Filed by the Registrant | ☒ | |

Filed by a Party other than the Registrant | ☐ |

☐ | Preliminary Proxy Statement | |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

☒ | Definitive Proxy Statement | |

☐ | Definitive Additional Materials | |

☐ | Soliciting Material under §240.14a-12 |

☒ | No fee required | |

☐ | Fee paid previously with preliminary materials | |

☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

MISSION |

We deliver energy products and services vital to an advancing world. |

VISION |

To create exceptional value for our stakeholders by providing solutions for a transforming energy future. |

CORE VALUES |

| SAFETY AND ENVIRONMENTAL |  | EXCELLENCE |

We commit to a zero-incident culture for the well-being of our employees, contractors and communities and to operate in an environmentally responsible manner. | We hold ourselves and others accountable to a standard of excellence through continuous improvement and teamwork. | ||

| ETHICS |  | SERVICE |

We act with honesty, integrity and adherence to the highest standards of personal and professional conduct. | We invest our time, effort and resources to serve each other, our customers and communities. | ||

| INCLUSION AND DIVERSITY |  | INNOVATION |

We respect the uniqueness and worth of each individual, and we believe that an inclusive and diverse workforce is essential for a sense of belonging, engagement and performance. | We seek to develop creative solutions by leveraging collaboration through ingenuity and technology. |

DEAR SHAREHOLDER |

|

|  Julie H. Edwards Board Chair |

2025 ONEOK, Inc. Proxy Statement | 3 |

NOTICE OF 2025 ANNUAL MEETING OF SHAREHOLDERS |

|

1 | To consider and vote on the election of the ten director nominees named in the accompanying proxy statement to serve on our Board of Directors. |  | FOR |

2 | To consider and vote on the ratification of the selection of PricewaterhouseCoopers LLP as the independent registered public accounting firm of ONEOK, Inc., for the year ending December 31, 2025. |  | FOR |

3 | To consider and vote to approve the ONEOK, Inc. 2025 Equity Incentive Plan. |  | FOR |

4 | To consider and vote to approve the ONEOK, Inc. 2025 Employee Stock Award Program. |  | FOR |

5 | To consider and vote on our executive compensation on a non-binding, advisory basis. |  | FOR |

6 | To consider and vote on such other business as may come properly before the meeting or any adjournment or postponement of the meeting. | |

TIME AND DATE May 21, 2025 9:00 a.m. Central Daylight Time |

VIRTUAL MEETING Register online at www.proxydocs.com/oke |

RECORD DATE March 24, 2025 Only shareholders of record at the close of business on the record date are entitled to receive notice of, and to vote at, the annual meeting. |

|

Important Notice Regarding Internet Availability of Proxy Materials for the Shareholder Meeting to be held on May 21, 2025. This notice of annual meeting, proxy statement, form of proxy, and our 2024 annual report to shareholders are being distributed and made available on or about April 2, 2025. This proxy statement and our 2024 annual report to shareholders are also available on our website at www.oneok.com. Additionally, you may access this proxy statement and our 2024 annual report at www.proxydocs.com/oke. |

4 | 2025 ONEOK, Inc. Proxy Statement |

TABLE OF CONTENTS |

|

| ||

| ||

2025 ONEOK, Inc. Proxy Statement | 5 |

| ||

| ||

| ||

6 | 2025 ONEOK, Inc. Proxy Statement |

SAFE HARBOR FOR FORWARD-LOOKING STATEMENTS |

|

WEB LINKS |

|

2025 ONEOK, Inc. Proxy Statement | 7 |

SUMMARY PROXY INFORMATION |

|

8 | 2025 ONEOK, Inc. Proxy Statement |

ONEOK BUSINESS LINES 2022 | KEY ACQUISITIONS(a) | ||

| Natural Gas Gathering and Processing | ||

| Natural Gas Pipelines | Transportation Storage | |

Transportation Fractionation Storage | |||

| Natural Gas Liquids | ||

ONEOK BUSINESS LINES 2025 | ||

| Natural Gas Gathering and Processing | |

| Natural Gas Pipelines | Transportation Storage |

Transportation Fractionation Storage | ||

| Natural Gas Liquids | |

| Refined Products | Transportation Storage |

Gathering Transportation Storage | ||

| Crude Oil | |

Refined Products Crude Oil LPG (early 2028) | ||

| Export Terminals | |

2025 ONEOK, Inc. Proxy Statement | 9 |

10 | 2025 ONEOK, Inc. Proxy Statement |

ONEOK, Inc. | S&P 500 Index | ONEOK Inc. Peer Group(1) | |||

2025 ONEOK, Inc. Proxy Statement | 11 |

|

•A commitment to regular board refreshment while also valuing diversity of backgrounds and perspectives: •Our Corporate Governance Committee and Board are continuously and actively engaged in board recruitment activities, with such topic being discussed at 17 committee or Board meetings since February 2022. •Attributes important in consideration of potential director candidates include, among others, leadership/chief executive officer experience, board or related energy industry knowledge, and transformational thinking. •Board recruitment activities include, but are not limited to, collecting and reviewing names and biographical information of numerous potential director candidates, eliminating many due to obvious conflicts and other factors, and prioritizing the remaining potential director candidates. •In 2025, our Board requested management to provide it more frequent updates on: Matters of Security •Cybersecurity •Resiliency measures •Physical security, including disaster preparedness •Crisis management •Disaster recovery Matters of Sustainability •Artificial intelligence •Energy transformation and alternative solutions •Environmental compliance •Health and safety •Corporate Sustainability Report |

12 | 2025 ONEOK, Inc. Proxy Statement |

| RISK OVERSIGHT BY THE BOARD, including regular engagement with and updates by our CEO, executive management and others and a comprehensive annual Enterprise Risk Management (“ERM”) process that encompasses the identification and assessment of a broad range of risks and the development of plans to mitigate these risks. Such risks generally relate to strategic, operational, financial, regulatory compliance, climate-related considerations, ESG, cybersecurity and human capital management aspects of our business. •With the increasing focus on climate-related disclosures, and as part of its oversight responsibilities, our Board sought and received additional updates on this topic from executive management. •As a result, at all 2024 regular in-person Board meetings, and at some telephonic meetings, the Board received updates on climate-related disclosures. Such practice is expected to continue in 2025. •Cybersecurity risks are communicated and discussed with our Board at least annually in conjunction with our overall ERM program. Our Internal Audit group provides periodic updates to our Audit Committee on testing completed to meet the Transportation Security Administration ("TSA") requirements. As part of its oversight responsibilities, our Board also receives frequent updates from executive management on our company’s physical and cybersecurity efforts. |

| ESG OVERSIGHT BY THE BOARD, including regular engagement with and updates by our CEO, executive management and others. •Regular updates to the Board on sustainability, including safety and health, ESG performance, community leadership and investment, and oversight of public policy engagement. •Our Board conducts a biannual examination of the company’s ESG practices, performance, risks and opportunities. Such examinations have been incorporated into the company's Audit Committee Charter, as amended and restated February 21, 2024, and are scheduled to take place at the Board’s February and August meetings. •In 2024, these examinations covered topics such as environmental, safety and health performance, mechanical integrity, process safety, integration and continuous improvement plans, greenhouse gas (“GHG”) emission trends, GHG emissions reduction performance, new regulatory requirements, ESG-related shareholder engagements, ESG performance, risks and opportunities. |

| HUMAN CAPITAL MANAGEMENT OVERSIGHT BY THE BOARD, including regular engagement with and updates by our CEO, executive management and others. •Our Board conducts a biannual examination of the company’s human capital management practices, performance, risks and opportunities. Such examinations have been incorporated into the company's Executive Compensation Committee (the “Committee”) Charter, as amended and restated February 21, 2024, and are scheduled to take place at the Board’s February and August meetings. •In 2024, these examinations covered topics such as workforce inclusion, people, culture, talent recruitment, integration, engagement, development, succession, employee benefits, business resource groups, community, awards and recognition. |

| OVERSIGHT OF OUR LOBBYING AND POLITICAL ACTIVITIES is conducted by our Board and the Corporate Governance Committee. We believe this oversight process facilitates accountability and transparency concerning our lobbying and political activities. •As a company, we generally do not make corporate contributions to (i) political candidates, parties, committees or campaigns, or (ii) 501(c)(4) organizations formed for political purposes. We have made such contributions in the past, but they were very infrequent and for immaterial amounts. We have no intention of making such contributions in the future, and any decision to do so would be subject to review by the Corporate Governance Committee. |

2025 ONEOK, Inc. Proxy Statement | 13 |

|  | |

WHAT WE DO | WHAT WE DON’T DO | |

Compensation Program Continuity — Our shareholders have provided strong support  for our compensation program over the years. The components of our executive compensation program have remained substantially the same for several years. We believe our program is designed appropriately, is well aligned with the interests of our shareholders and is key to achieving our business goals. We periodically evaluate the effectiveness of our program and its alignment with our business strategy. Independent Committee Determination — Our Executive Compensation Committee,  composed solely of independent directors, makes all compensation recommendations regarding each named executive officer ("NEO"). These recommendations are then submitted to the Board for its consideration and approval. Prudent Risk Management — The Committee designs compensation programs and  sets compensation targets intended to discourage excessive risk-taking. Pay-for-Performance — A significant portion of the compensation for our named  executive officers is in the form of at-risk, variable compensation based on company and individual performance, with a focus on creating long-term shareholder value. Competitive Compensation — In order to attract and retain qualified executives, our  compensation programs provide a competitive overall total rewards opportunity. Multiple Performance Metrics — Variable compensation is based on more than one  measure to encourage balanced incentives. Awards Are Capped — All of our variable compensation plans have caps on payouts.  Retention-Based Incentives — A significant portion of total compensation is subject to  multi-year vesting requirements. Share-Ownership Guidelines — We have market competitive share-ownership  guidelines for our directors and officers. “Clawback” Provisions — We have adopted a clawback policy in compliance with Rule  10D-1 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) and the corresponding NYSE listing standards that require recovery of erroneously awarded compensation. In addition to the mandatory clawback provisions, our clawback policy permits the discretionary recovery of incentive-based cash and any equity compensation in the event of fraud, negligence or intentional misconduct that directly or indirectly results in a material restatement of all or a portion of our financial statements. Tally Sheets — The Committee reviews total compensation tally sheets at least annually  as part of making individual compensation decisions. Independent Consultant — The Committee engages a compensation consultant that is  independent under the Securities and Exchange Commission rules and NYSE listing standards to provide advice and expertise on the design and implementation of our executive and director compensation programs. “Double Trigger” Vesting of Equity Awards in a Change in Control — Under our  2018 EIP, a change in control will not automatically trigger vesting of outstanding equity awards unless the acquirer does not assume or replace the outstanding awards. Rather, participants must experience a termination of employment without cause or resign for good reason within two years following a change in control for an award to vest. | Individual Employment Agreements —  We do not enter into individual employment agreements with our named executive officers. No Hedging of Company Stock —  Our securities/insider trading policy prohibits insiders, including our named executive officers, from engaging in hedging activities with respect to our stock. No Pledging of Company Stock —  Our officers and directors may not hold our securities in a margin account or pledge our securities as collateral for a loan, subject to an exception that may be granted by our chief executive officer for loans (not margin accounts) that can be repaid without resorting to the pledged securities. No Tax Gross-ups — We do not provide tax  gross-ups for change in control benefits. No Significant Perquisites — Our executive  officers, including the named executive officers, receive no recurring significant perquisites or other personal benefits. |

14 | 2025 ONEOK, Inc. Proxy Statement |

In designing our 2024 executive compensation program, our Executive Compensation Committee considered, among other factors, the strong shareholder approval at our 2024 annual meeting in favor (95.4% of the shares voted, including abstentions) of our 2023 executive compensation program and our executive pay practices. In view of this high level of shareholder support, the Executive Compensation Committee determined that no changes to the components of our executive compensation program were necessary in 2024. Our shareholders have provided consistently strong support for our compensation program since the inception of the say-on-pay advisory shareholder vote. |  |

