The Q3 2025 Investor Update should be read in conjunction with the Q3 2025 Earnings Release issued on October 22, 2025. Investor Update Q3 2025 .2

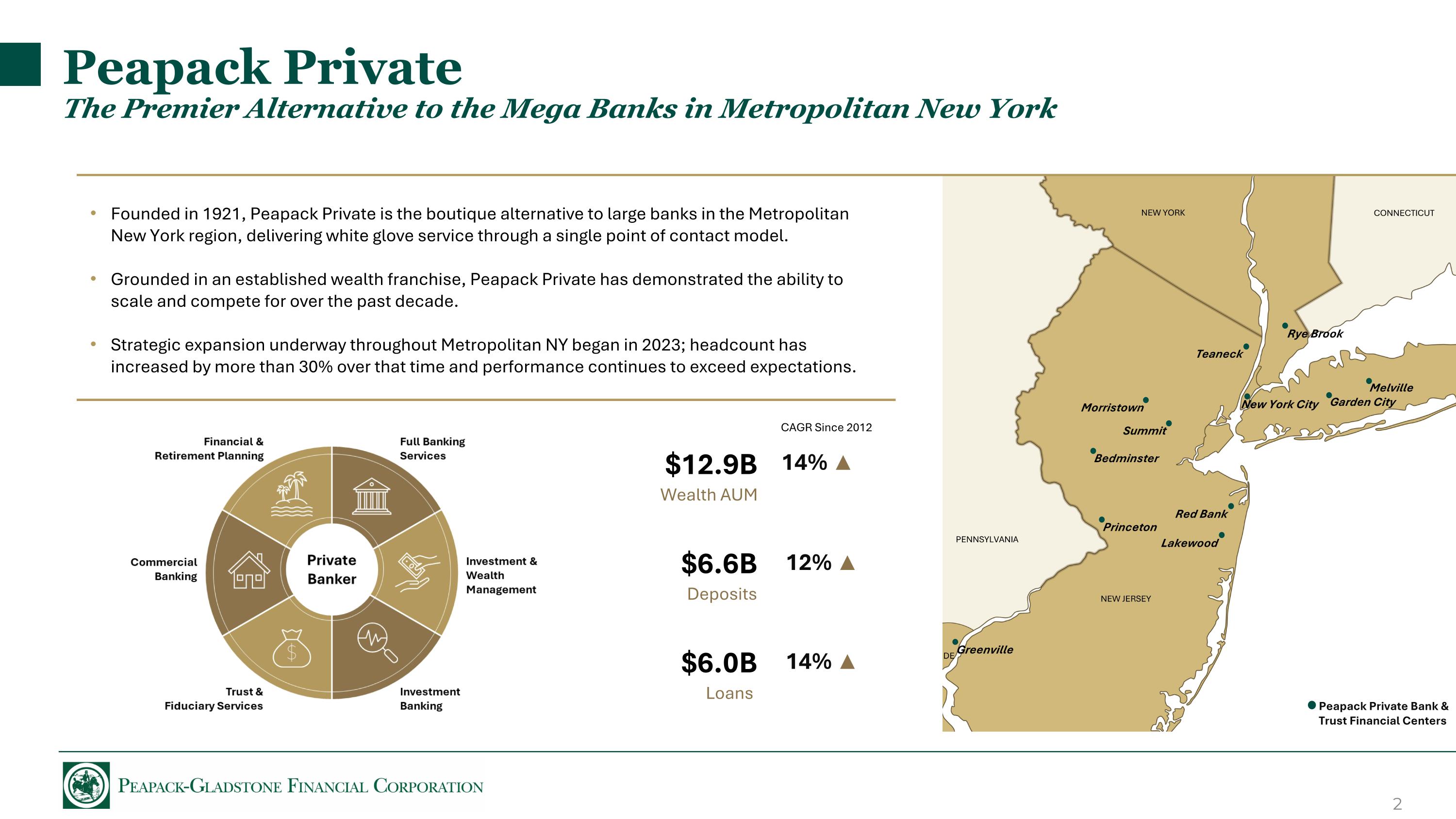

Bedminster New York City Melville NEW YORK NEW JERSEY CONNECTICUT PENNSYLVANIA Greenville Rye Brook Princeton Morristown Summit Red Bank Lakewood Teaneck DE Peapack Private Bank & Trust Financial Centers Garden City Peapack Private The Premier Alternative to the Mega Banks in Metropolitan New York $12.9B Wealth AUM $6.6B Deposits $6.0B Loans 14% ▲ 12% ▲ 14% ▲ CAGR Since 2012 Founded in 1921, Peapack Private is the boutique alternative to large banks in the Metropolitan New York region, delivering white glove service through a single point of contact model. Grounded in an established wealth franchise, Peapack Private has demonstrated the ability to scale and compete for over the past decade. Strategic expansion underway throughout Metropolitan NY began in 2023; headcount has increased by more than 30% over that time and performance continues to exceed expectations.

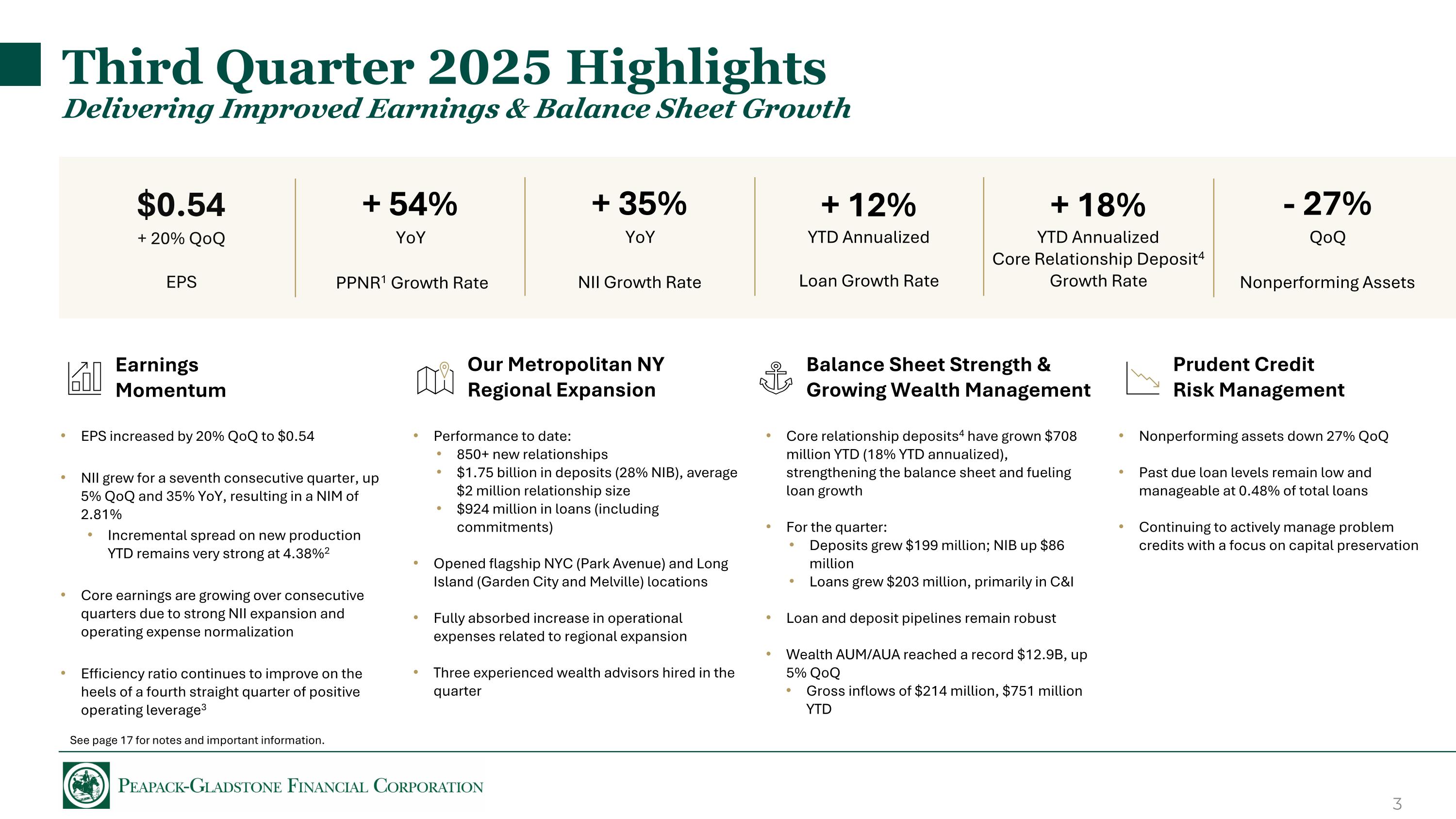

EPS increased by 20% QoQ to $0.54 NII grew for a seventh consecutive quarter, up 5% QoQ and 35% YoY, resulting in a NIM of 2.81% Incremental spread on new production YTD remains very strong at 4.38%2 Core earnings are growing over consecutive quarters due to strong NII expansion and operating expense normalization Efficiency ratio continues to improve on the heels of a fourth straight quarter of positive operating leverage3 Performance to date: 850+ new relationships $1.75 billion in deposits (28% NIB), average $2 million relationship size $924 million in loans (including commitments) Opened flagship NYC (Park Avenue) and Long Island (Garden City and Melville) locations Fully absorbed increase in operational expenses related to regional expansion Three experienced wealth advisors hired in the quarter Core relationship deposits4 have grown $708 million YTD (18% YTD annualized), strengthening the balance sheet and fueling loan growth For the quarter: Deposits grew $199 million; NIB up $86 million Loans grew $203 million, primarily in C&I Loan and deposit pipelines remain robust Wealth AUM/AUA reached a record $12.9B, up 5% QoQ Gross inflows of $214 million, $751 million YTD Nonperforming assets down 27% QoQ Past due loan levels remain low and manageable at 0.48% of total loans Continuing to actively manage problem credits with a focus on capital preservation Earnings Momentum Our Metropolitan NY Regional Expansion Balance Sheet Strength & Growing Wealth Management Prudent Credit Risk Management Third Quarter 2025 Highlights Delivering Improved Earnings & Balance Sheet Growth $0.54 + 20% QoQ EPS + 54% YoY PPNR1 Growth Rate + 35% YoY NII Growth Rate - 27% QoQ Nonperforming Assets + 18% YTD Annualized Core Relationship Deposit4 Growth Rate + 12% YTD Annualized Loan Growth Rate See page 17 for notes and important information.

