INTERNAL Company Update November 5, 2025

INTERNAL Available Information This presentation should be read together with, and is qualified in its entirety by reference to, the company’s most recent filings with the Securities and Exchange Commission and are available at: www.conedison.com/ en/. (Select “For Investors” and then select “SEC Filings,” respectively.) Forward-Looking Statements This presentation contains forward-looking statements that are intended to qualify for the safe-harbor provisions of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements are statements of future expectations and not facts. Words such as “forecasts,” “expects,” “estimates,” “anticipates,” “intends,” “believes,” “plans,” “will,” “target,” “guidance,” “potential,” “goal,” “consider” and similar expressions identify forward-looking statements. The forward-looking statements reflect information available and assumptions at the time the statements are made, and accordingly speak only as of that time. Actual results or developments might differ materially from those included in the forward-looking statements because of various factors such as those identified in reports Con Edison has filed with the Securities and Exchange Commission, including that Con Edison's subsidiaries are extensively regulated and may be subject to substantial penalties; its utility subsidiaries' rate plans may not provide a reasonable return; it may be adversely affected by changes to the utility subsidiaries' rate plans; the failure of, or damage to, its subsidiaries' facilities could adversely affect it; a cyber attack could adversely affect it; the failure of processes and systems, the failure to retain and attract employees and contractors, and their negative performance could adversely affect it; it is exposed to risks from the environmental consequences of its subsidiaries' operations, including increased costs related to climate change; its ability to pay dividends or interest depends on dividends from its subsidiaries; changes to tax laws could adversely affect it; it requires access to capital markets to satisfy funding requirements; a disruption in the wholesale energy markets, increased commodity costs or failure by an energy supplier or customer could adversely affect it; it faces risks related to health epidemics and other outbreaks; its strategies may not be effective to address changes in the external business environment; it faces risks related to supply chain disruptions, inflation and the imposition of tariffs (or subsequent changes to tariffs once announced or implemented); and it also faces other risks that are beyond its control. This list of factors is not all-inclusive because it is not possible to predict all factors that could cause actual results or developments to differ from the forward-looking statements. Con Edison assumes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. For more information, contact: Jan Childress, Director, Investor Relations Caroline Elsasser, Section Manager, Investor Relations Allison Duignan, Sr. Analyst, Investor Relations Tel: 212-460-6611 Tel: 212-460-4431 Tel: 212-460-6912 Email: childressj@coned.com Email: elsasserc@coned.com Email: duignana@coned.com Investor Relations conEdison.com 2

