Investor Presentation Second Quarter 2025 SNDA NYSE Listed August 11, 2025 Leading Owner, Operator & Investor

Forward-Looking Statements 2 This investor presentation contains forward-looking statements which are subject to certain risks and uncertainties that could cause our actual results and financial condition to differ materially from those indicated in the forward-looking statements, including, among others, the risks, uncertainties and factors set forth under “Item. 1A. Risk Factors” in our Annual Report on Form 10-K for the fiscal year ended December 31, 2024, filed with the Securities and Exchange Commission (the “SEC”) on March 17, 2025, and also include the following: the Company’s ability to generate sufficient cash flows from operations, proceeds from equity issuances and debt financings, and proceeds from the sale of assets to satisfy its short and long-term debt obligations and to fund the Company’s acquisitions and capital improvement projects to expand, redevelop, and/or reposition its senior living communities; elevated market interest rates that increase the cost of certain of our debt obligations; increased competition for, or a shortage of, skilled workers, including due to general labor market conditions, along with wage pressures resulting from such increased competition, low unemployment levels, use of contract labor, minimum wage increases and/or changes in immigration or overtime laws; the Company’s ability to obtain additional capital on terms acceptable to it; the Company’s ability to extend or refinance its existing debt as such debt matures; the Company’s compliance with its debt agreements, including certain financial covenants and the risk of cross-default in the event such non-compliance occurs; the Company’s ability to complete acquisitions and dispositions upon favorable terms or at all, including the possibility that the expected benefits and the Company’s projections related to such acquisitions may not materialize as expected; the risk of oversupply and increased competition in the markets which the Company operates; the Company’s ability to maintain effective internal controls over financial reporting and remediate the identified material weakness discussed in Item 9A of the Company’s Annual Report on Form 10-K for the year ended December 31, 2024; the cost and difficulty of complying with applicable licensure, legislative oversight, or regulatory changes; changes in reimbursement rates, methods or timing of payment under government reimbursement programs, including Medicaid; risks associated with current global economic conditions and general economic factors such as elevated labor costs due to shortages of medical and non-medical staff, competition in the labor market, increased costs of salaries, wages and benefits, and immigration laws, the consumer price index, commodity costs, fuel and other energy costs, supply chain disruptions, increased insurance costs, tariffs, elevated interest rates and tax rates; the impact from or the potential emergence and effects of a future epidemic, pandemic, outbreak of infectious disease or other health crisis; the Company’s ability to maintain the security and functionality of its information systems, to prevent a cybersecurity attack or breach, and to comply with applicable privacy and consumer protection laws, including HIPAA; and changes in accounting principles and interpretations. We caution you that the risks, uncertainties and other factors referenced above may not contain all of the risks, uncertainties and other factors that are important to you. In addition, we cannot assure you that we will realize the results, benefits or outcomes that we expect or anticipate or, even if substantially realized, that they will result in the consequences or affect us or our business in the way expected. For information about the Company, visit sonidaseniorliving.com or investors.sonidaseniorliving.com

Sonida Overview 3

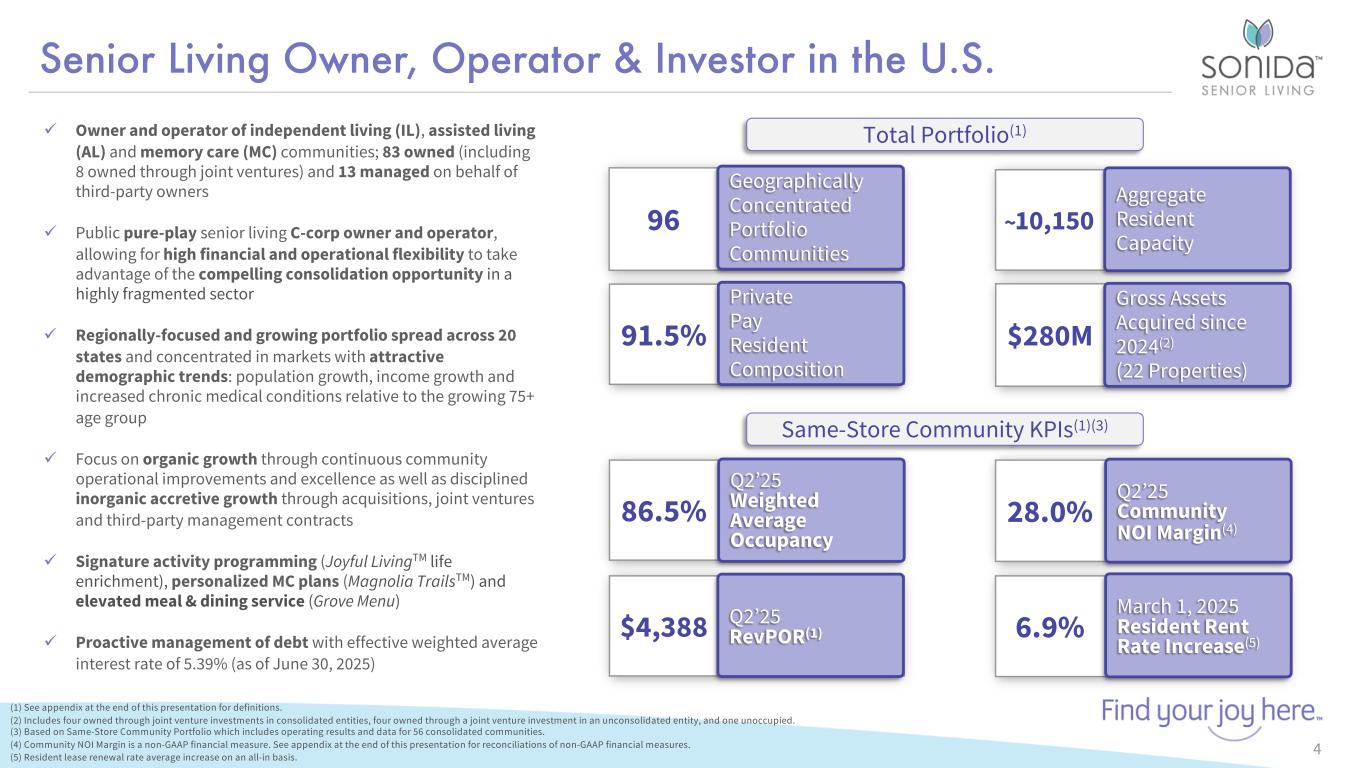

4 Senior Living Owner, Operator & Investor in the U.S. ü Owner and operator of independent living (IL), assisted living (AL) and memory care (MC) communities; 83 owned (including 8 owned through joint ventures) and 13 managed on behalf of third-party owners ü Public pure-play senior living C-corp owner and operator, allowing for high financial and operational flexibility to take advantage of the compelling consolidation opportunity in a highly fragmented sector ü Regionally-focused and growing portfolio spread across 20 states and concentrated in markets with attractive demographic trends: population growth, income growth and increased chronic medical conditions relative to the growing 75+ age group ü Focus on organic growth through continuous community operational improvements and excellence as well as disciplined inorganic accretive growth through acquisitions, joint ventures and third-party management contracts ü Signature activity programming (Joyful LivingTM life enrichment), personalized MC plans (Magnolia TrailsTM) and elevated meal & dining service (Grove Menu) ü Proactive management of debt with effective weighted average interest rate of 5.39% (as of June 30, 2025) 6.9% 28.0% $4,388 91.5% $280M 86.5% 10,15096 Geographically Concentrated Portfolio Communities Q2’25 Weighted Average Occupancy Private Pay Resident Composition Q2’25 RevPOR(1) March 1, 2025 Resident Rent Rate Increase(5) Q2’25 Community NOI Margin(4) Gross Assets Acquired since 2024(2) (22 Properties) Aggregate Resident Capacity (1) See appendix at the end of this presentation for definitions. (2) Includes four owned through joint venture investments in consolidated entities, four owned through a joint venture investment in an unconsolidated entity, and one unoccupied. (3) Based on Same-Store Community Portfolio which includes operating results and data for 56 consolidated communities. (4) Community NOI Margin is a non-GAAP financial measure. See appendix at the end of this presentation for reconciliations of non-GAAP financial measures. (5) Resident lease renewal rate average increase on an all-in basis. Total Portfolio(1) ~ Same-Store Community KPIs(1)(3)

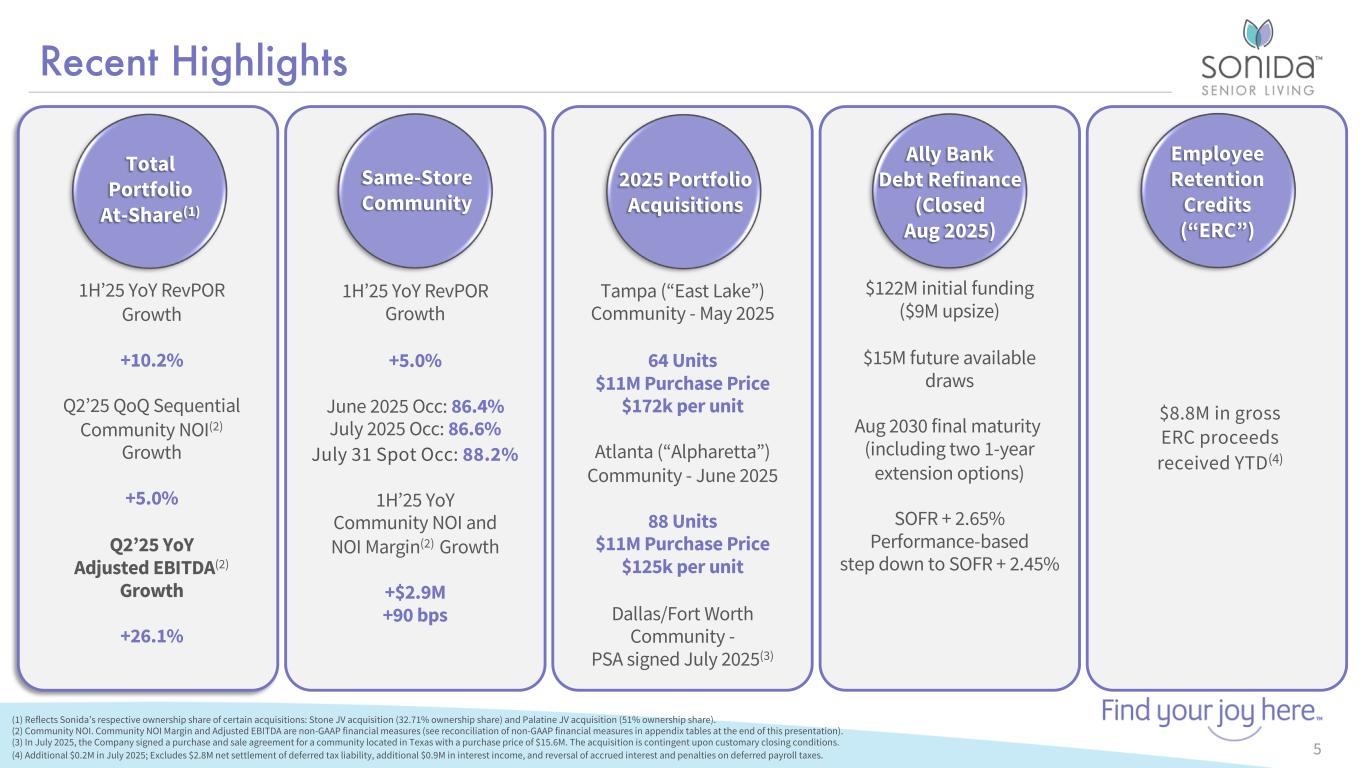

5 Recent Highlights Same-Store Community Ally Bank Debt Refinance (Closed Aug 2025) Employee Retention Credits (“ERC”) 1H’25 YoY RevPOR Growth +5.0% June 2025 Occ: 86.4% July 2025 Occ: 86.6% July 31 Spot Occ: 88.2% 1H’25 YoY Community NOI and NOI Margin(2) Growth +$2.9M +90 bps (1) Reflects Sonida’s respective ownership share of certain acquisitions: Stone JV acquisition (32.71% ownership share) and Palatine JV acquisition (51% ownership share). (2) Community NOI. Community NOI Margin and Adjusted EBITDA are non-GAAP financial measures (see reconciliation of non-GAAP financial measures in appendix tables at the end of this presentation). (3) In July 2025, the Company signed a purchase and sale agreement for a community located in Texas with a purchase price of $15.6M. The acquisition is contingent upon customary closing conditions. (4) Additional $0.2M in July 2025; Excludes $2.8M net settlement of deferred tax liability, additional $0.9M in interest income, and reversal of accrued interest and penalties on deferred payroll taxes. 2025 Portfolio Acquisitions Tampa (“East Lake”) Community - May 2025 64 Units $11M Purchase Price $172k per unit Atlanta (“Alpharetta”) Community - June 2025 88 Units $11M Purchase Price $125k per unit Dallas/Fort Worth Community - PSA signed July 2025(3) $122M initial funding ($9M upsize) $15M future available draws Aug 2030 final maturity (including two 1-year extension options) SOFR + 2.65% Performance-based step down to SOFR + 2.45% $8.8M in gross ERC proceeds received YTD(4) Total Portfolio At-Share(1) 1H’25 YoY RevPOR Growth +10.2% Q2’25 QoQ Sequential Community NOI(2) Growth +5.0% Q2’25 YoY Adjusted EBITDA(2) Growth +26.1%

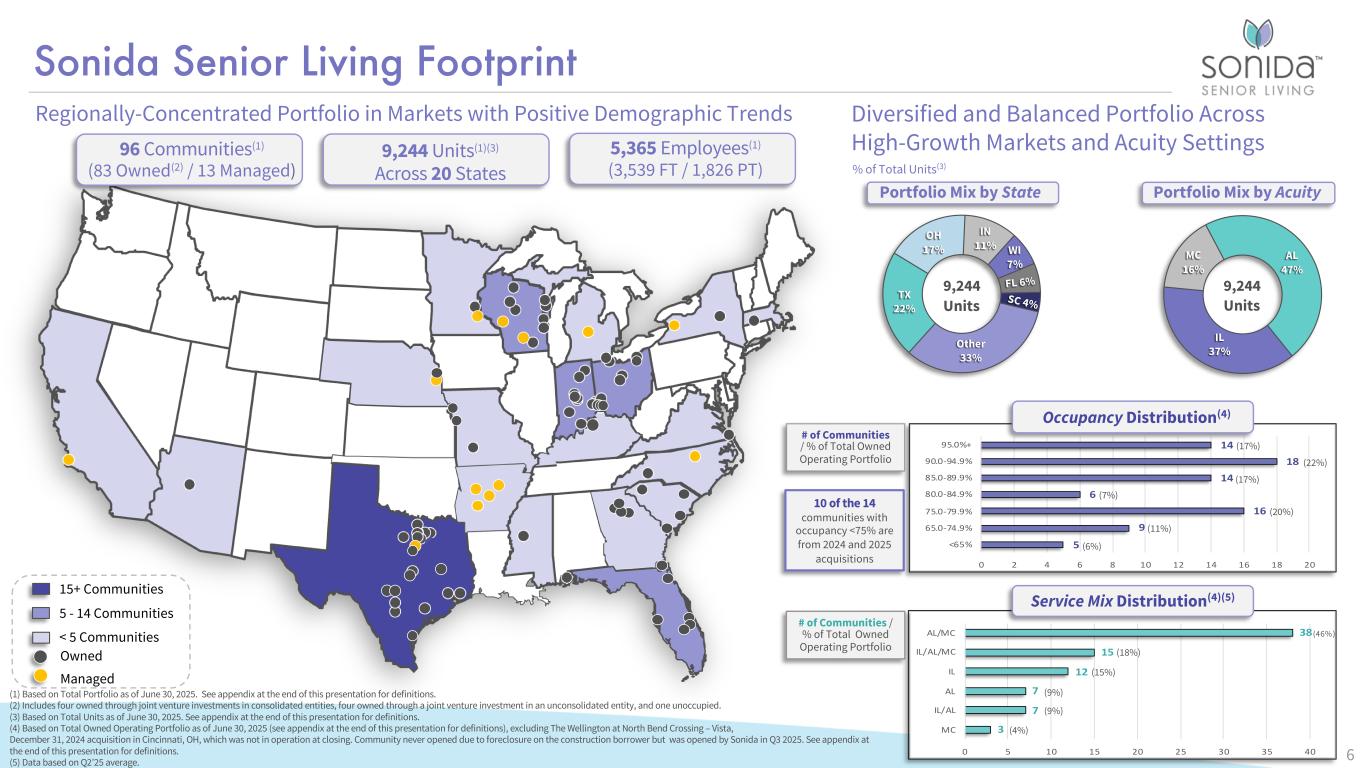

3 7 7 12 15 38 0 5 10 15 20 25 30 35 40 MC IL/AL AL IL IL/AL/MC AL/MC 5 9 16 6 14 18 14 0 2 4 6 8 10 12 14 16 18 20 <65% 65.0-74.9% 75.0-79.9% 80.0-84.9% 85.0-89.9% 90.0-94.9% 95.0%+ TX 22% OH 17% IN 11% WI 7% FL 6% SC 4% Other 33% Sonida Senior Living Footprint 15+ Communities 5 - 14 Communities < 5 Communities Managed Owned Portfolio Mix by State Regionally-Concentrated Portfolio in Markets with Positive Demographic Trends (1) Based on Total Portfolio as of June 30, 2025. See appendix at the end of this presentation for definitions. (2) Includes four owned through joint venture investments in consolidated entities, four owned through a joint venture investment in an unconsolidated entity, and one unoccupied. (3) Based on Total Units as of June 30, 2025. See appendix at the end of this presentation for definitions. (4) Based on Total Owned Operating Portfolio as of June 30, 2025 (see appendix at the end of this presentation for definitions), excluding The Wellington at North Bend Crossing – Vista, December 31, 2024 acquisition in Cincinnati, OH, which was not in operation at closing. Community never opened due to foreclosure on the construction borrower but was opened by Sonida in Q3 2025. See appendix at the end of this presentation for definitions. (5) Data based on Q2’25 average. % of Total Units(3) AL 47% IL 37% MC 16% 9,244 Units 9,244 Units Diversified and Balanced Portfolio Across High-Growth Markets and Acuity Settings96 Communities(1) (83 Owned(2) / 13 Managed) 9,244 Units(1)(3) Across 20 States 5,365 Employees(1) (3,539 FT / 1,826 PT) Portfolio Mix by Acuity Occupancy Distribution(4) # of Communities / % of Total Owned Operating Portfolio (17%) # of Communities / % of Total Owned Operating Portfolio (22%) (17%) (7%) (20%) (11%) (6%) (46%) (18%) (15%) (9%) (4%) (9%) Service Mix Distribution(4)(5) 6 10 of the 14 communities with occupancy <75% are from 2024 and 2025 acquisitions

