Q3 2026 CEO Letter & Financial Highlights .2

Our third quarter results reflect continued progress as our strategic investments translated into improving execution across the business. We delivered another quarter of year-over-year revenue growth and solid cash flow performance, while seeing increased customer interest in our new products and AI capabilities. Across the industry, AI is reshaping how organizations think about customer engagement. Voice continues to be the preferred way to communicate when interactions are complex, time-sensitive, or high value. At the same time, digital channels are playing an increasingly important role as customers expect faster, more flexible ways to connect. As these engagement models evolve alongside greater emphasis on security, privacy, and vendor consolidation, 8x8 is well positioned with a unified, secure platform designed to help organizations simplify their environments and modernize with confidence. Samuel C. Wilson, Chief Executive Officer .2

Third Quarter Fiscal 2026 Dear Stockholders, Customers, Partners and Employees, I'm pleased to share our third quarter results, which show strong evidence that our strategic investments across innovation, operational efficiency, and distribution are beginning to yield measurable results. We're seeing encouraging momentum across multiple dimensions of the business, though we remain focused on the execution work ahead. The most visible evidence of our growing momentum is record service revenue of $179.7 million, an increase of 3.6% year-over- year. This marks our third consecutive quarter of year-over-year service revenue growth and our 20th consecutive quarter of positive operating cash flow. I believe this shows our operating model is working: we are driving growth in the strategic components of our service revenue, while maintaining discipline on profitability and cash generation. Importantly, we continued to show steady progress against our key objectives for the year: achieve year-over-year revenue growth, complete the Fuze platform transition, harness the power of AI internally and in our platform, drive higher net revenue retention through multi-product adoption and transform our go-to- market strategy. CEO Letter to Stockholders .2 Financial Newsletter 3

Growth in Usage-Based Revenue A key driver of our growth was increased consumption of our usage-based offerings, which grew nearly 60% year-over-year. Usage-based revenue represented more than 20% of service revenue for the quarter, up from the mid-teens a year ago. Much of this growth comes from our CPaaS APIs, but we are also seeing an acceleration in adoption of AI-based solutions and contact center digital channels as customers move from experimentation to broad-scale implementation. The growth in our usage revenue and adoption of AI solutions go hand in hand. Both trends reflect the early stages of a broader industry shift away from pure SaaS subscriptions to hybrid and "tokenized" pricing models that combine committed subscriptions with consumption pricing. This "pay-as-you-go" approach appeals to customers because it reduces risk as they adopt new technologies. It also raises the bar for vendors because revenue is now linked directly to successful customer outcomes. With AI evolving as fast as it is, we believe this is the wave of the future. We're positioning ourselves ahead of this curve in multiple ways: with investments that enable simplified consumption-based pricing across our portfolio, process improvements that make it easier to do business with us, product-led growth initiatives that allow customers to “try before you buy,” and AI-driven automations that allow us to scale our customer success organization. We are our own "customer zero" as we reimagine every aspect of our business for the AI era. CEO Letter to Stockholders .2 4

AI Adoption is Accelerating AI adoption is moving beyond pilot projects into production at scale, and the numbers tell a compelling story. Customer adoption of our Intelligent Customer Assistant increased 70% year- over-year. Interactions with our Intelligent Customer Assistant and AI auto-attendant more than doubled from the third quarter of fiscal 2025. Voice AI interactions increased more than 200%, and now represent more than 80% of all AI interactions on our platform. Voice remains the channel of choice for important communications, and our core IP in voice communications is becoming an increasingly valuable competitive advantage. We've built this capability over decades, and it positions us uniquely as voice becomes the preferred interface for AI-powered customer experiences. Multi-Product Strategy and Channel Expansion Our strategy to expand multi-product adoption is gaining traction in ways that directly impact our business model. All of our top 20 customers now have multiple products, and most have three or more. This matters because customers with multiple products see us as a strategic platform partner rather than a point solution, resulting in substantially higher revenue, customer satisfaction and retention. On average, customers with 3 or more products generate more than 3 times the revenue of customers with 2 products. These customers stay longer and expand more, building the foundation for durable, long-term growth. A year ago, these numbers looked very different. The shift we're seeing now isn't accidental— it's the result of a deliberate focus on solution selling, better customer journey mapping, and tighter alignment between our sales, customer success, and technical support teams. At the same time, we're making meaningful progress in our channel strategy. Revenue through our partner channels – our most efficient go-to-market motion – is growing. We know we have work to do to expand our distribution globally, but we're seeing early traction from newly implemented partner programs and incentives. Importantly, channel-sourced pipeline is showing sequential improvement quarter over quarter as these new programs take root. This is significant because our channel partners are evolving with the market, serving as trusted advisors to their customers and helping organizations modernize legacy infrastructures and navigate complex technology transitions. As we strengthen our channel partnerships through improved enablement, better incentive alignment, and co-selling motions, we are creating a multiplier effect on our go-to-market reach and effectiveness. CEO Letter to Stockholders .2 5

New Products Gaining Traction Sales of new and strategic products re-accelerated in Q3, growing more than 20% year-over- year. Four of our strategic new products grew triple digits year-over-year, including 8x8 Engage. Specifically, our AI solutions grew over 30% year-over-year, though I believe this metric actually understates the impact of AI on our business. AI is embedded across our platform – it drives transcription in our meetings and insights in our contact center, allowing customers to realize immediate value from their investments in 8x8 solutions. Customers appreciate the future- proofing our AI strategy provides—they know their investment in 8x8 won't box them in as technology evolves. 8x8 Engage deserves special mention as it is one of the fastest growing products in our Company's history and continues to gain momentum across industries like healthcare, retail, and professional services. The product-market fit is exceptional, with strong early customer adoption and satisfaction. Engage recently won the Gold at the London Design Awards for user experience, a strong external validation of our product strategy and design focus. Customer Wins Validate Our Strategy Three examples from Q3 that demonstrate how customers are choosing 8x8 to solve real business challenges. Healthcare: Strategic Partnership Over Point Solutions A regional health system with over 850 employees selected 8x8 over both Zoom and RingCentral for a comprehensive unified communications and contact center deployment. What differentiated us? We went onsite to meet with their entire team – something neither competitor offered. We provided industry-matched references that spoke directly to their healthcare operations. We demonstrated deep understanding of their patient care workflows and compliance requirements. And critically, we showed them how our platform could support not just their current needs, but their future transformation toward enhanced patient care through self-service and proactive messaging. We won because we approached the sale as a strategic partner invested in their long-term success, not just a technology vendor selling seats. This is the consultative approach that drives competitive wins. Early Education: Complex Transformation Partnerships A U.S. based early education provider with over 43,000 employees chose 8x8 for a significant expansion of their unified communications. CEO Letter to Stockholders .2 6

