SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of November, 2025

Commission File Number 1-14668

COMPANHIA PARANAENSE DE ENERGIA

(Exact name of registrant as specified in its charter)

Energy Company of Paraná

(Translation of Registrant's name into English)

José Izidoro Biazetto, 158

81200-240 Curitiba, Paraná

Federative Republic of Brazil

+55 (41) 3331-4011

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F. Form 20-F ___X___ Form 40-F _______

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No ___X____

| Summary | ||

| 1. Consolidated Results | ||

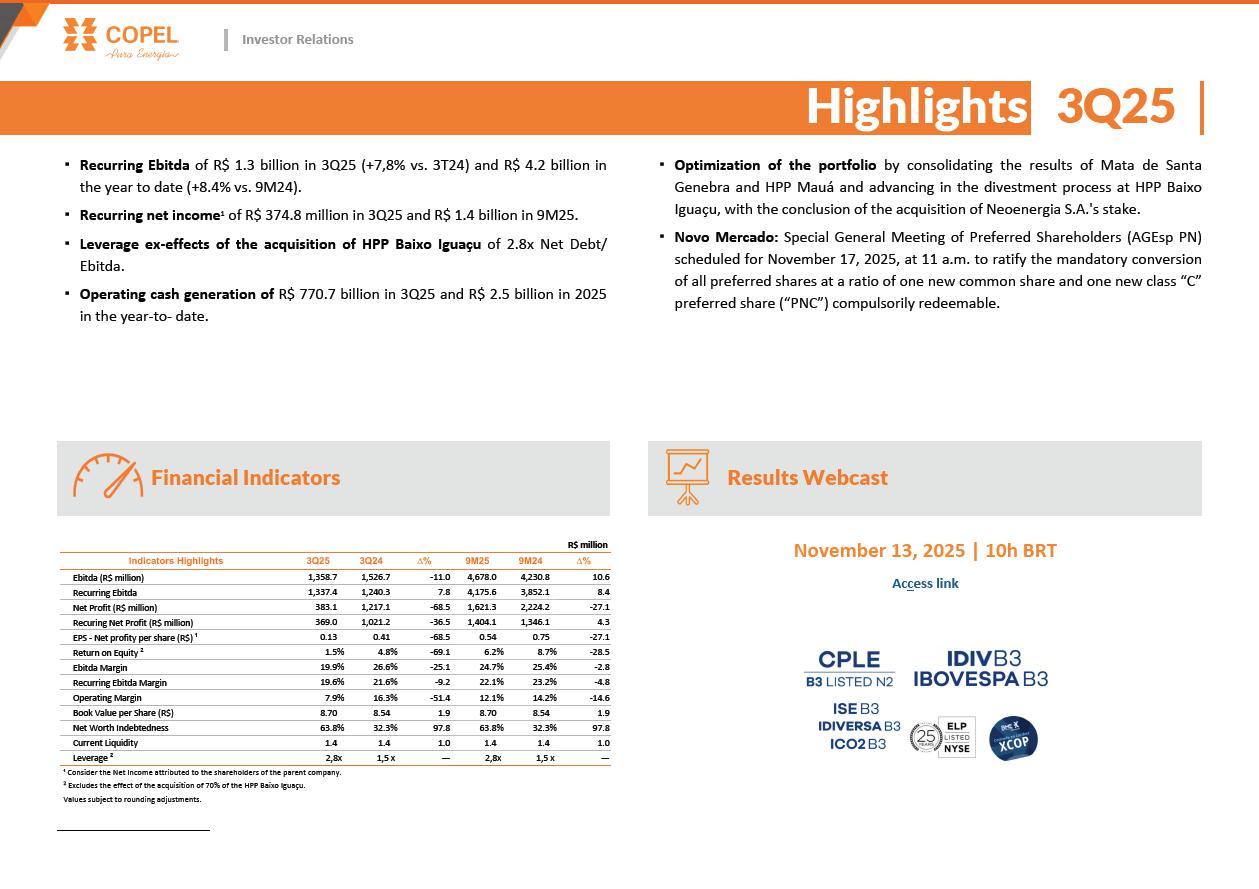

[1]

1 Copel Serviços, Elejor and other stakes in generation assets.

2 Excluding non-recurring items, mark-to-market - MTM at TradeCo, new replacement value for the adjustment to present value of the indemnifiable asset (VNR) at DisCo, equity equivalence and IFRS effects on transmission contract assets.

3 Copel (Holding), Copel Serviços and Elejor accounted for -2.1% of recurring Ebitda. 1

| 2 |

|

| 3 |

|

| 4 |

|

| 5 |

|

| 6 |

|

| 2. Investments | ||

| 7 |

|

|

3. Copel Geração e Transmissão (GenCo) (Consolidated Result) |

||

[4] Excluding non-recurring items and IFRS effects on transmission contract assets.

| 8 |

|

| 9 |

|

[5] Jandaíra I, II, III and IV wind farms (30° LEN - CCEAR 2025 - 2044).

| 10 |

|

[6] This refers to concession contract 060/2001, which represents 36.6% of GenCo's annual permitted revenue (APR) for transmission and proportional stakes.

| 11 |

|

| 4. Copel Distribuição (DisCo) | ||

| 12 |

|

| 13 |

|

| 14 |

|

| 5. Copel Comercialização (TradeCo) | ||

| 15 |

|

| 16 |

|

| 6. ESG performance | ||

| 17 |

|

| 18 |

|

| 7. Other highlights from the period | ||

7. Other highlights from the period

| 19 |

|

| 20 |

| EXHIBIT I - CONSOLIDATED RESULTS > INCOME STATEMENT |

| R$ '000 | |||||||

| Income Statement | 3Q25 | 3Q24 | Δ% | 9M25 | 9M24 | Δ% | |

| OPERATING REVENUES | 6,811,177 | 5,735,608 | 18.8 | 18,928,417 | 16,631,872 | 13.8 | |

| Electricity sales to final customers | 1,878,258 | 1,970,334 | -4.7 | 5,982,373 | 6,255,268 | -4.4 | |

| Electricity sales to distributors | 1,241,556 | 834657 | 48.8 | 3,357,229 | 2,301,493 | 45.9 | |

| Use of the main distribution and transmission grid | 1,752,729 | 1,660,092 | 5.6 | 5,212,408 | 5,133,304 | 1.5 | |

| Construction revenue | 952,822 | 661,016 | 44.1 | 2,435,282 | 1,908,985 | 27.6 | |

| Fair value of assets from the indemnity for the concession | 36,909 | 17,190 | 114.7 | 72,651 | 49,467 | 46.9 | |

| Result of Sectorial financial assets and liabilities | 845,437 | 420,709 | 101.0 | 1,408,164 | 566,185 | 148.7 | |

| Other operating revenues | 103,466 | 171,610 | -39.7 | 460,310 | 417,170 | 10.3 | |

| OPERATING COSTS AND EXPENSES | -5,866,333 | -4,640,519 | 26.4 | -15,545,166 | -13,715,653 | 13.3 | |

| Electricity purchased for resale | -3,083,439 | -2,327,982 | 32.5 | -7,899,201 | -6,314,383 | 25.1 | |

| Charge of the main distribution and transmission grid | -687,026 | -714,064 | -3.8 | -2,080,127 | -2,222,422 | -6.4 | |

| Personnel and management | -212,592 | -278,929 | -23.8 | -704,166 | -857,625 | -17.9 | |

| Pension and healthcare plans | -57,932 | -63,291 | -8.5 | -176,884 | -198,988 | -11.1 | |

| Materials and supplies | -19,122 | -22,093 | -13.4 | -64,036 | -62,236 | 2.9 | |

| Materials and supplies for power eletricity | — | — | — | — | -936 | — | |

| Third-party services | -287,408 | -274,613 | 4.7 | -848,418 | -772,679 | 9.8 | |

| Depreciation and amortization | -376,524 | -368,414 | 2.2 | -1,092,755 | -1,089,197 | 0.3 | |

| Provisions and reversals | -85,565 | -68,379 | 25.1 | -240,010 | -227,955 | 5.3 | |

| Construction cost | -950,376 | -658,392 | 44.3 | -2,426,558 | -1,902,041 | 27.6 | |

| Other cost and expenses | -106,349 | 135,638 | -178.4 | -13,011 | -67,191 | -80.6 | |

| EQUITY IN EARNINGS OF SUBSIDIARIES | 37,329 | 63,210 | -40.9 | 202,001 | 225,398 | -10.4 | |

| PROFIT BEFORE FINANCIAL RESULTS AND TAXES | 982,173 | 1,158,299 | -15.2 | 3,585,252 | 3,141,617 | 14.1 | |

| FINANCIAL RESULTS | -442,561 | -222,378 | 99.0 | -1,290,947 | -780,237 | 65.5 | |

| Financial income | 352,570 | 331,192 | 6.5 | 1,025,522 | 857,229 | 19.6 | |

| Financial expenses | -795,131 | -553,570 | 43.6 | -2,316,469 | -1,637,466 | 41.5 | |

| OPERATIONAL EXPENSES/ INCOME | 539,612 | 935,921 | -42.3 | 2,294,305 | 2,361,380 | -2.8 | |

| INCOME TAX AND SOCIAL CONTRIBUTION ON PROFIT | -175,437 | -198,541 | -11.6 | -691,899 | -628,745 | 10.0 | |

| Income tax and social contribution on profit | -72,813 | -65,713 | 10.8 | -225,118 | -208,150 | 8.2 | |

| Deferred income tax and social contribution on profit | -102,624 | -132,828 | -22.7 | -466,781 | -420,595 | 11.0 | |

| NET INCOME continuing operations | 364,175 | 737,380 | -50.6 | 1,602,406 | 1,732,635 | -7.5 | |

| NET INCOME discontinued operations | 18,898 | 479,709 | -96.1 | 18,898 | 491,571 | -96.2 | |

| NET INCOME | 383,073 | 1,217,089 | -68.5 | 1,621,304 | 2,224,206 | -27.1 | |

| Attributed to the controlling company's shareholders - continuing operations | 365,324 | 744,556 | -50.9 | 1,602,972 | 1,759,435 | -8.9 | |

| Attributed to the controlling company's shareholders - discontinued operations | 18,898 | 475,104 | — | 18,898 | 463,690 | -95.9 | |

| Attributed to non-controlling shareholders - continuing operations | -1,149 | -7,142 | -83.9 | -566 | -15,458 | -96.3 | |

| Attributed to non-controlling shareholders - discontinued operations | — | 4,571 | — | — | 16,539 | -100.0 | |

| EBITDA continued operations | 1,358,697 | 1,526,713 | -11.0 | 4,678,007 | 4,230,814 | 10.6 |

| 22 |

|

| EXHIBIT I - CONSOLIDATED RESULTS > BALANCE SHEET |

| R$ '000 | R$ '000 | |||||||

| Assets | Sep-25 | Dec-24 | Δ% | Liabilities | Sep-25 | Dec-24 | Δ% | |

| CURRENT | 13,140,211 | 13,041,808 | 0.8 | CURRENT | 9,161,089 | 10,342,380 | (11.4) | |

| Cash and cash equivalents | 3,815,007 | 4,161,939 | (8.3) | Payroll, social charges and accruals | 266,081 | 411,102 | (35.3) | |

| Bonds and securities | 155,621 | 623 | 24,879.3 | Suppliers | 3,008,055 | 2,324,423 | 29.4 | |

| Collaterals and escrow accounts | 9 | 9 | — | Income tax and social contribution payable | 58,969 | 83,482 | (29.4) | |

| Customers | 4,280,345 | 3,962,702 | 8.0 | Other taxes due | 327,463 | 302,345 | 8.3 | |

| Dividends receivable | 80,520 | 82,278 | (2.1) | Loans and financing | 214,337 | 1,231,205 | (82.6) | |

| Sectorial financial assets | 101,272.0 | — | — | Debentures | 1,943,347 | 2,025,110 | (4.0) | |

| Account receivable related to concession | 12,454 | 10,609 | 17.4 | Minimum compulsory dividend payable | 4,869 | 3,878 | 25.6 | |

| Contract Assets | 406,223 | 283,896 | 43.1 | Post employment benefits | 112,988 | 95,383 | 18.5 | |

| Fair value in energy purchase and sale operations | 257,470 | 217,350 | 18.5 | Customer charges due | 100,913 | 44,825 | 125.1 | |

| Other current receivables | 1,058,206 | 949,674 | 11.4 | Research and development and energy efficiency | 100,650 | 179,149 | (43.8) | |

| Inventories | 164,913 | 136,324 | 21.0 | Accounts Payable related to concession | 142,527 | 113,092 | 26.0 | |

| Income tax and social contribution | 361,936 | 296,128 | 22.2 | Net sectorial financial liabilities | 1,343,870 | 935,322 | 43.7 | |

| Other current recoverable taxes | 576,238 | 994,618 | (42.1) | Lease liability | 61,491 | 57,502 | 6.9 | |

| Prepaid expenses | 58,203 | 63,211 | (7.9) | Fair value in energy purchase and sale operations | 259,232 | 214,955 | 20.6 | |