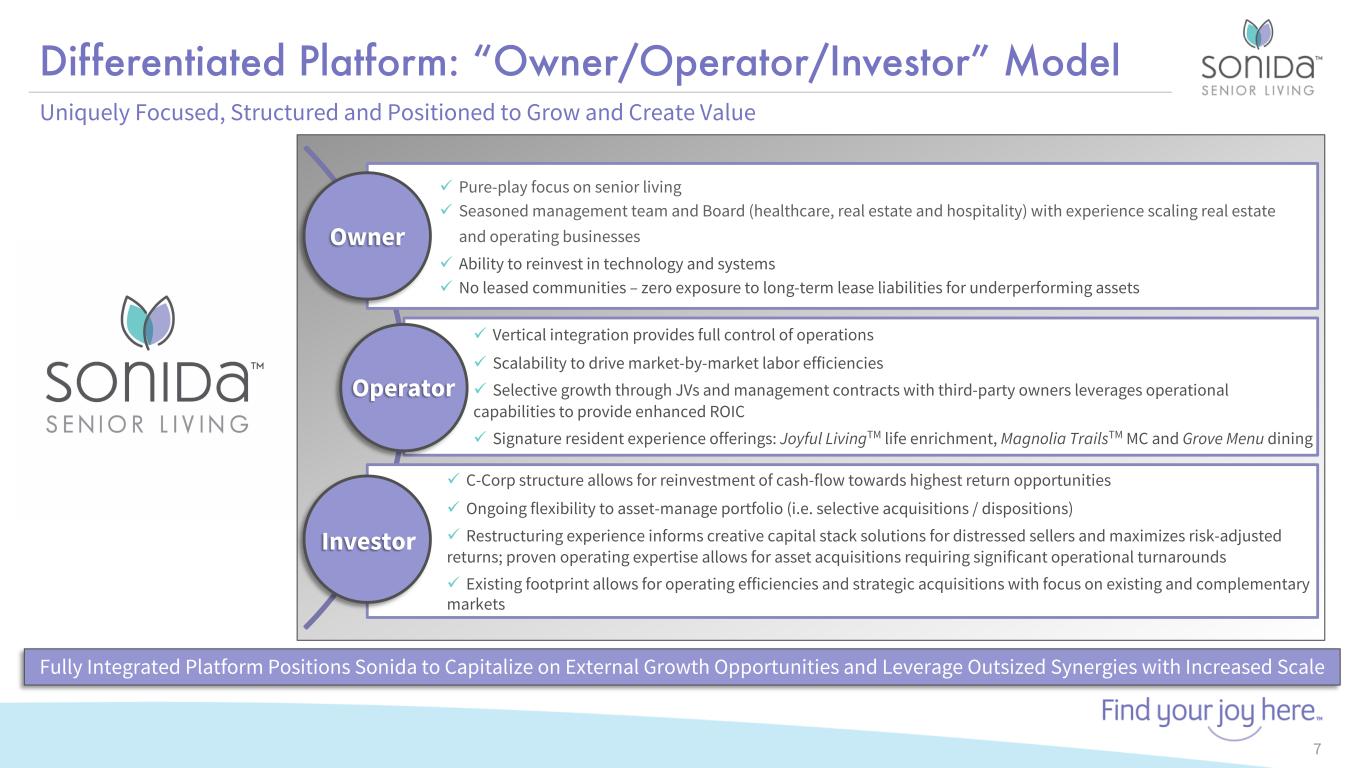

Differentiated Platform: “Owner/Operator/Investor” Model 7 Uniquely Focused, Structured and Positioned to Grow and Create Value Fully Integrated Platform Positions Sonida to Capitalize on External Growth Opportunities and Leverage Outsized Synergies with Increased Scale Owner Investor Operator ü Vertical integration provides full control of operations ü Scalability to drive market-by-market labor efficiencies ü Selective growth through JVs and management contracts with third-party owners leverages operational capabilities to provide enhanced ROIC ü Signature resident experience offerings: Joyful LivingTM life enrichment, Magnolia TrailsTM MC and Grove Menu dining ü C-Corp structure allows for reinvestment of cash-flow towards highest return opportunities ü Ongoing flexibility to asset-manage portfolio (i.e. selective acquisitions / dispositions) ü Restructuring experience informs creative capital stack solutions for distressed sellers and maximizes risk-adjusted returns; proven operating expertise allows for asset acquisitions requiring significant operational turnarounds ü Existing footprint allows for operating efficiencies and strategic acquisitions with focus on existing and complementary markets ü Pure-play focus on senior living ü Seasoned management team and Board (healthcare, real estate and hospitality) with experience scaling real estate and operating businesses ü Ability to reinvest in technology and systems ü No leased communities – zero exposure to long-term lease liabilities for underperforming assets

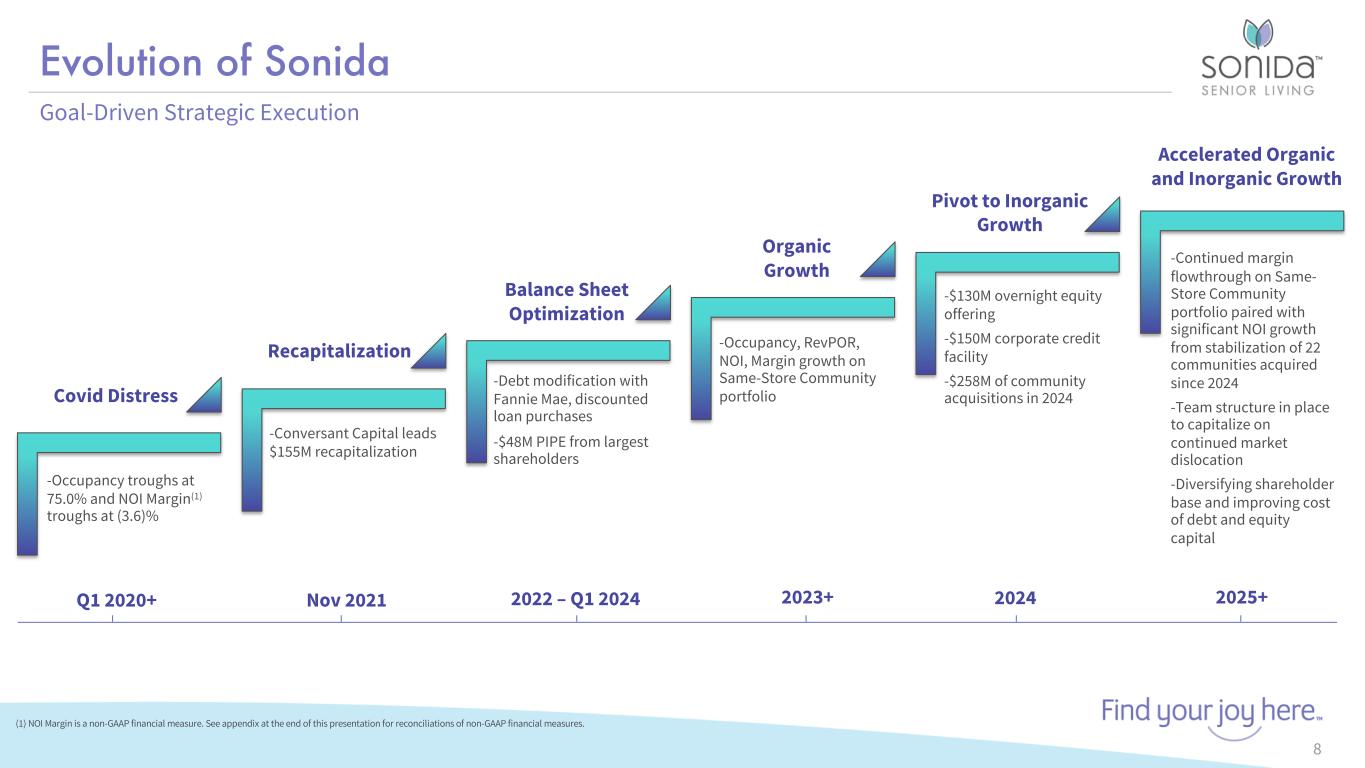

Evolution of Sonida 8 -Occupancy troughs at 75.0% and NOI Margin(1) troughs at (3.6)% -Conversant Capital leads $155M recapitalization -Debt modification with Fannie Mae, discounted loan purchases -$48M PIPE from largest shareholders -Occupancy, RevPOR, NOI, Margin growth on Same-Store Community portfolio -$130M overnight equity offering -$150M corporate credit facility -$258M of community acquisitions in 2024 -Continued margin flowthrough on Same- Store Community portfolio paired with significant NOI growth from stabilization of 22 communities acquired since 2024 -Team structure in place to capitalize on continued market dislocation -Diversifying shareholder base and improving cost of debt and equity capital Goal-Driven Strategic Execution Covid Distress Recapitalization Balance Sheet Optimization Organic Growth Accelerated Organic and Inorganic Growth Pivot to Inorganic Growth Q1 2020+ Nov 2021 2022 – Q1 2024 2023+ 2024 2025+ (1) NOI Margin is a non-GAAP financial measure. See appendix at the end of this presentation for reconciliations of non-GAAP financial measures.

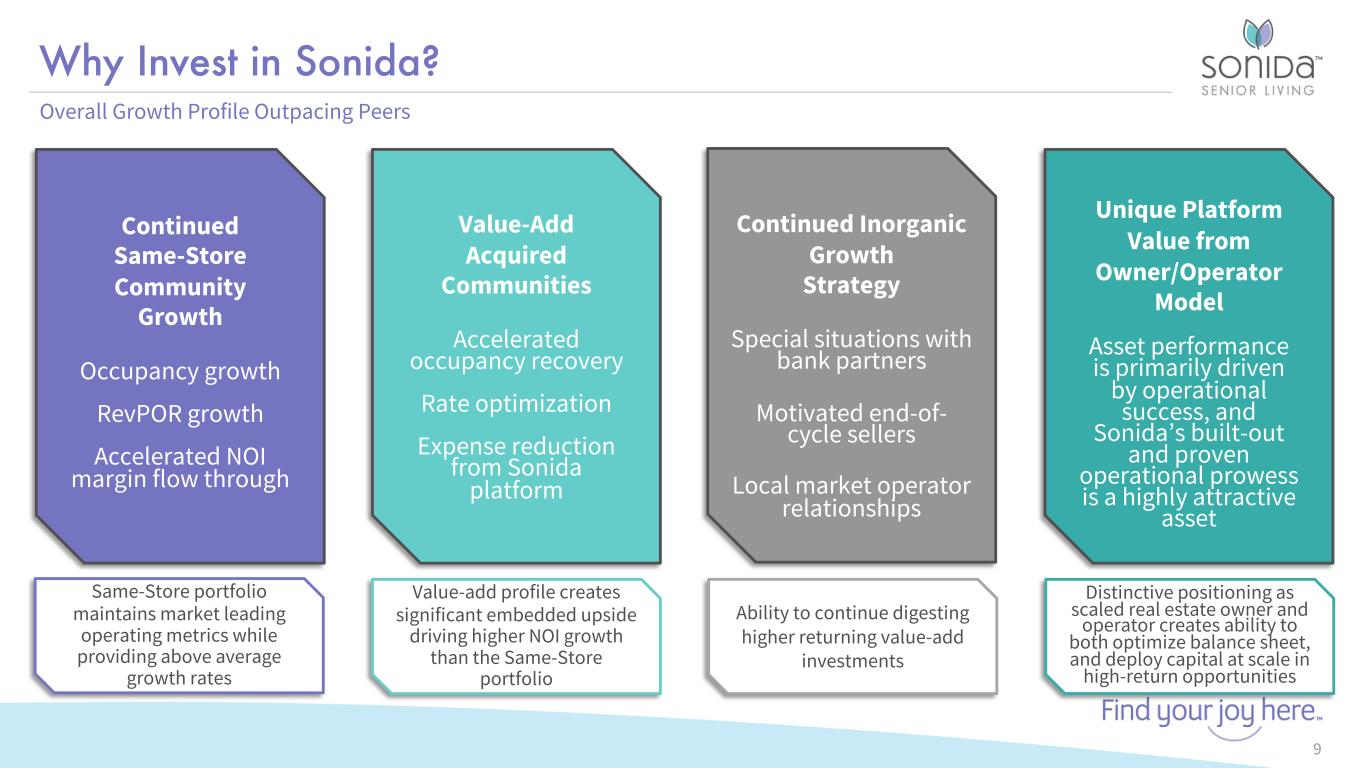

Why Invest in Sonida? 9 Continued Same-Store Community Growth Occupancy growth RevPOR growth Accelerated NOI margin flow through Value-Add Acquired Communities Accelerated occupancy recovery Rate optimization Expense reduction from Sonida platform Unique Platform Value from Owner/Operator Model Asset performance is primarily driven by operational success, and Sonida’s built-out and proven operational prowess is a highly attractive asset Same-Store portfolio maintains market leading operating metrics while providing above average growth rates Value-add profile creates significant embedded upside driving higher NOI growth than the Same-Store portfolio Ability to continue digesting higher returning value-add investments Distinctive positioning as scaled real estate owner and operator creates ability to both optimize balance sheet, and deploy capital at scale in high-return opportunities Overall Growth Profile Outpacing Peers Continued Inorganic Growth Strategy Special situations with bank partners Motivated end-of- cycle sellers Local market operator relationships

Financial Performance & Highlights 10

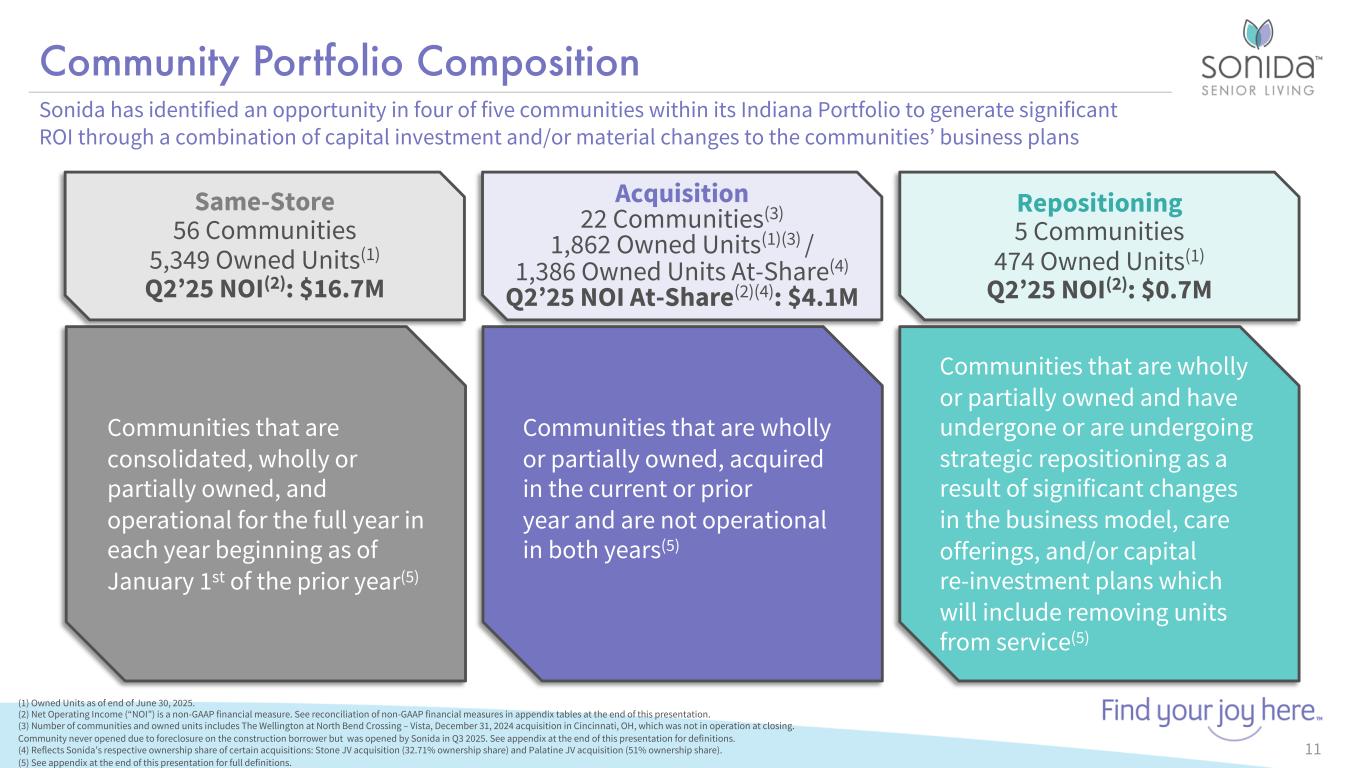

Community Portfolio Composition 11 Communities that are consolidated, wholly or partially owned, and operational for the full year in each year beginning as of January 1st of the prior year(5) Communities that are wholly or partially owned, acquired in the current or prior year and are not operational in both years(5) Communities that are wholly or partially owned and have undergone or are undergoing strategic repositioning as a result of significant changes in the business model, care offerings, and/or capital re-investment plans which will include removing units from service(5) Same-Store 56 Communities 5,349 Owned Units(1) Q2’25 NOI(2): $16.7M Acquisition 22 Communities(3) 1,862 Owned Units(1)(3) / 1,386 Owned Units At-Share(4) Q2’25 NOI At-Share(2)(4): $4.1M Repositioning 5 Communities 474 Owned Units(1) Q2’25 NOI(2): $0.7M (1) Owned Units as of end of June 30, 2025. (2) Net Operating Income (“NOI”) is a non-GAAP financial measure. See reconciliation of non-GAAP financial measures in appendix tables at the end of this presentation. (3) Number of communities and owned units includes The Wellington at North Bend Crossing – Vista, December 31, 2024 acquisition in Cincinnati, OH, which was not in operation at closing. Community never opened due to foreclosure on the construction borrower but was opened by Sonida in Q3 2025. See appendix at the end of this presentation for definitions. (4) Reflects Sonida’s respective ownership share of certain acquisitions: Stone JV acquisition (32.71% ownership share) and Palatine JV acquisition (51% ownership share). (5) See appendix at the end of this presentation for full definitions. Sonida has identified an opportunity in four of five communities within its Indiana Portfolio to generate significant ROI through a combination of capital investment and/or material changes to the communities’ business plans

