-more- Oct. 28, 2025 Analyst Contact: Megan Patterson 918-561-5325 Media Contact: Alicia Buffer 918-861-3749 ONEOK Announces Higher Third Quarter 2025 Earnings and Affirms 2025 Net Income and Adjusted EBITDA Guidance Ranges Record Rocky Mountain Region Volumes TULSA, Okla. - Oct. 28, 2025 - ONEOK, Inc. (NYSE: OKE) today announced higher third quarter 2025 results and affirmed full-year 2025 net income and adjusted EBITDA guidance ranges. Higher Third Quarter 2025 Results, Compared With Third Quarter 2024: • Net income of $940 million, resulting in $1.49 per diluted share. • Adjusted EBITDA of $2.12 billion (includes $7 million of transaction costs). • 17% increase in Rocky Mountain region NGL raw feed throughput volumes. • 6% increase in Mid-Continent region NGL raw feed throughput volumes. • 3% increase in Rocky Mountain region natural gas volumes processed. "ONEOK’s strong third quarter demonstrates the consistent execution of acquisition- related integration strategies by our employees, as well as the continued solid performance of our contiguously integrated assets," said Pierce H. Norton II, ONEOK president and chief executive officer. “We continued to benefit from steady demand across our businesses and increasing production in all of the basins where we operate. "Recently completed organic growth and synergy projects increase ONEOK’s capacity to grow earnings by expanding and extending our integrated assets, driving long-term value for stakeholders,” added Norton.

ONEOK Announces Higher Third Quarter 2025 Earnings and Affirms 2025 Net Income and Adjusted EBITDA Guidance Ranges Oct. 28, 2025 Page 2 -more- THIRD QUARTER 2025 FINANCIAL HIGHLIGHTS Three Months Ended Nine Months Ended Sept. 30, Sept. 30, 2025 2024 2025 2024 (Millions of dollars, except per share amounts) Net income (a) $ 940 $ 693 $ 2,484 $ 2,112 Net income attributable to ONEOK (a) $ 939 $ 693 $ 2,416 $ 2,112 Diluted earnings per common share (a) $ 1.49 $ 1.18 $ 3.87 $ 3.60 Adjusted EBITDA (b) $ 2,119 $ 1,545 $ 5,875 $ 4,610 Operating income (a) $ 1,558 $ 1,128 $ 4,209 $ 3,421 Operating costs $ 738 $ 582 $ 2,196 $ 1,720 Depreciation and amortization $ 378 $ 274 $ 1,126 $ 790 Equity in net earnings from investments $ 92 $ 92 $ 281 $ 256 Maintenance capital $ 162 $ 109 $ 362 $ 275 Capital expenditures (includes maintenance) $ 804 $ 468 $ 2,182 $ 1,459 (a) Amounts for the three and nine months ended Sept. 30, 2025, include pretax impacts of $10 million and $74 million, respectively, of transaction costs, related primarily to the EnLink acquisition, resulting in a net impact of 1 cent and 9 cents per diluted share after tax, respectively. (b) Amounts for the three and nine months ended Sept. 30, 2025, include $7 million and $59 million, respectively, of transaction costs related primarily to the EnLink acquisition. Transaction costs of $3 million and $15 million, respectively, were noncash and not included in adjusted EBITDA. Adjusted EBITDA is a non-GAAP measure and is explained in greater detail in the Non- GAAP Financial Measures section. ORGANIC GROWTH HIGHLIGHTS: • In August 2025, ONEOK announced plans to construct the Bighorn natural gas processing plant, a 300 million cubic feet per day (MMcf/d) plant in the Permian Basin, expected to be completed in mid-2027. • In August 2025, ONEOK entered into a joint venture agreement to construct the Eiger Express Pipeline, a 450-mile natural gas pipeline from the Permian Basin to Katy, Texas. FINANCIAL HIGHLIGHTS: • Synergy capture through the third quarter 2025 remains ahead of original expectations at the time of the acquisition announcements (see pg. 6 of the earnings presentation). • In August 2025, ONEOK completed a $3 billion senior notes offering. • In September 2025, ONEOK repaid the remaining $387 million of 2.2% senior notes at maturity. • In September 2025, ONEOK increased the size of its commercial paper program to $3.5 billion from $2.5 billion. • As of Sept. 30, 2025: ◦ No borrowings outstanding under ONEOK's $3.5 billion credit agreement or commercial paper program. ◦ Approximately $1.2 billion of cash and cash equivalents.

