Third Quarter 2025 Financial Supplement October 22, 2025

Important Notices This presentation is issued by Annaly Capital Management, Inc. ("Annaly"), an internally managed, publicly traded company that has elected to be taxed as a real estate investment trust for federal income tax purposes, and is being furnished in connection with Annaly’s Third Quarter 2025 earnings release. This presentation is provided for investors in Annaly for informational purposes only and is not an offer to sell, or a solicitation of an offer to buy, any security or instrument. Forward-Looking Statements This presentation, other written or oral communications, and our public documents to which we refer contain or incorporate by reference certain forward-looking statements which are based on various assumptions (some of which are beyond our control) and may be identified by reference to a future period or periods or by the use of forward-looking terminology, such as “may,” “will,” “believe,” “expect,” “anticipate,” “continue,” or similar terms or variations on those terms or the negative of those terms. Such statements include those relating to the Company’s future performance, macro outlook, the interest rate and credit environments, tax reform and future opportunities. Actual results could differ materially from those set forth in forward-looking statements due to a variety of factors, including, but not limited to, changes in interest rates; changes in the yield curve; changes in prepayment rates; the availability of mortgage-backed securities (“MBS”) and other securities for purchase; the availability of financing and, if available, the terms of any financing; changes in the market value of the Company’s assets; changes in business conditions and the general economy including cybersecurity incidents; the Company’s ability to grow its residential credit business; the Company's ability to grow its mortgage servicing rights business; credit risks related to the Company’s investments in credit risk transfer securities and residential mortgage-backed securities and related residential mortgage credit assets; risks related to investments in mortgage servicing rights; the Company’s ability to consummate any contemplated investment opportunities; changes in government regulations or policy affecting the Company’s business; the Company’s ability to maintain its qualification as a REIT for U.S. federal income tax purposes; the Company’s ability to maintain its exemption from registration under the Investment Company Act of 1940; and operational risks or risk management failures by us or critical third parties, including cybersecurity incidents. For a discussion of the risks and uncertainties which could cause actual results to differ from those contained in the forward-looking statements, see “Risk Factors” in our most recent Annual Report on Form 10-K and any subsequent Quarterly Reports on Form 10-Q. The Company does not undertake, and specifically disclaims any obligation, to publicly release the result of any revisions which may be made to any forward-looking statements to reflect the occurrence of anticipated or unanticipated events or circumstances after the date of such statements, except as required by law. We use our website (www.annaly.com) and LinkedIn account (www.linkedin.com/company/annaly-capital-management) as channels of distribution of company information. The information we post through these channels may be deemed material. Accordingly, investors should monitor these channels, in addition to following our press releases, SEC filings and public conference calls and webcasts. In addition, you may automatically receive email alerts and other information about Annaly when you enroll your email address by visiting the "News & Insights" section of our website, then clicking on "Subscribe" and completing the email notification form. Past performance is no guarantee of future results. There is no guarantee that any investment strategy referenced herein will work under all market conditions. Prior to making any investment decision, you should evaluate your ability to invest for the long-term, especially during periods of downturns in the market. You alone assume the responsibility of evaluating the merits and risks associated with any potential investment or investment strategy referenced herein. To the extent that this material contains reference to any past specific investment recommendations or strategies which were or would have been profitable to any person, it should not be assumed that recommendations made in the future will be profitable or will equal the performance of such past investment recommendations or strategies. The information contained herein is not intended to provide, and should not be relied upon for accounting, legal or tax advice or investment recommendations for Annaly or any of its affiliates. Regardless of source, information is believed to be reliable for purposes used herein, but Annaly makes no representation or warranty as to the accuracy or completeness thereof and does not take any responsibility for information obtained from sources outside of Annaly. Certain information contained in the presentation discusses general market activity, industry or sector trends, or other broad-based economic, market or political conditions and should not be construed as research or investment advice. 2

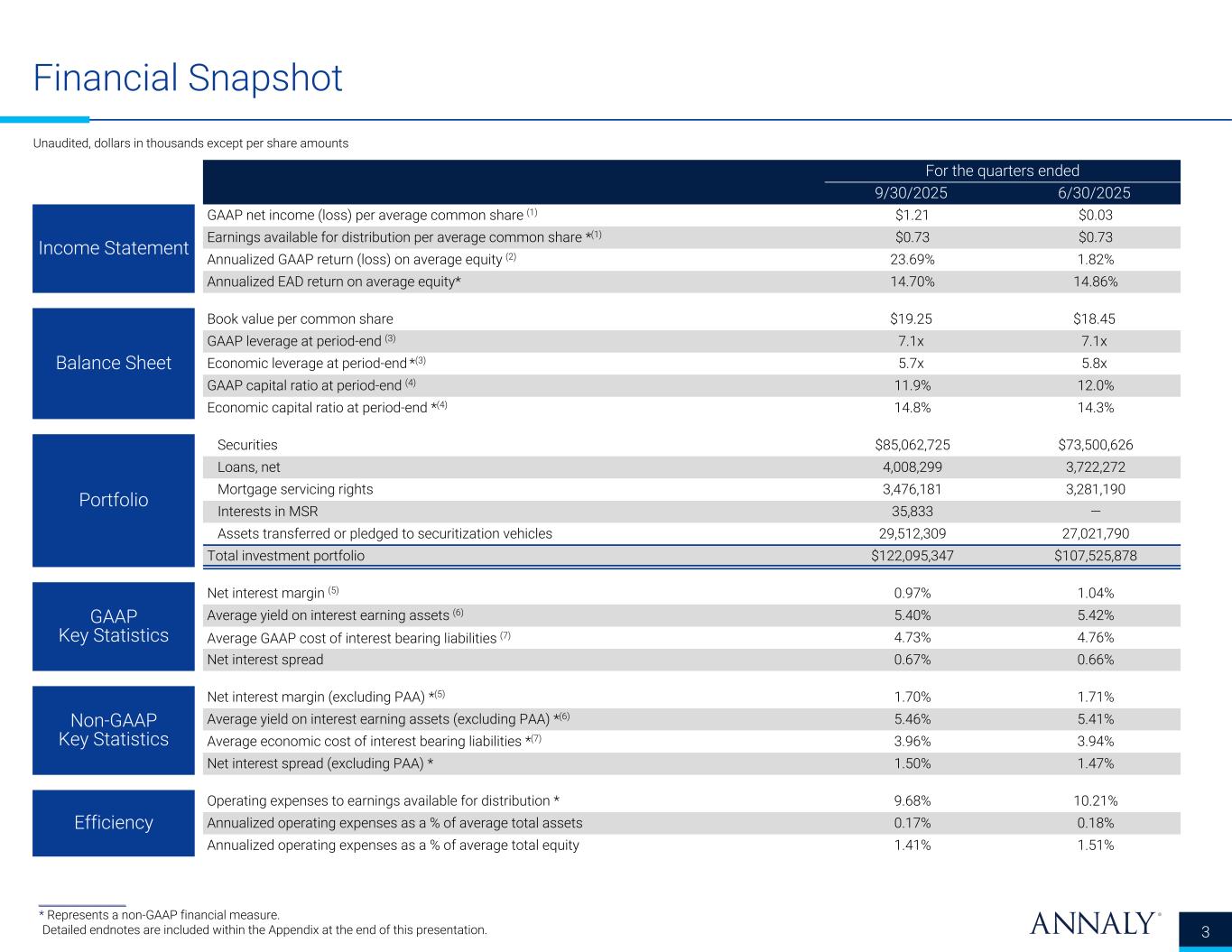

Financial Snapshot 3 Unaudited, dollars in thousands except per share amounts ___________________ * Represents a non-GAAP financial measure. Detailed endnotes are included within the Appendix at the end of this presentation. For the quarters ended 9/30/2025 6/30/2025 Income Statement GAAP net income (loss) per average common share (1) $1.21 $0.03 Earnings available for distribution per average common share *(1) $0.73 $0.73 Annualized GAAP return (loss) on average equity (2) 23.69% 1.82% Annualized EAD return on average equity* 14.70% 14.86% Balance Sheet Book value per common share $19.25 $18.45 GAAP leverage at period-end (3) 7.1x 7.1x Economic leverage at period-end *(3) 5.7x 5.8x GAAP capital ratio at period-end (4) 11.9% 12.0% Economic capital ratio at period-end *(4) 14.8% 14.3% Portfolio Securities $85,062,725 $73,500,626 Loans, net 4,008,299 3,722,272 Mortgage servicing rights 3,476,181 3,281,190 Interests in MSR 35,833 — Assets transferred or pledged to securitization vehicles 29,512,309 27,021,790 Total investment portfolio $122,095,347 $107,525,878 GAAP Key Statistics Net interest margin (5) 0.97% 1.04% Average yield on interest earning assets (6) 5.40% 5.42% Average GAAP cost of interest bearing liabilities (7) 4.73% 4.76% Net interest spread 0.67% 0.66% Non-GAAP Key Statistics Net interest margin (excluding PAA) *(5) 1.70% 1.71% Average yield on interest earning assets (excluding PAA) *(6) 5.46% 5.41% Average economic cost of interest bearing liabilities *(7) 3.96% 3.94% Net interest spread (excluding PAA) * 1.50% 1.47% Efficiency Operating expenses to earnings available for distribution * 9.68% 10.21% Annualized operating expenses as a % of average total assets 0.17% 0.18% Annualized operating expenses as a % of average total equity 1.41% 1.51%

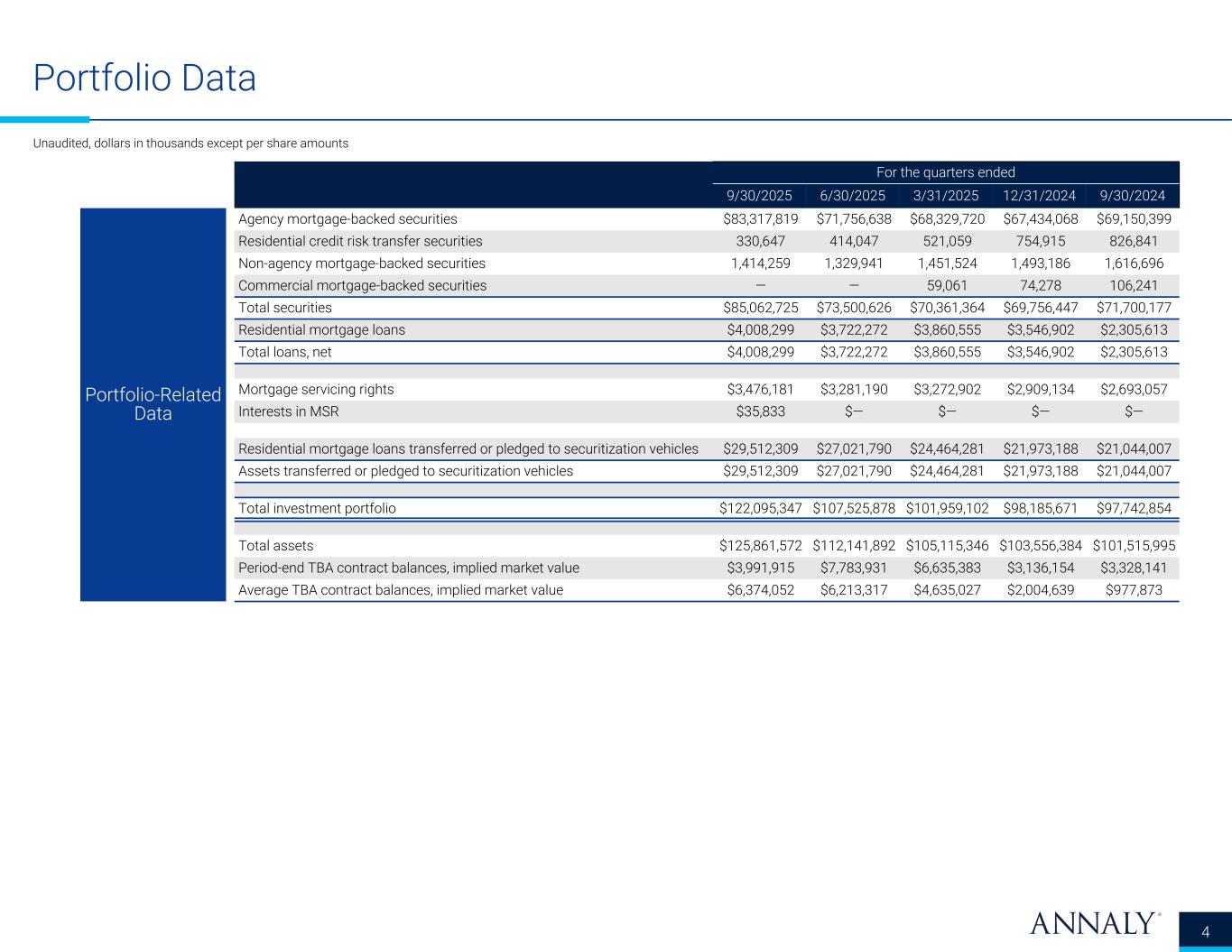

Portfolio Data 4 Unaudited, dollars in thousands except per share amounts For the quarters ended 9/30/2025 6/30/2025 3/31/2025 12/31/2024 9/30/2024 Portfolio-Related Data Agency mortgage-backed securities $83,317,819 $71,756,638 $68,329,720 $67,434,068 $69,150,399 Residential credit risk transfer securities 330,647 414,047 521,059 754,915 826,841 Non-agency mortgage-backed securities 1,414,259 1,329,941 1,451,524 1,493,186 1,616,696 Commercial mortgage-backed securities — — 59,061 74,278 106,241 Total securities $85,062,725 $73,500,626 $70,361,364 $69,756,447 $71,700,177 Residential mortgage loans $4,008,299 $3,722,272 $3,860,555 $3,546,902 $2,305,613 Total loans, net $4,008,299 $3,722,272 $3,860,555 $3,546,902 $2,305,613 Mortgage servicing rights $3,476,181 $3,281,190 $3,272,902 $2,909,134 $2,693,057 Interests in MSR $35,833 $— $— $— $— Residential mortgage loans transferred or pledged to securitization vehicles $29,512,309 $27,021,790 $24,464,281 $21,973,188 $21,044,007 Assets transferred or pledged to securitization vehicles $29,512,309 $27,021,790 $24,464,281 $21,973,188 $21,044,007 Total investment portfolio $122,095,347 $107,525,878 $101,959,102 $98,185,671 $97,742,854 Total assets $125,861,572 $112,141,892 $105,115,346 $103,556,384 $101,515,995 Period-end TBA contract balances, implied market value $3,991,915 $7,783,931 $6,635,383 $3,136,154 $3,328,141 Average TBA contract balances, implied market value $6,374,052 $6,213,317 $4,635,027 $2,004,639 $977,873