95.4% SAY-ON-PAY 2024 ANNUAL MEETING APPROVAL | |

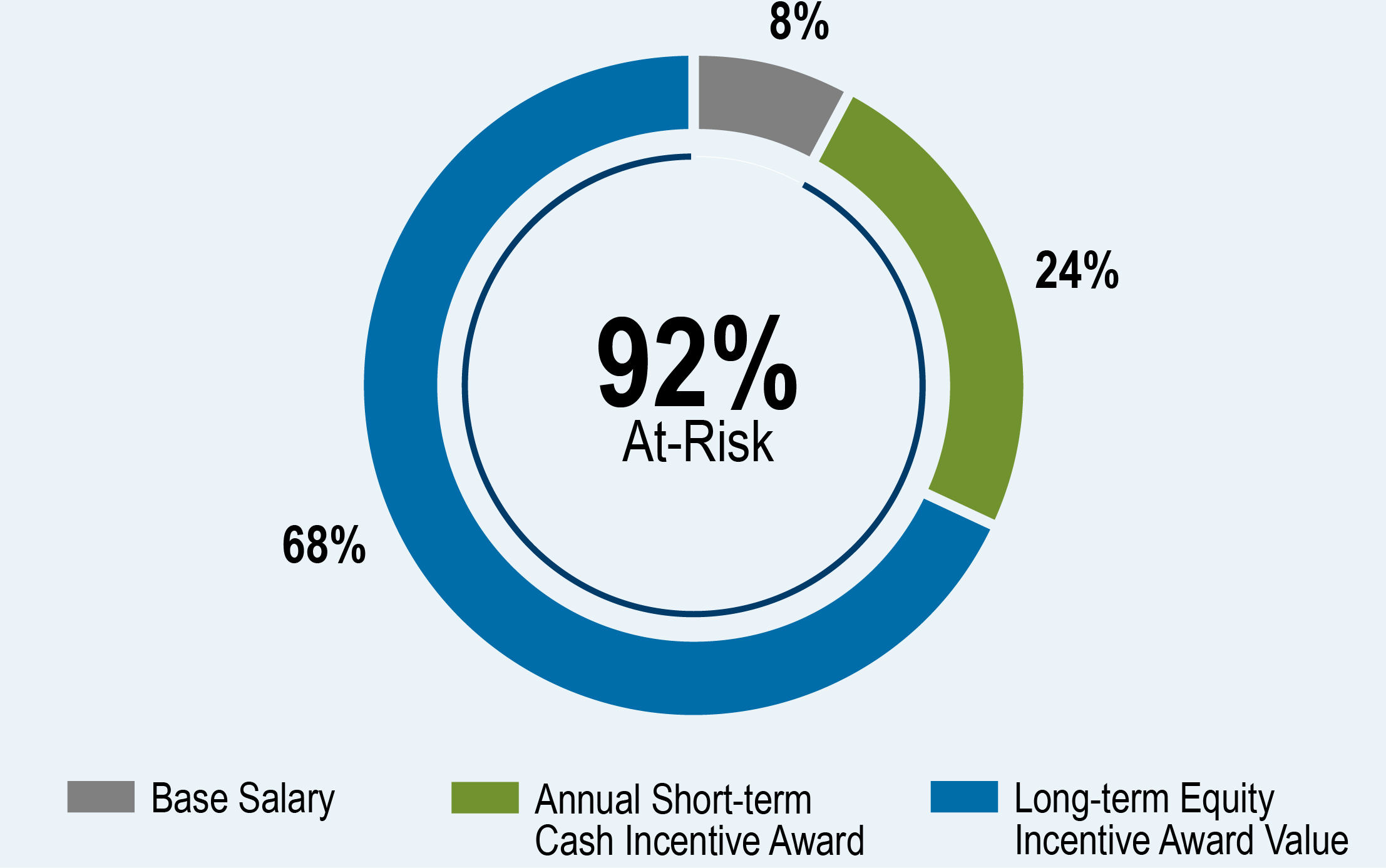

Our Board, upon the recommendation of our Executive Compensation Committee, awarded Mr. Norton incentive compensation for 2024 as our President and Chief Executive Officer, including payment of an annual short-term cash incentive award of $2,800,700 in recognition of his performance and leadership during the year and the grant of a long-term equity incentive award with a grant date target value of $8.0 million. Consistent with our executive compensation philosophy, a majority of Mr. Norton’s total direct compensation of approximately $11.7 million for 2024 was incentive-based and at-risk, as illustrated by the chart on the right. (For more | 2024 CEO COMPENSATION  |

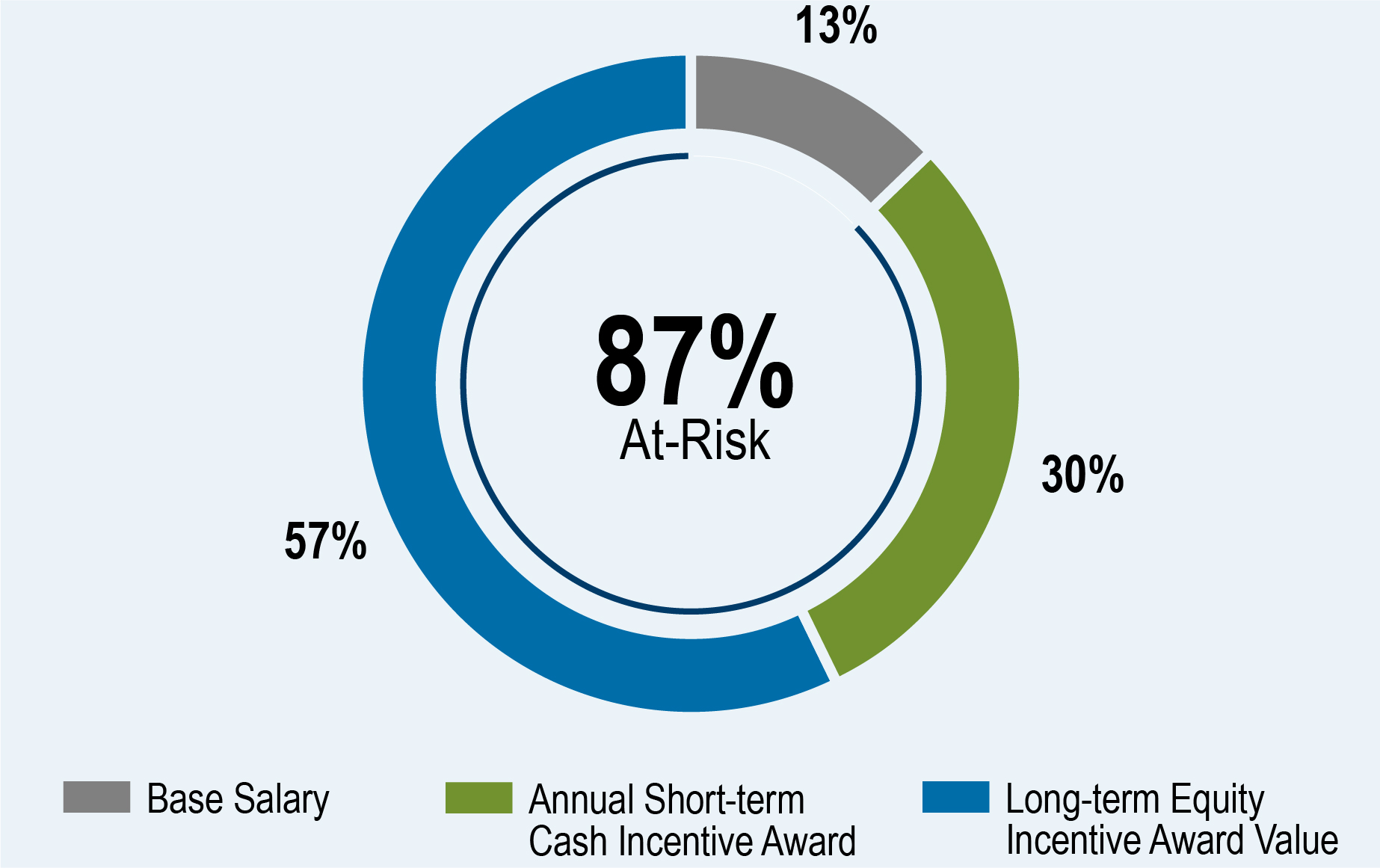

AVERAGE PAY MIX – OTHER NAMED EXECUTIVE OFFICERS  | |

2025 ONEOK, Inc. Proxy Statement | 15 |

Election Of Directors You will find in this proxy statement important information about the qualifications and experience of the ten director nominees, each of whom is a current director. The Corporate Governance Committee performs an annual assessment of the performance of the Board to ensure that our directors have the skills and experience to effectively oversee our company. All of our directors have proven leadership, sound judgment, integrity and a commitment to the success of our company. | ||||||

| Our Board recommends that shareholders VOTE IN FAVOR of each nominee for election. | |||||

Ratification of Our Independent Auditor You will also find in this proxy statement important information about our independent auditor, PricewaterhouseCoopers LLP. We believe PricewaterhouseCoopers LLP continues to provide high-quality service to our company. | ||||||

| Our Board recommends that shareholders VOTE IN FAVOR of ratification. | |||||

Approval of the ONEOK, Inc. 2025 Equity Incentive Plan We are seeking approval of the ONEOK, Inc. 2025 Equity Incentive Plan. | ||||||

| Our Board recommends that shareholders VOTE IN FAVOR of the approval of the ONEOK, Inc. 2025 Equity Incentive Plan. | |||||

Approval of the ONEOK, Inc. 2025 Employee Stock Award Program We are seeking approval of the ONEOK, Inc. 2025 Employee Stock Award Program. | ||||||

| Our Board recommends that shareholders VOTE IN FAVOR of the approval of the ONEOK, Inc. 2025 Employee Stock Award Program. | |||||

16 | 2025 ONEOK, Inc. Proxy Statement |

Advisory Vote on Executive Compensation Our shareholders have the opportunity to cast a non-binding, advisory vote on our executive compensation program. As recommended by our shareholders at our 2023 annual meeting, we provide our shareholders with an annual opportunity to vote on executive compensation. Shareholders holding 95.4% of our shares that were voted on our executive compensation program, including abstentions, at our 2024 annual meeting supported the design and practices of our executive compensation program. In evaluating this “say-on-pay” proposal, we recommend that you review our Compensation Discussion and Analysis in this proxy statement (beginning on page 73), which explains how and why the Executive Compensation Committee made its 2024 executive compensation decisions. | ||||||

| Our Board recommends that shareholders VOTE IN FAVOR of our executive compensation program. | |||||

Proposal | How does the Board recommend that shareholders vote? | Votes required for approval when quorum is present | Abstentions | Broker non-votes |

1.Election of Directors | The Board recommends that you vote FOR each nominee for election. | Majority of the votes cast by shareholders present online or by proxy and entitled to vote | Do not count as votes cast and have no effect on the outcome of the vote | Do not count as votes cast and have no effect on the outcome of the vote |

2.Ratification of our Independent Auditor | The Board recommends that you vote FOR the ratification of PricewaterhouseCoopers LLP as our independent registered public accounting firm for 2025. | Majority of the voting power of shareholders present online or by proxy and entitled to vote | Have the same effect as votes against this proposal | There are no broker non-votes on the auditor proposal because it is a routine item. Shares not voted in the discretion of a brokerage firm or similar person have the same effect as votes against this proposal |

3.Vote to approve the ONEOK, Inc. 2025 Equity Incentive Plan | The Board recommends that you vote FOR the approval of the ONEOK, Inc. 2025 Equity Incentive Plan. | Majority of the voting power of shareholders present online or by proxy and entitled to vote | Have the same effect as votes against this proposal | Do not count as shares entitled to vote and have no effect on the outcome of the vote |

4.Vote to approve the ONEOK, Inc. 2025 Employee Stock Award Program | The Board recommends that you vote FOR the approval of the ONEOK, Inc. 2025 Employee Stock Award Program. | Majority of the voting power of shareholders present online or by proxy and entitled to vote | Have the same effect as votes against this proposal | Do not count as shares entitled to vote and have no effect on the outcome of the vote |

5.Advisory Vote on Executive Compensation | The Board recommends that you vote FOR the approval, on an advisory basis, of the company’s executive compensation program. | Majority of the voting power of shareholders present online or by proxy and entitled to vote | Have the same effect as votes against this proposal | Do not count as shares entitled to vote and have no effect on the outcome of the vote |