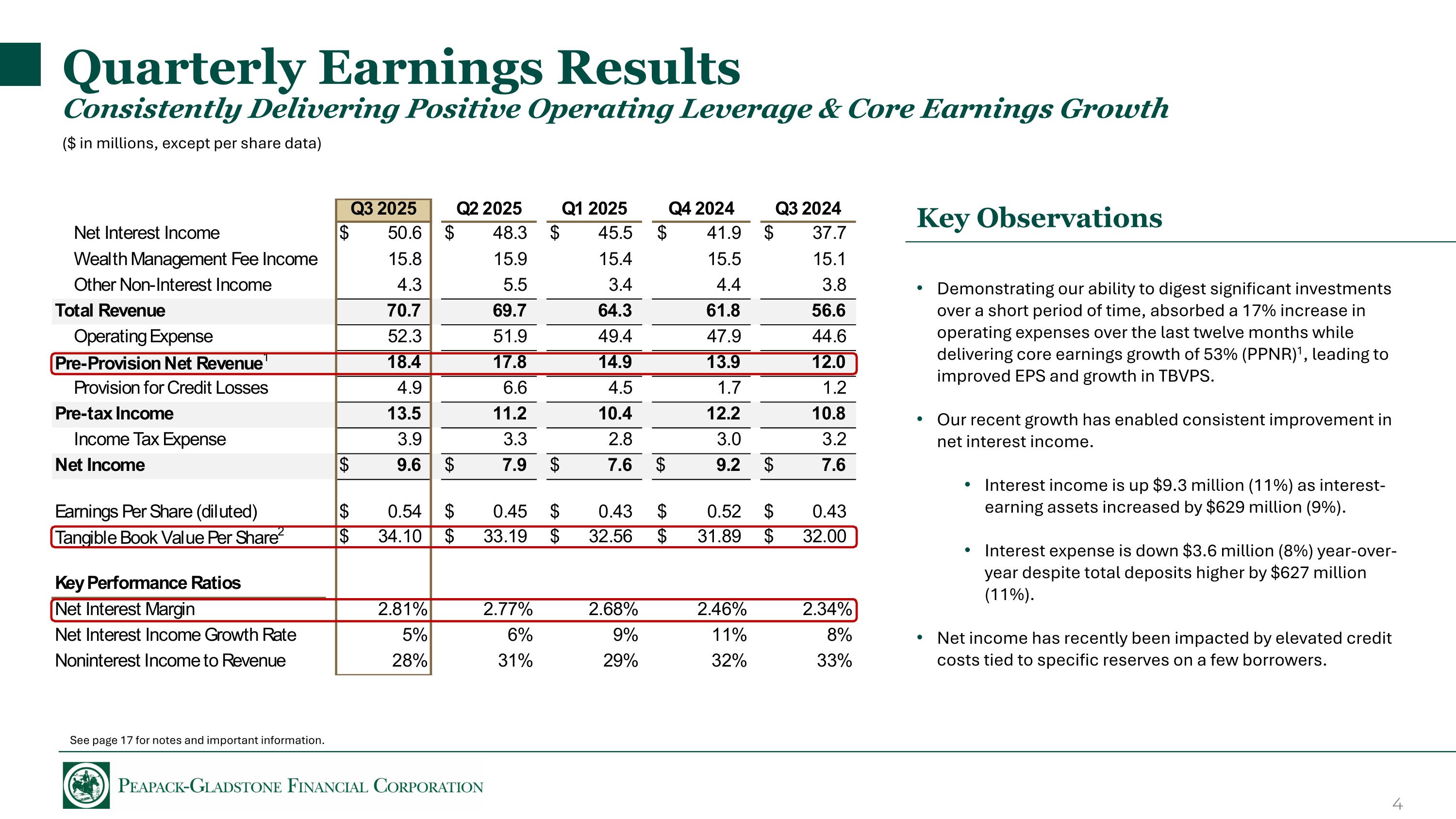

Quarterly Earnings Results Consistently Delivering Positive Operating Leverage & Core Earnings Growth Key Observations Demonstrating our ability to digest significant investments over a short period of time, absorbed a 17% increase in operating expenses over the last twelve months while delivering core earnings growth of 53% (PPNR)1, leading to improved EPS and growth in TBVPS. Our recent growth has enabled consistent improvement in net interest income. Interest income is up $9.3 million (11%) as interest-earning assets increased by $629 million (9%). Interest expense is down $3.6 million (8%) year-over-year despite total deposits higher by $627 million (11%). Net income has recently been impacted by elevated credit costs tied to specific reserves on a few borrowers. ($ in millions, except per share data) See page 17 for notes and important information.

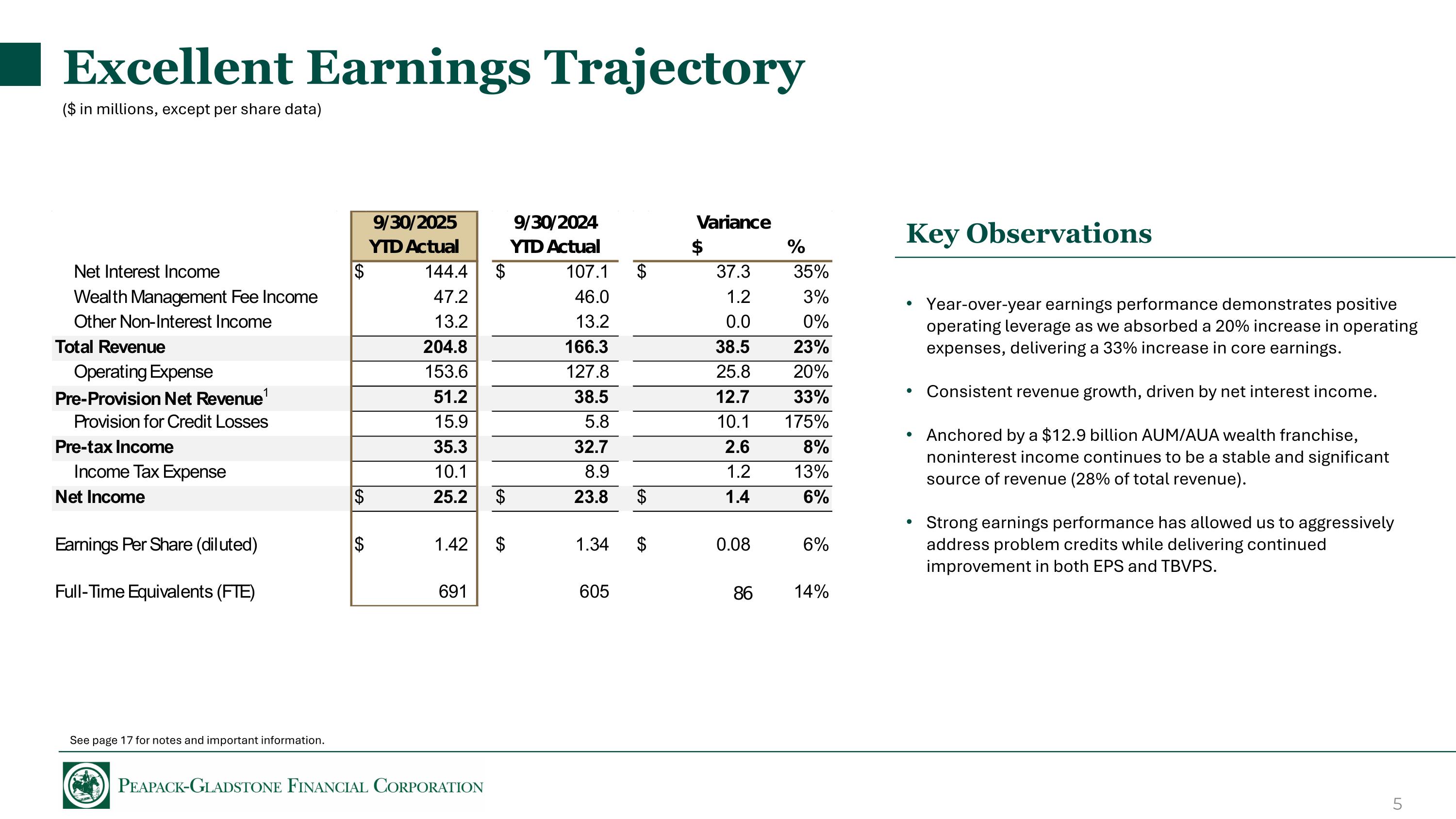

Excellent Earnings Trajectory Key Observations Year-over-year earnings performance demonstrates positive operating leverage as we absorbed a 20% increase in operating expenses, delivering a 33% increase in core earnings. Consistent revenue growth, driven by net interest income. Anchored by a $12.9 billion AUM/AUA wealth franchise, noninterest income continues to be a stable and significant source of revenue (28% of total revenue). Strong earnings performance has allowed us to aggressively address problem credits while delivering continued improvement in both EPS and TBVPS. ($ in millions, except per share data) See page 17 for notes and important information.

