Exhibit 4.2

DESCRIPTION OF the registrant’s registered securities

Class A common stock, par value $0.001 per share (the “Class A”), and class B common stock, par value $0.001 per share (the “Class B”), constitute the common stock of MicroStrategy Incorporated d/b/a Strategy (the “Company”) and 8.00% Series A Perpetual Strike Preferred Stock, par value $0.001 per share (the “Series A Strike Preferred”), constitutes the outstanding preferred stock of the Company. The following is a description of the Class A and the Series A Strike Preferred, which are the only securities of the Company registered pursuant to Section 12 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The following description summarizes certain information regarding the Class A and Series A Strike Preferred set forth in the Company’s Second Restated Certificate of Incorporation, as amended (the “Certificate”), the Certificate of Designations of the Series A Strike Preferred (the “Certificate of Designations”), and the Company’s Amended and Restated By-laws (the “By-laws”), as well as relevant provisions of the Delaware General Corporation Law (the “DGCL”). The description is qualified in its entirety by reference to the Certificate, the Certificate of Designations, and the By-laws, which are incorporated by reference to Exhibits 3.1, 3.2, 3.3, and 3.4 to the Annual Report on Form 10-K of which this Exhibit 4.2 is a part, and the applicable provisions of the DGCL.

Authorized Capital Stock

The Company’s authorized capital stock consists of 10,330,000,000 shares of Class A, 165,000,000 shares of Class B, and 1,005,000,000 shares of preferred stock, par value $0.001 per share, of which 7,300,000 have been designated as Series A Strike Preferred.

Class A Common Stock

Voting Rights. Holders of Class A are entitled to one (1) vote per share. Holders of Class A and Class B vote together as a single class on all matters presented to the stockholders for their vote or approval, except as may be required by Delaware law or as otherwise expressly specified in the Certificate. The Class A does not have cumulative voting. Directors are elected to the Company’s Board of Directors (the “Board”) by a plurality of the votes cast in such election. Any matters other than the election of directors to be voted upon by the stockholders at a meeting are decided by the affirmative vote of a majority of the votes cast by the holders of the Company’s capital stock entitled to vote, except when a different vote is required by law, the Certificate, or the By-laws. The Company may increase or decrease the number of authorized shares of Class A by action of the Board and the affirmative vote of a majority of the voting power of the Company’s capital stock entitled to vote.

Dividends. Holders of Class A are entitled to receive dividends when and if declared by the Board, out of legally available funds. The Company may not make any dividend or distribution with respect to any class of the Company’s common stock unless at the same time it makes a ratable dividend or distribution with respect to each outstanding share of the Company’s common stock, regardless of class. In the case of a stock dividend or other distribution payable in shares of a class of common stock, only shares of Class A may be distributed with respect to Class A and only shares of Class B may be distributed with respect to Class B, and the number of shares of common stock payable per share must be equal for each class. The Company’s ability to declare, pay, or set aside dividends on the Company’s common stock is subject to any preferential rights, powers, and preferences of any then-outstanding preferred stock.

Subdivision, Consolidation, Reclassification, or Other Changes. None of the shares of any class of the Company’s common stock may be subdivided, consolidated, reclassified, or otherwise changed unless concurrently shares of the other class of common stock are subdivided, consolidated, reclassified, or otherwise changed in the same proportion and manner.

Conversion Rights. Class A has no conversion rights.

Merger. Upon the Company’s merger or consolidation, holders of each class of common stock will be entitled to receive equal per share payments or distributions, except that in any transaction in which shares of capital stock are distributed, such shares may differ only to the extent that the Class A and Class B differ as provided in the Certificate.

Liquidation. Upon the Company’s dissolution or liquidation, holders of each class of common stock will be entitled to receive ratably all of the Company’s assets available for distribution to stockholders, subject to any preferential rights, powers, and preferences of any then-outstanding preferred stock.

Other Provisions. Holders of Class A are not entitled to preemptive rights. The rights of holders of Class A are subject to the rights, powers, and preferences of holders of shares of any then-outstanding preferred stock.

Preferred Stock

The Board is authorized, without further action by the Company’s stockholders, to issue up to 1,005,000,000 shares of preferred stock in one or more series and to fix the voting powers, designations, preferences, and the relative participating, optional, or other special rights, qualifications, limitations, or restrictions of the shares of each series of preferred stock, including the 7,300,000 shares of Series A Strike Preferred that have been authorized by the Board and issued and sold by the Company. The issuance of preferred stock could impede the completion of a merger, tender offer, or other takeover attempt.

Series A Strike Preferred

Generally

The Board has designated 7,300,000 shares of the Company’s preferred stock as Series A Strike Preferred and the Company has issued and sold all of these shares. Without the consent of any holder, the Company may, by resolution of the Board, increase the total number of authorized shares of Series A Strike Preferred, except that in no event will such increase be by an amount that exceeds the total number of authorized and undesignated shares of the Company’s preferred stock. In addition, without the consent of any holder of Series A Strike Preferred, the Company may issue additional Series A Strike Preferred with the same terms as the outstanding Series A Strike Preferred (except for certain differences, such as the date as of which regular dividends begin to accumulate on, the first regular dividend payment date for, and transfer restrictions applicable to, such additional Series A Strike Preferred). Furthermore, without the consent of any holder, the Company may resell any Series A Strike Preferred that it or any of its “subsidiaries” (as defined below under the caption “—Definitions”) has purchased or otherwise acquired. However, such additional or resold Series A Strike Preferred must be identified by a separate CUSIP number or by no CUSIP number if they are not fungible, for purposes of federal securities laws or, if applicable, the “depositary procedures” (as defined below under the caption “—Definitions”), with other Series A Strike Preferred that is then outstanding. In addition, without the consent of any holder, the Company may create and issue, or increase the authorized or issued number of, any other class or series of stock (including, for the avoidance of doubt, “dividend senior stock” or “liquidation senior stock” (as those terms are defined below under the caption “— Definitions”)).

Subject to applicable law, the Company or its subsidiaries may directly or indirectly repurchase Series A Strike Preferred in the open market or otherwise, whether through private or public tender or exchange offers, cash-settled swaps or other cash-settled derivatives.

Transfer Agent, Registrar, Conversion Agent and Paying Agent

U.S. Bank Trust Company, National Association is the initial transfer agent, registrar, conversion agent and paying agent for the Series A Strike Preferred. However, without prior notice to the preferred stockholders, the Company may change the transfer agent, registrar, paying agent and conversion agent and the Company or any of its subsidiaries may choose to act in that capacity as well (except that the transfer agent, registrar, paying agent or conversion agent with respect to any global certificate must at all times be a person that is eligible to act in that capacity under the depositary procedures).

Registered Holders

Absent manifest error, a person in whose name any share of Series A Strike Preferred is registered on the registrar’s books will be considered to be the holder of that share for all purposes, and only registered holders

(which, in the case of Series A Strike Preferred held through DTC, is initially DTC’s nominee, Cede & Co.) will have rights under the Certificate and the Certificate of Designations as holders of the Series A Strike Preferred. In this section, the registered holders of the Series A Strike Preferred are referred to as “holders” of the Series A Strike Preferred or “preferred stockholders.”

The Series A Strike Preferred was initially issued in global form, represented by one or more “global certificates” registered in the name of Cede & Co., as nominee of DTC, and DTC will act as the initial depositary for the Series A Strike Preferred. In limited circumstances, global certificates will be exchanged for “physical certificates” registered in the name of the applicable preferred stockholders. See “—Book Entry, Settlement and Clearance” for a definition of these terms and a description of certain DTC procedures that are applicable to Series A Strike Preferred represented by global certificates.

