Please wait

Filed Pursuant to Rule 424(b)(3)

Registration No. 333-159645

SUPPLEMENT NO. 6 DATED SEPTEMBER 24, 2012

TO PROSPECTUS DATED MARCH 29, 2012

AMBIENT CORPORATION

This document supplements the prospectus dated March 29, 2012, as subsequently amended by Supplement No.1 dated May 16, 2012, Supplement No. 2 dated June 12, 2012, Supplement No. 3 dated June 21, 2012, Supplement No. 4 dated August 16, 2012 and Supplement No. 5 dated September 12, 2012 by attaching to and making as part of this Prospectus Supplement the following documents of Ambient Corporation, all of which were filed with the Securities and Exchange Commission on September 24, 2012:

|

(i)

|

amended and restated Annual Report on Form 10-K/A for the year ended December 31, 2011:

|

|

(ii)

|

amended and restated Quarterly Report on Form 10-Q/A for the quarter ended March 31, 2012;

|

|

(iii)

|

Quarterly Report on Form 10-Q for the quarter ended June 30, 2012; and

|

|

(iv)

|

Current Report on Form 8-K.

|

This prospectus supplement is incorporated by reference into the prospectus. This Prospectus Supplement is not complete without, and may not be delivered or utilized except in connection with, the prospectus, including any amendments or supplements to the prospectus.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED ON THE ADEQUACY OR ACCURACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The date of this prospectus supplement is September 24, 2012.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

———————

FORM 10-K/A

(Amendment No. 1)

þ ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

for the fiscal year ended December 31, 2011

¨ TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from: _____________ to _____________

Commission file number 001-35259

———————

AMBIENT CORPORATION

(Exact name of registrant as specified in its charter)

———————

|

Delaware

|

|

98-0166007

|

|

(State or Other Jurisdiction

|

|

(I.R.S. Employer

|

|

of Incorporation)

|

|

Identification No.)

|

7 WELLS AVENUE, NEWTON, MASSACHUSETTS 02459

(Address of Principal Executive Office)

617-332-0004

(Registrant’s telephone number, including area code)

Securities Registered Under Section 12(b) of the Exchange Act:

|

Common Stock, par value $0.001 per share

|

|

NASDAQ Capital Market

|

Securities Registered Under Section 12(g) of the Exchange Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Securities Act of 1933. Yes ¨ No þ

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes o No þ

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 Regulation S-T (232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files Yes o No þ

Indicate by check mark if disclosure of delinquent filers in response to Item 405 of Regulation S-K is not contained in this form, and no disclosure will be contained, to the best of the registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. þ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of "accelerated filer and large accelerated filer" in Rule 12b-2 of the Exchange Act.

Large accelerated filer ¨ Accelerated filer ¨ Non-accelerated filer ¨ Smaller reporting company þ

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act.) Yes ¨ No þ

The registrant had 16,663,720 shares of common stock outstanding as of September 21, 2012. The aggregate market value of the common stock held by non-affiliates of the registrant as of June 30, 2011, was approximately $17.3 million computed by reference to the closing price of such common stock on the OTC Bulletin Board on such date.

Explanatory Note

We are filing this Amended Annual Report on Form 10-K/A (the “Amended Filing”) to our Annual Report on Form 10-K for the year ended December 31, 2011 originally filed with the Securities and Exchange Commission on March 6, 2012 (the “Original Filing”), to amend and restate our audited financial statements and related disclosures for the years ended December 31, 2007 through December 31, 2011. This Amended Filing will also include restated quarterly financial information for each of the first three quarterly periods in the fiscal years ended December 31, 2010 and 2011 and amend certain other Items in the Original Filing as listed in “Items Amended in this Filing” below, as a result of the restatement of our financial statements. The details of the amendments are discussed below and in Note 2 to the accompanying restated financial statements.

Background of Restatement

In connection with the preparation of Form 10-Q for the quarter ended June 30, 2012, management of the Company concluded that certain previously filed financial statements did not properly account for embedded derivative features of certain historical debt and warrants issued by the Company, which are described in detail below.

Convertible Debt: Certain historical convertible notes (the “Notes”) issued by the Company were previously recorded at their discounted face value. The discounts were comprised of both beneficial conversion features associated with the Notes and the fair value of warrants issued in connection with the Notes. However, the Notes contained certain features, including anti-dilution price protection and others that, in accordance with ASC-815, Derivatives and Hedging (“ASC 815”), should have been bifurcated from the host contract and accounted for as a derivative instrument (the “Embedded Derivatives”). Such Embedded Derivatives are recorded as a separate liability at their fair value on the date of issuance, and as a corresponding discount to the Notes which is amortized as interest expense over the term of the Notes. Changes in the fair values of these instruments require adjustments to the amount of the liabilities recorded on the Company’s balance sheet, and the corresponding gain or loss is required to be recorded in the Company’s statement of operations, as long as the Notes are outstanding.

Warrants: In connection with issuing the Notes, as well as in connection with other financing transactions, the Company issued warrants to purchase common stock (collectively, the “Warrants”). The Company had previously classified the value of the Warrants as equity. After further review, the Company determined that these instruments should have been classified as liabilities in accordance with ASC 815, due primarily to an anti-dilution price protection feature. Changes in the fair values of these instruments require adjustments to the amount of the liabilities recorded on the Company’s balance sheet, and the corresponding gain or loss is required to be recorded in the Company’s statement of operations.

Stock-based Compensation: The Company had previously used volatility assumptions based on the historical volatility of the price of the Company's common stock, which, based on the historical trading activity of the stock, resulted in inflated price volatilities that were not necessarily indicative of the expected volatility and were substantially higher than other peer-industry companies. Upon further review of the volatility assumptions, the Company determined that it was more appropriate to use an expected volatility based on the volatilities of its industry peer group. Such an approach was used to determine appropriate volatility assumptions for valuation purposes of the Embedded Derivatives and Warrants. As a result, assumed volatilities are lower than those previously used, which reduces stock-based compensation expense.

In addition to the adjustments listed above, the Company recorded immaterial adjustments to revenue to account for the deferral of maintenance revenue arising from the initial period of free maintenance provided upon shipment of our communication nodes.

All of the necessary adjustments relating to the Notes and Warrants are non-cash in nature and do not impact the Company’s total cash flows from operating, investing and financing activities. The adjustments are related to complex accounting requirements of certain characteristics of the Notes and Warrants that require the recording of debt discounts and related amortization, mark-to-market adjustments in the fair value of Warrants and Embedded Derivatives and gains or losses associated with the extinguishment of debt under certain circumstances.

As a result of these cumulative adjustments, as of December 31, 2011, accumulated deficit increased from $138.7 million to $221.4 million and additional paid in capital increased from $155.7 million to $237.4 million. At December 31, 2011, the net impact of the cumulative adjustments reduced overall stockholders’ equity by approximately $1.0 million. Since all of the Notes were either paid off or converted by early 2010 and many of the Warrants were either exercised or expired by the end of 2011, the estimated impact of accounting for these instruments in 2012 and for future periods is expected to be immaterial.

