| REIT | Real estate investment trust | ||||

| U.S. | United States | ||||

| ABR | Contractual minimum annualized base rent | ||||

| ASC | Accounting Standards Codification | ||||

| NAREIT | National Association of Real Estate Investment Trusts (an industry trade group) | ||||

| CPI | Consumer price index | ||||

| EUR | Euro | ||||

| EURIBOR | Euro Interbank Offered Rate | ||||

| SOFR | Secured Overnight Financing Rate | ||||

| NIBOR | Norwegian Interbank Offered Rate | ||||

| TIBOR | Tokyo Interbank Offered Rate | ||||

| CORRA | Canadian Overnight Repo Rate Average | ||||

| SONIA | Sterling Overnight Index Average | ||||

| Table of Contents | |||||

| Overview | |||||

| Financial Results | |||||

| Balance Sheets and Capitalization | |||||

| Real Estate | |||||

| Investment Activity | |||||

| Appendix | |||||

| Summary Metrics | |||||

| Financial Results | |||||||||||||||||||||||

| Revenues, including reimbursable costs – consolidated ($000s) | $ | 431,303 | |||||||||||||||||||||

| Net income attributable to W. P. Carey ($000s) | 140,996 | ||||||||||||||||||||||

| Net income attributable to W. P. Carey per diluted share | 0.64 | ||||||||||||||||||||||

Normalized pro rata cash NOI ($000s) (a) (b) | 372,194 | ||||||||||||||||||||||

Adjusted EBITDA ($000s) (a) (b) | 360,529 | ||||||||||||||||||||||

AFFO attributable to W. P. Carey ($000s) (a) (b) | 276,629 | ||||||||||||||||||||||

AFFO attributable to W. P. Carey per diluted share (a) (b) | 1.25 | ||||||||||||||||||||||

| Dividends declared per share – current quarter | 0.910 | ||||||||||||||||||||||

| Dividends declared per share – current quarter annualized | 3.640 | ||||||||||||||||||||||

| Dividend yield – annualized, based on quarter end share price of $67.57 | 5.4 | % | |||||||||||||||||||||

Dividend payout ratio – for the nine months ended September 30, 2025 (c) | 73.0 | % | |||||||||||||||||||||

| Balance Sheet and Capitalization | |||||||||||||||||||||||

| Equity market capitalization – based on quarter end share price of $67.57 ($000s) | $ | 14,807,600 | |||||||||||||||||||||

Net debt ($000s) (d) | 8,537,449 | ||||||||||||||||||||||

| Enterprise value ($000s) | 23,345,049 | ||||||||||||||||||||||

| Total consolidated debt ($000s) | 8,684,639 | ||||||||||||||||||||||

Gross assets ($000s) (e) | 20,017,583 | ||||||||||||||||||||||

Liquidity ($000s) (f) | 2,140,020 | ||||||||||||||||||||||

Net debt to enterprise value (b) | 36.6 | % | |||||||||||||||||||||

Net debt to adjusted EBITDA (annualized) (a) (b) | 5.9x | ||||||||||||||||||||||

Net debt to adjusted EBITDA (annualized) – inclusive of unsettled forward equity (a) (b) (g) | 5.8x | ||||||||||||||||||||||

| Total consolidated debt to gross assets | 43.4 | % | |||||||||||||||||||||

| Total consolidated secured debt to gross assets | 1.0 | % | |||||||||||||||||||||

Cash interest expense coverage ratio (a) (b) | 5.2x | ||||||||||||||||||||||

Weighted-average interest rate – for the three months ended September 30, 2025 (b) | 3.2 | % | |||||||||||||||||||||

Weighted-average interest rate – as of September 30, 2025 (b) | 3.1 | % | |||||||||||||||||||||

Weighted-average debt maturity (years) (b) | 4.5 | ||||||||||||||||||||||

| Moody's Investors Service – issuer rating | Baa1 (stable) | ||||||||||||||||||||||

| Standard & Poor's Ratings Services – issuer rating | BBB+ (stable) | ||||||||||||||||||||||

| Real Estate Portfolio (Pro Rata) | |||||||||||||||||||||||

ABR – total portfolio ($000s) (h) | $ | 1,509,230 | |||||||||||||||||||||

ABR – unencumbered portfolio (% / $000s) (h) (i) | 96.6% / | $ | 1,457,791 | ||||||||||||||||||||

| Number of net-leased properties | 1,662 | ||||||||||||||||||||||

Number of operating properties (j) | 47 | ||||||||||||||||||||||

Number of tenants – net-leased properties | 373 | ||||||||||||||||||||||

| ABR from top ten tenants as a % of total ABR – net-leased properties | 18.6 | % | |||||||||||||||||||||

ABR from investment grade tenants as a % of total ABR – net-leased properties (k) | 21.9 | % | |||||||||||||||||||||

Contractual same-store growth (l) | 2.4 | % | |||||||||||||||||||||

| Net-leased properties – square footage (millions) | 182.8 | ||||||||||||||||||||||

| Occupancy – net-leased properties | 97.0 | % | |||||||||||||||||||||

| Weighted-average lease term (years) | 12.1 | ||||||||||||||||||||||

| Investment volume – current quarter ($000s) | $ | 656,396 | |||||||||||||||||||||

| Dispositions – current quarter ($000s) | 495,201 | ||||||||||||||||||||||

| Maximum commitment for capital investments and commitments expected to be completed during 2025 ($000s) | 67,084 | ||||||||||||||||||||||

| Investing for the Long Run® | 1 | |||||||

| Investing for the Long Run® | 2 | |||||||

| Components of Net Asset Value | |||||

Normalized Pro Rata Cash NOI (a) (b) | Three Months Ended Sep. 30, 2025 | ||||||||||||||||

| Net lease properties | $ | 362,680 | |||||||||||||||

Self-storage and other operating properties (c) | 9,514 | ||||||||||||||||

Total normalized pro rata cash NOI (a) (b) | $ | 372,194 | |||||||||||||||

| Balance Sheet – Selected Information (Consolidated Unless Otherwise Stated) | As of Sep. 30, 2025 | ||||||||||||||||

| Assets | |||||||||||||||||

Book value of real estate excluded from normalized pro rata cash NOI (d) | $ | 290,299 | |||||||||||||||

| Cash and cash equivalents | 249,029 | ||||||||||||||||

Las Vegas retail complex construction loan (e) | 245,884 | ||||||||||||||||

| Other secured loans receivable, net | 34,692 | ||||||||||||||||

| Other assets, net: | |||||||||||||||||

| Straight-line rent adjustments | $ | 444,240 | |||||||||||||||

Investment in shares of Lineage (a cold storage REIT) (f) | 179,203 | ||||||||||||||||

| Deferred charges | 74,397 | ||||||||||||||||

Cash held at qualified intermediaries (g) | 64,071 | ||||||||||||||||

| Taxes receivable | 58,043 | ||||||||||||||||

| Office lease right-of-use assets, net | 48,638 | ||||||||||||||||

| Non-rent tenant and other receivables | 45,337 | ||||||||||||||||

| Restricted cash, including escrow (excludes cash held at qualified intermediaries) | 36,476 | ||||||||||||||||

| Deferred income taxes | 22,702 | ||||||||||||||||

| Prepaid expenses | 19,863 | ||||||||||||||||

| Leasehold improvements, furniture and fixtures | 11,217 | ||||||||||||||||

| Securities and derivatives | 1,904 | ||||||||||||||||

Rent receivables (h) | 1,867 | ||||||||||||||||

| Due from affiliates | 1,035 | ||||||||||||||||

| Other | 20,252 | ||||||||||||||||

| Total other assets, net | $ | 1,029,245 | |||||||||||||||

| Liabilities | |||||||||||||||||

Total pro rata debt outstanding (b) (i) | $ | 8,850,549 | |||||||||||||||

| Dividends payable | 204,722 | ||||||||||||||||

| Deferred income taxes | 164,846 | ||||||||||||||||

| Accounts payable, accrued expenses and other liabilities: | |||||||||||||||||

| Accounts payable and accrued expenses | $ | 172,541 | |||||||||||||||

| Prepaid and deferred rents | 151,958 | ||||||||||||||||

| Operating lease liabilities | 145,119 | ||||||||||||||||

| Tenant security deposits | 55,954 | ||||||||||||||||

| Accrued taxes payable | 45,238 | ||||||||||||||||

| Securities and derivatives | 20,608 | ||||||||||||||||

| Other | 55,917 | ||||||||||||||||

| Total accounts payable, accrued expenses and other liabilities | $ | 647,335 | |||||||||||||||

| Investing for the Long Run® | 3 | |||||||

| Investing for the Long Run® | 4 | |||||||

| Investing for the Long Run® | 5 | |||||||

| Consolidated Statements of Income – Last Five Quarters | |||||

| Three Months Ended | |||||||||||||||||||||||||||||

| Sep. 30, 2025 | Jun. 30, 2025 | Mar. 31, 2025 | Dec. 31, 2024 | Sep. 30, 2024 | |||||||||||||||||||||||||

| Revenues | |||||||||||||||||||||||||||||

| Real Estate: | |||||||||||||||||||||||||||||

| Lease revenues | $ | 372,087 | $ | 364,195 | $ | 353,768 | $ | 351,394 | $ | 334,039 | |||||||||||||||||||

| Income from finance leases and loans receivable | 26,498 | 20,276 | 17,458 | 16,796 | 15,712 | ||||||||||||||||||||||||

| Operating property revenues | 26,771 | 34,287 | 33,094 | 34,132 | 37,323 | ||||||||||||||||||||||||

| Other lease-related income | 3,660 | 9,643 | 3,121 | 1,329 | 7,701 | ||||||||||||||||||||||||

| 429,016 | 428,401 | 407,441 | 403,651 | 394,775 | |||||||||||||||||||||||||

| Investment Management: | |||||||||||||||||||||||||||||

| Asset management revenue | 1,218 | 1,304 | 1,350 | 1,461 | 1,557 | ||||||||||||||||||||||||

| Other advisory income and reimbursements | 1,069 | 1,072 | 1,067 | 1,053 | 1,051 | ||||||||||||||||||||||||

| 2,287 | 2,376 | 2,417 | 2,514 | 2,608 | |||||||||||||||||||||||||

| 431,303 | 430,777 | 409,858 | 406,165 | 397,383 | |||||||||||||||||||||||||

| Operating Expenses | |||||||||||||||||||||||||||||

| Depreciation and amortization | 125,586 | 120,595 | 129,607 | 115,770 | 115,705 | ||||||||||||||||||||||||

| General and administrative | 23,656 | 24,150 | 26,967 | 24,254 | 22,679 | ||||||||||||||||||||||||

| Impairment charges — real estate | 19,474 | 4,349 | 6,854 | 27,843 | — | ||||||||||||||||||||||||

| Operating property expenses | 15,049 | 16,721 | 16,544 | 16,586 | 17,765 | ||||||||||||||||||||||||

| Property expenses, excluding reimbursable tenant costs | 14,637 | 13,623 | 11,706 | 12,580 | 10,993 | ||||||||||||||||||||||||

| Reimbursable tenant costs | 14,562 | 17,718 | 17,092 | 15,661 | 13,337 | ||||||||||||||||||||||||

| Stock-based compensation expense | 11,153 | 10,943 | 9,148 | 9,667 | 13,468 | ||||||||||||||||||||||||

| Merger and other expenses | 1,021 | 192 | 556 | (484) | 283 | ||||||||||||||||||||||||

| 225,138 | 208,291 | 218,474 | 221,877 | 194,230 | |||||||||||||||||||||||||

| Other Income and Expenses | |||||||||||||||||||||||||||||

| Interest expense | (75,226) | (71,795) | (68,804) | (70,883) | (72,526) | ||||||||||||||||||||||||

| Gain on sale of real estate, net | 44,401 | 52,824 | 43,777 | 4,480 | 15,534 | ||||||||||||||||||||||||

Other gains and (losses) (a) | (31,011) | (148,768) | (42,197) | (77,224) | (77,107) | ||||||||||||||||||||||||

Non-operating income (b) | 3,030 | 3,495 | 7,910 | 13,847 | 13,669 | ||||||||||||||||||||||||

| Earnings from equity method investments | 2,361 | 6,161 | 5,378 | 302 | 6,124 | ||||||||||||||||||||||||

