3rd Quarter 2025 Earnings Presentation EagleBankCorp.com October 22, 2025 Scan for digital version

Forward Looking Statements 2 This presentation contains forward looking statements within the meaning of the Securities and Exchange Act of 1934, as amended, including statements of goals, intentions, and expectations as to future trends, plans, events or results of Company operations and policies and regarding general economic conditions. In some cases, forward-looking statements can be identified by use of words such as “may,” “will,” “anticipates,” “believes,” “expects,” “plans,” “strategy”, “estimates,” “potential,” “continue,” “should,” and similar words or phrases. These statements are based upon current and anticipated economic conditions, nationally and in the Company’s market, interest rates and interest rate policy, competitive factors and other conditions which by their nature, are not susceptible to accurate forecast and are subject to significant uncertainty. For details on factors that could affect these expectations, see the risk factors and other cautionary language included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2024, and other periodic and current reports filed with the SEC. Because of these uncertainties and the assumptions on which this discussion and the forward-looking statements are based, actual future operations and results in the future may differ materially from those indicated herein. Readers are cautioned against placing undue reliance on any such forward-looking statements. The Company’s past results are not necessarily indicative of future performance. The Company does not undertake to publicly revise or update forward-looking statements in this presentation to reflect events or circumstances that arise after the date of this presentation, except as may be required under applicable law. This presentation was delivered digitally. The Company makes no representation that subsequent to delivery of the presentation it was not altered. For more information about the Company, please refer to www.eaglebankcorp.com and go to the Investor Relations tab. Our outlook consists of forward-looking statements that are not historical factors or statements of current conditions but instead represent only our beliefs regarding future events, many of which, by their nature, are inherently uncertain and outside our control. We may be unable to achieve the results reflected in our outlook due to the risks described in our periodic and current reports filed with the SEC, including the risk factors in our Annual Report on Form 10-K for the year ended December 31, 2024 and our Quarterly Report on Form 10-Q for the quarters ended March 31, 2025 and June 30, 2025, as well as the following factors: the impact of the interest rate environment on business activity levels; declines in credit quality due to changes in the interest rate environment or changes in general economic, political, social and health conditions in the United States in general and in the local economies in which we conduct operations; our management of risks inherent in our real estate loan portfolio, including valuation risk, and the risk of a prolonged downturn in the real estate market; our management of liquidity risks; our funding profile, including the cost of our deposits and the impact of our funding costs on the competitiveness of our loan offerings; our ability to compete with other lenders, including non-bank lenders; the effects of monetary, fiscal and trade policies, including federal government spending and the impact of tariffs, the economic impact of an extended government shutdown; and the development of competitive new products and services. For further information on the Company please contact: Eric Newell P 240-497-1796 E enewell@eaglebankcorp.com

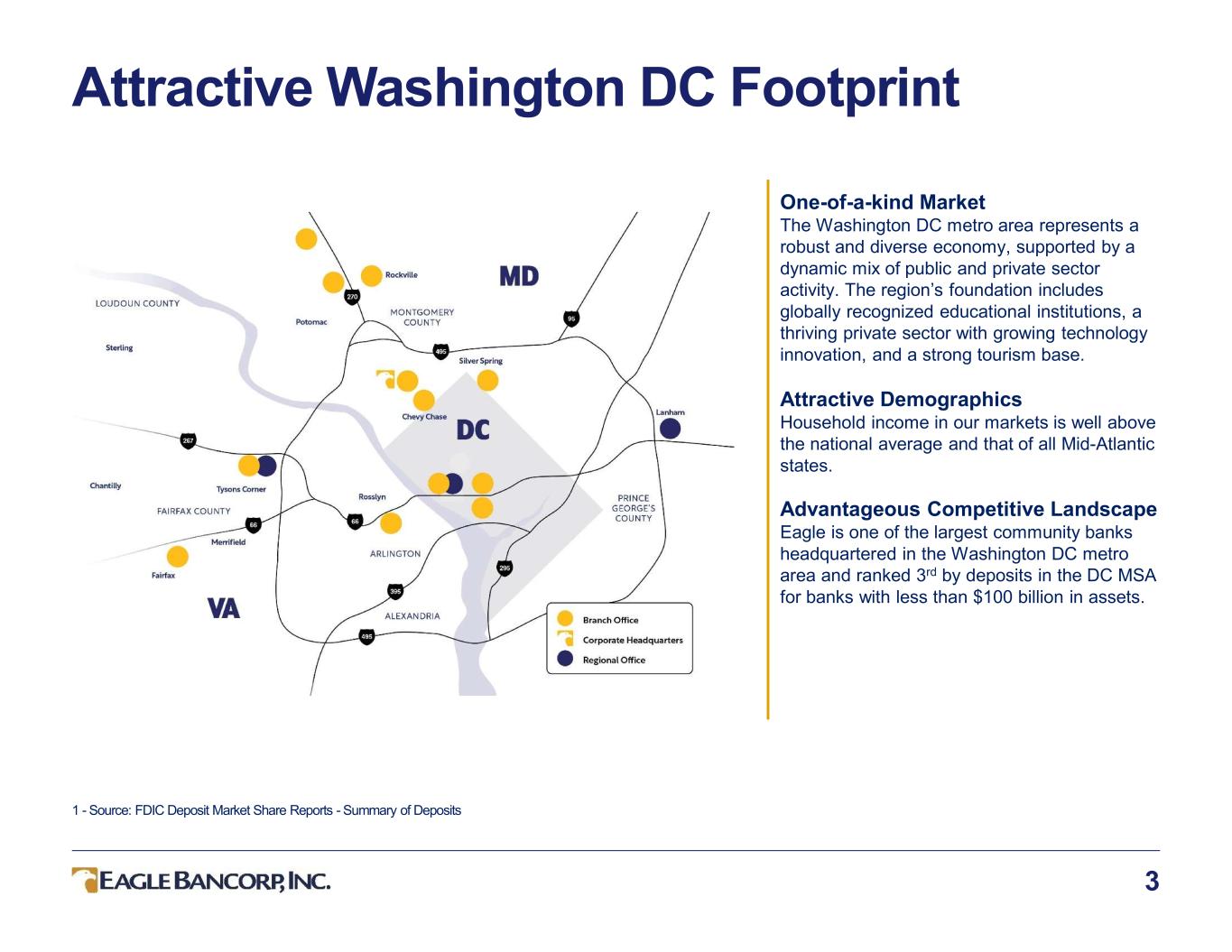

Attractive Washington DC Footprint 3 One-of-a-kind Market The Washington DC metro area represents a robust and diverse economy, supported by a dynamic mix of public and private sector activity. The region’s foundation includes globally recognized educational institutions, a thriving private sector with growing technology innovation, and a strong tourism base. Attractive Demographics Household income in our markets is well above the national average and that of all Mid-Atlantic states. Advantageous Competitive Landscape Eagle is one of the largest community banks headquartered in the Washington DC metro area and ranked 3rd by deposits in the DC MSA for banks with less than $100 billion in assets. 1 - Source: FDIC Deposit Market Share Reports - Summary of Deposits

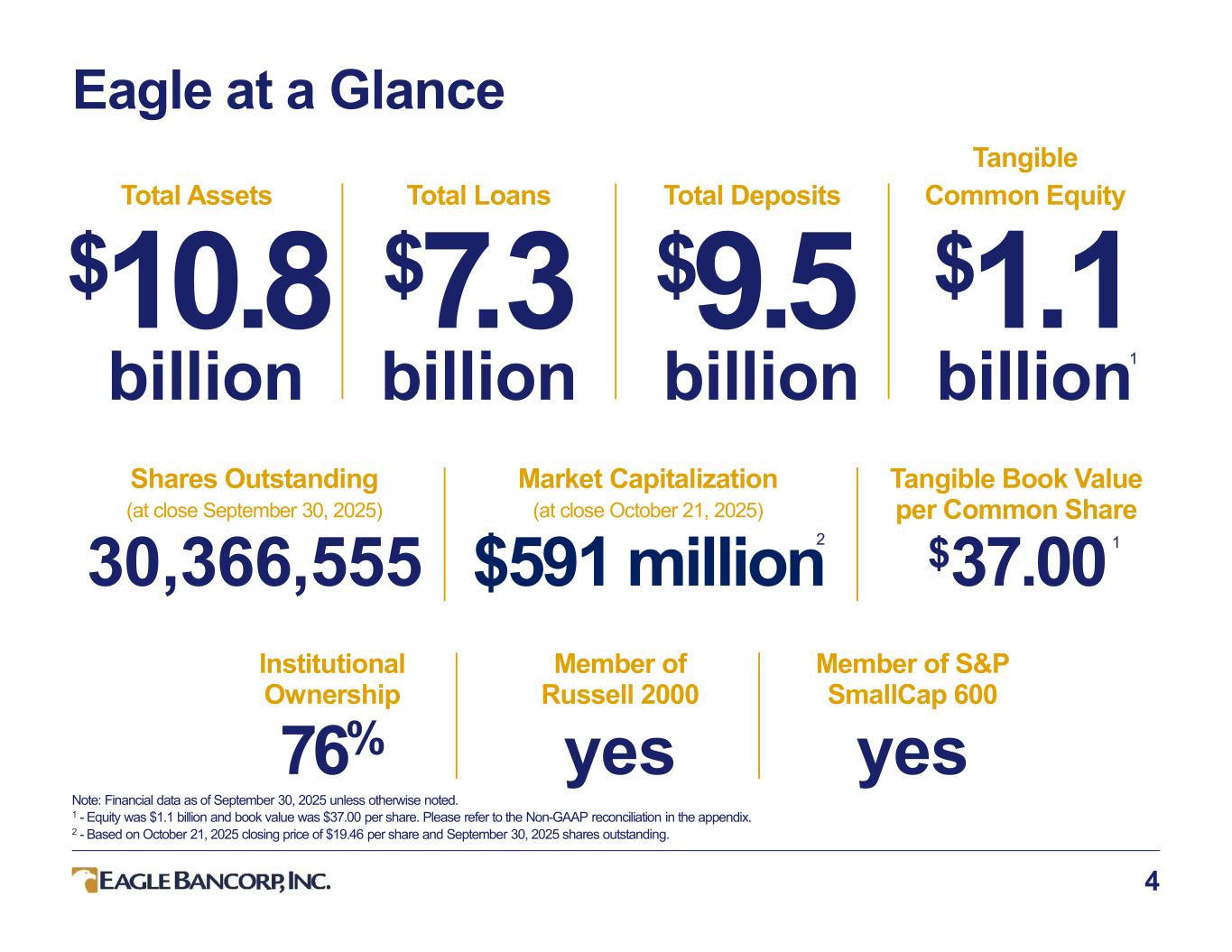

Eagle at a Glance 4 Total Assets $ billion Total Loans $ billion Total Deposits $ billion Tangible Common Equity $ billion Shares Outstanding (at close September 30, 2025) 30,366,555 Market Capitalization (at close October 21, 2025) $591 million Tangible Book Value per Common Share $37.00 Institutional Ownership 76% Member of Russell 2000 yes Member of S&P SmallCap 600 yes Note: Financial data as of September 30, 2025 unless otherwise noted. 1 - Equity was $1.1 billion and book value was $37.00 per share. Please refer to the Non-GAAP reconciliation in the appendix. 2 - Based on October 21, 2025 closing price of $19.46 per share and September 30, 2025 shares outstanding. 1 1 2

5 NOTE: Data at or for the quarter ended September 30, 2025 1 - Please refer to the Non-GAAP reconciliation in the appendix. 2 - Includes cash and cash equivalents. • Best-in-Class Capital Levels o CET1 Ratio = 13.58% Top quartile of all bank holding companies with $10 billion in assets or more o TCE / TA¹ = 10.39% o ACL / Gross Loans = 2.14% and ACL / Performing Office Loans = 11.36% • Long-term Strategy to Improve Operating Pre-Provision, Net Revenue (“PPNR”) Across All Interest Rate Environments o Continue the diversification of deposits designed to improve funding profile • Disciplined Cost Structure o Our cost structure is designed to remain disciplined and efficient, allowing us to support core banking operations, enhance profitability, and continue investing in key control functions such as risk management and compliance. o Branch-light, efficient operator. o Noninterest Expense / Average Assets = 1.43% o Efficiency Ratio = 59.3% • Strong Liquidity and Funding Position o Liquidity risk management is central to our strategy. • $5.3 billion in combined on-balance sheet liquidity2 and available borrowing capacity as of quarter-end, significantly exceeding our $2.3 billion in uninsured deposits and providing a coverage ratio of 230%. • This strong liquidity profile positions Eagle to respond proactively to market shifts and support our strategy to grow C&I lending. o Uninsured deposits only represent 24% of total deposits, having a weighted average relationship with EagleBank of over 8 years. • Capitalizing on Our Desirable Geography o The DMV has a robust and diverse economy including education, healthcare, technology, and defense sectors. o Access to a population with high household incomes, leading to more significant deposit base. Core Strengths Supporting Long-Term Performance

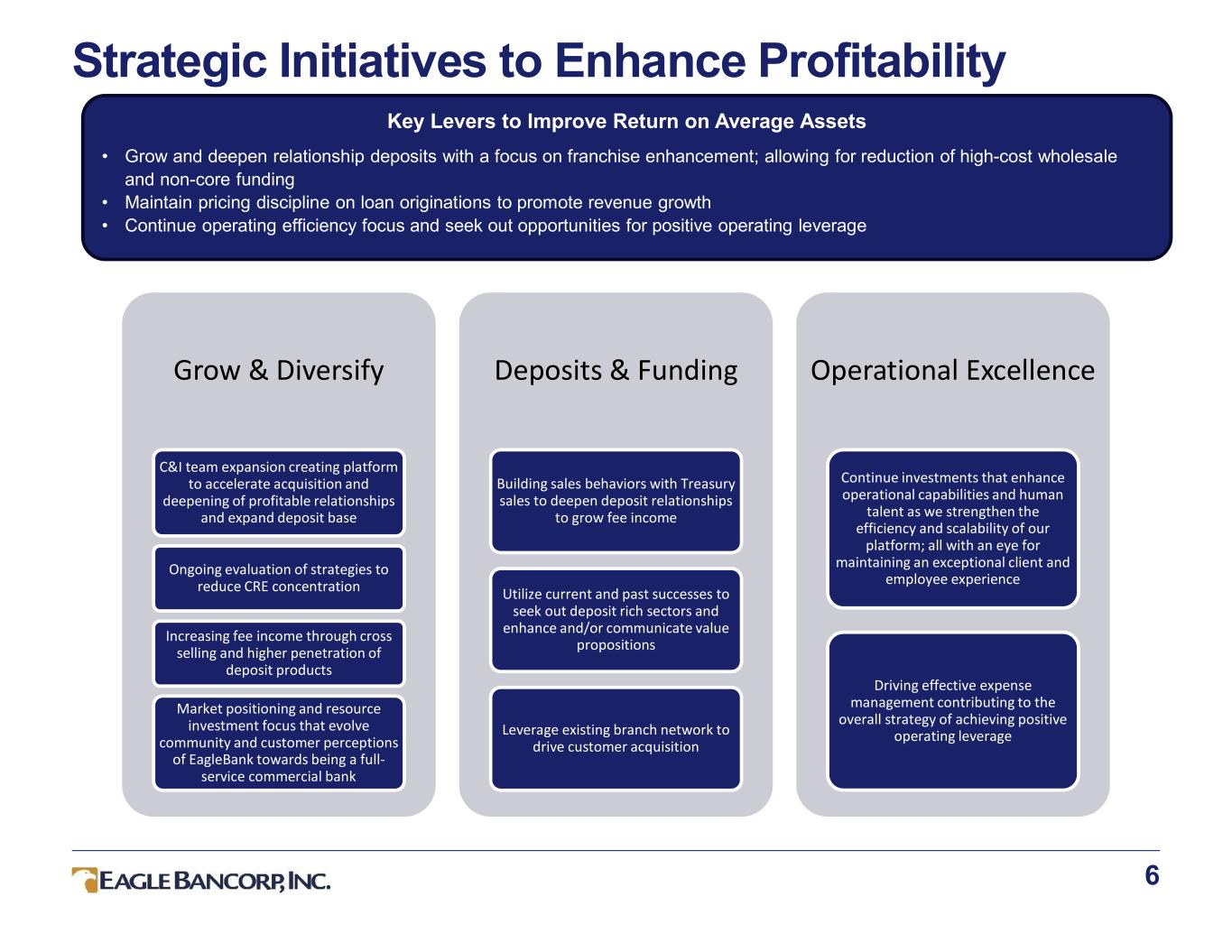

Key Levers to Improve Return on Average Assets • Grow and deepen relationship deposits with a focus on franchise enhancement; allowing for reduction of high-cost wholesale and non-core funding • Maintain pricing discipline on loan originations to promote revenue growth • Continue operating efficiency focus and seek out opportunities for positive operating leverage Strategic Initiatives to Enhance Profitability 6 Grow & Diversify C&I team expansion creating platform to accelerate acquisition and deepening of profitable relationships and expand deposit base Ongoing evaluation of strategies to reduce CRE concentration Increasing fee income through cross selling and higher penetration of deposit products Market positioning and resource investment focus that evolve community and customer perceptions of EagleBank towards being a full- service commercial bank Deposits & Funding Building sales behaviors with Treasury sales to deepen deposit relationships to grow fee income Utilize current and past successes to seek out deposit rich sectors and enhance and/or communicate value propositions Leverage existing branch network to drive customer acquisition Operational Excellence Continue investments that enhance operational capabilities and human talent as we strengthen the efficiency and scalability of our platform; all with an eye for maintaining an exceptional client and employee experience Driving effective expense management contributing to the overall strategy of achieving positive operating leverage