Detailed discussions of the impact of the proper accounting for the Notes and Warrants on our financial statements are contained in the consolidated financial statements in Part II – Item 8 of this Amended Filing.

Restatement of Other Financial Statements

In addition to this Amended Filing, we are concurrently filing an amendment to our Quarterly Report on Form 10-Q for the quarter ended March 31, 2012 (the “March 10-Q/A”). The March 10-Q/A is being filed to restate our unaudited financial statements and related financial information for the periods contained in that report and to amend certain other Items within the previously-issued quarterly filing, including Item 4 – “Controls and Procedures” to reflect a reassessment of our disclosure controls and procedures, and internal control over financial reporting.

Internal Control Consideration

Our management has determined that there was a control deficiency in our internal control over financial reporting that constitutes a material weakness, as discussed in Part II — Item 9A of this Amended Filing. A material weakness is a deficiency, or combination of control deficiencies, in internal control over financial reporting, such that there is a reasonable possibility that a material misstatement of the annual or interim consolidated financial statements will not be prevented or detected on a timely basis. For a discussion of management’s consideration of our disclosure controls and procedures and the material weakness identified, see Part II — Item 9A included in this Amended Filing.

Items Amended in This Filing

For the convenience of the reader, this Amended Filing sets forth the Original Filing, as modified and superseded where necessary to reflect the restatement. The following items have been amended as a result of, and to reflect, the restatement:

|

●

|

Part I – Item 1A Risk Factors

|

|

●

|

Part II – Item 6. Selected Financial Data

|

|

●

|

Part II – Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

|

●

|

Part II– Item 8. Financial Statements and Supplementary Data

|

|

●

|

Part II– Item 9A. Controls and Procedures (Restated)

|

| ● |

Part III-Item 11. Executive Compensation

|

In accordance with applicable SEC rules, this Amended Filing includes new certifications required by Rule 13a-14 under the Securities and Exchange Act of 1934 (“Exchange Act”) from our Chief Executive Officer and Chief Financial Officer dated as of the date of filing of this Amended Filing.

We have not updated items in this Amended filing to reflect events occuring subsequently to the Original Filing date other than those associated with the restatement of the Company's financial statements and an update to Part III-Item 12 Security Ownership of Certain Beneficial Owners.

AMBIENT CORPORATION

2011 FORM 10-K/A ANNUAL REPORT

TABLE OF CONTENTS

| |

|

|

Page

|

|

| |

PART I

|

|

|

|

| |

|

|

|

|

|

Item 1.

|

Business

|

|

|

4

|

|

| |

|

|

|

|

|

|

Item 1A.

|

Risk Factors

|

|

|

17

|

|

| |

|

|

|

|

|

|

Item 1B.

|

Unresolved Staff Comments

|

|

|

28

|

|

| |

|

|

|

|

|

|

Item 2.

|

Properties

|

|

|

28

|

|

| |

|

|

|

|

|

|

Item 3.

|

Legal Proceedings

|

|

|

28

|

|

| |

|

|

|

|

|

|

Item 4.

|

Mine Safety Disclosures

|

|

|

28

|

|

| |

|

|

|

|

|

| |

PART II

|

|

|

|

|

| |

|

|

|

|

|

|

Item 5.

|

Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

|

|

29

|

|

| |

|

|

|

|

|

|

Item 6.

|

Restated Selected Financial Data

|

|

|

30

|

|

| |

|

|

|

|

|

|

Item 7.

|

Restated Management Discussion and Analysis of Financial Condition and Results of Operation.

|

|

|

31

|

|

| |

|

|

|

|

|

|

Item 7A.

|

Quantitative and Qualitative Disclosures About Market Risk.

|

|

|

39

|

|

| |

|

|

|

|

|

|

Item 8.

|

Restated Financial Statements and Supplementary Data

|

|

|

39

|

|

| |

|

|

|

|

|

|

Item 9.

|

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure

|

|

|

39

|

|

| |

|

|

|

|

|

|

Item 9A

|

Controls and Procedures Restated

|

|

|

39

|

|

| |

|

|

|

|

|

|

Item 9B.

|

Other Information

|

|

|

40

|

|

| |

|

|

|

|

|

| |

PART III

|

|

|

|

|

| |

|

|

|

|

|

|

Item 10.

|

Directors, Executive Officers and Corporate Governance

|

|

|

41

|

|

| |

|

|

|

|

|

|

Item 11.

|

Executive Compensation

|

|

|

44

|

|

| |

|

|

|

|

|

|

Item 12.

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

|

|

48

|

|

| |

|

|

|

|

|

|

Item 13.

|

Certain Relationships and Related Transactions and Director Independence

|

|

|

49

|

|

| |

|

|

|

|

|

|

Item 14.

|

Principal Accountant Fees and Services

|

|

|

50

|

|

| |

|

|

|

|

|

|

Item 15.

|

Exhibits and Financial Statement Schedules

|

|

|

51

|

|

| |

|

|

|

|

|

|

SIGNATURES

|

|

|

54

|

|

FORWARD LOOKING STATEMENTS

The following discussion should be read in conjunction with the financial statements and related notes contained elsewhere in this annual report on Form 10-K. We make forward-looking statements in this report, in other materials we file with the Securities and Exchange Commission (the “SEC”) or that we otherwise release to the public, and on our website. In addition, our senior management might make forward-looking statements orally to analysts, investors, the media, and others. These statements are “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and 21E of the Securities Exchange Act of 1934, as amended. Statements concerning our future operations, prospects, strategies, financial condition, future economic performance (including growth and earnings) and demand for our products and services, and other statements of our plans, beliefs, or expectations, including the statements contained in Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” regarding our future plans, strategies and expectations are forward-looking statements. In some cases these statements are identifiable through the use of words such as “anticipate,” “believe,” “estimate,” “predict,” “expect,” “intend,” “plan,” “project,” “target,” “continue,” “can,” “could,” “may,” “should,” “will,” “would,” and similar expressions. You are cautioned not to place undue reliance on these forward-looking statements because these forward-looking statements we make are not guarantees of future performance and are subject to various assumptions, risks, and other factors that could cause actual results to differ materially from those suggested by these forward-looking statements. Thus, our ability to predict results or the actual effect of our future plans or strategies is inherently uncertain. Factors which could have a material adverse effect on our operations and future prospects include, but are not limited to, our ability to retain and attract customers, particularly in light of our current dependence on a single customer for all of our revenue; our expectations regarding our expenses and revenue, including our expectations that our research and development expenses and selling, general and administrative expenses may increase in absolute dollars; our material weakness in internal control over financial reporting; anticipated trends and challenges in our business and the markets in which we operate, including the market for smart grid technologies; our expectations regarding competition as more and larger companies enter our markets and as existing competitors improve or expand their product offerings; our plans for future products and enhancements of existing products; our anticipated cash needs and our estimates regarding our capital requirements; and our anticipated growth strategies. These risks and uncertainties, together with the other risks described from time to time in reports and documents that we file with the SEC, should be considered in evaluating forward-looking statements. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, performance or achievements. Indeed, it is likely that some of our assumptions will prove to be incorrect. Our actual results and financial position will vary from those projected or implied in the forward-looking statements and the variances may be material. Moreover, we do not assume the responsibility for the accuracy and completeness of these forward-looking statements. We expressly disclaim any obligation to update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise, except as required by law.