| Related parties | — | 621 | (100.0) | Other accounts payable | 987,947 | 1,199,195 | (17.6) | |

| Assets held for sale | 1,811,794 | 1,881,826 | (3.7) | Provision for allocation of Pis and Cofins credits | 59,640 | 580,000 | — | |

| NON-CURRENT | 48,908,206 | 44,342,348 | 10.3 | Liabilities associated with assets held for sale | 168,710 | 541,412 | (68.8) | |

| Long Term Assets | 19,347,248 | 15,315,121 | 26.3 | NON-CURRENT | 26,939,661 | 21,404,841 | 25.9 | |

| Bonds and securities | 688,675 | 529,085 | 30.2 | Social and labor obligations | 2,169 | 457 | 374.6 | |

| Other temporary investments | 31,327 | 30,603 | 2.4 | Suppliers | 130,938 | 142,380 | (8.0) | |

| Customers | 143,422 | 116,180 | 23.4 | Deferred income tax and social contribution | 2,053,413 | 1,895,459 | 8.3 | |

| Judicial deposits | 373,897 | 394,364 | (5.2) | Other taxes due | 253,381 | 291,195 | (13.0) | |

| Sectoral financial assets | 303,816 | — | — | Loans and financing | 3,196,297 | 3,387,589 | (5.6) | |

| Account receivable related to concession | 4,051,462 | 3,497,351 | 15.8 | Debentures | 15,574,106 | 10,602,255 | 46.9 | |

| Contract Assets | 10,296,319 | 6,927,010 | 48.6 | Post employment benefits | 1,068,935 | 1,063,326 | 0.5 | |

| Fair value in energy purchase and sale operations | 561,453 | 479,938 | 17.0 | Research and development and energy efficiency | 285,639 | 241,294 | 18.4 | |

| Other non-current receivables | 745,396 | 681,846 | 9.3 | Accounts Payable related to concession | 973,291 | 992,252 | (1.9) | |

| Income tax and social contribution | 103,115 | 164,043 | (37.1) | Net sectorial financial liabilities | — | 142,488 | — | |

| Deferred income tax and social contribution | 880,813 | 1,174,175 | (25.0) | Lease liability | 245,884 | 271,004 | (9.3) | |

| Other non-current recoverable taxes | 1,167,468 | 1,320,526 | (11.6) | Fair value in energy purchase and sale operations | 223,222 | 170,837 | 30.7 | |

| Advance expenses | 85 | — | — | Other accounts payable | 249,142 | 247,021 | 0.9 | |

| Investments | 2,926,176 | 3,577,937 | (18.2) | Provision for allocation of Pis and Cofins credits | 709,120 | 1,000,588 | (29.1) | |

| Property, plant and equipment, net | 8,229,048 | 8,516,697 | (3.4) | Provisions for litigation | 1,974,124 | 956,696 | 106.3 | |

| Intangible assets | 18,128,024 | 16,623,610 | 9.0 | EQUITY | 25,947,667 | 25,636,935 | 1.2 | |

| Right to use an asset | 277,710 | 308,983 | (10.1) | Attributed to controlling shareholders | 25,986,034 | 25,674,718 | 1.2 | |

| TOTAL | 62,048,417 | 57,384,156 | 8.1 | Share capital | 12,821,758 | 12,821,758 | — | |

| Capital reserves | 12,116 | 5,595 | 116.6 | |||||

| Equity valuation adjustments | 482,585 | 517,408 | (6.7) | |||||

| Treasury shares | (117,194) | (50,044) | 134.2 | |||||

| Legal reserves | 1,766,110 | 1,766,110 | — | |||||

| Tax incentive reserve | 4,009 | — | — | |||||

| Retained earnings | 9,363,687 | 9,363,866 | — | |||||

| Proposed additional dividend | — | 1,250,025 | (100.0) | |||||

| Accrued earnings | 1,652,963 | — | — | |||||

| Attributable to non-controlling interest | (38,367) | (37,783) | 1.5 | |||||

| TOTAL | 62,048,417 | 57,384,156 | 8.1 | |||||

| 23 |

|

| EXHIBIT I - CONSOLIDATED RESULTS > CASH FLOW |

| CASH FLOWS FROM OPERATIONAL ACTIVITIES | ||

| R$'000 | ||

| 09/30/25 | 09/30/24 | |

| Net income from continuing operations | 1,602.406 | 1,732.635 |

| Adjustments to reconcile net income for the period with cash generation from operating activities: | 3,241.563 | 3,799.845 |

| Unrealized monetary and exchange variation and debt charges - net | 2,045,940 | 1,511,124 |

| Interest - bonus from the grant of concession agreements under the quota system | -94,742 | -88,600 |

| Remuneration of transmission concession contracts | -563,403 | -597,298 |

| Income tax and social contribution | 225,118 | 208,150 |

| Deferred income tax and social contribution | 466,781 | 420,595 |

| Equity in earnings of investees | -202,001 | -225,398 |

| Appropriation of post-employment benefits obligations | 172,717 | 192,662 |

| Creation for research and development and energy efficiency programs | 148,920 | 132,771 |

| Recognition of fair value of assets from the indemnity for the concession | -72,651 | -49,467 |

| Sectorial financial assets and liabilities result | -1,551,696 | -623,896 |

| Depreciation and amortization | 1,092,755 | 1,089,197 |

| Provision from the voluntary dismissal program | 20,979 | 18,388 |

| Long-term incentives | 10,416 | 976 |

| Net operating estimated losses, provisions and reversals | 240,010 | 227,955 |

| Realization of added value in business combinations | -1,348 | -539 |

| Fair value in energy purchase and sale operations | -24,973 | 26,009 |

| Fair value adjustment of debt instruments and hedges (swaps) | 16,779 | — |

| Loss on disposal of accounts receivable related to concession | 2,093 | 3,193 |

| Loss on disposal of contract assets | 7,289 | 11,963 |

| Loss on disposal of property, plant and equipment | 4,551 | 16,084 |

| Loss on disposal of intangible assets | 75,985 | 62,406 |

| Result of write-offs of use rights of assets and liabilities of leases - net | — | -4,631 |

| Assets disposal results | -356,278 | -264,434 |

| Others | -24,084 | — |

| Decrease (increase) in assets | 700.833 | 674.876 |

| Trade accounts receivable | 353,483 | 583,818 |

| Dividends and interest on own capital received | 164,241 | 158,889 |

| Judicial deposits | 46,386 | 6,133 |

| Sectorial financial assets | 502,571 | 124,699 |

| Other receivables | -78,927 | -39,671 |

| Inventories | -28,589 | 27,493 |

| Income tax and social contribution recoverable | -178,513 | -162,094 |

| Other taxes recoverable | -85,411 | -33,493 |

| Prepaid expenses | 4,971 | 8,517 |

| Related parties | 621 | 585 |

| Increase (decrease) in liabilities | 162,968 | -507,704 |

| Payroll, social charges and accruals | -49,089 | -334,900 |

| Related parties | — | — |

| Suppliers | 398,007 | 110,944 |

| Other taxes | 827,585 | 654,962 |

| Post-employment benefits | -149,503 | -164,689 |

| Sectorial charges due | 56,088 | 7,188 |

| Research and development and energy efficiency | -199,080 | -235,389 |

| Payable related to the concession | -84,955 | -82,483 |

| Other accounts payable | -373,593 | -191,986 |

| Provisions for legal claims | -262,492 | -271,351 |

| CASH GENERATED BY OPERATING ACTIVITIES | 4,105.364 | 3,967.017 |

| Income tax and social contribution paid | -249,631 | -257,299 |

| Loans and financing - interest due and paid | -359,006 | -386,404 |

| Debentures - interest due and paid | -963,399 | -658,810 |

| Charges for lease liabilities paid | -24,081 | -23,957 |

| Charges on loans granted/obtained from related parties | — | |

| NET CASH GENERATED BY OPERATING ACTIVITIES FROM CONTINUING OPERATIONS | 2,509,247 | 2,640,547 |

| NET CASH GENERATED BY OPERATING ACTIVITIES FROM DISCONTINUED OPERATIONS | — | 3,620 |

| NET CASH GENERATED FROM OPERATING ACTIVITIES | 2,509,247 | 2,644,167 |

| CASH FLOWS FROM INVESTMENT ACTIVITIES | ||

| Financial investments | -88,352 | -39,727 |

| Loans and financing granted to related parties | — | — |

| Receipt of loans and financing granted to related parties | — | — |

| Additions to contract assets | -2,210.701 | -1,652.051 |

| Acquisitions of subsidiaries - effect on cash | -108,137 | -82,954 |

| Acquisitions in investments | — | 10,357 |

| Sale of investments | -26.319 | -9,923 |

| Additions in investments | 294 | 37,129 |

| Capital reduction of investees | — | — |

| Additions to property, plant and equipment | -190,433 | — |

| Sale of property, plant and equipment | -1,060.804 | — |

| Additions to intangible assets | 914,795 | 2,066 |

| NET CASH USED BY INVESTMENT ACTIVITIES FROM CONTINUING OPERATIONS | -2,769.657 | -1,735.103 |

| NET CASH USED BY INVESTMENT ACTIVITIES FROM DISCONTINUED OPERATIONS | — | 608.713 |

| NET CASH USED FROM INVESTING ACTIVITIES | -2,769.657 | -1,126.390 |

| CASH FLOWS FROM FINANCING ACTIVITIES | ||

| Issue of loans and financing | — | 2,474 |

| Issue of debentures | 5,000,000 | 2,320,000 |

| Transaction costs in the issuing of debentures | -66,366 | -55,612 |

| Payments of principal - loans and financing | -1,202,171 | -196,430 |

| Payments of principal - debentures | -2,448,147 | -1,061,675 |

| Amortization of principal of lease liabilities | -49,859 | -54,364 |

| Buyback of own shares | -70,040 | — |

| Dividends and interest on own capital paid | -1,249,037 | -586,257 |

| NET CASH GENERATED (USED) BY FINANCING ACTIVITIES FROM CONTINUING OPERATIONS | -85,620 | 368,136 |

| NET CASH GENERATED (USED) BY FINANCING ACTIVITIES FROM DISCONTINUED OPERATIONS | — | -9,656 |

| NET CASH GENERATED (USED) FROM FINANCING ACTIVITIES | -85.620 | 358.480 |

| TOTAL EFFECTS ON CASH AND CASH EQUIVALENTS | -346,030 | 1,876,257 |

| Cash and cash equivalents at the beginning of the period | 4,161,939 | 5,634,623 |

| Cash and cash equivalents at the end of the period | 3,815,007 | 7,580,218 |

| Change in cash and cash equivalents from discontinued operations | 902 | -69,338 |

| CHANGE IN CASH AND CASH EQUIVALENTS | -346,030 | 1,876,257 |

| 24 |

|

| EXHIBIT I - CONSOLIDATED RESULTS > ADJUSTED EBITDA AND FINANCIAL RESULT |

| R$'000 | ||||||

| RECURRING EBITDA | 3Q25 | 3Q24 | Δ% | 9M25 | 9M24 | Δ% |

| EBITDA | 1,359 | 1,527 | -11.0 | 4,678 | 4,231 | 10.6 |

| (-/+) Fair value in the purchase and sale of energy | 43 | -18 | -339.7 | -25 | 26 | -196.2 |

| (-/+) Provision (reversal) Incentive Dismissal Program | — | 18 | -100.0 | 21 | 18 | 14.1 |

| (-/+) Assets disposal /swap | -35 | -264 | -86.6 | -346 | -264 | 30.7 |

| (-/+) Ebitda from discontinued Op. Compagas and UEGA | — | 20 | -100.0 | — | 59 | -100.0 |

| (-/+) Equity Income | -37 | -63 | -41.0 | -202 | -225 | -10.4 |

| (-/+)NRV | -37 | -17 | 114.5 | -73 | -50 | 46.9 |

| (+/-)Difference in Revenue from Corporate/Regulatory Transfer (see item 3.1.1) | 45 | 38 | 20.4 | 122 | 58 | 111.6 |

| RECURRING EBITDA | 1,337 | 1,240 | 7.8 | 4,176 | 3,852 | 8.4 |

| R$'000 | ||||||

| 3Q25 | 3Q24 | Δ% | 9M25 | 9M24 | Δ% | |

| Financial Revenues | 352,570 | 330,431 | 6.7 | 1,025,522 | 857,230 | 19.6 |

| Income from investments held for trading | 176,485 | 205,967 | -14.3 | 520,551 | 537,453 | -3.1 |

| Late fees on electricity bills | 83,284 | 85,594 | -2.7 | 246,843 | 188,771 | 30.8 |

| Interest on taxes to be compensated | 37,409 | 40,253 | -7.1 | 120,716 | 58,695 | 105.7 |

| Monetary restatement and adjustment to present value of accounts payable related to concession | 4,450 | 3 | 148,233.3 | 38,802 | 17,838 | 117.5 |

| Income and monetary restatement of judicial deposits | 11,099 | 10,467 | 6.0 | 32,926 | 26,725 | 23.2 |