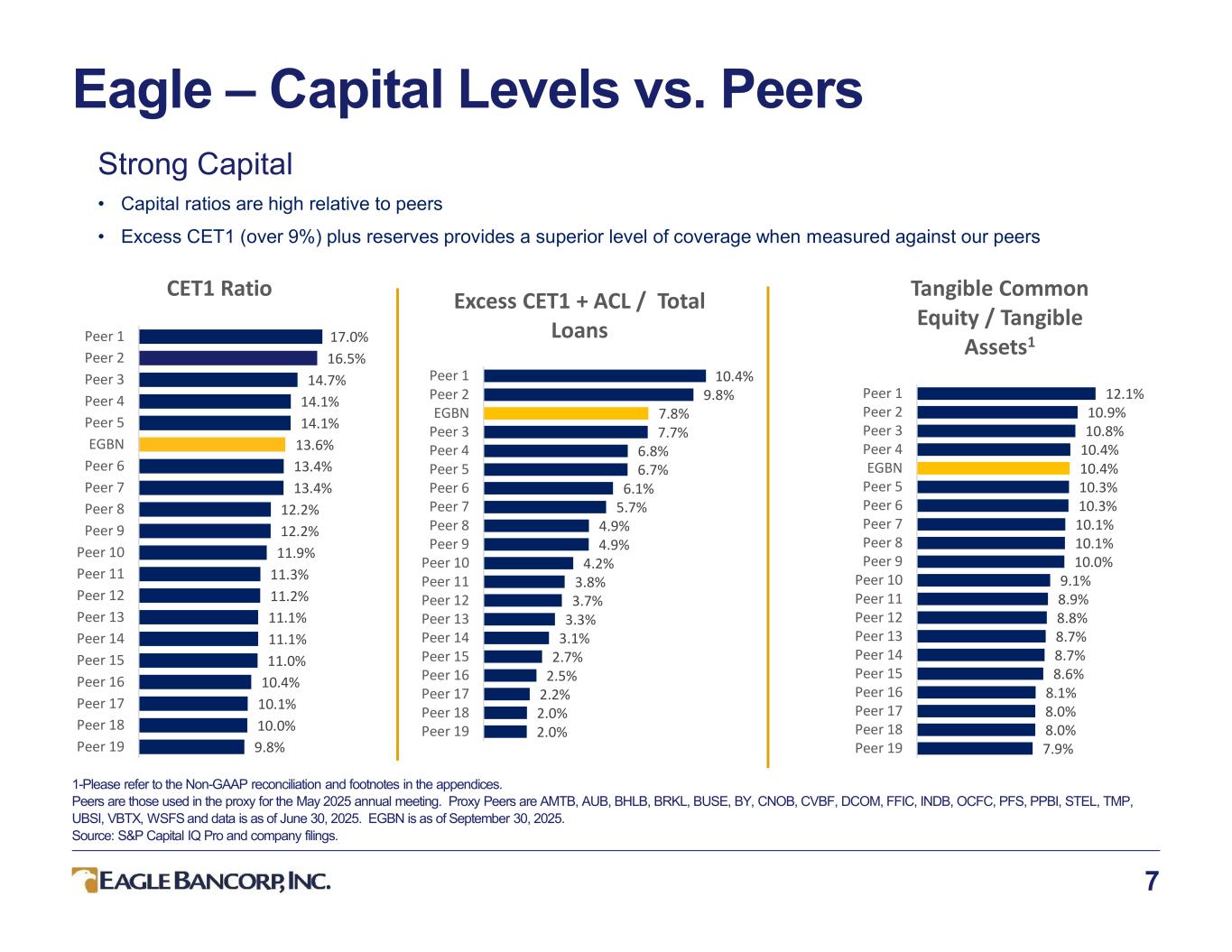

10.4% 9.8% 7.8% 7.7% 6.8% 6.7% 6.1% 5.7% 4.9% 4.9% 4.2% 3.8% 3.7% 3.3% 3.1% 2.7% 2.5% 2.2% 2.0% 2.0% Peer 1 Peer 2 EGBN Peer 3 Peer 4 Peer 5 Peer 6 Peer 7 Peer 8 Peer 9 Peer 10 Peer 11 Peer 12 Peer 13 Peer 14 Peer 15 Peer 16 Peer 17 Peer 18 Peer 19 Excess CET1 + ACL / Total Loans Eagle – Capital Levels vs. Peers 7 1-Please refer to the Non-GAAP reconciliation and footnotes in the appendices. Peers are those used in the proxy for the May 2025 annual meeting. Proxy Peers are AMTB, AUB, BHLB, BRKL, BUSE, BY, CNOB, CVBF, DCOM, FFIC, INDB, OCFC, PFS, PPBI, STEL, TMP, UBSI, VBTX, WSFS and data is as of June 30, 2025. EGBN is as of September 30, 2025. Source: S&P Capital IQ Pro and company filings. Strong Capital • Capital ratios are high relative to peers • Excess CET1 (over 9%) plus reserves provides a superior level of coverage when measured against our peers 17.0% 16.5% 14.7% 14.1% 14.1% 13.6% 13.4% 13.4% 12.2% 12.2% 11.9% 11.3% 11.2% 11.1% 11.1% 11.0% 10.4% 10.1% 10.0% 9.8% Peer 1 Peer 2 Peer 3 Peer 4 Peer 5 EGBN Peer 6 Peer 7 Peer 8 Peer 9 Peer 10 Peer 11 Peer 12 Peer 13 Peer 14 Peer 15 Peer 16 Peer 17 Peer 18 Peer 19 CET1 Ratio 12.1% 10.9% 10.8% 10.4% 10.4% 10.3% 10.3% 10.1% 10.1% 10.0% 9.1% 8.9% 8.8% 8.7% 8.7% 8.6% 8.1% 8.0% 8.0% 7.9% Peer 1 Peer 2 Peer 3 Peer 4 EGBN Peer 5 Peer 6 Peer 7 Peer 8 Peer 9 Peer 10 Peer 11 Peer 12 Peer 13 Peer 14 Peer 15 Peer 16 Peer 17 Peer 18 Peer 19 Tangible Common Equity / Tangible Assets1

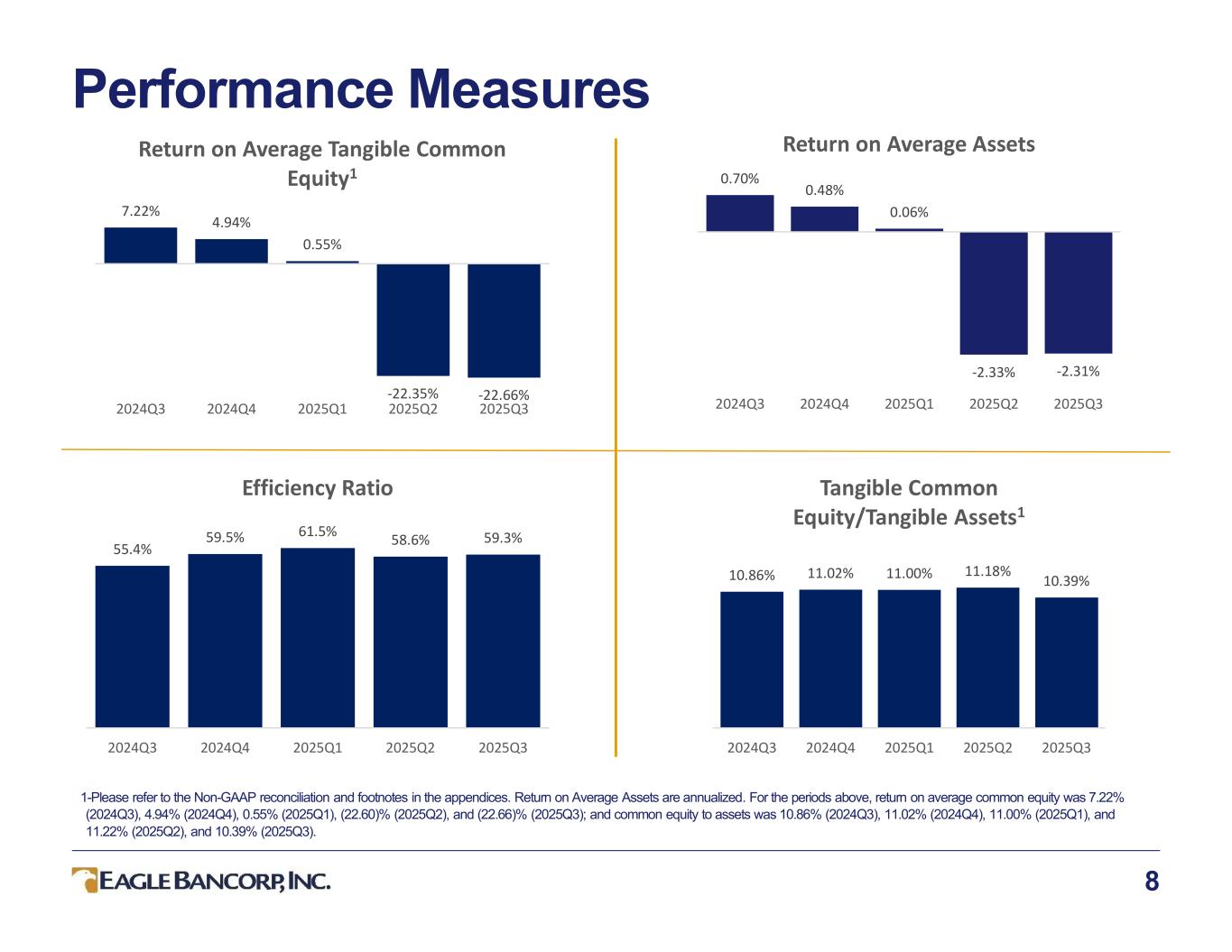

55.4% 59.5% 61.5% 58.6% 59.3% 2024Q3 2024Q4 2025Q1 2025Q2 2025Q3 Efficiency Ratio Performance Measures 8 1-Please refer to the Non-GAAP reconciliation and footnotes in the appendices. Return on Average Assets are annualized. For the periods above, return on average common equity was 7.22% (2024Q3), 4.94% (2024Q4), 0.55% (2025Q1), (22.60)% (2025Q2), and (22.66)% (2025Q3); and common equity to assets was 10.86% (2024Q3), 11.02% (2024Q4), 11.00% (2025Q1), and 11.22% (2025Q2), and 10.39% (2025Q3). 7.22% 4.94% 0.55% -22.35% -22.66% 2024Q3 2024Q4 2025Q1 2025Q2 2025Q3 Return on Average Tangible Common Equity1 0.70% 0.48% 0.06% -2.33% -2.31% 2024Q3 2024Q4 2025Q1 2025Q2 2025Q3 Return on Average Assets 10.86% 11.02% 11.00% 11.18% 10.39% 2024Q3 2024Q4 2025Q1 2025Q2 2025Q3 Tangible Common Equity/Tangible Assets1

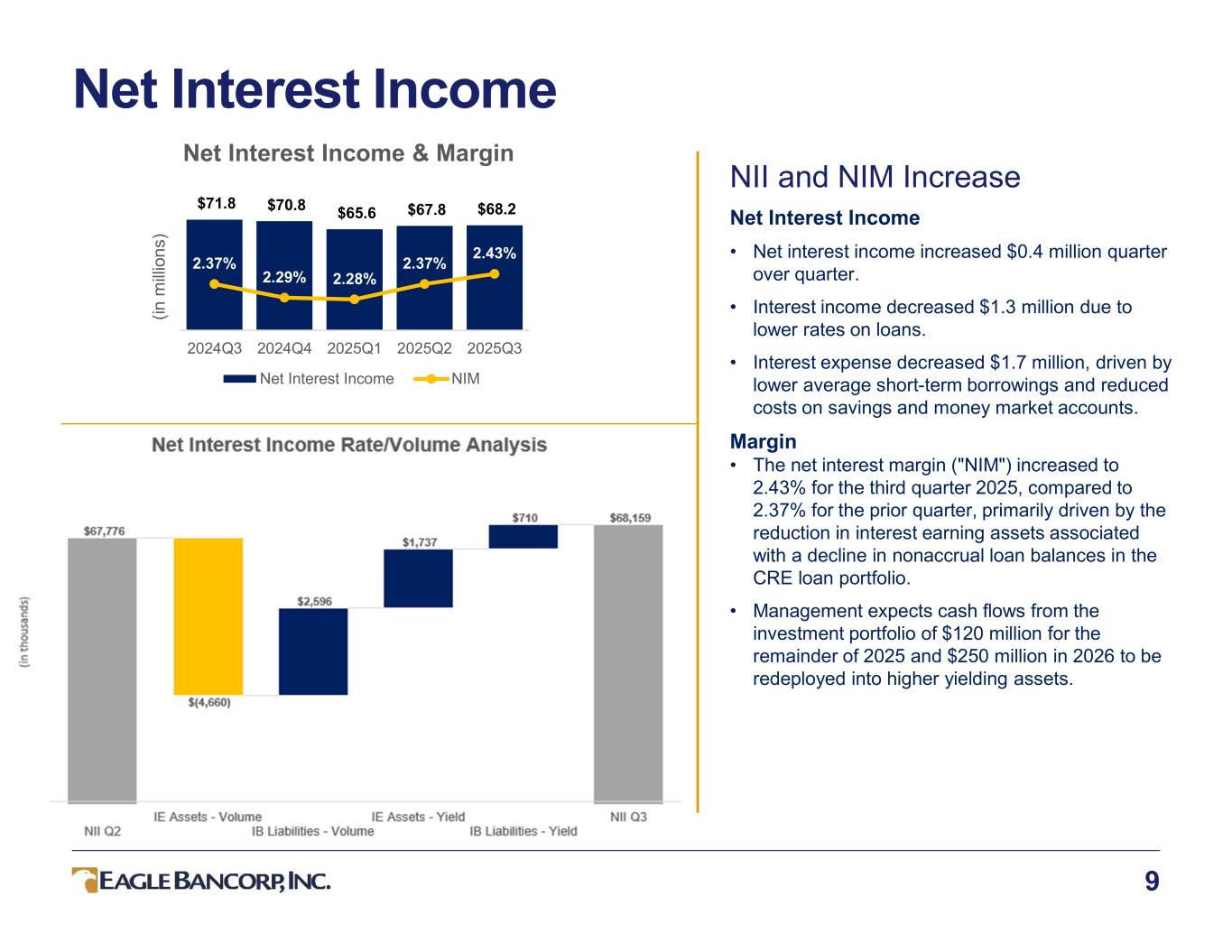

Net Interest Income 9 NII and NIM Increase Net Interest Income • Net interest income increased $0.4 million quarter over quarter. • Interest income decreased $1.3 million due to lower rates on loans. • Interest expense decreased $1.7 million, driven by lower average short-term borrowings and reduced costs on savings and money market accounts. Margin • The net interest margin ("NIM") increased to 2.43% for the third quarter 2025, compared to 2.37% for the prior quarter, primarily driven by the reduction in interest earning assets associated with a decline in nonaccrual loan balances in the CRE loan portfolio. • Management expects cash flows from the investment portfolio of $120 million for the remainder of 2025 and $250 million in 2026 to be redeployed into higher yielding assets. $71.8 $70.8 $65.6 $67.8 $68.2 2.37% 2.29% 2.28% 2.37% 2.43% 2.10% 2.30% 2.50% 2.70% 2.90% $- $20.0 $40.0 $60.0 $80.0 $100.0 2024Q3 2024Q4 2025Q1 2025Q2 2025Q3 (in m ill io n s) Net Interest Income & Margin Net Interest Income NIM