Transfers and Exchanges

A preferred stockholder may transfer or exchange its Series A Strike Preferred at the office of the registrar in accordance with the Certificate of Designations. The Company, the transfer agent and the registrar may require the preferred stockholder to, among other things, deliver appropriate endorsements or transfer instruments as they may reasonably require. In addition, subject to the terms of the Certificate of Designations, the Company, the transfer agent and the registrar may refuse to register the transfer or exchange of any share of Series A Strike Preferred that is subject to conversion, redemption or required repurchase.

Payments on the Series A Strike Preferred

The Company will pay (or cause a paying agent to pay) all declared cash regular dividends or other cash amounts due on any Series A Strike Preferred represented by a global certificate by wire transfer of immediately available funds. The Company will pay (or cause a paying agent to pay) all declared cash regular dividends or other cash amounts due on any Series A Strike Preferred represented by a physical certificate as follows:

To be timely, a written request referred to in the first bullet point above must be delivered no later than the “close of business” (as defined below under the caption “—Definitions”) on the following date: (i) with respect to the payment of any declared cash regular dividend due on a regular dividend payment date for the Series A Strike Preferred, the immediately preceding regular record date; and (ii) with respect to any other payment, the date that is 15 calendar days immediately before the date such payment is due.

If the due date for a payment on any Series A Strike Preferred is not a “business day” (as defined below under the caption “—Definitions”), then such payment may be made on the immediately following business day with the same force and effect as if such payment were made on that due date, and no interest, dividend or other amount will accrue or accumulate on such payment as a result of the related delay. Solely for purposes of the immediately preceding sentence, a day on which the applicable place of payment is authorized or required by law or executive order to close or be closed will be deemed not to be a “business day.”

Ranking

The Series A Strike Preferred will rank as follows:

The Class A and the Class B constitute dividend junior stock and liquidation junior stock. However, the terms of the Series A Strike Preferred do not restrict the Company from issuing dividend senior stock or liquidation senior stock.

Regular Dividends

Generally

The Series A Strike Preferred will accumulate cumulative dividends (referred to herein as “regular dividends”) at a rate per annum equal to 8.00% (such rate per annum, the “regular dividend rate”) on the liquidation preference thereof (and, to the extent described in the third immediately following paragraph, on unpaid regular dividends), regardless of whether or not declared or funds are legally available for their payment. Subject to the other provisions described below, such regular dividends will be payable when, as and if declared by the Board (which as used in this section also includes a committee of the Board duly authorized to act on its behalf), out of funds legally available for their payment to the extent paid in cash, quarterly in arrears on each “regular dividend payment date” (as defined below under the caption “—Definitions”) to the preferred stockholders of record as of the close of business on the “regular record date” (as defined below under the caption “—Definitions”) immediately preceding the applicable regular dividend payment date.

Regular dividends on the Series A Strike Preferred will accumulate from, and including, the last date to which regular dividends have been paid (or, if no regular dividends have been paid, from, and including, the initial issue date) to, but excluding, the next regular dividend payment date.

Declared regular dividends on the Series A Strike Preferred will be payable, at the Company’s election, in cash, shares of the Class A or a combination of cash and shares of the Class A, in the manner, and subject to the provisions, described below under the caption “—Method of Payment.” References herein to regular dividends “paid” on the Series A Strike Preferred, and any other similar language, will be deemed to include regular dividends paid thereon in shares of Class A in compliance with the provisions described in this “—Regular Dividends” section.

If any accumulated regular dividend (or any portion thereof) on the Series A Strike Preferred is not paid on the applicable regular dividend payment date (or, if such regular dividend payment date is not a business day, the next business day), then additional regular dividends, which are referred to herein as “compounded dividends,” will accumulate on the amount of such unpaid regular dividend, compounded quarterly at the regular dividend rate, from, and including, such regular dividend payment date to, but excluding, the date the same, including all compounded dividends thereon, is paid in full. Each reference herein to “accumulated” or “unpaid” regular dividends will include any compounded dividends that accumulate thereon pursuant to the provision described in this paragraph. Each payment of declared regular dividends on the Series A Strike Preferred will be applied to the

earliest “regular dividend period” (as defined below under the caption “—Definitions”) for which regular dividends have not yet been paid.

Accumulated regular dividends will be computed on the basis of a 360-day year comprised of twelve 30-day months.

Except as described in the next paragraph, the Certificate of Designations does not require the Company to declare regular dividends on the Series A Strike Preferred, even if funds are legally available for their payment. Accordingly, the Company may choose not to declare regular dividends on the Series A Strike Preferred.

If the Company sells any shares of Class A for cash through a registered public offering (including an at-the-market offering or follow-on offering) during the 90 calendar days preceding a regular record date, then, subject to the terms of any dividend senior stock, the Company will declare and pay the regular dividend due on the regular dividend payment date immediately after such regular record date (including, for the avoidance of doubt, compounded dividends, if any) to the extent the net proceeds to the Company of such sale(s) during such 90 calendar days are sufficient to pay such regular dividend. For the avoidance of doubt, payments of regular dividends will be applied in accordance with the last sentence of the fourth paragraph under this “—Regular Dividends— Generally” section. However, to the extent permitted by the depositary procedures and the terms of any senior dividend stock, and subject to the limitations described under the caption “—Method of Payment— Regular Dividends Paid Partially or Entirely in Shares of Class A Common Stock” below, to the extent, and only to the extent, funds are not legally available for such payment, and to the extent authorized, unissued and unreserved shares of Class A are available, such payment of regular dividends will be payable in shares of Class A. For these purposes, and for the avoidance of doubt, but without limitation, none of the following will constitute a sale of shares of Class A:

A;

For the avoidance of doubt, to the extent the Company fails to pay any portion of such regular dividend in cash or shares of Class A due to the limitations described in the preceding paragraph, such portion of such regular dividend will constitute unpaid regular dividends and will accumulate compounded dividends as described under the fourth paragraph under this “—Regular Dividends—Generally” section.

Method of Payment

Generally

Each declared regular dividend on the Series A Strike Preferred will be paid in cash unless the Company elects, by sending written notice to each preferred stockholder no later than the business day after the date of declaration of such regular dividend, to pay all or any portion of such regular dividend in shares of Class A. Such written notice must state the total dollar amount of the declared regular dividend per share of Series A Strike Preferred and the respective dollar portions thereof that will be paid in cash and in shares of Class A. Any such election made in such written notice, once sent, will be irrevocable (as to the applicable declared regular dividend) and will apply to all shares of Series A Strike Preferred then outstanding.

Regular Dividends Paid Partially or Entirely in Shares of Class A Common Stock

The number of shares of Class A payable in respect of any dollar amount of a declared regular dividend that the Company has duly elected to pay in shares of Class A will be (x) such dollar amount, divided by (y) the “regular dividend stock price” (as defined below under the caption “—Definitions”) for such regular dividend. However, notwithstanding anything to the contrary, in no event will the total number of shares of Class A issuable per share

of Series A Strike Preferred as payment for a declared regular dividend exceed an amount equal to (x) the total dollar amount of such declared regular dividend per share of Series A Strike Preferred (including, for the avoidance of doubt, the portion thereof that the Company elected to pay in shares of Class A), divided by (y) the “floor price” (as defined below under the caption “—Definitions”) in effect on the third “VWAP trading day” (as defined below under the caption “—Definitions”) preceding the regular dividend payment date for such regular dividend. If the dollar amount of such declared regular dividend per share of Series A Strike Preferred that the Company has duly elected to pay in shares of Class A exceeds the product of such regular dividend stock price and the maximum number of shares of Class A deliverable (without regard to the Company’s obligation to pay cash in lieu of any fractional share of Class A) per share of Series A Strike Preferred in respect of such regular dividend, then the Company will, to the extent the Company is legally able to do so and not prohibited by the terms of any dividend senior stock, declare and pay, on the relevant regular dividend payment date, such excess amount in cash. For the avoidance of doubt, to the extent the Company fails to so pay such excess amount in cash, such excess amount will constitute unpaid regular dividends and will accumulate compounded dividends as described under the fourth paragraph under “—Regular Dividends—Generally.”