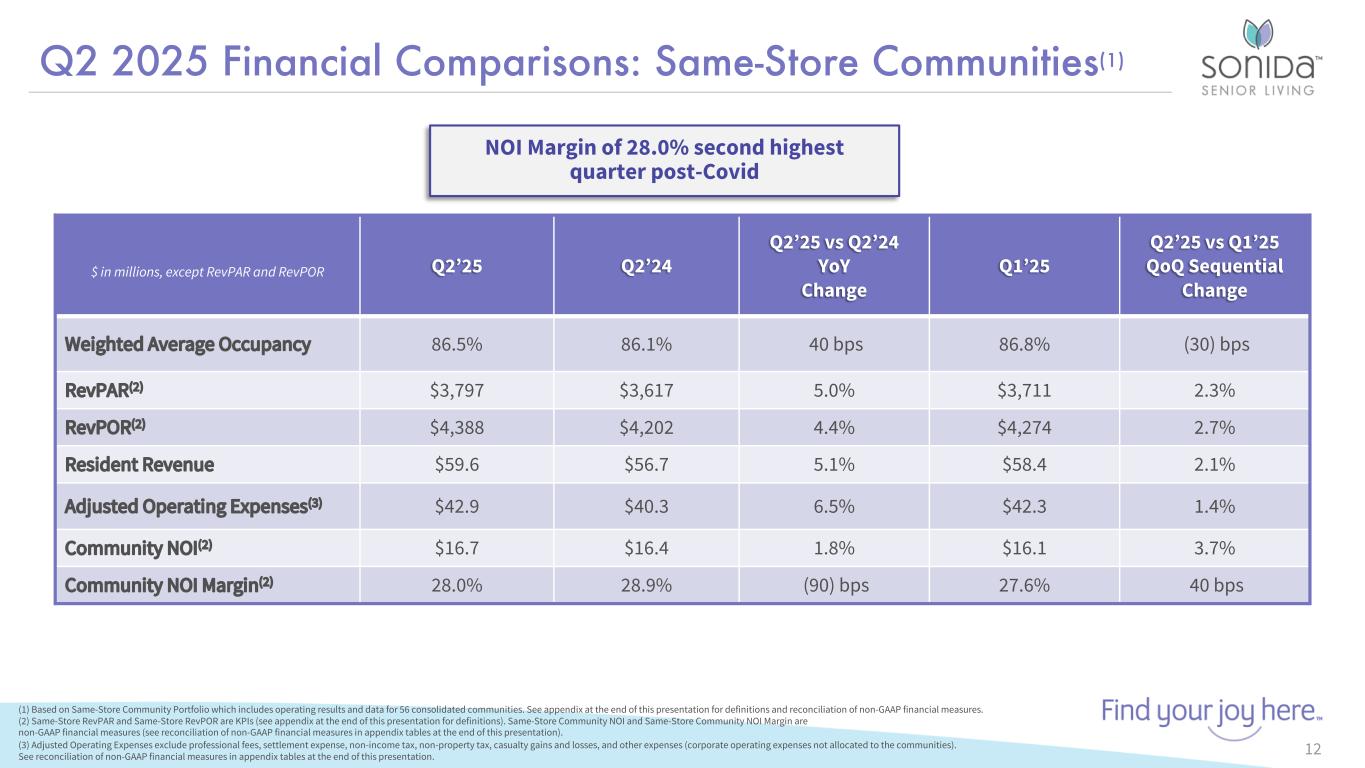

Q2 2025 Financial Comparisons: Same-Store Communities(1) 12 (1) Based on Same-Store Community Portfolio which includes operating results and data for 56 consolidated communities. See appendix at the end of this presentation for definitions and reconciliation of non-GAAP financial measures. (2) Same-Store RevPAR and Same-Store RevPOR are KPIs (see appendix at the end of this presentation for definitions). Same-Store Community NOI and Same-Store Community NOI Margin are non-GAAP financial measures (see reconciliation of non-GAAP financial measures in appendix tables at the end of this presentation). (3) Adjusted Operating Expenses exclude professional fees, settlement expense, non-income tax, non-property tax, casualty gains and losses, and other expenses (corporate operating expenses not allocated to the communities). See reconciliation of non-GAAP financial measures in appendix tables at the end of this presentation. NOI Margin of 28.0% second highest quarter post-Covid $ in millions, except RevPAR and RevPOR Q2’25 Q2’24 Q2’25 vs Q2’24 YoY Change Q1’25 Q2’25 vs Q1’25 QoQ Sequential Change 86.5% 86.1% 40 bps 86.8% (30) bps $3,797 $3,617 5.0% $3,711 2.3% $4,388 $4,202 4.4% $4,274 2.7% $59.6 $56.7 5.1% $58.4 2.1% $42.9 $40.3 6.5% $42.3 1.4% $16.7 $16.4 1.8% $16.1 3.7% 28.0% 28.9% (90) bps 27.6% 40 bps

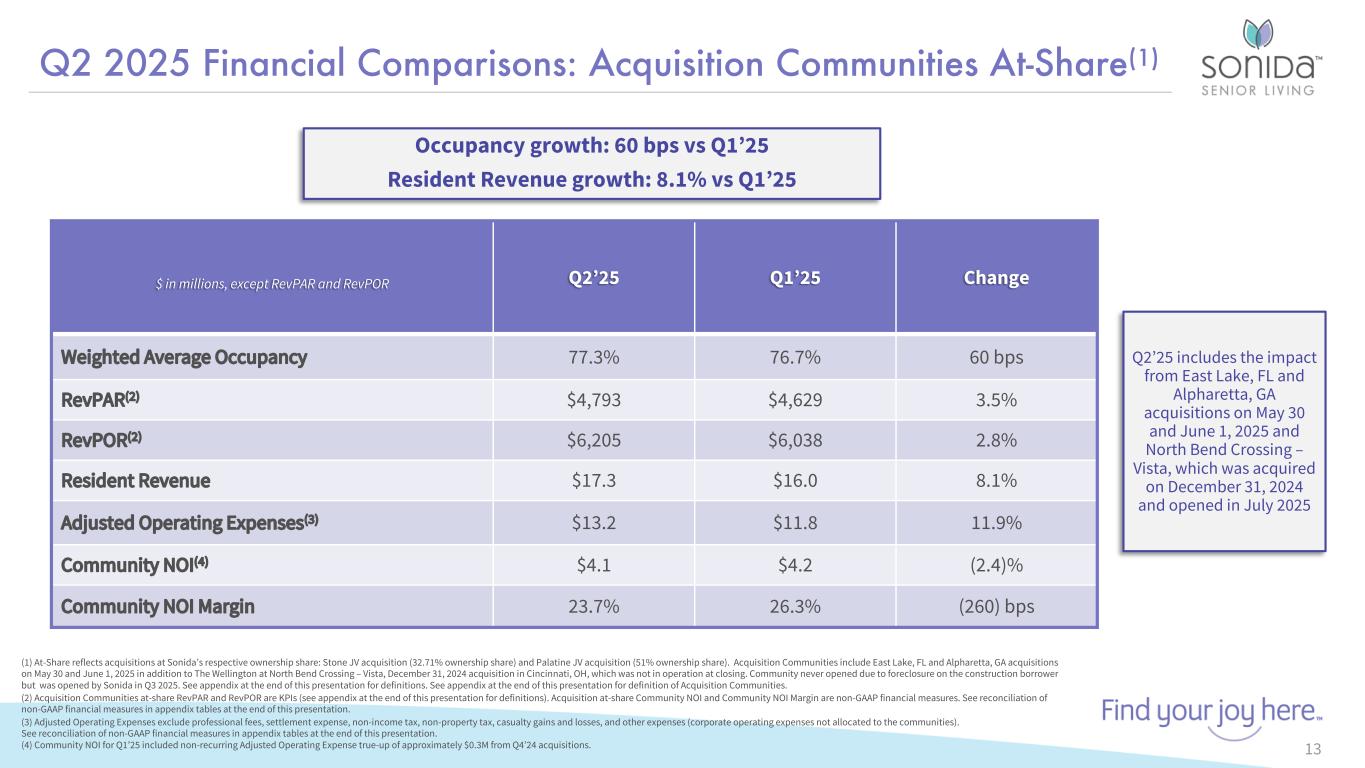

Q2 2025 Financial Comparisons: Acquisition Communities At-Share(1) 13 $ in millions, except RevPAR and RevPOR Q2’25 Q1’25 Change 77.3% 76.7% 60 bps $4,793 $4,629 3.5% $6,205 $6,038 2.8% $17.3 $16.0 8.1% $13.2 $11.8 11.9% $4.1 $4.2 (2.4)% 23.7% 26.3% (260) bps (1) At-Share reflects acquisitions at Sonida’s respective ownership share: Stone JV acquisition (32.71% ownership share) and Palatine JV acquisition (51% ownership share). Acquisition Communities include East Lake, FL and Alpharetta, GA acquisitions on May 30 and June 1, 2025 in addition to The Wellington at North Bend Crossing – Vista, December 31, 2024 acquisition in Cincinnati, OH, which was not in operation at closing. Community never opened due to foreclosure on the construction borrower but was opened by Sonida in Q3 2025. See appendix at the end of this presentation for definitions. See appendix at the end of this presentation for definition of Acquisition Communities. (2) Acquisition Communities at-share RevPAR and RevPOR are KPIs (see appendix at the end of this presentation for definitions). Acquisition at-share Community NOI and Community NOI Margin are non-GAAP financial measures. See reconciliation of non-GAAP financial measures in appendix tables at the end of this presentation. (3) Adjusted Operating Expenses exclude professional fees, settlement expense, non-income tax, non-property tax, casualty gains and losses, and other expenses (corporate operating expenses not allocated to the communities). See reconciliation of non-GAAP financial measures in appendix tables at the end of this presentation. (4) Community NOI for Q1’25 included non-recurring Adjusted Operating Expense true-up of approximately $0.3M from Q4’24 acquisitions. Occupancy growth: 60 bps vs Q1’25 Resident Revenue growth: 8.1% vs Q1’25 Q2’25 includes the impact from East Lake, FL and Alpharetta, GA acquisitions on May 30 and June 1, 2025 and North Bend Crossing – Vista, which was acquired on December 31, 2024 and opened in July 2025

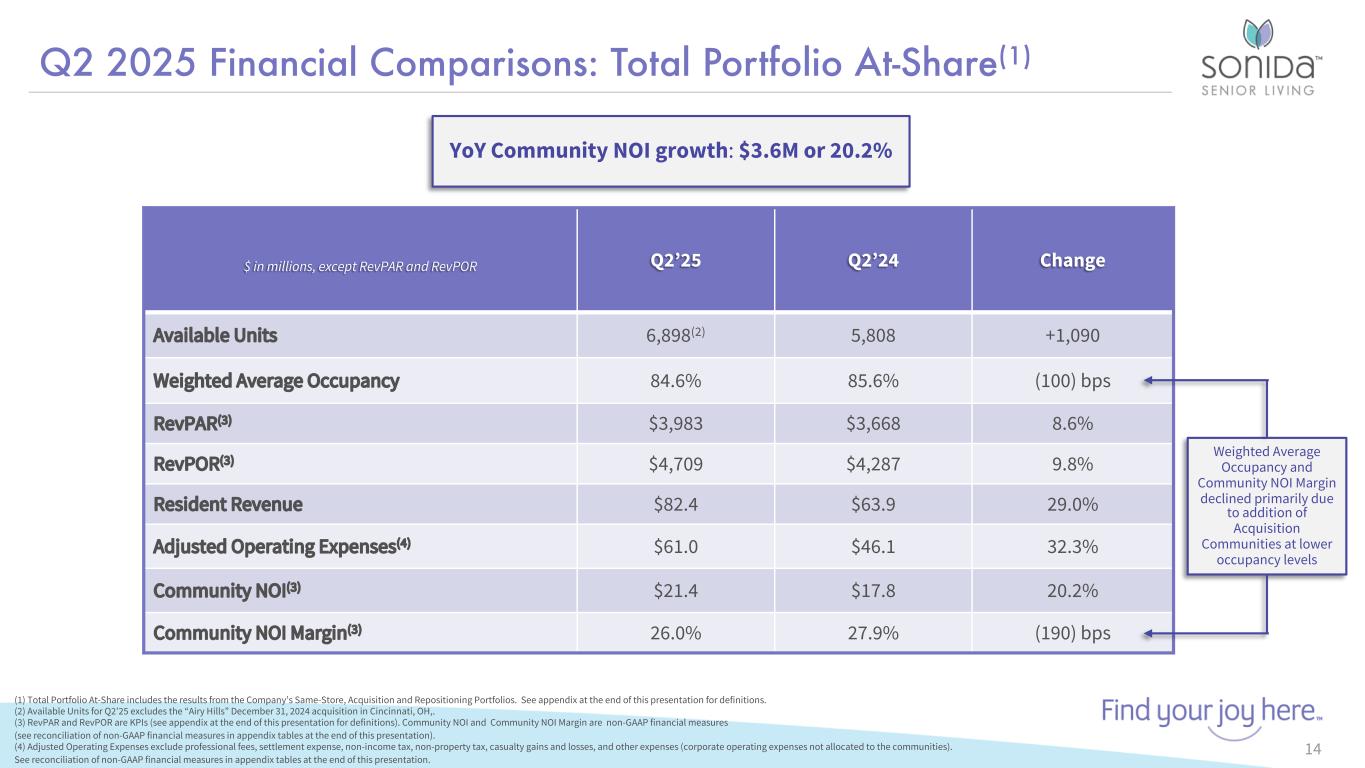

Q2 2025 Financial Comparisons: Total Portfolio At-Share(1) 14 $ in millions, except RevPAR and RevPOR Q2’25 Q2’24 Change 6,898(2) 5,808 +1,090 84.6% 85.6% (100) bps $3,983 $3,668 8.6% $4,709 $4,287 9.8% $82.4 $63.9 29.0% $61.0 $46.1 32.3% $21.4 $17.8 20.2% 26.0% 27.9% (190) bps (1) Total Portfolio At-Share includes the results from the Company’s Same-Store, Acquisition and Repositioning Portfolios. See appendix at the end of this presentation for definitions. (2) Available Units for Q2’25 excludes the “Airy Hills” December 31, 2024 acquisition in Cincinnati, OH,. (3) RevPAR and RevPOR are KPIs (see appendix at the end of this presentation for definitions). Community NOI and Community NOI Margin are non-GAAP financial measures (see reconciliation of non-GAAP financial measures in appendix tables at the end of this presentation). (4) Adjusted Operating Expenses exclude professional fees, settlement expense, non-income tax, non-property tax, casualty gains and losses, and other expenses (corporate operating expenses not allocated to the communities). See reconciliation of non-GAAP financial measures in appendix tables at the end of this presentation. YoY Community NOI growth: $3.6M or 20.2% Weighted Average Occupancy and Community NOI Margin declined primarily due to addition of Acquisition Communities at lower occupancy levels

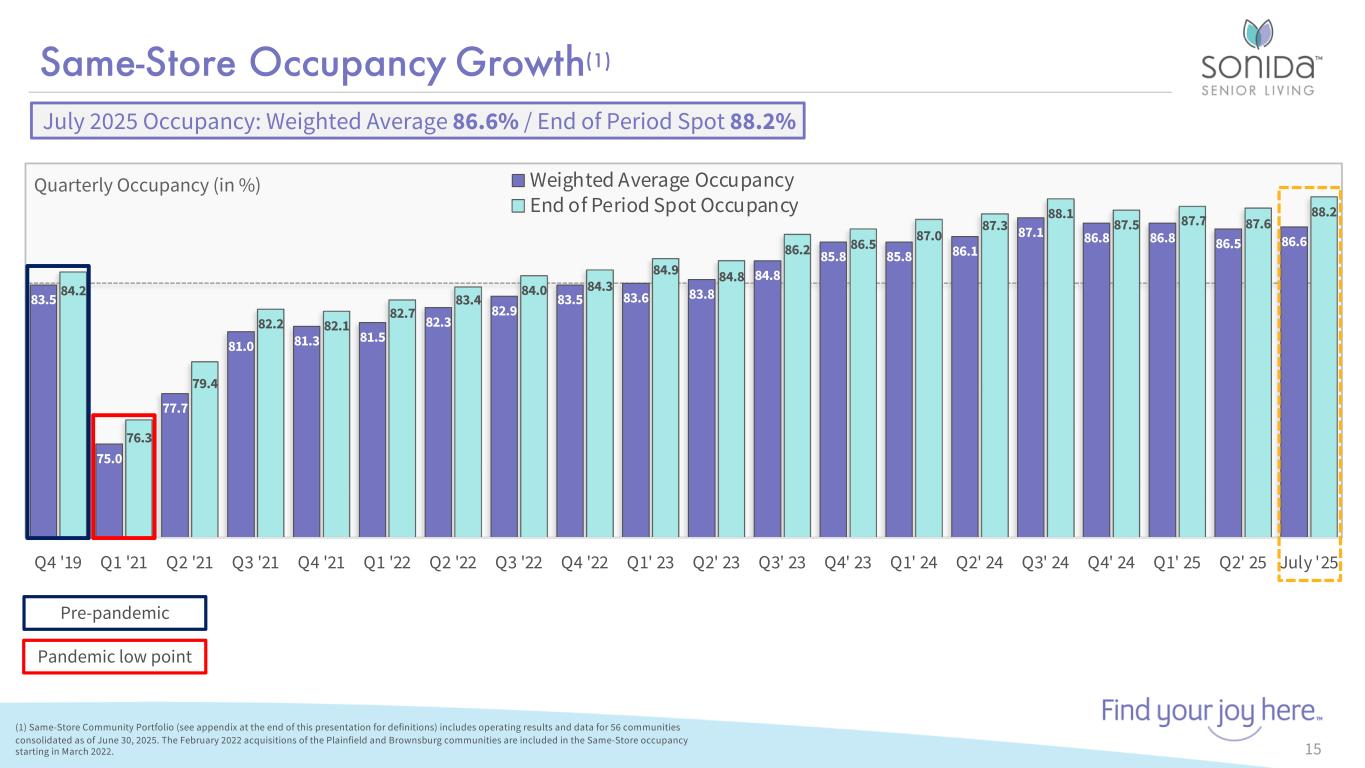

83.5 75.0 77.7 81.0 81.3 81.5 82.3 82.9 83.5 83.6 83.8 84.8 85.8 85.8 86.1 87.1 86.8 86.8 86.5 86.6 84.2 76.3 79.4 82.2 82.1 82.7 83.4 84.0 84.3 84.9 84.8 86.2 86.5 87.0 87.3 88.1 87.5 87.7 87.6 88.2 Q4 '19 Q1 '21 Q2 '21 Q3 '21 Q4 '21 Q1 '22 Q2 '22 Q3 '22 Q4 '22 Q1' 23 Q2' 23 Q3' 23 Q4' 23 Q1' 24 Q2' 24 Q3' 24 Q4' 24 Q1' 25 Q2' 25 July '25 Weighted Average Occupancy End of Period Spot Occupancy Same-Store Occupancy Growth(1) 15 Quarterly Occupancy (in %) Pandemic low point (1) Same-Store Community Portfolio (see appendix at the end of this presentation for definitions) includes operating results and data for 56 communities consolidated as of June 30, 2025. The February 2022 acquisitions of the Plainfield and Brownsburg communities are included in the Same-Store occupancy starting in March 2022. Pre-pandemic July 2025 Occupancy: Weighted Average 86.6% / End of Period Spot 88.2%