PART I

ITEM 1. BUSINESS

We are a leading provider of a smart grid communications platform designed to enable utilities to effectively deploy, integrate and communicate with multiple devices creating smart grid applications within the electric power grid. Our smart grid communications platform significantly improves the ability of utilities to use advanced technologies to upgrade their electric power grids, effectively making the grids more intelligent.

The term “smart grid” refers to the use of advanced technologies to upgrade the electric power grid, or the grid, effectively making the grid more intelligent and efficient. The grid was largely designed and built decades ago to reliably distribute electricity from generators to customers in a manner resulting in sizable capital investments and operating costs. A number of factors are increasingly straining the grid, including growing electricity demand, two-way power flow, the implementation of renewable and distributed energy sources and advanced pricing plans. As such, the aging grid is prone to reliability, security, availability and power quality issues, costing utilities and consumers billions of dollars each year. Technology is now revolutionizing the grid and transforming it into an efficient, communicating energy service platform. We believe that the smart grid will address the current shortcomings of the grid and deliver significant benefits to utilities and consumers of energy, including reduced costs, increased power reliability and quality, accommodation of renewable energy technologies, consumer empowerment over energy consumption and a platform for continued integration of new technologies.

The Ambient Smart Grid® communications platform, which includes hardware, software and firmware, enables utilities to effectively manage smart grid applications. Our communications platform provides utilities with a secure, two-way, flexible and open Internet protocol, or IP, architecture that efficiently networks smart grid applications and different technologies within each application and supports multiple communications technologies currently used by utilities, such as Wi-Fi, radio frequency, cellular technologies, power line communications, serial and Ethernet. Today, our communications platform enables the simultaneous integration and parallel communication of multiple smart grid applications provided by a variety of vendors, including smart metering, demand response and distribution automation. We believe that the Ambient Smart Grid® communications platform delivers significant benefits to utilities, including support of a single network; an open, scalable and interoperable platform; preservation of utility investments; third-party application hosting; remote and distributed intelligence; secure communications; and reduced overall implementation and operating costs.

The Ambient Smart Grid® products and services include communications nodes; a network management system, AmbientNMS®; integrated applications; and maintenance and consulting services. The communications nodes, our principal product, are physical boxes that contain the hardware and software needed for communications and data collection in support of smart grid assets. We have configured our communications nodes to act as individual data processors and collectors that receive signals from other networked devices, enabling smart grid applications. Duke Energy, our sole customer, to date has deployed approximately 105,000 of our communications nodes that receive data from smart electric and gas meters, using a variety of communications technologies, and process and transmit these data to the utility back office over a cellular carrier network for further processing. Furthermore, our communications nodes, in the fourth generation of development, also accommodate integrated applications that include our own developed technology and third-party technology, thereby substantially increasing their functionality. By enabling such system interoperability, our communications platform both reduces implementation and ongoing communications costs and improves overall power management efficiencies. We believe that, to date, no other single solution or technology has provided the necessary flexibility in a cost-effective manner, enabling a comprehensive digital communications platform while leveraging standards-based technologies. We developed our communications platform to fill this void.

Our long-standing relationship with Duke Energy, which we believe has one of the most forward-looking smart grid initiatives in North America, has led to rapid growth in our business. We entered into a long-term agreement in September 2009 with Duke Energy to supply the utility with our Ambient Smart Grid® communications platform and license our AmbientNMS® through 2015. We increased revenue from $2.2 million in 2009 to $20.2 million in 2010 to $62.1 million in 2011. As of December 31, 2011, we had backlog of approximately $35 million. We believe that there are opportunities for additional sales of our products and services with Duke Energy. Furthermore, we also intend to leverage our success with the utility to secure additional customers in the global utility market place.

We were incorporated in the state of Delaware on June 26, 1996. Our common stock currently trades on the NASDAQ Capital Market under the symbol “AMBT.”

Industry Overview

The Electric Power Distribution Grid

The grid was largely designed and built decades ago, and is increasingly becoming strained. According to the U.S. Department of Energy, or DOE, in the United States 70% of transmission lines are 25 years old or older; 70% of power transformers are 25 years old or older; and 60% of circuit breakers are 30 years old or older. The current grid infrastructure, both in the United States and abroad, simply is not designed to accommodate the dynamic electricity distribution requirements of today or the future. As a result, the aging grid is prone to reliability, security, availability and power quality issues, costing utilities and consumers billions of dollars each year. For example, according to the Electrical Power Research Institute, or EPRI, power disturbances and quality problems alone cost U.S. businesses between $119 billion and $188 billion each year.

The following factors highlight the deficiencies of today’s grid:

Severely Strained and Aging Grid. The strain on the grid has led to efficiency losses, service interruptions, higher electricity rates and costly unplanned maintenance and repair expenses. According to the EPRI, power quality issues alone already cost between $15 billion and $24 billion per year in the United States. As consumers and industries increase their reliance on electronic devices, these disturbances and quality issues will become more disruptive and more costly. Increased grid efficiency will help reduce the capital required for added grid infrastructure.

Inability of the Grid to Support Proliferation of Renewable Energy and Related Technologies. Over the past few years, utilities and consumers have increased their adoption of centralized and distributed renewable energy, such as wind, solar and energy storage technologies, as a source of electricity. According to the EIA, renewable energy sources will account for 23% of total electricity generation worldwide in 2035. Furthermore, expected growth in electric vehicles will create the need for charging stations, placing additional strain on the grid. The grid will not be able to accommodate all of these renewable energy initiatives. Moreover, approximately half of the states in the United States have some form of renewable portfolio standards, which require that specified amounts of electricity are sourced from renewable sources, resulting in a substantial anticipated increase in the need for grid modernization. This is a global trend evidenced, in part, by the European Union, or EU, climate energy goals. The EU has adopted aggressive climate and energy goals — the “20-20-20” targets — that aim to reduce EU greenhouse gas emissions at least 20% below 1990 levels, derive 20% of EU energy consumption from renewable resources and create a 20% reduction in primary energy use compared with projected levels through improving energy efficiency, in each case, by 2020.

Limited Real-Time Operational Insight, Communication and Analysis. The century-old grid in the United States consists of over 300,000 miles of transmission lines and over 1,000,000 megawatts of generating capacity. The importance of today’s grid to modern society is unquestionable; however, it remains largely untouched by modern networking and communications technologies. For example, power outages are still manually reported for the majority of the grid. The lack of communications technologies represents a significant limiting factor in the amount of information and control available to both utility operators and their customers. The lack of these technologies has also had a limiting effect on the ability of utilities to engage with their customers and for customers to take an active role in their consumption and cost of energy and resources.