The initial floor price is $119.03 per share of Class A, subject to adjustment, as provided in its definition, whenever the “conversion rate” (as defined below under the caption “—Definitions”) is adjusted pursuant to the provisions described below under the caption “—Conversion Rights—Conversion Rate Adjustments.”

Payment of Cash in Lieu of any Fractional Share of Class A Common Stock

Notwithstanding anything to the contrary in the provisions described above, in lieu of delivering any fractional share of Class A otherwise issuable as payment for all or any portion of a declared regular dividend that the Company has duly elected to pay in shares of Class A, the Company will, to the extent it is legally able to do so and not prohibited by the terms of any dividend senior stock, pay cash based on the “daily VWAP” (as defined below under the caption “—Definitions”) per share of Class A on the third VWAP trading day preceding the regular dividend payment date for such regular dividend. To the extent that the Company is not able to pay such fractional amount in cash under applicable law and in compliance with the Company’s indebtedness and the terms of any dividend senior stock, the Company will instead (regardless of the limitations described in the second immediately preceding paragraph, but subject to the availability of authorized, unissued and unreserved shares of Class A) round up to the nearest whole share for each holder, and the Company will not have any obligation to pay such amount in cash and such amount will not form a part of the cumulative dividends that may be deemed to accumulate on the shares of Series A Strike Preferred. For the avoidance of doubt, to the extent the Company fails to pay any portion of such declared regular dividend in cash or shares of Class A due to the limitations described in this paragraph, such portion of such regular dividend will constitute unpaid regular dividends and will accumulate compounded dividends as described under the fourth paragraph under “—Regular Dividends—Generally.”

When Preferred Stockholders Become Stockholders of Record of Shares of Class A Common Stock Issued as Payment for a Declared Regular Dividend

If the Company has duly elected to pay all or any portion of a declared regular dividend on any share of Series A Strike Preferred in shares of Class A, then such shares of Class A, when issued, will be registered in the name of the holder of such share of Series A Strike Preferred as of the close of business on the related regular record date, and such holder will be deemed to become the holder of record of such shares of Class A as of the close of business on the third VWAP trading day preceding the related regular dividend payment date.

Securities Laws Matters

If, in the Company’s reasonable judgment, the issuance of shares of Class A as payment for any declared regular dividend on the Series A Strike Preferred, or the resale of those shares by preferred stockholders or beneficial owners that are not, and have not at any time during the preceding three months been, an affiliate of the Company, requires registration under the Securities Act of 1933, as amended (the “Securities Act”), then the Company will use its commercially reasonable efforts to:

In addition, the Company will use its commercially reasonable efforts to qualify or register such shares under applicable U.S. state securities laws, to the extent required in the Company’s reasonable judgment. However, the Company will not be required to qualify as a foreign corporation in, or consent to general service of process under the laws of, any jurisdiction where the Company is not at such time so qualified or subject to such service of process. To the extent applicable, the Company will also use its commercially reasonable efforts to have such shares of Class A approved for listing on any U.S. national or regional securities exchange on which the Class A is then listed.

Treatment of Dividends Upon Repurchase Upon Fundamental Change, Conversion or Redemption

If the “fundamental change repurchase date” (as defined below under the caption “—Fundamental Change Permits Preferred Stockholders to Require the Company to Repurchase Series A Strike Preferred”), “conversion date” (as defined below under the caption “—Definitions”) or redemption date of any share of Series A Strike Preferred to be repurchased, converted or redeemed is after a regular record date for a declared regular dividend on the Series A Strike Preferred and on or before the next regular dividend payment date, then the holder of such share at the close of business on such regular record date will be entitled, notwithstanding such repurchase, conversion or redemption, as applicable, to receive, on or, at the Company’s election, before such regular dividend payment date, such declared regular dividend on such share. However, in the case of a conversion, the converting preferred stockholder must, in certain circumstances, deliver upon conversion cash in an amount equal to such declared regular dividend, as described under the caption “—Treatment of Dividends Upon Conversion.”

Except as described in the preceding paragraph, regular dividends on any share of Series A Strike Preferred will cease to accumulate from and after the fundamental change repurchase date, conversion date or redemption date, as applicable, for such share.

Limitations on the Company’s Ability to Pay Dividends

The Company may not have sufficient cash to pay regular dividends on the Series A Strike Preferred in cash. In addition, applicable law (including the DGCL), regulatory authorities and the agreements governing the Company’s indebtedness may restrict the Company’s ability to pay dividends on the Series A Strike Preferred. Similarly, statutory, contractual or other restrictions may limit the Company’s subsidiaries’ ability to pay dividends or make distributions, loans or advances to the Company to enable the Company to pay regular dividends to the extent paid in cash on the Series A Strike Preferred.

Priority of Dividends; Limitation on Junior Payments; No Participation Rights

Except as described below under “—Limitation on Dividends on Parity Stock” and “—Limitation on Certain Payments,” the Certificate of Designations does not prohibit or restrict the Company or the Board from declaring or paying any dividend or distribution (whether in cash, securities or other property, or any combination of the foregoing) on any class or series of the Company’s stock, and, unless such dividend or distribution is declared on the Series A Strike Preferred, the Series A Strike Preferred will not be entitled to participate in such dividend or distribution.

For purposes of the descriptions below under the captions “—Limitation on Dividends on Parity Stock” and

“—Limitation on Certain Payments,” a regular dividend on the Series A Strike Preferred will be deemed to have been paid if such regular dividend is declared and consideration in kind and amount that is sufficient, in accordance with the Certificate of Designations, to pay such regular dividend is set aside for the benefit of the preferred stockholders entitled thereto.

Limitation on Dividends on Parity Stock

If:

then, until and unless all accumulated and unpaid regular dividends on the outstanding Series A Strike Preferred have been paid, no dividends may be declared or paid on any class or series of dividend parity stock unless regular dividends are simultaneously declared on the Series A Strike Preferred on a pro rata basis, such that (i) the ratio of (x) the dollar amount of regular dividends so declared per share of Series A Strike Preferred to (y) the dollar amount of the total accumulated and unpaid regular dividends per share of Series A Strike Preferred immediately before the payment of such regular dividend is no less than (ii) the ratio of (x) the dollar amount of dividends so declared or paid per share of such class or series of dividend parity stock to (y) the dollar amount of the total accumulated and unpaid dividends per share of such class or series of dividend parity stock immediately before the payment of such dividend (which dollar amount in this clause (y) will, if dividends on such class or series of dividend parity stock are not cumulative, be the full amount of dividends per share thereof in respect of the most recent dividend period thereof).

Limitation on Certain Payments

If any Series A Strike Preferred is outstanding, then no dividends or distributions (whether in cash, securities or other property, or any combination of the foregoing) will be declared or paid on any of the Company’s “junior stock” (as defined below under the caption “—Definitions”), and neither the Company nor any of the Company’s subsidiaries will purchase, redeem or otherwise acquire for value (whether in cash, securities or other property, or any combination of the foregoing) any of the Company’s junior stock or dividend parity stock, in each case unless all accumulated regular dividends, if any, on the Series A Strike Preferred then outstanding for all prior completed regular dividend periods, if any, have been paid in full. However, the restrictions described in the preceding sentence will not apply to the following:

For the avoidance of doubt, the provisions described in this “—Limitation on Certain Payments” section will not prohibit or restrict the payment or other acquisition for value of any debt securities that are convertible into, or exchangeable for, any capital stock.

