DRAFT Supplemental Investor Materials November 5, 2025

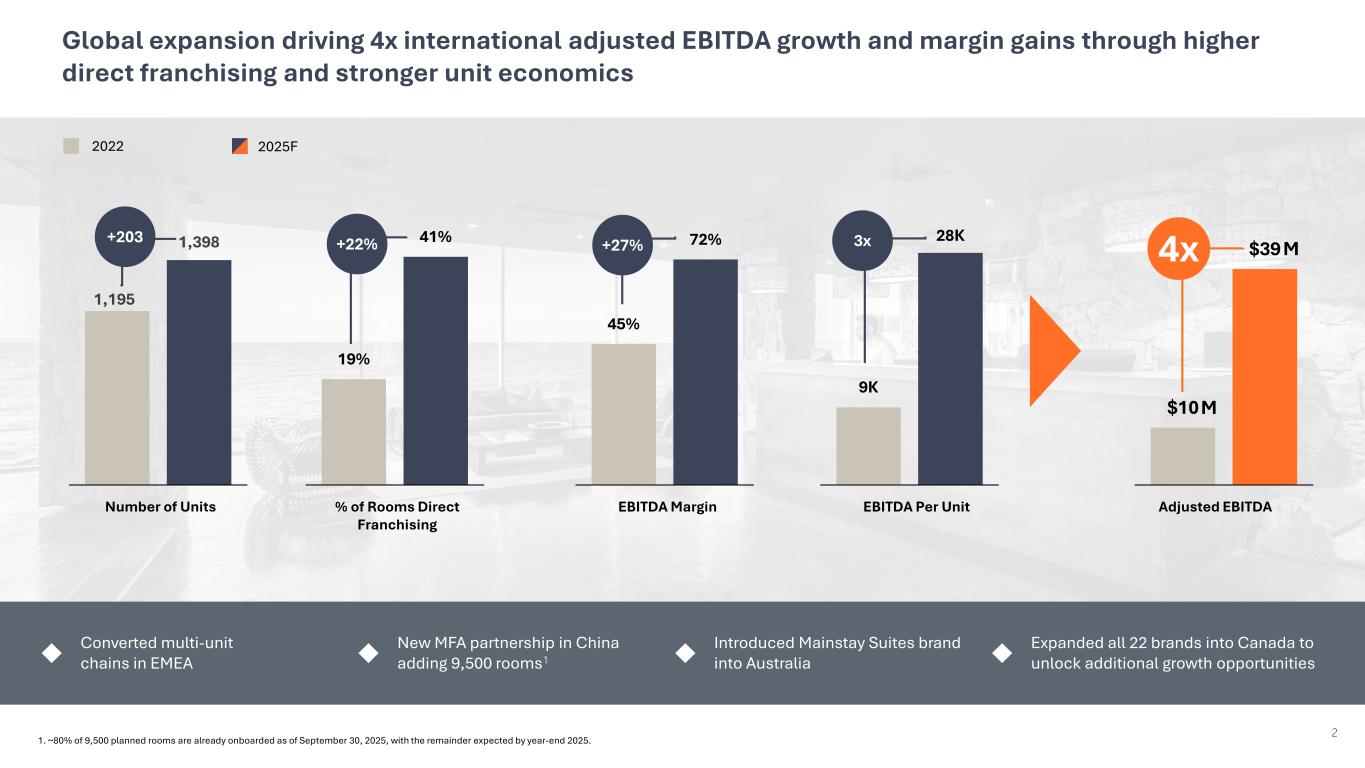

Global expansion driving 4x international adjusted EBITDA growth and margin gains through higher direct franchising and stronger unit economics 1,195 1,398 Number of Units 19% 41% % of Rooms Direct Franchising 45% 72% EBITDA Margin 9K 28K EBITDA Per Unit $10 $39 +203 +22% +27% 3x Adjusted EBITDA 4x 2025F 2022 Converted multi-unit chains in EMEA New MFA partnership in China adding 9,500 rooms1 Introduced Mainstay Suites brand into Australia Expanded all 22 brands into Canada to unlock additional growth opportunities 1. ~80% of 9,500 planned rooms are already onboarded as of September 30, 2025, with the remainder expected by year-end 2025. M M 2