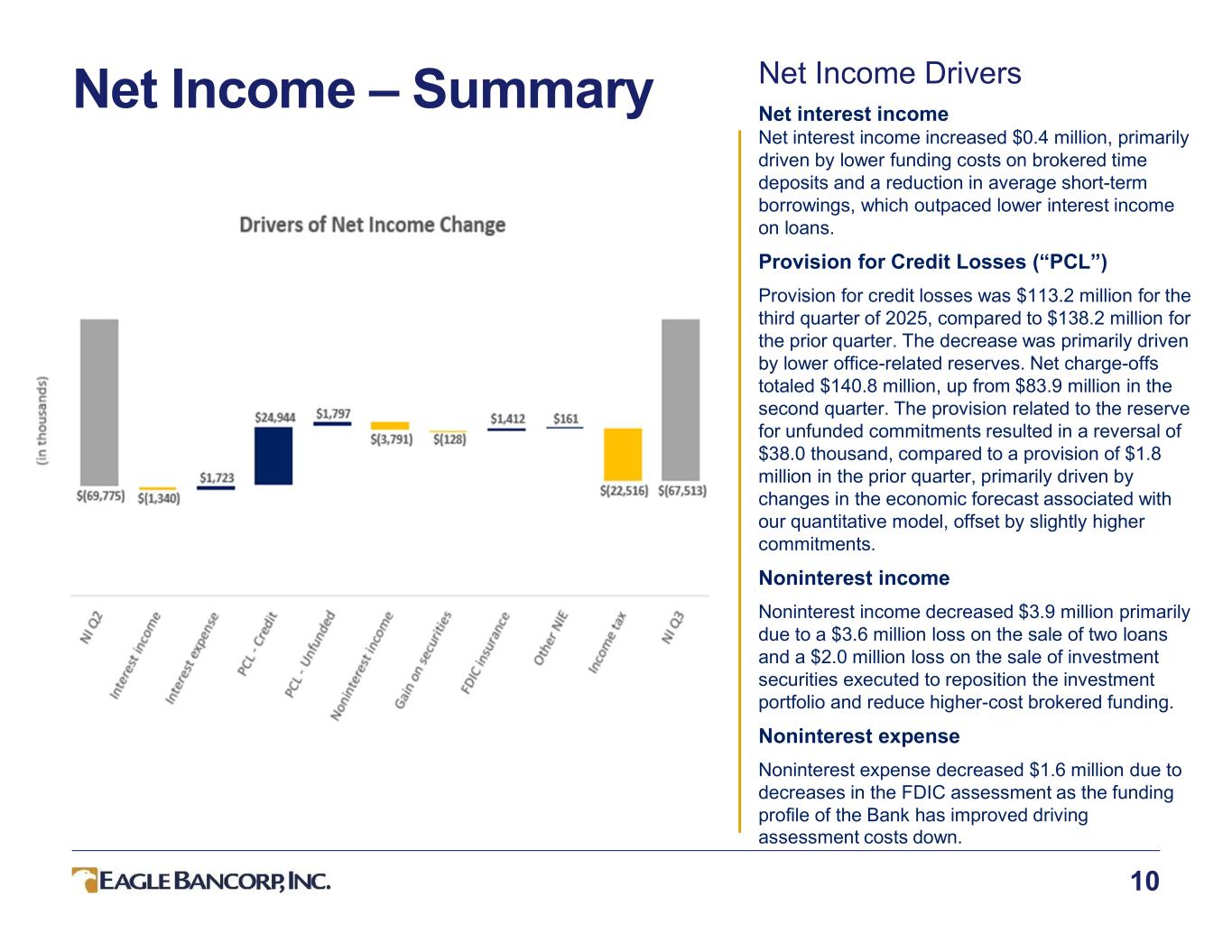

Net Income – Summary 10 Net Income Drivers Net interest income Net interest income increased $0.4 million, primarily driven by lower funding costs on brokered time deposits and a reduction in average short-term borrowings, which outpaced lower interest income on loans. Provision for Credit Losses (“PCL”) Provision for credit losses was $113.2 million for the third quarter of 2025, compared to $138.2 million for the prior quarter. The decrease was primarily driven by lower office-related reserves. Net charge-offs totaled $140.8 million, up from $83.9 million in the second quarter. The provision related to the reserve for unfunded commitments resulted in a reversal of $38.0 thousand, compared to a provision of $1.8 million in the prior quarter, primarily driven by changes in the economic forecast associated with our quantitative model, offset by slightly higher commitments. Noninterest income Noninterest income decreased $3.9 million primarily due to a $3.6 million loss on the sale of two loans and a $2.0 million loss on the sale of investment securities executed to reposition the investment portfolio and reduce higher-cost brokered funding. Noninterest expense Noninterest expense decreased $1.6 million due to decreases in the FDIC assessment as the funding profile of the Bank has improved driving assessment costs down.

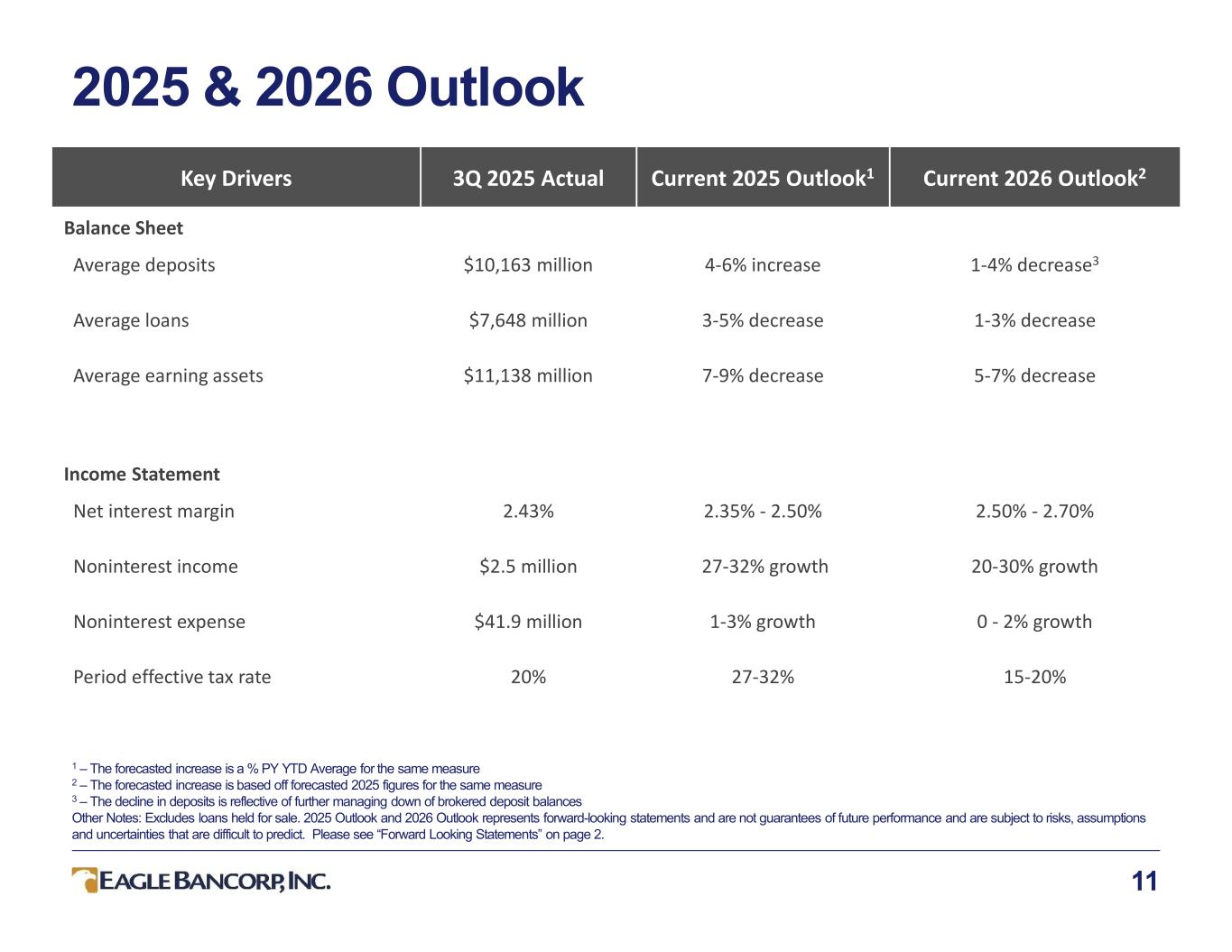

2025 & 2026 Outlook 11 1 – The forecasted increase is a % PY YTD Average for the same measure 2 – The forecasted increase is based off forecasted 2025 figures for the same measure 3 – The decline in deposits is reflective of further managing down of brokered deposit balances Other Notes: Excludes loans held for sale. 2025 Outlook and 2026 Outlook represents forward-looking statements and are not guarantees of future performance and are subject to risks, assumptions and uncertainties that are difficult to predict. Please see “Forward Looking Statements” on page 2. Current 2026 Outlook2Current 2025 Outlook13Q 2025 ActualKey Drivers Balance Sheet 1-4% decrease34-6% increase$10,163 millionAverage deposits 1-3% decrease3-5% decrease$7,648 millionAverage loans 5-7% decrease7-9% decrease$11,138 millionAverage earning assets Income Statement 2.50% - 2.70%2.35% - 2.50%2.43%Net interest margin 20-30% growth27-32% growth$2.5 millionNoninterest income 0 - 2% growth1-3% growth$41.9 millionNoninterest expense 15-20%27-32%20%Period effective tax rate

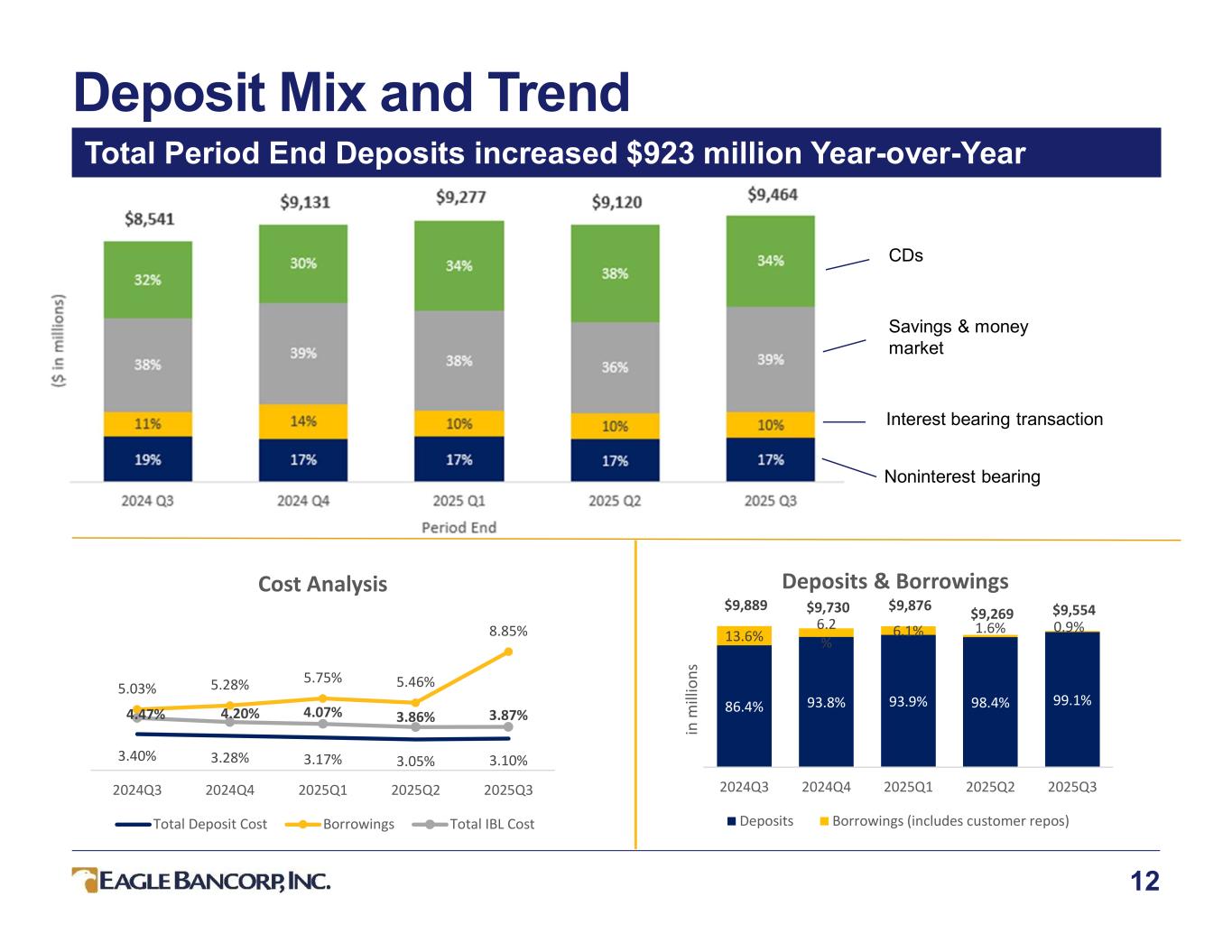

Deposit Mix and Trend 12 Total Period End Deposits increased $923 million Year-over-Year CDs Savings & money market Interest bearing transaction Noninterest bearing 3.40% 3.28% 3.17% 3.05% 3.10% 5.03% 5.28% 5.75% 5.46% 8.85% 4.47% 4.20% 4.07% 3.86% 3.87% 2024Q3 2024Q4 2025Q1 2025Q2 2025Q3 Cost Analysis Total Deposit Cost Borrowings Total IBL Cost 86.4% 93.8% 93.9% 98.4% 99.1% 13.6% 6.2 % 6.1% 1.6% 0.9% $9,889 $9,730 $9,876 $9,269 $9,554 2024Q3 2024Q4 2025Q1 2025Q2 2025Q3 in m ill io ns Deposits & Borrowings Deposits Borrowings (includes customer repos)