| Income from sectorial assets and liabilities | 16,280 | 5,281 | 208.3 | 32,222 | 40,795 | -21.0 |

| Adjust the fair value of debentures | 20,033 | — | — | 20,033 | — | — |

| (-) Pis/Pasep and Cofins on revenues | -14,714 | -13,772 | 6.8 | -43,507 | -34,963 | 24.4 |

| Other financial revenues | 18,244 | -3,362 | -642.7 | 56,936 | 21,916 | 159.8 |

| Financial Expenses | -795,131 | -553,570 | 43.6 | -2,316,469 | -1,637,466 | 41.5 |

| Monetary variation, foreign exchange and debt service charges | -655,907 | -419,198 | 56.5 | -1,869,617 | -1,251,890 | 49.3 |

| Monetary variation and adjustment to present value of accounts payable related to concession | -33,792 | -35,722 | -5.4 | -121,537 | -107,907 | 12.6 |

| Income from sectorial assets and liabilities (NE nº 8) | — | — | — | -77,774 | -33,027 | 135.5 |

| Monetary variation of litigation | -24,784 | -39,642 | -37.5 | -57,080 | -70,988 | -19.6 |

| Uptade of provision for allocation of Pis and Cofins credits | -6,852 | -21,656 | -68.4 | -52,717 | -26,385 | 99.8 |

| Swap effect on debentures | -36,812 | — | — | -36,812 | — | — |

| Interest on lease liabilities | -8,055 | -5,097 | 58.0 | -25,009 | -19,877 | 25.8 |

| Interest on tax installments | -7,097 | -6,647 | 6.8 | -20,269 | -21,110 | -4.0 |

| Interest on R&D and PEE | -6,600 | -5,608 | 17.7 | -18,209 | -16,723 | 8.9 |

| Pis/ Pasep and Cofins taxes over interest on equity | -10,175 | — | — | -10,231 | -27,812 | -63.2 |

| Other financial expenses | -5,057 | -20,000 | -74.7 | -27,214 | -61,747 | -55.9 |

| Financial income (expenses) | -442,561 | -223,139 | 98.3 | -1,290,947 | -780,236 | 65.5 |

| 25 |

|

| EXHIBIT I - CONSOLIDATED RESULTS > EQUITY IN EARNINGS OF SUBSIDIARIES AND INDICATORS |

| R$'000 | ||||||

| Variation in Equity in earnings of subsidiaries | 3T25 | 3T24 | Δ% | 9M25 | 9M24 | Δ% |

| Joint Ventures | 30,157 | 57,344 | (47.4) | 183,786 | 211,365 | (13.0) |

| Voltalia São Miguel do Gostoso I Participações S.A. | (283) | 3,656 | (107.7) | (4,384) | (1,189) | 268.7 |

| Caiuá Transmissora de Energia S.A. | 3,128 | 2,700 | 15.9 | 12,333 | 9,113 | 35.3 |

| Integração Maranhense Transmissora de Energia S.A. | 4,903 | 4,600 | 6.6 | 16,422 | 14,364 | 14.3 |

| Matrinchã Transmissora de Energia (TP NORTE) S.A. | 24,234 | 18,007 | 34.6 | 72,894 | 65,354 | 11.5 |

| Guaraciaba Transmissora de Energia (TP SUL) S.A. | 9,455 | 12,664 | (25.3) | 31,753 | 35,199 | (9.8) |

| Paranaíba Transmissora de Energia S.A. | 7,645 | 6,096 | 25.4 | 24,751 | 21,490 | 15.2 |

| Mata de Santa Genebra Transmissão S.A. | — | 2,387 | (100.0) | 23,057 | 36,764 | (37.3) |

| Cantareira Transmissora de Energia S.A. | (19,068) | 7,181 | (365.5) | 6,552 | 30,138 | (78.3) |

| Solar Paraná | 143 | 53 | 169.8 | 408 | 132 | 209.1 |

| Associates | 7,172 | 5,866 | 22.3 | 18,215 | 14,033 | 29.8 |

| Dona Francisca Energética S.A. | 1,865 | 1,480 | 26.0 | 5,035 | 4,002 | 25.8 |

| Foz do Chopim Energética Ltda. | 5,307 | 4,386 | 21.0 | 13,180 | 10,033 | 31.4 |

| Carbocampel S.A. | — | — | — | — | (2) | — |

| TOTAL | 37,329 | 63,210 | (40.9) | 202,001 | 225,398 | (10.4) |

| R$'000 | |||||||

|

Main Indicators -Associates Sep-25 |

Dona Francisca | Foz do Chopim | |||||

| Total assets | 172,252 | 43,080 | |||||

| Shareholder’s equity¹ | 161,667 | 40,845 | |||||

| Net operating revenue | 49,952 | 50,555 | |||||

| Net Income | 21,866 | 36,845 | |||||

| Participation in the enterprise - % | 23.03 | 35.77 | |||||

| Investment book value | 37,232 | 14,610 | |||||

| R$ mil | |||||||

|

Main Indicators -Joint ventures Sep-25 |

Voltalia | Caiuá | Integração Maranhense | Matrinchã | Guaraciaba | Paranaíba | Cantareira |

| Total assets | 228,486 | 351,435 | 631,606 | 3,350,123 | 1,713,159 | 2,023,603 | 1,821,827 |

| Shareholder’s equity¹ | 228,246 | 259,145 | 417,415 | 2,366,505 | 1,151,609 | 1,173,194 | 804,184 |

| Net operating revenue | — | 27,041 | 41,493 | 187,894 | 105,088 | 171,935 | 50,951 |

| Net Income | (9,576) | 22,894 | 28,389 | 105,988 | 45,373 | 90,684 | 9,469 |

| Participation in the enterprise - % | 49.0 | 49.0 | 49.0 | 49.0 | 49.0 | 24.5 | 49.0 |

| Investment book value | 111,841 | 126,981 | 204,533 | 1,159,587 | 564,288 | 287,433 | 394,050 |

| Note: Income from Transmitters according to adjustments for the application of CPC 47 / IFRS 15 in the Corporate Statements. | |||||||

| 26 |

|

| EXHIBIT I - CONSOLIDATED RESULTS > SHARE CAPITAL |

| Share Capital - As of September 30, 2025 | |||||||||

| mil ações | |||||||||

| Shareholders | ON | % | PNA | % | PNB | % | Especial* | TOTAL | % |

| State of Paraná | 358,563 | 27.6 % | — | — | 116,081 | 6.9 % | <1 | 474,644 | 15.9 % |

| BNDESPAR | 131,162 | 10.1 % | — | — | 524,646 | 31.2 % | — | 655,808 | 22.0 % |

| Free Floating | 801,852 | 61.7 % | 1,075 | 34.4 % | 1,030,306 | 61.4 % | — | 1,833,233 | 61.5 % |

| B3 | 788,628 | 60.6 % | 1,075 | 34.4 % | 939,927 | 56.0 % | — | 1,729,630 | 58.0 % |

| NYSE | 13,016 | 1.0 % | — | — | 88,753 | 5.3 % | — | 101,769 | 3.4 % |

| LATIBEX | 208 | — % | — | — | 1,626 | 0.1 % | — | 1,834 | 0.1 % |

| Other | 2,946 | 0.2 % | 2,053 | 66 | 949 | 0.1 % | — | 5,948 | 0.2 % |

| Treasury shares | 5,825 | 0.4 % | — | — % | 7,353 | 0.4 % | — | 13,178 | 0.4 % |

| TOTAL | 1,300,348 | 100 % | 3,128 | 100 % | 1,679,335 | 100 % | <1 | 2,982,811 | 100 % |

| * State of Paraná has a special class preferred share with veto power as established in the Statute. | |||||||||

| 27 |

|

| EXHIBIT II- RESULT BY SUBSIDIARY > COPEL GET (CONSOLIDATED) |

| R$ '000 | ||||||

| Income Statement | 3Q25 | 3Q24 | Δ% | 9M25 | 9M24 | Δ% |

| OPERATING REVENUES | 1,252,299 | 1,096,920 | 14.2 | 3,653,229 | 3,311,337 | 10.3 |

| Electricity sales to distributors | 878,430 | 866,090 | 1.4 | 2,678,548 | 2,528,738 | 5.9 |

| Use of the main transmission grid | 316,159 | 204,312 | 54.7 | 781,932 | 708,172 | 10.4 |

| Construction revenue | 54,530 | 19,013 | — | 165,671 | 48,887 | — |

| Other operating revenues | 3,180 | 7,505 | -57.6 | 27,078 | 25,540 | 6.0 |

| OPERATING COSTS AND EXPENSES | -727,611 | -430,080 | 69.2 | -1,713,548 | -1,693,164 | 1.2 |

| Electricity purchased for resale | -179,725 | -66,075 | — | -290,395 | -111,715 | — |

| Charges of main distribution and transmission grid | -125,444 | -143,403 | -12.5 | -386,559 | -438,291 | -11.8 |

| Personnel and management | -65,370 | -87,689 | -25.5 | -222,269 | -278,444 | -20.2 |

| Pension and healthcare plans | -16,887 | -19,172 | -11.9 | -52,369 | -60,603 | -13.6 |

| Materials and supplies | -8,550 | -6,030 | 41.8 | -24,628 | -14,557 | 69.2 |

| Materials and supplies for power eletricity | — | — | — | — | -936 | — |

| Third-party services | -58,239 | -68,491 | -15.0 | -191,576 | -202,014 | -5.2 |

| Depreciation and amortization | -186,411 | -205,511 | -9.3 | -541,112 | -625,566 | -13.5 |

| Provisions and reversals | -10,073 | -16,480 | -38.9 | -16,842 | -22,618 | -25.5 |

| Construction cost | -52,084 | -16,390 | — | -156,947 | -41,944 | — |

| Other cost and expenses | -24,828 | 199,161 | — | 169,149 | 103,524 | 63.4 |

| EQUITY IN EARNINGS OF SUBSIDIARIES | 35,603 | 58,021 | -38.6 | 200,940 | 222,454 | -9.7 |

| PROFIT BEFORE FINANCIAL RESULTS AND TAXES | 560,291 | 724,861 | -22.7 | 2,140,621 | 1,840,627 | 16.3 |

| FINANCIAL RESULTS | -269,049 | -133,918 | — | -762,640 | -447,250 | 70.5 |

| Financial income | 109,843 | 106,711 | 2.9 | 335,363 | 275,770 | 21.6 |

| Financial expenses | -378,892 | -240,629 | 57.5 | -1,098,003 | -723,020 | 51.9 |

| OPERATIONAL EXPENSES/ INCOME | 291,242 | 590,943 | -50.7 | 1,377,981 | 1,393,377 | -1.1 |

| INCOME TAX AND SOCIAL CONTRIBUTION ON PROFIT | -60,816 | -186,599 | -67.4 | -365,997 | -317,381 | 15.3 |

| Income tax and social contribution on profit | -69,124 | -60,379 | 14.5 | -199,814 | -174,792 | 14.3 |

| Deferred income tax and social contribution on profit | 8,308 | -126,220 | — | -166,183 | -142,589 | 16.5 |

| NET INCOME continuing operations | 230,426 | 404,344 | -43.0 | 1,011,984 | 1,075,996 | -5.9 |

| NET INCOME discontinued operations | 18,898.00 | 12,004 | 57.4 | 18,898.00 | -18,377 | — |

| NET INCOME | 249,324 | 416,348 | -40.1 | 1,030,882 | 1,057,619 | -2.5 |

| Attributed to shareholders of the parent company - continuing operations | 230,426 | 404,344 | -43.0 | 1,011,984 | 1,084,352 | -6.7 |

| Attributed to the controlling company's shareholders - discontinued operations | 18,898 | 12,004 | 57.4 | 18,898 | -11,586 | — |

| Attributed to non-controlling shareholders | — | — | — | — | -15,147 | — |

| EBITDA continuing operations | 746,702 | 930,372 | -19.7 | 2,681,733 | 2,466,193 | 8.7 |

| 28 |

|

| EXHIBIT II- RESULT BY SUBSIDIARY > COPEL DIS |

| R$ '000 | ||||||

| Income Statement | 3Q25 | 3Q24 | Δ% | 9M25 | 9M24 | Δ% |

| OPERATING REVENUES | 5,125,167 | 4,352,365 | 17.8 | 13,986,100 | 12,556,067 | 11.4 |

| Electricity sales to final customers | 1,463,734 | 1,482,084 | -1.2 | 4,770,004 | 4,835,789 | -1.4 |

| Electricity sales to distributors | 183,393 | 62,717 | 192.4 | 284,740 | 83,935 | 239.2 |

| Use of the main distribution grid | 1,556,804 | 1,568,245 | -0.7 | 4,782,283 | 4,774,303 | 0.2 |

| Construction revenue | 898,292 | 642,002 | 39.9 | 2,269,611 | 1,860,097 | 22.0 |

| Fair value of assets from the indemnity for the concession | 36,909 | 17,190 | 114.7 | 72,651 | 49,467 | 46.9 |

