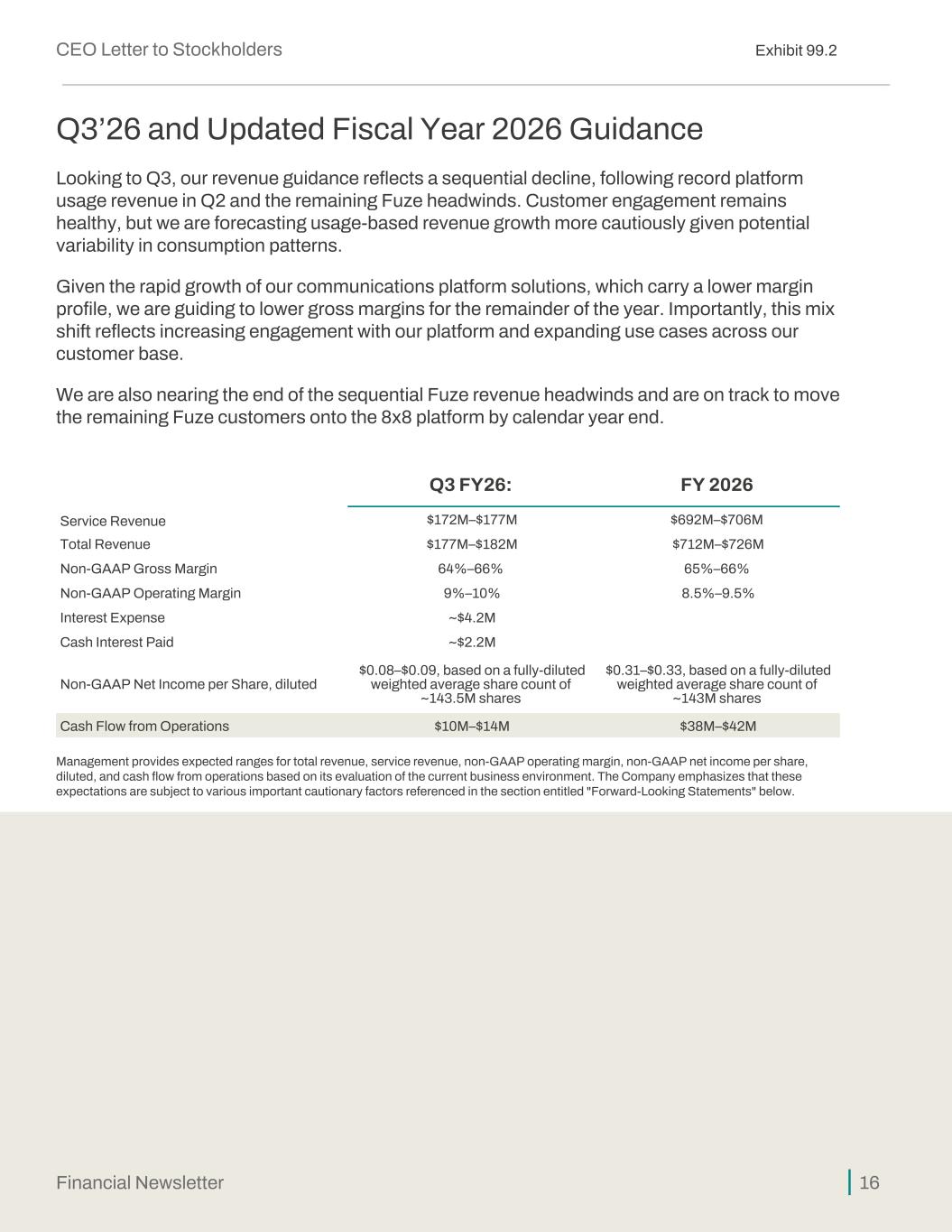

Q3’26 and Updated Fiscal Year 2026 Guidance Looking to Q3, our revenue guidance reflects a sequential decline, following record platform usage revenue in Q2 and the remaining Fuze headwinds. Customer engagement remains healthy, but we are forecasting usage-based revenue growth more cautiously given potential variability in consumption patterns. Given the rapid growth of our communications platform solutions, which carry a lower margin profile, we are guiding to lower gross margins for the remainder of the year. Importantly, this mix shift reflects increasing engagement with our platform and expanding use cases across our customer base. We are also nearing the end of the sequential Fuze revenue headwinds and are on track to move the remaining Fuze customers onto the 8x8 platform by calendar year end. Q3 FY26: FY 2026 Service Revenue $172M–$177M $692M–$706M Total Revenue $177M–$182M $712M–$726M Non-GAAP Gross Margin 64%–66% 65%–66% Non-GAAP Operating Margin 9%–10% 8.5%–9.5% Interest Expense ~$4.2M Cash Interest Paid ~$2.2M Non-GAAP Net Income per Share, diluted $0.08–$0.09, based on a fully-diluted weighted average share count of ~143.5M shares $0.31–$0.33, based on a fully-diluted weighted average share count of ~143M shares Cash Flow from Operations $10M–$14M $38M–$42M Management provides expected ranges for total revenue, service revenue, non-GAAP operating margin, non-GAAP net income per share, diluted, and cash flow from operations based on its evaluation of the current business environment. The Company emphasizes that these expectations are subject to various important cautionary factors referenced in the section entitled "Forward-Looking Statements" below. CEO Letter to Stockholders .2 Financial Newsletter 16

Forward-Looking Statements: This presentation includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and Section 21E of the Securities Exchange Act of 1934, as amended. Any statements that are not statements of historical fact may be deemed to be forward-looking statements. For example, words such as "may," "will," "should," "estimates," "predicts," "potential," "continue," "strategy," "believes," "anticipates," "plans," "expects," "intends," and similar expressions are intended to identify forward-looking statements. These forward- looking statements include, but are not limited to: the size of our market opportunity; the potential success and impact of our investments in artificial intelligence technologies; our expectation that we will complete all Fuze customer upgrades and wind down the Fuze business by the end of calendar year 2025; our strategic transformation initiatives; our ability to drive increased platform and multi-product adoption; our ability to increase profitability and cash flow and fund investment in innovation; whether we can increase customer