1© 2026 Sallie Mae Bank. All rights reserved. Earnings Presentation 4th Quarter & Full-Year 2025 .2

2© 2026 Sallie Mae Bank. All rights reserved. The following information is current as of January 22, 2026 (unless otherwise noted) and should be read in connection with the press release of SLM Corporation announcing its financial results for the quarter and year ended December 31, 2025, furnished to the Securities and Exchange Commission (“SEC”) on January 22, 2026, and subsequent reports filed with the SEC. This presentation contains “forward-looking statements” and information based on management’s current expectations as of the date of this presentation. Statements that are not historical facts, including statements about the Company’s beliefs, opinions, or expectations and statements that assume or are dependent upon future events, are forward-looking statements. These include, but are not limited to: strategies; goals and assumptions of SLM Corporation and its subsidiaries, collectively or individually as the context requires (the “Company”): the Company’s expectation and ability to execute loan sales and share repurchases; the Company’s expectation and ability to pay a quarterly cash dividend on our common stock in the future, subject to the approval of our Board of Directors; the Company’s 2026 guidance; the Company’s three-year horizon outlook; the Company’s credit outlook; the impact of acquisitions the Company has made or may make in the future; the Company’s projections regarding originations, net charge-offs, non-interest expenses, earnings, balance sheet position, and other metrics; any estimates related to accounting standard changes; and any estimates related to the impact of credit administration practices changes, including the results of simulations or other behavioral observations. Forward-looking statements are subject to risks, uncertainties, assumptions, and other factors, many of which are difficult to predict and generally beyond the control of the Company, which may cause actual results to be materially different from those reflected in such forward-looking statements. There can be no assurance that future developments affecting the Company will be the same as those anticipated by management. The Company cautions readers that a number of important factors could cause actual results to differ materially from those expressed in, or implied or projected by, such forward-looking statements. These factors include, among others, the risks and uncertainties set forth in Item 1A. “Risk Factors” and elsewhere in the Company’s most recently filed Annual Report on Form 10-K and subsequent filings with the Securities and Exchange Commission; increases in financing costs; limits on liquidity; increases in costs associated with compliance with laws and regulations; failure to comply with consumer protection, banking, and other laws or regulations; changes in laws, regulations, and supervisory expectations, especially in light of the goals of the Trump administration; our ability to timely develop new products and services and the acceptance of those products and services by potential and existing customers; changes in accounting standards and the impact of related changes in significant accounting estimates, including any regarding the measurement of our allowance for credit losses and the related provision expense; any adverse outcomes in any significant litigation to which the Company is a party; credit risk associated with the Company’s exposure to third parties, including counterparties to the Company’s derivative transactions; the effectiveness of our risk management framework and quantitative models; changes in the terms of education loans and the educational credit marketplace (including changes resulting from new laws and the implementation of existing laws); and changes in the demand for our deposit products, including changes caused by new or emerging market entrants or technologies. We could also be affected by, among other things: changes in our funding costs and availability; reductions to our credit ratings; cybersecurity incidents, cyberattacks, risks related to artificial intelligence (AI), and other failures or breaches of our operating systems or infrastructure, including those of third-party vendors; the societal, demographic, business, and legislative/regulatory impact of pandemics, other public health crises, severe weather events, and/or natural disasters; damage to our reputation; risks associated with restructuring initiatives, including failures to successfully implement cost-cutting programs and the adverse effects of such initiatives on our business; changes in the demand for higher education, educational financing, or in financing preferences of lenders, educational institutions, students, and their famil ies, including changes to the amount or availability of funding that educational institutions, students, or their families receive from government sources; changes in laws and regulations with respect to the student lending business and financial institutions generally; changes in banking rules and regulations, including increased capital requirements; increased competition from banks and other consumer lenders; the creditworthiness of our customers, or any change related thereto; changes in the general interest rate environment, including the rate relationships among relevant money-market instruments and those of our earning assets versus our funding arrangements; rates of prepayments on the loans owned by us; changes in general economic or macroeconomic conditions, including changes due to inflation, stagflation, recession, shifts in the labor market, changes to government policies or initiatives, such as tariffs, trade wars, wars, immigration, and student visa policies, which could negatively impact consumer or business sentiment, demand for higher education, demand for student loans, our financial and business results and/or modeling, and our ability to successfully effectuate any acquisitions, strategic partnerships, or initiatives. The preparation of our consolidated financial statements also requires management to make certain estimates and assumptions, including estimates and assumptions about future events. These estimates or assumptions may prove to be incorrect. All oral and written forward-looking statements attributed to the Company are expressly qualified in their entirety by the factors, risks, and uncertainties set forth in the foregoing cautionary statements, and are made only as of the date of this presentation or, where the statement is oral, as of the date stated. We do not undertake any obligation to update or revise any forward-looking statements to conform to actual results or changes in our expectations, nor to reflect events or circumstances that occur after the date on which such statements were made. In light of these risks, uncertainties, and assumptions, you should not put undue reliance on any forward- looking statements discussed hereto. Cautionary Note on Use of Non-GAAP Measurements This presentation includes non-GAAP financial information, including non-GAAP Delinquencies Including Strategic Partnership Loans in Repayment, non-GAAP Reserve Rates Including Strategic Partnership Warehouse Loans and non-GAAP NCOs as a Percentage of Average Loans in Repayment, which should be considered supplemental to, not a substitute for, or superior to, the financial measure calculated in accordance with GAAP. The Company believes that these non-GAAP financial measures provide users of our financial information with useful supplemental information that enables a better comparison of our performance across periods. There are a number of limitations related to the use of these non-GAAP financial measures and their nearest GAAP equivalents. For example, the Company's definitions of non-GAAP financial measures may differ from non-GAAP financial measures used by other companies. For descriptions of the non-GAAP financial information included herein, and reconciliations to the most directly comparable GAAP measures, see the appendix to this presentation beginning at slide 13. CAUTIONARY NOTE AND DISCLAIMER REGARDING FORWARD-LOOKING STATEMENTS

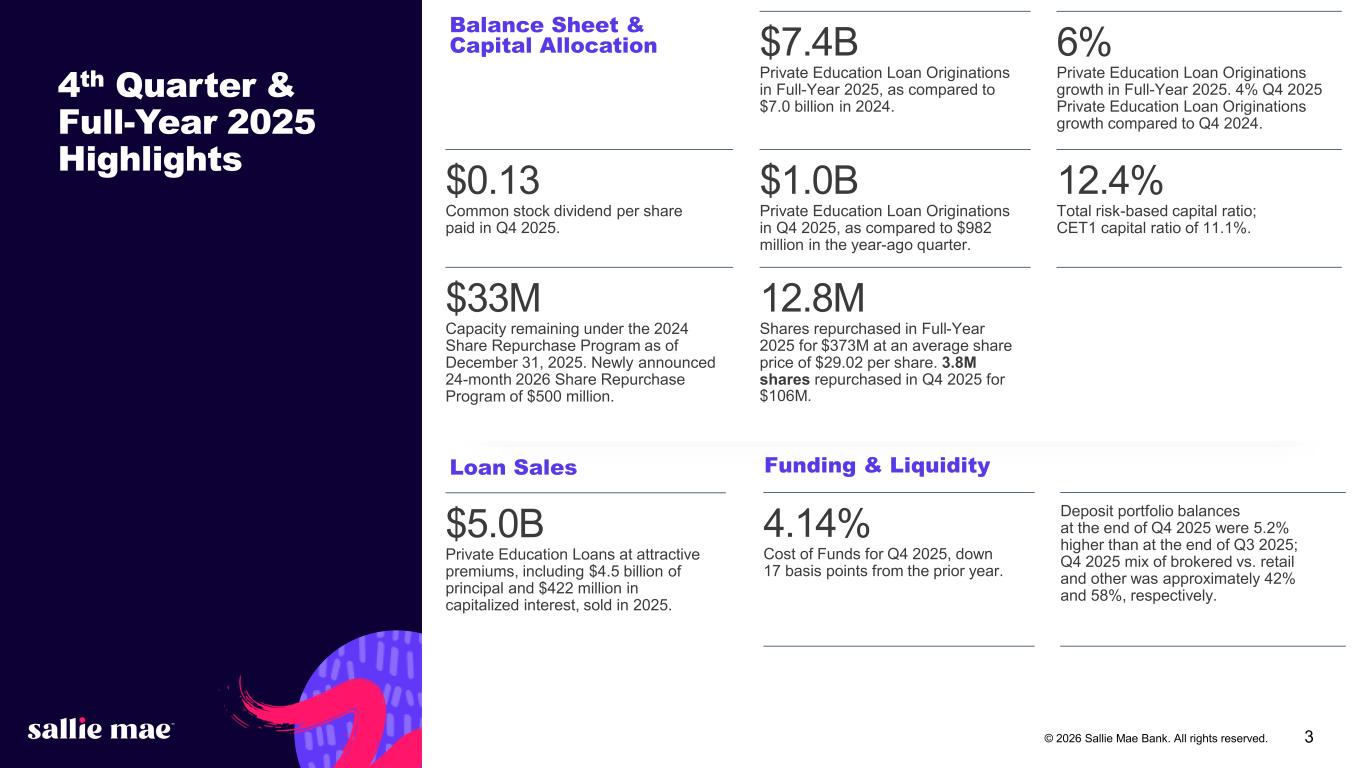

3© 2026 Sallie Mae Bank. All rights reserved. 4th Quarter & Full-Year 2025 Highlights $7.4B Private Education Loan Originations in Full-Year 2025, as compared to $7.0 billion in 2024. 6% Private Education Loan Originations growth in Full-Year 2025. 4% Q4 2025 Private Education Loan Originations growth compared to Q4 2024. $0.13 Common stock dividend per share paid in Q4 2025. $1.0B Private Education Loan Originations in Q4 2025, as compared to $982 million in the year-ago quarter. 12.4% Total risk-based capital ratio; CET1 capital ratio of 11.1%. $33M Capacity remaining under the 2024 Share Repurchase Program as of December 31, 2025. Newly announced 24-month 2026 Share Repurchase Program of $500 million. 12.8M Shares repurchased in Full-Year 2025 for $373M at an average share price of $29.02 per share. 3.8M shares repurchased in Q4 2025 for $106M. Balance Sheet & Capital Allocation 4.14% Cost of Funds for Q4 2025, down 17 basis points from the prior year. Deposit portfolio balances at the end of Q4 2025 were 5.2% higher than at the end of Q3 2025; Q4 2025 mix of brokered vs. retail and other was approximately 42% and 58%, respectively. Funding & LiquidityLoan Sales $5.0B Private Education Loans at attractive premiums, including $4.5 billion of principal and $422 million in capitalized interest, sold in 2025.

