January 28, 2026 Fourth Quarter 2025 Investor Presentation

Important Notices 2 This presentation is issued by Annaly Capital Management, Inc. ("Annaly"), an internally-managed, publicly traded company that has elected to be taxed as a real estate investment trust for federal income tax purposes, and is being furnished in connection with Annaly’s Fourth Quarter 2025 earnings release. This presentation is provided for investors in Annaly for informational purposes only and is not an offer to sell, or a solicitation of an offer to buy, any security or instrument. Forward-Looking Statements This presentation, other written or oral communications, and our public documents to which we refer contain or incorporate by reference certain forward-looking statements which are based on various assumptions (some of which are beyond our control) and may be identified by reference to a future period or periods or by the use of forward-looking terminology, such as “may,” “will,” “believe,” “expect,” “anticipate,” “continue,” “illustrative” or similar terms or variations on those terms or the negative of those terms. Such statements include those relating to the Company’s future performance, macro outlook, the interest rate and credit environments, tax reform and future opportunities. Actual results could differ materially from those set forth in forward-looking statements due to a variety of factors, including, but not limited to, changes in interest rates; changes in the yield curve; changes in prepayment rates; the availability of mortgage-backed securities (“MBS”) and other securities for purchase; the availability of financing and, if available, the terms of any financing; changes in the market value of the Company’s assets; changes in business conditions and the general economy; the Company’s ability to grow its residential credit business; the Company's ability to grow its mortgage servicing rights business; credit risks related to the Company’s investments in credit risk transfer securities and residential mortgage-backed securities and related residential mortgage credit assets; risks related to investments in mortgage servicing rights; the Company’s ability to consummate any contemplated investment opportunities; changes in government regulations or policy affecting the Company’s business; the Company’s ability to maintain its qualification as a REIT for U.S. federal income tax purposes; the Company’s ability to maintain its exemption from registration under the Investment Company Act of 1940; and operational risks or risk management failures by us or critical third parties, including cybersecurity incidents. For a discussion of the risks and uncertainties which could cause actual results to differ from those contained in the forward-looking statements, see “Risk Factors” in our most recent Annual Report on Form 10-K and any subsequent Quarterly Reports on Form 10-Q. The Company does not undertake, and specifically disclaims any obligation, to publicly release the result of any revisions which may be made to any forward-looking statements to reflect the occurrence of anticipated or unanticipated events or circumstances after the date of such statements, except as required by law. We use our website (www.annaly.com) and LinkedIn account (www.linkedin.com/company/annaly-capital-management) as channels of distribution of company information. The information we post through these channels may be deemed material. Accordingly, investors should monitor these channels, in addition to following our press releases, SEC filings and public conference calls and webcasts. In addition, you may automatically receive email alerts and other information about Annaly when you enroll your email address by visiting the "News & Insights" section of our website, then clicking on "Subscribe" and completing the email notification form. Our website, any alerts and social media channels are not incorporated into this document. Past performance is no guarantee of future results. There is no guarantee that any investment strategy referenced herein will work under all market conditions. There is no guarantee that illustrative returns will occur. Prior to making any investment decision, you should evaluate your ability to invest for the long-term, especially during periods of downturns in the market. You alone assume the responsibility of evaluating the merits and risks associated with any potential investment or investment strategy referenced herein. To the extent that this material contains reference to any past specific investment recommendations or strategies which were or would have been profitable to any person, it should not be assumed that recommendations made in the future will be profitable or will equal the performance of such past investment recommendations or strategies. The information contained herein is not intended to provide, and should not be relied upon for accounting, legal or tax advice or investment recommendations for Annaly or any of its affiliates. Regardless of source, information is believed to be reliable for purposes used herein, but Annaly makes no representation or warranty as to the accuracy or completeness thereof and does not take any responsibility for information obtained from sources outside of Annaly. Certain information contained in the presentation discusses general market activity, industry or sector trends, or other broad-based economic, market or political conditions and should not be construed as research or investment advice. Non-GAAP Financial Measures This presentation includes certain non-GAAP financial measures, including earnings available for distribution. We believe the non-GAAP financial measures are useful for management, investors, analysts, and other interested parties in evaluating our performance but should not be viewed in isolation and are not a substitute for financial measures computed in accordance with U.S. generally accepted accounting principles (“GAAP”). In addition, we may calculate our non-GAAP metrics, such as earnings available for distribution, or the premium amortization adjustment, differently than our peers making comparative analysis difficult.

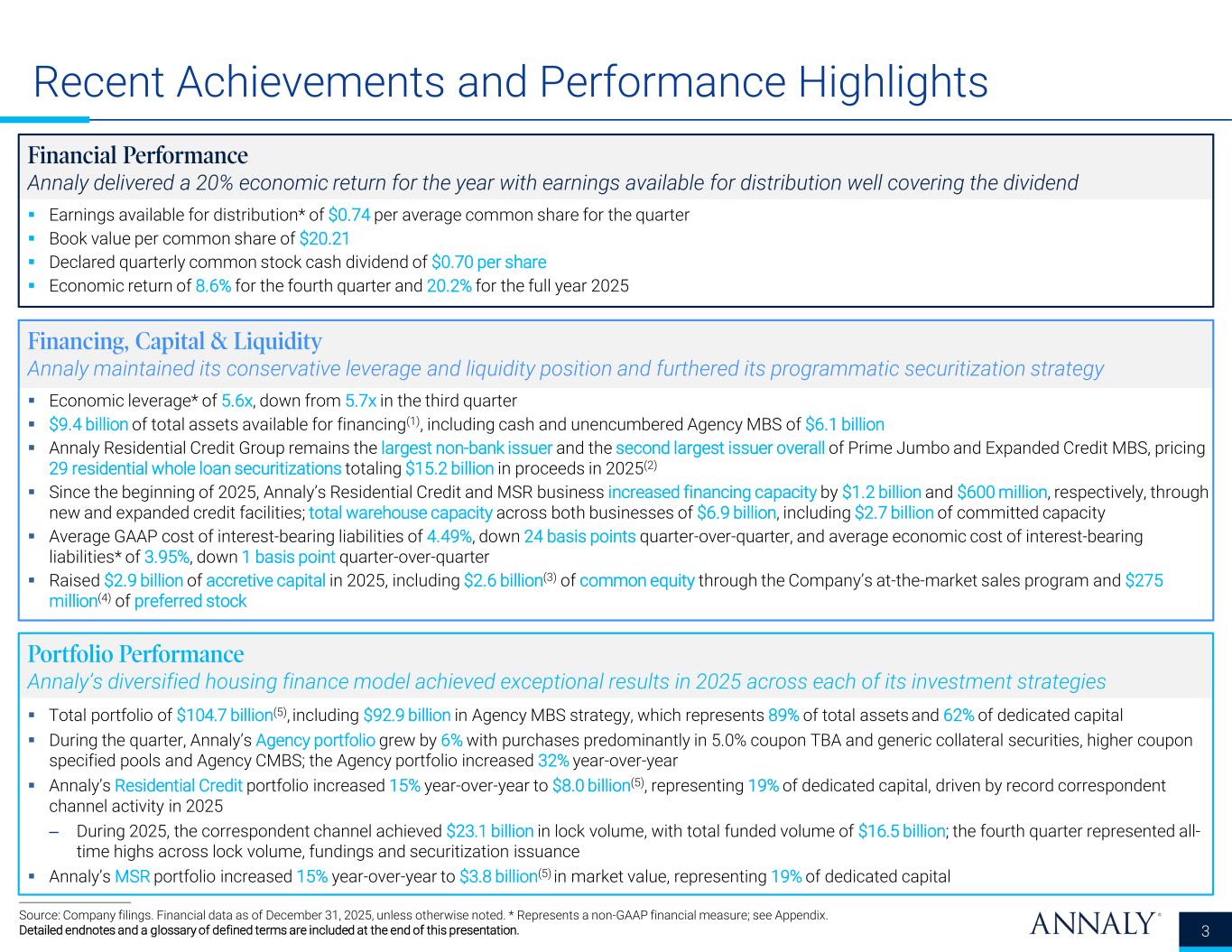

Recent Achievements and Performance Highlights Source: Company filings. Financial data as of December 31, 2025, unless otherwise noted. * Represents a non-GAAP financial measure; see Appendix. Detailed endnotes and a glossary of defined terms are included at the end of this presentation. Financial Performance Annaly delivered a 20% economic return for the year with earnings available for distribution well covering the dividend Earnings available for distribution* of $0.74 per average common share for the quarter Book value per common share of $20.21 Declared quarterly common stock cash dividend of $0.70 per share Economic return of 8.6% for the fourth quarter and 20.2% for the full year 2025 Financing, Capital & Liquidity Annaly maintained its conservative leverage and liquidity position and furthered its programmatic securitization strategy Economic leverage* of 5.6x, down from 5.7x in the third quarter $9.4 billion of total assets available for financing(1), including cash and unencumbered Agency MBS of $6.1 billion Annaly Residential Credit Group remains the largest non-bank issuer and the second largest issuer overall of Prime Jumbo and Expanded Credit MBS, pricing 29 residential whole loan securitizations totaling $15.2 billion in proceeds in 2025(2) Since the beginning of 2025, Annaly’s Residential Credit and MSR business increased financing capacity by $1.2 billion and $600 million, respectively, through new and expanded credit facilities; total warehouse capacity across both businesses of $6.9 billion, including $2.7 billion of committed capacity Average GAAP cost of interest-bearing liabilities of 4.49%, down 24 basis points quarter-over-quarter, and average economic cost of interest-bearing liabilities* of 3.95%, down 1 basis point quarter-over-quarter Raised $2.9 billion of accretive capital in 2025, including $2.6 billion(3) of common equity through the Company’s at-the-market sales program and $275 million(4) of preferred stock Portfolio Performance Annaly’s diversified housing finance model achieved exceptional results in 2025 across each of its investment strategies Total portfolio of $104.7 billion(5), including $92.9 billion in Agency MBS strategy, which represents 89% of total assets and 62% of dedicated capital During the quarter, Annaly’s Agency portfolio grew by 6% with purchases predominantly in 5.0% coupon TBA and generic collateral securities, higher coupon specified pools and Agency CMBS; the Agency portfolio increased 32% year-over-year Annaly’s Residential Credit portfolio increased 15% year-over-year to $8.0 billion(5), representing 19% of dedicated capital, driven by record correspondent channel activity in 2025 – During 2025, the correspondent channel achieved $23.1 billion in lock volume, with total funded volume of $16.5 billion; the fourth quarter represented all- time highs across lock volume, fundings and securitization issuance Annaly’s MSR portfolio increased 15% year-over-year to $3.8 billion(5) in market value, representing 19% of dedicated capital 3

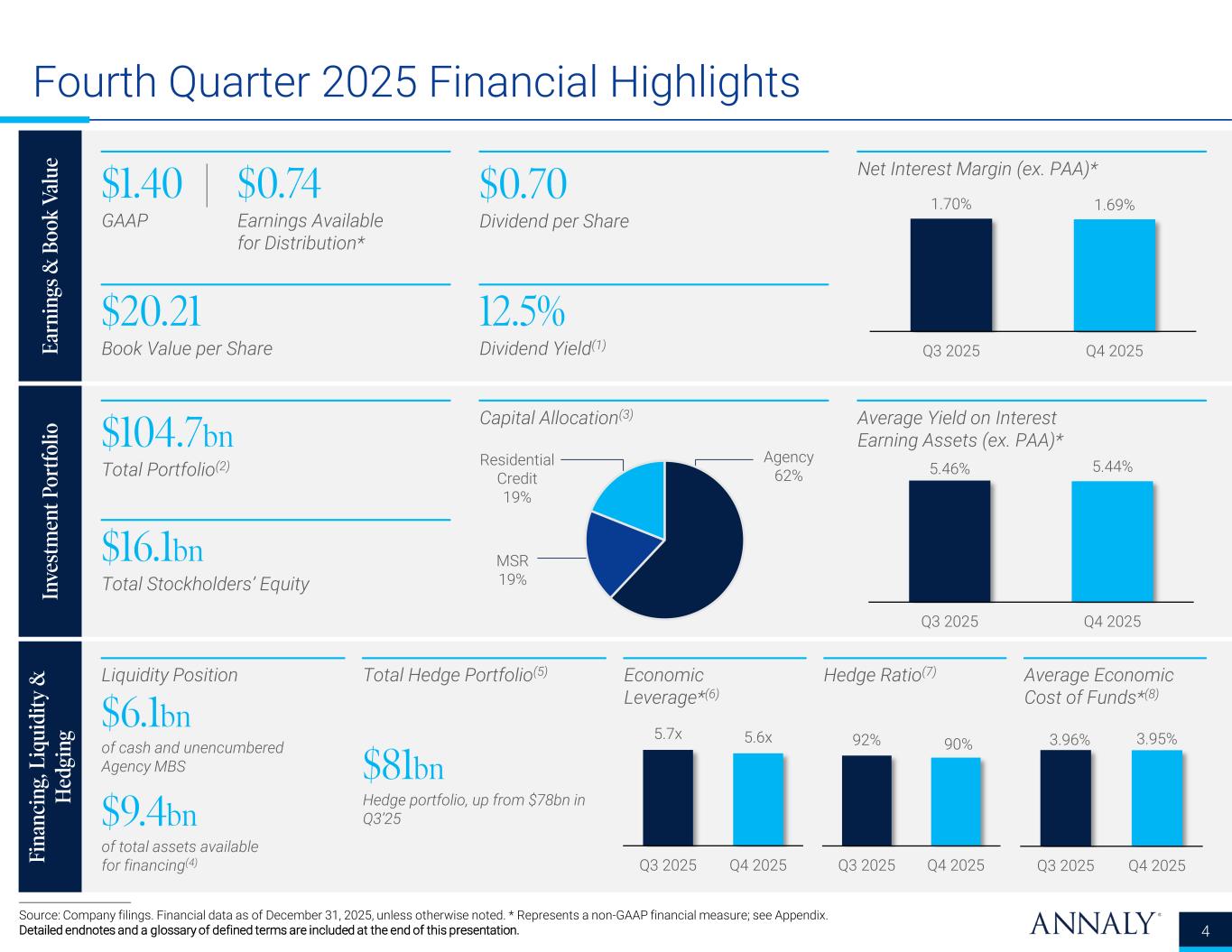

Fourth Quarter 2025 Financial Highlights Ea rn in gs & B oo k Va lu e In ve st m en t P or tf ol io Fi na nc in g, L iq ui di ty & H ed gi ng $1.40 | GAAP $0.74 Earnings Available for Distribution* $20.21 Book Value per Share 12.5% Dividend Yield(1) $0.70 Dividend per Share Net Interest Margin (ex. PAA)* $104.7bn Total Portfolio(2) $16.1bn Total Stockholders’ Equity Capital Allocation(3) Average Yield on Interest Earning Assets (ex. PAA)* Liquidity Position $6.1bn of cash and unencumbered Agency MBS $9.4bn of total assets available for financing(4) Total Hedge Portfolio(5) $81bn Hedge portfolio, up from $78bn in Q3’25 Economic Leverage*(6) Hedge Ratio(7) Average Economic Cost of Funds*(8) Source: Company filings. Financial data as of December 31, 2025, unless otherwise noted. * Represents a non-GAAP financial measure; see Appendix. Detailed endnotes and a glossary of defined terms are included at the end of this presentation. 4 Agency 62% MSR 19% Residential Credit 19% 5.46% 5.44% Q3 2025 Q4 2025 5.7x 5.6x Q3 2025 Q4 2025 92% 90% Q3 2025 Q4 2025 1.70% 1.69% Q3 2025 Q4 2025 3.96% 3.95% Q3 2025 Q4 2025