retention; whether our unified communication and contact center traffic will increase; our future revenue and growth (including platform usage revenue); whether we can sustain an increasing pace of innovation; the success of our go-to- market engine; our ability to improve general and administrative synergies; our ability to enhance shareholder value; and our financial outlook, revenue growth, and profitability, including whether we will achieve sustainable growth and profitability. These forward-looking statements are predictions only, and actual events or results may differ materially from such statements depending on a variety of factors. These factors include, but are not limited to: • Customer adoption and demand for our products may be lower than we anticipate. • A reduction in our total costs as a percentage of revenue may negatively impact our revenues and our business. • Impact of economic downturns, political instability, government shutdowns and threats of shutdowns, rising interest rates and other inflationary pressures on us and our customers. • Risks related to our delayed draw term loan due 2027 and convertible senior notes due 2028, including the impact of variable interest expense and timing of any future repayments or refinancing on our stock price. • We may not achieve our target service revenue or total revenue growth rates, or the revenue and other amounts we forecast in our guidance, for a particular quarter or for the full fiscal year. • Competitive dynamics of the UCaaS, CCaaS, CPaaS, video and other markets in which we compete may change in ways we are not anticipating. • Our customer churn rate may be higher than we anticipate. • Third parties may assert ownership rights in our IP, which may limit or prevent our continued use of the core technologies behind our solutions. • Risks related to our plans to sunset the Fuze platform and migrate customers to our own platform following our earlier acquisition of Fuze, Inc • The impact of U.S. trade restrictions, tariffs and international trade policies could adversely affect our costs and operations. • Investments we make in marketing, channel and value-added resellers (VARs), e-commerce, and new products may not result in revenue growth. For a discussion of such risks and uncertainties, which could cause actual results to differ from those contained in the forward-looking statements, see “Risk Factors” in the Forms 10-K and 10-Q filed by 8x8, Inc. with the Securities and Exchange Commission. All forward-looking statements are qualified in their entirety by this cautionary statement, and 8x8, Inc. undertakes no obligation to update publicly any forward-looking statement for any reason, except as required by law, even as new information becomes available or other events occur in the future. CEO Letter to Stockholders .2 Financial Newsletter 17