| Sectorial assets and liabilities result | 845,436 | 420,709 | 101.0 | 1,408,163 | 566,185 | 148.7 |

| Other operating revenues | 140,598 | 159,418 | -11.8 | 398,648 | 386,291 | 3.2 |

| OPERATING COSTS AND EXPENSES | -4,616,770 | -3,893,834 | 18.6 | -12,532,390 | -11,163,695 | 12.3 |

| Electricity purchased for resale | -2,344,772 | -1,910,333 | 22.7 | -6,170,339 | -5,222,496 | 18.1 |

| Charges of main transmission grid | -678,247 | -676,178 | 0.3 | -2,024,457 | -2,113,943 | -4.2 |

| Personnel and management | -115,838 | -166,337 | -30.4 | -399,998 | -514,552 | -22.3 |

| Pension and healthcare plans | -38,056 | -41,217 | -7.7 | -115,521 | -129,216 | -10.6 |

| Materials and supplies | -10,255 | -15,409 | -33.4 | -38,275 | -46,026 | -16.8 |

| Third-party services | -216,410 | -187,818 | 15.2 | -617,866 | -519,102 | 19.0 |

| Depreciation and amortization | -179,433 | -152,595 | 17.6 | -519,851 | -433,938 | 19.8 |

| Provisions and reversals | -73,628 | -46,880 | 57.1 | -221,736 | -188,090 | 17.9 |

| Construction cost | -898,292 | -642,002 | 39.9 | -2,269,611 | -1,860,097 | 22.0 |

| Other cost and expenses | -61,840 | -55,064 | 12.3 | -154,736 | -136,235 | 13.6 |

| PROFIT BEFORE FINANCIAL RESULTS AND TAXES | 508,397 | 458,531 | 10.9 | 1,453,710 | 1,392,372 | 4.4 |

| FINANCIAL RESULTS | -179,976 | -103,031 | 74.7 | -569,070 | -381,617 | 49.1 |

| Financial income | 194,454 | 162,905 | 19.4 | 519,387 | 367,811 | 41.2 |

| Financial expenses | -374,430 | -265,936 | 40.8 | -1,088,457 | -749,428 | 45.2 |

| OPERATIONAL EXPENSES/ INCOME | 328,421 | 355,500 | -7.6 | 884,640 | 1,010,755 | -12.5 |

| INCOME TAX AND SOCIAL CONTRIBUTION ON PROFIT | -103,077 | -111,695 | -7.7 | -273,909 | -317,165 | -13.6 |

| Income tax and social contribution on profit | — | — | — | — | — | — |

| Deferred income tax and social contribution on profit | -103,077 | -111,695 | -7.7 | -273,909 | -317,165 | -13.6 |

| NET INCOME (LOSS) | 225,344 | 243,805 | -7.6 | 610,731 | 693,590 | -11.9 |

| EBITDA | 687,830 | 611,127 | 12.6 | 1,973,561 | 1,826,310 | 8.1 |

| 29 |

|

| EXHIBIT II- RESULT BY SUBSIDIARY > COPEL DIS |

| R$'000 | ||||||

| OPERATING REVENUE | 3Q25 | 3Q24 | Δ% | 9M25 | 9M24 | Δ% |

| Electricity sales to final customers | 1,922,785 | 1,816,194 | 5.9 | 5,642,216.0 | 5,831,298.0 | -3.2 |

| Residential | 998,892 | 866,777 | 15.2 | 2,894,590.0 | 2,736,461.0 | 5.8 |

| Industrial | 145,126 | 173,431 | -16.3 | 410,976.0 | 527,212.0 | -22.0 |

| Commercial, service and other activities | 432,224 | 416,827 | 3.7 | 1,297,038.0 | 1,371,374.0 | -5.4 |

| Rural | 194,216 | 183,580 | 5.8 | 601,792.0 | 615,340.0 | -2.2 |

| Public Sector | 70,992 | 63,484 | 11.8 | 211,974.0 | 212,449.0 | -0.2 |

| Street lightining | 57,045 | 50,113 | 13.8 | 148,366.0 | 141,632.0 | 4.8 |

| Public Service | 24,290 | 61,982 | -60.8 | 77,480.0 | 226,830.0 | -65.8 |

| Donations and subsidies | 383,554 | 283,646 | 35.2 | 1,123,505.0 | 826,980.0 | 35.9 |

| Electricity sales to distributors | 190,495 | 65,329 | 191.6 | 295,980.0 | 88,072.0 | 236.1 |

| Bilateral contracts | 2,665 | 4,068 | -34.5 | 7,796.0 | 16,471.0 | -52.7 |

| Electricity Trading Chamber - CCEE | 187,830 | 61,261 | 206.6 | 288,184.0 | 71,601.0 | 302.5 |

| Use of the main distribution grid | 3,205,443 | 2,920,059 | 9.8 | 9,426,178.0 | 8,874,798.0 | 6.2 |

| Residential | 1,081,623 | 957,338 | 13.0 | 3,224,929.0 | 2,962,998.0 | 8.8 |

| Industrial | 343,882 | 338,325 | 1.6 | 984,752.0 | 965,024.0 | 2.0 |

| Commercial, service and other activities | 538,163 | 521,217 | 3.3 | 1,656,918.0 | 1,644,790.0 | 0.7 |

| Rural | 214,916 | 208,072 | 3.3 | 683,492.0 | 679,621.0 | 0.6 |

| Public Sector | 79,145 | 75,184 | 5.3 | 247,429.0 | 241,233.0 | 2.6 |

| Street lightining | 54,012 | 52,129 | 3.6 | 153,884.0 | 152,137.0 | 1.1 |

| Public Service | 35,356 | 57,505 | -38.5 | 107,352.0 | 194,389.0 | -44.8 |

| Free Market | 819,984 | 666,994 | 22.9 | 2,246,691.0 | 1,912,089.0 | 17.5 |

| Dealers and generators | 38,362 | 43,295 | -11.4 | 120,731.0 | 122,517.0 | -1.5 |

| Construction Revenue | 898,292 | 642,002 | 39.9 | 2,269,611.0 | 1,860,097.0 | 22.0 |

| Fair value of assets from the indemnity for the concession | 36,909 | 17,190 | 114.7 | 72,651.0 | 49,467.0 | 46.9 |

| Sectorial assets and liabilities result | 931,610 | 463,591 | 101.0 | 1,551,695.0 | 623,895.0 | 148.7 |

| Other operating income | 154,932 | 175,668 | -11.8 | 439,287.0 | 425,665.0 | 3.2 |

| Leases and rentals | 143,565 | 162,847 | -11.8 | 416,627.0 | 404,046.0 | 3.1 |

| Income from the provision of services | 1,723 | 1,942 | -11.3 | 3,355.0 | 3,696.0 | -9.2 |

| Other income | 9,644 | 10,879 | -11.4 | 19,305.0 | 17,923.0 | 7.7 |

| RECEITA OPERACIONAL BRUTA | 7,724,020 | 6,383,679 | 21.0 | 20,821,123.0 | 18,580,272.0 | 12.1 |

| (-) Tributos e deduções | -2,598,851 | -2,031,314 | 27.9 | -6,835,022.0 | -6,024,205.0 | 13.5 |

| (-) PIS/PASEP e COFINS | -540,173 | -453,255 | 19.2 | -1,460,826.0 | -1,315,394.0 | 11.1 |

| (-) ICMS | -851,647 | -794,979 | 7.1 | -2,554,192.0 | -2,436,437.0 | 4.8 |

| (-) Encargos Setoriais | -1,207,029 | -783,080 | 54.1 | -2,819,999.0 | -2,272,374.0 | 24.1 |

| (-) ISS | -2 | — | — | -5.0 | — | — |

| NET OPERATING REVENUES | 5,125,169 | 4,352,365 | 17.8 | 13,986,101.0 | 12,556,067.0 | 11.4 |

| 30 |

|

| EXHIBIT II- RESULT BY SUBSIDIARY > COPEL COM (MERCADO LIVRE) |

| R$ '000 | ||||||

| Income Statement | 3Q25 | 3Q24 | Δ% | 9M25 | 9M24 | Δ% |

| OPERATING REVENUES | 1,122,386 | 901,385 | 24.5 | 3,209,841.0 | 2,590,380.0 | 23.9 |

| Electricity sales to final customers | 414,694 | 488,576 | -15.1 | 1,212,945.0 | 1,420,544.0 | -14.6 |

| Electricity sales to distributors | 750,140 | 410,894 | 82.6 | 1,969,890.0 | 1,167,170.0 | 68.8 |

| Other operating revenues | -42,448 | 1,915 | — | 27,006.0 | 2,666.0 | 913.1 |

| OPERATING COSTS AND EXPENSES | -1,172,599 | -880,878 | 33.1 | -3,153,561.0 | -2,549,093.0 | 23.7 |

| Electricity purchased for resale | -1,162,277 | -871,755 | 33.3 | -3,125,498.0 | -2,523,054.0 | 23.9 |

| Personnel and management | -5,504 | -3,591 | 53.3 | -14,340.0 | -11,152.0 | 28.6 |

| Pension and healthcare plans | -429 | -429 | — | -1,302.0 | -1,321.0 | -1.4 |

| Materials and supplies | -113 | -14 | 720.7 | -221.0 | -48.0 | 360.3 |

| Third-party services | -724 | -1,847 | -60.8 | -2,730.0 | -4,253.0 | -35.8 |

| Depreciation and amortization | -500 | -443 | 12.9 | -1,387.0 | -1,313.0 | 5.7 |

| Provisions and reversals | -314 | -1,847 | -83.0 | -1,552.0 | -4,436.0 | -65.0 |

| Other cost and expenses | -2,738 | -953 | 187.3 | -6,530.0 | -3,516.0 | 85.7 |

| EQUITY IN EARNINGS OF SUBSIDIARIES | — | — | 0.0 | 0.0 | 0.0 | 0.0 |

| PROFIT BEFORE FINANCIAL RESULTS AND TAXES | -50,213 | 20,508 | — | 56,280.0 | 41,287.0 | 36.3 |

| FINANCIAL RESULTS | 9,190 | 10,626 | -13.5 | 28,800.0 | 29,924.0 | -3.8 |

| Financial income | 9,322 | 10,731 | -13.1 | 29,213.0 | 30,166.0 | -3.2 |

| Financial expenses | -132 | -105 | 25.8 | -414.0 | -242.0 | 71.0 |

| OPERATIONAL EXPENSES/ INCOME | -41,023 | 31,134 | — | 85,080.0 | 71,211.0 | 19.5 |

| INCOME TAX AND SOCIAL CONTRIBUTION ON PROFIT | 13,985 | -10,667 | — | -29,106.0 | -23,980.0 | 21.4 |

| Income tax and social contribution on profit | -963 | -4,893 | -80.3 | -21,069.0 | -32,723.0 | -35.6 |

| Deferred income tax and social contribution on profit | 14,948 | -5,774 | — | -8,036.0 | 8,743.0 | — |

| NET INCOME (LOSS) | -27,037 | 20,467 | — | 55,974.0 | 47,231.0 | 18.5 |

| EBITDA | -49,713 | 20,951 | — | 54,893.0 | 42,600.0 | 28.9 |

| 31 |

|

| EXHIBIT II- RESULT BY SUBSIDIARY > INCOME STATEMENT FOR THE QUARTER BY COMPANY |

| R$'000 | |||||||||||||||||

| Income Statement 3Q25 | GET | Distribuição | Compagas | Elejor | UEG Araucária | Serviços | Parques Eólicos | FDA | Bela Vista | Pequenos ativos mantidos para venda | MSG | C. Oeste, Marumbi, Uirapuru | Mercado Livre | Holding |