Any dividend senior stock that the Company may issue in the future could contain provisions similar to the one described in this “—Limitation on Certain Payments” section, which could prohibit the Company from paying accumulated dividends on the of Series A Strike Preferred or purchasing, redeeming or acquiring the of Series A Strike Preferred until and unless the Company first pays accumulated dividends in full on such dividend senior stock.

Rights Upon the Company’s Liquidation, Dissolution or Winding Up

If the Company liquidates, dissolves or winds up, whether voluntarily or involuntarily, then, subject to the rights of any of the Company’s creditors or holders of any outstanding liquidation senior stock, each share of Series A Strike Preferred will entitle the holder thereof to receive payment for the following amount out of the Company’s assets or funds legally available for distribution to the Company’s stockholders, before any such assets or funds are distributed to, or set aside for the benefit of, any liquidation junior stock:

Upon payment of such amount in full on the outstanding Series A Strike Preferred, holders of the Series A Strike Preferred will have no rights to the Company’s remaining assets or funds, if any. If such assets or funds are insufficient to fully pay such amount on all outstanding shares of Series A Strike Preferred and the corresponding amounts payable in respect of all outstanding shares of liquidation parity stock, if any, then, subject to the rights of any of the Company’s creditors or holders of any outstanding liquidation senior stock, such assets or funds will be distributed ratably on the outstanding shares of Series A Strike Preferred and liquidation parity stock in proportion to the full respective distributions to which such shares would otherwise be entitled.

For purposes of the provisions described above in this “—Rights Upon the Company’s Liquidation, Dissolution or Winding Up” section, the Company’s consolidation or combination with, or merger with or into, or the sale, lease or other transfer of all or substantially all of its assets (other than a sale, lease or other transfer in connection with its liquidation, dissolution or winding up) to, another person will not, in itself, constitute the Company’s liquidation, dissolution or winding up, even if, in connection therewith, the Series A Strike Preferred is converted into, or is exchanged for, or represents solely the right to receive, other securities, cash or other property, or any combination of the foregoing.

The Certificate of Designations does not contain any provision requiring funds to be set aside to protect the liquidation preference of the Series A Strike Preferred, even though it is substantially in excess of the par value thereof. As such, the Company may have no assets or funds available for payment on the Series A Strike Preferred upon its liquidation, dissolution or winding up.

Voting Rights

The Series A Strike Preferred has no voting rights except as described below or as provided in the Certificate or required by the DGCL.

Right to Designate up to Two Preferred Stock Directors Upon Regular Dividend Non-Payment Events

Generally

If a “regular dividend non-payment event” (as defined below under the caption “—Definitions”) occurs, then, subject to the other provisions described below, the authorized number of the Company’s directors will automatically increase by one (or the Company will vacate the offices of one director) and the preferred stockholders, voting together as a single class with the holders of each class or series of voting parity stock, if any, with similar voting rights regarding the election of directors upon a failure to pay dividends, which similar voting rights are then exercisable, will have the right to elect one director to fill such directorship at the Company’s next annual meeting of stockholders (or, if earlier, at a special meeting of the Company’s stockholders called for such purpose) and at each following annual meeting of the Company’s stockholders until such regular dividend non-payment event has been cured, at which time such right will terminate with respect to the Series A Strike Preferred until and unless a subsequent regular dividend non-payment event occurs. However, as a condition to the election of any such director, whom is referred to herein as a “preferred stock director,” such election must not cause the Company to violate any rule of any securities exchange or other trading facility on which any of the Company’s securities are then listed or qualified for trading requiring that a majority of the Company’s directors be independent. This condition is referred to herein as the “director qualification requirement.” In addition, notwithstanding anything to the contrary, the Board will at no time include more than two preferred stock directors, regardless of how many classes of voting parity stock (which term, solely for purposes of this sentence, includes the Series A Strike Preferred) have rights that are then exercisable to elect any number of preferred stock directors. Upon the termination of such right with respect to the Series A Strike Preferred and all other outstanding voting parity stock, if any, the term of office of any person then serving as a preferred stock director will immediately and automatically terminate (and, if the authorized number of the Company’s directors was increased by one or two, as applicable, in connection with such regular dividend non-payment event(s), then the authorized number of the Company’s directors will automatically decrease by one or two, as applicable).

A preferred stock director will hold office until the Company’s next annual meeting of stockholders or, if earlier, upon his or her death, resignation or removal or the termination of the term of such office as described above. However, if:

then (x) holders of the Series A Strike Preferred will be entitled to vote, as a single class with the holders of such class or series of voting parity stock, at such special meeting in respect of such election of such new director(s); and (y) the office of any such preferred stock director of the Series A Strike Preferred will terminate upon the election, at such special meeting, of the new director(s).

For the avoidance of doubt, the compensation, if any, payable to any preferred stock director will be at the Company’s sole and absolute discretion.

Removal and Vacancies of a Preferred Stock Director

At any time, a preferred stock director may be removed either (i) with cause in accordance with applicable law;

or (ii) with or without cause by the affirmative vote of the preferred stockholders, voting together as a single

class with the holders of each class or series of voting parity stock, if any, with similar voting rights regarding the election of directors upon a failure to pay dividends, which similar voting rights are then exercisable,

representing a majority of the combined voting power of the Series A Strike Preferred and such voting parity stock.

During the continuance of a regular dividend non-payment event, a vacancy in the office of a preferred stock director (other than a vacancy before the initial election of the preferred stock director in connection with such regular dividend non-payment event) may be filled, subject to the director qualification requirement, by the affirmative vote of the preferred stockholders, voting together as a single class with the holders of each class or series of voting parity stock, if any, with similar voting rights regarding the election of directors upon a failure to pay dividends, which similar voting rights are then exercisable, representing a majority of the combined voting power of the Series A Strike Preferred and such voting parity stock.

The Right to Call a Special Meeting to Elect a Preferred Stock Director

During the continuance of a regular dividend non-payment event, the preferred stockholders, and holders of each class or series of voting parity stock, if any, with similar voting rights regarding the election of directors upon a failure to pay dividends, which similar voting rights are then exercisable, representing at least 25% of the combined voting power of the Series A Strike Preferred and such voting parity stock will have the right to call a special meeting of stockholders for the election of a preferred stock director (including an election to fill any vacancy in the office of a preferred stock director). Such right may be exercised by written notice, executed by such preferred stockholders and holders, as applicable, delivered to the Company at its principal executive offices (except that, in the case of any global certificate representing the Series A Strike Preferred or such voting parity stock, such notice must instead comply with the applicable depositary procedures). However, if the Company’s next annual or special meeting of stockholders is scheduled to occur within 90 days after such right is exercised, and the Company is otherwise permitted to conduct such election at such next annual or special meeting, then such election will instead be included in the agenda for, and conducted at, such next annual or special meeting.

