1© 2025 Sallie Mae Bank. All rights reserved. Sallie Mae Investor Forum December 8, 2025

2 This Presentation of SLM Corporation (the “Company”) includes forward-looking statements within the meaning of the Securities Act of 1933, as amended, the Securities Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995. These forward-looking statements may be identified by words such as “may,” “will,” “expect,” “intend,” “anticipate,” “believe,” “estimate,” “plan,” “project,” “design,” “could,” “should,” “would,” “continue,” “seek,” “target,” “guidance,” “outlook,” “if current trends continue,” “optimistic,” “forecast”, “medium term,” “long term,” “over time,” and other similar words. Such statements include, but are not limited to, statements about the Company’s plans, objectives, expectations, intentions, estimates and strategies for the future, and other statements that are not historical facts. These forward-looking statements are based on the Company’s current objectives, beliefs and expectations, and they are subject to significant risks and uncertainties that may cause actual results and financial position and timing of certain events to differ materially from the information in the forward-looking statements. These risks and uncertainties include, among others, those set forth in Item 1A. “Risk Factors” and elsewhere in the Company’s most recently filed Annual Report on Form 10-K, and other risks and uncertainties listed from time to time in the Company’s other filings with the Securities and Exchange Commission. Additionally, there may be other factors of which the Company is not currently aware that may affect matters discussed in the forward-looking statements and may also cause actual results to differ materially from those discussed. Nothing in this Presentation is intended to be used as guidance. The frameworks, models, projections, future-oriented estimates and assumptions set forth in this Presentation have been prepared for illustrative purposes only, are forward-looking in nature, and are not intended as a substitute for more detailed modeling. Such information is not and should not be relied upon as statements of Company guidance. The Company's past performance is not indicative of future results, and actual results may differ materially from the projections and estimates modeled herein. The Company does not assume any obligation to update, revise or supplement any forward-looking information to reflect actual results, changes in assumptions or changes in other factors that occur after the date of this Presentation. In light of these risks, uncertainties and assumptions, you should not put undue reliance on the forward-looking information presented herein. © 2025 Sallie Mae Bank. All rights reserved. CAUTIONARY NOTE AND DISCLAIMER REGARDING FORWARD-LOOKING STATEMENTS

3© 2025 Sallie Mae Bank. All rights reserved. Sallie Mae is a Unique Franchise. Exceptional customer acquisition and engagement engine paired with a market-leading brand synonymous with higher education. Proprietary underwriting models, refined over decades of experience in student lending that goes far beyond traditional FICO-based approaches. Funding model that consistently delivers net interest margins in the low-to-mid 5% range and remains resilient across rate environments. Scalable, reliable, and effective servicing engine with a strong fixed-cost foundation that creates powerful operating leverage as volume scales. Sallie Mae provides students and their families with the products and services needed to confidently and successfully navigate their higher education journey.

4© 2025 Sallie Mae Bank. All rights reserved. Should result in… -Organic earnings growth -Generous capital return to shareholders Meaningful originations expansion Loan sales to support predictable and modest balance sheet growth Steadfast focus on expense management Strengthened risk management capabilities Evolved Investment Thesis (post CECL phase-in) Two years ago, we outlined our strategy for returning to balance sheet growth.

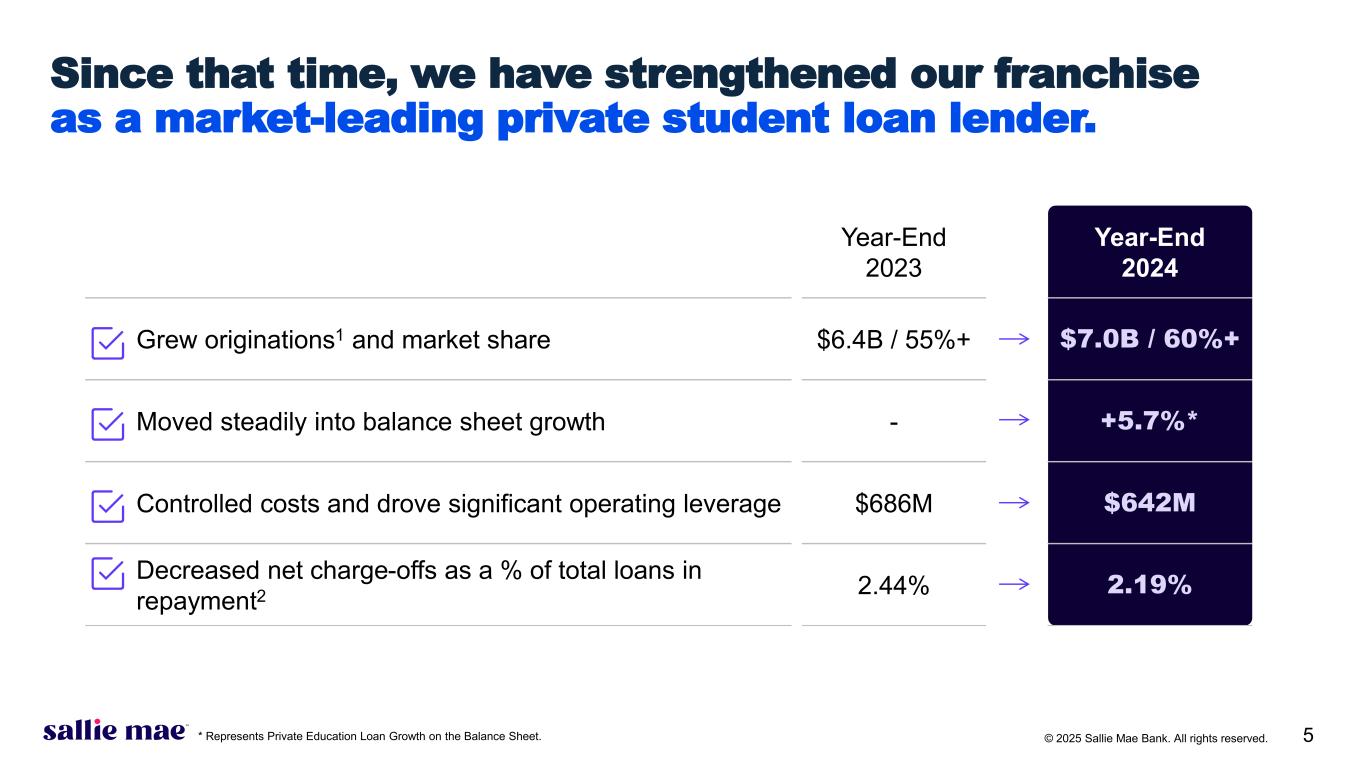

5© 2025 Sallie Mae Bank. All rights reserved. Year-End 2023 Year-End 2024 Grew originations1 and market share $6.4B / 55%+ $7.0B / 60%+ Moved steadily into balance sheet growth - +5.7%* Controlled costs and drove significant operating leverage $686M $642M Decreased net charge-offs as a % of total loans in repayment2 2.44% 2.19% Since that time, we have strengthened our franchise as a market-leading private student loan lender. * Represents Private Education Loan Growth on the Balance Sheet.

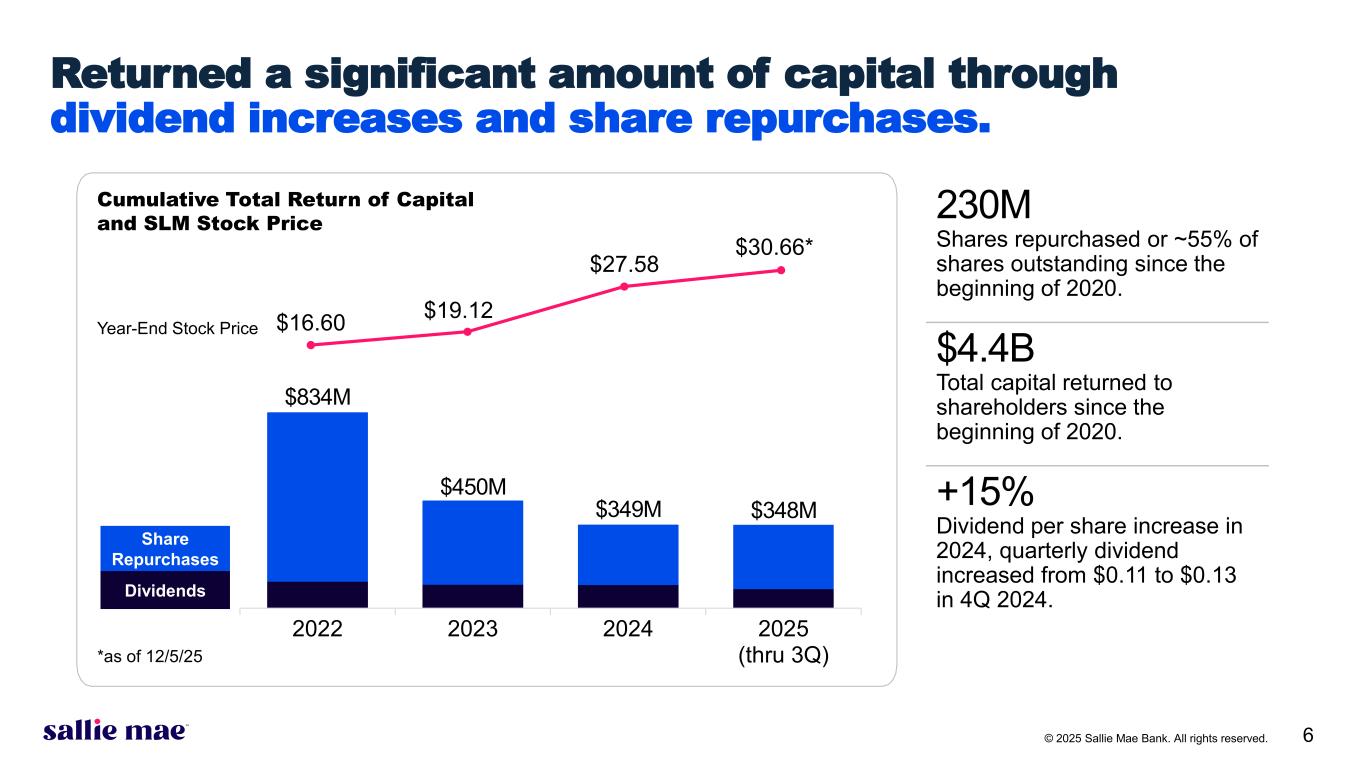

6© 2025 Sallie Mae Bank. All rights reserved. Returned a significant amount of capital through dividend increases and share repurchases. $0 $100 $200 $300 $400 $500 $600 $700 $800 2022 2023 2024 2025 (thru 3Q) $16.60 $19.12 $27.58 $30.66* $834M $450M $349M Cumulative Total Return of Capital and SLM Stock Price Year-End Stock Price 230M Shares repurchased or ~55% of shares outstanding since the beginning of 2020. $4.4B Total capital returned to shareholders since the beginning of 2020. +15% Dividend per share increase in 2024, quarterly dividend increased from $0.11 to $0.13 in 4Q 2024. *as of 12/5/25 Share Repurchases Dividends $348M