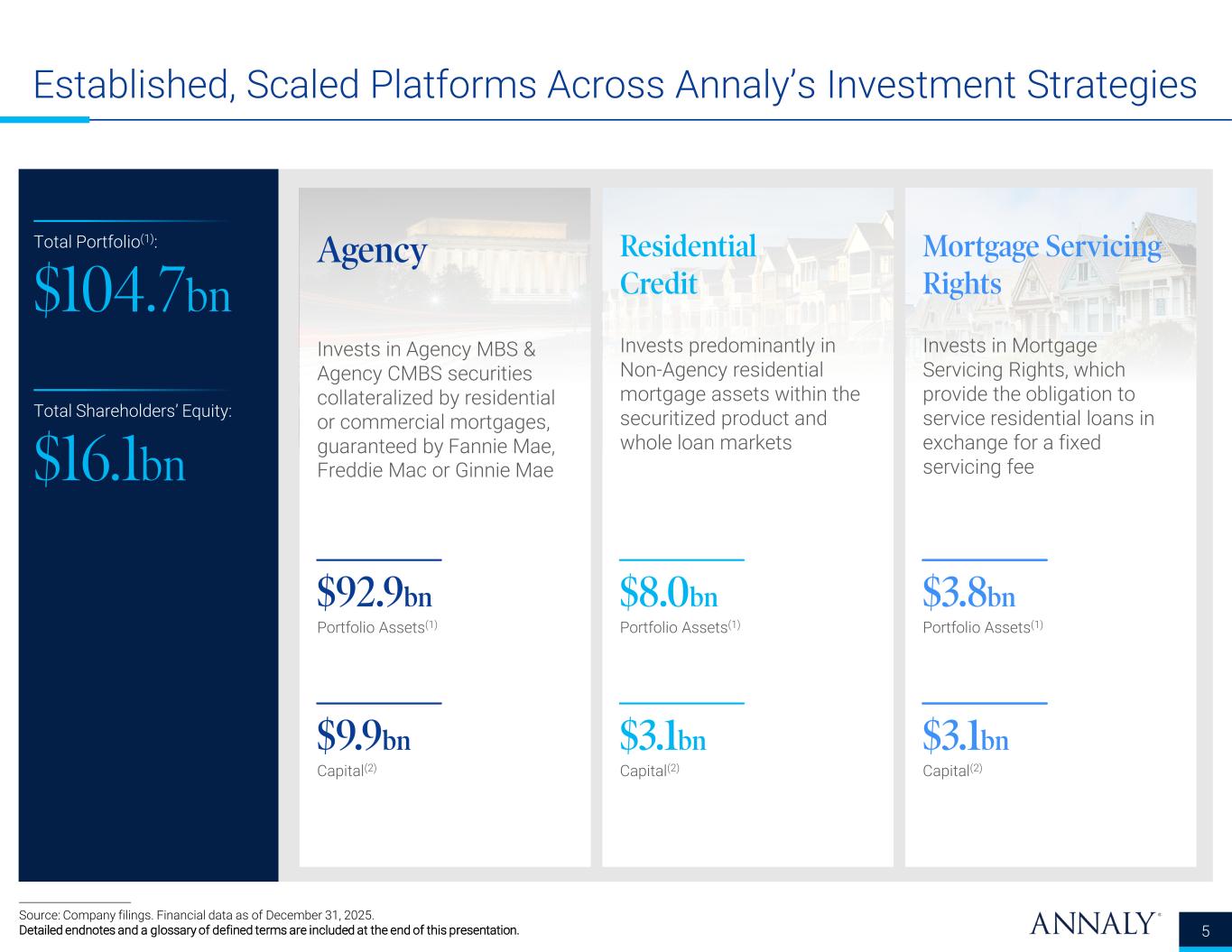

Established, Scaled Platforms Across Annaly’s Investment Strategies 5 Source: Company filings. Financial data as of December 31, 2025. Detailed endnotes and a glossary of defined terms are included at the end of this presentation. Agency Invests in Agency MBS & Agency CMBS securities collateralized by residential or commercial mortgages, guaranteed by Fannie Mae, Freddie Mac or Ginnie Mae $9.9bn Capital(2) $92.9bn Portfolio Assets(1) $3.1bn Capital(2) $8.0bn Portfolio Assets(1) Residential Credit Invests predominantly in Non-Agency residential mortgage assets within the securitized product and whole loan markets Mortgage Servicing Rights Invests in Mortgage Servicing Rights, which provide the obligation to service residential loans in exchange for a fixed servicing fee $3.1bn Capital(2) $3.8bn Portfolio Assets(1) Total Shareholders’ Equity: $16.1bn Total Portfolio(1): $104.7bn

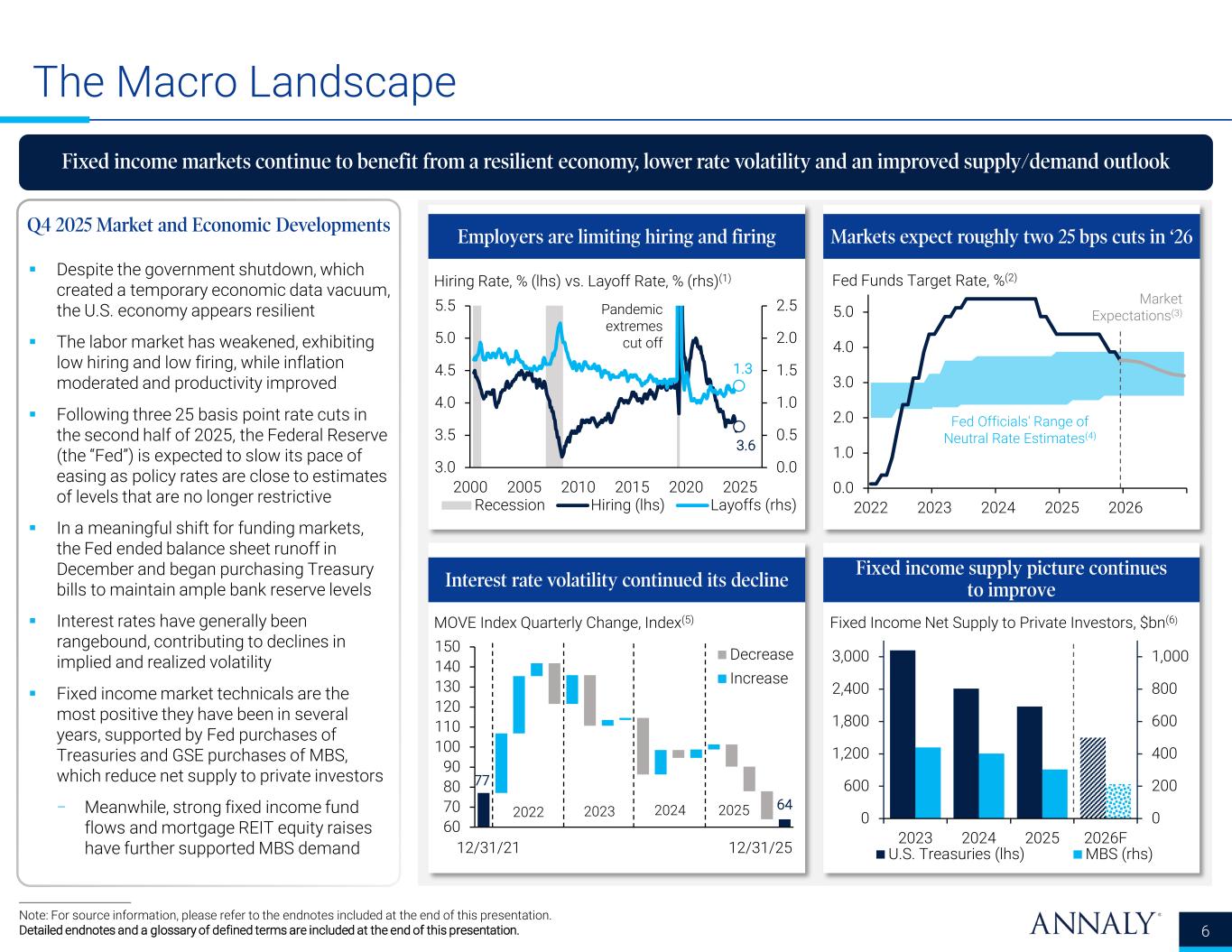

Q4 2025 Market and Economic Developments The Macro Landscape Note: For source information, please refer to the endnotes included at the end of this presentation. Detailed endnotes and a glossary of defined terms are included at the end of this presentation. Fixed income markets continue to benefit from a resilient economy, lower rate volatility and an improved supply/demand outlook 6 Despite the government shutdown, which created a temporary economic data vacuum, the U.S. economy appears resilient The labor market has weakened, exhibiting low hiring and low firing, while inflation moderated and productivity improved Following three 25 basis point rate cuts in the second half of 2025, the Federal Reserve (the “Fed”) is expected to slow its pace of easing as policy rates are close to estimates of levels that are no longer restrictive In a meaningful shift for funding markets, the Fed ended balance sheet runoff in December and began purchasing Treasury bills to maintain ample bank reserve levels Interest rates have generally been rangebound, contributing to declines in implied and realized volatility Fixed income market technicals are the most positive they have been in several years, supported by Fed purchases of Treasuries and GSE purchases of MBS, which reduce net supply to private investors − Meanwhile, strong fixed income fund flows and mortgage REIT equity raises have further supported MBS demand Interest rate volatility continued its decline Fixed income supply picture continues to improve Employers are limiting hiring and firing Markets expect roughly two 25 bps cuts in ‘26 3.6 1.3 0.0 0.5 1.0 1.5 2.0 2.5 3.0 3.5 4.0 4.5 5.0 5.5 2000 2005 2010 2015 2020 2025 Recession Hiring (lhs) Layoffs (rhs) Hiring Rate, % (lhs) vs. Layoff Rate, % (rhs)(1) Pandemic extremes cut off 77 64 60 70 80 90 100 110 120 130 140 150 Decrease Increase MOVE Index Quarterly Change, Index(5) 12/31/21 12/31/25 2022 2023 2024 2025 0 200 400 600 800 1,000 0 600 1,200 1,800 2,400 3,000 2023 2024 2025 2026F U.S. Treasuries (lhs) MBS (rhs) Fixed Income Net Supply to Private Investors, $bn(6) 0.0 1.0 2.0 3.0 4.0 5.0 2022 2023 2024 2025 2026 Fed Funds Target Rate, %(2) Market Expectations(3) Fed Officials' Range of Neutral Rate Estimates(4)

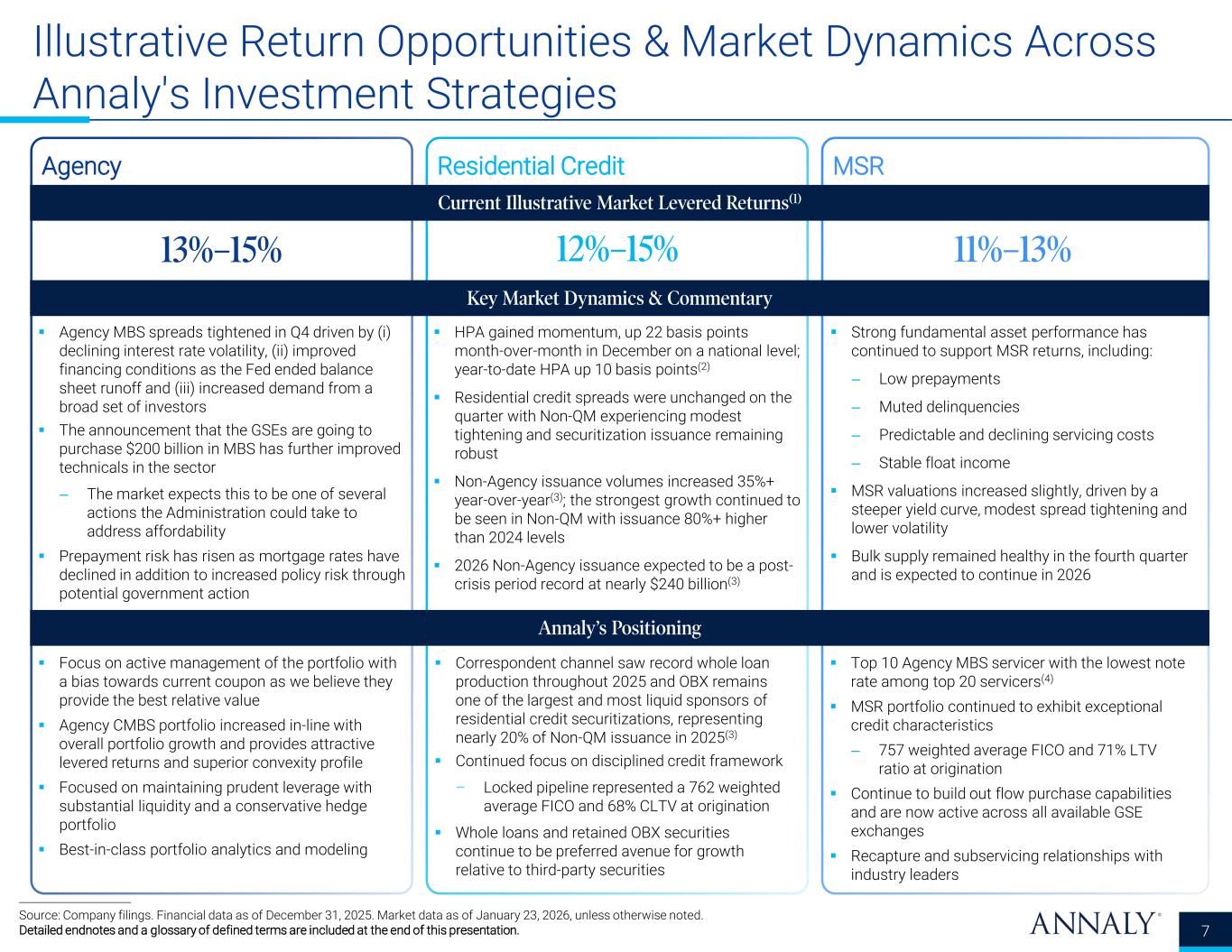

MSRResidential CreditAgency Key Market Dynamics & Commentary Current Illustrative Market Levered Returns(1) Illustrative Return Opportunities & Market Dynamics Across Annaly's Investment Strategies Source: Company filings. Financial data as of December 31, 2025. Market data as of January 23, 2026, unless otherwise noted. Detailed endnotes and a glossary of defined terms are included at the end of this presentation. Agency MBS spreads tightened in Q4 driven by (i) declining interest rate volatility, (ii) improved financing conditions as the Fed ended balance sheet runoff and (iii) increased demand from a broad set of investors The announcement that the GSEs are going to purchase $200 billion in MBS has further improved technicals in the sector – The market expects this to be one of several actions the Administration could take to address affordability Prepayment risk has risen as mortgage rates have declined in addition to increased policy risk through potential government action HPA gained momentum, up 22 basis points month-over-month in December on a national level; year-to-date HPA up 10 basis points(2) Residential credit spreads were unchanged on the quarter with Non-QM experiencing modest tightening and securitization issuance remaining robust Non-Agency issuance volumes increased 35%+ year-over-year(3); the strongest growth continued to be seen in Non-QM with issuance 80%+ higher than 2024 levels 2026 Non-Agency issuance expected to be a post- crisis period record at nearly $240 billion(3) Strong fundamental asset performance has continued to support MSR returns, including: – Low prepayments – Muted delinquencies – Predictable and declining servicing costs – Stable float income MSR valuations increased slightly, driven by a steeper yield curve, modest spread tightening and lower volatility Bulk supply remained healthy in the fourth quarter and is expected to continue in 2026 13%–15% 12%–15% 11%–13% Top 10 Agency MBS servicer with the lowest note rate among top 20 servicers(4) MSR portfolio continued to exhibit exceptional credit characteristics – 757 weighted average FICO and 71% LTV ratio at origination Continue to build out flow purchase capabilities and are now active across all available GSE exchanges Recapture and subservicing relationships with industry leaders Correspondent channel saw record whole loan production throughout 2025 and OBX remains one of the largest and most liquid sponsors of residential credit securitizations, representing nearly 20% of Non-QM issuance in 2025(3) Continued focus on disciplined credit framework – Locked pipeline represented a 762 weighted average FICO and 68% CLTV at origination Whole loans and retained OBX securities continue to be preferred avenue for growth relative to third-party securities Focus on active management of the portfolio with a bias towards current coupon as we believe they provide the best relative value Agency CMBS portfolio increased in-line with overall portfolio growth and provides attractive levered returns and superior convexity profile Focused on maintaining prudent leverage with substantial liquidity and a conservative hedge portfolio Best-in-class portfolio analytics and modeling 7 Annaly’s Positioning