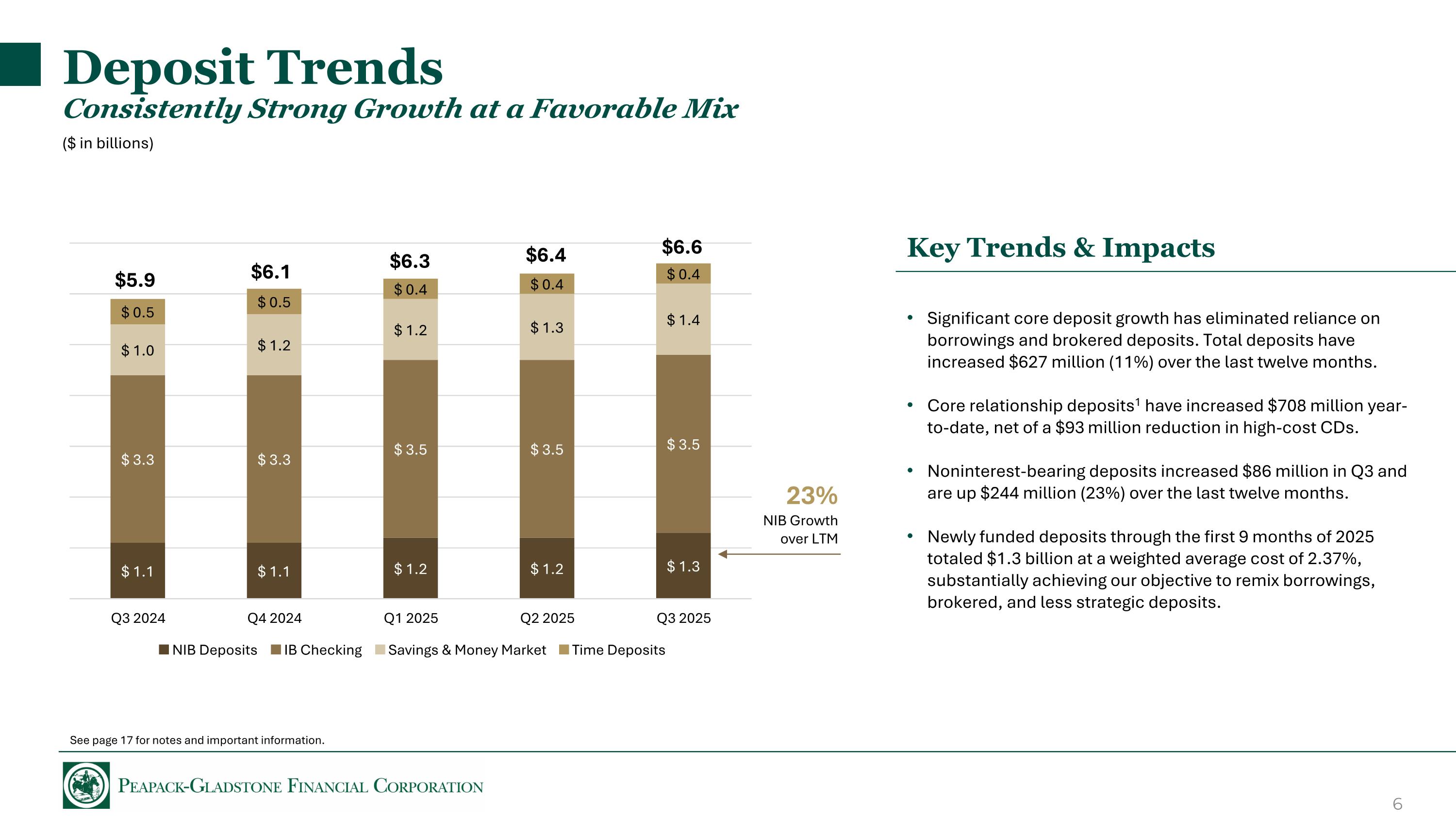

Deposit Trends Consistently Strong Growth at a Favorable Mix Key Trends & Impacts Significant core deposit growth has eliminated reliance on borrowings and brokered deposits. Total deposits have increased $627 million (11%) over the last twelve months. Core relationship deposits1 have increased $708 million year-to-date, net of a $93 million reduction in high-cost CDs. Noninterest-bearing deposits increased $86 million in Q3 and are up $244 million (23%) over the last twelve months. Newly funded deposits through the first 9 months of 2025 totaled $1.3 billion at a weighted average cost of 2.37%, substantially achieving our objective to remix borrowings, brokered, and less strategic deposits. $5.9 $6.1 $6.3 $6.4 23% NIB Growth over LTM ($ in billions) $6.6 See page 17 for notes and important information.

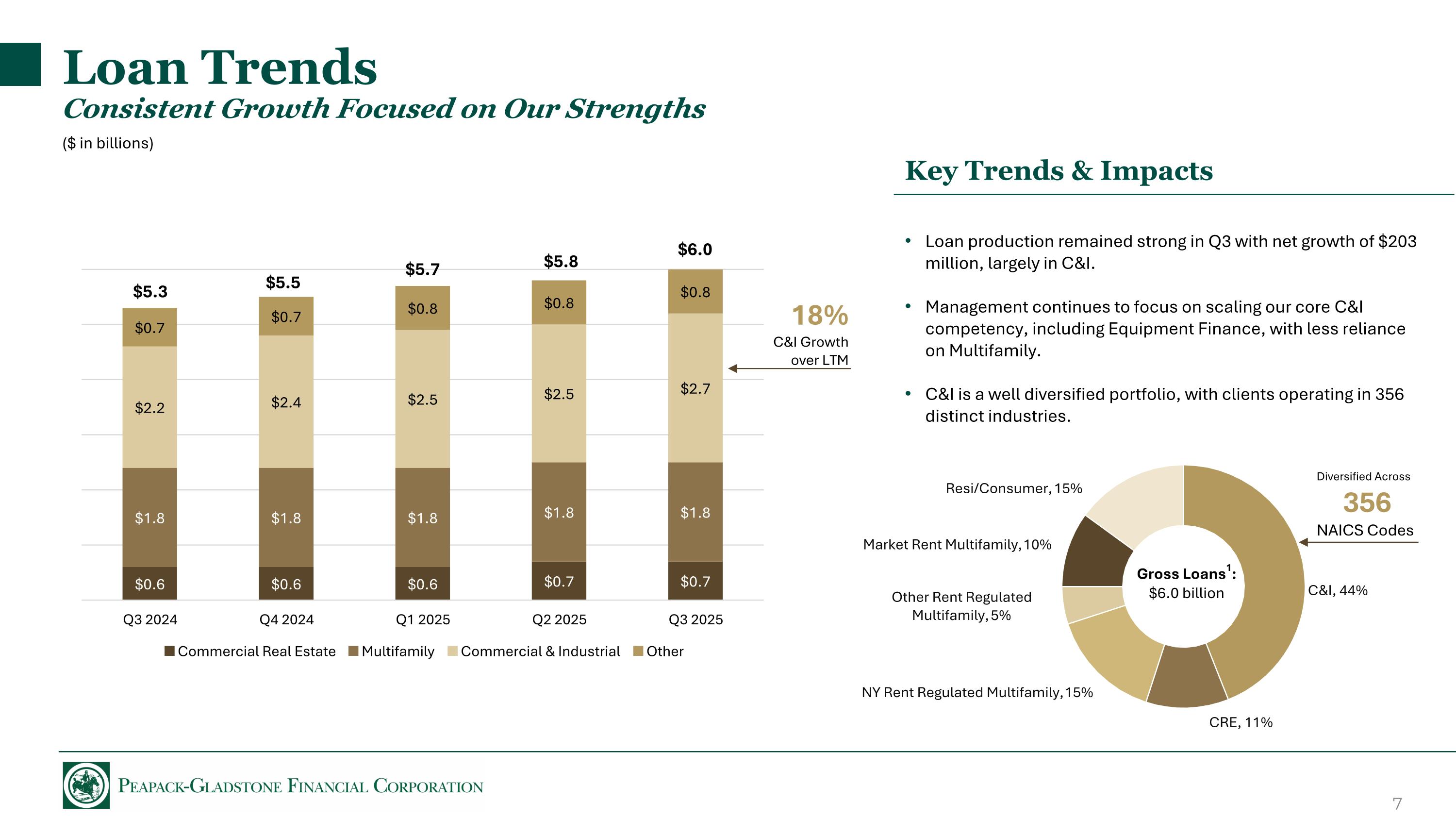

Loan Trends Consistent Growth Focused on Our Strengths Key Trends & Impacts Loan production remained strong in Q3 with net growth of $203 million, largely in C&I. Management continues to focus on scaling our core C&I competency, including Equipment Finance, with less reliance on Multifamily. C&I is a well diversified portfolio, with clients operating in 356 distinct industries. Diversified Across 356 NAICS Codes Gross Loans1: $6.0 billion $5.3 $5.5 $5.7 $5.8 $6.0 ($ in billions) 18% C&I Growth over LTM

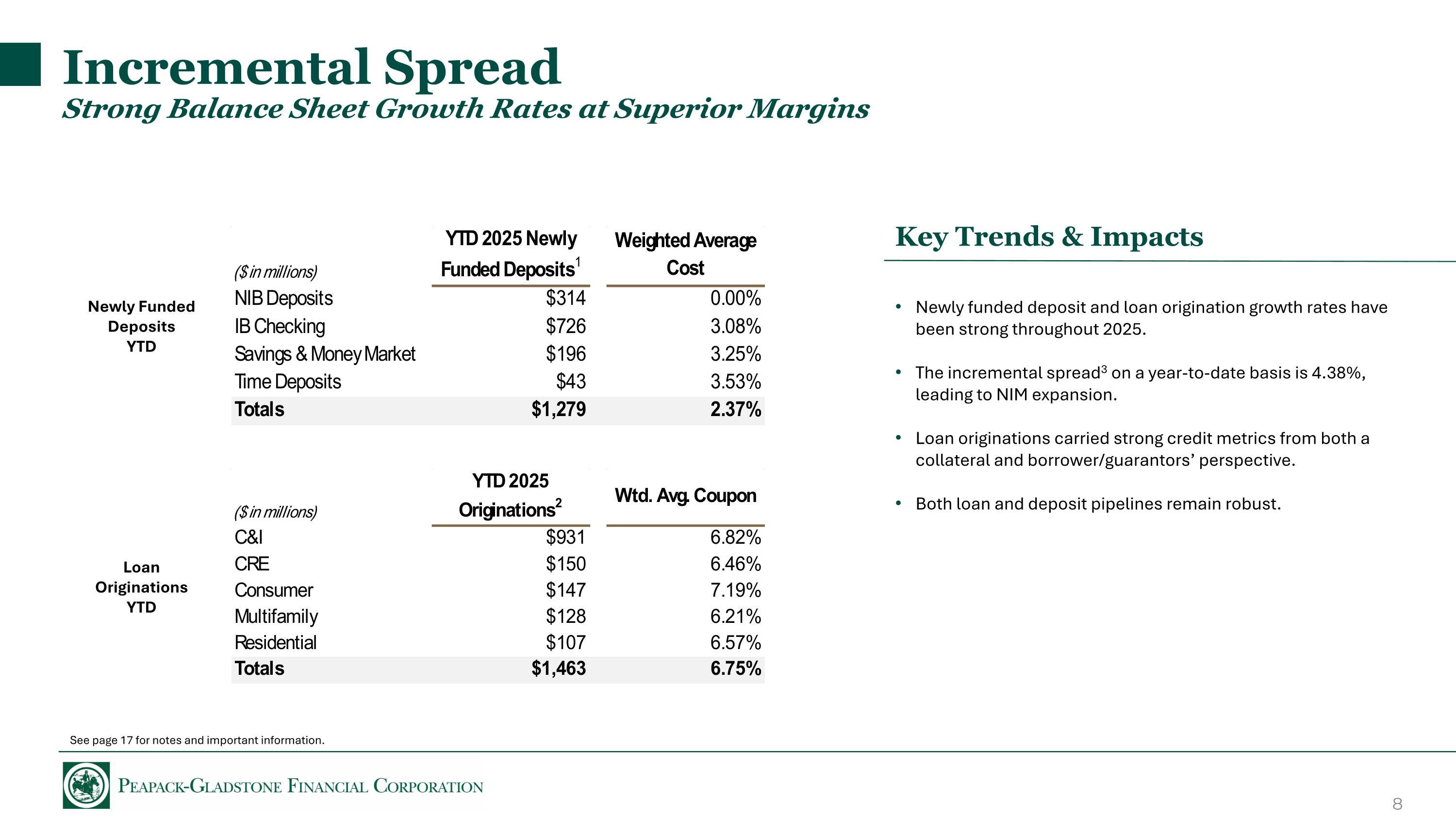

Incremental Spread Strong Balance Sheet Growth Rates at Superior Margins Key Trends & Impacts Newly funded deposit and loan origination growth rates have been strong throughout 2025. The incremental spread3 on a year-to-date basis is 4.38%, leading to NIM expansion. Loan originations carried strong credit metrics from both a collateral and borrower/guarantors’ perspective. Both loan and deposit pipelines remain robust. Loan Originations YTD Newly Funded Deposits YTD See page 17 for notes and important information.