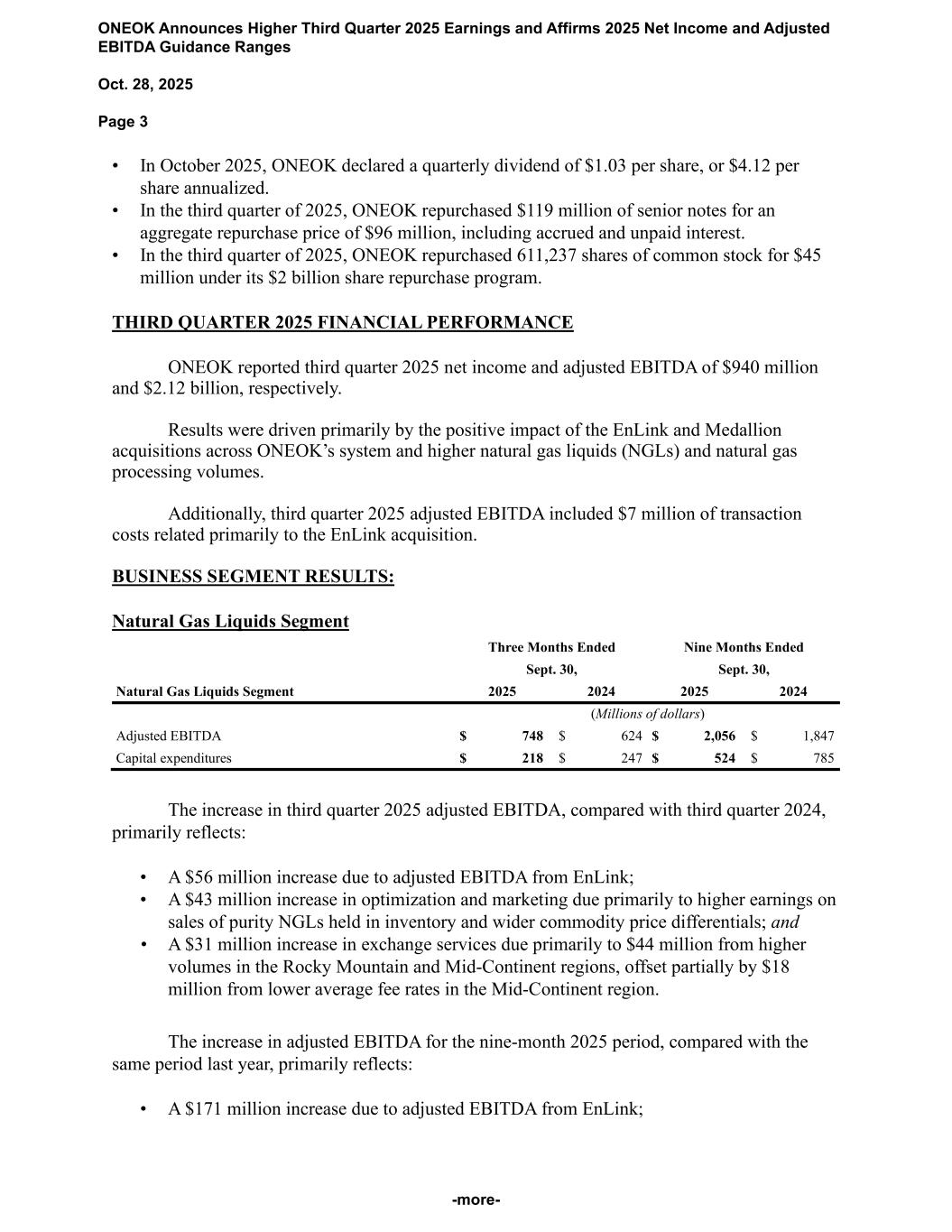

ONEOK Announces Higher Third Quarter 2025 Earnings and Affirms 2025 Net Income and Adjusted EBITDA Guidance Ranges Oct. 28, 2025 Page 3 -more- • In October 2025, ONEOK declared a quarterly dividend of $1.03 per share, or $4.12 per share annualized. • In the third quarter of 2025, ONEOK repurchased $119 million of senior notes for an aggregate repurchase price of $96 million, including accrued and unpaid interest. • In the third quarter of 2025, ONEOK repurchased 611,237 shares of common stock for $45 million under its $2 billion share repurchase program. THIRD QUARTER 2025 FINANCIAL PERFORMANCE ONEOK reported third quarter 2025 net income and adjusted EBITDA of $940 million and $2.12 billion, respectively. Results were driven primarily by the positive impact of the EnLink and Medallion acquisitions across ONEOK’s system and higher natural gas liquids (NGLs) and natural gas processing volumes. Additionally, third quarter 2025 adjusted EBITDA included $7 million of transaction costs related primarily to the EnLink acquisition. BUSINESS SEGMENT RESULTS: Natural Gas Liquids Segment Three Months Ended Nine Months Ended Sept. 30, Sept. 30, Natural Gas Liquids Segment 2025 2024 2025 2024 (Millions of dollars) Adjusted EBITDA $ 748 $ 624 $ 2,056 $ 1,847 Capital expenditures $ 218 $ 247 $ 524 $ 785 The increase in third quarter 2025 adjusted EBITDA, compared with third quarter 2024, primarily reflects: • A $56 million increase due to adjusted EBITDA from EnLink; • A $43 million increase in optimization and marketing due primarily to higher earnings on sales of purity NGLs held in inventory and wider commodity price differentials; and • A $31 million increase in exchange services due primarily to $44 million from higher volumes in the Rocky Mountain and Mid-Continent regions, offset partially by $18 million from lower average fee rates in the Mid-Continent region. The increase in adjusted EBITDA for the nine-month 2025 period, compared with the same period last year, primarily reflects: • A $171 million increase due to adjusted EBITDA from EnLink;

ONEOK Announces Higher Third Quarter 2025 Earnings and Affirms 2025 Net Income and Adjusted EBITDA Guidance Ranges Oct. 28, 2025 Page 4 -more- • A $26 million increase in optimization and marketing due primarily to higher earnings on sales of purity NGLs held in inventory; • A $21 million increase in exchange services due primarily to: ◦ $74 million from higher volumes in the Rocky Mountain region; and ◦ $29 million from higher average fee rates in the Rocky Mountain region; offset partially by ◦ $41 million from lower average fee rates in the Mid-Continent region; ◦ $15 million from lower volumes in the Mid-Continent region; and ◦ $16 million from higher costs, primarily transportation; and • A $6 million increase in adjusted EBITDA from unconsolidated affiliates due primarily to higher volumes delivered to the Overland Pass Pipeline; offset by • A $20 million increase in operating costs due primarily to higher employee-related costs associated with the growth of ONEOK’s operations. Refined Products and Crude Segment Three Months Ended Nine Months Ended Sept. 30, Sept. 30, Refined Products and Crude Segment 2025 2024 2025 2024 (Millions of dollars) Adjusted EBITDA $ 582 $ 441 $ 1,610 $ 1,289 Capital expenditures $ 214 $ 45 $ 539 $ 120 The increase in third quarter 2025 adjusted EBITDA, compared with third quarter 2024, primarily reflects: • A $91 million increase due to adjusted EBITDA from Medallion and EnLink; • A $24 million increase in transportation and storage due primarily to $29 million from the timing of operational gains and losses and $15 million from higher refined products transportation rates, offset partially by $12 million from lower refined products volumes and $10 million related to a lower rate on a capacity lease; • A $12 million increase due primarily to the sale of environmental credits generated by ONEOK’s liquids blending business; • A $9 million increase in optimization and marketing due primarily to higher liquids blending earnings; and • A $6 million decrease in operating costs due primarily to timing. The increase in adjusted EBITDA for the nine-month 2025 period, compared with the same period last year, primarily reflects: • A $273 million increase due to adjusted EBITDA from Medallion and EnLink; • A $41 million decrease in operating costs due primarily to lower outside services; and

