Please wait

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant [X]

Filed by a Party other than the Registrant [

]

Check the appropriate box:

|

[ ]

|

Preliminary Proxy Statement

|

|

[ ]

|

Confidential, For Use of the Commission Only (as permitted by Rule

14a-6(e)(2))

|

|

[X]

|

Definitive Proxy Statement

|

|

[ ]

|

Definitive Additional Materials

|

|

[ ]

|

Soliciting Material Pursuant to §240.14a-12

|

Track Group, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the

Registrant)

Payment of Filing Fee (Check the appropriate box):

|

[X]

|

No

fee required.

|

|

[ ]

|

Fee

computed on table below per Exchange Act Rules 14a-6(i)(1) and

0-11.

|

|

|

(1)

|

Title of each class of securities to which transaction

applies:

|

|

|

|

|

|

|

(2)

|

Aggregate number of securities to which transaction

applies:

|

|

|

|

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed

pursuant to Exchange Act Rule 0-11 (set forth the amount on which

the filing fee is calculated and state how it was

determined):

|

|

|

|

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

|

|

|

|

(5)

|

Total fee paid:

|

|

|

|

|

|

[ ]

|

Fee

paid previously with preliminary materials.

|

|

[ ]

|

Check

box if any part of the fee is offset as provided by Exchange Act

Rule 0-11(a)(2) and identify the filing for which the offsetting

fee was paid previously. Identify the previous filing by

registration statement number, or the Form or Schedule and the date

of its filing.

|

|

|

(1)

|

Amount Previously Paid:

|

|

|

|

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

|

|

|

|

|

|

(3)

|

Filing Party:

|

|

|

|

|

|

|

(4)

|

Date Filed:

|

1215 W. Lakeview Court

Romeoville, Illinois 60446

(877) 260-2010

January

10, 2017

Dear Stockholders:

You are cordially invited to attend the 2017

Annual Meeting of Stockholders of Track Group (the

“Annual

Meeting”), which will be

held at our corporate offices located at 1215 W. Lakeview Court,

Romeoville, Illinois, on February 14, 2017 at 10:00 A.M., local

time.

Details of the business to be conducted at the

Annual Meeting are described in the attached Notice of Annual

Meeting and this Proxy Statement. We have also made available a

copy of our Annual Report on Form 10-K for the year ended September

30, 2016 (“Annual

Report”) along with this

Proxy Statement. We encourage you to read our Annual Report. It

includes our audited financial statements and provides information

about our business and services.

In order for us to have

an efficient Annual Meeting, please either submit your vote online

by following the instructions on the enclosed proxy card, or sign,

date and return the enclosed proxy promptly in the accompanying

reply envelope. If you are able to attend the Annual Meeting and

wish to change your proxy vote, you may do so simply by voting in

person at the Annual Meeting. Regardless of whether you plan to attend the

Annual Meeting in person, please read the accompanying

Proxy Statement and then submit your vote as promptly as

possible. Voting

promptly will save us additional expense in soliciting proxies and

will ensure that your shares are represented at the Annual

Meeting.

Our

Board of Directors has unanimously approved the proposals set forth

in the Proxy Statement and we recommend that you vote in favor of

each such proposal.

We

look forward to seeing you at the Annual Meeting.

Sincerely,

Gordon

O. Jesperson

Corporate Secretary and General Counsel

|

|

YOUR VOTE IS IMPORTANT

All stockholders are cordially invited to attend the Annual Meeting

in person. However, to ensure your representation at the Annual

Meeting, you are urged to vote online or complete, sign, date and

return, in the enclosed postage paid envelope, the enclosed proxy

card as soon as possible. Returning your proxy will help us assure

that a quorum will be present at the Annual Meeting and avoid the

additional expense of duplicate proxy solicitations. Any

stockholder attending the Meeting may vote in person, even if he or

she has returned a proxy.

|

|

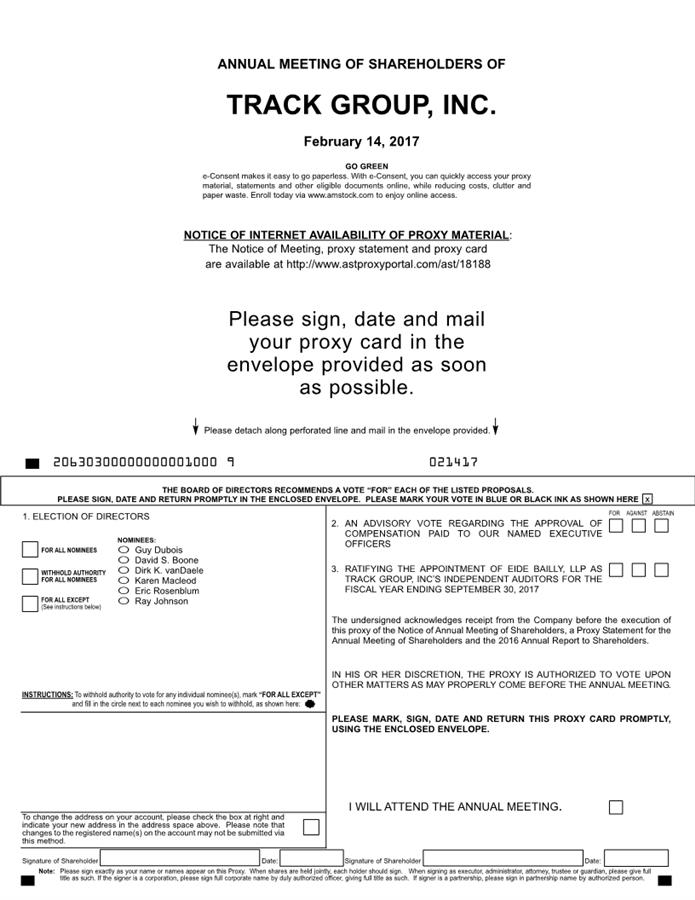

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD

February 14, 2017

To the Stockholders of Track Group, Inc.:

NOTICE

IS HEREBY GIVEN that the Annual Meeting of Stockholders of Track

Group, Inc., a Delaware corporation, will be held on Tuesday,

February 14, 2017, at 10:00 A.M. (local time), at our offices

located at 1215 W. Lakeview Court, Romeoville, Illinois, for the

following purposes:

1.

elect six directors to serve until the 2018 Annual Meeting of

Stockholders or until their successors are duly elected and

qualified;

2.

to consider an advisory vote on executive compensation paid to the

Company’s Named Executive Officers;

3.

to ratify the appointment of Eide Bailly, LLP as our independent

auditors for the fiscal year ending September 30, 2017;

and

4.

to transact such other business as may properly come before the

annual meeting and any adjournment or postponement

thereof.

These

matters are more fully discussed in the attached Proxy

Statement.

The close of business on December 23, 2016 (the

“Record Date”) has been fixed as the Record Date for the

determination of stockholders entitled to notice of, and to vote

at, the Annual Meeting or any adjournments or postponements

thereof. Only holders of record of our common stock, par value

$0.0001, at the close of

business on the Record Date are entitled to notice of, and to vote

at the Annual Meeting. A complete list of stockholders entitled to

vote at the Annual Meeting will be available for examination by any

of our stockholders for purposes pertaining to the Annual Meeting

at our corporate offices, 1215 W. Lakeview Court, Romeoville,

Illinois, during normal business hours for a period of 10 days

prior to the Annual Meeting, and at the time and place of the

Annual Meeting. We are providing a copy of our Annual

Report on Form 10-K for the year ended September 30, 2016 with the

accompanying Proxy Statement.