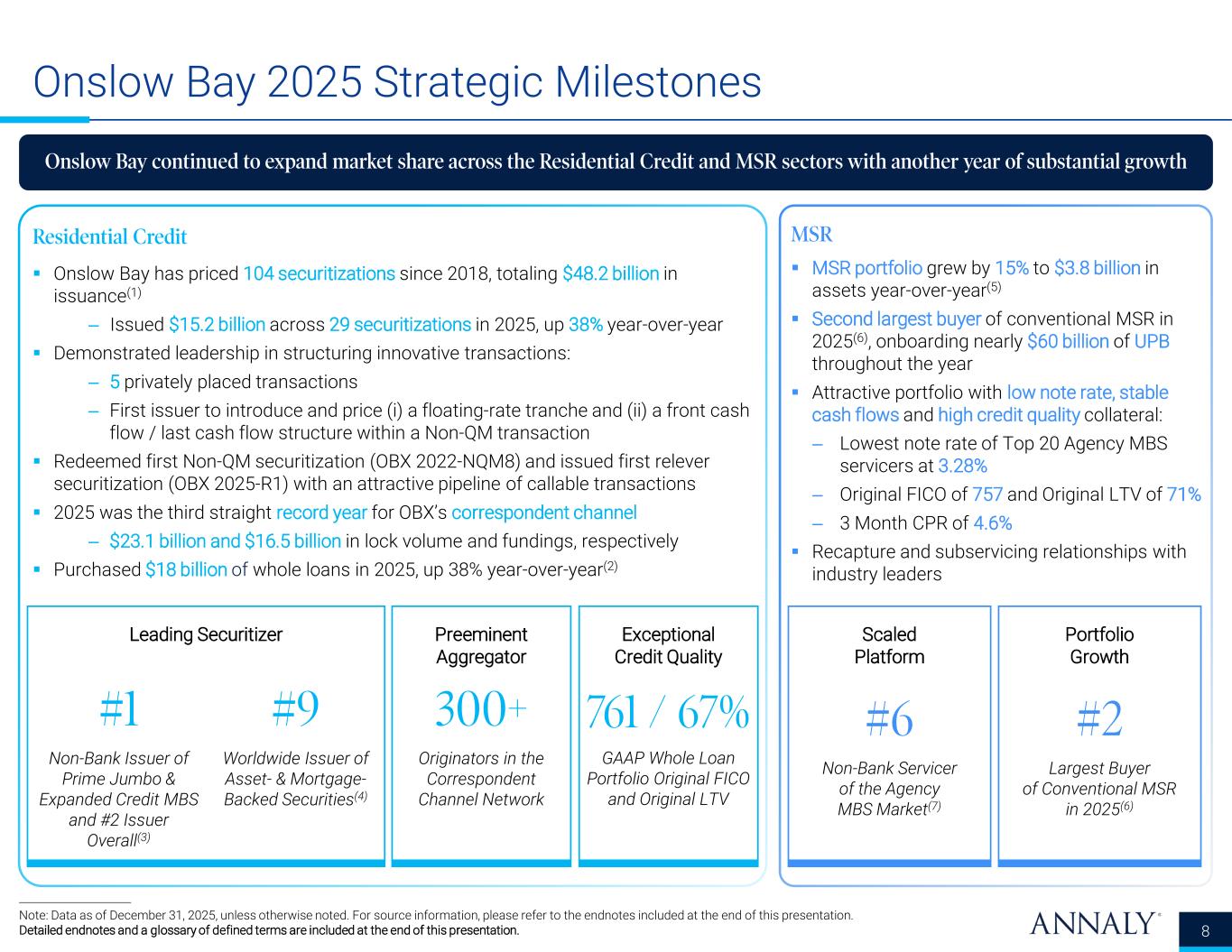

Onslow Bay 2025 Strategic Milestones Onslow Bay continued to expand market share across the Residential Credit and MSR sectors with another year of substantial growth Note: Data as of December 31, 2025, unless otherwise noted. For source information, please refer to the endnotes included at the end of this presentation. Detailed endnotes and a glossary of defined terms are included at the end of this presentation. 8 Key Milestones Across Our Housing Finance Expansion Strategy Residential Credit Onslow Bay has priced 104 securitizations since 2018, totaling $48.2 billion in issuance(1) – Issued $15.2 billion across 29 securitizations in 2025, up 38% year-over-year Demonstrated leadership in structuring innovative transactions: – 5 privately placed transactions – First issuer to introduce and price (i) a floating-rate tranche and (ii) a front cash flow / last cash flow structure within a Non-QM transaction Redeemed first Non-QM securitization (OBX 2022-NQM8) and issued first relever securitization (OBX 2025-R1) with an attractive pipeline of callable transactions 2025 was the third straight record year for OBX’s correspondent channel – $23.1 billion and $16.5 billion in lock volume and fundings, respectively Purchased $18 billion of whole loans in 2025, up 38% year-over-year(2) MSR MSR portfolio grew by 15% to $3.8 billion in assets year-over-year(5) Second largest buyer of conventional MSR in 2025(6), onboarding nearly $60 billion of UPB throughout the year Attractive portfolio with low note rate, stable cash flows and high credit quality collateral: – Lowest note rate of Top 20 Agency MBS servicers at 3.28% – Original FICO of 757 and Original LTV of 71% – 3 Month CPR of 4.6% Recapture and subservicing relationships with industry leaders Preeminent Aggregator 300+ Originators in the Correspondent Channel Network Exceptional Credit Quality 761 / 67% GAAP Whole Loan Portfolio Original FICO and Original LTV Scaled Platform #6 Non-Bank Servicer of the Agency MBS Market(7) Portfolio Growth #2 Largest Buyer of Conventional MSR in 2025(6) Leading Securitizer #1 Non-Bank Issuer of Prime Jumbo & Expanded Credit MBS and #2 Issuer Overall(3) #9 Worldwide Issuer of Asset- & Mortgage- Backed Securities(4)

Business Update

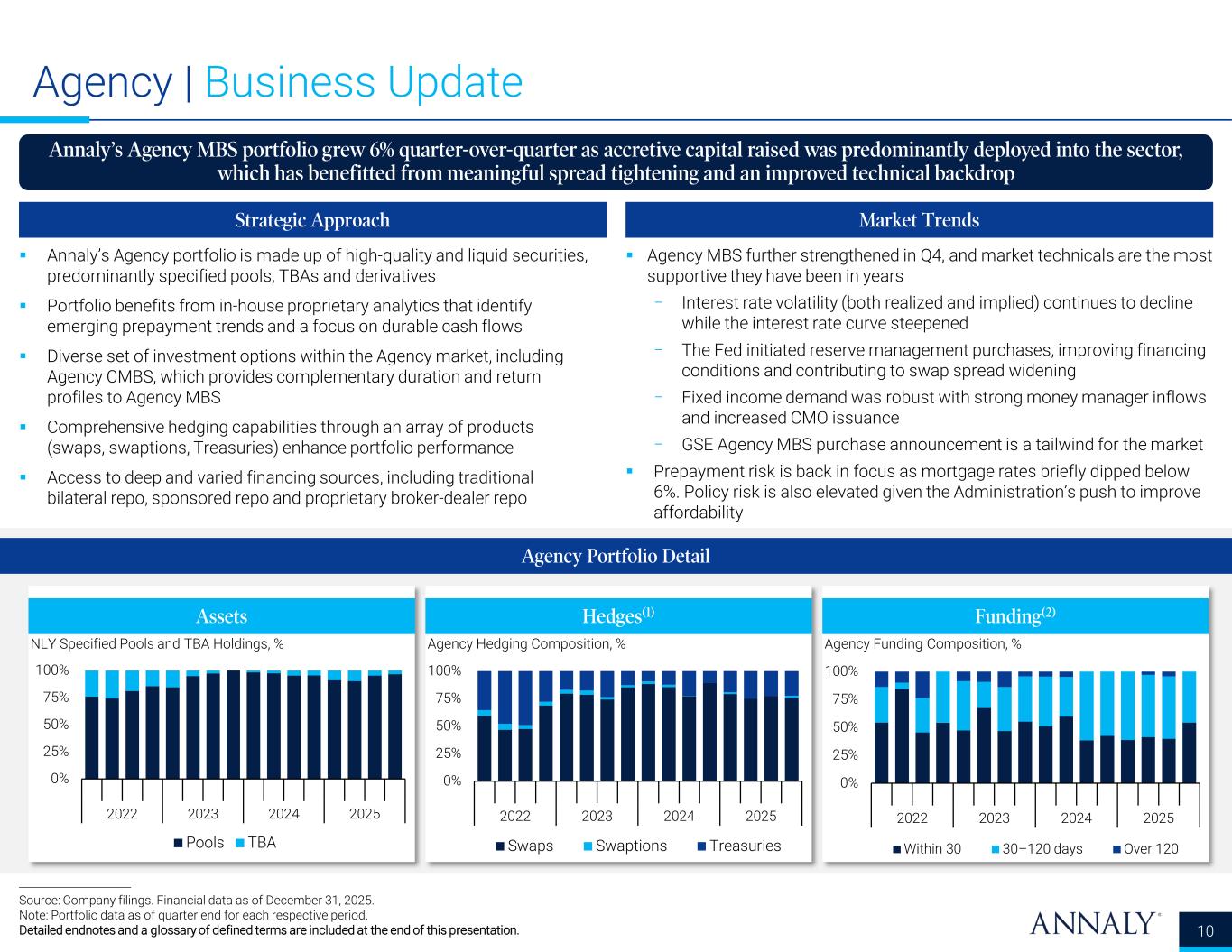

Annaly’s Agency portfolio is made up of high-quality and liquid securities, predominantly specified pools, TBAs and derivatives Portfolio benefits from in-house proprietary analytics that identify emerging prepayment trends and a focus on durable cash flows Diverse set of investment options within the Agency market, including Agency CMBS, which provides complementary duration and return profiles to Agency MBS Comprehensive hedging capabilities through an array of products (swaps, swaptions, Treasuries) enhance portfolio performance Access to deep and varied financing sources, including traditional bilateral repo, sponsored repo and proprietary broker-dealer repo Agency | Business Update Annaly’s Agency MBS portfolio grew 6% quarter-over-quarter as accretive capital raised was predominantly deployed into the sector, which has benefitted from meaningful spread tightening and an improved technical backdrop 10 Source: Company filings. Financial data as of December 31, 2025. Note: Portfolio data as of quarter end for each respective period. Detailed endnotes and a glossary of defined terms are included at the end of this presentation. Agency Portfolio Detail Assets Hedges(1) Funding(2) Strategic Approach Agency MBS further strengthened in Q4, and market technicals are the most supportive they have been in years − Interest rate volatility (both realized and implied) continues to decline while the interest rate curve steepened − The Fed initiated reserve management purchases, improving financing conditions and contributing to swap spread widening − Fixed income demand was robust with strong money manager inflows and increased CMO issuance − GSE Agency MBS purchase announcement is a tailwind for the market Prepayment risk is back in focus as mortgage rates briefly dipped below 6%. Policy risk is also elevated given the Administration’s push to improve affordability Market Trends 0% 25% 50% 75% 100% 2022 2023 2024 2025 Pools TBA NLY Specified Pools and TBA Holdings, % 0% 25% 50% 75% 100% 2022 2023 2024 2025 Swaps Swaptions Treasuries Agency Hedging Composition, % 0% 25% 50% 75% 100% 2022 2023 2024 2025 Within 30 30–120 days Over 120 Agency Funding Composition, %

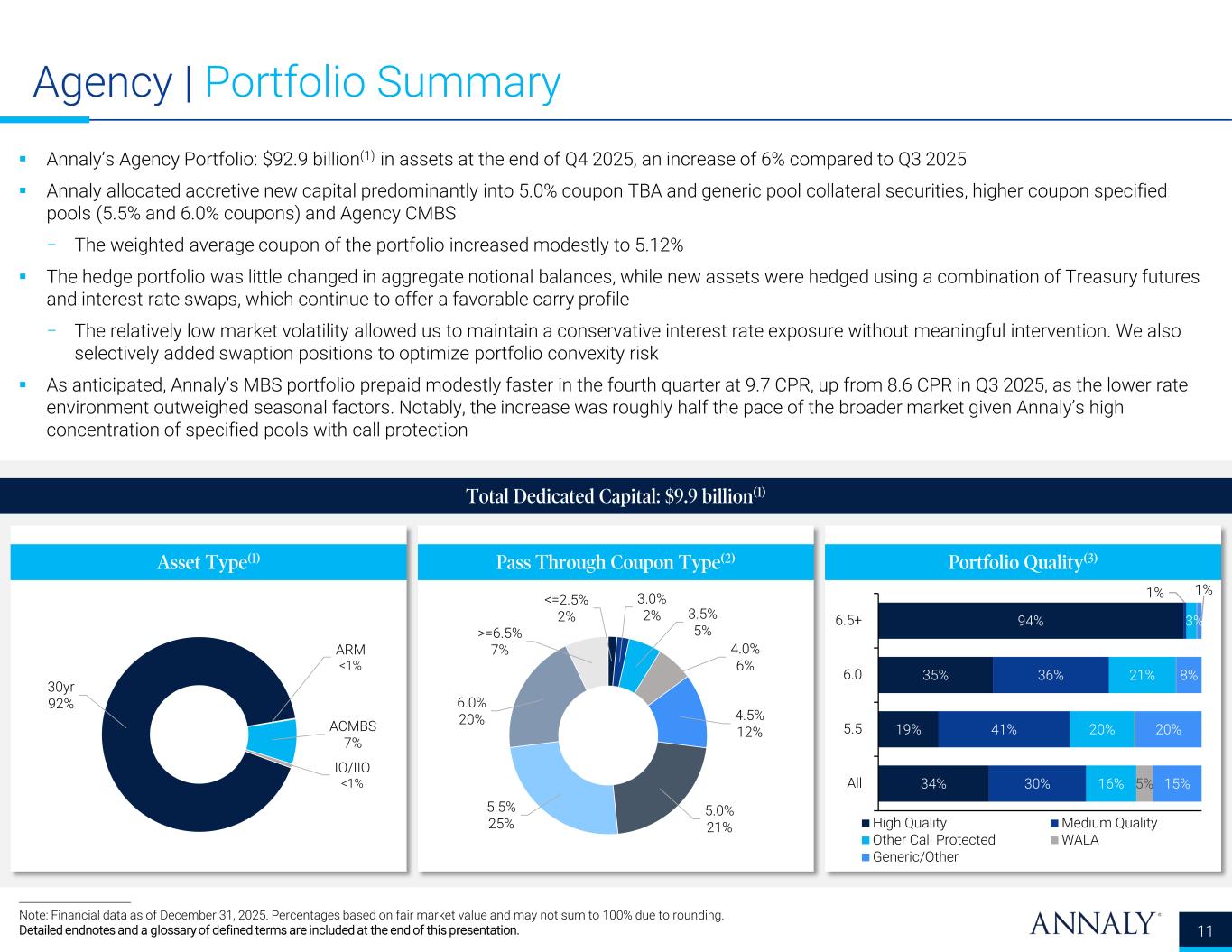

Agency | Portfolio Summary 11 Total Dedicated Capital: $9.9 billion(1) Note: Financial data as of December 31, 2025. Percentages based on fair market value and may not sum to 100% due to rounding. Detailed endnotes and a glossary of defined terms are included at the end of this presentation. Annaly’s Agency Portfolio: $92.9 billion(1) in assets at the end of Q4 2025, an increase of 6% compared to Q3 2025 Annaly allocated accretive new capital predominantly into 5.0% coupon TBA and generic pool collateral securities, higher coupon specified pools (5.5% and 6.0% coupons) and Agency CMBS − The weighted average coupon of the portfolio increased modestly to 5.12% The hedge portfolio was little changed in aggregate notional balances, while new assets were hedged using a combination of Treasury futures and interest rate swaps, which continue to offer a favorable carry profile − The relatively low market volatility allowed us to maintain a conservative interest rate exposure without meaningful intervention. We also selectively added swaption positions to optimize portfolio convexity risk As anticipated, Annaly’s MBS portfolio prepaid modestly faster in the fourth quarter at 9.7 CPR, up from 8.6 CPR in Q3 2025, as the lower rate environment outweighed seasonal factors. Notably, the increase was roughly half the pace of the broader market given Annaly’s high concentration of specified pools with call protection Asset Type(1) Pass Through Coupon Type(2) Portfolio Quality(3) 34% 19% 35% 94% 30% 41% 36% 1% 16% 20% 21% 3% 5% 15% 20% 8% 1% All 5.5 6.0 6.5+ High Quality Medium Quality Other Call Protected WALA Generic/Other <=2.5% 2% 3.0% 2% 3.5% 5% 4.0% 6% 4.5% 12% 5.0% 21% 5.5% 25% 6.0% 20% >=6.5% 7% 30yr 92% ARM <1% ACMBS 7% IO/IIO <1%