ONEOK Announces Higher Third Quarter 2025 Earnings and Affirms 2025 Net Income and Adjusted EBITDA Guidance Ranges Oct. 28, 2025 Page 5 -more- • A $20 million increase due primarily to the sale of environmental credits generated by ONEOK’s liquids blending business; offset by • A $25 million decrease in optimization and marketing due primarily to lower liquids blending earnings. Natural Gas Gathering and Processing Segment Three Months Ended Nine Months Ended Sept. 30, Sept. 30, Natural Gas Gathering and Processing Segment 2025 2024 2025 2024 (Millions of dollars) Adjusted EBITDA $ 566 $ 318 $ 1,597 $ 995 Capital expenditures $ 302 $ 102 $ 884 $ 319 The increase in third quarter 2025 adjusted EBITDA, compared with third quarter 2024, primarily reflects: • A $250 million increase due to adjusted EBITDA from EnLink; and • A $28 million increase from higher volumes due primarily to increased production in the Mid-Continent and Rocky Mountain regions; offset by • A $34 million decrease due to lower realized prices, primarily NGL prices, net of hedging. The increase in adjusted EBITDA for the nine-month 2025 period, compared with the same period last year, primarily reflects: • A $703 million increase due to adjusted EBITDA from EnLink; and • A $62 million increase from higher volumes due primarily to increased production in the Mid-Continent and Rocky Mountain regions; offset by • An $86 million decrease due to lower realized prices, primarily NGL prices, net of hedging; • A $65 million decrease from the divestiture of certain non-strategic assets in 2024; and • A $12 million increase in operating costs due primarily to $16 million from higher employee-related costs associated with the growth of ONEOK’s operations, offset partially by $6 million from lower outside services due to the timing of projects. Natural Gas Pipelines Segment Three Months Ended Nine Months Ended Sept. 30, Sept. 30, Natural Gas Pipelines Segment 2025 2024 2025 2024 (Millions of dollars) Adjusted EBITDA $ 200 $ 166 $ 600 $ 483 Capital expenditures $ 55 $ 56 $ 169 $ 187

ONEOK Announces Higher Third Quarter 2025 Earnings and Affirms 2025 Net Income and Adjusted EBITDA Guidance Ranges Oct. 28, 2025 Page 6 -more- The increase in third quarter 2025 adjusted EBITDA, compared with third quarter 2024, primarily reflects: • A $70 million increase due to adjusted EBITDA from EnLink; offset by • A $34 million decrease due to the interstate natural gas pipeline divestiture. The increase in adjusted EBITDA for the nine-month 2025 period, compared with the same period last year, primarily reflects: • A $219 million increase due to adjusted EBITDA from EnLink; offset by • A $97 million decrease due to the interstate natural gas pipeline divestiture. EARNINGS CONFERENCE CALL AND WEBCAST: Members of ONEOK’s management team will participate in a conference call at 11 a.m. Eastern (10 a.m. Central) on Oct. 29, 2025. The call will also be webcast. To participate in the conference call, dial 800-343-4136, conference ID: OKE3Q25, or log on to the webcast at www.oneok.com. If you are unable to participate in the conference call or the webcast, the replay will be available on ONEOK’s website, www.oneok.com, for one year. A recording will be available by phone for seven days. The playback call may be accessed at 800-934-3639. LINK TO EARNINGS TABLES AND PRESENTATION: https://ir.oneok.com/financial-information/financial-reports NON-GAAP (GENERALLY ACCEPTED ACCOUNTING PRINCIPLES) FINANCIAL MEASURES: ONEOK has disclosed in this news release adjusted earnings before interest, taxes, depreciation and amortization (adjusted EBITDA), a non-GAAP financial metric used to measure the company’s financial performance. Adjusted EBITDA is defined as net income adjusted for interest expense, depreciation and amortization, noncash impairment charges, income taxes, noncash compensation expense, and other noncash items; and includes adjusted EBITDA from the company’s unconsolidated affiliates using the same recognition and measurement methods used to record equity in net earnings from investments. Adjusted EBITDA from unconsolidated affiliates is calculated consistently with the definition above and excludes items such as interest expense, depreciation and amortization, income taxes and other noncash items.