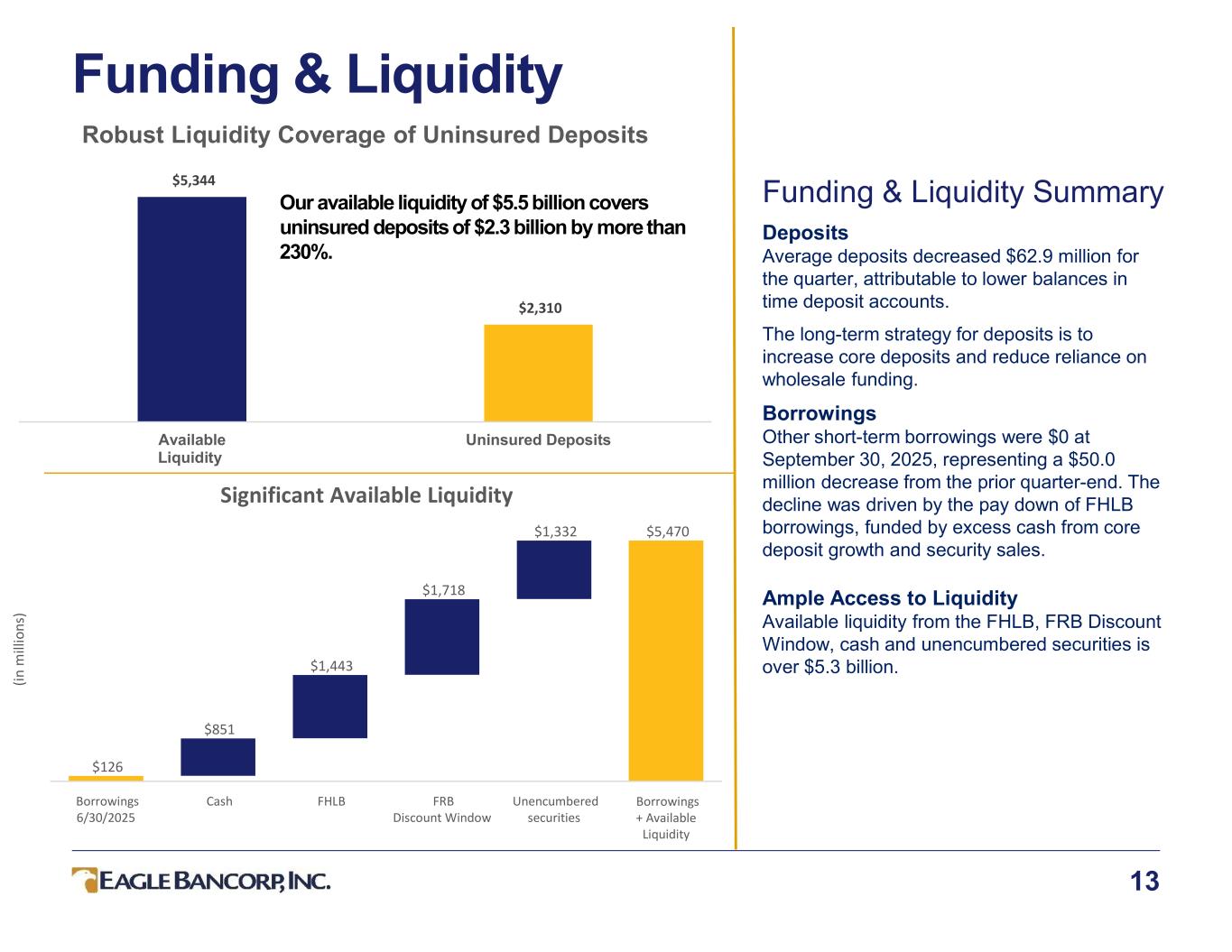

$5,344 $2,310 Available Liquidity Uninsured Deposits Robust Liquidity Coverage of Uninsured Deposits Funding & Liquidity 13 Funding & Liquidity Summary Deposits Average deposits decreased $62.9 million for the quarter, attributable to lower balances in time deposit accounts. The long-term strategy for deposits is to increase core deposits and reduce reliance on wholesale funding. Borrowings Other short-term borrowings were $0 at September 30, 2025, representing a $50.0 million decrease from the prior quarter-end. The decline was driven by the pay down of FHLB borrowings, funded by excess cash from core deposit growth and security sales. Ample Access to Liquidity Available liquidity from the FHLB, FRB Discount Window, cash and unencumbered securities is over $5.3 billion. Our available liquidity of $5.5 billion covers uninsured deposits of $2.3 billion by more than 230%. $126 $851 $1,443 $1,718 $1,332 $5,470 Borrowings 6/30/2025 Cash FHLB FRB Discount Window Unencumbered securities Borrowings + Available Liquidity (in m ill io ns ) Significant Available Liquidity

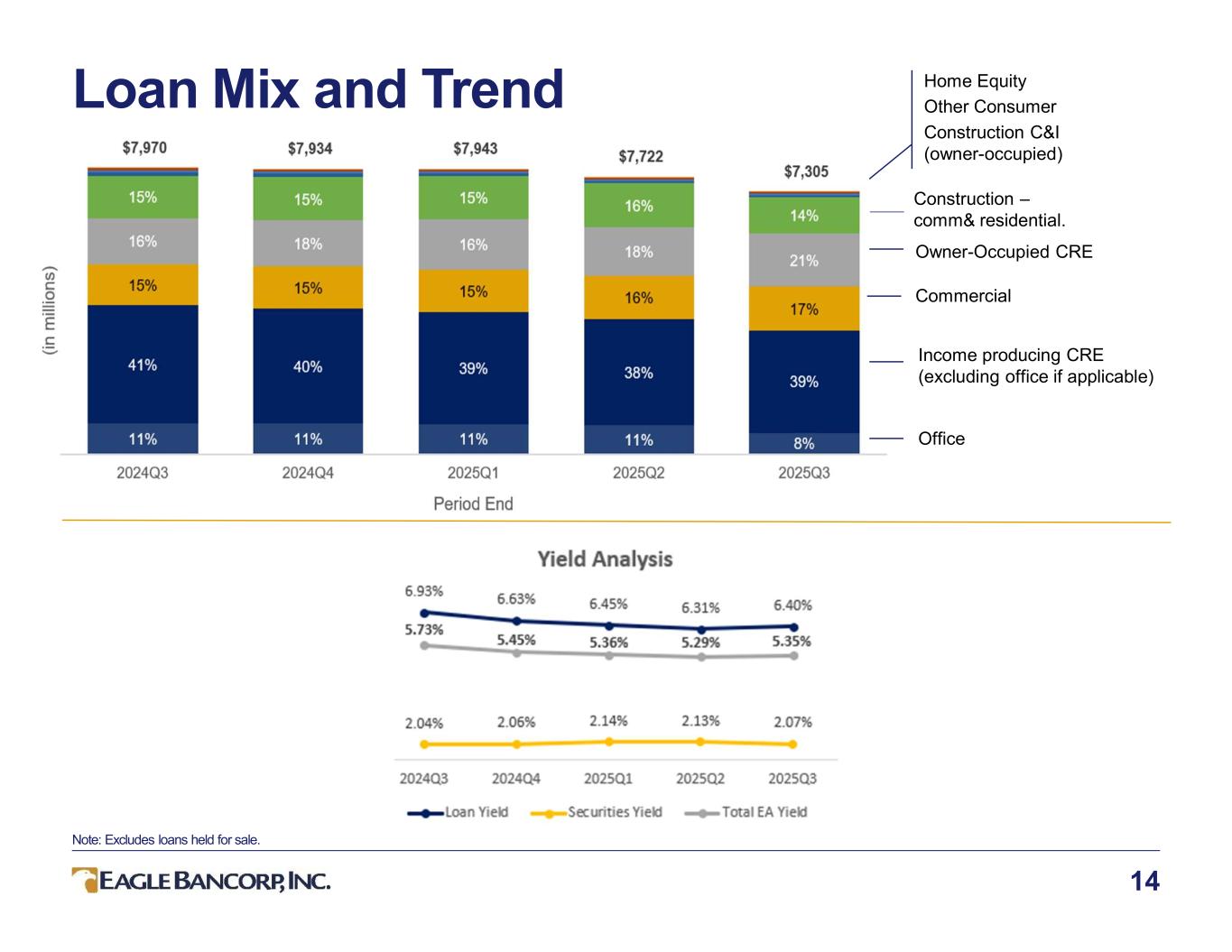

Loan Mix and Trend 14 Commercial Owner-Occupied CRE Construction – comm& residential. Home Equity Other Consumer Construction C&I (owner-occupied) Office Income producing CRE (excluding office if applicable) Note: Excludes loans held for sale.

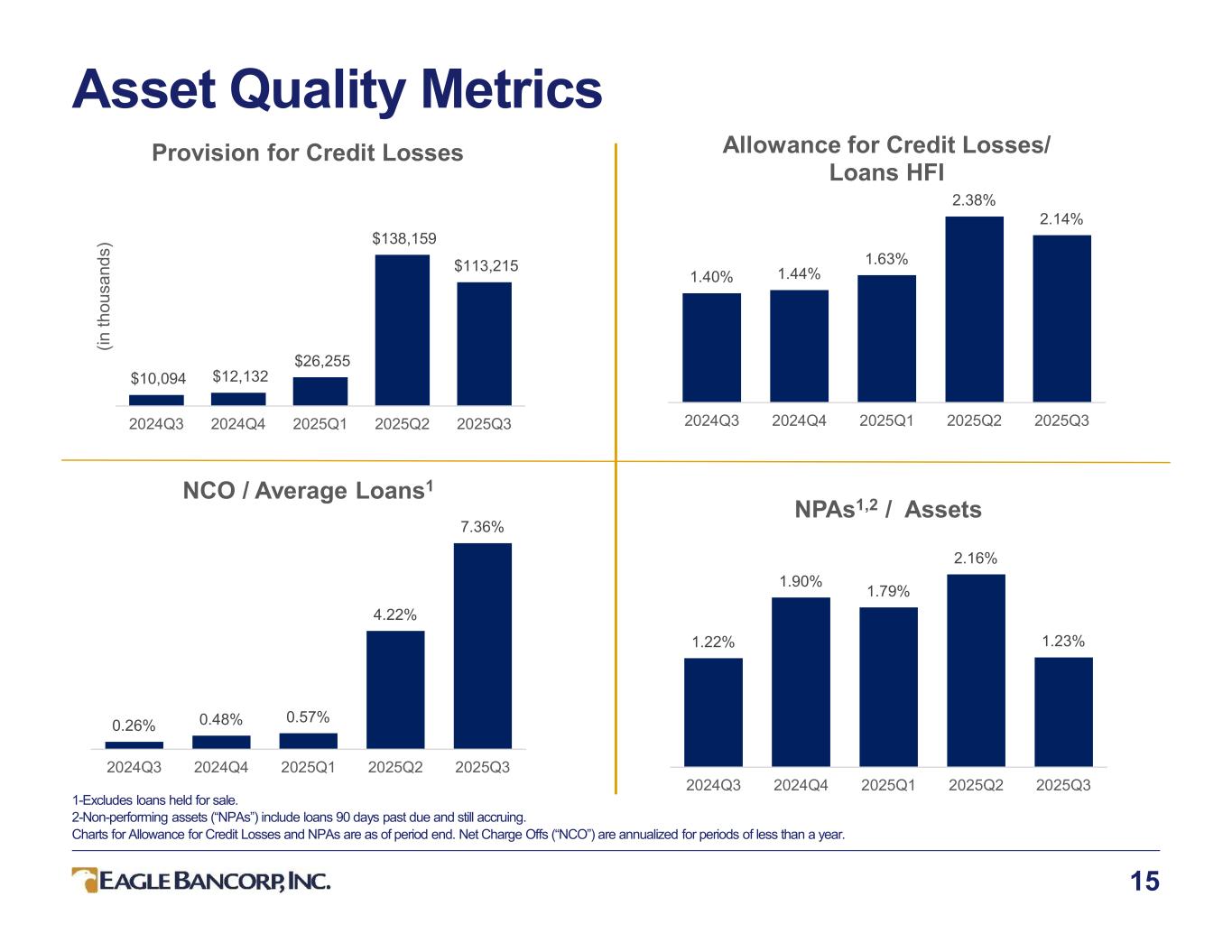

Asset Quality Metrics 15 1-Excludes loans held for sale. 2-Non-performing assets (“NPAs”) include loans 90 days past due and still accruing. Charts for Allowance for Credit Losses and NPAs are as of period end. Net Charge Offs (“NCO”) are annualized for periods of less than a year. $10,094 $12,132 $26,255 $138,159 $113,215 2024Q3 2024Q4 2025Q1 2025Q2 2025Q3 (in th ou sa nd s) Provision for Credit Losses 1.40% 1.44% 1.63% 2.38% 2.14% 2024Q3 2024Q4 2025Q1 2025Q2 2025Q3 Allowance for Credit Losses/ Loans HFI 0.26% 0.48% 0.57% 4.22% 7.36% 2024Q3 2024Q4 2025Q1 2025Q2 2025Q3 NCO / Average Loans1 1.22% 1.90% 1.79% 2.16% 1.23% 2024Q3 2024Q4 2025Q1 2025Q2 2025Q3 NPAs1,2 / Assets

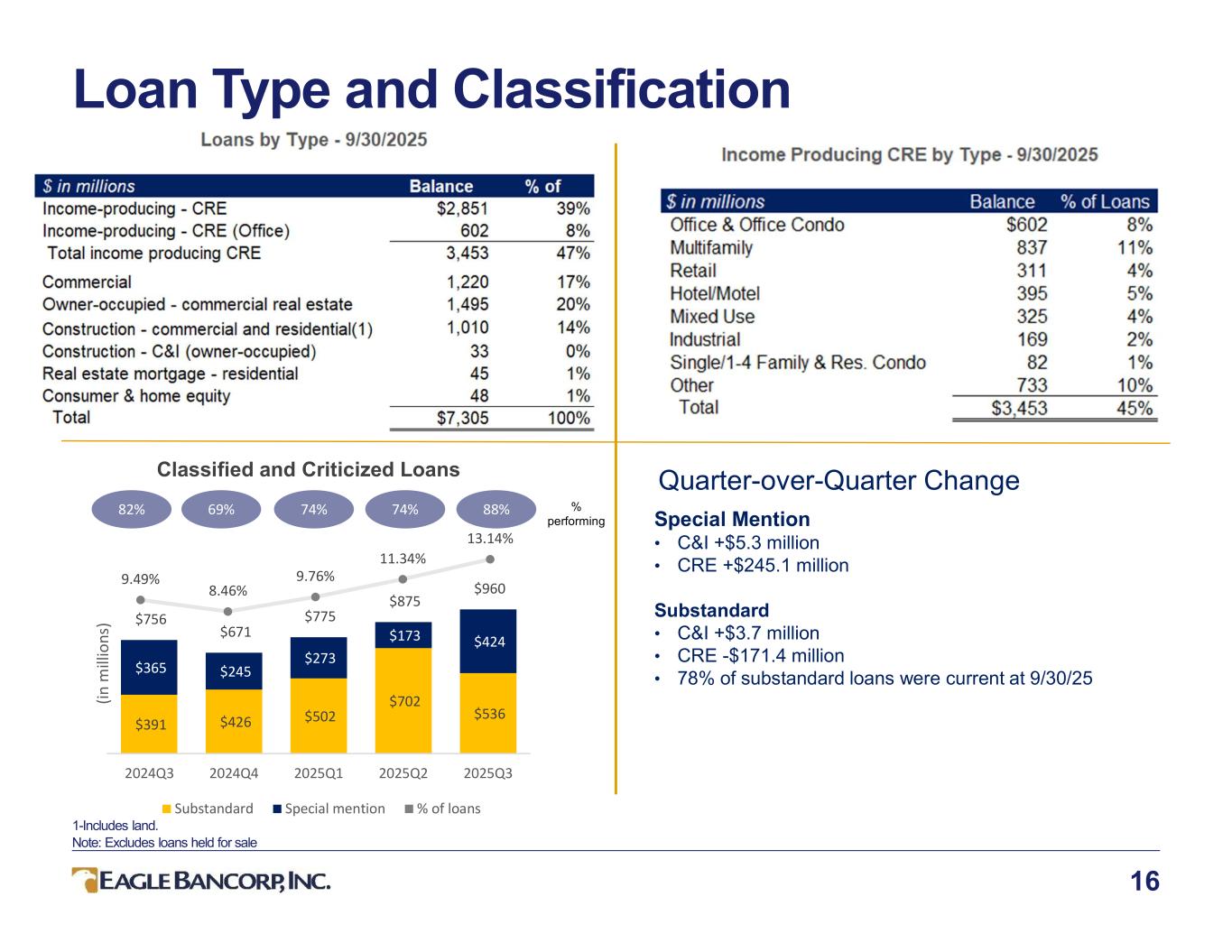

$391 $426 $502 $702 $536 $365 $245 $273 $173 $424 $756 $671 $775 $875 $960 2024Q3 2024Q4 2025Q1 2025Q2 2025Q3 (in m ill io ns ) Substandard Special mention % of loans 16 Loan Type and Classification 1-Includes land. Note: Excludes loans held for sale Quarter-over-Quarter Change Special Mention • C&I +$5.3 million • CRE +$245.1 million Substandard • C&I +$3.7 million • CRE -$171.4 million • 78% of substandard loans were current at 9/30/25 Classified and Criticized Loans 74%74%69%82% 88% % performing 9.49% 8.46% 9.76% 11.34% 13.14%