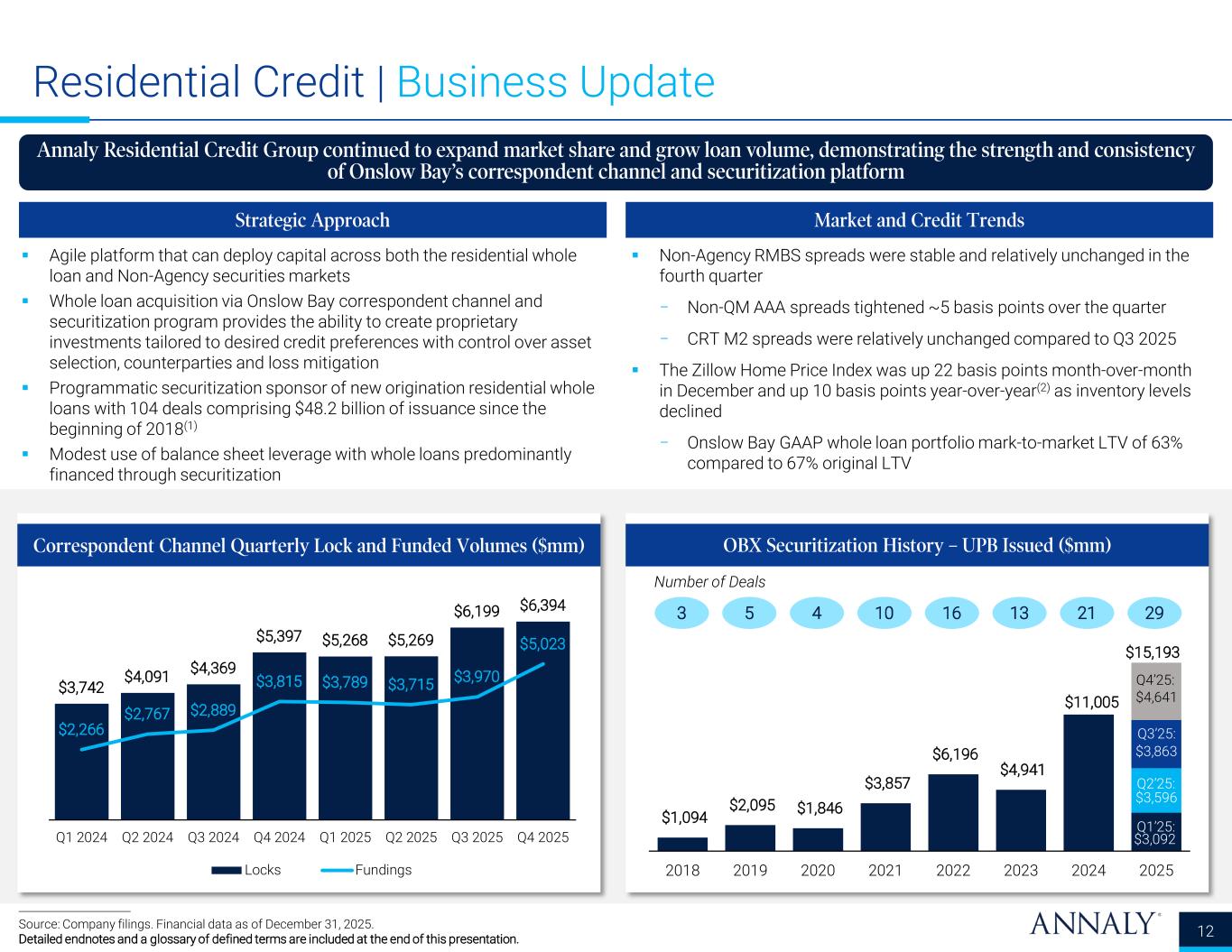

$3,092 $3,596 $3,863 $4,641 $1,094 $2,095 $1,846 $3,857 $6,196 $4,941 $11,005 $15,193 2018 2019 2020 2021 2022 2023 2024 2025 Q1’25: Q2’25: Q3’25: Q4’25: Residential Credit | Business Update Annaly Residential Credit Group continued to expand market share and grow loan volume, demonstrating the strength and consistency of Onslow Bay’s correspondent channel and securitization platform 12Source: Company filings. Financial data as of December 31, 2025. Detailed endnotes and a glossary of defined terms are included at the end of this presentation. Agile platform that can deploy capital across both the residential whole loan and Non-Agency securities markets Whole loan acquisition via Onslow Bay correspondent channel and securitization program provides the ability to create proprietary investments tailored to desired credit preferences with control over asset selection, counterparties and loss mitigation Programmatic securitization sponsor of new origination residential whole loans with 104 deals comprising $48.2 billion of issuance since the beginning of 2018(1) Modest use of balance sheet leverage with whole loans predominantly financed through securitization Strategic Approach Non-Agency RMBS spreads were stable and relatively unchanged in the fourth quarter − Non-QM AAA spreads tightened ~5 basis points over the quarter − CRT M2 spreads were relatively unchanged compared to Q3 2025 The Zillow Home Price Index was up 22 basis points month-over-month in December and up 10 basis points year-over-year(2) as inventory levels declined − Onslow Bay GAAP whole loan portfolio mark-to-market LTV of 63% compared to 67% original LTV Market and Credit Trends Correspondent Channel Quarterly Lock and Funded Volumes ($mm) OBX Securitization History – UPB Issued ($mm) 3 5 4 10 16 13 21 Number of Deals 29 $3,742 $4,091 $4,369 $5,397 $5,268 $5,269 $6,199 $6,394 $2,266 $2,767 $2,889 $3,815 $3,789 $3,715 $3,970 $5,023 Q1 2024 Q2 2024 Q3 2024 Q4 2024 Q1 2025 Q2 2025 Q3 2025 Q4 2025 Locks Fundings

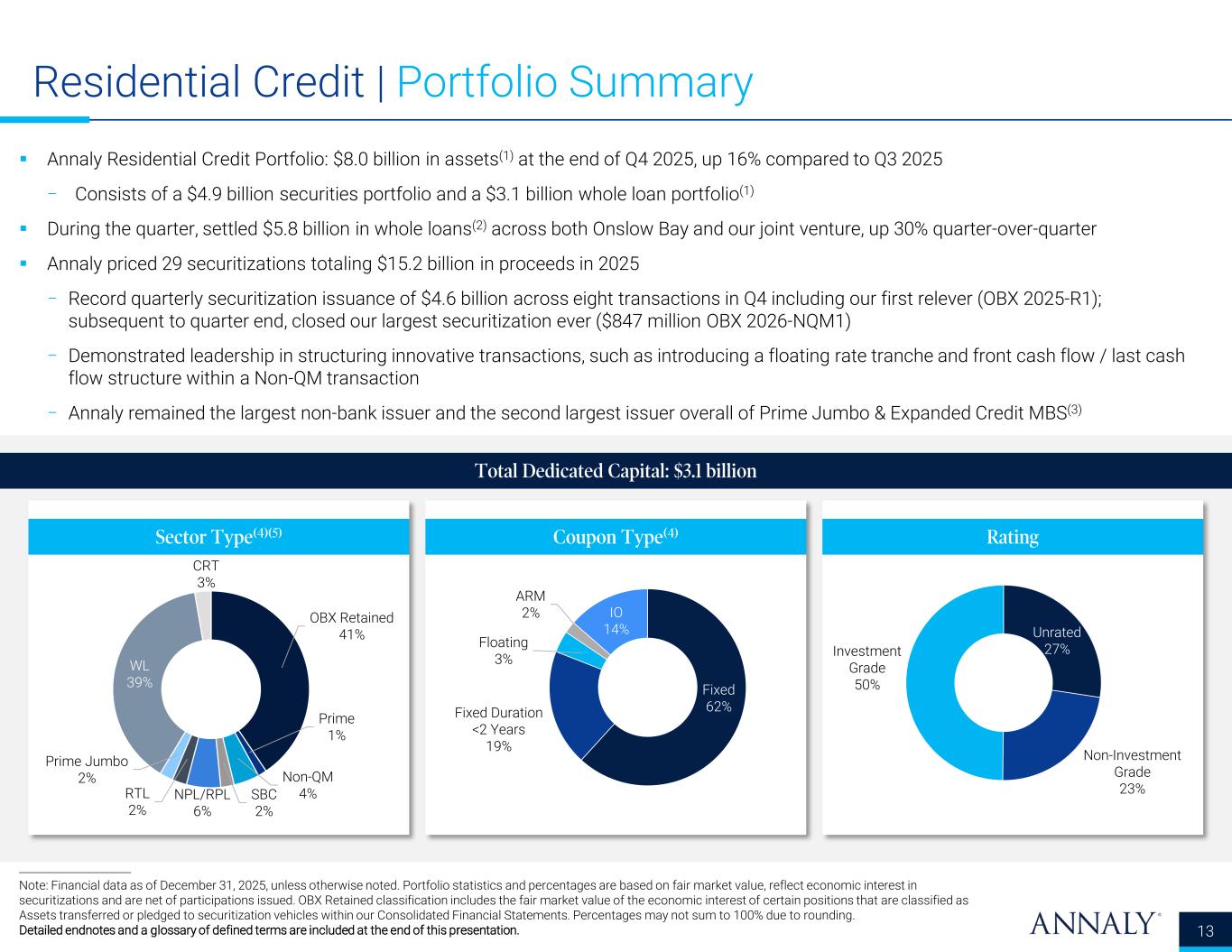

Residential Credit | Portfolio Summary Annaly Residential Credit Portfolio: $8.0 billion in assets(1) at the end of Q4 2025, up 16% compared to Q3 2025 − Consists of a $4.9 billion securities portfolio and a $3.1 billion whole loan portfolio(1) During the quarter, settled $5.8 billion in whole loans(2) across both Onslow Bay and our joint venture, up 30% quarter-over-quarter Annaly priced 29 securitizations totaling $15.2 billion in proceeds in 2025 − Record quarterly securitization issuance of $4.6 billion across eight transactions in Q4 including our first relever (OBX 2025-R1); subsequent to quarter end, closed our largest securitization ever ($847 million OBX 2026-NQM1) − Demonstrated leadership in structuring innovative transactions, such as introducing a floating rate tranche and front cash flow / last cash flow structure within a Non-QM transaction − Annaly remained the largest non-bank issuer and the second largest issuer overall of Prime Jumbo & Expanded Credit MBS(3) 13 Note: Financial data as of December 31, 2025, unless otherwise noted. Portfolio statistics and percentages are based on fair market value, reflect economic interest in securitizations and are net of participations issued. OBX Retained classification includes the fair market value of the economic interest of certain positions that are classified as Assets transferred or pledged to securitization vehicles within our Consolidated Financial Statements. Percentages may not sum to 100% due to rounding. Detailed endnotes and a glossary of defined terms are included at the end of this presentation. Total Dedicated Capital: $3.1 billion Sector Type(4)(5) Coupon Type(4) Rating OBX Retained 41% Prime 1% Non-QM 4%SBC 2% NPL/RPL 6% RTL 2% Prime Jumbo 2% WL 39% CRT 3% Fixed 62%Fixed Duration <2 Years 19% Floating 3% ARM 2% IO 14% Unrated 27% Non-Investment Grade 23% Investment Grade 50%

