1 © 2025 Sallie Mae Bank. All rights reserved. 2025 Stephens Annual Investment Conference Presentation November 17th, 2025

2© 2025 Sallie Mae Bank. All rights reserved. This Presentation of SLM Corporation (the “Company”) includes forward-looking statements within the meaning of the Securities Act of 1933, as amended, the Securities Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995. These forward-looking statements may be identified by words such as “may,” “will,” “expect,” “intend,” “anticipate,” “believe,” “estimate,” “plan,” “project,” “could,” “should,” “would,” “continue,” “seek,” “target,” “guidance,” “outlook,” “if current trends continue,” “optimistic,” “forecast”, “medium term,” “long term,” and other similar words. Such statements include, but are not limited to, statements about the Company’s plans, objectives, expectations, intentions, estimates and strategies for the future, and other statements that are not historical facts. These forward-looking statements are based on the Company’s current objectives, beliefs and expectations, and they are subject to significant risks and uncertainties that may cause actual results and financial position and timing of certain events to differ materially from the information in the forward-looking statements. These risks and uncertainties include, among others, those set forth in Item 1A. “Risk Factors” and elsewhere in the Company’s most recently filed Annual Report on Form 10-K, and other risks and uncertainties listed from time to time in the Company’s other filings with the Securities and Exchange Commission. Additionally, there may be other factors of which the Company is not currently aware that may affect matters discussed in the forward-looking statements and may also cause actual results to differ materially from those discussed. The Company does not assume any obligation to publicly update, revise, or supplement any forward-looking statement to reflect actual results, changes in assumptions or changes in other factors affecting these forward-looking statements that occur after the date such statements were made. Any forward-looking statements speak only as of the date hereof or as of the dates indicated in the statement. In light of these risks, uncertainties, and assumptions, you should not put undue reliance on any forward-looking statements discussed. CAUTIONARY NOTE AND DISCLAIMER REGARDING FORWARD-LOOKING STATEMENTS

3 $132M GAAP Net Income attributable to common stock in Q3 2025. $0.63 Q3 2025 GAAP diluted earnings per common share. 5.18% Net interest margin for Q3 2025; an increase of 18 basis points from Q3 2024. $180M Total non-interest expenses in Q3 2025, as compared to $172M total non-interest expenses in the year-ago quarter. 3rd Quarter 2025 Highlights $2.9B Private Education Loan Originations(1) in Q3 2025 as compared to $2.8B in the year-ago quarter. $0.13 Common stock dividend per share paid in Q3 2025. 24.3% Return on Common Equity (2) for Q3 2025. 12.6% Total risk-based capital ratio; CET1 capital ratio of 11.3%. 5.6M Shares repurchased in Q3 2025 under the 2024 share repurchase program at an avg. price of $29.45 per share; $138 million of capacity left under repurchase program authorization as of September 30, 2025. Balance Sheet & Capital Allocation Income Statement & Earnings Summary © 2025 Sallie Mae Bank. All rights reserved.