ONEOK Announces Higher Third Quarter 2025 Earnings and Affirms 2025 Net Income and Adjusted EBITDA Guidance Ranges Oct. 28, 2025 Page 7 -more- Adjusted EBITDA is useful to investors because it and similar measures are used by many companies in the industry as a measure of financial performance and is commonly employed by financial analysts and others to evaluate ONEOK’s financial performance and to compare the company’s financial performance with the performance of other companies within the industry. Adjusted EBITDA should not be considered in isolation or as a substitute for net income or any other measure of financial performance presented in accordance with GAAP. This non-GAAP financial measure excludes some, but not all, items that affect net income. Additionally, this calculation may not be comparable with similarly titled measures of other companies. A reconciliation of net income to adjusted EBITDA is included in the tables. At ONEOK (NYSE: OKE), we deliver energy products and services vital to an advancing world. We are a leading midstream operator that provides gathering, processing, fractionation, transportation, storage and marine export services. Through our approximately 60,000-mile pipeline network, we transport the natural gas, natural gas liquids (NGLs), refined products and crude oil that help meet domestic and international energy demand, contribute to energy security and provide safe, reliable and responsible energy solutions needed today and into the future. As one of the largest integrated energy infrastructure companies in North America, ONEOK is delivering energy that makes a difference in the lives of people in the U.S. and around the world. ONEOK is an S&P 500 company headquartered in Tulsa, Oklahoma. For information about ONEOK, visit the website: www.oneok.com. For the latest news about ONEOK, find us on LinkedIn, Facebook, X and Instagram. This news release contains certain "forward-looking statements" within the meaning of federal securities laws. Words such as “anticipates,” “believes,” “continues,” “could,” “estimates,” “expects,” “forecasts,” “goal,” “guidance,” “intends,” “may,” “might,” “outlook,” “plans,” “potential,” “projects,” “scheduled,” “should,” “target,” “will,” “would,” and similar expressions may be used to identify forward-looking statements. Forward-looking statements are not statements of historical fact and reflect our current views about future events. Such forward-looking statements include, but are not limited to, future financial and operating results, our plans, objectives, expectations and intentions, and other statements that are not historical facts, including future results of operations, adjusted EBITDA, projected cash flow and liquidity, business strategy, expected synergies or cost savings, and other plans and objectives for future operations. No assurances can be given that the forward-looking statements contained in this news release will occur as projected and actual results may differ materially from those projected. Forward-looking statements are based on current expectations, estimates and assumptions that involve a number of risks and uncertainties, many of which are beyond our control, and are not guarantees of future results. Accordingly, there are or will be important factors that could cause actual results to differ materially from those indicated in such statements and, therefore, you should not place undue reliance on any such statements and caution must be exercised in relying on forward-looking statements. These risks and uncertainties include, without limitation, the following: • the impact on drilling and production by factors beyond our control, including the demand for natural gas, NGLs, Refined Products and crude oil; producers’ desire and ability to drill and obtain necessary permits; regulatory compliance; reserve performance; and capacity constraints and/or shut downs on the pipelines that transport crude oil, natural gas, NGLs, and Refined Products from producing areas and our facilities; • the impact of unfavorable economic and market conditions, inflationary pressures, which may increase our capital expenditures and operating costs, raise the cost of capital or depress economic growth; • the impact of the volatility of natural gas, NGL, Refined Products and crude oil prices on our earnings and cash flows, which is impacted by a variety of factors beyond our control, including international terrorism and conflicts and geopolitical instability; • the impact of reduced volatility in energy prices or new government regulations that could discourage our storage customers from holding positions in Refined Products, crude oil and natural gas; • the economic or other impact of announced or future tariffs, including inflationary impacts; • the economic or other impact of the current federal government shutdown; • our dependence on producers, gathering systems, refineries and pipelines owned and operated by others and the impact of any closures, interruptions or reduced activity levels at these facilities; • the impact of increased attention to ESG issues, including climate change, and risks associated with the physical and financial impacts of climate change; • risks associated with operational hazards and unforeseen interruptions at our operations;

ONEOK Announces Higher Third Quarter 2025 Earnings and Affirms 2025 Net Income and Adjusted EBITDA Guidance Ranges Oct. 28, 2025 Page 8 -more- • the inability of insurance proceeds to cover all liabilities or incurred costs and losses, or lost earnings, resulting from a loss; • the risk of increased costs for insurance premiums or less favorable coverage; • demand for our services and products in the proximity of our facilities; • risks associated with our ability to hedge against commodity price risks or interest rate risks; • a breach of information security, including a cybersecurity attack, or failure of one or more key information technology or operational systems, and terrorist attacks, including cyber sabotage; • exposure to construction risk and supply risks if adequate natural gas, NGL, Refined Products and crude oil supply is unavailable upon completion of facilities; • the accuracy of estimates of hydrocarbon reserves, which could result in lower than anticipated volumes; • our lack of ownership over all of the land on which our property is located and certain of our facilities and equipment; • the impact of changes in estimation, type of commodity and other factors on our measurement adjustments; • excess capacity on our pipelines, processing, fractionation, terminal and storage assets; • risks associated with the period of time our assets have been in service; • our partial reliance on cash distributions from our unconsolidated affiliates on our operating cash flows; • our ability to cause our joint ventures to take or not take certain actions unless some or all of our joint-venture participants agree; • our reliance on others to construct and/or operate certain joint-venture assets and to provide other services; • our ability to use net operating losses and certain tax attributes; • increased regulation of exploration and production activities, including hydraulic fracturing, well setbacks and disposal of wastewater; • impacts of regulatory oversight and potential penalties on our business; • risks associated with the rate regulation, challenges or changes, which may reduce the amount of cash we generate; • the impact of our gas liquids blending activities, which subject us to federal regulations that govern renewable fuel requirements in the U.S.; • incurrence of significant costs to comply with the regulation of greenhouse gas emissions; • the impact of federal and state laws and regulations relating to the protection of the environment, public health and safety on our operations, as well as increased litigation and activism challenging oil and gas development as well as changes to and/or increased penalties from the enforcement of laws, regulations and policies; • the impact of unforeseen changes in interest rates, debt and equity markets and other external factors over which we have no control; • actions by rating agencies concerning our credit; • our indebtedness and guarantee obligations could cause adverse consequences, including making us vulnerable to general adverse economic and industry conditions, limiting our ability to borrow additional funds and placing us at competitive disadvantages compared with our competitors that have less debt; • an event of default may require us to offer to repurchase certain of our or ONEOK Partners’ senior notes or may impair our ability to access capital; • the right to receive payments on our outstanding debt securities and subsidiary guarantees is unsecured and effectively subordinated to any future secured indebtedness and any existing and future indebtedness of our subsidiaries that do not guarantee the senior notes; • use by a court of fraudulent conveyance to avoid or subordinate the cross guarantees of our or ONEOK Partners’ indebtedness; • the risks associated with pending or possible acquisitions and dispositions, including our ability to finance or integrate any such acquisitions and any regulatory delay or conditions imposed by regulatory bodies in connection with any such acquisitions and dispositions; • the risk that the EnLink and Medallion businesses will not be integrated successfully; • our ability to effectively manage our expanded operations following closing of recent acquisitions; • our ability to pay dividends; • our exposure to the credit risk of our customers or counterparties; • a shortage of skilled labor; • misconduct or other improper activities engaged in by our employees; • the impact of potential impairment charges; • the impact of the changing cost of providing pension and health care benefits, including postretirement health care benefits, to eligible employees and qualified retirees; • our ability to maintain an effective system of internal controls; and • the risk factors listed in the reports we have filed and may file with the SEC. Forward-looking statements are based on the estimates and opinions of management at the time the statements are made. Other than as required under securities laws, ONEOK undertakes no obligation to publicly update any forward-looking statement, whether as a result of new information, future events or changes in circumstances, expectations or otherwise. The foregoing review of important factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included herein and elsewhere, including the Risk Factors included in the most recent reports on Form 10-K and Form 10-Q and other documents of ONEOK on file with the SEC. ONEOK's SEC filings are available publicly on the SEC's website at www.sec.gov. ###