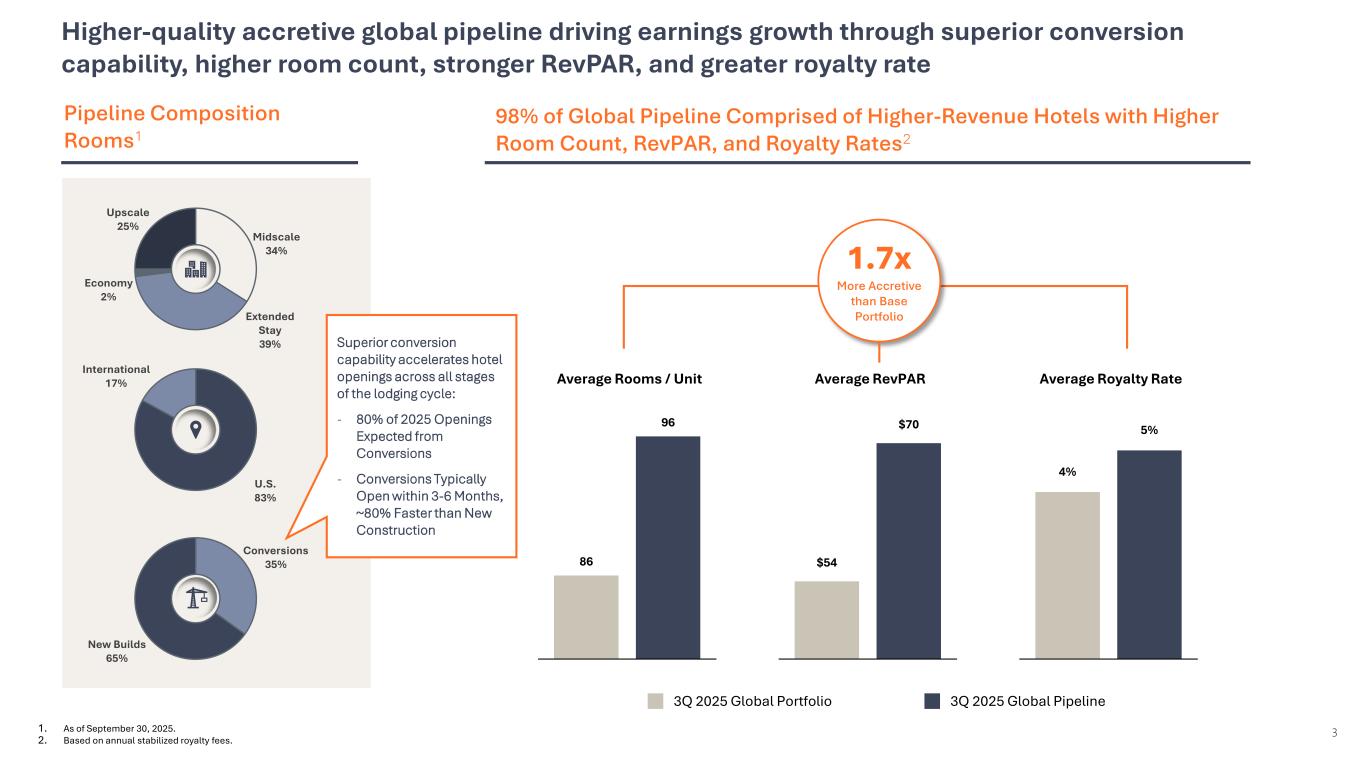

Higher-quality accretive global pipeline driving earnings growth through superior conversion capability, higher room count, stronger RevPAR, and greater royalty rate 98% of Global Pipeline Comprised of Higher-Revenue Hotels with Higher Room Count, RevPAR, and Royalty Rates2 Midscale 34% Extended Stay 39% Economy 2% Upscale 25% U.S. 83% International 17% Conversions 35% New Builds 65% 3Q 2025 Global Pipeline3Q 2025 Global Portfolio 86 96 $54 $70 4% 5% Average Rooms / Unit Average RevPAR Average Royalty Rate Superior conversion capability accelerates hotel openings across all stages of the lodging cycle: - 80% of 2025 Openings Expected from Conversions - Conversions Typically Open within 3-6 Months, ~80% Faster than New Construction 1.7x More Accretive than Base Portfolio 1. As of September 30, 2025. 2. Based on annual stabilized royalty fees. 3 Pipeline Composition Rooms1

Forward Looking Statements 4 Information set forth herein includes “forward-looking statements.” Certain, but not necessarily all, of such forward-looking statements can be identified by the use of forward- looking terminology, such as “expect,” “estimate,” “believe,” “anticipate,” “should,” “will,” “forecast,” “plan,” “project,” “assume,” or similar words of futurity. All statements other than historical facts are forward-looking statements. These forward-looking statements are based on management’s current beliefs, assumptions, and expectations regarding future events, which in turn are based on information currently available to management. Such statements may relate to projections of Choice’s revenue, expenses, EBITDA, adjusted EBITDA, earnings, debt levels, ability to repay outstanding indebtedness, payment of dividends, net surplus or deficit, repurchases of common stock and other financial and operational measures, including occupancy and open hotels, RevPAR, strategic investment and acquisition performance, international expansion performance, macroeconomic backdrop and Choice’s liquidity, among other matters. We caution you not to place undue reliance on any such forward-looking statements. Forward-looking statements do not guarantee future performance and involve known and unknown risks, uncertainties, and other factors. Several factors could cause actual results, performance or achievements of the company to differ materially from those expressed in or contemplated by the forward-looking statements. Such risks include, but are not limited to, changes to general, domestic