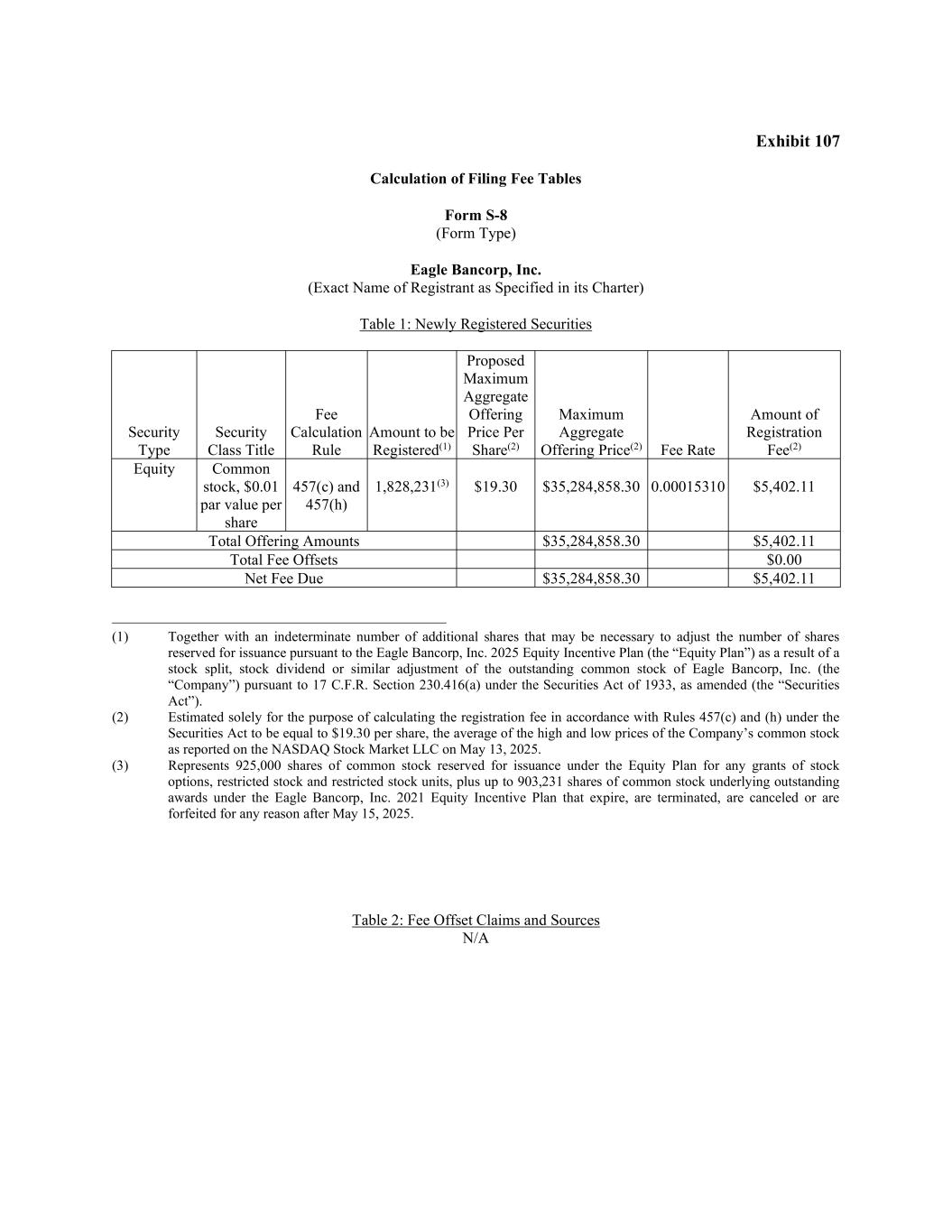

Exhibit 107 Calculation of Filing Fee Tables Form S-8 (Form Type) Eagle Bancorp, Inc. (Exact Name of Registrant as Specified in its Charter) Table 1: Newly Registered Securities Security Type Security Class Title Fee Calculation Rule Amount to be Registered(1) Proposed Maximum Aggregate Offering Price Per Share(2) Maximum Aggregate Offering Price(2) Fee Rate Amount of Registration Fee(2) Equity Common stock, $0.01 par value per share 457(c) and 457(h) 1,828,231(3) $19.30 $35,284,858.30 0.00015310 $5,402.11 Total Offering Amounts $35,284,858.30 $5,402.11 Total Fee Offsets $0.00 Net Fee Due $35,284,858.30 $5,402.11 ___________________________________________ (1) Together with an indeterminate number of additional shares that may be necessary to adjust the number of shares reserved for issuance pursuant to the Eagle Bancorp, Inc. 2025 Equity Incentive Plan (the “Equity Plan”) as a result of a stock split, stock dividend or similar adjustment of the outstanding common stock of Eagle Bancorp, Inc. (the “Company”) pursuant to 17 C.F.R. Section 230.416(a) under the Securities Act of 1933, as amended (the “Securities Act”). (2) Estimated solely for the purpose of calculating the registration fee in accordance with Rules 457(c) and (h) under the Securities Act to be equal to $19.30 per share, the average of the high and low prices of the Company’s common stock as reported on the NASDAQ Stock Market LLC on May 13, 2025. (3) Represents 925,000 shares of common stock reserved for issuance under the Equity Plan for any grants of stock options, restricted stock and restricted stock units, plus up to 903,231 shares of common stock underlying outstanding awards under the Eagle Bancorp, Inc. 2021 Equity Incentive Plan that expire, are terminated, are canceled or are forfeited for any reason after May 15, 2025. Table 2: Fee Offset Claims and Sources N/A