Whether or not you expect to

attend in person, we urge you to vote your shares as promptly as

possible by either submitting your vote online by following the

instructions on the enclosed proxy card, or by signing and

returning the enclosed proxy card in the postage-paid envelope

provided, so that your shares may be represented and voted at the

Annual Meeting. If your shares

are held in the name of a bank, broker or other fiduciary, please

follow the instructions on the voting instruction card furnished by

the record holder.

Our Board of Directors unanimously recommends that you vote

“FOR” the Annual Meeting Proposal Nos. 1, 2 and 3, all

of which are described in detail in the accompanying Proxy

Statement.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR

THE STOCKHOLDER MEETING TO BE HELD ON FEBRUARY 14, 2017 - THE

ANNUAL REPORT AND PROXY STATEMENT ARE AVAILABLE ONLINE AT:

http://www.astproxyportal.com/ast/18188

|

|

|

|

|

By Order of the Board of Directors,

|

|

|

|

|

|

|

|

|

|

Guy Dubois

|

|

|

Chief Executive Officer and Chairman of the Board of

Directors

|

Romeoville, Illinois

January 10, 2017

1215 Lakeview Court

Romeoville, Illinois 60446

(877) 260-2010

PROXY STATEMENT

General

This Proxy Statement is furnished in connection

with the solicitation by the Board of Directors (the

“Board”) of Track Group, a Delaware corporation

(the “Company,” “we,” “us,” or “our”), of proxies for use at the Annual Meeting

of Stockholders of the Company to be held at the Company’s

offices located at 1215 W. Lakeview Court, Romeoville, Illinois, on

Tuesday, February 14, 2017, at 10:00 a.m. (local time), and at any

adjournment or postponement thereof (the “Annual

Meeting”).

Who Can Vote

Stockholders of record at the close of business on

December 23, 2016 (the “Record Date”) are entitled to notice of and to vote at

the Annual Meeting. As of the close of business on the Record Date,

the Company had 10,333,516 shares of common stock issued and

outstanding. Each holder of common stock is entitled to one vote

for each share held as of the Record Date.

How You Can Vote

On or

about January 10, 2017,

we mailed these proxy materials to each of our stockholders

entitled to notice of and to vote at the Annual Meeting. The proxy

materials are also available free of charge on the Internet

at http://www.astproxyportal.com/ast/18188.

Stockholders

are invited to attend the Annual Meeting to vote on the proposals

described in this proxy statement. However, stockholders do not

need to attend the Annual Meeting to vote. Instead, stockholders

may submit their vote online by following the instructions on the

enclosed proxy card, or by simply completing, signing and returning

the enclosed proxy card.

If your proxy is properly returned to the Company,

the shares represented thereby will be voted at the Annual Meeting

in accordance with the instructions specified thereon. If return

your proxy without specifying how the shares represented thereby

are to be voted, the proxy will be voted (i) FOR the election of six directors nominated by our

Board, (ii) FOR the advisory vote to approve executive

compensation paid to the Company’s Named Executive Officers

(the “Say-on-Pay Proposal”); (iii) FOR ratification of the appointment of Eide Bailly,

LLP as our independent auditors for the year ended September

30, 2017; and (iv) at the discretion of the proxy holders on any

other matter that may properly come before the Annual Meeting or

any adjournment or postponement thereof.

If

a bank holds your shares, broker or other institution, you will

receive instructions from the holder of record that you must follow

for your shares to be voted.

Broker Non-Votes

A

“broker non-vote” occurs when a nominee (typically a

broker or bank) holding shares for a beneficial owner (typically

referred to as shares being held in “street name”)

submits a proxy for the Annual Meeting, but does not vote on a

particular proposal because the nominee has not received voting

instructions from the beneficial owner and does not have

discretionary authority to vote the shares with respect to that

proposal.

Brokers

and other nominees may vote on “routine” proposals on

behalf of beneficial owners who have not furnished voting

instructions, subject to the rules applicable to broker nominees

concerning transmission of proxy materials to beneficial owners,

and subject to any proxy voting policies and procedures of those

firms. The ratification of the independent registered public

accountants, for example, is a routine proposal. Brokers and other

nominees may not vote on “non-routine” proposals,

unless they have received voting instructions from the beneficial

owner. The election of directors and the Say-on-Pay Proposal are

considered “non-routine” proposals. This means that

brokers and other firms must obtain voting instructions from the

beneficial owner to vote on these matters; otherwise they will not

be able to cast a vote for these “non-routine”

proposals. If your shares are held in the name of a broker, bank or

other nominee, please follow their voting instructions so you can

instruct your broker on how to vote your shares.

Revocation of Proxies

Stockholders

of record can revoke their proxies at any time before they are

exercised in any one of three ways:

●

by voting in person at the Annual Meeting;

●

by submitting written notice of revocation to the Secretary of the

Company prior to the Annual Meeting; or

●

by submitting another proxy bearing a later date that is properly

executed prior to or at the Annual Meeting.

Quorum

In

order for any business to be conducted at the Annual Meeting, there

must be a quorum, meaning a majority of the shares of our common

stock issued and outstanding and entitled to vote at the Annual

Meeting must be present, either in person or by proxy. If you

submit a properly executed proxy, regardless of whether you abstain

from voting on one or more matters, your shares will be counted as

present at the Annual Meeting for the purpose of establishing a

quorum. Shares that constitute broker non-votes will also be

counted as present at the Annual Meeting for the purpose of

establishing a quorum. If a quorum is not present at the scheduled

time of the Annual Meeting, the stockholders who are present may

adjourn the Annual Meeting until a quorum is present. The time and

place of the adjourned Annual Meeting will be announced at the time

the adjournment is taken, and no other notice will be given. An

adjournment will have no effect on the business that may be

conducted at the Annual Meeting.

Vote Required for Approval

Proposal No.

1:

Election of

Directors.

Directors are elected by a plurality vote. This means the director

nominees who receive the highest number of affirmative votes cast

at the Annual Meeting, up to the number of directors to be elected,

will be elected as directors. Abstentions and broker non-votes will

have no effect on the outcome of the election of the

directors.

Proposal

No. 2: Advisory Vote to Approve Executive

Compensation. This advisory vote is

not binding on us, our Board of Directors, or management. The

number of votes cast “FOR” must exceed the number of

votes cast “AGAINST” this Proposal to approve, on an

advisory basis, the compensation paid to the Company’s Named

Executive Officers; and

Proposal

No. 3: Ratification of Appointment of

Auditors. To ratify the

appointment of Eide Bailly, LLP as our independent auditors for the

fiscal year ending September 30, 2017, the number of votes cast

“FOR” must exceed the number of votes cast

“AGAINST” this Proposal. A properly executed proxy marked

“ABSTAIN” will not be voted, although it will be

counted as present and entitled to vote for purposes of the

Proposal. Accordingly, an abstention will have the

effect of a vote against this Proposal. A broker or other nominee

will generally have discretionary authority to vote on this

Proposal because it is considered a routine matter, and therefore

we do not expect broker non-votes with respect to this Proposal.

However, any broker non-votes received will have no effect on the

outcome of this Proposal.