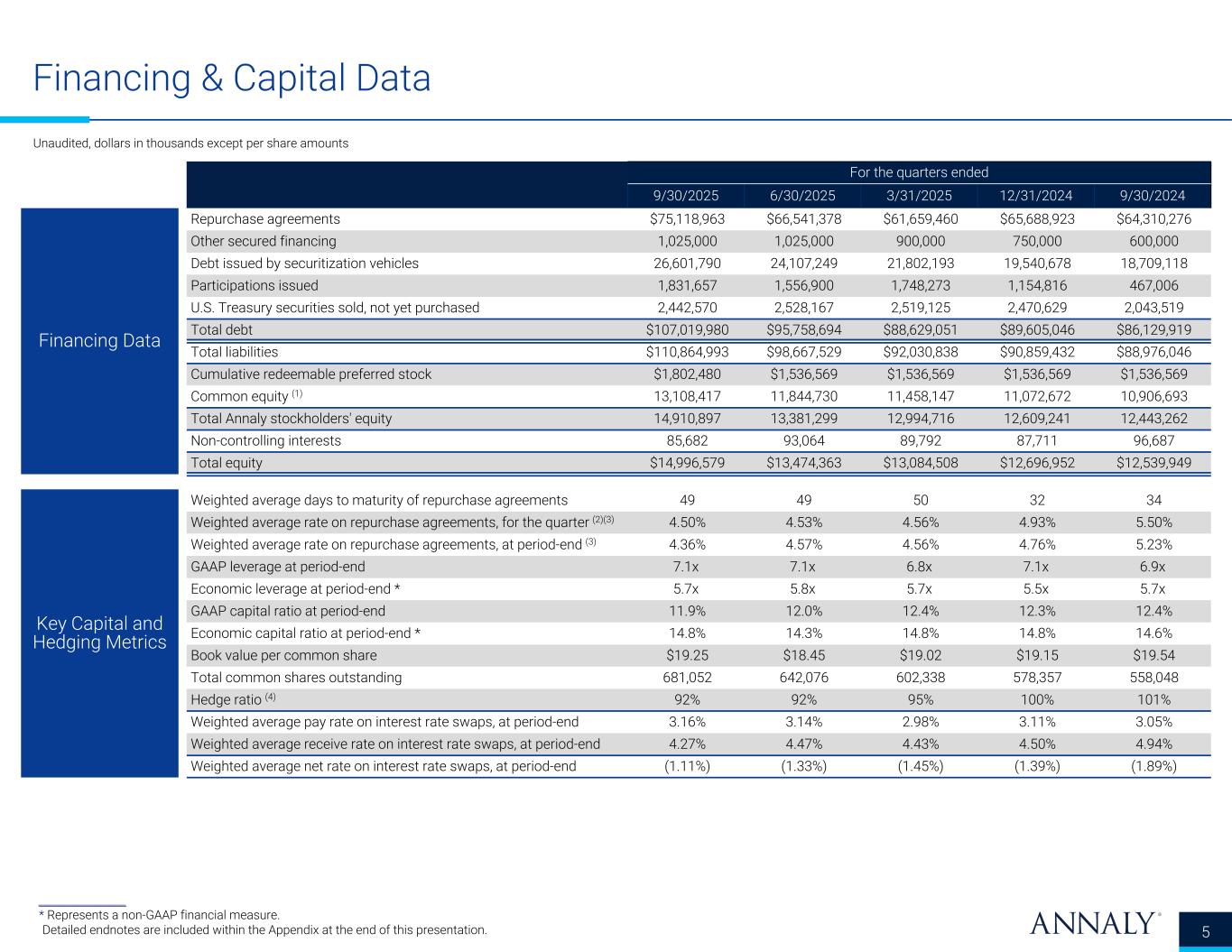

Financing & Capital Data 5 For the quarters ended 9/30/2025 6/30/2025 3/31/2025 12/31/2024 9/30/2024 Financing Data Repurchase agreements $75,118,963 $66,541,378 $61,659,460 $65,688,923 $64,310,276 Other secured financing 1,025,000 1,025,000 900,000 750,000 600,000 Debt issued by securitization vehicles 26,601,790 24,107,249 21,802,193 19,540,678 18,709,118 Participations issued 1,831,657 1,556,900 1,748,273 1,154,816 467,006 U.S. Treasury securities sold, not yet purchased 2,442,570 2,528,167 2,519,125 2,470,629 2,043,519 Total debt $107,019,980 $95,758,694 $88,629,051 $89,605,046 $86,129,919 Total liabilities $110,864,993 $98,667,529 $92,030,838 $90,859,432 $88,976,046 Cumulative redeemable preferred stock $1,802,480 $1,536,569 $1,536,569 $1,536,569 $1,536,569 Common equity (1) 13,108,417 11,844,730 11,458,147 11,072,672 10,906,693 Total Annaly stockholders' equity 14,910,897 13,381,299 12,994,716 12,609,241 12,443,262 Non-controlling interests 85,682 93,064 89,792 87,711 96,687 Total equity $14,996,579 $13,474,363 $13,084,508 $12,696,952 $12,539,949 Key Capital and Hedging Metrics Weighted average days to maturity of repurchase agreements 49 49 50 32 34 Weighted average rate on repurchase agreements, for the quarter (2)(3) 4.50% 4.53% 4.56% 4.93% 5.50% Weighted average rate on repurchase agreements, at period-end (3) 4.36% 4.57% 4.56% 4.76% 5.23% GAAP leverage at period-end 7.1x 7.1x 6.8x 7.1x 6.9x Economic leverage at period-end * 5.7x 5.8x 5.7x 5.5x 5.7x GAAP capital ratio at period-end 11.9% 12.0% 12.4% 12.3% 12.4% Economic capital ratio at period-end * 14.8% 14.3% 14.8% 14.8% 14.6% Book value per common share $19.25 $18.45 $19.02 $19.15 $19.54 Total common shares outstanding 681,052 642,076 602,338 578,357 558,048 Hedge ratio (4) 92% 92% 95% 100% 101% Weighted average pay rate on interest rate swaps, at period-end 3.16% 3.14% 2.98% 3.11% 3.05% Weighted average receive rate on interest rate swaps, at period-end 4.27% 4.47% 4.43% 4.50% 4.94% Weighted average net rate on interest rate swaps, at period-end (1.11%) (1.33%) (1.45%) (1.39%) (1.89%) Unaudited, dollars in thousands except per share amounts ___________________ * Represents a non-GAAP financial measure. Detailed endnotes are included within the Appendix at the end of this presentation.

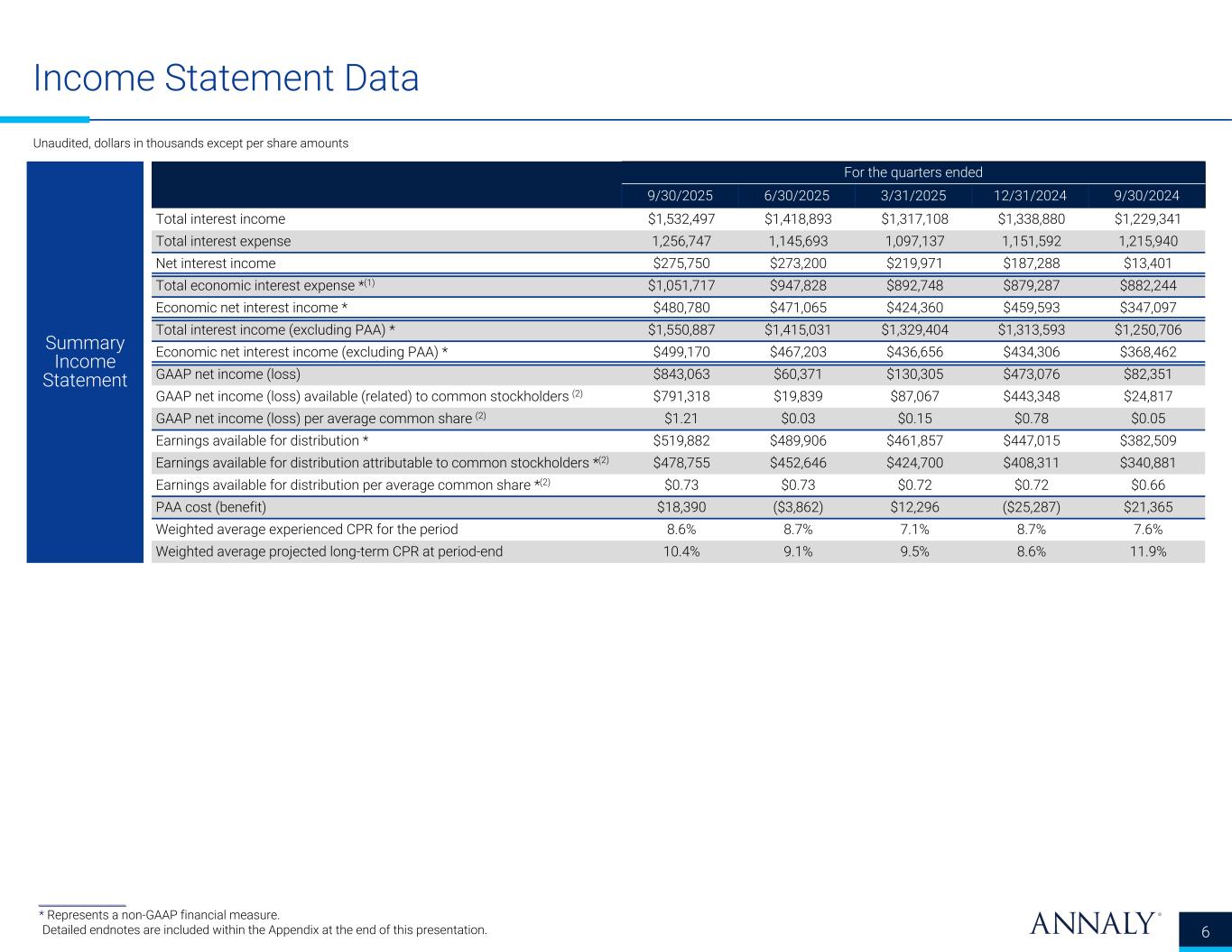

Income Statement Data 6 Summary Income Statement For the quarters ended 9/30/2025 6/30/2025 3/31/2025 12/31/2024 9/30/2024 Total interest income $1,532,497 $1,418,893 $1,317,108 $1,338,880 $1,229,341 Total interest expense 1,256,747 1,145,693 1,097,137 1,151,592 1,215,940 Net interest income $275,750 $273,200 $219,971 $187,288 $13,401 Total economic interest expense *(1) $1,051,717 $947,828 $892,748 $879,287 $882,244 Economic net interest income * $480,780 $471,065 $424,360 $459,593 $347,097 Total interest income (excluding PAA) * $1,550,887 $1,415,031 $1,329,404 $1,313,593 $1,250,706 Economic net interest income (excluding PAA) * $499,170 $467,203 $436,656 $434,306 $368,462 GAAP net income (loss) $843,063 $60,371 $130,305 $473,076 $82,351 GAAP net income (loss) available (related) to common stockholders (2) $791,318 $19,839 $87,067 $443,348 $24,817 GAAP net income (loss) per average common share (2) $1.21 $0.03 $0.15 $0.78 $0.05 Earnings available for distribution * $519,882 $489,906 $461,857 $447,015 $382,509 Earnings available for distribution attributable to common stockholders *(2) $478,755 $452,646 $424,700 $408,311 $340,881 Earnings available for distribution per average common share *(2) $0.73 $0.73 $0.72 $0.72 $0.66 PAA cost (benefit) $18,390 ($3,862) $12,296 ($25,287) $21,365 Weighted average experienced CPR for the period 8.6% 8.7% 7.1% 8.7% 7.6% Weighted average projected long-term CPR at period-end 10.4% 9.1% 9.5% 8.6% 11.9% ___________________ * Represents a non-GAAP financial measure. Detailed endnotes are included within the Appendix at the end of this presentation. Unaudited, dollars in thousands except per share amounts

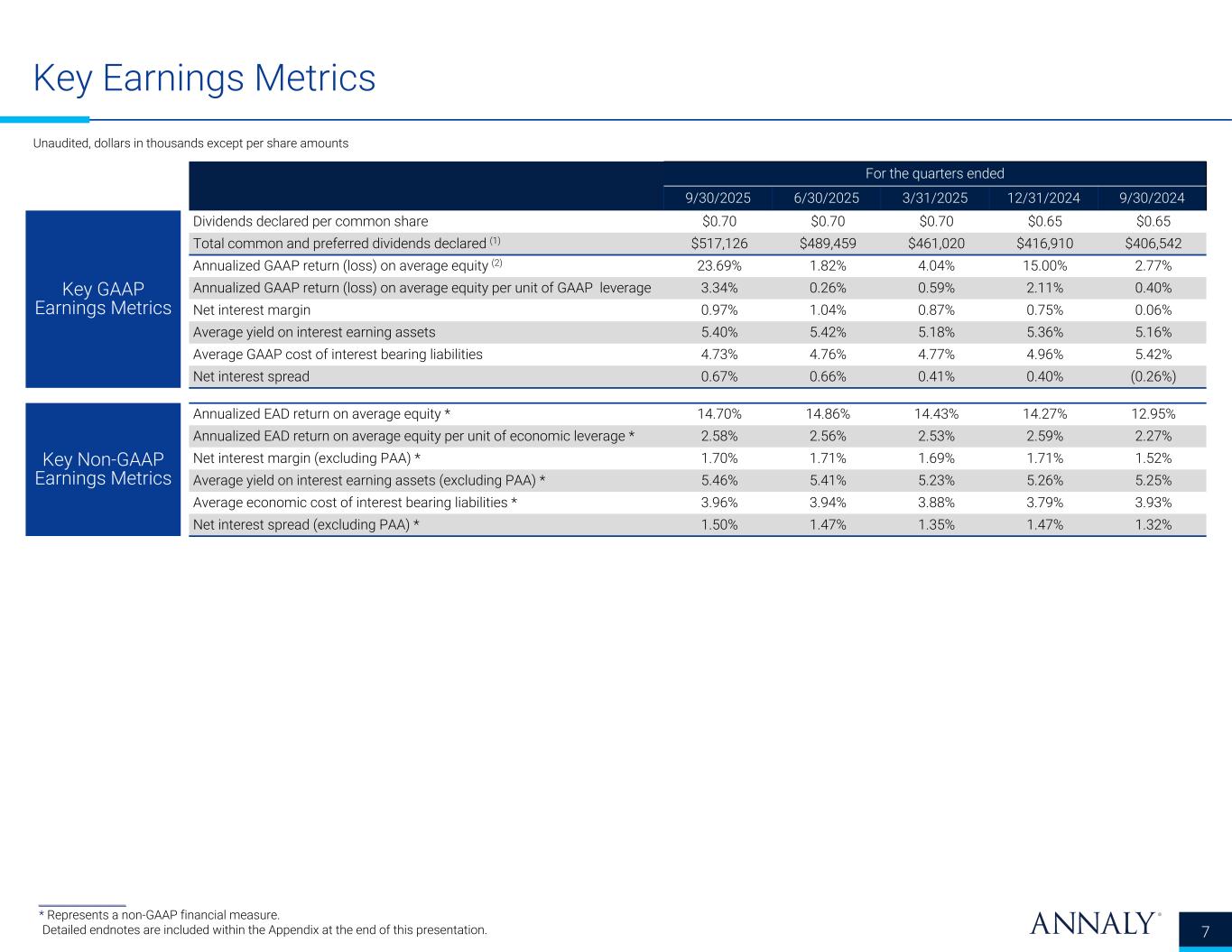

Key Earnings Metrics 7 Unaudited, dollars in thousands except per share amounts ___________________ * Represents a non-GAAP financial measure. Detailed endnotes are included within the Appendix at the end of this presentation. For the quarters ended 9/30/2025 6/30/2025 3/31/2025 12/31/2024 9/30/2024 Key GAAP Earnings Metrics Dividends declared per common share $0.70 $0.70 $0.70 $0.65 $0.65 Total common and preferred dividends declared (1) $517,126 $489,459 $461,020 $416,910 $406,542 Annualized GAAP return (loss) on average equity (2) 23.69% 1.82% 4.04% 15.00% 2.77% Annualized GAAP return (loss) on average equity per unit of GAAP leverage 3.34% 0.26% 0.59% 2.11% 0.40% Net interest margin 0.97% 1.04% 0.87% 0.75% 0.06% Average yield on interest earning assets 5.40% 5.42% 5.18% 5.36% 5.16% Average GAAP cost of interest bearing liabilities 4.73% 4.76% 4.77% 4.96% 5.42% Net interest spread 0.67% 0.66% 0.41% 0.40% (0.26%) Key Non-GAAP Earnings Metrics Annualized EAD return on average equity * 14.70% 14.86% 14.43% 14.27% 12.95% Annualized EAD return on average equity per unit of economic leverage * 2.58% 2.56% 2.53% 2.59% 2.27% Net interest margin (excluding PAA) * 1.70% 1.71% 1.69% 1.71% 1.52% Average yield on interest earning assets (excluding PAA) * 5.46% 5.41% 5.23% 5.26% 5.25% Average economic cost of interest bearing liabilities * 3.96% 3.94% 3.88% 3.79% 3.93% Net interest spread (excluding PAA) * 1.50% 1.47% 1.35% 1.47% 1.32%

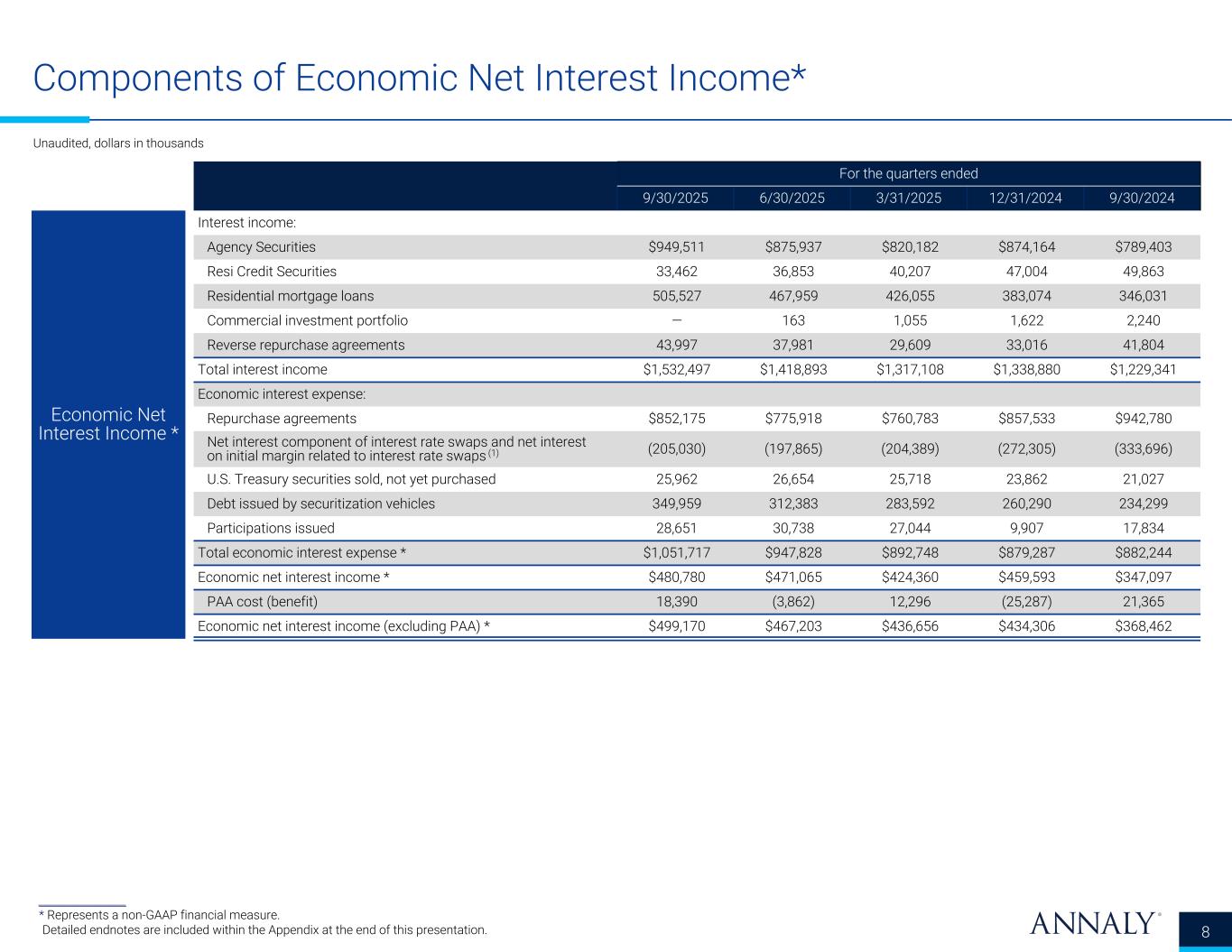

Components of Economic Net Interest Income* 8 ___________________ * Represents a non-GAAP financial measure. Detailed endnotes are included within the Appendix at the end of this presentation. Unaudited, dollars in thousands For the quarters ended 9/30/2025 6/30/2025 3/31/2025 12/31/2024 9/30/2024 Economic Net Interest Income * Interest income: Agency Securities $949,511 $875,937 $820,182 $874,164 $789,403 Resi Credit Securities 33,462 36,853 40,207 47,004 49,863 Residential mortgage loans 505,527 467,959 426,055 383,074 346,031 Commercial investment portfolio — 163 1,055 1,622 2,240 Reverse repurchase agreements 43,997 37,981 29,609 33,016 41,804 Total interest income $1,532,497 $1,418,893 $1,317,108 $1,338,880 $1,229,341 Economic interest expense: Repurchase agreements $852,175 $775,918 $760,783 $857,533 $942,780 Net interest component of interest rate swaps and net interest on initial margin related to interest rate swaps (1) (205,030) (197,865) (204,389) (272,305) (333,696) U.S. Treasury securities sold, not yet purchased 25,962 26,654 25,718 23,862 21,027 Debt issued by securitization vehicles 349,959 312,383 283,592 260,290 234,299 Participations issued 28,651 30,738 27,044 9,907 17,834 Total economic interest expense * $1,051,717 $947,828 $892,748 $879,287 $882,244 Economic net interest income * $480,780 $471,065 $424,360 $459,593 $347,097 PAA cost (benefit) 18,390 (3,862) 12,296 (25,287) 21,365 Economic net interest income (excluding PAA) * $499,170 $467,203 $436,656 $434,306 $368,462