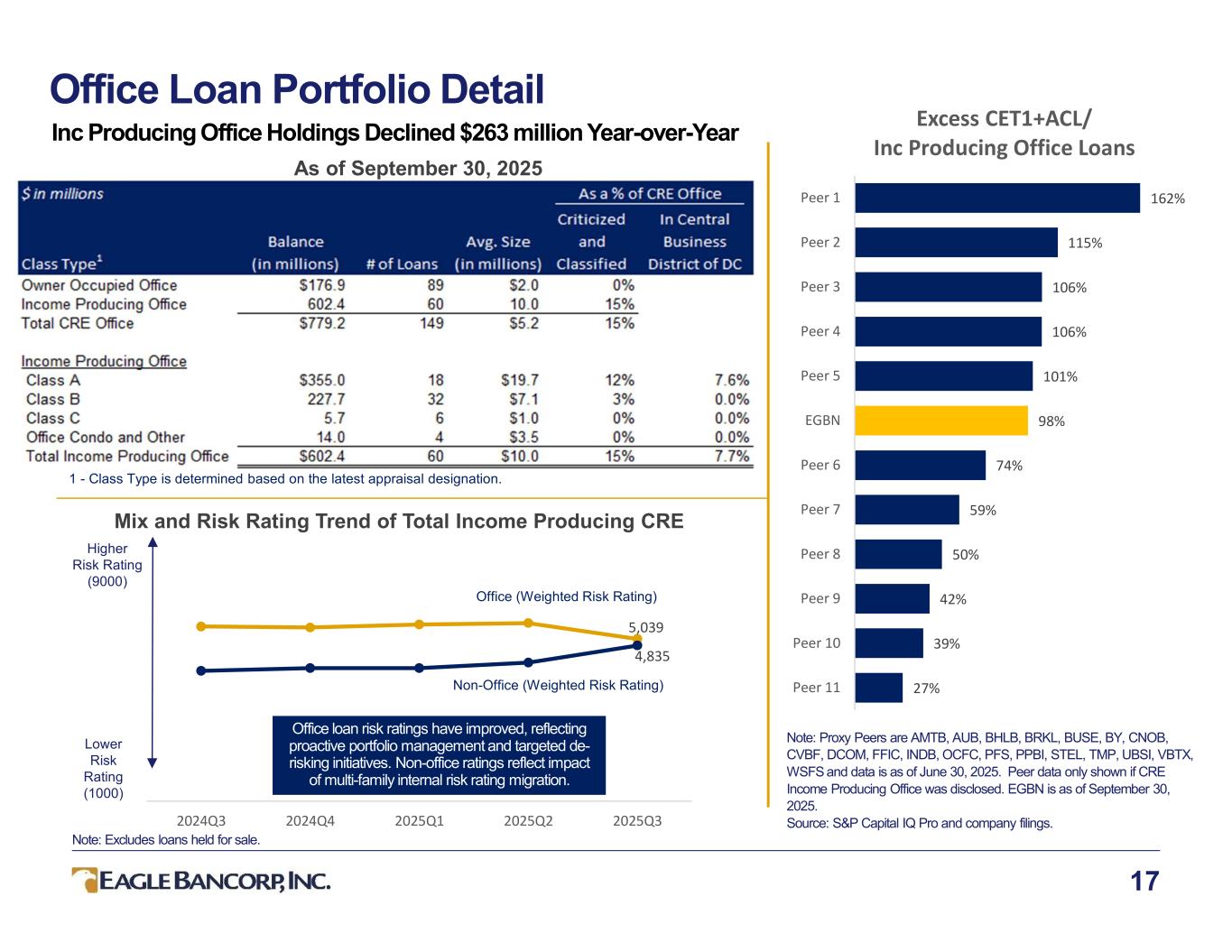

162% 115% 106% 106% 101% 98% 74% 59% 50% 42% 39% 27% Peer 1 Peer 2 Peer 3 Peer 4 Peer 5 EGBN Peer 6 Peer 7 Peer 8 Peer 9 Peer 10 Peer 11 Excess CET1+ACL/ Inc Producing Office Loans 5,039 4,835 2024Q3 2024Q4 2025Q1 2025Q2 2025Q3 17 As of September 30, 2025 Note: Proxy Peers are AMTB, AUB, BHLB, BRKL, BUSE, BY, CNOB, CVBF, DCOM, FFIC, INDB, OCFC, PFS, PPBI, STEL, TMP, UBSI, VBTX, WSFS and data is as of June 30, 2025. Peer data only shown if CRE Income Producing Office was disclosed. EGBN is as of September 30, 2025. Source: S&P Capital IQ Pro and company filings. 1 - Class Type is determined based on the latest appraisal designation. Higher Risk Rating (9000) Lower Risk Rating (1000) Office (Weighted Risk Rating) Non-Office (Weighted Risk Rating) Mix and Risk Rating Trend of Total Income Producing CRE Office loan risk ratings have improved, reflecting proactive portfolio management and targeted de- risking initiatives. Non-office ratings reflect impact of multi-family internal risk rating migration. Office Loan Portfolio Detail Inc Producing Office Holdings Declined $263 million Year-over-Year Note: Excludes loans held for sale.

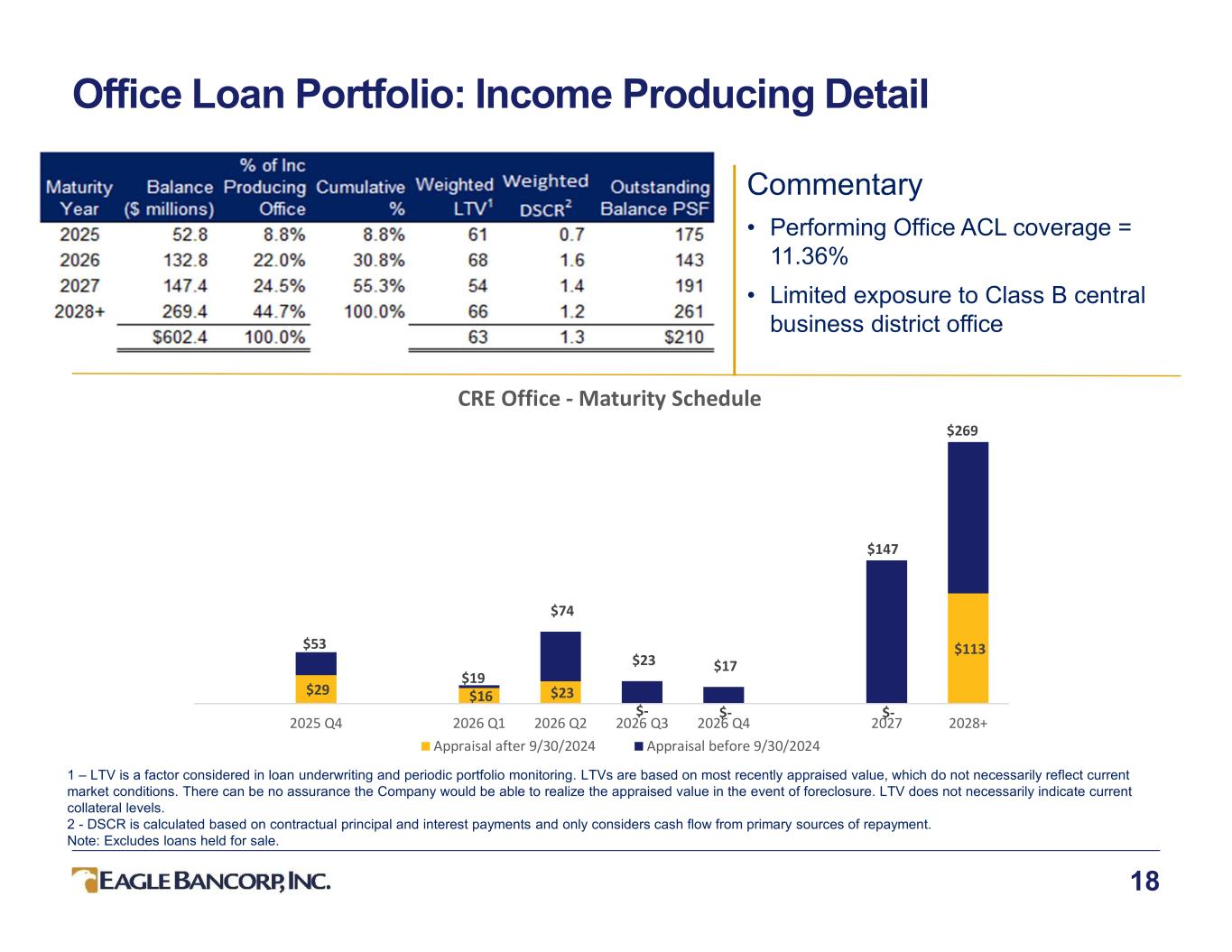

$29 $16 $23 $- $- $- $113 $53 $19 $74 $23 $17 $147 $269 2025 Q4 2026 Q1 2026 Q2 2026 Q3 2026 Q4 2027 2028+ CRE Office - Maturity Schedule Appraisal after 9/30/2024 Appraisal before 9/30/2024 18 1 – LTV is a factor considered in loan underwriting and periodic portfolio monitoring. LTVs are based on most recently appraised value, which do not necessarily reflect current market conditions. There can be no assurance the Company would be able to realize the appraised value in the event of foreclosure. LTV does not necessarily indicate current collateral levels. 2 - DSCR is calculated based on contractual principal and interest payments and only considers cash flow from primary sources of repayment. Note: Excludes loans held for sale. Commentary • Performing Office ACL coverage = 11.36% • Limited exposure to Class B central business district office Office Loan Portfolio: Income Producing Detail

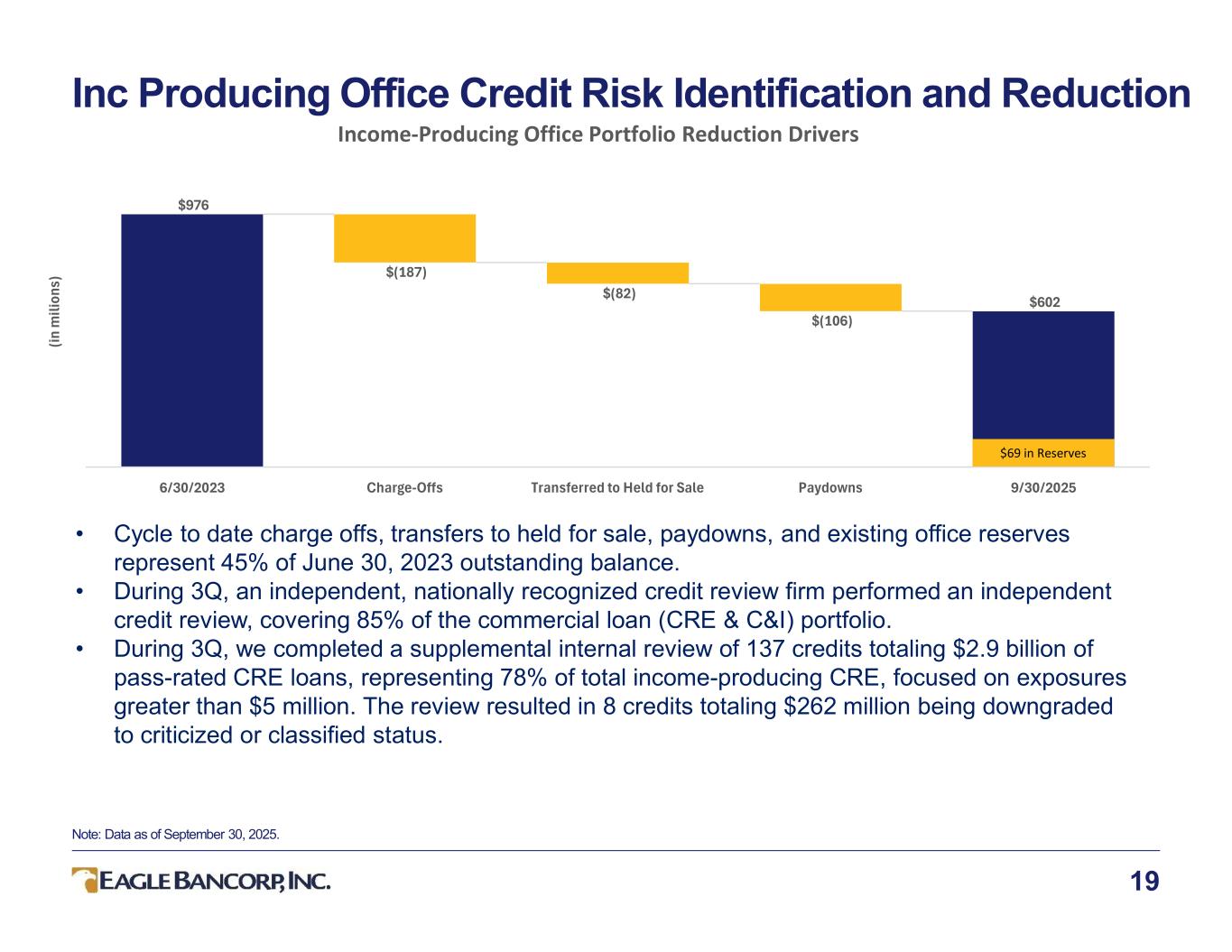

$976 $(187) $(82) $(106) $602 6/30/2023 Charge-Offs Transferred to Held for Sale Paydowns 9/30/2025 (in m ili on s) Income-Producing Office Portfolio Reduction Drivers 19 Inc Producing Office Credit Risk Identification and Reduction Note: Data as of September 30, 2025. • Cycle to date charge offs, transfers to held for sale, paydowns, and existing office reserves represent 45% of June 30, 2023 outstanding balance. • During 3Q, an independent, nationally recognized credit review firm performed an independent credit review, covering 85% of the commercial loan (CRE & C&I) portfolio. • During 3Q, we completed a supplemental internal review of 137 credits totaling $2.9 billion of pass-rated CRE loans, representing 78% of total income-producing CRE, focused on exposures greater than $5 million. The review resulted in 8 credits totaling $262 million being downgraded to criticized or classified status. $69 in Reserves