The Smart Grid

We believe that grid modernization will address the shortcomings of the current grid as well as deliver significant benefits to utilities and consumers of energy. The smart grid encompasses multiple technologies and applications, and represents significantly more than just smart electric meters. The U.S. Energy Independence and Security Act of 2007 provided the following, thorough definition of the smart grid:

The term “smart grid” refers to a modernization of the electricity delivery system so it monitors, protects and automatically optimizes the operation of its interconnected elements — from the central and distributed generator through the high-voltage network and distribution system, to industrial users and building automation systems, to energy storage installations and to end-use consumers and their thermostats, electric vehicles, appliances and other household devices. The smart grid will be characterized by a two-way flow of electricity and information to create an automated, widely distributed energy delivery network. It incorporates into the grid the benefits of distributed computing and communications to deliver real-time information and enable the near-instantaneous balance of supply and demand at the device level.

In brief, the term “smart grid” refers to the use of advanced communications technologies and modern computing capabilities to upgrade and modernize the electric power grid (and even other utility infrastructures, such as gas and water), effectively making the grid more intelligent and efficient. We believe that the implementation of intelligent and seamless communication across the grid represents the largest expected wave of information technology spending, similar to the previous telecommunications and Internet investment cycles.

Smart Grid Applications

The smart grid will connect millions of devices that generate, distribute, control, monitor and use energy, thereby enabling utilities and consumers to dynamically interact with the energy supply chain. The smart grid is more than just smart meters, and we believe that fully realizing the benefits of the smart grid will require the implementation of a variety of technologies and applications. For all smart grid applications to work seamlessly together, a flexible and open communications platform is needed for the interoperability of each connected smart grid application, including the following:

Smart Meters. Smart meters encompass the meters themselves, related communications equipment and data management systems that record and monitor real-time energy consumption information at regular intervals. Smart meters allow for two-way communication of data between the smart meter and a utility’s back office, providing utilities with valuable information to measure and control production, transmission and distribution more efficiently and providing consumers with information to make informed choices regarding energy consumption. This technology further enables a utility to reduce the costs of operating its distribution system by automating various functions that are currently performed manually, such as reading customer meters and turning power on and off at the customer meter.

Demand Response. Demand response is an initiative in which utilities provide incentives to consumers to reduce energy usage during times of peak demand. Demand response includes technology that can manage the consumption of electricity in conjunction with supply and demand fluctuations, enabling variable pricing and providing information to encourage consumers to make more active decisions about their energy usage. Utilities can use demand response to enable consumers to reduce, or provide direct utility control of, electricity use, particularly during high price/demand periods, by sending time-differentiated prices to customers via the meter and recording customers’ actual real-time usage. Demand response technology enables utilities to better manage their distribution network, delivering electricity more efficiently and potentially reducing peak and baseload generation requirements.

Distribution Automation. Distribution automation encompasses utilities deploying control devices and communications infrastructure to monitor and control energy distribution in real time, enabling intelligent control over grid functions at the distribution level. Utilities use distribution automation applications to directly control the flow of electricity from individual substations to consumers in order to improve the quality of power generation, reduce the frequency, duration and scale of power outages, reduce energy losses and ultimately optimize operating efficiency and reliability of the grid.

Network Management Systems. Utilities require back office software and computer hardware systems to monitor and manage the vast numbers of devices and information collected by those devices from various smart grid applications. Network management systems control smart grid devices and collect and process data in the back office relying on two-way communications.

Smart Grid Requirements

The success of the smart grid, with its promise of delivering significant benefits to utilities, consumers and the environment, will depend upon the successful implementation of smart grid applications that rely on a network communications infrastructure. Due to the varied nature of applications, technologies and communication methods, the dedicated communications infrastructure requires ample flexibility in order to accommodate and support all connected applications. Key requirements of the smart grid include the following:

Communications Platform. A secure, flexible and open communications platform is required to enable the smart grid. The communications platform provides real-time, two-way information flow from multiple smart grid applications to a network management system at a utility’s operations center, providing the critical foundation upon which a utility deploys its smart grid applications. A flexible, purpose-built communications platform accommodates different functional requirements of each smart grid application, allows different communications technologies to work in parallel and allows a utility to rapidly scale a large number of smart grid applications.

Interoperability. Various agencies, including the U.S. National Institute of Standards and Technology and the Institute of Electrical and Electronics Engineers, are developing specific smart grid standards that will allow for software and hardware components from different applications, vendors and technologies to seamlessly work together. Interoperability standards, and an open communications platform that supports them, will allow for growth of the smart grid that is not predicated on any one proprietary network architecture or communication technology.

Scalability. As utilities incorporate millions of smart grid devices into the grid, all of which will generate vast amounts of information, the communications platform must both support all connected applications in parallel and allow for quick and cost-effective deployment of new smart grid devices and new applications. A communications platform that cannot scale or is limited with latency or bandwidth issues seriously curtails realizing the full benefits of a smart grid.

Security. With increasing threats of cyber-attacks and the corresponding increased sophistication of malicious technology, communications infrastructure must provide security to protect the assets of the utility, preserve the reliability of the grid and protect consumers. Secure, IP-based communication protocols are an integral part of any communications platform.

Cost Effectiveness. An interoperable, scalable and flexible communications platform allows a utility to deploy a single platform for all smart grid applications, reducing operation and maintenance costs associated with running separate networks. A flexible communications platform also allows utilities to avoid stranding assets by incorporating legacy technologies into more advanced systems, while also providing a platform for future technologies.

Anticipated Smart Grid Investment

Pike Research forecasts that smart grid investment will total $52 billion in North America by 2015, $80 billion in Europe by 2020 and $171 billion in Asia by 2017. The U.S. government is a substantial proponent of smart grid technologies, primarily through the American Recovery and Reinvestment Act of 2009, or ARRA, which awarded more than $3.4 billion in stimulus funding for smart grid technology development and demonstration, plus $615 million for smart grid storage, across 99 smart grid initiatives to be spent by 2013. Due to the cost-share nature of the awards, U.S. investment in smart grid technologies associated with the ARRA reached approximately $8 billion in projects to be completed by 2015. The rollout of smart meters, one specific smart grid application, is currently a driving factor in the deployment of the smart grid. According to EIA, approximately 7% of all electric meters in the United States are smart meters, illustrating a large remaining opportunity for smart meters alone.

We expect that distribution automation, another important smart grid application, may represent the fastest growing and potentially largest area of smart grid investment. According to SBI Energy, the global substation automation product market is expected to reach $106 billion by 2015, where a bulk of the growth is expected to come from countries that are working to modernize their electricity networks and accommodate smart grid technologies. We expect future investment in all smart grid applications and technologies to substantially increase.

Smart Grid Benefits

The following represent some of the most significant benefits of the smart grid:

Reduces Costs for Utilities and Consumers. To meet the long-term demand for electricity, utilities will need to invest substantial capital for added generation and transmission and distribution infrastructure. However, according to the DOE, utilities in the United States can save up to $163 billion through 2025 in costs associated with this investment through increased energy efficiency with the grid, reducing transmission congestion and preserving reserve capacity resulting from the deployment of smart grid applications. By avoiding such substantial costs, utilities can therefore better mitigate anticipated consumer rate increases. Moreover, the two-way communication facilitated by smart grid technologies will enhance utilities’ ability to balance supply and demand of electricity, allowing them to more efficiently utilize their generation assets and reduce the amount of expensive peak demand assets. According to the EPRI, an investment of $338 to $476 billion in smart grid initiatives over the next 20 years will provide overall benefits valued between $1.3 and $2.0 trillion.