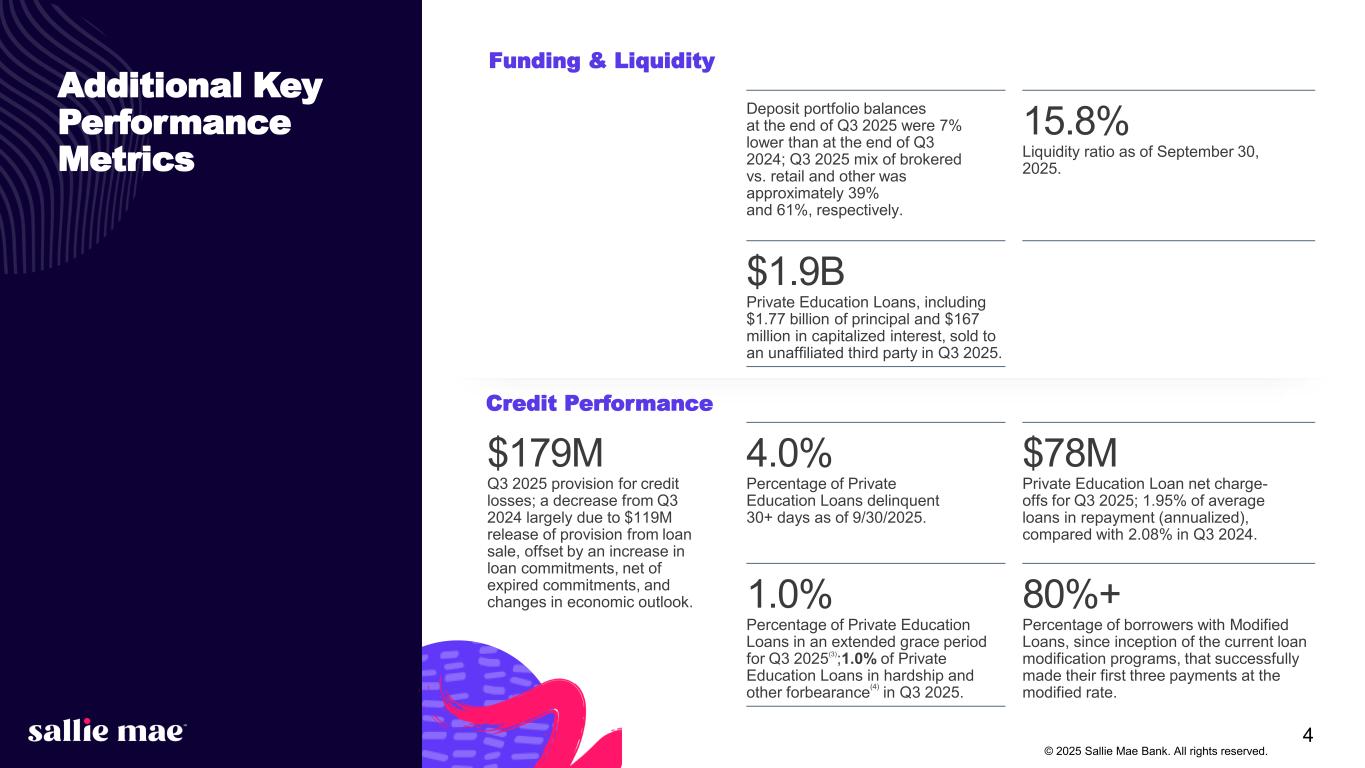

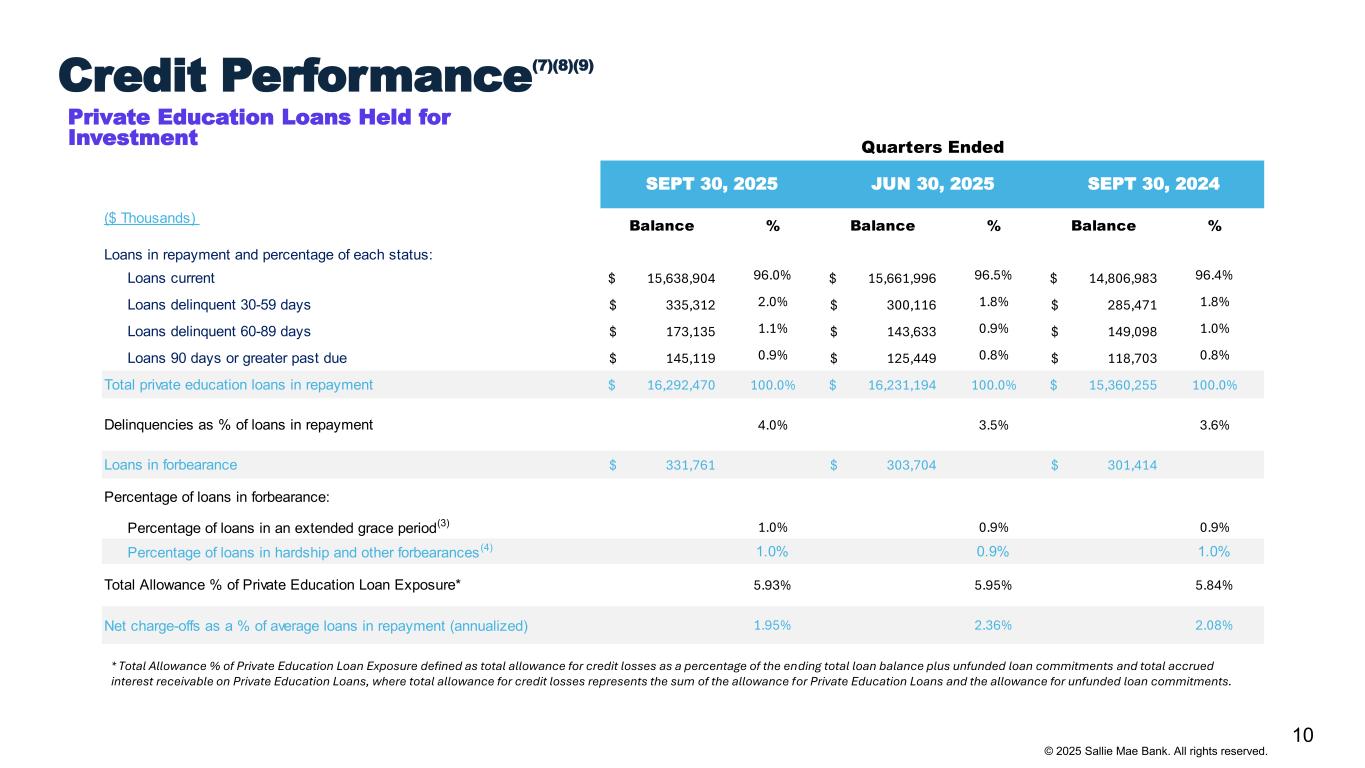

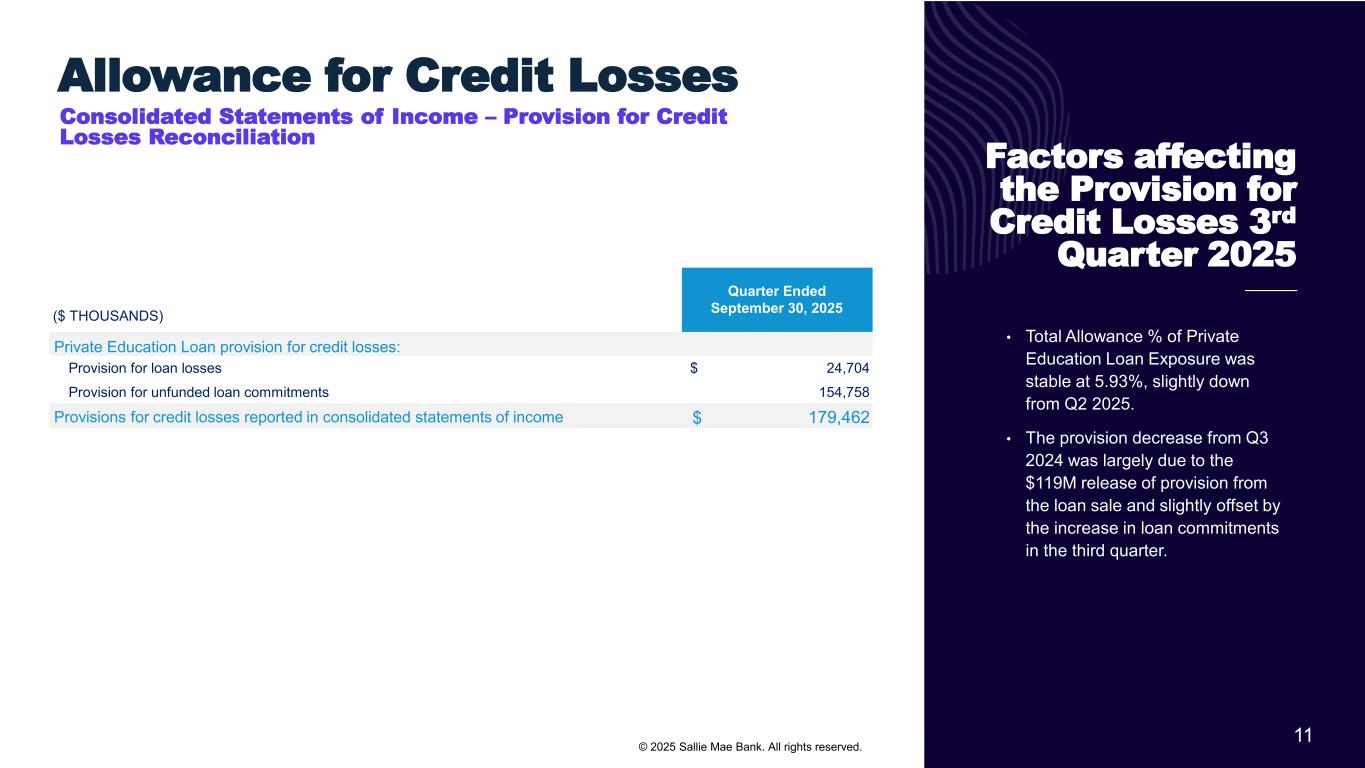

4 $179M Q3 2025 provision for credit losses; a decrease from Q3 2024 largely due to $119M release of provision from loan sale, offset by an increase in loan commitments, net of expired commitments, and changes in economic outlook. 4.0% Percentage of Private Education Loans delinquent 30+ days as of 9/30/2025. $78M Private Education Loan net charge- offs for Q3 2025; 1.95% of average loans in repayment (annualized), compared with 2.08% in Q3 2024. 1.0% Percentage of Private Education Loans in an extended grace period for Q3 2025 (3) ;1.0% of Private Education Loans in hardship and other forbearance (4) in Q3 2025. 80%+ Percentage of borrowers with Modified Loans, since inception of the current loan modification programs, that successfully made their first three payments at the modified rate. Additional Key Performance Metrics Credit Performance Funding & Liquidity Deposit portfolio balances at the end of Q3 2025 were 7% lower than at the end of Q3 2024; Q3 2025 mix of brokered vs. retail and other was approximately 39% and 61%, respectively. 15.8% Liquidity ratio as of September 30, 2025. $1.9B Private Education Loans, including $1.77 billion of principal and $167 million in capitalized interest, sold to an unaffiliated third party in Q3 2025. © 2025 Sallie Mae Bank. All rights reserved.