Solicitation

We

will bear the entire cost of solicitation, including the

preparation, assembly, printing and mailing of this Proxy

Statement, the proxy and any additional solicitation materials

furnished to the stockholders. Copies of any solicitation materials

will be furnished to brokerage houses, fiduciaries and custodians

holding shares in their names that are beneficially owned by others

so that they may forward this solicitation material to such

beneficial owners. In addition, we may reimburse such persons for

their costs in forwarding the solicitation materials to such

beneficial owners. The original solicitation of proxies by mail may

be supplemented by a solicitation by telephone, facsimile or other

means by our directors, officers or employees. No additional

compensation will be paid to these individuals for any such

services. Except as described above, we do not presently intend to

solicit proxies other than by mail and telephone.

PROPOSAL NO. 1

ELECTION OF DIRECTORS

General

The Company’s Certificate of Incorporation

provides that the number of directors

that constitute the entire Board shall be fixed from time to time

by resolution adopted by a majority of the entire

Board. A director elected by the Board to fill a vacancy

shall serve for the remainder of the term of that director and

until the director’s successor is elected and qualified. The

Board of Directors has recommended for election the following six

individuals to the Board of Directors at the Annual Meeting: Guy

Dubois, David S. Boone, Dirk van Daele, Eric Rosenblum, Karen

Macleod and Dr. Ray Johnson.

Each

nominee, if elected at the Annual Meeting, will hold office for a

one-year term until the next Annual Meeting of Shareholders or

until their successor is duly elected, unless prior thereto the

director resigns or the director’s office becomes vacant by

reason of death or other cause. If any such person is

unable or unwilling to serve as a nominee for the office of

director at the date of the Annual Meeting or any postponement or

adjournment thereof, the proxies may be voted for a substitute

nominee, designated by the proxy holders or by the present Board to

fill such vacancy, or for the balance of those nominees named

without nomination of a substitute, and the Board may be reduced

accordingly. The Board has no reason to believe that any

of such nominees will be unwilling or unable to serve if elected as

a director.

Required Vote

Directors

are elected by a plurality vote. This means that the nominees for

directors who receive the highest number of affirmative votes cast

at the Annual Meeting, up to the number of directors to be elected,

will be elected as directors. Abstentions and broker non-votes will

have no effect on the outcome of the election of the

directors.

Board of Directors Recommendation

The Board recommends a vote “FOR” the election of each nominee set forth

below.

Nominee Biographies

Following

are the names and ages of each nominee for election as a director,

the principal occupation of each, the year in which each was first

elected or nominated as a director of the Company (if applicable),

the business experience of each nominee for at least the past five

years and certain other information concerning each of the

nominees

|

Name

|

|

Served as

Director Since

|

|

Age

|

|

Principal Business Experience

|

|

|

|

|

|

|

|

|

|

Guy Dubois

|

|

2012

|

|

58

|

|

Guy Dubois has served as our Chairman since February 2013, and

became a director in December 2012. Mr. Dubois also served as a

member of the Company’s Executive Committee from October 2012

to September 2016, and was appointed to serve as Chief Executive

Officer of the Company in September 2016. Mr. Dubois is a director

of Singapore-based Tetra House Pte. Ltd., a provider of consulting

and advisory services worldwide; and a director of RNTS Media NV, a

Luxembourg listed digital content developer and mobile application

advertising monetization platform provider. Mr. Dubois is a former

director and CEO of Gategroup AG, and held various executive

leadership roles at Gate Gourmet Holding LLC. Mr. Dubois has held

executive management positions at Roche Vitamins Inc. in New

Jersey, as well as regional management roles in that firm’s

Asia Pacific operations. Mr. Dubois also served the European

Organization for Nuclear Research (CERN) team in Switzerland in

various roles, including treasurer and chief accountant. Mr. Dubois

also worked with IBM in Sweden as Product Support Specialist for

Financial Applications. A Belgian citizen, Mr. Dubois holds a

degree in financial science and accountancy from the Limburg

Business School in Diepenbeek, Belgium.

In considering Mr. Dubois as a director of the Company, the current

Board of Directors reviewed his extensive financial and management

expertise and experience. In addition, Mr. Dubois’ public

company senior management and board experience, and the leadership

he has shown in his positions with prior companies, were considered

important factors in the determination of the current Board of

Directors.

|

|

|

|

|

|

|

|

|

|

David S. Boone

|

|

2011

|

|

56

|

|

David S. Boone became a director of the Company on December 21,

2011. Mr. Boone currently serves as the CEO of Alacura and Angel

MedFlight, a private equity backed medical transportation company.

He has served in executive roles with a variety of publicly traded

and start-up organizations including Kraft General Foods, Sears,

PepsiCo, Safeway and Belo Corporation, as well as serving as the

CFO of Intira Corporation and CEO of Paranet Solutions, LLC. In

addition, he has served as a consultant with the Boston Consulting

Group. Mr. Boone was CEO, President and Director of American

CareSource Holdings from 2005 to 2011, a NASDAQ traded company. He

was the 2009 Ernst and Young Entrepreneur of the Year winner for

Health Care in the Southwest Region. Mr. Boone serves on a number

of private company boards and serves on the board of the Texas

Kidney Foundation. Mr. Boone graduated from the University of

Illinois, cum laude, in 1983 majoring in accounting. Mr. Boone is a

Certified Public Accountant. He received his master’s degree

in business administration from Harvard Business School in

1989.

In considering Mr. Boone as a director of the Company, the current

Board of Directors reviewed his extensive financial expertise and

experience. In addition, Mr. Boone's public company senior

management and board experience, and the leadership he has shown in

his positions with prior companies and as a director of the

Company, were considered important factors in the determination of

the current Board of Directors.

|

|

Name

|

|

Served as

Director Since

|

|

Age

|

|

Principal Business Experience

|

|

|

|

|

|

|

|

|

|

Dirk Karel J. van Daele

|

|

2015

|

|

55

|

|

Mr. van Daele, a resident of Switzerland, became a director of the

Company in May 2015 and is currently a principal of Anoa Capital

SA, a Luxembourg investment advisory company focused on advisory

services for direct lending and acquisition of secondary loan

portfolios. Mr. van Daele has served in that capacity since January

2010. Prior to joining Anoa Capital SA, Mr. van Daele was the

Managing Director and Head of Global Finance, Asia Pacific

(Singapore) for Union Bank of Switzerland, having served in that

capacity since July 1998. He received his Master of Arts in

Economics at the University of Louvain (Belgium) in

1984.

In considering Mr. van Daele’s nomination, the Board of

Directors believed his extensive international finance, banking and

senior management experience would assist in the Board’s

deliberations as the Company expands operations internationally and

finances its growth.

|

|

|

|

|

|

|

|

|

| Karen

Macleod |

|

2016

|

|

53

|

|

Ms. Macleod

became a director of the Company in

January 2016 and currently serves as CEO

of Arete Group LLC, a professional services firm. Prior to Arete

Group, Ms. Macleod was President of Tatum LLC, a New York-based

professional services firm owned by Randstad, from 2011-2014, and

was a co-founder of Resources Connection (NASDAQ:RECN), now known

as RGP, a multinational professional services firm founded as a

division of Deloitte in June 1996. Ms. Macleod served in several

positions for RGP, including as a director from 1999- 2009 and

President, North America from 2004-2009. Prior to RGP, Ms. Macleod

held several positions in the audit department of Deloitte between

1985-1994. Ms. Macleod currently serves as a director for A-Connect

(Schweiz) AG, a privately held, Swiss-based global

professional services firm and was a director for Overland

Solutions from 2006-2013. Ms. Macleod holds a Bachelor of

Science in Business/Managerial Economics from the University of

California, Santa Barbara.