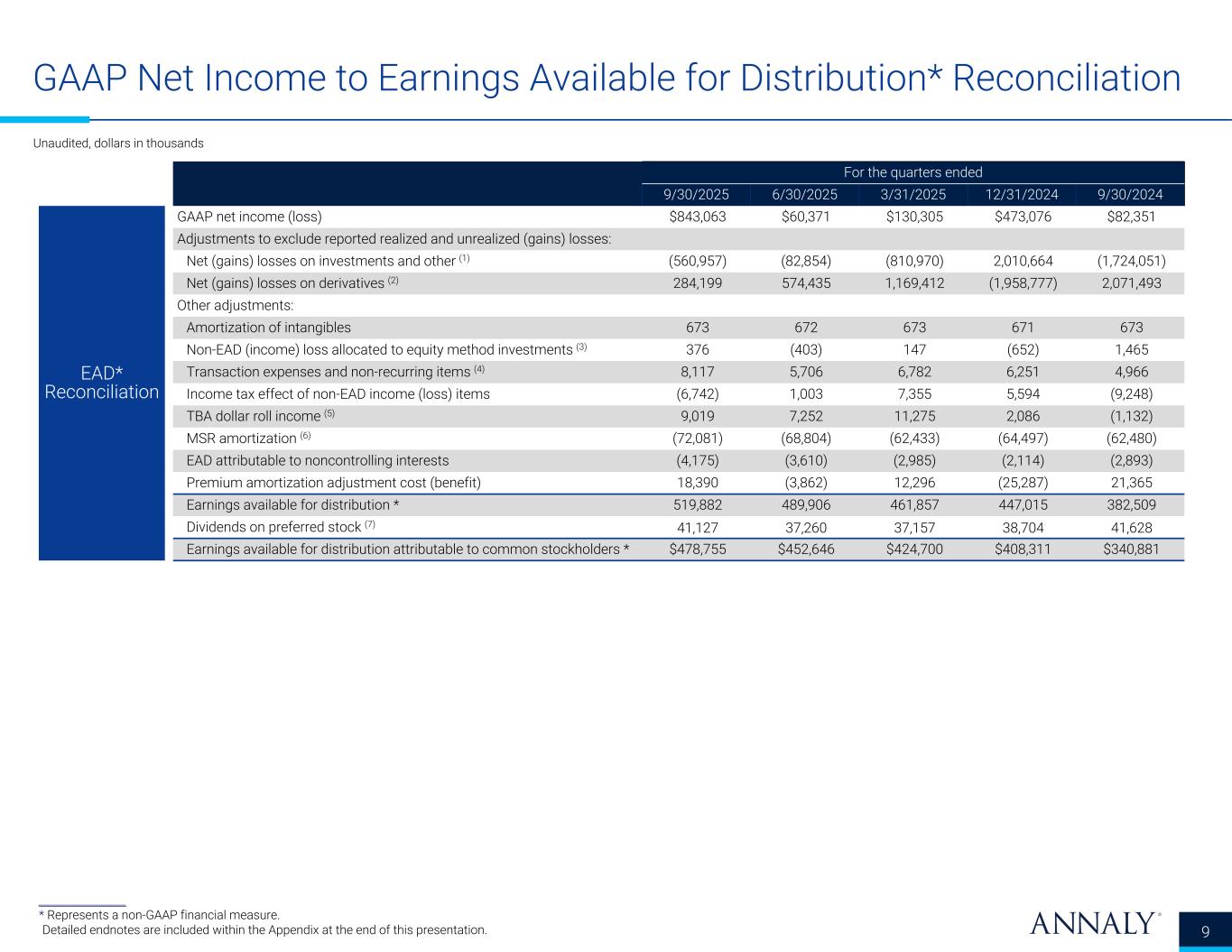

GAAP Net Income to Earnings Available for Distribution* Reconciliation 9 ___________________ * Represents a non-GAAP financial measure. Detailed endnotes are included within the Appendix at the end of this presentation. Unaudited, dollars in thousands For the quarters ended 9/30/2025 6/30/2025 3/31/2025 12/31/2024 9/30/2024 EAD* Reconciliation GAAP net income (loss) $843,063 $60,371 $130,305 $473,076 $82,351 Adjustments to exclude reported realized and unrealized (gains) losses: Net (gains) losses on investments and other (1) (560,957) (82,854) (810,970) 2,010,664 (1,724,051) Net (gains) losses on derivatives (2) 284,199 574,435 1,169,412 (1,958,777) 2,071,493 Other adjustments: Amortization of intangibles 673 672 673 671 673 Non-EAD (income) loss allocated to equity method investments (3) 376 (403) 147 (652) 1,465 Transaction expenses and non-recurring items (4) 8,117 5,706 6,782 6,251 4,966 Income tax effect of non-EAD income (loss) items (6,742) 1,003 7,355 5,594 (9,248) TBA dollar roll income (5) 9,019 7,252 11,275 2,086 (1,132) MSR amortization (6) (72,081) (68,804) (62,433) (64,497) (62,480) EAD attributable to noncontrolling interests (4,175) (3,610) (2,985) (2,114) (2,893) Premium amortization adjustment cost (benefit) 18,390 (3,862) 12,296 (25,287) 21,365 Earnings available for distribution * 519,882 489,906 461,857 447,015 382,509 Dividends on preferred stock (7) 41,127 37,260 37,157 38,704 41,628 Earnings available for distribution attributable to common stockholders * $478,755 $452,646 $424,700 $408,311 $340,881

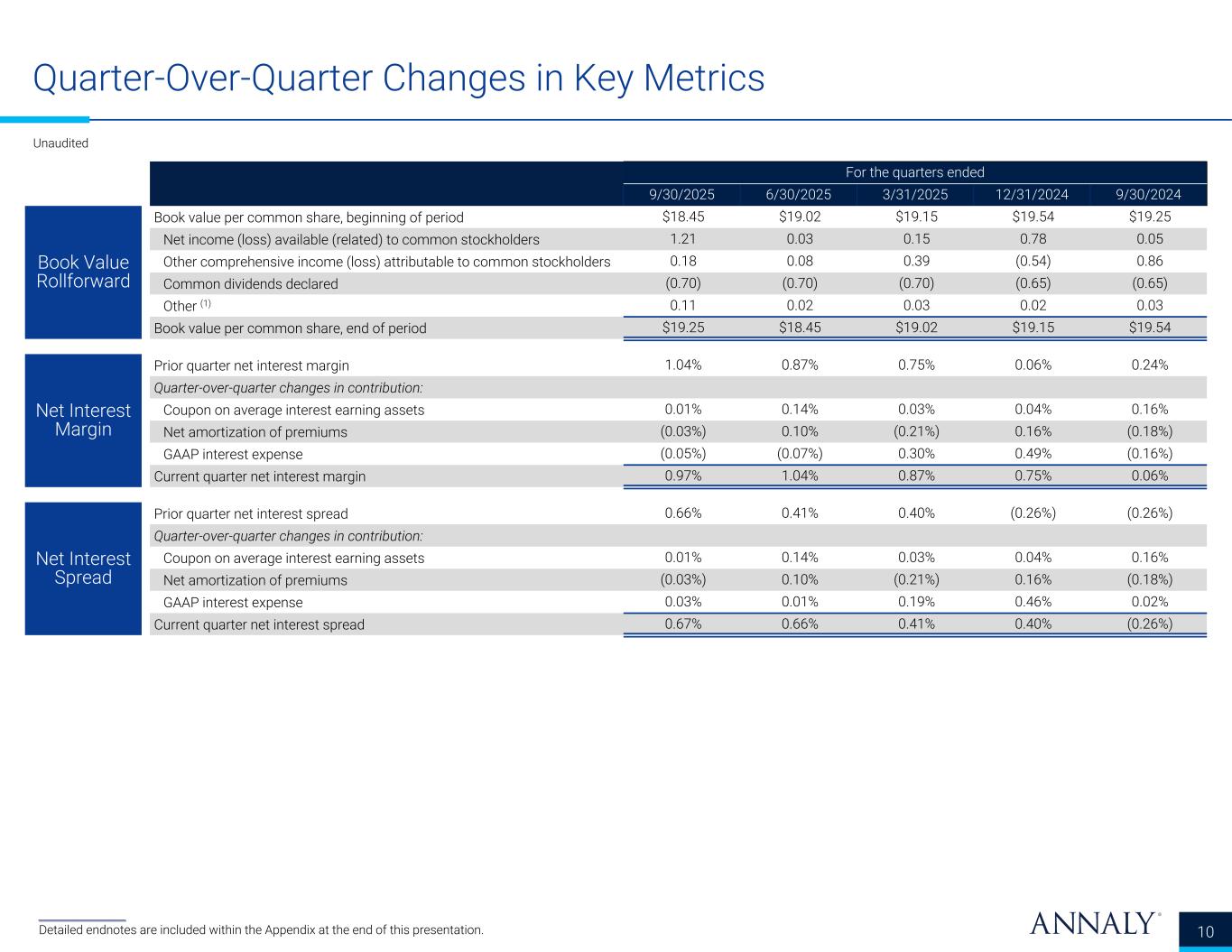

Quarter-Over-Quarter Changes in Key Metrics 10 Unaudited ___________________ Detailed endnotes are included within the Appendix at the end of this presentation. For the quarters ended 9/30/2025 6/30/2025 3/31/2025 12/31/2024 9/30/2024 Book Value Rollforward Book value per common share, beginning of period $18.45 $19.02 $19.15 $19.54 $19.25 Net income (loss) available (related) to common stockholders 1.21 0.03 0.15 0.78 0.05 Other comprehensive income (loss) attributable to common stockholders 0.18 0.08 0.39 (0.54) 0.86 Common dividends declared (0.70) (0.70) (0.70) (0.65) (0.65) Other (1) 0.11 0.02 0.03 0.02 0.03 Book value per common share, end of period $19.25 $18.45 $19.02 $19.15 $19.54 Net Interest Margin Prior quarter net interest margin 1.04% 0.87% 0.75% 0.06% 0.24% Quarter-over-quarter changes in contribution: Coupon on average interest earning assets 0.01% 0.14% 0.03% 0.04% 0.16% Net amortization of premiums (0.03%) 0.10% (0.21%) 0.16% (0.18%) GAAP interest expense (0.05%) (0.07%) 0.30% 0.49% (0.16%) Current quarter net interest margin 0.97% 1.04% 0.87% 0.75% 0.06% Net Interest Spread Prior quarter net interest spread 0.66% 0.41% 0.40% (0.26%) (0.26%) Quarter-over-quarter changes in contribution: Coupon on average interest earning assets 0.01% 0.14% 0.03% 0.04% 0.16% Net amortization of premiums (0.03%) 0.10% (0.21%) 0.16% (0.18%) GAAP interest expense 0.03% 0.01% 0.19% 0.46% 0.02% Current quarter net interest spread 0.67% 0.66% 0.41% 0.40% (0.26%)

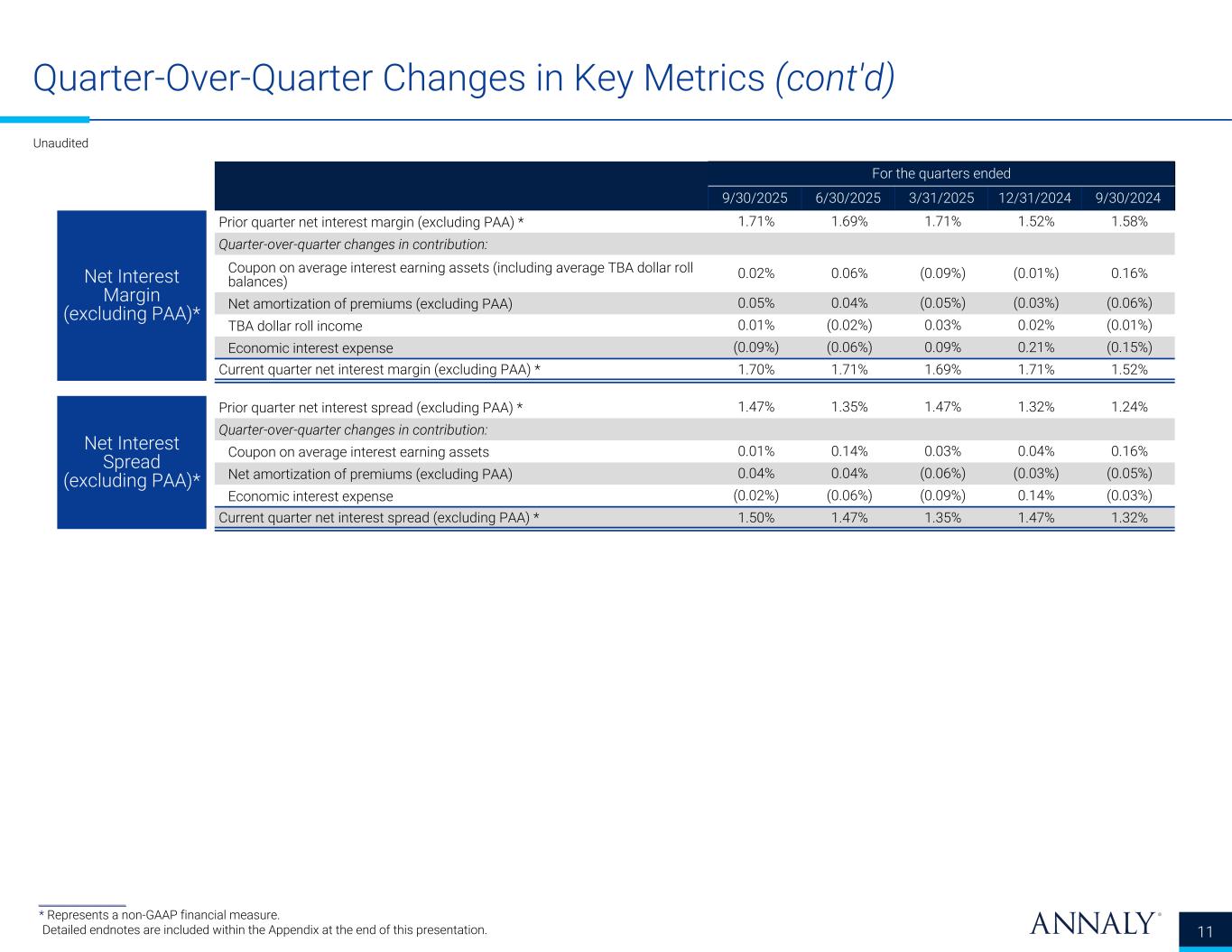

Quarter-Over-Quarter Changes in Key Metrics (cont'd) 11 Unaudited ___________________ * Represents a non-GAAP financial measure. Detailed endnotes are included within the Appendix at the end of this presentation. For the quarters ended 9/30/2025 6/30/2025 3/31/2025 12/31/2024 9/30/2024 Net Interest Margin (excluding PAA)* Prior quarter net interest margin (excluding PAA) * 1.71% 1.69% 1.71% 1.52% 1.58% Quarter-over-quarter changes in contribution: Coupon on average interest earning assets (including average TBA dollar roll balances) 0.02% 0.06% (0.09%) (0.01%) 0.16% Net amortization of premiums (excluding PAA) 0.05% 0.04% (0.05%) (0.03%) (0.06%) TBA dollar roll income 0.01% (0.02%) 0.03% 0.02% (0.01%) Economic interest expense (0.09%) (0.06%) 0.09% 0.21% (0.15%) Current quarter net interest margin (excluding PAA) * 1.70% 1.71% 1.69% 1.71% 1.52% Net Interest Spread (excluding PAA)* Prior quarter net interest spread (excluding PAA) * 1.47% 1.35% 1.47% 1.32% 1.24% Quarter-over-quarter changes in contribution: Coupon on average interest earning assets 0.01% 0.14% 0.03% 0.04% 0.16% Net amortization of premiums (excluding PAA) 0.04% 0.04% (0.06%) (0.03%) (0.05%) Economic interest expense (0.02%) (0.06%) (0.09%) 0.14% (0.03%) Current quarter net interest spread (excluding PAA) * 1.50% 1.47% 1.35% 1.47% 1.32%