Gain on change in control of interests (c) | — | — | — | — | 31,849 | ||||||||||||||||||||||||

| (56,445) | (158,083) | (53,936) | (129,478) | (82,457) | |||||||||||||||||||||||||

| Income before income taxes | 149,720 | 64,403 | 137,448 | 54,810 | 120,696 | ||||||||||||||||||||||||

| Provision for income taxes | (8,495) | (13,091) | (11,632) | (7,772) | (9,044) | ||||||||||||||||||||||||

| Net Income | 141,225 | 51,312 | 125,816 | 47,038 | 111,652 | ||||||||||||||||||||||||

| Net (income) loss attributable to noncontrolling interests | (229) | (92) | 8 | (15) | 46 | ||||||||||||||||||||||||

| Net Income Attributable to W. P. Carey | $ | 140,996 | $ | 51,220 | $ | 125,824 | $ | 47,023 | $ | 111,698 | |||||||||||||||||||

| Basic Earnings Per Share | $ | 0.64 | $ | 0.23 | $ | 0.57 | $ | 0.21 | $ | 0.51 | |||||||||||||||||||

| Diluted Earnings Per Share | $ | 0.64 | $ | 0.23 | $ | 0.57 | $ | 0.21 | $ | 0.51 | |||||||||||||||||||

| Weighted-Average Shares Outstanding | |||||||||||||||||||||||||||||

| Basic | 220,562,909 | 220,569,259 | 220,401,156 | 220,223,239 | 220,221,366 | ||||||||||||||||||||||||

| Diluted | 221,087,833 | 220,874,935 | 220,720,310 | 220,577,900 | 220,404,149 | ||||||||||||||||||||||||

| Dividends Declared Per Share | $ | 0.910 | $ | 0.900 | $ | 0.890 | $ | 0.880 | $ | 0.875 | |||||||||||||||||||

| Investing for the Long Run® | 6 | |||||||

| FFO and AFFO, Consolidated – Last Five Quarters | |||||

| Three Months Ended | |||||||||||||||||||||||||||||

| Sep. 30, 2025 | Jun. 30, 2025 | Mar. 31, 2025 | Dec. 31, 2024 | Sep. 30, 2024 | |||||||||||||||||||||||||

| Net income attributable to W. P. Carey | $ | 140,996 | $ | 51,220 | $ | 125,824 | $ | 47,023 | $ | 111,698 | |||||||||||||||||||

| Adjustments: | |||||||||||||||||||||||||||||

| Depreciation and amortization of real property | 124,906 | 119,930 | 128,937 | 115,107 | 115,028 | ||||||||||||||||||||||||

| Gain on sale of real estate, net | (44,401) | (52,824) | (43,777) | (4,480) | (15,534) | ||||||||||||||||||||||||

| Impairment charges — real estate | 19,474 | 4,349 | 6,854 | 27,843 | — | ||||||||||||||||||||||||

Gain on change in control of interests (a) | — | — | — | — | (31,849) | ||||||||||||||||||||||||

Proportionate share of adjustments to earnings from equity method investments (b) | 2,271 | 2,231 | 1,643 | 2,879 | 3,028 | ||||||||||||||||||||||||

Proportionate share of adjustments for noncontrolling interests (c) | (82) | (82) | (78) | (79) | (96) | ||||||||||||||||||||||||

| Total adjustments | 102,168 | 73,604 | 93,579 | 141,270 | 70,577 | ||||||||||||||||||||||||

FFO (as defined by NAREIT) Attributable to W. P. Carey (d) | 243,164 | 124,824 | 219,403 | 188,293 | 182,275 | ||||||||||||||||||||||||

| Adjustments: | |||||||||||||||||||||||||||||

Other (gains) and losses (e) | 31,011 | 148,768 | 42,197 | 77,224 | 77,107 | ||||||||||||||||||||||||

| Straight-line and other leasing and financing adjustments | (20,424) | (15,374) | (19,033) | (24,849) | (21,187) | ||||||||||||||||||||||||

| Stock-based compensation | 11,153 | 10,943 | 9,148 | 9,667 | 13,468 | ||||||||||||||||||||||||

| Amortization of deferred financing costs | 4,874 | 4,628 | 4,782 | 4,851 | 4,851 | ||||||||||||||||||||||||

Above- and below-market rent intangible lease amortization, net | 4,363 | 5,061 | 1,123 | 10,047 | 6,263 | ||||||||||||||||||||||||

| Tax (benefit) expense – deferred and other | (1,215) | 2,820 | (782) | 96 | (1,576) | ||||||||||||||||||||||||

| Merger and other expenses | 1,021 | 192 | 556 | (484) | 283 | ||||||||||||||||||||||||

| Other amortization and non-cash items | 587 | 579 | 560 | 557 | 587 | ||||||||||||||||||||||||

Proportionate share of adjustments to earnings from equity method investments (b) | 2,194 | 309 | (86) | 2,266 | (2,632) | ||||||||||||||||||||||||

Proportionate share of adjustments for noncontrolling interests (c) | (99) | (80) | (48) | (62) | (91) | ||||||||||||||||||||||||

| Total adjustments | 33,465 | 157,846 | 38,417 | 79,313 | 77,073 | ||||||||||||||||||||||||

AFFO Attributable to W. P. Carey (d) | $ | 276,629 | $ | 282,670 | $ | 257,820 | $ | 267,606 | $ | 259,348 | |||||||||||||||||||

| Summary | |||||||||||||||||||||||||||||

FFO (as defined by NAREIT) attributable to W. P. Carey (d) | $ | 243,164 | $ | 124,824 | $ | 219,403 | $ | 188,293 | $ | 182,275 | |||||||||||||||||||

FFO (as defined by NAREIT) attributable to W. P. Carey per diluted share (d) | $ | 1.10 | $ | 0.57 | $ | 0.99 | $ | 0.85 | $ | 0.83 | |||||||||||||||||||

AFFO attributable to W. P. Carey (d) | $ | 276,629 | $ | 282,670 | $ | 257,820 | $ | 267,606 | $ | 259,348 | |||||||||||||||||||

AFFO attributable to W. P. Carey per diluted share (d) | $ | 1.25 | $ | 1.28 | $ | 1.17 | $ | 1.21 | $ | 1.18 | |||||||||||||||||||

| Diluted weighted-average shares outstanding | 221,087,833 | 220,874,935 | 220,720,310 | 220,577,900 | 220,404,149 | ||||||||||||||||||||||||

| Investing for the Long Run® | 7 | |||||||

| Elements of Pro Rata Statement of Income and AFFO Adjustments | |||||

Equity Method Investments (a) | Noncontrolling Interests (b) | AFFO Adjustments | ||||||||||||||||||

| Revenues | ||||||||||||||||||||

| Real Estate: | ||||||||||||||||||||

Lease revenues | $ | 4,426 | $ | (268) | $ | (13,545) | (c) | |||||||||||||

| Income from finance leases and loans receivable | 138 | (46) | (727) | |||||||||||||||||

| Operating property revenues | — | — | ||||||||||||||||||

| Other lease-related income | 3 | — | — | |||||||||||||||||

Investment Management: | ||||||||||||||||||||

| Asset management revenue | — | — | — | |||||||||||||||||

| Other advisory income and reimbursements | — | — | — | |||||||||||||||||

| Operating Expenses | ||||||||||||||||||||

| Depreciation and amortization | 2,032 | (83) | (126,957) | (d) | ||||||||||||||||

| General and administrative | (1) | — | — | |||||||||||||||||

| Impairment charges — real estate | — | — | (19,474) | (e) | ||||||||||||||||

| Operating property expenses | — | — | (30) | (e) | ||||||||||||||||

Property expenses, excluding reimbursable tenant costs | 483 | (22) | (462) | (e) | ||||||||||||||||

| Reimbursable tenant costs | 802 | (42) | — | |||||||||||||||||

Stock-based compensation expense | — | — | (11,154) | (e) | ||||||||||||||||

| Merger and other expenses | — | — | (1,021) | |||||||||||||||||

| Other Income and Expenses | ||||||||||||||||||||

| Interest expense | (810) | 2 | 4,920 | (f) | ||||||||||||||||

| Gain on sale of real estate, net | — | — | (44,402) | |||||||||||||||||

| Other gains and (losses) | (10) | 141 | 30,880 | (g) | ||||||||||||||||

| Non-operating income | 205 | — | — | |||||||||||||||||

| Earnings from equity method investments | (442) | — | 383 | (h) | ||||||||||||||||

| Provision for income taxes | (194) | (37) | (974) | (i) | ||||||||||||||||

| Net income attributable to noncontrolling interests | — | 61 | — | |||||||||||||||||

| Investing for the Long Run® | 8 | |||||||

| Capital Expenditures | |||||

Turnover Costs (a) | |||||

| Tenant improvements | $ | 9,077 | |||

| Leasing costs | 988 | ||||

| Total Tenant Improvements and Leasing Costs | 10,065 | ||||

| Property improvements — net-lease properties | 1,158 | ||||

| Property improvements — operating properties | 50 | ||||

| Total Turnover Costs | $ | 11,273 | |||

| Maintenance Capital Expenditures | |||||

| Net-lease properties | $ | 677 | |||

| Operating properties | 1,968 | ||||

| Total Maintenance Capital Expenditures | $ | 2,645 | |||

| Investing for the Long Run® | 9 | |||||||

| Investing for the Long Run® | 10 | |||||||

| Consolidated Balance Sheets | |||||

| September 30, 2025 | December 31, 2024 | ||||||||||

| Assets | |||||||||||

| Investments in real estate: | |||||||||||

| Land, buildings and improvements — net lease and other | $ | 14,056,399 | $ | 12,842,869 | |||||||

| Land, buildings and improvements — operating properties | 626,368 | 1,198,676 | |||||||||

| Net investments in finance leases and loans receivable | 1,149,856 | 798,259 | |||||||||

In-place lease intangible assets and other | 2,405,227 | 2,297,572 | |||||||||

Above-market rent intangible assets | 671,501 | 665,495 | |||||||||

| Investments in real estate | 18,909,351 | 17,802,871 | |||||||||

Accumulated depreciation and amortization (a) | (3,508,787) | (3,222,396) | |||||||||

| Assets held for sale, net | 8,062 | — | |||||||||

| Net investments in real estate | 15,408,626 | 14,580,475 | |||||||||

| Equity method investments | 311,173 | 301,115 | |||||||||

| Cash and cash equivalents | 249,029 | 640,373 | |||||||||

| Other assets, net | 1,029,245 | 1,045,218 | |||||||||

| Goodwill | 986,967 | 967,843 | |||||||||

| Total assets | $ | 17,985,040 | $ | 17,535,024 | |||||||

| Liabilities and Equity | |||||||||||

| Debt: | |||||||||||

| Senior unsecured notes, net | $ | 6,943,940 | $ | 6,505,907 | |||||||

| Unsecured term loans, net | 1,194,466 | 1,075,826 | |||||||||

| Unsecured revolving credit facility | 354,846 | 55,448 | |||||||||

| Non-recourse mortgages, net | 191,387 | 401,821 | |||||||||

| Debt, net | 8,684,639 | 8,039,002 | |||||||||

| Accounts payable, accrued expenses and other liabilities | 647,335 | 596,994 | |||||||||

Below-market rent and other intangible liabilities, net | 111,339 | 119,831 | |||||||||

| Deferred income taxes | 164,846 | 147,461 | |||||||||

| Dividends payable | 204,722 | 197,612 | |||||||||

| Total liabilities | 9,812,881 | 9,100,900 | |||||||||

Preferred stock, $0.001 par value, 50,000,000 shares authorized; none issued | — | — | |||||||||