In considering Ms. Macleod’s nomination, the Board of

Directors believes Ms. Macleod’s senior public company

leadership experience along with her finance and accounting

background are important to the ongoing growth of the Company and

corporate governance excellence.

|

|

|

|

|

|

|

|

|

|

|

|

2016

|

|

47

|

|

Mr.Rosenblum

became a director of the Company in September 2016 and is currently

a senior executive with Palantir Technologies (a privately held big

data analytics company), where he oversees several product groups.

In his role, he has overseen the deployment of data analytics

platforms for both government and large commercial institutions.

From 2012 to 2014, Mr. Rosenblum served as a Vice President and

Chief Operating Officer at drawbridge, Inc. a mobile advertising

start-up, during which time Drawbridge developed a cross-device

digital marketing technology based on algorithms without the use of

personally identifiable information. Mr. Rosenblum served as a

Director of Product, and Director of Strategy and Business

operations at Google, Inc. from 2008 to 2012. From 2005 to 2008 he

served as a Managing Director, China and General Manager, Strategy

for Realnetworks, Inc. Mr. Rosenblum earned his Bachelor’s

degree in East Asian Studies and Economics at Harvard University

and his Masters of Business Administration from the Massachusetts

Institute of Technology.

In considering Mr. Rosenblum’s nomination, the Board of

Directors believed his extensive technological and analytics

background, international business and management experience would

assist in the Board’s deliberations regarding product

development and international growth.

|

|

|

|

|

|

|

|

|

|

Dr. Ray Johnson

|

|

2016

|

|

61

|

|

Dr. Johnson became a director of the Company in September 2016 and

currently serves as an Executive in Residence with Bessemer Venture

Partners. From 2006 through February 2015, Dr. Johnson served as

the Senior Vice President and Chief Technology Officer of the

Lockheed Martin Corporation, where he led the strategic areas of

technology, engineering, production operations, global supply

chain, program management, and logistics and sustainment. Prior to

his time with Lockheed Martin, Dr. Johnson served as the Chief

Operating Officer for Modern Technology Solutions, Inc. of

Alexandria, Virginia from 2005 to 2006, and from 1996 to 2005, he

served in a number of executive positions with Science Applications

International Corporation, including Senior Vice President and

General Manager of the Advanced Concepts Business Unit. Dr. Johnson

served for 12 years as an officer in the U.S. Air Force. Currently

Dr. Johnson serves as a director on the boards of: QxBranch, LLC,

Terrestrial Energy, Inc., United Sciences, LLC, and 8 Rivers

Capital, LLC, all privately held companies. He received his

Bachelor’s degree in Electrical Engineering from Oklahoma

State University, and his Master’s and Ph.D. degrees in

Electrical Engineering from the Air Force Institute of

Technology.

In considering Dr. Johnson’s nomination, the Board of

Directors reviewed his extensive technology expertise and

experience. In addition, Dr. Johnson's public company senior

management and board experience, and the leadership he has shown in

his positions with prior companies, were considered important

factors in the determination of the current Board of

Directors.

|

Board Meetings and Committees

The

Board met eight times during the year ended September 30, 2016 and

all incumbent directors attended at least 75% of the aggregate

number of meetings of the Board and of the committees on which such

directors served. The Board encourages the directors to attend our

annual meetings of stockholders when stockholder participation is

expected.

Independent Directors

The

Board believes that a majority of its members should be independent

directors. The Board has determined that, other than Mr. Dubois,

all of its current directors, as well as each of the nominees for

election, are independent directors as defined by the rules and

regulations of the NASDAQ Stock Market.

The members of the Audit Committee and Compensation

Committee of the Board each meet the independence standards

established by the NASDAQ Stock Market and the U.S. Securities and

Exchange Commission (the “SEC”) for audit committees and compensation

committees. In addition, the Board has determined that of its

current directors, Ms. Macleod and Mr. van Daele each satisfy the

definition of an “audit committee financial expert”

under SEC rules and regulations. These designations do not impose

any duties, obligations or liabilities that are greater than those

generally imposed as members of the Audit Committee and the Board,

and the designation as audit committee financial expert does not

affect the duties, obligations or liability of any other member of

the Audit Committee or the Board.

Board Committees and Charters

The

Board of Directors has three standing committees: the Audit

Committee, Compensation Committee, and Nominating and Corporate

Governance Committee. These committees assist the Board

of Directors to perform its responsibilities and make informed

decisions.

Audit Committee

The primary duties of the Audit Committee are to

oversee (i) management’s conduct of our financial reporting

process, including reviewing the financial reports and other

financial information provided by the Company, and reviewing our

systems of internal accounting and financial controls, (ii) our

independent auditors’ qualifications and independence and the

audit and non-audit services provided to the Company, and (iii) the

engagement and performance of our independent auditors. The

Audit Committee assists the Board in providing oversight of our

financial and related activities, including capital market

transactions. The Audit Committee has a charter, a copy of which is

available on our website at www.trackgrp.com.

The

Audit Committee meets with our Chief Financial Officer and with our

independent registered public accounting firm and evaluates the

responses by the Chief Financial Officer both to the facts

presented and to the judgments made by our independent registered

public accounting firm. The Audit Committee met four times

during fiscal year 2016 and all members of the Audit Committee

attended at least 75% of the Committee’s

meetings.

Members

of the Audit Committee currently consist of Ms. Macleod, Mr.

Rosenblum and Mr. van Daele. Each member of the Audit

Committee, satisfies, according to the full Board of Directors, the

definition of independent director as established in the NASDAQ

Stock Market Rules and are financially literate. In

accordance with Section 407 of the Sarbanes-Oxley Act of 2002, the

Board of Directors designated Ms. Macleod as the Audit

Committee’s “Audit Committee Financial Expert” as

defined by the applicable regulations promulgated by the

SEC.

The Audit Committee reviewed and discussed the

matters required by United States auditing standards required by

the Public Company Accounting Oversight Board

(“PCAOB”) and our audited financial statements for

the fiscal year ended September 30, 2016 with management and our

independent registered public accounting firm. The Audit

Committee has received the written disclosures and the letter from

our independent registered public accounting firm required by

Independence Standards Board No. 1, and the Audit Committee has

discussed with the independent registered public accounting firm

the independent registered public accounting firm's

independence.

Compensation Committee

Members of the Compensation Committee currently

consist of Dr. Johnson and Mr. Rosenblum. The Compensation

Committee met two times during fiscal year 2016. The Board of

Directors appoints members of the Compensation Committee. Mr.

Rosenblum and Dr. Johnson are independent directors, as determined

by the Board of Directors in accordance with the NASDAQ Stock

Market Rules, including Rule 5605(d)(2)(A). The

Compensation Committee is governed by a charter approved by the

Board of Directors, a copy of which is available on the

Company’s website www.trackgrp.com.

The

Compensation Committee has responsibility for developing and

maintaining an executive compensation policy that creates a direct

relationship between pay levels and corporate performance and

returns to stockholders. The Committee monitors the results of such

policy to assure that the compensation payable to our executive

officers provides overall competitive pay levels, creates proper

incentives to enhance shareholder value, rewards superior

performance, and is justified by the returns available to

stockholders.