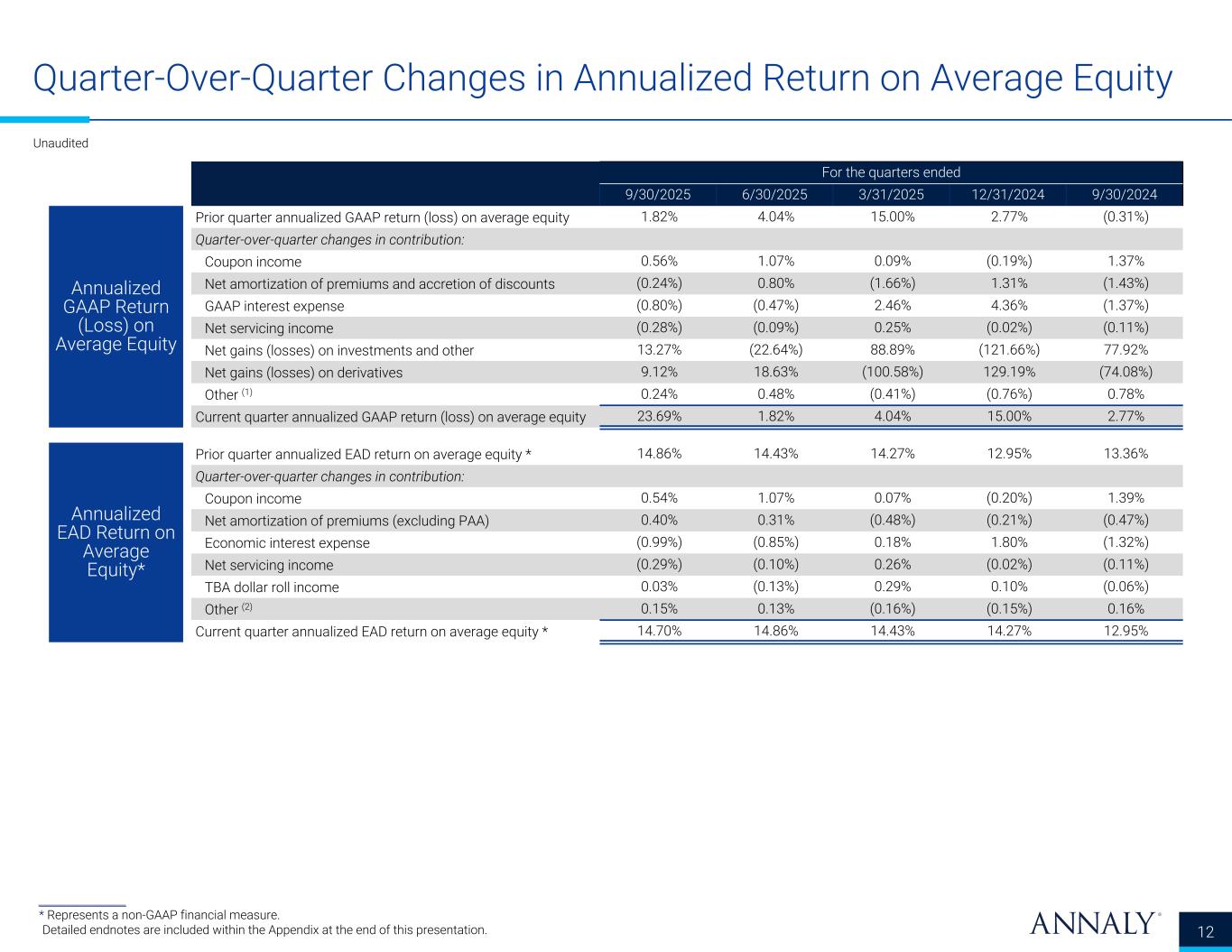

Quarter-Over-Quarter Changes in Annualized Return on Average Equity 12 ___________________ * Represents a non-GAAP financial measure. Detailed endnotes are included within the Appendix at the end of this presentation. Unaudited For the quarters ended 9/30/2025 6/30/2025 3/31/2025 12/31/2024 9/30/2024 Annualized GAAP Return (Loss) on Average Equity Prior quarter annualized GAAP return (loss) on average equity 1.82% 4.04% 15.00% 2.77% (0.31%) Quarter-over-quarter changes in contribution: Coupon income 0.56% 1.07% 0.09% (0.19%) 1.37% Net amortization of premiums and accretion of discounts (0.24%) 0.80% (1.66%) 1.31% (1.43%) GAAP interest expense (0.80%) (0.47%) 2.46% 4.36% (1.37%) Net servicing income (0.28%) (0.09%) 0.25% (0.02%) (0.11%) Net gains (losses) on investments and other 13.27% (22.64%) 88.89% (121.66%) 77.92% Net gains (losses) on derivatives 9.12% 18.63% (100.58%) 129.19% (74.08%) Other (1) 0.24% 0.48% (0.41%) (0.76%) 0.78% Current quarter annualized GAAP return (loss) on average equity 23.69% 1.82% 4.04% 15.00% 2.77% Annualized EAD Return on Average Equity* Prior quarter annualized EAD return on average equity * 14.86% 14.43% 14.27% 12.95% 13.36% Quarter-over-quarter changes in contribution: Coupon income 0.54% 1.07% 0.07% (0.20%) 1.39% Net amortization of premiums (excluding PAA) 0.40% 0.31% (0.48%) (0.21%) (0.47%) Economic interest expense (0.99%) (0.85%) 0.18% 1.80% (1.32%) Net servicing income (0.29%) (0.10%) 0.26% (0.02%) (0.11%) TBA dollar roll income 0.03% (0.13%) 0.29% 0.10% (0.06%) Other (2) 0.15% 0.13% (0.16%) (0.15%) 0.16% Current quarter annualized EAD return on average equity * 14.70% 14.86% 14.43% 14.27% 12.95%

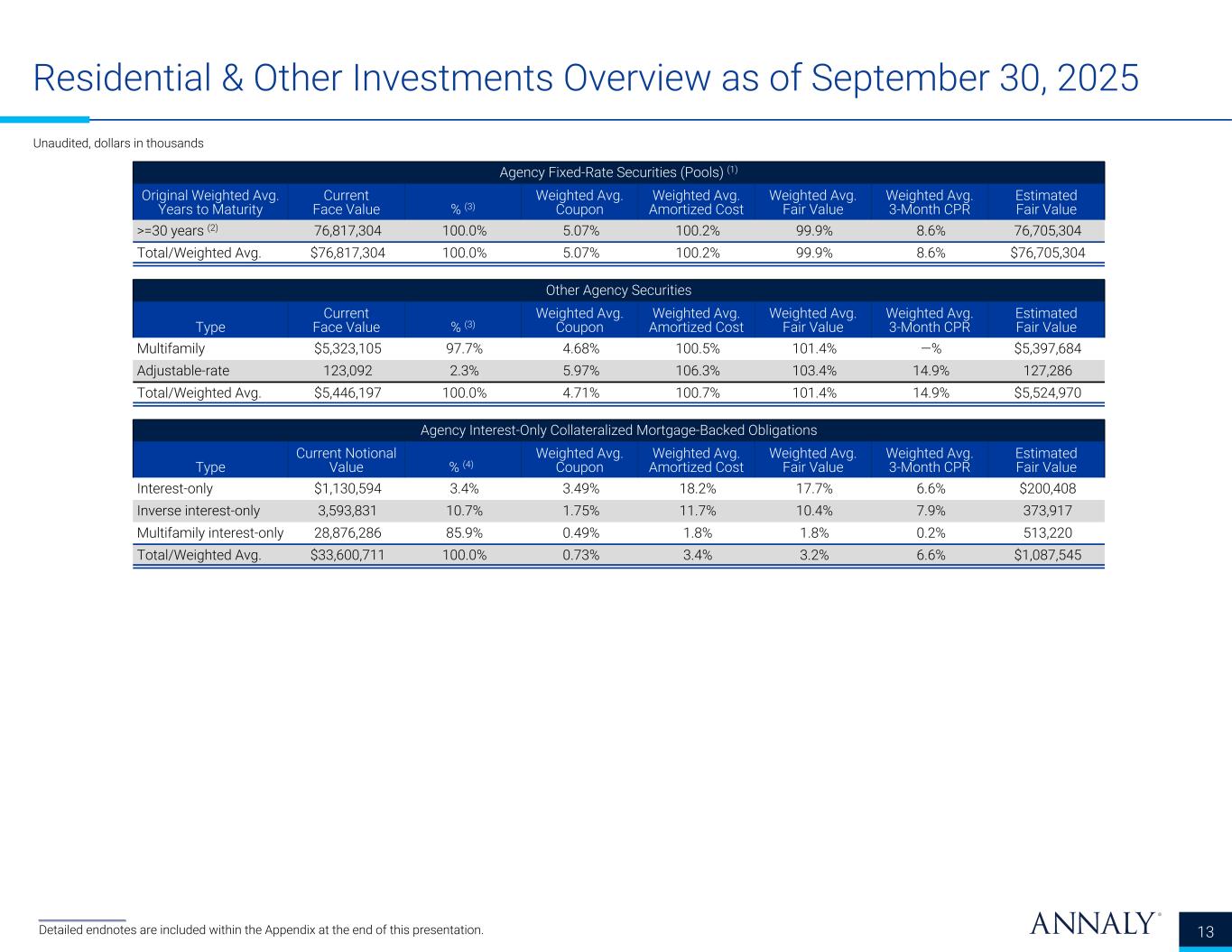

Residential & Other Investments Overview as of September 30, 2025 13 ___________________ Detailed endnotes are included within the Appendix at the end of this presentation. Unaudited, dollars in thousands Agency Fixed-Rate Securities (Pools) (1) Original Weighted Avg. Years to Maturity Current Face Value % (3) Weighted Avg. Coupon Weighted Avg. Amortized Cost Weighted Avg. Fair Value Weighted Avg. 3-Month CPR Estimated Fair Value >=30 years (2) 76,817,304 100.0% 5.07% 100.2% 99.9% 8.6% 76,705,304 Total/Weighted Avg. $76,817,304 100.0% 5.07% 100.2% 99.9% 8.6% $76,705,304 Other Agency Securities Type Current Face Value % (3) Weighted Avg. Coupon Weighted Avg. Amortized Cost Weighted Avg. Fair Value Weighted Avg. 3-Month CPR Estimated Fair Value Multifamily $5,323,105 97.7% 4.68% 100.5% 101.4% —% $5,397,684 Adjustable-rate 123,092 2.3% 5.97% 106.3% 103.4% 14.9% 127,286 Total/Weighted Avg. $5,446,197 100.0% 4.71% 100.7% 101.4% 14.9% $5,524,970 Agency Interest-Only Collateralized Mortgage-Backed Obligations Type Current Notional Value % (4) Weighted Avg. Coupon Weighted Avg. Amortized Cost Weighted Avg. Fair Value Weighted Avg. 3-Month CPR Estimated Fair Value Interest-only $1,130,594 3.4% 3.49% 18.2% 17.7% 6.6% $200,408 Inverse interest-only 3,593,831 10.7% 1.75% 11.7% 10.4% 7.9% 373,917 Multifamily interest-only 28,876,286 85.9% 0.49% 1.8% 1.8% 0.2% 513,220 Total/Weighted Avg. $33,600,711 100.0% 0.73% 3.4% 3.2% 6.6% $1,087,545

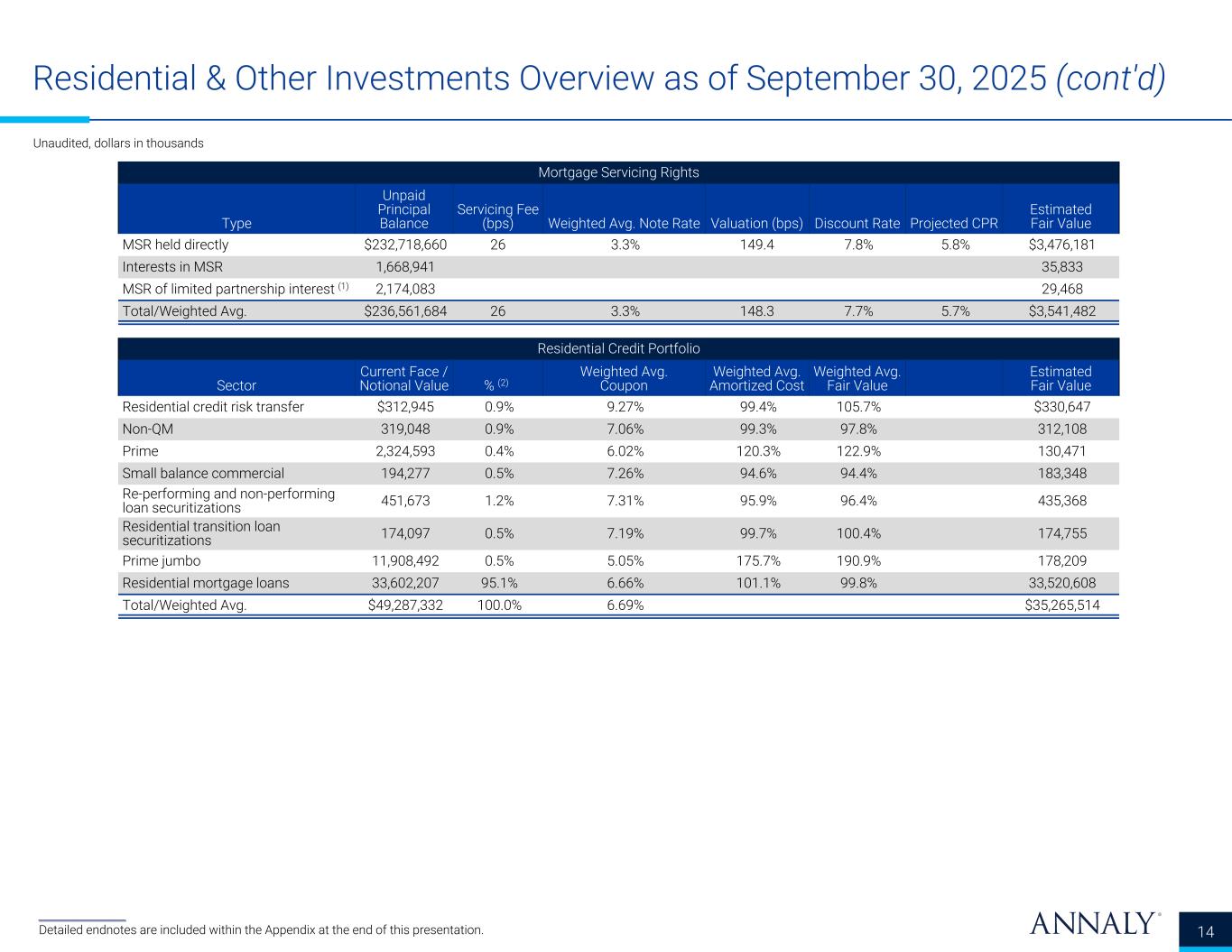

Residential & Other Investments Overview as of September 30, 2025 (cont'd) 14 Unaudited, dollars in thousands ___________________ Detailed endnotes are included within the Appendix at the end of this presentation. Mortgage Servicing Rights Type Unpaid Principal Balance Servicing Fee (bps) Weighted Avg. Note Rate Valuation (bps) Discount Rate Projected CPR Estimated Fair Value MSR held directly $232,718,660 26 3.3% 149.4 7.8% 5.8% $3,476,181 Interests in MSR 1,668,941 35,833 MSR of limited partnership interest (1) 2,174,083 29,468 Total/Weighted Avg. $236,561,684 26 3.3% 148.3 7.7% 5.7% $3,541,482 Residential Credit Portfolio Sector Current Face / Notional Value % (2) Weighted Avg. Coupon Weighted Avg. Amortized Cost Weighted Avg. Fair Value Estimated Fair Value Residential credit risk transfer $312,945 0.9% 9.27% 99.4% 105.7% $330,647 Non-QM 319,048 0.9% 7.06% 99.3% 97.8% 312,108 Prime 2,324,593 0.4% 6.02% 120.3% 122.9% 130,471 Small balance commercial 194,277 0.5% 7.26% 94.6% 94.4% 183,348 Re-performing and non-performing loan securitizations 451,673 1.2% 7.31% 95.9% 96.4% 435,368 Residential transition loan securitizations 174,097 0.5% 7.19% 99.7% 100.4% 174,755 Prime jumbo 11,908,492 0.5% 5.05% 175.7% 190.9% 178,209 Residential mortgage loans 33,602,207 95.1% 6.66% 101.1% 99.8% 33,520,608 Total/Weighted Avg. $49,287,332 100.0% 6.69% $35,265,514

