Summary of key items that may impact 2026 results

We expect to introduce 2026 guidance on December 3, 2025 at Investor Day. The following is an initial summary of key items

that are expected to impact 2026 results:

•Core operations – Slower demand across the life science sector and increased supply for life science real estate could negatively

impact future occupancy. Additional considerations include the following:

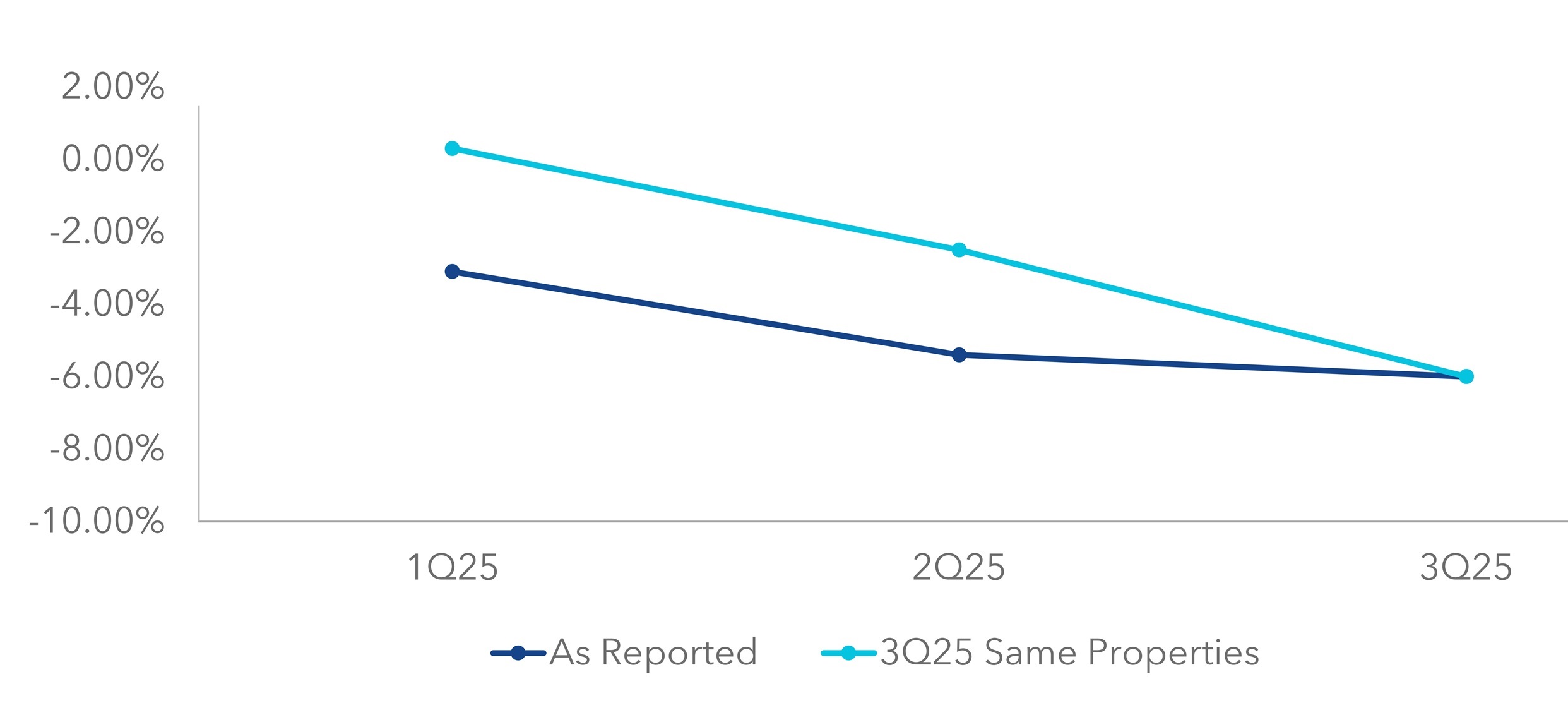

•Same property net operating income decrease for the three months ended September 30, 2025 compared to the three months

ended September 30, 2024 of 6.0% reflects a decline relative to the first half of 2025. Refer to “Same properties” in Item 2 for

additional details.