Common stock, $0.001 par value, 450,000,000 shares authorized; 219,144,586 and 218,848,844 shares, respectively, issued and outstanding | 219 | 219 | |||||||||

| Additional paid-in capital | 11,822,063 | 11,805,179 | |||||||||

| Distributions in excess of accumulated earnings | (3,484,513) | (3,203,974) | |||||||||

| Deferred compensation obligation | 80,186 | 78,503 | |||||||||

| Accumulated other comprehensive loss | (262,222) | (250,232) | |||||||||

| Total stockholders' equity | 8,155,733 | 8,429,695 | |||||||||

| Noncontrolling interests | 16,426 | 4,429 | |||||||||

| Total equity | 8,172,159 | 8,434,124 | |||||||||

| Total liabilities and equity | $ | 17,985,040 | $ | 17,535,024 | |||||||

| Investing for the Long Run® | 11 | |||||||

| Capitalization | |||||

| Description | Shares | Share Price | Market Value | |||||||||||||||||||||||

| Equity | ||||||||||||||||||||||||||

| Common equity | 219,144,586 | $ | 67.57 | $ | 14,807,600 | |||||||||||||||||||||

| Preferred equity | — | |||||||||||||||||||||||||

| Total Equity Market Capitalization | 14,807,600 | |||||||||||||||||||||||||

Outstanding Balance (a) | ||||||||||||||||||||||||||

| Pro Rata Debt | ||||||||||||||||||||||||||

| Non-recourse mortgages | 287,151 | |||||||||||||||||||||||||

| Unsecured term loans (due February 14, 2028) | 615,389 | |||||||||||||||||||||||||

| Unsecured term loan (due April 24, 2029) | 587,050 | |||||||||||||||||||||||||

| Unsecured revolving credit facility (due February 14, 2029) | 354,846 | |||||||||||||||||||||||||

| Senior unsecured notes: | ||||||||||||||||||||||||||

| Due April 9, 2026 (EUR) | 587,050 | |||||||||||||||||||||||||

| Due October 1, 2026 (USD) | 350,000 | |||||||||||||||||||||||||

| Due April 15, 2027 (EUR) | 587,050 | |||||||||||||||||||||||||

| Due April 15, 2028 (EUR) | 587,050 | |||||||||||||||||||||||||

| Due July 15, 2029 (USD) | 325,000 | |||||||||||||||||||||||||

| Due September 28, 2029 (EUR) | 176,115 | |||||||||||||||||||||||||

| Due June 1, 2030 (EUR) | 616,403 | |||||||||||||||||||||||||

| Due July 15, 2030 (USD) | 400,000 | |||||||||||||||||||||||||

| Due February 1, 2031 (USD) | 500,000 | |||||||||||||||||||||||||

| Due February 1, 2032 (USD) | 350,000 | |||||||||||||||||||||||||

| Due July 23, 2032 (EUR) | 763,165 | |||||||||||||||||||||||||

| Due September 28, 2032 (EUR) | 234,820 | |||||||||||||||||||||||||

| Due April 1, 2033 (USD) | 425,000 | |||||||||||||||||||||||||

| Due June 30, 2034 (USD) | 400,000 | |||||||||||||||||||||||||

| Due November 19, 2034 (EUR) | 704,460 | |||||||||||||||||||||||||

| Total Pro Rata Debt | 8,850,549 | |||||||||||||||||||||||||

| Total Capitalization | $ | 23,658,149 | ||||||||||||||||||||||||

| Investing for the Long Run® | 12 | |||||||

| Debt Overview | |||||

| USD-Denominated | EUR-Denominated | Other Currencies (a) | Total | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Outstanding Balance | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Out-standing Balance (in USD) | Weigh-ted Avg. Interest Rate | Out-standing Balance (in USD) | Weigh-ted Avg. Interest Rate | Out-standing Balance (in USD) | Weigh-ted Avg. Interest Rate | Amount (in USD) | % of Total | Weigh-ted Avg. Interest Rate | Weigh-ted Avg. Maturity (Years) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Non-Recourse Debt (b) (c) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Fixed (d) | $ | 157,813 | 4.8 | % | $ | 73,234 | 5.1 | % | $ | 20,566 | 4.6 | % | $ | 251,613 | 2.8 | % | 4.9 | % | 1.7 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Floating | — | — | % | 35,538 | 3.7 | % | — | — | % | 35,538 | 0.4 | % | 3.7 | % | 0.6 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

Total Pro Rata Non-Recourse Debt | 157,813 | 4.8 | % | 108,772 | 4.6 | % | 20,566 | 4.6 | % | 287,151 | 3.2 | % | 4.7 | % | 1.5 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

Recourse Debt (b) (c) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Fixed – Senior unsecured notes: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Due April 9, 2026 | — | — | % | 587,050 | 2.3 | % | — | — | % | 587,050 | 6.6 | % | 2.3 | % | 0.5 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Due October 1, 2026 | 350,000 | 4.3 | % | — | — | % | — | — | % | 350,000 | 4.0 | % | 4.3 | % | 1.0 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Due April 15, 2027 | — | — | % | 587,050 | 2.1 | % | — | — | % | 587,050 | 6.6 | % | 2.1 | % | 1.5 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Due April 15, 2028 | — | — | % | 587,050 | 1.4 | % | — | — | % | 587,050 | 6.6 | % | 1.4 | % | 2.5 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Due July 15, 2029 | 325,000 | 3.9 | % | — | — | % | — | — | % | 325,000 | 3.7 | % | 3.9 | % | 3.8 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Due September 28, 2029 | — | — | % | 176,115 | 3.4 | % | — | — | % | 176,115 | 2.0 | % | 3.4 | % | 4.0 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Due June 1, 2030 | — | — | % | 616,403 | 1.0 | % | — | — | % | 616,403 | 7.0 | % | 1.0 | % | 4.7 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Due July 15, 2030 | 400,000 | 4.7 | % | — | — | % | — | — | % | 400,000 | 4.5 | % | 4.7 | % | 4.8 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Due February 1, 2031 | 500,000 | 2.4 | % | — | — | % | — | — | % | 500,000 | 5.6 | % | 2.4 | % | 5.3 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Due February 1, 2032 | 350,000 | 2.5 | % | — | — | % | — | — | % | 350,000 | 4.0 | % | 2.5 | % | 6.3 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Due July 23, 2032 | — | — | % | 763,165 | 4.3 | % | — | — | % | 763,165 | 8.6 | % | 4.3 | % | 6.8 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Due September 28, 2032 | — | — | % | 234,820 | 3.7 | % | — | — | % | 234,820 | 2.7 | % | 3.7 | % | 7.0 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Due April 1, 2033 | 425,000 | 2.3 | % | — | — | % | — | — | % | 425,000 | 4.8 | % | 2.3 | % | 7.5 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Due June 30, 2034 | 400,000 | 5.4 | % | — | — | % | — | — | % | 400,000 | 4.5 | % | 5.4 | % | 8.8 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Due November 19, 2034 | — | — | % | 704,460 | 3.7 | % | — | — | % | 704,460 | 8.0 | % | 3.7 | % | 9.1 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

Total Senior Unsecured Notes | 2,750,000 | 3.6 | % | 4,256,113 | 2.6 | % | — | — | % | 7,006,113 | 79.2 | % | 3.0 | % | 4.9 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Swapped to Fixed: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Unsecured term loan (due April 24, 2029) (e) | — | — | % | 587,050 | 2.8 | % | — | — | % | 587,050 | 6.6 | % | 2.8 | % | 3.6 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

Unsecured term loan (due February 14, 2028) (e) | — | — | % | — | — | % | 362,957 | 4.7 | % | 362,957 | 4.1 | % | 4.7 | % | 2.4 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Floating: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Unsecured revolving credit facility (due February 14, 2029) (f) | 42,000 | 4.9 | % | 86,884 | 2.6 | % | 225,962 | 4.1 | % | 354,846 | 4.0 | % | 3.9 | % | 3.4 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

Unsecured term loan (due February 14, 2028) (g) | — | — | % | 252,432 | 2.7 | % | — | — | % | 252,432 | 2.9 | % | 2.7 | % | 2.4 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total Recourse Debt | 2,792,000 | 3.6 | % | 5,182,479 | 2.7 | % | 588,919 | 4.5 | % | 8,563,398 | 96.8 | % | 3.1 | % | 4.6 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

Total Pro Rata Debt Outstanding | $ | 2,949,813 | 3.6 | % | $ | 5,291,251 | 2.7 | % | $ | 609,485 | 4.5 | % | $ | 8,850,549 | 100.0 | % | 3.1 | % | 4.5 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Investing for the Long Run® | 13 | |||||||

| Debt Maturity | |||||

| Real Estate | Debt | |||||||||||||||||||||||||||||||||||||

Number of Properties (a) | Weighted-Average Interest Rate | Total Outstanding Balance (b) (c) | % of Total Outstanding Balance | |||||||||||||||||||||||||||||||||||

| Year of Maturity | ABR (a) | Balloon | ||||||||||||||||||||||||||||||||||||

| Non-Recourse Debt | ||||||||||||||||||||||||||||||||||||||

| Remaining 2025 | 1 | $ | 2,397 | 5.7 | % | $ | 224 | $ | 439 | — | % | |||||||||||||||||||||||||||

| 2026 | 36 | 28,795 | 4.7 | % | 154,916 | 160,226 | 1.8 | % | ||||||||||||||||||||||||||||||

| 2027 | 3 | 1,272 | 4.2 | % | 28,417 | 28,763 | 0.4 | % | ||||||||||||||||||||||||||||||

| 2028 | 5 | 13,960 | 5.0 | % | 73,620 | 80,363 | 0.9 | % | ||||||||||||||||||||||||||||||

| 2029 | 3 | 1,464 | 4.0 | % | 10,911 | 11,820 | 0.1 | % | ||||||||||||||||||||||||||||||

| 2031 | 1 | 1,158 | 6.0 | % | — | 2,161 | — | % | ||||||||||||||||||||||||||||||

| 2033 | 1 | 2,393 | 5.6 | % | 1,648 | 3,379 | — | % | ||||||||||||||||||||||||||||||

Total Pro Rata Non-Recourse Debt | 50 | $ | 51,439 | 4.7 | % | $ | 269,736 | 287,151 | 3.2 | % | ||||||||||||||||||||||||||||

| Recourse Debt | ||||||||||||||||||||||||||||||||||||||

| Fixed – Senior unsecured notes: | ||||||||||||||||||||||||||||||||||||||

| Due April 9, 2026 (EUR) | 2.3 | % | 587,050 | 6.6 | % | |||||||||||||||||||||||||||||||||

| Due October 1, 2026 (USD) | 4.3 | % | 350,000 | 4.0 | % | |||||||||||||||||||||||||||||||||

| Due April 15, 2027 (EUR) | 2.1 | % | 587,050 | 6.6 | % | |||||||||||||||||||||||||||||||||

| Due April 15, 2028 (EUR) | 1.4 | % | 587,050 | 6.6 | % | |||||||||||||||||||||||||||||||||

| Due July 15, 2029 (USD) | 3.9 | % | 325,000 | 3.7 | % | |||||||||||||||||||||||||||||||||

| Due September 28, 2029 (EUR) | 3.4 | % | 176,115 | 2.0 | % | |||||||||||||||||||||||||||||||||

| Due June 1, 2030 (EUR) | 1.0 | % | 616,403 | 7.0 | % | |||||||||||||||||||||||||||||||||

| Due July 15, 2030 (USD) | 4.7 | % | 400,000 | 4.5 | % | |||||||||||||||||||||||||||||||||

| Due February 1, 2031 (USD) | 2.4 | % | 500,000 | 5.6 | % | |||||||||||||||||||||||||||||||||

| Due February 1, 2032 (USD) | 2.5 | % | 350,000 | 4.0 | % | |||||||||||||||||||||||||||||||||

| Due July 23, 2032 (EUR) | 4.3 | % | 763,165 | 8.6 | % | |||||||||||||||||||||||||||||||||

| Due September 28, 2032 (EUR) | 3.7 | % | 234,820 | 2.7 | % | |||||||||||||||||||||||||||||||||

| Due April 1, 2033 (USD) | 2.3 | % | 425,000 | 4.8 | % | |||||||||||||||||||||||||||||||||

| Due June 30, 2034 (USD) | 5.4 | % | 400,000 | 4.5 | % | |||||||||||||||||||||||||||||||||

| Due November 19, 2034 (EUR) | 3.7 | % | 704,460 | 8.0 | % | |||||||||||||||||||||||||||||||||

| Total Senior Unsecured Notes | 3.0 | % | 7,006,113 | 79.2 | % | |||||||||||||||||||||||||||||||||

| Swapped to Fixed: | ||||||||||||||||||||||||||||||||||||||

Unsecured term loan (due April 24, 2029) (d) | 2.8 | % | 587,050 | 6.6 | % | |||||||||||||||||||||||||||||||||