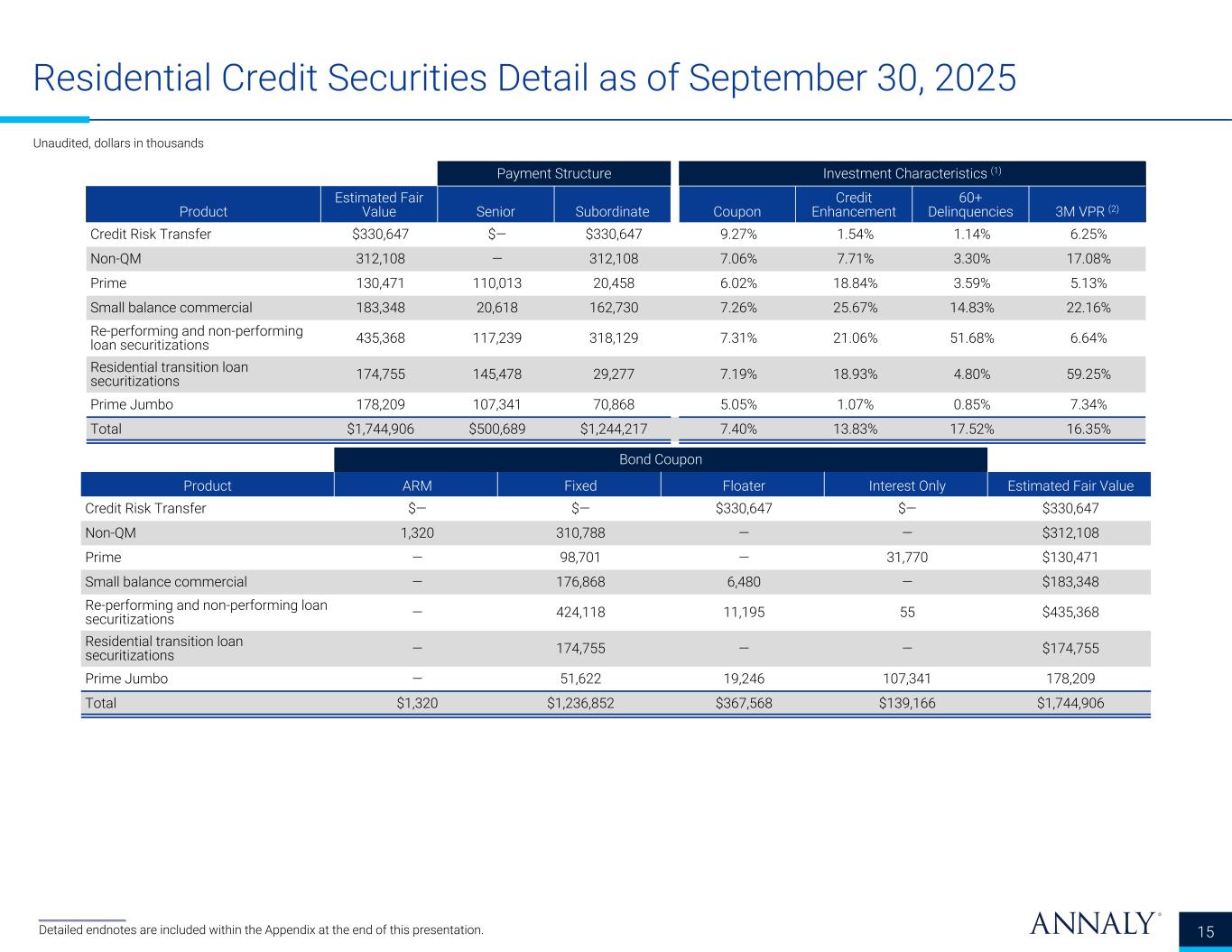

Residential Credit Securities Detail as of September 30, 2025 15 ___________________ Detailed endnotes are included within the Appendix at the end of this presentation. Unaudited, dollars in thousands Payment Structure Investment Characteristics (1) Product Estimated Fair Value Senior Subordinate Coupon Credit Enhancement 60+ Delinquencies 3M VPR (2) Credit Risk Transfer $330,647 $— $330,647 9.27% 1.54% 1.14% 6.25% Non-QM 312,108 — 312,108 7.06% 7.71% 3.30% 17.08% Prime 130,471 110,013 20,458 6.02% 18.84% 3.59% 5.13% Small balance commercial 183,348 20,618 162,730 7.26% 25.67% 14.83% 22.16% Re-performing and non-performing loan securitizations 435,368 117,239 318,129 7.31% 21.06% 51.68% 6.64% Residential transition loan securitizations 174,755 145,478 29,277 7.19% 18.93% 4.80% 59.25% Prime Jumbo 178,209 107,341 70,868 5.05% 1.07% 0.85% 7.34% Total $1,744,906 $500,689 $1,244,217 7.40% 13.83% 17.52% 16.35% Bond Coupon Product ARM Fixed Floater Interest Only Estimated Fair Value Credit Risk Transfer $— $— $330,647 $— $330,647 Non-QM 1,320 310,788 — — $312,108 Prime — 98,701 — 31,770 $130,471 Small balance commercial — 176,868 6,480 — $183,348 Re-performing and non-performing loan securitizations — 424,118 11,195 55 $435,368 Residential transition loan securitizations — 174,755 — — $174,755 Prime Jumbo — 51,622 19,246 107,341 178,209 Total $1,320 $1,236,852 $367,568 $139,166 $1,744,906

Hedging & Liabilities as of September 30, 2025 16 Unaudited, dollars in thousands ___________________ Detailed endnotes are included within the Appendix at the end of this presentation. Maturity Current Notional (1)(2) Weighted Avg. Pay Rate Weighted Avg. Receive Rate Weighted Avg. Years to Maturity(3) Interest Rate Swaps 0 to 3 years $27,644,137 3.58% 4.24% 1.50 > 3 to 6 years 14,396,904 2.75% 4.30% 4.71 > 6 to 10 years 17,994,427 2.98% 4.27% 7.45 Greater than 10 years 1,959,430 3.37% 4.26% 22.27 Total / Weighted Avg. $61,994,898 3.16% 4.27% 4.54 U.S. Treasury Hedging Positions Type Long Contracts Short Contracts Net Positions Weighted Avg. Years to Maturity U.S. Treasury Positions - 2 year $— ($3,658,000) ($3,658,000) 2.00 U.S. Treasury Positions - 5 year $1,783,700 $— $1,783,700 4.40 U.S. Treasury Positions - 10 year & greater $— ($14,289,500) ($14,289,500) 11.50 Total / Weighted Avg. $1,783,700 ($17,947,500) ($16,163,800) 9.10 Repurchase Agreements and Other Secured Financing Maturity Principal Balance Weighted Avg. Rate At Period End Within 30 days $29,097,594 4.42% 30 to 59 days 14,059,608 4.38% 60 to 89 days 23,209,704 4.27% 90 to 119 days 4,578,922 4.18% Over 120 days(4) 5,198,135 5.06% Total / Weighted Avg. $76,143,963 4.40% Total Indebtedness Principal Balance Weighted Average Rate Days to Maturity(5)At Period End For the Quarter Repurchase agreements $75,118,963 4.36% 4.50% 49 Other secured financing 1,025,000 6.94% 7.00% 399 Debt issued by securitization vehicles 27,098,983 5.54% 5.30% 12,974 Participations issued 1,772,035 6.65% 6.58% 10,835 Total indebtedness $105,014,981

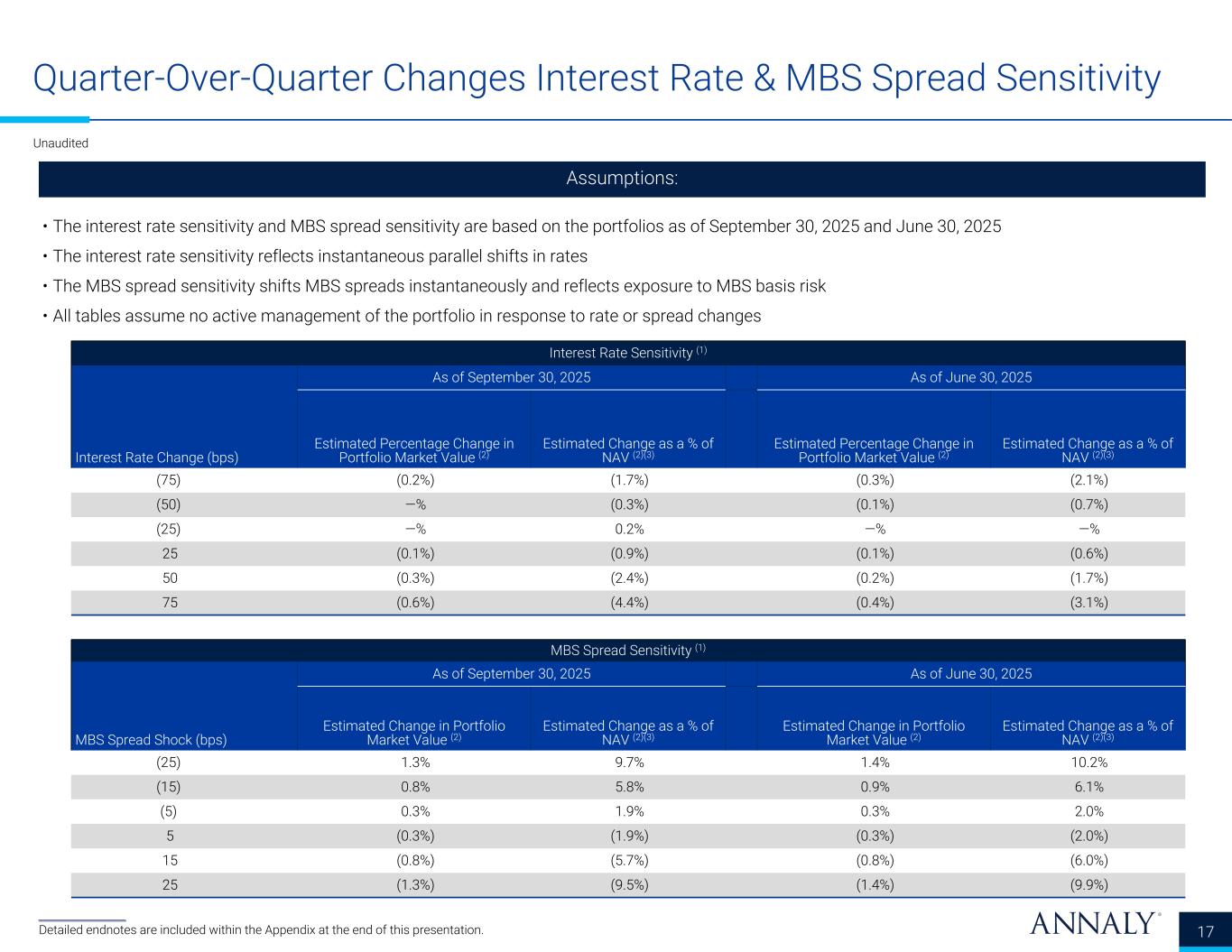

Quarter-Over-Quarter Changes Interest Rate & MBS Spread Sensitivity 17 ___________________ Detailed endnotes are included within the Appendix at the end of this presentation. Unaudited Assumptions: • The interest rate sensitivity and MBS spread sensitivity are based on the portfolios as of September 30, 2025 and June 30, 2025 • The interest rate sensitivity reflects instantaneous parallel shifts in rates • The MBS spread sensitivity shifts MBS spreads instantaneously and reflects exposure to MBS basis risk • All tables assume no active management of the portfolio in response to rate or spread changes Interest Rate Sensitivity (1) Interest Rate Change (bps) As of September 30, 2025 As of June 30, 2025 Estimated Percentage Change in Portfolio Market Value (2) Estimated Change as a % of NAV (2)(3) Estimated Percentage Change in Portfolio Market Value (2) Estimated Change as a % of NAV (2)(3) (75) (0.2%) (1.7%) (0.3%) (2.1%) (50) —% (0.3%) (0.1%) (0.7%) (25) —% 0.2% —% —% 25 (0.1%) (0.9%) (0.1%) (0.6%) 50 (0.3%) (2.4%) (0.2%) (1.7%) 75 (0.6%) (4.4%) (0.4%) (3.1%) MBS Spread Sensitivity (1) MBS Spread Shock (bps) As of September 30, 2025 As of June 30, 2025 Estimated Change in Portfolio Market Value (2) Estimated Change as a % of NAV (2)(3) Estimated Change in Portfolio Market Value (2) Estimated Change as a % of NAV (2)(3) (25) 1.3% 9.7% 1.4% 10.2% (15) 0.8% 5.8% 0.9% 6.1% (5) 0.3% 1.9% 0.3% 2.0% 5 (0.3%) (1.9%) (0.3%) (2.0%) 15 (0.8%) (5.7%) (0.8%) (6.0%) 25 (1.3%) (9.5%) (1.4%) (9.9%)