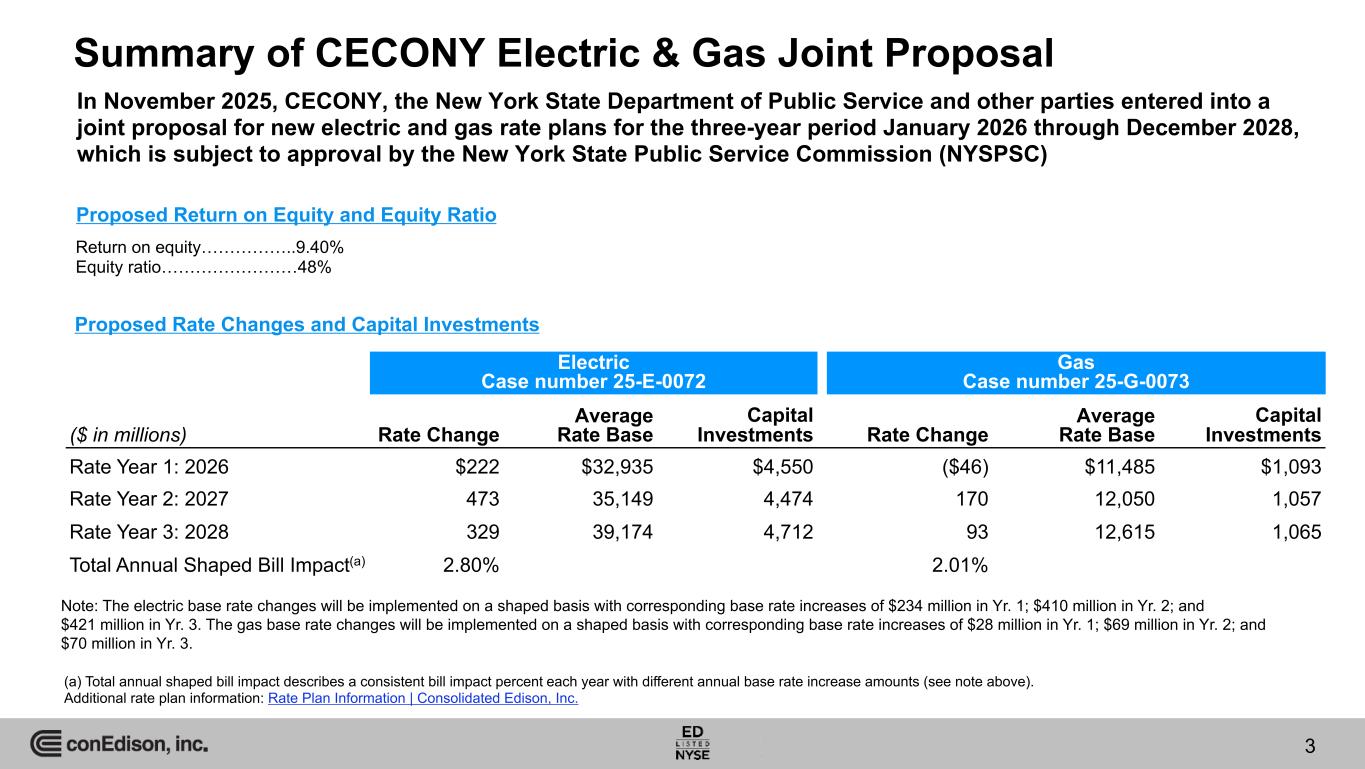

INTERNAL 33 Summary of CECONY Electric & Gas Joint Proposal (a) Total annual shaped bill impact describes a consistent bill impact percent each year with different annual base rate increase amounts (see note above). Additional rate plan information: Rate Plan Information | Consolidated Edison, Inc. Electric Case number 25-E-0072 Gas Case number 25-G-0073 ($ in millions) Rate Change Average Rate Base Capital Investments Rate Change Average Rate Base Capital Investments Rate Year 1: 2026 $222 $32,935 $4,550 ($46) $11,485 $1,093 Rate Year 2: 2027 473 35,149 4,474 170 12,050 1,057 Rate Year 3: 2028 329 39,174 4,712 93 12,615 1,065 Total Annual Shaped Bill Impact(a) 2.80% 2.01% In November 2025, CECONY, the New York State Department of Public Service and other parties entered into a joint proposal for new electric and gas rate plans for the three-year period January 2026 through December 2028, which is subject to approval by the New York State Public Service Commission (NYSPSC) Return on equity……………..9.40% Equity ratio……………………48% Proposed Return on Equity and Equity Ratio Proposed Rate Changes and Capital Investments Note: The electric base rate changes will be implemented on a shaped basis with corresponding base rate increases of $234 million in Yr. 1; $410 million in Yr. 2; and $421 million in Yr. 3. The gas base rate changes will be implemented on a shaped basis with corresponding base rate increases of $28 million in Yr. 1; $69 million in Yr. 2; and $70 million in Yr. 3.