ONEOK Announces Higher Third Quarter 2025 Earnings and Affirms 2025 Net Income and Adjusted EBITDA Guidance Ranges Oct. 28, 2025 Page 9 -more- ONEOK, Inc. and Subsidiaries CONSOLIDATED STATEMENTS OF INCOME Three Months Ended Nine Months Ended Sept. 30, Sept. 30, (Unaudited) 2025 2024 2025 2024 (Millions of dollars, except per share amounts) Revenues Commodity sales $ 7,416 $ 4,083 $ 21,054 $ 12,005 Services and other 1,218 940 3,510 2,693 Total revenues 8,634 5,023 24,564 14,698 Cost of sales and fuel (exclusive of items shown separately below) 5,962 3,027 16,977 8,815 Operations and maintenance 639 512 1,912 1,481 Depreciation and amortization 378 274 1,126 790 General taxes 99 70 284 239 Transaction costs 10 10 74 17 Other operating expense (income), net (12) 2 (18) (65) Operating income 1,558 1,128 4,209 3,421 Equity in net earnings from investments 92 92 281 256 Other income, net 37 17 78 28 Interest expense (net of capitalized interest of $19, $19, $41 and $47, respectively) (450) (325) (1,330) (923) Income before income taxes 1,237 912 3,238 2,782 Income taxes (297) (219) (754) (670) Net income 940 693 2,484 2,112 Less: Net income attributable to noncontrolling interests 1 — 68 — Net income attributable to ONEOK 939 693 2,416 2,112 Less: Preferred stock dividends — 1 — 1 Net income available to common shareholders $ 939 $ 692 $ 2,416 $ 2,111 Basic earnings per common share $ 1.49 $ 1.18 $ 3.88 $ 3.61 Diluted earnings per common share $ 1.49 $ 1.18 $ 3.87 $ 3.60 Average shares (millions) Basic 630.6 584.8 623.1 584.5 Diluted 631.5 586.7 624.1 586.1

ONEOK Announces Higher Third Quarter 2025 Earnings and Affirms 2025 Net Income and Adjusted EBITDA Guidance Ranges Oct. 28, 2025 Page 10 -more- ONEOK, Inc. and Subsidiaries CONSOLIDATED BALANCE SHEETS Sept. 30, Dec. 31, (Unaudited) 2025 2024 Assets (Millions of dollars) Current assets Cash and cash equivalents $ 1,199 $ 733 Accounts receivable, net 2,580 2,326 Inventories 871 748 Other current assets 535 431 Total current assets 5,185 4,238 Property, plant and equipment Property, plant and equipment 54,454 52,274 Accumulated depreciation and amortization 7,296 6,339 Net property, plant and equipment 47,158 45,935 Other assets Investments in unconsolidated affiliates 2,773 2,316 Goodwill 8,108 8,091 Intangible assets, net 2,935 3,039 Other assets 457 450 Total other assets 14,273 13,896 Total assets $ 66,616 $ 64,069