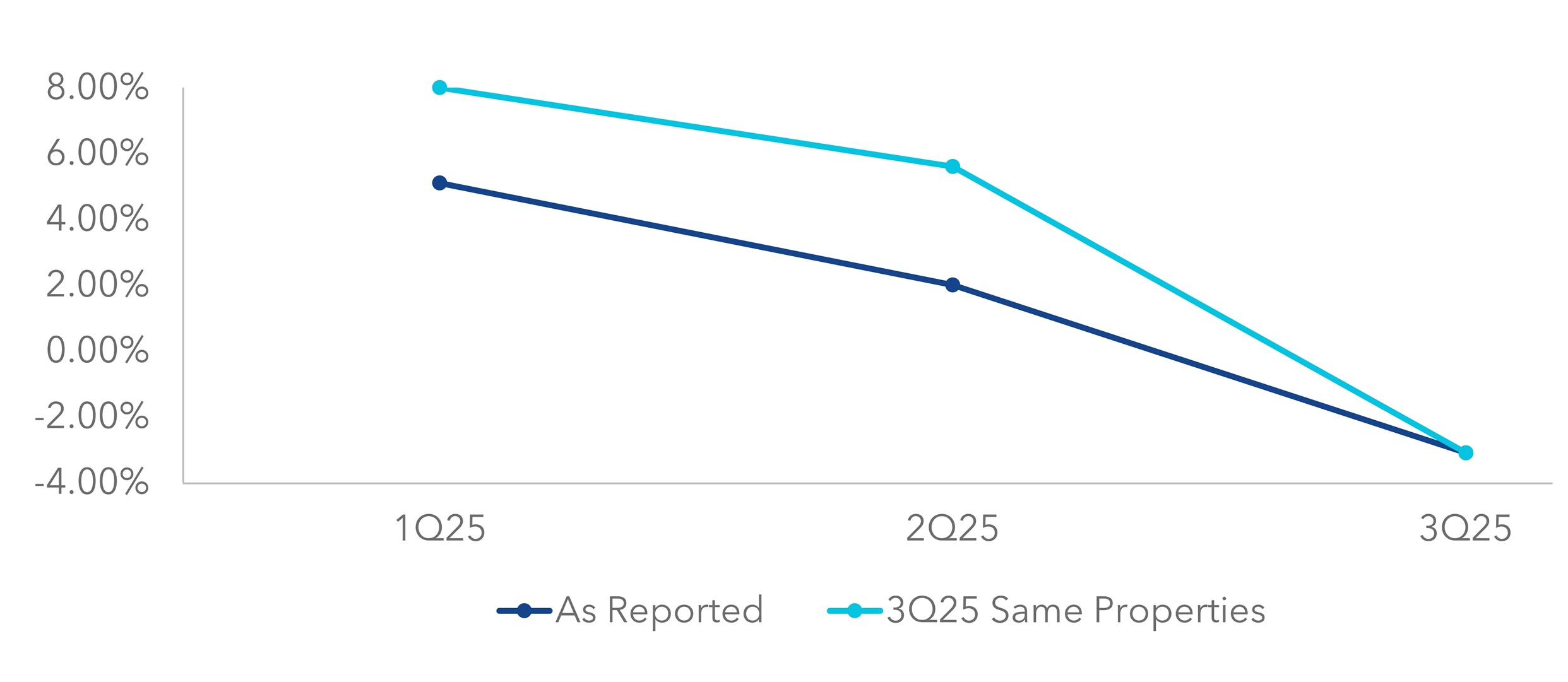

•Operating occupancy has decreased four consecutive quarters from 94.7% as of September 30, 2024 to 90.6% as of

September 30, 2025.

•Before the benefit of excluding assets designated as held for sale which contained vacancy, occupancy during the three

months ended September 30, 2025 declined 1.1% compared to the three months ended June 30, 2025, primarily related to

lease expirations during the third quarter of 2025. These lease expirations resulting in the 1.1% decline in occupancy

previously generated annual rental revenue aggregating approximately $29.0 million and had a weighted-average lease

expiration date at the end of July 2025. We are currently marketing these spaces.