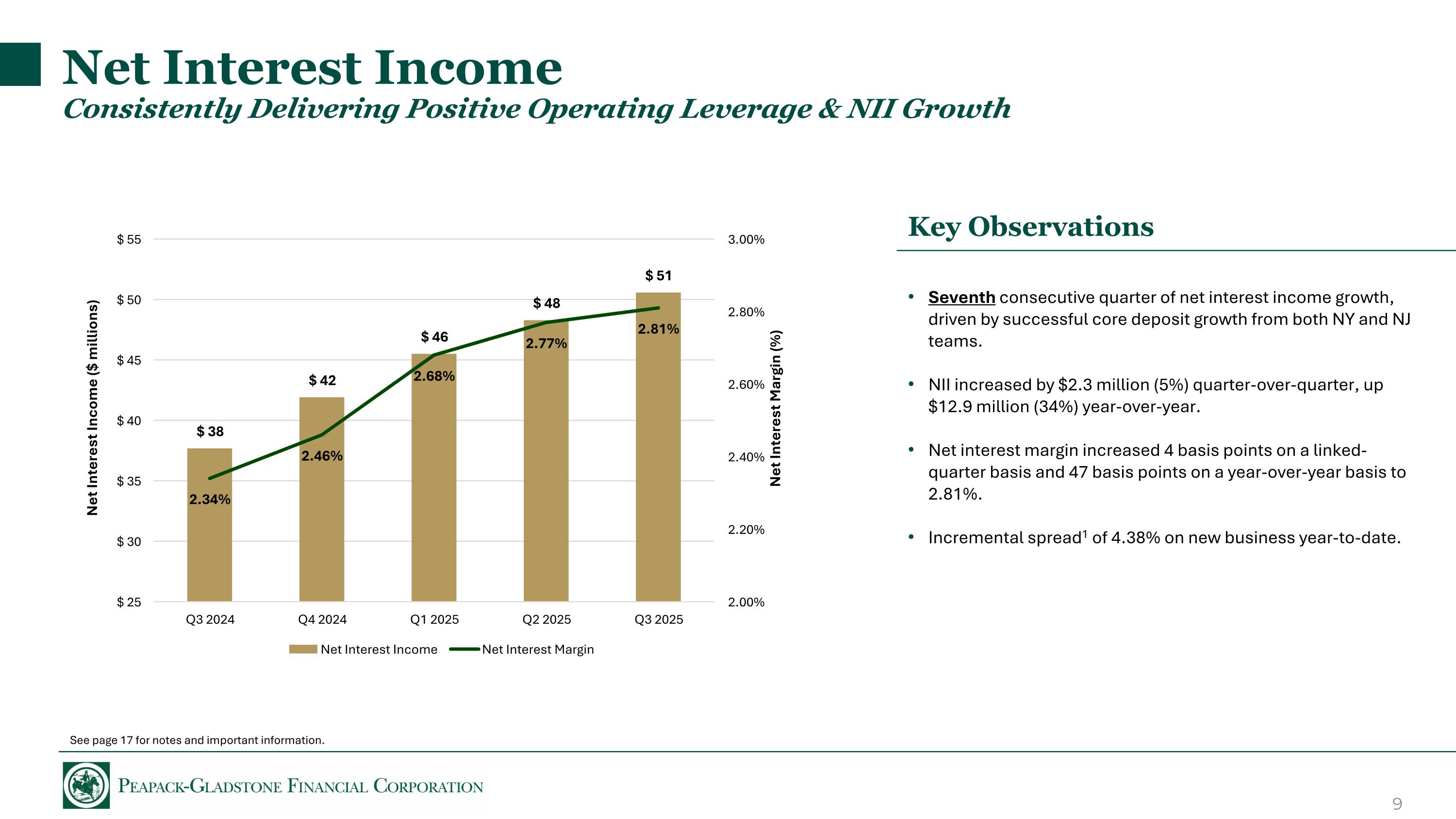

Net Interest Income Consistently Delivering Positive Operating Leverage & NII Growth Key Observations Seventh consecutive quarter of net interest income growth, driven by successful core deposit growth from both NY and NJ teams. NII increased by $2.3 million (5%) quarter-over-quarter, up $12.9 million (34%) year-over-year. Net interest margin increased 4 basis points on a linked-quarter basis and 47 basis points on a year-over-year basis to 2.81%. Incremental spread1 of 4.38% on new business year-to-date. See page 17 for notes and important information.

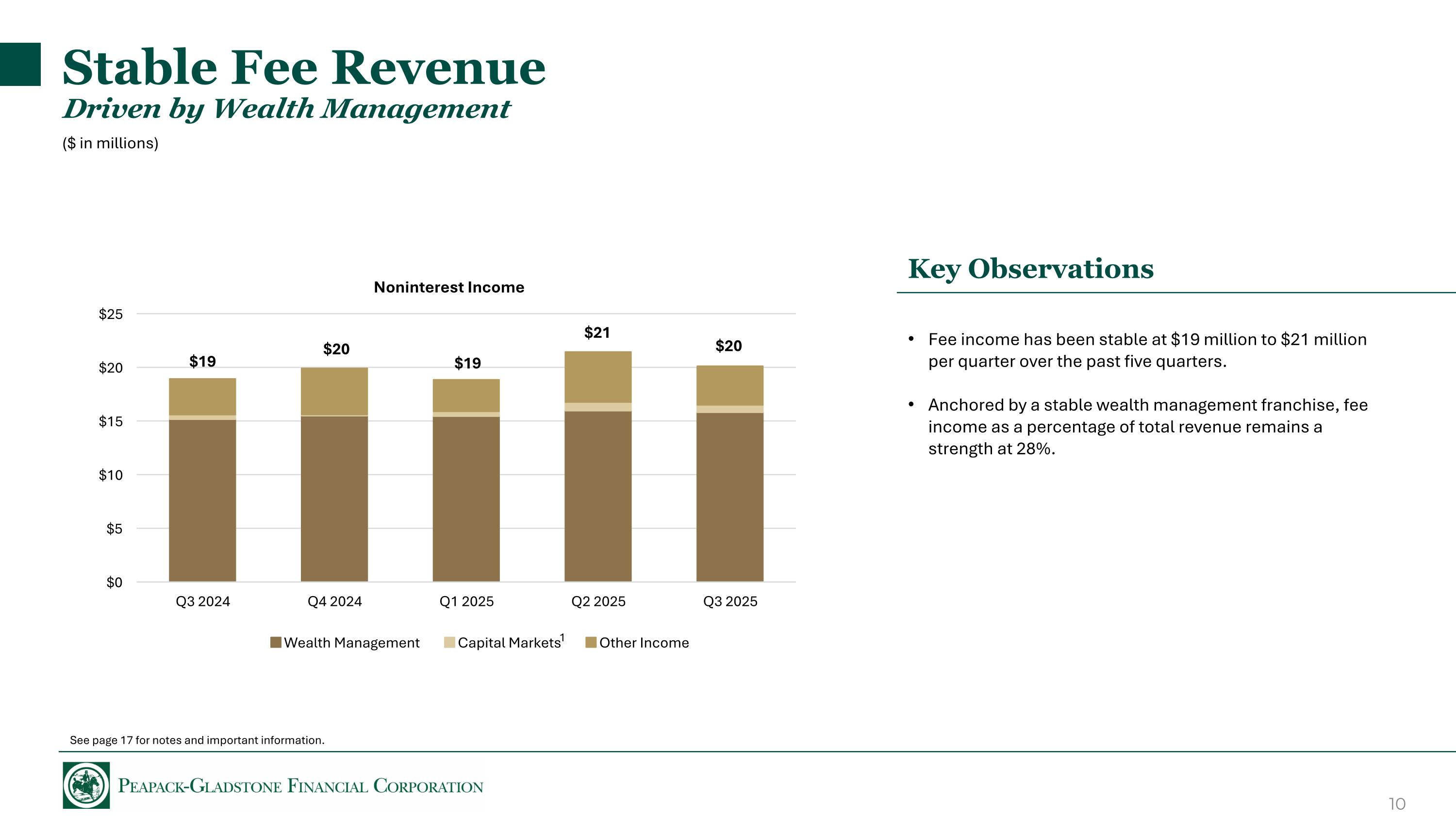

Stable Fee Revenue Driven by Wealth Management Key Observations Fee income has been stable at $19 million to $21 million per quarter over the past five quarters. Anchored by a stable wealth management franchise, fee income as a percentage of total revenue remains a strength at 28%. $19 $20 $19 $21 $20 ($ in millions) 1 See page 17 for notes and important information.