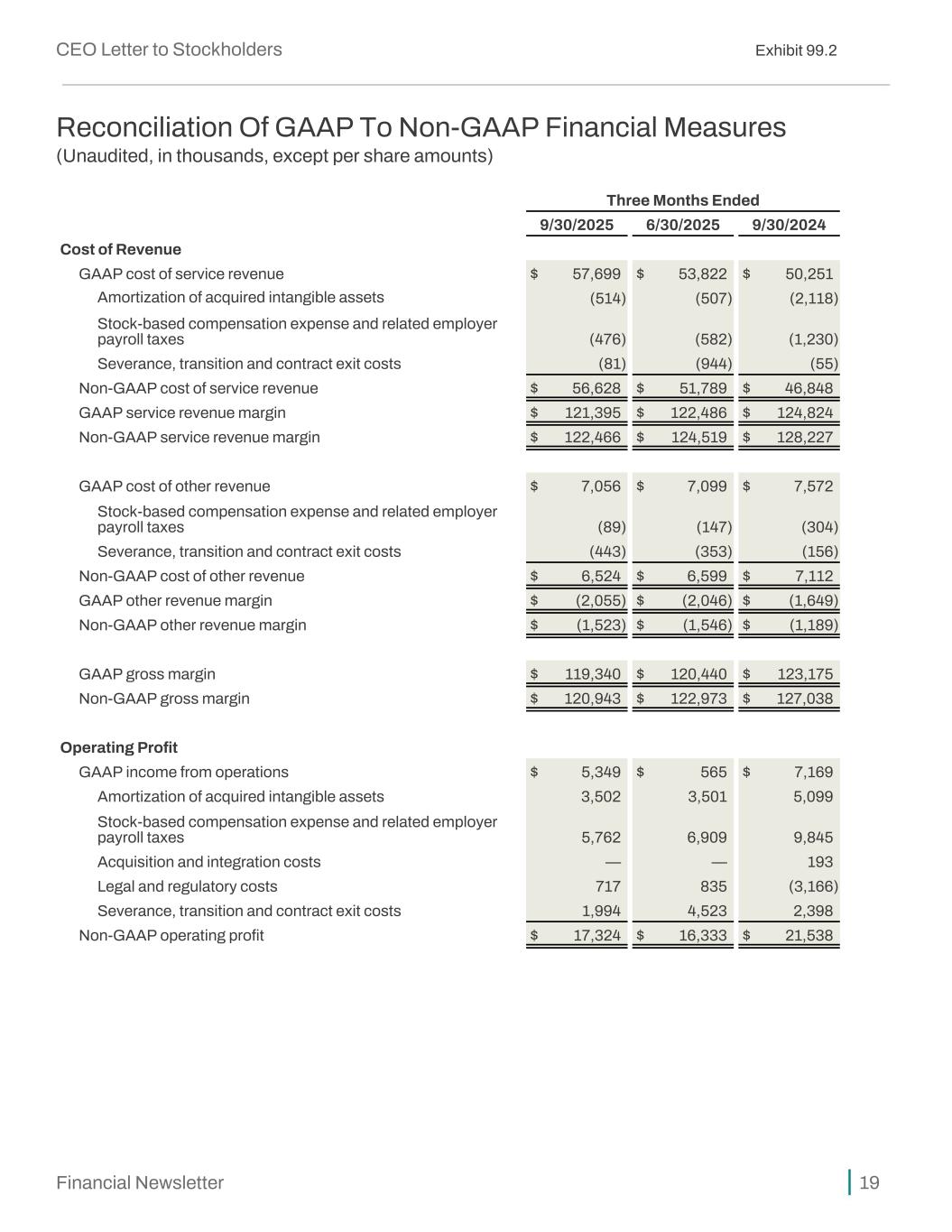

Explanation of GAAP to Non-GAAP Reconciliation Non-GAAP Service Revenue Gross Margin, Other Revenue Gross Margin, and Total Revenue Gross Margin Non-GAAP Service Revenue Gross Profit and Margin as a percentage of Service Revenue and Non-GAAP Other Revenue Gross Profit and Margin as a percentage of Other Revenue are computed as Service Revenue less Non-GAAP Cost of Service Revenue divided by Service Revenue and Other Revenue less Non-GAAP Cost of Other Revenue divided by Other Revenue, respectively. Non-GAAP Total Revenue Gross Profit and Margin as a percentage of Total Revenue is computed as Total Revenue less Non-GAAP Cost of Service Revenue and Non-GAAP Cost of Other Revenue divided by Total Revenue. Management believes the Company’s investors benefit from understanding these adjustments and from an alternative view of the Company’s Cost of Service Revenue and Cost of Other Revenue, as well as the Company's Service, Other and Total Revenue Gross Margin performance compared to prior periods and trends. Non-GAAP Operating Profit and Non-GAAP Operating Margin Non-GAAP Operating Profit excludes: amortization of acquired intangible assets, stock-based compensation expense and related employer payroll taxes, acquisition and integration expenses, certain legal and regulatory costs, certain severance, transition and contract exit costs, and impairment of long-lived assets from Operating Profit (Loss). Non-GAAP Operating Margin is Non-GAAP Operating Profit divided by Revenue. Management believes that these exclusions provide investors with a supplemental view of the Company’s ongoing operating performance. CEO Letter to Stockholders .2 Financial Newsletter 18

