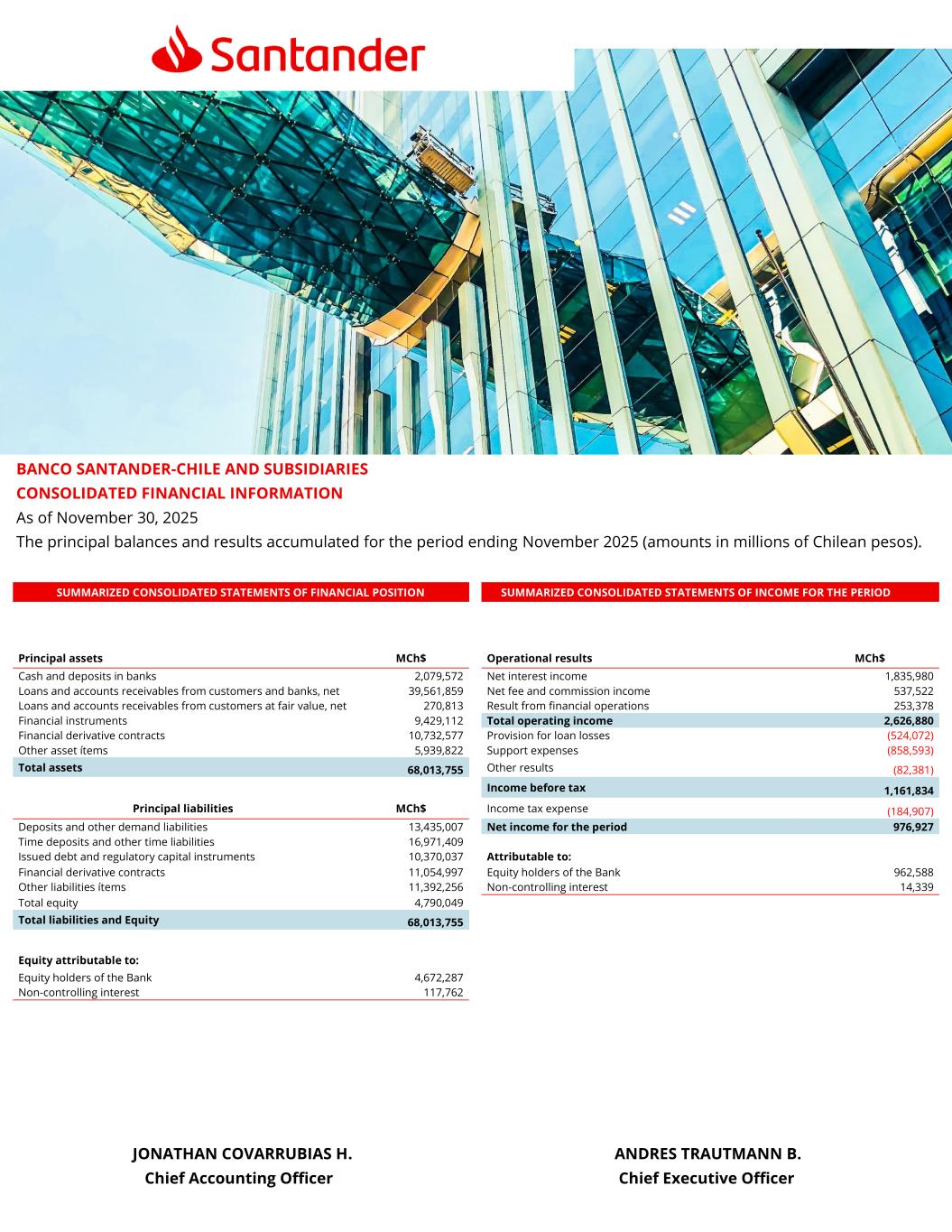

SUMMARIZED CONSOLIDATED STATEMENTS OF FINANCIAL POSITION SUMMARIZED CONSOLIDATED STATEMENTS OF INCOME FOR THE PERIOD Principal assets MCh$ Operational results MCh$ Cash and deposits in banks 2,079,572 Net interest income 1,835,980 Loans and accounts receivables from customers and banks, net 39,561,859 Net fee and commission income 537,522 Loans and accounts receivables from customers at fair value, net 270,813 Result from financial operations 253,378 Financial instruments 9,429,112 Total operating income 2,626,880 Financial derivative contracts 10,732,577 Provision for loan losses (524,072) Other asset ítems 5,939,822 Support expenses (858,593) Total assets 68,013,755 Other results (82,381) Income before tax 1,161,834 Principal liabilities MCh$ Income tax expense (184,907) Deposits and other demand liabilities 13,435,007 Net income for the period 976,927 Time deposits and other time liabilities 16,971,409 Issued debt and regulatory capital instruments 10,370,037 Attributable to: Financial derivative contracts 11,054,997 Equity holders of the Bank 962,588 Other liabilities ítems 11,392,256 Non-controlling interest 14,339 Total equity 4,790,049 Total liabilities and Equity 68,013,755 Equity attributable to: Equity holders of the Bank 4,672,287 Non-controlling interest 117,762 BANCO SANTANDER-CHILE AND SUBSIDIARIES CONSOLIDATED FINANCIAL INFORMATION As of November 30, 2025 The principal balances and results accumulated for the period ending November 2025 (amounts in millions of Chilean pesos). JONATHAN COVARRUBIAS H. ANDRES TRAUTMANN B. Chief Accounting Officer Chief Executive Officer