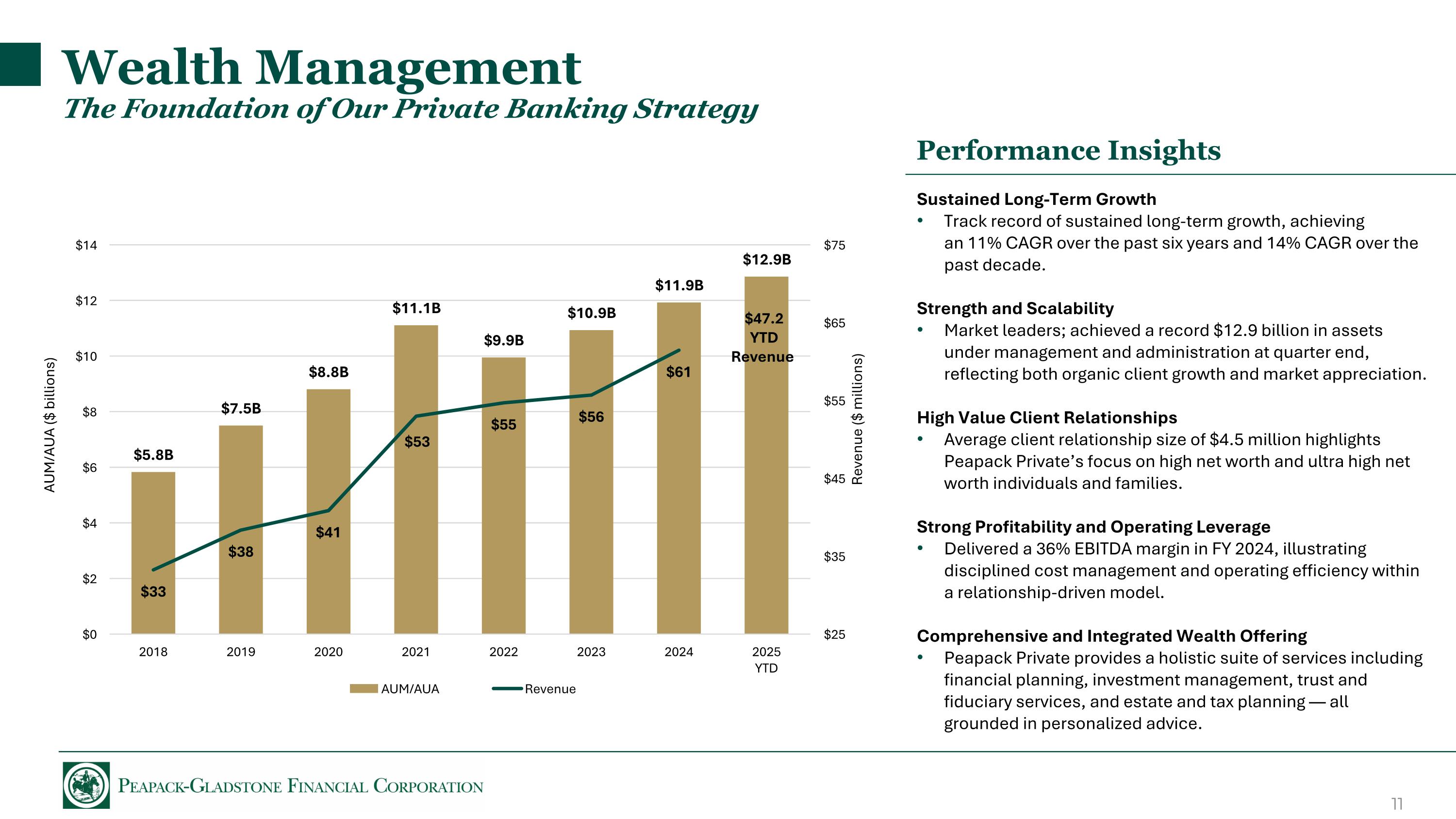

Wealth Management The Foundation of Our Private Banking Strategy Performance Insights Sustained Long-Term Growth Track record of sustained long-term growth, achieving an 11% CAGR over the past six years and 14% CAGR over the past decade. Strength and Scalability Market leaders; achieved a record $12.9 billion in assets under management and administration at quarter end, reflecting both organic client growth and market appreciation. High Value Client Relationships Average client relationship size of $4.5 million highlights Peapack Private’s focus on high net worth and ultra high net worth individuals and families. Strong Profitability and Operating Leverage Delivered a 36% EBITDA margin in FY 2024, illustrating disciplined cost management and operating efficiency within a relationship-driven model. Comprehensive and Integrated Wealth Offering Peapack Private provides a holistic suite of services including financial planning, investment management, trust and fiduciary services, and estate and tax planning — all grounded in personalized advice. $47.2 YTD Revenue

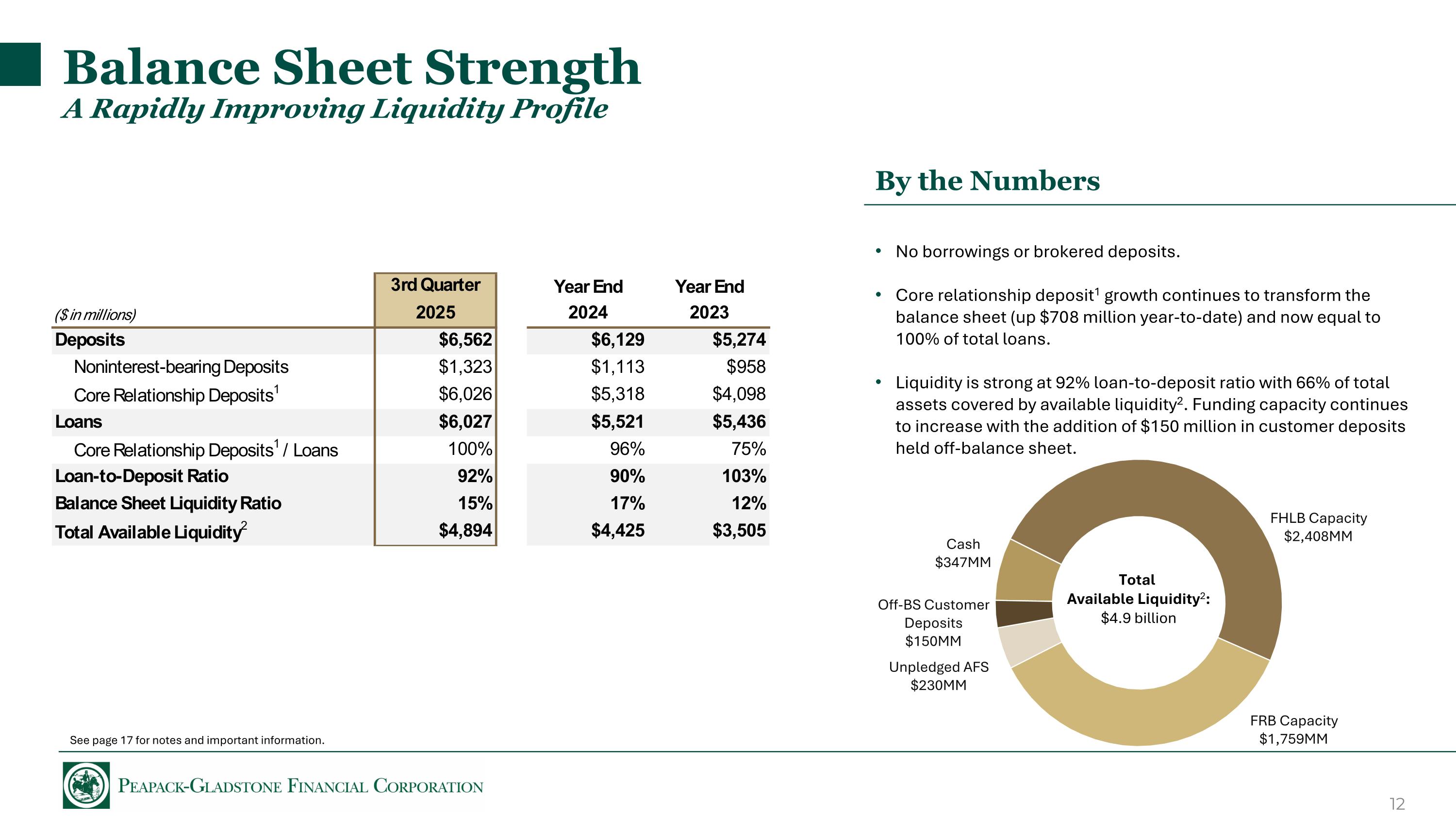

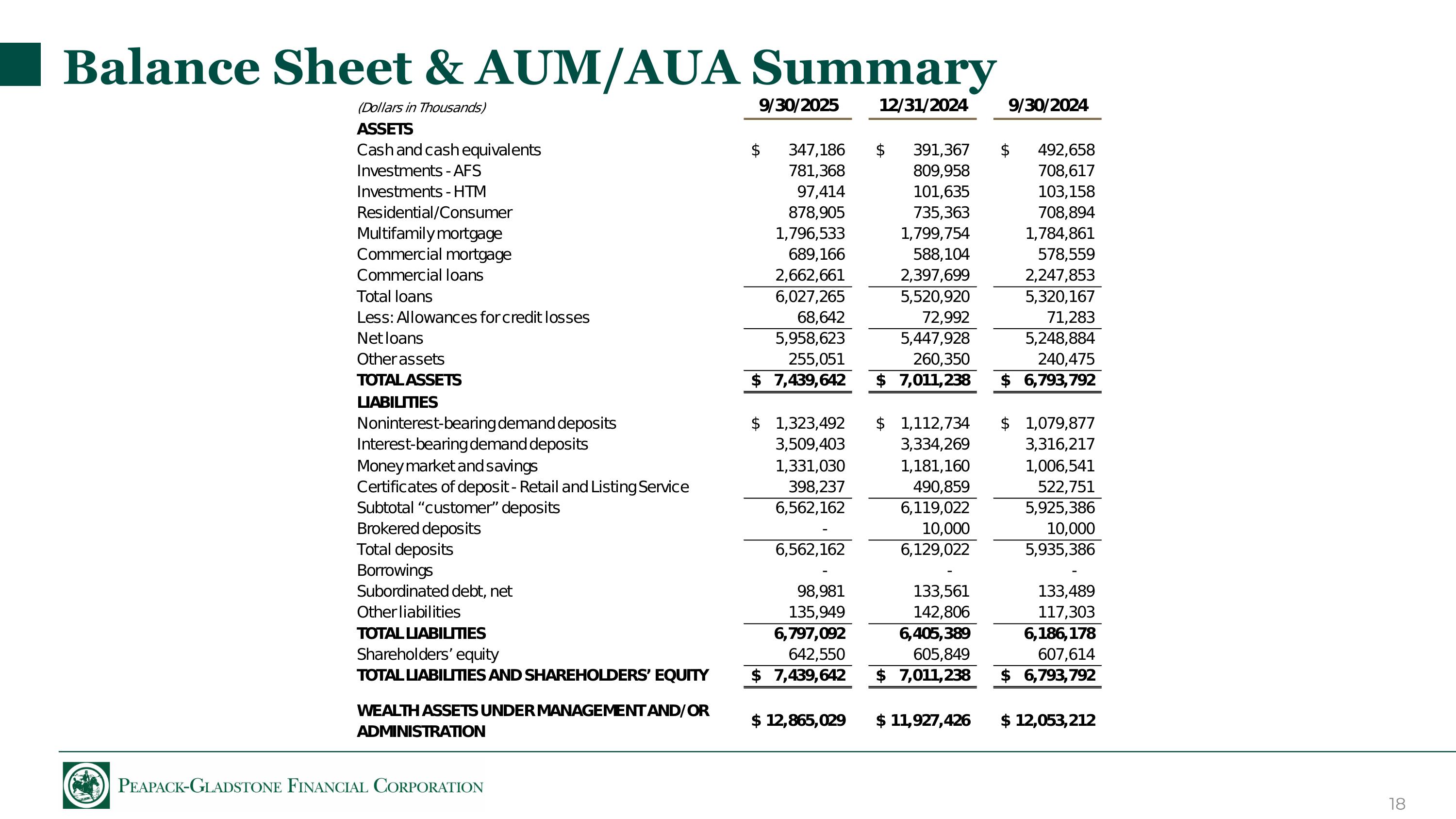

Balance Sheet Strength A Rapidly Improving Liquidity Profile By the Numbers No borrowings or brokered deposits. Core relationship deposit1 growth continues to transform the balance sheet (up $708 million year-to-date) and now equal to 100% of total loans. Liquidity is strong at 92% loan-to-deposit ratio with 66% of total assets covered by available liquidity2. Funding capacity continues to increase with the addition of $150 million in customer deposits held off-balance sheet. Total Available Liquidity2: $4.9 billion See page 17 for notes and important information.