Unsecured term loan (due Feb 14, 2028) (d) | 4.7 | % | 362,957 | 4.1 | % | |||||||||||||||||||||||||||||||||

| Floating: | ||||||||||||||||||||||||||||||||||||||

Unsecured revolving credit facility (due February 14, 2029) (e) | 3.9 | % | 354,846 | 4.0 | % | |||||||||||||||||||||||||||||||||

Unsecured term loan (due February 14, 2028) (f) | 2.7 | % | 252,432 | 2.9 | % | |||||||||||||||||||||||||||||||||

| Total Recourse Debt | 3.1 | % | 8,563,398 | 96.8 | % | |||||||||||||||||||||||||||||||||

| Total Pro Rata Debt Outstanding | 3.1 | % | $ | 8,850,549 | 100.0 | % | ||||||||||||||||||||||||||||||||

| Investing for the Long Run® | 14 | |||||||

| Senior Unsecured Notes | |||||

| Issuer | Senior Unsecured Notes | |||||||||||||||||||

| Ratings Agency | Rating | Outlook | Rating | |||||||||||||||||

| Moody's | Baa1 | Stable | Baa1 | |||||||||||||||||

| Standard & Poor’s | BBB+ | Stable | BBB+ | |||||||||||||||||

| Covenant | Metric | Required | As of Sep. 30, 2025 | |||||||||||||||||

| Limitation on the incurrence of debt | "Total Debt" / "Total Assets" | ≤ 60% | 42.0% | |||||||||||||||||

| Limitation on the incurrence of secured debt | "Secured Debt" / "Total Assets" | ≤ 40% | 0.9% | |||||||||||||||||

Limitation on the incurrence of debt based on consolidated EBITDA to annual debt service charge | "Consolidated EBITDA" / "Annual Debt Service Charge" | ≥ 1.5x | 5.0x | |||||||||||||||||

| Maintenance of unencumbered asset value | "Unencumbered Assets" / "Total Unsecured Debt" | ≥ 150% | 230.9% | |||||||||||||||||

| Investing for the Long Run® | 15 | |||||||

| Investing for the Long Run® | 16 | |||||||

| Investment Activity – Investment Volume | |||||

| Property Type(s) | Closing Date / Asset Completion Date | Gross Investment Amount | Investment Type | Lease Term (Years) (a) | Gross Square Footage | |||||||||||||||||||||||||||||||||||||||

| Tenant / Lease Guarantor | Property Location(s) | |||||||||||||||||||||||||||||||||||||||||||

| 1Q25 | ||||||||||||||||||||||||||||||||||||||||||||

| Reddy Ice LLC (59 properties) | Various, United States | Industrial, Warehouse | Feb-25 | $ | 136,022 | Sale-leaseback | 20 | 1,072,575 | ||||||||||||||||||||||||||||||||||||

| Las Vegas Retail Complex | Las Vegas, NV | Retail | Feb-25 | 5,000 | 47.5% Joint Venture Acquisition | 8 | 75,255 | |||||||||||||||||||||||||||||||||||||

Dollar General Corporation (4 properties) | Various, United States | Retail | Mar-25 | 8,474 | Acquisition | 15 | 42,388 | |||||||||||||||||||||||||||||||||||||

| Ernest Health Holdings, LLC | Mishawaka, IN | Specialty (Healthcare) | Mar-25 | 31,762 | Acquisition | 15 | 55,210 | |||||||||||||||||||||||||||||||||||||

Majestic Steel USA, Inc. (b) | Blytheville, AR | Industrial | Mar-25 | 91,910 | Sale-leaseback | 24 | 513,633 | |||||||||||||||||||||||||||||||||||||

| 1Q25 Total | 273,168 | 16 | 1,759,061 | |||||||||||||||||||||||||||||||||||||||||

| 2Q25 | ||||||||||||||||||||||||||||||||||||||||||||

Linde + Wiemann SE & Co. KG (4 properties) (c) | Various, Germany (3 properties) and La Garriga, Spain | Industrial | Apr-25 | 42,981 | Sale-leaseback | 25 | 640,732 | |||||||||||||||||||||||||||||||||||||

| United Natural Foods, Inc. | Santa Fe Springs, CA | Warehouse | Apr-25 | 128,043 | Acquisition | 10 | 302,850 | |||||||||||||||||||||||||||||||||||||

| Berry Global Group, Inc. | Evansville, IN | Industrial | Apr-25 | 8,150 | Renovation | 15 | N/A | |||||||||||||||||||||||||||||||||||||

Morato Pane S.p.A. (9 properties) (c) | Various, Italy (7 properties) and Málaga and Burgos, Spain | Industrial | May-25 | 73,280 | Sale-leaseback | 20 | 1,159,154 | |||||||||||||||||||||||||||||||||||||

| Soteria Intermediate Inc. | Chattanooga, TN | Industrial | Jun-25 | 20,247 | Sale-leaseback | 15 | 211,379 | |||||||||||||||||||||||||||||||||||||

Hertz Global Holdings, Inc (2 properties) | Newark, NJ and Boston, MA | Industrial | Jun-25 | 101,856 | Sale-leaseback | 20 | 81,664 | |||||||||||||||||||||||||||||||||||||

| TI Automotive (formerly ABC Technologies Holdings Inc.) | Galeras, Mexico | Industrial | Jun-25 | 4,843 | Expansion | 18 | 60,181 | |||||||||||||||||||||||||||||||||||||

Premium Brands Holdings Corporation (b) | McDonald, TN | Industrial | Jun-25 | 166,060 | Sale-leaseback | 25 | 356,960 | |||||||||||||||||||||||||||||||||||||

| 2Q25 Total | 545,460 | 19 | 2,812,920 | |||||||||||||||||||||||||||||||||||||||||

| Investing for the Long Run® | 17 | |||||||

| Investment Activity – Investment Volume (continued) | |||||

| Property Type(s) | Closing Date / Asset Completion Date | Gross Investment Amount | Investment Type | Lease Term (Years) (a) | Gross Square Footage | |||||||||||||||||||||||||||||||||||||||

| Tenant / Lease Guarantor | Property Location(s) | |||||||||||||||||||||||||||||||||||||||||||

| 3Q25 | ||||||||||||||||||||||||||||||||||||||||||||

Valeo Foods (6 properties) (b) (c) | Various, United Kingdom (3 properties), Czech Republic (2 properties), and Slovakia (1 property) | Industrial | Jul-25 | $ | 103,380 | Sale-leaseback | 25 | 1,354,721 | ||||||||||||||||||||||||||||||||||||

| Hertz Global Holdings, Inc | San Francisco, CA | Industrial | Jul-25 | 49,604 | Sale-leaseback | 20 | 69,200 | |||||||||||||||||||||||||||||||||||||

Dollar General Corporation (8 properties) | Various, United States | Retail | Jul-25; Aug-25 | 15,796 | Acquisition | 15 | 85,046 | |||||||||||||||||||||||||||||||||||||

WM Morrison Supermarkets PLC (2 properties) (c) | Loughborough and Ilkeston, United Kingdom | Retail | Jul-25 | 68,308 | Acquisition | 15 | 121,669 | |||||||||||||||||||||||||||||||||||||

| Sumitomo Heavy Industries, LTD. | Bedford, MA | Research and Development | Jul-25 | 44,000 | Redevelopment | 15 | N/A | |||||||||||||||||||||||||||||||||||||

| Ryerson Holding Corporation | Houston, TX | Industrial | Jul-25 | 18,357 | Acquisition | 6 | 170,178 | |||||||||||||||||||||||||||||||||||||

Europe Snacks (4 properties) (c) | Various, France (3 properties) and Medina del Campo, Spain | Industrial | Jul-25 | 56,388 | Sale-leaseback | 20 | 726,538 | |||||||||||||||||||||||||||||||||||||

Enel S.p.A. (35 properties) (c) | Various, Italy | Industrial, Warehouse | Aug-25 | 81,900 | Acquisition | 12 | 1,008,560 | |||||||||||||||||||||||||||||||||||||

AeriTek Global Holdings LLC (4 properties) | Monterrey and San Juan del Rio, Mexico | Industrial | Aug-25 | 44,033 | Sale-leaseback | 20 | 525,044 | |||||||||||||||||||||||||||||||||||||

| Canadian Solar Inc. | Mesquite, TX | Industrial | Sep-25 | 92,271 | Acquisition | 10 | 756,668 | |||||||||||||||||||||||||||||||||||||

| EOS Fitness OPCO Holdings, LLC | Kissimmee, FL | Retail | Sep-25 | 14,338 | Acquisition | 20 | 42,000 | |||||||||||||||||||||||||||||||||||||

Polytainers Inc. (3 properties) (c) | Toronto and Markham, Canada; and Lee's Summit, MO | Industrial | Sep-25 | 67,170 | Sale-leaseback | 20 | 489,972 | |||||||||||||||||||||||||||||||||||||

| 3Q25 Total | 655,545 | 17 | 5,349,596 | |||||||||||||||||||||||||||||||||||||||||

| Year-to-Date Total | 1,474,173 | 18 | 9,921,577 | |||||||||||||||||||||||||||||||||||||||||

| Property Type | Loan Origination | Loan Maturity Date | Funding | Outstanding | Maximum Commitment | |||||||||||||||||||||||||||||||||||||||||||||

| Description | Property Location | Current Quarter | Year to Date | |||||||||||||||||||||||||||||||||||||||||||||||

Construction Loan (d) | ||||||||||||||||||||||||||||||||||||||||||||||||||

SW Corner of Las Vegas & Harmon (e) (f) | Las Vegas, NV | Retail | Jun-21 | 2026 | $ | — | $ | 3,170 | $ | 245,884 | $ | 256,887 | ||||||||||||||||||||||||||||||||||||||

SE Corner of Las Vegas & Harmon (g) | Las Vegas, NV | Retail | Nov-24 | 2025 | 456 | 1,080 | 17,891 | 23,449 | ||||||||||||||||||||||||||||||||||||||||||

SE Corner of Las Vegas & Elvis Presley (g) | Las Vegas, NV | Retail | Nov-24 | 2025 | 395 | 1,755 | 16,801 | 25,000 | ||||||||||||||||||||||||||||||||||||||||||

| Total | 851 | 6,005 | 280,576 | 305,336 | ||||||||||||||||||||||||||||||||||||||||||||||

| Year-to-Date Total Investment Volume | $ | 1,480,178 | ||||||||||||||||||||||||||||||||||||||||||||||||

| Investing for the Long Run® | 18 | |||||||

Investment Activity – Capital Investments and Commitments (a) | |||||

| Primary Transaction Type | Property Type | Expected Completion / Closing Date | Additional Gross Square Footage | Lease Term (Years) (b) | Funded During Three Months Ended Sep. 30, 2025 (c) | Total Funded Through Sep. 30, 2025 | Maximum Commitment / Gross Investment Amount | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Tenant | Location | Remaining | Total | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Janus International Group, Inc. (d) | Surprise, AZ | Build-to-Suit | Industrial | Q4 2025 | 131,753 | 20 | $ | 4,601 | $ | 14,538 | $ | 6,613 | $ | 21,713 | ||||||||||||||||||||||||||||||||||||||||||||||||

Hedin Mobility Group AB (e) (f) | Amsterdam, The Netherlands | Renovation | Retail | Q4 2025 | 39,826 | 22 | — | — | 17,612 | 17,612 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

Tidal Wave Auto Spa (f) | New Hartford, NY | Purchase Commitment | Retail (Car Wash) | Q4 2025 | 3,600 | 18 | — | — | 5,077 | 5,077 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

Fraikin SAS (e) | Various, France | Renovation | Industrial | Q4 2025 | N/A | 16 | — | 4,508 | 3,593 | 8,101 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Various | Various, United States | Solar Projects | Various | Various | N/A | N/A | 1,647 | 5,945 | 8,636 | 14,581 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Expected Completion Date 2025 Total | 175,179 | 20 | 6,248 | 24,991 | 41,531 | 67,084 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Scania CV AB (e) | Oskarshamn, Sweden | Build-to-Suit | Warehouse | Q1 2026 | 204,645 | 15 | 3,643 | 5,391 | 11,771 | 17,162 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

