Please wait

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

———————

FORM 10-K

———————

þ ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

for the fiscal year ended December 31, 2013

o TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from: _____________ to _____________

Commission file number 001-35259

AMBIENT CORPORATION

(Exact name of registrant as specified in its charter)

———————

|

Delaware

|

|

98-0166007

|

|

(State or Other Jurisdiction of Incorporation)

|

|

(I.R.S. Employer Identification No.)

|

7 WELLS AVENUE, NEWTON, MASSACHUSETTS 02459

(Address of Principal Executive Office)

617-332-0004

(Registrant’s telephone number, including area code)

Securities Registered Under Section 12(b) of the Exchange Act:

|

Common Stock, par value $0.001 per share

|

|

NASDAQ Capital Market

|

Securities Registered Under Section 12(g) of the Exchange Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Securities Act of 1933. Yes o No þ

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 Regulation S-T (232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files Yes þ No o

Indicate by check mark if disclosure of delinquent filers in response to Item 405 of Regulation S-K is not contained in this form, and no disclosure will be contained, to the best of the registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or smaller reporting company. See definition of "large accelerated filer, “accelerated filer" and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer o Accelerated filer o Non-accelerated filer o Smaller reporting company þ

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act.) Yes o No þ

The registrant had 17,341,339 shares of common stock outstanding as of April 10, 2014. The aggregate market value of the common stock held by non-affiliates of the registrant as of June 28, 2013, was approximately $7.9 million computed by reference to the closing price of such common stock on the NASDAQ Capital Market on such date.

DOCUMENTS INCORPORATED BY REFERENCE

The Registrant intends to file a definitive proxy statement pursuant to Regulation 14A in connection with its 2014 Annual Meeting of Stockholders within 120 days after the close of the fiscal year covered by this Form 10-K. Portions of such proxy statement are incorporated by reference into Items 10, 11, 12, 13 and 14 of Part III of this report.

AMBIENT CORPORATION

2013 FORM 10-K ANNUAL REPORT

| |

|

|

Page

|

|

| |

PART I

|

|

|

|

| |

|

|

|

|

|

Item 1.

|

Business

|

|

|

4 |

|

| |

|

|

|

|

|

|

Item 1A.

|

Risk Factors

|

|

|

10 |

|

| |

|

|

|

|

|

|

Item 1B.

|

Unresolved Staff Comments

|

|

|

19 |

|

| |

|

|

|

|

|

|

Item 2.

|

Properties

|

|

|

19 |

|

| |

|

|

|

|

|

|

Item 3.

|

Legal Proceedings

|

|

|

19 |

|

| |

|

|

|

|

|

|

Item 4.

|

Mine Safety Disclosures

|

|

|

19 |

|

| |

|

|

|

|

|

| |

PART II

|

|

|

|

|

| |

|

|

|

|

|

|

Item 5.

|

Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

|

|

20 |

|

| |

|

|

|

|

|

|

Item 6.

|

Selected Financial Data

|

|

|

21 |

|

| |

|

|

|

|

|

|

Item 7.

|

Management Discussion and Analysis of Financial Condition and Results of Operation.

|

|

|

21 |

|

| |

|

|

|

|

|

|

Item 7A.

|

Quantitative and Qualitative Disclosures About Market Risk.

|

|

|

28 |

|

| |

|

|

|

|

|

|

Item 8.

|

Financial Statements and Supplementary Data

|

|

|

28 |

|

| |

|

|

|

|

|

|

Item 9.

|

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure

|

|

|

28 |

|

| |

|

|

|

|

|

|

Item 9A

|

Controls and Procedures

|

|

|

28 |

|

| |

|

|

|

|

|

|

Item 9B.

|

Other Information

|

|

|

28 |

|

| |

|

|

|

|

|

| |

PART III

|

|

|

|

|

| |

|

|

|

|

|

|

Item 10.

|

Directors, Executive Officers and Corporate Governance

|

|

|

29 |

|

| |

|

|

|

|

|

|

Item 11.

|

Executive Compensation

|

|

|

29 |

|

| |

|

|

|

|

|

|

Item 12.

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

|

|

29 |

|

| |

|

|

|

|

|

|

Item 13.

|

Certain Relationships and Related Transactions, and Director Independence

|

|

|

29 |

|

| |

|

|

|

|

|

|

Item 14.

|

Principal Accountant Fees and Services

|

|

|

29 |

|

| |

|

|

|

|

|

| |

PART IV

|

|

|

|

|

| |

|

|

|

|

|

|

Item 15.

|

Exhibits and Financial Statement Schedules

|

|

|

29 |

|

| |

|

|

|

|

|

|

SIGNATURES

|

|

|

31 |

|

FORWARD LOOKING STATEMENTS

The following discussion should be read in conjunction with the financial statements and related notes contained elsewhere in this annual report on Form 10-K. We make forward-looking statements in this report, in other materials we file with the Securities and Exchange Commission (the “SEC”) or that we otherwise release to the public, and on our website. In addition, our senior management might make forward-looking statements orally to analysts, investors, the media, and others. These statements are “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and 21E of the Securities Exchange Act of 1934, as amended. Statements concerning our future operations, prospects, strategies, financial condition, future economic performance (including growth and earnings) and demand for our products and services, and other statements of our plans, beliefs, or expectations, including the statements contained in Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” regarding our future plans, strategies and expectations are forward-looking statements. In some cases these statements are identifiable through the use of words such as “anticipate,” “believe,” “estimate,” “predict,” “expect,” “intend,” “plan,” “project,” “target,” “continue,” “can,” “could,” “may,” “should,” “will,” “would,” and similar expressions. You are cautioned not to place undue reliance on these forward-looking statements because these forward-looking statements we make are not guarantees of future performance and are subject to various assumptions, risks, and other factors that could cause actual results to differ materially from those suggested by these forward-looking statements. Thus, our ability to predict results or the actual effect of our future plans or strategies is inherently uncertain. Factors which could have a material adverse effect on our operations and future prospects include, but are not limited to, our ability to continue as a going concern; our ability to comply with the continued listing requirements of the NASDAQ Capital Market; our ability to secure additional financing and/or defer expenditures; our ability to retain and attract customers, particularly in light of our historical dependence on a single customer for substantially all of our revenue; our expectations regarding our expenses and revenue; strategic alternatives that may become available to us; expectations regarding our ability to reduce operating expenses as a result of streamlining operations anticipated trends and challenges in our business and the markets in which we operate, including the market for smart grid technologies; our expectations regarding competition as more and larger companies enter our markets and as existing competitors improve or expand their product offerings; our plans for future products and enhancements of existing products; our anticipated cash needs and our estimates regarding our capital requirements. These risks and uncertainties, together with the other risks described from time to time in reports and documents that we file with the SEC, should be considered in evaluating forward-looking statements. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, performance or achievements. Indeed, it is likely that some of our assumptions will prove to be incorrect. Our actual results and financial position will vary from those projected or implied in the forward-looking statements and the variances may be material. Moreover, we do not assume the responsibility for the accuracy and completeness of these forward-looking statements. We expressly disclaim any obligation to update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise, except as required by law.