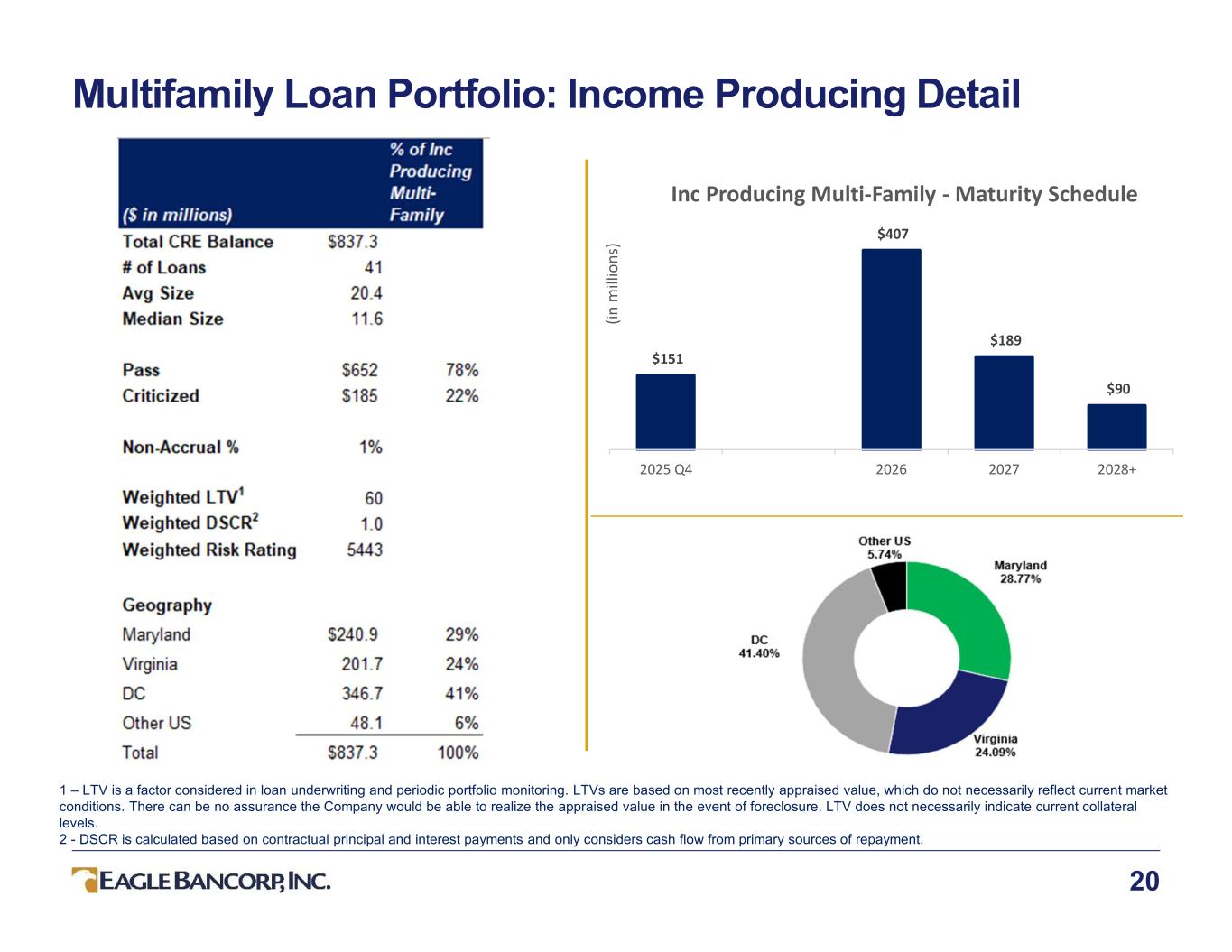

20 1 – LTV is a factor considered in loan underwriting and periodic portfolio monitoring. LTVs are based on most recently appraised value, which do not necessarily reflect current market conditions. There can be no assurance the Company would be able to realize the appraised value in the event of foreclosure. LTV does not necessarily indicate current collateral levels. 2 - DSCR is calculated based on contractual principal and interest payments and only considers cash flow from primary sources of repayment. Multifamily Loan Portfolio: Income Producing Detail $151 $407 $189 $90 2025 Q4 2026 2027 2028+ (in m ill io ns ) Inc Producing Multi-Family - Maturity Schedule

Appendix

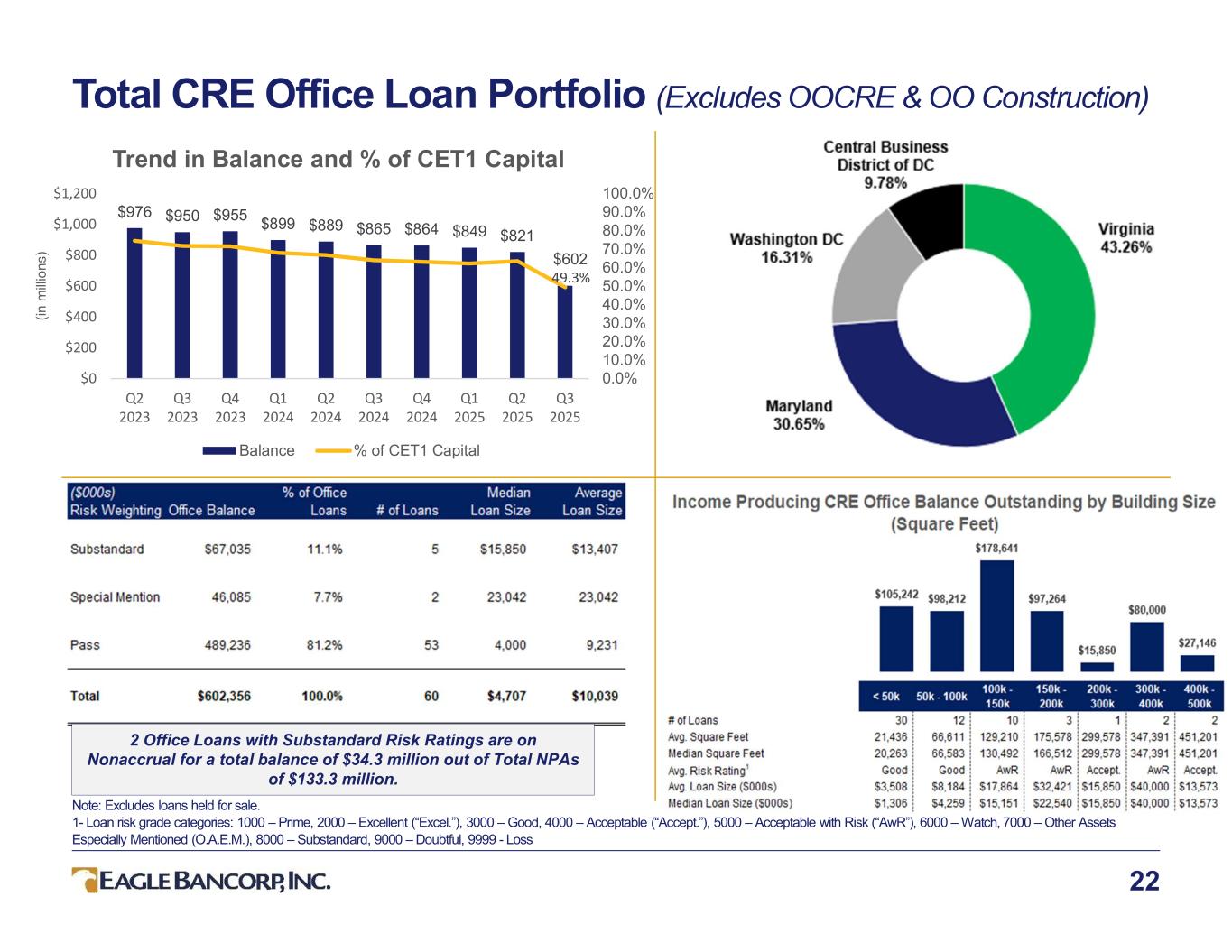

Total CRE Office Loan Portfolio (Excludes OOCRE & OO Construction) 22 2 Office Loans with Substandard Risk Ratings are on Nonaccrual for a total balance of $34.3 million out of Total NPAs of $133.3 million. Note: Excludes loans held for sale. 1- Loan risk grade categories: 1000 – Prime, 2000 – Excellent (“Excel.”), 3000 – Good, 4000 – Acceptable (“Accept.”), 5000 – Acceptable with Risk (“AwR”), 6000 – Watch, 7000 – Other Assets Especially Mentioned (O.A.E.M.), 8000 – Substandard, 9000 – Doubtful, 9999 - Loss $976 $950 $955 $899 $889 $865 $864 $849 $821 $602 49.3% 0.0% 10.0% 20.0% 30.0% 40.0% 50.0% 60.0% 70.0% 80.0% 90.0% 100.0% $0 $200 $400 $600 $800 $1,000 $1,200 Q2 2023 Q3 2023 Q4 2023 Q1 2024 Q2 2024 Q3 2024 Q4 2024 Q1 2025 Q2 2025 Q3 2025 (in m ill io n s) Trend in Balance and % of CET1 Capital Balance % of CET1 Capital

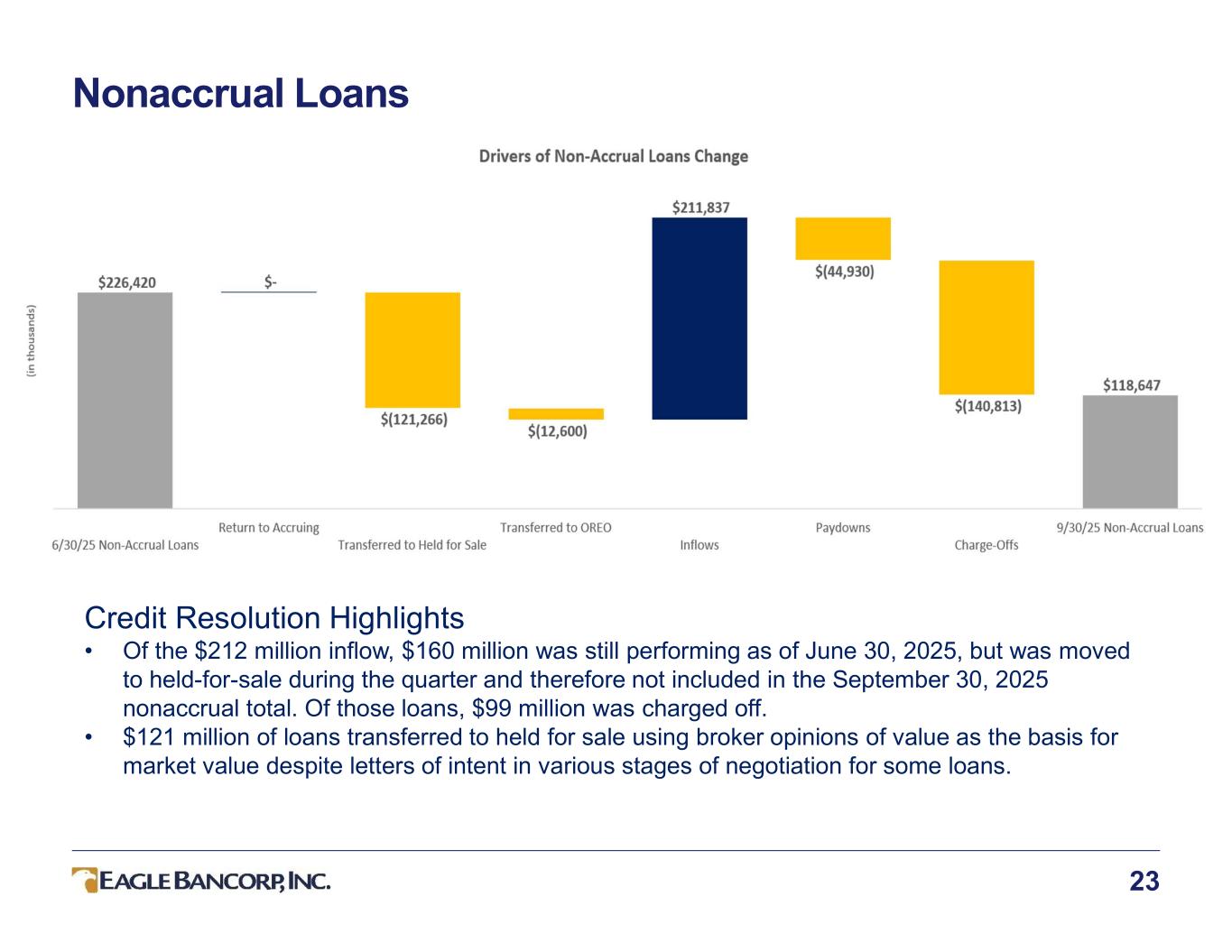

23 Nonaccrual Loans Credit Resolution Highlights • Of the $212 million inflow, $160 million was still performing as of June 30, 2025, but was moved to held-for-sale during the quarter and therefore not included in the September 30, 2025 nonaccrual total. Of those loans, $99 million was charged off. • $121 million of loans transferred to held for sale using broker opinions of value as the basis for market value despite letters of intent in various stages of negotiation for some loans.