Appendix

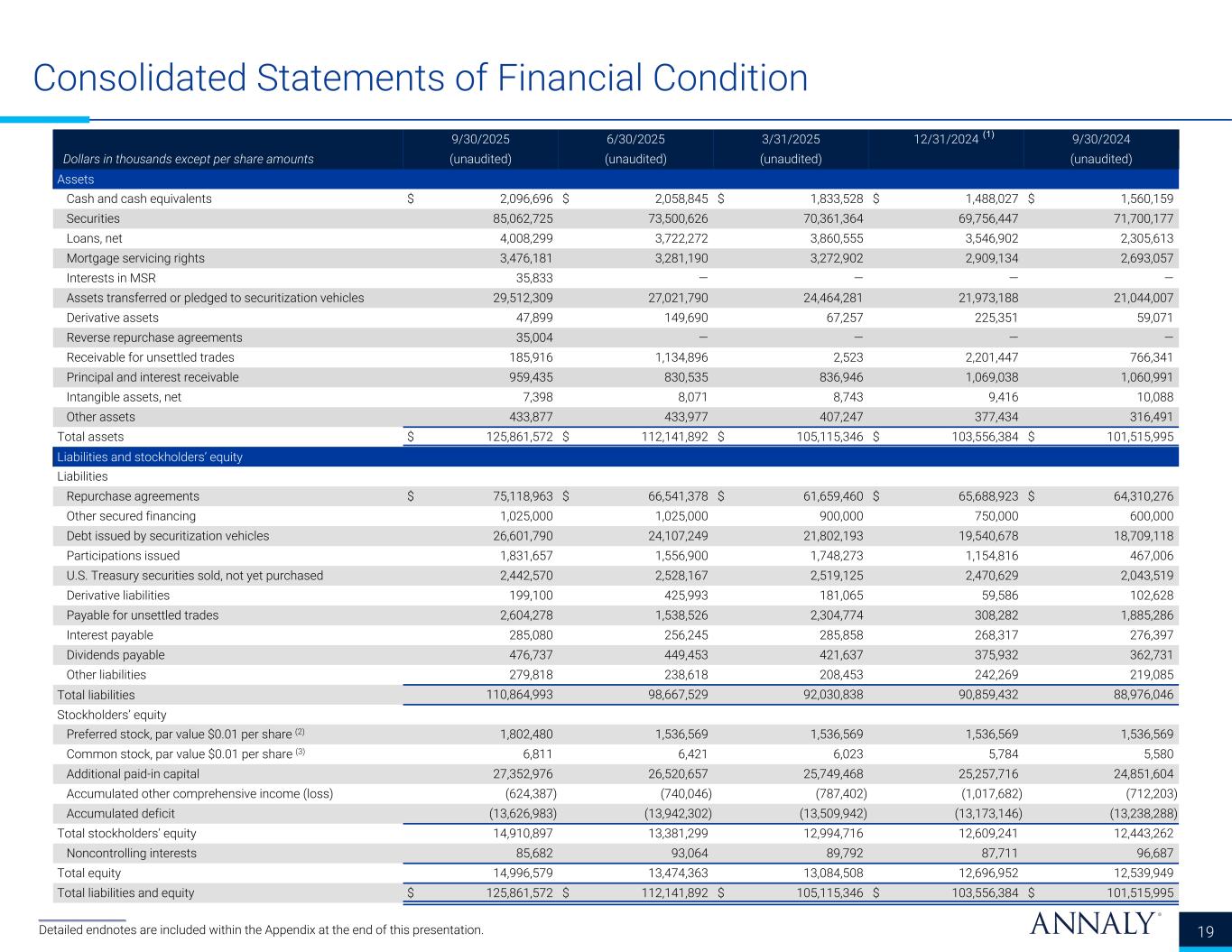

Consolidated Statements of Financial Condition 19 ___________________ Detailed endnotes are included within the Appendix at the end of this presentation. 9/30/2025 6/30/2025 3/31/2025 12/31/2024 9/30/2024 Dollars in thousands except per share amounts (unaudited) (unaudited) (unaudited) (unaudited) Assets Cash and cash equivalents $ 2,096,696 $ 2,058,845 $ 1,833,528 $ 1,488,027 $ 1,560,159 Securities 85,062,725 73,500,626 70,361,364 69,756,447 71,700,177 Loans, net 4,008,299 3,722,272 3,860,555 3,546,902 2,305,613 Mortgage servicing rights 3,476,181 3,281,190 3,272,902 2,909,134 2,693,057 Interests in MSR 35,833 — — — — Assets transferred or pledged to securitization vehicles 29,512,309 27,021,790 24,464,281 21,973,188 21,044,007 Derivative assets 47,899 149,690 67,257 225,351 59,071 Reverse repurchase agreements 35,004 — — — — Receivable for unsettled trades 185,916 1,134,896 2,523 2,201,447 766,341 Principal and interest receivable 959,435 830,535 836,946 1,069,038 1,060,991 Intangible assets, net 7,398 8,071 8,743 9,416 10,088 Other assets 433,877 433,977 407,247 377,434 316,491 Total assets $ 125,861,572 $ 112,141,892 $ 105,115,346 $ 103,556,384 $ 101,515,995 Liabilities and stockholders’ equity Liabilities Repurchase agreements $ 75,118,963 $ 66,541,378 $ 61,659,460 $ 65,688,923 $ 64,310,276 Other secured financing 1,025,000 1,025,000 900,000 750,000 600,000 Debt issued by securitization vehicles 26,601,790 24,107,249 21,802,193 19,540,678 18,709,118 Participations issued 1,831,657 1,556,900 1,748,273 1,154,816 467,006 U.S. Treasury securities sold, not yet purchased 2,442,570 2,528,167 2,519,125 2,470,629 2,043,519 Derivative liabilities 199,100 425,993 181,065 59,586 102,628 Payable for unsettled trades 2,604,278 1,538,526 2,304,774 308,282 1,885,286 Interest payable 285,080 256,245 285,858 268,317 276,397 Dividends payable 476,737 449,453 421,637 375,932 362,731 Other liabilities 279,818 238,618 208,453 242,269 219,085 Total liabilities 110,864,993 98,667,529 92,030,838 90,859,432 88,976,046 Stockholders’ equity Preferred stock, par value $0.01 per share (2) 1,802,480 1,536,569 1,536,569 1,536,569 1,536,569 Common stock, par value $0.01 per share (3) 6,811 6,421 6,023 5,784 5,580 Additional paid-in capital 27,352,976 26,520,657 25,749,468 25,257,716 24,851,604 Accumulated other comprehensive income (loss) (624,387) (740,046) (787,402) (1,017,682) (712,203) Accumulated deficit (13,626,983) (13,942,302) (13,509,942) (13,173,146) (13,238,288) Total stockholders’ equity 14,910,897 13,381,299 12,994,716 12,609,241 12,443,262 Noncontrolling interests 85,682 93,064 89,792 87,711 96,687 Total equity 14,996,579 13,474,363 13,084,508 12,696,952 12,539,949 Total liabilities and equity $ 125,861,572 $ 112,141,892 $ 105,115,346 $ 103,556,384 $ 101,515,995 (1)

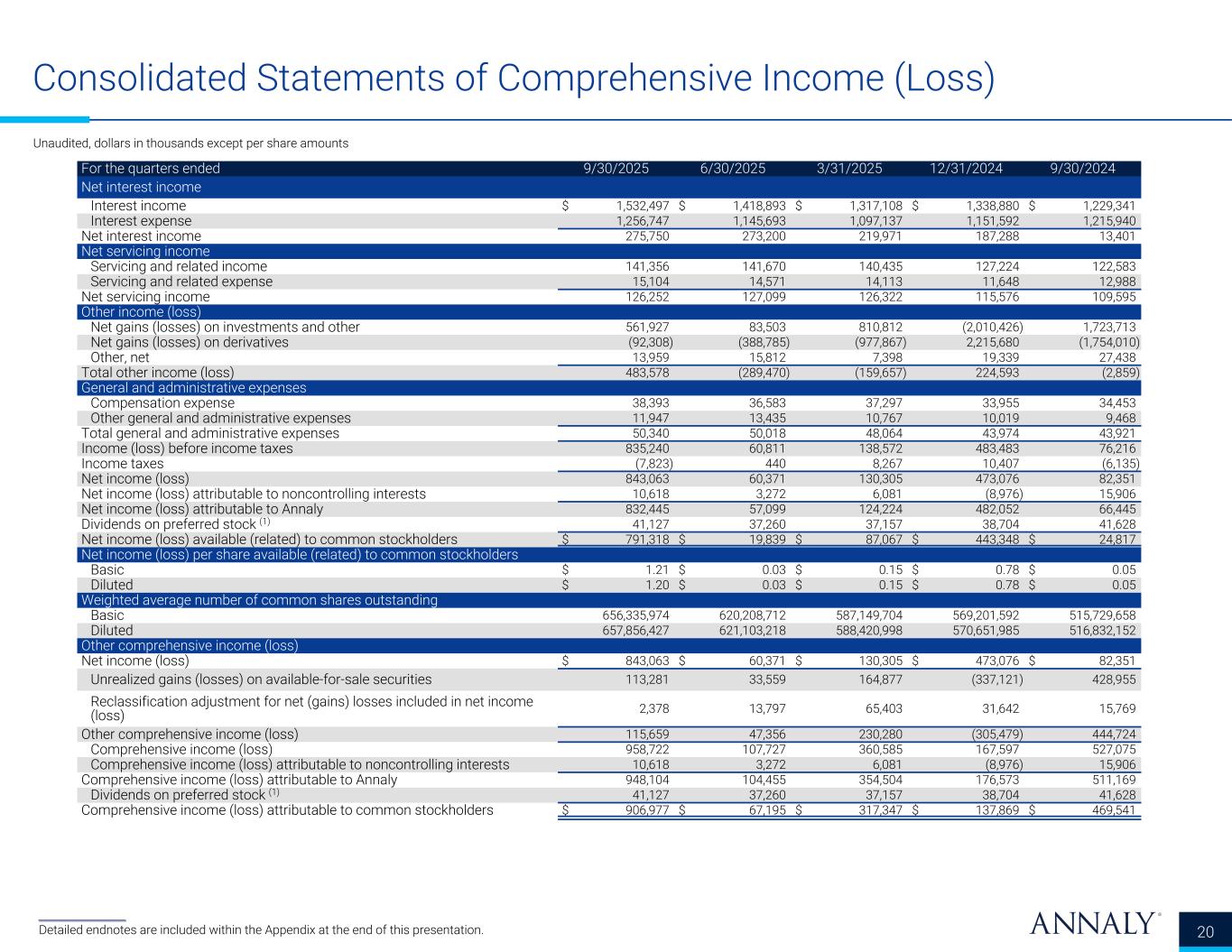

Consolidated Statements of Comprehensive Income (Loss) 20 Unaudited, dollars in thousands except per share amounts For the quarters ended 9/30/2025 6/30/2025 3/31/2025 12/31/2024 9/30/2024 Net interest income Interest income $ 1,532,497 $ 1,418,893 $ 1,317,108 $ 1,338,880 $ 1,229,341 Interest expense 1,256,747 1,145,693 1,097,137 1,151,592 1,215,940 Net interest income 275,750 273,200 219,971 187,288 13,401 Net servicing income Servicing and related income 141,356 141,670 140,435 127,224 122,583 Servicing and related expense 15,104 14,571 14,113 11,648 12,988 Net servicing income 126,252 127,099 126,322 115,576 109,595 Other income (loss) Net gains (losses) on investments and other 561,927 83,503 810,812 (2,010,426) 1,723,713 Net gains (losses) on derivatives (92,308) (388,785) (977,867) 2,215,680 (1,754,010) Other, net 13,959 15,812 7,398 19,339 27,438 Total other income (loss) 483,578 (289,470) (159,657) 224,593 (2,859) General and administrative expenses Compensation expense 38,393 36,583 37,297 33,955 34,453 Other general and administrative expenses 11,947 13,435 10,767 10,019 9,468 Total general and administrative expenses 50,340 50,018 48,064 43,974 43,921 Income (loss) before income taxes 835,240 60,811 138,572 483,483 76,216 Income taxes (7,823) 440 8,267 10,407 (6,135) Net income (loss) 843,063 60,371 130,305 473,076 82,351 Net income (loss) attributable to noncontrolling interests 10,618 3,272 6,081 (8,976) 15,906 Net income (loss) attributable to Annaly 832,445 57,099 124,224 482,052 66,445 Dividends on preferred stock (1) 41,127 37,260 37,157 38,704 41,628 Net income (loss) available (related) to common stockholders $ 791,318 $ 19,839 $ 87,067 $ 443,348 $ 24,817 Net income (loss) per share available (related) to common stockholders Basic $ 1.21 $ 0.03 $ 0.15 $ 0.78 $ 0.05 Diluted $ 1.20 $ 0.03 $ 0.15 $ 0.78 $ 0.05 Weighted average number of common shares outstanding Basic 656,335,974 620,208,712 587,149,704 569,201,592 515,729,658 Diluted 657,856,427 621,103,218 588,420,998 570,651,985 516,832,152 Other comprehensive income (loss) Net income (loss) $ 843,063 $ 60,371 $ 130,305 $ 473,076 $ 82,351 Unrealized gains (losses) on available-for-sale securities 113,281 33,559 164,877 (337,121) 428,955 Reclassification adjustment for net (gains) losses included in net income (loss) 2,378 13,797 65,403 31,642 15,769 Other comprehensive income (loss) 115,659 47,356 230,280 (305,479) 444,724 Comprehensive income (loss) 958,722 107,727 360,585 167,597 527,075 Comprehensive income (loss) attributable to noncontrolling interests 10,618 3,272 6,081 (8,976) 15,906 Comprehensive income (loss) attributable to Annaly 948,104 104,455 354,504 176,573 511,169 Dividends on preferred stock (1) 41,127 37,260 37,157 38,704 41,628 Comprehensive income (loss) attributable to common stockholders $ 906,977 $ 67,195 $ 317,347 $ 137,869 $ 469,541 ___________________ Detailed endnotes are included within the Appendix at the end of this presentation.

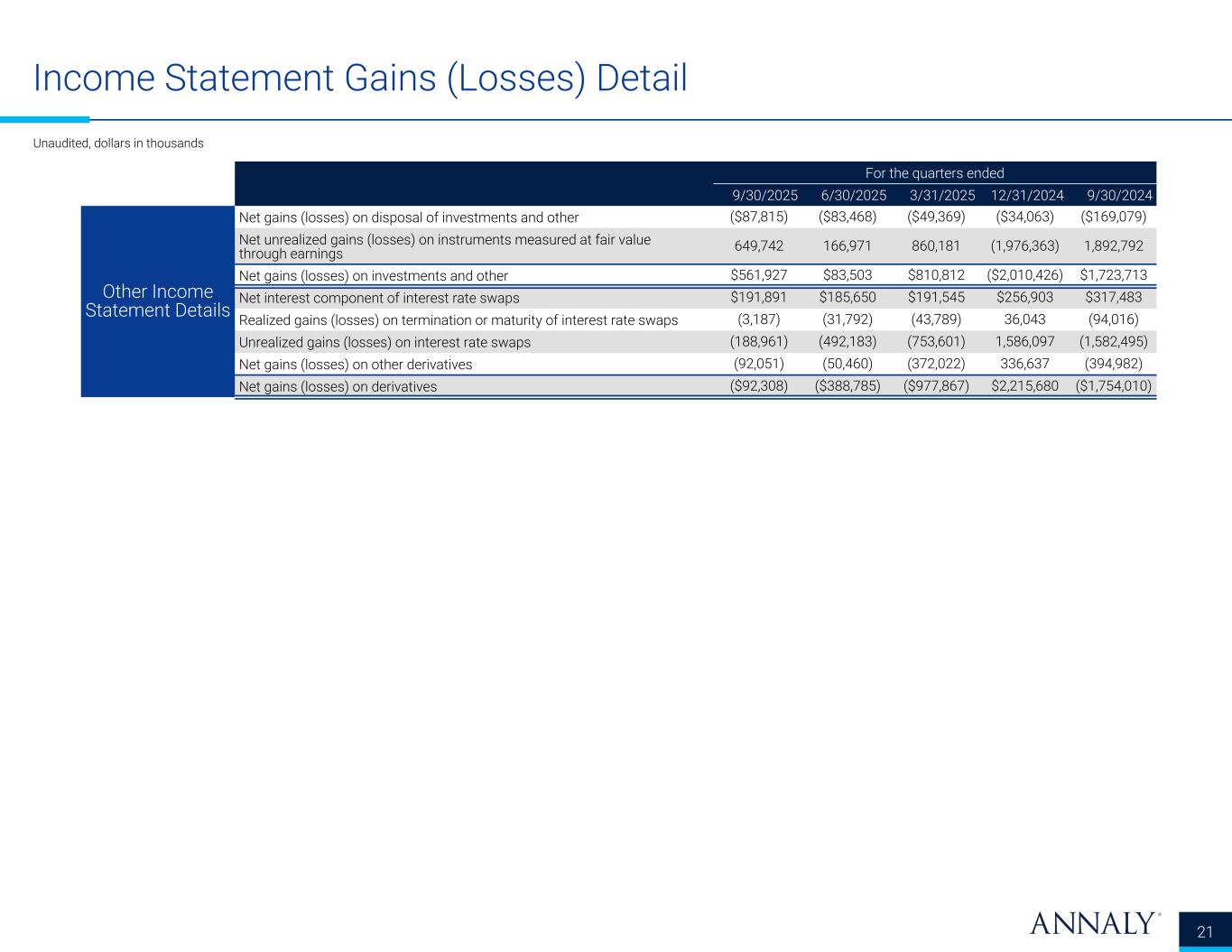

Income Statement Gains (Losses) Detail 21 Unaudited, dollars in thousands For the quarters ended 9/30/2025 6/30/2025 3/31/2025 12/31/2024 9/30/2024 Other Income Statement Details Net gains (losses) on disposal of investments and other ($87,815) ($83,468) ($49,369) ($34,063) ($169,079) Net unrealized gains (losses) on instruments measured at fair value through earnings 649,742 166,971 860,181 (1,976,363) 1,892,792 Net gains (losses) on investments and other $561,927 $83,503 $810,812 ($2,010,426) $1,723,713 Net interest component of interest rate swaps $191,891 $185,650 $191,545 $256,903 $317,483 Realized gains (losses) on termination or maturity of interest rate swaps (3,187) (31,792) (43,789) 36,043 (94,016) Unrealized gains (losses) on interest rate swaps (188,961) (492,183) (753,601) 1,586,097 (1,582,495) Net gains (losses) on other derivatives (92,051) (50,460) (372,022) 336,637 (394,982) Net gains (losses) on derivatives ($92,308) ($388,785) ($977,867) $2,215,680 ($1,754,010)