PART I

Ambient Corporation is a provider of a communications and application platform that incorporates various communication technologies and enables utilities and other grid managers to implement a grid modernization program, deploying different applications, whether Ambient or third-party developed. Our innovative platform enables grid managers to deploy and integrate multiple smart grid applications and technologies, in parallel, on a single communications infrastructure, supporting smart metering, distribution automation, distribution management, demand response, distributed generation, and more.

The term “smart grid” refers to the use of advanced technologies to upgrade the electric power grid, or the grid, effectively making the grid more intelligent and efficient. The grid was largely designed and built decades ago to reliably distribute electricity from generators to customers in a manner that resulted in sizable capital investments and operating costs. A number of factors are increasingly straining the grid, including growing electricity demand, two-way power flow requirements, the implementation of renewable and distributed energy sources, and advanced pricing plans. As such, the aging grid is prone to reliability, security, availability, and power quality issues, costing utilities and consumers billions of dollars each year. Technology is now revolutionizing the grid and transforming it into an efficient, communicating energy service platform. We believe that the smart grid will address the current shortcomings of the grid and deliver significant benefits to utilities and consumers of energy, including reduced costs, increased power reliability and quality, accommodation of renewable energy technologies, consumer empowerment over energy consumption, and a platform for continued integration of new technologies.

The Ambient Smart Grid® communications and applications platform, which includes hardware, software and firmware, enables grid managers to effectively manage smart grid applications. Our communications platform provides utilities with a secure, two-way, flexible and open Internet protocol, or IP, architecture that efficiently networks smart grid applications and different technologies within each application and supports multiple communications technologies currently used by utilities, such as Wi-Fi, radio frequency (RF), cellular technologies, power line communications (PLC), serial and Ethernet. We believe that the Ambient Smart Grid® communications platform delivers significant benefits to utilities, and other grid managers, including support of a single network; an open, scalable and interoperable platform; preservation of investments; third-party application hosting; remote and distributed intelligence; secure communications; and reduced overall implementation and operating costs.

The Ambient Smart Grid products and services include an expanded communications node product base; a network management system, AmbientNMS®; integrated applications; and maintenance and consulting services. The communications nodes are physical boxes that contain the hardware and software needed for communications and data collection in support of smart grid assets. We have configured our communications nodes to act as individual data processors and collectors, which receive signals from other networked devices, enabling smart grid applications. Duke Energy, historically our marquee customer, has commercially deployed to date approximately 141,000 of our communications nodes, which receive data from approximately one million endpoints, primarily including both data from smart electric and gas meters, using a variety of communications technologies, and process and transmit these data to the utility back office over a cellular carrier network for further processing. Our communications nodes, in the fourth generation of development, also accommodate integrated applications that include our own developed technology and third-party technology, thereby substantially increasing their functionality. By enabling such system interoperability, our communications platform both reduces implementation and ongoing communications costs, and improves overall power management efficiencies.

Our long-standing relationship with Duke Energy has been the source of substantially all of our revenue since 2008. In 2009, we entered into a long-term agreement with Duke Energy to supply the utility with our Ambient Smart Grid® communications platform, and license our AmbientNMS®, through 2015. Since we established our relationship with Duke Energy, we have focused on developing our technology to meet the needs of their smart grid communications platform, with the intention of marketing the technology to grid managers, globally.

Based upon the success of our relationship with Duke Energy and our proven technology, we have recently refocused our resources on new business development, marketing and sales programs, and further technology development in order to expand our customer base. To that end, in 2013, Consolidated Edison selected Ambient for a long-standing grid monitoring project collecting power quality data from commercial and industrial meters, and Consolidated Edison began deploying the Ambient product. In late 2013, the scope of work with Consolidated Edison expanded beyond the initial project, which has led to additional sales of our communications nodes. In addition, we are participating in a number of field trials with European utilities and working with partners to introduce our technology to global markets.

We were incorporated in the state of Delaware in June, 1996. Our common stock currently trades on the NASDAQ Capital Market under the symbol “AMBT.”

The Electric Power Distribution Grid

The grid was largely designed and built decades ago, and is becoming increasingly strained. Much of the current grid infrastructure, both in the United States and abroad, is over 25 years old and simply is not designed to accommodate the dynamic electricity distribution requirements of today or the future. As a result, the aging grid is prone to reliability, security, availability, and power quality issues, costing utilities and consumers billions of dollars each year.

The Smart Grid

We believe that grid modernization will address the shortcomings of the current grid, as well as deliver significant benefits to utilities and consumers of energy. The smart grid encompasses multiple technologies and applications, and represents significantly more than just smart electric meters. The U.S. Energy Independence and Security Act of 2007 provided the following, thorough definition of the smart grid:

The term smart grid refers to a modernization of the electricity delivery system so that it monitors, protects, and automatically optimizes the operation of its interconnected elements from the central and distributed generator through the high-voltage network and distribution system to industrial users and building automation systems, to energy storage installations, and to end-use consumers and their thermostats, electric vehicles, appliances and other household devices. The smart grid will be characterized by a two-way flow of electricity and information to create an automated, widely distributed energy delivery network. It incorporates into the grid the benefits of distributed computing and communications to deliver real-time information and enable the near-instantaneous balance of supply and demand at the device level.

In brief, the term smart grid refers to the use of advanced communications technologies and modern computing capabilities to upgrade and modernize the electric power grid (and other utility infrastructures, such as gas and water), effectively making the grid more intelligent and efficient. We believe that the implementation of intelligent and seamless communication across the grid represents an expected increase of information technology spending, similar to the previous telecommunications and Internet investment cycles.

Smart Grid Applications

The smart grid will connect millions of devices that generate, distribute, control, monitor, and use energy, thereby enabling utilities and consumers to dynamically interact with the energy supply chain. The smart grid is more than just smart meters, and we believe that fully realizing the benefits of the smart grid will require the implementation of a variety of technologies and applications. For all smart grid applications to work seamlessly together, a flexible and open communications platform is needed for the interoperability of each connected smart grid application, including the following:

Smart Meters. Smart meters encompass the meters themselves, related communications equipment and data management systems that record and monitor real-time energy consumption information at regular intervals. Smart meters allow for two-way communication of data between the smart meter and a utility’s back office, providing utilities with valuable information to measure and control production, transmission, and distribution more efficiently, and providing consumers with information to make informed choices regarding energy consumption. This technology further enables a utility to reduce the costs of operating its distribution system by automating various functions that are currently performed manually, such as reading customer meters, and turning power on and off at the customer meter.

Distribution Automation. Distribution automation encompasses utilities deploying control devices and communications infrastructure to monitor and control energy distribution in real time, enabling intelligent control over grid functions at the distribution level. Utilities use distribution automation applications to directly control the flow of electricity from individual substations to consumers in order to improve the quality of power generation; reduce the frequency, duration, and scale of power outages; reduce energy losses; and ultimately optimize operating efficiency and reliability of the grid.