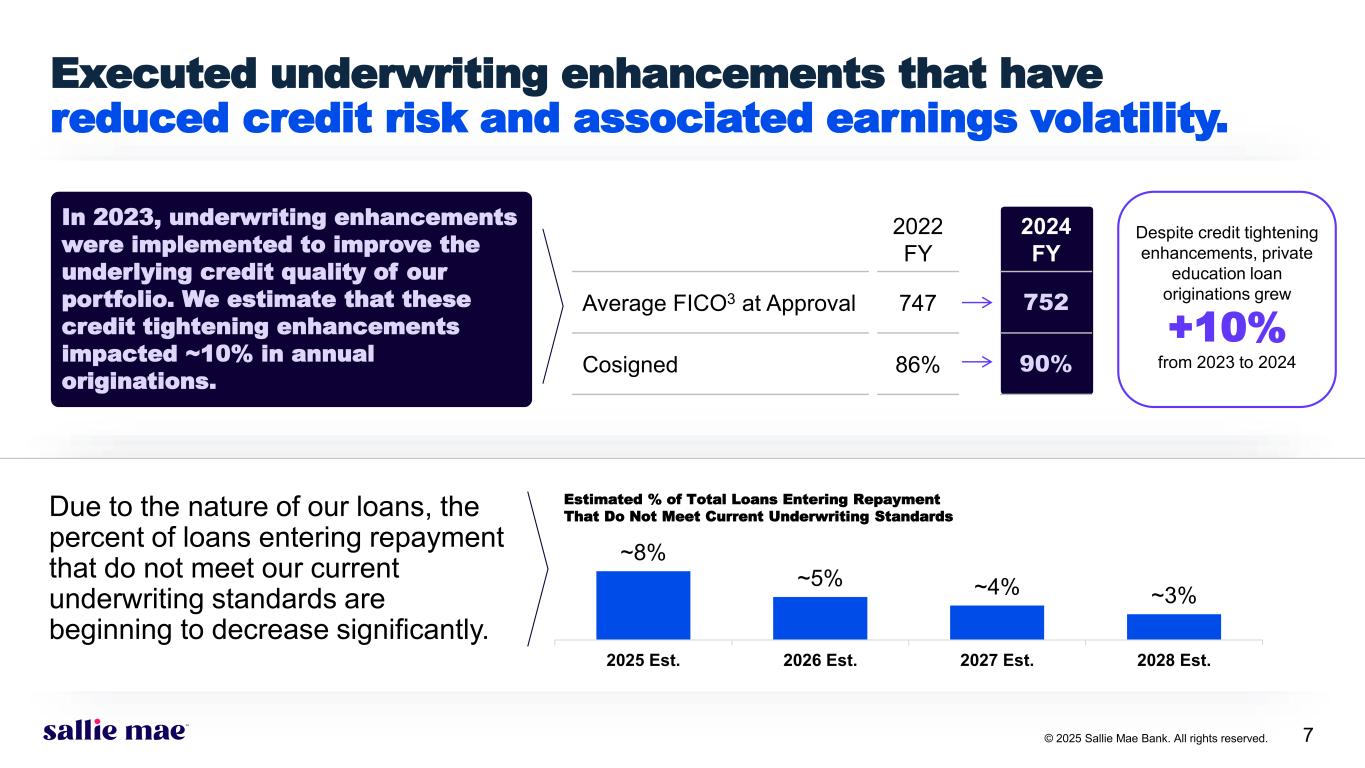

7© 2025 Sallie Mae Bank. All rights reserved. 2022 FY 2024 FY Average FICO3 at Approval 747 752 Cosigned 86% 90% Executed underwriting enhancements that have reduced credit risk and associated earnings volatility. In 2023, underwriting enhancements were implemented to improve the underlying credit quality of our portfolio. We estimate that these credit tightening enhancements impacted ~10% in annual originations. Despite credit tightening enhancements, private education loan originations grew +10% from 2023 to 2024 ~8% ~5% ~4% ~3% 2025 Est. 2026 Est. 2027 Est. 2028 Est. Due to the nature of our loans, the percent of loans entering repayment that do not meet our current underwriting standards are beginning to decrease significantly. Estimated % of Total Loans Entering Repayment That Do Not Meet Current Underwriting Standards

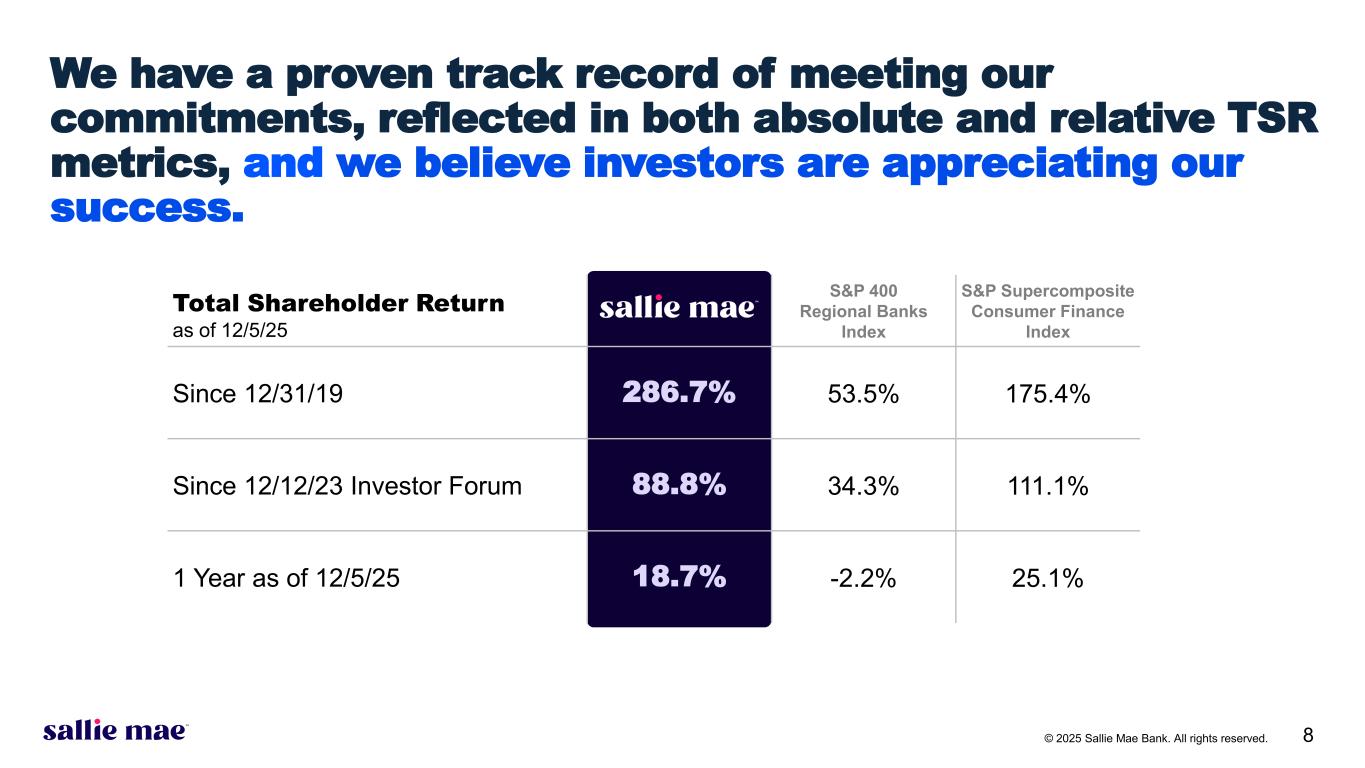

8© 2025 Sallie Mae Bank. All rights reserved. Total Shareholder Return as of 12/5/25 S&P 400 Regional Banks Index S&P Supercomposite Consumer Finance Index Since 12/31/19 286.7% 53.5% 175.4% Since 12/12/23 Investor Forum 88.8% 34.3% 111.1% 1 Year as of 12/5/25 18.7% -2.2% 25.1% We have a proven track record of meeting our commitments, reflected in both absolute and relative TSR metrics, and we believe investors are appreciating our success.

9© 2025 Sallie Mae Bank. All rights reserved. While we are excited about this performance, some meaningful developments are evolving our strategy. #1 PLUS program changes that will significantly increase our volume of originations. Recent Developments #2 Expansion of our customer acquisition & engagement engine that is enhancing our attractive franchise. #3 Rapid growth of the private credit markets in both scale and sophistication present a compelling opportunity.

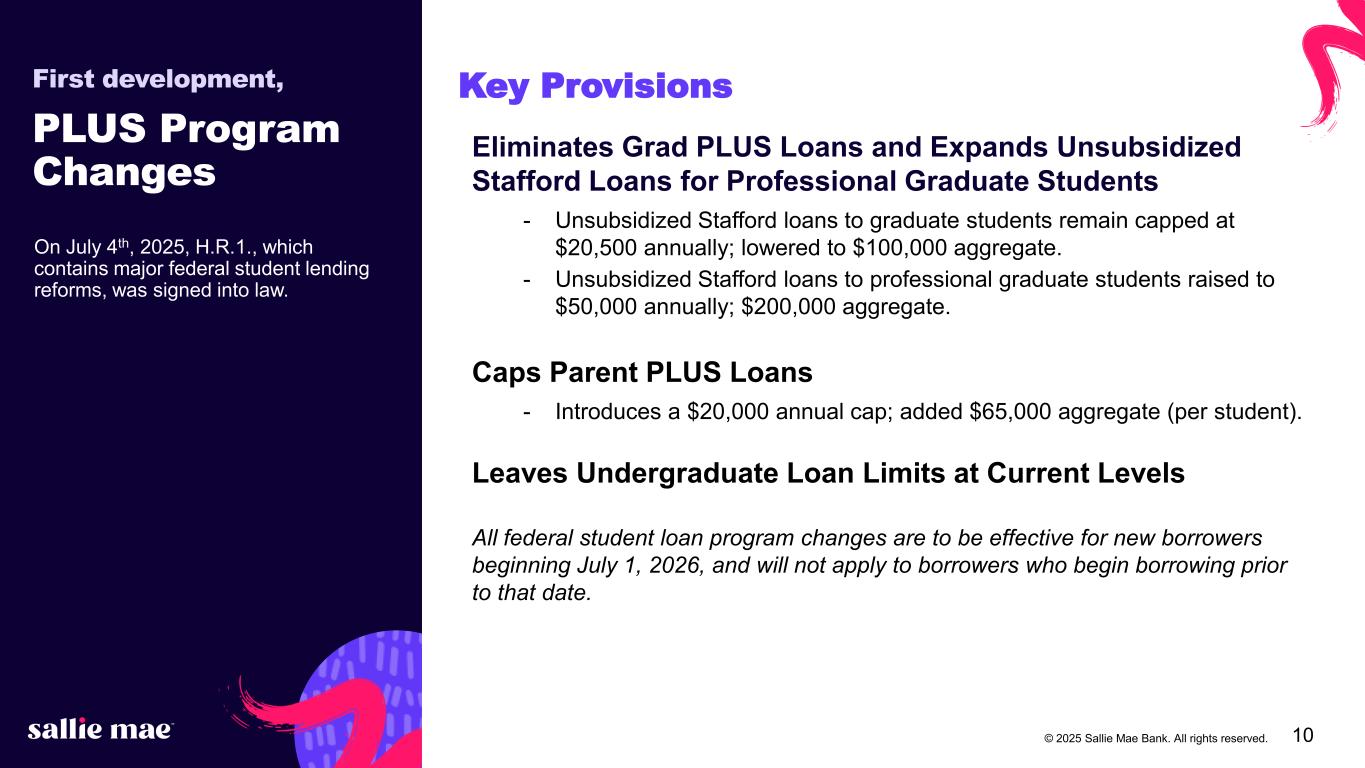

10© 2025 Sallie Mae Bank. All rights reserved. First development, PLUS Program Changes On July 4th, 2025, H.R.1., which contains major federal student lending reforms, was signed into law. Eliminates Grad PLUS Loans and Expands Unsubsidized Stafford Loans for Professional Graduate Students - Unsubsidized Stafford loans to graduate students remain capped at $20,500 annually; lowered to $100,000 aggregate. - Unsubsidized Stafford loans to professional graduate students raised to $50,000 annually; $200,000 aggregate. Caps Parent PLUS Loans - Introduces a $20,000 annual cap; added $65,000 aggregate (per student). Leaves Undergraduate Loan Limits at Current Levels All federal student loan program changes are to be effective for new borrowers beginning July 1, 2026, and will not apply to borrowers who begin borrowing prior to that date. Key Provisions

11© 2025 Sallie Mae Bank. All rights reserved. These changes bring significant opportunity, and we are working to ensure every aspect of our business is prepared. Sharpening Strategies Program specific product constructs, underwriting, and pricing strategies. Marketing strategies to target a new cohort of borrowers. Elevating Experiences Further reduction of friction and time to complete loan application. Increased self-service capabilities. Enabling Scale New private credit strategic partnerships to support funding. Operational staffing and automation investments, including opportunities to leverage AI capabilities.