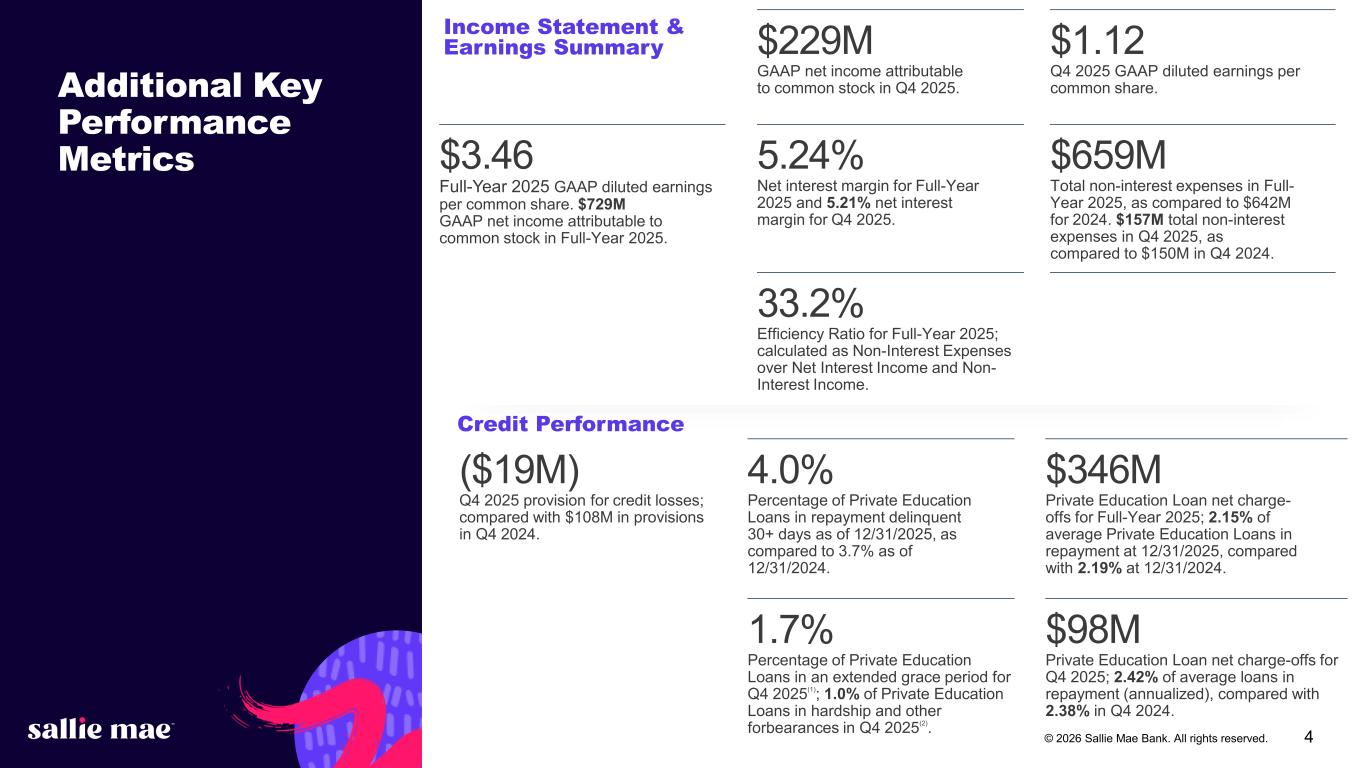

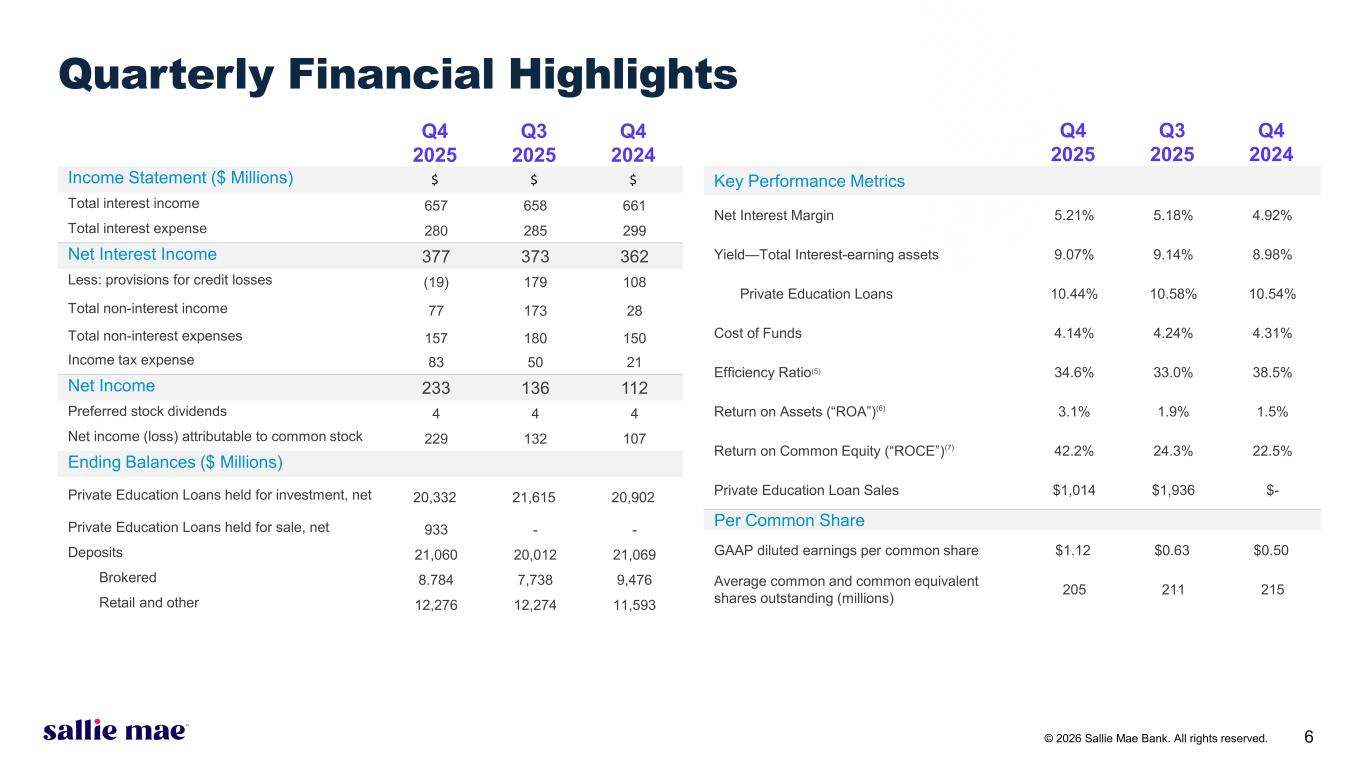

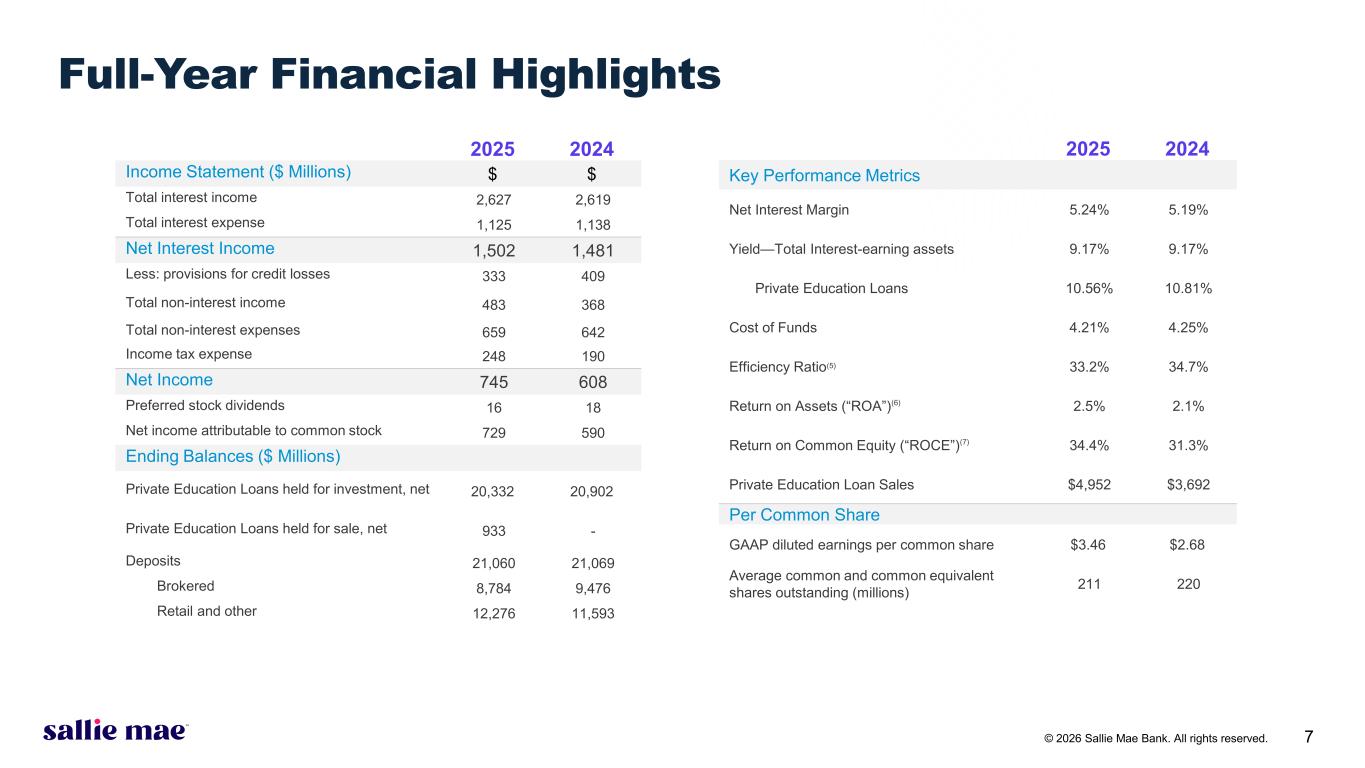

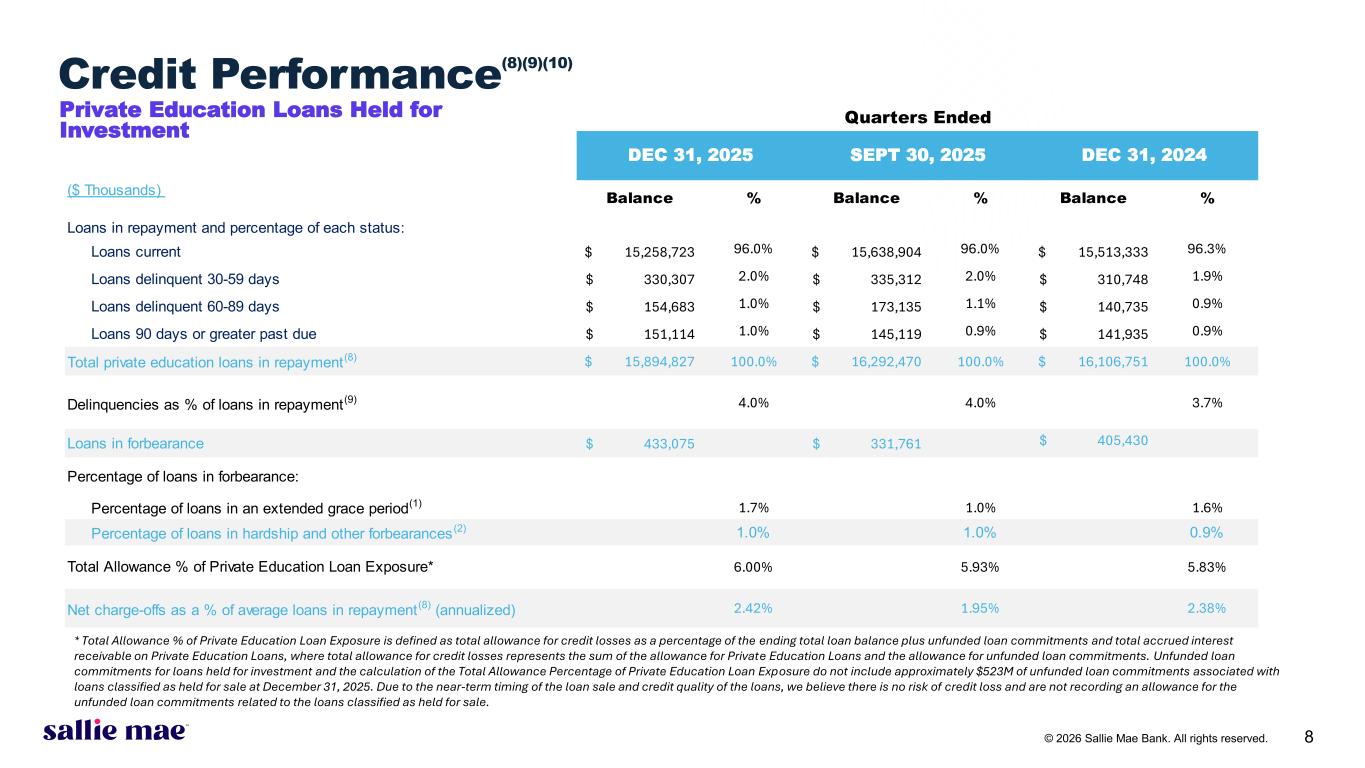

4© 2026 Sallie Mae Bank. All rights reserved. ($19M) Q4 2025 provision for credit losses; compared with $108M in provisions in Q4 2024. 4.0% Percentage of Private Education Loans in repayment delinquent 30+ days as of 12/31/2025, as compared to 3.7% as of 12/31/2024. $346M Private Education Loan net charge- offs for Full-Year 2025; 2.15% of average Private Education Loans in repayment at 12/31/2025, compared with 2.19% at 12/31/2024. 1.7% Percentage of Private Education Loans in an extended grace period for Q4 2025 (1) ; 1.0% of Private Education Loans in hardship and other forbearances in Q4 2025 (2) . $98M Private Education Loan net charge-offs for Q4 2025; 2.42% of average loans in repayment (annualized), compared with 2.38% in Q4 2024. Additional Key Performance Metrics Credit Performance $229M GAAP net income attributable to common stock in Q4 2025. $1.12 Q4 2025 GAAP diluted earnings per common share. $3.46 Full-Year 2025 GAAP diluted earnings per common share. $729M GAAP net income attributable to common stock in Full-Year 2025. 5.24% Net interest margin for Full-Year 2025 and 5.21% net interest margin for Q4 2025. $659M Total non-interest expenses in Full- Year 2025, as compared to $642M for 2024. $157M total non-interest expenses in Q4 2025, as compared to $150M in Q4 2024. 33.2% Efficiency Ratio for Full-Year 2025; calculated as Non-Interest Expenses over Net Interest Income and Non- Interest Income. Income Statement & Earnings Summary

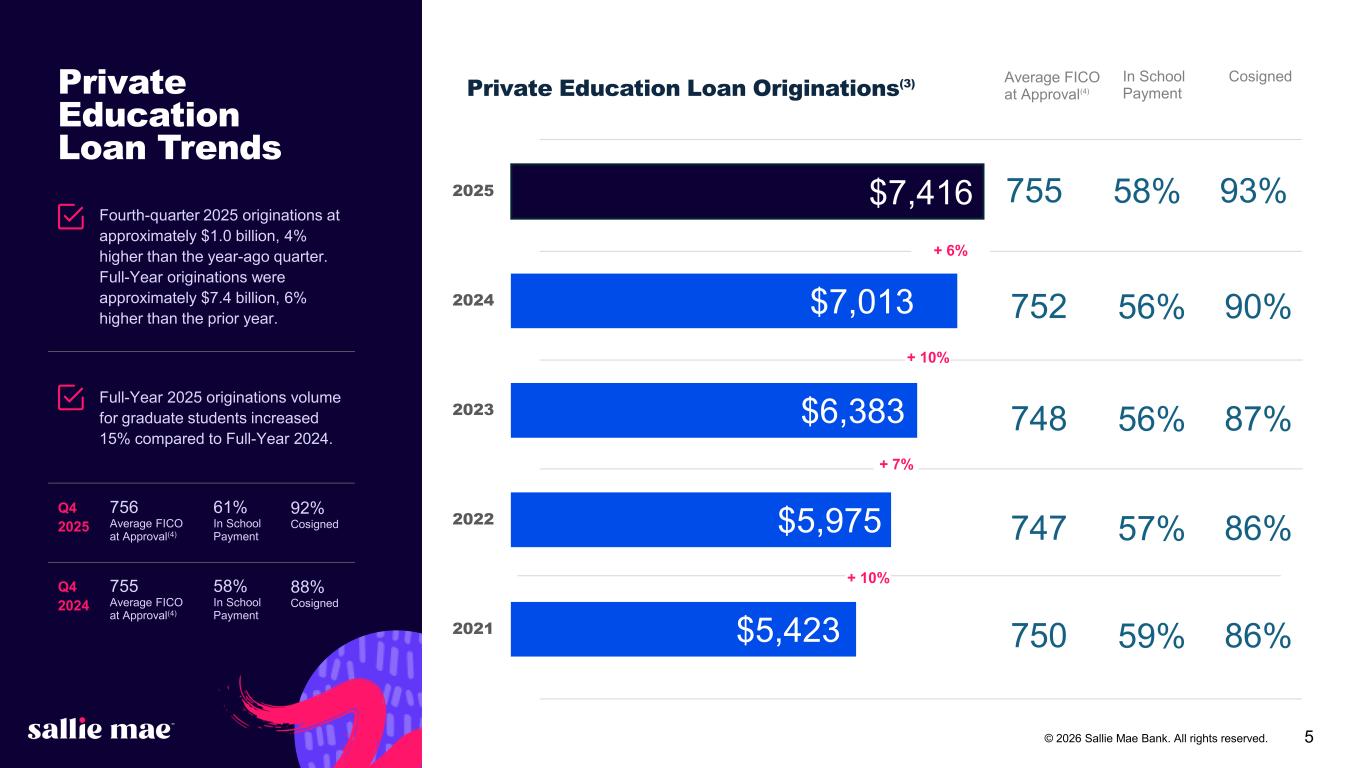