Demand Response. Demand response is an initiative in which utilities provide incentives to consumers to reduce energy usage during times of peak demand. Demand response includes technology that can manage the consumption of electricity in conjunction with supply and demand fluctuations, enabling variable pricing and providing information to encourage consumers to make more active decisions about their energy usage. Utilities can use demand response to enable consumers to reduce, or provide direct utility control of, electricity use, particularly during high price/demand periods, by sending time-differentiated prices to customers via the meter, and recording customers’ actual real-time usage. Demand response technology enables utilities to better manage their distribution network, delivering electricity more efficiently, and potentially reducing peak and base load generation requirements.

Network Management Systems. Utilities require back office software and computer hardware systems to monitor and manage the vast numbers of devices and information collected by those devices from various smart grid applications. Network management systems control smart grid devices and collect and process data in the back office, relying on two-way communications.

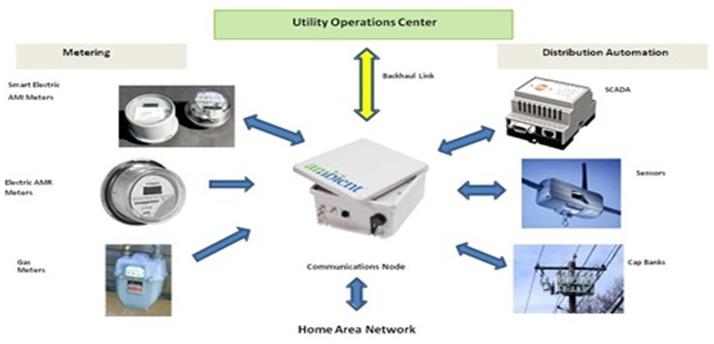

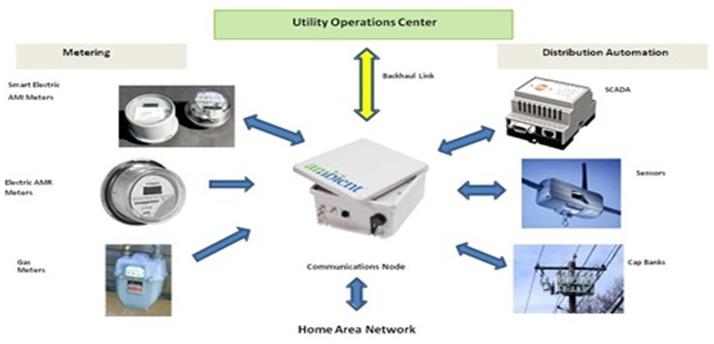

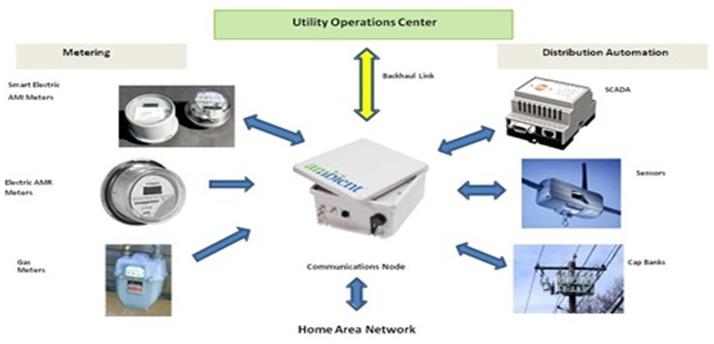

Ambient Smart Grid® Communications and Applications Nodes. Communications nodes are physical boxes that contain the hardware and software needed for communications and data collection in support of grid assets. We configured our communications nodes to act as individual data processors and collectors, which receive signals from other networked devices, enabling smart grid applications. Our communications nodes can also contain our own or third-party embedded applications. We are currently in the final testing and evaluation of our fourth-generation communications nodes. The following is a graphical depiction of how our communications nodes interact and connect with smart grid applications and a utility.

AmbientNMS® is a network management system that manages large numbers of communications nodes, devices and customers on a network. A utility can use the AmbientNMS® to effectively manage its entire grid distribution system, providing valuable information over a single communications network. We customize AmbientNMS®, providing a utility with the tools necessary to tailor its monitoring and processing and to act upon vast amounts of information on a real-time basis. For example, we have integrated our AmbientNMS® into an industry standard Distribution and Outage Management System (DOMS) that provides for the delivery of faster, more accurate information to power outage notification and restoration systems. DOMS allows utilities to quickly assess and respond to power delivery issues in reduced response time, thereby better managing disruptions and enhancing system reliability. AmbientNMS® also provides the functionality to predict, and precisely control, the amount of data traffic to be used by individual devices and the communications network as a whole. Utilities can systematically push software updates to deployed communications nodes and other downstream devices.

Ambient Power Quality Monitoring (PQM). In a changing and challenging power environment with increased electricity demand and adoption of renewable and low carbon technologies, distribution grids are under stress, and utilities are under pressure to maintain and improve efficiency and reliability, and avoid or defer costly infrastructure upgrades. The Ambient Power Quality Monitoring Solution– (AmbientPQM) facilitates real-time visibility of distribution networks for proactive grid management to help surmount these challenges and ensure continued quality of customer service. AmbientPQM is a combination of software and hardware (PQM application, Ambient Smart Grid Nodes, and Sensors) that enables utilities and distribution network operators to measure an array of power quality parameters on medium and/or low voltage distribution grids, both on overhead and/or underground lines, and at distribution substations or transformers.

Maintenance and Consulting Service. We provide maintenance and implementation services to maintain the software installed within our communications platform. We can remotely distribute software upgrades and added features to deployed communications nodes within the network. We also provide a variety of consulting services relating to product development, network management services, and smart grid deployment strategies. We provide maintenance and consulting services to provide a turnkey offering of our communications platform.

Duke Energy Relationship

Since 2005, we have maintained a strategic relationship with Duke Energy, and are one of the leading suppliers of its smart grid communications technology in connection with its grid modernization strategies. With what we believe was one of the most forward-looking smart grid initiatives in North America in the past decade, Duke Energy’s smart grid deployment includes digital and automated technology, such as communications nodes, smart meters, and automated power delivery equipment. The following table summarizes the evolution of our relationship with Duke Energy:

| |

|

|

| |

|

|

|

2008

|

●

|

Commercial agreement for 9,000 communications nodes

|

| |

|

|

|

2009

|

●

|

Award to Duke Energy of $204 million in American Recovery and Reinvestment Act of 2009 digital grid stimulus funds and Duke Energy announcement of plans to invest a total of $1 billion in smart grid deployment initiatives over five years

|

| |

●

|

Long-term supply agreement with Duke Energy to supply our communications nodes and services through 2015

|

| |

|

|

|

2010

|

●

|

Full-scale smart grid deployment begun by Duke Energy in Ohio, contemplating the deployment of smart meters, automated power distribution equipment and, a communications network encompassing more than 130,000 of our communications nodes, 700,000 electric meters, and 450,000 gas meters