This was a complex sale requiring a flexible OpEx model that aligned with their finance-driven, stage-gated approval process. We bundled unified communications, professional services, deployment, monitoring, and dedicated resources into a structure that met both their financial and operational requirements. We removed execution risk early by proposing a scalable implementation and device replacement strategy Throughout the extended buying cycle, we acted as a transformation partner, enabling pilot locations and maintaining strong alignment across IT, Procurement, Finance, and Professional Services stakeholders. This is exactly the kind of strategic partnership that drives long-term value and positions us for future expansion opportunities. Veterinary Services: Installed Base Expansion Through Trust A large veterinary and pet hospital company with 35,000 employees expanded their investment with us by adding significant contact center capacity during the quarter. We earned this expansion through disciplined, consistent engagement. We maintained weekly cadence with their new contact center leadership team. We focused on understanding their current state and future vision. We aligned on roadmap priorities and demonstrated how our solution supported their evolving initiatives with concrete use cases and business outcomes. This expansion enabled them to better support their operational goals and advance key customer-facing initiatives with confidence. This is installed base expansion done right – it's about being a trusted advisor who understands the customer's business, not just a vendor pushing products. These wins reflect common themes: customers are choosing integrated platforms over point solutions, valuing strategic partnerships, and selecting vendors positioned for the future of AI- powered communications. They also reflect our internal commitment to leveraging AI to map customers' journeys, tailor solutions, and improve the quality and quantity of customer interactions. CEO Letter to Stockholders .2 7

Completing the Fuze Migration In Q3, we reached a significant operational milestone with the completion of the final upgrades of Fuze customers to the 8x8 platform. Every one of our customers is now on our modern, unified 8x8 communications platform. This sets the stage for improved customer retention, better expansion opportunities, higher satisfaction, and meaningfully more efficient operations across our network and back-office systems. While the final disposition of the remaining Fuze customers created a revenue headwind for the fourth quarter and fiscal 2027, the strategic benefit is clear. We can now focus 100% of our energy on growth and customer success rather than managing legacy infrastructure. This removes a multi-year operational burden that has constrained our agility and diverted resources from higher-value activities. Positioned for Key Industry Trends We're realistic about the competitive and evolving marketplace. We know we need to accelerate installed base expansion and drive stronger channel momentum. Our updated guidance ranges reflect this realism as we navigate these market dynamics. But we believe we're well-positioned against the key trends shaping our industry. Platform Convergence Product segmentation between unified communications, contact center, and CPaaS is breaking down. Customer experience and employee experience are converging. Buyers want to unify communications and manage it as core infrastructure. Our integrated platform strategy positions us squarely at the center of this shift. We're not bolting together acquisitions – we've built a unified platform from the ground up that seamlessly integrates UC, contact center, and CPaaS capabilities. AI Embedded Everywhere AI is becoming table stakes across the communications stack, but what matters now is the depth of the integration and how effectively it delivers value. Our platform integrates AI at every level – from voice and messaging APIs to contact center and collaboration tools – giving customers flexibility and future-proofing their investments. We're not forcing customers to choose a single AI model or approach. Instead, we provide a flexible communications platform that enables integrations across a broad range of applied AI solutions and large language models. CEO Letter to Stockholders .2 8

Customers appreciate this "future-proofed" approach. They know their investment in the 8x8 platform doesn't box them in as technology evolves. Providers want to partner with us because instead of competing with their AI offerings, we provide the communications infrastructure that makes their AI applications more valuable. Voice as the AI Interface Even in an AI-first world, voice remains the preferred channel for customer interactions. The data from our own platform confirms this – voice AI interactions represent the vast majority of our AI activity and are growing faster than any other modality. Our decades of intellectual property in voice communications – building carrier-grade, crystal- clear global voice networks with high availability, global PSTN deployments, E911 compliance, and security and fraud capabilities – creates a competitive advantage that widens as voice becomes the primary interface for AI-powered customer experiences. AI model providers don't want to own high-availability global voice networks and deal with real- world friction like latency, regulatory compliance, and carrier relationships. They want to partner with companies like 8x8 who handle these complexities as core competencies. Security, privacy, identity, and trust Fraud continues to rise and regulation and data residency requirements are increasing globally. In an AI-plus-voice world, trust, compliance, and sovereignty become table stakes and a durable source of differentiation at scale. We are investing in innovation that enables detection of voice fraud and other emerging threats. Our enterprise-grade security, global compliance posture, and commitment to data sovereignty position us well as regulatory requirements tighten. Channel as the Growth Engine Distribution and customer intimacy remain critical success factors. Technology reaches buyers through channels and product-led growth motions. Channel partners go beyond distribution and act as trusted advisors to their customers, driving modernization of legacy infrastructures and adoption of new technologies . We're expanding our channel programs and seeing early results. Our investments in partner incentives, enablement, and support are gaining traction. We're in the early stages of this journey, but the sequential improvement in channel-sourced pipeline and revenue demonstrates momentum. CEO Letter to Stockholders .2 9