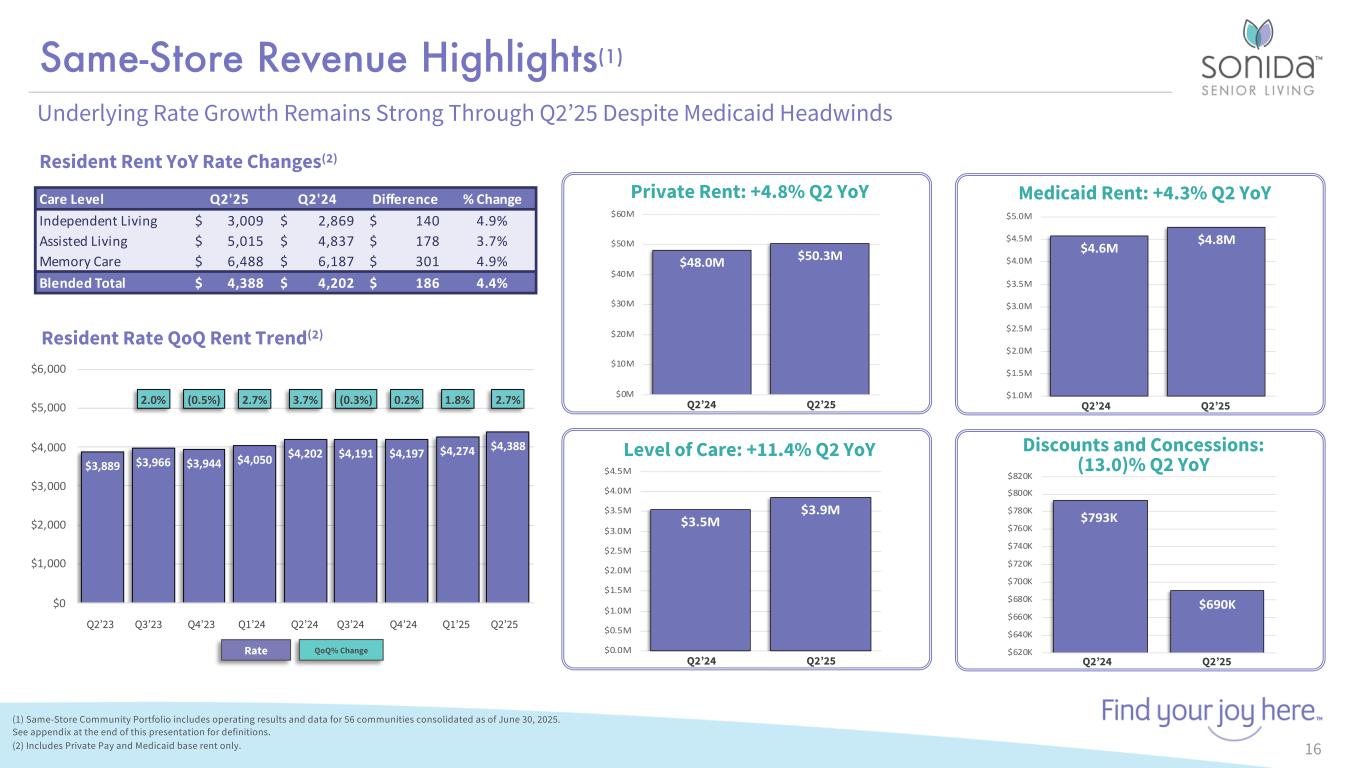

$793K $690K $620K $640K $660K $680K $700K $720K $740K $760K $780K $800K $820K Same-Store Revenue Highlights(1) 16(2) Includes Private Pay and Medicaid base rent only. (1) Same-Store Community Portfolio includes operating results and data for 56 communities consolidated as of June 30, 2025. See appendix at the end of this presentation for definitions. Underlying Rate Growth Remains Strong Through Q2’25 Despite Medicaid Headwinds Medicaid Rent: +4.3% Q2 YoY Level of Care: +11.4% Q2 YoY Discounts and Concessions: (13.0)% Q2 YoY Resident Rent YoY Rate Changes(2) Resident Rate QoQ Rent Trend(2) $3,889 $3,966 $3,944 $4,050 $4,202 $4,191 $4,197 $4,274 $4,388 2.0% (0.5%) 2.7% 3.7% (0.3%) 0.2% 1.8% 2.7% $0 $1,000 $2,000 $3,000 $4,000 $5,000 $6,000 06/ 202 3 09/ 202 3 12/ 202 3 03/ 202 4 06/ 202 4 09/ 202 4 12/ 202 4 03/ 202 5 06/ 202 5 QoQ% ChangeRate Q2’23 Q3’23 Q4’23 Q1’24 Q2’24 Q3’24 Q4’24 Q1’25 Q2’25 $48.0M $50.3M $0M $10M $20M $30M $40M $50M $60M Private Rent: +4.8% Q2 YoY $3.5M $3.9M $0.0M $0.5M $1.0M $1.5M $2.0M $2.5M $3.0M $3.5M $4.0M $4.5M Q2’24 Q2’25 Q2’24 Q2’25 Q2’24 Q2’25 Care Level Q2'25 Q2'24 Difference % Change Independent Living 3,009$ 2,869$ 140$ 4.9% Assisted Living 5,015$ 4,837$ 178$ 3.7% Memory Care 6,488$ 6,187$ 301$ 4.9% Blended Total 4,388$ 4,202$ 186$ 4.4% $4.6M $4.8M $1.0M $1.5M $2.0M $2.5M $3.0M $3.5M $4.0M $4.5M $5.0M Q2’24 Q2’25

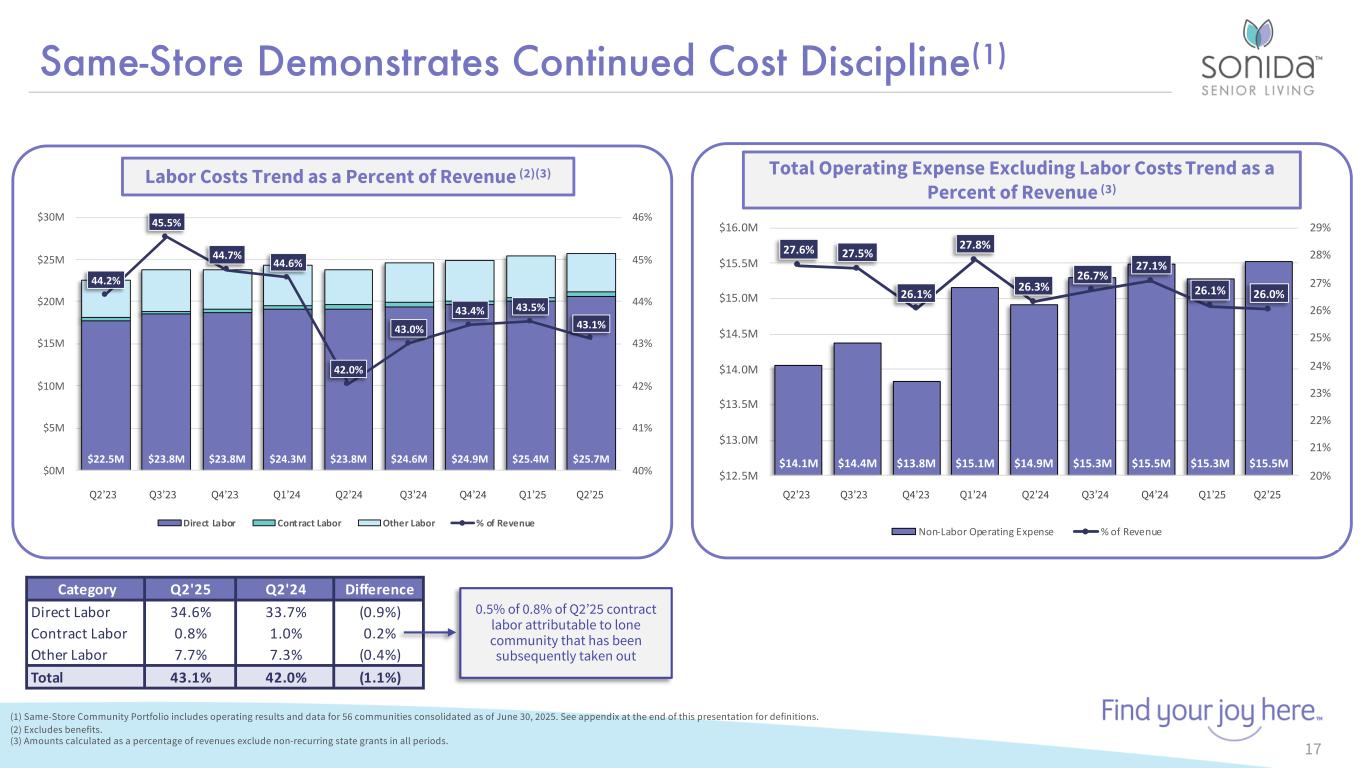

Same-Store Demonstrates Continued Cost Discipline(1) 17 Labor Costs Trend as a Percent of Revenue (2)(3) (1) Same-Store Community Portfolio includes operating results and data for 56 communities consolidated as of June 30, 2025. See appendix at the end of this presentation for definitions. (2) Excludes benefits. (3) Amounts calculated as a percentage of revenues exclude non-recurring state grants in all periods. Total Operating Expense Excluding Labor Costs Trend as a Percent of Revenue (3) Category Q2'25 Q2'24 Difference Direct Labor 34.6% 33.7% (0.9%) Contract Labor 0.8% 1.0% 0.2% Other Labor 7.7% 7.3% (0.4%) Total 43.1% 42.0% (1.1%) $22.5M $23.8M $23.8M $24.3M $23.8M $24.6M $24.9M $25.4M $25.7M 44.2% 45.5% 44.7% 44.6% 42.0% 43.0% 43.4% 43.5% 43.1% 40% 41% 42% 43% 44% 45% 46% $0M $5M $10M $15M $20M $25M $30M 06/2023 09/2023 12/2023 03/2024 06/2024 09/2024 12/2024 03/2025 06/2025 Direct Labor Contract Labor Other Labor % of Revenue Q2’23 Q3’23 Q4’23 Q1’24 Q2’24 Q3’24 Q4’24 Q1’25 Q2’25 $14.1M $14.4M $13.8M $15.1M $14.9M $15.3M $15.5M $15.3M $15.5M 27.6% 27.5% 26.1% 27.8% 26.3% 26.7% 27.1% 26.1% 26.0% 20% 21% 22% 23% 24% 25% 26% 27% 28% 29% $12.5M $13.0M $13.5M $14.0M $14.5M $15.0M $15.5M $16.0M 06/ 202 3 09/ 202 3 12/ 202 3 03/ 202 4 06/ 202 4 09/ 202 4 12/ 202 4 03/ 202 5 06/ 202 5 Non-Labor Operating Expense % of Revenue Q ’23 Q3’23 Q4’23 Q1’24 Q2’24 Q3’24 Q4’24 Q1’25 Q ’25 0.5% of 0.8% of Q2’25 contract labor attributable to lone community that has been subsequently taken out

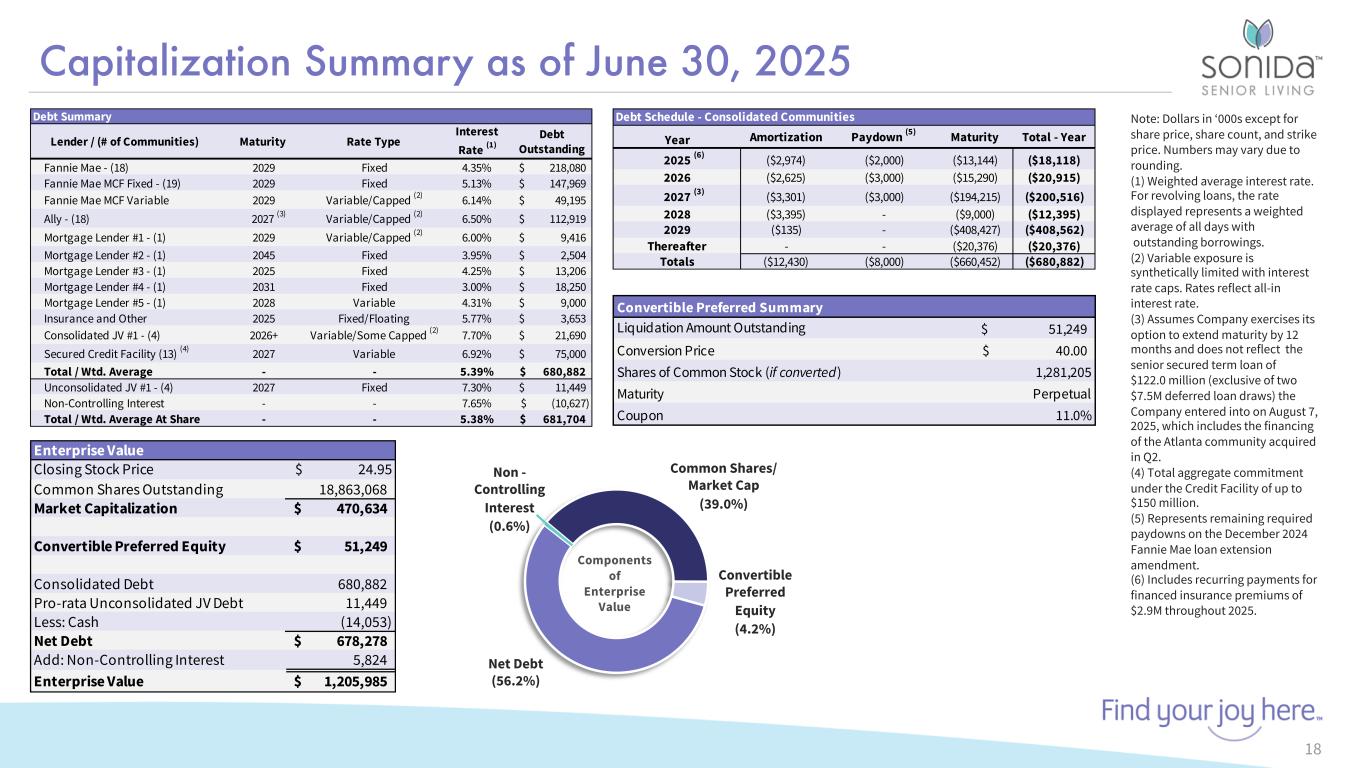

Capitalization Summary as of June 30, 2025 18 Note: Dollars in ‘000s except for share price, share count, and strike price. Numbers may vary due to rounding. (1) Weighted average interest rate. For revolving loans, the rate displayed represents a weighted average of all days with outstanding borrowings. (2) Variable exposure is synthetically limited with interest rate caps. Rates reflect all-in interest rate. (3) Assumes Company exercises its option to extend maturity by 12 months and does not reflect the senior secured term loan of $122.0 million (exclusive of two $7.5M deferred loan draws) the Company entered into on August 7, 2025, which includes the financing of the Atlanta community acquired in Q2. (4) Total aggregate commitment under the Credit Facility of up to $150 million. (5) Represents remaining required paydowns on the December 2024 Fannie Mae loan extension amendment. (6) Includes recurring payments for financed insurance premiums of $2.9M throughout 2025. Common Shares/ Market Cap (39.0%) Convertible Preferred Equity (4.2%) Net Debt (56.2%) Non - Controlling Interest (0.6%) Components of Enterprise Value Enterprise Value Closing Stock Price $ 24.95 Common Shares Outstanding 18,863,068 Market Capitalization 470,634$ Convertible Preferred Equity 51,249$ Consolidated Debt 680,882 Pro-rata Unconsolidated JV Debt 11,449 Less: Cash (14,053) Net Debt 678,278$ Add: Non-Controlling Interest 5,824 Enterprise Value 1,205,985$ Debt Schedule - Consolidated Communities Year Amortization Paydown (5) Maturity Total - Year 2025 (6) ($2,974) ($2,000) ($13,144) ($18,118) 2026 ($2,625) ($3,000) ($15,290) ($20,915) 2027 (3) ($3,301) ($3,000) ($194,215) ($200,516) 2028 ($3,395) - ($9,000) ($12,395) 2029 ($135) - ($408,427) ($408,562) Thereafter - - ($20,376) ($20,376) Totals ($12,430) ($8,000) ($660,452) ($680,882) Convertible Preferred Summary Liquidation Amount Outstanding 51,249$ Conversion Price 40.00$ Shares of Common Stock (if converted) 1,281,205 Maturity Perpetual Coupon 11.0% Debt Summary Lender / (# of Communities) Maturity Rate Type Interest Rate (1) Debt Outstanding Fannie Mae - (18) 2029 Fixed 4.35% 218,080$ Fannie Mae MCF Fixed - (19) 2029 Fixed 5.13% 147,969$ Fannie Mae MCF Variable 2029 Variable/Capped (2) 6.14% 49,195$ Ally - (18) 2027 (3) Variable/Capped (2) 6.50% 112,919$ Mortgage Lender #1 - (1) 2029 Variable/Capped (2) 6.00% 9,416$ Mortgage Lender #2 - (1) 2045 Fixed 3.95% 2,504$ Mortgage Lender #3 - (1) 2025 Fixed 4.25% 13,206$ Mortgage Lender #4 - (1) 2031 Fixed 3.00% 18,250$ Mortgage Lender #5 - (1) 2028 Variable 4.31% 9,000$ Insurance and Other 2025 Fixed/Floating 5.77% 3,653$ Consolidated JV #1 - (4) 2026+ Variable/Some Capped (2) 7.70% 21,690$ Secured Credit Facility (13) (4) 2027 Variable 6.92% 75,000$ Total / Wtd. Average - - 5.39% 680,882$ Unconsolidated JV #1 - (4) 2027 Fixed 7.30% 11,449$ Non-Controlling Interest - - 7.65% (10,627)$ Total / Wtd. Average At Share - - 5.38% 681,704$