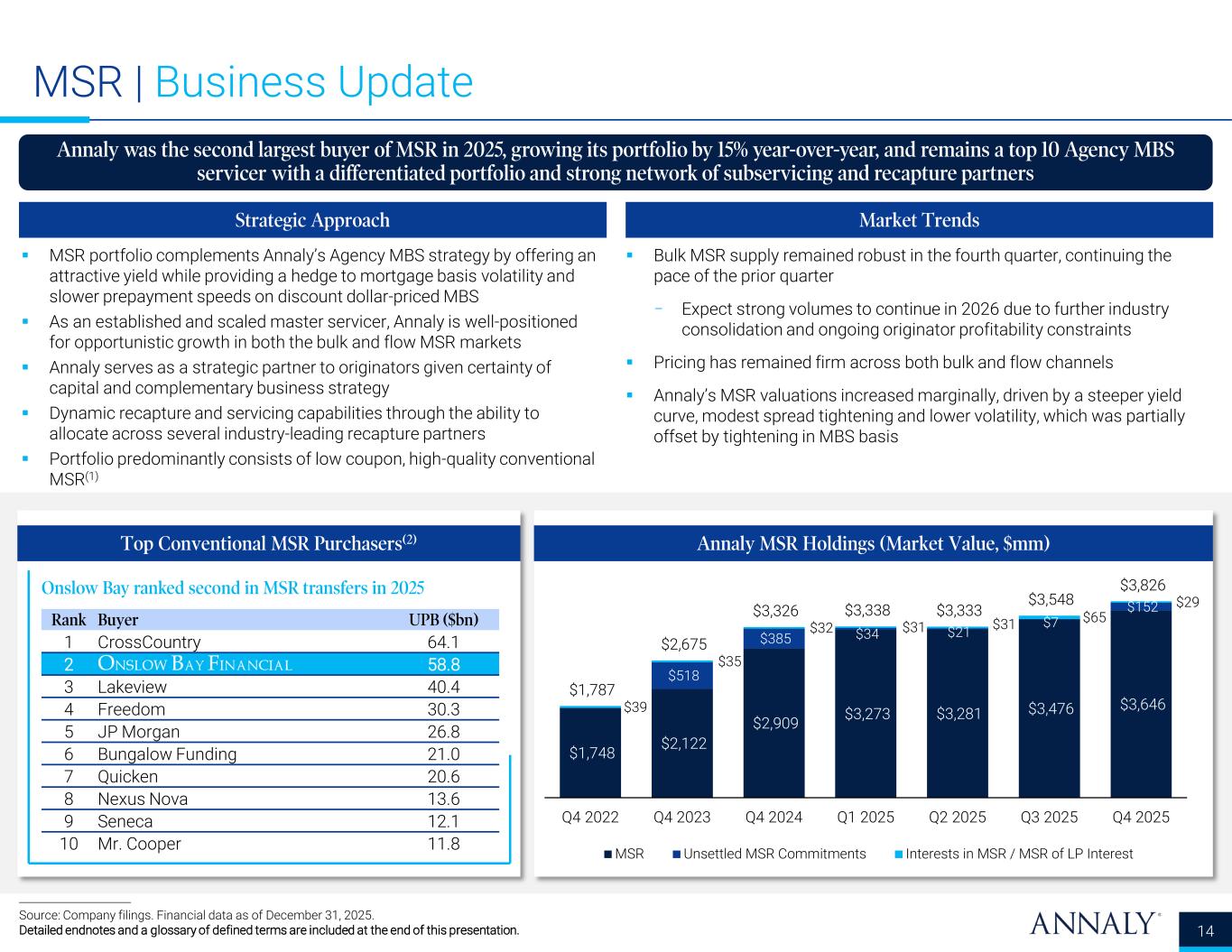

MSR | Business Update 14 Source: Company filings. Financial data as of December 31, 2025. Detailed endnotes and a glossary of defined terms are included at the end of this presentation. Annaly was the second largest buyer of MSR in 2025, growing its portfolio by 15% year-over-year, and remains a top 10 Agency MBS servicer with a differentiated portfolio and strong network of subservicing and recapture partners MSR portfolio complements Annaly’s Agency MBS strategy by offering an attractive yield while providing a hedge to mortgage basis volatility and slower prepayment speeds on discount dollar-priced MBS As an established and scaled master servicer, Annaly is well-positioned for opportunistic growth in both the bulk and flow MSR markets Annaly serves as a strategic partner to originators given certainty of capital and complementary business strategy Dynamic recapture and servicing capabilities through the ability to allocate across several industry-leading recapture partners Portfolio predominantly consists of low coupon, high-quality conventional MSR(1) Strategic Approach Bulk MSR supply remained robust in the fourth quarter, continuing the pace of the prior quarter − Expect strong volumes to continue in 2026 due to further industry consolidation and ongoing originator profitability constraints Pricing has remained firm across both bulk and flow channels Annaly’s MSR valuations increased marginally, driven by a steeper yield curve, modest spread tightening and lower volatility, which was partially offset by tightening in MBS basis Market Trends Annaly MSR Holdings (Market Value, $mm)Top Conventional MSR Purchasers(2) Onslow Bay ranked second in MSR transfers in 2025 Rank Buyer UPB ($bn) 1 CrossCountry 64.1 2 58.8 3 Lakeview 40.4 4 Freedom 30.3 5 JP Morgan 26.8 6 Bungalow Funding 21.0 7 Quicken 20.6 8 Nexus Nova 13.6 9 Seneca 12.1 10 Mr. Cooper 11.8 $1,748 $2,122 $2,909 $3,273 $3,281 $3,476 $3,646 $518 $385 $34 $21 $7 $152 $39 $35 $32 $31 $31 $65 $29 $1,787 $2,675 $3,326 $3,338 $3,333 $3,548 $3,826 Q4 2022 Q4 2023 Q4 2024 Q1 2025 Q2 2025 Q3 2025 Q4 2025 MSR Unsettled MSR Commitments Interests in MSR / MSR of LP Interest

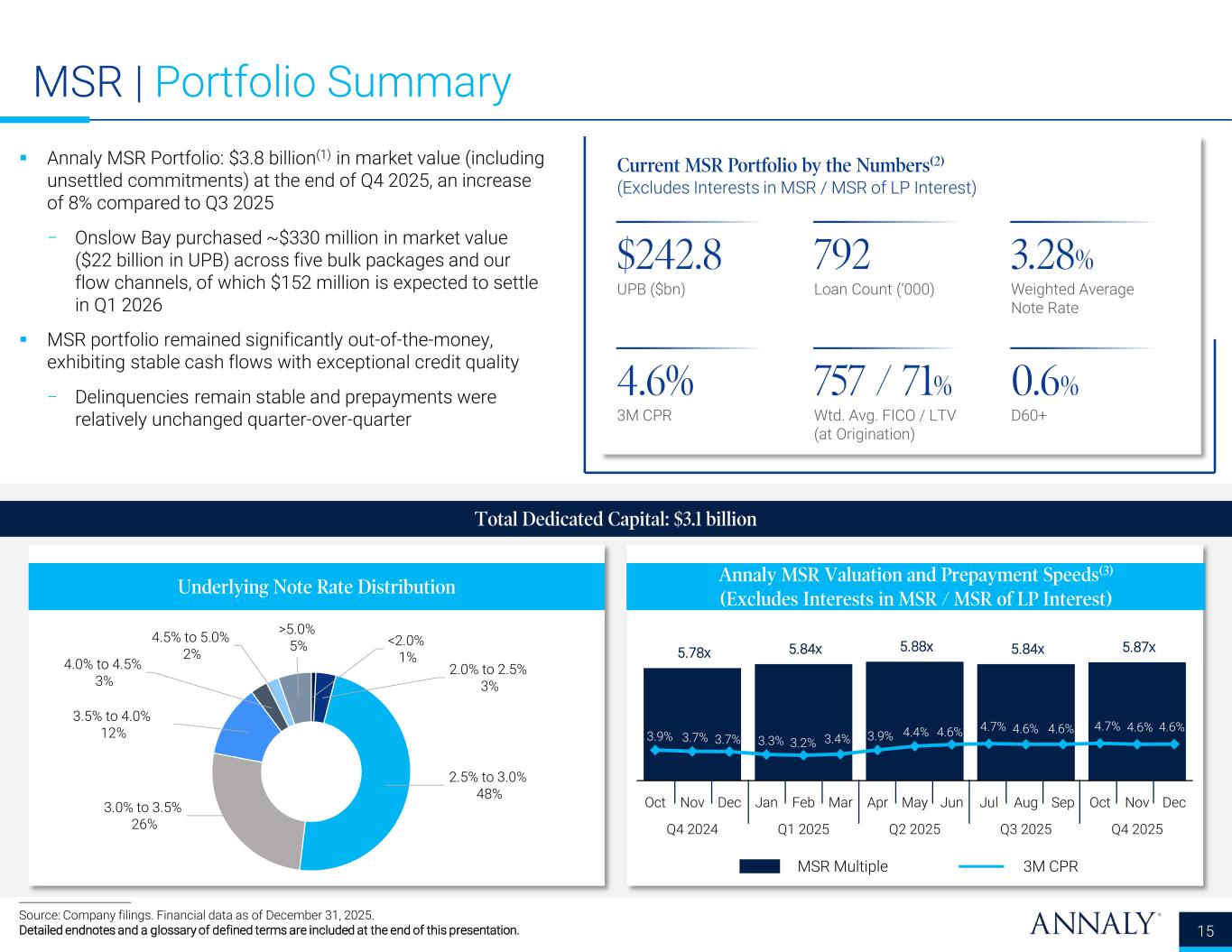

Annaly MSR Portfolio: $3.8 billion(1) in market value (including unsettled commitments) at the end of Q4 2025, an increase of 8% compared to Q3 2025 − Onslow Bay purchased ~$330 million in market value ($22 billion in UPB) across five bulk packages and our flow channels, of which $152 million is expected to settle in Q1 2026 MSR portfolio remained significantly out-of-the-money, exhibiting stable cash flows with exceptional credit quality − Delinquencies remain stable and prepayments were relatively unchanged quarter-over-quarter MSR | Portfolio Summary 15 Source: Company filings. Financial data as of December 31, 2025. Detailed endnotes and a glossary of defined terms are included at the end of this presentation. Current MSR Portfolio by the Numbers(2) (Excludes Interests in MSR / MSR of LP Interest) 3M CPR 4.6% UPB ($bn) $242.8 Loan Count (‘000) 792 Weighted Average Note Rate 3.28% Wtd. Avg. FICO / LTV (at Origination) 757 / 71% D60+ 0.6% Total Dedicated Capital: $3.1 billion Underlying Note Rate Distribution Annaly MSR Valuation and Prepayment Speeds(3) (Excludes Interests in MSR / MSR of LP Interest) MSR Multiple 3M CPR <2.0% 1% 2.0% to 2.5% 3% 2.5% to 3.0% 48% 3.0% to 3.5% 26% 3.5% to 4.0% 12% 4.0% to 4.5% 3% 4.5% to 5.0% 2% >5.0% 5% 5.78x 5.84x 5.88x 5.84x 5.87x 3.9% 3.7% 3.7% 3.3% 3.2% 3.4% 3.9% 4.4% 4.6% 4.7% 4.6% 4.6% 4.7% 4.6% 4.6% Oct Nov Dec Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Q4 2024 Q1 2025 Q2 2025 Q3 2025 Q4 2025

Financial Highlights and Trends

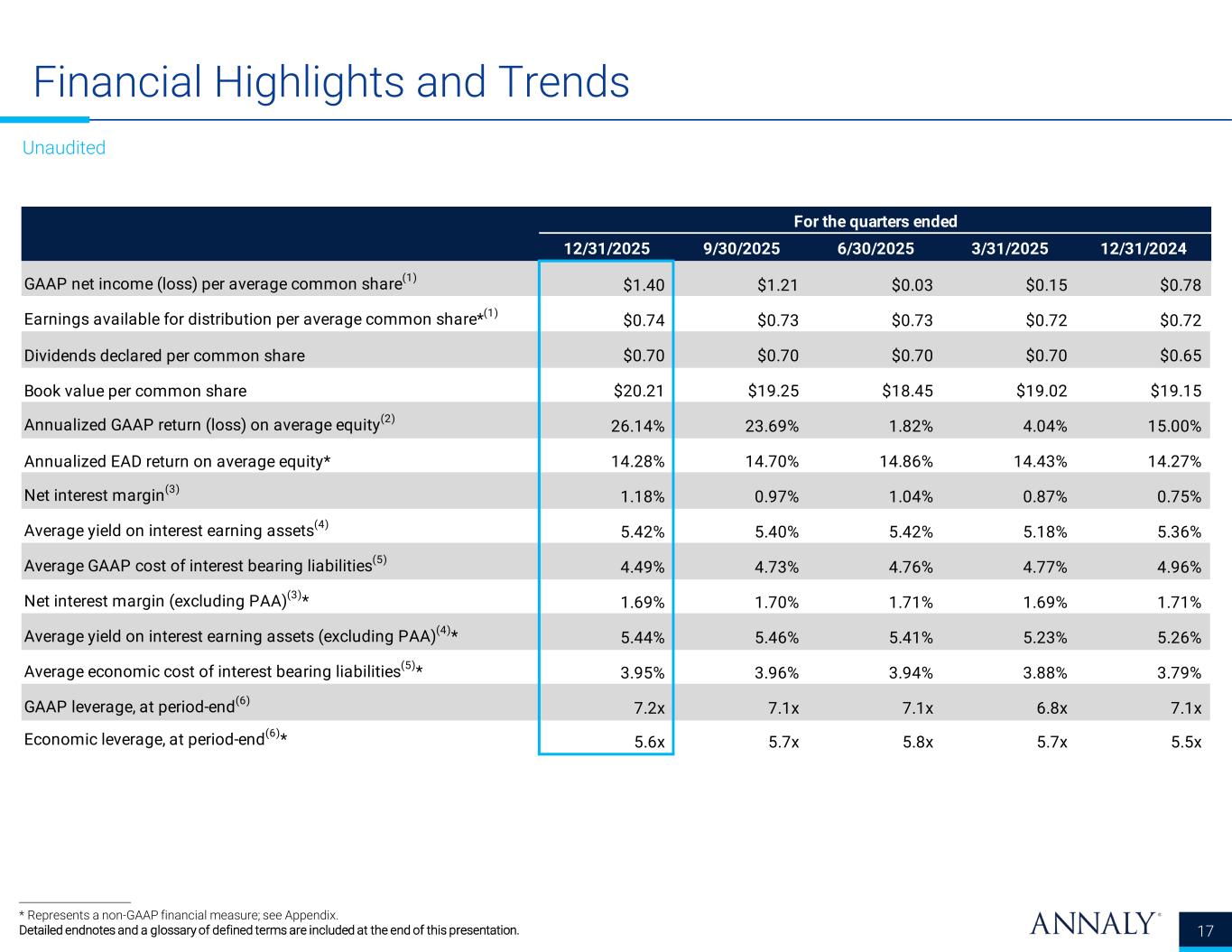

Financial Highlights and Trends 17 * Represents a non-GAAP financial measure; see Appendix. Detailed endnotes and a glossary of defined terms are included at the end of this presentation. Unaudited For the quarters ended 12/31/2025 9/30/2025 6/30/2025 3/31/2025 12/31/2024 GAAP net income (loss) per average common share(1) $1.40 $1.21 $0.03 $0.15 $0.78 Earnings available for distribution per average common share*(1) $0.74 $0.73 $0.73 $0.72 $0.72 Dividends declared per common share $0.70 $0.70 $0.70 $0.70 $0.65 Book value per common share $20.21 $19.25 $18.45 $19.02 $19.15 Annualized GAAP return (loss) on average equity(2) 26.14% 23.69% 1.82% 4.04% 15.00% Annualized EAD return on average equity* 14.28% 14.70% 14.86% 14.43% 14.27% Net interest margin(3) 1.18% 0.97% 1.04% 0.87% 0.75% Average yield on interest earning assets(4) 5.42% 5.40% 5.42% 5.18% 5.36% Average GAAP cost of interest bearing liabilities(5) 4.49% 4.73% 4.76% 4.77% 4.96% Net interest margin (excluding PAA)(3)* 1.69% 1.70% 1.71% 1.69% 1.71% Average yield on interest earning assets (excluding PAA)(4)* 5.44% 5.46% 5.41% 5.23% 5.26% Average economic cost of interest bearing liabilities(5)* 3.95% 3.96% 3.94% 3.88% 3.79% GAAP leverage, at period-end(6) 7.2x 7.1x 7.1x 6.8x 7.1x Economic leverage, at period-end(6)* 5.6x 5.7x 5.8x 5.7x 5.5x