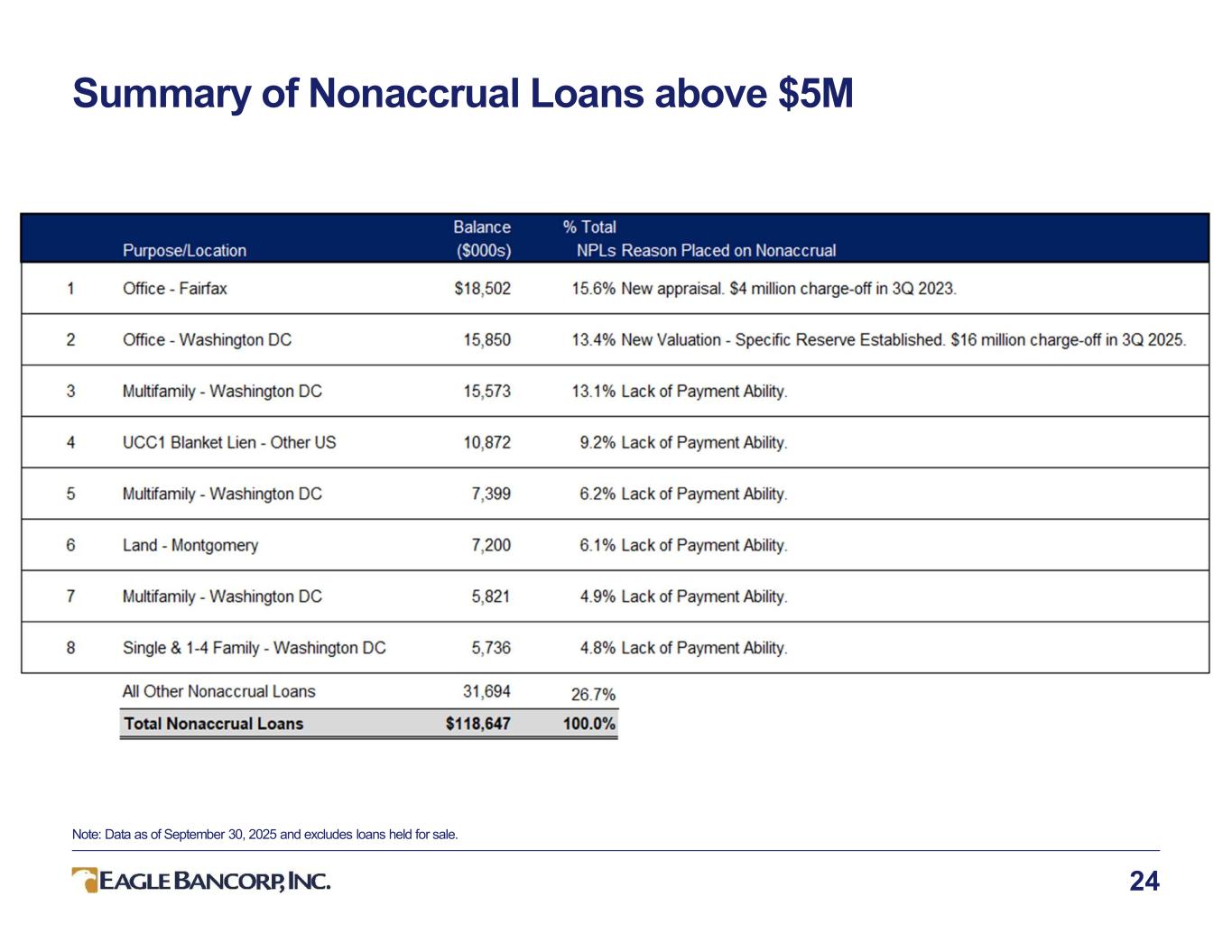

24 Summary of Nonaccrual Loans above $5M Note: Data as of September 30, 2025 and excludes loans held for sale.

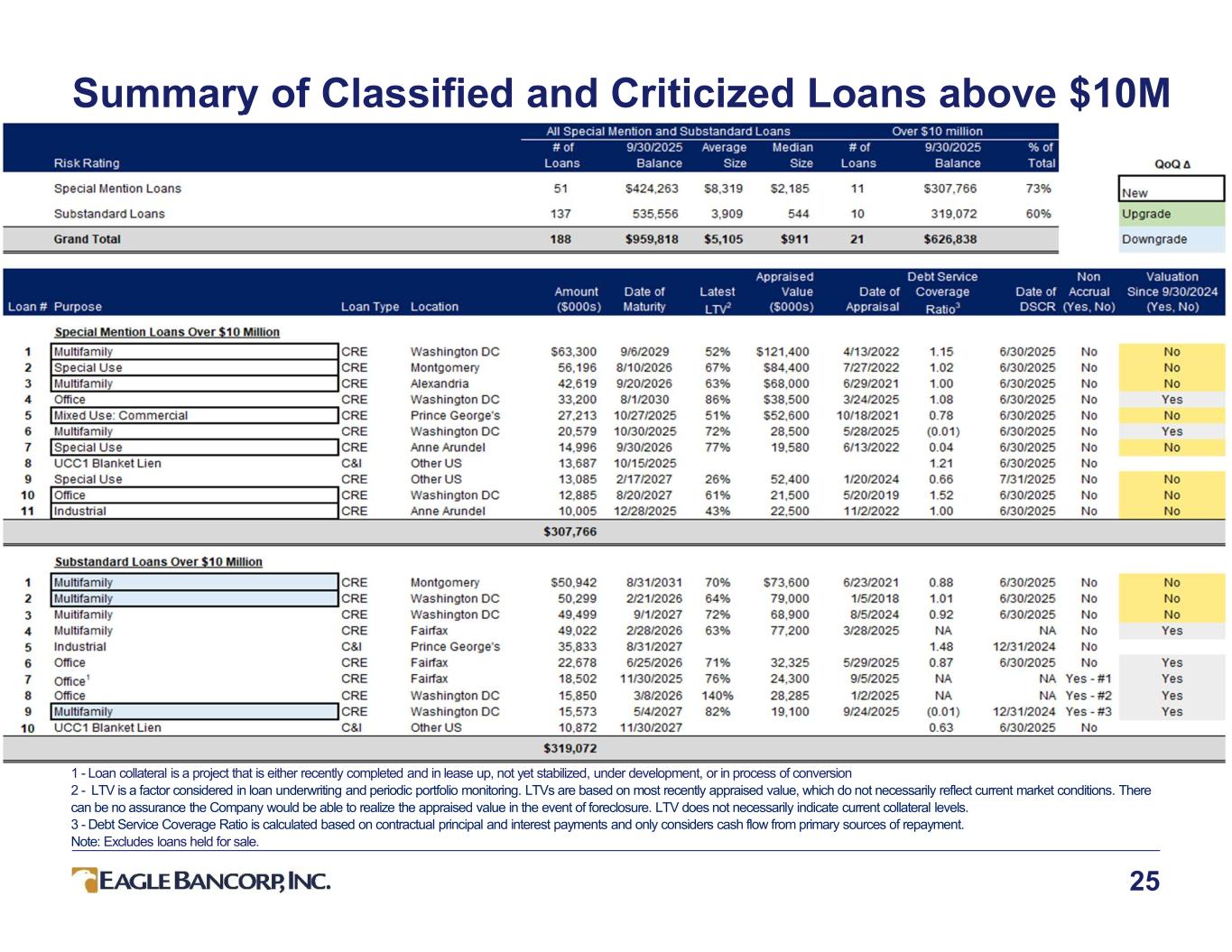

25 Summary of Classified and Criticized Loans above $10M 1 - Loan collateral is a project that is either recently completed and in lease up, not yet stabilized, under development, or in process of conversion 2 - LTV is a factor considered in loan underwriting and periodic portfolio monitoring. LTVs are based on most recently appraised value, which do not necessarily reflect current market conditions. There can be no assurance the Company would be able to realize the appraised value in the event of foreclosure. LTV does not necessarily indicate current collateral levels. 3 - Debt Service Coverage Ratio is calculated based on contractual principal and interest payments and only considers cash flow from primary sources of repayment. Note: Excludes loans held for sale.

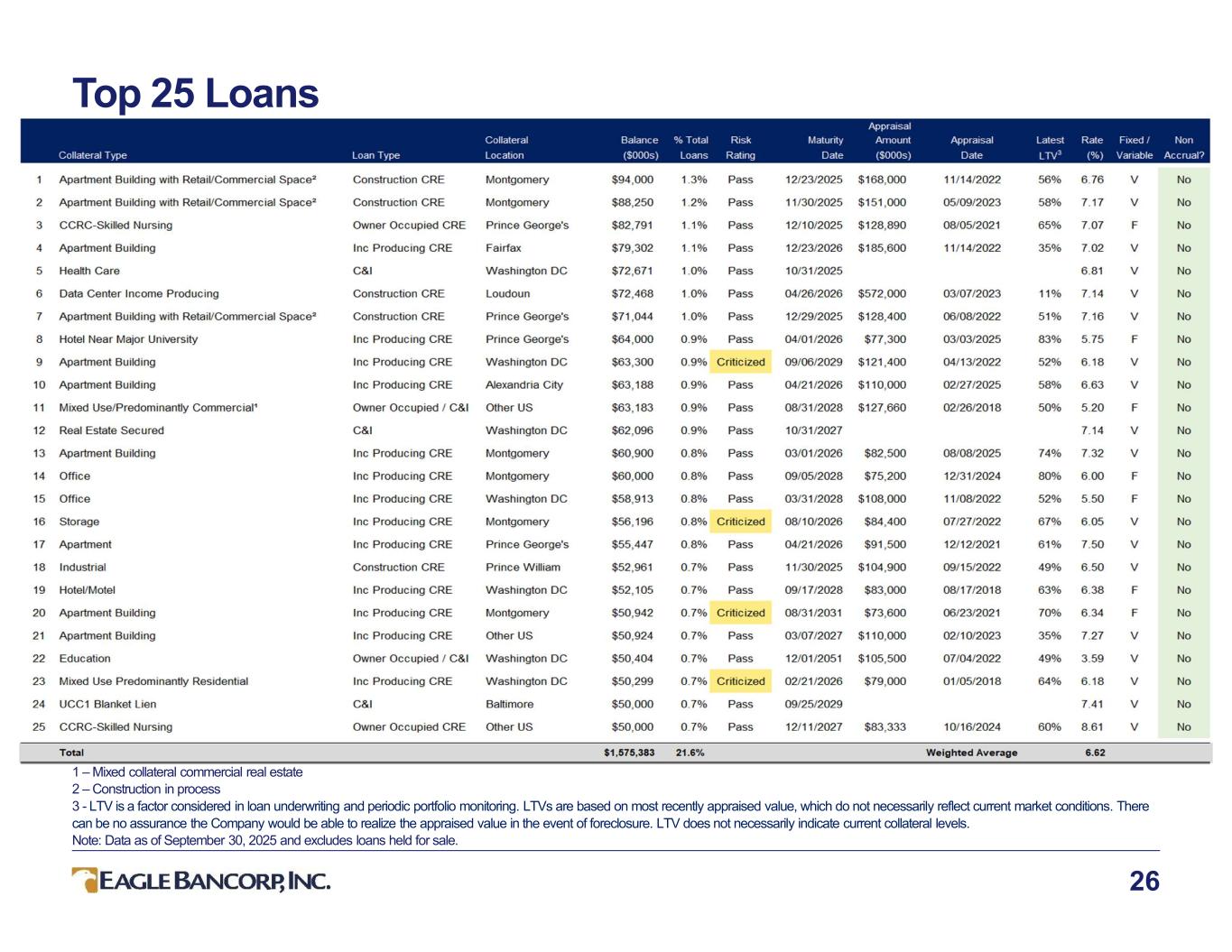

26 Top 25 Loans 1 – Mixed collateral commercial real estate 2 – Construction in process 3 - LTV is a factor considered in loan underwriting and periodic portfolio monitoring. LTVs are based on most recently appraised value, which do not necessarily reflect current market conditions. There can be no assurance the Company would be able to realize the appraised value in the event of foreclosure. LTV does not necessarily indicate current collateral levels. Note: Data as of September 30, 2025 and excludes loans held for sale.

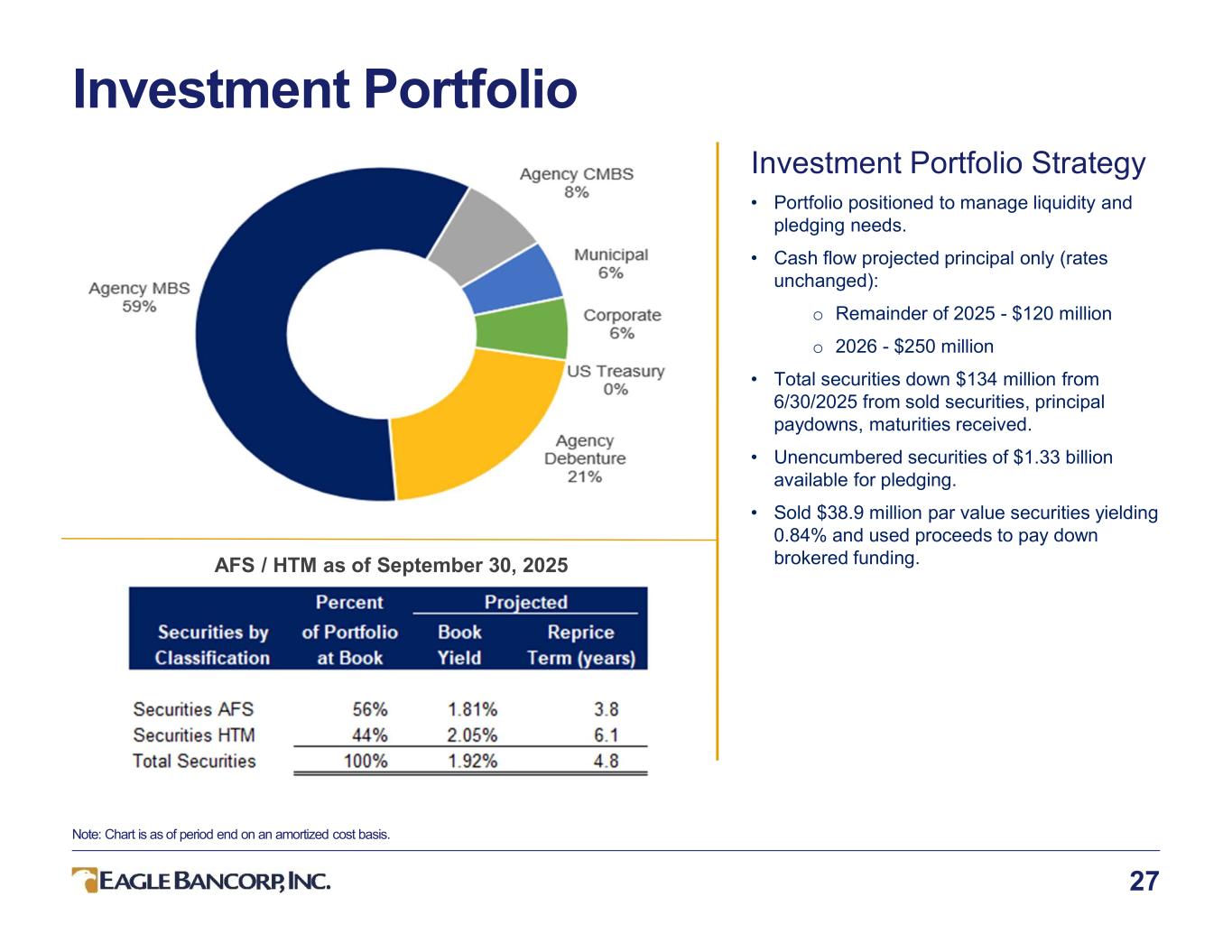

Investment Portfolio 27 Investment Portfolio Strategy • Portfolio positioned to manage liquidity and pledging needs. • Cash flow projected principal only (rates unchanged): o Remainder of 2025 - $120 million o 2026 - $250 million • Total securities down $134 million from 6/30/2025 from sold securities, principal paydowns, maturities received. • Unencumbered securities of $1.33 billion available for pledging. • Sold $38.9 million par value securities yielding 0.84% and used proceeds to pay down brokered funding. Note: Chart is as of period end on an amortized cost basis. AFS / HTM as of September 30, 2025

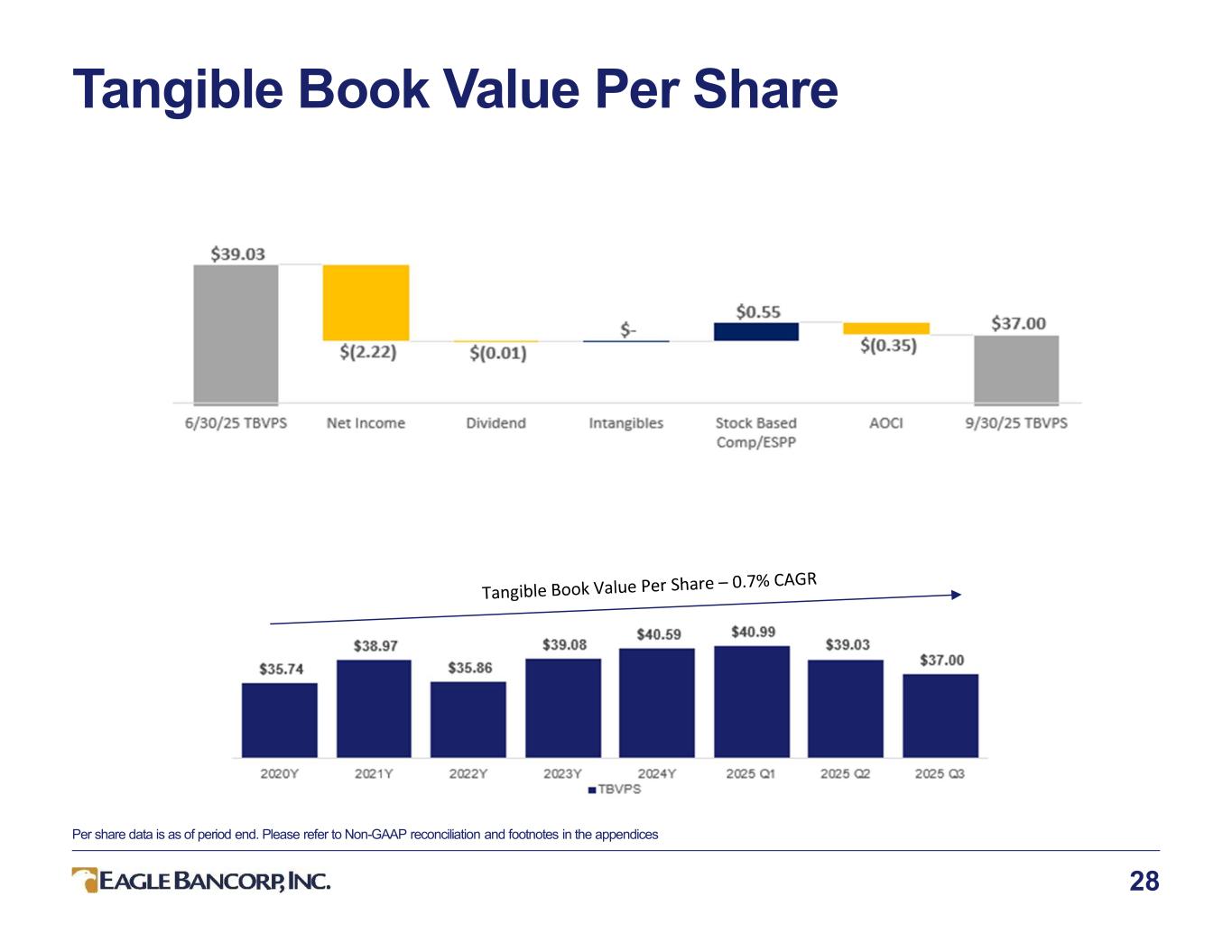

Tangible Book Value Per Share 28 Per share data is as of period end. Please refer to Non-GAAP reconciliation and footnotes in the appendices