Looking Ahead To wrap up, we're seeing encouraging signs across the business. Usage-based revenue is scaling rapidly. AI adoption is accelerating as customers move from pilots to production. Existing customers are expanding their commitments with multiple products. New products like 8x8 Engage and our AI-based solutions are gaining significant traction. Our outcome-focused platform strategy is resonating with customers and partners. We have momentum entering the fourth quarter and strong confidence in our ability to deliver sustained, profitable growth and shareholder value over time. When we look back a year from now, I believe we will see that Q3 marked the inflection point in our transformation. To the 8x8 team: your resilience is what made this return to growth possible. To our customers and partners: thank you for the trust and collaboration that guide us every day. And to our stockholders: thank you for believing in our long-term vision. Onward, Samuel Wilson Chief Executive Officer 8x8, Inc. CEO Letter to Stockholders .2 10

Our third quarter performance reflected improved execution across revenue, non-GAAP operating margin and cash flow, enabling us to raise our guidance for the fourth quarter and the full fiscal year. This momentum is supported by disciplined cost management, ongoing deleveraging, and a continued focus on generating durable profitability and cash flow.” Kevin Kraus, Chief Financial Officer CEO Letter to Stockholders .2 11

Financial Highlights Our fiscal third quarter reflected strong financial execution and continued progress against our operating priorities. We delivered our third consecutive quarter of year-over-year revenue growth and achieved an all-time high for service revenue, while exceeding the high end of our guidance ranges for operating profit, earnings per share, and cash flow from operations. These results were driven by accelerating demand for our usage-based offerings, improved sales execution, and consistent operational focus, underscoring the strength of our operating model. Following our strong Q3 results, we raised our guidance ranges for fourth quarter and full year revenue, operating margin, and cash flow. In addition, we successfully completed the final upgrades of Fuze customers to the 8x8 platform. While the decommissioning of the of the Fuze platform creates some near-term revenue headwinds, operating on a single platform allows to improve efficiency, reduce complexity, and drive higher customer satisfaction and retention across the business. CEO Letter to Stockholders .2 12

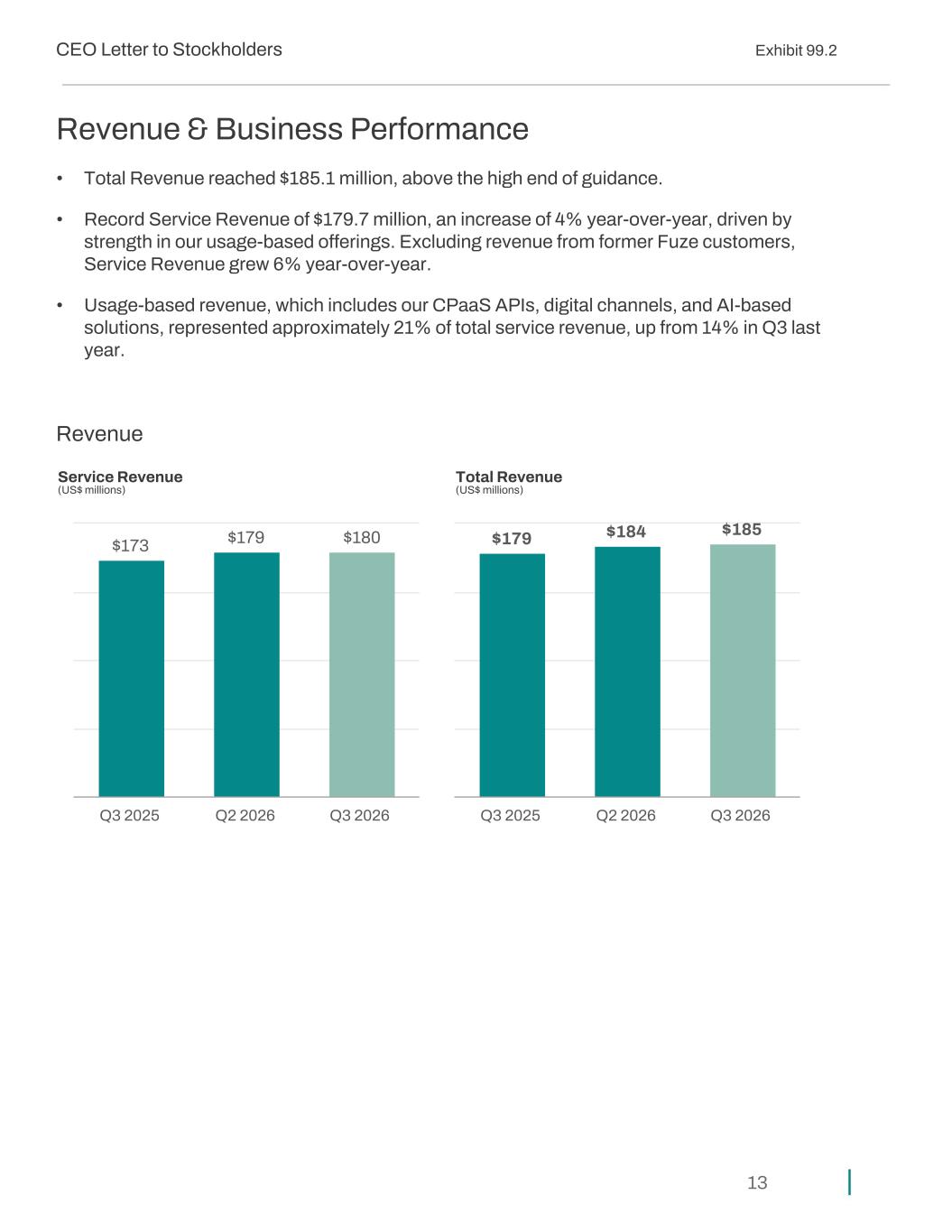

Revenue & Business Performance • Total Revenue reached $185.1 million, above the high end of guidance. • Record Service Revenue of $179.7 million, an increase of 4% year-over-year, driven by strength in our usage-based offerings. Excluding revenue from former Fuze customers, Service Revenue grew 6% year-over-year. • Usage-based revenue, which includes our CPaaS APIs, digital channels, and AI-based solutions, represented approximately 21% of total service revenue, up from 14% in Q3 last year. Revenue Service Revenue (US$ millions) Total Revenue (US$ millions) $173 $179 $180 Q3 2025 Q2 2026 Q3 2026 $179 $184 $185 Q3 2025 Q2 2026 Q3 2026 CEO Letter to Stockholders .2 13