and foreign economic conditions, including access to liquidity and capital; changes in consumer demand and confidence, including consumer discretionary spending and the demand for travel, transient and group business; the timing and amount of future dividends and share repurchases; future domestic or global outbreaks of epidemics, pandemics or contagious diseases or fear of such outbreaks, and the related impact on the global hospitality industry, particularly but not exclusively the U.S. travel market; changes in law and regulation applicable to the travel, lodging or franchising industries, including with respect to the status of the company’s relationship with employees of our franchisees; foreign currency fluctuations; variability and unpredictability in trade relations, sanctions, tariffs or other trade controls; the federal government funding lapse and related government shutdown; impairments or declines in the value of the company’s assets; operating risks common in the travel, lodging or franchising industries; changes to the desirability of our brands as viewed by hotel operators and customers; changes to the terms or termination of our contracts with franchisees and our relationships with our franchisees; our ability to keep pace with improvements in technology utilized for marketing and reservation systems and other operating systems; our ability to grow our franchise system; exposure to risks related to our hotel development, financing, franchise agreement acquisition costs and ownership activities; exposures to risks associated with our investments in new businesses; fluctuations in the supply and demand for hotel rooms; our ability to realize anticipated benefits from acquired businesses; impairments or losses relating to acquired businesses; the level of acceptance of alternative growth strategies we may implement; the impact of inflation; cyber security and data breach risks; climate change and sustainability related concerns; ownership and financing activities; hotel closures or financial difficulties of our franchisees; operating risks associated with our international operations; labor shortages; the outcome of litigation; and our ability to effectively manage our indebtedness and secure our indebtedness. These and other risk factors are discussed in detail in the company’s filings with the U.S. Securities and Exchange Commission, including our Annual Report on Form 10-K. We undertake no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise, except as required by law.