EOS Fitness OPCO Holdings, LLC (d) | Surprise, AZ | Build-to-Suit | Retail | Q1 2026 | 40,000 | 20 | 1,234 | 5,955 | 5,862 | 12,000 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Rocky Vista University LLC | Billings, MT | Build-to-Suit | Education (Medical School) | Q2 2026 | 57,000 | 25 | — | 2,508 | 22,492 | 25,000 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

TI Automotive (formerly ABC Technologies Holdings Inc.) (d) (e) | Brampton, Canada | Build-to-Suit | Industrial | Q3 2026 | 120,222 | 20 | 222 | 469 | 18,050 | 18,534 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

AEG Presents LLC (g) | Austin, TX | Build-to-Suit | Specialty | Q4 2026 | 56,403 | 30 | 459 | 4,332 | 43,224 | 47,556 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Expected Completion Date 2026 Total | 478,270 | 24 | 5,558 | 18,655 | 101,399 | 120,252 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

AEG Presents LLC (g) | Portland, OR | Build-to-Suit | Specialty | Q1 2027 | 57,825 | 30 | 2,392 | 7,193 | 53,520 | 60,713 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Expected Completion Date 2027 Total | 57,825 | 30 | 2,392 | 7,193 | 53,520 | 60,713 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Capital Investments and Commitments Total | 711,274 | 24 | $ | 14,198 | $ | 50,839 | $ | 196,450 | $ | 248,049 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Investing for the Long Run® | 19 | |||||||

| Investment Activity – Dispositions | |||||

| Tenant / Lease Guarantor | Property Location(s) | Gross Sale Price | Closing Date | Property Type(s) | Gross Square Footage | |||||||||||||||||||||||||||

| 1Q25 | ||||||||||||||||||||||||||||||||

Hedin Mobility Group AB (2 properties) (a) | Eindhoven and Amsterdam, The Netherlands | $ | 16,593 | Jan-25 | Retail | 136,465 | ||||||||||||||||||||||||||

Pendragon PLC (a) | Derby, United Kingdom | 2,158 | Jan-25 | Retail | 34,764 | |||||||||||||||||||||||||||

Pendragon PLC (a) | Newport, United Kingdom | 752 | Jan-25 | Retail | 3,868 | |||||||||||||||||||||||||||

Vacant (formerly Pendragon PLC) (a) | Milton Keynes, United Kingdom | 6,560 | Feb-25 | Retail | 25,942 | |||||||||||||||||||||||||||

Pendragon PLC (a) | Portsmouth, United Kingdom | 1,506 | Feb-25 | Retail | 28,638 | |||||||||||||||||||||||||||

| Vacant (former Prima Wawona Packing Co., LLC) | Reedley, CA | 21,500 | Mar-25 | Warehouse | 325,981 | |||||||||||||||||||||||||||

Hellweg Die Profi-Baumärkte GmbH & Co. KG (a) | Gronau, Germany | 3,569 | Mar-25 | Retail | 45,876 | |||||||||||||||||||||||||||

| Belk, Inc. | Jonesville, SC | 77,194 | Mar-25 | Warehouse | 861,141 | |||||||||||||||||||||||||||

| 1Q25 Total | 129,832 | 1,462,675 | ||||||||||||||||||||||||||||||

| 2Q25 | ||||||||||||||||||||||||||||||||

Vita Euroland Agriculture B.V (a) | Gorinchem, The Netherlands | 8,488 | Apr-25 | Warehouse | 133,500 | |||||||||||||||||||||||||||

Accord Carton LLC (2 properties) (b) | Alsip, IL | 20,757 | Apr-25 | Industrial | 471,890 | |||||||||||||||||||||||||||

Hellweg Die Profi-Baumärkte GmbH & Co. KG (3 properties) (a) | Ennepetal, Nordhausen, and Paderborn, Germany | 14,501 | May-25 | Retail | 198,002 | |||||||||||||||||||||||||||

| Vacant | Middleburg Heights, OH | 2,225 | May-25 | Industrial | 28,185 | |||||||||||||||||||||||||||

| TI Automotive (formerly ABC Technologies Holdings Inc.) | Saline, MI | 7,900 | May-25 | Industrial | 111,072 | |||||||||||||||||||||||||||

Memora Servicios Funerarios S.L (26 properties) (a) | Various, Spain | 161,952 | Jun-25 | Specialty (Funeral Home) | 370,204 | |||||||||||||||||||||||||||

| Self-Storage Operating Properties (10 properties) | Various, United States | 111,525 | Jun-25 | Self-Storage (Operating) | 678,767 | |||||||||||||||||||||||||||

| Serco Inc. | San Diego, CA | 26,250 | Jun-25 | Research & Development | 157,721 | |||||||||||||||||||||||||||

Do It Best Corp. (formerly True Value Company, LLC) (c) | Mankato, MN | 10,605 | Jun-25 | Warehouse | 309,507 | |||||||||||||||||||||||||||

| 2Q25 Total | 364,203 | 2,458,848 | ||||||||||||||||||||||||||||||

| 3Q25 | ||||||||||||||||||||||||||||||||

| Self-Storage Operating Properties (22 properties) | Various, United States | 349,225 | Jul-25, Aug-25 | Self-Storage (Operating) | 1,797,870 | |||||||||||||||||||||||||||

Plantasjen Norge AS (a) | Linkoping, Sweden | 7,408 | Jul-25 | Retail | 58,770 | |||||||||||||||||||||||||||

| Leipold Inc. | Windsor, CT | 6,600 | Jul-25 | Industrial | 40,362 | |||||||||||||||||||||||||||

Wagon Automotive GmbH (a) | Nagold, Germany | 18,221 | Aug-25 | Industrial | 305,437 | |||||||||||||||||||||||||||

Vacant (d) | St. Petersburg, FL | 7,000 | Sep-25 | Warehouse | 70,322 | |||||||||||||||||||||||||||

Hellweg Die Profi-Baumärkte GmbH & Co. KG (3 properties) (a) | Bünde, Guben, and Wuppertal, Germany | 28,834 | Sep-25 | Retail | 232,113 | |||||||||||||||||||||||||||

| Student Housing Operating Property | Austin, TX | 77,913 | Sep-25 | Student Housing (Operating) | 190,475 | |||||||||||||||||||||||||||

| 3Q25 Total | 495,201 | 2,695,349 | ||||||||||||||||||||||||||||||

| Year-to-Date Total Dispositions | $ | 989,236 | 6,616,872 | |||||||||||||||||||||||||||||

| Investing for the Long Run® | 20 | |||||||

| Joint Ventures | |||||

| Joint Venture or JV (Principal Tenant) | JV Partnership | Consolidated | Pro Rata (a) | |||||||||||||||||||||||||||||||||||

| Asset Type | WPC % | Debt Outstanding (b) | ABR | Debt Outstanding (c) | ABR | |||||||||||||||||||||||||||||||||

Unconsolidated Joint Venture (Equity Method Investment) (d) | ||||||||||||||||||||||||||||||||||||||

Las Vegas Retail Complex (e) | Net lease | 47.50% | $ | 245,884 | $ | 22,501 | $ | 116,795 | $ | 10,688 | ||||||||||||||||||||||||||||

| Harmon Retail Corner | Common equity interest | 15.00% | 143,000 | — | 21,450 | — | ||||||||||||||||||||||||||||||||

Kesko Senukai (f) | Net lease | 70.00% | 101,537 | 18,091 | 71,076 | 12,664 | ||||||||||||||||||||||||||||||||

| Total Unconsolidated Joint Ventures | 490,421 | 40,592 | 209,321 | 23,352 | ||||||||||||||||||||||||||||||||||

Consolidated Joint Ventures (g) | ||||||||||||||||||||||||||||||||||||||

COOP Ost SA (f) | Net lease | 90.10% | — | 7,061 | — | 6,362 | ||||||||||||||||||||||||||||||||

Fentonir Trading & Investments Limited (f) | Net lease | 94.90% | — | 2,867 | — | 2,721 | ||||||||||||||||||||||||||||||||

| McCoy-Rockford, Inc. | Net lease | 90.00% | — | 991 | — | 892 | ||||||||||||||||||||||||||||||||

| State of Iowa Board of Regents | Net lease | 90.00% | — | 707 | — | 636 | ||||||||||||||||||||||||||||||||

| Total Consolidated Joint Ventures | — | 11,626 | — | 10,611 | ||||||||||||||||||||||||||||||||||

Total Unconsolidated and Consolidated Joint Ventures | $ | 490,421 | $ | 52,218 | $ | 209,321 | $ | 33,963 | ||||||||||||||||||||||||||||||

| Investing for the Long Run® | 21 | |||||||

| Top 25 Tenants | |||||

| Tenant / Lease Guarantor | Description | Number of Properties | ABR | ABR % | Weighted-Average Lease Term (Years) | |||||||||||||||||||||||||||

| Extra Space Storage, Inc. | Net lease self-storage properties in the U.S. leased to publicly traded self-storage REIT | 43 | $ | 41,332 | 2.7 | % | 23.9 | |||||||||||||||||||||||||

Apotex Pharmaceutical Holdings Inc. (a) | Pharmaceutical R&D and manufacturing properties in the Greater Toronto Area leased to generic drug manufacturer | 11 | 33,448 | 2.2 | % | 17.5 | ||||||||||||||||||||||||||

Metro Cash & Carry Italia S.p.A. (b) | Business-to-business retail stores in Italy leased to cash and carry wholesaler | 19 | 30,869 | 2.0 | % | 4.6 | ||||||||||||||||||||||||||

Fortenova Grupa d.d. (b) | Grocery stores and one warehouse in Croatia leased to European food retailer | 19 | 28,382 | 1.9 | % | 8.6 | ||||||||||||||||||||||||||

OBI Group (b) | Retail properties in Poland leased to German DIY retailer | 26 | 27,444 | 1.8 | % | 5.6 | ||||||||||||||||||||||||||

TI Automotive (formerly ABC Technologies Holdings Inc.) (a) (d) | Automotive parts manufacturing properties in the U.S., Canada and Mexico leased to OEM supplier | 22 | 25,510 | 1.7 | % | 19.5 | ||||||||||||||||||||||||||

Fedrigoni S.p.A (b) | Industrial and warehouse facilities in Germany, Italy and Spain leased to global manufacturer of premium packaging and labels | 16 | 25,078 | 1.7 | % | 18.2 | ||||||||||||||||||||||||||

Eroski Sociedad Cooperative (b) | Grocery stores and warehouses in Spain leased to Spanish food retailer | 63 | 24,086 | 1.6 | % | 10.5 | ||||||||||||||||||||||||||

| Nord Anglia Education, Inc. | K-12 private schools in Orlando, Miami and Houston leased to international day and boarding school operator | 3 | 23,599 | 1.6 | % | 18.0 | ||||||||||||||||||||||||||

Quikrete Holdings, Inc. (b) | Industrial facilities in the U.S. and Canada leased to concrete and building products manufacturer | 27 | 20,644 | 1.4 | % | 17.7 | ||||||||||||||||||||||||||

| Top 10 Total | 249 | 280,392 | 18.6 | % | 14.7 | |||||||||||||||||||||||||||

| Berry Global Inc. | Manufacturing facilities in the U.S. leased to international producer and supplier of packaging solutions | 8 | 20,616 | 1.4 | % | 13.0 | ||||||||||||||||||||||||||

Kesko Senukai (b) | Distribution facilities and retail properties in Lithuania, Estonia and Latvia leased to European DIY retailer | 20 | 20,113 | 1.3 | % | 6.4 | ||||||||||||||||||||||||||

| Advance Auto Parts, Inc. | Distribution facilities in the U.S. leased to automotive aftermarket parts provider | 28 | 18,980 | 1.3 | % | 7.3 | ||||||||||||||||||||||||||

Hellweg Die Profi-Baumärkte GmbH & Co. KG (b) (c) | Retail properties in Germany leased to German DIY retailer | 22 | 18,714 | 1.2 | % | 15.1 | ||||||||||||||||||||||||||