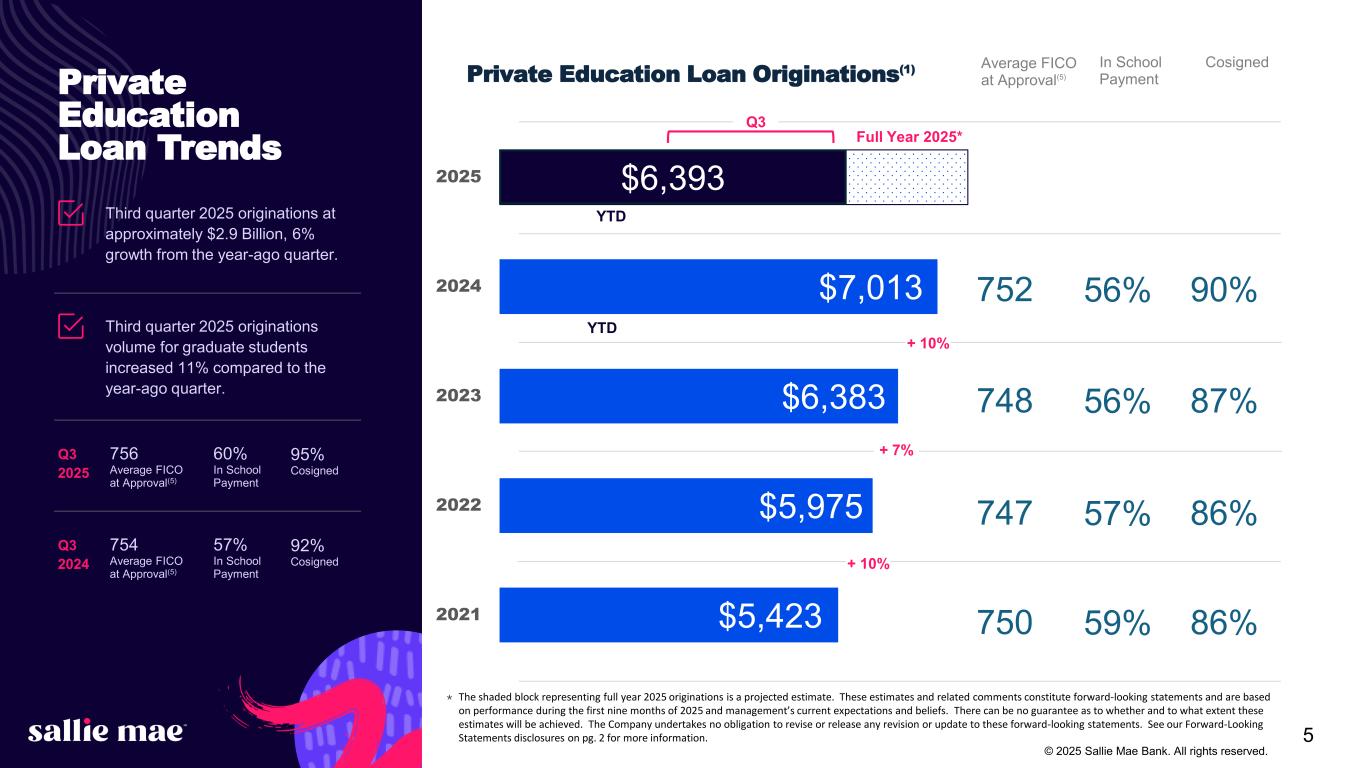

5 © 2025 Sallie Mae Bank. All rights reserved. $5,423 $5,975 $6,383 $7,013 2021 2022 2023 2024 2025 87%748 56% 86%747 57% 86%750 59% Private Education Loan Trends Third quarter 2025 originations at approximately $2.9 Billion, 6% growth from the year-ago quarter. Third quarter 2025 originations volume for graduate students increased 11% compared to the year-ago quarter. Average FICO at Approval(5) In School Payment Cosigned Private Education Loan Originations(1) + 7% + 10% 756 Average FICO at Approval(5) 60% In School Payment 95% Cosigned Q3 2025 754 Average FICO at Approval(5) 57% In School Payment 92% Cosigned Q3 2024 + 10% * $6,393 YTD Full Year 2025* YTD 90%752 56% * The shaded block representing full year 2025 originations is a projected estimate. These estimates and related comments constitute forward-looking statements and are based on performance during the first nine months of 2025 and management’s current expectations and beliefs. There can be no guarantee as to whether and to what extent these estimates will be achieved. The Company undertakes no obligation to revise or release any revision or update to these forward-looking statements. See our Forward-Looking Statements disclosures on pg. 2 for more information. Q3