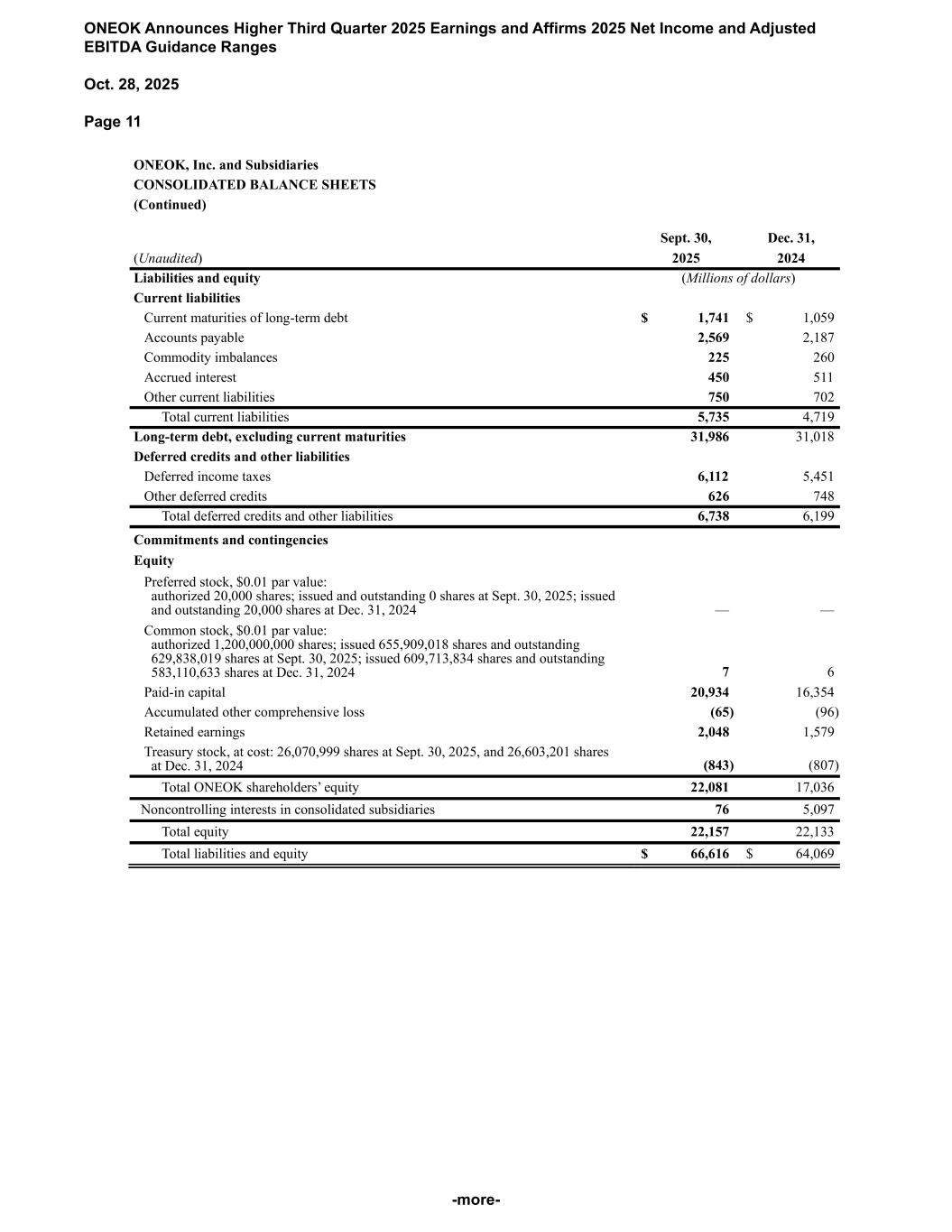

ONEOK Announces Higher Third Quarter 2025 Earnings and Affirms 2025 Net Income and Adjusted EBITDA Guidance Ranges Oct. 28, 2025 Page 11 -more- ONEOK, Inc. and Subsidiaries CONSOLIDATED BALANCE SHEETS (Continued) Sept. 30, Dec. 31, (Unaudited) 2025 2024 Liabilities and equity (Millions of dollars) Current liabilities Current maturities of long-term debt $ 1,741 $ 1,059 Accounts payable 2,569 2,187 Commodity imbalances 225 260 Accrued interest 450 511 Other current liabilities 750 702 Total current liabilities 5,735 4,719 Long-term debt, excluding current maturities 31,986 31,018 Deferred credits and other liabilities Deferred income taxes 6,112 5,451 Other deferred credits 626 748 Total deferred credits and other liabilities 6,738 6,199 Commitments and contingencies Equity Preferred stock, $0.01 par value: authorized 20,000 shares; issued and outstanding 0 shares at Sept. 30, 2025; issued and outstanding 20,000 shares at Dec. 31, 2024 — — Common stock, $0.01 par value: authorized 1,200,000,000 shares; issued 655,909,018 shares and outstanding 629,838,019 shares at Sept. 30, 2025; issued 609,713,834 shares and outstanding 583,110,633 shares at Dec. 31, 2024 7 6 Paid-in capital 20,934 16,354 Accumulated other comprehensive loss (65) (96) Retained earnings 2,048 1,579 Treasury stock, at cost: 26,070,999 shares at Sept. 30, 2025, and 26,603,201 shares at Dec. 31, 2024 (843) (807) Total ONEOK shareholders’ equity 22,081 17,036 Noncontrolling interests in consolidated subsidiaries 76 5,097 Total equity 22,157 22,133 Total liabilities and equity $ 66,616 $ 64,069