Voting and Consent Rights with Respect to Specified Matters

Subject to the other provisions described below, while any Series A Strike Preferred is outstanding, each of the following events will require, and cannot be effected without, the affirmative vote or consent of preferred

stockholders, and holders of each class or series of voting parity stock, if any, with similar voting or consent rights with respect to such event, representing at least a majority of the combined outstanding voting power of

the Series A Strike Preferred and such voting parity stock, if any:

(1) any amendment, modification or repeal of any provision of the Certificate or the Certificate of Designations that materially adversely affects the special rights, preferences or voting powers of the Series A Strike Preferred (other than an amendment, modification or repeal permitted by the provisions described below under the caption “—Certain Amendments Permitted Without Consent”); or

(2) the Company’s consolidation or combination with, or merger with or into, another person, or any binding or statutory share exchange or reclassification involving the Series A Strike Preferred, in each case unless:

However, a consolidation, combination, merger, share exchange or reclassification that satisfies the requirements of clauses (a), (b) and (c) of paragraph (2) above will not require any vote or consent pursuant to paragraph

(1) above. In addition, each of the following will be deemed not to materially adversely affect the rights, preferences or voting powers of the Series A Strike Preferred (or cause any of the rights, preferences or voting powers of any such preference securities to be materially less favorable as described above) and will not require any vote or consent pursuant to either of the preceding clauses (1) or (2):

If any event described in paragraphs (1) or (2) above would materially adversely affect the rights, preferences or voting powers of one or more, but not all, classes or series of voting parity stock (which term, solely for these purposes, includes the Series A Strike Preferred), then those classes or series whose rights, preferences or voting powers would not be materially adversely affected will be deemed not to have voting or consent rights with respect to such event. Furthermore, an amendment, modification or repeal described in paragraph (1) above that materially adversely affects the special rights, preferences or voting powers of the Series A Strike Preferred cannot be effected without the affirmative vote or consent of preferred stockholders, voting separately as a class, of at least a majority of the Series A Strike Preferred then outstanding.

Certain Amendments Permitted Without Consent

Notwithstanding anything to the contrary described in paragraph (1) above under the caption “—Voting and Consent Rights with Respect to Specified Matters,” the Company may amend, modify or repeal any of the terms of the Series A Strike Preferred without the vote or consent of any preferred stockholder to:

Procedures for Voting and Consents

If any vote or consent of the preferred stockholders will be held or solicited, including at a regular annual meeting or a special meeting of stockholders, then the Board will adopt customary rules and procedures at its discretion to govern such vote or consent, subject to the other provisions described in this section. Such rules and procedures may include fixing a record date to determine the preferred stockholders (and, if applicable, holders of voting parity stock) that are entitled to vote or provide consent, as applicable, rules governing the solicitation and use of proxies or written consents and customary procedures for the nomination and designation, by preferred stockholders (and, if applicable, holders of voting parity stock), of preferred stock directors for election. Without limiting the foregoing, the persons calling any special meeting of stockholders pursuant to the provisions described above under “—Right to Designate up to Two Preferred Stock Directors Upon Regular Dividend Non-Payment Events—The Right to Call a Special Meeting to Elect a Preferred Stock Director” will, at their election, be entitled to specify one or more preferred stock director nominees in the notice referred to in such section, if such special meeting is scheduled to include the election of any preferred stock director (including an election to fill any vacancy in the office of any preferred stock director).

Each share of Series A Strike Preferred will be entitled to one vote on each matter on which the holders of the Series A Strike Preferred are entitled to vote separately as a class and not together with the holders of any other class or series of stock. The respective voting powers of the Series A Strike Preferred and all classes or series of voting parity stock entitled to vote on any matter together as a single class will be determined (including for purposes of determining whether a plurality, majority or other applicable portion of votes has been obtained) in proportion to their respective liquidation amounts. Solely for these purposes, the liquidation amount of the Series A Strike Preferred or any such class or series of voting parity stock will be the maximum amount payable in respect of the Series A Strike Preferred or such class or series, as applicable, assuming the Company is liquidated on the record date for the applicable vote or consent (or, if there is no record date, on the date of such vote or consent).

At any meeting in which the Series A Strike Preferred (and, if applicable, any class or series of voting parity stock) is entitled to elect any preferred stock director (including to fill any vacancy in the office of any preferred stock director), the presence, in person or by proxy, of holders of Series A Strike Preferred (and, if applicable,

holders of each such class or series) representing a majority of the outstanding voting power of the Series A Strike Preferred (and, if applicable, each such class or series) will constitute a quorum. The affirmative vote of a majority of the outstanding voting power of the Series A Strike Preferred (and, if applicable, each such class or series) cast at such a meeting at which a quorum is present will be sufficient to elect a preferred stock director.

A consent or affirmative vote of the preferred stockholders pursuant to the provisions described above under the caption “—Voting and Consent Rights with Respect to Specified Matters” may be given or obtained either in writing without a meeting or in person or by proxy at a regular annual meeting or a special meeting of stockholders.

Redemption at the Company’s Option

The Series A Strike Preferred will not be redeemable at the Company’s option except pursuant to an optional redemption or a tax redemption, as described below.

Optional Redemption

Subject to the terms of the Certificate of Designations, the Company has the right, at its election, to redeem all, and not less than all, of the Series A Strike Preferred, at any time, for cash if the total aggregate liquidation preference of Series A Strike Preferred then outstanding is less than 25% of the aggregate liquidation preference of the Series A Strike Preferred issued in the initial offering thereof on the initial issue date. A redemption pursuant to the provision described in this paragraph is referred to herein as an “optional redemption.”

Tax Redemption

Subject to the terms of the Certificate of Designations, the Company has the right, at its election, to redeem all, and not less than all, of the Series A Strike Preferred, at any time, for cash if a “tax event” (as defined below under the caption “—Definitions”) occurs. A redemption pursuant to this provision described in this paragraph is referred to herein as a “tax redemption.”

Redemption Date

The redemption date will be a business day of the Company’s choosing that is no more than 60, nor less than 15, calendar days after the date the Company send the related redemption notice, as described below.

Redemption Price

The redemption price for a share of Series A Strike Preferred called for optional redemption will be an amount equal to (i) the liquidation preference of such share, plus (ii) accumulated and unpaid regular dividends on such share to, but excluding, the redemption date. However, if the redemption date is after a regular record date for a declared regular dividend on the Series A Strike Preferred and on or before the next regular dividend payment date, then (a) the holder of such share at the close of business on such regular record date will be entitled, notwithstanding such redemption, to receive, on or, at the Company’s election, before such regular dividend payment date, such declared regular dividend on such share; and (b) the amount referred to in clause (ii) of the preceding sentence will instead be the excess, if any, of (x) the accumulated and unpaid regular dividends on such share to, but excluding, such redemption date over (y) the amount of such declared regular dividend on such share.

The redemption price for a share of Series A Strike Preferred called for tax redemption will be an amount equal to (i) the greater of (1) the liquidation preference of such share and (2) the average of the last reported sale prices per share of Series A Strike Preferred for the five consecutive trading days ending on, and including, the trading day immediately before the date on which the Company sends the related redemption notice, plus (ii) accumulated and unpaid regular dividends on such share to, but excluding, the redemption date. However, if the redemption date is after a regular record date for a declared regular dividend on the Series A Strike Preferred and on or before the next regular dividend payment date, then (a) the holder of such share at the close of business on such regular record date

will be entitled, notwithstanding such redemption, to receive, on or, at the Company’s election, before such regular dividend payment date, such declared regular dividend on such share; and (b) the amount referred to in clause (ii) of the preceding sentence will instead be the excess, if any, of (x) the accumulated and unpaid regular dividends on such share to, but excluding, such redemption date over (y) the amount of such declared regular dividend on such share.

Redemption Notice

The Company will send to the preferred stockholders notice of the redemption containing certain information set forth in the Certificate of Designations, including the redemption price and the redemption date.