5© 2026 Sallie Mae Bank. All rights reserved. $5,423 $5,975 $6,383 $7,013 2021 2022 2023 2024 2025 90%752 56% 87%748 56% 86%747 57% Private Education Loan Trends Fourth-quarter 2025 originations at approximately $1.0 billion, 4% higher than the year-ago quarter. Full-Year originations were approximately $7.4 billion, 6% higher than the prior year. Full-Year 2025 originations volume for graduate students increased 15% compared to Full-Year 2024. Average FICO at Approval(4) In School Payment Cosigned Private Education Loan Originations(3) + 7% + 10% + 6% 756 Average FICO at Approval(4) 61% In School Payment 92% Cosigned Q4 2025 755 Average FICO at Approval(4) 58% In School Payment 88% Cosigned Q4 2024 + 10% 86%750 59% $7,416 93%755 58%

6© 2026 Sallie Mae Bank. All rights reserved. Q4 2025 Q3 2025 Q4 2024 Income Statement ($ Millions) $ $ $ Total interest income 657 658 661 Total interest expense 280 285 299 Net Interest Income 377 373 362 Less: provisions for credit losses (19) 179 108 Total non-interest income 77 173 28 Total non-interest expenses 157 180 150 Income tax expense 83 50 21 Net Income 233 136 112 Preferred stock dividends 4 4 4 Net income (loss) attributable to common stock 229 132 107 Ending Balances ($ Millions) Private Education Loans held for investment, net 20,332 21,615 20,902 Private Education Loans held for sale, net 933 - - Deposits 21,060 20,012 21,069 Brokered 8.784 7,738 9,476 Retail and other 12,276 12,274 11,593 Q4 2025 Q3 2025 Q4 2024 Key Performance Metrics Net Interest Margin 5.21% 5.18% 4.92% Yield—Total Interest-earning assets 9.07% 9.14% 8.98% Private Education Loans 10.44% 10.58% 10.54% Cost of Funds 4.14% 4.24% 4.31% Efficiency Ratio(5) 34.6% 33.0% 38.5% Return on Assets (“ROA”)(6) 3.1% 1.9% 1.5% Return on Common Equity (“ROCE”)(7) 42.2% 24.3% 22.5% Private Education Loan Sales $1,014 $1,936 $- Per Common Share GAAP diluted earnings per common share $1.12 $0.63 $0.50 Average common and common equivalent shares outstanding (millions) 205 211 215 Quarterly Financial Highlights