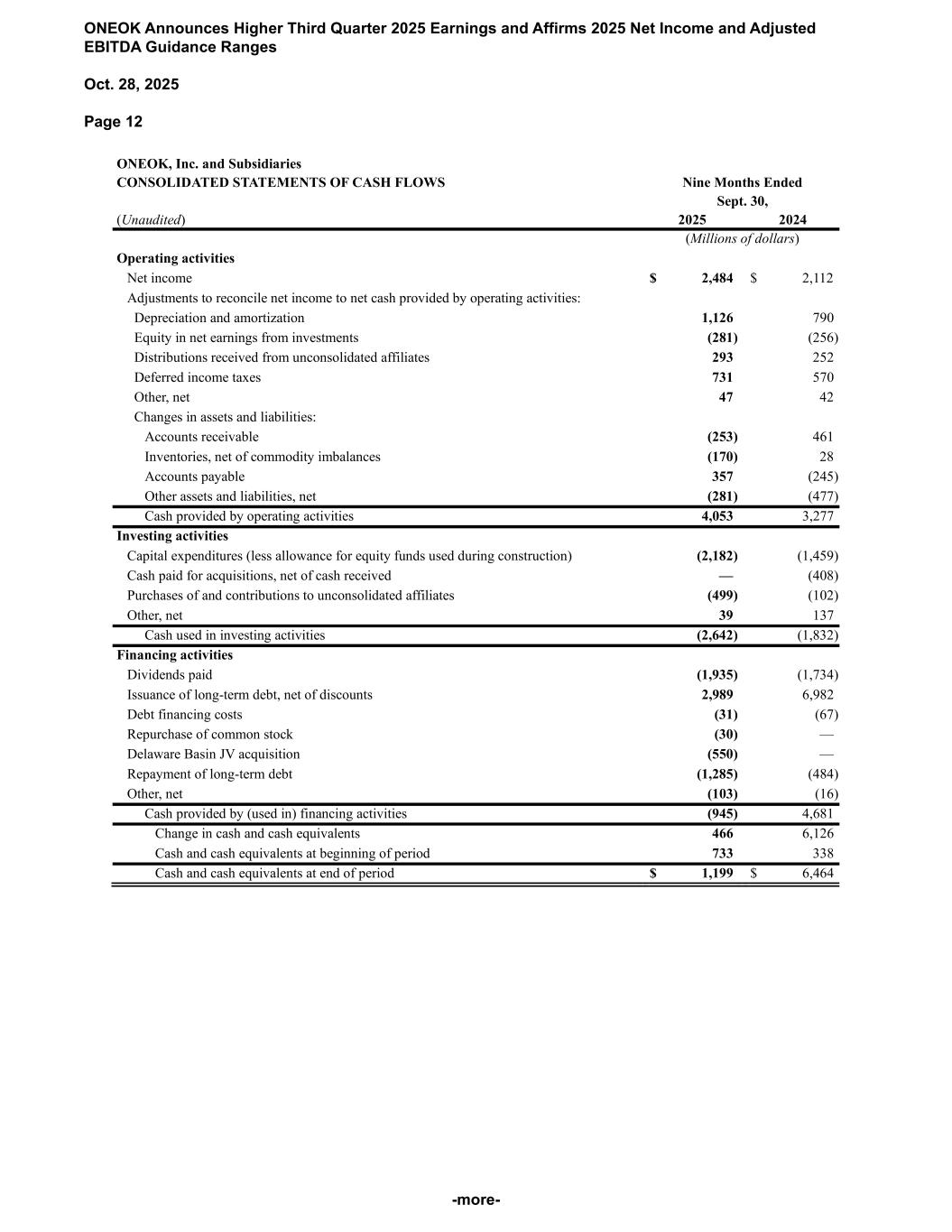

ONEOK Announces Higher Third Quarter 2025 Earnings and Affirms 2025 Net Income and Adjusted EBITDA Guidance Ranges Oct. 28, 2025 Page 12 -more- ONEOK, Inc. and Subsidiaries CONSOLIDATED STATEMENTS OF CASH FLOWS Nine Months Ended Sept. 30, (Unaudited) 2025 2024 (Millions of dollars) Operating activities Net income $ 2,484 $ 2,112 Adjustments to reconcile net income to net cash provided by operating activities: Depreciation and amortization 1,126 790 Equity in net earnings from investments (281) (256) Distributions received from unconsolidated affiliates 293 252 Deferred income taxes 731 570 Other, net 47 42 Changes in assets and liabilities: Accounts receivable (253) 461 Inventories, net of commodity imbalances (170) 28 Accounts payable 357 (245) Other assets and liabilities, net (281) (477) Cash provided by operating activities 4,053 3,277 Investing activities Capital expenditures (less allowance for equity funds used during construction) (2,182) (1,459) Cash paid for acquisitions, net of cash received — (408) Purchases of and contributions to unconsolidated affiliates (499) (102) Other, net 39 137 Cash used in investing activities (2,642) (1,832) Financing activities Dividends paid (1,935) (1,734) Issuance of long-term debt, net of discounts 2,989 6,982 Debt financing costs (31) (67) Repurchase of common stock (30) — Delaware Basin JV acquisition (550) — Repayment of long-term debt (1,285) (484) Other, net (103) (16) Cash provided by (used in) financing activities (945) 4,681 Change in cash and cash equivalents 466 6,126 Cash and cash equivalents at beginning of period 733 338 Cash and cash equivalents at end of period $ 1,199 $ 6,464