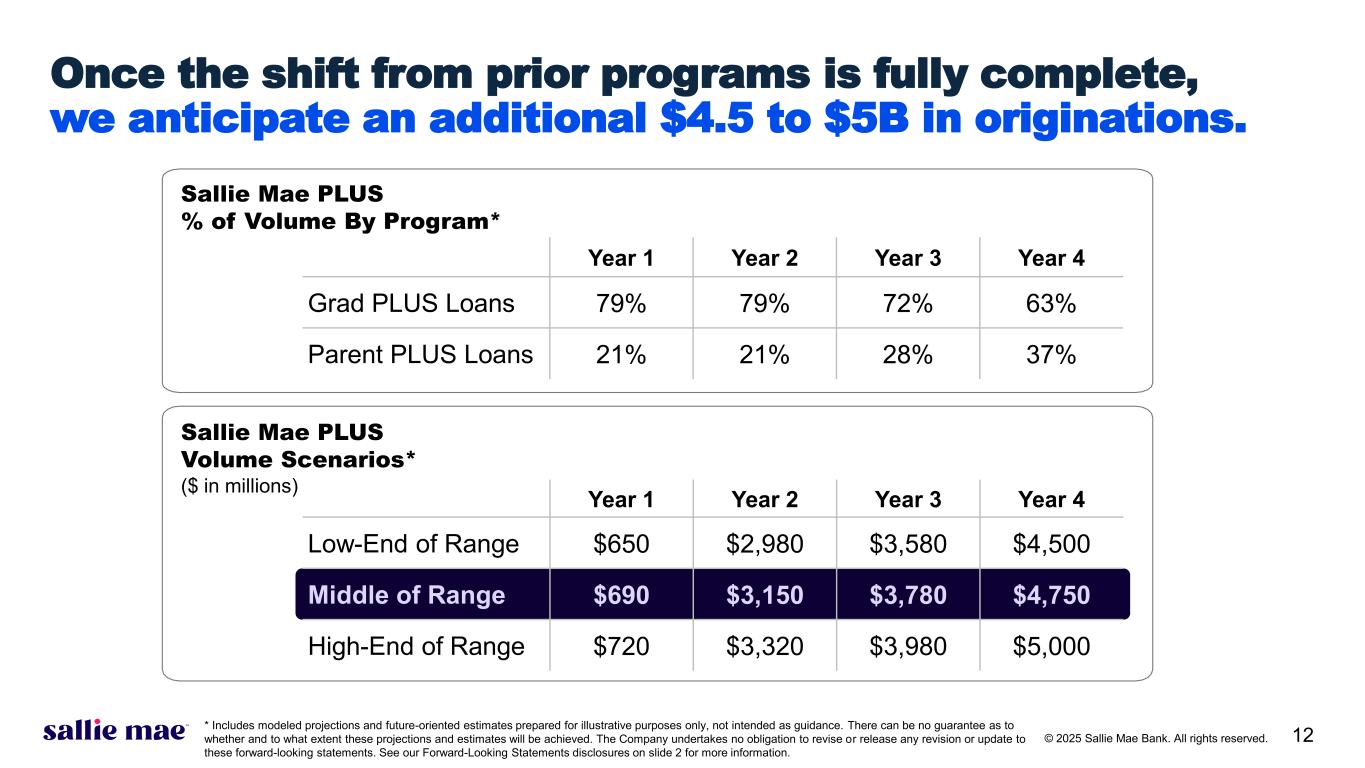

12© 2025 Sallie Mae Bank. All rights reserved. Year 1 Year 2 Year 3 Year 4 Low-End of Range $650 $2,980 $3,580 $4,500 Middle of Range $690 $3,150 $3,780 $4,750 High-End of Range $720 $3,320 $3,980 $5,000 Year 1 Year 2 Year 3 Year 4 Grad PLUS Loans 79% 79% 72% 63% Parent PLUS Loans 21% 21% 28% 37% Once the shift from prior programs is fully complete, we anticipate an additional $4.5 to $5B in originations. Sallie Mae PLUS % of Volume By Program* Sallie Mae PLUS Volume Scenarios* ($ in millions) * Includes modeled projections and future-oriented estimates prepared for illustrative purposes only, not intended as guidance. There can be no guarantee as to whether and to what extent these projections and estimates will be achieved. The Company undertakes no obligation to revise or release any revision or update to these forward-looking statements. See our Forward-Looking Statements disclosures on slide 2 for more information.

13© 2025 Sallie Mae Bank. All rights reserved. Second development, Expansion of Our Customer Acquisition & Engagement Engine By providing the products and services needed to confidently and successfully navigate their higher education journey. We are engaging with millions of students and families each year.

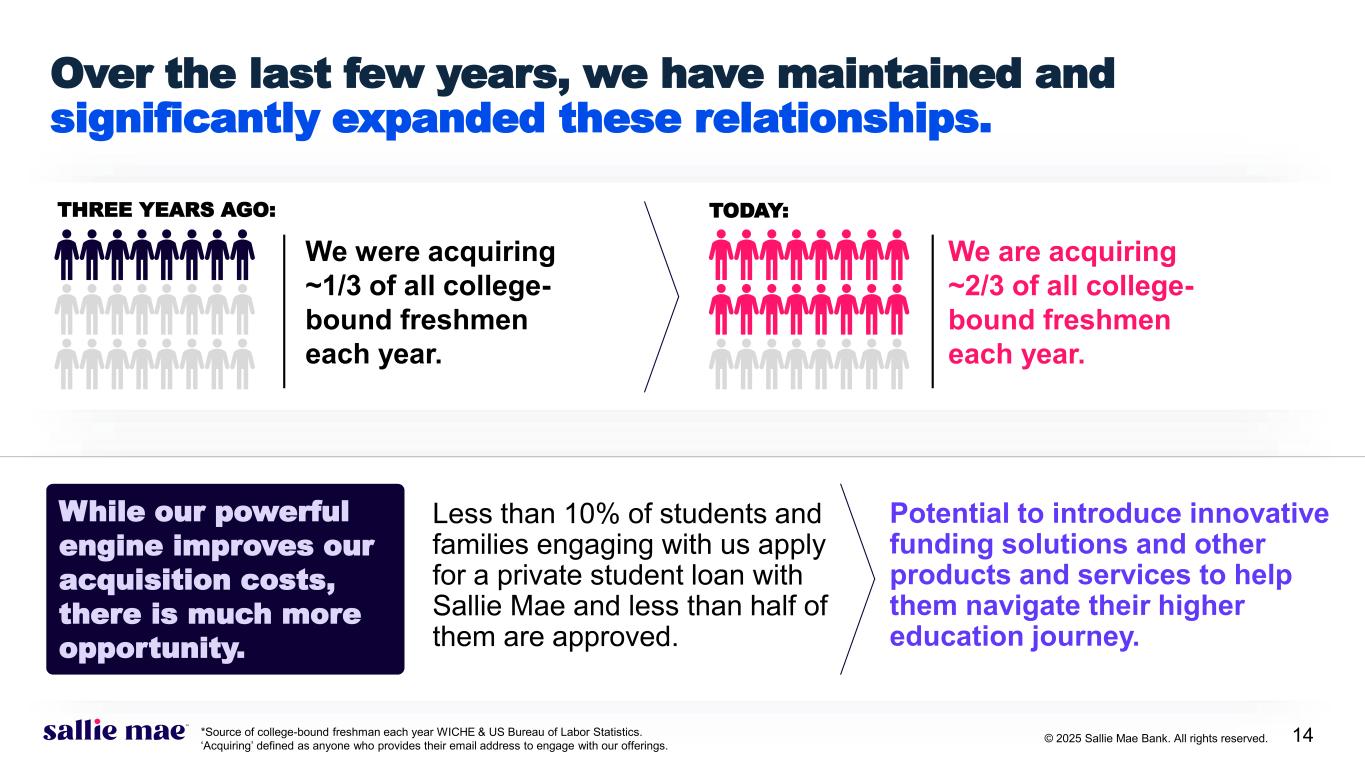

14© 2025 Sallie Mae Bank. All rights reserved. Over the last few years, we have maintained and significantly expanded these relationships. We were acquiring ~1/3 of all college- bound freshmen each year. TODAY: We are acquiring ~2/3 of all college- bound freshmen each year. THREE YEARS AGO: While our powerful engine improves our acquisition costs, there is much more opportunity. Less than 10% of students and families engaging with us apply for a private student loan with Sallie Mae and less than half of them are approved. Potential to introduce innovative funding solutions and other products and services to help them navigate their higher education journey. *Source of college-bound freshman each year WICHE & US Bureau of Labor Statistics. ‘Acquiring’ defined as anyone who provides their email address to engage with our offerings.

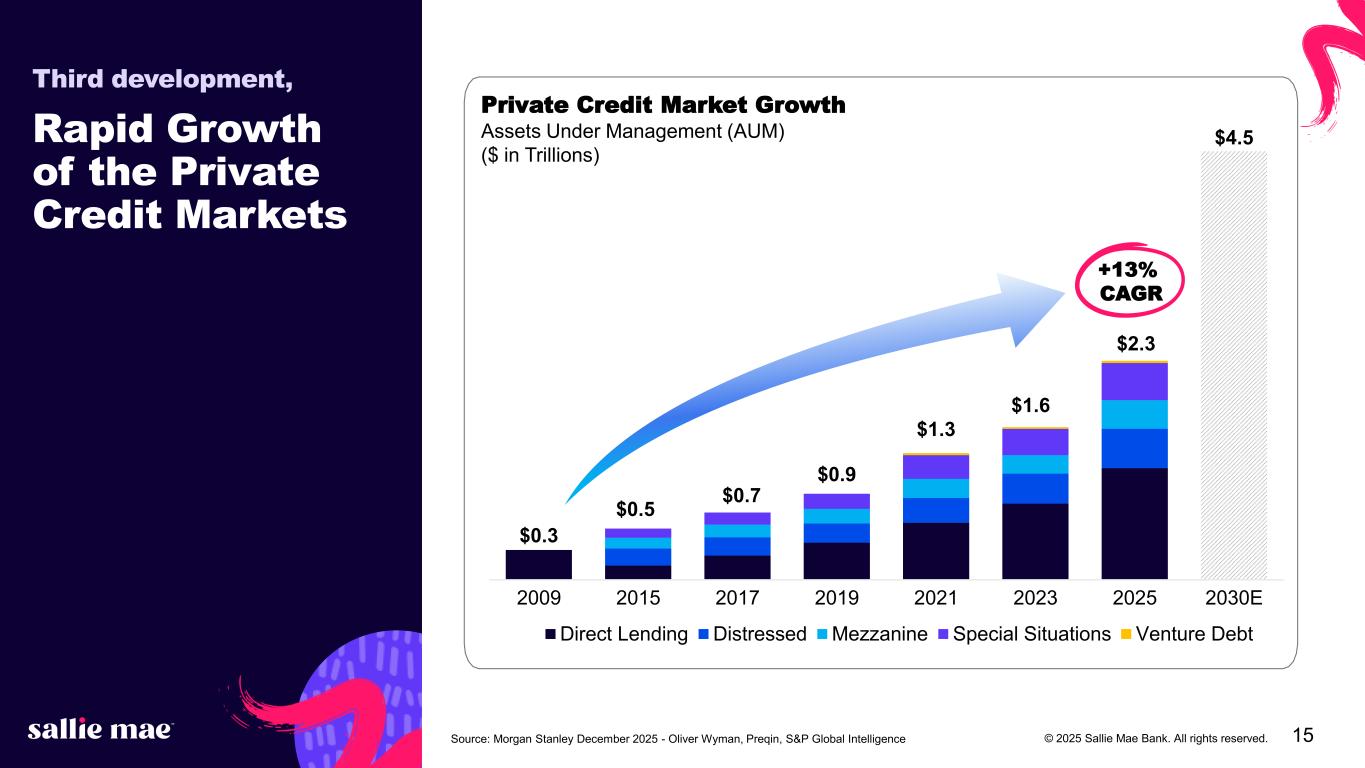

15© 2025 Sallie Mae Bank. All rights reserved. Third development, Rapid Growth of the Private Credit Markets Private Credit Market Growth Assets Under Management (AUM) ($ in Trillions) $0.3 $0.5 $0.7 $0.9 $1.3 $1.6 $2.3 $4.5 2009 2015 2017 2019 2021 2023 2025 2030E Direct Lending Distressed Mezzanine Special Situations Venture Debt +13% CAGR Source: Morgan Stanley December 2025 - Oliver Wyman, Preqin, S&P Global Intelligence

16 16 © 2025 Sallie Mae Bank. All rights reserved. ~$1.5T Total Addressable Market Private Credit THEN NOWMiddle Market Sponsor Lending Agricultural Lending Auto Loans Aviation Finance BNPL Corporate Fleet Finance Corporate Loans CRE Debt Credit Card Equipment Finance and Leasing Franchise Finance Fund Finance Home Improvement Infrastructure Debt Inventory Finance Music Royalties Personal Loans Railcar Leasing Rental Car Finance Residential Mortgages Student Loans Supply Chain Finance ~$50T+ Total Addressable Market The private credit market has evolved to a $50T+ total addressable market. Source: Morgan Stanley June 2025