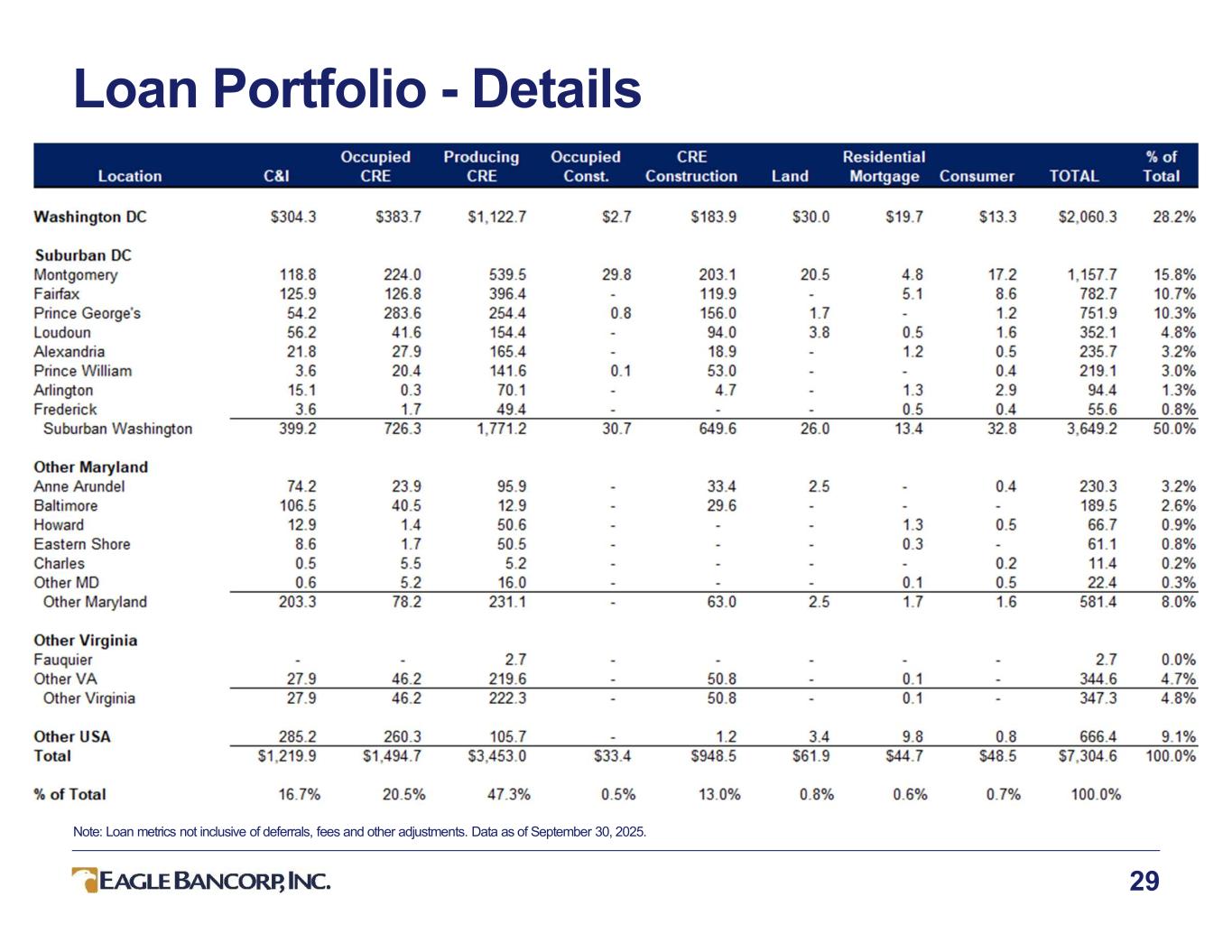

Loan Portfolio - Details 29 Note: Loan metrics not inclusive of deferrals, fees and other adjustments. Data as of September 30, 2025.

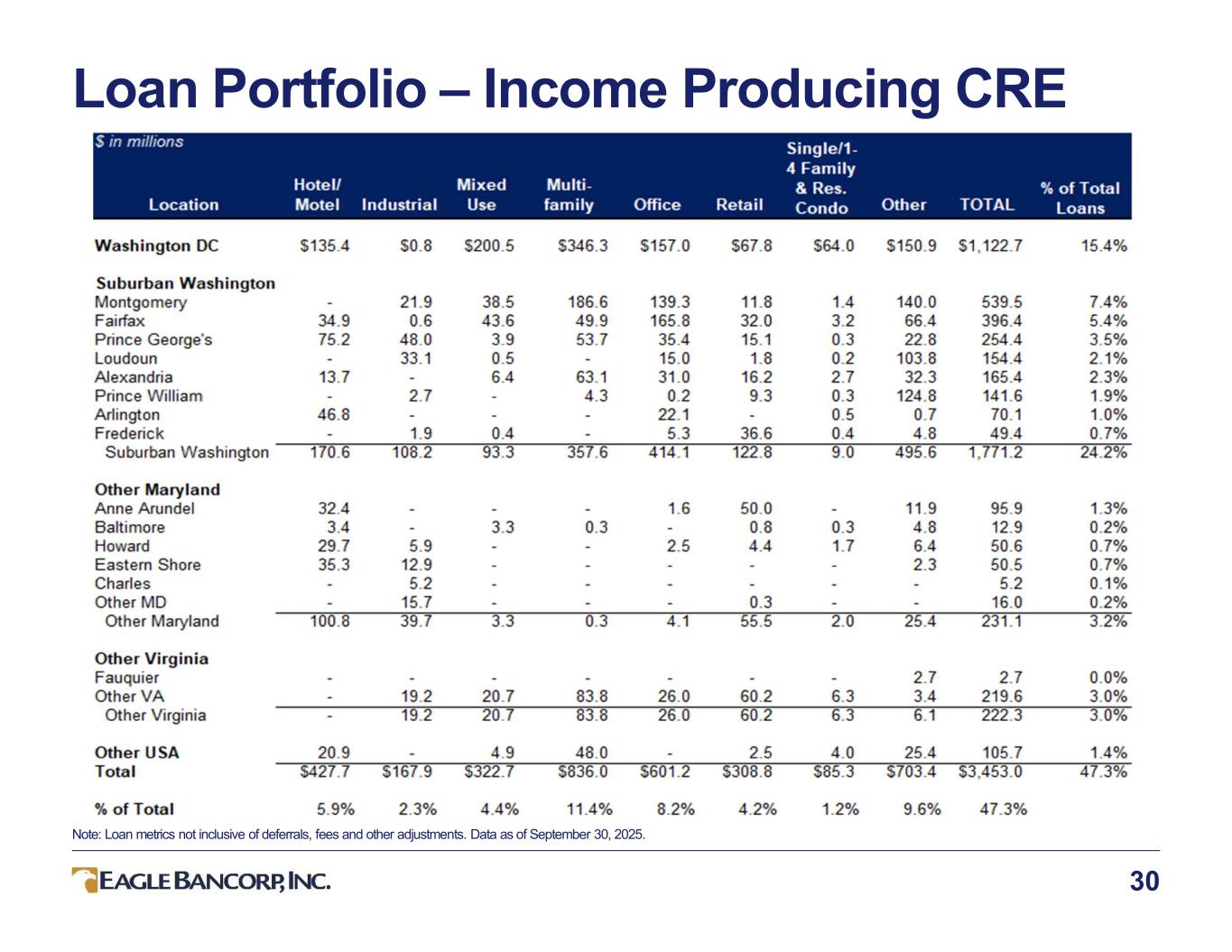

Loan Portfolio – Income Producing CRE 30 Note: Loan metrics not inclusive of deferrals, fees and other adjustments. Data as of September 30, 2025.

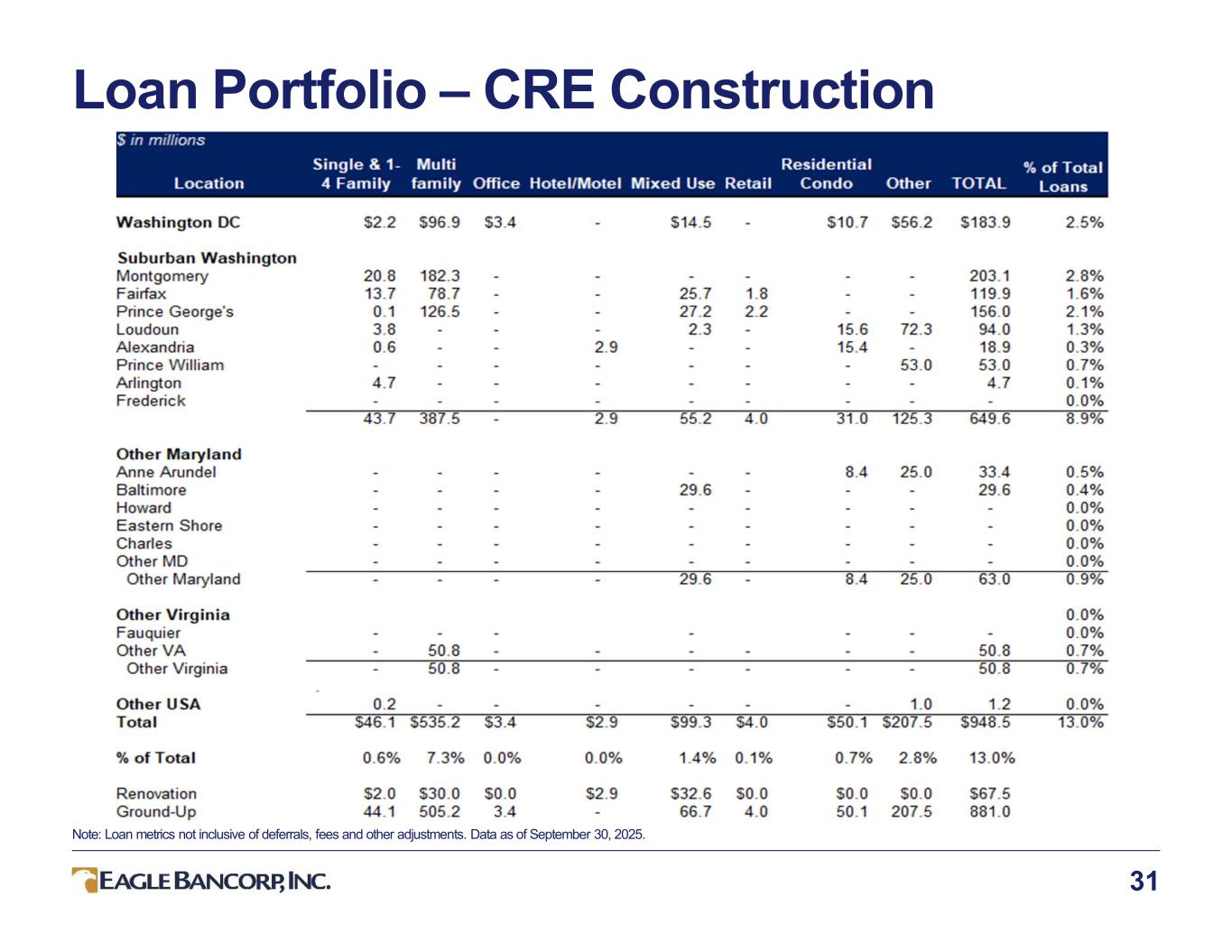

Loan Portfolio – CRE Construction 31 Note: Loan metrics not inclusive of deferrals, fees and other adjustments. Data as of September 30, 2025.

32 Non-GAAP Reconciliation (unaudited)

33 Non-GAAP Reconciliation (unaudited)

34 Non-GAAP Reconciliation (unaudited) Tangible common equity to tangible assets (the "tangible common equity ratio"), tangible book value per common share, tangible book value per common share excluding accumulated other comprehensive income (“AOCI”), and the return on average tangible common equity are non-GAAP financial measures derived from GAAP based amounts. The Company calculates the tangible common equity ratio by excluding the balance of intangible assets from common shareholders' equity and dividing by tangible assets. The Company calculates tangible book value per common share by dividing tangible common equity by common shares outstanding, as compared to book value per common share, which the Company calculates by dividing common shareholders' equity by common shares outstanding; to calculate the tangible book value per common share excluding the AOCI, tangible common equity is reduced by the loss on the AOCI before dividing by common shares outstanding. The Company calculates the annualized return on average tangible common equity ratio by dividing net income available to common shareholders by average tangible common equity which is calculated by excluding the average balance of intangible assets from the average common shareholders’ equity. The Company considers this information important to shareholders as tangible equity is a measure that is consistent with the calculation of capital for bank regulatory purposes, which excludes intangible assets from the calculation of risk-based ratios and as such is useful for investors, regulators, management and others to evaluate capital adequacy and to compare against other financial institutions. The above table provides reconciliation of these financial measures defined by GAAP with non-GAAP financial measures. Efficiency ratio is a non-GAAP measure calculated by dividing GAAP non-interest expense by the sum of GAAP net interest income and GAAP non-interest (loss) income. Management believes that reporting the non-GAAP efficiency ratio more closely measures its effectiveness of controlling operational activities. The table above shows the calculation of the efficiency ratio from these GAAP measures. Adjusted PPNR excludes the impact of loan sales in its calculation to provide a clearer view of core operating performance. Management believes this adjusted measure better reflects underlying revenue trends and expense discipline by removing the volatility associated with nonrecurring or opportunistic balance sheet actions. Forward-Looking Non-GAAP Financial Measures: From time to time we may discuss forward-looking non-GAAP financial measures, such as forward-looking estimates for expenses excluding FDIC deposit insurance assessments. We are unable to provide a reconciliation of forward-looking non-GAAP financial measures to their most directly comparable GAAP financial measures because we are unable to provide, without unreasonable effort, a meaningful or accurate calculation or estimation of amounts that would be necessary for the reconciliation due to the complexity and inherent difficulty in forecasting and quantifying future amounts. Such unavailable information could be significant to future results.