|

| |

●

|

Deployment by Duke Energy of approximately 20,000 of our communications nodes

|

| |

|

|

|

2011

|

●

|

Deployed a cumulative total of approximately 75,000 communications nodes, including approximately 3,000 of our communications nodes in the Carolinas

|

| |

|

|

|

2012

|

● |

Deployed a cumulative total of approximately 125,000 communications nodes

|

| |

|

|

|

2013

|

● |

Deployed a cumulative total of approximately 141,000 communications nodes, including as part of a system-wide upgrade of the North Carolina deployment, Duke deployed approximately 2,300 of our latest model of the Ambient communication node, the X-3200

|

We believe that we have demonstrated that our technology is secure, two-way, flexible, open, scalable, reliable, and cost-effective through the deployment, to date, of approximately 141,000 communications nodes in the field with Duke Energy. Throughout the past five years, we have worked with Duke Energy to develop our functionality of our communications platform, which has enabled Duke Energy to deploy its smart grid initiative in the state of Ohio.

We believe that we have a potential opportunity to continue to support Duke Energy in their grid modernization efforts, if it were to eventually implement a full deployment of smart grid communications nodes in Indiana, Kentucky, and the Carolinas. While Duke Energy is using information from its North Carolina pilot programs and its Ohio deployment to enhance its customer experience, Duke Energy has not determined to implement a full deployment, and even if such determination is made, Duke Energy has not determined it would primarily use our nodes and communications platform in any such deployment.

Current Operational Focus

Based on our proven technology, we are focusing on new business development and marketing and sales programs, and technology development in order to expand our customer base.

To that end, in 2013, Consolidated Edison selected Ambient for a long-standing grid monitoring project collecting power quality data from commercial and industrial meters, and began deploying this solution. In late 2013, the scope of work with Consolidated Edison expanded beyond the initial project, which has led to additional sales of our communications nodes. In addition, we are participating in a number of field trials with European utilities and working with partners to introduce our technology to global markets. Subject to raising additional significant capital, we plan to increase investment in our marketing and sales efforts over the next twelve months.

We are also an active participant in the Coalition of the Willing (COW), a collaboration of seven companies showcasing the interoperability of their hardware, software, and communications. Each vendor’s products are linked together using an open-source, standards-based field message bus. The COW group, which includes Duke Energy, as well as other leading companies, has developed a demonstration project around voltage management assets to show how interoperable hardware, software, and systems from multiple suppliers can be used to build a distributed intelligence platform that eliminates silos, improves grid performance, enables interoperability between grid assets, reduces costs, and increases security.

As further discussed below under Item7 (Management’s Discussion and Analysis), we are in the process of exploring a range of strategic alternatives to enhance stockholder value, including, but not limited to, a sale of Ambient, a business combination or collaboration, joint development, and partnership opportunities. Our strategic process is both active and ongoing and includes a range of interactions with potential transaction counterparties. No assurance can be provided that these efforts will successfully result in any transaction.

Our business success in the immediate future will depend largely on our ability to secure additional financing, execute on a strategic alternative and expand our customer base.

Research and Development

As of December 31, 2013, the majority of our employees are engaged in product development activities. We also engage independent contractors to provide research and development services. Research and development efforts are critical to ensure the success and growth of our business. We intend to continue to work with our customers so that we can continue to develop and provide additional product offerings. We incurred research and development expenses of approximately $14.3 million in 2012, and $11.2 million in 2013.

In an effort to preserve working capital, we implemented a series of restructuring measures in May and October 2013, principally consisting of reduction in our work force and reduction in cash compensation of our senior management. As a result of this restructuring, we expect that research and development expenses will continue to decline during 2014.

Intellectual Property

We currently rely upon a combination of trade secrets, patents, copyrights, and trademarks, as well as non-disclosure agreements and invention assignment agreements, to protect our technologies and other proprietary company information. As of January 31, 2013, our intellectual property portfolio included 26 U.S. patents and seven pending U.S. patent applications. We also have many patents issued by various foreign jurisdictions, and pending applications filed in foreign jurisdictions. Approximately half of our issued and pending U.S. patents relate to our legacy utilities communications technologies, and the other half relate to our communications platform, including our Energy Sensing Solution. Our issued U.S. patents will expire between 2020 and 2029. Ambient, Ambient Smart Grid and AmbientNMS are registered trademarks of Ambient Corporation. AmbientPQM is a trademark of Ambient Corporation.

Our policy is to require our employees, consultants, advisors, and collaborators to execute confidentiality agreements. Additionally, we require our employees and consultants to execute assignment of invention agreements upon the commencement of employment, consulting, or advisory relationships. These agreements generally provide that all confidential information developed or made known to a party by us during the course of the party’s association with us is to be kept confidential and is not to be disclosed to any third party, except in specific circumstances. In the case of employees and consultants, the agreements also provide that all inventions conceived by employees or consultants in the course of their employment or consulting relationship with us will be our exclusive property.

Employees

As of December 31, 2013, we had 41 employees. All of our employees, except for six, are located at our Newton, Massachusetts, headquarters. None of our employees is covered by collective bargaining agreements. We have never experienced any work stoppages, and we consider our relations with our employees to be good.

Manufacturing and Assembly

In 2009, we entered into a Master Supply and Alliance Agreement with Bel Fuse Inc., a global producer of high-quality electronic components, for the manufacture and assembly of our communications nodes. We leverage the capabilities of Bel Fuse Inc. with respect to its low-cost, global manufacturing capabilities, supply-chain management and engineering expertise. Additionally, we purchase components, such as Ambient designed brackets and other accessories, which typically are shipped directly to our customers.

Competition

Competition in the smart grid market space is ever increasing and involves evolving technologies, developing industry standards, frequent new product introductions, changes in customer or regulatory requirements, and localized market requirements. Competitive pressures require us to keep pace with the evolving needs of utilities and other smart grid managers; to continue to develop and introduce new products, features, and services in a timely, efficient, and cost-effective manner; and to stay abreast of regulatory factors and standard-setting bodies affecting the communication and utility industries.

We compete with a wide array of manufacturers, vendors, strategic alliances, systems developers, and other businesses. These include smart grid communications technology companies, ranging from relatively smaller companies focusing mainly on communications technology to large Internet, hardware, and software companies. In addition, some providers of smart meters may add communications capabilities in the future to provide some level of connectivity to a utility’s back office.

We believe that we can compete effectively in the market based on a number of factors, including the proven technology of our communications platform, our successful commercial deployment with Duke Energy, the scalable and interoperable products that we have purpose-built for the utility environment, and our competitive cost of ownership. We will have to secure financing or complete a strategic alternative and continue to evolve our product offerings, continually invest in research and development and in business development, and/or acquire complementary technologies in order to remain competitive in the future.