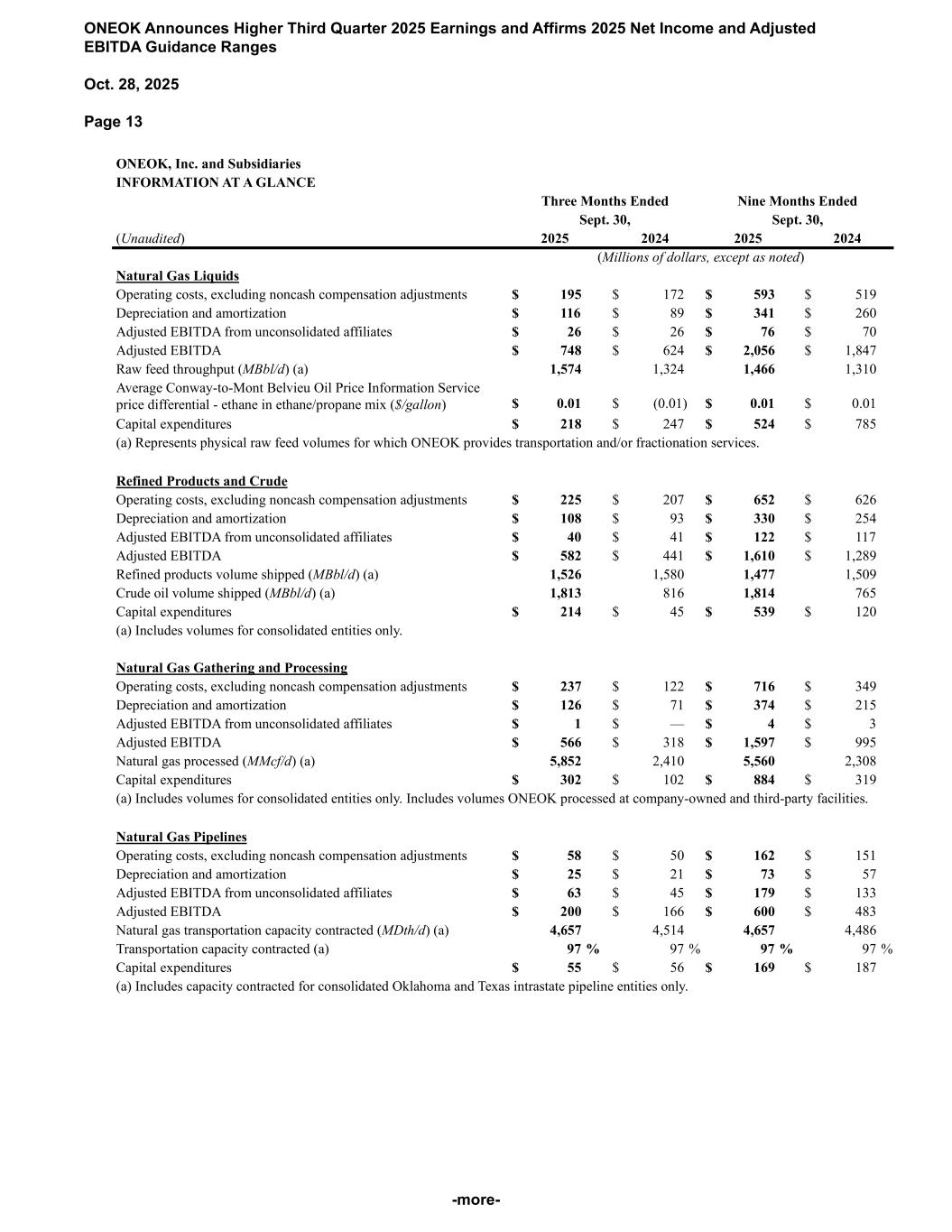

ONEOK Announces Higher Third Quarter 2025 Earnings and Affirms 2025 Net Income and Adjusted EBITDA Guidance Ranges Oct. 28, 2025 Page 13 -more- ONEOK, Inc. and Subsidiaries INFORMATION AT A GLANCE Three Months Ended Nine Months Ended Sept. 30, Sept. 30, (Unaudited) 2025 2024 2025 2024 (Millions of dollars, except as noted) Natural Gas Liquids Operating costs, excluding noncash compensation adjustments $ 195 $ 172 $ 593 $ 519 Depreciation and amortization $ 116 $ 89 $ 341 $ 260 Adjusted EBITDA from unconsolidated affiliates $ 26 $ 26 $ 76 $ 70 Adjusted EBITDA $ 748 $ 624 $ 2,056 $ 1,847 Raw feed throughput (MBbl/d) (a) 1,574 1,324 1,466 1,310 Average Conway-to-Mont Belvieu Oil Price Information Service price differential - ethane in ethane/propane mix ($/gallon) $ 0.01 $ (0.01) $ 0.01 $ 0.01 Capital expenditures $ 218 $ 247 $ 524 $ 785 (a) Represents physical raw feed volumes for which ONEOK provides transportation and/or fractionation services. Refined Products and Crude Operating costs, excluding noncash compensation adjustments $ 225 $ 207 $ 652 $ 626 Depreciation and amortization $ 108 $ 93 $ 330 $ 254 Adjusted EBITDA from unconsolidated affiliates $ 40 $ 41 $ 122 $ 117 Adjusted EBITDA $ 582 $ 441 $ 1,610 $ 1,289 Refined products volume shipped (MBbl/d) (a) 1,526 1,580 1,477 1,509 Crude oil volume shipped (MBbl/d) (a) 1,813 816 1,814 765 Capital expenditures $ 214 $ 45 $ 539 $ 120 (a) Includes volumes for consolidated entities only. Natural Gas Gathering and Processing Operating costs, excluding noncash compensation adjustments $ 237 $ 122 $ 716 $ 349 Depreciation and amortization $ 126 $ 71 $ 374 $ 215 Adjusted EBITDA from unconsolidated affiliates $ 1 $ — $ 4 $ 3 Adjusted EBITDA $ 566 $ 318 $ 1,597 $ 995 Natural gas processed (MMcf/d) (a) 5,852 2,410 5,560 2,308 Capital expenditures $ 302 $ 102 $ 884 $ 319 (a) Includes volumes for consolidated entities only. Includes volumes ONEOK processed at company-owned and third-party facilities. Natural Gas Pipelines Operating costs, excluding noncash compensation adjustments $ 58 $ 50 $ 162 $ 151 Depreciation and amortization $ 25 $ 21 $ 73 $ 57 Adjusted EBITDA from unconsolidated affiliates $ 63 $ 45 $ 179 $ 133 Adjusted EBITDA $ 200 $ 166 $ 600 $ 483 Natural gas transportation capacity contracted (MDth/d) (a) 4,657 4,514 4,657 4,486 Transportation capacity contracted (a) 97 % 97 % 97 % 97 % Capital expenditures $ 55 $ 56 $ 169 $ 187 (a) Includes capacity contracted for consolidated Oklahoma and Texas intrastate pipeline entities only.

ONEOK Announces Higher Third Quarter 2025 Earnings and Affirms 2025 Net Income and Adjusted EBITDA Guidance Ranges Oct. 28, 2025 Page 14 -more- ONEOK, Inc. RECONCILIATION OF NON-GAAP FINANCIAL MEASURES Three Months Ended Nine Months Ended Sept. 30, Sept. 30, (Unaudited) 2025 2024 2025 2024 (Millions of dollars) Reconciliation of net income to adjusted EBITDA Net income $ 940 $ 693 $ 2,484 $ 2,112 Interest expense, net of capitalized interest 450 325 1,330 923 Depreciation and amortization 378 274 1,126 790 Income taxes 297 219 754 670 Adjusted EBITDA from unconsolidated affiliates 129 112 381 323 Equity in net earnings from investments (92) (92) (281) (256) Noncash compensation expense and other (a) 17 14 81 48 Adjusted EBITDA $ 2,119 $ 1,545 $ 5,875 $ 4,610 Reconciliation of segment adjusted EBITDA to adjusted EBITDA Segment adjusted EBITDA: Natural Gas Gathering and Processing $ 566 $ 318 $ 1,597 $ 995 Natural Gas Liquids 748 624 2,056 1,847 Natural Gas Pipelines 200 166 600 483 Refined Products and Crude 582 441 1,610 1,289 Other (a) 23 (4) 12 (4) Adjusted EBITDA $ 2,119 $ 1,545 $ 5,875 $ 4,610 (a) The three and nine months ended Sept. 30, 2025, included transaction costs related primarily to the EnLink acquisition of $7 million and $59 million, respectively, included within other and $3 million and $15 million, respectively, included within noncash compensation expense and other.