The

Compensation Committee also acts on behalf of the Board of

Directors in administering compensation plans approved by the

Board, in a manner consistent with the terms of such plans

(including, as applicable, the granting of stock options,

restricted stock, stock units and other awards, the review of

performance goals established before the start of the relevant plan

year, and the determination of performance compared to the goals at

the end of the plan year). The Committee reviews and makes

recommendations to the Board with respect to new compensation

incentive plans and equity-based plans; reviews and recommends the

compensation of the Company’s directors to the full Board for

approval; and reviews and makes recommendations to the Board on

changes in major benefit programs of executive officers of the

Company.

Nominating and Corporate Governance Committee

Messrs.

van Daele, Boone and Dr. Johnson currently serve as members of the

Nominating and Corporate Governance Committee. The Nominating

Committee has the responsibility for identifying and recommending

candidates to fill vacant and newly created Board positions,

setting corporate governance guidelines regarding director

qualifications and responsibilities, and planning for senior

management succession.

The Nominating and Corporate Governance Committee

is required to review the qualifications and backgrounds of all

directors and nominees (without regard to whether a nominee has

been recommended by stockholders), as well as the overall

composition of the Board of Directors, and recommend a slate of

directors to be nominated for election at the annual meeting of

stockholders, or, in the case of a vacancy on the Board of

Directors, recommend a director to be elected by the Board to fill

such vacancy. The Nominating and Corporate Governance

Committee held one meeting during fiscal 2016. The Nominating and

Corporate Governance Committee’s charter is available on our

website, www.trackgrp.com.

Director Nominations

The

Board nominates directors for election at each annual meeting of

stockholders and appoints new directors to fill vacancies when they

arise. The Nominating and Corporate Governance Committee has the

responsibility to identify, evaluate, recruit and recommend

qualified candidates to the Board for such nomination or

appointment.

A

stockholder who wishes to suggest a prospective nominee for the

Board should notify the Secretary of the Company or any member of

the Nominating and Corporate Governance Committee in writing with

any supporting material the stockholder considers appropriate.

Nominees suggested by stockholders are considered in the same way

as nominees suggested from other sources. Once the Nominating and

Corporate Governance Committee chooses a slate of candidates, the

Nominating and Corporate Governance Committee recommends the

candidates to the entire Board, and the Board then determines

whether to recommend the slate to the

stockholders.

In

addition, the Company’s Bylaws contain provisions that

address the process by which a stockholder may nominate an

individual to stand for election to the Board at the

Company’s annual meeting of stockholders. In order to

nominate a candidate for director, a stockholder must give timely

notice in writing to the Secretary of the Company and otherwise

comply with the provisions of the Company’s Bylaws.

Information required by the Company’s Bylaws to be in the

notice include: the name, contact information and share ownership

information for the candidate and the person making the nomination

and other information about the nominee that must be disclosed in

proxy solicitations under Section 14 of the Securities

Exchange Act of 1934 and its related rules and regulations. The

Nominating and Corporate Governance Committee may also require any

proposed nominee to furnish such other information as may

reasonably be required by the Nominating and Corporate Governance

Committee to determine the eligibility of such proposed nominee to

serve as director of the Company. The recommendation should be sent

to: Secretary, Track Group, Inc., 1215 W. Lakeview Court,

Romeoville, Illinois 60446. You can obtain a copy of the

Company’s Bylaws by writing to the Secretary at this

address.

Stockholder Communications

If

you wish to communicate with the Board, you may send your

communication in writing to: Secretary, Track Group, Inc., 1215 W.

Lakeview Court, Romeoville, Illinois 60446. You must include your

name and address in the written communication and indicate whether

you are a stockholder of the Company. The Secretary will review any

communication received from a stockholder, and all material and

appropriate communications from stockholders will be forwarded to

the appropriate director or directors or committee of the Board

based on the subject matter.

Code of Ethics

We have established a Code of Business Ethics that

applies to our officers, directors and employees. The

Code of Business Ethics contains general guidelines for conducting

our business consistent with the highest standards of business

ethics, and is intended to qualify as a “code of

ethics” within the meaning of Section 406 of the

Sarbanes-Oxley Act of 2002 and the rules promulgated

thereunder. We will post on our

website, www.trackgrp.com, any

amendments to or waivers from a provision of our Code of Business

Ethics that applies to our principal executive officer, principal

financial officer, principal accounting officer, controller or

persons performing similar functions and that relates to any

element of the Code of Business Ethics.

Board Leadership Structure

Our

Board of Directors has discretion to determine whether to separate

or combine the roles of Chief Executive Officer and Chairman of the

Board. Guy Dubois has served in both roles since September 11,

2016, and our Board continues to believe that his combined role is

most advantageous to the Company and our stockholders, as Mr.

Dubois possesses in-depth knowledge of the issues, opportunities

and risks facing us, our business and our industry and is best

positioned to fulfill the responsibilities of our Chief Executive

Officer, as well as the Chairman’s responsibility to develop

meeting agendas that focus the Board’s time and attention on

the most critical matters and to facilitate constructive dialogue

among Board members on strategic issues.

In

addition to Mr. Dubois’ leadership, the Board maintains

effective independent oversight through a number of governance

practices, including, open and direct communication with

management, input on meeting agendas, and regular executive

sessions.

Board Role in Risk Assessment

Management,

in consultation with outside professionals, as applicable,

identifies risks associated with the Company’s operations,

strategies and financial statements. Risk assessment is also

performed through periodic reports received by the Audit Committee

from management, counsel and the Company’s independent

registered public accountants relating to risk assessment and

management. Audit Committee members meet privately in executive

sessions with representatives of the Company’s independent

registered public accountants. The Board also provides risk

oversight through its periodic reviews of the financial and

operational performance of the Company.

PROPOSAL NO. 2

ADVISORY VOTE ON EXECUTIVE COMPENSATION

The

Company’s executive compensation program is designed to

attract, motivate and retain a talented team of executives. The

Company seeks to accomplish this goal in a way that rewards

performance that is aligned with its stockholders’ long-term

interests. The Company believes that its executive compensation

program achieves this goal and is strongly aligned with the

long-term interests of its stockholders.

Pursuant

to Section 14A of the Exchange Act, the Company is submitting a

proposal to its stockholders for an advisory vote on the

compensation of its named executive officers. This Proposal,

commonly known as a “say-on-pay” proposal, is a

non-binding vote, but gives stockholders the opportunity to express

their views on the compensation of the Company’s named

executive officers. This vote is not intended to address any

specific item of compensation, but rather the overall compensation

of the named executive officers.

Accordingly,

the following resolution is submitted for stockholders for

approval:

RESOLVED, that the stockholders of Track Group, Inc.,

approve, on an advisory basis, the compensation of its named

executive officers as disclosed in the Proxy Statement for the

Annual Meeting to be held February 14, 2017, pursuant to Item 402

of Regulation S-K, the accompanying tabular disclosure regarding

named executive officer compensation and the corresponding

narrative disclosure and footnotes.

As

an advisory vote, this Proposal is not binding. However, the

Compensation Committee, which is responsible for designing and

administering the Company’s executive compensation program,

values the opinions expressed by stockholders in their vote on this

Proposal and will consider the outcome of the vote when making

future compensation decisions for named executive

officers.

Vote Required

The

affirmative “FOR” vote must exceed the number of votes

“AGAINST” to approve this non-binding matter. Broker

non-votes are counted towards a quorum, but are not counted for any

purpose in determining whether this Proposal has been approved.

Unless otherwise instructed on the proxy or unless authority to

vote is withheld, shares represented by executed proxies will be

voted “FOR” this Proposal.