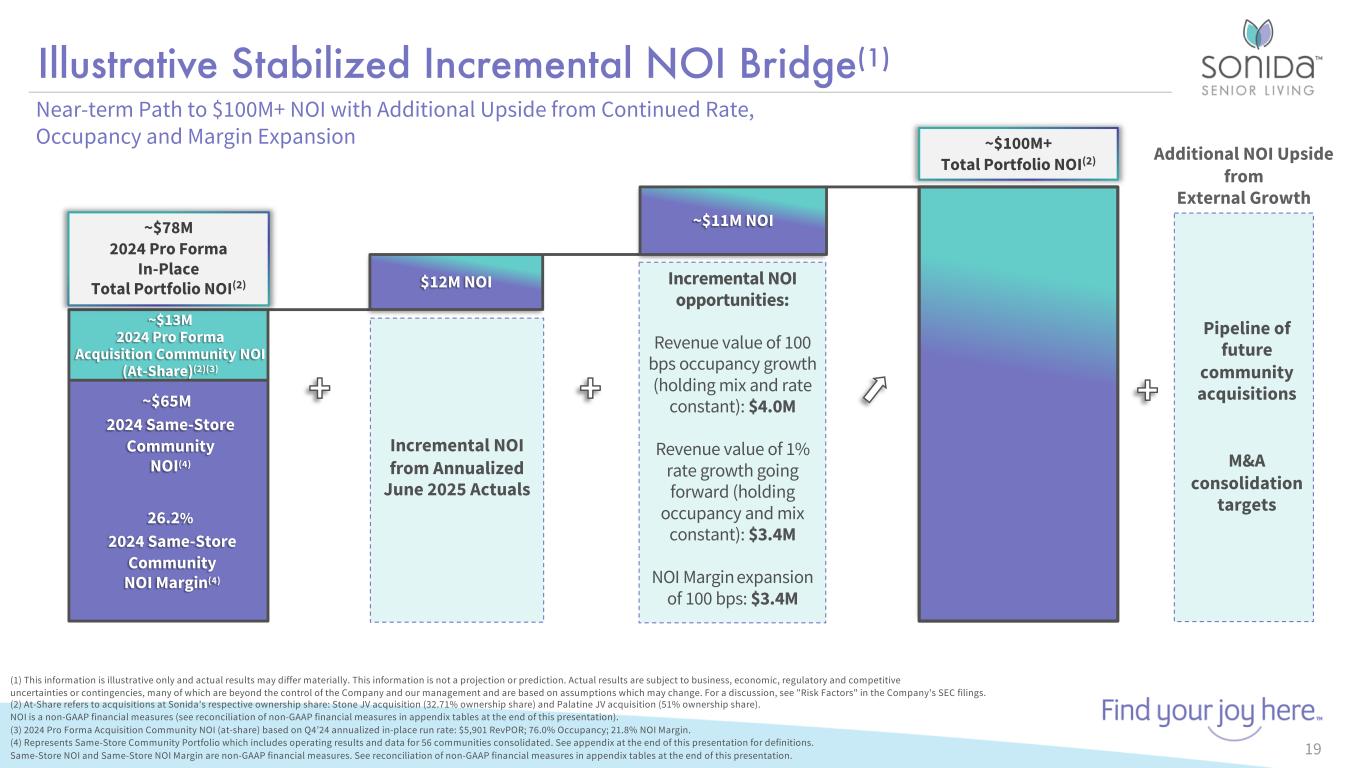

Illustrative Stabilized Incremental NOI Bridge(1) Near-term Path to $100M+ NOI with Additional Upside from Continued Rate, Occupancy and Margin Expansion (1) This information is illustrative only and actual results may differ materially. This information is not a projection or prediction. Actual results are subject to business, economic, regulatory and competitive uncertainties or contingencies, many of which are beyond the control of the Company and our management and are based on assumptions which may change. For a discussion, see "Risk Factors" in the Company's SEC filings. (2) At-Share refers to acquisitions at Sonida’s respective ownership share: Stone JV acquisition (32.71% ownership share) and Palatine JV acquisition (51% ownership share). NOI is a non-GAAP financial measures (see reconciliation of non-GAAP financial measures in appendix tables at the end of this presentation). (3) 2024 Pro Forma Acquisition Community NOI (at-share) based on Q4’24 annualized in-place run rate: $5,901 RevPOR; 76.0% Occupancy; 21.8% NOI Margin. (4) Represents Same-Store Community Portfolio which includes operating results and data for 56 communities consolidated. See appendix at the end of this presentation for definitions. Same-Store NOI and Same-Store NOI Margin are non-GAAP financial measures. See reconciliation of non-GAAP financial measures in appendix tables at the end of this presentation. 2024 Same-Store Community NOI(4) 26.2% $12M NOI Pipeline of future community acquisitions M&A consolidation targets Incremental NOI opportunities: Revenue value of 100 bps occupancy growth (holding mix and rate constant): $4.0M Revenue value of 1% rate growth going forward (holding occupancy and mix constant): $3.4M NOI Margin expansion of 100 bps: $3.4M Incremental NOI from Annualized June 2025 Actuals 2024 Same-Store Community NOI Margin(4) Additional NOI Upside from External Growth ~$65M ~$100M+ Total Portfolio NOI(2) ~$78M 2024 Pro Forma In-Place Total Portfolio NOI(2) ~$11M NOI ~$13M 2024 Pro Forma Acquisition Community NOI (At-Share)(2)(3) 19

Capital Allocation Strategy 20

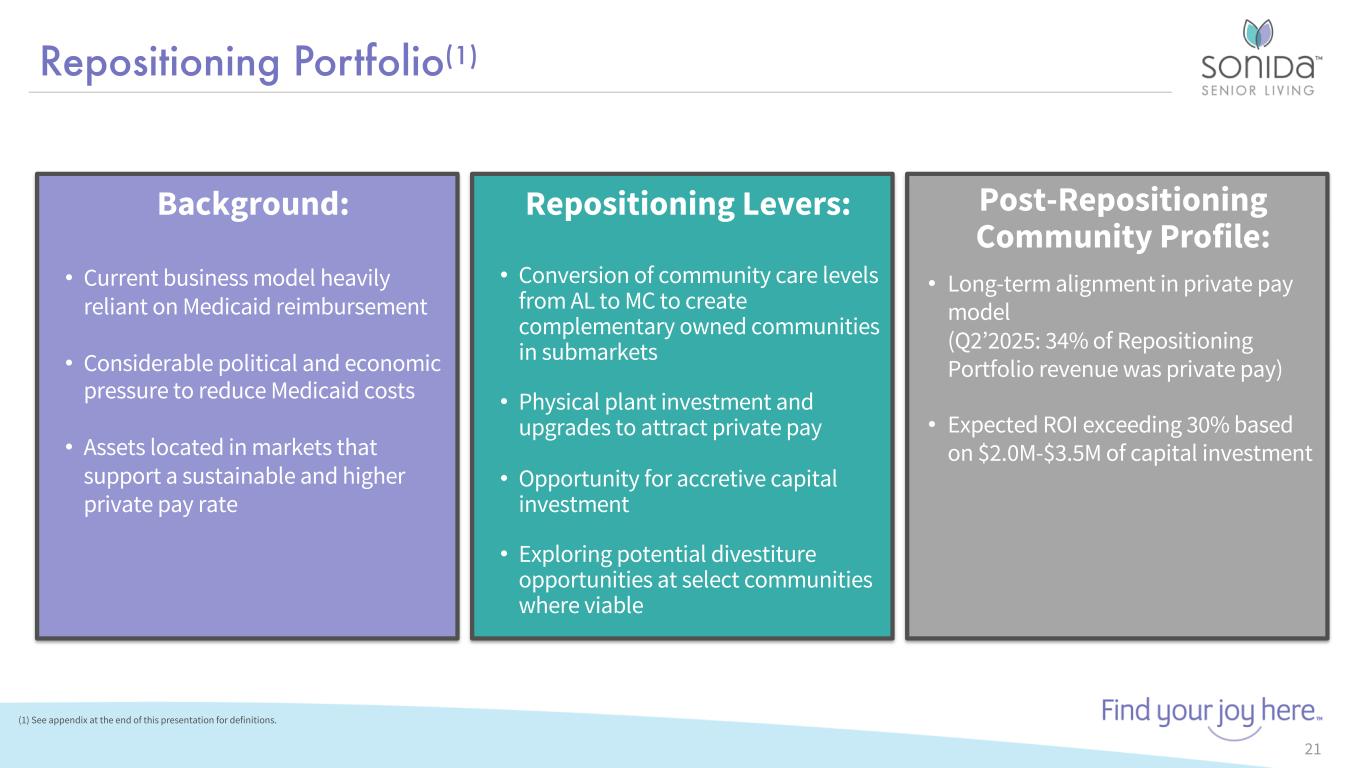

Repositioning Portfolio(1) (1) See appendix at the end of this presentation for definitions. 21 Background: • Current business model heavily reliant on Medicaid reimbursement • Considerable political and economic pressure to reduce Medicaid costs • Assets located in markets that support a sustainable and higher private pay rate Repositioning Levers: • Conversion of community care levels from AL to MC to create complementary owned communities in submarkets • Physical plant investment and upgrades to attract private pay • Opportunity for accretive capital investment • Exploring potential divestiture opportunities at select communities where viable Post-Repositioning Community Profile: • Long-term alignment in private pay model (Q2’2025: 34% of Repositioning Portfolio revenue was private pay) • Expected ROI exceeding 30% based on $2.0M-$3.5M of capital investment

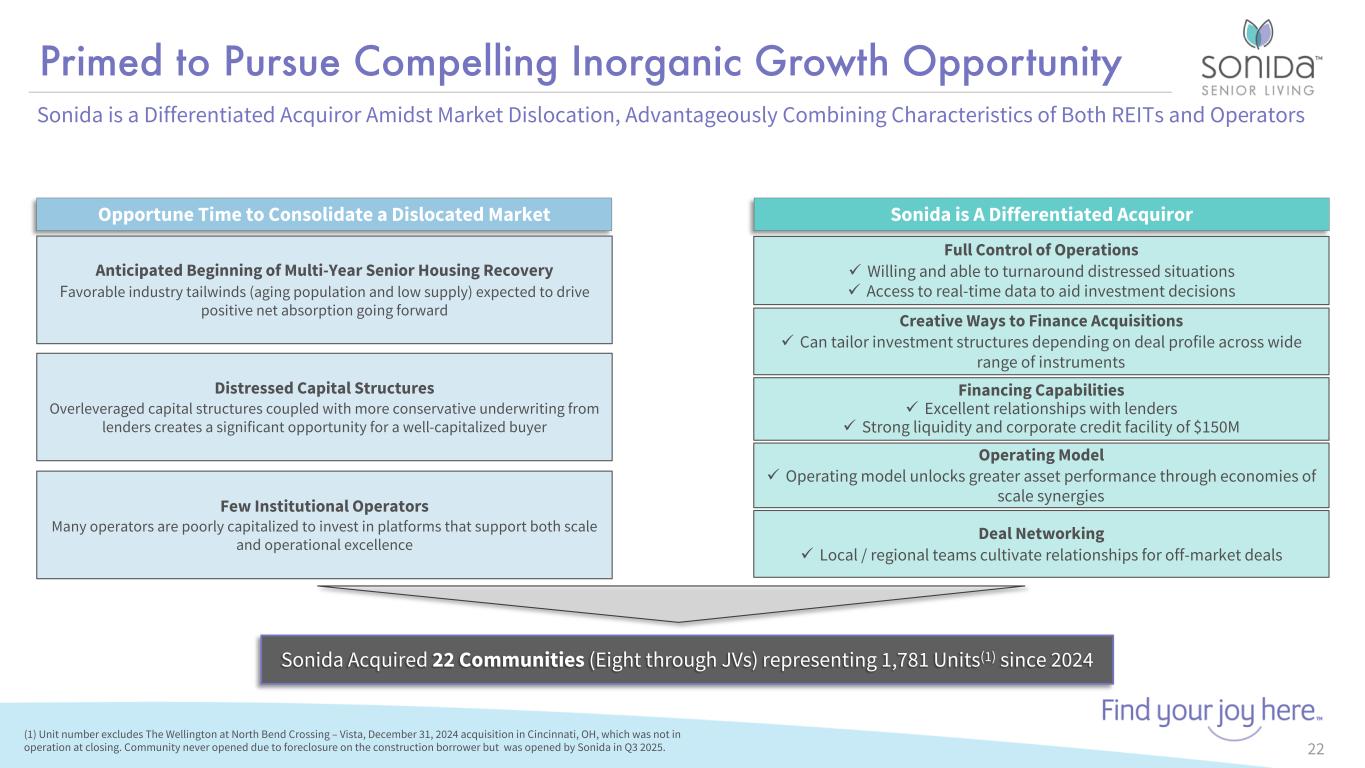

Primed to Pursue Compelling Inorganic Growth Opportunity 22 Sonida is a Differentiated Acquiror Amidst Market Dislocation, Advantageously Combining Characteristics of Both REITs and Operators Opportune Time to Consolidate a Dislocated Market Anticipated Beginning of Multi-Year Senior Housing Recovery Favorable industry tailwinds (aging population and low supply) expected to drive positive net absorption going forward Distressed Capital Structures Overleveraged capital structures coupled with more conservative underwriting from lenders creates a significant opportunity for a well-capitalized buyer Few Institutional Operators Many operators are poorly capitalized to invest in platforms that support both scale and operational excellence Full Control of Operations ü Willing and able to turnaround distressed situations ü Access to real-time data to aid investment decisions Sonida is A Differentiated Acquiror Creative Ways to Finance Acquisitions ü Can tailor investment structures depending on deal profile across wide range of instruments Financing Capabilities ü Excellent relationships with lenders ü Strong liquidity and corporate credit facility of $150M Operating Model ü Operating model unlocks greater asset performance through economies of scale synergies Deal Networking ü Local / regional teams cultivate relationships for off-market deals Sonida Acquired 22 Communities (Eight through JVs) representing 1,781 Units(1) since 2024 (1) Unit number excludes The Wellington at North Bend Crossing – Vista, December 31, 2024 acquisition in Cincinnati, OH, which was not in operation at closing. Community never opened due to foreclosure on the construction borrower but was opened by Sonida in Q3 2025.

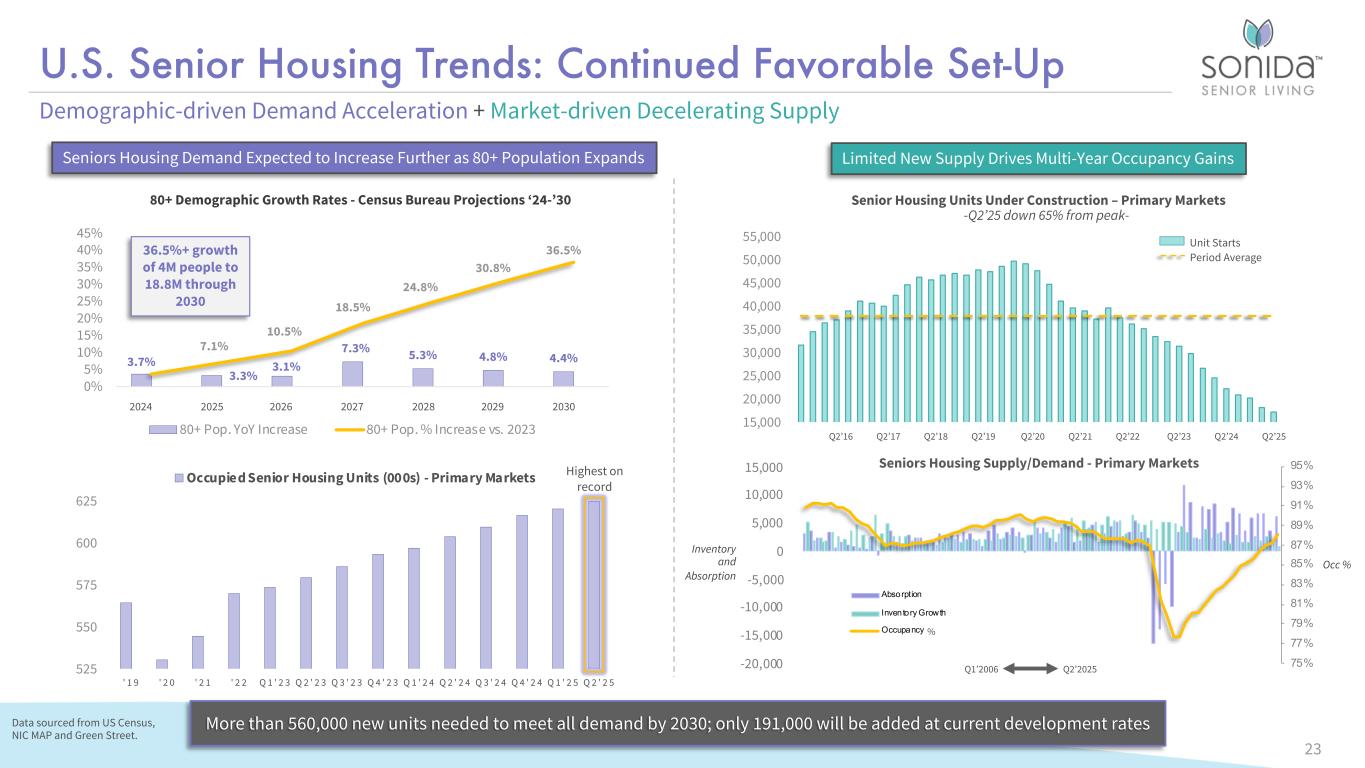

U.S. Senior Housing Trends: Continued Favorable Set-Up Data sourced from US Census, NIC MAP and Green Street. 525 550 575 600 625 ' 1 9 ' 2 0 ' 2 1 ' 2 2 Q 1 ' 2 3 Q 2 ' 2 3 Q 3 ' 2 3 Q 4 ' 2 3 Q 1 ' 2 4 Q 2 ' 2 4 Q 3 ' 2 4 Q 4 ' 2 4 Q 1 ' 2 5 Q 2 ' 2 5 Occupied Senior Housing Units (000s) - Primary Markets Demographic-driven Demand Acceleration + Market-driven Decelerating Supply -Q2’25 down 65% from peak- 3.7% 3.3% 3.1% 7.3% 5.3% 4.8% 4.4% 7.1% 10.5% 18.5% 24.8% 30.8% 36.5% 0% 5% 10% 15% 20% 25% 30% 35% 40% 45% 2024 2025 2026 2027 2028 2029 2030 80+ Demographic Growth Rates - Census Bureau Projections ‘24-’30 80+ Pop. YoY Increase 80+ Pop. % Increase vs. 2023 Seniors Housing Demand Expected to Increase Further as 80+ Population Expands Limited New Supply Drives Multi-Year Occupancy Gains 36.5%+ growth of 4M people to 18.8M through 2030 Senior Housing Units Under Construction – Primary Markets More than 560,000 new units needed to meet all demand by 2030; only 191,000 will be added at current development rates 2024 2025 2026 2027 2028 2029 2030 15,000 20,000 25,000 30,000 35,000 40,000 45,000 50,000 55,000 Q 2 ' 1 8 Q 2 ' 2 1 Q 2 ' 2 4 % Occ % Inventory and Absorption Unit Starts Period Average Q2’16 Q2’17 Q2’18 Q2’19 Q2’20 Q2’21 Q2’22 Q2’23 Q2’24 Q2’25 23 Q1’2006 Q2’2025 75% 77% 79% 81% 83% 85% 87% 89% 91% 93% 95% -20,000 -15,000 -10,000 -5,000 0 5,000 10,000 15,000 Seniors Housing Supply/Demand - Primary Markets Absorption Inventory Growth Occupancy Highest on record