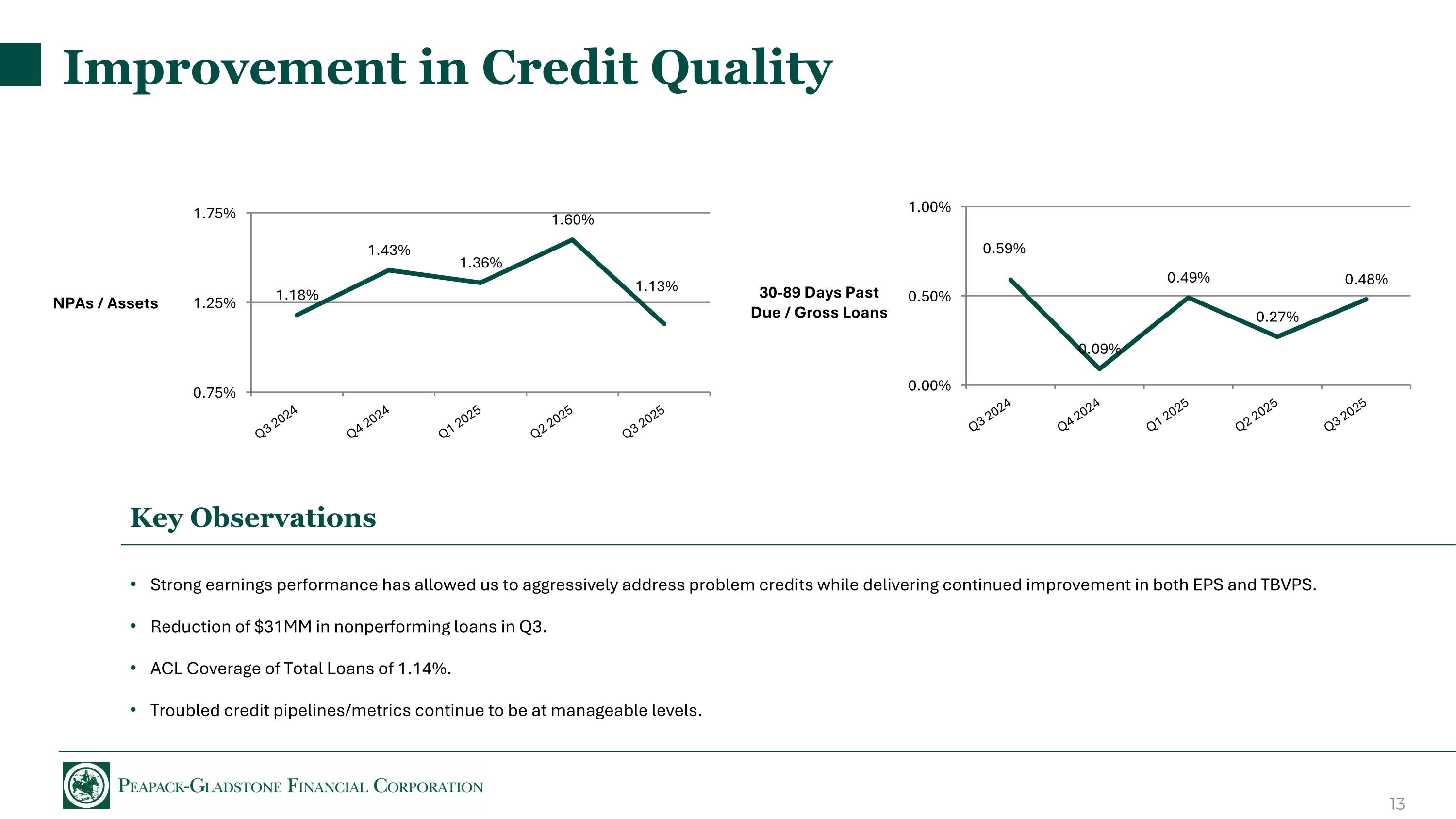

Improvement in Credit Quality 30-89 Days Past Due / Gross Loans NPAs / Assets Key Observations Strong earnings performance has allowed us to aggressively address problem credits while delivering continued improvement in both EPS and TBVPS. Reduction of $31MM in nonperforming loans in Q3. ACL Coverage of Total Loans of 1.14%. Troubled credit pipelines/metrics continue to be at manageable levels.

Positioned for Long-Term Growth & Compelling Returns Moody’s affirmed our investment grade rating with a stable outlook during the third quarter. Peapack Private is the boutique alternative to large banks in the Metro NY region; to date, expansion results have exceeded expectations and pipelines remain strong. We are capitalizing on our affluent geographic market by delivering growth in wealth management and spread income. Continued expansion of our private banking business model, which is anchored by a valuable and scarce $12.9 billion AUM/AUA wealth management business. Ongoing expansion of our $2.7 billion commercial lending business and complementary treasury management platform and sell-side advisory services. We continue to attract and retain top-tier talent. Actively embracing artificial intelligence to drive operational efficiency and support the delivery of white glove customer service to our client by promoting utilization across the company with a focus on governance and innovation. Laser focused on cultivating and fostering a strong client-centric culture. ABA Best Banks To Work For seven years in a row. Crain’s 2024 and 2025 Best Places to Work in NYC.

Statement Regarding Forward-Looking Information This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements are not historical facts and may include expressions about Management’s strategies and Management’s expectations about financial results, new and existing programs and products, investments, relationships, opportunities and market conditions. These statements may be identified by such forward-looking terminology as “expect,” “look,” “believe,” “anticipate,” “may,” or similar statements or variations of such terms. Actual results may differ materially from such forward-looking statements. Factors that may cause actual results to differ materially from those contemplated by such forward-looking statements include, but are not limited to: 1) our ability to successfully grow our business and implement our strategic plan including our entry into New York City and Long Island, and our ability to generate revenues to offset the increased personnel and other costs related to the strategic plan; 2) the current or anticipated impact of military conflict, terrorism or other geopolitical events; 3) the impact of anticipated higher operating expenses in 2025 and beyond; 4) our ability to successfully integrate wealth management firm and team acquisitions; 5) our ability to manage our growth; 6) a decline in the economy, in particular in our New Jersey and New York market areas, including potential recessionary conditions; 7) declines in our net interest margin caused by the interest rate environment (including the shape of the yield curve) and our highly competitive market; 8) declines in the value in our investment portfolio; 9) higher than expected increases in our allowance for credit losses; 10) higher than expected increases in credit losses or in the level of nonperforming, classified or criticized loans or charge-offs; 11) changes in interest rates and the effects of inflation; 12) a decline in real estate values within our market areas; 13) legislative and regulatory actions; 14) changes in monetary policy by the Federal Reserve Board; 15) changes to tax or accounting matters; 16) successful cyberattacks against our IT infrastructure and that of our IT providers; 17) higher than expected FDIC insurance premiums; 18) adverse weather conditions; 19) a reduction in our lower-cost funding sources; 20) changes in liquidity, including the size and composition of our deposit portfolio and the percentage of uninsured deposits in the portfolio; 21) our ability to adapt to technological changes; 22) claims and litigation pertaining to fiduciary responsibility, environmental laws and other matters; 23) the imposition of tariffs or other domestic or international governmental policies and potential retaliatory responses; 24) the impact of the current federal government shutdown; 25) our ability to retain key employees; 26) demands for loans and deposits in our market areas; 27) adverse changes in securities markets; 28) changes in New York City rent regulation law; and 29) other unexpected material adverse changes in our operations or earnings. The Company undertakes no duty to update any forward-looking statement to conform the statement to actual results or changes in the Company’s expectations. Although we believe that the expectations reflected in the forward-looking statements are reasonable, the Company cannot guarantee future results, levels of activity, performance or achievements.

Appendices

Notes Third Quarter 2025 Highlights slide See Non-GAAP Financial Measurement Reconciliation included in these appendices. Incremental spread is defined as the weighted average loan coupon of loans originated in the period less the average cost of newly funded deposit accounts for the same period. Operating Leverage is defined as the percentage change in total revenue less the percentage change in operating expense. Core relationship deposits defined as deposit relationships that are not custodial, brokered, or listing service. Quarterly Earnings Results slide See Non-GAAP Financial Measurement Reconciliation included in these appendices. See Non-GAAP Financial Measurement Reconciliation included in these appendices. Excellent Earnings Trajectory slide See Non-GAAP Financial Measurement Reconciliation included in these appendices. Deposit Trends slide Core relationship deposits defined as deposit relationships that are not custodial, brokered, or listing service. Loan Trends slide 1) Gross loans include loans held for sale. Incremental Spread slide 1) Newly funded deposits include deposits opened within the past twelve months, funded for the first time during the noted time period (year-to-date). 2) Origination volumes include funded loans and unfunded commitments. 3) Incremental spread is defined as the weighted average loan coupon of loans originated in the period less the average cost of newly funded deposit accounts for the same period. Net Interest Income slide 1) Incremental spread is defined as the weighted average loan coupon of loans originated in the period less the average cost of newly funded deposit accounts for the same period. Stable Fee Revenue slide 1) Capital Markets income consists of Corporate Advisory, Mortgage Banking, SBA Lending, and Back-to-Back Swap fee income. Balance Sheet Strength slide Core relationship deposits defined as deposit relationships that are not custodial, brokered, or listing service. Total available liquidity defined as cash plus cash equivalents plus unpledged available-for-sale securities plus borrowing capacity less borrowings, letters of credit, and pledged securities plus customer deposits held off balance sheet.