Reconciliation Of GAAP To Non-GAAP Financial Measures (Unaudited, in thousands, except per share amounts) Three Months Ended 9/30/2025 6/30/2025 9/30/2024 Cost of Revenue GAAP cost of service revenue $ 57,699 $ 53,822 $ 50,251 Amortization of acquired intangible assets (514) (507) (2,118) Stock-based compensation expense and related employer payroll taxes (476) (582) (1,230) Severance, transition and contract exit costs (81) (944) (55) Non-GAAP cost of service revenue $ 56,628 $ 51,789 $ 46,848 GAAP service revenue margin $ 121,395 $ 122,486 $ 124,824 Non-GAAP service revenue margin $ 122,466 $ 124,519 $ 128,227 GAAP cost of other revenue $ 7,056 $ 7,099 $ 7,572 Stock-based compensation expense and related employer payroll taxes (89) (147) (304) Severance, transition and contract exit costs (443) (353) (156) Non-GAAP cost of other revenue $ 6,524 $ 6,599 $ 7,112 GAAP other revenue margin $ (2,055) $ (2,046) $ (1,649) Non-GAAP other revenue margin $ (1,523) $ (1,546) $ (1,189) GAAP gross margin $ 119,340 $ 120,440 $ 123,175 Non-GAAP gross margin $ 120,943 $ 122,973 $ 127,038 Operating Profit GAAP income from operations $ 5,349 $ 565 $ 7,169 Amortization of acquired intangible assets 3,502 3,501 5,099 Stock-based compensation expense and related employer payroll taxes 5,762 6,909 9,845 Acquisition and integration costs — — 193 Legal and regulatory costs 717 835 (3,166) Severance, transition and contract exit costs 1,994 4,523 2,398 Non-GAAP operating profit $ 17,324 $ 16,333 $ 21,538 CEO Letter to Stockholders .2 Financial Newsletter 19