2025 ONEOK, Inc. Proxy Statement | 17 |

ABOUT THE 2025 ANNUAL MEETING |

|

18 | 2025 ONEOK, Inc. Proxy Statement |

2025 ONEOK, Inc. Proxy Statement | 19 |

| Via the Internet •Go to the website at www.proxypush.com/oke, which is available 24 hours a day, seven days a week, until 11:59 p.m. Central Daylight Time on May 20, 2025. •Enter the control number that appears on your proxy card. This process is designed to verify that you are a shareholder and allows you to vote your shares and confirm that your instructions have been properly recorded. •Follow the simple instructions. •If you appoint a proxy via the internet, you do not have to return your proxy card. |

| By Telephone •On a touch-tone telephone, call toll-free 1-866-883-3382, 24 hours a day, seven days a week, until 11:59 p.m. Central Daylight Time on May 20, 2025. •Enter the control number that appears on your proxy card. This process is designed to verify that you are a shareholder and allows you to vote your shares and confirm that your instructions have been properly recorded. •Follow the simple recorded instructions. •If you appoint a proxy by telephone, you do not have to return your proxy card. |

| By Mail •Mark your selections on the proxy card. •Date and sign your name exactly as it appears on your proxy card. •Mail the proxy card in the enclosed postage-paid envelope. •If mailed, your completed and signed proxy card must be received prior to the commencement of voting at the annual meeting. |

20 | 2025 ONEOK, Inc. Proxy Statement |

2025 ONEOK, Inc. Proxy Statement | 21 |

22 | 2025 ONEOK, Inc. Proxy Statement |

2025 ONEOK, Inc. Proxy Statement | 23 |

OUTSTANDING STOCK AND VOTING |

|

24 | 2025 ONEOK, Inc. Proxy Statement |

2025 ONEOK, Inc. Proxy Statement | 25 |

26 | 2025 ONEOK, Inc. Proxy Statement |

GOVERNANCE OF THE COMPANY |

|

2025 ONEOK, Inc. Proxy Statement | 27 |

28 | 2025 ONEOK, Inc. Proxy Statement |

2025 ONEOK, Inc. Proxy Statement | 29 |

30 | 2025 ONEOK, Inc. Proxy Statement |

2025 ONEOK, Inc. Proxy Statement | 31 |

32 | 2025 ONEOK, Inc. Proxy Statement |

2025 ONEOK, Inc. Proxy Statement | 33 |

AUDIT COMMITTEE RESPONSIBILITIES | |||

NUMBER OF MEETINGS IN 2024: 5 | 2024 COMMITTEE MEMBERS: | ||

Brian L. Derksen (Chair) Lori. A. Gobillot | Mark W. Helderman Wayne T. Smith | ||

The primary responsibilities of the Audit Committee include, without limitation: •Appointing, compensating, retaining and overseeing our independent auditor, including review of their qualifications, independence and performance; •Reviewing the scope, plans and results relating to external audits of our financial statements and our internal control over financial reporting; •Reviewing the internal audit function, its performance, the adequacy of its resources and the areas of internal audit emphasis; •Monitoring and evaluating our financial condition; •Monitoring and evaluating the integrity of our financial reporting processes and procedures; •Assessing our significant financial risks and exposures and evaluating the adequacy of our internal controls in connection with such risks and exposures, including, but not limited to, internal control over financial reporting and disclosure controls and procedures; •Reviewing policies and procedures on risk-control assessment and accounting risk exposure, including our companywide risk control activities; •Periodically reviewing significant (as determined by the Audit Committee) transactions between the company or any of its direct or indirect subsidiaries and any related party; •Establishing procedures for the receipt, retention and treatment of complaints received by the company regarding accounting, internal accounting controls and auditing matters, and for the confidential, anonymous submission to the Audit Committee by the company’s employees of concerns regarding questionable accounting or auditing matters; •Reviewing our computerized information systems, applications and related controls and our tax planning efforts, taxing authority developments, pending audits and the adequacy of tax reserves; •Monitoring our compliance with our policies on ethical business conduct; and •Reviewing the company’s ESG practices, performance, risks and opportunities. | |||

34 | 2025 ONEOK, Inc. Proxy Statement |

EXECUTIVE COMPENSATION COMMITTEE RESPONSIBILITIES | |||

NUMBER OF MEETINGS IN 2024: 5 | 2024 COMMITTEE MEMBERS: | ||

Eduardo A. Rodriguez (Chair) Randall J. Larson | Pattye L. Moore Gerald B. Smith | ||

The primary responsibilities of the Executive Compensation Committee include, without limitation: •Evaluating, in consultation with our Corporate Governance Committee, the performance of our chief executive officer, and recommending to our Board the compensation of our chief executive officer and other executive officers; •Reviewing and approving, in consultation with our Corporate Governance Committee, the annual objectives of our chief executive officer; •Reviewing our executive compensation program to support the attraction, retention and appropriate compensation of executive officers in order to motivate their performance in the achievement of our business objectives and to align their interests with the long-term interests of our shareholders; •Assessing the risks associated with our compensation program; •Reviewing and making recommendations to the Board on executive officer and director compensation and personnel policies, programs and plans; and •Reviewing the company’s management of human capital. | |||

2025 ONEOK, Inc. Proxy Statement | 35 |

CORPORATE GOVERNANCE COMMITTEE RESPONSIBILITIES | |||

NUMBER OF MEETINGS IN 2024: 3 | 2024 COMMITTEE MEMBERS: | ||

Randall J. Larson (Chair) Brian L. Derksen Lori A. Gobillot | Mark W. Helderman Pattye L. Moore Eduardo A. Rodriguez | Gerald B. Smith Wayne T. Smith | |

The primary responsibilities of the Corporate Governance Committee include, without limitation: •Identifying and recommending qualified director candidates, including qualified director candidates suggested by our shareholders in written submissions to our corporate secretary in accordance with our Corporate Governance Guidelines, our By-laws and the rules of the Securities and Exchange Commission; •Making recommendations to the Board with respect to electing directors and filling vacancies on the Board; •Adopting an effective process for director selection and tenure by making recommendations on the Board’s organization and practices and by aiding in identifying and recruiting director candidates; •Reviewing and making recommendations to the Board with respect to the organization, structure, size, composition and operation of the Board and its committees; •In consultation with our Board Chair, our chief executive officer and the Executive Compensation Committee, overseeing management succession and development; •Reviewing, assessing risk and making recommendations with respect to other corporate governance matters; and •Reviewing the company’s legislative affairs and political activities. | |||

36 | 2025 ONEOK, Inc. Proxy Statement |

2025 ONEOK, Inc. Proxy Statement | 37 |

Cash Retainer(1) | Stock Retainer(2) | Committee Chair Cash Retainers | Board Chair Cash Retainer | Lead Director Cash Retainer | ||||||||||||

May 2024 through April 2025 | $110,000 | $170,000 | Audit | $25,000 | $185,000 | $25,000 | ||||||||||

Executive Compensation | $20,000 | |||||||||||||||

Corporate Governance | $20,000 | |||||||||||||||

Cash Retainer(1) | Stock Retainer(2) | Committee Chair Cash Retainers | Board Chair Cash Retainer | Lead Director Cash Retainer | ||||||||||||

May 2023 through April 2024 | $100,000 | $150,000 | Audit | $25,000 | $165,000 | $25,000 | ||||||||||

Executive Compensation | $20,000 | |||||||||||||||

Corporate Governance | $20,000 | |||||||||||||||

38 | 2025 ONEOK, Inc. Proxy Statement |

Director | Fees Earned or Paid in Cash(1) | Stock Awards(1),(2),(3) | Change in Pension Value and Nonqualified Deferred Compensation Earnings(4) | All Other Compensation(5) | Total | |||||||

Brian L. Derksen | $135,000 | $170,000 | $— | $5,000 | $310,000 | |||||||

Julie H. Edwards | $295,000 | $170,000 | $353 | $1,000 | $466,353 | |||||||

Lori A. Gobillot | $110,000 | $170,000 | $— | $1,000 | $281,000 | |||||||

Mark W. Helderman | $110,000 | $170,000 | $— | $1,000 | $281,000 | |||||||

Randall J. Larson | $130,000 | $170,000 | $— | $1,000 | $301,000 | |||||||

Steven J. Malcolm(6) | $33,333 | $— | $— | $22,500 | $55,833 | |||||||

Jim W. Mogg(6) | $20,000 | $— | $706 | $15,000 | $35,706 | |||||||

Pattye L. Moore | $110,000 | $170,000 | $242 | $11,000 | $291,242 | |||||||

Eduardo A. Rodriguez | $130,000 | $170,000 | $— | $4,500 | $304,500 | |||||||

Gerald B. Smith | $110,000 | $170,000 | $— | $23,500 | $303,500 | |||||||

Wayne T. Smith | $110,000 | $170,000 | $— | $11,000 | $291,000 | |||||||

Director | Board Fees Deferred to Phantom Stock in 2024(a) | Dividends Earned on Phantom Stock and Reinvested in 2024(b) | Total Phantom Stock Held at December 31, 2024 | Board Fees Deferred to Cash in 2024(c) | Total Board Fees Deferred to Cash at December 31, 2024 | |||||||||

Brian L. Derksen | $170,000 | $131,009 | 35,043 | $— | $— | |||||||||

Julie H. Edwards | $— | $16,751 | 4,346 | $1,537 | $27,697 | |||||||||

Lori A. Gobillot | $170,000 | $14,406 | 4,787 | $— | $— | |||||||||

Mark W. Helderman | $— | $— | — | $— | $— | |||||||||

Randall J. Larson | $— | $— | — | $— | $— | |||||||||

Steven J. Malcolm | $— | $— | — | $— | $— | |||||||||

Jim W. Mogg | $— | $235,477 | — | $— | $— | |||||||||

Pattye L. Moore | $170,000 | $749,483 | 195,525 | $721 | $12,998 | |||||||||

Eduardo A. Rodriguez | $34,000 | $57,928 | 15,240 | $— | $— | |||||||||

Gerald B. Smith | $170,000 | $43,630 | 12,370 | $— | $— | |||||||||

Wayne T. Smith | $170,000 | $10,302 | 3,723 | $— | $— | |||||||||

2025 ONEOK, Inc. Proxy Statement | 39 |

40 | 2025 ONEOK, Inc. Proxy Statement |

2025 ONEOK, Inc. Proxy Statement | 41 |

CORPORATE SUSTAINABILITY |

|

|  |  |  |  |

ENVIRONMENTAL STEWARDSHIP Our goal is to operate our assets in a sustainable manner and to minimize the impact of our operations on the environment. | SAFETY AND HEALTH The safety and health of our employees, customers and communities in which we operate are at the forefront of each business and operational decision we make. | HUMAN CAPITAL MANAGEMENT We strive to provide a competitive total rewards package to our employees and foster a culture of inclusion where everyone connected with our company feels valued. | COMMUNITY INVESTMENTS We value being a good corporate citizen and are committed to fostering partnerships between our company and the communities in which we operate. | POLITICAL ADVOCACY AND OVERSIGHT Political contributions to federal, state and local candidates are made by the ONEOK PAC, which is funded entirely by voluntary contributions from eligible company employees. |

42 | 2025 ONEOK, Inc. Proxy Statement |

Board of Directors |

CEO and Executive Management |

Vice president, environment, safety and health (ESH) and committees |

Management and Business Segment Leaders |

Employees |

Provides key leadership, oversight and diverse energy industry and business expertise. Oversees executive management's development and implementation of the company's ESG practices. •Non-executive independent board chair •Independent committee chairs – Audit, Executive Compensation and Corporate Governance Committees | ||||||

Oversee the development, implementation and reporting of the company's ESG practices; facilitate annual, comprehensive enterprise risk management process with participation and oversight from the Board. | ||||||

Oversee the development, implementation and reporting of ESG practices. | ||||||

•ESH Leadership Committee | •Sustainability Leadership Committee | |||||

Support the integration of ESG practices into daily operations. Key business segments driving initiatives include: | ||||||