Board of Directors Recommendation

The Board recommends that stockholders vote

“FOR” the advisory resolution above, approving

of the compensation paid to the Company’s named executive

officers.

PROPOSAL NO. 3

RATIFICATION OF THE APPOINTMENT OF

EIDE BAILLY, LLP TO SERVE AS OUR

REGISTERED PUBLIC ACCOUNTING FIRM FOR THE CURRENT FISCAL

YEAR

The Board of Directors has appointed Eide

Bailly, LLP (“Eide Bailly”) as our independent registered public

accounting firm for the current fiscal year and hereby recommends

that the stockholders ratify such appointment.

The

Board of Directors may terminate the appointment of Eide Bailly as

the Company’s independent registered public accounting firm

without the approval of the stockholders whenever the Board of

Directors deems such termination necessary or

appropriate.

Representatives

of Eide Bailly will be present at the Annual Meeting, or available

by telephone, and will have an opportunity to make a statement if

they so desire and to respond to appropriate questions from

stockholders.

Principal Accountant Fees and Services

Audit Fees

Audit

services consist of the audit of our annual consolidated financial

statements, and other services related to filings and registration

statements filed by us and our subsidiaries, and other pertinent

matters. Eide Bailly has served as our independent registered

public accounting firm since September 24, 2013. We paid

Eide Bailly approximately $155,552 and $125,982 for audit services

for the year ended September 30, 2016 and 2015,

respectively.

Tax Fees, Audit Related Fees, and All Other Fees

The

Company paid Eide Bailly $24,415 and $1,863 for tax and audit

related fees, respectively, during the year ended September 30,

2016, and $31,937 and $8,375 for tax and audit related fees,

respectively, during the year ended September 30,

2015.

Auditor Independence

Our

Audit Committee considered that the work done for us in fiscal year

2016 and 2015 by Eide Bailly was compatible with maintaining

Eide Bailly’s independence.

Required Vote

Ratification

of the selection of Eide Bailly as the Company’s independent

auditors for the fiscal year ending September 30, 2017 requires the

affirmative vote of a majority of the shares present or represented

by proxy and entitled to vote at the Annual Meeting. Under Delaware

law and the Company’s Certificate of Incorporation and

Bylaws, an abstention will have the same legal effect as a vote

against the ratification of Eide Bailly and each broker non-vote

will reduce the absolute number, but not the percentage, of

affirmative votes necessary for approval of the ratification.

Unless otherwise instructed on the proxy or unless authority to

vote is withheld, shares represented by executed proxies will be

voted “FOR” the ratification of Eide Bailly as the

Company’s independent auditors for the fiscal year ending

September 30, 2017.

Board of Directors Recommendation

The Board of Directors recommends that stockholders vote

“FOR” the ratification of the selection of Eide

Bailly, LLP as the Company’s independent auditors for the

fiscal year ending September 30, 2017.

EXECUTIVE OFFICERS

The

Company’s executive officers are appointed by the Board on an

annual basis and serve at the discretion of the Board, subject to

the terms of any employment agreements they may have with the

Company. The following is a brief description of the present and

past business experience of each of the Company’s current

executive officers.

|

Name

|

|

Age

|

|

Position

|

|

Guy Dubois

|

|

58

|

|

Chief Executive Officer

|

|

Peter K. Poli

|

|

55

|

|

Chief Financial Officer

|

|

Derek Cassell

|

|

43

|

|

President

|

Guy Dubois. Mr. Dubois’ biography appears on page

4 of this Proxy Statement, under Proposal No.

1.

Peter K. Poli

has served as our Chief Financial

Officer since January 2017. Before joining the Company, Mr. Poli

served as the Chief Financial Officer of Grand Banks Yachts Limited

from August 18, 2014 through December 31, 2015. In addition, he

served as an Executive Director of Grand Banks Yachts from March

31, 2008 through October 28, 2015. Prior to his time with Grand

Banks Yachts Limited, Mr. Poli served as the Chief Financial

Officer for Acumen Fund Inc., USA, I-Works Inc., and as Vice

President and Chief Financial Officer of FTD.COM. Mr. Poli also

spent nine years as an Investment Banker with Dean Witter Reynolds,

Inc. and served as the CFO of a wholly-owned subsidiary of Morgan

Stanley Dean Witter from 1997 to 1999. In addition, Mr. Poli has

served as an Independent Director of Leapnet, Inc. since May 2000.

Mr. Poli holds BA in Economics and Engineering from Brown

University in 1983 and an MBA from Harvard Business School in

1987.

Derek Cassell

has served as our President since

December 2016, and previously served as a Divisional President for

the Company from June 2014 until December 2016. From September 2008

until June 2014, Mr. Cassell served as an Executive Vice President

of Emerge Monitoring, which was part of the Bankers Surety Team.

Mr. Cassell has over 20 years experience providing correctional

solutions to the criminal justice industry. His previous positions

include Director of Operations for ADT Correctional Services,

Director of Customer Support for G4S Justice Services and National

Sales and Marketing Manager for ElmoTech Inc. He holds a Criminal

Justice Degree from Henry Ford College in Dearborn Heights,

Michigan.

EXECUTIVE COMPENSATION

Set

out in the following summary compensation table are the particulars

of compensation paid to the following persons for our fiscal years

ended September 30, 2016 and 2015:

(a)

our principal executive officer;

(b)

our most highly compensated executive

officers who were serving as executive officers at the end of the

fiscal year ended September 30, 2016 who had total compensation

exceeding $100,000 (together, with the principal executive officer,

the “ Named Executive

Officers”);

and

(c)

additional individuals for whom disclosure would have been provided

under (b) but for the fact that the individual was not serving as

an executive officer at the end of the most recently completed

financial year.

|

Name and

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Guy

Dubois

|

2016

|

$-

|

$-

|

$30,000

|

$170,182

|

$-

|

$200,182

|

|

Chairman and Chief Executive Officer

|

2015

|

$-

|

$-

|

$-

|

$419,445

|

$-

|

$419,455

|

|

|

|

|

|

|

|

|

|

Peter Poli (1)

|

2016

|

$-

|

$-

|

$-

|

$-

|

$-

|

$-

|

|

Chief Financial Officer

|

2015

|

$-

|

$-

|

$-

|

$-

|

$-

|

$-

|

|

|

|

|

|

|

|

|

|

Derek Cassell (2)

|

2016

|

$206,076

|

$-

|

$42,500

|

$-

|

$-

|

$248,576

|

|

President

|

2015

|

$190,000

|

$-

|

$42,500

|

$-

|

$-

|

$232,500

|

|

|

|

|

|

|

|

|

|

John R. Merrill (3)

|

2016

|

$153,854

|

$-

|

$42,500

|

$-

|

$-

|

$196,354

|

|

Former Chief Financial Officer

|

2015

|

$180,000

|

$-

|

$42,500

|

$-

|

$74,700

|

$297,200

|

|

|

|

|

|

|

|

|

|

Mark Attarian (4)

|

2016

|

$91,167

|

$-

|

$-

|

$-

|

$-

|

$91,167

|

|

Former Chief Financial Officer

|

2015

|

$-

|

$-

|

$-

|

$-

|

$-

|

$-

|

|

(1)

|

Mr. Poli began serving as our Chief Financial Officer on January 6,

2017 and, as such, did not receive any compensation from the

Company during either fiscal 2016 or 2015.

|

|

(2)

|

Mr. Cassell was appointed President of the Company on December 19,

2016. Prior to this appointment, Mr. Cassell served as the

Company’s President of the Company’s America’s

Division since June 2014.

|

|

(3)

|

Mr. Merrill’s employment as the Company’s Chief

Financial Officer was terminated on September 27,

2016.

|

|

(4)

|

Mr. Attarian was appointed to serve as the Company’s Chief

Financial Officer on September 12, 2016, and previously served as

the Company’s Chief Administrative Officer since July 11,

2016. Mr. Attarian subsequently resigned from the Company on

November 15, 2016.

|

Narrative Disclosure to the Executive Compensation

Table

Compensation Paid to our Chief Executive Officer

Our

current principal executive officer, Guy Dubois, was granted

warrants equal to $300,000 for his additional work as a director

and member of the Board’s Executive Committee, the then the

acting principal executive officer of the Company, during the

fiscal year ended September 30, 2015, consisting of warrants

to purchase 113,310 shares of common stock at an exercise price of

$9.65 per share. These warrants vest in equal monthly increments

over a period of one year or immediately upon the hiring of a new

Chief Executive Officer. These warrants were valued at

the date of grant using the Black-Scholes model.