Elimin. e Reclassif. |

Consolidado | |

| Geração | Transmissão | ||||||||||||||||

| NET OPERATING INCOME | 590,479 | 273,419 | 5,125,167 | — | 34,901 | — | 2,411 | 155,644 | 149,661 | 8,185 | — | 83,684 | 23,152 | 1,122,386 | — | -757,912 | 6,811,177 |

| Electricity sales to final customers | — | — | 1,463,734 | — | — | — | — | — | — | — | — | — | — | 414,694 | — | -170 | 1,878,258 |

| Electricity sales to distributors | 580,339 | — | 183,393 | — | 34,814 | — | — | 155,644 | 149,661 | 8,185 | — | — | — | 750,140 | — | -620,620 | 1,241,556 |

| Use of the main distribution and transmission grid (TUSD/ TUST) | — | 218,364 | 1,556,804 | — | — | — | — | — | — | — | — | 82,677 | 17,776 | — | — | -122,892 | 1,752,729 |

| Construction revenue | — | 48,247 | 898,292 | — | — | — | — | — | — | — | — | 915 | 5,368 | — | — | — | 952,822 |

| Fair value of assets from the indemnity for the concession | — | — | 36,909 | — | — | — | — | — | — | — | — | — | — | — | — | — | 36,909 |

| Sectoral assets and liabilities result | — | — | 845,437 | — | — | — | — | — | — | — | — | — | — | — | — | — | 845,437 |

| Other operating revenues | 10,140 | 6,808 | 140,598 | — | 87 | — | 2,411 | — | — | — | — | 92 | 8 | -42,448 | — | -14,230 | 103,466 |

| OPERATING COSTS AND EXPENSES | -342,550 | -111,403 | -4,616,769 | — | -22,708 | — | -2,490 | -171,994 | -104,602 | -6,294 | — | -9,704 | -6,731 | -1,172,599 | -52,832 | 754,343 | -5,866,333 |

| Energy purchased for resale | -122,727 | — | -2,344,772 | — | -27 | — | — | -41,511 | -28,990 | -1,238 | — | — | — | -1,162,276 | — | 618,102 | -3,083,439 |

| Charges of the main distribution and transmission grid | -71,028 | — | -678,247 | — | -6,245 | — | — | -18,175 | -37,203 | -360 | — | — | — | — | — | 124,232 | -687,026 |

| Personnel and management | -32,443 | -28,419 | -115,838 | — | -1,250 | — | -95 | -2,430 | -974 | -86 | — | -882 | -136 | -5,504 | -24,535 | — | -212,592 |

| Private pension and health plans | -8,780 | -7,525 | -38,056 | — | -41 | — | -18 | -331 | -144 | -11 | — | -76 | -20 | -429 | -2,501 | — | -57,932 |

| Materials and supplies | -1,256 | -1,218 | -10,254 | — | -83 | — | -9 | -5,466 | -523 | -45 | — | -14 | -33 | -113 | -109 | — | -19,122 |

| Third-party services | -21,732 | -13,381 | -216,410 | — | -3,752 | — | -1,378 | -23,038 | -5,474 | -973 | — | -5,843 | -1,668 | -723 | -7,560 | 14,524 | -287,408 |

| Depreciation and amortization | -83,232 | -4,820 | -179,433 | — | -8,157 | — | -968 | -69,573 | -19,307 | -2,850 | — | -77 | -10 | -500 | -1,055 | -6,542 | -376,524 |

| Provisions and reversals | -5,102 | -4,208 | -73,628 | — | — | — | — | -116 | -23 | -571 | — | -163 | -3 | -315 | -4,231 | 2,795 | -85,565 |

| Construction cost | — | -46,034 | -898,292 | — | — | — | — | — | — | — | — | -1,425 | -4,625 | — | — | — | -950,376 |

| Other operating costs and expenses | 3,750 | -5,798 | -61,839 | — | -3,153 | — | -22 | -11,354 | -11,964 | -160 | — | -1,224 | -236 | -2,739 | -12,841 | 1,232 | -106,349 |

| EQUITY IN EARNINGS OF SUBSIDIARIES | 889 | 84,928 | — | — | — | — | — | -20,435 | — | — | — | — | — | — | 428,744 | -456,797 | 37,329 |

| EARNINGS BEFORE INCOME TAXES | 248,818 | 246,944 | 508,398 | — | 12,193 | — | -79 | -36,785 | 45,059 | 1,891 | — | 73,980 | 16,421 | -50,213 | 375,912 | -460,366 | 982,173 |

| FINANCIAL RESULTS | -139,302 | -110,707 | -179,977 | — | -17,987 | — | -1,636 | 2,934 | 3,314 | 2,451 | 676 | -30,813 | 2,397 | 9,189 | 16,900 | — | -442,561 |

| Financial income | 22,067 | 15,463 | 194,454 | — | 7,538 | — | 1,454 | 50,033 | 5,666 | 2,460 | — | 11,270 | 2,883 | 9,321 | 29,962 | -1 | 352,570 |

| Financial expenses | -161,369 | -126,170 | -374,431 | — | -25,525 | — | -3,090 | -47,099 | -2,352 | -9 | 676 | -42,083 | -486 | -132 | -13,062 | 1 | -795,131 |

| OPERATIONAL EXPENSES / INCOME | 109,516 | 136,237 | 328,421 | — | -5,794 | — | -1,715 | -33,851 | 48,373 | 4,342 | 676 | 43,167 | 18,818 | -41,024 | 392,812 | -460,366 | 539,612 |

| INCOME TAX AND SOCIAL CONTRIBUTION ON PROFIT | -593 | -14,732 | -103,077 | — | 1,962 | — | — | -22,253 | -16,269 | -1,093 | — | -14,712 | 6,708 | 13,986 | -27,488 | 2,124 | -175,437 |

| NET INCOME FROM CONTINUING OPERATIONS | 108,923 | 121,505 | 225,344 | — | -3,832 | — | -1,715 | -56,104 | 32,104 | 3,249 | 676 | 28,455 | 25,526 | -27,038 | 365,324 | -458,242 | 364,175 |

| NET INCOME FROM DISCONTINUED OPERATIONS | 18,898 | — | — | — | — | — | — | — | — | — | — | — | — | — | — | — | 18,898 |

| NET INCOME | 127,821 | 121,505 | 225,344 | — | -3,832 | — | -1,715 | -56,104 | 32,104 | 3,249 | 676 | 28,455 | 25,526 | -27,038 | 365,324 | -458,242 | 383,073 |

| Attributed to shareholders of the parent company - continuing operations | 109,477 | 120,951 | 225,344 | — | -2,683 | — | -1,716 | -56,092 | 32,103 | 3,248 | 670 | 28,454 | 25,526 | -27,036 | 384,220 | -477,137 | 365,329 |

| Attributed to shareholders of the parent company - discontinued operations | 18,898 | — | — | — | — | — | — | — | — | — | — | — | — | — | — | — | 18,898 |

| Attributed to non-controlling shareholders - continuing operations | — | — | — | — | 1,428 | — | — | — | — | — | — | — | — | — | — | — | 1,428 |

| Attributed to non-controlling shareholders - discontinued operations | — | — | — | — | — | — | — | — | — | — | — | — | — | — | — | — | — |

| EBITDA continuing operations | 332,050 | 251,764 | 687,831 | — | 20,350 | — | 889 | 32,788 | 64,366 | 4,741 | — | 74,057 | 16,431 | -49,713 | 376,967 | -453,824 | 1,358,697 |

| 32 |

|

| Income Statement 3Q24 | GET | Distribuição | Compagas | Elejor | UEG Araucária | Serviços | Parques Eólicos | FDA | Bela Vista | Pequenos ativos mantidos pra venda | MSG | C. Oeste, Marumbi, Uirapuru | Mercado Livre | Holding |

Elimin. e Reclassif. |

Consolidado | |||

| Geração | Transmissão | ||||||||||||||||||

| NET OPERATING INCOME | 528,893 | 211,441 | 4,352,365 | 155,965 | 19,880 | — | 2,920 | 182,149 | 156,887 | 9,425 | — | — | 21,098 | 901,383 | — | -806,798 | 5,735,608 | ||

| Electricity sales to final customers | — | — | 1,482,084 | — | — | — | — | — | — | — | — | 488,575 | — | -325 | 1,970,334 | ||||

| Electricity sales to distributors | 517,630 | — | 62,717 | — | 19,760 | — | — | 182,150 | 156,884 | 9,425 | — | 410,894 | — | -524,803 | 834,657 | ||||

| Use of the main distribution and transmission grid (TUSD/ TUST) | — | 187,755 | 1,568,245 | — | — | — | — | — | — | — | 18,665 | — | — | -114,573 | 1,660,092 | ||||

| Construction revenue | — | 16,588 | 642,002 | 3,287 | — | — | — | — | — | — | 2,426 | — | — | -3,287 | 661,016 | ||||

| Fair value of assets from the indemnity for the concession | — | — | 17,190 | — | — | — | — | — | — | — | — | — | — | — | 17,190 | ||||

| Distribution of piped gas | — | — | — | 152,678 | — | — | — | — | — | — | — | — | — | -152,678 | — | ||||

| Sectoral assets and liabilities result | — | — | 420,709 | — | — | — | — | — | — | — | — | — | — | — | 420,709 | ||||

| Other operating revenues | 11,263 | 7,098 | 159,418 | — | 120 | — | 2,920 | -1 | 3 | — | 7 | 1,914 | — | -11,132 | 171,610 | ||||

| OPERATING COSTS AND EXPENSES | -187,540 | -6,451 | -3,893,834 | -140,556 | -26,214 | — | -2,072 | -160,633 | -71,122 | -5,796 | — | — | -4,457 | -880,878 | -62,277 | 801,310 | -4,640,519 | ||

| Energy purchased for resale | -37,649 | — | -1,910,333 | — | -2,871 | — | — | -19,446 | -7,404 | -1,572 | — | — | — | -871,755 | — | 523,048 | -2,327,982 | ||

| Charges of the main distribution and transmission grid | -89,832 | — | -676,178 | — | -6,104 | — | — | -17,327 | -38,231 | -345 | — | — | — | — | — | 113,953 | -714,064 | ||

| Personnel and management | -47,883 | -35,249 | -166,338 | -7,703 | -1,547 | — | -39 | -3,726 | -525 | -140 | — | — | -166 | -3,591 | -19,724 | 7,702 | -278,929 | ||

| Private pension and health plans | -10,666 | -7,796 | -41,217 | -1,003 | -40 | — | -6 | -581 | -82 | -22 | — | — | -26 | -429 | -2,426 | 1,003 | -63,291 | ||

| Materials | -2,931 | -1,969 | -15,409 | -449 | -138 | — | — | -724 | -346 | -21 | — | — | -31 | -14 | -502 | 441 | -22,093 | ||

| Raw material and supplies - energy production | — | — | — | — | — | — | — | — | — | — | — | — | — | — | — | — | — | ||

| Natural gas and supplies for gas business | — | — | — | -113,280 | — | — | — | — | — | — | — | — | — | — | — | 113,280 | — | ||

| Third-party services | -24,009 | -12,365 | -187,818 | -1,166 | -4,684 | — | -972 | -31,746 | -9,371 | -688 | — | — | -1,182 | -1,847 | -11,753 | 12,988 | -274,613 | ||

| Depreciation and amortization | -89,870 | -4,403 | -152,595 | -4,752 | -7,972 | — | -1,053 | -69,143 | -31,885 | -2,847 | — | — | -11 | -443 | -843 | -2,597 | -368,414 | ||

| Provisions and reversals | -10,873 | -5,082 | -46,881 | -5,019 | — | — | — | -285 | — | — | — | — | -356 | -1,847 | -20,182 | 22,145 | -68,379 | ||

| Construction cost | — | -13,987 | -642,002 | -3,287 | — | — | — | — | — | — | — | — | -2,403 | — | — | 3,287 | -658,392 | ||

| Other operating costs and expenses | 126,173 | 74,400 | -55,063 | -3,897 | -2,858 | — | -2 | -17,655 | 16,722 | -161 | — | — | -282 | -952 | -6,847 | 6,060 | 135,638 | ||

| EQUITY IN EARNINGS OF SUBSIDIARIES | 53,839 | 70,463 | — | — | — | — | — | 5,422 | — | — | — | — | — | — | 673,175 | -739,689 | 63,210 | ||

| EARNINGS BEFORE INCOME TAXES | 395,192 | 275,453 | 458,531 | 15,409 | -6,334 | — | 848 | 26,938 | 85,765 | 3,629 | — | — | 16,641 | 20,505 | 610,898 | -745,177 | 1,158,299 | ||

| FINANCIAL RESULTS | -76,970 | -50,400 | -103,031 | -5,518 | -29,724 | — | -1,043 | -14,328 | 5,391 | 1,151 | — | — | 1,238 | 10,626 | 34,711 | 5,519 | -222,378 | ||

| Financial income | 35,847 | 21,724 | 162,905 | 4,279 | 4,628 | — | 1,230 | 40,722 | 5,526 | 1,151 | — | — | 1,741 | 10,731 | 47,308 | -6,600 | 331,192 | ||

| Financial expenses | -112,817 | -72,124 | -265,936 | -9,797 | -34,352 | — | -2,273 | -55,050 | -135 | — | — | — | -503 | -105 | -12,597 | 12,119 | -553,570 | ||

| OPERATIONAL EXPENSES / INCOME | 318,222 | 225,053 | 355,500 | 9,891 | -36,058 | — | -195 | 12,610 | 91,156 | 4,780 | — | — | 17,879 | 31,131 | 645,609 | -739,658 | 935,921 | ||

| INCOME TAX AND SOCIAL CONTRIBUTION ON PROFIT | -83,874 | -55,059 | -111,695 | -3,698 | 12,252 | — | -780 | -17,222 | -30,987 | -686 | — | — | -1,169 | -10,667 | 98,947 | 6,097 | -198,541 | ||

| NET INCOME continuing operations | 234,348 | 169,994 | 243,805 | 6,193 | -23,806 | — | -975 | -4,612 | 60,169 | 4,094 | — | — | 16,710 | 20,464 | 744,556 | -733,561 | 737,380 | ||

| NET INCOME discontinued operations | 12,004 | — | — | — | — | — | — | — | — | — | — | — | — | — | 475,104 | -7,399 | 479,709 | ||

| NET INCOME | 246,352 | 169,994 | 243,805 | 6,193 | -23,806 | — | -975 | -4,612 | 60,169 | 4,094 | — | — | 16,710 | 20,464 | 1,219,660 | -740,960 | 1,217,089 | ||

| Attributed to shareholders of the parent company - continuing operations | 234,348 | 169,994 | 243,805 | — | -16,902 | — | -975 | -4,612 | 60,169 | 4,094 | — | — | 16,710 | 20,464 | 1,340,046 | -918,243 | 744,556 | ||

| Attributed to the controlling company's shareholders - discontinued operations | 12,004 | — | — | 3,158 | — | — | — | — | — | — | — | — | — | — | -120,386 | 592,332 | 475,104 | ||

| Attributed to non-controlling shareholders - continuing operations | — | — | — | — | -6,904 | — | — | — | — | — | — | — | — | — | — | -238 | -7,142 | ||

| Attributed to non-controlling shareholders - discontinued operations | — | — | — | 3,035 | — | — | — | — | — | — | — | — | — | — | — | 1,536 | 4,571 | ||

| EBITDA continuing operations | 485,062 | 279,856 | 611,126 | 20,161 | 1,638 | — | 1,901 | 96,081 | 117,650 | 6,476 | — | — | 16,652 | 20,948 | 611,741 | -742,580 | 1,526,713 | ||

| 33 |

|

| ANEXO II - RESULTADO POR SUBSIDIÁRIA > DRE POR EMPRESA ACUMULADO |

| R$'000 | |||||||||||||||||

| Income Statement 9M25 | GET | Distribuição | Compagas | Elejor | UEG Araucária | Serviços | Parques Eólicos | FDA | Bela Vista | Small Assets | MSG | C. Oeste, Marumbi, Uirapuru | Mercado Livre | Holding |