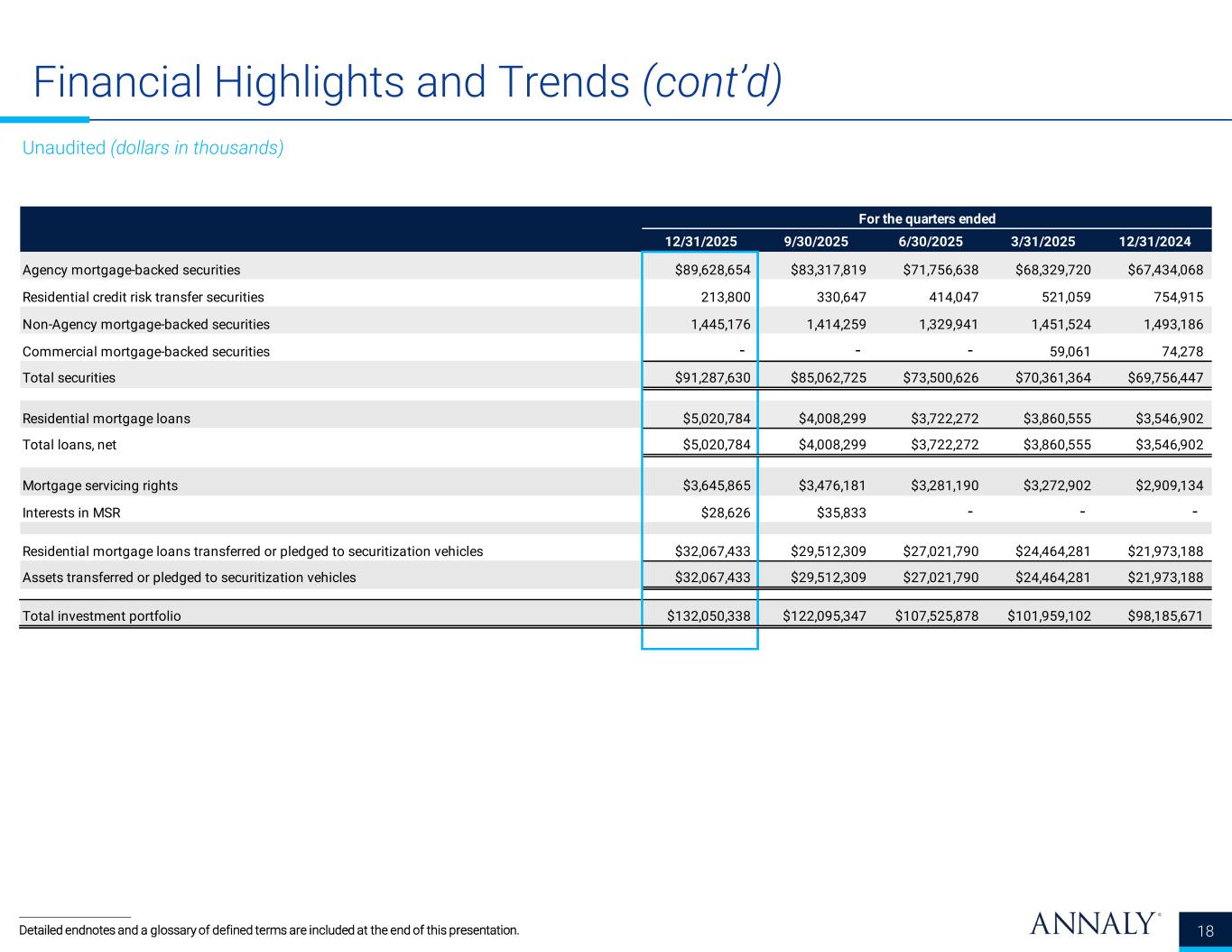

Financial Highlights and Trends (cont’d) 18 Unaudited (dollars in thousands) Detailed endnotes and a glossary of defined terms are included at the end of this presentation. For the quarters ended 12/31/2025 9/30/2025 6/30/2025 3/31/2025 12/31/2024 Agency mortgage-backed securities $89,628,654 $83,317,819 $71,756,638 $68,329,720 $67,434,068 Residential credit risk transfer securities 213,800 330,647 414,047 521,059 754,915 Non-Agency mortgage-backed securities 1,445,176 1,414,259 1,329,941 1,451,524 1,493,186 Commercial mortgage-backed securities - - - 59,061 74,278 Total securities $91,287,630 $85,062,725 $73,500,626 $70,361,364 $69,756,447 Residential mortgage loans $5,020,784 $4,008,299 $3,722,272 $3,860,555 $3,546,902 Total loans, net $5,020,784 $4,008,299 $3,722,272 $3,860,555 $3,546,902 Mortgage servicing rights $3,645,865 $3,476,181 $3,281,190 $3,272,902 $2,909,134 Interests in MSR $28,626 $35,833 - - - Residential mortgage loans transferred or pledged to securitization vehicles $32,067,433 $29,512,309 $27,021,790 $24,464,281 $21,973,188 Assets transferred or pledged to securitization vehicles $32,067,433 $29,512,309 $27,021,790 $24,464,281 $21,973,188 Total investment portfolio $132,050,338 $122,095,347 $107,525,878 $101,959,102 $98,185,671

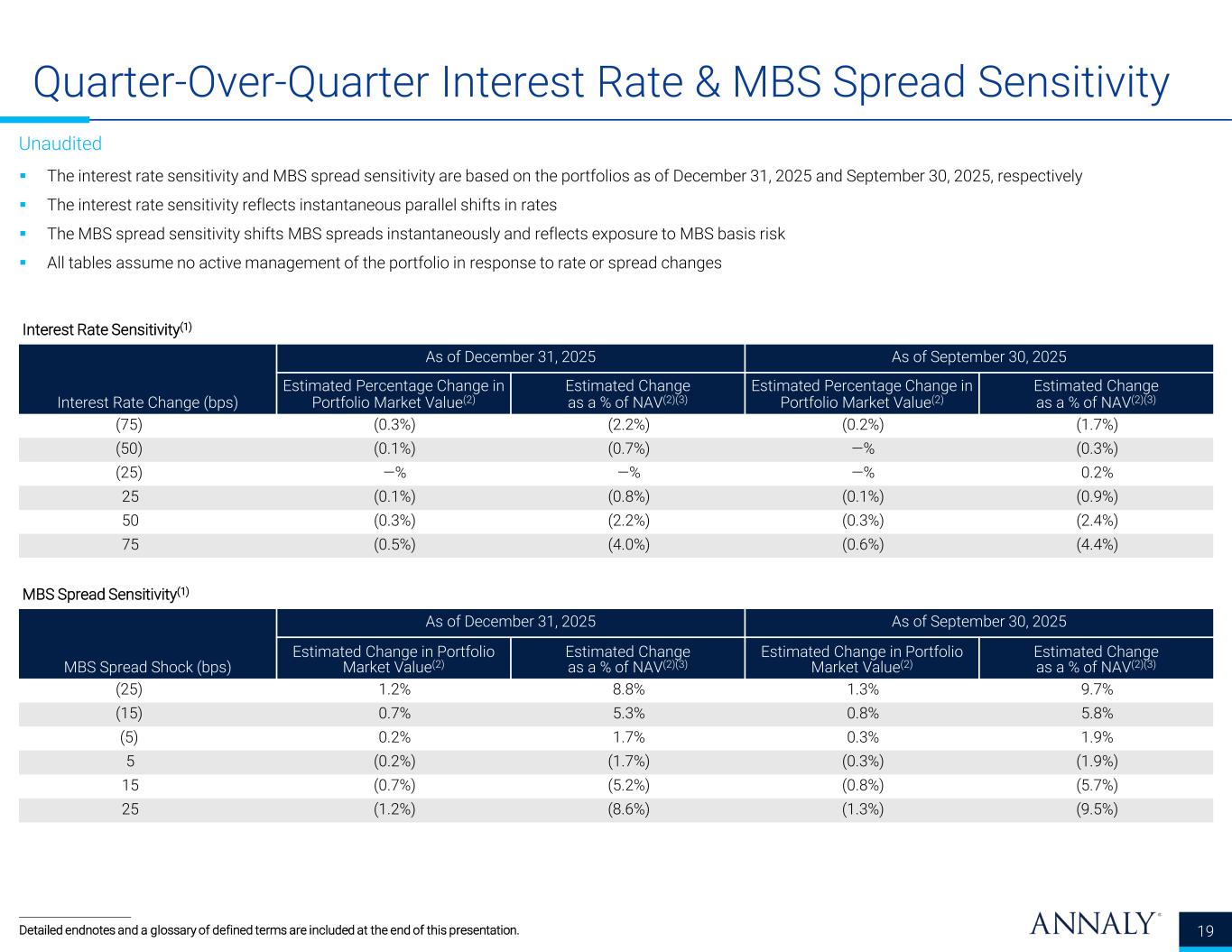

Quarter-Over-Quarter Interest Rate & MBS Spread Sensitivity The interest rate sensitivity and MBS spread sensitivity are based on the portfolios as of December 31, 2025 and September 30, 2025, respectively The interest rate sensitivity reflects instantaneous parallel shifts in rates The MBS spread sensitivity shifts MBS spreads instantaneously and reflects exposure to MBS basis risk All tables assume no active management of the portfolio in response to rate or spread changes 19 Unaudited Interest Rate Sensitivity(1) Interest Rate Change (bps) As of December 31, 2025 As of September 30, 2025 Estimated Percentage Change in Portfolio Market Value(2) Estimated Change as a % of NAV(2)(3) Estimated Percentage Change in Portfolio Market Value(2) Estimated Change as a % of NAV(2)(3) (75) (0.3%) (2.2%) (0.2%) (1.7%) (50) (0.1%) (0.7%) —% (0.3%) (25) —% —% —% 0.2% 25 (0.1%) (0.8%) (0.1%) (0.9%) 50 (0.3%) (2.2%) (0.3%) (2.4%) 75 (0.5%) (4.0%) (0.6%) (4.4%) MBS Spread Sensitivity(1) MBS Spread Shock (bps) As of December 31, 2025 As of September 30, 2025 Estimated Change in Portfolio Market Value(2) Estimated Change as a % of NAV(2)(3) Estimated Change in Portfolio Market Value(2) Estimated Change as a % of NAV(2)(3) (25) 1.2% 8.8% 1.3% 9.7% (15) 0.7% 5.3% 0.8% 5.8% (5) 0.2% 1.7% 0.3% 1.9% 5 (0.2%) (1.7%) (0.3%) (1.9%) 15 (0.7%) (5.2%) (0.8%) (5.7%) 25 (1.2%) (8.6%) (1.3%) (9.5%) Detailed endnotes and a glossary of defined terms are included at the end of this presentation.

Appendix | Non-GAAP Reconciliations

Non-GAAP Reconciliations 21 Earnings Available for Distribution (“EAD”), a non-GAAP measure, is defined as the sum of (a) economic net interest income, (b) TBA dollar roll income, (c) net servicing income less realized amortization of MSR, (d) other income (loss) (excluding amortization of intangibles, non-EAD income allocated to equity method investments and other non-EAD components of other income (loss)), (e) general and administrative expenses (excluding transaction expenses and non-recurring items) and (f) income taxes (excluding the income tax effect of non-EAD income (loss) items) and excludes (g) the premium amortization adjustment ("PAA") representing the cumulative impact on prior periods, but not the current period, of quarter-over-quarter changes in estimated long-term prepayment speeds related to the Company’s Agency mortgage-backed securities. For additional definitions of non-GAAP measures, please refer to Annaly’s Fourth Quarter 2025 earnings release.

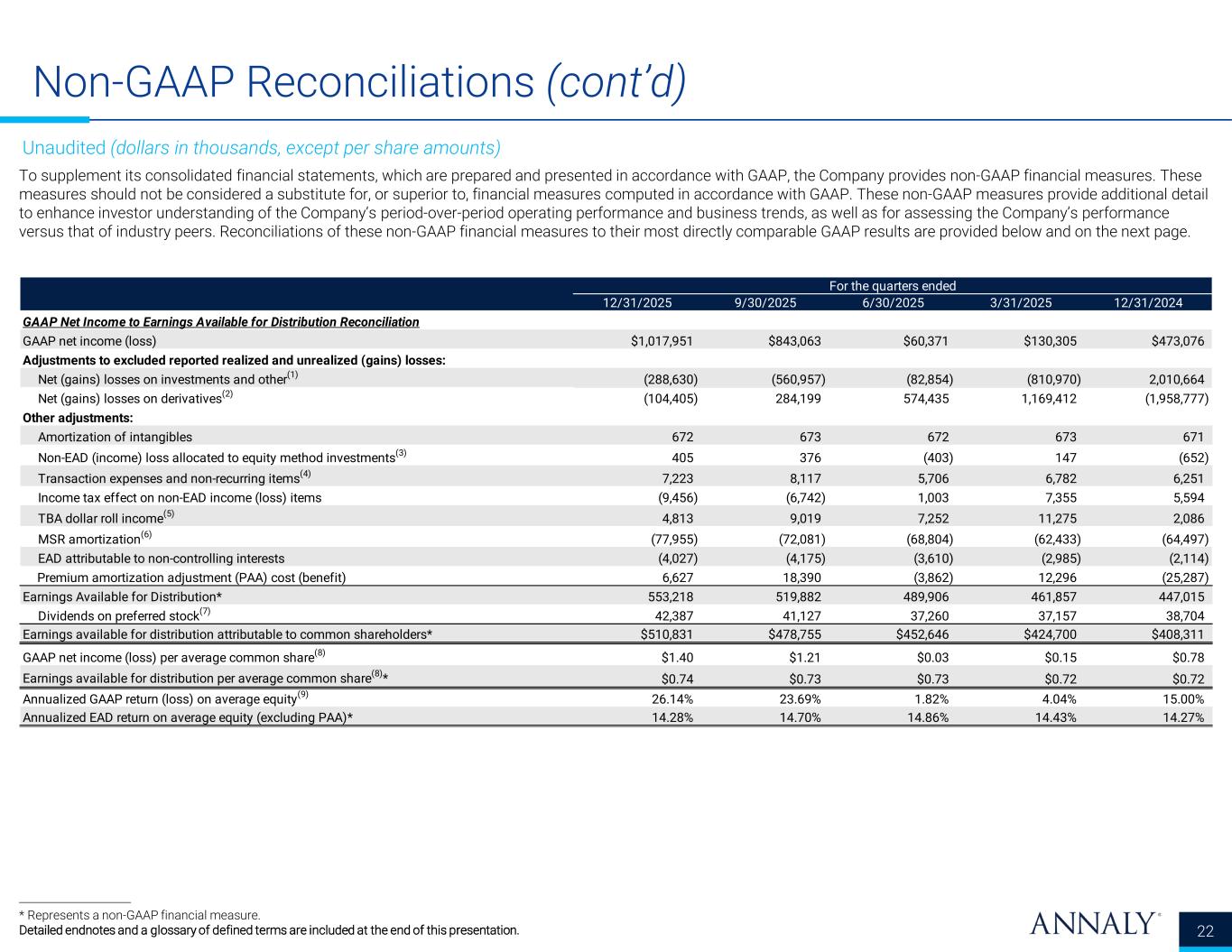

For the quarters ended 12/31/2025 9/30/2025 6/30/2025 3/31/2025 12/31/2024 GAAP Net Income to Earnings Available for Distribution Reconciliation GAAP net income (loss) $1,017,951 $843,063 $60,371 $130,305 $473,076 Adjustments to excluded reported realized and unrealized (gains) losses: Net (gains) losses on investments and other(1) (288,630) (560,957) (82,854) (810,970) 2,010,664 Net (gains) losses on derivatives(2) (104,405) 284,199 574,435 1,169,412 (1,958,777) Other adjustments: Amortization of intangibles 672 673 672 673 671 Non-EAD (income) loss allocated to equity method investments(3) 405 376 (403) 147 (652) Transaction expenses and non-recurring items(4) 7,223 8,117 5,706 6,782 6,251 Income tax effect on non-EAD income (loss) items (9,456) (6,742) 1,003 7,355 5,594 TBA dollar roll income(5) 4,813 9,019 7,252 11,275 2,086 MSR amortization(6) (77,955) (72,081) (68,804) (62,433) (64,497) EAD attributable to non-controlling interests (4,027) (4,175) (3,610) (2,985) (2,114) Premium amortization adjustment (PAA) cost (benefit) 6,627 18,390 (3,862) 12,296 (25,287) Earnings Available for Distribution* 553,218 519,882 489,906 461,857 447,015 Dividends on preferred stock(7) 42,387 41,127 37,260 37,157 38,704 Earnings available for distribution attributable to common shareholders* $510,831 $478,755 $452,646 $424,700 $408,311 GAAP net income (loss) per average common share(8) $1.40 $1.21 $0.03 $0.15 $0.78 Earnings available for distribution per average common share(8)* $0.74 $0.73 $0.73 $0.72 $0.72 Annualized GAAP return (loss) on average equity(9) 26.14% 23.69% 1.82% 4.04% 15.00% Annualized EAD return on average equity (excluding PAA)* 14.28% 14.70% 14.86% 14.43% 14.27% Non-GAAP Reconciliations (cont’d) 22 To supplement its consolidated financial statements, which are prepared and presented in accordance with GAAP, the Company provides non-GAAP financial measures. These measures should not be considered a substitute for, or superior to, financial measures computed in accordance with GAAP. These non-GAAP measures provide additional detail to enhance investor understanding of the Company’s period-over-period operating performance and business trends, as well as for assessing the Company’s performance versus that of industry peers. Reconciliations of these non-GAAP financial measures to their most directly comparable GAAP results are provided below and on the next page. Unaudited (dollars in thousands, except per share amounts) * Represents a non-GAAP financial measure. Detailed endnotes and a glossary of defined terms are included at the end of this presentation.