To

date, Mr. Dubois has only received compensation for his service as

a director and member of the Executive Committee. Mr.

Dubios’s compensation during the year ended September 30,

2016 consisted of warrants to purchase an aggregate total of 68,659

shares of common stock with an average exercise price of $6.97 per

share, and 4,167 shares of common stock.

Poli Employment Agreement

On December 12, 2016,

the Company entered into a three-year employment agreement with Mr.

Poli (the “Poli Employment

Agreement”). Under the

terms and conditions of the Poli Employment Agreement, Mr. Poli

will receive a base salary equal to $240,000 per annum beginning in

January 2017, and received an option to purchase 100,000 shares of

the Company’s common stock at an exercise price per share

equal to the closing price of the Company’s common stock on

the date approved by the Board. One-half of this option is

scheduled to vest on January 1, 2018, and the remaining one-half is

scheduled to vest on January 1, 2019.

Cassell Employment Agreement

On December 1, 2016,

the Company entered into an employment agreement with Mr. Cassell

(the “Cassell Employment

Agreement”). Under the

terms and conditions of the Cassell Employment Agreement, Mr.

Cassell will receive a base salary equal to $240,000 per annum, and

received an option to purchase 100,000 shares of the

Company’s common stock at an exercise price per share equal

to the closing price of the Company’s common stock on the

date approved by the Board. One-half of this option is scheduled to

vest on September 30, 2017, and the remaining one-half is scheduled

to vest on September 30, 2018.

Attarian Employment Agreement

On September 11, 2016,

the Company entered into a two-year employment agreement with Mr.

Attarian (the “Attarian

Employment Agreement”). Under the

terms and conditions of the Attarian Employment Agreement, Mr.

Attarian will receive a for a base salary equal to $250,000 per

annum, and received an option to purchase 125,000 shares of common

stock of the Company at an exercise price equal to the per share

sale price of any underwritten public offering of the Company's

common stock occurring between the date of the Attarian Employment

Agreement and December 31, 2016 (the "Option").

In the event the public offering does not occur by December 31,

2016, the exercise price of the Option shall be equal to the

average of the closing price of the Company common stock on the 30

trading days immediately preceding December 31, 2016. The Option

vests 25% on December 31, 2016, with the balance vesting in equal

monthly installments over the following 36 months. Mr. Attarian

resigned from the Company effective November 15, 2016 and therefore

forfeited the Option.

Merrill Employment Agreement

On November 19, 2014, the Company entered into a

two-year employment agreement with John Merrill (the

“Merrill Employment

Agreement”). Under the terms and

conditions of the Merrill Employment Agreement, Mr.

Merrill received an annual base

salary of $180,000 and was eligible to participate in the

Company’s Employee Bonus Plan and 2012 Equity Incentive Award

Plan, wherein Mr. Merrill may earn a variable cash bonus and/or

shares of the Company’s common stock based on individual

performance and achieving specific Company milestones. Mr. Merrill

was also entitled to participate in such life insurance,

disability, medical, dental, retirement plans and other programs as

may be made generally available from time to time by the Company

for the benefit of similarly situated employees or its employees

generally. Mr. Merrill's employment with the Company was terminated

on September 27, 2016.

Outstanding Equity Awards at September 30, 2016

The

following table discloses outstanding stock option awards and

warrants held by each of the Named Executive Officers at

September 30, 2016:

Outstanding Equity Awards at Fiscal Year-End 2016

|

Name (1)

|

Number of securities underlying unexercised options (#)

exercisable

|

Number of securities underlying unexercised options (#)

exercisable

|

Equity incentive plan awards: Number of underlying unexercised

unearned options (#)

|

Option

exercise

price ($)

|

|

Number of shares or units of stock that have not vested

(#)

|

Market value of shares or units of stock that have not vested

($)

|

Equity incentive plan awards: Number of Unearned shares, units or

other rights that have not vested (#)

|

Equity incentive plan awards: Market or Payout value of unearned

shares, units or other rights that have not vested ($)

|

|

|

|

|

|

|

|

|

|

|

|

|

Guy

Dubois

|

2,385

|

-

|

-

|

$12.580

|

3/21/2017

|

-

|

-

|

-

|

-

|

|

|

64,665

|

-

|

-

|

$9.000

|

4/15/2017

|

-

|

-

|

-

|

-

|

|

|

4,083

|

-

|

-

|

$14.700

|

6/30/2017

|

-

|

-

|

-

|

-

|

|

|

2,280

|

-

|

-

|

$19.460

|

9/30/2017

|

-

|

-

|

-

|

-

|

|

|

2,432

|

-

|

-

|

$18.750

|

3/31/2018

|

-

|

-

|

-

|

-

|

|

|

51,576

|

-

|

-

|

$17.450

|

6/2/2018

|

-

|

-

|

-

|

-

|

|

|

2,647

|

-

|

-

|

$15.450

|

6/30/2018

|

-

|

-

|

-

|

-

|

|

|

14,988

|

-

|

-

|

$12.01

|

1/27/2017

|

-

|

-

|

-

|

-

|

|

|

8,868

|

-

|

-

|

$10.15

|

4/20/2017

|

-

|

-

|

-

|

-

|

|

|

113,310

|

-

|

-

|

$9.65

|

8/14/2017

|

-

|

-

|

-

|

-

|

|

|

8,571

|

-

|

-

|

$10.50

|

9/30/2017

|

-

|

-

|

-

|

-

|

|

|

12,676

|

-

|

-

|

$7.10

|

10/14/2017

|

-

|

-

|

-

|

-

|

|

|

15,126

|

-

|

-

|

$5.95

|

1/15/2018

|

-

|

-

|

-

|

-

|

|

|

14,286

|

-

|

-

|

$6.30

|

3/31/2018

|

-

|

-

|

-

|

-

|

|

|

18,000

|

-

|

-

|

$5.00

|

6/30/2018

|

-

|

-

|

-

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

John

R. Merrill

|

-

|

-

|

-

|

$-

|

-

|

-

|

-

|

-

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

Mark

Attarian

|

-

|

125,000

|

-

|

$(2)

|

09/11/2019

|

-

|

-

|

-

|

-

|

(1)

Mr. Poli and Mr.

Cassell do not appear in this table, as they were each appointed to

their respective positions after the end of fiscal

2016.