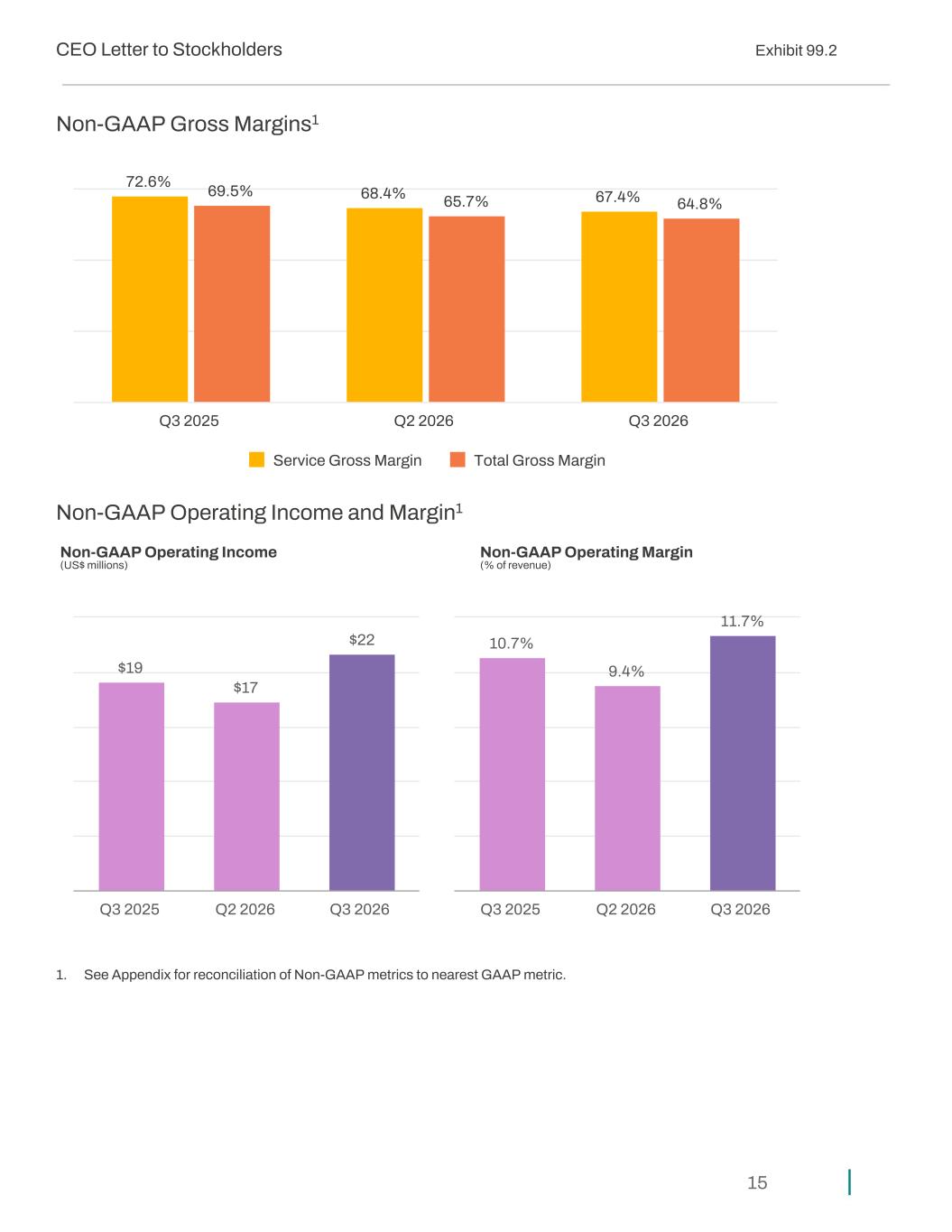

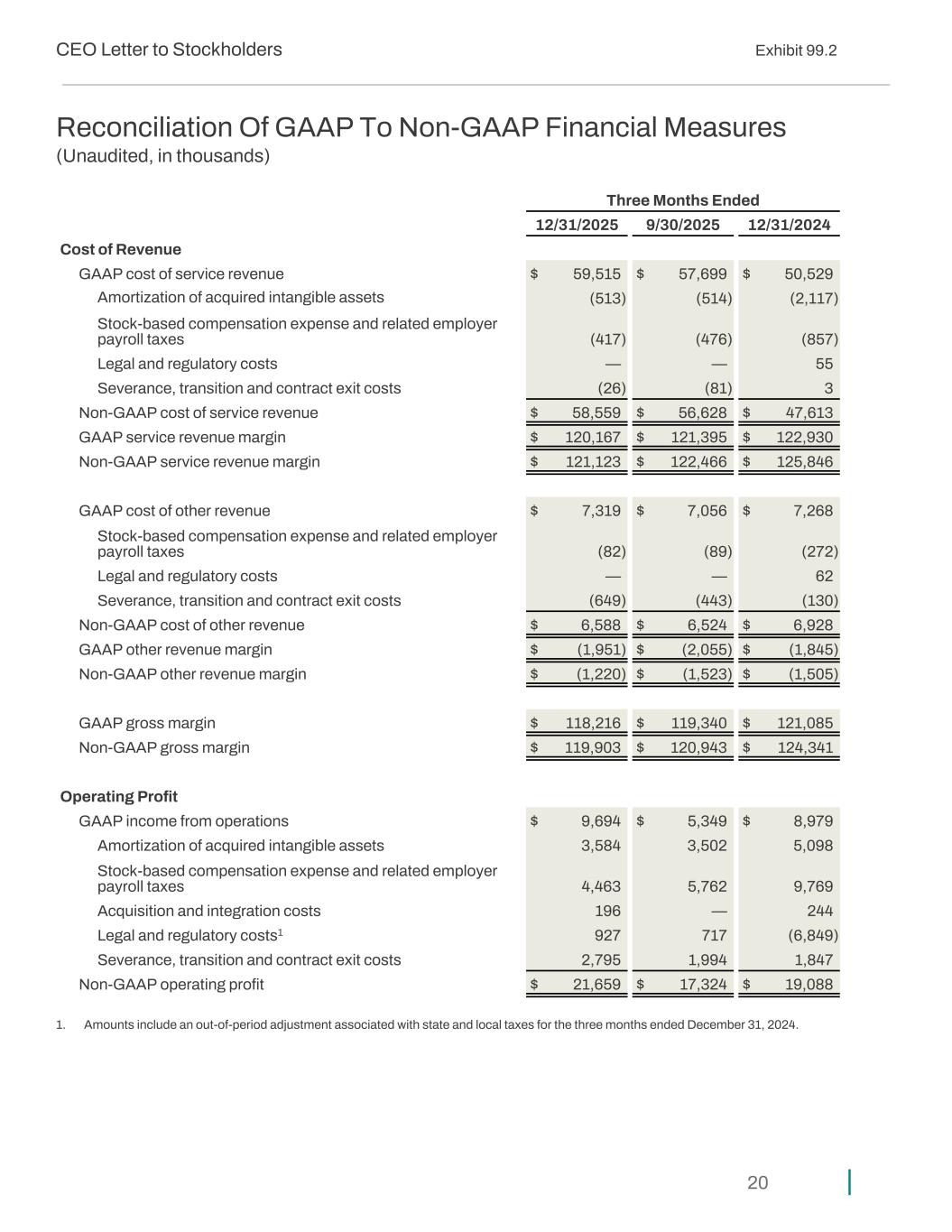

Profitability & Margin • GAAP Gross Profit was $118.2 million, or 63.9% of revenue, compared to gross profit of $ $121.1 million, or 67.7% of revenue, in the third quarter of fiscal 2025. • Non-GAAP Gross Profit was $119.9 million, or 64.8% of revenue, compared to non- GAAP gross profit of $124.3 million, or 69.5% of revenue, in the third quarter of fiscal 2025. The year-over-year decline in gross profit reflected a higher mix of usage-based platform revenue. • GAAP Operating Income was $9.7 million, or 5.2% of revenue, and positive for the sixth consecutive quarter. ◦ Non-GAAP Operating Income of $21.7 million, or 11.7% of revenue, increased year- over-year and sequentially, exceeded the high end of our guidance range. • GAAP net income per share (diluted) was $0.04, compared to $0.02 per share in the third quarter of fiscal 2025. ◦ Non-GAAP net income per share (diluted) was $0.12, compared to $0.11 per share in the year ago quarter. The year-over-year increase in GAAP and non-GAAP net income per share (diluted) reflected higher operating income and lower interest expense relative to the prior period. CEO Letter to Stockholders .2 14

Non-GAAP Gross Margins1 72.6% 68.4% 67.4%69.5% 65.7% 64.8% Service Gross Margin Total Gross Margin Q3 2025 Q2 2026 Q3 2026 Non-GAAP Operating Income and Margin1 Non-GAAP Operating Income (US$ millions) Non-GAAP Operating Margin (% of revenue) $19 $17 $22 Q3 2025 Q2 2026 Q3 2026 10.7% 9.4% 11.7% Q3 2025 Q2 2026 Q3 2026 1. See Appendix for reconciliation of Non-GAAP metrics to nearest GAAP metric. CEO Letter to Stockholders .2 15