•Sustainability and ESH groups | •Operations teams | |||||

Carry out ONEOK's business and ESG practices while serving as the point of contact for key company stakeholders. | ||||||

2025 ONEOK, Inc. Proxy Statement | 43 |

44 | 2025 ONEOK, Inc. Proxy Statement |

2025 ONEOK, Inc. Proxy Statement | 45 |

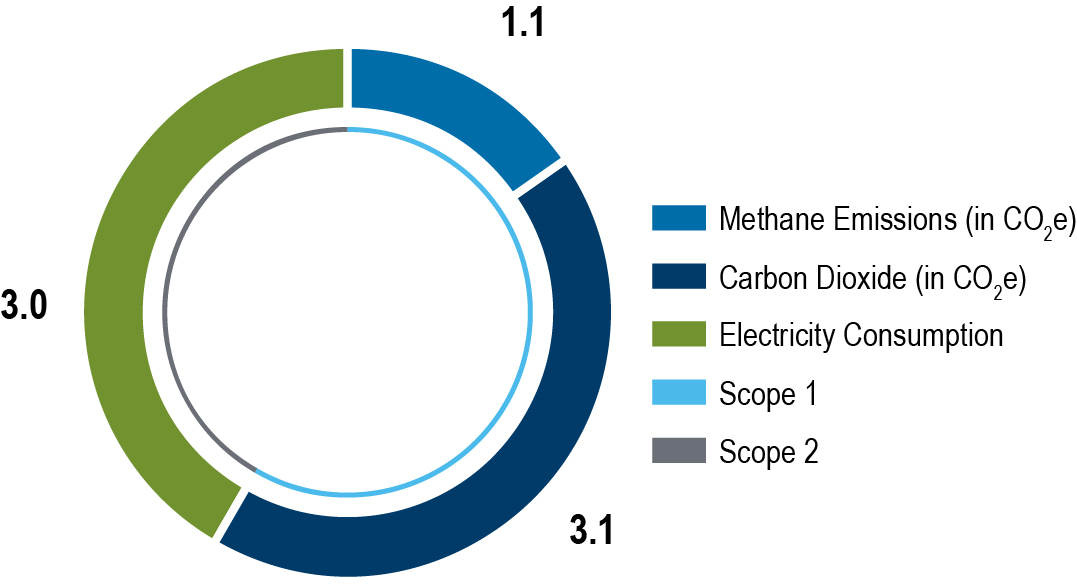

|  |

2.2 MMT CO2e reduction SCOPE 1 & 2 EMISSIONS BY 2030(1) | |

46 | 2025 ONEOK, Inc. Proxy Statement |

|  |  |  |

Electrification of Natural Gas Compression Assets | Methane Mitigation through Best Management Practices | System Optimizations | Collaborating with Utility Providers to Increase the Availability of Lower-Carbon Power Options |

|

PROGRESS 77% achieved 77% = 1.7 MMT reduction vs. 2019 |

0 | 1.1MMT | 2.2MMT |

2025 ONEOK, Inc. Proxy Statement | 47 |

48 | 2025 ONEOK, Inc. Proxy Statement |

2025 ONEOK, Inc. Proxy Statement | 49 |

50 | 2025 ONEOK, Inc. Proxy Statement |

| |||||||||||

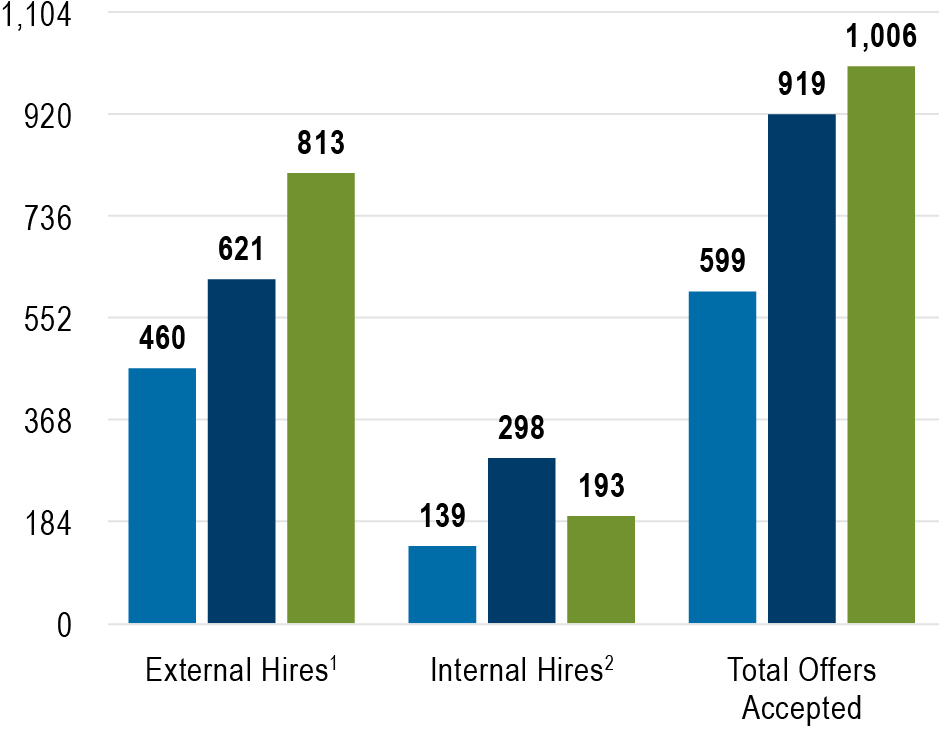

2,975 | 4,775 | 5,177 | |||||||||

g | 2022 | g | 2023 | g | 2024 | ||||||

2025 ONEOK, Inc. Proxy Statement | 51 |

52 | 2025 ONEOK, Inc. Proxy Statement |

| |

| ONEOK routinely engages with our shareholders and others to better understand their views on ESG matters, carefully considering the feedback we receive and acting when appropriate. |

2025 ONEOK, Inc. Proxy Statement | 53 |

Election of Directors Set forth on the following pages is certain information with respect to each nominee for election as a director, each of whom is a current director. | ||||||

| Our Board unanimously recommends a vote FOR each nominee. | |||||

| |||

“Our Board refreshment process remains a priority for ONEOK’s Corporate Governance Committee and Board as we plan for the continued near and long-term success of the company.” – Randall J. Larson, Corporate Governance Committee Chair | |||