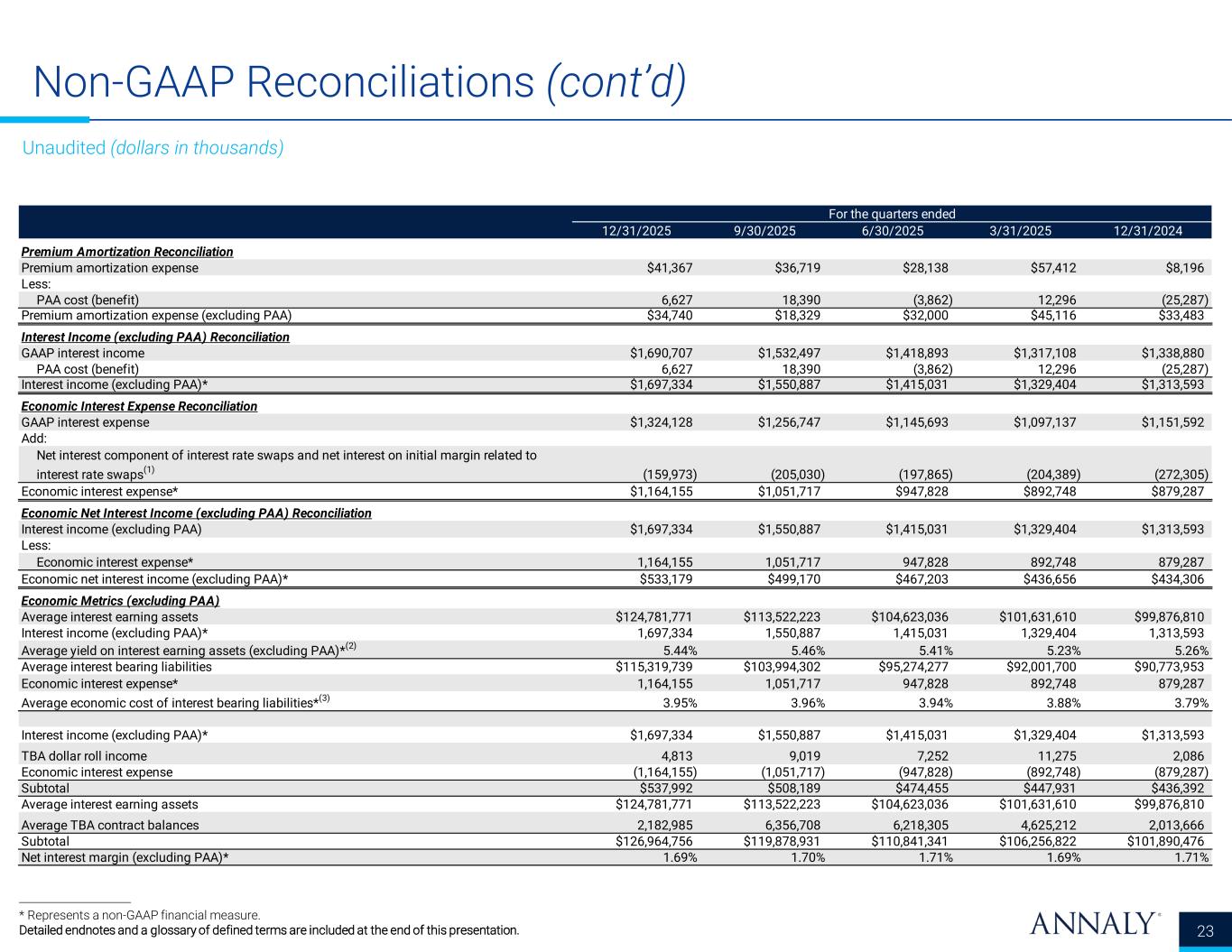

Non-GAAP Reconciliations (cont’d) 23 Unaudited (dollars in thousands) * Represents a non-GAAP financial measure. Detailed endnotes and a glossary of defined terms are included at the end of this presentation. For the quarters ended 12/31/2025 9/30/2025 6/30/2025 3/31/2025 12/31/2024 Premium Amortization Reconciliation Premium amortization expense $41,367 $36,719 $28,138 $57,412 $8,196 Less: PAA cost (benefit) 6,627 18,390 (3,862) 12,296 (25,287) Premium amortization expense (excluding PAA) $34,740 $18,329 $32,000 $45,116 $33,483 Interest Income (excluding PAA) Reconciliation GAAP interest income $1,690,707 $1,532,497 $1,418,893 $1,317,108 $1,338,880 PAA cost (benefit) 6,627 18,390 (3,862) 12,296 (25,287) Interest income (excluding PAA)* $1,697,334 $1,550,887 $1,415,031 $1,329,404 $1,313,593 Economic Interest Expense Reconciliation GAAP interest expense $1,324,128 $1,256,747 $1,145,693 $1,097,137 $1,151,592 Add: Net interest component of interest rate swaps and net interest on initial margin related to interest rate swaps(1) (159,973) (205,030) (197,865) (204,389) (272,305) Economic interest expense* $1,164,155 $1,051,717 $947,828 $892,748 $879,287 Economic Net Interest Income (excluding PAA) Reconciliation Interest income (excluding PAA) $1,697,334 $1,550,887 $1,415,031 $1,329,404 $1,313,593 Less: Economic interest expense* 1,164,155 1,051,717 947,828 892,748 879,287 Economic net interest income (excluding PAA)* $533,179 $499,170 $467,203 $436,656 $434,306 Economic Metrics (excluding PAA) Average interest earning assets $124,781,771 $113,522,223 $104,623,036 $101,631,610 $99,876,810 Interest income (excluding PAA)* 1,697,334 1,550,887 1,415,031 1,329,404 1,313,593 Average yield on interest earning assets (excluding PAA)*(2) 5.44% 5.46% 5.41% 5.23% 5.26% Average interest bearing liabilities $115,319,739 $103,994,302 $95,274,277 $92,001,700 $90,773,953 Economic interest expense* 1,164,155 1,051,717 947,828 892,748 879,287 Average economic cost of interest bearing liabilities*(3) 3.95% 3.96% 3.94% 3.88% 3.79% Interest income (excluding PAA)* $1,697,334 $1,550,887 $1,415,031 $1,329,404 $1,313,593 TBA dollar roll income 4,813 9,019 7,252 11,275 2,086 Economic interest expense (1,164,155) (1,051,717) (947,828) (892,748) (879,287) Subtotal $537,992 $508,189 $474,455 $447,931 $436,392 Average interest earning assets $124,781,771 $113,522,223 $104,623,036 $101,631,610 $99,876,810 Average TBA contract balances 2,182,985 6,356,708 6,218,305 4,625,212 2,013,666 Subtotal $126,964,756 $119,878,931 $110,841,341 $106,256,822 $101,890,476 Net interest margin (excluding PAA)* 1.69% 1.70% 1.71% 1.69% 1.71%

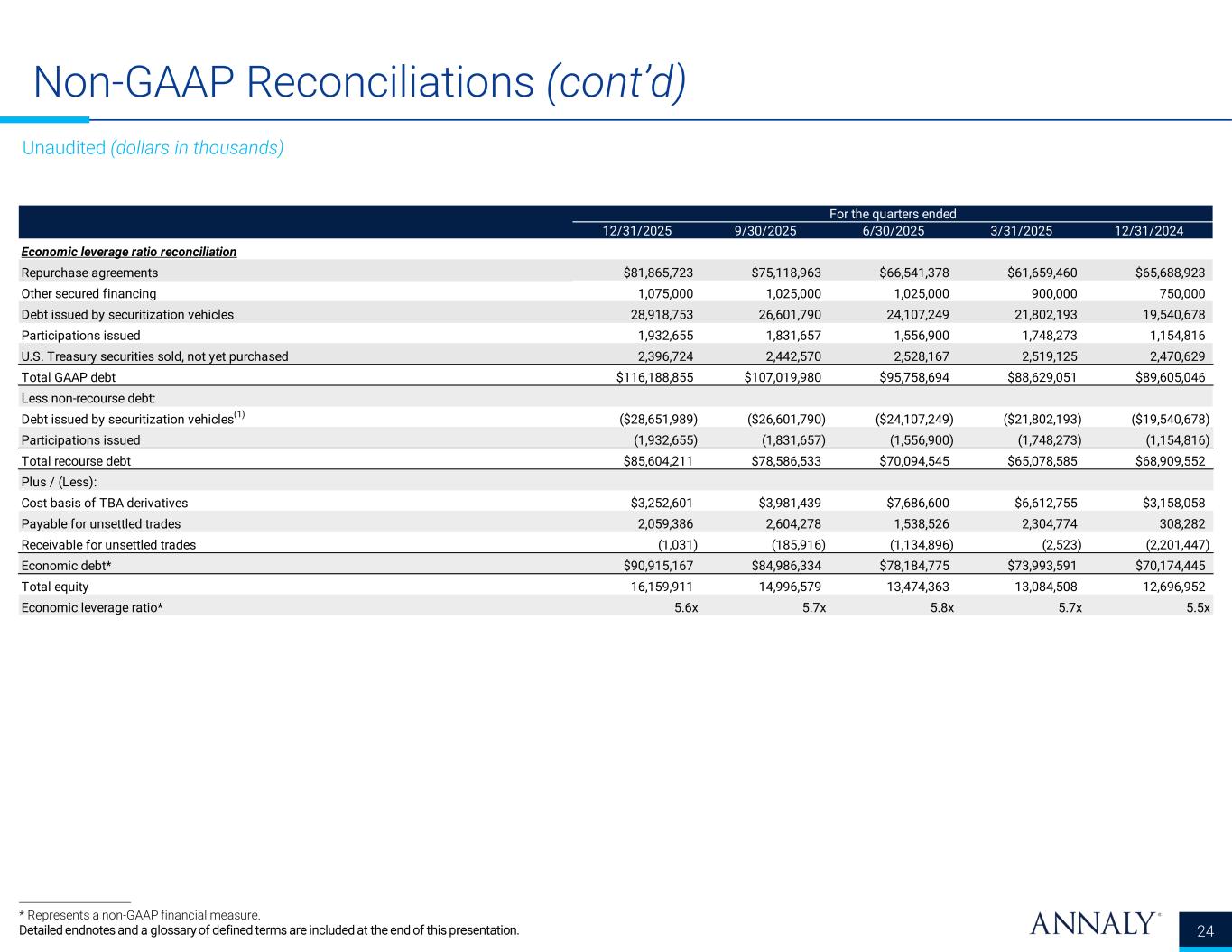

Non-GAAP Reconciliations (cont’d) 24 Unaudited (dollars in thousands) * Represents a non-GAAP financial measure. Detailed endnotes and a glossary of defined terms are included at the end of this presentation. For the quarters ended 12/31/2025 9/30/2025 6/30/2025 3/31/2025 12/31/2024 Economic leverage ratio reconciliation Repurchase agreements $81,865,723 $75,118,963 $66,541,378 $61,659,460 $65,688,923 Other secured financing 1,075,000 1,025,000 1,025,000 900,000 750,000 Debt issued by securitization vehicles 28,918,753 26,601,790 24,107,249 21,802,193 19,540,678 Participations issued 1,932,655 1,831,657 1,556,900 1,748,273 1,154,816 U.S. Treasury securities sold, not yet purchased 2,396,724 2,442,570 2,528,167 2,519,125 2,470,629 Total GAAP debt $116,188,855 $107,019,980 $95,758,694 $88,629,051 $89,605,046 Less non-recourse debt: Debt issued by securitization vehicles(1) ($28,651,989) ($26,601,790) ($24,107,249) ($21,802,193) ($19,540,678) Participations issued (1,932,655) (1,831,657) (1,556,900) (1,748,273) (1,154,816) Total recourse debt $85,604,211 $78,586,533 $70,094,545 $65,078,585 $68,909,552 Plus / (Less): Cost basis of TBA derivatives $3,252,601 $3,981,439 $7,686,600 $6,612,755 $3,158,058 Payable for unsettled trades 2,059,386 2,604,278 1,538,526 2,304,774 308,282 Receivable for unsettled trades (1,031) (185,916) (1,134,896) (2,523) (2,201,447) Economic debt* $90,915,167 $84,986,334 $78,184,775 $73,993,591 $70,174,445 Total equity 16,159,911 14,996,579 13,474,363 13,084,508 12,696,952 Economic leverage ratio* 5.6x 5.7x 5.8x 5.7x 5.5x

Glossary and Endnotes

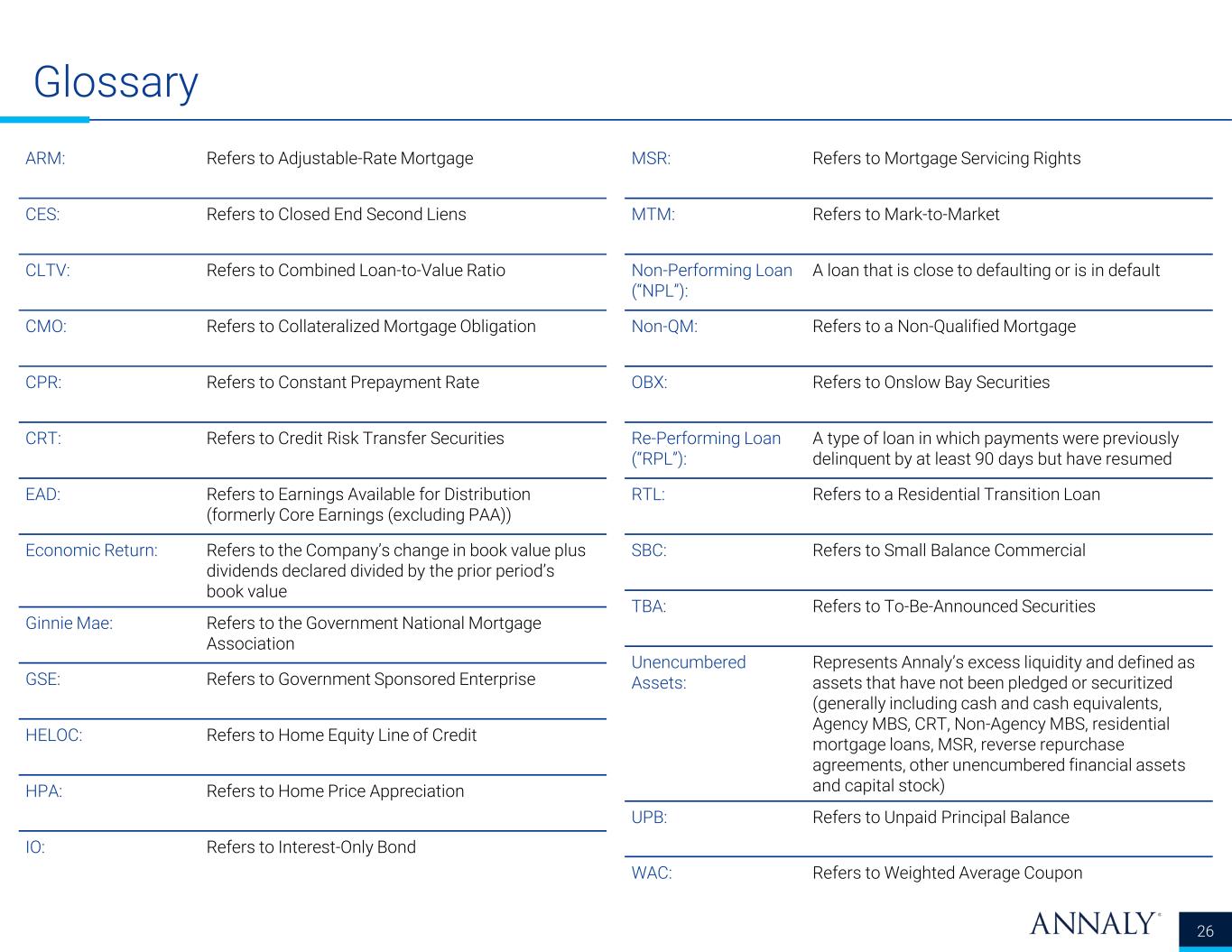

Glossary 26 ARM: Refers to Adjustable-Rate Mortgage CES: Refers to Closed End Second Liens CLTV: Refers to Combined Loan-to-Value Ratio CMO: Refers to Collateralized Mortgage Obligation CPR: Refers to Constant Prepayment Rate CRT: Refers to Credit Risk Transfer Securities EAD: Refers to Earnings Available for Distribution (formerly Core Earnings (excluding PAA)) Economic Return: Refers to the Company’s change in book value plus dividends declared divided by the prior period’s book value Ginnie Mae: Refers to the Government National Mortgage Association GSE: Refers to Government Sponsored Enterprise HELOC: Refers to Home Equity Line of Credit HPA: Refers to Home Price Appreciation IO: Refers to Interest-Only Bond MSR: Refers to Mortgage Servicing Rights MTM: Refers to Mark-to-Market Non-Performing Loan (“NPL”): A loan that is close to defaulting or is in default Non-QM: Refers to a Non-Qualified Mortgage OBX: Refers to Onslow Bay Securities Re-Performing Loan (“RPL”): A type of loan in which payments were previously delinquent by at least 90 days but have resumed RTL: Refers to a Residential Transition Loan SBC: Refers to Small Balance Commercial TBA: Refers to To-Be-Announced Securities Unencumbered Assets: Represents Annaly’s excess liquidity and defined as assets that have not been pledged or securitized (generally including cash and cash equivalents, Agency MBS, CRT, Non-Agency MBS, residential mortgage loans, MSR, reverse repurchase agreements, other unencumbered financial assets and capital stock) UPB: Refers to Unpaid Principal Balance WAC: Refers to Weighted Average Coupon