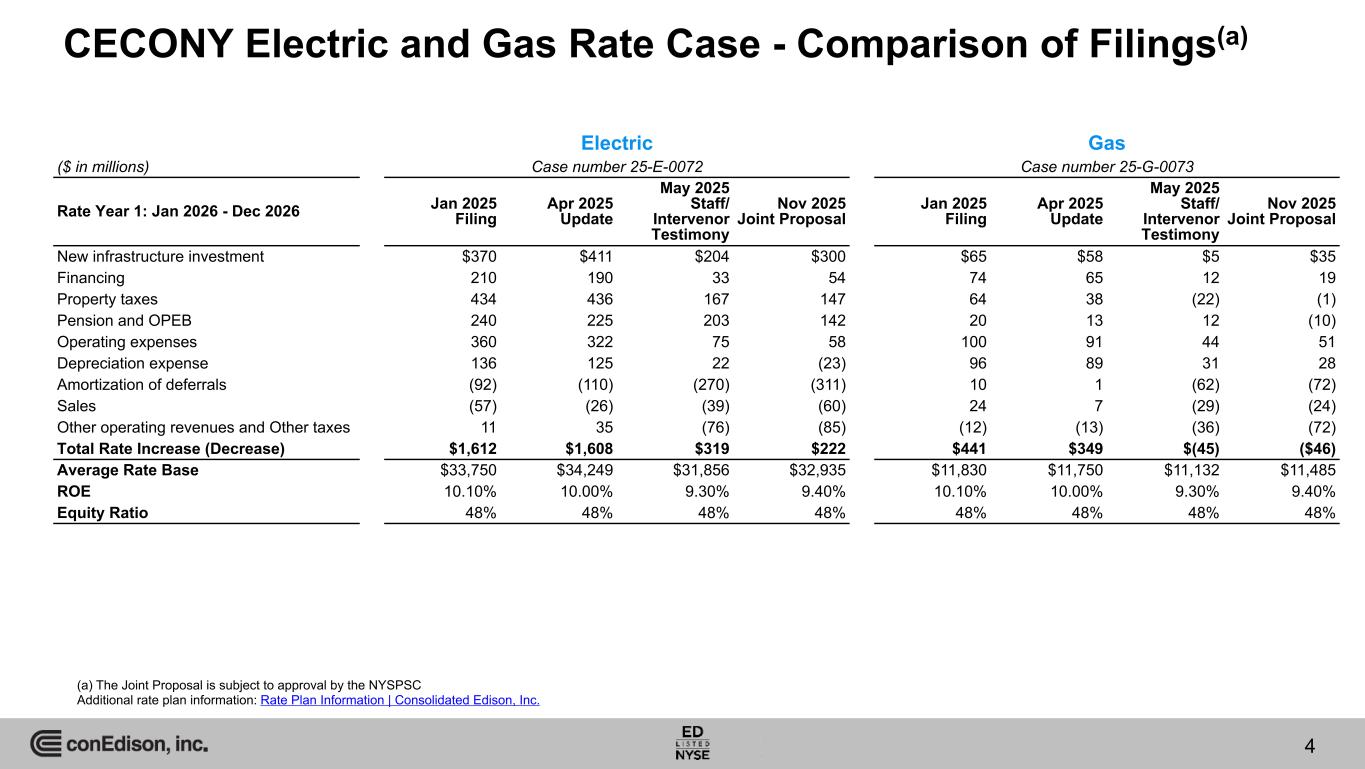

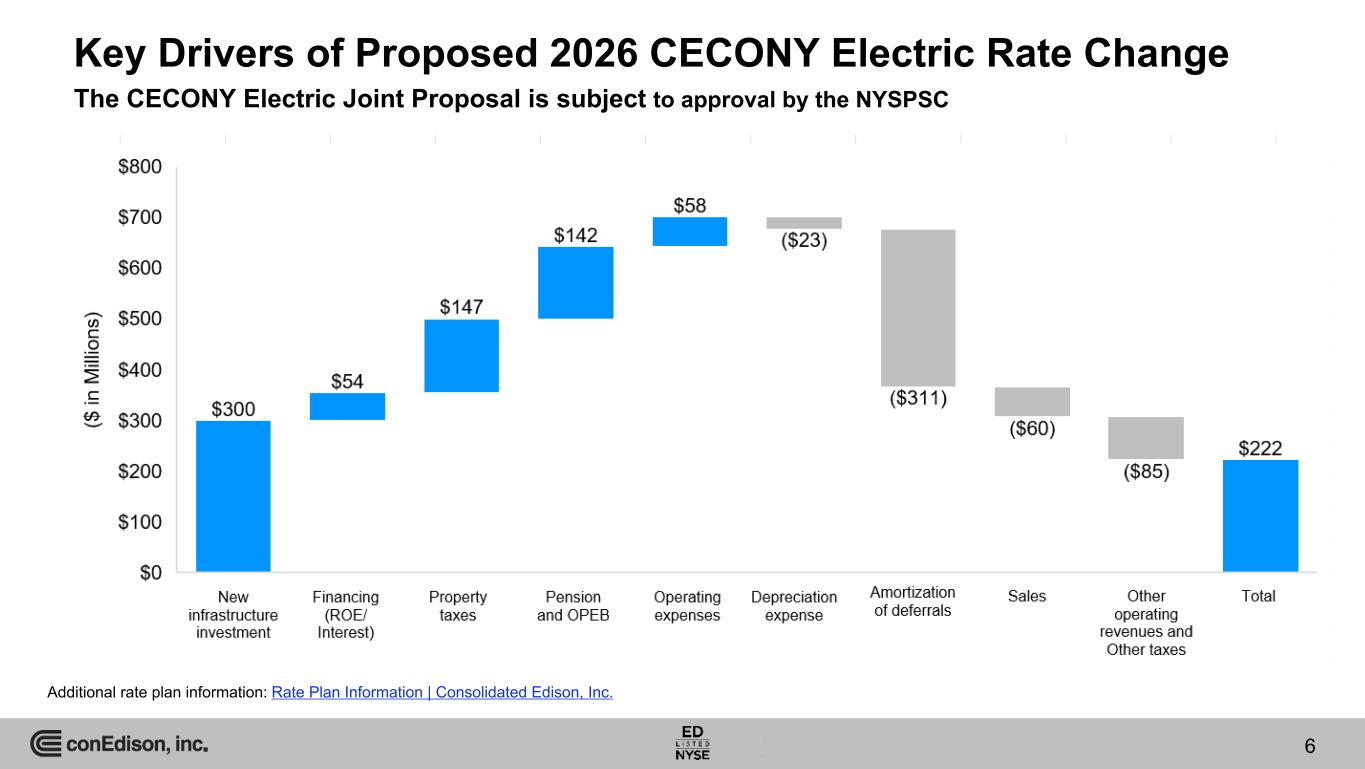

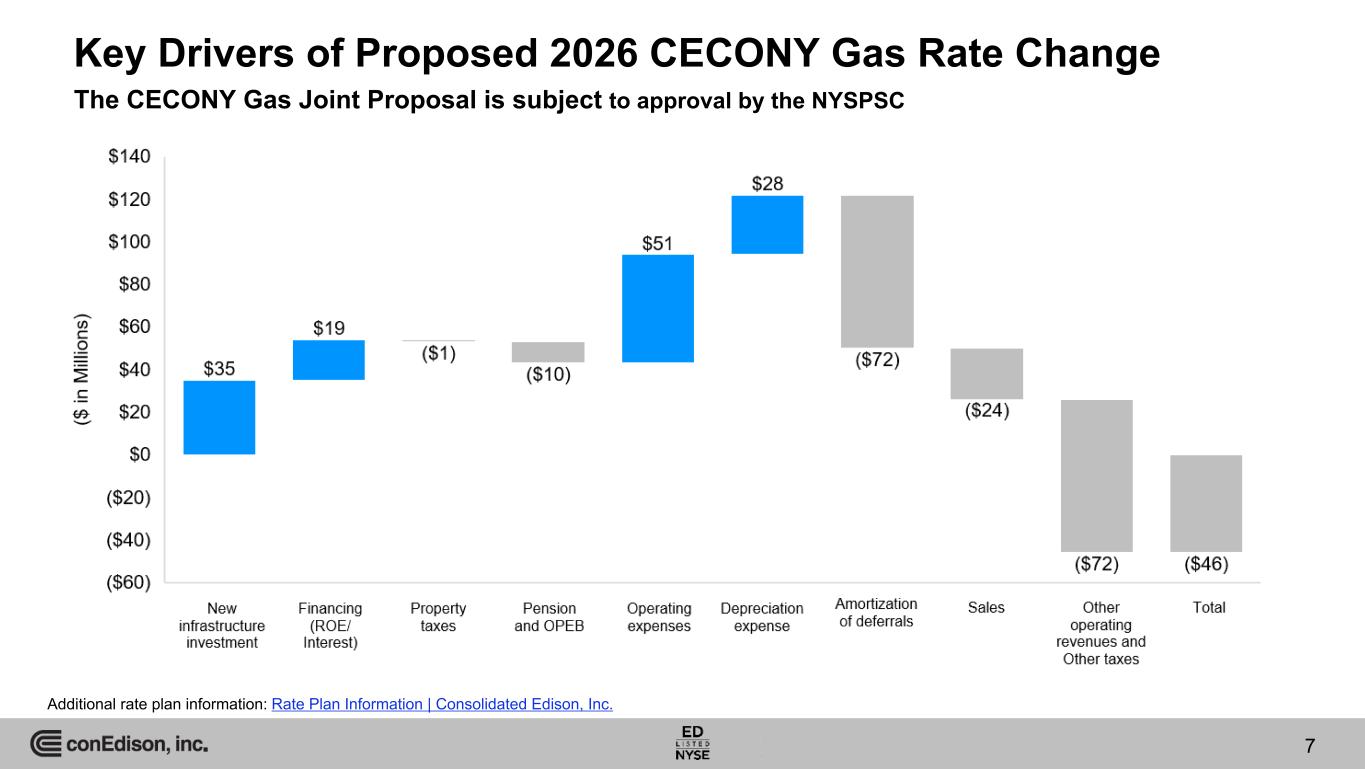

INTERNAL (a) The Joint Proposal is subject to approval by the NYSPSC Additional rate plan information: Rate Plan Information | Consolidated Edison, Inc. CECONY Electric and Gas Rate Case - Comparison of Filings(a) 4 Electric Gas ($ in millions) Case number 25-E-0072 Case number 25-G-0073 Rate Year 1: Jan 2026 - Dec 2026 Jan 2025 Filing Apr 2025 Update May 2025 Staff/ Intervenor Testimony Nov 2025 Joint Proposal Jan 2025 Filing Apr 2025 Update May 2025 Staff/ Intervenor Testimony Nov 2025 Joint Proposal New infrastructure investment $370 $411 $204 $300 $65 $58 $5 $35 Financing 210 190 33 54 74 65 12 19 Property taxes 434 436 167 147 64 38 (22) (1) Pension and OPEB 240 225 203 142 20 13 12 (10) Operating expenses 360 322 75 58 100 91 44 51 Depreciation expense 136 125 22 (23) 96 89 31 28 Amortization of deferrals (92) (110) (270) (311) 10 1 (62) (72) Sales (57) (26) (39) (60) 24 7 (29) (24) Other operating revenues and Other taxes 11 35 (76) (85) (12) (13) (36) (72) Total Rate Increase (Decrease) $1,612 $1,608 $319 $222 $441 $349 $(45) ($46) Average Rate Base $33,750 $34,249 $31,856 $32,935 $11,830 $11,750 $11,132 $11,485 ROE 10.10% 10.00% 9.30% 9.40% 10.10% 10.00% 9.30% 9.40% Equity Ratio 48% 48% 48% 48% 48% 48% 48% 48%