Conversion Rights

Generally

Preferred stockholders will have the right to convert some (subject to the limitation described below) or all of their shares of Series A Strike Preferred into shares of Class A (together with cash in lieu of any fractional share, if applicable), at an initial conversion rate of 0.1000 shares of Class A per share of Series A Strike Preferred (which represents an initial conversion price of approximately $1,000.00 per share of Class A). The conversion rate is subject to adjustment if certain events occur. The “conversion price” (as defined below under the caption “—Definitions”) at any given time will be equal to the liquidation preference divided by the conversion rate in effect at such time. Accordingly, an adjustment to the conversion rate will result in a corresponding, inverse adjustment to the conversion price. Notwithstanding anything to the contrary, in no event will any preferred stockholder be entitled to convert a number of shares of Series A Strike Preferred that is not a whole number.

The Certificate of Designations contains a provision that limits the ability of a beneficial owner of Series A Strike Preferred to convert less than all of such beneficial owner’s Series A Strike Preferred unless the total number of shares of such beneficial owner’s Series A Strike Preferred surrendered for conversion with the same conversion date is such that the consideration due upon such conversion includes at least one whole share of Class A. Specifically, the minimum number of shares of a beneficial owner’s Series A Strike Preferred that may be surrendered for conversion with the same conversion date is the lesser of (i) all of such beneficial owner’s Series A Strike Preferred; and (ii) a number of shares equal to the “minimum perpetual strike preferred stock conversion denomination” (as defined below under the caption “—Definitions”).

When the Series A Strike Preferred May Be Converted

Except as described below, Series A Strike Preferred may be surrendered for conversion only after the “open of business” (as defined below under the caption “—Definitions”) and before the close of business on a day that is a business day.

If a preferred stockholder has validly delivered a “fundamental change repurchase notice” (as defined below under the caption “—Fundamental Change Permits Preferred Stockholders to Require the Company to Repurchase Series A Strike Preferred”) with respect to any share of Series A Strike Preferred, then such share may not be converted, except to the extent (i) such notice is withdrawn in accordance with the procedures described below; or (ii) the Company fails to pay the related fundamental change repurchase price for such share. In addition, if the Company calls the Series A Strike Preferred for redemption, then the Series A Strike Preferred may not be converted after the close of business on the second business day immediately before the related redemption date (unless the Company fails to pay the redemption price due on such redemption date in full, in which case the Series A Strike Preferred may be converted at any time until such time as the Company pays such redemption price in full).

Treatment of Dividends Upon Conversion

The Company will not adjust the conversion rate to account for any accumulated and unpaid dividends on any Series A Strike Preferred being converted. Notwithstanding anything to the contrary, if the conversion date of

any share of Series A Strike Preferred is after a regular record date for a declared regular dividend on the Series A Strike Preferred and on or before the next regular dividend payment date, then:

However, such holder need not deliver such cash:

Conversion Procedures

To convert a beneficial interest in a global certificate, the owner of the beneficial interest must:

Issuance of Class A Common Stock.”

To convert any share of Series A Strike Preferred represented by a physical certificate, the holder of such share must:

The first business day on which the requirements described above to convert a share of Series A Strike Preferred are satisfied is referred to herein as the “conversion date.”

Settlement Upon Conversion

Consideration Due Upon Conversion

Upon conversion of any Series A Strike Preferred, the Company will deliver, for each share of Series A Strike Preferred being converted, a number of shares of Class A equal to the conversion rate in effect immediately before the close of business on the conversion date for such conversion. However, in lieu of delivering any fractional share of Class A otherwise due upon conversion, the Company will, to the extent it is legally able to do so, pay

cash based on the last reported sale price per share of the Class A on the conversion date for such conversion (or, if such conversion date is not a trading day, the immediately preceding trading day). In the event that the Company cannot pay cash in lieu of a fractional share, the Company will, to the extent authorized, unissued and unreserved shares of Class A are available, instead round up to the nearest whole share for each holder and the Company will not have any obligation to pay such amount in cash. The consideration due upon conversion of any Series A Strike Preferred is referred to herein as the “conversion consideration.”

Delivery of the Conversion Consideration

The Company will (subject to the depositary procedures, if such Series A Strike Preferred is represented by a global certificate) pay or deliver, as applicable, the conversion consideration due upon conversion of any Series A Strike Preferred on or before the second business day immediately after the conversion date for such conversion.

Delivery of Treasury Shares

Each share of Class A delivered upon conversion of the Series A Strike Preferred will be a newly issued or treasury share. To the extent the Company delivers shares of Class A held in its treasury in settlement of any obligation under the Certificate of Designations to deliver shares of Class A, each reference herein to the issuance of shares of Class A in connection therewith will be deemed to include such delivery.

When Converting Preferred Stockholders Become Stockholders of Record of the Shares of Class A Common Stock Issuable Upon Conversion

The person in whose name any share of Class A is issuable upon conversion of any Series A Strike Preferred will be deemed to become the holder of record of that share as of the close of business on the conversion date for such conversion.

Taxes Upon Issuance of Class A Common Stock

The Company will pay any documentary, stamp or similar issue or transfer tax or duty due on the issue of any shares of Class A upon conversion of, or as payment for all or any portion of any declared regular dividends on, the Series A Strike Preferred of any preferred stockholder. However, if any tax or duty is due because such preferred stockholder requests those shares to be registered in a name other than such preferred stockholder’s name, then such preferred stockholder must pay such tax or duty. For the avoidance of doubt, the Company or any other withholding agent may collect any required withholding tax at the time of conversion or payment or require alternative arrangements (e.g., a deposit for taxes prior to delivery of conversion consideration) to ensure that the Company or such withholding agent is not out of pocket for any potential withholding tax liability (e.g., for any conversion consideration attributable to previously unpaid and accumulated dividends).

Conversion Rate Adjustments

Generally

The conversion rate will be adjusted for the events described below. However, the Company is not required to adjust the conversion rate for these events (other than a stock split or combination or a tender or exchange offer) if each preferred stockholder participates, at the same time and on the same terms as holders of Class A, and solely by virtue of being a holder of the Series A Strike Preferred, in such transaction or event without having to convert such preferred stockholder’s Series A Strike Preferred and as if such preferred stockholder held a number of shares of Class A equal to the product of (i) the conversion rate in effect on the related record date; and (ii) the total number of shares of Series A Strike Preferred held by such preferred stockholder on such record date.

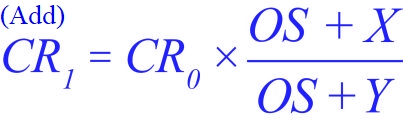

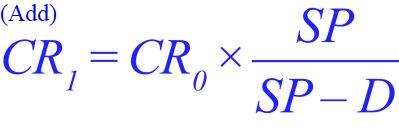

(1) Stock Dividends, Splits and Combinations. If the Company issues solely shares of Class A as a dividend or distribution on all or substantially all shares of Class A, or if the Company effects a stock split or a stock combination of the Class A (in each case excluding an issuance solely pursuant to a class A common stock change event, as to which the provisions described below under the caption “—Effect of Class A Common Stock Change Event” will apply), then the conversion rate will be adjusted based on the following formula:

where:

CR0 = the conversion rate in effect immediately before the close of business on the “record date” (as defined below under the caption “—Definitions”) for such dividend or distribution, or immediately before the close of business on the effective date of such stock split or stock combination, as applicable;

CR1 = the conversion rate in effect immediately after the close of business on such record date or effective date, as applicable;

OS0 = the number of shares of Class A outstanding immediately before the close of business on such record date or effective date, as applicable, without giving effect to such dividend, distribution, stock split or stock combination; and

OS1 = the number of shares of Class A outstanding immediately after giving effect to such dividend, distribution, stock split or stock combination.