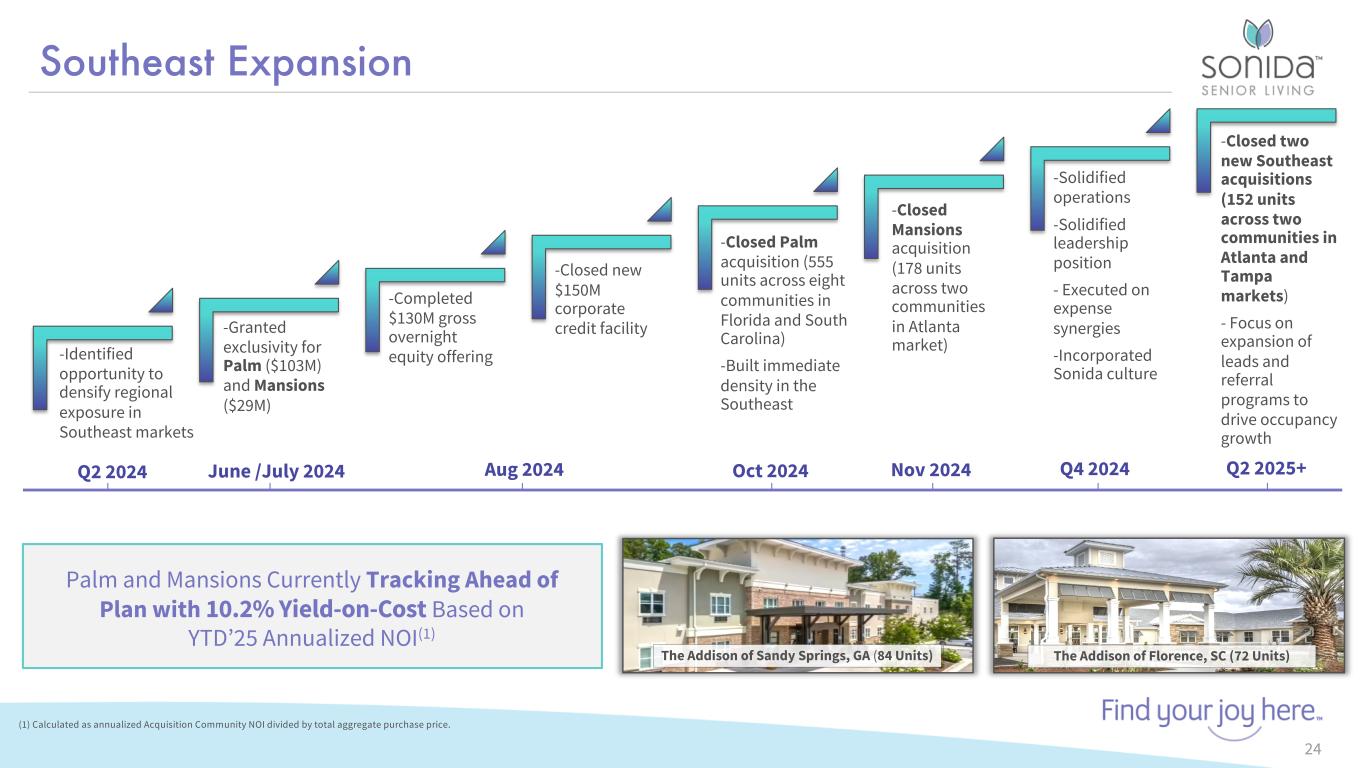

Southeast Expansion 24 -Identified opportunity to densify regional exposure in Southeast markets -Granted exclusivity for Palm ($103M) and Mansions ($29M) -Completed $130M gross overnight equity offering -Closed new $150M corporate credit facility -Closed Palm acquisition (555 units across eight communities in Florida and South Carolina) -Built immediate density in the Southeast -Closed Mansions acquisition (178 units across two communities in Atlanta market) -Solidified operations -Solidified leadership position - Executed on expense synergies -Incorporated Sonida culture -Closed two new Southeast acquisitions (152 units across two communities in Atlanta and Tampa markets) - Focus on expansion of leads and referral programs to drive occupancy growth June /July 2024 Aug 2024 Oct 2024 Nov 2024 Q4 2024 Q2 2025+ The Addison of Florence, SC (72 Units)The Addison of Sandy Springs, GA (84 Units) Q2 2024 (1) Calculated as annualized Acquisition Community NOI divided by total aggregate purchase price. Palm and Mansions Currently Tracking Ahead of Plan with 10.2% Yield-on-Cost Based on YTD’25 Annualized NOI(1)

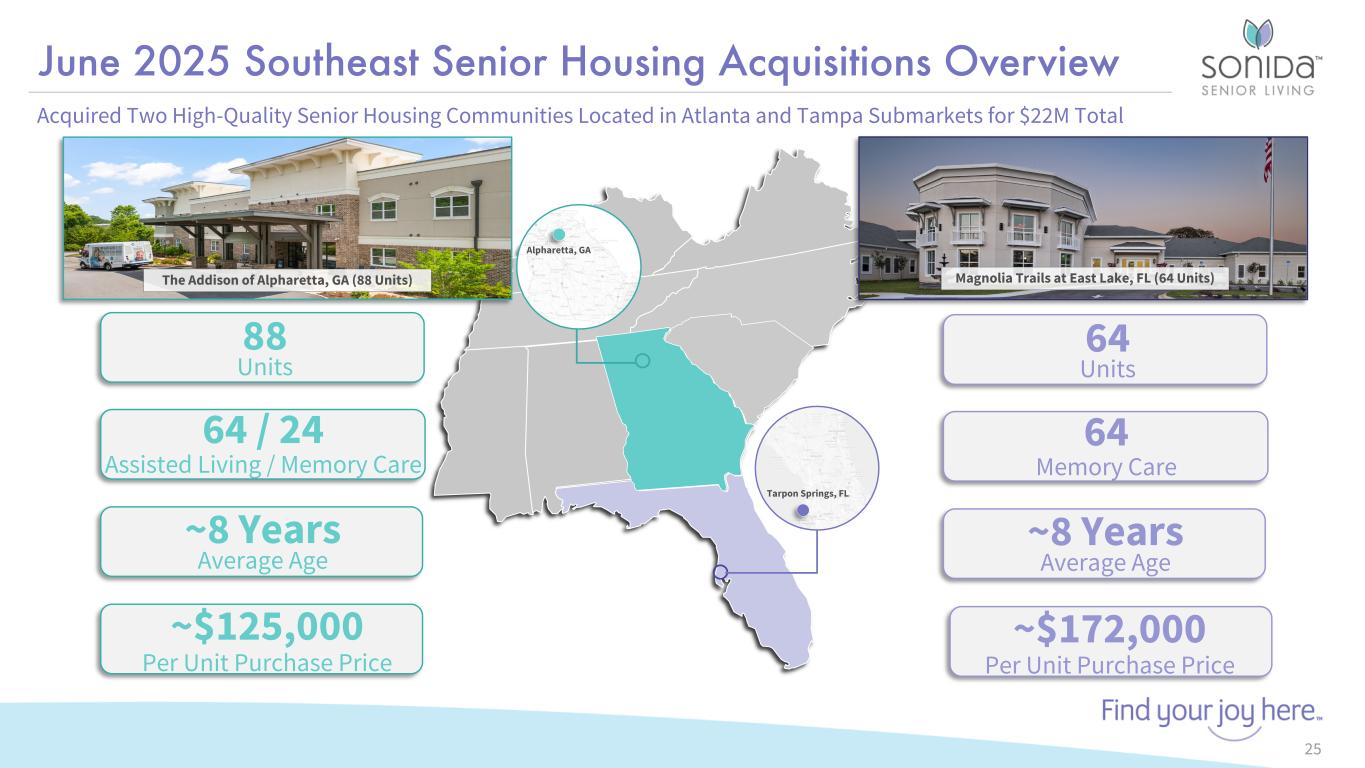

June 2025 Southeast Senior Housing Acquisitions Overview 25 Acquired Two High-Quality Senior Housing Communities Located in Atlanta and Tampa Submarkets for $22M Total Tarpon Springs, FL Alpharetta, GA Magnolia Trails at East Lake, FL (64 Units)The Addison of Alpharetta, GA (88 Units) 88 Units 64 / 24 Assisted Living / Memory Care ~8 Years Average Age ~$125,000 Per Unit Purchase Price 64 Units 64 Memory Care ~8 Years Average Age ~$172,000 Per Unit Purchase Price

June 2025 Southeast Acquisition Highlights 26 § Opportunity to unlock potential operational upside through stabilization of portfolio § Significant occupancy uplift potential § Potential to drive attractive NOI margin expansion Operational & Financial Upside § Further solidifies presence in strategic markets with strong demographic tailwinds and limited supply growth and builds additional density in the Southeast High-Quality Portfolio in Attractive, High-Growth Markets § Alpharetta acquisition expands Atlanta portfolio to four assets § East Lake acquisition expands Florida portfolio to eight assets § Further leverage operating scale through cost efficiencies, local resource pooling, and enhanced marketing presence Enhanced Economies of Scale § Alpharetta: Acquired at $125K/unit, representing significant discount to replacement cost § East Lake: Acquired at $172K/unit, reflecting meaningful discount to replacement cost § Potential to expand to double digit yields at stabilization Unlocks Long-Term Value Acquired Two High-Quality Senior Housing Communities Located in Alpharetta, GA and East Lake, FL

Appendix – Supplemental Information 27

A-1 Operating Highlights A-2 Community NOI A-3 Net Operating Income Reconciliation A-4 Adjusted EBITDA Reconciliation A-5 Table of Contents Sonida Investment Portfolio - Market Fundamentals Definitions A-6 Non-GAAP Financial Measures A-7 28

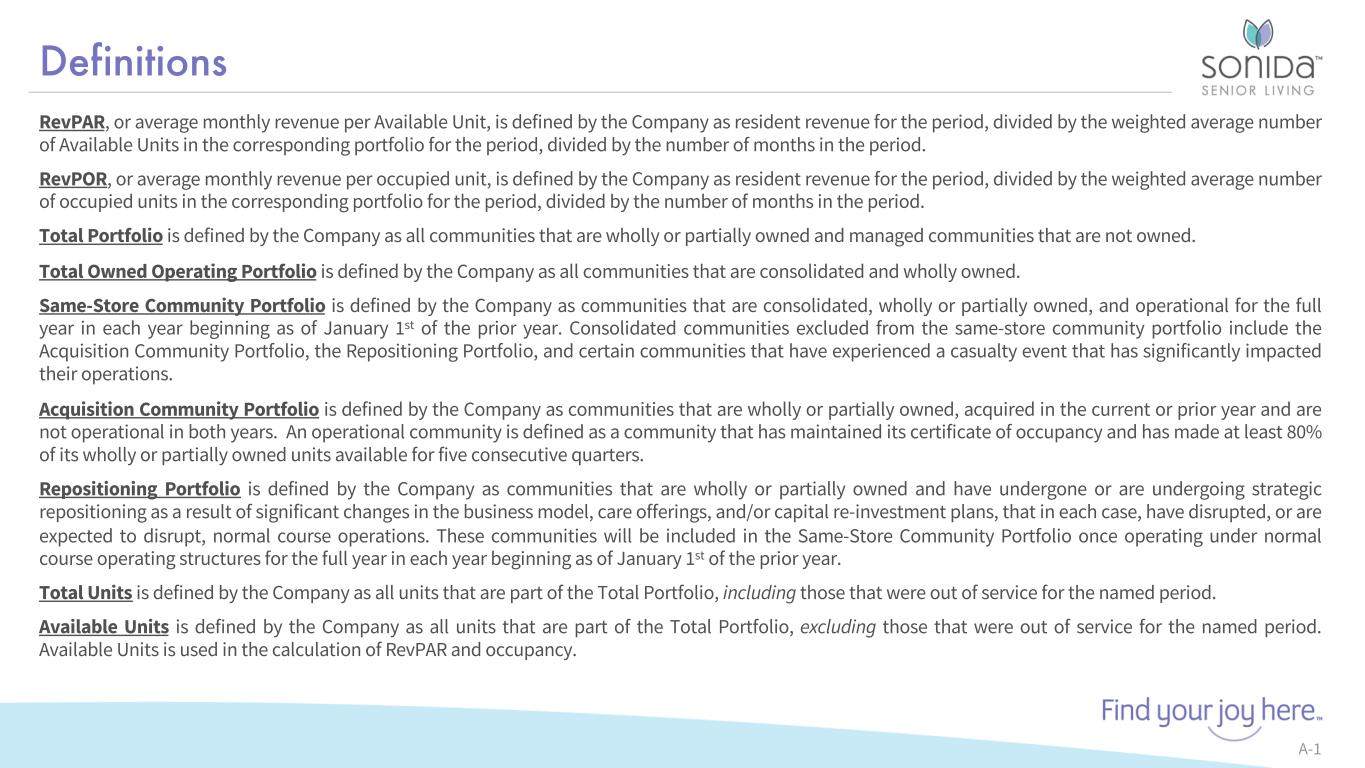

Definitions A-1 RevPAR, or average monthly revenue per Available Unit, is defined by the Company as resident revenue for the period, divided by the weighted average number of Available Units in the corresponding portfolio for the period, divided by the number of months in the period. RevPOR, or average monthly revenue per occupied unit, is defined by the Company as resident revenue for the period, divided by the weighted average number of occupied units in the corresponding portfolio for the period, divided by the number of months in the period. Total Portfolio is defined by the Company as all communities that are wholly or partially owned and managed communities that are not owned. Total Owned Operating Portfolio is defined by the Company as all communities that are consolidated and wholly owned. Same-Store Community Portfolio is defined by the Company as communities that are consolidated, wholly or partially owned, and operational for the full year in each year beginning as of January 1st of the prior year. Consolidated communities excluded from the same-store community portfolio include the Acquisition Community Portfolio, the Repositioning Portfolio, and certain communities that have experienced a casualty event that has significantly impacted their operations. Acquisition Community Portfolio is defined by the Company as communities that are wholly or partially owned, acquired in the current or prior year and are not operational in both years. An operational community is defined as a community that has maintained its certificate of occupancy and has made at least 80% of its wholly or partially owned units available for five consecutive quarters. Repositioning Portfolio is defined by the Company as communities that are wholly or partially owned and have undergone or are undergoing strategic repositioning as a result of significant changes in the business model, care offerings, and/or capital re-investment plans, that in each case, have disrupted, or are expected to disrupt, normal course operations. These communities will be included in the Same-Store Community Portfolio once operating under normal course operating structures for the full year in each year beginning as of January 1st of the prior year. Total Units is defined by the Company as all units that are part of the Total Portfolio, including those that were out of service for the named period. Available Units is defined by the Company as all units that are part of the Total Portfolio, excluding those that were out of service for the named period. Available Units is used in the calculation of RevPAR and occupancy.