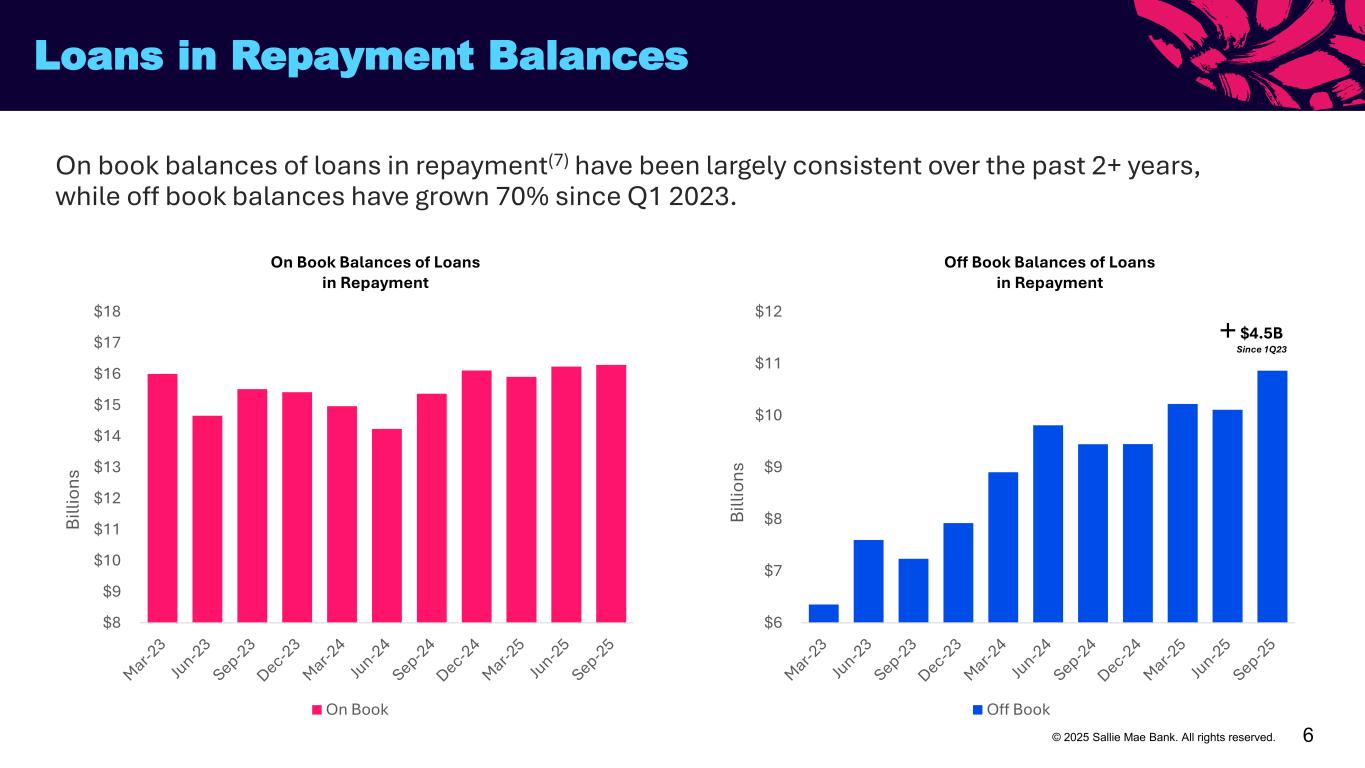

6© 2025 Sallie Mae Bank. All rights reserved. $8 $9 $10 $11 $12 $13 $14 $15 $16 $17 $18 Bi lli on s On Book $6 $7 $8 $9 $10 $11 $12 Bi lli on s Off Book $4.5B Since 1Q23 On Book Balances of Loans in Repayment Off Book Balances of Loans in Repayment On book balances of loans in repayment(7) have been largely consistent over the past 2+ years, while off book balances have grown 70% since Q1 2023. Loans in Repayment Balances