Business Highlights Innovation on the 8x8 Platform for CX 8x8 continued to advance the 8x8 Platform for Customer Experience with new capabilities that strengthen collaboration, streamline omnichannel engagement, and simplify operations for global enterprises. Recent innovations include: • Integrated Workforce Management: 8x8 introduced Workforce Management (WFM) aa s standard capability in every 8x8 Contact Center seat at no extra cost, enabling organizations to forecast, schedule, and staff more efficiently, simplifying operations for businesses of all sizes. • Simpler, Smarter Collaboration: 8x8 expanded its platform with native support for Mitel desk phones, allowing enterprises to modernize their voice infrastructure without replacing existing hardware and gain immediate access to 8x8’s AI-powered communications platform. New features in 8x8 Work, including AI-powered transcriptions, secure Android device management for shared devices, integrated file sharing in meetings and advanced meeting configuration, help distributed teams stay connected, compliant, and productive. • AI-Powered Support and Automation: The company introduced Live Summarizations and Native Transcription capabilities that apply AI in real time to improve agent productivity in the contact center, eliminating the need for manual wrap-ups, enhancing CRM data accuracy, and improving service quality. • Enhanced Omnichannel Engagement: 8x8 extended its digital channel reach with support for Viber and upgraded WhatsApp business messaging, adding call-to-action buttons, carousel templates, and secure media hosting to drive richer, conversion-ready customer interactions. New email picking tools and call parking features in 8x8 Engage features give frontline teams more flexibility to respond faster and collaborate seamlessly across channels. Together, these innovations reflect 8x8’s focus on unifying customer and employee experiences through intelligent, secure, and connected communication, empowering organizations to engage more effectively, operate more efficiently, and deliver better outcomes across every interaction. CEO Letter to Stockholders .2 Financial Newsletter 20

Recognition and Awards • Named a Leader in the IDC MarketScape: European Contact Center-as-a-Service Applications Software 2025 Vendor Assessment • Awarded Best Communications Provider-Enterprise by the Comms Council UK. • Recognized in the 2025 Gartner Magic Quadrant for Unified Communications as a Service. • Named in Tech Titans Report as Top UK Public Sector Tech Supplier. • Recognized across five categories in the 22nd Annual International Business Awards®, including a Gold Stevie® Award for Customer Service Executive of the Year. • Won Platinum Pinnacle Marketing & Comms Award for AI-powered Marketing Innovation for the Power of You. • Won Platinum MarCom Award for Social Media Marketing Campaign for the Power of You. Corporate and Leadership Updates Demonstrating its continued focus on long-term profitability, operational efficiency, and execution excellence, 8x8 advanced both its leadership strategy and financial discipline during the quarter. • Appointed Stephen Hamill as Chief Revenue Officer, following his success driving global adoption of 8x8’s CPaaS solutions. • Made a $10 million early term loan payment, with an additional $5 million paid in October, bringing total debt reduction to $224 million, or 41%, since August 2022—reflecting the company’s commitment to disciplined capital management and profitable growth. These actions reinforce 8x8’s strategy to drive sustainable innovation and deliver lasting shareholder value. CEO Letter to Stockholders .2 Financial Newsletter 21

Q2 2026 Press Releases 8x8 Named in Tech Titans Report as Top UK Public Sector Tech Supplier July 02, 2025 8x8 Celebrates Global Partner Excellence with 2025 Elevate Awards July 08, 2025 8x8 Expands Native SMS Support in Australia to Advance Customer Experience August 26, 2025 8x8 Recognized with Five Stevie Awards for Customer Service and Technology Excellence September 02, 2025 8x8 and ULAP Networks Partner to Accelerate Business Growth in Regulated Markets September 11, 2025 8x8 Launches “CX Champions Fantasy Team” to Recognize the Real People Powering Great Customer Experience September 16, 2025 Seamless Mobile Video CX Now Available Across Asia-Pacific via 8x8, Modica Group Partnership September 23, 2025 8x8 Launches No-Code SMS Fraud Protection to Combat $2.1B Global Threat September 25, 2025 8x8 Recognized in 2025 Gartner® Magic Quadrant™ for UCaaS for Fourteenth Year in Row September 26, 2025 Recent Blog Posts The Future of WhatsApp Engagement with MM Lite API: Smarter, Not Louder How CPaaS Is Reshaping Contact Centers for the Omnichannel Era How to Orchestrate SMS, WhatsApp, and Video Like a Pro: No-Fluff Best Practices That Scale Silent Shields, Real-Time Trust: The Business Case for Voice Number Masking CEO Letter to Stockholders .2 Financial Newsletter 22

CEO Letter to Stockholders .2 Financial Newsletter 23