Elimin. e Reclassif. |

Consolidated | |

| Geração | Transmissão | ||||||||||||||||

| NET OPERATING INCOME | 1,679,414 | 790,448 | 13,986,101 | — | 113,051 | — | 8,542 | 573,088 | 447,026 | 27,996 | 27,740 | 114,752 | 70,764 | 3,209,841 | — | -2,120,346 | 18,928,417 |

| Electricity sales to final customers | — | — | 4,770,004 | — | — | — | — | — | — | — | — | — | — | 1,212,945 | — | -576 | 5,982,373 |

| Electricity sales to distributors | 1,644,065 | — | 284,740 | — | 112,846 | — | — | 564,749 | 447,026 | 27,996 | 27,740 | — | — | 1,969,890 | — | -1,721,823 | 3,357,229 |

| Use of the main distribution and transmission grid (TUSD/ TUST) | — | 620,982 | 4,782,283 | — | — | — | — | — | — | — | — | 113,575 | 54,521 | — | — | -358,953 | 5,212,408 |

| Construction revenue | — | 148,395 | 2,269,611 | — | — | — | — | — | — | — | — | 1,055 | 16,221 | — | — | — | 2,435,282 |

| Fair value of assets from the indemnity for the concession | — | — | 72,651 | — | — | — | — | — | — | — | — | — | — | — | — | — | 72,651 |

| Sectoral assets and liabilities result | — | — | 1,408,164 | — | — | — | — | — | — | — | — | — | — | — | — | — | 1,408,164 |

| Other operating revenues | 35,349 | 21,071 | 398,648 | — | 205 | — | 8,542 | 8,339 | — | — | — | 122 | 22 | 27,006 | — | -38,994 | 460,310 |

| OPERATING COSTS AND EXPENSES | -521,745 | -470,763 | -12,532,390 | — | -70,449 | — | -7,474 | -454,409 | -272,652 | -15,978 | -7,461 | -14,130 | -19,958 | -3,153,561 | -111,405 | 2,107,209 | -15,545,166 |

| Energy purchased for resale | -213,165 | — | -6,170,339 | — | -91 | — | — | -60,717 | -46,253 | -2,098 | -515 | — | — | -3,125,498 | — | 1,719,475 | -7,899,201 |

| Charges of the main distribution and transmission grid | -225,800 | — | -2,024,457 | — | -18,544 | — | — | -52,760 | -112,814 | -1,056 | -2,186 | — | — | — | — | 357,491 | -2,080,126 |

| Personnel and management | -117,326 | -92,035 | -399,998 | — | -4,013 | — | -316 | -8,070 | -2,474 | -292 | — | -1,650 | -422 | -14,340 | -63,230 | — | -704,166 |

| Private pension and health plans | -28,125 | -22,444 | -115,521 | — | -119 | — | -60 | -1,167 | -366 | -42 | — | -161 | -64 | -1,302 | -7,513 | — | -176,884 |

| Materials and supplies | -6,450 | -4,529 | -38,275 | — | -347 | — | -8 | -12,203 | -1,398 | -55 | — | 43 | -37 | -222 | -556 | — | -64,037 |

| Materials and supplies for power eletricity | — | — | — | — | — | — | — | — | — | — | — | — | — | — | — | — | — |

| Third-party services | -65,579 | -38,876 | -617,866 | — | -12,812 | — | -3,857 | -89,847 | -19,726 | -2,860 | -1 | -7,956 | -4,555 | -2,730 | -21,774 | 40,021 | -848,418 |

| Depreciation and amortization | -231,156 | -13,535 | -519,851 | — | -24,442 | — | -2,919 | -208,600 | -57,902 | -8,551 | -4,513 | -103 | -24 | -1,387 | -3,044 | -16,728 | -1,092,755 |

| Provisions and reversals | -6,627 | -9,869 | -221,736 | — | — | — | -250 | -1,297 | -23 | -572 | 100 | -255 | -36 | -1,552 | -943 | 3,050 | -240,010 |

| Construction cost | — | -140,466 | -2,269,611 | — | — | — | — | — | — | — | — | -2,342 | -14,139 | — | — | — | -2,426,558 |

| Other operating costs and expenses | 372,483 | -149,009 | -154,736 | — | -10,081 | — | -64 | -19,748 | -31,696 | -452 | -346 | -1,706 | -681 | -6,530 | -14,345 | 3,900 | -13,011 |

| EQUITY IN EARNINGS OF SUBSIDIARIES | 157,992 | 281,295 | — | — | — | — | — | 12,975 | — | — | — | — | — | — | 1,676,396 | -1,926,657 | 202,001 |

| EARNINGS BEFORE INCOME TAXES | 1,315,661 | 600,980 | 1,453,711 | — | 42,602 | — | 1,068 | 131,654 | 174,374 | 12,018 | 20,279 | 100,622 | 50,806 | 56,280 | 1,564,991 | -1,939,794 | 3,585,252 |

| FINANCIAL RESULTS | -393,633 | -289,627 | -569,071 | — | -45,360 | — | -4,253 | -58,611 | 6,926 | 6,245 | 115 | -40,979 | 6,923 | 28,799 | 61,579 | — | -1,290,947 |

| Financial income | 94,105 | 65,383 | 519,387 | — | 48,953 | — | 4,090 | 132,780 | 14,665 | 6,254 | — | 13,764 | 8,411 | 29,213 | 88,522 | -5 | 1,025,522 |

| Financial expenses | -487,738 | -355,010 | -1,088,458 | — | -94,313 | — | -8,343 | -191,391 | -7,739 | -9 | 115 | -54,743 | -1,488 | -414 | -26,943 | 5 | -2,316,469 |

| OPERATIONAL EXPENSES / INCOME | 922,028 | 311,353 | 884,640 | — | -2,758 | — | -3,185 | 73,043 | 181,300 | 18,263 | 20,394 | 59,643 | 57,729 | 85,079 | 1,626,570 | -1,939,794 | 2,294,305 |

| INCOME TAX AND SOCIAL CONTRIBUTION ON PROFIT | -213,016 | -8,380 | -273,909 | — | 881 | — | -168 | -60,717 | -60,856 | -3,004 | -824 | -20,276 | -5,376 | -29,105 | -23,598 | 6,449 | -691,899 |

| NET INCOME | 709,012 | 302,973 | 610,731 | — | -1,877 | — | -3,353 | 12,326 | 120,444 | 15,259 | 19,570 | 39,367 | 52,353 | 55,974 | 1,602,972 | -1,933,345 | 1,602,406 |

| Attributed to shareholders of the parent company - continuing operations | 690,114 | 302,973 | 610,731 | — | -1,314 | — | -3,353 | 12,326 | 120,444 | 15,259 | 19,570 | 39,367 | 52,353 | 55,974 | 1,584,074 | -1,914,447 | 1,584,071 |

| Attributed to shareholders of the parent company - descontinued operations | 18,898 | — | — | — | — | — | — | — | — | — | — | — | — | — | 18,898 | -18,898 | 18,898 |

| Attributed to non-controlling shareholders - continuing operations | — | — | — | — | -563 | — | — | — | — | — | — | — | — | — | — | -563 | |

| EBITDA continuing operations | 1,546,817 | 614,515 | 1,973,562 | — | 67,044 | — | 3,987 | 340,254 | 232,276 | 20,569 | 24,792 | 100,725 | 50,830 | 57,667 | 1,568,035 | -1,923,066 | 4,678,007 |

| 34 |

|

| Income Statement 9M24 | GET | Distribuição | Compagas | Elejor | UEG Araucária | Serviços | Parques Eólicos | FDA | Bela Vista | C. Oeste, Marumbi, Uirapuru | Small Assets | MSG | Mercado Livre | Holding | Elimination | Consolidated | |

| Geração | Transmissão | ||||||||||||||||

| NET OPERATING INCOME | 1,588,303 | 724,766 | 12,556,067 | 562,129 | 67,212 | — | 3,093 | 542,593 | 416,916 | 26,594 | — | — | 59,742 | 2,590,380 | — | -2,505,923 | 16,631,872 |

| Electricity sales to final customers | — | — | 4,835,789 | — | — | — | — | — | — | — | — | — | — | 1,420,544 | — | -1,065 | 6,255,268 |

| Electricity sales to distributors | 1,547,071 | — | 83,935 | — | 66,834 | — | — | 538,443 | 416,908 | 26,594 | — | — | — | 1,167,170 | — | -1,545,462 | 2,301,493 |

| Use of the main distribution and transmission grid (TUSD/ TUST) | — | 656,585 | 4,774,303 | — | — | — | — | — | — | — | — | — | 58,828 | — | — | -356,412 | 5,133,304 |

| Construction revenue | — | 47,995 | 1,860,097 | 13,618 | — | — | — | — | — | — | — | — | 893 | — | — | -13,618 | 1,908,985 |

| Fair value of assets from the indemnity for the concession | — | — | 49,467 | — | — | — | — | — | — | — | — | — | — | — | — | — | 49,467 |

| Distribution of piped gas | — | — | — | 548,511 | — | — | — | — | — | — | — | — | — | — | — | -548,511 | — |

| Sectoral assets and liabilities result | — | — | 566,185 | — | — | — | — | — | — | — | — | — | — | — | — | — | 566,185 |

| Other operating revenues | 41,232 | 20,186 | 386,291 | — | 378 | — | 3,093 | 4,150 | 8 | — | — | — | 21 | 2,666 | — | -40,855 | 417,170 |

| OPERATING COSTS AND EXPENSES | -806,253 | -173,188 | -11,163,695 | -503,516 | -71,378 | -44,679 | -4,340 | -455,323 | -260,488 | -14,964 | — | — | -7,342 | -2,549,093 | -166,560 | 2,505,166 | -13,715,653 |

| Energy purchased for resale | -53,356 | — | -5,222,496 | — | -2,928 | — | — | -47,088 | -9,559 | -1,991 | — | — | — | -2,523,054 | — | 1,546,089 | -6,314,383 |

| Charges of the main distribution and transmission grid | -275,413 | — | -2,113,943 | — | -18,726 | -18,392 | — | -49,679 | -119,233 | -1,033 | — | — | — | — | — | 373,997 | -2,222,422 |

| Personnel and management | -152,031 | -112,000 | -514,553 | -33,621 | -4,255 | -3,124 | -128 | -11,765 | -1,661 | -447 | — | — | -540 | -11,152 | -49,092 | 36,744 | -857,625 |

| Private pension and health plans | -33,753 | -24,664 | -129,216 | -4,083 | -124 | -364 | -21 | -1,783 | -253 | -68 | — | — | -83 | -1,321 | -7,702 | 4,447 | -198,988 |

| Materials | -6,794 | -3,818 | -46,026 | -416 | -239 | -18 | -16 | -2,596 | -1,182 | -87 | — | — | -72 | -48 | -1,350 | 426 | -62,236 |

| Raw material and supplies - energy production | -936 | — | — | — | — | -944 | — | — | — | — | — | — | — | — | — | 944 | -936 |

| Natural gas and supplies for gas business | — | — | — | -397,554 | — | — | — | — | — | — | — | — | — | — | — | 397,554 | — |

| Third-party services | -67,174 | -37,982 | -519,102 | -10,650 | -12,598 | -9,842 | -2,533 | -96,707 | -27,186 | -2,263 | — | — | -4,588 | -4,253 | -35,198 | 57,397 | -772,679 |