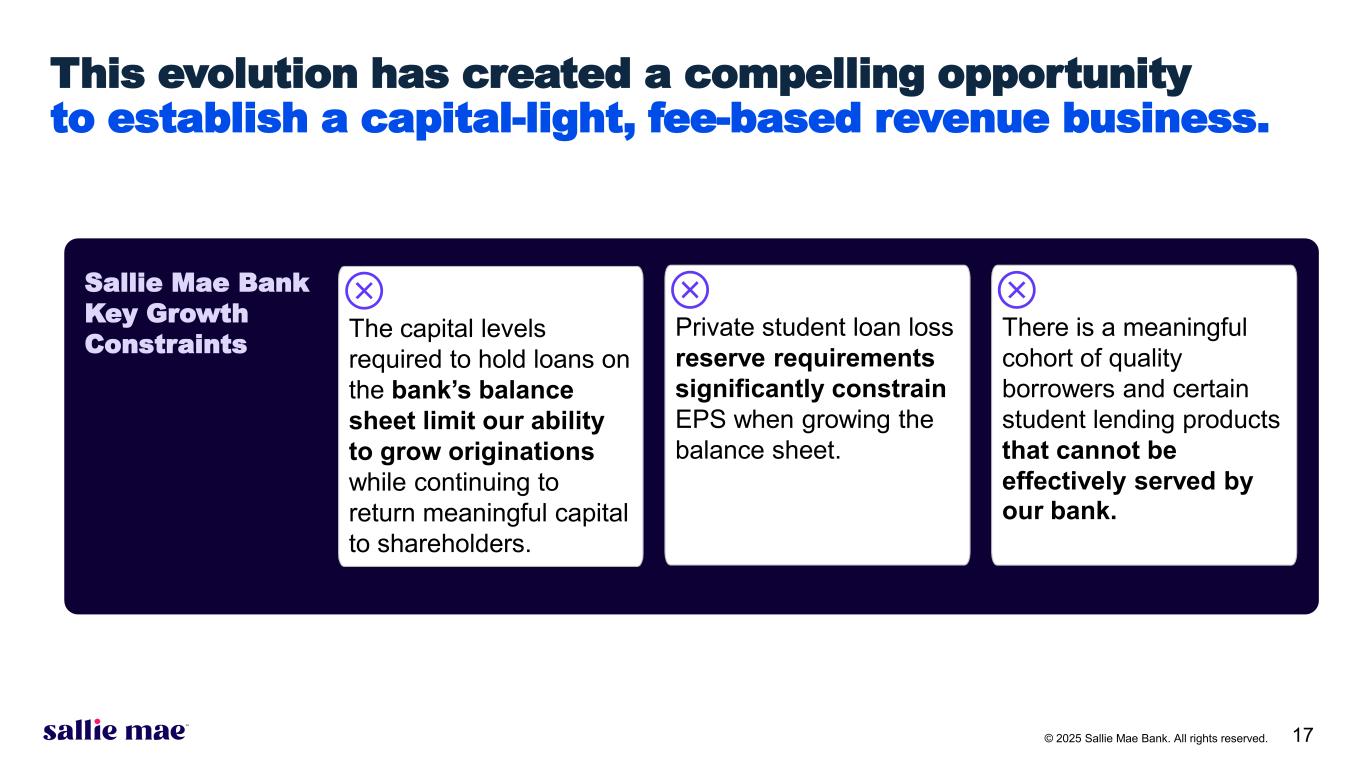

17© 2025 Sallie Mae Bank. All rights reserved. This evolution has created a compelling opportunity to establish a capital-light, fee-based revenue business. The capital levels required to hold loans on the bank’s balance sheet limit our ability to grow originations while continuing to return meaningful capital to shareholders. Sallie Mae Bank Key Growth Constraints Private student loan loss reserve requirements significantly constrain EPS when growing the balance sheet. There is a meaningful cohort of quality borrowers and certain student lending products that cannot be effectively served by our bank.

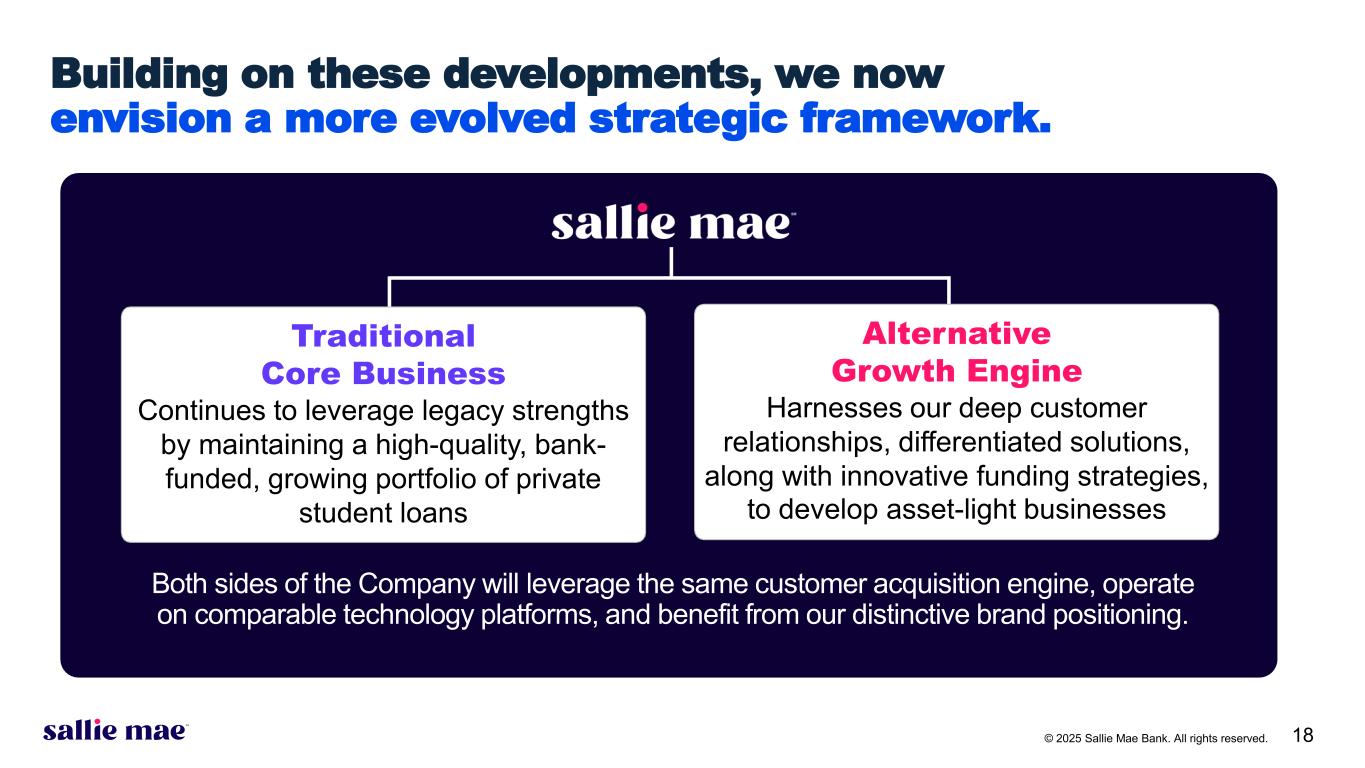

18© 2025 Sallie Mae Bank. All rights reserved. Both sides of the Company will leverage the same customer acquisition engine, operate on comparable technology platforms, and benefit from our distinctive brand positioning. Building on these developments, we now envision a more evolved strategic framework. Traditional Core Business Continues to leverage legacy strengths by maintaining a high-quality, bank- funded, growing portfolio of private student loans Alternative Growth Engine Harnesses our deep customer relationships, differentiated solutions, along with innovative funding strategies, to develop asset-light businesses

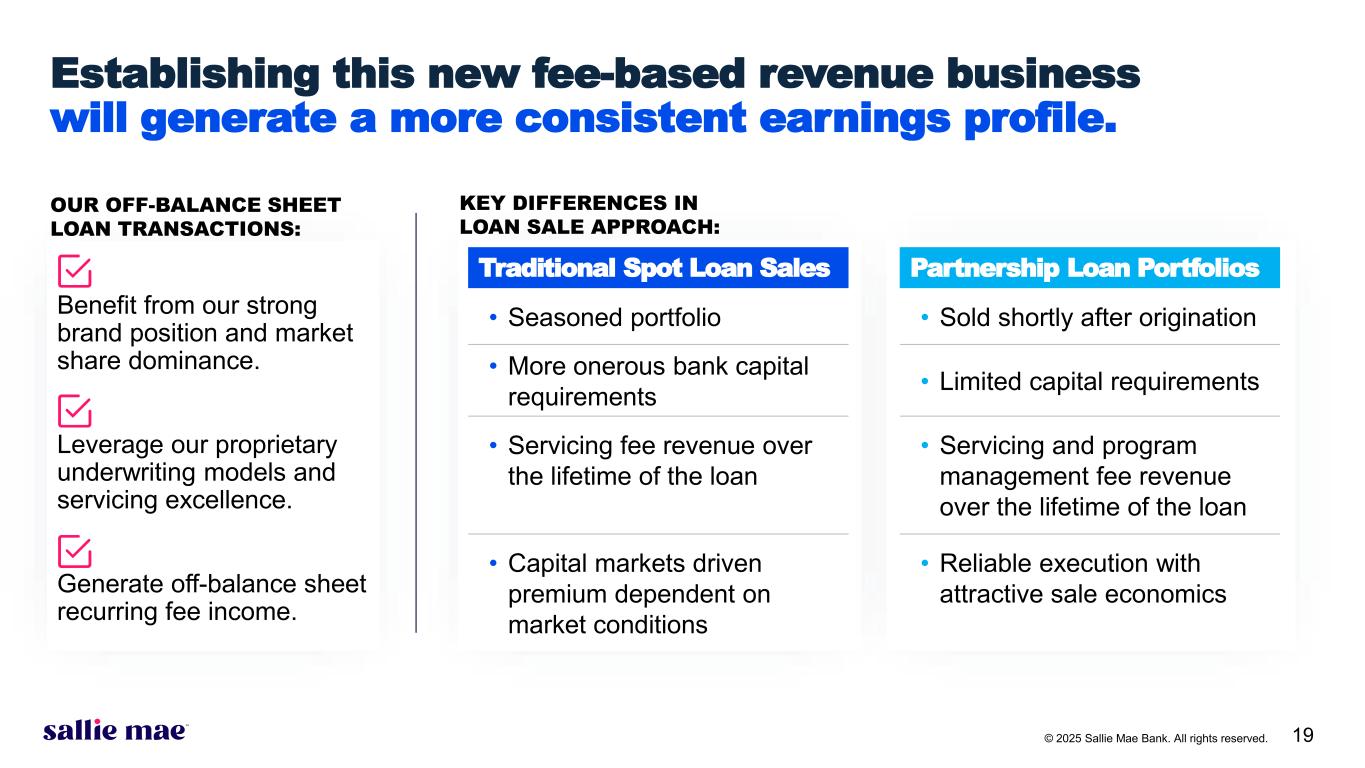

19© 2025 Sallie Mae Bank. All rights reserved. Traditional Spot Loan Sales Partnership Loan Portfolios • Seasoned portfolio • Sold shortly after origination • More onerous bank capital requirements • Limited capital requirements • Servicing fee revenue over the lifetime of the loan • Servicing and program management fee revenue over the lifetime of the loan • Capital markets driven premium dependent on market conditions • Reliable execution with attractive sale economics Establishing this new fee-based revenue business will generate a more consistent earnings profile. Benefit from our strong brand position and market share dominance. Leverage our proprietary underwriting models and servicing excellence. Generate off-balance sheet recurring fee income. OUR OFF-BALANCE SHEET LOAN TRANSACTIONS: KEY DIFFERENCES IN LOAN SALE APPROACH:

20© 2025 Sallie Mae Bank. All rights reserved. Methodology of Data Summaries To illustrate the power of our evolved investment thesis, we have provided brief illustrative vignettes in the pages that follow. While viewing this data, it is important to keep in mind: • This data is not to be understood as guidance and is not a substitute for our annual guidance process, which in turn is not a guarantee of performance. We will provide guidance for 2026 when we report on Q4 and full-year 2025 results. • This data is the output from a simplified financial framework and as such does not reflect or assume any changes in macroeconomic conditions. • We have made simplifying assumptions based largely on the most recent financial performance of the Company, except when there was a compelling reason for not doing so. Assumptions are found on the pages that follow and in the Appendix to this Presentation. • The purpose of these illustrative vignettes is to provide a general sense of how our evolved investment thesis might translate into performance. • We expect investors and analysts to draw their own conclusions about how these key variables might evolve over time. • We expect that these simplified views will provide a useful road map as analysts and investors develop their own, more detailed, and dynamic, assumptions and models. • Unknown events, such as future disruptions in the student lending market and/or the capital markets, could cause the illustrative vignettes presented herein to be unrepresentative of any future performance. • Our past performance and any assumptions based on our past performance are not indicative of future results. • See the Appendix beginning at slide 32 of this presentation for a detailed list of assumptions made for key variables used in our simplified financial framework, as well as the Forward-Looking Statements disclosures on slide 2.