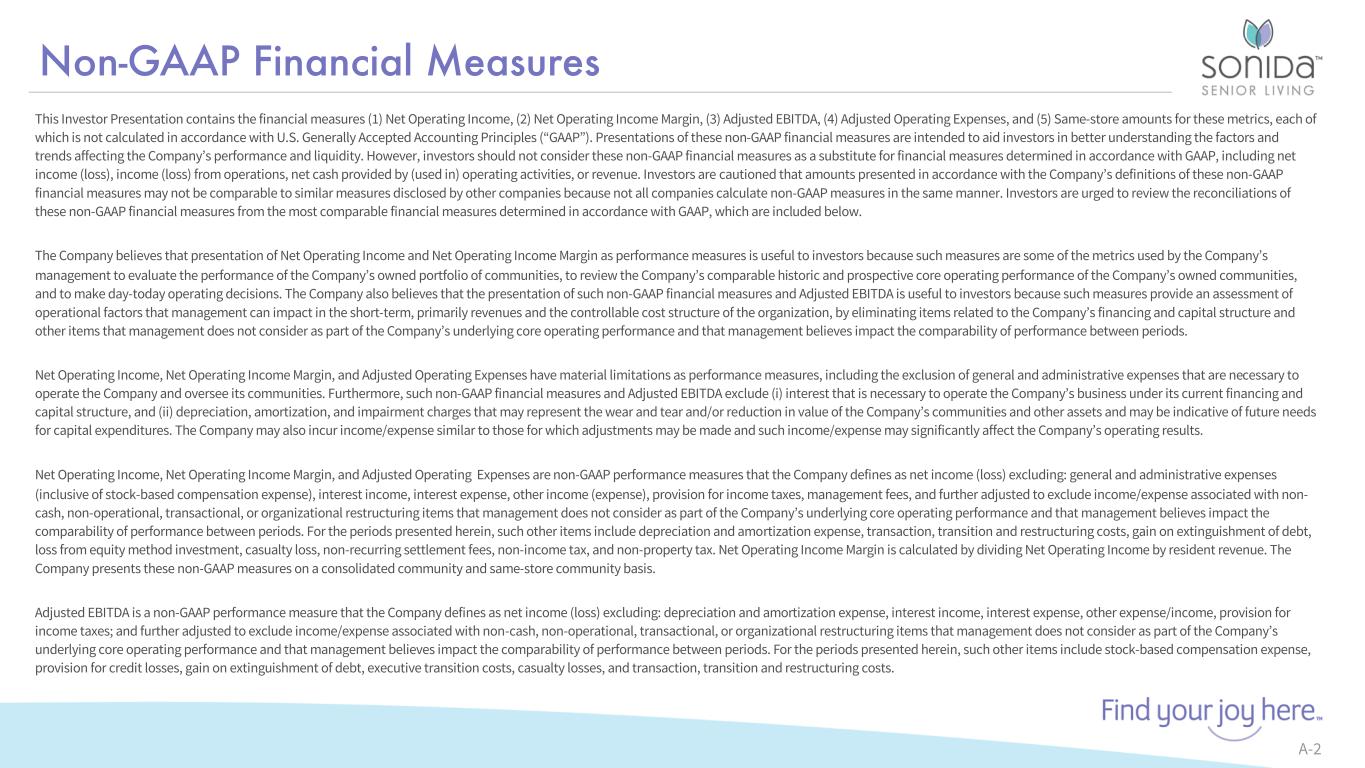

Non-GAAP Financial Measures A-2 This Investor Presentation contains the financial measures (1) Net Operating Income, (2) Net Operating Income Margin, (3) Adjusted EBITDA, (4) Adjusted Operating Expenses, and (5) Same-store amounts for these metrics, each of which is not calculated in accordance with U.S. Generally Accepted Accounting Principles (“GAAP”). Presentations of these non-GAAP financial measures are intended to aid investors in better understanding the factors and trends affecting the Company’s performance and liquidity. However, investors should not consider these non-GAAP financial measures as a substitute for financial measures determined in accordance with GAAP, including net income (loss), income (loss) from operations, net cash provided by (used in) operating activities, or revenue. Investors are cautioned that amounts presented in accordance with the Company’s definitions of these non-GAAP financial measures may not be comparable to similar measures disclosed by other companies because not all companies calculate non-GAAP measures in the same manner. Investors are urged to review the reconciliations of these non-GAAP financial measures from the most comparable financial measures determined in accordance with GAAP, which are included below. The Company believes that presentation of Net Operating Income and Net Operating Income Margin as performance measures is useful to investors because such measures are some of the metrics used by the Company’s management to evaluate the performance of the Company’s owned portfolio of communities, to review the Company’s comparable historic and prospective core operating performance of the Company’s owned communities, and to make day-today operating decisions. The Company also believes that the presentation of such non-GAAP financial measures and Adjusted EBITDA is useful to investors because such measures provide an assessment of operational factors that management can impact in the short-term, primarily revenues and the controllable cost structure of the organization, by eliminating items related to the Company’s financing and capital structure and other items that management does not consider as part of the Company’s underlying core operating performance and that management believes impact the comparability of performance between periods. Net Operating Income, Net Operating Income Margin, and Adjusted Operating Expenses have material limitations as performance measures, including the exclusion of general and administrative expenses that are necessary to operate the Company and oversee its communities. Furthermore, such non-GAAP financial measures and Adjusted EBITDA exclude (i) interest that is necessary to operate the Company’s business under its current financing and capital structure, and (ii) depreciation, amortization, and impairment charges that may represent the wear and tear and/or reduction in value of the Company’s communities and other assets and may be indicative of future needs for capital expenditures. The Company may also incur income/expense similar to those for which adjustments may be made and such income/expense may significantly affect the Company’s operating results. Net Operating Income, Net Operating Income Margin, and Adjusted Operating Expenses are non-GAAP performance measures that the Company defines as net income (loss) excluding: general and administrative expenses (inclusive of stock-based compensation expense), interest income, interest expense, other income (expense), provision for income taxes, management fees, and further adjusted to exclude income/expense associated with non- cash, non-operational, transactional, or organizational restructuring items that management does not consider as part of the Company’s underlying core operating performance and that management believes impact the comparability of performance between periods. For the periods presented herein, such other items include depreciation and amortization expense, transaction, transition and restructuring costs, gain on extinguishment of debt, loss from equity method investment, casualty loss, non-recurring settlement fees, non-income tax, and non-property tax. Net Operating Income Margin is calculated by dividing Net Operating Income by resident revenue. The Company presents these non-GAAP measures on a consolidated community and same-store community basis. Adjusted EBITDA is a non-GAAP performance measure that the Company defines as net income (loss) excluding: depreciation and amortization expense, interest income, interest expense, other expense/income, provision for income taxes; and further adjusted to exclude income/expense associated with non-cash, non-operational, transactional, or organizational restructuring items that management does not consider as part of the Company’s underlying core operating performance and that management believes impact the comparability of performance between periods. For the periods presented herein, such other items include stock-based compensation expense, provision for credit losses, gain on extinguishment of debt, executive transition costs, casualty losses, and transaction, transition and restructuring costs.

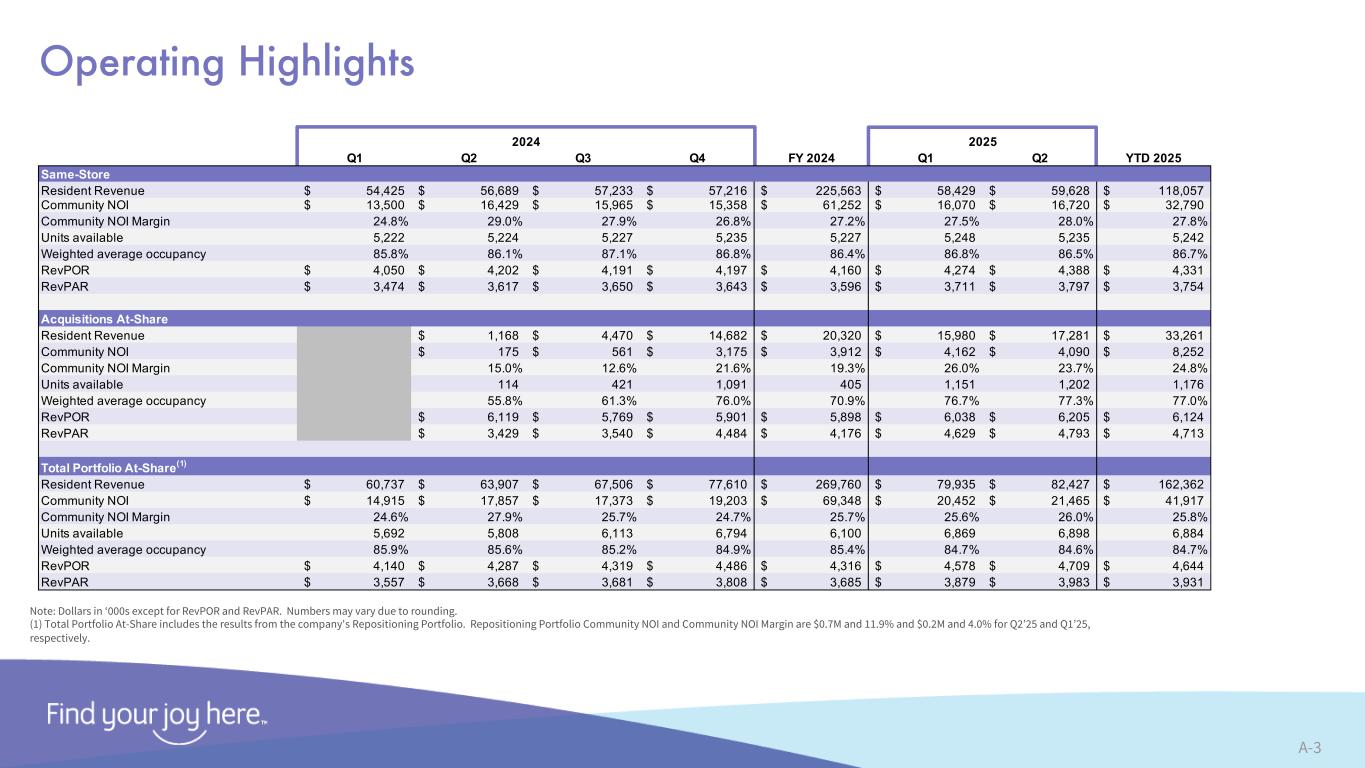

Operating Highlights A-3 Note: Dollars in ‘000s except for RevPOR and RevPAR. Numbers may vary due to rounding. (1) Total Portfolio At-Share includes the results from the company's Repositioning Portfolio. Repositioning Portfolio Community NOI and Community NOI Margin are $0.7M and 11.9% and $0.2M and 4.0% for Q2’25 and Q1’25, respectively. 2024 Q1 Q2 Q3 Q4 FY 2024 Q1 Q2 YTD 2025 Same-Store Resident Revenue 54,425$ 56,689$ 57,233$ 57,216$ 225,563$ 58,429$ 59,628$ 118,057$ Community NOI 13,500$ 16,429$ 15,965$ 15,358$ 61,252$ 16,070$ 16,720$ 32,790$ Community NOI Margin 24.8% 29.0% 27.9% 26.8% 27.2% 27.5% 28.0% 27.8% Units available 5,222 5,224 5,227 5,235 5,227 5,248 5,235 5,242 Weighted average occupancy 85.8% 86.1% 87.1% 86.8% 86.4% 86.8% 86.5% 86.7% RevPOR 4,050$ 4,202$ 4,191$ 4,197$ 4,160$ 4,274$ 4,388$ 4,331$ RevPAR 3,474$ 3,617$ 3,650$ 3,643$ 3,596$ 3,711$ 3,797$ 3,754$ Acquisitions At-Share Resident Revenue 1,168$ 4,470$ 14,682$ 20,320$ 15,980$ 17,281$ 33,261$ Community NOI 175$ 561$ 3,175$ 3,912$ 4,162$ 4,090$ 8,252$ Community NOI Margin 15.0% 12.6% 21.6% 19.3% 26.0% 23.7% 24.8% Units available 114 421 1,091 405 1,151 1,202 1,176 Weighted average occupancy 55.8% 61.3% 76.0% 70.9% 76.7% 77.3% 77.0% RevPOR 6,119$ 5,769$ 5,901$ 5,898$ 6,038$ 6,205$ 6,124$ RevPAR 3,429$ 3,540$ 4,484$ 4,176$ 4,629$ 4,793$ 4,713$ Total Portfolio At-Share(1) Resident Revenue 60,737$ 63,907$ 67,506$ 77,610$ 269,760$ 79,935$ 82,427$ 162,362$ Community NOI 14,915$ 17,857$ 17,373$ 19,203$ 69,348$ 20,452$ 21,465$ 41,917$ Community NOI Margin 24.6% 27.9% 25.7% 24.7% 25.7% 25.6% 26.0% 25.8% Units available 5,692 5,808 6,113 6,794 6,100 6,869 6,898 6,884 Weighted average occupancy 85.9% 85.6% 85.2% 84.9% 85.4% 84.7% 84.6% 84.7% RevPOR 4,140$ 4,287$ 4,319$ 4,486$ 4,316$ 4,578$ 4,709$ 4,644$ RevPAR 3,557$ 3,668$ 3,681$ 3,808$ 3,685$ 3,879$ 3,983$ 3,931$ 2025

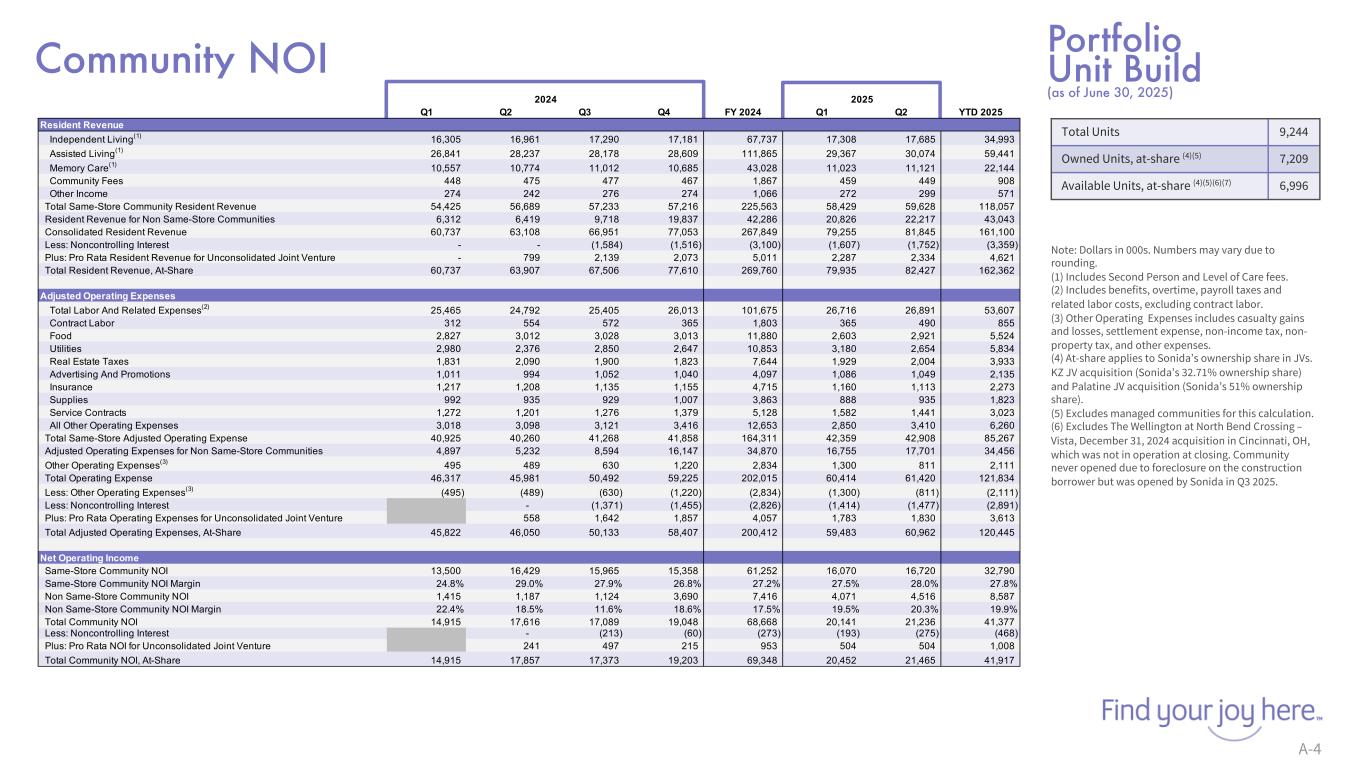

A-4 Community NOI Note: Dollars in 000s. Numbers may vary due to rounding. (1) Includes Second Person and Level of Care fees. (2) Includes benefits, overtime, payroll taxes and related labor costs, excluding contract labor. (3) Other Operating Expenses includes casualty gains and losses, settlement expense, non-income tax, non- property tax, and other expenses. (4) At-share applies to Sonida’s ownership share in JVs. KZ JV acquisition (Sonida’s 32.71% ownership share) and Palatine JV acquisition (Sonida’s 51% ownership share). (5) Excludes managed communities for this calculation. (6) Excludes The Wellington at North Bend Crossing – Vista, December 31, 2024 acquisition in Cincinnati, OH, which was not in operation at closing. Community never opened due to foreclosure on the construction borrower but was opened by Sonida in Q3 2025. Portfolio Unit Build (as of June 30, 2025) Total Units 9,244 Owned Units, at-share (4)(5) 7,209 Available Units, at-share (4)(5)(6)(7) 6,996 2024 Q1 Q2 Q3 Q4 FY 2024 Q1 Q2 YTD 2025 Resident Revenue Independent Living(1) 16,305 16,961 17,290 17,181 67,737 17,308 17,685 34,993 Assisted Living(1) 26,841 28,237 28,178 28,609 111,865 29,367 30,074 59,441 Memory Care(1) 10,557 10,774 11,012 10,685 43,028 11,023 11,121 22,144 Community Fees 448 475 477 467 1,867 459 449 908 Other Income 274 242 276 274 1,066 272 299 571 Total Same-Store Community Resident Revenue 54,425 56,689 57,233 57,216 225,563 58,429 59,628 118,057 Resident Revenue for Non Same-Store Communities 6,312 6,419 9,718 19,837 42,286 20,826 22,217 43,043 Consolidated Resident Revenue 60,737 63,108 66,951 77,053 267,849 79,255 81,845 161,100 Less: Noncontrolling Interest - - (1,584) (1,516) (3,100) (1,607) (1,752) (3,359) Plus: Pro Rata Resident Revenue for Unconsolidated Joint Venture - 799 2,139 2,073 5,011 2,287 2,334 4,621 Total Resident Revenue, At-Share 60,737 63,907 67,506 77,610 269,760 79,935 82,427 162,362 Adjusted Operating Expenses Total Labor And Related Expenses(2) 25,465 24,792 25,405 26,013 101,675 26,716 26,891 53,607 Contract Labor 312 554 572 365 1,803 365 490 855 Food 2,827 3,012 3,028 3,013 11,880 2,603 2,921 5,524 Utilities 2,980 2,376 2,850 2,647 10,853 3,180 2,654 5,834 Real Estate Taxes 1,831 2,090 1,900 1,823 7,644 1,929 2,004 3,933 Advertising And Promotions 1,011 994 1,052 1,040 4,097 1,086 1,049 2,135 Insurance 1,217 1,208 1,135 1,155 4,715 1,160 1,113 2,273 Supplies 992 935 929 1,007 3,863 888 935 1,823 Service Contracts 1,272 1,201 1,276 1,379 5,128 1,582 1,441 3,023 All Other Operating Expenses 3,018 3,098 3,121 3,416 12,653 2,850 3,410 6,260 Total Same-Store Adjusted Operating Expense 40,925 40,260 41,268 41,858 164,311 42,359 42,908 85,267 Adjusted Operating Expenses for Non Same-Store Communities 4,897 5,232 8,594 16,147 34,870 16,755 17,701 34,456 Other Operating Expenses(3) 495 489 630 1,220 2,834 1,300 811 2,111 Total Operating Expense 46,317 45,981 50,492 59,225 202,015 60,414 61,420 121,834 Less: Other Operating Expenses(3) (495) (489) (630) (1,220) (2,834) (1,300) (811) (2,111) Less: Noncontrolling Interest - (1,371) (1,455) (2,826) (1,414) (1,477) (2,891) Plus: Pro Rata Operating Expenses for Unconsolidated Joint Venture 558 1,642 1,857 4,057 1,783 1,830 3,613 Total Adjusted Operating Expenses, At-Share 45,822 46,050 50,133 58,407 200,412 59,483 60,962 120,445 Net Operating Income Same-Store Community NOI 13,500 16,429 15,965 15,358 61,252 16,070 16,720 32,790 Same-Store Community NOI Margin 24.8% 29.0% 27.9% 26.8% 27.2% 27.5% 28.0% 27.8% Non Same-Store Community NOI 1,415 1,187 1,124 3,690 7,416 4,071 4,516 8,587 Non Same-Store Community NOI Margin 22.4% 18.5% 11.6% 18.6% 17.5% 19.5% 20.3% 19.9% Total Community NOI 14,915 17,616 17,089 19,048 68,668 20,141 21,236 41,377 Less: Noncontrolling Interest - (213) (60) (273) (193) (275) (468) Plus: Pro Rata NOI for Unconsolidated Joint Venture 241 497 215 953 504 504 1,008 Total Community NOI, At-Share 14,915 17,857 17,373 19,203 69,348 20,452 21,465 41,917 2025

