Cautionary Statement and Other Disclosures This presentation contains “forward-looking statements” within the meaning of

Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. All statements other than statements of historical fact included in this presentation and the oral statements made in connection herewith are

forward-looking statements made in good faith by CenterPoint Energy, Inc. (“CenterPoint Energy” or the “Company”) and are intended to qualify for the safe harbor from liability established by the Private Securities Litigation

Reform Act of 1995, including statements concerning CenterPoint Energy’s expectations, beliefs, plans, objectives, goals, strategies, future operations, events, financial position, earnings and guidance, growth, costs, prospects, capital

investments or performance or underlying assumptions and other statements that are not historical facts. You should not place undue reliance on forward-looking statements. You can generally identify our forward-looking statements by the words

“anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “forecast,” “goal,” “intend,” “may,” “objective,”

“plan,” “potential,” “predict,” “projection,” “should,” “target,” “will,” or other similar words. The absence of these words, however, does not mean that the

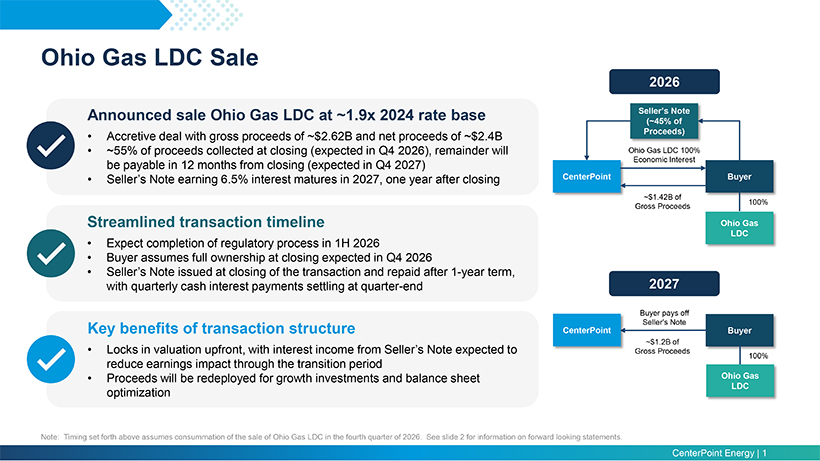

statements are not forward-looking. Examples of forward-looking statements in this presentation include, but are not limited to, the timing of the Closing of the Transaction, the timing of the Seller Note and potential earnings impacts, and the

Company’s intended use of the proceeds of the Transaction. We have based our forward-looking statements on our management’s beliefs and assumptions based on information currently available to our management at the time the statements are

made. We caution you that assumptions, beliefs, expectations, intentions, and projections about future events may and often do vary materially from actual results. Therefore, we cannot assure you that actual results will not differ materially from

those expressed or implied by our forward-looking statements. Some of the factors that could cause actual results to differ from those expressed or implied by our forward-looking information include risks and uncertainties relating to (1) the timing

of the expiration or termination of the Hart-Scott-Rodino waiting period and the receipt of any consents, waivers or approvals required to be obtained pursuant to applicable antitrust laws, (2) the occurrence of any event, change or other

circumstances that could give rise to the termination of the Transaction or could otherwise cause the failure of the Transaction to close, (3) the risk that a condition to the closing of the Transaction may not be satisfied, including obtaining

required regulatory approvals, (4) the outcome of any legal proceedings, regulatory proceedings or enforcement matters that may be instituted relating to the Transaction, (5) the timing to consummate the Transaction, (6) disruption from the

Transaction making it more difficult to maintain relationships with customers, employees, regulators or suppliers, (7) the diversion of management time and attention on the Transaction and (8) other factors discussed in the Company’s Annual

Report on Form 10-K for the fiscal year ended December 31, 2024, the Company’s Quarterly Reports on Form 10-Q for the quarters ended March 31, 2025 and June 30, 2025 and other reports the Company may file from time to time with the Securities

and Exchange Commission This presentation contains time sensitive information that is accurate as of the date hereof (unless otherwise specified as accurate as of another date). Some of the information in this presentation is unaudited and may be

subject to change. We undertake no obligation to update the information presented herein except as required by law. Investors and others should note that we may announce material information using SEC filings, press releases, public conference

calls, webcasts and the Investor Relations page of our website. In the future, we will continue to use these channels to distribute material information about the Company and to communicate important information about the Company, key personnel,

corporate initiatives, regulatory updates and other matters. Information that we post on our website could be deemed material; therefore, we encourage investors, the media, our customers, business partners and others interested in our Company to

review the information we post on our website.