Increases Power Reliability and Quality. The smart grid’s two-way communications capabilities provide real-time information about the grid’s electricity characteristics, such as current and voltage, allowing grid operators and smart devices to identify and optimize how electricity flows through the grid. Smart grid technologies, such as distributed capacitor banks and Volt/VAR controls, can smooth out the overall quality of electricity as well as protect grid elements and customers against sudden power surges and other transient power events, all while decreasing line loss. According to the EPRI, power quality issues cost between $15 billion and $24 billion per year in the United States, costs that we believe can be substantially avoided by utilizing the smart grid.

Accommodates Renewable Energy Sources and Electric Vehicles. Utilities need smart grid technologies to support the widespread adoption of renewable energy sources, electric vehicles and other clean technology solutions. The intermittent nature of renewable electricity, the developing energy storage technologies and the demand of electric vehicles all create challenges for utilities in matching energy generating sources with demand. We believe that each of these issues is effectively addressed with a full smart grid implementation.

Facilitates Consumer Empowerment. Two-way communication will allow consumers to proactively monitor and control the way in which they consume electricity, which will ultimately help consumers to lower their electricity bills. Utilities can also develop improved pricing practices aimed at creating a more efficient pricing structure that addresses potential pricing inequalities during normal and peak demand cycles.

Provides a Platform for Technology Innovation. The development of new smart grid applications and technologies and their continued integration into the grid are critical to full development of the smart grid. The smart grid will allow for the seamless integration of new technologies into the grid without the need to substantially change existing infrastructure, thereby avoiding significant capital costs required to support ever-evolving technologies.

Our Solution

The Ambient Smart Grid® Communications Platform

The Ambient Smart Grid® communications platform, which includes hardware, software and firmware, enables utilities to both effectively manage smart grid applications and directly integrate certain applications into our products themselves. Our communications platform provides a utility with a secure, two-way, flexible and open IP architecture that efficiently networks smart grid applications and different technologies within each application and supports multiple communications technologies currently used by utilities, such as Wi-Fi, radio frequency, cellular technologies, power line communications, serial and Ethernet. Our communications platform enables the integration of smart grid applications, such as smart metering, demand response, distribution automation and monitoring, and direct load control. It also provides an open and flexible platform allowing for the addition of multiple applications, as well as enhancements and future applications.

Our Ambient Smart Grid® communications nodes are attached on or near a utility’s transformer, and they support applications and connectivity to devices that comprise the smart grid. These communications nodes are physical boxes we designed for use in the harsh, outdoor environments in which utilities operate. Our network management system, known as AmbientNMS® is the software that manages the large numbers of devices on a smart grid network. By enabling such system interoperability, our communications platform both reduces implementation and ongoing communications costs, and improves overall power management efficiencies. Furthermore, our communications platform also accommodate smart grid applications installed directly into our communications nodes, which include our own developed technology and third-party technology, thereby substantially increasing their functionality.

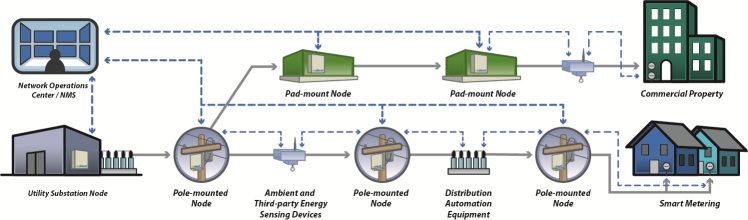

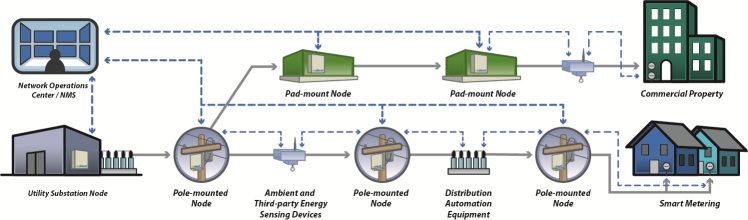

The following diagram depicts our products in the utility infrastructure:

Ambient Smart Grid® Benefits

Our products offer the following benefits to utilities:

Support of a Single Network Through Flexible Communication. Our communications nodes support multiple communication technologies simultaneously, allowing a utility to leverage a single communications platform to support many smart grid applications that rely on different communication technologies, such as cellular, Wi-Fi, 900MHz radio frequency, power line carrier, serial and Ethernet, all operating in parallel in a single communications node.

Open Platform for Scalability and Interoperability. Our AmbientNMS® or third-party management systems, can manage our open communications platform. Our communications platform offers flexibility that allows utilities to deploy multiple smart grid applications from multiple vendors, including our competitors, and it can evolve with new technologies.

Preservation of Utility Smart Grid Investments. The flexibility and open architecture of our communications platform protect a utility against stranding existing assets, including an investment in our communications platform itself. It is a major impediment for utility smart grid investment if a utility is not able to recover, or is concerned about recovering, the costs of previously deployed assets. For example, our communications nodes can support the collection of data from legacy, one-way communicating meters, (often referred to as AMR meters) which many utilities have previously installed and carry significant undepreciated value on their balance sheets. It is generally not cost effective for utilities to replace these legacy meters with current, two-way communicating smart meters; however, they can use our communications nodes to increase the intelligence/functionality of the existing system and eliminate costly, time-delayed manual data collection routines, such as drive-by meter readings. As utilities gradually replace legacy smart grid assets with current technologies throughout the natural replacement cycle, they can seamlessly integrate into our existing communications nodes and communications platform, eliminating the need for a costly, wholesale deployment as smart grid technologies and applications continue to evolve.

Local Application Hosting and Development Framework. We have designed our communications nodes to host both Ambient-developed applications and third-party applications. By leveraging our open communications platform, excess processing power and flash memory, we can integrate smart grid applications for utilities directly into our communications nodes, expanding their overall functionality. Our open framework and flexibility provide an environment for new applications and the ability to add newly developed or tailored applications to our communications nodes even after they have been deployed. Utilities can perform central updates to our communications nodes, eliminating the need for deploying human and equipment capital, thereby providing for quick and inexpensive software updates.

Remote and Distributed Intelligence. Our communications nodes are equipped with powerful processing capabilities that allow for local management and control of smart grid data, which may be aggregated from multiple smart grid applications. Processing and storage capabilities within our communications nodes allow a utility to more efficiently manage a vast amount of distributed data.

Secure Communications. We secure our communications platform through the use of both physical tamper detection features and secure protocols that encrypt data traffic. Additionally, we are active participants in helping to establish industry standards regarding security and other technical requirements, allowing us to continually improve the security of our products.

Reduced Overall Communications Implementation and Operating Costs. We deliver our communications platform completely preconfigured to the needs of the utility, allowing for a rapid and simplified deployment. Simplifying the deployment process of smart grid applications saves utilities time and cost because the deployments of smart grid applications require a substantial human effort. Our communications nodes are deployed preconfigured and are capable of communicating with several different applications via a variety of communication technologies. As a result, no other follow-on effort is required in order to become active within a utility’s communications network. Furthermore, there is no need for a utility to develop and invest in separate, application-specific communications platforms in order to integrate all smart grid-related assets because our communications platform provides for a single network that can accommodate a variety of applications and technologies in parallel.