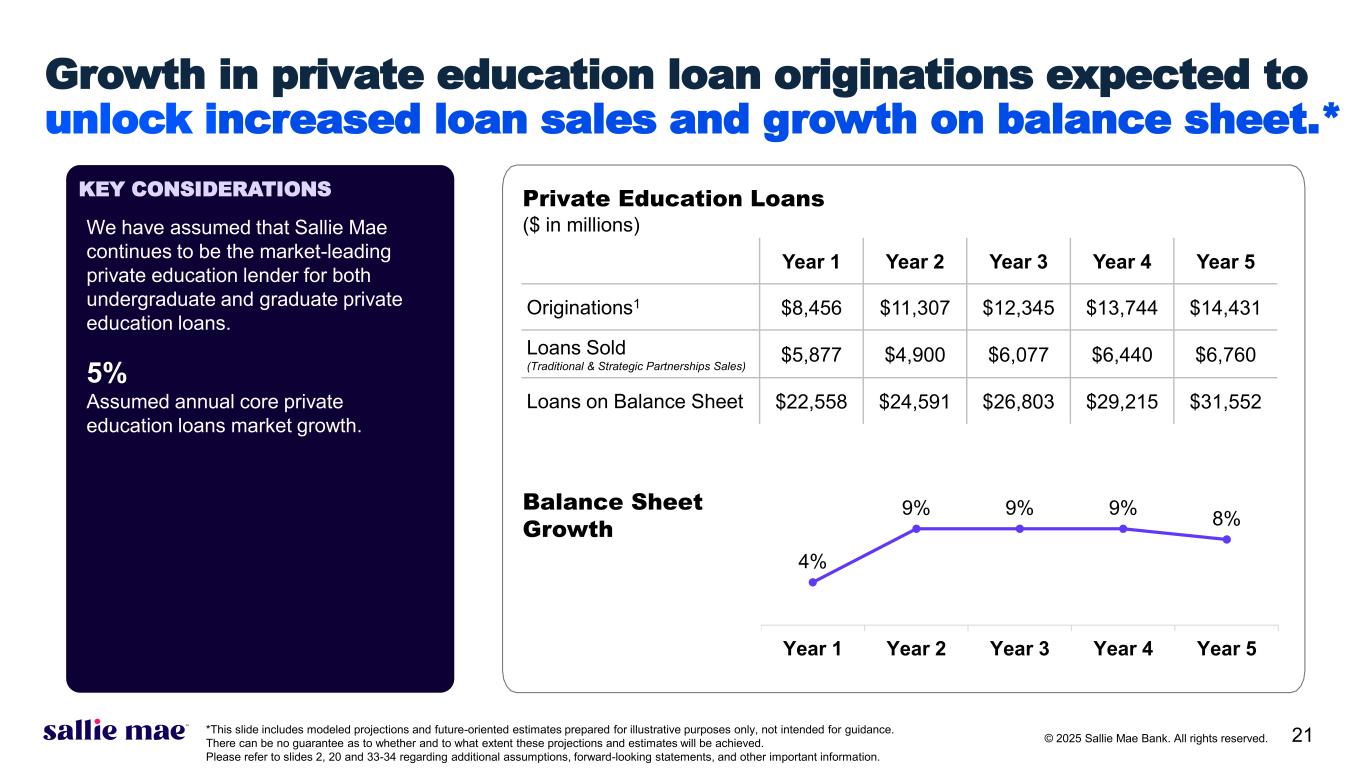

21© 2025 Sallie Mae Bank. All rights reserved. Year 1 Year 2 Year 3 Year 4 Year 5 Originations1 $8,456 $11,307 $12,345 $13,744 $14,431 Loans Sold (Traditional & Strategic Partnerships Sales) $5,877 $4,900 $6,077 $6,440 $6,760 Loans on Balance Sheet $22,558 $24,591 $26,803 $29,215 $31,552 Private Education Loans ($ in millions) 4% 9% 9% 9% 8% Year 1 Year 2 Year 3 Year 4 Year 5 Balance Sheet Growth We have assumed that Sallie Mae continues to be the market-leading private education lender for both undergraduate and graduate private education loans. 5% Assumed annual core private education loans market growth. KEY CONSIDERATIONS Growth in private education loan originations expected to unlock increased loan sales and growth on balance sheet.* *This slide includes modeled projections and future-oriented estimates prepared for illustrative purposes only, not intended for guidance. There can be no guarantee as to whether and to what extent these projections and estimates will be achieved. Please refer to slides 2, 20 and 33-34 regarding additional assumptions, forward-looking statements, and other important information.

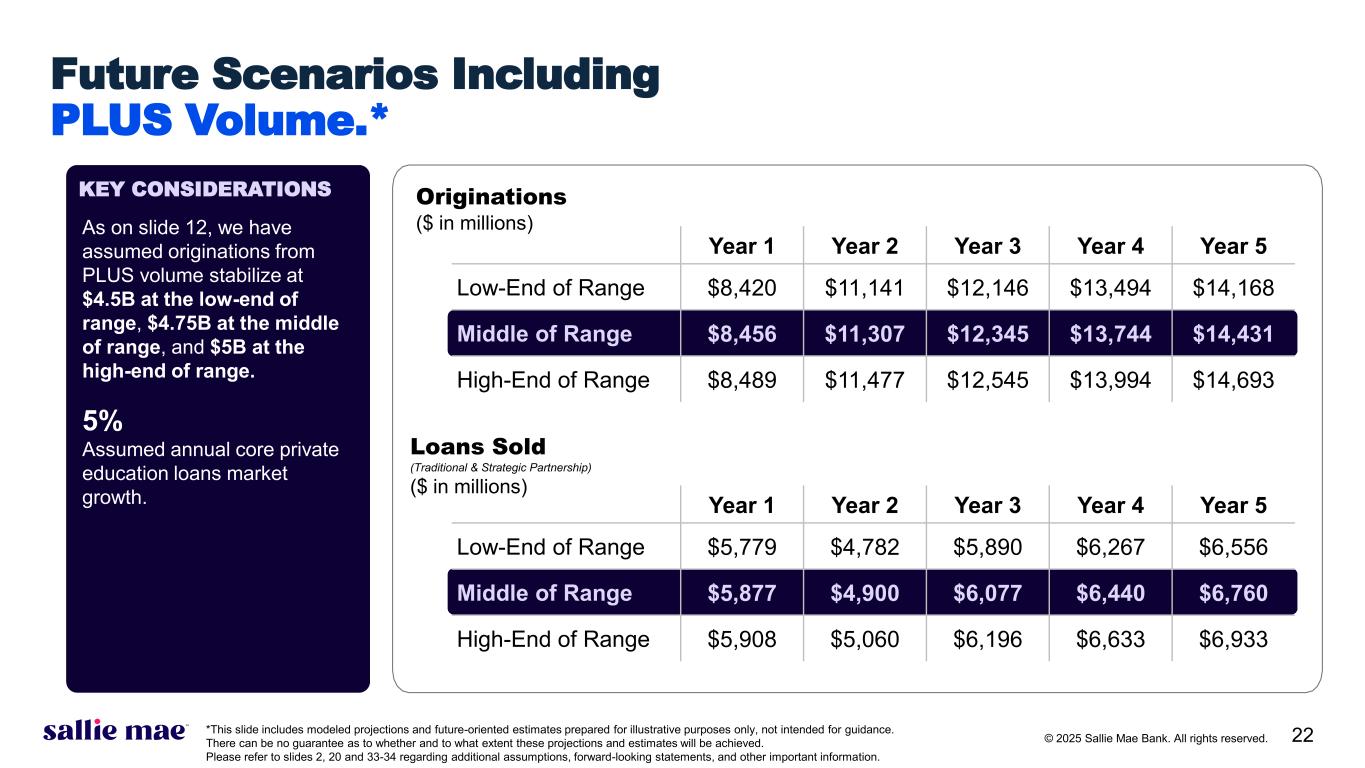

22© 2025 Sallie Mae Bank. All rights reserved. Originations ($ in millions)As on slide 12, we have assumed originations from PLUS volume stabilize at $4.5B at the low-end of range, $4.75B at the middle of range, and $5B at the high-end of range. 5% Assumed annual core private education loans market growth. KEY CONSIDERATIONS Year 1 Year 2 Year 3 Year 4 Year 5 Low-End of Range $8,420 $11,141 $12,146 $13,494 $14,168 Middle of Range $8,456 $11,307 $12,345 $13,744 $14,431 High-End of Range $8,489 $11,477 $12,545 $13,994 $14,693 Loans Sold (Traditional & Strategic Partnership) ($ in millions) Year 1 Year 2 Year 3 Year 4 Year 5 Low-End of Range $5,779 $4,782 $5,890 $6,267 $6,556 Middle of Range $5,877 $4,900 $6,077 $6,440 $6,760 High-End of Range $5,908 $5,060 $6,196 $6,633 $6,933 Future Scenarios Including PLUS Volume.* *This slide includes modeled projections and future-oriented estimates prepared for illustrative purposes only, not intended for guidance. There can be no guarantee as to whether and to what extent these projections and estimates will be achieved. Please refer to slides 2, 20 and 33-34 regarding additional assumptions, forward-looking statements, and other important information.