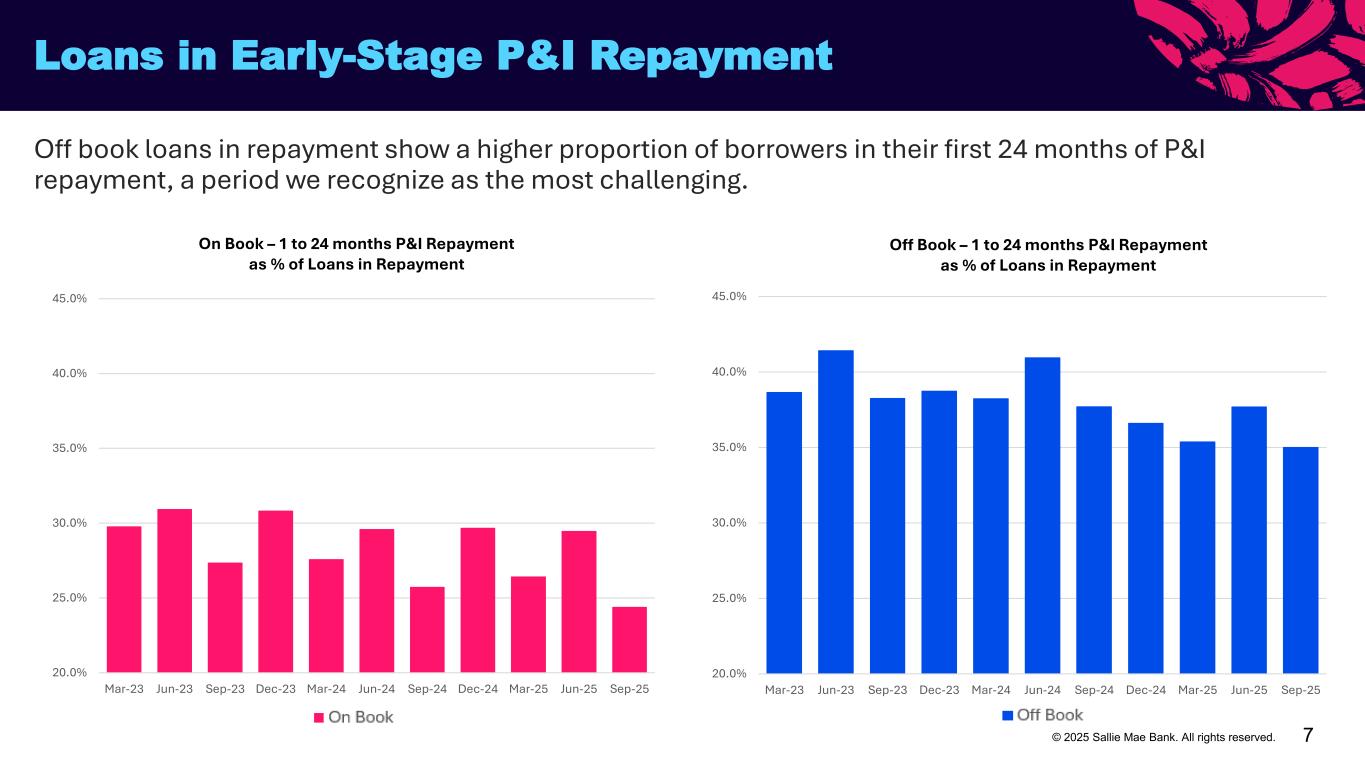

7© 2025 Sallie Mae Bank. All rights reserved. Loans in Early-Stage P&I Repayment Off book loans in repayment show a higher proportion of borrowers in their first 24 months of P&I repayment, a period we recognize as the most challenging. On Book – 1 to 24 months P&I Repayment as % of Loans in Repayment Off Book – 1 to 24 months P&I Repayment as % of Loans in Repayment 20.0% 25.0% 30.0% 35.0% 40.0% 45.0% Mar-23 Jun-23 Sep-23 Dec-23 Mar-24 Jun-24 Sep-24 Dec-24 Mar-25 Jun-25 Sep-25 20.0% 25.0% 30.0% 35.0% 40.0% 45.0% Mar-23 Jun-23 Sep-23 Dec-23 Mar-24 Jun-24 Sep-24 Dec-24 Mar-25 Jun-25 Sep-25

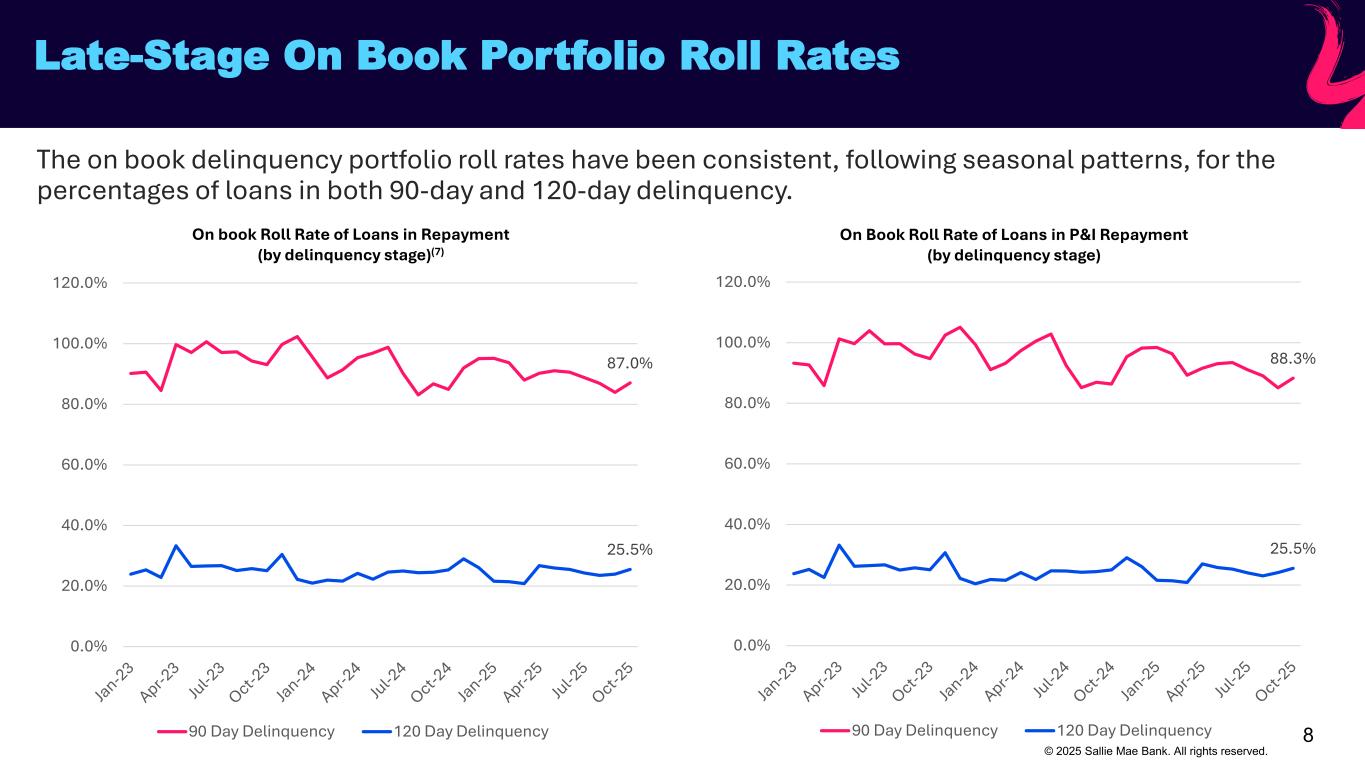

8 87.0% 25.5% 0.0% 20.0% 40.0% 60.0% 80.0% 100.0% 120.0% 90 Day Delinquency 120 Day Delinquency 88.3% 25.5% 0.0% 20.0% 40.0% 60.0% 80.0% 100.0% 120.0% 90 Day Delinquency 120 Day Delinquency On book Roll Rate of Loans in Repayment (by delinquency stage)(7) On Book Roll Rate of Loans in P&I Repayment (by delinquency stage) Late-Stage On Book Portfolio Roll Rates The on book delinquency portfolio roll rates have been consistent, following seasonal patterns, for the percentages of loans in both 90-day and 120-day delinquency. © 2025 Sallie Mae Bank. All rights reserved.