7© 2026 Sallie Mae Bank. All rights reserved. 2025 2024 Income Statement ($ Millions) $ $ Total interest income 2,627 2,619 Total interest expense 1,125 1,138 Net Interest Income 1,502 1,481 Less: provisions for credit losses 333 409 Total non-interest income 483 368 Total non-interest expenses 659 642 Income tax expense 248 190 Net Income 745 608 Preferred stock dividends 16 18 Net income attributable to common stock 729 590 Ending Balances ($ Millions) Private Education Loans held for investment, net 20,332 20,902 Private Education Loans held for sale, net 933 - Deposits 21,060 21,069 Brokered 8,784 9,476 Retail and other 12,276 11,593 2025 2024 Key Performance Metrics Net Interest Margin 5.24% 5.19% Yield—Total Interest-earning assets 9.17% 9.17% Private Education Loans 10.56% 10.81% Cost of Funds 4.21% 4.25% Efficiency Ratio(5) 33.2% 34.7% Return on Assets (“ROA”)(6) 2.5% 2.1% Return on Common Equity (“ROCE”)(7) 34.4% 31.3% Private Education Loan Sales $4,952 $3,692 Per Common Share GAAP diluted earnings per common share $3.46 $2.68 Average common and common equivalent shares outstanding (millions) 211 220 Full-Year Financial Highlights

8© 2026 Sallie Mae Bank. All rights reserved. Credit Performance (8)(9)(10) Private Education Loans Held for Investment * Total Allowance % of Private Education Loan Exposure is defined as total allowance for credit losses as a percentage of the ending total loan balance plus unfunded loan commitments and total accrued interest receivable on Private Education Loans, where total allowance for credit losses represents the sum of the allowance for Private Education Loans and the allowance for unfunded loan commitments. Unfunded loan commitments for loans held for investment and the calculation of the Total Allowance Percentage of Private Education Loan Exposure do not include approximately $523M of unfunded loan commitments associated with loans classified as held for sale at December 31, 2025. Due to the near-term timing of the loan sale and credit quality of the loans, we believe there is no risk of credit loss and are not recording an allowance for the unfunded loan commitments related to the loans classified as held for sale. ($ Thousands) Balance % Balance % Balance % Loans in repayment and percentage of each status: Loans current 15,258,723$ 96.0% 15,638,904$ 96.0% 15,513,333$ 96.3% Loans delinquent 30-59 days 330,307$ 2.0% 335,312$ 2.0% 310,748$ 1.9% Loans delinquent 60-89 days 154,683$ 1.0% 173,135$ 1.1% 140,735$ 0.9% Loans 90 days or greater past due 151,114$ 1.0% 145,119$ 0.9% 141,935$ 0.9% Total private education loans in repayment(8) 15,894,827$ 100.0% 16,292,470$ 100.0% 16,106,751$ 100.0% Delinquencies as % of loans in repayment(9) 4.0% 4.0% 3.7% Loans in forbearance 433,075$ 331,761$ 405,430$ Percentage of loans in forbearance: Percentage of loans in an extended grace period(1) 1.7% 1.0% 1.6% Percentage of loans in hardship and other forbearances (2) 1.0% 1.0% 0.9% 6.00% 5.93% 5.83% Net charge-offs as a % of average loans in repayment (8) (annualized) 2.42% 1.95% 2.38% Total Allowance % of Private Education Loan Exposure* DEC 31, 2024 Quarters Ended DEC 31, 2025 SEPT 30, 2025

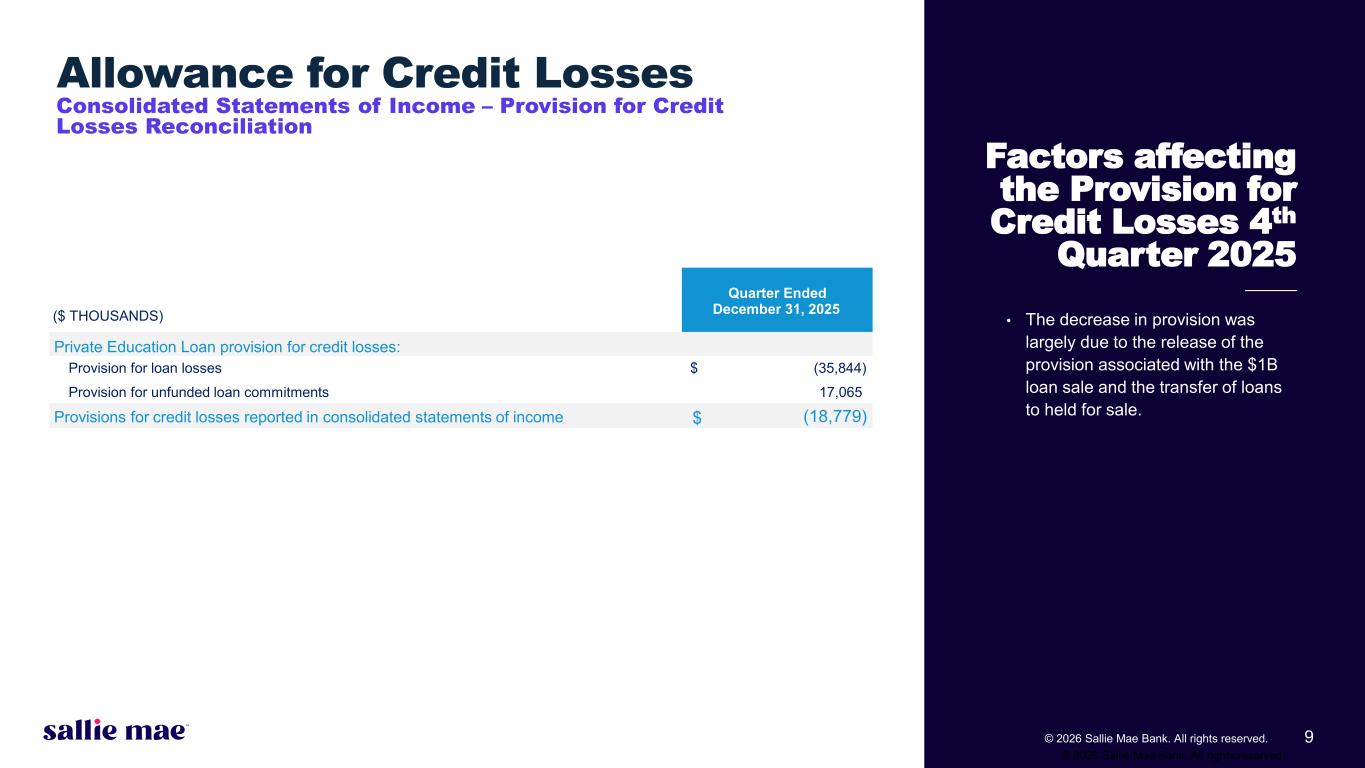

© 2025 Sallie Mae Bank. All rights reserved. 9 © 2026 Sallie Mae Bank. All rights reserved. 6 Factors affecting the Provision for Credit Losses 4th Quarter 2025 Consolidated Statements of Income – Provision for Credit Losses Reconciliation • The decrease in provision was largely due to the release of the provision associated with the $1B loan sale and the transfer of loans to held for sale. Quarter Ended December 31, 2025 ($ THOUSANDS) Private Education Loan provision for credit losses: Provision for loan losses (35,844)$ Provision for unfunded loan commitments 17,065 Provisions for credit losses reported in consolidated statements of income (18,779)$ Allowance for Credit Losses