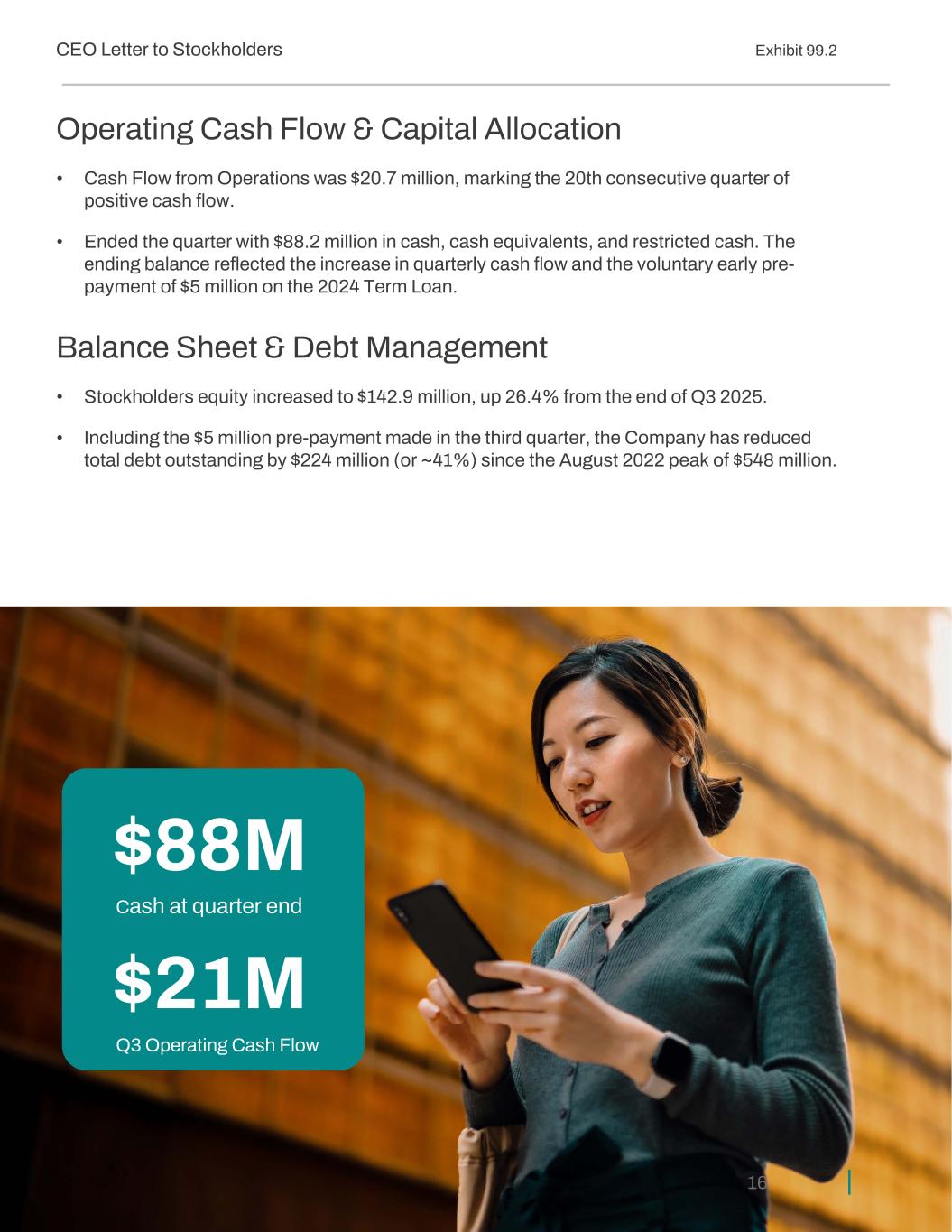

Operating Cash Flow & Capital Allocation • Cash Flow from Operations was $20.7 million, marking the 20th consecutive quarter of positive cash flow. • Ended the quarter with $88.2 million in cash, cash equivalents, and restricted cash. The ending balance reflected the increase in quarterly cash flow and the voluntary early pre- payment of $5 million on the 2024 Term Loan. Balance Sheet & Debt Management • Stockholders equity increased to $142.9 million, up 26.4% from the end of Q3 2025. • Including the $5 million pre-payment made in the third quarter, the Company has reduced total debt outstanding by $224 million (or ~41%) since the August 2022 peak of $548 million. $88M Cash at quarter end $21M Q3 Operating Cash Flow CEO Letter to Stockholders .2 16

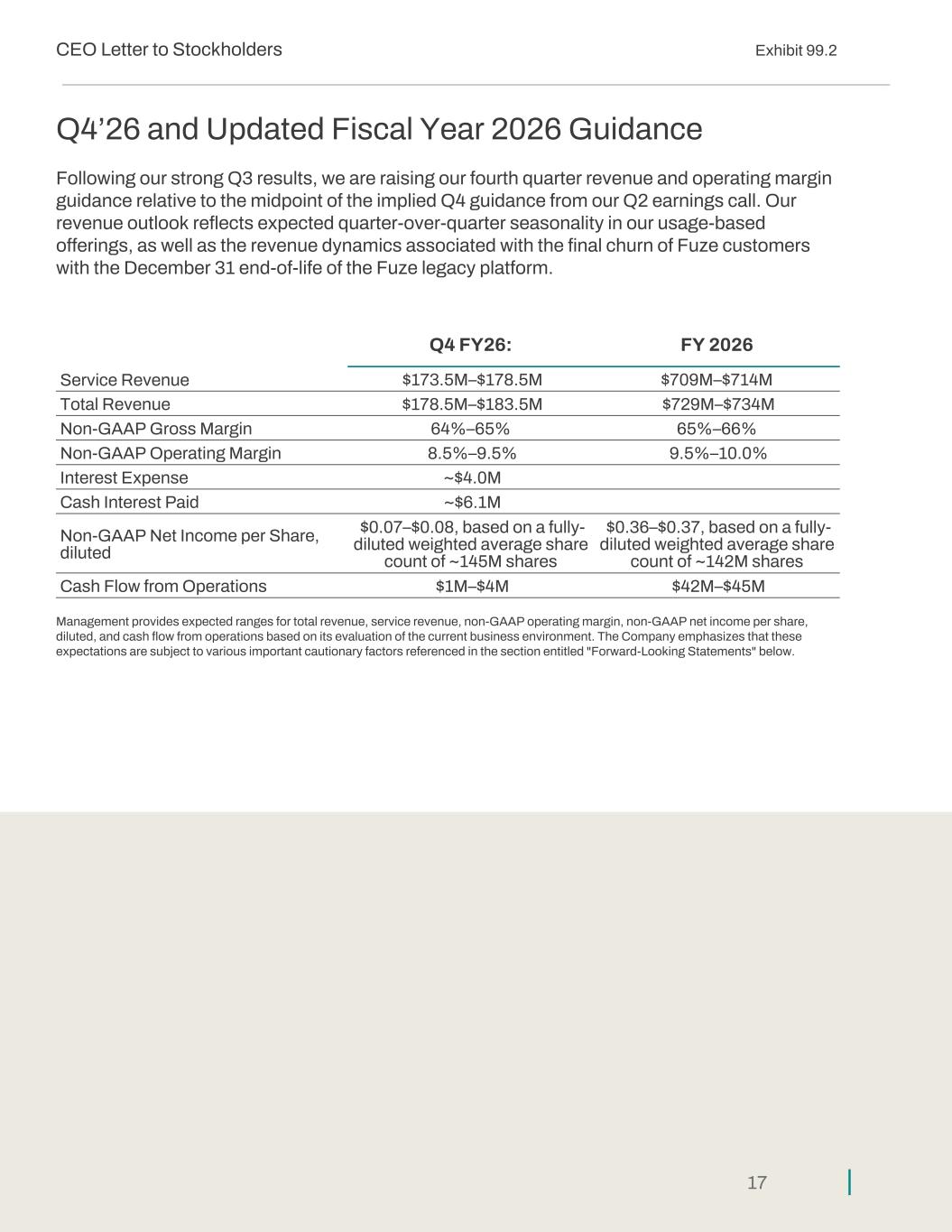

Q4’26 and Updated Fiscal Year 2026 Guidance Following our strong Q3 results, we are raising our fourth quarter revenue and operating margin guidance relative to the midpoint of the implied Q4 guidance from our Q2 earnings call. Our revenue outlook reflects expected quarter-over-quarter seasonality in our usage-based offerings, as well as the revenue dynamics associated with the final churn of Fuze customers with the December 31 end-of-life of the Fuze legacy platform. Q4 FY26: FY 2026 Service Revenue $173.5M–$178.5M $709M–$714M Total Revenue $178.5M–$183.5M $729M–$734M Non-GAAP Gross Margin 64%–65% 65%–66% Non-GAAP Operating Margin 8.5%–9.5% 9.5%–10.0% Interest Expense ~$4.0M Cash Interest Paid ~$6.1M Non-GAAP Net Income per Share, diluted $0.07–$0.08, based on a fully- diluted weighted average share count of ~145M shares $0.36–$0.37, based on a fully- diluted weighted average share count of ~142M shares Cash Flow from Operations $1M–$4M $42M–$45M Management provides expected ranges for total revenue, service revenue, non-GAAP operating margin, non-GAAP net income per share, diluted, and cash flow from operations based on its evaluation of the current business environment. The Company emphasizes that these expectations are subject to various important cautionary factors referenced in the section entitled "Forward-Looking Statements" below. CEO Letter to Stockholders .2 17

