SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of December, 2025

Commission File Number 1-14668

COMPANHIA PARANAENSE DE ENERGIA

(Exact name of registrant as specified in its charter)

Energy Company of Paraná

(Translation of Registrant's name into English)

José Izidoro Biazetto, 158

81200-240 Curitiba, Paraná

Federative Republic of Brazil

+55 (41) 3331-4011

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F. Form 20-F ___X___ Form 40-F _______

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No ___X____

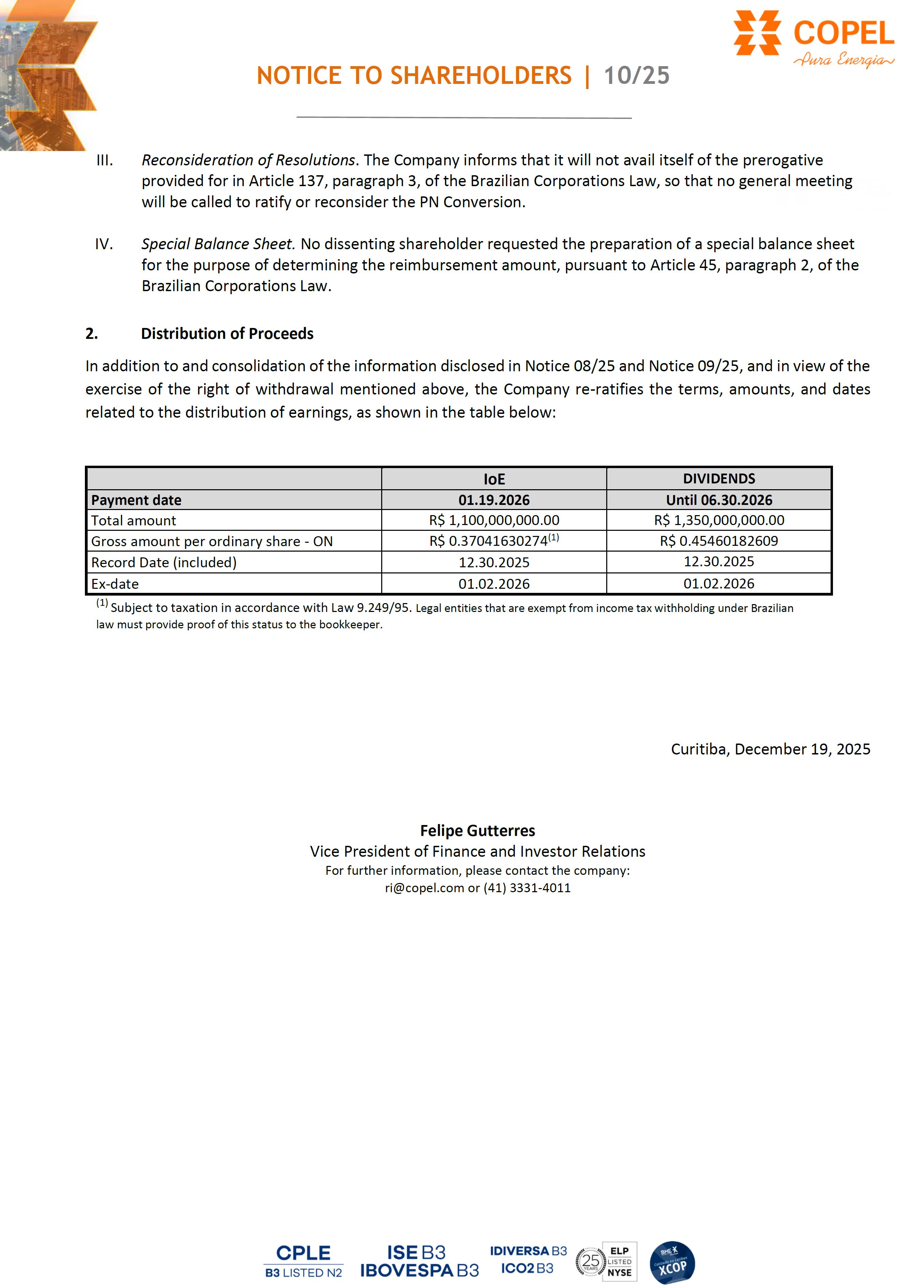

NOTICE TO SHAREHOLDERS | 10/25 COMPANHIA PARANAENSE DE ENERGIA - COPEL CNPJ/ME 76.483.817/0001-20 - NIRE 41300036535 CVM Registration 1431-1 B3 (CPLE3, CPLE5) NYSE (ELP, ELPC) LATIBEX (XCOPA, XCOPO) Final date for dissenting preferred shareholders to exercise their right of withdrawal COMPANHIA PARANAENSE DE ENERGIA - COPEL (“Company”), in continuation of Material Fact 13/25 and Notices to Shareholders 07/25 (“Notice 07/25”), 08/25 (“Notice 08/25”) and 09/25 (“Notice 09/25”), hereby informs its shareholders and the market in general of the following: 1. Final date for dissenting preferred shareholders to exercise their right of withdrawal The deadline for dissenting preferred shareholders to exercise their right of withdrawal from the decision taken at the special meeting of preferred shareholders held on November 17, 2025 (“AGESP”), which ratified the mandatory conversion of all preferred shares issued by the Company (“PNA”) into common shares and class “C” preferred shares, registered, book-entry, and without par value, compulsorily redeemable, at a ratio of one new common share and one new PNC share for each PNA share (“PN Conversion”), ended on December 18, 2025. Pursuant to Article 137, paragraph 1, of Law No. 6,404, dated December 15, 1976, as amended (“Corporation Law”), the approval of the above matter granted the right of withdrawal to PNA holders who did not approve the PN Conversion at the AGESP, for a period of 30 days from the publication of the minutes of the AGESP, which took place on November 18, 2025, thus beginning on November 19, 2025, and ending on December 18, 2025, inclusive (“Withdrawal Period”). During the Withdrawal Period, PNA shareholders exercised their right of withdrawal, so the applicable deadlines and procedures will continue as follows: I. Refund Amount. Pursuant to Notice 07/25, the refund amount to be paid as a result of the exercise of the right of withdrawal will correspond to R$ 8.6467556201 per share. a) Considering that shareholders holding 738 (seven hundred and thirty-eight) PNA shares exercised their respective right of withdrawal, the amounts owed by the Company as a result of this exercise total R$ 6,381.21 (six thousand, three hundred and eighty-one reais and twenty-one cents). II. Refund Payment Date. The refund payment to PNA holders who exercised their right of withdrawal will be made on December 19, 2025, in accordance with