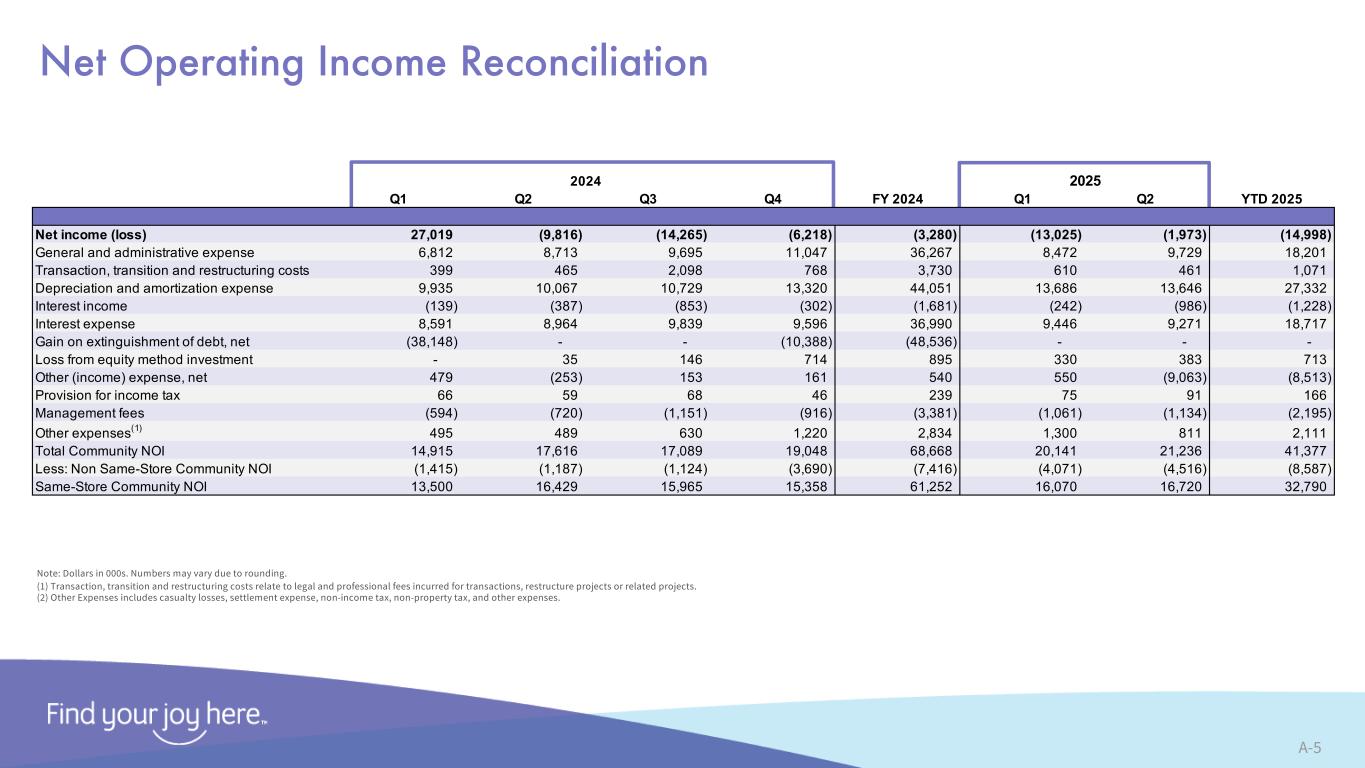

Net Operating Income Reconciliation A-5 Note: Dollars in 000s. Numbers may vary due to rounding. (1) Transaction, transition and restructuring costs relate to legal and professional fees incurred for transactions, restructure projects or related projects. (2) Other Expenses includes casualty losses, settlement expense, non-income tax, non-property tax, and other expenses. 2024 Q1 Q2 Q3 Q4 FY 2024 Q1 Q2 YTD 2025 Net income (loss) 27,019 (9,816) (14,265) (6,218) (3,280) (13,025) (1,973) (14,998) General and administrative expense 6,812 8,713 9,695 11,047 36,267 8,472 9,729 18,201 Transaction, transition and restructuring costs 399 465 2,098 768 3,730 610 461 1,071 Depreciation and amortization expense 9,935 10,067 10,729 13,320 44,051 13,686 13,646 27,332 Interest income (139) (387) (853) (302) (1,681) (242) (986) (1,228) Interest expense 8,591 8,964 9,839 9,596 36,990 9,446 9,271 18,717 Gain on extinguishment of debt, net (38,148) - - (10,388) (48,536) - - - Loss from equity method investment - 35 146 714 895 330 383 713 Other (income) expense, net 479 (253) 153 161 540 550 (9,063) (8,513) Provision for income tax 66 59 68 46 239 75 91 166 Management fees (594) (720) (1,151) (916) (3,381) (1,061) (1,134) (2,195) Other expenses(1) 495 489 630 1,220 2,834 1,300 811 2,111 Total Community NOI 14,915 17,616 17,089 19,048 68,668 20,141 21,236 41,377 Less: Non Same-Store Community NOI (1,415) (1,187) (1,124) (3,690) (7,416) (4,071) (4,516) (8,587) Same-Store Community NOI 13,500 16,429 15,965 15,358 61,252 16,070 16,720 32,790 2025

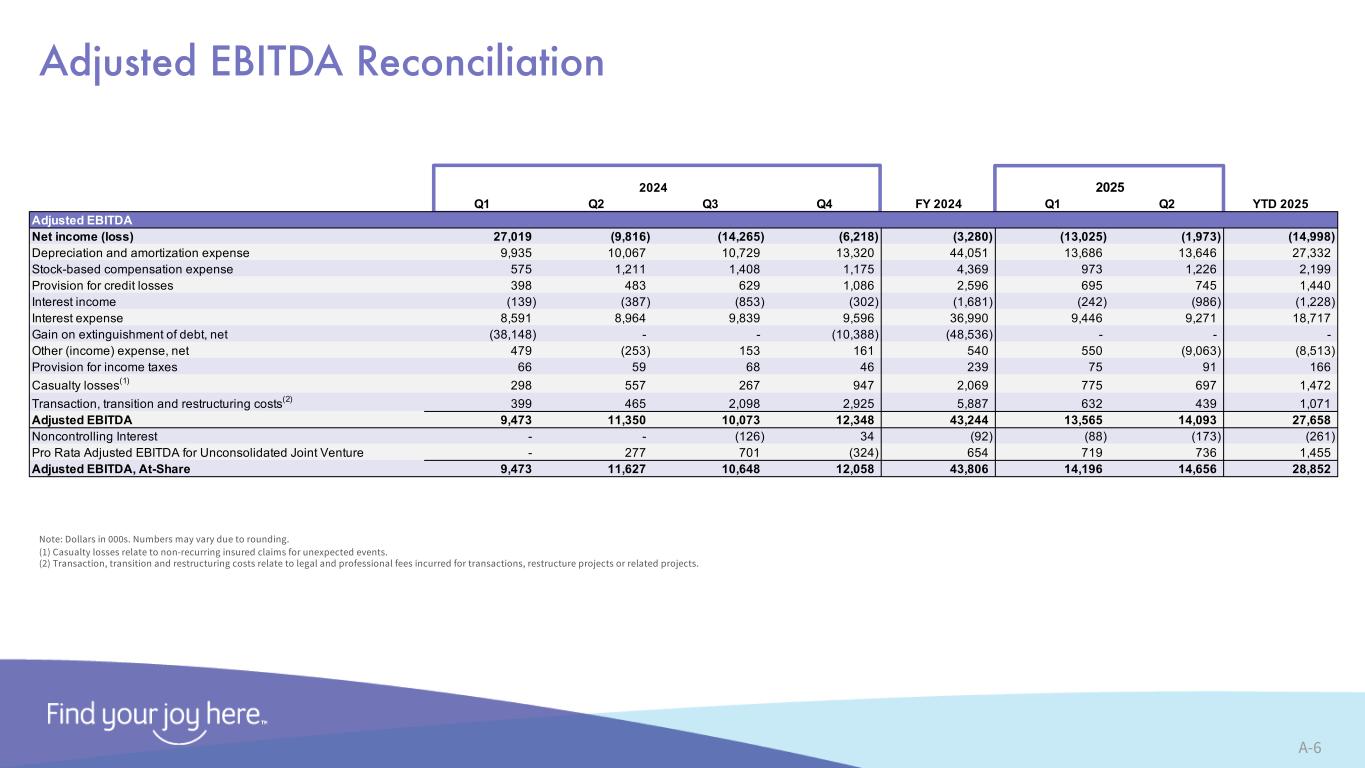

Adjusted EBITDA Reconciliation A-6 Note: Dollars in 000s. Numbers may vary due to rounding. (1) Casualty losses relate to non-recurring insured claims for unexpected events. (2) Transaction, transition and restructuring costs relate to legal and professional fees incurred for transactions, restructure projects or related projects. 2024 Q1 Q2 Q3 Q4 FY 2024 Q1 Q2 YTD 2025 Adjusted EBITDA Net income (loss) 27,019 (9,816) (14,265) (6,218) (3,280) (13,025) (1,973) (14,998) Depreciation and amortization expense 9,935 10,067 10,729 13,320 44,051 13,686 13,646 27,332 Stock-based compensation expense 575 1,211 1,408 1,175 4,369 973 1,226 2,199 Provision for credit losses 398 483 629 1,086 2,596 695 745 1,440 Interest income (139) (387) (853) (302) (1,681) (242) (986) (1,228) Interest expense 8,591 8,964 9,839 9,596 36,990 9,446 9,271 18,717 Gain on extinguishment of debt, net (38,148) - - (10,388) (48,536) - - - Other (income) expense, net 479 (253) 153 161 540 550 (9,063) (8,513) Provision for income taxes 66 59 68 46 239 75 91 166 Casualty losses(1) 298 557 267 947 2,069 775 697 1,472 Transaction, transition and restructuring costs(2) 399 465 2,098 2,925 5,887 632 439 1,071 Adjusted EBITDA 9,473 11,350 10,073 12,348 43,244 13,565 14,093 27,658 Noncontrolling Interest - - (126) 34 (92) (88) (173) (261) Pro Rata Adjusted EBITDA for Unconsolidated Joint Venture - 277 701 (324) 654 719 736 1,455 Adjusted EBITDA, At-Share 9,473 11,627 10,648 12,058 43,806 14,196 14,656 28,852 2025

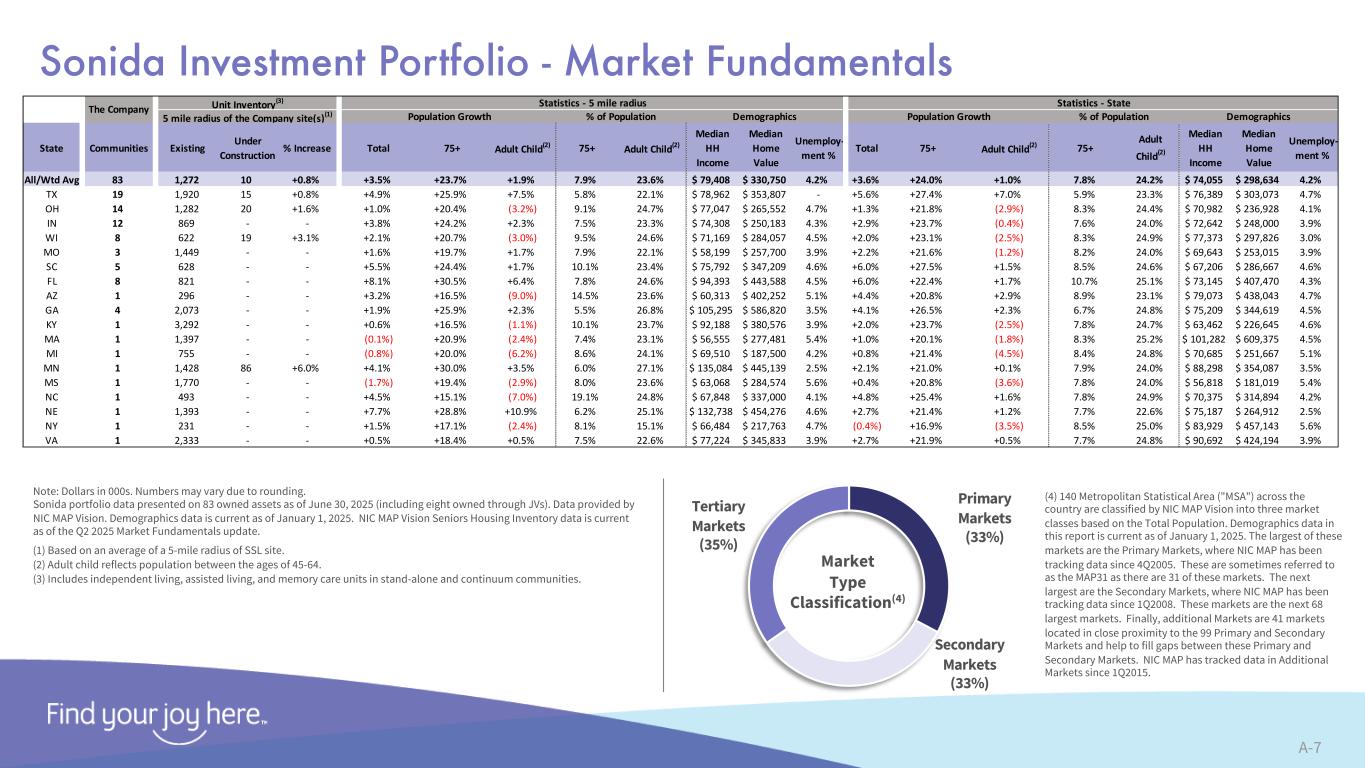

Sonida Investment Portfolio - Market Fundamentals A-7 (1) Based on an average of a 5-mile radius of SSL site. (2) Adult child reflects population between the ages of 45-64. (3) Includes independent living, assisted living, and memory care units in stand-alone and continuum communities. Primary Markets (33%) Secondary Markets (33%) Tertiary Markets (35%) Market Type Classification(4) Note: Dollars in 000s. Numbers may vary due to rounding. Sonida portfolio data presented on 83 owned assets as of June 30, 2025 (including eight owned through JVs). Data provided by NIC MAP Vision. Demographics data is current as of January 1, 2025. NIC MAP Vision Seniors Housing Inventory data is current as of the Q2 2025 Market Fundamentals update. (4) 140 Metropolitan Statistical Area ("MSA") across the country are classified by NIC MAP Vision into three market classes based on the Total Population. Demographics data in this report is current as of January 1, 2025. The largest of these markets are the Primary Markets, where NIC MAP has been tracking data since 4Q2005. These are sometimes referred to as the MAP31 as there are 31 of these markets. The next largest are the Secondary Markets, where NIC MAP has been tracking data since 1Q2008. These markets are the next 68 largest markets. Finally, additional Markets are 41 markets located in close proximity to the 99 Primary and Secondary Markets and help to fill gaps between these Primary and Secondary Markets. NIC MAP has tracked data in Additional Markets since 1Q2015. State Communities Existing Under Construction % Increase Total 75+ Adult Child(2) 75+ Adult Child(2) Median HH Income Median Home Value Unemploy- ment % Total 75+ Adult Child(2) 75+ Adult Child(2) Median HH Income Median Home Value Unemploy- ment % All/Wtd Avg 83 1,272 10 +0.8% +3.5% +23.7% +1.9% 7.9% 23.6% $ 79,408 $ 330,750 4.2% +3.6% +24.0% +1.0% 7.8% 24.2% $ 74,055 $ 298,634 4.2% TX 19 1,920 15 +0.8% +4.9% +25.9% +7.5% 5.8% 22.1% $ 78,962 $ 353,807 - +5.6% +27.4% +7.0% 5.9% 23.3% $ 76,389 $ 303,073 4.7% OH 14 1,282 20 +1.6% +1.0% +20.4% (3.2%) 9.1% 24.7% $ 77,047 $ 265,552 4.7% +1.3% +21.8% (2.9%) 8.3% 24.4% $ 70,982 $ 236,928 4.1% IN 12 869 - - +3.8% +24.2% +2.3% 7.5% 23.3% $ 74,308 $ 250,183 4.3% +2.9% +23.7% (0.4%) 7.6% 24.0% $ 72,642 $ 248,000 3.9% WI 8 622 19 +3.1% +2.1% +20.7% (3.0%) 9.5% 24.6% $ 71,169 $ 284,057 4.5% +2.0% +23.1% (2.5%) 8.3% 24.9% $ 77,373 $ 297,826 3.0% MO 3 1,449 - - +1.6% +19.7% +1.7% 7.9% 22.1% $ 58,199 $ 257,700 3.9% +2.2% +21.6% (1.2%) 8.2% 24.0% $ 69,643 $ 253,015 3.9% SC 5 628 - - +5.5% +24.4% +1.7% 10.1% 23.4% $ 75,792 $ 347,209 4.6% +6.0% +27.5% +1.5% 8.5% 24.6% $ 67,206 $ 286,667 4.6% FL 8 821 - - +8.1% +30.5% +6.4% 7.8% 24.6% $ 94,393 $ 443,588 4.5% +6.0% +22.4% +1.7% 10.7% 25.1% $ 73,145 $ 407,470 4.3% AZ 1 296 - - +3.2% +16.5% (9.0%) 14.5% 23.6% $ 60,313 $ 402,252 5.1% +4.4% +20.8% +2.9% 8.9% 23.1% $ 79,073 $ 438,043 4.7% GA 4 2,073 - - +1.9% +25.9% +2.3% 5.5% 26.8% $ 105,295 $ 586,820 3.5% +4.1% +26.5% +2.3% 6.7% 24.8% $ 75,209 $ 344,619 4.5% KY 1 3,292 - - +0.6% +16.5% (1.1%) 10.1% 23.7% $ 92,188 $ 380,576 3.9% +2.0% +23.7% (2.5%) 7.8% 24.7% $ 63,462 $ 226,645 4.6% MA 1 1,397 - - (0.1%) +20.9% (2.4%) 7.4% 23.1% $ 56,555 $ 277,481 5.4% +1.0% +20.1% (1.8%) 8.3% 25.2% $ 101,282 $ 609,375 4.5% MI 1 755 - - (0.8%) +20.0% (6.2%) 8.6% 24.1% $ 69,510 $ 187,500 4.2% +0.8% +21.4% (4.5%) 8.4% 24.8% $ 70,685 $ 251,667 5.1% MN 1 1,428 86 +6.0% +4.1% +30.0% +3.5% 6.0% 27.1% $ 135,084 $ 445,139 2.5% +2.1% +21.0% +0.1% 7.9% 24.0% $ 88,298 $ 354,087 3.5% MS 1 1,770 - - (1.7%) +19.4% (2.9%) 8.0% 23.6% $ 63,068 $ 284,574 5.6% +0.4% +20.8% (3.6%) 7.8% 24.0% $ 56,818 $ 181,019 5.4% NC 1 493 - - +4.5% +15.1% (7.0%) 19.1% 24.8% $ 67,848 $ 337,000 4.1% +4.8% +25.4% +1.6% 7.8% 24.9% $ 70,375 $ 314,894 4.2% NE 1 1,393 - - +7.7% +28.8% +10.9% 6.2% 25.1% $ 132,738 $ 454,276 4.6% +2.7% +21.4% +1.2% 7.7% 22.6% $ 75,187 $ 264,912 2.5% NY 1 231 - - +1.5% +17.1% (2.4%) 8.1% 15.1% $ 66,484 $ 217,763 4.7% (0.4%) +16.9% (3.5%) 8.5% 25.0% $ 83,929 $ 457,143 5.6% VA 1 2,333 - - +0.5% +18.4% +0.5% 7.5% 22.6% $ 77,224 $ 345,833 3.9% +2.7% +21.9% +0.5% 7.7% 24.8% $ 90,692 $ 424,194 3.9% DemographicsThe Company Unit Inventory(3) Statistics - 5 mile radius Statistics - State 5 mile radius of the Company site(s)(1) Population Growth % of Population Demographics Population Growth % of Population