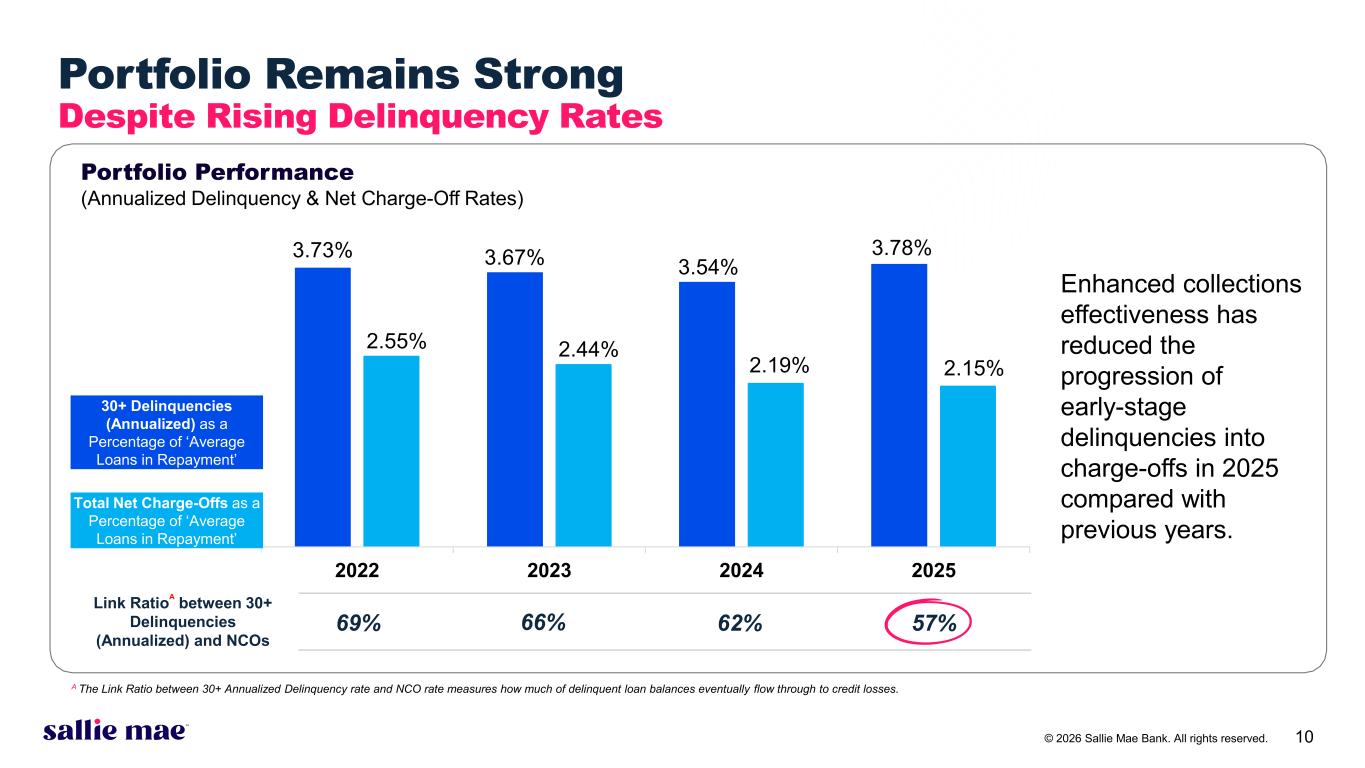

10© 2026 Sallie Mae Bank. All rights reserved. Portfolio Remains Strong Despite Rising Delinquency Rates Portfolio Performance (Annualized Delinquency & Net Charge-Off Rates) 3.73% 3.67% 3.54% 3.78% 2.55% 2.44% 2.19% 2.15% 2022 2023 2024 2025 30+ Delinquencies (Annualized) as a Percentage of ‘Average Loans in Repayment’ Total Net Charge-Offs as a Percentage of ‘Average Loans in Repayment’ 69% 66% 62% 57% Enhanced collections effectiveness has reduced the progression of early-stage delinquencies into charge-offs in 2025 compared with previous years. Link Ratio A between 30+ Delinquencies (Annualized) and NCOs A The Link Ratio between 30+ Annualized Delinquency rate and NCO rate measures how much of delinquent loan balances eventually flow through to credit losses.

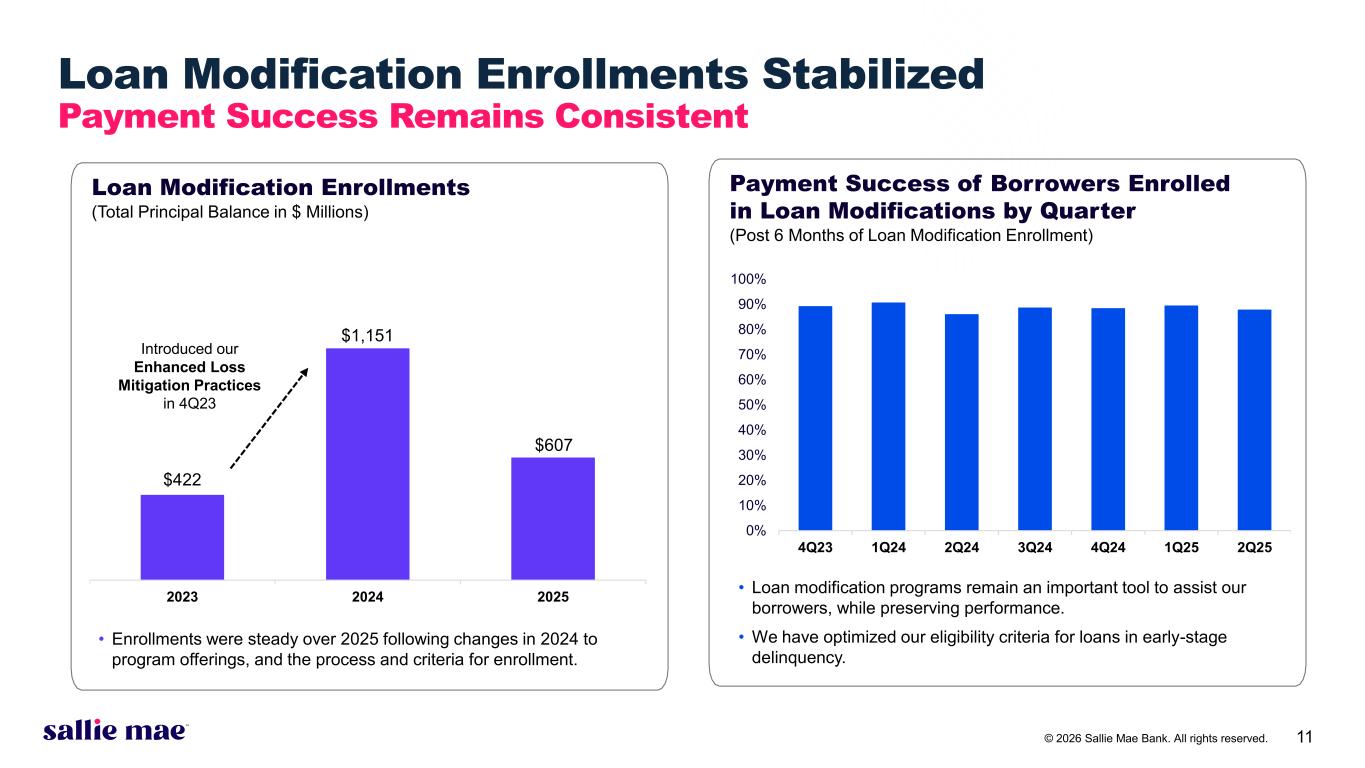

11© 2026 Sallie Mae Bank. All rights reserved. Loan Modification Enrollments Stabilized Payment Success Remains Consistent Loan Modification Enrollments (Total Principal Balance in $ Millions) Payment Success of Borrowers Enrolled in Loan Modifications by Quarter (Post 6 Months of Loan Modification Enrollment) $422 $1,151 $607 2023 2024 2025 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% 4Q23 1Q24 2Q24 3Q24 4Q24 1Q25 2Q25 • Enrollments were steady over 2025 following changes in 2024 to program offerings, and the process and criteria for enrollment. • Loan modification programs remain an important tool to assist our borrowers, while preserving performance. • We have optimized our eligibility criteria for loans in early-stage delinquency. Introduced our Enhanced Loss Mitigation Practices in 4Q23

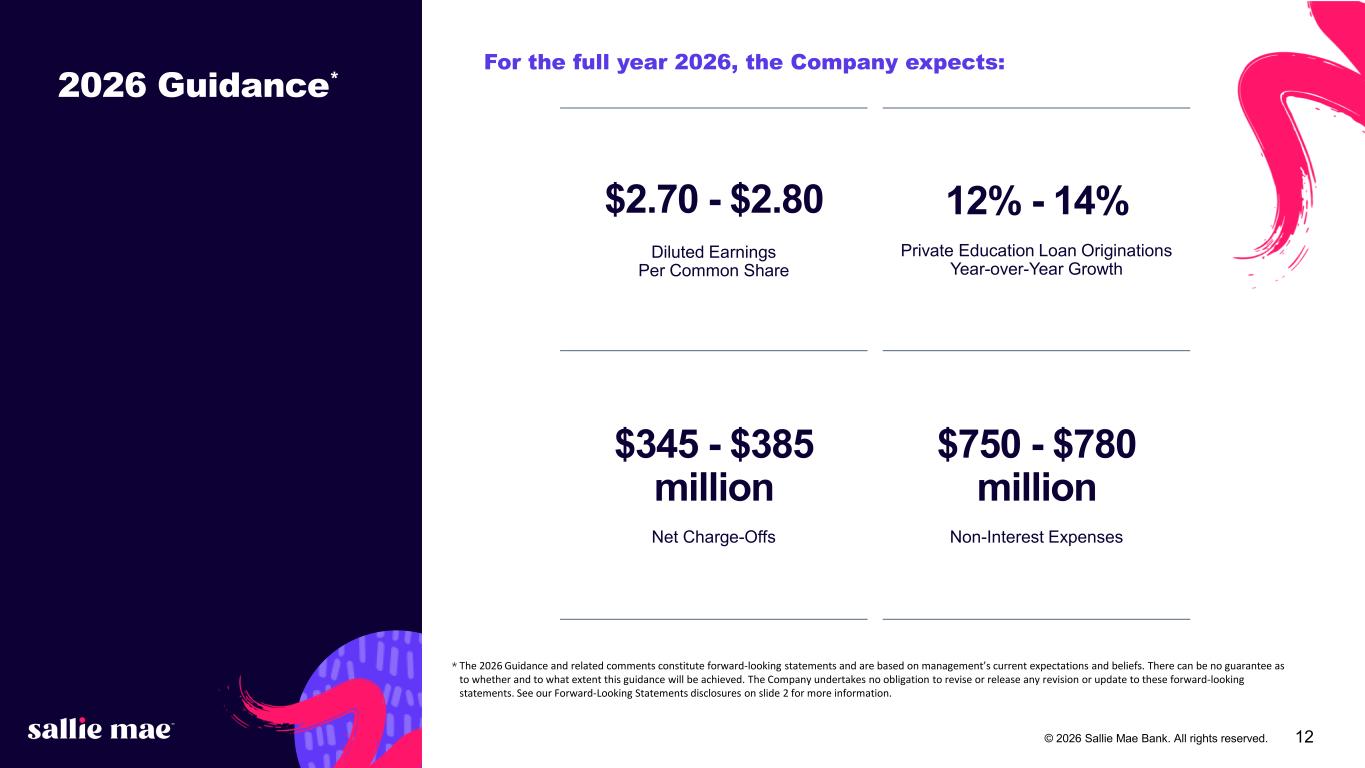

12© 2026 Sallie Mae Bank. All rights reserved. 2026 Guidance* For the full year 2026, the Company expects: $2.70 - $2.80 Diluted Earnings Per Common Share 12% - 14% Private Education Loan Originations Year-over-Year Growth $345 - $385 million Net Charge-Offs $750 - $780 million Non-Interest Expenses * The 2026 Guidance and related comments constitute forward-looking statements and are based on management’s current expectations and beliefs. There can be no guarantee as to whether and to what extent this guidance will be achieved. The Company undertakes no obligation to revise or release any revision or update to these forward-looking statements. See our Forward-Looking Statements disclosures on slide 2 for more information.