Pendragon PLC (b) | Dealerships in the United Kingdom leased to automotive retailer | 46 | 18,501 | 1.2 | % | 13.1 | ||||||||||||||||||||||||||

| Maker’s Pride (formerly Hearthside Food Solutions LLC) | Production, packaging and distribution facilities in the U.S. leased to North American contract food manufacturer | 18 | 17,636 | 1.2 | % | 16.8 | ||||||||||||||||||||||||||

Koninklijke Jumbo Food Groep B.V (b) | Logistics and cold storage warehouse facilities in the Netherlands leased to European supermarket chain | 5 | 16,879 | 1.1 | % | 6.3 | ||||||||||||||||||||||||||

| Dollar General Corporation | Retail properties in the U.S. leased to discount retailer | 118 | 16,012 | 1.1 | % | 13.7 | ||||||||||||||||||||||||||

Danske Fragtmaend Ejendomme A/S (b) | Distribution facilities in Denmark leased to Danish freight company | 15 | 15,093 | 1.0 | % | 11.4 | ||||||||||||||||||||||||||

Intergamma Bouwmarkten B.V. (b) | Retail properties in the Netherlands leased to European DIY retailer | 36 | 14,944 | 1.0 | % | 7.8 | ||||||||||||||||||||||||||

| Top 20 Total | 565 | 457,880 | 30.4 | % | 13.3 | |||||||||||||||||||||||||||

| Do It Best Corp. (formerly True Value Company, LLC) | Distribution facilities and manufacturing facility in the U.S. leased to global hardware wholesaler | 6 | 14,202 | 0.9 | % | 6.3 | ||||||||||||||||||||||||||

| Dick’s Sporting Goods, Inc. | Retail properties and single distribution facility in the U.S. leased to sporting goods retailer | 9 | 13,616 | 0.9 | % | 5.9 | ||||||||||||||||||||||||||

| Premium Brands Holdings Corporation | Food processing facility outside Chattanooga, TN leased to global specialty food manufacturer | 1 | 12,616 | 0.8 | % | 24.8 | ||||||||||||||||||||||||||

| Canadian Solar Inc. | Distribution and manufacturing facilities in Dallas and Louisville leased to global renewable energy company | 2 | 12,255 | 0.8 | % | 10.5 | ||||||||||||||||||||||||||

| Henkel AG & Co. KGaA | Distribution facility in Bowling Green, KY leased to global provider of consumer products and adhesives | 1 | 11,880 | 0.8 | % | 16.6 | ||||||||||||||||||||||||||

Top 25 Total (e) | 584 | $ | 522,449 | 34.6 | % | 13.2 | ||||||||||||||||||||||||||

| Investing for the Long Run® | 22 | |||||||

| Diversification by Property Type | |||||

| Total Net-Lease Portfolio | ||||||||||||||||||||||||||

| Property Type | ABR | ABR % | Square Footage (a) | Square Footage % | ||||||||||||||||||||||

| U.S. | ||||||||||||||||||||||||||

| Industrial | $ | 393,947 | 26.1 | % | 58,023 | 31.7 | % | |||||||||||||||||||

| Warehouse | 229,885 | 15.2 | % | 43,314 | 23.7 | % | ||||||||||||||||||||

Retail (b) | 110,004 | 7.3 | % | 5,121 | 2.8 | % | ||||||||||||||||||||

Other (c) | 173,855 | 11.5 | % | 9,469 | 5.2 | % | ||||||||||||||||||||

| U.S. Total | 907,691 | 60.1 | % | 115,927 | 63.4 | % | ||||||||||||||||||||

| International | ||||||||||||||||||||||||||

| Industrial | 195,209 | 12.9 | % | 25,336 | 13.9 | % | ||||||||||||||||||||

| Warehouse | 154,164 | 10.3 | % | 22,785 | 12.5 | % | ||||||||||||||||||||

Retail (b) | 217,445 | 14.4 | % | 16,968 | 9.3 | % | ||||||||||||||||||||

Other (c) | 34,721 | 2.3 | % | 1,759 | 0.9 | % | ||||||||||||||||||||

| International Total | 601,539 | 39.9 | % | 66,848 | 36.6 | % | ||||||||||||||||||||

| Total | ||||||||||||||||||||||||||

| Industrial | 589,156 | 39.0 | % | 83,359 | 45.6 | % | ||||||||||||||||||||

| Warehouse | 384,049 | 25.5 | % | 66,099 | 36.2 | % | ||||||||||||||||||||

Retail (b) | 327,449 | 21.7 | % | 22,089 | 12.1 | % | ||||||||||||||||||||

Other (c) | 208,576 | 13.8 | % | 11,228 | 6.1 | % | ||||||||||||||||||||

Total (d) | $ | 1,509,230 | 100.0 | % | 182,775 | 100.0 | % | |||||||||||||||||||

| Investing for the Long Run® | 23 | |||||||

| Diversification by Tenant Industry | |||||

| Total Net-Lease Portfolio | ||||||||||||||||||||||||||

Industry Type (a) | ABR | ABR % | Square Footage | Square Footage % | ||||||||||||||||||||||

| Food Retail | $ | 148,851 | 9.9 | % | 10,867 | 5.9 | % | |||||||||||||||||||

| Packaged Foods & Meats | 148,194 | 9.8 | % | 18,559 | 10.2 | % | ||||||||||||||||||||

| Home Improvement Retail | 97,999 | 6.5 | % | 12,187 | 6.7 | % | ||||||||||||||||||||

| Auto Parts & Equipment | 81,791 | 5.4 | % | 12,225 | 6.7 | % | ||||||||||||||||||||

| Automotive Retail | 76,918 | 5.1 | % | 7,023 | 3.8 | % | ||||||||||||||||||||

| Education Services | 60,418 | 4.0 | % | 2,778 | 1.5 | % | ||||||||||||||||||||

| Pharmaceuticals | 48,155 | 3.2 | % | 3,076 | 1.7 | % | ||||||||||||||||||||

| Air Freight & Logistics | 46,409 | 3.1 | % | 7,075 | 3.9 | % | ||||||||||||||||||||

| Self-Storage REITs | 41,332 | 2.7 | % | 3,170 | 1.7 | % | ||||||||||||||||||||

| Industrial Machinery | 40,504 | 2.7 | % | 5,570 | 3.0 | % | ||||||||||||||||||||

| Trading Companies & Distributors | 38,132 | 2.5 | % | 8,663 | 4.7 | % | ||||||||||||||||||||

| Metal & Glass Containers | 37,299 | 2.5 | % | 5,083 | 2.8 | % | ||||||||||||||||||||

| Building Products | 30,817 | 2.0 | % | 6,653 | 3.6 | % | ||||||||||||||||||||

| Other Specialty Retail | 29,041 | 1.9 | % | 3,233 | 1.8 | % | ||||||||||||||||||||

| Paper Products | 25,078 | 1.7 | % | 4,459 | 2.4 | % | ||||||||||||||||||||

| Specialty Chemicals | 24,370 | 1.6 | % | 4,303 | 2.4 | % | ||||||||||||||||||||

| Diversified Support Services | 23,909 | 1.6 | % | 2,372 | 1.3 | % | ||||||||||||||||||||

| Construction Materials | 23,557 | 1.5 | % | 3,781 | 2.1 | % | ||||||||||||||||||||

| Food Distributors | 19,316 | 1.3 | % | 1,552 | 0.8 | % | ||||||||||||||||||||

| Construction Machinery | 19,123 | 1.3 | % | 2,528 | 1.4 | % | ||||||||||||||||||||

| Passenger Ground Transportation | 18,841 | 1.2 | % | 850 | 0.5 | % | ||||||||||||||||||||

| Consumer Staples Merchandise Retail | 18,215 | 1.2 | % | 1,541 | 0.8 | % | ||||||||||||||||||||

| Leisure Facilities | 18,102 | 1.2 | % | 656 | 0.4 | % | ||||||||||||||||||||

| Hotels & Resorts | 16,472 | 1.1 | % | 1,073 | 0.6 | % | ||||||||||||||||||||

| Commodity Chemicals | 16,417 | 1.1 | % | 2,493 | 1.4 | % | ||||||||||||||||||||

| Diversified Metals | 16,281 | 1.1 | % | 3,290 | 1.8 | % | ||||||||||||||||||||

Other (63 industries, each <1% ABR) (b) | 343,689 | 22.8 | % | 47,715 | 26.1 | % | ||||||||||||||||||||

Total (c) | $ | 1,509,230 | 100.0 | % | 182,775 | 100.0 | % | |||||||||||||||||||

| Investing for the Long Run® | 24 | |||||||

| Diversification by Geography | |||||

| Total Net-Lease Portfolio | ||||||||||||||||||||||||||

| Region | ABR | ABR % | Square Footage (a) | Square Footage % | ||||||||||||||||||||||

| U.S. | ||||||||||||||||||||||||||

| South | ||||||||||||||||||||||||||

| Texas | $ | 92,882 | 6.1 | % | 11,702 | 6.4 | % | |||||||||||||||||||

| Florida | 44,679 | 3.0 | % | 3,707 | 2.0 | % | ||||||||||||||||||||

| Tennessee | 39,035 | 2.6 | % | 4,572 | 2.5 | % | ||||||||||||||||||||

| Georgia | 28,402 | 1.9 | % | 4,415 | 2.4 | % | ||||||||||||||||||||

| Alabama | 21,314 | 1.4 | % | 3,504 | 1.9 | % | ||||||||||||||||||||

Other (b) | 26,692 | 1.8 | % | 3,024 | 1.7 | % | ||||||||||||||||||||

| Total South | 253,004 | 16.8 | % | 30,924 | 16.9 | % | ||||||||||||||||||||

| Midwest | ||||||||||||||||||||||||||

| Illinois | 63,982 | 4.2 | % | 9,474 | 5.2 | % | ||||||||||||||||||||

| Ohio | 41,092 | 2.7 | % | 8,383 | 4.6 | % | ||||||||||||||||||||

| Indiana | 40,217 | 2.7 | % | 6,173 | 3.4 | % | ||||||||||||||||||||

| Michigan | 27,122 | 1.8 | % | 4,499 | 2.5 | % | ||||||||||||||||||||

| Wisconsin | 19,866 | 1.3 | % | 3,351 | 1.8 | % | ||||||||||||||||||||

Other (b) | 51,465 | 3.4 | % | 7,174 | 3.9 | % | ||||||||||||||||||||

| Total Midwest | 243,744 | 16.1 | % | 39,054 | 21.4 | % | ||||||||||||||||||||

| East | ||||||||||||||||||||||||||

| North Carolina | 41,065 | 2.7 | % | 8,858 | 4.8 | % | ||||||||||||||||||||

| Pennsylvania | 32,781 | 2.2 | % | 3,416 | 1.9 | % | ||||||||||||||||||||

| Kentucky | 29,737 | 2.0 | % | 4,485 | 2.4 | % | ||||||||||||||||||||

| Massachusetts | 25,049 | 1.6 | % | 1,216 | 0.7 | % | ||||||||||||||||||||

| New York | 22,568 | 1.5 | % | 2,284 | 1.2 | % | ||||||||||||||||||||

| New Jersey | 22,334 | 1.5 | % | 1,008 | 0.5 | % | ||||||||||||||||||||

| South Carolina | 19,495 | 1.3 | % | 4,485 | 2.5 | % | ||||||||||||||||||||

Other (b) | 34,904 | 2.3 | % | 5,247 | 2.9 | % | ||||||||||||||||||||

| Total East | 227,933 | 15.1 | % | 30,999 | 16.9 | % | ||||||||||||||||||||

| West | ||||||||||||||||||||||||||

| California | 75,892 | 5.0 | % | 5,351 | 2.9 | % | ||||||||||||||||||||

| Arizona | 22,381 | 1.5 | % | 2,372 | 1.3 | % | ||||||||||||||||||||

| Nevada | 17,747 | 1.2 | % | 485 | 0.3 | % | ||||||||||||||||||||

Other (b) | 66,990 | 4.4 | % | 6,742 | 3.7 | % | ||||||||||||||||||||

| Total West | 183,010 | 12.1 | % | 14,950 | 8.2 | % | ||||||||||||||||||||

| U.S. Total | 907,691 | 60.1 | % | 115,927 | 63.4 | % | ||||||||||||||||||||

| International | ||||||||||||||||||||||||||

| Italy | 77,711 | 5.2 | % | 9,911 | 5.4 | % | ||||||||||||||||||||

| The Netherlands | 67,611 | 4.5 | % | 6,784 | 3.7 | % | ||||||||||||||||||||

| Poland | 66,276 | 4.4 | % | 8,460 | 4.6 | % | ||||||||||||||||||||

| United Kingdom | 61,559 | 4.1 | % | 4,848 | 2.7 | % | ||||||||||||||||||||

Canada (c) | 59,476 | 3.9 | % | 5,737 | 3.1 | % | ||||||||||||||||||||

| Germany | 47,191 | 3.1 | % | 5,580 | 3.1 | % | ||||||||||||||||||||

| Spain | 35,959 | 2.4 | % | 3,522 | 1.9 | % | ||||||||||||||||||||

| Croatia | 29,306 | 1.9 | % | 2,063 | 1.1 | % | ||||||||||||||||||||

| France | 28,061 | 1.9 | % | 2,149 | 1.2 | % | ||||||||||||||||||||

| Denmark | 27,606 | 1.8 | % | 3,002 | 1.7 | % | ||||||||||||||||||||

Mexico (d) | 26,139 | 1.7 | % | 4,190 | 2.3 | % | ||||||||||||||||||||

| Lithuania | 15,144 | 1.0 | % | 1,640 | 0.9 | % | ||||||||||||||||||||

Other (e) | 59,500 | 4.0 | % | 8,962 | 4.9 | % | ||||||||||||||||||||

| International Total | 601,539 | 39.9 | % | 66,848 | 36.6 | % | ||||||||||||||||||||