•Our guidance for operating occupancy percentage in North America as of December 31, 2025 assumes an approximate 1%

benefit related to a range of assets with vacancy that could potentially qualify for designation as held for sale by December 31,

2025, but that have not yet qualified as of September 30, 2025. After considering this potential adjustment, the midpoint of our

guidance range for occupancy as of December 31, 2025 implies an 80 bps decline in operating occupancy percentage during

the fourth quarter of 2025.

•There are key lease expirations primarily located in the Greater Boston, San Francisco Bay Area, and San Diego markets

aggregating 1.2 million RSF with a weighted-average lease expiration date of March 19, 2026 and annual rental revenue

aggregating $81 million, which are expected to become vacant upon lease expiration. We expect downtime on these spaces

ranging from 6 to 24 months on a weighted-average basis. Refer to “Summary of contractual lease expirations” in Item 2 for

additional details.

•Capitalized interest – There is approximately $4.2 billion of average real estate basis capitalized during the nine months ended

September 30, 2025, related to future pipeline projects undergoing critical pre-construction activities, including various phases of

entitlement, design, site work, and other activities necessary to begin aboveground vertical construction. We expect these projects

to reach anticipated pre-construction milestones on April 14, 2026, on a weighted-average real estate investment basis. We will

evaluate, on an asset-by-asset basis, whether to (i) proceed with additional pre-construction and/or construction activities based on

leasing demand and/or market conditions, (ii) pause future investments, or (iii) consider the potential dispositions of these real

estate assets. If we cease activities necessary to prepare a project for its intended use, costs related to such project, including

interest, payroll, property taxes, insurance, and other costs directly related and essential to the construction of Class A/A+

properties, will be expensed as incurred. Refer to “Average real estate basis used for capitalization of interest” in Item 2 for

additional details.

•Realized gains on non-real estate investments – The midpoint of our revised guidance range for 2025 realized gains on non-real

estate investments assumes approximately $15 million for the fourth quarter of 2025, compared to the quarterly average realized

gains of approximately $32 million per quarter for the nine months ended September 30, 2025. Refer to “Note 7 – Investments” to

our unaudited consolidated financial statements in Item 1 for additional details.

•General and administrative expenses – Over the past several years, we have implemented comprehensive measures to reduce our

expenditures across our organization, including our general and administrative expenses. These initiatives are expected to

generate a reduction in general and administrative expenses of approximately $49 million, or 29%, during the year ending

December 31, 2025 (at the midpoint of our 2025 guidance range) compared to the year ended December 31, 2024. Given that

some of these costs savings are expected to be temporary in nature, we anticipate approximately half of the cost reductions

expected to be achieved in 2025 will continue in 2026.

•Dispositions and equity-type capital

•As of October 27, 2025, our share of pending dispositions subject to non-refundable deposits, signed letters of intent, and/or

purchase and sale agreement negotiations aggregated $1.0 billion. We expect these dispositions to close in late fourth quarter

of 2025; therefore, the corresponding reduction in EBITDA is expected to impact the first quarter of 2026. Refer to

“Dispositions and sale of partial interests” in Item 2 for additional details.

•We expect construction spending in 2026 to be similar or slightly higher than the $1.75 billion midpoint of our guidance range

for 2025 construction in order to complete our active construction projects and significant revenue- and non-revenue-

enhancing capital expenditures necessary to lease vacant space. Given the factors previously described that could negatively

impact EBITDA, we may require significant equity-type capital to manage our leverage profile.

•We expect a significant source of funding to come from the sale of non-core assets in 2026. We anticipate an end to our large-

scale non-core asset sales program in 2026 or early 2027. As of September 30, 2025, 77% of our annual rental revenue is

from our Megacampus™ platform, and we expect this percentage to continue to grow over time.

•Dividends and net cash provided by operating activities after dividends

•From 2013 to 2025, dividends per share and funds from operations per share, as adjusted have been highly correlated, with

cumulative increases of 102% and 105%, respectively.

•The factors previously described could lead to a reduction in funds from operations per share, as adjusted and net cash

provided by operating activities. At the current dividend rate, the amount of net cash provided by operating activities after

payment of dividends available to recycle and address our 2026 capital needs could be reduced. As a result, we expect our

Board of Directors to carefully evaluate our 2026 dividend strategy.