| Depreciation and amortization | -280,055 | -12,450 | -433,938 | -27,146 | -24,232 | -10,316 | -1,729 | -206,666 | -95,773 | -8,540 | — | — | -33 | -1,313 | -2,420 | 15,414 | -1,089,197 |

| Provisions and reversals | -16,938 | -10,202 | -188,091 | -7,541 | — | -176 | — | -445 | -7 | -38 | — | — | -293 | -4,436 | -49,357 | 49,569 | -227,955 |

| Construction cost | — | -41,077 | -1,860,097 | -13,618 | — | — | — | — | — | — | — | — | -867 | — | — | 13,618 | -1,902,041 |

| Other operating costs and expenses | 80,197 | 69,005 | -136,233 | -8,887 | -8,276 | -1,503 | 87 | -38,594 | -5,634 | -497 | — | — | -866 | -3,516 | -21,441 | 8,967 | -67,191 |

| EQUITY IN EARNINGS OF SUBSIDIARIES | 83,246 | 269,437 | — | — | — | — | — | -10,003 | — | — | — | — | — | — | 1,825,750 | -1,943,032 | 225,398 |

| EARNINGS BEFORE INCOME TAXES | 865,296 | 821,015 | 1,392,372 | 58,613 | -4,166 | -44,679 | -1,247 | 77,267 | 156,428 | 11,630 | — | — | 52,400 | 41,287 | 1,659,190 | -1,943,789 | 3,141,617 |

| FINANCIAL RESULTS | -231,737 | -161,521 | -381,617 | -10,607 | -73,886 | -4,372 | -487 | -82,874 | 22,036 | 3,156 | — | — | 5,061 | 29,924 | 95,876 | 10,811 | -780,237 |

| Financial income | 88,115 | 54,876 | 367,811 | 29,114 | 29,394 | 1,068 | 2,063 | 101,948 | 22,474 | 3,111 | — | — | 6,617 | 30,166 | 157,457 | -36,985 | 857,229 |

| Financial expenses | -319,852 | -216,397 | -749,428 | -39,721 | -103,280 | -5,440 | -2,550 | -184,822 | -438 | 45 | — | — | -1,556 | -242 | -61,581 | 47,796 | -1,637,466 |

| OPERATIONAL EXPENSES / INCOME | 633,559 | 659,494 | 1,010,755 | 48,006 | -78,052 | -49,051 | -1,734 | -5,607 | 178,464 | 14,786 | — | — | 57,461 | 71,211 | 1,755,066 | -1,932,978 | 2,361,380 |

| INCOME TAX AND SOCIAL CONTRIBUTION ON PROFIT | -122,134 | -86,568 | -317,165 | -17,301 | 26,532 | — | -1,117 | -47,565 | -60,653 | -1,890 | — | — | -4,079 | -23,980 | 4,369 | 22,806 | -628,745 |

| NET INCOME continuing operations | 511,425 | 572,926 | 693,590 | 30,705 | -51,520 | -49,051 | -2,851 | -53,172 | 117,811 | 12,896 | — | — | 53,382 | 47,231 | 1,759,435 | -1,910,172 | 1,732,635 |

| NET INCOME discontinued operations | -11,586 | — | — | — | — | — | — | — | — | — | — | — | — | — | 463,690 | 39,467 | 491,571 |

| NET INCOME | 499,839 | 572,926 | 693,590 | 30,705 | -51,520 | -49,051 | -2,851 | -53,172 | 117,811 | 12,896 | — | — | 53,382 | 47,231 | 2,223,125 | -1,870,705 | 2,224,206 |

| Attributed to shareholders of the parent company - continuing operations | 511,425 | 572,926 | 693,590 | — | -36,579 | — | -2,851 | -53,172 | 117,811 | 12,896 | — | — | 53,382 | 47,231 | 1,747,850 | -1,905,074 | 1,759,435 |

| Attributed to the controlling company's shareholders - discontinued operations | -11,586 | — | — | 15,660 | — | -39,829 | — | — | — | — | — | — | — | — | 475,275 | 24,171 | 463,690 |

| Attributed to non-controlling shareholders - continuing operations | — | — | — | — | -14,941 | — | — | — | — | — | — | — | — | — | — | -517 | -15,458 |

| Attributed to non-controlling shareholders - discontinued operations | — | — | — | 15,045 | — | -9,222 | — | — | — | — | — | — | — | — | — | 10,715 | 16,539 |

| EBITDA continuing operations | 1,145,351 | 833,465 | 1,826,310 | 85,759 | 20,066 | -34,363 | 482 | 283,933 | 252,201 | 20,170 | — | — | 52,433 | 42,600 | 1,661,610 | -1,959,203 | 4,230,814 |

| 35 |

|

| EXHIBIT II- RESULT BY SUBSIDIARY > ASSETS BY COMPANY |

| R$'000 | ||||||||||||||||

| Assets - Sep-2025 | Geração e Transmissão | Distribuição | Compagas | Elejor | UEG Araucária | Serviços | Parques Eólicos | FDA | Bela Vista | Small Assets | MSG | Costa Oeste, Marumbi, Uirapuru | Mercado Livre | Holding | Elimin. e Reclassif. | Consolidado |

| CURRENT | 3,155 | 6,537 | — | 122 | — | 125 | 1,183 | 154 | 71 | — | 331 | 90 | 898 | 2,699 | -2,226 | 13,140 |

| Cash and cash equivalents | 343 | 1,514 | — | 90 | — | 36 | 1,013 | 75 | 66 | — | 61 | 59 | 183 | 376 | — | 3,815 |

| Bonds and securities | — | — | — | 1 | — | 1 | — | — | — | — | 154 | — | — | — | — | 156 |

| Collaterals and escrow accounts | — | — | — | — | — | — | — | — | — | — | — | — | — | — | — | — |

| Customers | 378 | 3,473 | — | 14 | — | 1 | 97 | 64 | 4 | — | 40 | 9 | 434 | — | -233 | 4,280 |

| Dividends receivable | 132 | — | — | — | — | — | 33 | — | — | — | — | — | — | 1,870 | -1,954 | 81 |

| Sectorial financial assets | — | 101,272 | — | — | — | — | — | — | — | — | — | — | — | — | — | 101,272 |

| Account receivable related to concession | 12 | — | — | — | — | — | — | — | — | — | — | — | — | — | — | 12 |

| Contract Assets | 314 | — | — | — | — | — | — | — | — | — | 73 | 19 | — | — | — | 406 |

| Fair value in the purchase and sale of energy | — | — | — | — | — | — | — | — | — | — | — | — | 257 | — | — | 257 |

| Other current receivables | 143 | 566 | — | 3 | — | — | 3 | 13 | — | — | 1 | 1 | 1 | 333 | -6 | 1,058 |

| Inventories | 34 | 129 | — | 2 | — | — | — | — | — | — | — | — | — | — | — | 165 |

| Income tax and social contribution | 47 | 144 | — | 8 | — | 2 | 33 | — | 1 | — | 1 | 2 | 22 | 102 | — | 362 |

| Other current recoverable taxes | 12 | 563 | — | — | — | — | — | 1 | — | — | — | — | — | — | — | 576 |

| Prepaid expenses | 8 | 41 | — | 4 | — | — | 2 | 1 | — | — | — | — | — | 1 | — | 58 |

| Related parties | 13 | 7 | — | — | — | — | 3 | — | — | — | — | — | — | 10 | -33 | — |

| Assets held for sale | 1,718 | — | — | — | — | 86 | — | — | — | — | — | — | — | 7 | — | 1,812 |

| NON-CURRENT | 24,168 | 18,508 | — | 603 | — | 23 | 7,494 | 2,226 | 176 | — | 3,199 | 523 | 601 | 23,608 | -32,221 | 48,908 |

| Long Term Assets | 6,575 | 7,628 | — | 133 | — | 20 | 659 | 55 | — | — | 3,198 | 523 | 591 | 312 | -346 | 19,347 |

| Bonds and securities | 185 | 3 | — | — | — | — | 365 | 19 | — | — | 112 | 4 | — | — | — | 689 |

| Other temporary investments | — | — | — | — | — | 20 | — | — | — | — | — | — | — | 11 | — | 31 |

| Customers | — | 143 | — | — | — | — | — | — | — | — | — | — | — | — | — | 143 |

| Judicial deposits | 47 | 182 | — | — | — | — | 5 | — | — | — | — | — | 17 | 122 | — | 374 |

| Sectoral financial assets | — | 304 | — | — | — | — | — | — | — | — | — | — | — | — | — | 304 |

| Account receivable related to concession | 911 | 3,141 | — | — | — | — | — | — | — | — | — | — | — | — | — | 4,051 |

| Contract Assets | 4,712 | 2,037 | — | — | — | — | — | — | — | — | 3,079 | 519 | — | — | -51 | 10,296 |

| Fair value in the purchase and sale of energy | — | — | — | — | — | — | — | — | — | — | — | — | 561 | — | — | 561 |

| Other non-current receivables | 623 | 82 | — | 7 | — | — | — | 34 | — | — | — | — | — | — | — | 745 |

| Income tax and social contribution | 2 | 64 | — | — | — | — | — | — | — | — | 6 | — | 12 | 19 | — | 103 |

| Deferred income tax and social contribution | — | 644 | — | 120 | — | — | — | — | — | — | — | — | — | 116 | — | 881 |

| Other non-current recoverable taxes | 94 | 1,029 | — | — | — | — | — | 1 | — | — | — | — | — | 43 | — | 1,167 |

| Prepaid expenses | — | — | — | — | — | — | — | — | — | — | — | — | — | — | — | — |

| Related parties | — | — | — | 6 | — | — | 288 | — | — | — | — | — | — | — | -294 | — |

| Investments | 10,487 | — | — | — | — | — | 2,463 | — | — | — | — | — | — | 23,272 | -33,297 | 2,926 |

| Property, plant and equipment, net | 3,129 | — | — | 305 | — | 1 | 4,315 | 299 | 172 | — | — | 1 | 1 | 6 | — | 8,229 |

| Intangible assets | 3,900 | 10,738 | — | 165 | — | 2 | 12 | 1,872 | 4 | — | — | — | 5 | 10 | 1,421 | 18,128 |

| Right to use an asset | 78 | 141 | — | — | — | — | 45 | — | — | — | 1 | — | 4 | 8 | — | 278 |

| TOTAL | 27,323 | 25,044 | — | 725 | — | 148 | 8,678 | 2,380 | 247 | — | 3,530 | 613 | 1,499 | 26,307 | -34,448 | 62,048 |

| 36 |

|

| EXHIBIT II- RESULT BY SUBSIDIARY > ASSETS BY COMPANY |

| R$'000 | ||||||||||||||

| Assets - Sep-2024 | Geração e Transmissão | Distribuição | Compagas | Elejor | UEG Araucária | Serviços | Parques Eólicos | FDA | Bela Vista | Costa Oeste, Marumbi, Uirapuru | Mercado Livre | Holding | Elimin. e Reclassif. | Consolidado |

| CURRENT | 3,478,566 | 6,769,769 | — | 124,996 | — | 48,889 | 1,119,406 | 146,365 | 60,415 | 106,590 | 916,049 | 3,264,843 | -2,994,084 | 13,041,808 |

| Cash and cash equivalents | 511,790 | 1,734,522 | — | 97,082 | — | 42,389 | 976,988 | 61,545 | 55,027 | 77,510 | 324,750 | 280,340 | -13 | 4,161,939 |

| Bonds and securities | — | — | — | — | — | 528 | — | — | — | — | — | 95 | — | 624 |

| Collaterals and escrow accounts | — | 9 | — | — | — | — | — | — | — | — | — | — | — | 9 |

| Customers | 379,135 | 3,267,284 | — | 10,752 | — | 3,795 | 94,192 | 76,636 | 4,118 | 8,750 | 348,795 | — | -230,755 | 3,962,702 |

| Dividends receivable | 153,322 | — | — | — | — | — | 8,393 | — | — | — | — | 2,644,431 | -2,723,868 | 82,278 |

| Sectorial financial assets | — | — | — | — | — | — | — | — | — | — | — | — | — | 10,609 |

| Account receivable related to concession | 10,609 | — | — | — | — | — | — | — | — | 18,050 | — | — | — | 283,896 |

| Contract Assets | 265,846 | — | — | — | — | — | — | — | — | — | 217,350 | — | — | 217,350 |

| Other current receivables | 90,679 | 541,676 | — | 3,210 | — | 74 | 4,084 | 6,595 | — | 549 | 8,561 | 301,929 | -7,680 | 949,674 |

| Inventories | 39,204 | 95,620 | — | 1,299 | — | — | — | — | — | 201 | — | — | — | 136,324 |

| Income tax and social contribution | 108,582 | 101,406 | — | 10,831 | — | 2,035 | 25,086 | 134 | 907 | 1,409 | 13,387 | 32,349 | — | 296,128 |

| Other current recoverable taxes | 10,626 | 979,880 | — | — | — | — | 80 | 1,035 | 8 | — | 2,990 | — | — | 994,618 |