AVAILABLE INFORMATION

Our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and all amendments to those reports are made available free of charge though our Internet website (http://www.ambientcorp.com) as soon as practicable after such material is electronically filed with, or furnished to, the Securities and Exchange Commission. Except as otherwise stated in these documents, the information contained on our website or available by hyperlink from our website is not incorporated by reference into this report or any other documents we file, with or furnish to, the Securities and Exchange Commission.

ITEM 1A. RISK FACTORS

Our business, financial condition and results of operations could be materially adversely affected by various risks, including, but not limited to the principal risks noted below.

We need to raise additional funds on an immediate basis to support our operations, and if we fail to do so, we will likely need to cease doing business.

As of December 31, 2013, we had available cash balances of $907,000, and as of April 8, 2014, we had available cash balances of approximately $926,000. We will need to raise additional capital and/or increase revenues on an immediate basis in order to satisfy our obligations under our existing contracts, pay existing current liabilities as they come due, and meet our operating requirements. In order to augment our working capital, in August 2013, we entered into a financing arrangement with Vicis Capital Master Fund (“Vicis”), our majority stockholder, pursuant to which we have access to up to $5 million in available credit, all of which becomes due on June 30, 2014. Between January and April 10, 2014, we completed four draw-downs in the aggregate amount of $2.0 million. If we do not have available cash from revenues or additional financing by June 30, 2014, we will not have sufficient cash flow to meet our working capital needs and will be unable to repay amounts due under the Vicis credit facility when due, which will have a material adverse impact on our business and operations.

Furthermore, even if we are able to pay down the amounts borrowed under the financing arrangement with Vicis, absent the addition of new customers, or the material increase in revenues from existing customers, current projected revenue is not sufficient to sustain our operations in the long term. In addition, we may require additional capital to respond to business opportunities, challenges, acquisitions, or unforeseen circumstances, and may determine to engage in equity or debt financings or enter into credit facilities for other reasons. As such, we will need to obtain additional equity or debt financing and/or divest certain assets, neither of which can be assured on a commercially reasonable basis, if at all. Any debt financing obtained by us in the future could involve restrictive covenants relating to our capital-raising activities and other financial and operational matters, which may make it more difficult for us to obtain additional capital and to pursue business opportunities. If we raise additional funds through further issuances of equity, convertible debt securities, or other securities convertible into equity, our existing stockholders could suffer significant dilution in their percentage ownership of our company, and any new equity securities we issue could have rights, preferences, and privileges senior to those of holders of our common stock. Our success in these efforts will be subject to investor sentiment regarding the macro and micro economic conditions under which we operate, including stock price volatility. There is no assurance that we will be successful in generating significant revenues or executing on a strategic alternative or obtaining adequate financing. Any failure by us to successfully implement these plans would have a material adverse effect on our business, including the ability to continue operations.

Based on our most recent cash flow projections, we believe that we have sufficient cash and cash equivalents to provide sufficient funds for our operations through June 2014. However, projecting operating results is inherently uncertain, and actual expenses can exceed those that are projected.

Management believes that there are conditions that raise substantial doubt about our ability to continue as a going concern. The accompanying consolidated financial statements do not include any adjustments relating to the recoverability of reported assets or liabilities should we be unable to continue as a going concern. Our independent public accountants have included an explanatory paragraph in their report accompanying our audited consolidated financial statements for the years ended December 31, 2013, and 2012, relating to the uncertainty of our ability to continue as a going concern. This condition may make it more difficult for us to raise additional capital.

A default by us under the secured financing arrangement with Vicis would enable it to take control of our assets.

Between January and April 10, 2014, we completed four draw-downs in the aggregate amount of $2.0 million under the financing arrangement between us and Vicis. We currently anticipate that we will be further drawing down on this credit line. Any amounts drawn down under this facility, are required to be repaid by June 30, 2014 (see Note 13 to the accompanying Consolidated Financial Statements). To secure all amounts due under the financing arrangement, we granted to Vicis a security interest in all of our assets, including our intellectual property. A default by us under these notes would enable the holder to foreclose on our assets, including our intellectual property. Any foreclosure could force us to substantially curtail or cease our operations.

We have historically depended on one customer for substantially all of our revenue and any material delay, reduction, or cancellation of orders from this customer would significantly reduce our revenue projections, and would have a material negative impact on our business.

Duke Energy accounted for substantially all of our revenue for each of our last two fiscal years. Any material delay, reduction, or cancellation of orders from Duke Energy would have a material adverse effect on our business, including significantly reduced revenue, unabsorbed overhead, and incurred net losses.

Although we have a long-term contract that stipulates the general terms of our relationship, Duke Energy does not provide us with firm purchase commitments for the duration of the contract. Instead, Duke Energy provides us with periodic purchase orders. Duke Energy can delay, reduce, or cancel purchase orders at any time prior to the anticipated lead time for delivery of the products (typically three months), subject to Duke Energy’s payment of a cancellation fee not to exceed the price of the products cancelled. Duke Energy may also delay, reduce, or cancel its purchase orders without penalty if we are unable to deliver the products ordered thereunder within a specified time from the scheduled delivery date.

We have had limited profitability, and we may be unable to achieve profitability in future periods.

For 2013, we had a net loss of $17.7 million and an accumulated deficit of $244.6 million. To grow our revenue and customer base, we will need to increase spending associated with research and development, and business development, thereby increasing our operating expenses at a time when we are experiencing financial challenges. We expect to incur net losses in the foreseeable future, and we may be unable to grow our revenue and expand our customer base to achieve profitability on an annual basis.

We depend on factors affecting the utility industry over which we exercise no control.

We expect, to derive substantially all of our revenue from sales of products to utilities and other smart grid managers. Purchases of our products may be deferred as a result of many factors, including economic downturns, slowdowns in new residential and commercial construction, access to capital at acceptable terms, utility specific financial circumstances, mergers and acquisitions, regulatory decisions, weather conditions, and interest rates. We may experience variability in operating results on an annual and a quarterly basis as a result of these factors.

Utility industry sales cycles can be lengthy and unpredictable, which can negatively impact our ability to expand the deployment of our products with new customers.

Sales cycles for smart grid projects are generally long and unpredictable due to budgeting, procurement, and regulatory approval processes that can take up to several years to complete. Utility customers typically issue requests for quotes and proposals, establish evaluation committees, review different technical options, require pilot programs prior to commercial deployments, analyze cost and benefit metrics, consider regulatory factors, and follow their normal budget approval processes. In addition, many electric utilities tend to be risk-averse and tend to follow industry trends rather than be the first to purchase new products or services. These tendencies can extend the lead time for, or prevent acceptance of, new products or services, including those for smart grid initiatives, despite the support of the federal government through grants and other incentives.

Accordingly, potential customers may take longer to reach a decision to initiate smart grid programs or to purchase our products or services. It is not unusual for a utility customer to go through the entire sales process and not accept any proposal or quote. This extended sales process requires the dedication of significant time by our personnel to develop relationships at various levels and within various departments of utilities, and our use of significant financial resources, with no certainty of success or recovery of our related expenses. Long and unpredictable sales cycles with utility customers could have a material adverse effect on our business, operating results, or financial condition.