13© 2026 Sallie Mae Bank. All rights reserved. Appendix Impact on Private Education Loan Portfolio Due to Evolved Strategy

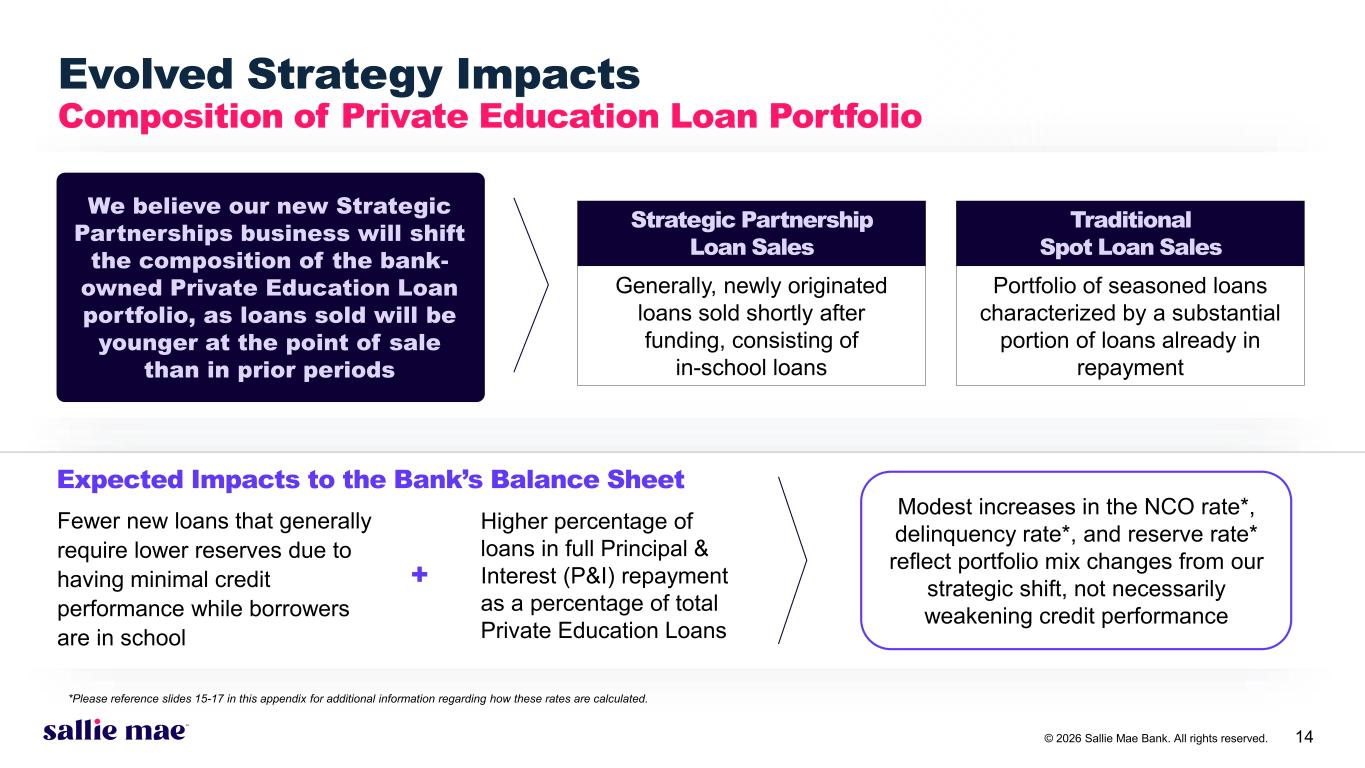

14© 2026 Sallie Mae Bank. All rights reserved. We believe our new Strategic Partnerships business will shift the composition of the bank- owned Private Education Loan portfolio, as loans sold will be younger at the point of sale than in prior periods Evolved Strategy Impacts Composition of Private Education Loan Portfolio Strategic Partnership Loan Sales Traditional Spot Loan Sales Generally, newly originated loans sold shortly after funding, consisting of in-school loans Portfolio of seasoned loans characterized by a substantial portion of loans already in repayment Expected Impacts to the Bank’s Balance Sheet Fewer new loans that generally require lower reserves due to having minimal credit performance while borrowers are in school + Higher percentage of loans in full Principal & Interest (P&I) repayment as a percentage of total Private Education Loans Modest increases in the NCO rate*, delinquency rate*, and reserve rate* reflect portfolio mix changes from our strategic shift, not necessarily weakening credit performance *Please reference slides 15-17 in this appendix for additional information regarding how these rates are calculated.

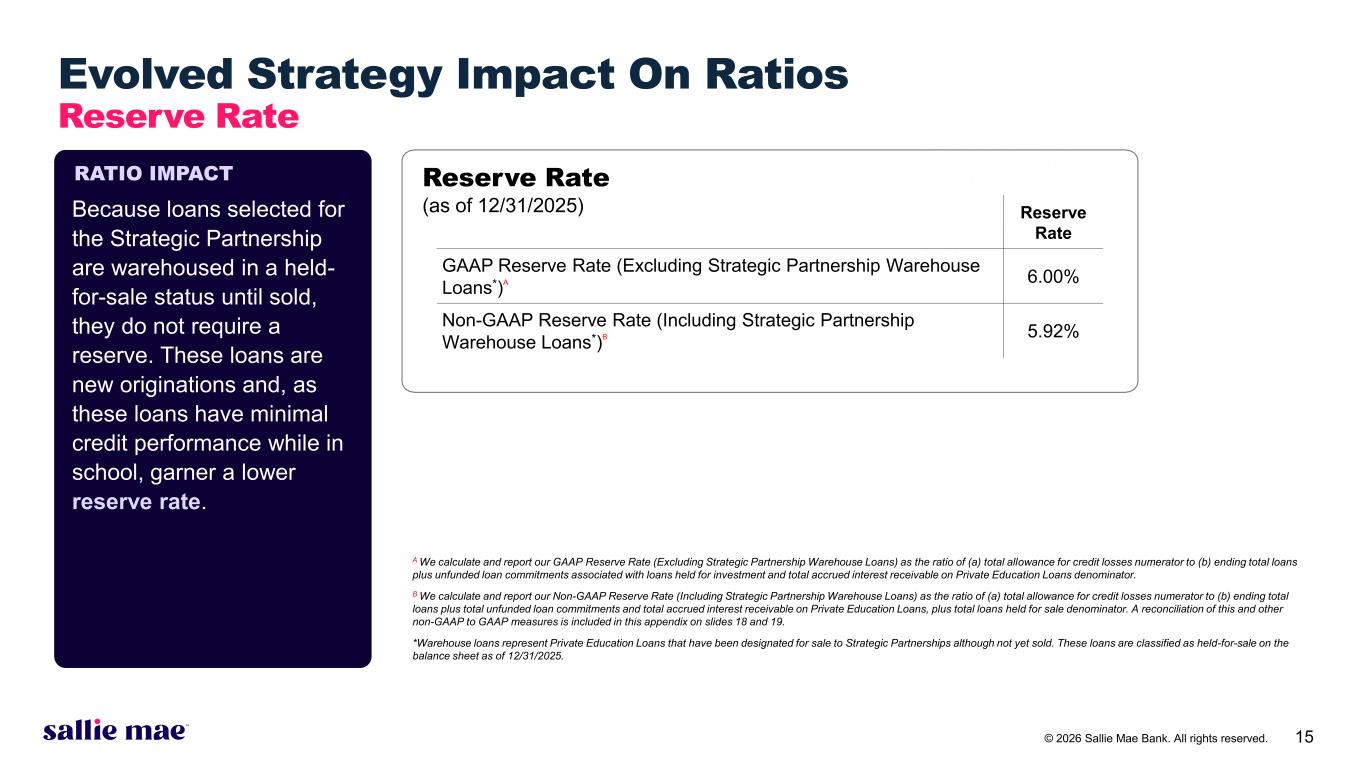

15© 2026 Sallie Mae Bank. All rights reserved. Reserve Rate GAAP Reserve Rate (Excluding Strategic Partnership Warehouse Loans*) A 6.00% Non-GAAP Reserve Rate (Including Strategic Partnership Warehouse Loans*) B 5.92% Evolved Strategy Impact On Ratios Reserve Rate Reserve Rate (as of 12/31/2025) RATIO IMPACT A We calculate and report our GAAP Reserve Rate (Excluding Strategic Partnership Warehouse Loans) as the ratio of (a) total allowance for credit losses numerator to (b) ending total loans plus unfunded loan commitments associated with loans held for investment and total accrued interest receivable on Private Education Loans denominator. B We calculate and report our Non-GAAP Reserve Rate (Including Strategic Partnership Warehouse Loans) as the ratio of (a) total allowance for credit losses numerator to (b) ending total loans plus total unfunded loan commitments and total accrued interest receivable on Private Education Loans, plus total loans held for sale denominator. A reconciliation of this and other non-GAAP to GAAP measures is included in this appendix on slides 18 and 19. *Warehouse loans represent Private Education Loans that have been designated for sale to Strategic Partnerships although not yet sold. These loans are classified as held-for-sale on the balance sheet as of 12/31/2025. Because loans selected for the Strategic Partnership are warehoused in a held- for-sale status until sold, they do not require a reserve. These loans are new originations and, as these loans have minimal credit performance while in school, garner a lower reserve rate.