Forward-Looking Statements: This presentation includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and Section 21E of the Securities Exchange Act of 1934, as amended. Any statements that are not statements of historical fact may be deemed to be forward-looking statements. For example, words such as "may," "will," "should," "estimates," "predicts," "potential," "continue," "strategy," "believes," "anticipates," "plans," "expects," "intends," and similar expressions are intended to identify forward-looking statements. These forward- looking statements include, but are not limited to: the size of our market opportunity; the potential success and impact of our investments in artificial intelligence technologies; our strategic transformation initiatives; our ability to drive increased platform and multi-product adoption; our ability to increase profitability and cash flow and fund investment in innovation; whether we can increase customer retention; whether our unified communication and contact center traffic will increase; our future revenue and growth (including platform usage revenue); whether we can sustain innovation; the success of our go-to-market engine; our ability to improve general and administrative synergies; our ability to enhance shareholder value; and our financial outlook, revenue growth, and profitability, including whether we will achieve sustainable growth and profitability. These forward-looking statements are predictions only, and actual events or results may differ materially from such statements depending on a variety of factors. These factors include, but are not limited to: • Customer adoption and demand for our products may be lower than we anticipate. • A reduction in our total costs as a percentage of revenue may negatively impact our revenues and our business. • Impact of economic downturns, political instability, government shutdowns and threats of shutdowns, rising interest rates and other inflationary pressures on us and our customers. • Risks related to our delayed draw term loan due 2027 and convertible senior notes due 2028, including the impact of variable interest expense and timing of any future repayments or refinancing on our stock price. • We may not achieve our target service revenue or total revenue growth rates, or the revenue and other amounts we forecast in our guidance, for a particular quarter or for the full fiscal year. • Competitive dynamics of the UCaaS, CCaaS, CPaaS, video and other markets in which we compete may change in ways we are not anticipating. • Our customer churn rate may be higher than we anticipate. • Third parties may assert ownership rights in our IP, which may limit or prevent our continued use of the core technologies behind our solutions. • The impact of U.S. trade restrictions, tariffs and international trade policies could adversely affect our costs and operations. • Investments we make in marketing, channel and value-added resellers (VARs), e-commerce, and new products may not result in revenue growth. For a discussion of such risks and uncertainties, which could cause actual results to differ from those contained in the forward-looking statements, see “Risk Factors” in the Forms 10-K and 10-Q filed by 8x8, Inc. with the Securities and Exchange Commission. All forward-looking statements are qualified in their entirety by this cautionary statement, and 8x8, Inc. undertakes no obligation to update publicly any forward-looking statement for any reason, except as required by law, even as new information becomes available or other events occur in the future. CEO Letter to Stockholders .2 18

Explanation of GAAP to Non-GAAP Reconciliation Non-GAAP Service Revenue Gross Margin, Other Revenue Gross Margin, and Total Revenue Gross Margin Non-GAAP Service Revenue Gross Profit and Margin as a percentage of Service Revenue and Non-GAAP Other Revenue Gross Profit and Margin as a percentage of Other Revenue are computed as Service Revenue less Non-GAAP Cost of Service Revenue divided by Service Revenue and Other Revenue less Non-GAAP Cost of Other Revenue divided by Other Revenue, respectively. Non-GAAP Total Revenue Gross Profit and Margin as a percentage of Total Revenue is computed as Total Revenue less Non-GAAP Cost of Service Revenue and Non-GAAP Cost of Other Revenue divided by Total Revenue. Management believes the Company’s investors benefit from understanding these adjustments and from an alternative view of the Company’s Cost of Service Revenue and Cost of Other Revenue, as well as the Company's Service, Other and Total Revenue Gross Margin performance compared to prior periods and trends. Non-GAAP Operating Profit and Non-GAAP Operating Margin Non-GAAP Operating Profit excludes: amortization of acquired intangible assets, stock-based compensation expense and related employer payroll taxes, acquisition and integration expenses, certain legal and regulatory costs, certain severance and transition and contract exit costs from Operating Profit (Loss). Non-GAAP Operating Margin is Non-GAAP Operating Profit divided by Revenue. Management believes that these exclusions provide investors with a supplemental view of the Company’s ongoing operating performance. CEO Letter to Stockholders .2 19

Reconciliation Of GAAP To Non-GAAP Financial Measures (Unaudited, in thousands) Three Months Ended 12/31/2025 9/30/2025 12/31/2024 Cost of Revenue GAAP cost of service revenue $ 59,515 $ 57,699 $ 50,529 Amortization of acquired intangible assets (513) (514) (2,117) Stock-based compensation expense and related employer payroll taxes (417) (476) (857) Legal and regulatory costs — — 55 Severance, transition and contract exit costs (26) (81) 3 Non-GAAP cost of service revenue $ 58,559 $ 56,628 $ 47,613 GAAP service revenue margin $ 120,167 $ 121,395 $ 122,930 Non-GAAP service revenue margin $ 121,123 $ 122,466 $ 125,846 GAAP cost of other revenue $ 7,319 $ 7,056 $ 7,268 Stock-based compensation expense and related employer payroll taxes (82) (89) (272) Legal and regulatory costs — — 62 Severance, transition and contract exit costs (649) (443) (130) Non-GAAP cost of other revenue $ 6,588 $ 6,524 $ 6,928 GAAP other revenue margin $ (1,951) $ (2,055) $ (1,845) Non-GAAP other revenue margin $ (1,220) $ (1,523) $ (1,505) GAAP gross margin $ 118,216 $ 119,340 $ 121,085 Non-GAAP gross margin $ 119,903 $ 120,943 $ 124,341 Operating Profit GAAP income from operations $ 9,694 $ 5,349 $ 8,979 Amortization of acquired intangible assets 3,584 3,502 5,098 Stock-based compensation expense and related employer payroll taxes 4,463 5,762 9,769 Acquisition and integration costs 196 — 244 Legal and regulatory costs1 927 717 (6,849) Severance, transition and contract exit costs 2,795 1,994 1,847 Non-GAAP operating profit $ 21,659 $ 17,324 $ 19,088 1. Amounts include an out-of-period adjustment associated with state and local taxes for the three months ended December 31, 2024. CEO Letter to Stockholders .2 20