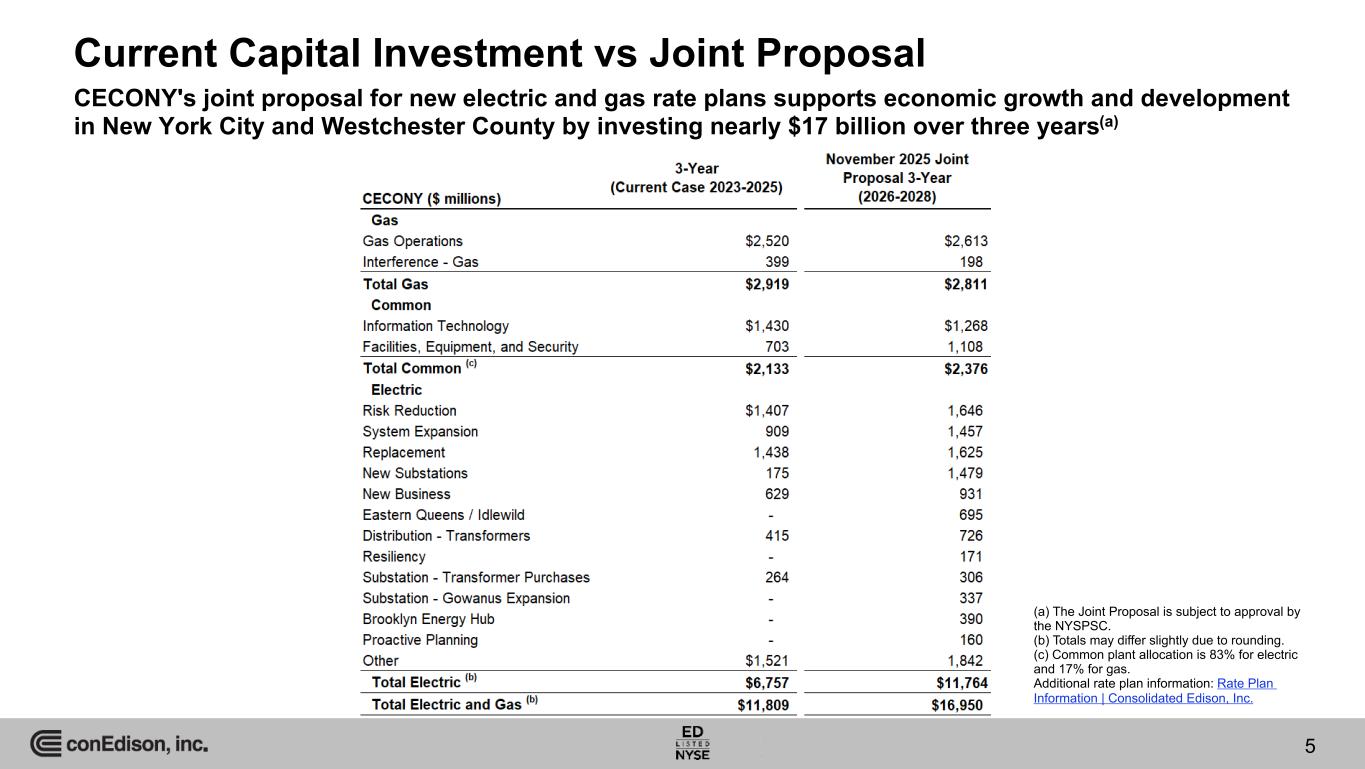

INTERNAL 55 Current Capital Investment vs Joint Proposal (a) The Joint Proposal is subject to approval by the NYSPSC. (b) Totals may differ slightly due to rounding. (c) Common plant allocation is 83% for electric and 17% for gas. Additional rate plan information: Rate Plan Information | Consolidated Edison, Inc. CECONY's joint proposal for new electric and gas rate plans supports economic growth and development in New York City and Westchester County by investing nearly $17 billion over three years(a)

INTERNAL 66 Key Drivers of Proposed 2026 CECONY Electric Rate Change The CECONY Electric Joint Proposal is subject to approval by the NYSPSC Additional rate plan information: Rate Plan Information | Consolidated Edison, Inc.

INTERNAL 77 Key Drivers of Proposed 2026 CECONY Gas Rate Change Additional rate plan information: Rate Plan Information | Consolidated Edison, Inc. The CECONY Gas Joint Proposal is subject to approval by the NYSPSC