Our Products and Services

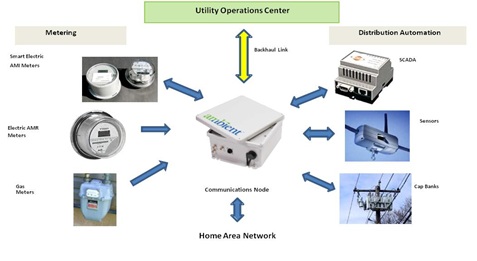

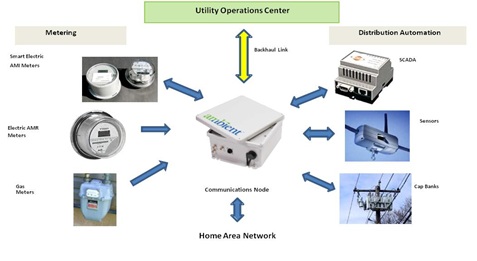

Ambient Smart Grid® Communications Nodes. Communications nodes are physical boxes that contain the hardware and software needed for communications and data collection in support of smart grid assets. We configured our communications nodes to act as individual data processors and collectors that receive signals from other networked devices, enabling smart grid applications. Our communications nodes can also contain our own or third-party embedded smart grid applications. We are currently in final testing and evaluation of our fourth-generation communications nodes. The following is a graphical depiction of how our communications nodes interact and connect with smart grid applications and the utility.

AmbientNMS® is a network management system that manages large numbers of communications nodes, devices and customers on a smart grid network. A utility can use the AmbientNMS® to effectively manage its entire smart grid distribution system, providing valuable information over a single communications network. We customize AmbientNMS®, providing a utility with the tools necessary to tailor its monitoring and processing and to act upon vast amounts of information on a real-time basis. For example, we have integrated our AmbientNMS® into an industry standard Distribution and Outage Management System (DOMS) that provides for the delivery of faster, more accurate information to power outage notification and restoration systems. This allows utilities to quickly assess and respond to power delivery issues in reduced response time, thereby better managing disruptions and enhancing system reliability. AmbientNMS® also provides the functionality to predict, and precisely control, the amount of data traffic to be used by individual devices and the communications network as a whole. Utilities can systematically push software updates to deployed communications nodes and other downstream devices.

Ambient Energy Sensing Solution. Our Energy Sensing Solution monitors critical aspects of a utility’s distribution network through measurement of current and voltage characteristics. Having the capability of measuring and monitoring power quality allows a utility to obtain real-time insight into characteristics such as power factor and general power quality, as well as the ability to quickly identify problem areas from a central location without having to deploy equipment and human capital to do so. Real-time power quality monitoring also allows utilities to better interface with their customers who may have strict tolerances associated with their power requirements, and it also can provide critical information for outage notification and restoration systems. The hardware and software used in our Energy Sensing Solution are incorporated directly into our communications nodes, creating a much more efficient use of capital and utility pole real estate.

Partial Discharge Monitoring. The same Energy Sensing technology that allows our communications platform to pull current information from the medium voltage distribution lines, also allows our communications nodes to monitor the health of the power lines. Real-time information regarding the health of buried power lines is not generally available today. Our communications platform offers utilities this information, thereby allowing utilities the ability to more-effectively maintain their underground distribution lines and manage their replacement schedules.

Maintenance and Consulting Service. We provide maintenance and implementation services to maintain the software installed within our communications platform. We can remotely distribute software upgrades and added features to deployed communications nodes within the network. We also provide a variety of consulting services relating to product development, network management services and smart grid deployment strategies. We provide maintenance and consulting services to provide a turnkey offering of our communications platform.

Duke Energy Relationship

Since 2005, we have maintained a strategic relationship with Duke Energy and we believe that we are the leading supplier of its smart grid communications technology in connection with its smart grid implementation. With what we believe is one of the most forward-looking smart grid initiatives in North America, Duke Energy announced plans to invest $1 billion over the next five years in smart grid equipment for its service territories including Ohio, Indiana, Kentucky and the Carolinas. Specifically, Duke Energy’s smart grid deployment includes digital and automated technology, such as communications nodes, smart meters and automated power delivery equipment. The following table summarizes the evolution of our relationship with Duke Energy:

|

2005

|

● |

Security and safety testing of our communications nodes

|

| |

|

|

|

2006

|

● |

Delivery of approximately 700 communications nodes for pilot deployment

|

| |

|

|

|

2008

|

● |

Commercial agreement for 9,000 communications nodes

|

| |

|

|

|

2009

|

● |

Award to Duke Energy of $204 million in ARRA digital grid stimulus funds and Duke Energy announcement of plans to invest a total of $1 billion in smart grid deployment initiatives over five years

|

| |

● |

Long-term supply agreement with Duke Energy to supply our communications nodes and services through 2015

|

| |

|

|

|

2010

|

● |

Full-scale smart grid deployment by Duke Energy in Ohio, which includes smart meters, automated power distribution equipment and a communications network encompassing more than 130,000 of our communications nodes, 700,000 electric meters and 450,000 gas meters

|

| |

● |

Deployment by Duke Energy of approximately 20,000 of our communications nodes

|

| |

|

|

|

2011

|

● |

Deployed a cumulative total of approximately 75,000 Ambient communications nodes, including approximately 3,000 of our communications nodes in the Carolinas

|

| |

● |

Total backlog of approximately $35 million as of December 31, 2011 |

Duke Energy is actively deploying thousands of our communications nodes each month and is licensing the AmbientNMS® system, specifically for its deployment in Ohio. We believe that we are the predominant provider of communications nodes and network management system software for Duke Energy’s Ohio deployment.

We believe that we have demonstrated that our technology is secure, two-way, flexible, open, scalable, reliable and cost-effective through the total deployment of approximately 105,000 communications nodes in the field with Duke Energy. We believe that Duke Energy will continue to predominantly use our communications platform for the remainder of its Ohio smart grid deployment through 2013. Furthermore, Duke Energy’s pilot deployment of approximately 3,000 communications nodes in the Carolinas predominantly uses our communications platform as well. Throughout the past five years, we have worked with Duke Energy to develop our communications platform, which has enabled Duke Energy’s ability to deploy its smart grid initiatives.

We believe that we have a substantial opportunity to grow our business with Duke Energy. In addition to the 130,000 communications nodes scheduled for deployment in Ohio, we estimate that Duke Energy would potentially require hundreds of thousands of communications nodes if it implements a full deployment of smart grid communications nodes in Indiana, Kentucky and the Carolinas. According to Duke Energy, it is currently working through the planning process to finalize full-scale deployment plans in Kentucky and the Carolinas and has filed with the North Carolina Public Utilities Commission for the required approvals. Duke Energy is using information from its North Carolina pilot programs and its Ohio deployment to enhance its customer experience in its other service territories. We believe that substantially all smart grid communications nodes deployed by Duke Energy to date are our communications nodes.