Business Highlights Innovation on the 8x8 Platform for CX 8x8 continued to advance the 8x8 Platform for CX with new capabilities that strengthen collaboration, streamline omnichannel engagement, and simplify operations for global enterprises. Recent innovations include: • Integrated Workforce Management: The Company introduced Workforce Management (WFM) as a standard capability in every 8x8 Contact Center seat at no extra cost, enabling organizations to forecast, schedule, and staff more efficiently, simplifying operations for businesses of all sizes. • 8x8 Retail Nationwide, Purpose-Built for Frontline Retail: Integrated with MDM for secure, large- scale device management, 8x8 Retail Nationwide supports shared handhelds for fast onboarding, and enables centralized remote configuration and control across connected stores, HQ, and warehouses. It expands the Company's retail portfolio alongside 8x8 Social Connect, 8x8 Aftersale Assist, and 8x8 Sales Assist. • Customer 360 Enhances Agent Productivity and CX: Customer 360 transforms 8x8 Agent Workspace into a unified customer intelligence hub. Agents gain immediate access to interaction history, profile details, and AI-driven insights like sentiment and topic detection, enabling faster, more informed service without switching tools. • Scalable, Controlled Large-Scale Meetings on 8x8 Work: New meeting controls in 8x8 Work support large virtual events, allowing presenters to manage speakers and promote attendees in real time, ideal for town halls and webinars. • Accessible, Streamlined Navigation in 8x8 Work: The new WCAG-compliant Site Map ensures inclusive, one-click access to all features, helping users quickly find tools and navigate the platform efficiently. • Smarter Ring Group Availability in 8x8 Work: Self-service ring group management gives users more control over interruptions, while real-time analytics help teams optimize coverage and improve responsiveness. • Real-Time User Status Reporting: The new User Status report in 8x8 Work delivers live availability data, helping managers make informed staffing decisions and adapt to changing demand. • Native Mitel Support Simplifies Cloud Migration: Native SIP support for Mitel desk phones, helping enterprises preserve hardware, cut costs, and speed cloud adoption. This integration delivers high-quality voice, faster deployment, and seamless access to the 8x8 Platform for CX, ideal for hybrid and regulated environments. • New Privacy Standard Enhances Cloud Trust: The adoption of ISO/IEC 27018 strengthens personal data protection across the 8x8 Platform for CX. This new certification helps customers reduce compliance risk, accelerate vendor approvals, and trust that privacy is built into every part of their communications. Together, these innovations reflect 8x8's focus on unifying customer and employee experiences through intelligent, secure, and connected communication, empowering organizations to engage more effectively, operate more efficiently, and deliver better outcomes across every interaction. CEO Letter to Stockholders .2 21

Recognition and Awards • Chief Marketing Officer Bruno Bertini won Platinum in the Pinnacle Business Awards in the category of Executive Leadership. • 8x8 was recognized as a Major Player in the IDC MarketScape: Worldwide AI-Enabled Contact Center Workforce Engagement Management 2025–2026 Vendor Assessment. • Won Gold in the User Experience Design (UX) – Business category at the 2025 London Design Awards for 8x8 Engage. These accolades reflect 8x8's continued commitment to innovation, operational excellence, and helping organizations around the world deliver exceptional customer and employee experiences. NEW: Executive Insights Recent Blog Posts Why Empowering the Retail Frontline is Now an IT Priority Winter ‘26 Release: What’s Improved Across Intelligence and Collaboration Contact Center Disclosure in an AI-Driven World Finally, Meetings and Calls that Work for You Turbocharging Public Service: How AI is Powering the Next Chapter of Citizen Experience Behind the Build: PrimeSource Connects Teams, Empowers Employees, and Delivers Superior Customer Service No More Missed Messages: How AI Keeps You in the Loop CEO Letter to Stockholders .2 22

Q3 2026 Press Releases Dec 19, 2025 8x8 to Showcase Unified Retail Communications at NRF 2026 Nov 26, 2025 8x8 Engage Wins Gold at 2025 London Design Awards for Outstanding User Experience Nov 25, 2025 8x8 Strengthens Customer Data Privacy With New International Cloud Protection Standard Nov 20, 2025 Customers Resolve Issues Faster With New AI, Omnichannel Enhancements From 8x8 Nov 6, 2025 8x8 Sees Surge in AI Adoption as Organizations Race to Deliver Faster, Smarter Customer Engagement Nov 4 2025 8x8 Adds Native Support for Mitel Phones, Enhancing Platform Access and Enterprise Voice Flexibility Nov 4 2025 8x8 Makes Workforce Management Native in Every Contact Center Seat at No Extra Cost Oct 30, 2025 8x8 Calls on Congress to Act as Universal Service Fund Nears Breaking Point Oct 16, 2025 Report: UK Customers Still Prefer Human Support Over AI Oct 14, 2025 8x8, Inc. Schedules Second Quarter Fiscal 2026 Earnings Release and Conference Call Oct 2, 2025 8x8 Earns Industrywide Recognition for Innovation, Customer Experience, and AI Leadership CEO Letter to Stockholders .2 23

CEO Letter to Stockholders .2 24