54 | 2025 ONEOK, Inc. Proxy Statement |

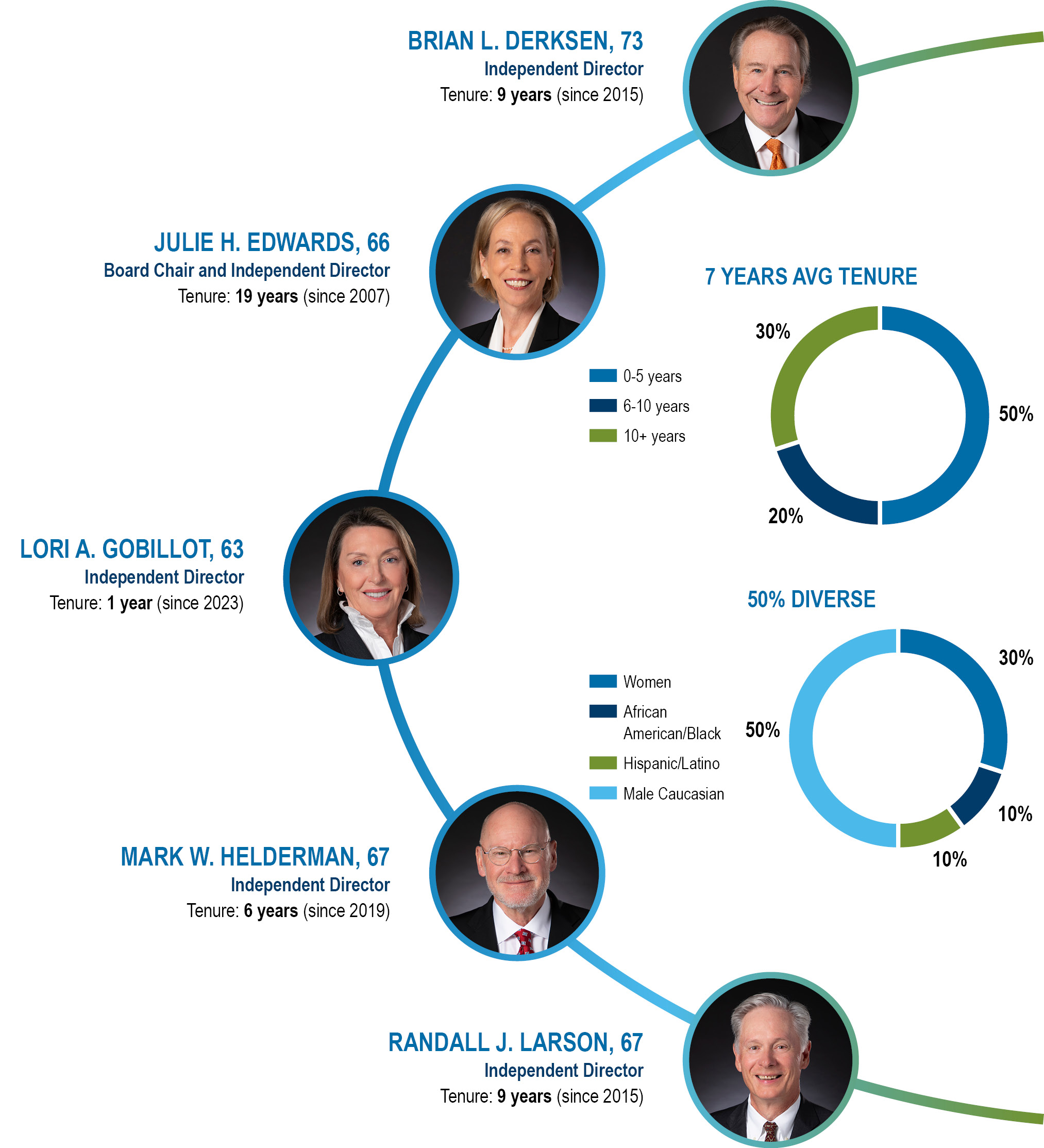

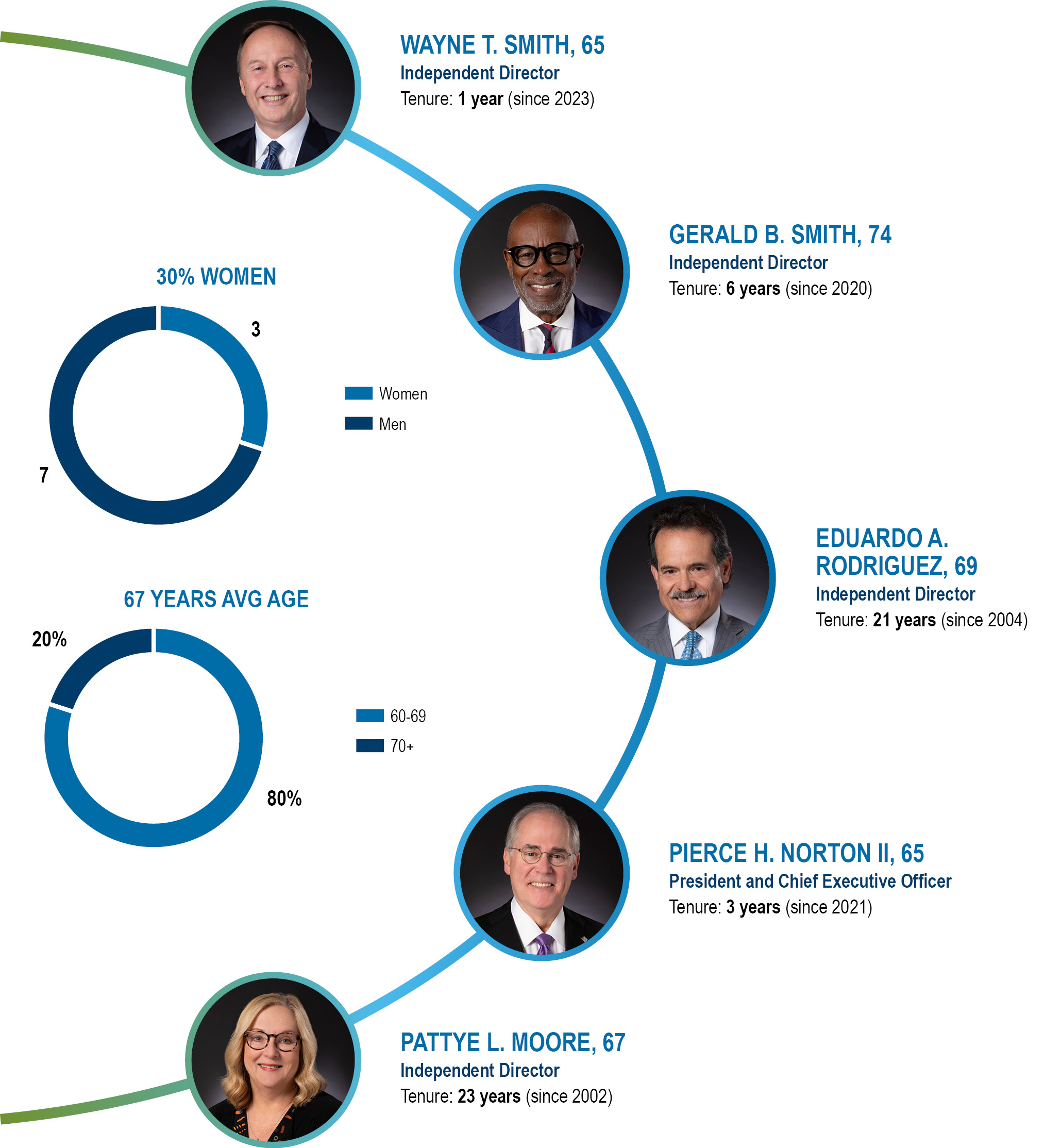

Demographic Background (as of May 21, 2025) | BRIAN L. DERKSEN | JULIE H. EDWARDS | LORI A. GOBILLOT | MARK W. HELDERMAN | RANDALL J. LARSON | PATTYE L. MOORE | PIERCE H. NORTON II | EDUARDO A. RODRIGUEZ | GERALD B. SMITH | WAYNE T. SMITH |

BOARD TENURE (YEARS) | 9 | 19 | 1 | 6 | 9 | 23 | 3 | 21 | 6 | 1 |

AGE (YEARS) | 73 | 66 | 63 | 67 | 67 | 67 | 65 | 69 | 74 | 65 |

GENDER (MALE/FEMALE) | M | F | F | M | M | F | M | M | M | M |

Race/Ethnicity | ||||||||||

HISPANIC/LATINO |  | |||||||||

AFRICAN AMERICAN/BLACK |  | |||||||||

CAUCASIAN/WHITE |  |  |  |  |  |  |  |  | ||

2025 ONEOK, Inc. Proxy Statement | 55 |

BRIAN L. DERKSEN | JULIE H. EDWARDS | LORI A. GOBILLOT | MARK W. HELDERMAN | RANDALL J. LARSON | PATTYE L. MOORE | PIERCE H. NORTON II | EDUARDO A. RODRIGUEZ | GERALD B. SMITH | WAYNE T. SMITH | |

ACCOUNTING/AUDITING We operate in complex financial and regulatory environments with significant disclosure requirements and detailed business processes and internal controls. |  |  |  |  |  |  |  |  |  | |

BUSINESS OPERATIONS We have significant operations focused on natural gas and natural gas liquids gathering, processing, fractionation, storage and transportation. |  |  |  |  |  |  | ||||

CAPITAL MANAGEMENT We allocate capital in various ways to run our operations, grow our business and return value to shareholders. |  |  |  |  |  |  |  |  |  |  |

CORPORATE GOVERNANCE LEADERSHIP As a public company, we expect effective oversight and transparency, and our stakeholders demand it. |  |  |  |  |  |  |  |  |  |  |

FINANCIAL EXPERTISE/LITERACY Our business involves complex financial transactions and reporting requirements. |  |  |  |  |  |  |  |  |  |  |

INDEPENDENCE Independent directors have no material relationships with us and are essential in providing effective and unbiased oversight. |  |  |  |  |  |  |  |  |  | |

INDUSTRY EXPERIENCE Experience in the oil and gas midstream industry provides a relevant understanding of our business and strategy. |  |  |  | |||||||

CAPITAL MARKETS Our business is capital intensive and requires access to capital and credit markets in order to grow our business. |  |  |  |  |  |  |  |  |  | |

PUBLIC COMPANY EXECUTIVE EXPERIENCE Experience leading a large, widely-held organization provides practical insights on need for transparency, accountability, and integrity. |  |  |  |  |  |  | ||||

RECENT PUBLIC COMPANY BOARD EXPERIENCE We value individuals who understand public company reporting responsibilities and have experience with the issues commonly faced by public companies. |  |  |  |  |  |  |  |  |  |  |

REGULATORY/RISK MANAGEMENT A complex regulatory and risk environment requires us to develop policies and procedures that effectively manage compliance and risk. |  |  |  |  |  |  |  |  |  |  |

56 | 2025 ONEOK, Inc. Proxy Statement |

2025 ONEOK, Inc. Proxy Statement | 57 |

58 | 2025 ONEOK, Inc. Proxy Statement |

| ||

BRIAN L. DERKSEN, 73 Director since: 2015 | INDEPENDENT COMMITTEES: Audit (Chair), Corporate Governance | |

CAREER HIGHLIGHTS: •Served as Global Deputy Chief Executive Officer of Deloitte Touche Tohmatsu Limited (“DTTL”) from 2011 until 2014. •Served as Deputy Chief Executive Officer of Deloitte LLP (“Deloitte U.S.”) from 2003 to 2011. •Served as Managing Partner of the financial advisory business and the Mid-America region of Deloitte U.S. In fulfilling his roles for DTTL and Deloitte U.S., he acted in his capacity as a partner in Deloitte U.S. He retired as a partner of Deloitte U.S. in May 2014. •Certified Public Accountant. •During the period from November 2014 through May 2015, he was engaged to serve as an independent consultant in the information technology sector. •Holds a Bachelor of Science degree from the University of Saskatchewan (Canada) and a Master of Business Administration degree from Duke University’s Fuqua School of Business. | OTHER BOARDS: •A member of the board of directors since 2018 of Brookshire Grocery Company, a privately held company with approximately 200 grocery stores. He also has served as the Audit Committee Chair since 2018 as well as the independent lead director since April 2022. SKILLS AND QUALIFICATIONS: •Extensive experience and expertise in accounting, auditing, financial reporting, taxation and management consulting. •Extensive senior executive experience provides him with particular expertise in leadership, strategic vision and corporate governance matters. |

| |

2025 ONEOK, Inc. Proxy Statement | 59 |

| ||

JULIE H. EDWARDS, 66 Director since: 2007 | Independent Board Chair | |

CAREER HIGHLIGHTS: •Board Chair of ONEOK, Inc. •Retired in 2007 from Southern Union Company where she served as Senior Vice President-Corporate Development from November 2006 to January 2007 and as Senior Vice President and Chief Financial Officer from July 2005 to November 2006. •Served as an executive officer of Frontier Oil Corporation, having served as Chief Financial Officer from 1994 to 2005 and as Treasurer from 1991 to 1994. •Served as an investment banker with Smith Barney, Harris, Upham & Co., Inc. in New York and Houston, after joining the company as an associate in 1985, when she graduated from the Wharton School of the University of Pennsylvania with an M.B.A. •Served as an exploration geologist in the oil industry, having earned a Bachelor of Science in Geology and Geophysics from Yale University in 1980. •Served on the ONEOK Board of Directors in 2004 and 2005 and was also a member of the Board of Directors of ONEOK Partners GP, L.L.C., from 2009 until the consummation of the merger transaction with ONEOK in June 2017. •Previously served as a member of the board of directors of Noble Corporation, plc a U.K.-based offshore drilling contractor, until February 2021 where she was on the Compensation and Finance Committees and was Chair of the Nominating and Governance Committee, and was a member of the board of directors of NATCO Group, Inc., an oil field services and equipment manufacturing company, from 2004 until its sale to Cameron International Corporation in November 2009. | OTHER BOARDS: •None. SKILLS AND QUALIFICATIONS: •Broad experience and understanding of various segments within the energy industry (exploration and production, refining and marketing, natural gas transmission, processing and distribution, production technology and contract drilling), and significant senior accounting, finance, capital markets, corporate development and management experience and expertise. •Demonstrated leadership and has been effective in her role as past chair of our Audit Committee and immediate past chair of our Corporate Governance Committee. •Achieved the Computer Emergency Response Team (CERT) Certificate in Cybersecurity Oversight in August 2024 from the Carnegie Mellon University, Software Engineering Institute. |

| |

60 | 2025 ONEOK, Inc. Proxy Statement |

| ||

LORI A. GOBILLOT, 63 Director since: 2023 | INDEPENDENT COMMITTEES: Audit, Corporate Governance | |

CAREER HIGHLIGHTS: •Served as Vice President, Integration Management, at United Airlines, Inc., from 2010 until 2012. •Served in officer roles in both legal and business functions at Continental Airlines/United Airlines during her career at the airlines from 1999 to 2012. •Served as an attorney with the law firm of Vinson & Elkins from 1993-1999. •Earned a Bachelor of Business Administration degree from the University of Texas and a Juris Doctor from the University of Texas School of Law. •Prior to attending law school, she was engaged in real estate development with Trammell Crow Company and consulting with Arthur Anderson. | OTHER BOARDS: •Serves on the board of directors of Republic Airways Holdings, Inc., since 2017, where she is Chair of the Compensation Committee. •Served on the board of directors of Magellan Midstream Partners L.P. from 2016 until the completion of the acquisition by the Company, where she served on the Compensation Committee, the Nominating and Governance Committee and the Sustainability Committee. •Served on the board of directors of Bristow Group Inc. from 2012-2019, where she was Chair of the Compensation Committee and served on the Corporate Governance and Nominating Committee. •Serves as President and a member of the board of directors of A Lighted Path, since 2023, a nonprofit that focuses on improving outcomes for challenged youth. SKILLS AND QUALIFICATIONS: •Extensive executive, legal and project management experience at a capital intensive and highly regulated FORTUNE® 200 company. •Extensive experience in corporate governance and executive compensation. •Extensive board leadership experience in aviation and energy. |

| |

2025 ONEOK, Inc. Proxy Statement | 61 |

| ||

MARK W. HELDERMAN, 67 Director since: 2019 | INDEPENDENT COMMITTEES: Audit, Corporate Governance | |

CAREER HIGHLIGHTS: •Held positions of increasing responsibility from 1997 through January 2019, at Sasco Capital Inc., an independent, institutional investment firm focused primarily on corporate turnarounds, restructurings and transformations, until he retired as Managing Director and Co-Portfolio Manager. •Worked in equity research and sales for Roulston Research Company from 1989 to 1996 and for McDonald & Company from 1986 to 1989, both in Cleveland, Ohio. | OTHER BOARDS: •None SKILLS AND QUALIFICATIONS: •More than 30 years of experience in the U.S. equities markets, including constructive engagement with senior management teams to develop a deep understanding of their corporate vision, value creation philosophy, commitment to long-term sustainable value and shareholder alignment. •Experience in more than 50 strategic, transformational restructurings spanning several industries including the energy value chain from upstream exploration and production, onshore and offshore oil field services, midstream, downstream petrochemicals and refining, regulated utilities and merchant energy. •More than 20 years of broad experience as an analyst in the commodity, energy, industrial and utility sectors. •Extensive financial experience and expertise. |

| |

62 | 2025 ONEOK, Inc. Proxy Statement |

| ||

RANDALL J. LARSON, 67 Director since: 2015 | INDEPENDENT COMMITTEES: Executive Compensation, Corporate Governance (Chair) | |