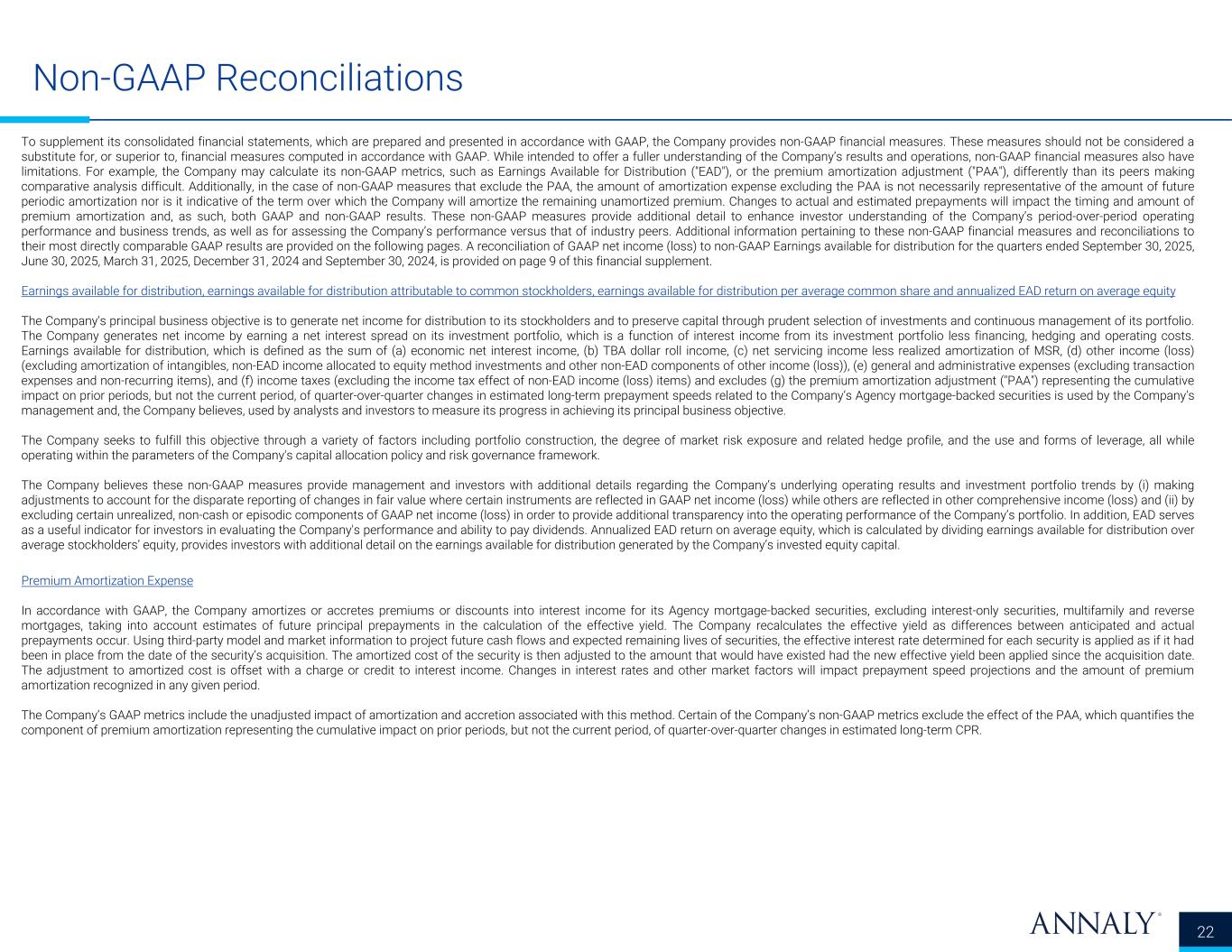

Non-GAAP Reconciliations 22 To supplement its consolidated financial statements, which are prepared and presented in accordance with GAAP, the Company provides non-GAAP financial measures. These measures should not be considered a substitute for, or superior to, financial measures computed in accordance with GAAP. While intended to offer a fuller understanding of the Company’s results and operations, non-GAAP financial measures also have limitations. For example, the Company may calculate its non-GAAP metrics, such as Earnings Available for Distribution ("EAD"), or the premium amortization adjustment ("PAA"), differently than its peers making comparative analysis difficult. Additionally, in the case of non-GAAP measures that exclude the PAA, the amount of amortization expense excluding the PAA is not necessarily representative of the amount of future periodic amortization nor is it indicative of the term over which the Company will amortize the remaining unamortized premium. Changes to actual and estimated prepayments will impact the timing and amount of premium amortization and, as such, both GAAP and non-GAAP results. These non-GAAP measures provide additional detail to enhance investor understanding of the Company’s period-over-period operating performance and business trends, as well as for assessing the Company’s performance versus that of industry peers. Additional information pertaining to these non-GAAP financial measures and reconciliations to their most directly comparable GAAP results are provided on the following pages. A reconciliation of GAAP net income (loss) to non-GAAP Earnings available for distribution for the quarters ended September 30, 2025, June 30, 2025, March 31, 2025, December 31, 2024 and September 30, 2024, is provided on page 9 of this financial supplement. Earnings available for distribution, earnings available for distribution attributable to common stockholders, earnings available for distribution per average common share and annualized EAD return on average equity The Company's principal business objective is to generate net income for distribution to its stockholders and to preserve capital through prudent selection of investments and continuous management of its portfolio. The Company generates net income by earning a net interest spread on its investment portfolio, which is a function of interest income from its investment portfolio less financing, hedging and operating costs. Earnings available for distribution, which is defined as the sum of (a) economic net interest income, (b) TBA dollar roll income, (c) net servicing income less realized amortization of MSR, (d) other income (loss) (excluding amortization of intangibles, non-EAD income allocated to equity method investments and other non-EAD components of other income (loss)), (e) general and administrative expenses (excluding transaction expenses and non-recurring items), and (f) income taxes (excluding the income tax effect of non-EAD income (loss) items) and excludes (g) the premium amortization adjustment ("PAA") representing the cumulative impact on prior periods, but not the current period, of quarter-over-quarter changes in estimated long-term prepayment speeds related to the Company’s Agency mortgage-backed securities is used by the Company's management and, the Company believes, used by analysts and investors to measure its progress in achieving its principal business objective. The Company seeks to fulfill this objective through a variety of factors including portfolio construction, the degree of market risk exposure and related hedge profile, and the use and forms of leverage, all while operating within the parameters of the Company's capital allocation policy and risk governance framework. The Company believes these non-GAAP measures provide management and investors with additional details regarding the Company’s underlying operating results and investment portfolio trends by (i) making adjustments to account for the disparate reporting of changes in fair value where certain instruments are reflected in GAAP net income (loss) while others are reflected in other comprehensive income (loss) and (ii) by excluding certain unrealized, non-cash or episodic components of GAAP net income (loss) in order to provide additional transparency into the operating performance of the Company’s portfolio. In addition, EAD serves as a useful indicator for investors in evaluating the Company's performance and ability to pay dividends. Annualized EAD return on average equity, which is calculated by dividing earnings available for distribution over average stockholders’ equity, provides investors with additional detail on the earnings available for distribution generated by the Company’s invested equity capital. Premium Amortization Expense In accordance with GAAP, the Company amortizes or accretes premiums or discounts into interest income for its Agency mortgage-backed securities, excluding interest-only securities, multifamily and reverse mortgages, taking into account estimates of future principal prepayments in the calculation of the effective yield. The Company recalculates the effective yield as differences between anticipated and actual prepayments occur. Using third-party model and market information to project future cash flows and expected remaining lives of securities, the effective interest rate determined for each security is applied as if it had been in place from the date of the security’s acquisition. The amortized cost of the security is then adjusted to the amount that would have existed had the new effective yield been applied since the acquisition date. The adjustment to amortized cost is offset with a charge or credit to interest income. Changes in interest rates and other market factors will impact prepayment speed projections and the amount of premium amortization recognized in any given period. The Company’s GAAP metrics include the unadjusted impact of amortization and accretion associated with this method. Certain of the Company’s non-GAAP metrics exclude the effect of the PAA, which quantifies the component of premium amortization representing the cumulative impact on prior periods, but not the current period, of quarter-over-quarter changes in estimated long-term CPR.

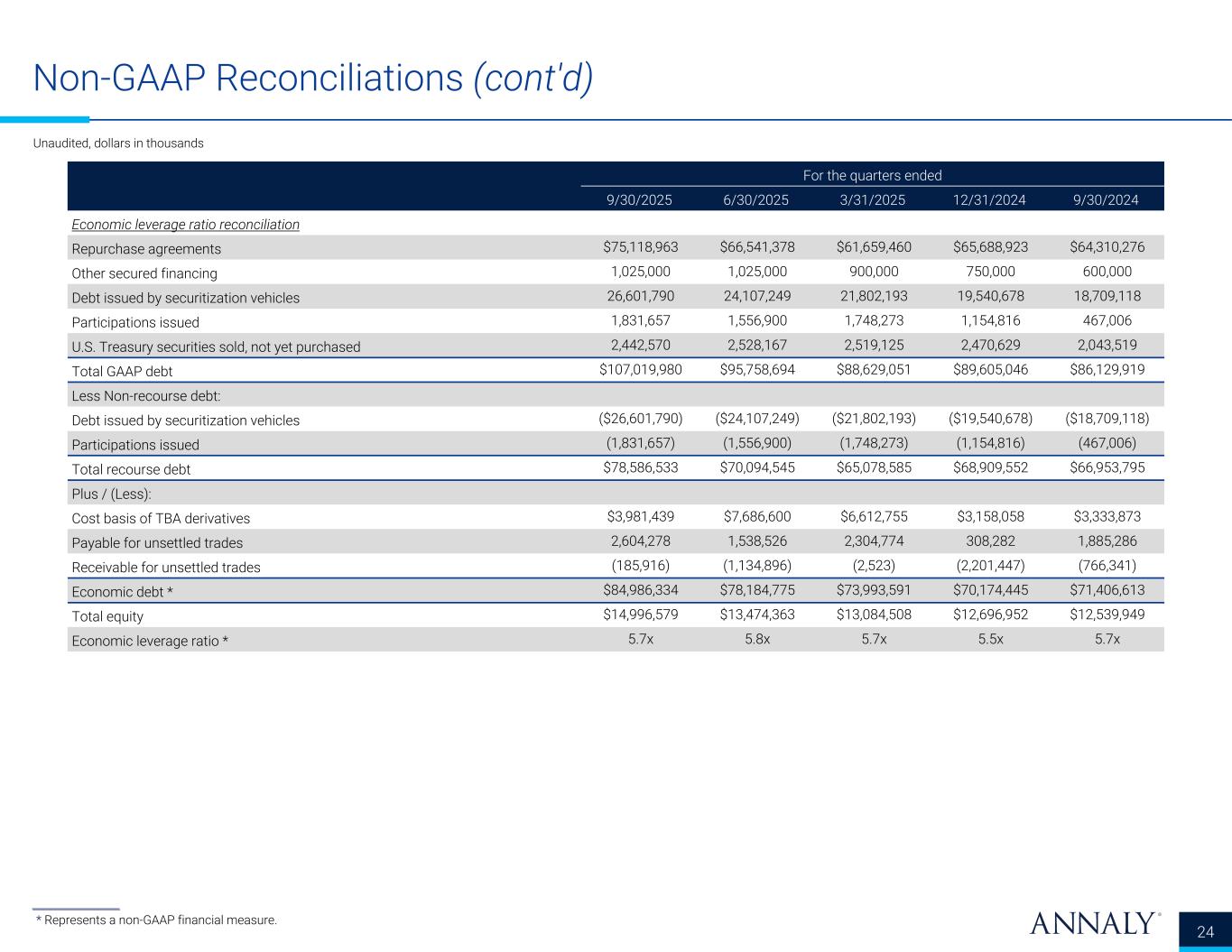

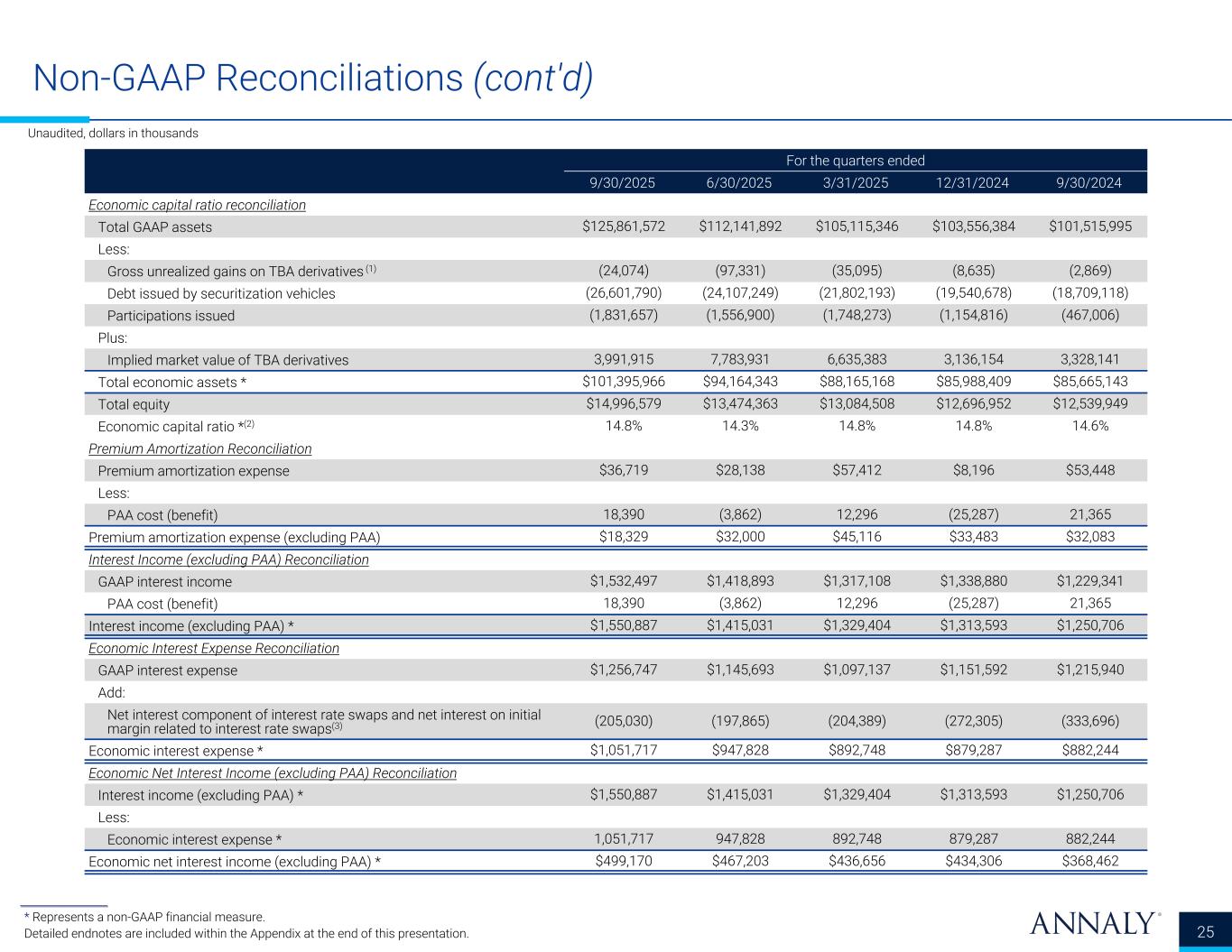

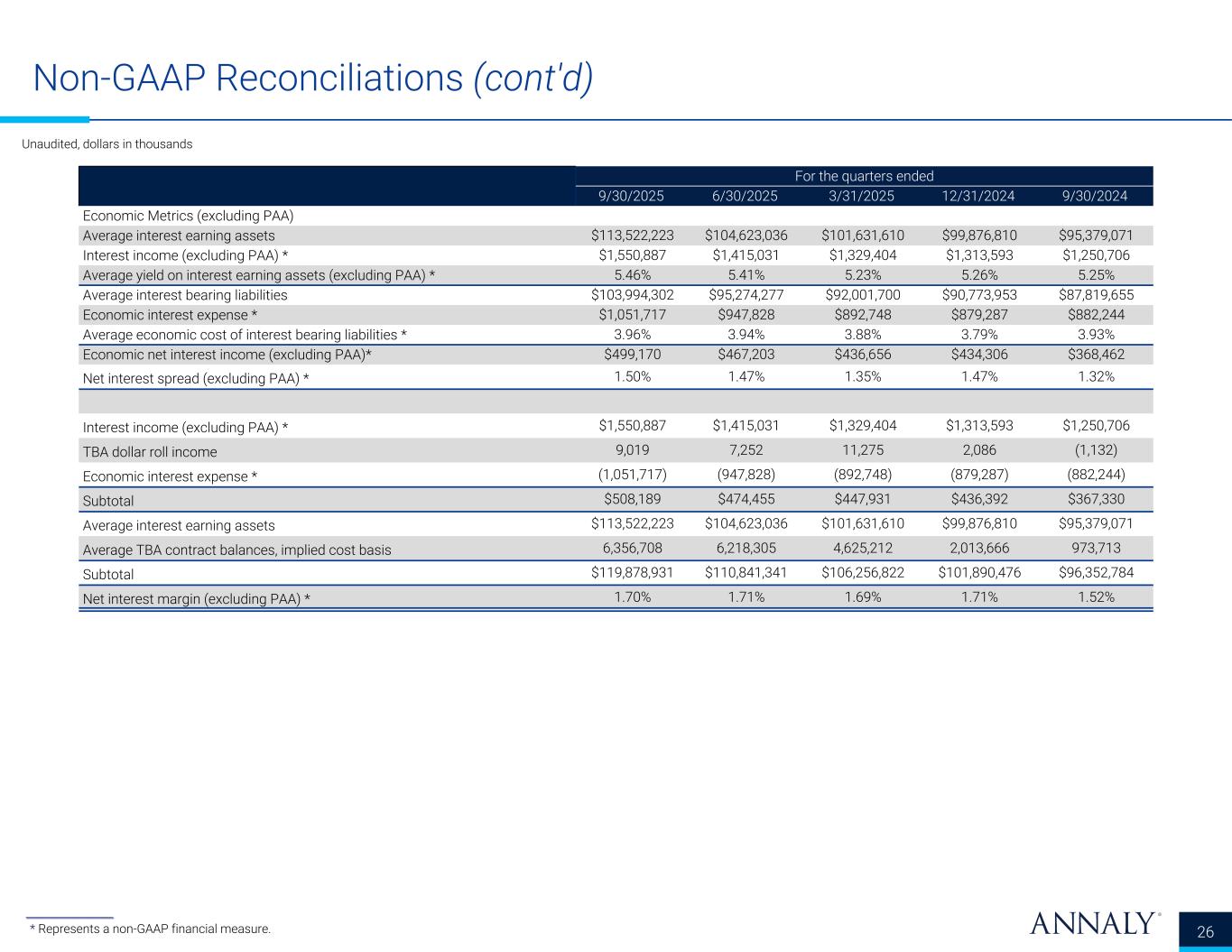

Non-GAAP Reconciliations (cont'd) 23 Economic leverage and economic capital ratios The Company uses capital coupled with borrowed funds to invest primarily in real estate related investments, earning the spread between the yield on its assets and the cost of its borrowings and hedging activities. The Company’s capital structure is designed to offer an efficient complement of funding sources to generate positive risk-adjusted returns for its stockholders while maintaining appropriate liquidity to support its business and meet the Company’s financial obligations under periods of market stress. To maintain its desired capital profile, the Company utilizes a mix of debt and equity funding. Debt funding may include the use of repurchase agreements, loans, securitizations, participations issued, lines of credit, asset backed lending facilities, corporate bond issuance, convertible bonds or other liabilities. Equity capital primarily consists of common and preferred stock. The Company’s economic leverage ratio is computed as the sum of recourse debt, cost basis of TBA derivatives outstanding, and net forward purchases (sales) of investments divided by total equity. Recourse debt consists of repurchase agreements, other secured financing, and U.S. Treasury securities sold, not yet purchased. Debt issued by securitization vehicles and participations issued are non-recourse to the Company and are excluded from economic leverage. Interest income (excluding PAA), economic interest expense and economic net interest income (excluding PAA) Interest income (excluding PAA) represents interest income excluding the effect of the PAA, and serves as the basis for deriving average yield on interest earning assets (excluding PAA), net interest spread (excluding PAA) and net interest margin (excluding PAA), which are discussed below. The Company believes this measure provides management and investors with additional detail to enhance their understanding of the Company’s operating results and trends by excluding the component of premium amortization expense representing the cumulative impact on prior periods, but not the current period, of quarter-over-quarter changes in estimated long-term prepayment speeds related to the Company’s Agency mortgage-backed securities (other than interest-only securities, multifamily and reverse mortgages), which can obscure underlying trends in the performance of the portfolio. Economic interest expense includes GAAP interest expense, the net interest component of interest rate swaps (which includes net interest on variation margin related to interest rate swaps) and net interest on initial margin related to interest rate swaps. The Company uses interest rate swaps to manage its exposure to changing interest rates on its repurchase agreements by economically hedging cash flows associated with these borrowings. Accordingly, adding the net interest component of interest rate swaps to interest expense, as computed in accordance with GAAP, reflects the total contractual interest expense and thus, provides investors with additional information about the cost of the Company's financing strategy. The Company may use market agreed coupon (“MAC”) interest rate swaps in which the Company may receive or make a payment at the time of entering into such interest rate swap to compensate for the off-market nature of such interest rate swap. In accordance with GAAP, upfront payments associated with MAC interest rate swaps are not reflected in the net interest component of interest rate swaps in the Company's Consolidated Statements of Comprehensive Income (Loss). Average yield on interest earning assets (excluding PAA), net interest spread (excluding PAA), net interest margin (excluding PAA) and average economic cost of interest bearing liabilities Net interest spread (excluding PAA), which is the difference between the average yield on interest earning assets (excluding PAA) and the average economic cost of interest bearing liabilities, which represents annualized economic interest expense divided by average interest bearing liabilities, and net interest margin (excluding PAA), which is calculated as the sum of interest income (excluding PAA) plus TBA dollar roll income less interest expense and the net interest component of interest rate swaps divided by the sum of average interest earning assets plus average TBA contract balances, provide management with additional measures of the Company’s profitability that management relies upon in monitoring the performance of the business.

