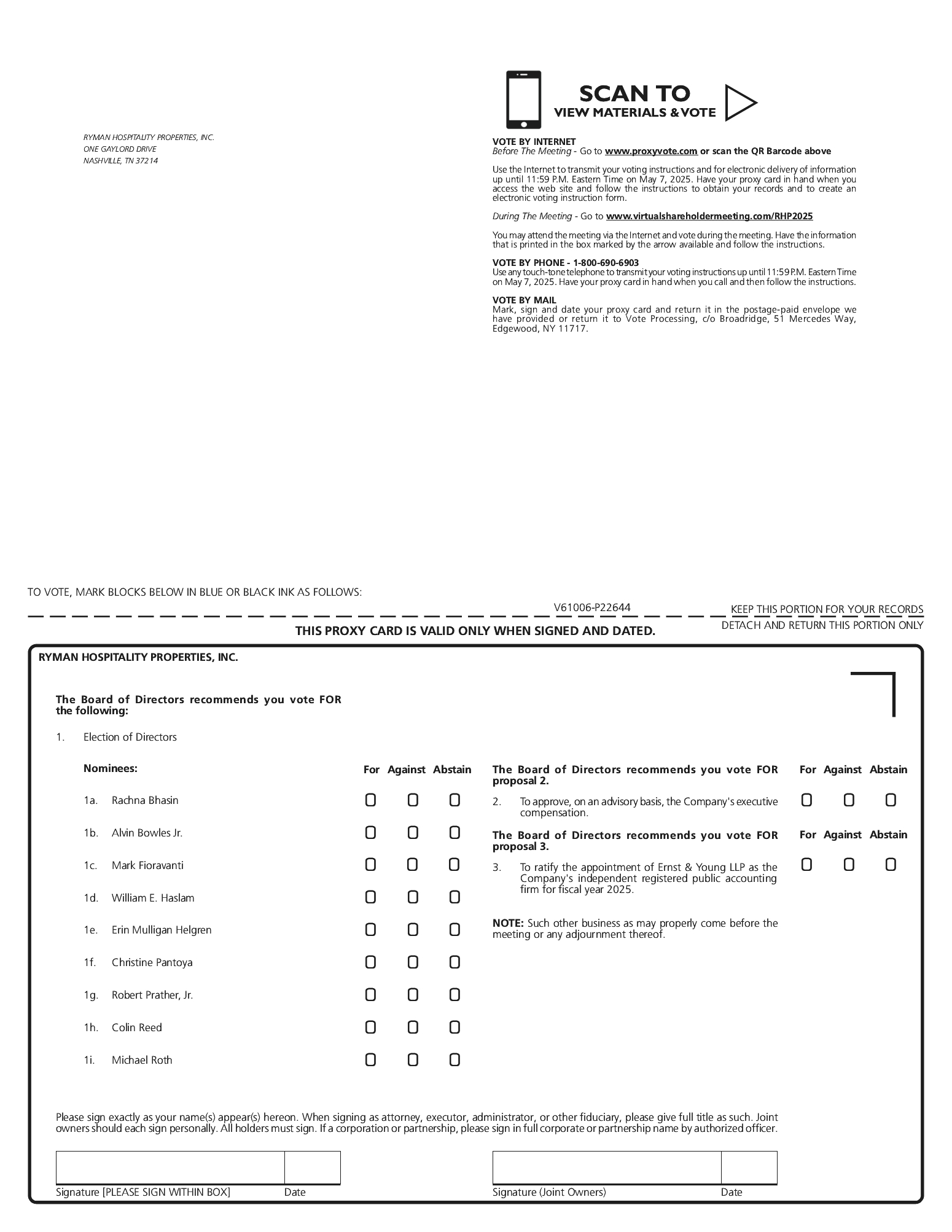

Discretionary Voting of Proxies on Other Matters

We do not intend to bring any proposals to the Annual Meeting other than Proposals 1, 2 and 3. As noted above, our Bylaws require stockholders to give advance notice of any proposal intended to be presented at an annual meeting. The deadline for this notice has passed, and we did not receive any such notice made in compliance with our Bylaws. If any other matter properly comes before our stockholders for a vote at the Annual Meeting, the persons named in the accompanying proxy card intend to vote the shares represented by them in accordance with their best judgment.

Instructions for Attending the Annual Meeting Virtually

We intend to conduct the Annual Meeting both in-person and online via live webcast. However, we may impose additional procedures or limitations on in-person meeting attendees, or we may decide to hold the meeting entirely online (i.e., a virtual-only meeting). We will announce any changes to the Annual Meeting via a press release and the filing of additional soliciting materials with the Securities and Exchange Commission, and we will also announce any changes on our proxy website, located at https://ir.rymanhp.com/proxy-materials-1. We encourage you to check this website in advance if you plan to attend the Annual Meeting in person.

To participate in the Annual Meeting virtually, visit www.virtualshareholdermeeting.com/RHP2025 and enter the control number included on your proxy materials. You may begin to log into the meeting platform beginning at 9:45 a.m. central time on May 8, 2025. The Annual Meeting will begin promptly at 10:00 a.m. central time.

The virtual meeting platform is fully supported across browsers (Internet Explorer, Chrome and Safari) and devices (including computers, tablets and cell phones) running the most updated version of applicable software. Participants should ensure that they have a reliable WiFi connection whenever they intend to participate in the Annual Meeting. Participants should allow time to log in and ensure that they can hear streaming audio prior to the start of the meeting. If you encounter any difficulties accessing the virtual meeting during the check-in or meeting time, please call the technical support number that will be posted on the virtual meeting log-in page.

If you wish to submit a question prior to the Annual Meeting, you may do so beginning at 9:00 a.m. eastern time on April 18, 2025, until 11:59 p.m. eastern time on April 25, 2025, by logging into www.proxyvote.com and entering your control number included on your proxy materials. Once past the login screen, click on “Question for Management”, type in your question and click “Submit”. In addition, www.proxyvote.com will re-open for questions beginning at 8:30 a.m. eastern time on May 5, 2025 until 11:59 p.m. eastern time on May 7, 2025. If you would like to submit your question during the Annual Meeting, log into the virtual meeting platform at www.virtualshareholdermeeting.com/RHP2025, type your question into the “Ask a Question” field and click “Submit”.

Questions pertinent to meeting matters will be answered during the question and answer period immediately following the formal business portion of the Annual Meeting. In order to give as many shareholders as possible the opportunity to ask questions, each shareholder will be limited to one question. Questions regarding personal matters, such as employment or service-related issues, or other matters not deemed pertinent to meeting matters or otherwise suitable for discussion at the meeting (in the discretion of the presiding officer at the meeting) will not be answered. Any questions suitable for discussion at the meeting that cannot be answered during the meeting due to time constraints will be posted online and answered at https://ir.rymanhp.com/proxy-materials-1 (and such questions (and answers) will be available as soon as practicable after the meeting and will remain available for two weeks after posting).

By Order of the Board of Directors,

Scott J. Lynn, Secretary

Nashville, Tennessee

April 4, 2025