CAREER HIGHLIGHTS: •Served as Chief Executive Officer of the general partner of TransMontaigne Partners L.P. from September 2006 to August 2009; as Chief Financial Officer from January 2003 to September 2006; and Controller from May 2002 to January 2003. •Served as a partner with KPMG LLP in its Silicon Valley and National (New York City) offices from July 1994 to May 2002. •Served as a Professional Accounting Fellow in the Office of Chief Accountant of the United States Securities and Exchange Commission from July 1992 to July 1994. •Holds a Bachelor of Business Administration degree from the University of Wisconsin—Eau Claire, and a Master of Business Administration degree from the University of Wisconsin—Madison. | OTHER BOARDS: •Served on the board of directors, where he was chair of the Audit Committee and a member of the Conflicts Committee, of Valero Energy Partners GP LLC prior to its merger with Valero Energy Corp. •Served as a director of the general partner of MarkWest Energy Partners, L.P. prior to its merger with MPLX LP where he was Chair of the Audit Committee and a member of the Compensation Committee. •Served as a director of the general partner of Oiltanking Partners, L.P. where he was Chair of the Audit Committee and a member of the Conflicts Committee from August 2011 through February 2014. SKILLS AND QUALIFICATIONS: •Broad experience and understanding of the energy industry and significant senior public accounting, finance, capital markets and corporate development experience and expertise. •Extensive executive, managerial, industry and financial experience and expertise. |

| |

2025 ONEOK, Inc. Proxy Statement | 63 |

| ||

PATTYE L. MOORE, 67 Director since: 2002 | INDEPENDENT COMMITTEES: Executive Compensation, Corporate Governance | |

CAREER HIGHLIGHTS: •Served as the non-executive chair of the board of Red Robin Gourmet Burgers, a restaurant chain, from February 2010 to November 2019. Ms. Moore retired from the Red Robin Board at the end of 2019. •Served as interim Chief Executive Officer of Red Robin from April 2019 to October 2019. •Served on the board of directors of Sonic Corp. from 2000 through January 2006 and was the President of Sonic from January 2002 to November 2004. •Held numerous senior management positions during her 12 years at Sonic, including Executive Vice President, Senior Vice President-Marketing and Brand Development and Vice President-Marketing. •Is a business strategy consultant, speaker and the author of Confessions from the Corner Office, a book on leadership instincts, published by Wiley & Sons in 2007. | OTHER BOARDS: •Serves as a director of ONE Gas, Inc. where she serves on the Audit, Corporate Governance and Executive Committees. •Serves on the board of directors of QuikTrip Corporation, a privately held company. •Served as chair of the board of the National Arthritis Foundation. SKILLS AND QUALIFICATIONS: •Extensive senior management, marketing, business strategy, brand development and corporate governance experience. •Extensive experience in leadership, management development, strategic planning, corporate governance and executive compensation. •Extensive experience as a member of the board of directors of numerous nonprofit organizations. •Named an NACD Board Leadership Fellow by the National Association of Corporate Directors and is a recipient of the 2017 Directorship 100 award. |

| |

64 | 2025 ONEOK, Inc. Proxy Statement |

| ||

PIERCE H. NORTON II, 65 Director since: 2021 | Non-Independent (Chief Executive Officer) | |

CAREER HIGHLIGHTS: •President and CEO of ONEOK, Inc. •Served as President and Chief Executive Officer of ONE Gas, Inc. from January 2014 until June 2021, and a member of the ONE Gas, Inc. Board of Directors. •Prior to the separation of ONE Gas in January 2014, Norton served as Executive Vice President, commercial, of ONEOK and ONEOK Partners. •Served as Executive Vice President and Chief Operating Officer of ONEOK and ONEOK Partners with responsibilities for natural gas gathering and processing, natural gas pipelines, natural gas liquids, natural gas distribution and energy services business segments. •Served as President of the ONEOK Distribution Companies – Oklahoma Natural Gas, Kansas Gas Service and Texas Gas Service. •Holds a Bachelor of Science in Mechanical Engineering from the University of Alabama in Tuscaloosa and is a graduate of Harvard Business School’s Advanced Management Program. •University of Alabama College of Engineering Distinguished Fellow. •2023 Tulsa Community College Vision Dinner Honoree. •2021 American Gas Association Distinguished Service Award. •2017 OK Ethics Executive Pilot Award. •2011 IABC Tulsa Bronze Quill Communicator of the Year. | OTHER BOARDS: •Board member of the American Petroleum Institute (API). •2024 Tulsa Area United Way Annual Campaign Tri-Chair. •Former member of the American Gas Association’s board of directors and served as its 2017 Chairman. •Former board member of the Tulsa Community College Foundation and past-chair of the Audit Committee. •Former board member of the Tulsa Community Foundation and past- chair of the Audit Committee. •Former board member of the Interstate Natural Gas Association of America. •Former board member of the Texas Pipeline Association. •Former board member of the North Dakota Petroleum Council. •Former board member of the Western Energy Alliance. SKILLS AND QUALIFICATIONS: •Mr. Norton served in a variety of roles of continually increasing responsibility at ONEOK and ONEOK Partners from November 2004 to January 2014. In these roles, he had direct responsibility for and extensive experience in strategic and financial planning, acquisitions and divestitures, operations, management supervisions and development and compliance. •Extensive engineering management, construction management, marketing, finance, corporate governance and executive compensation experience. |

| |

2025 ONEOK, Inc. Proxy Statement | 65 |

| ||

EDUARDO A. RODRIGUEZ, 69 Director since: 2004 | INDEPENDENT COMMITTEES: Executive Compensation (Chair), Corporate Governance | |

CAREER HIGHLIGHTS: •Serves as President of Strategic Communications Consulting Group since 2005. •Served as Executive Vice President and a member of the board of directors of Hunt Building Corporation, a privately held company engaged in construction and real estate development headquartered in El Paso, Texas. •Spent 20 years in the electric utility industry at El Paso Electric Company, when it was a publicly traded, investor-owned utility, where he served in various senior-level executive positions, including General Counsel, Senior Vice President for Customer and Corporate Services, Executive Vice President and Chief Operating Officer. | OTHER BOARDS: •Serves as a director of ONE Gas, Inc. where he serves on the Audit, Executive Compensation and Executive Committees and is chair of the Corporate Governance Committee and Lead Independent Director. SKILLS AND QUALIFICATIONS: •Extensive senior management, operational, entrepreneurial and legal experience in a variety of industries. •A licensed attorney in the states of Texas and New Mexico and is admitted to the United States District Court for the Western District of Texas. •Mr. Rodriguez has practiced law for more than 40 years. •Extensive legal and business, strategic planning, corporate governance and regulatory compliance experience and expertise. |

| |

66 | 2025 ONEOK, Inc. Proxy Statement |

| ||

GERALD B. SMITH, 74 Director since: 2020 | INDEPENDENT COMMITTEES: Executive Compensation, Corporate Governance | |

CAREER HIGHLIGHTS: •Serves as Chairman of Smith Graham & Co., an investment management firm he founded in 1990 and served as Chief Executive Officer until 2023. •Served as a director of Cooper Industries plc from 2000 until 2012 and served as Lead Independent Director of Cooper Industries plc from 2007 until 2012. •Served as Senior Vice President and Director of Fixed Income of Underwood Neuhaus & Company. | OTHER BOARDS: •Serves as a director of Eaton Corporation plc since 2012 where he serves on the Executive and Finance Committees and is Chair of the Audit Committee. •Served as a director and Chair of the Investment Committee of the New York Life Insurance Company until April 2023. •Served as a Chairman of the Texas Southern University Foundation Board until 2023 when he became Chairman Emeritus. •Served as a director and Chair of the Budget Planning Committee of the Federal Reserve Bank of Dallas until December 2023 and is a former director of the Federal Reserve Bank of Dallas, Houston branch. •Served as a director of the Greater Houston Partnership. •Former board of trustees member and Chair of the Investment Oversight Committee for the Charles Schwab Family of Funds. •Former Board Member of ONEOK, Inc. from 2009 to 2013 and also served on the Audit and Executive Compensation Committees. •Former Board Member of ONEOK Partners, L.P. from 2006 to 2013 where he served as Chair of the Audit Committee. SKILLS AND QUALIFICATIONS: •Mr. Smith has expertise in finance, portfolio management and marketing through executive positions in the financial services industry. •Experience as director of companies in the oil and gas and energy services businesses has provided him with valuable insight into markets in which ONEOK also participates. •Past experience as lead independent director of Cooper provides ongoing institutional knowledge of legacy Cooper businesses and provides him valuable insight on financial, operational and strategic matters. |

| |

2025 ONEOK, Inc. Proxy Statement | 67 |

| ||

WAYNE T. SMITH, 65 Director since: 2023 | INDEPENDENT COMMITTEES: Audit, Corporate Governance | |

CAREER HIGHLIGHTS: •Served as Chairman and Chief Executive Officer of BASF Corporation from May 2015 through May 2021. •Served as a Member of the Board of Management Directors of BASF SE from 2012 through May 2021. •Served as Vice President and General Manager of Specialty Construction Chemicals of W.R. Grace and Company from 2000 to 2004. •Served as Vice President and General Manager of the Packaged Products business of the BOC Group from 1998-2000. •Holds a Bachelor of Science degree in chemical engineering from Syracuse University and a Master of Business Administration from the Wharton School of the University of Pennsylvania. •Served on the Dean’s Leadership Council for the College of Engineering and Computer Science at Syracuse University. | OTHER BOARDS: •Serves as a director of Air Products and Chemicals, Inc., where he maintains the role of Chairman of the Board. •Served on the board of directors of Inter Pipeline. SKILLS AND QUALIFICATIONS: •Mr. Smith has more than 35 years of experience in the chemicals industry. •Extensive experience across broad value chains in the chemical industry, including petrochemicals, polymers and highly specialized chemicals. |

| |

68 | 2025 ONEOK, Inc. Proxy Statement |

Ratify the Selection of PricewaterhouseCoopers LLP as Our Independent Registered Public Accounting Firm for the Year Ending December 31, 2025 | ||||||

| Our Board unanimously recommends a vote FOR the ratification of the selection of PricewaterhouseCoopers LLP as our independent registered public accounting firm for 2025. | |||||

2025 ONEOK, Inc. Proxy Statement | 69 |

(Thousands of Dollars) | |||

2024 | 2023 | ||

Audit Fees * Includes $3,170 fees related to the EnLink and Medallion acquisitions. | $9,197* | $5,065 | |

Audit Related Fees(1) | $158 | $17 | |

Tax Fees(2) | $0 | $0 | |

All other Fees(3) | $2 | $1 | |

Total | $9,357 | $5,083 | |

70 | 2025 ONEOK, Inc. Proxy Statement |

2025 ONEOK, Inc. Proxy Statement | 71 |

STOCK OWNERSHIP |

|

Title of Class | Name and Address of Beneficial Owner | Amount and Nature of Beneficial Ownership | Percent of Class |

Common Stock | The Vanguard Group, Inc. 100 Vanguard Blvd. Malvern, PA 19355 | 69,671,688 | 11.96%(1) |

Common Stock | BlackRock, Inc. 50 Hudson Yards New York, NY 10001 | 52,604,741 | 9.00%(2) |

Common Stock | State Street Corporation State Street Financial Ctr. One Congress Street, Suite 1 Boston, MA 02114 | 38,698,295 | 6.64%(3) |

72 | 2025 ONEOK, Inc. Proxy Statement |

Name | Shares of ONEOK Common Stock Beneficially Owned(1) | ONEOK Directors’ Deferred Compensation Plan Phantom Stock(2) | Total Shares of ONEOK Common Stock Beneficially Owned Plus ONEOK Directors’ Deferred Compensation Plan Phantom Stock | ONEOK Percent of Class(3) |

Kevin L. Burdick | 167,306 | 0 | 167,306 | Less than 1% |

Brian L. Derksen | 18,700 | 35,412 | 54,112 | Less than 1% |

Julie H. Edwards | 63,335 | 4,392 | 67,727 | Less than 1% |

Lori A. Gobillot | 1,413 | 4,838 | 6,251 | Less than 1% |

Mark W. Helderman | 32,215 | 0 | 32,215 | Less than 1% |

Walter S. Hulse, III | 189,693 | 0 | 189,693 | Less than 1% |

Randall J. Larson | 29,548 | 0 | 29,548 | Less than 1% |

Pattye L. Moore | 0 | 197,584 | 197,584 | Less than 1% |

Pierce H. Norton II | 117,701 | 0 | 117,701 | Less than 1% |

Eduardo A. Rodriguez | 26,820 | 15,401 | 42,221 | Less than 1% |

Gerald B. Smith | 0 | 12,501 | 12,501 | Less than 1% |

Wayne T. Smith | 2,700 | 3,762 | 6,462 | Less than 1% |

Sheridan C. Swords(4) | 233,087 | 0 | 233,087 | Less than 1% |

Lyndon C. Taylor | 336 | 0 | 336 | Less than 1% |

All directors and executive officers as a group | 1,067,251 | 273,890 | 1,341,141 | Less than 1% |