(2)

Per the Attarian Employment

Agreement, the exercise

price of this option was set to be equal to the per share sale

price of any underwritten public offering of the Company's common

stock occurring between the date of the Attarian Employment

Agreement and December 31, 2016. However, the exercise price was

not determined, as Mr. Attarian

resigned from the Company on November 15, 2016 and forfeited the

option.

Compliance with Section 16(a) of the Exchange Act

Section

16(a) of the Exchange Act requires our officers, directors, and

persons who beneficially own more than ten percent of our common

stock to file reports of ownership and changes in ownership with

the SEC. Officers, directors, and greater-than-ten-percent

stockholders are also required by the SEC to furnish us with copies

of all Section 16(a) forms that they file.

Based

solely upon a review of these forms that were furnished to us, we

believe that all reports required to be filed by these individuals

and persons under Section 16(a) were filed during fiscal year 2016

and that such filings were timely except the

following:

●

Mr. Dubois, our

CEO and a director, filed a Form 5 reporting five late

transactions;

●

Mr. Boone, a

director, filed a Form 5 reporting two late transactions;

and

●

Mr. van Daele, a

director, filed a Form 5 reporting two late

transactions.

DIRECTOR COMPENSATION

The

table below summarizes the compensation paid by us to our

non-employee directors for

the fiscal year ended September 30, 2016:

|

|

|

|

|

|

|

Name**

|

|

|

|

|

|

|

|

|

|

|

|

David

Boone

|

$-

|

$59,997

|

$178,107

|

$238,104

|

|

Karen

Macleod

|

$-

|

$15,000

|

$66,730

|

$81,730

|

|

Dirk

van Daele

|

$-

|

$22,171

|

$128,310

|

$150,481

|

*

Fees

earned by our non-employee directors was paid in common stock or

options to purchase common stock at the option of the

director. A liability for these fees was included with

accrued expenses at September 30, 2016.

**

Mr.

Rosenblum and Dr. Johnson do not appear in this table as they were

each appointed to the Board on September 11, 2016, and did not

receive compensation from the Company during the year ended

September 30, 2016.

During the year ended September 30, 2016, we accrued $5,000 per

month in fees payable to each director, to be issued in shares of

common stock valued on the last date of the quarter. Alternatively,

any director may elect to receive warrants with an exercise price

at the current market price at the date of grant in the amount of

three times the amount had the director elected to take shares,

valued at the date of grant using the Black-Scholes valuation

method. Additionally, the Chairman of the Board and Chairman

of the Audit Committee accrued $10,000 per month rather than

$5,000. Beginning in fiscal 2017, we are accruing $25,000 per

quarter for each director, payable in common stock or warrants with

an exercise price at the current market price at the date of grant,

all grants of common stock or warrants are to be valued at the date

of grant using the Black-Scholes valuation method.

Director Warrants

The following table lists the warrants to purchase shares of common

stock held by each of our non-employee directors as of January 7,

2017:

|

|

Grant

|

|

Expiration

|

|

Exercise

|

|

Number of

|

|

Compensation

|

|

Name

|

Date

|

|

Date

|

|

Price

|

|

Options

|

|

Expense

|

|

|

|

|

|

|

|

|

|

|

|

|

David S. Boone

|

3/22/13

|

|

3/21/17

|

|

$

|

12.58

|

|

|

8,943

|

|

$

|

43,809

|

|

|

7/1/13

|

|

6/30/17

|

|

$

|

14.70

|

|

|

4,083

|

|

$

|

23,640

|

|

|

10/1/13

|

|

9/30/17

|

|

$

|

19.46

|

|

|

2,280

|

|

$

|

17,982

|

|

|

1/2/14

|

|

12/31/18

|

|

$

|

19.29

|

|

|

2,344

|

|

$

|

12,014

|

|

|

10/15/15

|

|

10/14/17

|

|

$

|

7.10

|

|

|

12,676

|

|

$

|

24,571

|

|

|

1/15/16

|

|

1/15/18

|

|

$

|

5.95

|

|

|

15,126

|

|

$

|

45,008

|

|

|

7/1/16

|

|

6/30/18

|

|

$

|

5.00

|

|

|

18,000

|

|

$

|

53,460

|

|

|

9/30/16

|

|

9/30/18

|

|

$

|

7.20

|

|

|

12,500

|

|

$

|

30,000

|

|

|

10/1/16

|

|

9/30/18

|

|

$

|

7.20

|

|

|

5,882

|

|

$

|

25,000

|

|

|

12/30/16

|

|

12/30/18

|

|

$

|

4.50

|

|

|

9,191

|

|

$

|

25,000

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Karen Macleod

|

7/1/16

|

|

6/30/18

|

|

$

|

5.00

|

|

|

9,000

|

|

$

|

26,730

|

|

|

9/30/16

|

|

9/30/18

|

|

$

|

7.20

|

|

|

6,250

|

|

$

|

15,000

|

|

|

10/1/16

|

|

9/30/18

|

|

$

|

7.20

|

|

|

5,882

|

|

$

|

25,000

|

|

|

12/30/16

|

|

12/30/18

|

|

$

|

4.50

|

|

|

9,191

|

|

$ |

25,000

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dirk van Daele

|

10/15/15

|

|

10/14/17

|

|

$

|

7.10

|

|

|

6,338

|

|

$

|

16,504

|

|

|

1/15/16

|

|

1/15/18

|

|

$

|

5.95

|

|

|

7,563

|

|

$

|

22,504

|

|

|

7/1/16

|

|

6/30/18

|

|

$

|

5.00

|

|

|

9,000

|

|

$

|

26,730

|

|

|

9/30/16

|

|

9/30/18

|

|

$

|

7.20

|

|

|

6,250

|

|

$

|

15,000

|

|

|

10/1/16

|

|

9/30/18

|

|

$

|

7.20

|

|

|

5,882

|

|

$

|

25,000

|

|

|

12/30/16

|

|

12/30/18

|

|

$

|

4.50

|

|

|

9,191

|

|

$

|

25,000

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dr. Ray Johnson

|

10/1/16

|

|

9/30/18

|

|

$

|

7.20

|

|

|

5,882

|

|

$

|

25,000

|

|

|

12/30/16

|

|

12/30/18

|

|

$

|

4.50

|

|

|

9,191

|

|

$

|

25,000

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Eric Rosenblum

|

10/1/16

|

|

9/30/18

|

|

$

|

7.20

|

|

|

5,882

|

|

$

|

25,000

|

|

|

12/30/16

|

|

12/30/18

|

|

$

|

4.50

|

|

|

9,191

|

|

$

|

25,000

|

*

Compensation

paid to Mr. Dubois, who is the Company's Chief Executive Officer

and Chairman of the Board of Directors, during the year ended

September 2016 is reflected in the Executive Compensation Table

above.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND

MANAGEMENT

The following table presents information regarding

beneficial ownership as of January 7, 2017 (the

“Table Date”), of our common stock by (i) each

shareholder known to us to be the beneficial owner of more than

five percent of our common stock; (ii) each of our Named Executive

Officers serving as of the Table Date; (iii) each of our directors

serving as of the Table Date; and (iv) all of our executive

officers and directors as a group.

We have determined beneficial ownership in

accordance with the rules of the SEC. Except as

indicated by the footnotes below, we believe, based on the

information furnished to us, that the persons and entities named in

the table below have sole voting and dispositive power with respect

to all securities they beneficially own. As of the Table

Date, the applicable percentage ownership is based

on 10,333,516 shares of common stock issued and

outstanding.

Beneficial