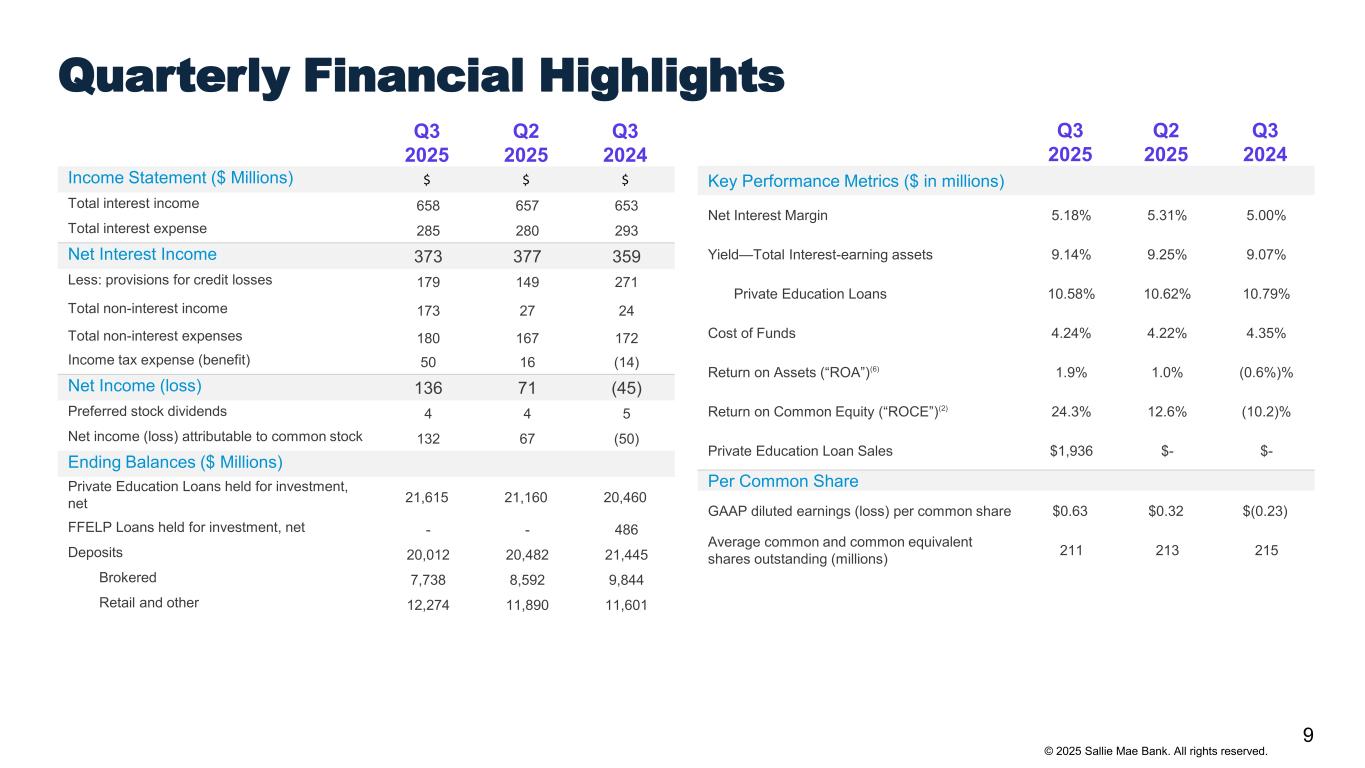

9 © 2025 Sallie Mae Bank. All rights reserved. Q3 2025 Q2 2025 Q3 2024 Income Statement ($ Millions) $ $ $ Total interest income 658 657 653 Total interest expense 285 280 293 Net Interest Income 373 377 359 Less: provisions for credit losses 179 149 271 Total non-interest income 173 27 24 Total non-interest expenses 180 167 172 Income tax expense (benefit) 50 16 (14) Net Income (loss) 136 71 (45) Preferred stock dividends 4 4 5 Net income (loss) attributable to common stock 132 67 (50) Ending Balances ($ Millions) Private Education Loans held for investment, net 21,615 21,160 20,460 FFELP Loans held for investment, net - - 486 Deposits 20,012 20,482 21,445 Brokered 7,738 8,592 9,844 Retail and other 12,274 11,890 11,601 Q3 2025 Q2 2025 Q3 2024 Key Performance Metrics ($ in millions) Net Interest Margin 5.18% 5.31% 5.00% Yield—Total Interest-earning assets 9.14% 9.25% 9.07% Private Education Loans 10.58% 10.62% 10.79% Cost of Funds 4.24% 4.22% 4.35% Return on Assets (“ROA”)(6) 1.9% 1.0% (0.6%)% Return on Common Equity (“ROCE”)(2) 24.3% 12.6% (10.2)% Private Education Loan Sales $1,936 $- $- Per Common Share GAAP diluted earnings (loss) per common share $0.63 $0.32 $(0.23) Average common and common equivalent shares outstanding (millions) 211 213 215 Quarterly Financial Highlights