If any dividend, distribution, stock split or stock combination of the type described in this paragraph (1) is declared or announced, but not so paid or made, then the conversion rate will be readjusted, effective as of the date the Board determines not to pay such dividend or distribution or to effect such stock split or stock combination, to the conversion rate that would then be in effect had such dividend, distribution, stock split or stock combination not been declared or announced.

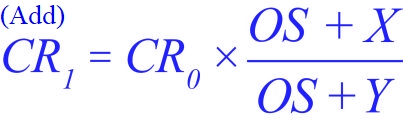

(2) Rights, Options and Warrants. If the Company distributes, to all or substantially all holders of Class A, rights, options or warrants (other than rights issued or otherwise distributed pursuant to a stockholder rights plan, as to which the provisions described below in paragraph (3)(a) and under the caption “—Stockholder Rights Plans” will apply) entitling such holders, for a period of not more than 60 calendar days after the record date of such distribution, to subscribe for or purchase shares of Class A at a price per share that is less than the average of the last reported sale prices per share of the Class A for the 10 consecutive trading days ending on, and including, the trading day immediately before the date such distribution is announced, then the conversion rate will be increased based on the following formula:

where:

CR0 = the conversion rate in effect immediately before the close of business on such record date;

CR1 = the conversion rate in effect immediately after the close of business on such record date;

OS = the number of shares of Class A outstanding immediately before the close of business on such record date;

X = the total number of shares of Class A issuable pursuant to such rights, options or warrants; and

Y = a number of shares of Class A obtained by dividing (x) the aggregate price payable to exercise such rights, options or warrants by (y) the average of the last reported sale prices per share of the Class A for the 10 consecutive trading days ending on, and including, the trading day immediately before the date such distribution is announced.

To the extent such rights, options or warrants are not so distributed, the conversion rate will be readjusted to the conversion rate that would then be in effect had the increase to the conversion rate for such distribution been made on the basis of only the rights, options or warrants, if any, actually distributed. In addition, to the extent that shares of Class A are not delivered after the expiration of such rights, options or warrants (including as a result of such rights, options or warrants not being exercised), the conversion rate will be readjusted to the conversion rate that would then be in effect had the increase to the conversion rate for such

distribution been made on the basis of delivery of only the number of shares of Class A actually delivered upon exercise of such rights, options or warrants.

For purposes of this paragraph (2), in determining whether any rights, options or warrants entitle holders of Class A to subscribe for or purchase shares of Class A at a price per share that is less than the average of the last reported sale prices per share of the Class A for the 10 consecutive trading days ending on, and including, the trading day immediately before the date the distribution of such rights, options or warrants is announced, and in determining the aggregate price payable to exercise such rights, options or warrants, there will be taken into account any consideration the Company receives for such rights, options or warrants and any amount payable on exercise thereof, with the value of such consideration, if not cash, to be determined by the Company in good faith and in a commercially reasonable manner.

(3) Spin-Offs and Other Distributed Property.

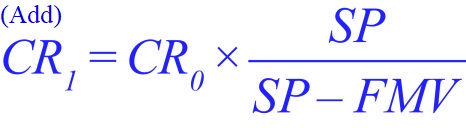

(a) Distributions Other than Spin-Offs. If the Company distributes shares of its “capital stock” (as defined below under the caption “—Definitions”), evidences of its indebtedness or other assets or property of the Company, or rights, options or warrants to acquire the Company’s capital stock or other securities, to all or substantially all holders of the Class A, excluding:

then the conversion rate will be increased based on the following formula:

where:

CR0 = the conversion rate in effect immediately before the close of business on the record date for such distribution;

CR1 = the conversion rate in effect immediately after the close of business on such record date;

SP = the average of the last reported sale prices per share of the Class A for the 10 consecutive trading days ending on, and including, the trading day immediately before the “ex-dividend date” (as defined below under the caption “—Definitions”) for such distribution; and

FMV = the fair market value (as determined by the Company in good faith and in a commercially reasonable manner), as of such record date, of the shares of capital stock, evidences of indebtedness, assets, property, rights, options or warrants distributed per share of Class A pursuant to such distribution.

However, if FMV is equal to or greater than SP, then, in lieu of the foregoing adjustment to the conversion rate, each preferred stockholder will receive, for each share of Series A Strike Preferred held by such preferred stockholder on such record date, at the same time and on the same terms as holders of Class A, and without having to convert its Series A Strike Preferred, the amount and kind of shares of capital stock, evidences of indebtedness, assets, property, rights, options or warrants that such preferred stockholder would have received in such distribution if such preferred stockholder had owned, on such record date, a number of shares of Class A equal to the conversion rate in effect on such record date.

To the extent such distribution is not so paid or made, the conversion rate will be readjusted to the conversion rate that would then be in effect had the adjustment been made on the basis of only the distribution, if any, actually made or paid.

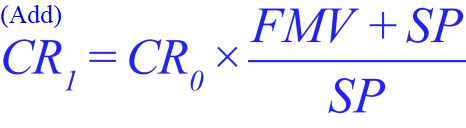

(b) Spin-Offs. If the Company distributes or dividends shares of capital stock of any class or series, or similar equity interests, of or relating to an “affiliate” (as defined below under the caption “—Definitions”) or subsidiary or other business unit of the Company to all or substantially all holders of Class A (other than solely pursuant to (x) a class A common stock change event, as to which the provisions described below under the caption “—Effect of Class A Common Stock Change Event” will apply; or (y) a tender offer or exchange offer for shares of Class A, as to which the provisions described below in paragraph (5) will apply), and such capital stock or equity interests are listed or quoted (or will be listed or quoted upon the consummation of the transaction) on a U.S. national securities exchange (a “spin-off”), then the conversion rate will be increased based on the following formula:

where:

CR0 = the conversion rate in effect immediately before the close of business on the last trading day of the “spin-off valuation period” (as defined below) for such spin-off;

CR1 = the conversion rate in effect immediately after the close of business on the last trading day of the spin-off valuation period;

FMV = the product of (x) the average of the last reported sale prices per share or unit of the capital stock or equity interests distributed in such spin-off over the 10 consecutive trading day period (the “spin-off valuation period”) beginning on, and including, the ex-dividend date for such spin-off (such average to be determined as if references to Class A in the definitions of “last reported sale price,” “trading day” and “market disruption event” were instead references to such capital stock or equity interests); and (y) the number of shares or units of such capital stock or equity interests distributed per share of Class A in such spin-off; and

SP = the average of the last reported sale prices per share of Class A for each trading day in the spin-off valuation period.

Notwithstanding anything to the contrary, if the conversion date for any share of Series A Strike Preferred to be converted occurs during the spin-off valuation period, then, solely for purposes of determining the consideration due in respect of such conversion, such spin-off valuation period will be deemed to consist of the trading days occurring in the period from, and including, the ex-dividend date for such spin-off to, and including, such conversion date.

To the extent any dividend or distribution of the type described above in this paragraph (3)(b) is declared but not made or paid, the conversion rate will be readjusted to the conversion rate that would then be in effect had the adjustment been made on the basis of only the dividend or distribution, if any, actually made or paid.

(4) Cash Dividends or Distributions. If any cash dividend or distribution is made to all or substantially all holders of Class A, then the conversion rate will be increased based on the following formula:

where:

CR0 = the conversion rate in effect immediately before the close of business on the record date for such dividend or distribution;

CR1 = the conversion rate in effect immediately after the close of business on such record date;

SP = the last reported sale price per share of Class A on the trading day immediately before the ex-dividend date for such dividend or distribution; and

D = the cash amount distributed per share of Class A in such dividend or distribution.