The market for our products and services, and smart grid technology generally, is still developing, and we will have difficulty securing new customers if the market develops less extensively or more slowly than we expect.

The market for our products and services, and smart grid technology generally, is still developing, and it is uncertain whether our products and services will achieve and sustain high levels of demand and market acceptance. Assuming we secure immediately needed funding, our future success will depend, to a substantial extent, on the willingness and ability of utilities to implement smart grid technology. Many utilities lack the financial resources and/or technical expertise required to evaluate, deploy, and operate smart grid technology. Regulatory agencies, including public utility commissions, govern utilities’ activities, and they may not create a regulatory environment that is conducive to the implementation of smart grid technologies in a particular jurisdiction. Furthermore, some utilities may be reluctant or unwilling to adopt smart grid technology because they may be unable to develop a business case to justify the upfront and ongoing expenditures. If utilities do not widely adopt smart grid technologies, or do so more slowly than we expect, we will have difficulty securing new customers, which will adversely affect our business and operating results.

Because the markets for our products are highly competitive, we may lose sales to our competitors, which would harm our revenue and operating results.

Competition in the smart grid market is intense and involves changing technologies, evolving industry standards, new product introductions, changes in customer or regulatory requirements, and localized market requirements. Competitive pressures require us to keep pace with the evolving needs of utilities; to continue to develop and introduce new products, features and services in a timely, efficient, and cost-effective manner; and to stay abreast of regulatory factors affecting the utility industry.

We compete with a wide array of manufacturers, vendors, strategic alliances, systems developers, and other businesses, including other smart grid communications technology companies, ranging from relatively smaller companies focusing mainly on communications technology to large Internet and software-based companies. In addition, some providers of smart meters may add communications capabilities to their existing business in the future, which could decrease our base of potential customers and could decrease our revenue and profitability. “Early adopters,” or customers that have sought out new technologies and services, have largely comprised the target market for our products. Because the number of early adopters is limited, we will need to expand our target markets by marketing and selling our products to mainstream customers to generate revenue.

Some of our present and potential future competitors have, or may have, greater name recognition, experience, and customer bases, as well as substantially greater financial, technical, sales, marketing, manufacturing and other resources than we possess and that afford them competitive advantages. These potential competitors may undertake more extensive marketing campaigns, adopt more aggressive pricing policies, obtain more favorable pricing from suppliers and manufacturers and exert more influence on sales channels than we do. Competitors may sell products at lower prices in order to obtain market share. Competitors may be able to respond more quickly than we can to new or emerging technologies and changes in customer requirements. Competitors may also be able to devote greater resources to the development, promotion, and sale of their products and services than we can. Competitors may introduce products and services that are more cost-efficient, provide superior performance, or achieve greater market acceptance than our products and services. Our competitors may make strategic acquisitions or establish cooperative relationships among themselves or with third parties that enhance their ability to address the needs of our prospective customers. It is possible that new competitors or alliances among current and new competitors may emerge and rapidly gain significant market share. Other companies may also drive technological innovation and develop products that are equal or superior in quality and performance to our products and render our products non-competitive or obsolete.

Any of these competitive factors could make it more difficult for us to attract and retain customers, cause us to lower our prices in order to compete, or reduce our market share and revenue, any of which could have a material adverse effect on our operating results and financial condition. If we fail to compete successfully with current or future competitors, we could experience material adverse effects on our business, financial condition, results of operations, and cash flows.

The nature of our communications platform is complex and highly integrated, and if we fail to successfully manage releases or integrate new solutions, it could harm our revenues, operating income, and reputation.

Our communications nodes, in the fourth generation of development, accommodate integrated applications that include our own developed technology and third-party technology, thereby substantially increasing their functionality. By enabling such system interoperability, our communications platform both reduces implementation and ongoing communications costs, and improves overall power management efficiencies.

Due to this complexity and the condensed development cycles under which we operate, we may experience errors in our software, corruption or loss of our data, or unexpected performance issues from time to time. For example, our solutions may face interoperability difficulties with software operating systems or programs being used by our customers, or new releases, upgrades, fixes or the integration of acquired technologies may have unanticipated consequences on the operation and performance of our other solutions. If we encounter integration challenges or discover errors in our solutions late in our development cycle, it may cause us to delay our launch dates. Any major integration or interoperability issues or launch delays could have a material adverse effect on our revenues, operating income and reputation.

Existing and future regulations concerning the electric utility industry may present technical, regulatory, and economic barriers that may significantly impact future demand for our products.

International, federal, state, and local government regulations and policies, as well as internal policies and regulations promulgated by electric utilities, heavily influence the market for the electric utility industry. These regulations and policies often relate to investment initiatives, including decisions relating to investment in smart grid technologies, as well as building codes, public safety regulations, and licensing requirements. In addition, certain of our contracts with our potential utility customers may be subject to approval by federal, state, or local regulatory agencies, which may not be obtained or be issued on a timely basis. In the United States, and in a number of other countries, these regulations and policies are being modified and may continue to be modified and have a substantial impact on the market for our and other smart grid-related technologies. If such regulations or policies do not continue to gain acceptance for smart grid initiatives, or the adoption of such initiatives takes substantially longer than expected, our prospects for developing new customers could be significantly limited.

The adoption of industry standards applicable to our products or services could limit our ability to compete in the marketplace.

Standards bodies, which are formal and informal associations that seek to establish voluntary, non-governmental product and technology standards, are influential in the United States and abroad. We participate in voluntary standards organizations in order to both help promote non-proprietary, open standards for interoperability with our products, and to prevent the adoption of exclusionary standards. However, we are not able to control the content of adopted voluntary standards and do not have the resources to participate in all voluntary standards processes that may affect our markets. The adoption, or expected adoption, of voluntary standards that are incompatible with our products or technology, or that favor our competitors’ products or technology could limit the market opportunity for our products and services or render them obsolete, any of which could materially and adversely affect our revenue, results of operations, and financial condition.

If we become subject to product returns and product liability claims resulting from defects in our products, we may fail to achieve market acceptance of our products, and our business could be harmed.

We develop complex products for use in an evolving marketplace and generally warrant our products for a period of twelve months from the date of sale. Despite testing by us and customers, our products may contain, or may be alleged to contain, undetected errors or failures. In addition, a customer or its installation partners may improperly install or implement our products. The integration of our products in smart grid networks or applications may entail the risk of product liability or warranty claims based on disruption to these networks or applications. Any such manufacturing errors or product defects could result in a delay in recognition or loss of revenue, loss of market share, or failure to achieve market acceptance. Additionally, these defects could result in financial or other damages to a customer; cause us to incur significant warranty, support and repair costs; and divert the attention of our engineering personnel from our product development efforts. A product liability claim brought against us, even if unsuccessful, would likely be time-consuming and costly to defend. The occurrence of these problems would likely harm our business.