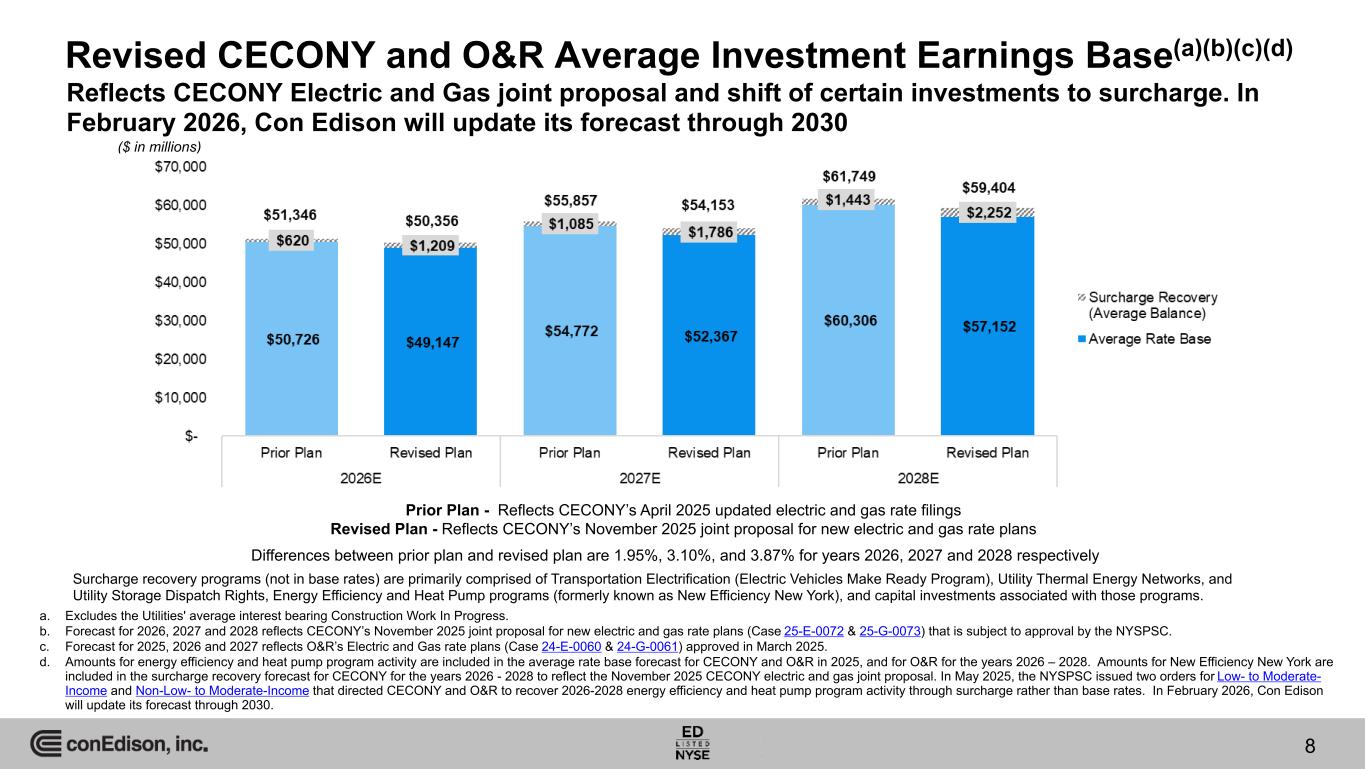

INTERNAL Revised CECONY and O&R Average Investment Earnings Base(a)(b)(c)(d) 8 Reflects CECONY Electric and Gas joint proposal and shift of certain investments to surcharge. In February 2026, Con Edison will update its forecast through 2030 Surcharge recovery programs (not in base rates) are primarily comprised of Transportation Electrification (Electric Vehicles Make Ready Program), Utility Thermal Energy Networks, and Utility Storage Dispatch Rights, Energy Efficiency and Heat Pump programs (formerly known as New Efficiency New York), and capital investments associated with those programs. a. Excludes the Utilities' average interest bearing Construction Work In Progress. b. Forecast for 2026, 2027 and 2028 reflects CECONY’s November 2025 joint proposal for new electric and gas rate plans (Case 25-E-0072 & 25-G-0073) that is subject to approval by the NYSPSC. c. Forecast for 2025, 2026 and 2027 reflects O&R’s Electric and Gas rate plans (Case 24-E-0060 & 24-G-0061) approved in March 2025. d. Amounts for energy efficiency and heat pump program activity are included in the average rate base forecast for CECONY and O&R in 2025, and for O&R for the years 2026 – 2028. Amounts for New Efficiency New York are included in the surcharge recovery forecast for CECONY for the years 2026 - 2028 to reflect the November 2025 CECONY electric and gas joint proposal. In May 2025, the NYSPSC issued two orders for Low- to Moderate- Income and Non-Low- to Moderate-Income that directed CECONY and O&R to recover 2026-2028 energy efficiency and heat pump program activity through surcharge rather than base rates. In February 2026, Con Edison will update its forecast through 2030. ($ in millions) Prior Plan - Reflects CECONY’s April 2025 updated electric and gas rate filings Revised Plan - Reflects CECONY’s November 2025 joint proposal for new electric and gas rate plans Differences between prior plan and revised plan are 1.95%, 3.10%, and 3.87% for years 2026, 2027 and 2028 respectively

INTERNALINTERNAL Company Update November 5, 2025