Total (f) | $ | 1,509,230 | 100.0 | % | 182,775 | 100.0 | % | |||||||||||||||||||

| Investing for the Long Run® | 25 | |||||||

| Contractual Rent Increases | |||||

| Total Net-Lease Portfolio | ||||||||||||||||||||||||||

| Rent Adjustment Measure | ABR | ABR % | Square Footage | Square Footage % | ||||||||||||||||||||||

| Uncapped CPI | $ | 464,665 | 30.8 | % | 44,719 | 24.4 | % | |||||||||||||||||||

| Capped CPI | 282,438 | 18.7 | % | 39,148 | 21.4 | % | ||||||||||||||||||||

| CPI-linked | 747,103 | 49.5 | % | 83,867 | 45.8 | % | ||||||||||||||||||||

| Fixed | 707,328 | 46.9 | % | 89,598 | 49.0 | % | ||||||||||||||||||||

Other (a) | 48,014 | 3.2 | % | 3,598 | 2.0 | % | ||||||||||||||||||||

| None | 6,785 | 0.4 | % | 298 | 0.2 | % | ||||||||||||||||||||

| Vacant | — | — | % | 5,414 | 3.0 | % | ||||||||||||||||||||

Total (b) | $ | 1,509,230 | 100.0 | % | 182,775 | 100.0 | % | |||||||||||||||||||

| Investing for the Long Run® | 26 | |||||||

| Same-Store Analysis | |||||

| ABR | |||||||||||||||||||||||

| As of | |||||||||||||||||||||||

| Sep. 30, 2025 | Sep. 30, 2024 | Increase | % Increase | ||||||||||||||||||||

| Property Type | |||||||||||||||||||||||

| Industrial | $ | 434,606 | $ | 424,295 | $ | 10,311 | 2.4 | % | |||||||||||||||

| Warehouse | 350,828 | 343,647 | 7,181 | 2.1 | % | ||||||||||||||||||

Retail (a) | 286,603 | 279,842 | 6,761 | 2.4 | % | ||||||||||||||||||

Other (b) | 165,923 | 160,908 | 5,015 | 3.1 | % | ||||||||||||||||||

| Total | $ | 1,237,960 | $ | 1,208,692 | $ | 29,268 | 2.4 | % | |||||||||||||||

| Rent Adjustment Measure | |||||||||||||||||||||||

| Uncapped CPI | $ | 410,944 | $ | 400,447 | $ | 10,497 | 2.6 | % | |||||||||||||||

| Capped CPI | 250,696 | 244,927 | 5,769 | 2.4 | % | ||||||||||||||||||

| CPI-linked | 661,640 | 645,374 | 16,266 | 2.5 | % | ||||||||||||||||||

| Fixed | 526,735 | 515,816 | 10,919 | 2.1 | % | ||||||||||||||||||

Other (c) | 44,150 | 42,067 | 2,083 | 5.0 | % | ||||||||||||||||||

| None | 5,435 | 5,435 | — | — | % | ||||||||||||||||||

| Total | $ | 1,237,960 | $ | 1,208,692 | $ | 29,268 | 2.4 | % | |||||||||||||||

| Geography | |||||||||||||||||||||||

| U.S. | $ | 711,467 | $ | 694,869 | $ | 16,598 | 2.4 | % | |||||||||||||||

| Europe | 450,716 | 440,103 | 10,613 | 2.4 | % | ||||||||||||||||||

Other International (d) | 75,777 | 73,720 | 2,057 | 2.8 | % | ||||||||||||||||||

| Total | $ | 1,237,960 | $ | 1,208,692 | $ | 29,268 | 2.4 | % | |||||||||||||||

| Same-Store Portfolio Summary | |||||||||||||||||||||||

| Number of properties | 1,270 | ||||||||||||||||||||||

| Square footage (in thousands) | 150,744 | ||||||||||||||||||||||

| Investing for the Long Run® | 27 | |||||||

| Same-Store Pro Rata Rental Income | |||||||||||||||||||||||

| Three Months Ended | |||||||||||||||||||||||

| Sep. 30, 2025 | Sep. 30, 2024 | Increase | % Increase | ||||||||||||||||||||

| Property Type | |||||||||||||||||||||||

| Industrial | $ | 115,485 | $ | 111,702 | $ | 3,783 | 3.4 | % | |||||||||||||||

| Warehouse | 89,624 | 91,260 | (1,636) | (1.8) | % | ||||||||||||||||||

Retail (a) | 72,534 | 70,389 | 2,145 | 3.0 | % | ||||||||||||||||||

Other (b) | 41,768 | 39,663 | 2,105 | 5.3 | % | ||||||||||||||||||

| Total | $ | 319,411 | $ | 313,014 | $ | 6,397 | 2.0 | % | |||||||||||||||

| Rent Adjustment Measure | |||||||||||||||||||||||

| Uncapped CPI | $ | 107,007 | $ | 102,707 | $ | 4,300 | 4.2 | % | |||||||||||||||

| Capped CPI | 65,529 | 66,547 | (1,018) | (1.5) | % | ||||||||||||||||||

| CPI-linked | 172,536 | 169,254 | 3,282 | 1.9 | % | ||||||||||||||||||

| Fixed | 136,786 | 134,218 | 2,568 | 1.9 | % | ||||||||||||||||||

Other (c) | 8,693 | 8,144 | 549 | 6.7 | % | ||||||||||||||||||

| None | 1,396 | 1,398 | (2) | (0.1) | % | ||||||||||||||||||

| Total | $ | 319,411 | $ | 313,014 | $ | 6,397 | 2.0 | % | |||||||||||||||

| Geography | |||||||||||||||||||||||

| U.S. | $ | 185,802 | $ | 181,250 | $ | 4,552 | 2.5 | % | |||||||||||||||

| Europe | 114,959 | 113,577 | 1,382 | 1.2 | % | ||||||||||||||||||

Other International (d) | 18,650 | 18,187 | 463 | 2.5 | % | ||||||||||||||||||

| Total | $ | 319,411 | $ | 313,014 | $ | 6,397 | 2.0 | % | |||||||||||||||

| Same-Store Portfolio Summary | |||||||||||||||||||||||

| Number of properties | 1,193 | ||||||||||||||||||||||

| Square footage (in thousands) | 161,299 | ||||||||||||||||||||||

| Investing for the Long Run® | 28 | |||||||

| Three Months Ended | |||||||||||

| Sep. 30, 2025 | Sep. 30, 2024 | ||||||||||

| Consolidated Lease Revenues | |||||||||||

| Total lease revenues – as reported | $ | 372,087 | $ | 334,039 | |||||||

| Income from finance leases and loans receivable | 26,498 | 15,712 | |||||||||

| Less: Reimbursable tenant costs – as reported | (14,562) | (13,337) | |||||||||

| Less: Income from secured loans receivable | (669) | (556) | |||||||||

| 383,354 | 335,858 | ||||||||||

| Adjustments for Pro Rata Ownership of Real Estate Joint Ventures: | |||||||||||

| Add: Pro rata share of adjustments from equity method investments | 3,625 | 3,848 | |||||||||

| Less: Pro rata share of adjustments for noncontrolling interests | (272) | (194) | |||||||||

| 3,353 | 3,654 | ||||||||||

| Adjustments for Pro Rata Non-Cash Items: | |||||||||||

| Less: Straight-line and other leasing and financing adjustments | (20,424) | (21,187) | |||||||||

| Add: Above- and below-market rent intangible lease amortization | 4,363 | 6,263 | |||||||||

| Less: Adjustments for pro rata ownership | 1,780 | (1,290) | |||||||||

| (14,281) | (16,214) | ||||||||||

Adjustment to normalize for (i) properties not continuously owned since July 1, 2024 and (ii) constant currency presentation for prior year quarter (e) | (53,015) | (10,284) | |||||||||

| Same-Store Pro Rata Rental Income | $ | 319,411 | $ | 313,014 | |||||||

| Investing for the Long Run® | 29 | |||||||

| Leasing Activity | |||||

Lease Renewals and Extensions (a) | Property and Tenant Improvements (c) | Leasing Commissions | ||||||||||||||||||||||||||||||||||||||||||||||||

| ABR | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Property Type | Square Feet | Number of Leases | Prior Lease | New Lease (b) | Rent Recapture | Incremental Lease Term | ||||||||||||||||||||||||||||||||||||||||||||

| Industrial | 3,305,143 | 5 | $ | 23,378 | $ | 23,378 | 100.0 | % | $ | — | $ | — | 3.6 years | |||||||||||||||||||||||||||||||||||||

| Warehouse | 602,144 | 1 | 3,127 | 3,127 | 100.0 | % | — | — | 1.4 years | |||||||||||||||||||||||||||||||||||||||||

| Retail | 127,075 | 2 | 1,075 | 770 | 71.6 | % | — | — | 2.0 years | |||||||||||||||||||||||||||||||||||||||||

| Other | 131,129 | 2 | 2,510 | 2,655 | 105.8 | % | 1,486 | 613 | 10.0 years | |||||||||||||||||||||||||||||||||||||||||

| Total / Weighted Average | 4,165,491 | 10 | $ | 30,090 | $ | 29,930 | 99.5 | % | $ | 1,486 | $ | 613 | 4.0 years | |||||||||||||||||||||||||||||||||||||

| Q3 Summary | ||||||||||||||||||||||||||||||||||||||||||||||||||

Prior Lease ABR (% of Total Portfolio) | 2.0 | % | ||||||||||||||||||||||||||||||||||||||||||||||||

| New Leases | Property and Tenant Improvements (c) | Leasing Commissions | ||||||||||||||||||||||||||||||||||||

| ABR | ||||||||||||||||||||||||||||||||||||||

| Property Type | Square Feet | Number of Leases | New Lease (b) | New Lease Term | ||||||||||||||||||||||||||||||||||

| Industrial | — | — | $ | — | $ | — | $ | — | N/A | |||||||||||||||||||||||||||||

| Warehouse | — | — | — | — | — | N/A | ||||||||||||||||||||||||||||||||

| Retail | 514,287 | 7 | 5,378 | 7,045 | 109 | 14.4 years | ||||||||||||||||||||||||||||||||