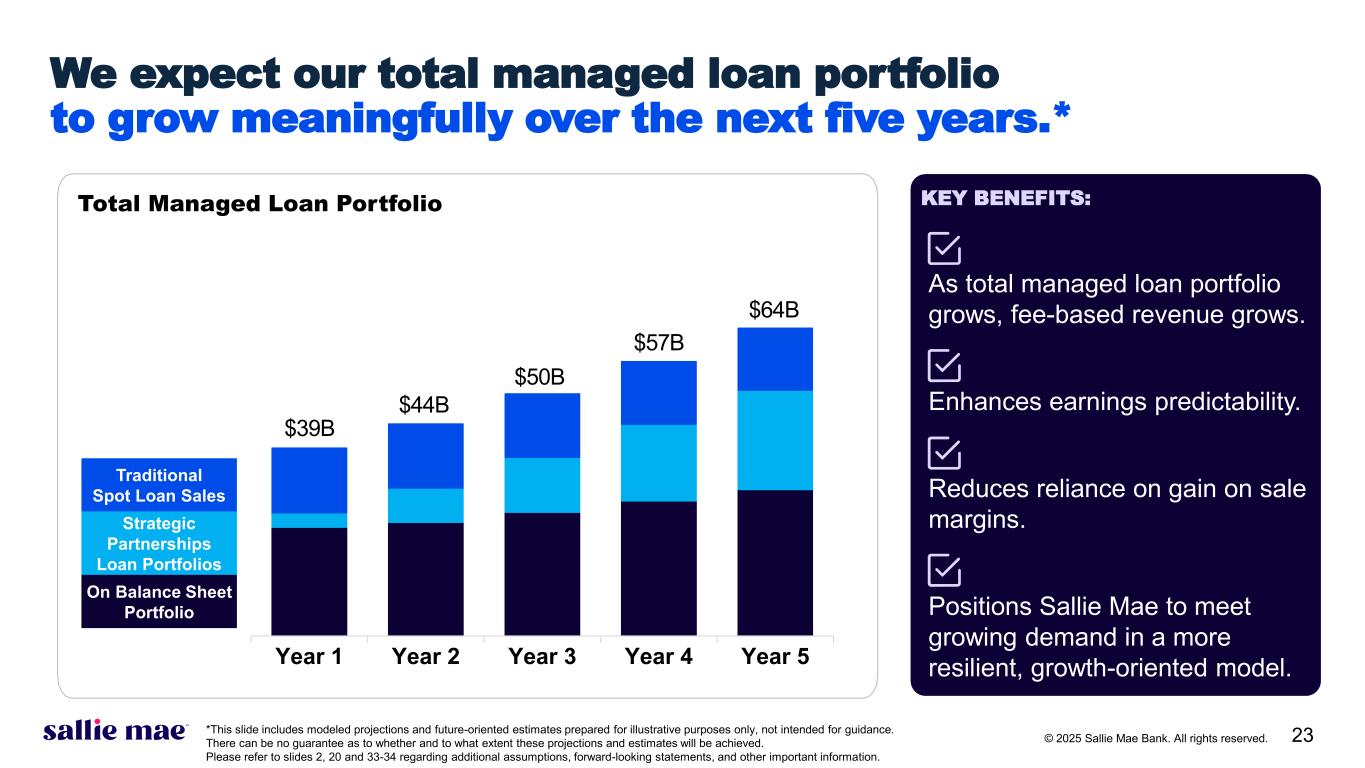

23© 2025 Sallie Mae Bank. All rights reserved. We expect our total managed loan portfolio to grow meaningfully over the next five years.* Year 1 Year 2 Year 3 Year 4 Year 5 Total Managed Loan Portfolio Traditional Spot Loan Sales Strategic Partnerships Loan Portfolios On Balance Sheet Portfolio $39B $44B $50B $57B $64B As total managed loan portfolio grows, fee-based revenue grows. Enhances earnings predictability. Reduces reliance on gain on sale margins. Positions Sallie Mae to meet growing demand in a more resilient, growth-oriented model. KEY BENEFITS: *This slide includes modeled projections and future-oriented estimates prepared for illustrative purposes only, not intended for guidance. There can be no guarantee as to whether and to what extent these projections and estimates will be achieved. Please refer to slides 2, 20 and 33-34 regarding additional assumptions, forward-looking statements, and other important information.

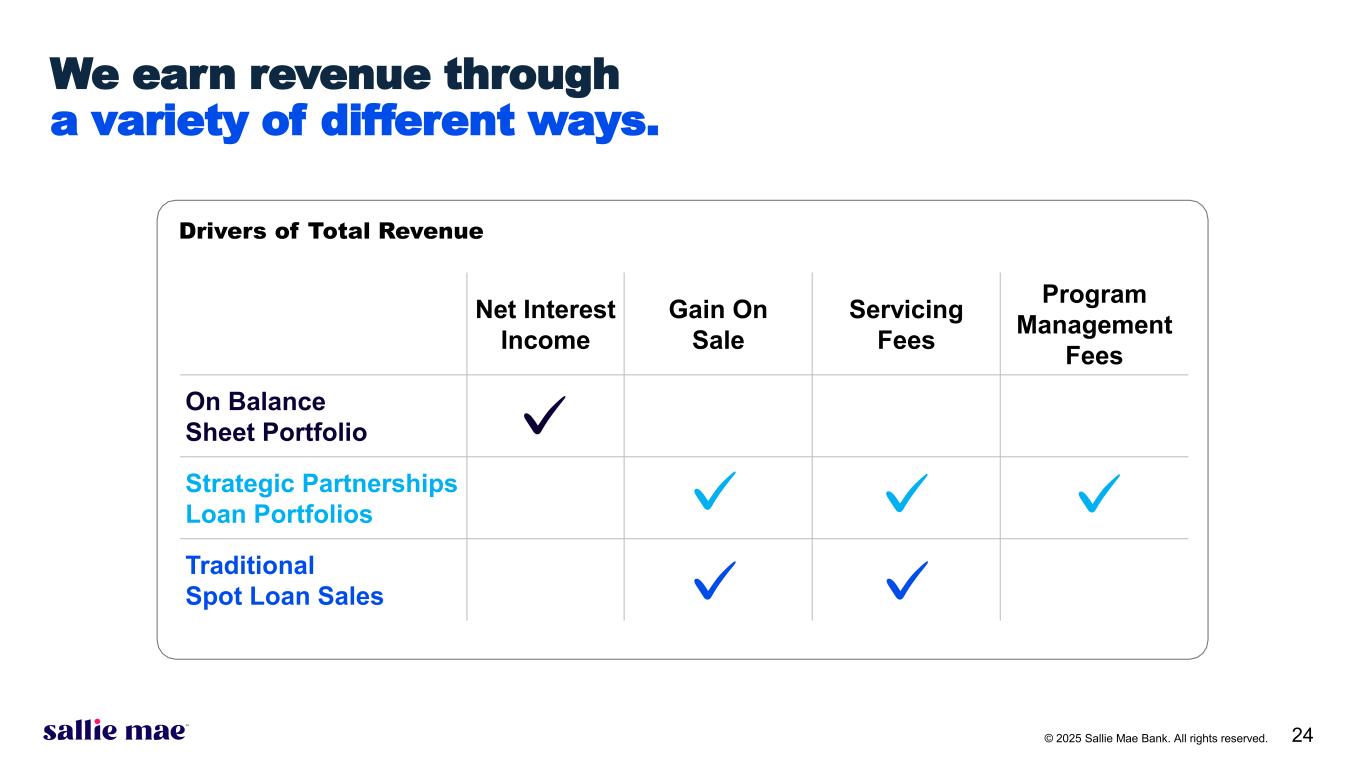

24© 2025 Sallie Mae Bank. All rights reserved. Net Interest Income Gain On Sale Servicing Fees Program Management Fees On Balance Sheet Portfolio Strategic Partnerships Loan Portfolios Traditional Spot Loan Sales We earn revenue through a variety of different ways. Drivers of Total Revenue

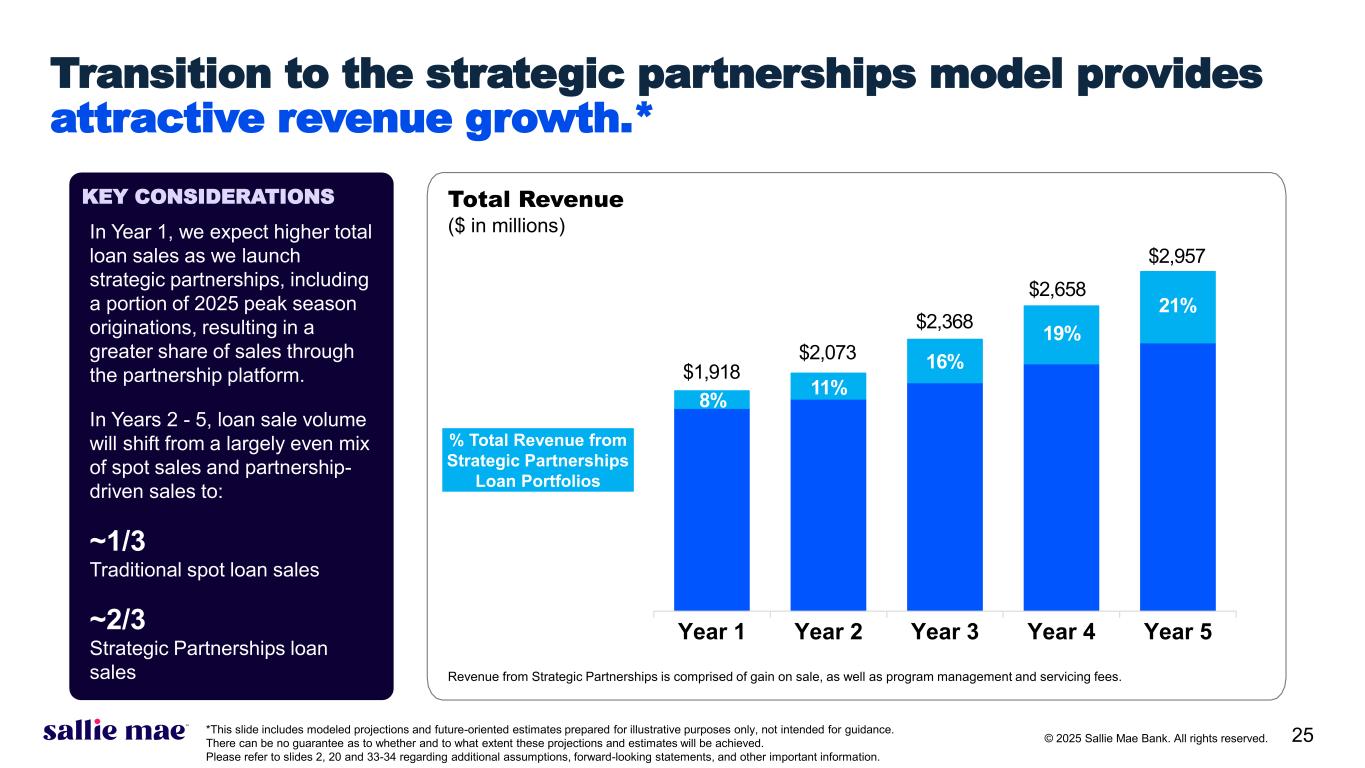

25© 2025 Sallie Mae Bank. All rights reserved. In Year 1, we expect higher total loan sales as we launch strategic partnerships, including a portion of 2025 peak season originations, resulting in a greater share of sales through the partnership platform. In Years 2 - 5, loan sale volume will shift from a largely even mix of spot sales and partnership- driven sales to: ~1/3 Traditional spot loan sales ~2/3 Strategic Partnerships loan sales KEY CONSIDERATIONS Total Revenue ($ in millions) Transition to the strategic partnerships model provides attractive revenue growth.* Year 1 Year 2 Year 3 Year 4 Year 5 $1,918 $2,073 $2,368 $2,658 $2,957 % Total Revenue from Strategic Partnerships Loan Portfolios 8% 11% 16% 19% 21% Revenue from Strategic Partnerships is comprised of gain on sale, as well as program management and servicing fees. *This slide includes modeled projections and future-oriented estimates prepared for illustrative purposes only, not intended for guidance. There can be no guarantee as to whether and to what extent these projections and estimates will be achieved. Please refer to slides 2, 20 and 33-34 regarding additional assumptions, forward-looking statements, and other important information.

