BASE LISTING PARTICULARS

14 March 2025

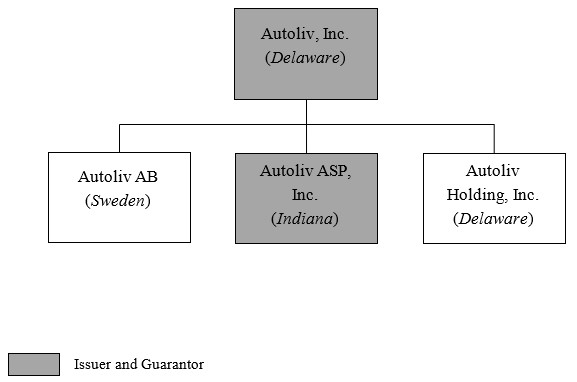

AUTOLIV, INC.

(incorporated as a company with limited liability in the State of Delaware, U.S.A.)

EUR 3,000,000,000

Guaranteed Euro Medium Term Note Programme

Guaranteed by

AUTOLIV ASP, INC.

(incorporated as a company with limited liability in the State of Indiana, U.S.A.)

Under the Guaranteed Euro Medium Term Note Programme (the “Programme”) described in this base listing particulars (the “Base Listing Particulars”), Autoliv, Inc. (the “Issuer” or “Autoliv”), subject to compliance with all relevant laws, regulations and directives, may from time to time issue euro medium term notes (the “Notes”) guaranteed by Autoliv ASP, Inc. (the “Guarantor”). The aggregate nominal amount of Notes outstanding under the Programme will not at any time exceed EUR 3,000,000,000 (or the equivalent in other currencies at the time of issue). The Notes may be issued on a continuing basis to one or more of the Dealers specified herein or any other Dealer appointed under the Programme from time to time by the Issuer and the Guarantor (each a “Dealer” and together the “Dealers”), which appointment may be for a specific issue or on an on-going basis. References in this Base Listing Particulars to the “relevant Dealer” shall, in the case of an issue of Notes being (or intended to be) subscribed by more than one Dealer, be to all Dealers agreeing to subscribe such Notes. The Notes will be issued in registered form.

Prospective investors should have regard to the factors described in the section headed “Risk Factors” herein.

This Base Listing Particulars does not constitute a prospectus for the purposes of Article 8 of Regulation (EU) 2017/1129 (as amended, the “EU Prospectus Regulation”) and, accordingly, no offer to the public may be made and no admission to trading may be applied for on any market in the European Economic Area (the “EEA”) or the United Kingdom (the “UK”) designated as a regulated market, for the purposes of the EU Prospectus Regulation or Regulation (EU) 2017/1129 as it forms part of domestic law of the United Kingdom by virtue of the European Union (Withdrawal) Act 2018 (“EUWA”) (the “UK Prospectus Regulation”) (as the case may be). Application has been made to The Irish Stock Exchange plc trading as Euronext Dublin (“Euronext Dublin”) for its approval of this Base Listing Particulars. Application has been made to Euronext Dublin for the Notes issued under the Programme to be admitted to the official list (the “Official List”) and to trading on the Global Exchange Market of Euronext Dublin (the “GEM”) for a period of 12 months from the date of these Base Listing Particulars. The GEM is not a regulated market for the purposes of Directive 2014/65/EU on markets in financial instruments (as amended, “MiFID II”). References in this Base Listing Particulars to Notes being “listed” (and all related references) shall mean that such Notes have been admitted to the Official List and to trading on the GEM. The Programme provides that Notes may be unlisted or listed on such other or further stock exchange(s) as may be agreed between the Issuer and the relevant Dealer and as specified in the applicable pricing supplement (the “Pricing Supplement”). These Base Listing Particulars constitute base listing particulars for the purposes of such application and have been approved by Euronext Dublin.

The Notes and the guarantee of the Notes by the Guarantor (the “Guarantee”) have not been and will not be registered under the United States Securities Act of 1933, as amended (the “Securities Act”) or with any securities regulatory authority of any state or other jurisdiction of the United States. The Notes and the Guarantee are being offered and sold outside the United States to non-U.S. persons (as defined in Regulation S) in offshore transactions in reliance on Regulation S under the Securities Act (“Regulation S”), and may not be offered or sold in the United States or to, or for the account or benefit of, U.S. persons, except pursuant to an exemption from, or in a transaction not subject to, the registration requirements of the Securities Act.

The Issuer has been assigned a long-term debt credit rating of Baa1 by Moody’s Investors Services Limited (“Moody’s”) and BBB+ by Fitch Ratings Limited (“Fitch”), and the Guarantor has been assigned a long-term debt credit rating of BBB+ by Fitch.

Arranger

Morgan Stanley

Dealers

Morgan Stanley |

|

Bank of China |

BNP PARIBAS |

Citigroup |

ING |

J.P. Morgan |

Mizuho |

MUFG |

SEB |

Standard Chartered Bank AG |

Wells Fargo Securities |