Balance Sheet & AUM/AUA Summary

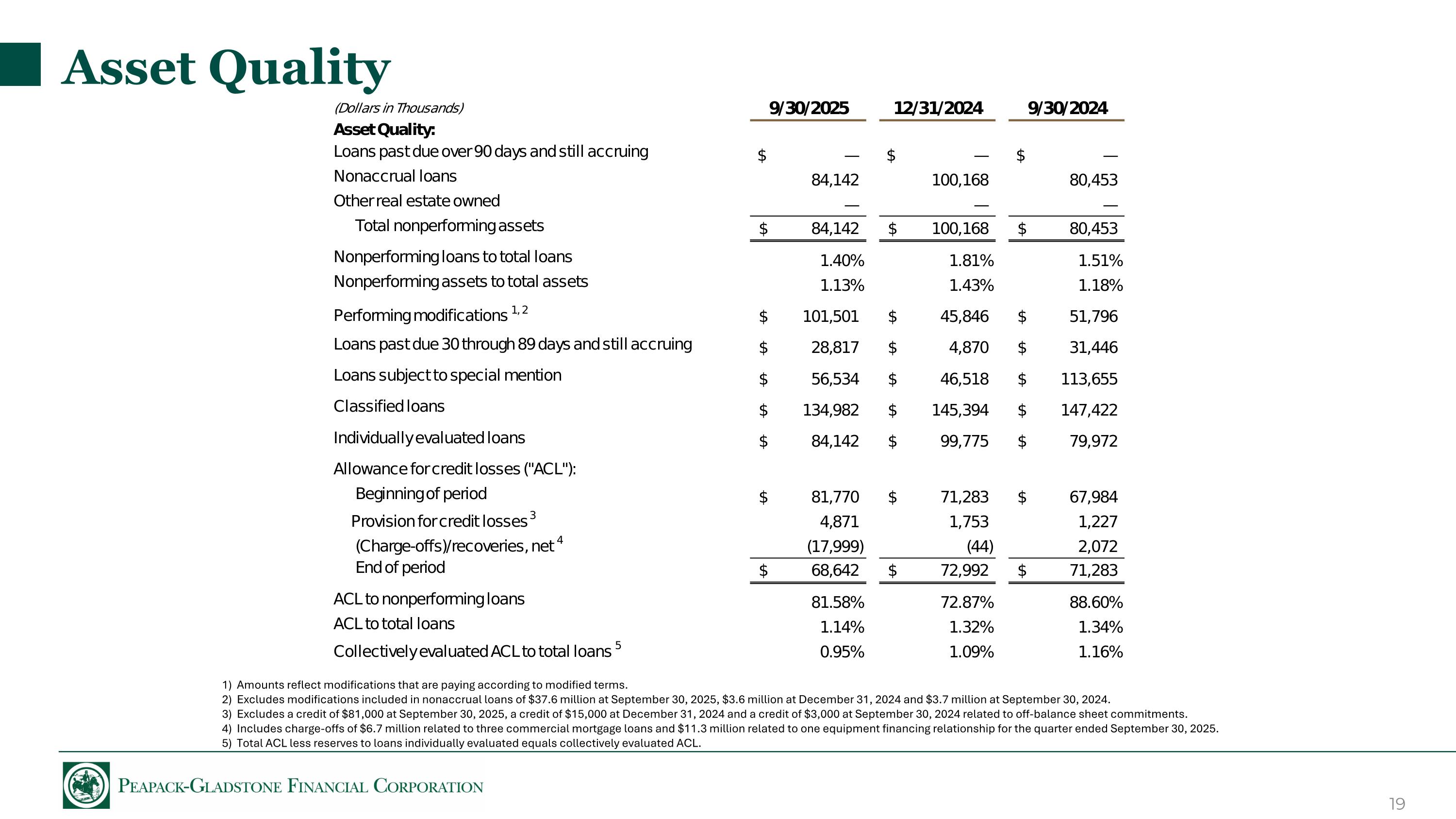

Asset Quality 1) Amounts reflect modifications that are paying according to modified terms. 2) Excludes modifications included in nonaccrual loans of $37.6 million at September 30, 2025, $3.6 million at December 31, 2024 and $3.7 million at September 30, 2024. 3) Excludes a credit of $81,000 at September 30, 2025, a credit of $15,000 at December 31, 2024 and a credit of $3,000 at September 30, 2024 related to off-balance sheet commitments. 4) Includes charge-offs of $6.7 million related to three commercial mortgage loans and $11.3 million related to one equipment financing relationship for the quarter ended September 30, 2025. 5) Total ACL less reserves to loans individually evaluated equals collectively evaluated ACL.

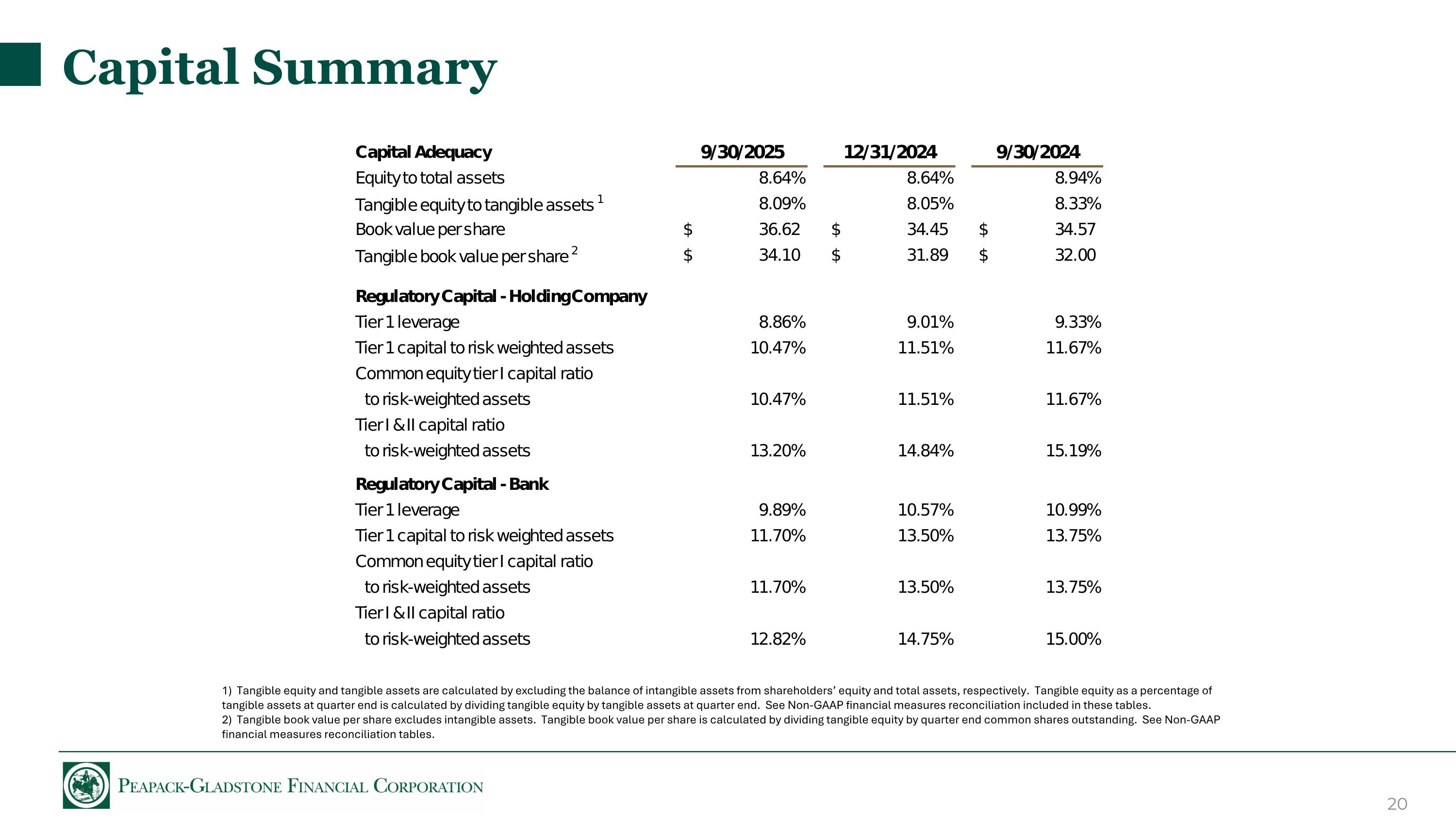

Capital Summary 1) Tangible equity and tangible assets are calculated by excluding the balance of intangible assets from shareholders’ equity and total assets, respectively. Tangible equity as a percentage of tangible assets at quarter end is calculated by dividing tangible equity by tangible assets at quarter end. See Non-GAAP financial measures reconciliation included in these tables. 2) Tangible book value per share excludes intangible assets. Tangible book value per share is calculated by dividing tangible equity by quarter end common shares outstanding. See Non-GAAP financial measures reconciliation tables.