Competitive Strengths

We believe that the following competitive strengths help us to maintain a leading position in providing smart grid communications solutions to utilities:

Proven Technology. Since 2008, Duke Energy has successfully deployed our communications platform. With the deployment of approximately 75,000 communications nodes providing the connectivity for a variety of smart grid applications, we have demonstrated that our technology is quickly scalable and highly reliable. We believe that our communications nodes have met all of the strict reliability requirements of Duke Energy and have proven reliable through years of exposure to the elements. We believe that our continued ability to satisfy Duke Energy’s rigorous qualification standards and testing, as well as our proven ability to scale, provides us with an advantage over many of our competitors.

Premier Utility Customer. Duke Energy is one of the largest utilities in the United States with what we believe to be one of the most forward-looking smart grid initiatives in North America. We have served as a strategic partner of Duke Energy’s smart grid programs since 2005. Duke Energy has successfully deployed our products on a commercial scale. We believe that other utilities will adopt Duke Energy’s vision of implementing a communications platform that can accommodate a variety of smart grid applications and communications technologies, moving beyond a focus on smart meters, in order to realize the full benefits of the smart grid.

Communications Focused. Since 2000, we have maintained a focus on the development of a communications platform that meets the needs of utilities. Our commitment to this market segment allows us to focus all research and development and engineering efforts on meeting the challenges of this market and rapidly responding to customer needs. We do not design or provide equipment such as meters or home area network devices. Rather, we focus on the communications platform that enables these devices. Our focus, experience and industry know-how, built over three increasingly robust generations of our current communications platform, allow us to quickly react to the ever-changing and individualized needs of utilities, thereby providing a competitive edge over our competitors with products that may not represent their core competency.

Purpose-Built Products. Our substantial industry experience and relationship with Duke Energy have led to the development of products that are purpose-built for the harsh, outdoor environments in which utilities must operate. We have designed our equipment for direct placement onto the distribution infrastructure, which exposes it to the natural elements, without the need for an additional enclosure. Further, the internal elements of our communications nodes include, which includes hardened components, battery backups, excess surge protection and other components. Preconfigured and self-registering communications nodes allow for rapid and safe installation and eliminate the need for on-site field engineers, reducing installation time and cost.

Our Growth Strategy

Our objective is to maintain our market leadership position in providing a communications and application platform that enables a utility’s comprehensive smart grid initiatives. The following key initiatives comprise our growth strategy:

Expand Our Relationship with Duke Energy. We plan to expand our relationship with Duke Energy as it continues its smart grid deployment initiatives in additional service territories and with additional applications. We expect that, as Duke Energy deploys smart grid assets in other regions, including Indiana, Kentucky and the Carolinas, an opportunity exists for us to provide thousands of our communications nodes. Furthermore, as we continue to work with Duke Energy, we expect that we will be able to develop and provide additional product offerings.

Secure New Utility Customers. We intend to leverage our successful commercial deployment with Duke Energy to secure new domestic and international customers that are evaluating communications platforms to accommodate and integrate a variety of smart grid applications. These new customers may include utilities that have already deployed smart meter-centric systems and utilities that are still developing their smart grid plans. We intend to use this industry momentum in promoting our communications platform to the many utilities with whom we have relationships, as well as other utilities interested in an open communications architecture. We will also promote our communications platform to utilities that are limited by legacy metering technology. We believe that our technology can help utilities expand the functionality of their previously deployed smart metering initiatives, and we intend to pursue this market segment. To facilitate this initiative, we expect to substantially increase our investment in business development activities, including investing in initiatives aimed at penetrating both domestic and international markets.

Establish Strategic Relationships. We plan to form additional strategic relationships with smart grid application vendors, including meter manufacturers, distribution automation equipment manufacturers, communications providers and other key value-added providers in the smart grid industry. By establishing such relationships, we believe that we can accelerate the sales of our products. Further, by incorporating our communications platform into existing smart grid applications, we can help such providers offer a complete smart grid solution in addition to the equipment that they offer, while lowering the overall cost of deployment for a utility.

Continue Product Innovation and Development. We will continue to invest in the development of new capabilities for our communications platform in order to meet the evolving needs of utilities. For example, we have already developed Energy Sensing Solutions and Partial Discharge Monitoring that are directly integrated into our communications nodes. We will also continue to invest in expanding the functionality of our communications platform to accommodate the proprietary technologies of our competitors, thereby providing utilities with the added flexibility of utilizing multiple vendors. We have released three generations of our Ambient Smart Grid® products, and we are currently in the final testing stages of our fourth generation products, which we expect to begin shipping during 2012. With our commitment to research and development, we believe that we will provide significantly improved products with greater functionality delivered at lower cost than previously released products.

Sales and Marketing

We believe that the successful deployment of Duke Energy’s smart grid implementation in Ohio, which includes our communications platform, will result in other utilities adopting similar smart grid strategies to fully realize the benefits of the smart grid. We expect to leverage this success in order to acquire new utility customers. We expect to increase selling, marketing and business development activities, including the hire of additional personnel, to secure new customers domestically and internationally.

Given the strategic impact of smart grid applications on a utility, a utility’s decision-making process typically involves top-level executives and large multi-functional teams across many organizational layers. Utilities generally undertake extensive budgeting, procurement, competitive bidding, technical and performance review activities. Additionally, utilities often seek regulatory approval for projects if they expect to recover project costs through customer rate base increases. Such regulatory approval processes can be lengthy. A typical sales cycle with a new utility can take 12 months or more, depending on the size of the utility and the smart grid initiatives it intends to deploy. Utilities generally conduct both lab testing and field pilots to verify the functionality of products prior to awarding a contract for a larger deployment. However, based upon our experience with pilot programs with Duke Energy and the flexible nature of our communications platform, we believe that we are well positioned to effectively execute such pilot programs. Furthermore, new customers can learn how our technology is deployed within Duke Energy’s territories. For example, our communications platform is profiled at Duke Energy’s Envision Center in Ohio where prospective customers can observe the integration of our technology into Duke Energy’s smart grid initiatives. Furthermore, prospective customers can gain a better understanding of the potential financial benefits of a smart grid related project as documented in the results of an independent third-party audit conducted at the request of the Public Utility Commission of Ohio relating to Duke Energy’s Ohio smart grid project progress to date.

Strategic Alliances and Relationships

We believe that we possess the internal resources for the further development of our technology. However, we have, and will continue to develop, relationships with certain suppliers, smart grid equipment manufacturers and wireless communication providers to ensure that we can offer competitive products to support our business development initiatives. Specifically, we have established relationships with certain component suppliers, such as Qualcomm, Sierra Wireless and Novatel Wireless. We have also entered into joint marketing agreements with certain wireless communication providers, including Verizon Wireless and Sprint.

As an example of our efforts to improve the interoperability of our communications platform with various smart grid applications, we have entered into an Interoperability and Co-Marketing Agreement with Tollgrade Communications, Inc., a leading provider of network assurance solutions for the telecommunications and utility industries, which allows us to incorporate its LightHouse™ centralized remote monitoring system for electric power utilities and also provides for the opportunity to develop additional technologies.