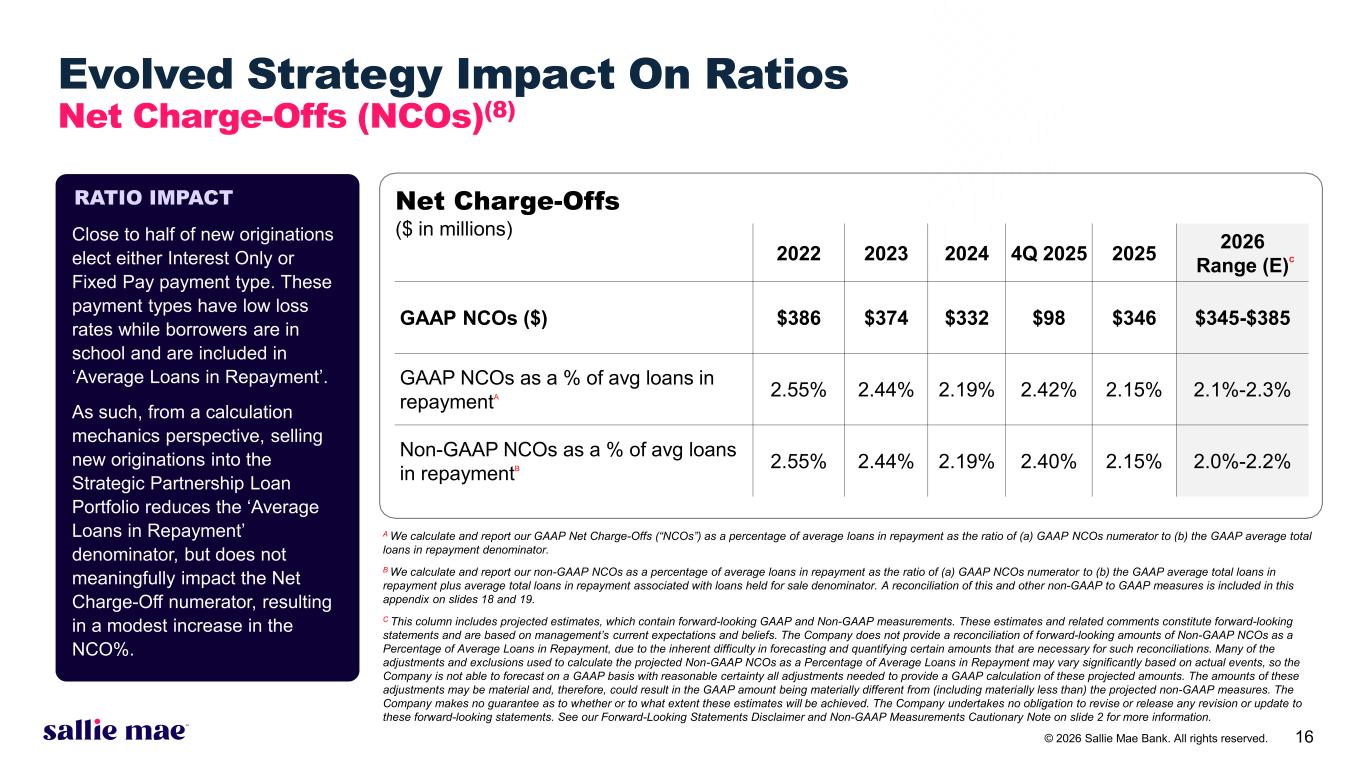

16© 2026 Sallie Mae Bank. All rights reserved. Evolved Strategy Impact On Ratios Net Charge-Offs (NCOs)(8) RATIO IMPACT Close to half of new originations elect either Interest Only or Fixed Pay payment type. These payment types have low loss rates while borrowers are in school and are included in ‘Average Loans in Repayment’. As such, from a calculation mechanics perspective, selling new originations into the Strategic Partnership Loan Portfolio reduces the ‘Average Loans in Repayment’ denominator, but does not meaningfully impact the Net Charge-Off numerator, resulting in a modest increase in the NCO%. 2022 2023 2024 4Q 2025 2025 2026 Range (E) C GAAP NCOs ($) $386 $374 $332 $98 $346 $345-$385 GAAP NCOs as a % of avg loans in repaymentA 2.55% 2.44% 2.19% 2.42% 2.15% 2.1%-2.3% Non-GAAP NCOs as a % of avg loans in repaymentB 2.55% 2.44% 2.19% 2.40% 2.15% 2.0%-2.2% Net Charge-Offs ($ in millions) A We calculate and report our GAAP Net Charge-Offs (“NCOs”) as a percentage of average loans in repayment as the ratio of (a) GAAP NCOs numerator to (b) the GAAP average total loans in repayment denominator. B We calculate and report our non-GAAP NCOs as a percentage of average loans in repayment as the ratio of (a) GAAP NCOs numerator to (b) the GAAP average total loans in repayment plus average total loans in repayment associated with loans held for sale denominator. A reconciliation of this and other non-GAAP to GAAP measures is included in this appendix on slides 18 and 19. C This column includes projected estimates, which contain forward-looking GAAP and Non-GAAP measurements. These estimates and related comments constitute forward-looking statements and are based on management’s current expectations and beliefs. The Company does not provide a reconciliation of forward-looking amounts of Non-GAAP NCOs as a Percentage of Average Loans in Repayment, due to the inherent difficulty in forecasting and quantifying certain amounts that are necessary for such reconciliations. Many of the adjustments and exclusions used to calculate the projected Non-GAAP NCOs as a Percentage of Average Loans in Repayment may vary significantly based on actual events, so the Company is not able to forecast on a GAAP basis with reasonable certainty all adjustments needed to provide a GAAP calculation of these projected amounts. The amounts of these adjustments may be material and, therefore, could result in the GAAP amount being materially different from (including materially less than) the projected non-GAAP measures. The Company makes no guarantee as to whether or to what extent these estimates will be achieved. The Company undertakes no obligation to revise or release any revision or update to these forward-looking statements. See our Forward-Looking Statements Disclaimer and Non-GAAP Measurements Cautionary Note on slide 2 for more information.

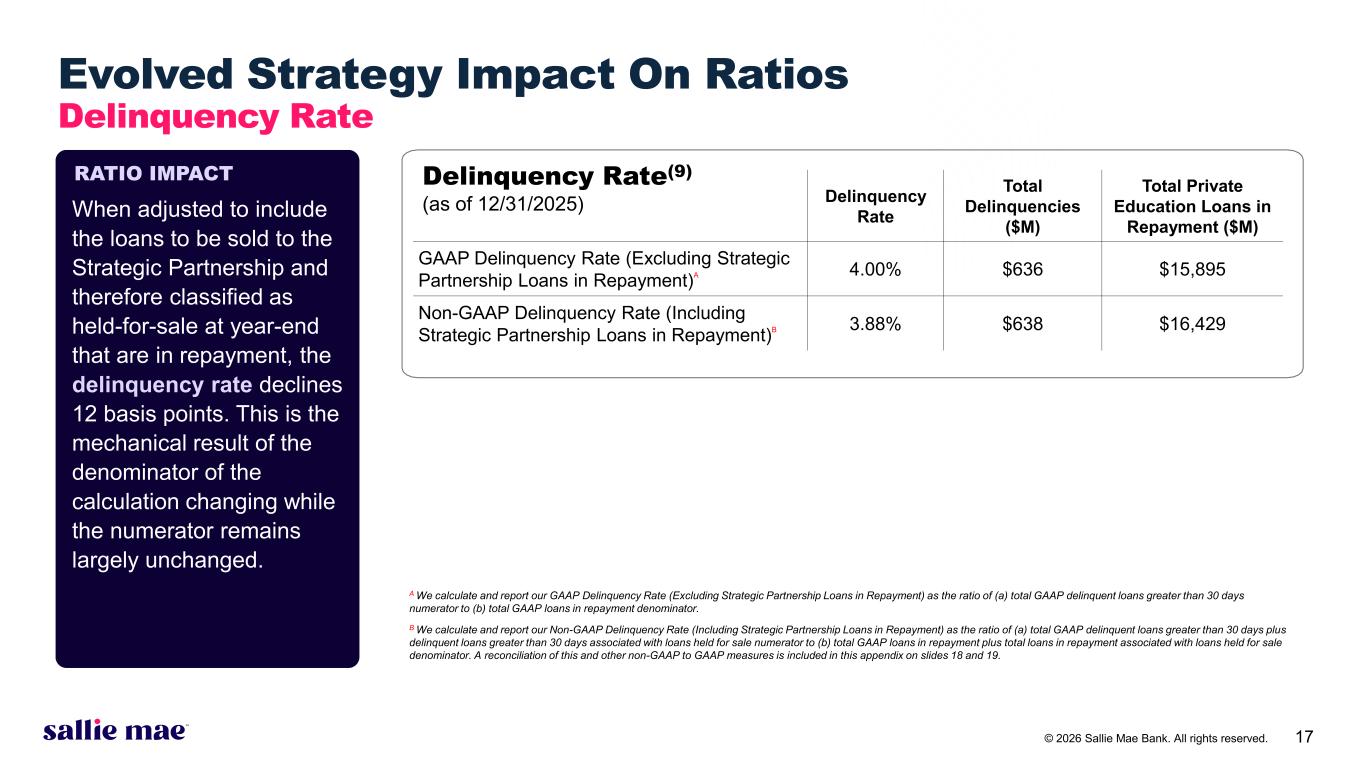

17© 2026 Sallie Mae Bank. All rights reserved. Evolved Strategy Impact On Ratios Delinquency Rate Delinquency Rate Total Delinquencies ($M) Total Private Education Loans in Repayment ($M) GAAP Delinquency Rate (Excluding Strategic Partnership Loans in Repayment) A 4.00% $636 $15,895 Non-GAAP Delinquency Rate (Including Strategic Partnership Loans in Repayment) B 3.88% $638 $16,429 Delinquency Rate(9) (as of 12/31/2025) RATIO IMPACT When adjusted to include the loans to be sold to the Strategic Partnership and therefore classified as held-for-sale at year-end that are in repayment, the delinquency rate declines 12 basis points. This is the mechanical result of the denominator of the calculation changing while the numerator remains largely unchanged. A We calculate and report our GAAP Delinquency Rate (Excluding Strategic Partnership Loans in Repayment) as the ratio of (a) total GAAP delinquent loans greater than 30 days numerator to (b) total GAAP loans in repayment denominator. B We calculate and report our Non-GAAP Delinquency Rate (Including Strategic Partnership Loans in Repayment) as the ratio of (a) total GAAP delinquent loans greater than 30 days plus delinquent loans greater than 30 days associated with loans held for sale numerator to (b) total GAAP loans in repayment plus total loans in repayment associated with loans held for sale denominator. A reconciliation of this and other non-GAAP to GAAP measures is included in this appendix on slides 18 and 19.