2025 ONEOK, Inc. Proxy Statement | 73 |

EXECUTIVE COMPENSATION DISCUSSION AND ANALYSIS |

|

74 | 2025 ONEOK, Inc. Proxy Statement |

Mr. Hulse, 125% | Mr. Burdick, 120% | Mr. Swords, 115% | Mr. Taylor, 125% |

2025 ONEOK, Inc. Proxy Statement | 75 |

76 | 2025 ONEOK, Inc. Proxy Statement |

2025 ONEOK, Inc. Proxy Statement | 77 |

78 | 2025 ONEOK, Inc. Proxy Statement |

2025 ONEOK, Inc. Proxy Statement | 79 |

80 | 2025 ONEOK, Inc. Proxy Statement |

| ||

OUR ENERGY PEERS FOR 2024 WERE: | ||

Cheniere Energy, Inc. Diamondback Energy, Inc. Energy Transfer LP Enterprise Products Partners L.P. Hess Corporation | Kinder Morgan, Inc. Marathon Petroleum Corporation Phillips 66 Plains All American Pipeline, L.P. Targa Resources Corp. | TC Energy Corporation The Williams Companies, Inc. Western Midstream Partners, LP |

2025 ONEOK, Inc. Proxy Statement | 81 |

82 | 2025 ONEOK, Inc. Proxy Statement |

2025 ONEOK, Inc. Proxy Statement | 83 |

Base Salary | Short-Term Incentive Target | Long-Term Incentive Target | ||||||

Name | 2024 | 2023 | 2024 | 2023 | 2024 | 2023 | ||

Pierce H. Norton II | $925,000 | $835,000 | 150% | 125% | $8,000,000 | $5,000,000 | ||

Walter S. Hulse, III | $650,000 | $600,000 | 110% | 100% | $3,250,000 | $2,200,000 | ||

Kevin L. Burdick | $550,000 | $500,000 | 95% | 95% | $1,800,000 | $1,600,000 | ||

Sheridan C. Swords | $525,000 | $500,000 | 95% | 85% | $1,800,000 | $1,250,001 | ||

Lyndon C. Taylor | $600,000 | $550,000 | 95% | 90% | $1,850,000 | $500,000 | ||

84 | 2025 ONEOK, Inc. Proxy Statement |

2025 ONEOK, Inc. Proxy Statement | 85 |

ONEOK, Inc. Corporate Performance Criteria 2024 Fiscal Year | Threshold (Pays 0%) | Target (Pays 100%) | Maximum (Pays 200%) | Weighting | Target Payout | Maximum Payout | |||

Earnings per share (EPS) | $4.25 | $4.80 | $5.36 | 40% | 40% | 80% | |||

Return on invested capital (ROIC) | 11.69% | 12.81% | 13.92% | 40% | 40% | 80% | |||

Total recordable incident rate (TRIR) | 0.60 | 0.40 | 0.30 | 10% | 10% | 20% | |||

Agency reportable environmental event rate (AREER) | 1.11 | 0.74 | 0.56 | 10% | 10% | 20% | |||

Total | 100% | 100% | 200% | ||||||

86 | 2025 ONEOK, Inc. Proxy Statement |

Metric | Measurement Approach | Comment |

EPS | Full-year earnings (net of adjustments described below) for legacy ONEOK business, divided by weighted- average diluted shares outstanding from 1/1/2024 through 12/31/2024. | Neutralizes impact of acquisitions. |

ROIC | Full-year EBIT (net of adjustments described below) for legacy ONEOK business, divided by daily average invested capital from 1/1/2024 through 10/31/2024. | Neutralizes impact of acquisitions, including changes to capital base. |

Name | Target Award as Percentage of Base Salary | Maximum Award as a Percentage of Base Salary |

Pierce H. Norton II | 150.0% | 375.0% |

Walter S. Hulse, III | 110.0% | 275.0% |

Kevin L. Burdick | 95.0% | 237.5% |

Sheridan C. Swords | 95.0% | 237.5% |

Lyndon C. Taylor | 95.0% | 237.5% |

2025 ONEOK, Inc. Proxy Statement | 87 |

Mr. Norton, 110% | Mr. Hulse, 125% | Mr. Burdick, 120% | Mr. Swords, 115% | Mr. Taylor, 125% |

$55,000 | X | 0.06 | X | 0.9 | X | 1.835 | = | $5,450 | ||||

Base salary at December 31 | STI target based on a percentage of base salary | Individual employee performance modifier (0 to 125%) | Company performance modifier (0 to 200%) | Employee incentive award (rounded to nearest $100) | ||||||||

88 | 2025 ONEOK, Inc. Proxy Statement |

2025 ONEOK, Inc. Proxy Statement | 89 |

ONEOK TSR Ranking vs. Peer Group | Percentage of Performance Units Earned |

90th Percentile and above | 200% |

75th Percentile | 150% |

50th Percentile | 100% |

25th Percentile | 50% |

Below 25th percentile | 0% |

ONEOK TSR Ranking vs. Peer Group | Percentage of Performance Units Earned |

90th Percentile and above | 200% |

75th Percentile | 150% |

50th Percentile | 100% |

25th Percentile | 50% |

Below 25th percentile | 0% |

90 | 2025 ONEOK, Inc. Proxy Statement |

2025 ONEOK, Inc. Proxy Statement | 91 |

Level | Position | Market Value of ONEOK Stock Held |

LEVEL 1 | Vice President | 2 times base salary |

LEVEL 2 | Senior Vice President | 3 times base salary |

LEVEL 3 | Executive Vice President | 4 times base salary |

LEVEL 4 | President and Chief Executive Officer | 6 times base salary |

92 | 2025 ONEOK, Inc. Proxy Statement |

2025 ONEOK, Inc. Proxy Statement | 93 |

Name and Principal Position | Year | Salary | Stock Awards(1) | Non-equity Incentive Plan Compensation(2) | Change in Pension Value and Nonqualified Deferred Compensation Earnings(3) | All Other Compensation(4) | Total | ||||||

Pierce H. Norton II President and Chief Executive Officer | 2024 | $925,000 | $9,081,124 | $2,800,700 | $— | $430,509 | $13,237,333 | ||||||

2023 | $835,000 | $6,274,485 | $2,101,100 | $— | $336,989 | $9,547,574 | |||||||

2022 | $835,000 | $5,618,292 | $1,467,300 | $— | $218,432 | $8,139,024 | |||||||

Walter S. Hulse, III Chief Financial Officer, Treasurer and Executive Vice President, Corporate Development and Investor Relations | 2024 | $650,000 | $3,690,593 | $1,640,000 | $— | $278,685 | $6,259,278 | ||||||

2023 | $600,000 | $2,760,803 | $1,372,500 | $— | $190,814 | $4,924,117 | |||||||

2022 | $580,000 | $2,122,475 | $809,800 | $— | $179,137 | $3,691,412 | |||||||

Kevin L. Burdick Executive Vice President and Chief Enterprise Services Officer | 2024 | $550,000 | $2,045,043 | $1,150,500 | $— | $229,551 | $3,975,094 | ||||||

2023 | $500,000 | $2,007,859 | $1,043,100 | $— | $153,963 | $3,704,922 | |||||||

2022 | $500,000 | $1,997,646 | $607,100 | $— | $164,867 | $3,269,613 | |||||||

Sheridan C. Swords Executive Vice President and Chief Commercial Officer | 2024 | $525,000 | $2,045,043 | $1,052,500 | $336,265 | $89,080 | $4,047,888 | ||||||

2023 | $500,000 | $1,756,885 | $855,500 | $661,416 | $71,844 | $3,845,645 | |||||||

2022 | $500,000 | $1,560,634 | $613,400 | $— | $75,772 | $2,749,806 | |||||||

Lyndon C. Taylor Executive Vice President, Chief Legal Officer and Assistant Secretary(5) | 2024 | $600,000 | $2,101,875 | $1,307,400 | $— | $158,665 | $4,167,940 | ||||||

Name | 2024 |

Pierce H. Norton II | $14,957,532 |

Walter S. Hulse, III | $6,076,450 |

Kevin L. Burdick | $3,365,390 |

Sheridan C. Swords | $3,365,390 |

Lyndon C. Taylor | $3,458,962 |

94 | 2025 ONEOK, Inc. Proxy Statement |

Name | Nonqualified Deferred Compensation Plan(a) | Match Under 401(k) Plan(b) | Company Profit-Sharing Contributions(c) | Holiday Gift | Relocation Expenses | Personal Use of Company Aircraft(d) | Charitable Contributions(e) | |||||||||||||

Pierce H. Norton II | $348,389 | $20,700 | $24,150 | $40 | $— | $12,230 | $25,000 | |||||||||||||

Walter S. Hulse, III | $217,967 | $19,000 | $24,150 | $40 | $— | $8,153 | $9,375 | |||||||||||||

Kevin L. Burdick | $162,161 | $20,700 | $24,150 | $40 | $— | $— | $22,500 | |||||||||||||

Sheridan C. Swords | $62,090 | $20,700 | $— | $40 | $— | $— | $6,250 | |||||||||||||

Lyndon C. Taylor | $70,152 | $20,700 | $24,150 | $40 | $21,123 | $— | $22,500 | |||||||||||||

2025 ONEOK, Inc. Proxy Statement | 95 |

Estimated Future Payouts Under Non-Equity Incentive Plan Awards(1) | Estimated Future Payouts Under Equity Incentive Plan Awards(2),(5) | All Other Stock Awards: Number of Shares of Stock or Units(3),(5) | Grant Date Fair Value of Stock and Option Awards(4) | |||||||||||

Name | Grant Date | Threshold | Target | Maximum | Threshold | Target | Maximum | |||||||

Pierce H. Norton II | ||||||||||||||

Restricted Units | 2/21/2024 | 21,819 | $1,599,987 | |||||||||||

Performance Units | 2/21/2024 | 43,638 | 87,277 | 174,554 | $7,478,766 | |||||||||

Short-Term Incentive | $— | $1,385,700 | $3,464,300 | |||||||||||

Employee Stock Awards | 26 | $2,371 | ||||||||||||

Walter S. Hulse, III | ||||||||||||||

Restricted Units | 2/21/2024 | 8,864 | $649,997 | |||||||||||

Performance Units | 2/21/2024 | 17,728 | 35,456 | 70,912 | $3,038,225 | |||||||||

Short-Term Incentive | $— | $714,100 | $1,785,200 | |||||||||||

Employee Stock Awards | 26 | $2,371 | ||||||||||||

Kevin L. Burdick | ||||||||||||||

Restricted Units | 2/21/2024 | 4,909 | $359,977 | |||||||||||

Performance Units | 2/21/2024 | 9,818 | 19,637 | 39,274 | $1,682,695 | |||||||||

Short-Term Incentive | $— | $521,800 | $1,304,600 | |||||||||||

Employee Stock Awards | 26 | $2,371 | ||||||||||||

Sheridan C. Swords | ||||||||||||||

Restricted Units | 2/21/2024 | 4,909 | $359,977 | |||||||||||

Performance Units | 2/21/2024 | 9,818 | 19,637 | 39,274 | $1,682,695 | |||||||||

Short-Term Incentive | $— | $498,100 | $1,245,300 | |||||||||||

Employee Stock Awards | 26 | $2,371 | ||||||||||||

Lyndon C. Taylor | ||||||||||||||

Restricted Units | 2/21/2024 | 5,046 | $370,023 | |||||||||||

Performance Units | 2/21/2024 | 10,091 | 20,183 | 40,366 | $1,729,481 | |||||||||