10 © 2025 Sallie Mae Bank. All rights reserved. Credit Performance(7)(8)(9) Private Education Loans Held for Investment * Total Allowance % of Private Education Loan Exposure defined as total allowance for credit losses as a percentage of the ending total loan balance plus unfunded loan commitments and total accrued interest receivable on Private Education Loans, where total allowance for credit losses represents the sum of the allowance for Private Education Loans and the allowance for unfunded loan commitments. ($ Thousands) Balance % Balance % Balance % Loans in repayment and percentage of each status: Loans current 15,638,904$ 96.0% 15,661,996$ 96.5% 14,806,983$ 96.4% Loans delinquent 30-59 days 335,312$ 2.0% 300,116$ 1.8% 285,471$ 1.8% Loans delinquent 60-89 days 173,135$ 1.1% 143,633$ 0.9% 149,098$ 1.0% Loans 90 days or greater past due 145,119$ 0.9% 125,449$ 0.8% 118,703$ 0.8% Total private education loans in repayment 16,292,470$ 100.0% 16,231,194$ 100.0% 15,360,255$ 100.0% Delinquencies as % of loans in repayment 4.0% 3.5% 3.6% Loans in forbearance 331,761$ 303,704$ 301,414$ Percentage of loans in forbearance: Percentage of loans in an extended grace period(3) 1.0% 0.9% 0.9% Percentage of loans in hardship and other forbearances (4) 1.0% 0.9% 1.0% 5.93% 5.95% 5.84% Net charge-offs as a % of average loans in repayment (annualized) 1.95% 2.36% 2.08% Total Allowance % of Private Education Loan Exposure* SEPT 30, 2024 Quarters Ended SEPT 30, 2025 JUN 30, 2025

11 © 2025 Sallie Mae Bank. All rights reserved. Factors affecting the Provision for Credit Losses 3rd Quarter 2025 Allowance for Credit Losses Consolidated Statements of Income – Provision for Credit Losses Reconciliation • Total Allowance % of Private Education Loan Exposure was stable at 5.93%, slightly down from Q2 2025. • The provision decrease from Q3 2024 was largely due to the $119M release of provision from the loan sale and slightly offset by the increase in loan commitments in the third quarter. Quarter Ended September 30, 2025 ($ THOUSANDS) Private Education Loan provision for credit losses: Provision for loan losses 24,704$ Provision for unfunded loan commitments 154,758 Provisions for credit losses reported in consolidated statements of income 179,462$ © 2025 Sallie Mae Bank. All rights reserved.

12 2025 Guidance* For the full year 2025, the Company expects: $3.35 - $3.45 GAAP Diluted Earnings Per Common Share 5% - 6% Private Education Loan Originations Year-over-Year Growth 2.0% - 2.2% Total Loan Portfolio Net Charge-Offs as a Percentage of Average Loans in Repayment $655 - $675 Million Non-Interest Expenses * The 2025 Guidance and related comments constitute forward-looking statements and are based on management’s current expectations and beliefs. There can be no guarantee as to whether and to what extent this guidance will be achieved. The Company undertakes no obligation to revise or release any revision or update to these forward-looking statements. See our Forward-Looking Statements disclosures on pg. 2 for more information. © 2025 Sallie Mae Bank. All rights reserved.

13 1. Originations represent loans that were funded or acquired during the period presented. 2. We calculate and report our Return on Common Equity (“ROCE”) as the ratio of (a) GAAP net income (loss) attributable to SLM Corporation common stock numerator (annualized) to (b) the net denominator, which consists of GAAP total average equity less total average preferred stock. 3. We calculate the percentage of loans in an extended grace period as the ratio of (a) Private Education Loans in forbearance in an extended grace period numerator to (b) Private Education Loans in repayment and forbearance denominator. An extended grace period aligns with The Office of the Comptroller of the Currency definition of an additional, consecutive, one-time period during which no payment is required for up to six months after the initial grace period. We typically grant this extended grace period to customers who may be having difficulty finding employment before the full principal and interest repayment period starts or once it has begun. 4. We calculate the percentage of loans in hardship and other forbearances as the ratio of (a) Private Education Loans in hardship and other forbearances (excluding loans in an extended grace period and delinquent loans in disaster forbearance) numerator to (b) Private Education Loans in repayment and forbearance denominator. If the customer is in financial hardship, we work with the customer and/or cosigner and identify any available alternative arrangements designed to reduce monthly payment obligations, which may include a short-term hardship forbearance. 5. Represents the higher credit score of the cosigner or the borrower. 6. We calculate and report our Return on Assets (“ROA”) as the ratio of (a) GAAP net income (loss) numerator (annualized) to (b) the GAAP total average assets denominator. 7. For purposes of this slide, loans in repayment include loans making interest only or fixed payments, as well as loans that have entered full principal and interest repayment status after any applicable grace period (but do not include loans in the “loans in forbearance” metric). 8. For purposes of this slide, loans in forbearance include loans for customers who have requested extension of grace period generally during employment transition or who have temporarily ceased making full payments due to hardship or other factors (other than delinquent loans in disaster forbearance), consistent with established loan program servicing policies and procedures. 9. The period of delinquency is based on the number of days scheduled payments are contractually past due. Footnotes © 2025 Sallie Mae Bank. All rights reserved.