44th Annual J.P. Morgan Healthcare Conference Alexander Hardy Greg Friberg Chief Executive Officer Chief R&D Officer BioMarin Pharmaceutical Inc. January 12, 2026

Forward-Looking Statements This presentation and the associated conference call and webcast contain forward-looking statements about the business prospects of BioMarin Pharmaceutical Inc. (BioMarin or the company), including, without limitation, statements about: preliminary estimated unaudited financial information for the year ended December 31, 2025, including total revenues and revenues from sales of VOXZOGO, as well as the expected asset write-down related to ROCTAVIAN and the related impact to BioMarin’s non-GAAP financial results; expectations related to the consummation of BioMarin’s proposed acquisition of Amicus Therapeutics and the anticipated benefits of such proposed acquisition, including strategic fit, acceleration of growth and diversification of revenue, and expectations of substantial accretion beginning in 2027; BioMarin’s future financial performance, including the expectations of Total Revenues, revenue growth rates, and Non-GAAP Diluted EPS for, in certain instances, the full-year 2026 and future periods, and the underlying drivers of those results, such as the revenue opportunity represented by treatments for Skeletal Conditions, namely VOXZOGO and BMN 333, the expected demand and continued growth of BioMarin’s Enzyme Therapies portfolio, including PALYNZIQ and the potential addition of adolescent age label expansion, as well as the planned expansion of and revenue opportunity represented by Galafold and the planned expansion, accelerated global launch and revenue opportunity of Pombiliti and Opfolda; plans and expectations regarding the development, commercialization and commercial prospects of BioMarin’s product candidates and commercial products, including the prospects and timing of actions relating to clinical studies and trials and product approvals, such as study initiations, data readouts, submissions, filings, approvals, and label expansions; BioMarin’s plans for pipeline expansion through external innovation; plans regarding ROCTAVIAN; plans to expand VOXZOGO for achondroplasia, as well as plans to add a second indication for hypochondroplasia in 2027 following the expected release of pivotal data with VOXZOGO in hypochondroplasia in the first half of 2026; expectations for BMN 333’s efficacy compared to VOXZOGO’s and ability to set a new standard of treatment for achondroplasia; the expected benefits and availability of BioMarin’s commercial products and product candidates; and potential growth opportunities and trends, including the assumptions and expectations regarding total addressable patient population (TAPP) with respect to the conditions targeted by BioMarin’s product candidates and commercial products. These forward-looking statements are predictions and involve risks and uncertainties such that actual results may differ materially from these statements. These risks and uncertainties include, without limitations, risks relating to the completion of BioMarin’s normal quarterly and annual accounting and financial statement closing procedures for the quarter and the year ended December 31, 2025; the timing of orders for commercial products; BioMarin’s ability to meet product demand; risks and uncertainties with respect to the consummation of the proposed acquisition of Amicus Therapeutics and BioMarin’s ability to obtain financing in the anticipated timeframe, if at all, including whether Amicus Therapeutics’ stockholders will approve the acquisition, the possibility of competing offers, the possibility that various closing conditions for the transaction may not be satisfied or waived; the effects of the proposed acquisition on BioMarin’s stock price and/or operating results, BioMarin’s ability to realize the anticipated benefits of the proposed acquisition, including risks relating to integration, BioMarin’s evaluation of the potential impact of the transaction on its financial results and financial guidance; the effects of the transaction on relationships with key third parties, including employees, customers, suppliers, other business partners or governmental entities, risks that the proposed transaction diverts management’s attention from ongoing business operations, among others; and those factors detailed in BioMarin's filings with the Securities and Exchange Commission, including, without limitation, the factors contained under the caption Risk Factors in BioMarin’s Quarterly Report on Form 10-Q for the quarter ended September 30, 2025, as such factors may be updated by any subsequent reports. Investors are urged not to place undue reliance on forward-looking statements, which speak only as of the date hereof. BioMarin is under no obligation, and expressly disclaims any obligation to update or alter any forward-looking statement, whether as a result of new information, future events or otherwise. Unaudited, Preliminary Financial Results The financial information provided for the year ended December 31, 2025 is unaudited, preliminary, and subject to BioMarin’s normal quarterly and annual accounting and financial statement closing procedures. Such information does not present all information necessary for an understanding of BioMarin’s results of operations for the fiscal year ended December 31, 2025, and should not be viewed as a substitute for full financial statements prepared in accordance with U.S. generally accepted accounting principles. There can be no assurance that actual results will not differ from the preliminary estimates in this presentation. BioMarin expects to report its results for the fourth quarter and full year 2025 in February 2026. 2