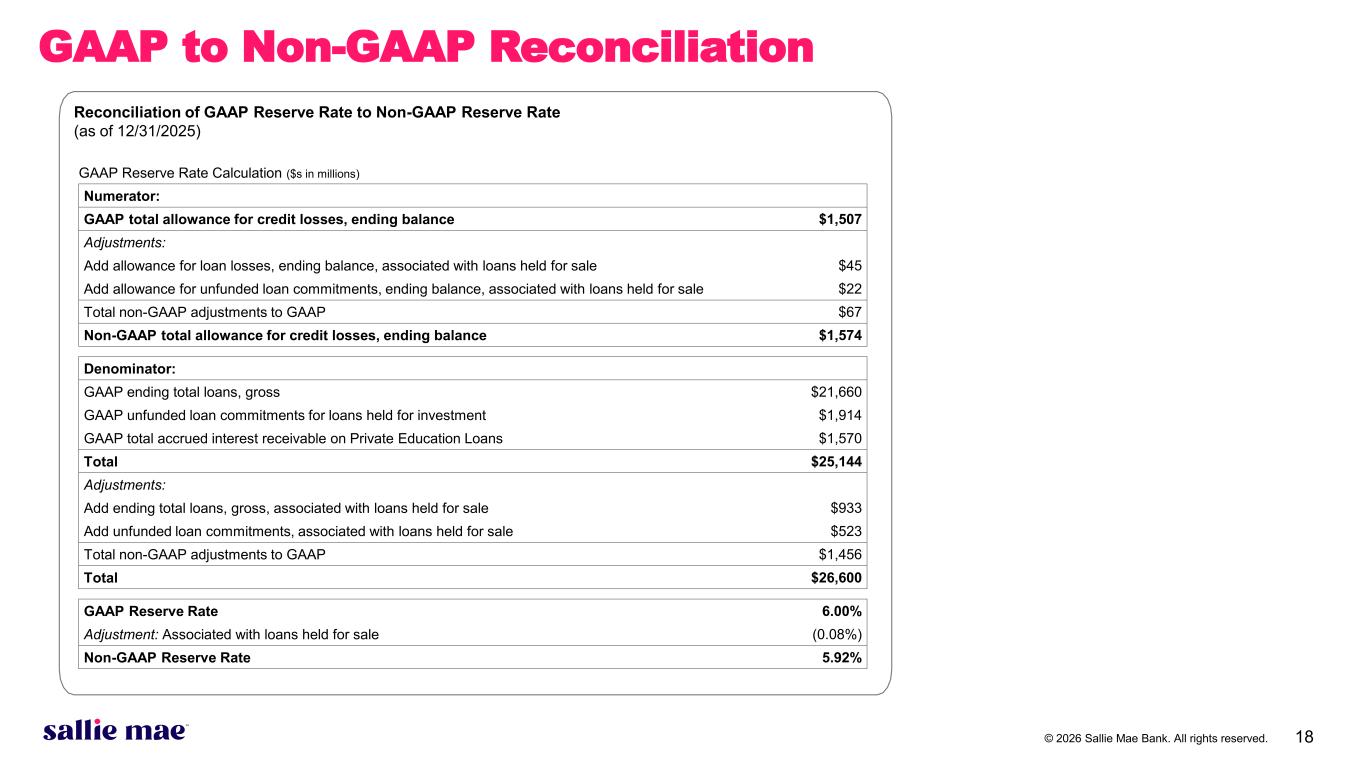

© 2026 Sallie Mae Bank. All rights reserved. 18 GAAP to Non-GAAP Reconciliation GAAP Reserve Rate Calculation ($s in millions) Numerator: GAAP total allowance for credit losses, ending balance $1,507 Adjustments: Add allowance for loan losses, ending balance, associated with loans held for sale $45 Add allowance for unfunded loan commitments, ending balance, associated with loans held for sale $22 Total non-GAAP adjustments to GAAP $67 Non-GAAP total allowance for credit losses, ending balance $1,574 Denominator: GAAP ending total loans, gross $21,660 GAAP unfunded loan commitments for loans held for investment $1,914 GAAP total accrued interest receivable on Private Education Loans $1,570 Total $25,144 Adjustments: Add ending total loans, gross, associated with loans held for sale $933 Add unfunded loan commitments, associated with loans held for sale $523 Total non-GAAP adjustments to GAAP $1,456 Total $26,600 GAAP Reserve Rate 6.00% Adjustment: Associated with loans held for sale (0.08%) Non-GAAP Reserve Rate 5.92% Reconciliation of GAAP Reserve Rate to Non-GAAP Reserve Rate (as of 12/31/2025)

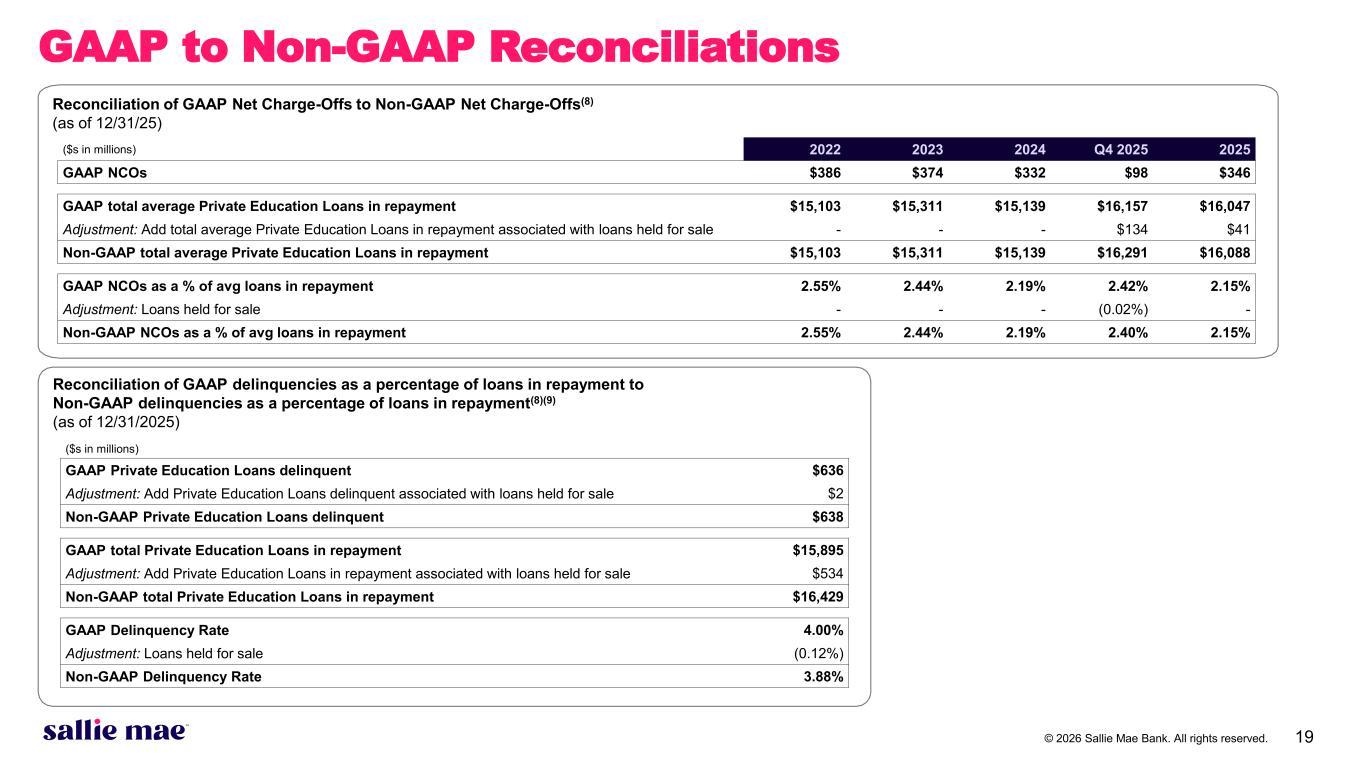

© 2026 Sallie Mae Bank. All rights reserved. 19 GAAP to Non-GAAP Reconciliations ($s in millions) GAAP Private Education Loans delinquent $636 Adjustment: Add Private Education Loans delinquent associated with loans held for sale $2 Non-GAAP Private Education Loans delinquent $638 GAAP total Private Education Loans in repayment $15,895 Adjustment: Add Private Education Loans in repayment associated with loans held for sale $534 Non-GAAP total Private Education Loans in repayment $16,429 GAAP Delinquency Rate 4.00% Adjustment: Loans held for sale (0.12%) Non-GAAP Delinquency Rate 3.88% Reconciliation of GAAP delinquencies as a percentage of loans in repayment to Non-GAAP delinquencies as a percentage of loans in repayment(8)(9) (as of 12/31/2025) ($s in millions) 2022 2023 2024 Q4 2025 2025 GAAP NCOs $386 $374 $332 $98 $346 GAAP total average Private Education Loans in repayment $15,103 $15,311 $15,139 $16,157 $16,047 Adjustment: Add total average Private Education Loans in repayment associated with loans held for sale - - - $134 $41 Non-GAAP total average Private Education Loans in repayment $15,103 $15,311 $15,139 $16,291 $16,088 GAAP NCOs as a % of avg loans in repayment 2.55% 2.44% 2.19% 2.42% 2.15% Adjustment: Loans held for sale - - - (0.02%) - Non-GAAP NCOs as a % of avg loans in repayment 2.55% 2.44% 2.19% 2.40% 2.15% Reconciliation of GAAP Net Charge-Offs to Non-GAAP Net Charge-Offs(8) (as of 12/31/25)

© 2026 Sallie Mae Bank. All rights reserved. 20 1. We calculate the percentage of loans in an extended grace period as the ratio of (a) Private Education Loans in forbearance in an extended grace period numerator to (b) Private Education Loans in repayment and forbearance denominator. An extended grace period aligns with The Office of the Comptroller of the Currency definition of an additional, consecutive, one-time period during which no payment is required for up to six months after the initial grace period. We typically grant this extended grace period to customers who may be having difficulty finding employment before the full principal and interest repayment period starts or once it has begun. 2. We calculate the percentage of loans in hardship and other forbearances as the ratio of (a) Private Education Loans in hardship and other forbearances (excluding loans in an extended grace period) numerator to (b) Private Education Loans in repayment and forbearance denominator. If the customer is in financial hardship, we work with the customer and/or cosigner and identify any available alternative arrangements designed to reduce monthly payment obligations, which may include a short-term hardship forbearance. 3. Originations represent loans that were funded or acquired during the period presented. 4. Represents the higher credit score of the cosigner or the borrower. 5. We calculate and report our Efficiency Ratio as the ratio of (a) total non-interest expenses numerator to (b) the net denominator, which consists of net interest income plus total non- interest income. 6. We calculate and report our Return on Assets (“ROA”) as the ratio of (a) GAAP net income (loss) numerator (annualized) to (b) the GAAP total average assets denominator. 7. We calculate and report our Return on Common Equity (“ROCE”) as the ratio of (a) GAAP net income (loss) attributable to SLM Corporation common stock numerator (annualized) to (b) the net denominator, which consists of GAAP total average equity less total average preferred stock. 8. For purposes of this slide, loans in repayment include loans making interest only or fixed payments, as well as loans that have entered full principal and interest repayment status after any applicable grace period (but do not include those loans while they are in forbearance). 9. The period of delinquency is based on the number of days scheduled payments are contractually past due. 10. For purposes of this slide, loans in forbearance include loans for customers who have requested extension of grace period generally during employment transition or who have temporarily ceased making full payments due to hardship or other factors, consistent with established loan program servicing policies and procedures. Footnotes