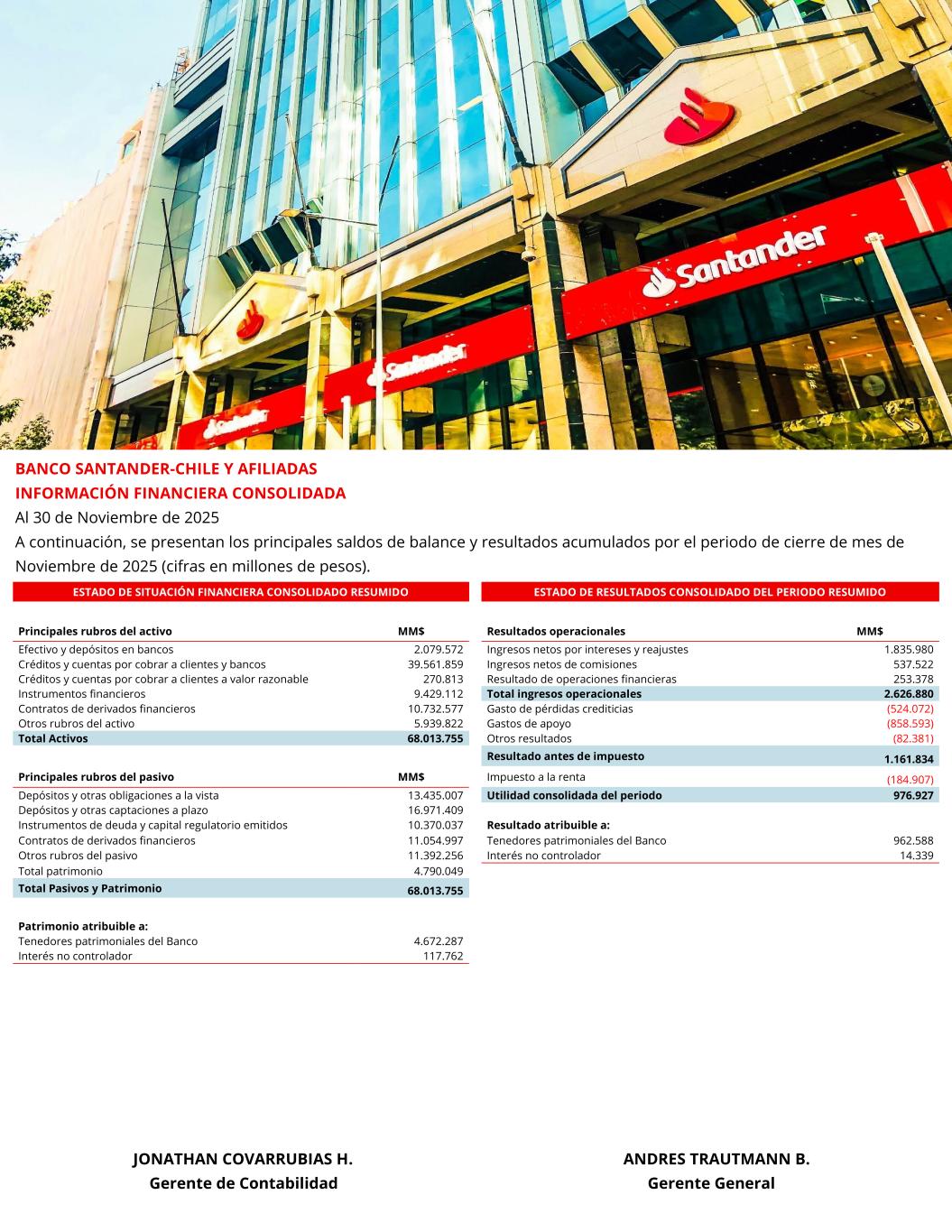

B ESTADO DE SITUACIÓN FINANCIERA CONSOLIDADO RESUMIDO ESTADO DE RESULTADOS CONSOLIDADO DEL PERIODO RESUMIDO Principales rubros del activo MM$ Resultados operacionales MM$ Efectivo y depósitos en bancos 2.079.572 Ingresos netos por intereses y reajustes 1.835.980 Créditos y cuentas por cobrar a clientes y bancos 39.561.859 Ingresos netos de comisiones 537.522 Créditos y cuentas por cobrar a clientes a valor razonable 270.813 Resultado de operaciones financieras 253.378 Instrumentos financieros 9.429.112 Total ingresos operacionales 2.626.880 Contratos de derivados financieros 10.732.577 Gasto de pérdidas crediticias (524.072) Otros rubros del activo 5.939.822 Gastos de apoyo (858.593) Total Activos 68.013.755 Otros resultados (82.381) Resultado antes de impuesto 1.161.834 Principales rubros del pasivo MM$ Impuesto a la renta (184.907) Depósitos y otras obligaciones a la vista 13.435.007 Utilidad consolidada del periodo 976.927 Depósitos y otras captaciones a plazo 16.971.409 Instrumentos de deuda y capital regulatorio emitidos 10.370.037 Resultado atribuible a: Contratos de derivados financieros 11.054.997 Tenedores patrimoniales del Banco 962.588 Otros rubros del pasivo 11.392.256 Interés no controlador 14.339 Total patrimonio 4.790.049 Total Pasivos y Patrimonio 68.013.755 Patrimonio atribuible a: Tenedores patrimoniales del Banco 4.672.287 Interés no controlador 117.762 BANCO SANTANDER-CHILE Y AFILIADAS INFORMACIÓN FINANCIERA CONSOLIDADA Al 30 de Noviembre de 2025 A continuación, se presentan los principales saldos de balance y resultados acumulados por el periodo de cierre de mes de Noviembre de 2025 (cifras en millones de pesos). JONATHAN COVARRUBIAS H. ANDRES TRAUTMANN B. Gerente de Contabilidad Gerente General

IMPORTANT NOTICE The unaudited financial information has been prepared in accordance with the Compendium of Accounting Standards for Banks effective from January 1, 2022 issued by the Financial Market Commission (FMC), The accounting principles issued by the FMC are substantially similar to IFRS but there are some exceptions, The FMC is the banking industry regulator according to article 2 of the General Banking Law, which by General Regulation establishes the accounting principles to be used by the banking industry, For those principles not covered by the Compendium of Accounting Standards for Banks, banks can use generally accepted accounting principles issued by the Chilean Accountant’s Association AG which coincide with International Financial Reporting Standards (IFRS) issued by the International Accounting Standards Board (IASB), If discrepancies exist between the accounting principles issued by the FMC (Compendium of Accounting Standards for Banks) and IFRS the Compendium of Accounting Standards for Banks will take precedence, ¿Qué podemos hacer por ti hoy?