Research and Development

The majority of our employees are engaged in product research and development activities. We also engage independent contractors to provide research and development services. Research and development is critical to ensure the continued success and growth of our business. We plan to expand our research and development activities, including hiring additional personnel. We also intend to continue to work with our customers so that we can continue to develop and provide additional product offerings.

We incurred research and development expenses of approximately $4.9 million in 2009, $6.2 million in 2010 and $11.7 million in 2011.

Intellectual Property

We currently rely upon a combination of trade secrets, patents, copyrights and trademarks, as well as non-disclosure agreements and invention assignment agreements, to protect our technologies and other proprietary company information. As of December 31, 2011, our intellectual property portfolio included 26 patents issued or allowed by the United States Patent and Trademark Office, (USPTO) and we have 5 pending patent applications in the United States. We have also filed many of our U.S. patents in various foreign jurisdictions, and expect that we will file our U.S. pending patent applications in foreign jurisdictions as well. Approximately half of our issued and pending U.S. patents relate to our legacy utilities communications technologies, and the other half relate to our communications platform, including our Energy Sensing Solution. Our issued U.S. patents will expire between 2020 and 2029. Ambient®, Ambient Smart Grid®, Communications for a Smarter Grid® and AmbientNMS® are registered trademarks of Ambient Corporation with the USPTO. We have other marks registered and pending with the USPTO.

Our policy is to require our employees, consultants, advisors and collaborators to execute confidentiality agreements. Additionally, we require our employees and consultants to execute assignment of invention agreements upon the commencement of employment, consulting or advisory relationships. These agreements generally provide that all confidential information developed or made known to a party by us during the course of the party’s association with our company is to be kept confidential and not to be disclosed to third parties except in specific circumstances. In the case of employees and consultants, the agreements also provide that all inventions conceived by the individuals in the course of their employment or consulting relationship will be our exclusive property.

Employees

As of December 31, 2011, we had 88 full-time employees. Almost of all of our employees are located at our Newton, Massachusetts headquarters, and we have three field engineers located at various Duke Energy locations. None of our employees are covered by collective bargaining agreements. We have never experienced any work stoppages and consider our relations with our employees to be good.

We have had a contract with Insperity, formerly known as Administaff, which is a professional employment organization. Pursuant to this contract, we and Insperity were co-employers of our personnel. Insperity was responsible for paying the salaries and wages of our personnel and providing our personnel with health, dental and various other types of insurance and benefits at favorable rates for which we would not otherwise qualify. Insperity paid salaries and wages of our personnel directly from our bank accounts, and we paid Insperity a fee for its services.

As of January 1, 2012, we terminated our contract with Insperity and currently administer our human resource related activities internally.

Manufacturing and Assembly

We have a Master Supply and Alliance Agreement with Bel Fuse Inc., a global producer of high-quality electronic components, for the manufacture and assembly of our communications nodes. We leverage the capabilities of Bel Fuse Inc. with respect to its low-cost, global manufacturing capabilities, supply-chain management and engineering expertise. As we continue to value engineer our communications nodes, deliver higher volumes and source alternative key components, we believe that we will continue to reduce our production costs.

Our products are made to order and are shipped directly to our customer’s warehouses in the United States. We purchase components, such as power cords, brackets and other accessories, which typically are shipped directly to our customer. In order to minimize total cost and limit our exposure of excess inventory, we typically do not hold significant amounts of finished goods or component materials at any given time.

Competition

Competition in the smart grid market is increasing and involves evolving technologies, developing industry standards, frequent new product introductions, changes in customer or regulatory requirements and localized market requirements. Competitive pressures require us to keep pace with the evolving needs of utilities; to continue to develop and introduce new products, features and services in a timely, efficient and cost-effective manner; and to stay abreast of regulatory factors affecting the utility industry.

We compete with a wide array of manufacturers, vendors, strategic alliances, systems developers and other businesses. These include smart grid communications technology companies, ranging from relatively smaller companies focusing mainly on communications technology to large Internet, hardware and software companies. In addition, some providers of smart meters may add communications capabilities in the future to provide some level of connectivity to the utility’s back office.

Some of our present and potential future competitors have, or may have, greater name recognition, experience and customer bases, as well as substantially greater financial, technical, sales, marketing, manufacturing and other resources than we possess and that afford them competitive advantages. These potential competitors may undertake more extensive marketing campaigns, adopt more aggressive pricing policies, obtain more favorable pricing from suppliers and manufacturers and exert more influence on sales channels than we do. Competitors may sell products at lower prices in order to obtain market share. Competitors may be able to respond more quickly than we can to new or emerging technologies and changes in customer requirements. Competitors may also be able to devote greater resources to the development, promotion and sale of their products and services than we can. Competitors may introduce products and services that are more cost-efficient, provide superior performance or achieve greater market acceptance than our products and services. Other companies may also drive technological innovation and develop products that are equal or superior in quality and performance to our products and render our products non-competitive or obsolete.

We believe that we compete effectively in the market based on a number of factors. These factors include the proven technology of our communications platform, our successful commercial deployments with Duke Energy, our focus on our communications platform, our scalable and interoperable products that we have purpose-built for the utility environment and our competitive cost of ownership. However, we may have to change our product offerings, invest more heavily in research and development or business development or acquire complementary technologies in order to remain competitive in the future.

AVAILABLE INFORMATION

Our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and all amendments to those reports are made available free of charge though our internet website (http://www.ambientcorp.com) as soon as practicable after such material is electronically filed with, or furnished to, the Securities and Exchange Commission. Except as otherwise stated in these documents, the information contained on our website or available by hyperlink from our website is not incorporated by reference into this report or any other documents we file with or furnish to the Securities and Exchange Commission.

ITEM 1A. RISK FACTORS

Our business, financial condition and results of operations could be materially adversely affected by various risks, including, but not limited to the principal risks noted below.

We currently depend on one customer for substantially all of our revenue, and any material delay, reduction or cancellation of orders from this customer would significantly reduce our revenue and have a material negative impact on our business.

Duke Energy accounted for all of our revenue for each of our last three fiscal years. Any material delay, reduction or cancellation of orders from Duke Energy would have a material adverse effect on our business, including significantly reduced revenue, unabsorbed overhead and incurred net losses.

Although we have a long-term contract that stipulates the general terms of our relationship, Duke Energy does not provide us with firm purchase commitments for the duration of the contract. Instead, Duke Energy provides us with 12-month rolling order forecasts and periodic purchase orders. Duke Energy can delay, reduce or cancel purchase orders at any time prior to the anticipated lead time for delivery of the products (typically three months), subject to Duke Energy’s payment of a cancellation fee not to exceed the price of the products cancelled. Duke Energy may also delay, reduce or cancel its purchase orders without penalty if we are unable to deliver the products ordered thereunder within a specified time from the scheduled delivery date.

Our immediate business opportunities continue to be primarily dependent on the success of our deployments with Duke Energy and the future decisions of Duke Energy relating to its smart grid deployment in its service territories. Our goal is to increase our business with Duke Energy and to attract new customers. We may not achieve this goal within an acceptable period of time or at all. The failure to increase our business with Duke Energy or to attract new customers would have a material adverse effect on our business and prospects.