Non-GAAP Reconciliations (cont'd) 24 Unaudited, dollars in thousands For the quarters ended 9/30/2025 6/30/2025 3/31/2025 12/31/2024 9/30/2024 Economic leverage ratio reconciliation Repurchase agreements $75,118,963 $66,541,378 $61,659,460 $65,688,923 $64,310,276 Other secured financing 1,025,000 1,025,000 900,000 750,000 600,000 Debt issued by securitization vehicles 26,601,790 24,107,249 21,802,193 19,540,678 18,709,118 Participations issued 1,831,657 1,556,900 1,748,273 1,154,816 467,006 U.S. Treasury securities sold, not yet purchased 2,442,570 2,528,167 2,519,125 2,470,629 2,043,519 Total GAAP debt $107,019,980 $95,758,694 $88,629,051 $89,605,046 $86,129,919 Less Non-recourse debt: Debt issued by securitization vehicles ($26,601,790) ($24,107,249) ($21,802,193) ($19,540,678) ($18,709,118) Participations issued (1,831,657) (1,556,900) (1,748,273) (1,154,816) (467,006) Total recourse debt $78,586,533 $70,094,545 $65,078,585 $68,909,552 $66,953,795 Plus / (Less): Cost basis of TBA derivatives $3,981,439 $7,686,600 $6,612,755 $3,158,058 $3,333,873 Payable for unsettled trades 2,604,278 1,538,526 2,304,774 308,282 1,885,286 Receivable for unsettled trades (185,916) (1,134,896) (2,523) (2,201,447) (766,341) Economic debt * $84,986,334 $78,184,775 $73,993,591 $70,174,445 $71,406,613 Total equity $14,996,579 $13,474,363 $13,084,508 $12,696,952 $12,539,949 Economic leverage ratio * 5.7x 5.8x 5.7x 5.5x 5.7x ___________________ * Represents a non-GAAP financial measure.

Non-GAAP Reconciliations (cont'd) 25 For the quarters ended 9/30/2025 6/30/2025 3/31/2025 12/31/2024 9/30/2024 Economic capital ratio reconciliation Total GAAP assets $125,861,572 $112,141,892 $105,115,346 $103,556,384 $101,515,995 Less: Gross unrealized gains on TBA derivatives (1) (24,074) (97,331) (35,095) (8,635) (2,869) Debt issued by securitization vehicles (26,601,790) (24,107,249) (21,802,193) (19,540,678) (18,709,118) Participations issued (1,831,657) (1,556,900) (1,748,273) (1,154,816) (467,006) Plus: Implied market value of TBA derivatives 3,991,915 7,783,931 6,635,383 3,136,154 3,328,141 Total economic assets * $101,395,966 $94,164,343 $88,165,168 $85,988,409 $85,665,143 Total equity $14,996,579 $13,474,363 $13,084,508 $12,696,952 $12,539,949 Economic capital ratio *(2) 14.8% 14.3% 14.8% 14.8% 14.6% Premium Amortization Reconciliation Premium amortization expense $36,719 $28,138 $57,412 $8,196 $53,448 Less: PAA cost (benefit) 18,390 (3,862) 12,296 (25,287) 21,365 Premium amortization expense (excluding PAA) $18,329 $32,000 $45,116 $33,483 $32,083 Interest Income (excluding PAA) Reconciliation GAAP interest income $1,532,497 $1,418,893 $1,317,108 $1,338,880 $1,229,341 PAA cost (benefit) 18,390 (3,862) 12,296 (25,287) 21,365 Interest income (excluding PAA) * $1,550,887 $1,415,031 $1,329,404 $1,313,593 $1,250,706 Economic Interest Expense Reconciliation GAAP interest expense $1,256,747 $1,145,693 $1,097,137 $1,151,592 $1,215,940 Add: Net interest component of interest rate swaps and net interest on initial margin related to interest rate swaps(3) (205,030) (197,865) (204,389) (272,305) (333,696) Economic interest expense * $1,051,717 $947,828 $892,748 $879,287 $882,244 Economic Net Interest Income (excluding PAA) Reconciliation Interest income (excluding PAA) * $1,550,887 $1,415,031 $1,329,404 $1,313,593 $1,250,706 Less: Economic interest expense * 1,051,717 947,828 892,748 879,287 882,244 Economic net interest income (excluding PAA) * $499,170 $467,203 $436,656 $434,306 $368,462 Unaudited, dollars in thousands ___________________ * Represents a non-GAAP financial measure. Detailed endnotes are included within the Appendix at the end of this presentation.

Non-GAAP Reconciliations (cont'd) 26 Unaudited, dollars in thousands For the quarters ended 9/30/2025 6/30/2025 3/31/2025 12/31/2024 9/30/2024 Economic Metrics (excluding PAA) Average interest earning assets $113,522,223 $104,623,036 $101,631,610 $99,876,810 $95,379,071 Interest income (excluding PAA) * $1,550,887 $1,415,031 $1,329,404 $1,313,593 $1,250,706 Average yield on interest earning assets (excluding PAA) * 5.46% 5.41% 5.23% 5.26% 5.25% Average interest bearing liabilities $103,994,302 $95,274,277 $92,001,700 $90,773,953 $87,819,655 Economic interest expense * $1,051,717 $947,828 $892,748 $879,287 $882,244 Average economic cost of interest bearing liabilities * 3.96% 3.94% 3.88% 3.79% 3.93% Economic net interest income (excluding PAA)* $499,170 $467,203 $436,656 $434,306 $368,462 Net interest spread (excluding PAA) * 1.50% 1.47% 1.35% 1.47% 1.32% Interest income (excluding PAA) * $1,550,887 $1,415,031 $1,329,404 $1,313,593 $1,250,706 TBA dollar roll income 9,019 7,252 11,275 2,086 (1,132) Economic interest expense * (1,051,717) (947,828) (892,748) (879,287) (882,244) Subtotal $508,189 $474,455 $447,931 $436,392 $367,330 Average interest earning assets $113,522,223 $104,623,036 $101,631,610 $99,876,810 $95,379,071 Average TBA contract balances, implied cost basis 6,356,708 6,218,305 4,625,212 2,013,666 973,713 Subtotal $119,878,931 $110,841,341 $106,256,822 $101,890,476 $96,352,784 Net interest margin (excluding PAA) * 1.70% 1.71% 1.69% 1.71% 1.52% ___________________ * Represents a non-GAAP financial measure.

Page 6 (1) Economic interest expense is comprised of GAAP interest expense, the net interest component of interest rate swaps, and net interest on initial margin related to interest rate swaps, which is reported in Other, net in the Company’s Consolidated Statements of Comprehensive Income (Loss). Net interest on variation margin related to interest rate swaps is included in the Net interest component of interest rate swaps in the Company’s Consolidated Statements of Comprehensive Income (Loss). (2) Net of dividends on preferred stock. The quarter ended September 30, 2025 includes cumulative and undeclared dividends of $3.7 million on the Company's Series J Preferred Stock as of September 30, 2025. Page 7 (1) Includes dividend equivalents on share-based awards. (2) Annualized GAAP return (loss) on average equity annualizes realized and unrealized gains and (losses) which may not be indicative of full year performance, unannualized GAAP return (loss) on average equity is 5.92%, 0.45%, 1.01%, 3.75%, and 0.69% for the quarters ended September 30, 2025, June 30, 2025, March 31, 2025, December 31, 2024 and September 30, 2024, respectively. Page 8 (1) Interest on initial margin related to interest rate swaps is reported in Other, net in the Company’s Consolidated Statements of Comprehensive Income (Loss). Page 9 (1) Includes write-downs or recoveries on investments which are reported in Other, net in the Company's Consolidated Statements of Comprehensive Income (Loss). (2) The adjustment to add back Net (gains) losses on derivatives does not include the net interest component of interest rate swaps which is reflected in earnings available for distribution. The net interest component of interest rate swaps totaled $191.9 million, $185.7 million, $191.5 million, $256.9 million and $317.5 million for the quarters ended September 30, 2025, June 30, 2025, March 31, 2025, December 31, 2024 and September 30, 2024, respectively. (3) The Company excludes non-EAD (income) loss allocated to equity method investments, which represents the unrealized (gains) losses allocated to equity interests in a portfolio of MSR, which is reported in Other, net in the Company’s Consolidated Statements of Comprehensive Income (Loss). (4) All quarters presented include costs incurred in connection with securitizations of residential whole loans. (5) TBA dollar roll income represents a component of Net gains (losses) on derivatives. (6) MSR amortization utilizes purchase date cash flow assumptions and actual unpaid principal balances and is calculated as the difference between projected MSR yield income and net servicing income for the period. (7) The quarter ended September 30, 2025 includes cumulative and undeclared dividends of $3.7 million on the Company's Series J Preferred Stock as of September 30, 2025. Page 10 (1) Other includes the impact of net proceeds from the issuance, repurchase or redemption of common and preferred stock, stock compensation expense, the settlement of stock-based awards in satisfaction of withholding tax requirements and other timing differences on share count related to any of the aforementioned items. Endnotes Page 3 (1) Net of dividends on preferred stock. The quarter ended September 30, 2025 includes cumulative and undeclared dividends of $3.7 million on the Company's Series J Preferred Stock as of September 30, 2025. (2) Annualized GAAP return (loss) on average equity annualizes realized and unrealized gains and (losses) which may not be indicative of full year performance, unannualized GAAP return (loss) on average equity is 5.92% and 0.45% for the quarters ended September 30, 2025 and June 30, 2025, respectively. (3) GAAP leverage is computed as the sum of repurchase agreements, other secured financing, debt issued by securitization vehicles, participations issued and U.S. Treasury securities sold, not yet purchased divided by total equity. Economic leverage is computed as the sum of recourse debt, cost basis of to-be-announced ("TBA") derivatives outstanding, and net forward purchases (sales) of investments divided by total equity. Recourse debt consists of repurchase agreements, other secured financing, and U.S. Treasury securities sold, not yet purchased. Debt issued by securitization vehicles and participations issued are non-recourse to the Company and are excluded from economic leverage. (4) GAAP capital ratio is computed as total equity divided by total assets. Economic capital ratio is computed as total equity divided by total economic assets. Total economic assets include the implied market value of TBA derivatives and are net of debt issued by securitization vehicles and participations issued. (5) Net interest margin represents interest income less interest expense divided by average interest earning assets. Net interest margin (excluding PAA) represents the sum of the Company's interest income (excluding PAA) plus TBA dollar roll income less interest expense and the net interest component of interest rate swaps divided by the sum of average interest earning assets plus average TBA contract balances. (6) Average yield on interest earning assets represents annualized interest income divided by average interest earning assets. Average interest earning assets reflects the average amortized cost of our investments during the period. Average yield on interest earning assets (excluding PAA) is calculated using annualized interest income (excluding PAA). (7) Average GAAP cost of interest bearing liabilities represents annualized interest expense divided by average interest bearing liabilities. Average interest bearing liabilities reflects the average balances during the period. Average economic cost of interest bearing liabilities represents annualized economic interest expense divided by average interest bearing liabilities. Page 5 (1) Consists of common stock, additional paid-in capital, accumulated other comprehensive income (loss) and accumulated deficit. (2) Utilizes an actual/360 factor. (3) The average and period-end rates are net of reverse repurchase agreements. Without netting reverse repurchase agreements, the average rate and the period-end rate was unchanged for each period. (4) Measures total notional balances of interest rate swaps, interest rate swaptions (excluding receiver swaptions), futures and U.S. Treasury securities sold, not yet purchased, at fair value relative to repurchase agreements, other secured financing, cost basis of TBA derivatives outstanding and net forward purchases (sales) of investments; excludes MSR and the effects of term financing, both of which serve to reduce interest rate risk. Additionally, the hedge ratio does not take into consideration differences in duration between assets and liabilities. 27

Page 19 (1) Derived from the audited consolidated financial statements at December 31, 2024. (2) 6.95% Series F Fixed-to-Floating Rate Cumulative Redeemable Preferred Stock - Includes 28,800,000 shares authorized, issued and outstanding. 6.50% Series G Fixed-to-Floating Rate Cumulative Redeemable Preferred Stock - Includes 17,000,000 shares authorized, issued and outstanding. 6.75% Series I Preferred Stock - Includes 17,700,000 shares authorized, issued and outstanding, 8.875% Series J Cumulative Redeemable Preferred Stock - Includes 11,500,000 shares authorized, and 11,000,000 issued and outstanding. (3) Includes 1,456,750,000 shares authorized. Includes 681,052,317 shares issued and outstanding at September 30, 2025; 642,076,127 shares issued and outstanding at June 30, 2025; 602,338,286 shares issued and outstanding at March 31, 2025; 578,357,118 shares issued and outstanding at December 31, 2024; and 558,047,743 shares issued and outstanding at September 30, 2024. Page 20 (1) The quarter ended September 30, 2025 includes cumulative and undeclared dividends of $3.7 million on the Company's Series J Preferred Stock as of September 30, 2025. Page 25 (1) Included in Derivative assets in the Company’s Consolidated Statements of Financial Condition. (2) Economic capital ratio is computed as total equity divided by total economic assets. (3) Interest on initial margin related to interest rate swaps is reported in Other, net in the Company’s Consolidated Statements of Comprehensive Income (Loss). Endnotes (cont'd) 28 Page 12 (1) Includes other, net, general and administrative expenses and income taxes. (2) Includes other, net (excluding non-EAD items), MSR amortization (a component of net gains (losses) on investments and other), general and administrative expenses (excluding transaction related expenses) and income taxes (excluding non-EAD income tax). Page 13 (1) Excludes TBA contracts with a notional value of $4.2 billion. (2) Includes fixed-rate collateralized mortgage obligations with an estimated fair value of $2.7 million. (3) Weighted by current face value. (4) Weighted by current notional value. Page 14 (1) Included in Other assets in the Company’s Consolidated Statements of Financial Condition. (2) Weighted by estimated fair value. Page 15 (1) Investment characteristics exclude the impact of interest-only securities. (2) Represents the 3 month voluntary prepayment rate. Page 16 (1) Current notional is presented net of receiver swaps. (2) As of September 30, 2025, 2% and 98% of the Company's interest rate swaps were linked to the Federal funds rate and the Secured Overnight Financing Rate, respectively. (3) The weighted average years to maturity of payer interest rate swaps is offset by the weighted average years to maturity of receiver interest rate swaps. As such, the net weighted average years to maturity for each maturity bucket may fall outside of the range listed. (4) Approximately 1% of the total repurchase agreements and other secured financing have a remaining maturity over one year. (5) Determined based on estimated weighted average lives of the underlying debt instruments. Page 17 (1) Interest rate and MBS spread sensitivity are based on results from third party models in conjunction with internally derived inputs. Actual results could differ materially from these estimates. (2) Scenarios include Residential Investment Securities, residential mortgage loans, MSR and derivative instruments. (3) Net asset value (“NAV”) represents book value of common equity.