We currently maintain property, general commercial liability, errors and omissions, and other lines of insurance. Such insurance may be insufficient in amount to cover any particular claim, or we might not carry insurance that covers a specific claim. In addition, such insurance may not be available in the future or the cost of such insurance may increase substantially.

Our ability to provide bid bonds, performance bonds, or letters of credit may be limited and could negatively affect our ability to bid on or enter into significant long-term agreements.

We may be required to provide bid bonds or performance bonds to secure our performance under customer contracts or, in some cases, as a prerequisite to submitting a bid on a potential project. Our ability to obtain such bonds will depend upon our capitalization, working capital, past performance, management expertise and reputation, and external factors beyond our control, including the overall capacity of the surety market. Surety companies consider those factors in relation to the amount of our tangible net worth and other underwriting standards that may change from time to time. Surety companies may require that we collateralize a percentage of the bond with our cash or other form of credit enhancement. Events that affect surety markets generally may result in bonding becoming more difficult to obtain in the future, or being available only at a significantly greater cost. In addition, utilities may require collateral guarantees in the form of letters of credit to secure performance or to fund possible damages as the result of an event of default under any contracts with them. If we enter into significant long-term agreements that require the issuance of letters of credit, our liquidity could be negatively impacted. Our inability to obtain adequate bonding or letters of credit and, as a result, to bid or enter into significant long-term agreements, could have a material adverse effect on our ability to effectively compete and could impact our business.

We currently rely on a single contract manufacturer to produce our products, and a loss of our sole contract manufacturer, or its inability to satisfy our quality and other requirements, could severely disrupt the production and supply of our products.

We utilize one contract manufacturer for all of our production requirements. This manufacturing is conducted in China by a U.S.-based company that also performs services for numerous other companies. We depend on our manufacturer to maintain high levels of productivity and satisfactory delivery schedules. Our reliance on our manufacturer reduces our control over the manufacturing process, exposing us to risks, including reduced control over quality assurance, product costs, and product supply. Any financial, operational, or other difficulties involving our manufacturer could adversely affect us. We currently do not have guarantees of production capacity, prices, lead times, or delivery schedules with our contract manufacturer. Since our manufacturer serves other customers, a number of which have greater production requirements than we do, our manufacturer could determine to prioritize production capacity for other customers or reduce or eliminate production for us, on short notice. We could also encounter lower manufacturing productivity and longer delivery schedules in commencing volume production of new products. Any of these problems could result in our inability to deliver our products in a timely manner and adversely affect our operating results. The loss of our relationship with our manufacturer, or its inability to conduct its manufacturing services for us as anticipated in terms of cost, quality, and timeliness, could adversely affect our ability to fill customer orders in accordance with required delivery, quality and performance requirements. If this were to occur, the resulting decline in revenue would harm our business.

If any one of these risks materializes, it could significantly impact our operations and our ability to fulfill our obligations under purchase orders with Duke Energy, as well as future orders from Duke Energy or other customers. Qualifying new manufacturers is time-consuming and might result in unforeseen manufacturing and operational problems. If we had to transition to an alternative contract manufacturer, we could experience operational delays, increased product costs, and increased operating costs, which could irreparably harm our relationship with Duke Energy, harm our reputation, and potentially impact our ability to secure new customers.

Shortages of components and materials may delay or reduce our sales and increase our costs, thereby harming our results of operations.

The inability of our manufacturer to obtain sufficient quantities of components and other materials necessary for the production of our products could result in reduced or delayed sales or lost orders. Any delay in or loss of sales could adversely impact our operating results. Some of the materials used in the production of our products are available from a limited number of foreign suppliers, particularly suppliers located in Asia. In most cases, neither we nor our manufacturer has long-term supply contracts with these suppliers. As a result, we are subject to increased costs, supply interruptions, and difficulties in obtaining materials.

Security breaches involving our smart grid products or services, publicized breaches in smart grid products and services offered by others, or the public perception of security risks or vulnerability created by the deployment of the smart grid in general, whether or not valid, could harm our business.

The security technologies we have integrated into our communications platform and products that are designed to detect unauthorized activity and prevent or minimize security breaches may not function as expected, and our products and services, those of other companies with whose products our products and services are integrated or interact, or even the products of other smart grid solutions providers may be subject to significant real or perceived security breaches.

Our communications platform allows utilities to monitor, compile, and analyze sensitive information related to consumers’ energy usage, as well as the performance of different parts of the electric power distribution grid. As part of our data transfer and managed services, we may store and/or come into contact with sensitive consumer information and data when we perform operational, installation, or maintenance functions for a utility customer. If, in handling this information, we, our partners, or a utility customer fail to comply with privacy or security laws, we could face significant legal and financial exposure to claims of government agencies, utility customers, and consumers whose privacy is compromised. Even the perception that we, our partners, or a utility customer has improperly handled sensitive, confidential information could have a negative effect on our business. In addition, third parties may, through computer viruses, physical or electronic break-ins, and other means, attempt to breach our security measures, or inappropriately use or access our AmbientNMS® or the communications nodes we have in the field. If a breach is successful, sensitive information may be improperly obtained, manipulated, or corrupted, and we may face legal and financial exposure. In addition, a breach could lead to a loss of confidence in our products and services, and our business could suffer.

Our current and anticipated future products and services allow authorized personnel to remotely control equipment at residential and commercial locations, as well as at various points on the grid. For example, our software could allow a utility to remotely connect and disconnect electricity at specific customer locations. If an unauthorized third party were to breach our security measures and disrupt, gain access to, or take control of any of our products or services, our business and reputation could be severely harmed.

Our products and services may also be integrated or interface with products and services sold by third parties, and rely on the security of those products and their secure transmission of proprietary data over the Internet and other networks. Because we do not have control over the security measures implemented by third parties in their products or in the transmission of data over the Internet and other networks, we cannot ensure the complete integrity or security of such third-party products and transmissions.

Concerns about security or customer privacy may result in the adoption of state or federal legislation that restricts the implementation of smart grid technology or requires us to make modifications to our products, which could significantly limit the deployment of our technologies or result in significant expense to modify our products.

Although we have not experienced security breaches associated with our product, any real or perceived security breach could seriously harm our reputation and result in significant legal and financial exposure, inhibit market acceptance of our products and services, halt or delay the deployment by utilities of our products and services, cause us to lose sales, trigger unfavorable legislation and regulatory action, and inhibit the growth of the overall market for smart grid products and services. Any of these risks could have a material adverse effect on our business, operating results, and financial condition.

We use some open source software in our products and services that may subject our products and services to general release or require us to reengineer our products and services, which may cause harm to our business.