However, if D is equal to or greater than SP, then, in lieu of the foregoing adjustment to the conversion rate, each preferred stockholder will receive, for each share of Series A Strike Preferred held by such preferred stockholder on such record date, at the same time and on the same terms as holders of Class A, and without having to convert its Series A Strike Preferred, the amount of cash that such preferred stockholder would have received in such dividend or distribution if such preferred stockholder had owned, on such record date, a number of shares of Class A equal to the conversion rate in effect on such record date. To the extent such dividend or distribution is declared but not made or paid, the conversion rate will be readjusted to the conversion rate that would then be in effect had the adjustment been made on the basis of only the dividend or distribution, if any, actually made or paid.

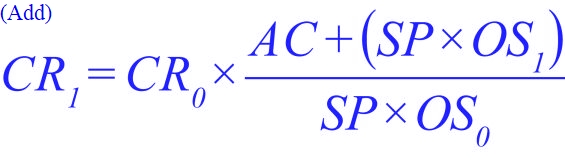

(5) Tender Offers or Exchange Offers. If the Company or any of its subsidiaries makes a payment in respect of a tender offer or exchange offer for shares of Class A (other than solely pursuant to an odd-lot tender offer pursuant to Rule 13e-4(h)(5) under the Exchange Act), and the value (determined as of the expiration time by the Company in good faith and in a commercially reasonable manner) of the cash and other consideration paid per share of Class A in such tender or exchange offer exceeds the last reported sale price per share of the Class A on the trading day immediately after the last date (the “expiration date”) on which tenders or exchanges may be made pursuant to such tender or exchange offer (as it may be amended), then the conversion rate will be increased based on the following formula:

where:

CR0 = the conversion rate in effect immediately before the close of business on the last trading day of the “tender/exchange offer valuation period” (as defined below) for such tender or exchange offer;

CR1 = the conversion rate in effect immediately after the close of business on the last trading day of the tender/exchange offer valuation period;

AC = the aggregate value (determined as of the time (the “expiration time”) such tender or exchange offer expires by the Company in good faith and in a commercially reasonable manner) of all cash and other consideration paid for shares of Class A purchased or exchanged in such tender or exchange offer;

OS0 = the number of shares of Class A outstanding immediately before the expiration time (including all shares of Class A accepted for purchase or exchange in such tender or exchange offer);

OS1 = the number of shares of Class A outstanding immediately after the expiration time (excluding all shares of Class A accepted for purchase or exchange in such tender or exchange offer); and

SP = the average of the last reported sale prices per share of the Class A over the 10 consecutive trading day period (the “tender/exchange offer valuation period”) beginning on, and including, the trading day immediately after the expiration date;

provided, however, that the conversion rate will in no event be adjusted down pursuant to the provisions described in this paragraph (5), except to the extent provided in the immediately following paragraph. Notwithstanding anything to the contrary, if the conversion date for any share of Series A Strike Preferred to be converted occurs during the tender/exchange offer valuation period for such tender or exchange offer, then, solely for purposes of determining the consideration due in respect of such conversion, such tender/exchange offer valuation period will be deemed to consist of the trading days occurring in the period from, and including, the trading day immediately after the expiration date to, and including, such conversion date.

To the extent such tender or exchange offer is announced but not consummated (including as a result of being precluded from consummating such tender or exchange offer under applicable law), or any purchases or exchanges of shares of Class A in such tender or exchange offer are rescinded, the conversion rate will be readjusted to the conversion rate that would then be in effect had the adjustment been made on the basis of only the purchases or exchanges of shares of Class A, if any, actually made, and not rescinded, in such tender or exchange offer.

The Company will not be required to adjust the conversion rate except as described above in this “Conversion Rate Adjustments—Generally” section. Without limiting the foregoing, the Company will not be required to adjust the conversion rate on account of:

Notice of Conversion Rate Adjustments

Upon the effectiveness of any adjustment to the conversion rate pursuant to the provisions described above under the caption “—Conversion Rate Adjustments—Generally,” the Company will, as soon as reasonably practicable and no later than 10 business days after the date of such effectiveness, send notice to the preferred stockholders containing (i) a brief description of the transaction or other event on account of which such adjustment was made; (ii) the conversion rate in effect immediately after such adjustment; and (iii) the effective time of such adjustment.

Voluntary Conversion Rate Increases

To the extent permitted by law and applicable stock exchange rules, the Company, from time to time, may (but is not required to) increase the conversion rate by any amount if (i) the Board determines that such increase is in the Company’s best interest or that such increase is advisable to avoid or diminish any income tax imposed on holders of Class A or rights to purchase Class A as a result of any dividend or distribution of shares (or rights to acquire shares) of the Company’s common stock or any similar event; (ii) such increase is in effect for a period of at least 20 business days; and (iii) such increase is irrevocable during such period.

Tax Considerations

A holder or beneficial owner of the Series A Strike Preferred may, in some circumstances, including a cash distribution or dividend on the Class A, be deemed to have received a distribution that is subject to U.S. federal income tax as a result of an adjustment or the non-occurrence of an adjustment to the conversion rate or with respect to any deferred dividend or discount at issuance. Applicable withholding taxes (including backup withholding) may be withheld from dividends and payments upon conversion of the Series A Strike Preferred. In addition, if any withholding taxes (including backup withholding) are paid on behalf of a preferred stockholder, then those withholding taxes may be set off against payments of cash or the delivery of shares of Class A in respect of the Series A Strike Preferred (or, in some circumstances, any payments on the Class A) or sales proceeds received by, or other funds or assets of, that preferred stockholder. The Company or any other withholding agent may also require alternative arrangements to collect any withholding tax (e.g., a deposit for taxes prior to delivery of conversion consideration) to ensure that the Company or such withholding agent is not out-of-pocket for any potential withholding tax liability.

The Deferral Exception

If an adjustment to the conversion rate otherwise required by the Certificate of Designations would result in a change of less than 1% to the conversion rate, then the Company may, at its election, defer and carry forward such adjustment, except that all such deferred adjustments must be given effect immediately upon the earliest of the following: (i) when all such deferred adjustments would, had they not been so deferred and carried forward, result in a change of at least 1% to the conversion rate; (ii) the conversion date of any share of Series A Strike Preferred; (iii) the day the Company sends a notice of redemption; and (iv) the date on which a fundamental change occurs. The Company’s ability to defer adjustments as described above is referred to herein as the “deferral exception.”

Stockholder Rights Plans

If any shares of Class A are to be issued upon conversion of any Series A Strike Preferred and, at the time of such conversion, the Company has in effect any stockholder rights plan, then the holder of such Series A Strike Preferred will be entitled to receive, in addition to, and concurrently with the delivery of, the consideration otherwise due upon such conversion, the rights set forth in such stockholder rights plan, unless such rights have separated from the Class A at such time, in which case, and only in such case, the conversion rate will be adjusted pursuant to the provisions described above in paragraph (3)(a) under the caption “—Conversion Rate Adjustments—Generally” on account of such separation as if, at the time of such separation, the Company had made a distribution of the type referred to in such paragraph to all holders of the Class A, subject to potential readjustment pursuant to the provisions described in such paragraph.

Effect of Class A Common Stock Change Event

Generally

If there occurs any:

and, as a result of which, the Class A is converted into, or is exchanged for, or represents solely the right to receive, other securities, cash or other property, or any combination of the foregoing (such an event, a “class A common stock change event,” and such other securities, cash or property, the “reference property,” and the amount and kind of reference property that a holder of one share of Class A would be entitled to receive on account of such class A common stock change event (without giving effect to any arrangement not to issue or deliver a fractional portion of any security or other property), a “reference property unit”), then, notwithstanding anything to the contrary,