Short-Term Incentive | $— | $569,300 | $1,423,200 | |||||||||||

Employee Stock Awards | 26 | $2,371 | ||||||||||||

96 | 2025 ONEOK, Inc. Proxy Statement |

Stock Awards | ||||||

Name | Number of Shares or Units of Stock That Have Not Vested(1),(3) | Market Value of Shares or Units of Stock That Have Not Vested(4) | Equity Incentive Plan Awards: Number of Unearned Shares, Units or Other Rights That Have Not Vested(2),(3) | Equity Incentive Plan Awards: Market or Payout Value of Unearned Shares, Units or Other Rights That Have Not Vested(4) | ||

Pierce H. Norton II | 56,243 | $5,646,797 | 336,522 | $33,786,809 | ||

Walter S. Hulse, III | 22,918 | $2,300,967 | 140,062 | $14,062,225 | ||

Kevin L. Burdick | 16,467 | $1,653,287 | 91,606 | $9,197,242 | ||

Sheridan C. Swords | 14,469 | $1,452,688 | 84,218 | $8,455,487 | ||

Lyndon C. Taylor | 13,449 | $1,350,280 | 41,799 | $4,196,620 | ||

Name | Number of Restricted Units | Vest Date |

Pierce H. Norton II | 17,185 | February 23, 2025 |

16,516 | February 22, 2026 | |

22,542 | February 17, 2027 | |

Walter S. Hulse, III | 6,492 | February 23, 2025 |

7,268 | February 22, 2026 | |

9,158 | February 17, 2027 | |

Kevin L. Burdick | 6,110 | February 23, 2025 |

5,285 | February 22, 2026 | |

5,072 | February 17, 2027 | |

Sheridan C. Swords | 4,773 | February 23, 2025 |

4,624 | February 22, 2026 | |

5,072 | February 17, 2027 | |

Lyndon C. Taylor | 8,236 | February 22, 2026 |

5,213 | February 17, 2027 |

2025 ONEOK, Inc. Proxy Statement | 97 |

Name | Number of Performance Units | Vest Date |

Pierce H. Norton II | 30,652 | February 23, 2025 |

125,117 | February 22, 2026 | |

180,753 | February 17, 2027 | |

Walter S. Hulse, III | 11,580 | February 23, 2025 |

55,052 | February 22, 2026 | |

73,430 | February 17, 2027 | |

Kevin L. Burdick | 10,899 | February 23, 2025 |

40,038 | February 22, 2026 | |

40,669 | February 17, 2027 | |

Sheridan C. Swords | 8,515 | February 23, 2025 |

35,034 | February 22, 2026 | |

40,669 | February 17, 2027 | |

Lyndon C. Taylor | 41,799 | February 17, 2027 |

Stock Awards | |||

Name | Number of Shares Acquired on Vesting(5) | Value Realized on Vesting(6) | |

Pierce H. Norton II | 85,781 | $6,465,257 | |

Walter S. Hulse, III | 39,766 | $2,862,758 | |

Kevin L. Burdick | 37,426 | $2,694,315 | |

Sheridan C. Swords | 29,240 | $2,104,958 | |

Lyndon C. Taylor | — | $— | |

98 | 2025 ONEOK, Inc. Proxy Statement |

Name | Plan Name(1) | Number of Years Credited Service | Present Value of Accumulated Benefit(2) | Payments During Last Fiscal Year | ||

Pierce H. Norton II | Supplemental Executive Retirement Plan | — | $— | $— | ||

Retirement Plan | — | $— | $— | |||

Walter S. Hulse, III | Supplemental Executive Retirement Plan | — | $— | $— | ||

Retirement Plan | — | $— | $— | |||

Kevin L. Burdick | Supplemental Executive Retirement Plan | — | $— | $— | ||

Retirement Plan | — | $— | $— | |||

Sheridan C. Swords | Supplemental Executive Retirement Plan | 20 | $2,463,282 | $— | ||

Retirement Plan | 20 | $913,100 | $— | |||

Lyndon C. Taylor | Supplemental Executive Retirement Plan | — | $— | $— | ||

Retirement Plan | — | $— | $— | |||

2025 ONEOK, Inc. Proxy Statement | 99 |

Name | Executive Contributions in Last Fiscal Year | Registrant Contributions in Last Fiscal Year(1) | Aggregate Earnings in Last Fiscal Year(2) | Aggregate Withdrawals / Distributions | Aggregate Balance at Last Fiscal Year End(3) | |||||

Pierce H. Norton II | $18,476 | $348,389 | $48,273 | $— | $907,724 | |||||

Walter S. Hulse, III | $169,708 | $217,967 | $225,826 | $(11,601) | $2,461,313 | |||||

Kevin L. Burdick | $27,465 | $162,161 | $136,544 | $— | $1,876,025 | |||||

Sheridan C. Swords | $15,730 | $62,090 | $1,771,803 | $— | $6,648,080 | |||||

Lyndon C. Taylor | $59,923 | $70,152 | $6,693 | $— | $151,491 | |||||

100 | 2025 ONEOK, Inc. Proxy Statement |

Fund Name | Plan Level Returns |

Vanguard Federal Money Market—Investor Shares Intermediate-Term Bond | 5.23% |

Vanguard Cash Reserves Federal Money Market Fund—Admiral Shares | 5.24% |

Baird Core Plus Bond Fund - Institutional | 2.54% |

Vanguard Total Bond Market Index—Admiral Shares Target-Date—Lifecycle | 1.24% |

Vanguard Target Retirement Income Fund—Investor Shares | 6.58% |

Vanguard Target Retirement 2020 Fund—Investor Shares | 7.75% |

Vanguard Target Retirement 2025 Fund—Investor Shares | 9.44% |

Vanguard Target Retirement 2030 Fund—Investor Shares | 10.64% |

Vanguard Target Retirement 2035 Fund—Investor Shares | 11.78% |

Vanguard Target Retirement 2040 Fund—Investor Shares | 12.88% |

Vanguard Target Retirement 2045 Fund—Investor Shares | 13.91% |

Vanguard Target Retirement 2050 Fund—Investor Shares | 14.64% |

Vanguard Target Retirement 2055 Fund—Investor Shares | 14.64% |

Vanguard Target Retirement 2060 Fund—Investor Shares | 14.63% |

Vanguard Target Retirement 2065 Fund—Investor Shares | 14.62% |

Vanguard Target Retirement 2070 Fund—Investor Shares(1) | 14.59% |

Fidelity Balanced—Class K Large Cap Value | 16.13% |

Vanguard Institutional Index—Instl Shares Large Cap Growth | 24.97% |

JPMorgan Large Cap Growth—Class R6 | 34.17% |

Vanguard PRIMECAP Fund —Admiral Shares | 13.52% |

Dodge & Cox Stock Fund—Class X | 14.63% |

Vanguard Extended Market Index Fund—Institutional Shares | 16.91% |

JPMorgan Small Cap Equity Fund—Class R6 | 10.30% |

Dodge & Cox International Stock Fund—Class X | 3.91% |

Vanguard FTSE All-World ex-US Index—Admiral Shares Diversified Emerging Markets | 5.44% |

Fidelity Emerging Markets Index Fund | 6.80% |

William Blair International Leaders Fund—R6 Class Shares | (0.50%) |

2025 ONEOK, Inc. Proxy Statement | 101 |

102 | 2025 ONEOK, Inc. Proxy Statement |

2025 ONEOK, Inc. Proxy Statement | 103 |

Pierce H. Norton II | Termination Without Cause | Termination Upon Disability or Retirement | Termination Upon Death | Qualifying Termination Following a Change in Control | ||||

Cash Severance | $— | $1,385,700 | $1,385,700 | $6,928,543 | ||||

Health and Welfare Benefits | $104,817 | $104,817 | $99,487 | $147,575 | ||||

Equity | ||||||||

Restricted Units | $3,271,534 | $3,271,534 | $3,271,534 | $5,646,797 | ||||

Performance Units | $— | $7,145,870 | $7,145,870 | $23,247,419 | ||||

Total | $3,271,534 | $10,417,404 | $10,417,404 | $28,894,216 | ||||

Total | $3,376,351 | $11,907,921 | $11,902,591 | $35,970,334 | ||||

Walter S. Hulse, III | Termination Without Cause | Termination Upon Disability or Retirement | Termination Upon Death | Qualifying Termination Following a Change in Control | ||||

Cash Severance | $— | $714,100 | $714,100 | $2,726,533 | ||||

Health and Welfare Benefits | $78,259 | $78,259 | $78,259 | $121,017 | ||||

Equity | ||||||||

Restricted Units | $1,316,846 | $1,316,846 | $1,316,846 | $2,300,967 | ||||

Performance Units | $— | $3,045,433 | $3,045,433 | $9,511,896 | ||||

Total | $1,316,846 | $4,362,279 | $4,362,279 | $11,812,863 | ||||

Total | $1,395,105 | $5,154,638 | $5,154,638 | $14,660,413 | ||||

Kevin L. Burdick | Termination Without Cause | Termination Upon Disability or Retirement | Termination Upon Death | Qualifying Termination Following a Change in Control | ||||

Cash Severance | $— | $521,800 | $521,800 | $2,142,190 | ||||

Health and Welfare Benefits | $39,084 | $39,084 | $71,830 | $68,203 | ||||

Equity | ||||||||

Restricted Units | $1,045,164 | $1,045,164 | $1,045,164 | $1,653,287 | ||||

Performance Units | $— | $2,008,904 | $2,008,904 | $6,646,078 | ||||

Total | $1,045,164 | $3,054,068 | $3,054,068 | $8,299,365 | ||||

Total | $1,084,248 | $3,614,952 | $3,647,698 | $10,509,758 | ||||

104 | 2025 ONEOK, Inc. Proxy Statement |

Sheridan C. Swords | Termination Without Cause | Termination Upon Disability or Retirement | Termination Upon Death | Qualifying Termination Following a Change in Control | ||||

Cash Severance | $— | $498,100 | $498,100 | $2,044,854 | ||||

Health and Welfare Benefits | $66,423 | $66,423 | $66,423 | $106,134 | ||||

Equity | ||||||||

Restricted Units | $877,797 | $877,797 | $877,797 | $1,452,688 | ||||

Performance Units | $— | $1,840,031 | $1,840,031 | $5,917,576 | ||||

Total | $877,797 | $2,717,828 | $2,717,828 | $7,370,264 | ||||

Total | $944,220 | $3,282,351 | $3,282,351 | $9,521,252 | ||||

Lyndon C. Taylor | Termination Without Cause | Termination Upon Disability or Retirement1 | Termination Upon Death | Qualifying Termination Following a Change in Control | ||||

Cash Severance | $— | $569,300 | $569,300 | $2,337,062 | ||||

Health and Welfare Benefits | $40,333 | $40,333 | $92,189 | $68,093 | ||||

Equity | ||||||||

Restricted Units | $466,960 | $466,960 | $466,960 | $1,350,280 | ||||

Performance Units | $— | $676,094 | $676,094 | $2,434,098 | ||||

Total | $466,960 | $1,143,054 | $1,143,054 | $3,784,378 | ||||

Total | $507,293 | $1,752,687 | $1,804,543 | $6,189,533 | ||||

2025 ONEOK, Inc. Proxy Statement | 105 |

Approval of the ONEOK, Inc. 2025 Equity Incentive Plan | ||||||

| Our Board unanimously recommends a vote FOR the approval of the ONEOK, Inc. 2025 Equity Incentive Plan. | |||||

106 | 2025 ONEOK, Inc. Proxy Statement |

Feature/Practice | Description |

No Discounted Options or Stock Appreciation Rights (“SARs”) | Stock options and SARs may not be granted with an exercise price lower than the market value of the underlying shares on the grant date. |

No Repricing or Cash Buyouts Without Shareholder Approval | The purchase price of an option or SAR may not be reduced without shareholder approval, and underwater options or SARs may not be exchanged, surrendered, or cancelled and regranted for awards with a lower exercise price or cash without shareholder approval, except in connection with a change in our capitalization. |

No Liberal Share Recycling | We do not allow the reuse for future awards of shares used to pay the exercise price or withholding taxes for an outstanding award, unissued shares resulting from the net settlement of an outstanding option or SAR, or shares purchased in the open market using proceeds of an option exercise. |