the payment rules set forth in the Brazilian Corporations Law, as provided for in Notice 07/25. NOTICE TO SHAREHOLDERS | 10/25 III. Reconsideration of Resolutions. The Company informs that it will not avail itself of the prerogative provided for in Article 137, paragraph 3, of the Brazilian Corporations Law, so that no general meeting will be called to ratify or reconsider the PN Conversion. IV. Special Balance Sheet. No dissenting shareholder requested the preparation of a special balance sheet for the purpose of determining the reimbursement amount, pursuant to Article 45, paragraph 2, of the Brazilian Corporations Law. 2. Distribution of Proceeds In addition to and consolidation of the information disclosed in Notice 08/25 and Notice 09/25, and in view of the exercise of the right of withdrawal mentioned above, the Company re-ratifies the terms, amounts, and dates related to the distribution of earnings, as shown in the table below: IoE DIVIDENDS Payment date 01.19.2026 Until 06.30.2026 Total amount R$ 1,100,000,000.00 R$ 1,350,000,000.00 Gross amount per ordinary share - ON R$ 0.37041630274(1) R$ 0.45460182609 Record Date (included) 12.30.2025 12.30.2025 Ex-date 01.02.2026 01.02.2026 (1) Subject to taxation in accordance with Law 9.249/95. Legal entities that are exempt from income tax withholding under Brazilian law must provide proof of this status to the bookkeeper. Curitiba, December 19, 2025 Felipe Gutterres Vice President of Finance and Investor Relations For further information, please contact the company: ri@copel.com or (41) 3331-4011

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date December 19, 2025

| COMPANHIA PARANAENSE DE ENERGIA – COPEL | ||

| By: |

/S/ Daniel Pimentel Slaviero |

|

| Daniel Pimentel Slaviero Chief Executive Officer |

||

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements. These statements are statements that are not historical facts, and are based on management's current view and estimates of future economic circumstances, industry conditions, company performance and financial results. The words "anticipates", "believes", "estimates", "expects", "plans" and similar expressions, as they relate to the company, are intended to identify forward-looking statements. Statements regarding the declaration or payment of dividends, the implementation of principal operating and financing strategies and capital expenditure plans, the direction of future operations and the factors or trends affecting financial condition, liquidity or results of operations are examples of forward-looking statements. Such statements reflect the current views of management and are subject to a number of risks and uncertainties. There is no guarantee that the expected events, trends or results will actually occur. The statements are based on many assumptions and factors, including general economic and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual results to differ materially from current expectations.