Non-GAAP Financial Measures This presentation includes both GAAP information and Non-GAAP information. Non-GAAP Income is defined by the company as GAAP Net Income excluding amortization of intangible assets, stock-based compensation expense and, in certain periods, certain other specified items, as detailed below when applicable. For the quarter and year ended December 31, 2025, these other items are expected to include approximately $120 to $125 million of the asset write-down related to ROCTAVIAN. The company also includes a Non-GAAP adjustment for the estimated tax impact of the reconciling items. Non-GAAP R&D expenses and Non-GAAP SG&A expenses are defined by the company as GAAP R&D expenses and GAAP SG&A expenses, respectively, excluding stock- based compensation expense and, in certain periods, certain other specified items, as detailed below when applicable. Non-GAAP Diluted EPS is defined by the company as Non-GAAP Income divided by Non-GAAP Weighted-Average Diluted Shares Outstanding. Non-GAAP Weighted-Average Diluted Shares Outstanding is defined by the company as GAAP Weighted-Average Diluted Shares Outstanding, adjusted to include any common shares issuable under the company’s equity plans and convertible debt in periods when they are dilutive under Non-GAAP. BioMarin regularly uses both GAAP and Non-GAAP results and expectations internally to assess its financial operating performance and evaluate key business decisions related to its principal business activities: the discovery, development, manufacture, marketing and sale of innovative biologic therapies. Because such Non-GAAP metrics are important internal measurements for BioMarin, BioMarin believes that providing this information in conjunction with GAAP information enhances investors’ and analysts’ ability to meaningfully compare the company’s results from period to period and to its forward- looking guidance, and to identify operating trends in the company’s principal business. Non-GAAP financial measures are not meant to be considered in isolation or as a substitute for, or superior to comparable GAAP measures and should be read in conjunction with the consolidated financial information prepared in accordance with GAAP. Investors should note that the Non-GAAP information is not prepared under any comprehensive set of accounting rules or principles and does not reflect all of the amounts associated with the company’s results of operations as determined in accordance with GAAP. Investors should also note that these Non-GAAP financial measures have no standardized meaning prescribed by GAAP and, therefore, have limits in their usefulness to investors. In addition, from time to time in the future there may be other items that the company may exclude for purposes of its Non-GAAP financial measures; likewise, the company may in the future cease to exclude items that it has historically excluded for purposes of its Non-GAAP financial measures. Because of the non-standardized definitions, the Non-GAAP financial measure as used by BioMarin in this presentation may be calculated differently from, and therefore may not be directly comparable to, similarly titled measures used by other companies. BioMarin has not provided a reconciliation of non-GAAP EPS to the most directly comparable GAAP reported financial measure because the company has not yet completed its normal quarterly and annual accounting and financial statement closing procedures and is unable to predict with reasonable certainty certain GAAP items, such as the financial impact of changes resulting from its strategic portfolio and business operating model reviews; potential future asset impairments; gains and losses on investments; and other unusual gains and losses without unreasonable effort. These items are uncertain, depend on various factors, and could have a material impact on our GAAP reported results for the period. As such, any reconciliations provided would imply a degree of precision that could be confusing or misleading to investors. 3

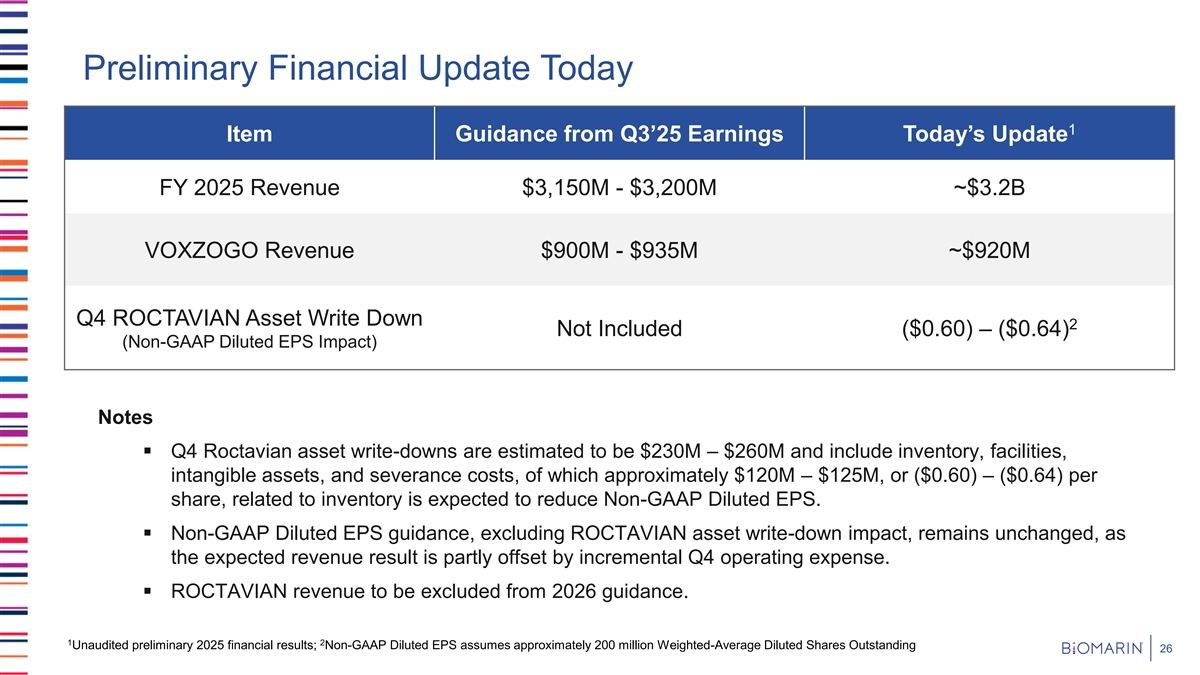

Preliminary Financial Update Today 1 Item Guidance from Q3’25 Earnings Today’s Update FY 2025 Revenue $3,150M - $3,200M ~$3.2B VOXZOGO Revenue $900M - $935M ~$920M Q4 ROCTAVIAN Asset Write Down 2 Not Included ($0.60) – ($0.64) (Non-GAAP Diluted EPS Impact) Notes ▪ Q4 Roctavian asset write-downs are estimated to be $230M – $260M and include inventory, facilities, intangible assets, and severance costs, of which approximately $120M – $125M, or ($0.60) – ($0.64) per share, related to inventory is expected to reduce Non-GAAP Diluted EPS. ▪ Non-GAAP Diluted EPS guidance, excluding ROCTAVIAN asset write-down impact, remains unchanged, as the expected revenue result is partly offset by incremental Q4 operating expense. ▪ ROCTAVIAN revenue to be excluded from 2026 guidance. 1 2 Unaudited preliminary 2025 financial results; Non-GAAP Diluted EPS assumes approximately 200 million Weighted-Average Diluted Shares Outstanding 26