We use some open source software in connection with our products and services. From time to time, companies that incorporate open source software into their products have faced claims challenging the ownership of open source software and/or compliance with open source license terms. Therefore, we could be subject to suits by parties claiming ownership of what we believe to be open source software or noncompliance with open source licensing terms. Some open source software licenses require users who distribute open source software as part of their software to publicly disclose all or part of the source code to such software and/or make available any derivative works of the open source code on unfavorable terms or at no cost. We monitor the use of open source software in our products and services and try to ensure that none of the open source software is used in a manner that would require us to disclose the source code to the related product or that would otherwise breach the terms of an open source agreement. However, such use could inadvertently occur and we may be required to release our proprietary source code, pay damages for breach of contract, reengineer our products, discontinue the sale of our products in the event that reengineering cannot be accomplished on a timely basis, or take other remedial action that may divert resources away from our development efforts, any of which could adversely affect our business, operating results, and financial condition.

Our quarterly results are inherently unpredictable and subject to substantial fluctuations, and, as a result, we may fail to meet the expectations of securities analysts and investors, which could adversely affect the trading price of our common stock.

Our revenue and other operating results may vary significantly from quarter to quarter as a result of a number of factors, many of which are outside of our control. There can be no assurance that our revenue will increase or will not decrease on a quarterly or annual basis in the future.

The factors that may contribute to the unpredictability of our quarterly results and cause our stock price to fluctuate include the following:

| |

|

|

| |

● |

our inability to obtain financing or execute on a strategy alternative;

|

| |

●

|

long, and sometimes unpredictable, sales and customer deployment cycles;

|

| |

●

|

changes in the mix of products and services sold;

|

| |

●

|

our current dependence on a single customer;

|

| |

●

|

changing market conditions;

|

| |

●

|

changes in the competitive environment;

|

| |

●

|

failures of our products or components that we use in our products, that delay deployments, harm our reputation or result in high warranty costs, contractual penalties, or terminations;

|

| |

●

|

product or project failures by third-party vendors, utility customers, or competitors that result in the cancellation, slowing down, or deferring of projects;

|

| |

●

|

liquidated damage provisions in our current or future contracts, which could result in significant penalties if triggered or, even if not triggered, could affect our ability to recognize revenue in a given period;

|

| |

●

|

the ability of our suppliers and manufacturers to deliver supplies and products to us on a timely basis;

|

| |

●

|

delays associated with government funding programs for smart grid projects;

|

| |

●

|

political and consumer sentiment and the related impact on the scope and timing of smart grid deployment; and

|

| |

●

|

economic, regulatory, and political conditions in the markets where we operate or anticipate operating.

|

As a result, we believe that quarter to quarter comparisons of operating results are not necessarily indicative of what our future performance will be. In future quarters, our operating results may be below the expectations of securities analysts or investors, in which case the price of our common stock may decline.

Negative economic conditions in the United States, and globally, may have a material and adverse effect on our operating results, cash flow, and financial condition.

The economies in the United States and countries around the world have been recovering from a global financial crisis and recession, which began in 2008, but financial markets and world economies continue to be volatile. Significant long-term effects will likely result from the financial crisis and recession, including slower and more volatile future global economic growth than during the years prior to the financial crisis of 2008. A lower future economic growth rate could result in reductions in sales of our products and services, slower adoption of new technologies and an increase price competition. Any of these events would likely harm our business, results of operations and financial condition.

International manufacturing and sales risks could adversely affect our operating results.

Our products are produced in China by a U.S.-based, third-party contract manufacturer. We are also seeking to expand our addressable market by pursuing opportunities to sell our products in international markets. We have had little experience operating in markets outside of the United States. Accordingly, new markets may require us to respond to new and unanticipated regulatory, marketing, sales, and other challenges. We may not be successful in responding to these and other challenges that we may face as we enter and attempt to expand in international markets. International operations also entail a variety of other risks. The manufacture of our products abroad and our potential sales into international markets expose us to various economic, political, and other risks that could adversely affect our operations and operating results, including the following:

| |

●

|

potentially reduced protection for intellectual property rights;

|

| |

●

|

political, social, or economic instability in certain parts of the world;

|

| |

●

|

unexpected changes in legislature or regulatory requirements of foreign countries;

|

| |

●

|

differing labor regulations;

|

| |

●

|

tariffs and duties and other trade barrier restrictions;

|

| |

●

|

possible employee turnover or labor unrest;

|

| |

●

|

the burdens and costs of compliance with a variety of foreign laws;

|

| |

●

|

currency exchange fluctuations;

|

| |

●

|

potentially adverse tax consequences; and

|

| |

●

|

potentially longer payment cycles and greater difficulty in accounts receivable collections.

|

International operations are also subject to general geopolitical risks, such as political, social, and economic instability and changes in diplomatic and trade relations. One or more of these factors could adversely affect any international operations and result in lower revenue than we expect and could significantly affect our profitability.

Our inability to protect our intellectual property could impair our competitive advantage, reduce our revenue, and increase our costs.

Our success and ability to compete depend in part on our ability to maintain the proprietary aspects of our technologies and products. We rely on a combination of trade secrets, patents, copyrights, trademarks, confidentiality agreements, and other contractual provisions to protect our intellectual property, but these measures may provide only limited protection. We generally enter into written confidentiality and non-disclosure agreements with our employees, consultants, customers, manufacturers, and other recipients of our technologies and products and assignment of invention agreements with our employees and consultants. We may not always be able to enforce these agreements and may fail to enter into any such agreement in every instance when appropriate. We license from third parties certain technology used in and for our products. These third-party licenses are granted with restrictions; therefore, such third-party technology may not remain available to us on terms beneficial to us. Our failure to enforce and protect our intellectual property rights or obtain from third parties the right to use necessary technology could have a material adverse effect on our business, operating results, and financial condition. In addition, the laws of some foreign countries do not protect proprietary rights as fully as do the laws of the United States.

Patents may not issue from the patent applications that we have filed or may file in the future. Our issued patents may be challenged, invalidated, or circumvented, and claims of our patents may not be of sufficient scope or strength, or issued in the proper geographic regions, to provide meaningful protection or any commercial advantage. We have not applied for, and do not have, any copyright registration on our technologies or products. We have applied to register certain of our trademarks in the United States and other countries. We cannot assure you that we will obtain registrations of principal or other trademarks in key markets. Failure to obtain registrations could compromise our ability to protect fully our trademarks and brands, and could increase the risk of challenge from third parties to our use of our trademarks and brands.

We may be required to incur substantial expenses and divert management attention and resources in defending intellectual property litigation against us.

We cannot be certain that our technologies and products do not and will not infringe on issued patents or other proprietary rights of others. While we are not currently subject to any infringement claim, any future claim, with or without merit, could result in significant litigation costs and diversion of resources, including the attention of management, and could require us to enter into royalty and licensing agreements, any of which could have a material adverse effect on our business. We may not be able to obtain such licenses on commercially reasonable terms, if at all, or the terms of any offered licenses may be unacceptable to us. If forced to cease using such technology, we may be unable to develop or obtain alternate technology. Accordingly, an adverse determination in a judicial or administrative proceeding, or failure to obtain necessary licenses, could prevent us from manufacturing, using, or selling certain of our products, which could have a material adverse effect on our business, operating results, and financial condition.