Self-Storage (net lease) (d) | 88,459 | 2 | 1,193 | — | — | 24.1 years | ||||||||||||||||||||||||||||||||

| Other | — | — | — | — | — | N/A | ||||||||||||||||||||||||||||||||

Total / Weighted Average (e) | 602,746 | 9 | $ | 6,571 | $ | 7,045 | $ | 109 | 16.2 years | |||||||||||||||||||||||||||||

| Investing for the Long Run® | 30 | |||||||

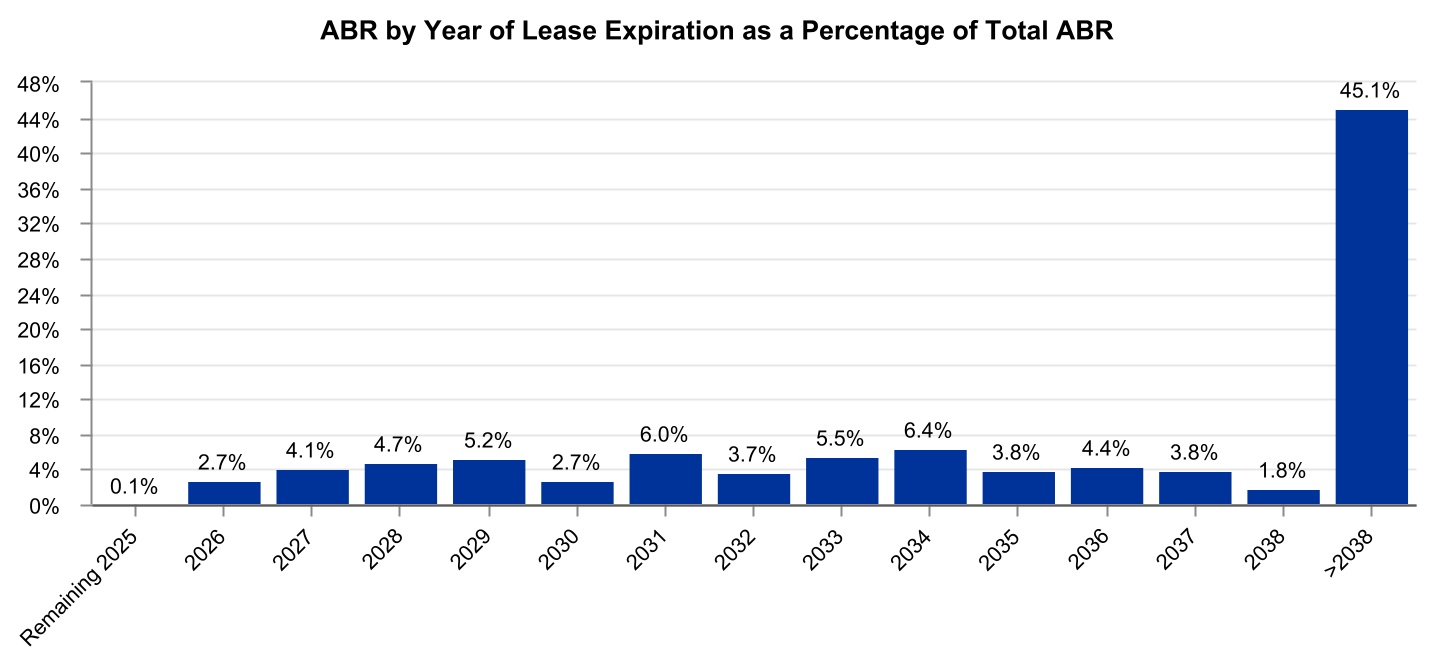

| Lease Expirations | |||||

Year of Lease Expiration (a) | Number of Leases Expiring | Number of Tenants with Leases Expiring | ABR | ABR % | Square Footage | Square Footage % | ||||||||||||||||||||||||||||||||

| Remaining 2025 | 4 | 5 | $ | 1,572 | 0.1 | % | 166 | 0.1 | % | |||||||||||||||||||||||||||||

| 2026 | 23 | 23 | 40,901 | 2.7 | % | 5,542 | 3.0 | % | ||||||||||||||||||||||||||||||

| 2027 | 45 | 28 | 62,640 | 4.1 | % | 6,855 | 3.8 | % | ||||||||||||||||||||||||||||||

| 2028 | 45 | 27 | 71,109 | 4.7 | % | 7,348 | 4.0 | % | ||||||||||||||||||||||||||||||

| 2029 | 60 | 33 | 78,675 | 5.2 | % | 8,649 | 4.7 | % | ||||||||||||||||||||||||||||||

| 2030 | 35 | 30 | 41,009 | 2.7 | % | 4,031 | 2.2 | % | ||||||||||||||||||||||||||||||

| 2031 | 46 | 27 | 90,041 | 6.0 | % | 10,599 | 5.8 | % | ||||||||||||||||||||||||||||||

| 2032 | 46 | 24 | 55,429 | 3.7 | % | 7,257 | 4.0 | % | ||||||||||||||||||||||||||||||

| 2033 | 32 | 25 | 83,063 | 5.5 | % | 11,790 | 6.5 | % | ||||||||||||||||||||||||||||||

| 2034 | 59 | 27 | 95,959 | 6.4 | % | 9,464 | 5.2 | % | ||||||||||||||||||||||||||||||

| 2035 | 25 | 21 | 56,985 | 3.8 | % | 8,115 | 4.4 | % | ||||||||||||||||||||||||||||||

| 2036 | 45 | 21 | 66,785 | 4.4 | % | 7,891 | 4.3 | % | ||||||||||||||||||||||||||||||

| 2037 | 43 | 20 | 56,626 | 3.8 | % | 7,851 | 4.3 | % | ||||||||||||||||||||||||||||||

| 2038 | 46 | 13 | 27,831 | 1.8 | % | 2,766 | 1.5 | % | ||||||||||||||||||||||||||||||

| Thereafter (>2038) | 382 | 132 | 680,605 | 45.1 | % | 79,037 | 43.2 | % | ||||||||||||||||||||||||||||||

| Vacant | — | — | — | — | % | 5,414 | 3.0 | % | ||||||||||||||||||||||||||||||

Total (b) | 936 | $ | 1,509,230 | 100.0 | % | 182,775 | 100.0 | % | ||||||||||||||||||||||||||||||

| Investing for the Long Run® | 31 | |||||||

| Self-Storage Operating Properties Portfolio | |||||

State / District | Number of Properties | Number of Units | Square Footage | Square Footage % | Period End Occupancy | |||||||||||||||||||||||||||

| Texas | 12 | 6,645 | 835 | 28.7 | % | 89.1 | % | |||||||||||||||||||||||||

| Illinois | 10 | 4,822 | 666 | 22.9 | % | 88.2 | % | |||||||||||||||||||||||||

| Florida | 7 | 5,839 | 547 | 18.8 | % | 90.8 | % | |||||||||||||||||||||||||

| California | 2 | 1,101 | 121 | 4.2 | % | 94.0 | % | |||||||||||||||||||||||||

| Hawaii | 2 | 956 | 95 | 3.3 | % | 95.9 | % | |||||||||||||||||||||||||

| Tennessee | 2 | 884 | 122 | 4.2 | % | 86.9 | % | |||||||||||||||||||||||||

| North Carolina | 1 | 947 | 121 | 4.1 | % | 89.7 | % | |||||||||||||||||||||||||

| Arkansas | 1 | 843 | 115 | 4.0 | % | 64.9 | % | |||||||||||||||||||||||||

| Ohio | 1 | 598 | 73 | 2.5 | % | 87.3 | % | |||||||||||||||||||||||||

| Georgia | 1 | 546 | 73 | 2.5 | % | 77.8 | % | |||||||||||||||||||||||||

| Louisiana | 1 | 541 | 59 | 2.0 | % | 89.7 | % | |||||||||||||||||||||||||

| Oregon | 1 | 442 | 40 | 1.4 | % | 94.0 | % | |||||||||||||||||||||||||

| Missouri | 1 | 329 | 41 | 1.4 | % | 94.9 | % | |||||||||||||||||||||||||

Total (a) | 42 | 24,493 | 2,908 | 100.0 | % | 88.5 | % | |||||||||||||||||||||||||

| Investing for the Long Run® | 32 | |||||||

| Investing for the Long Run® | 33 | |||||||

| Normalized Pro Rata Cash NOI | |||||

| Three Months Ended Sep. 30, 2025 | |||||

| Consolidated Lease Revenues | |||||

| Total lease revenues – as reported | $ | 372,087 | |||

| Income from finance leases and loans receivable – as reported | 26,498 | ||||

| Less: Income from secured loans receivable | (669) | ||||

| Less: Consolidated Reimbursable and Non-Reimbursable Property Expenses | |||||

| Reimbursable property expenses – as reported | 14,562 | ||||

| Non-reimbursable property expenses – as reported | 14,637 | ||||

| 368,717 | |||||

| Plus: NOI from Operating Properties | |||||

| Self-storage revenues | 13,725 | ||||

| Self-storage expenses | (5,847) | ||||

| 7,878 | |||||

| Hotel revenues | 10,695 | ||||

| Hotel expenses | (7,963) | ||||

| 2,732 | |||||

| Student housing and other revenues | 2,351 | ||||

| Student housing and other expenses | (1,239) | ||||

| 1,112 | |||||

| 380,439 | |||||

| Adjustments for Pro Rata Ownership of Real Estate Joint Ventures: | |||||

| Add: Pro rata share of NOI from equity method investments | 4,936 | ||||

| Less: Pro rata share of NOI attributable to noncontrolling interests | (215) | ||||

| 4,721 | |||||

| 385,160 | |||||

| Adjustments for Pro Rata Non-Cash Items: | |||||

| Less: Straight-line and other leasing and financing adjustments | (20,424) | ||||

| Add: Above- and below-market rent intangible lease amortization | 4,363 | ||||

| Add: Other non-cash items | 550 | ||||

| (15,511) | |||||

Pro Rata Cash NOI (a) | 369,649 | ||||

Adjustment to normalize for net lease investments and dispositions (b) | 4,753 | ||||

Adjustment to normalize for operating property dispositions (b) | (2,208) | ||||

Normalized Pro Rata Cash NOI (a) | $ | 372,194 | |||

| Investing for the Long Run® | 34 | |||||||

| Three Months Ended Sep. 30, 2025 | |||||

| Net Income Attributable to W. P. Carey | |||||

| Net income attributable to W. P. Carey – as reported | $ | 140,996 | |||

| Adjustments for Consolidated Operating Expenses | |||||

| Add: Operating expenses – as reported | 225,138 | ||||

| Less: Operating property expenses – as reported | (15,049) | ||||

| Less: Property expenses, excluding reimbursable tenant costs – as reported | (14,637) | ||||

| 195,452 | |||||

| Adjustments for Other Consolidated Revenues and Expenses: | |||||

| Add: Other income and (expenses) – as reported | 56,445 | ||||

| Less: Reimbursable property expenses – as reported | (14,562) | ||||

| Add: Provision for income taxes – as reported | 8,495 | ||||

| Less: Other lease-related income – as reported | (3,660) | ||||

| Less: Asset management fees revenue – as reported | (1,218) | ||||

| Less: Other advisory income and reimbursements – as reported | (1,069) | ||||

| 44,431 | |||||

| Other Adjustments: | |||||

| Less: Straight-line and other leasing and financing adjustments | (20,424) | ||||

| Add: Adjustments for pro rata ownership | 4,977 | ||||

Adjustment to normalize for net lease investments and dispositions (b) | 4,753 | ||||

| Add: Above- and below-market rent intangible lease amortization | 4,363 | ||||

Adjustment to normalize for operating property dispositions (b) | (2,208) | ||||

| Less: Income from secured loans receivable | (669) | ||||

| Add: Property expenses, excluding reimbursable tenant costs, non-cash | 523 | ||||

| (8,685) | |||||

Normalized Pro Rata Cash NOI (a) | $ | 372,194 | |||

| Investing for the Long Run® | 35 | |||||||

| Adjusted EBITDA – Last Five Quarters | |||||

| Three Months Ended | |||||||||||||||||||||||||||||

| Sep. 30, 2025 | Jun. 30, 2025 | Mar. 31, 2025 | Dec. 31, 2024 | Sep. 30, 2024 | |||||||||||||||||||||||||

| Net income | $ | 141,225 | $ | 51,312 | $ | 125,816 | $ | 47,038 | $ | 111,652 | |||||||||||||||||||