Endnotes 27 Page 3 1. Comprised of $7.8bn of unencumbered assets, which represents Annaly’s excess liquidity and defined as assets that have not been pledged or securitized (generally including cash and cash equivalents, Agency MBS, CRT, Non-Agency MBS, residential mortgage loans, MSR, reverse repurchase agreements, other unencumbered financial assets and capital stock), and $1.5bn of fair value of collateral pledged for future advances. 2. Issuer ranking data from Inside Nonconforming Markets from 2024 to 2025 (January 16, 2026 issue). Used with permission. 3. Net of sales agent commissions and other offering expenses. 4. Represents gross proceeds before deducting the underwriting discount and other estimated offering expenses. Includes the underwriters’ exercise of their overallotment option to purchase additional shares of stock. 5. Total portfolio represents Annaly’s investments that are on-balance sheet as well as investments that are off- balance sheet in which Annaly has economic exposure. Assets exclude assets transferred or pledged to securitization vehicles of $32.1bn, include TBA purchase contracts (market value) of $3.3bn, include unsettled MSR commitments of $152mm, include $3.2bn of retained securities that are eliminated in consolidation and are shown net of participations issued totaling $1.9bn. MSR commitments represent the market value of deals where Annaly has executed a letter of intent. There can be no assurance whether these deals will close or when they will close. Page 4 1. Dividend yield is based on annualized Q4 2025 dividend of $0.70 and a closing price of $22.36 on December 31, 2025. 2. Total portfolio represents Annaly’s investments that are on-balance sheet as well as investments that are off- balance sheet in which Annaly has economic exposure. Assets exclude assets transferred or pledged to securitization vehicles of $32.1bn, include TBA purchase contracts (market value) of $3.3bn, include unsettled MSR commitments of $152mm, include $3.2bn of retained securities that are eliminated in consolidation and are shown net of participations issued totaling $1.9bn. MSR commitments represent the market value of deals where Annaly has executed a letter of intent. There can be no assurance whether these deals will close or when they will close. 3. Capital allocation for each of the investment strategies is calculated as the difference between each investment strategy’s allocated assets, which include TBA purchase contracts, and liabilities. 4. Comprised of $7.8bn of unencumbered assets, which represents Annaly’s excess liquidity and defined as assets that have not been pledged or securitized (generally including cash and cash equivalents, Agency MBS, CRT, Non-Agency MBS, residential mortgage loans, MSR, reverse repurchase agreements, other unencumbered financial assets and capital stock), and $1.5bn of fair value of collateral pledged for future advances. 5. Hedge portfolio excludes long receiver swaptions. 6. Computed as the sum of recourse debt, cost basis of TBA derivatives outstanding and net forward purchases (sales) of investments divided by total equity. Recourse debt consists of repurchase agreements, other secured financing, structured repurchase transactions (included within Debt issued by securitization vehicles) and U.S. Treasury securities sold, not yet purchased. Debt issued by securitization vehicles (excluding structured repurchase transactions) and participations issued are non-recourse to us and are excluded from this measure. 7. Hedge ratio measures total notional balances of interest rate swaps, interest rate swaptions (excluding long receiver swaptions) and futures and U.S. Treasury securities sold, not yet purchased relative to repurchase agreements, other secured financing and cost basis of TBA derivatives outstanding and net forward purchases (sales) of investments; excludes MSR and the effects of term financing, both of which serve to reduce interest rate risk. Additionally, the hedge ratio does not take into consideration differences in duration between assets and liabilities. 8. Average economic cost of funds reflects economic interest expense. Page 5 1. Total portfolio represents Annaly’s investments that are on-balance sheet as well as investments that are off- balance sheet in which Annaly has economic exposure. Agency assets include TBA purchase contracts (market value) of $3.3bn. Residential Credit assets exclude assets transferred or pledged to securitization vehicles of $32.1bn, include $3.2bn of retained securities that are eliminated in consolidation and are shown net of participations issued totaling $1.9bn. MSR assets include unsettled commitments of $152mm. MSR commitments represent the market value of deals where Annaly has executed a letter of intent. There can be no assurance whether these deals will close or when they will close. 2. Capital allocation for each of the investment strategies is calculated as the difference between each investment strategy’s allocated assets, which include TBA purchase contracts, and liabilities. Page 6 1. Represents the 3-month moving averages of hiring and layoff rates from the Bureau of Labor Statistics' Job Openings and Labor Turnover Survey through November 2025. 2. Represents the Federal Funds Target Rate as retrieved via Bloomberg through December 2025. 3. Represents market expectations derived from overnight index swaps for 2026 as retrieved via Bloomberg on January 23, 2026. 4. Represents the range of estimates for Federal Open Market Committee members’ projections of the long-term Federal Funds Target Rate. 5. Represents the Bank of America MOVE index as retrieved via Bloomberg. 6. Represents the annual supply of U.S. Treasuries and Agency MBS less any changes in the Fed’s or GSEs’ retained portfolios. Includes estimates for 2026. Page 7 1. Levered return assumptions are for illustrative purposes only and attempt to represent current market asset returns and available leverage and financing terms for prospective investments of the same, or of a substantially similar, nature to those held in Annaly’s portfolio in each respective group. Illustrative levered returns do not represent returns of Annaly’s actual portfolio. For MSR, illustrative levered returns are shown hedged with Agency MBS/TBA. 2. Based on data from the Zillow U.S. Home Value Index for the period ended December 31, 2025. Month-over- month data is seasonally adjusted, while year-over-year data is not. 3. Based on data compiled from market research as of December 31, 2025, including reports from BofA Securities, JP Morgan and Nomura. 4. Based on information aggregated from Fannie Mae and Freddie Mac monthly loan level files by eMBS servicing transfer data as of December 31, 2025. Excludes transfer activity related to platform acquisitions. Page 8 1. Includes three whole loan securitizations that priced in January 2026 totaling $2.0bn. 2. Purchases as of December 31, 2025, including loans from a joint venture with a sovereign wealth fund as well as loans from sponsored securitizations. 3. Issuer ranking data from Inside Nonconforming Markets for 2024 – 2025 (January 16, 2026 issue). Used with permission. 4. Issuer ranking data from Green Street (January 9, 2026 issue). Used with permission. 5. Includes unsettled MSR commitments of $152mm. MSR commitments represent the market value of deals where Annaly has executed a letter of intent. There can be no assurance whether these deals will close or when they will close. 6. Based on information aggregated from 2025 Fannie Mae and Freddie Mac monthly loan level files by eMBS servicing transfer data as of December 31, 2025. Excludes transfer activity related to platform acquisitions. 7. Based on data from Inside Mortgage Finance for the period ended December 31, 2025. Used with permission Page 10 1. Represents Agency's hedging profile and does not reflect Annaly's full hedging profile across all three businesses. 2. Represents Agency’s funding profile and does not reflect Annaly's full funding profile across all three businesses. Page 11 1. Includes TBA purchase contracts. 2. Includes TBA purchase contracts and fixed-rate pass-through certificates. 3. Includes fixed-rate pass-through certificates only. “High Quality Spec” protection is defined as pools backed by original loan balances of up to $150k, highest LTV pools (CR>125% LTV), geographic concentrations (NY/PR). “Med Quality Spec” includes loan balance pools greater than or equal to $175k up to $300k and high LTV (CQ 105-125% LTV) and 40-year pools. “Other Call Protected” is defined as pools backed by Florida loans, pools with mission density scores greater than or equal to 2, as well as investor and second home pools. “40+ WALA” is defined as weighted average loan age greater than 40 months and treated as seasoned collateral. Page 12 1. Includes three whole loan securitizations that priced in January 2026 totaling $2.0bn. 2. Based on data from the Zillow U.S. Home Value Index for the period ended December 31, 2025. Month-over- month data is seasonally adjusted, while year-over-year data is not.

Endnotes (cont’d) 28 Page 13 1. Excludes assets transferred or pledged to securitization vehicles of $32.1bn, include $3.2bn of retained securities that are eliminated in consolidation and are shown net of participations issued totaling $1.9bn. 2. Whole loans settled include loans from a joint venture with a sovereign wealth fund as well as loans from sponsored securitizations. 3. Issuer ranking data from Inside Nonconforming Markets from 2024 to 2025 (January 16, 2026 issue). Used with permission. 4. Shown exclusive of securitized residential mortgage loans of consolidated variable interest entities. 5. Prime includes $31.2mm of Prime IO, OBX Retained contains $477.5mm of IOs and Prime Jumbo includes $106.5mm of Prime Jumbo IO. Page 14 1. Portfolio excludes retained servicing on whole loans within the Residential Credit portfolio. 2. Based on information aggregated from 2025 Fannie Mae and Freddie Mac monthly loan level files by eMBS servicing transfer data as of December 31, 2025. Excludes transfer activity related to platform acquisitions. Page 15 1. MSR assets include unsettled commitments of $152mm. MSR commitments represent the market value of deals where Annaly has executed a letter of intent. There can be no assurance whether these deals will close or when they will close. 2. Excludes unsettled commitments of $152mm. D60+ stat based on UPB. 3. Excludes unsettled commitments. Prepayment data excludes assets in interim servicing. Page 17 1. Net of dividends on preferred stock. The quarter ended December 31, 2025 excludes, and the quarter ended September 30, 2025 includes, cumulative and undeclared dividends of $3.7mm on the Company's Series J Preferred Stock as of September 30, 2025. 2. Annualized GAAP return (loss) on average equity annualizes realized and unrealized gains and (losses) which may not be indicative of full year performance, unannualized GAAP return (loss) on average equity is 6.53%, 5.92%, 0.45%, 1.01% and 3.75% for the quarters ended December 31, 2025, September 30, 2025, June 30, 2025, March 31, 2025 and December 31, 2024, respectively. 3. Net interest margin represents interest income less interest expense divided by average interest earning assets. Net interest margin (excluding PAA) represents the sum of the Company's interest income (excluding PAA) plus TBA dollar roll income less interest expense and the net interest component of interest rate swaps divided by the sum of average interest earning assets plus average TBA contract balances. 4. Average yield on interest earning assets represents annualized interest income divided by average interest earning assets. Average interest earning assets reflects the average amortized cost of our investments during the period. Average yield on interest earning assets (excluding PAA) is calculated using annualized interest income (excluding PAA). 5. Average GAAP cost of interest bearing liabilities represents annualized interest expense divided by average interest bearing liabilities. Average interest bearing liabilities reflects the average balances during the period. Average economic cost of interest bearing liabilities represents annualized economic interest expense divided by average interest bearing liabilities. Economic interest expense is comprised of GAAP interest expense, the net interest component of interest rate swaps, and net interest on initial margin related to interest rate swaps, which is reported in Other, net in the Company’s Consolidated Statements of Comprehensive Income (Loss). Net interest on variation margin related to interest rate swaps is included in the Net interest component of interest rate swaps in the Company’s Consolidated Statements of Comprehensive Income (Loss). 6. GAAP leverage is computed as the sum of repurchase agreements, other secured financing, debt issued by securitization vehicles, participations issued and U.S. Treasury securities sold, not yet purchased divided by total equity. Economic leverage is computed as the sum of recourse debt, cost basis of to-be-announced ("TBA") derivatives outstanding, and net forward purchases (sales) of investments divided by total equity. Recourse debt consists of repurchase agreements, other secured financing, structured repurchase transactions (included within Debt issued by securitization vehicles) and U.S. Treasury securities sold, not yet purchased. Debt issued by securitization vehicles (excluding structured repurchase transactions) and participations issued are non- recourse to us and are excluded from economic leverage. Page 19 1. Interest rate and MBS spread sensitivity are based on results from third party models in conjunction with internally derived inputs, analysis, and adjustments. Models are periodically updated to help better capture market risks and conditions. Such updates are completed by third parties and through the Company’s calibration of external models. Any model updates that occur are reflected in the period in which they occur. Actual results could differ materially from these estimates. 2. Scenarios include residential investment securities, residential mortgage loans, MSR and derivative instruments. 3. Net asset value (“NAV”) represents book value of common equity. Non-GAAP Reconciliations Page 22 1. Includes write-downs or recoveries on investments which is reported in Other, net in the Company’s Consolidated Statement of Comprehensive Income (Loss). 2. The adjustment to add back Net (gains) losses on derivatives does not include the net interest component of interest rate swaps which is reflected in earnings available for distribution. The net interest component of interest rate swaps totaled $147.4mm, $191.9mm, $185.7mm, $191.5mm and $256.9mm for the quarters ended December 31, 2025, September 30, 2025, June 30, 2025, March 31, 2025 and December 31, 2024, respectively. 3. The Company excludes non-EAD (income) loss allocated to equity method investments, which represents the unrealized (gains) losses allocated to equity interests in a portfolio of MSR, which is a component of Other income (loss). 4. All quarters presented include costs incurred in connection with securitizations of residential whole loans. 5. TBA dollar roll income represents a component of Net gains (losses) on derivatives. 6. MSR amortization represents the portion of changes in fair value that is attributable to the realization of estimated cash flows on the Company’s MSR portfolio and is reported as a component of Net unrealized gains (losses) on instruments measured at fair value. 7. The quarter ended December 31, 2025 excludes, and the quarter ended September 30, 2025 includes, cumulative and undeclared dividends of $3.7mm on the Company's Series J Preferred Stock as of September 30, 2025. 8. Net of dividends on preferred stock. 9. Annualized GAAP return (loss) on average equity annualizes realized and unrealized gains and (losses) which may not be indicative of full year performance, unannualized GAAP return (loss) on average equity is 6.53%, 5.92%, 0.45%, 1.01% and 3.75% for the quarters ended December 31, 2025, September 30, 2025, June 30, 2025, March 31, 2025 and December 31, 2024, respectively. Page 23 1. Interest on initial margin related to interest rate swaps is reported in Other, net in the Company’s Consolidated Statement of Comprehensive Income (Loss). 2. Average yield on interest earning assets (excluding PAA) represents annualized interest income (excluding PAA) divided by average interest earning assets. Average interest earning assets reflects the average amortized cost of our investments during the period. 3. Average economic cost of interest bearing liabilities represents annualized economic interest expense divided by average interest bearing liabilities. Average interest bearing liabilities reflects the average balances during the period. Economic interest expense is comprised of GAAP interest expense, the net interest component of interest rate swaps, and net interest on initial margin related to interest rate swaps, which is reported in Other, net in the Company’s Consolidated Statements of Comprehensive Income (Loss). Net interest on variation margin related to interest rate swaps is included in the Net interest component of interest rate swaps in the Company’s Consolidated Statements of Comprehensive Income (Loss). Page 24 1. Non-recourse debt excludes debt issued by securitization vehicles related to structured repurchase transactions.