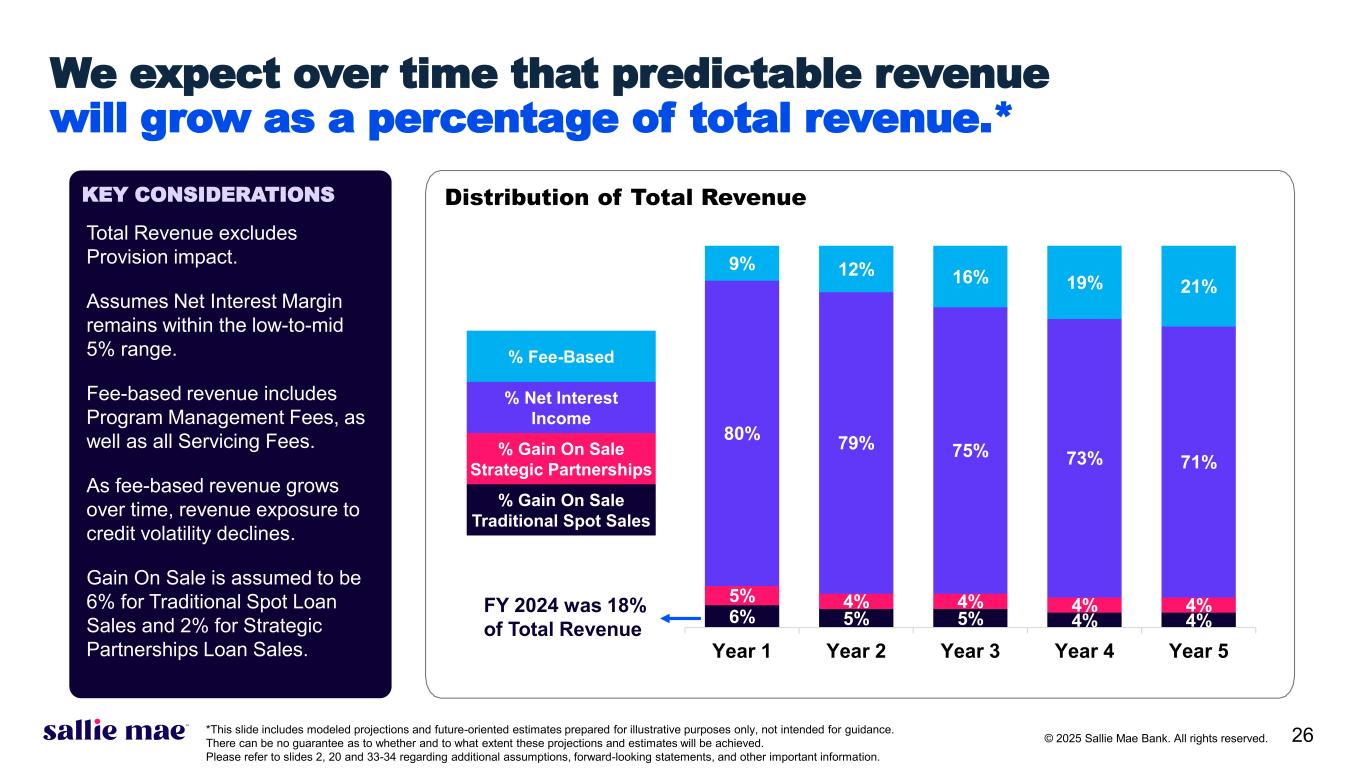

26© 2025 Sallie Mae Bank. All rights reserved. Total Revenue excludes Provision impact. Assumes Net Interest Margin remains within the low-to-mid 5% range. Fee-based revenue includes Program Management Fees, as well as all Servicing Fees. As fee-based revenue grows over time, revenue exposure to credit volatility declines. Gain On Sale is assumed to be 6% for Traditional Spot Loan Sales and 2% for Strategic Partnerships Loan Sales. KEY CONSIDERATIONS Distribution of Total Revenue 6% 5% 5% 4% 4% 5% 4% 4% 4% 4% 80% 79% 75% 73% 71% 9% 12% 16% 19% 21% Year 1 Year 2 Year 3 Year 4 Year 5 % Fee-Based % Net Interest Income % Gain On Sale Strategic Partnerships % Gain On Sale Traditional Spot Sales We expect over time that predictable revenue will grow as a percentage of total revenue.* FY 2024 was 18% of Total Revenue *This slide includes modeled projections and future-oriented estimates prepared for illustrative purposes only, not intended for guidance. There can be no guarantee as to whether and to what extent these projections and estimates will be achieved. Please refer to slides 2, 20 and 33-34 regarding additional assumptions, forward-looking statements, and other important information.

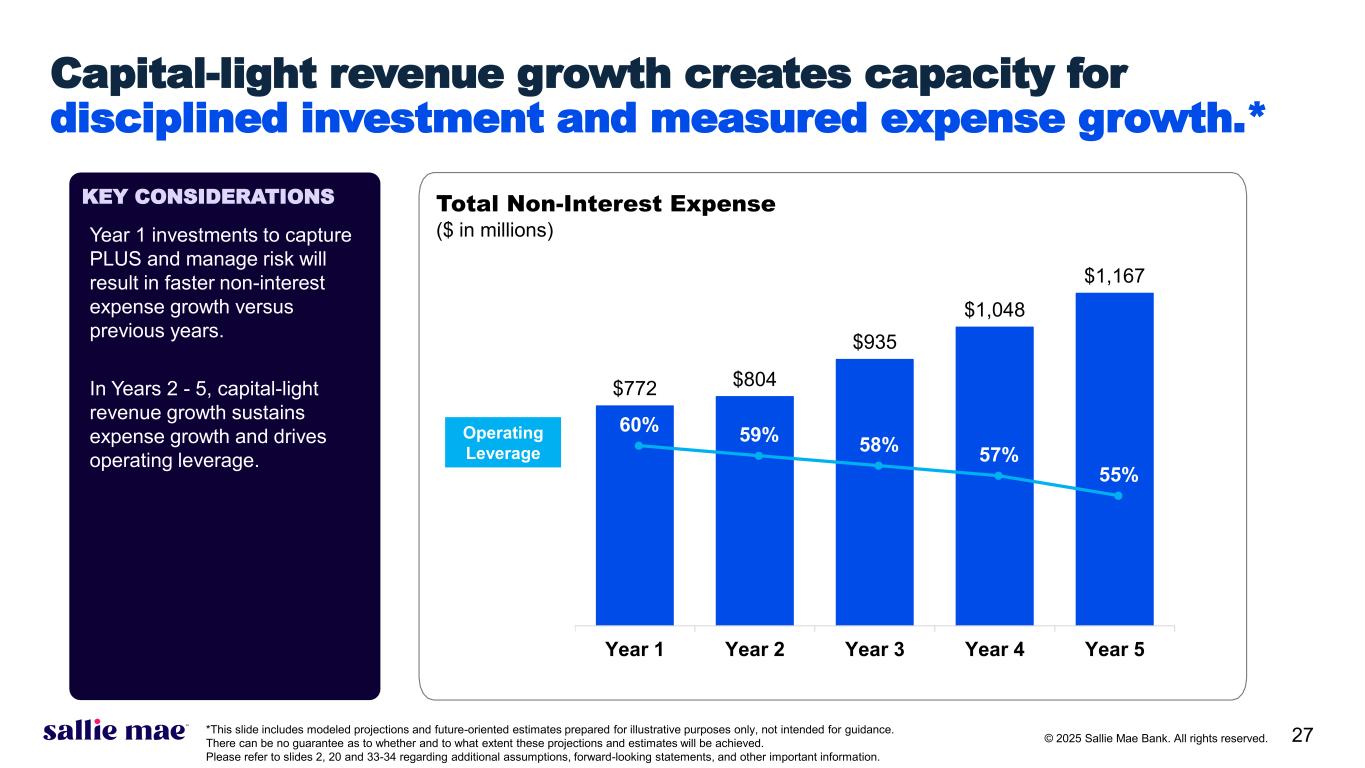

27© 2025 Sallie Mae Bank. All rights reserved. Capital-light revenue growth creates capacity for disciplined investment and measured expense growth.* $772 $804 $935 $1,048 $1,167 Year 1 Year 2 Year 3 Year 4 Year 5 60% 59% 58% 57% 55% Year 1 investments to capture PLUS and manage risk will result in faster non-interest expense growth versus previous years. In Years 2 - 5, capital-light revenue growth sustains expense growth and drives operating leverage. KEY CONSIDERATIONS Total Non-Interest Expense ($ in millions) Operating Leverage *This slide includes modeled projections and future-oriented estimates prepared for illustrative purposes only, not intended for guidance. There can be no guarantee as to whether and to what extent these projections and estimates will be achieved. Please refer to slides 2, 20 and 33-34 regarding additional assumptions, forward-looking statements, and other important information.

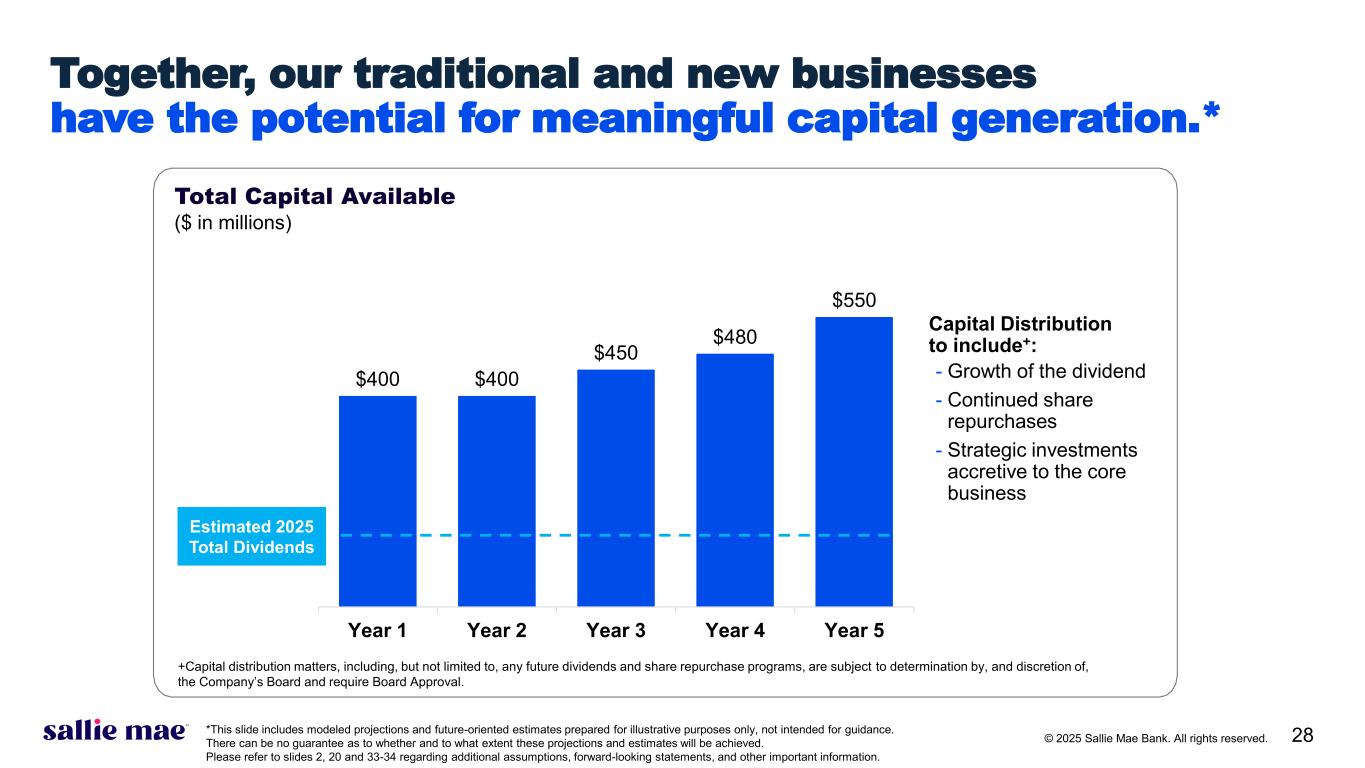

28© 2025 Sallie Mae Bank. All rights reserved. Together, our traditional and new businesses have the potential for meaningful capital generation.* Total Capital Available ($ in millions) $400 $400 $450 $480 $550 Year 1 Year 2 Year 3 Year 4 Year 5 Capital Distribution to include+: - Growth of the dividend - Continued share repurchases - Strategic investments accretive to the core business Estimated 2025 Total Dividends +Capital distribution matters, including, but not limited to, any future dividends and share repurchase programs, are subject to determination by, and discretion of, the Company’s Board and require Board Approval. *This slide includes modeled projections and future-oriented estimates prepared for illustrative purposes only, not intended for guidance. There can be no guarantee as to whether and to what extent these projections and estimates will be achieved. Please refer to slides 2, 20 and 33-34 regarding additional assumptions, forward-looking statements, and other important information.

29© 2025 Sallie Mae Bank. All rights reserved. Drive consistent earnings growth Reduce credit risk and earnings volatility Maintain robust capital return Transition to an asset-light growth model Should result in… - Sustainable EPS growth - Competitive capital returns - Greater resilience to market and credit cycles Evolved Investment Thesis The goal of our evolved strategy is to drive sustainable growth and greater resiliency.