| Prepaid expenses | 9,288 | 42,066 | — | 1,822 | — | 68 | 7,913 | 420 | 355 | 122 | 216 | 944 | — | 63,211 |

| Related parties | 17,664 | 7,306 | — | — | — | — | 2,670 | — | — | — | — | 4,754 | -31,773 | 621 |

| Assets classified as held for sale | 1,881,821 | — | — | — | — | — | — | — | — | — | — | — | 5 | 1,881,826 |

| NON-CURRENT | 22,800,216 | 16,797,534 | — | 623,724 | — | 100,266 | 7,961,804 | 2,279,634 | 184,758 | 508,080 | 531,035 | 23,164,333 | -30,609,036 | 44,342,348 |

| Long Term Assets | 6,186,586 | 6,847,655 | — | 132,366 | — | 15,084 | 747,629 | 54,415 | — | 507,812 | 520,497 | 708,857 | -405,709 | 15,315,121 |

| Bonds and securities | 149,368 | 3,159 | — | — | — | — | 353,799 | 17,941 | — | 4,815 | — | — | — | 529,085 |

| Other temporary investments | — | — | — | — | — | 14,709 | — | — | — | — | — | 15,894 | — | 30,603 |

| Customers | — | 116,180 | — | — | — | — | — | — | — | — | — | — | — | 116,180 |

| Judicial deposits | 49,775 | 190,181 | — | — | — | 72 | 484 | — | — | 242 | 16,933 | 136,677 | — | 394,364 |

| Sectoral financial assets | — | — | — | — | — | — | — | — | — | — | — | — | — | — |

| Account receivable related to concession | 886,620 | 2,610,731 | — | — | — | — | — | — | — | — | — | — | — | 3,497,351 |

| Contract Assets | 4,729,547 | 1,701,448 | — | — | — | — | — | — | — | 502,754 | — | — | -6,739 | 6,927,010 |

| Other non-current receivables | 276,590 | 65,322 | — | — | — | — | — | — | — | — | 479,938 | — | — | 479,938 |

| Income tax and social contribution | 1,819 | 59,940 | — | 6,954 | — | — | — | 34,860 | — | — | — | 298,120 | — | 681,846 |

| Deferred income tax and social contribution | — | 918,078 | — | — | — | — | — | — | — | — | 22,780 | 79,504 | — | 164,043 |

| Other non-current recoverable taxes | 92,867 | 1,182,616 | — | 119,561 | — | — | — | — | — | — | — | 136,536 | — | 1,174,175 |

| Prepaid expenses | — | — | — | — | — | 303 | 224 | 1,614 | — | — | 776 | 42,126 | — | 1,320,526 |

| Related parties | — | — | — | 5,851 | — | — | 393,122 | — | — | — | — | — | -398,970 | — |

| Investments | 10,104,390 | 442 | — | — | — | — | 2,698,723 | — | — | — | — | 22,431,868 | -31,657,485 | 3,577,937 |

| Property, plant and equipment, net | 3,160,968 | — | — | 317,388 | — | 80,590 | 4,462,642 | 306,000 | 180,931 | 229 | 702 | 7,248 | — | 8,516,697 |

| Intangible assets | 3,260,920 | 9,788,358 | — | 173,337 | — | 901 | 8,809 | 1,918,982 | 3,827 | 39 | 5,731 | 8,546 | 1,454,158 | 16,623,610 |

| Right to use an asset | 87,352 | 161,079 | — | 633 | — | 3,691 | 44,001 | 237 | — | — | 4,174 | 7,815 | — | 308,983 |

| TOTAL | 26,278,782 | 23,567,303 | — | 748,720 | — | 149,155 | 9,081,210 | 2,425,999 | 245,173 | 614,670 | 1,447,083 | 26,429,176 | -33,603,120 | 57,384,156 |

| 37 |

|

| EXHIBIT II- RESULT BY SUBSIDIARY > LIABILITIES BY COMPANY |

| R$'000 | ||||||||||||||||

| Liabilities - Sep-25 | Geração e Transmissão | Distribuição | Compagas | Elejor | UEG Araucária | Serviços | Parques Eólicos | FDA | Bela Vista | Small Assets | MSG | Costa Oeste, Marumbi, Uirapuru | Mercado Livre | Holding | Eliminations | Consolidated |

| CURRENT | 3,184 | 6,021 | — | 117 | — | 18 | 903 | 106 | 3 | — | 139 | 31 | 834 | 36 | -2,230 | 9,161 |

| Social charges and accruals | 79 | 163 | — | 1 | — | — | — | — | — | — | — | — | 5 | 18 | — | 266 |

| Associated companies and parent company | 7 | 16 | — | — | — | — | 9 | 1 | — | — | 1 | — | — | 2 | -37 | — |

| Suppliers | 305 | 2,377 | — | 7 | — | 9 | 74 | 30 | 2 | — | 6 | 2 | 429 | 5 | -239 | 3,008 |

| Income Tax and Social Contribution payable | — | — | — | — | — | — | 12 | 44 | 1 | — | — | 2 | — | — | — | 59 |

| Other taxes | 27 | 277 | — | 1 | — | — | 8 | 3 | — | — | 3 | — | 7 | — | — | 327 |

| Loans and financing | 79 | 3 | — | — | — | — | 128 | — | — | — | — | 5 | — | — | — | 214 |

| Debentures | 832 | 923 | — | — | — | 4 | 59 | — | — | — | 125 | — | — | — | — | 1,943 |

| Dividends payable | 1,395 | 357 | — | — | — | — | 64 | — | — | — | — | 20 | 118 | 5 | -1,954 | 5 |

| Post employment benefits | 30 | 79 | — | — | — | — | — | — | — | — | — | — | — | 5 | — | 113 |

| Customer charges due | 11 | 89 | — | — | — | — | — | — | — | — | — | — | — | — | — | 101 |

| Research and development and energy efficiency | 3 | 86 | — | — | — | — | — | 8 | — | — | 1 | 1 | — | — | — | 101 |

| Payables related to concession | 25 | — | — | 105 | — | — | — | 12 | — | — | — | — | — | — | — | 143 |

| Sectorial financial liabilities | — | 1,344 | — | — | — | — | — | — | — | — | — | — | — | — | — | 1,344 |

| Other accounts payable | 12 | 47 | — | — | — | — | 1 | — | — | — | — | — | — | 1 | — | 61 |

| Fair value in energy purchase and sale operations | — | — | — | — | — | — | — | — | — | — | — | — | 259 | — | — | 259 |

| Other bills to pay | 215 | 199 | — | 2 | — | — | 548 | 7 | — | — | 1 | — | 15 | 1 | — | 988 |

| PIS and Cofins to be refunded to consumers | — | — | — | — | — | — | — | — | — | — | — | — | — | — | — | — |

| Provision for allocation of Pis and Cofins credits | — | 60 | — | — | — | — | — | — | — | — | — | — | — | — | — | 60 |

| Provisions for litigation | — | — | — | — | — | — | — | — | — | — | — | — | — | — | — | — |

| Liabilities associated with assets held for sale | 165 | — | — | — | — | 4 | — | — | — | — | — | — | — | — | — | 169 |

| NON-CURRENT | 9,571 | 10,869 | — | 736 | — | 70 | 2,833 | 78 | 4 | — | 1,988 | 36 | 341 | 285 | 128 | 26,940 |

| Social accruals | — | — | — | — | — | — | — | — | — | — | — | — | — | 2 | — | 2 |

| Associated companies and parent company | — | — | — | — | — | — | 285 | — | — | — | — | — | — | 6 | -291 | — |

| Suppliers | 131 | — | — | — | — | — | — | — | — | — | — | — | — | — | — | 131 |

| Deferred income tax and social contribution | 1,496 | — | — | 1 | — | — | 40 | 8 | 2 | — | 239 | 20 | 110 | — | 138 | 2,053 |

| Tax liabilities | — | 253 | — | — | — | — | — | — | — | — | — | — | — | — | — | 253 |

| Loans and financing | 463 | 750 | — | — | — | — | 1,972 | — | — | — | — | 12 | — | — | — | 3,196 |

| Debentures | 5,917 | 7,531 | — | — | — | 70 | 332 | — | — | — | 1,723 | — | — | — | — | 15,574 |

| Post-employment benefits | 308 | 722 | — | — | — | — | — | — | — | — | — | — | 2 | 37 | — | 1,069 |

| Research and development and energy efficiency | — | 278 | — | — | — | — | — | 3 | — | — | 4 | — | — | — | — | 286 |

| Payables related to the concession | 176 | — | — | 731 | — | — | — | 66 | — | — | — | — | — | — | — | 973 |

| Sectorial financial liabilities | — | — | — | — | — | — | — | — | — | — | — | — | — | — | — | — |

| Lease liability | 74 | 109 | — | — | — | — | 49 | — | — | — | — | — | 5 | 8 | — | 246 |

| Other payables | — | — | — | — | — | — | — | — | — | — | — | — | 223 | — | — | 223 |

| Fair value in energy purchase and sale operations | 60 | 34 | — | — | — | — | 153 | — | — | — | 1 | — | — | 90 | -90 | 249 |

| PIS/Cofins to be refunded to consumers | — | — | — | — | — | — | — | — | — | — | — | — | — | — | — | — |

| Provision for allocation of PIS and COFINS | — | 709 | — | — | — | — | — | — | — | — | — | — | — | — | — | 709 |

| Provisions for litigation | 947 | 483 | — | 3 | — | — | 2 | — | 2 | — | 20 | 4 | — | 142 | 371 | 1,974 |

| EQUITY | 14,569 | 8,154 | — | -128 | — | 60 | 4,942 | 2,196 | 241 | — | 1,404 | 546 | 324 | 25,986 | -32,346 | 25,948 |

| Attributable to controlling shareholders | 14,569 | 8,154 | — | -128 | — | 60 | 4,942 | 2,196 | 241 | — | 1,404 | 546 | 324 | 25,986 | -32,308 | 25,986 |

| Capital | 6,843 | 5,372 | — | 36 | — | 79 | 4,878 | 2,010 | 224 | — | 1,135 | 275 | 237 | 12,822 | -21,088 | 12,822 |

| Advance for Future Capital Increase | — | — | — | — | — | — | 26 | — | — | — | — | 1 | — | — | -27 | — |

| Capital reserves | — | 1 | — | — | — | — | — | — | — | — | — | — | 1 | 12 | -2 | 12 |

| Asset valuation adjustments | 502 | — | — | 2 | — | — | — | — | — | — | — | — | — | 483 | -504 | 483 |

| Treasury shares | — | — | — | — | — | — | — | — | — | — | — | — | — | -117 | — | -117 |

| Legal Reserves | 1,028 | 392 | — | — | — | — | 53 | 66 | 1 | — | 22 | 32 | 30 | 1,766 | -1,624 | 1,766 |

| Profit retention reserve | 5,240 | 1,778 | — | — | — | — | 321 | — | — | — | 161 | 187 | — | 9,364 | -7,686 | 9,364 |

| Tax incentive reserve | 4 | — | — | — | — | — | — | — | — | — | — | — | — | 4 | -4 | 4 |

| Additional proposed dividends | — | — | — | — | — | — | — | — | — | — | — | — | — | — | — | — |

| Accumulated profit | 952 | 611 | — | -166 | — | -19 | -336 | 120 | 15 | — | 85 | 52 | 56 | 1,653 | -1,372 | 1,653 |

| Attributable to noncontrolling interests | — | — | — | — | — | — | — | — | — | — | — | — | — | — | -38 | -38 |

| TOTAL | 27,323 | 25,044 | — | 725 | — | 148 | 8,678 | 2,380 | 247 | — | 3,530 | 613 | 1,499 | 26,307 | -34,448 | 62,048 |

| 38 |

|

| EXHIBIT II- RESULT BY SUBSIDIARY > LIABILITIES BY COMPANY |

| R$'000 | ||||||||||||||

| Liabilities - Sep-24 | Geração e Transmissão | Distribuição | Compagas | Elejor | UEG Araucária | Serviços | Parques Eólicos | FDA | Bela Vista | Costa Oeste, Marumbi, Uirapuru | Mercado Livre | Holding | Eliminations | Consolidated |

| CURRENT | 5,107,929 | 5,979,105 | — | 114,110 | — | 11,151 | 655,490 | 153,431 | 5,495 | 29,976 | 878,302 | 404,699 | -2,997,302 | 10,342,381 |

| Social charges and accruals | 119,712 | 265,757 | — | 381 | — | — | — | — | — | — | 4,447 | 20,805 | — | 411,102 |

| Associated companies and parent company | 10,810 | 11,482 | — | — | — | 160 | 9,617 | 520 | 141 | 162 | 368 | 1,690 | -34,954 | — |

| Suppliers | 319,382 | 1,792,275 | — | 3,857 | — | 9,345 | 56,148 | 21,547 | 718 | 5,323 | 350,946 | 3,362 | -238,481 | 2,324,423 |

| Income Tax and Social Contribution payable | — | — | — | — | — | 457 | 9,548 | 72,506 | 368 | 602 | — | — | — | 83,482 |