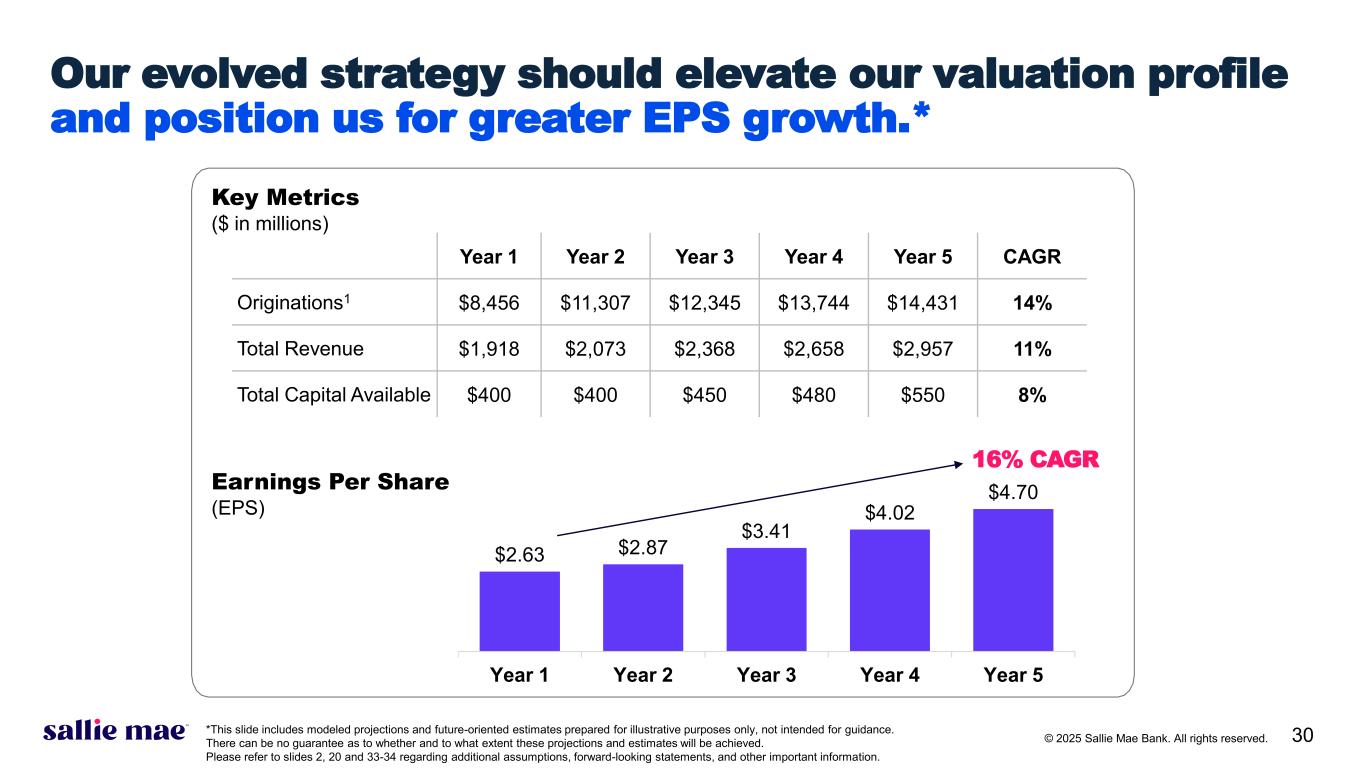

30© 2025 Sallie Mae Bank. All rights reserved. Year 1 Year 2 Year 3 Year 4 Year 5 CAGR Originations1 $8,456 $11,307 $12,345 $13,744 $14,431 14% Total Revenue $1,918 $2,073 $2,368 $2,658 $2,957 11% Total Capital Available $400 $400 $450 $480 $550 8% Key Metrics ($ in millions) $2.63 $2.87 $3.41 $4.02 $4.70 Year 1 Year 2 Year 3 Year 4 Year 5 16% CAGR Our evolved strategy should elevate our valuation profile and position us for greater EPS growth.* *This slide includes modeled projections and future-oriented estimates prepared for illustrative purposes only, not intended for guidance. There can be no guarantee as to whether and to what extent these projections and estimates will be achieved. Please refer to slides 2, 20 and 33-34 regarding additional assumptions, forward-looking statements, and other important information. Earnings Per Share (EPS)

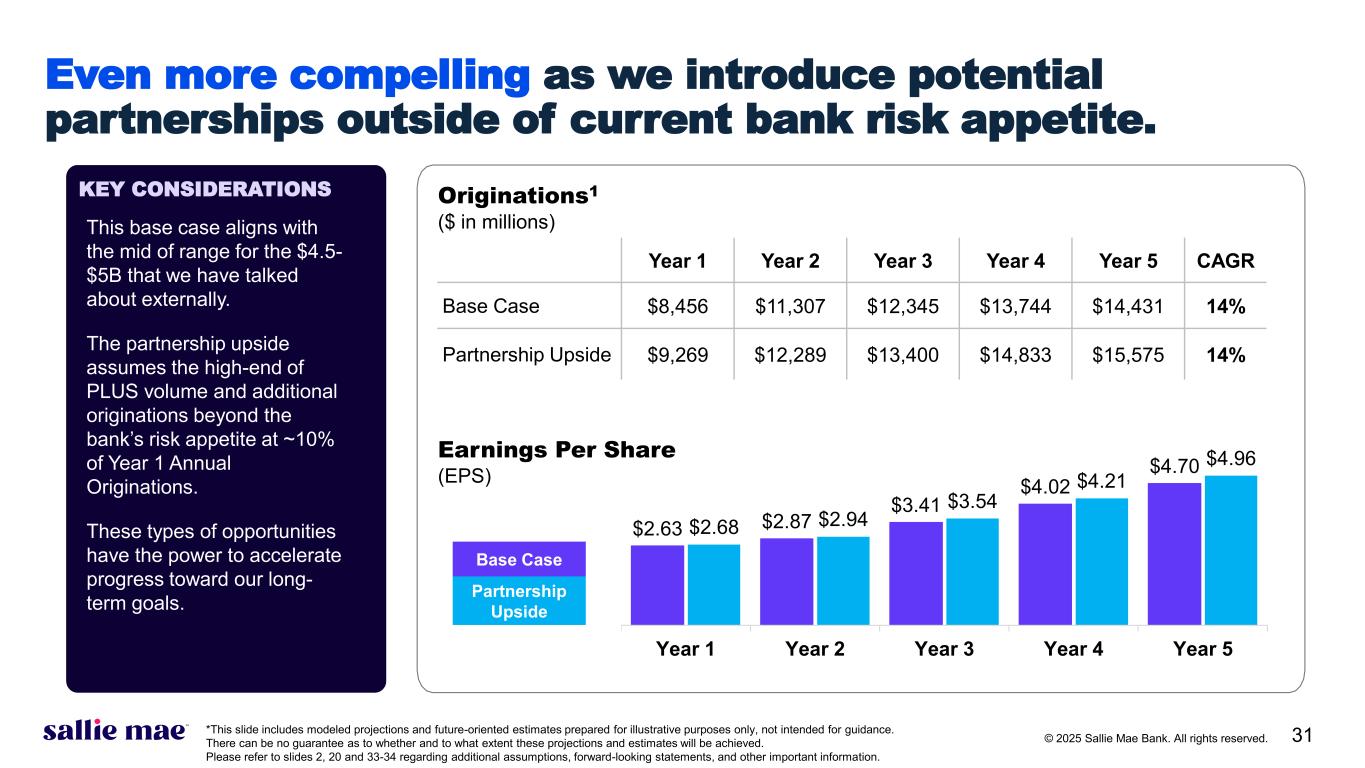

31© 2025 Sallie Mae Bank. All rights reserved. This base case aligns with the mid of range for the $4.5- $5B that we have talked about externally. The partnership upside assumes the high-end of PLUS volume and additional originations beyond the bank’s risk appetite at ~10% of Year 1 Annual Originations. These types of opportunities have the power to accelerate progress toward our long- term goals. KEY CONSIDERATIONS Earnings Per Share (EPS) Year 1 Year 2 Year 3 Year 4 Year 5 CAGR Base Case $8,456 $11,307 $12,345 $13,744 $14,431 14% Partnership Upside $9,269 $12,289 $13,400 $14,833 $15,575 14% $2.63 $2.87 $3.41 $4.02 $4.70 $2.68 $2.94 $3.54 $4.21 $4.96 Year 1 Year 2 Year 3 Year 4 Year 5 Originations1 ($ in millions) Base Case Partnership Upside Even more compelling as we introduce potential partnerships outside of current bank risk appetite. *This slide includes modeled projections and future-oriented estimates prepared for illustrative purposes only, not intended for guidance. There can be no guarantee as to whether and to what extent these projections and estimates will be achieved. Please refer to slides 2, 20 and 33-34 regarding additional assumptions, forward-looking statements, and other important information.

32© 2025 Sallie Mae Bank. All rights reserved. Appendix

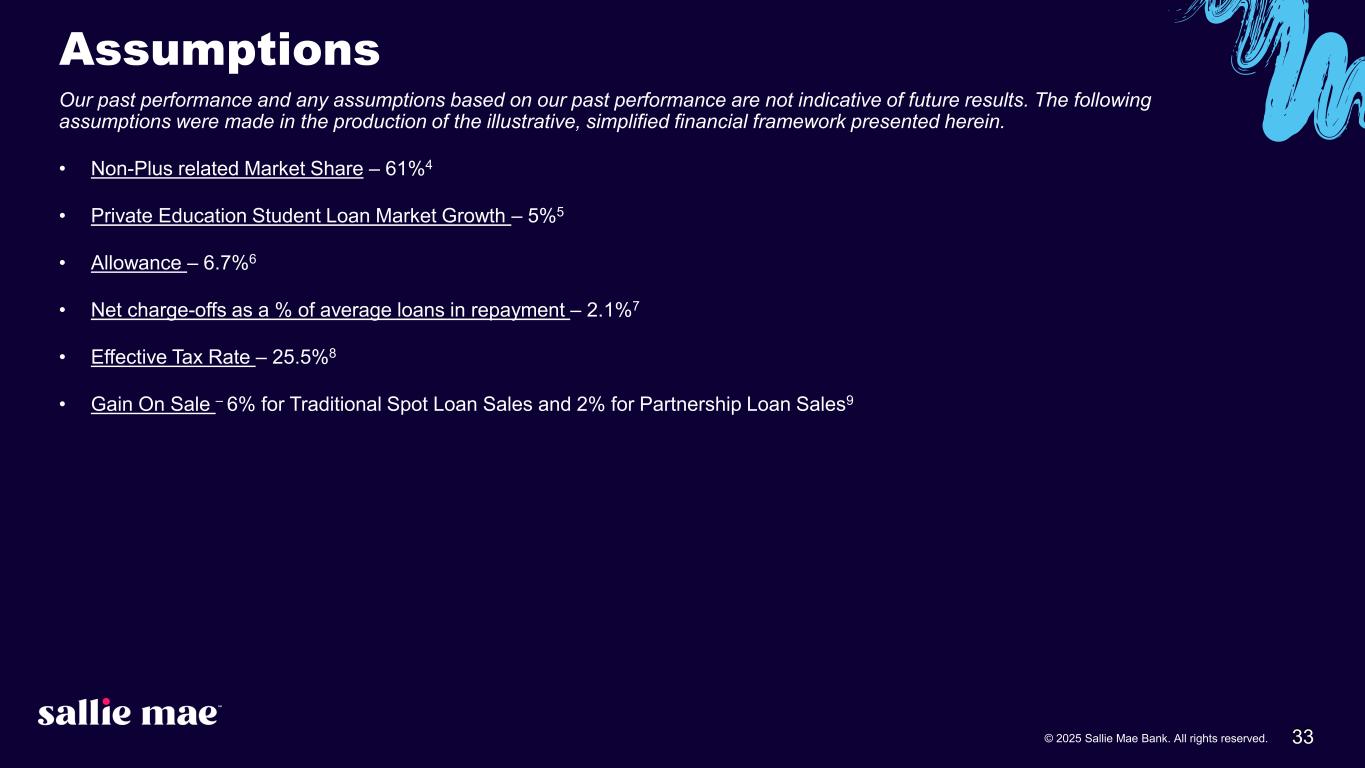

33© 2025 Sallie Mae Bank. All rights reserved. Our past performance and any assumptions based on our past performance are not indicative of future results. The following assumptions were made in the production of the illustrative, simplified financial framework presented herein. • Non-Plus related Market Share – 61%4 • Private Education Student Loan Market Growth – 5%5 • Allowance – 6.7%6 • Net charge-offs as a % of average loans in repayment – 2.1%7 • Effective Tax Rate – 25.5%8 • Gain On Sale – 6% for Traditional Spot Loan Sales and 2% for Partnership Loan Sales9 Assumptions

34© 2025 Sallie Mae Bank. All rights reserved. 1. Originations represent loans that were funded or acquired during the period presented. 2. Loans in repayment include loans making interest only or fixed payments, as well as loans that have entered full principal and interest repayment status after any applicable grace period. 3. Represents the higher credit score of the cosigner or the borrower. 4. Source: Enterval CBA Report for FY 2024. Based on Full Market. 5. Assumes Private Student Loan Market growth remains consistent with our internal estimates as of the date of this Presentation. 6. Based on the most recent information in the Q3 2025 10-Q, calculated as allowance/ private education student loan principal. 7. Assumes net charge-offs as a % of average loans in repayment remain at a rate consistent with our internal estimates as of the date of this Presentation. 8. Assumes tax rate remains consistent with our internal estimates as of the date of this Presentation. 9. Assumes gain on sale premiums remains consistent with our internal estimates as of the date of this Presentation. Footnotes