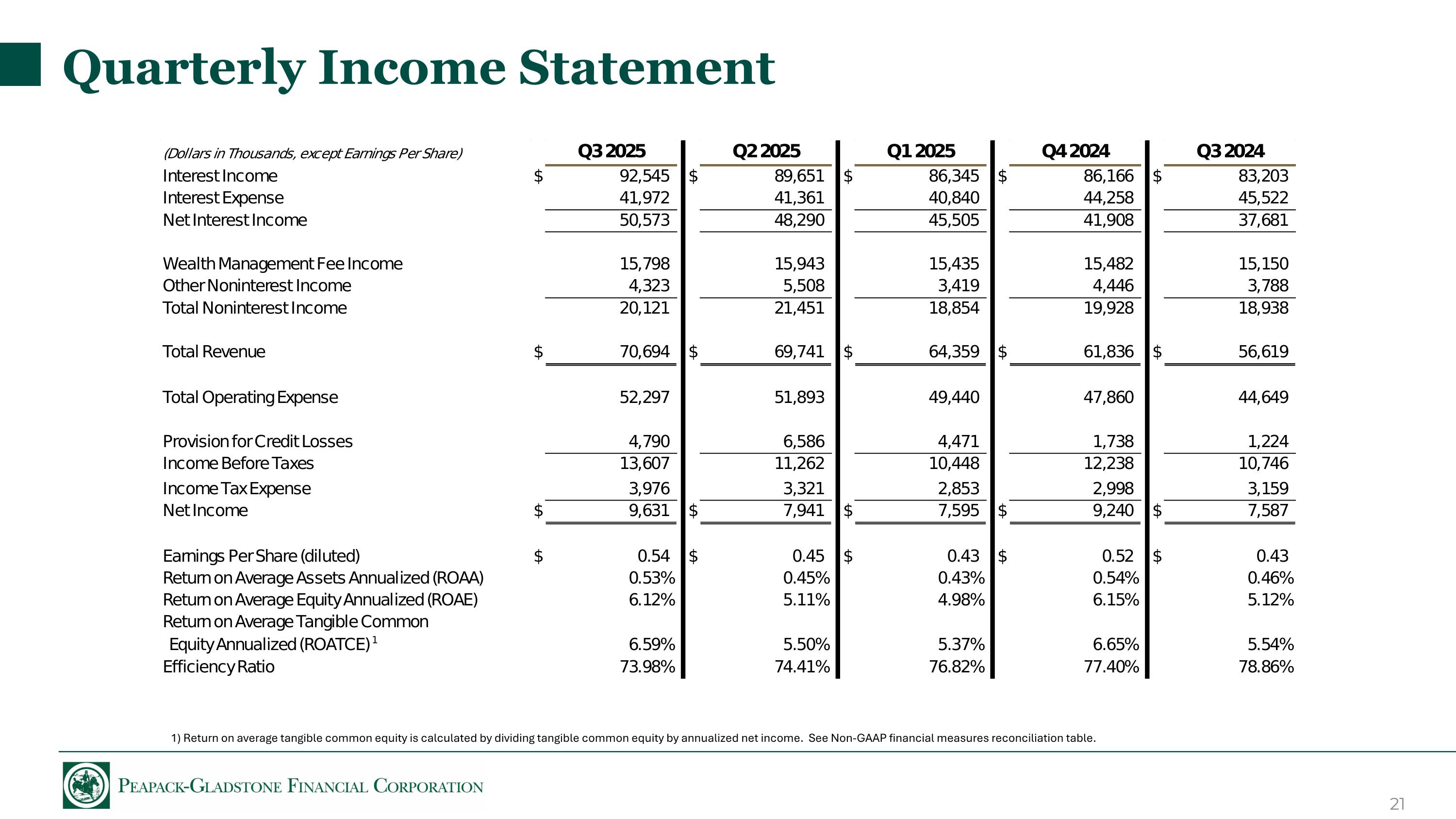

Quarterly Income Statement 1) Return on average tangible common equity is calculated by dividing tangible common equity by annualized net income. See Non-GAAP financial measures reconciliation table.

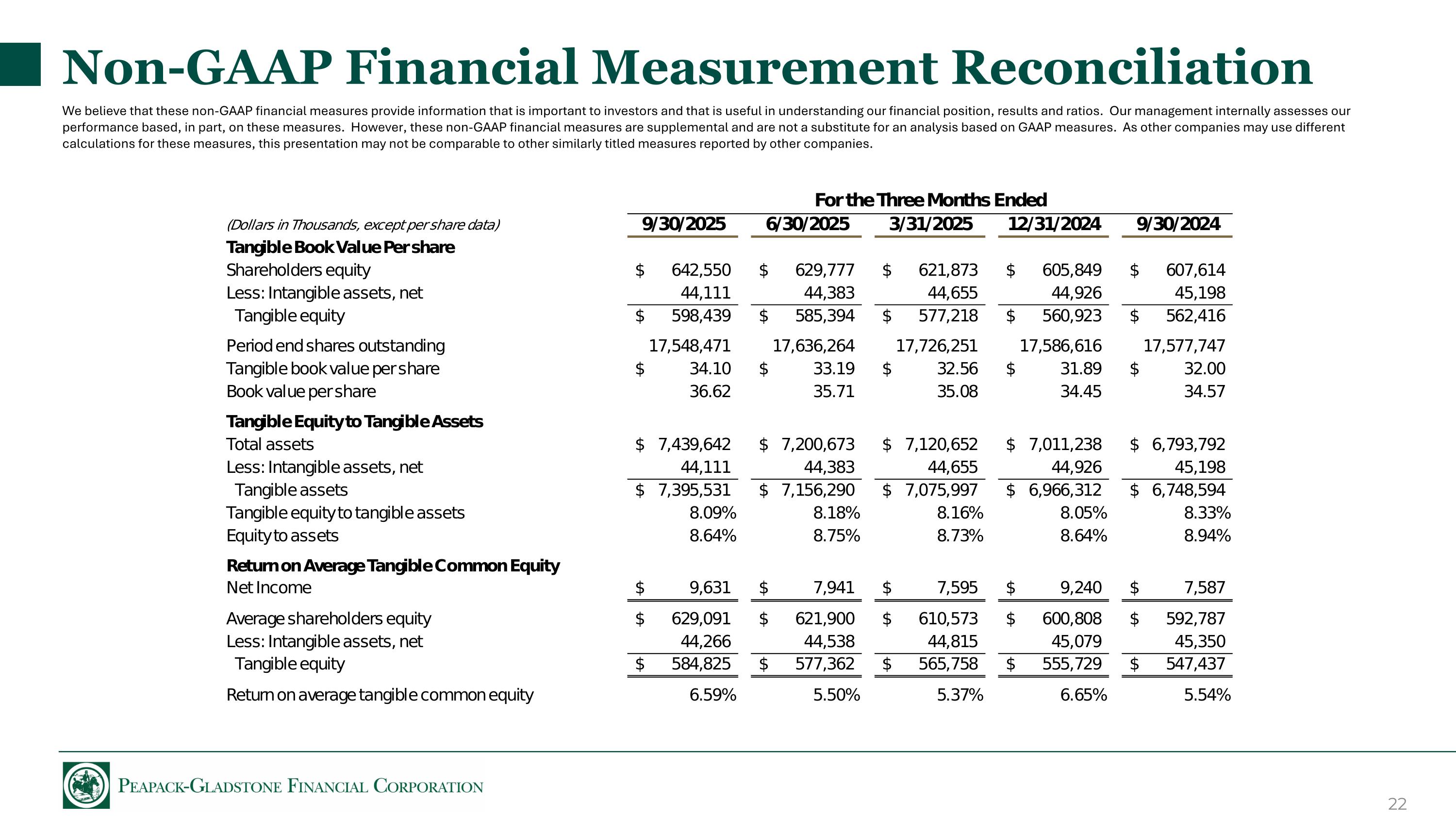

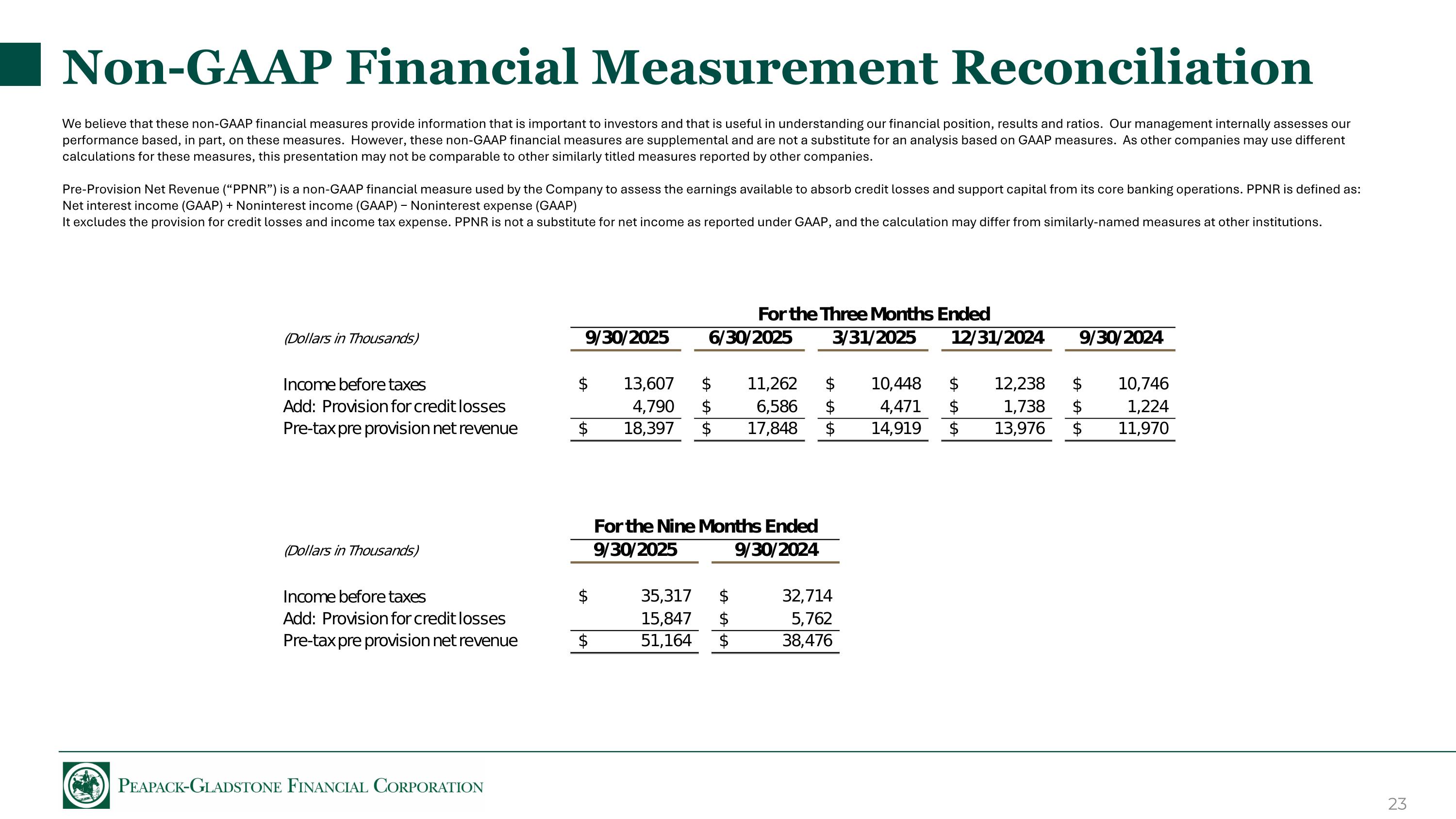

Non-GAAP Financial Measurement Reconciliation We believe that these non-GAAP financial measures provide information that is important to investors and that is useful in understanding our financial position, results and ratios. Our management internally assesses our performance based, in part, on these measures. However, these non-GAAP financial measures are supplemental and are not a substitute for an analysis based on GAAP measures. As other companies may use different calculations for these measures, this presentation may not be comparable to other similarly titled measures reported by other companies.

Non-GAAP Financial Measurement Reconciliation We believe that these non-GAAP financial measures provide information that is important to investors and that is useful in understanding our financial position, results and ratios. Our management internally assesses our performance based, in part, on these measures. However, these non-GAAP financial measures are supplemental and are not a substitute for an analysis based on GAAP measures. As other companies may use different calculations for these measures, this presentation may not be comparable to other similarly titled measures reported by other companies. Pre-Provision Net Revenue (“PPNR”) is a non-GAAP financial measure used by the Company to assess the earnings available to absorb credit losses and support capital from its core banking operations. PPNR is defined as: Net interest income (GAAP) + Noninterest income (GAAP) − Noninterest expense (GAAP) It excludes the provision for credit losses and income tax expense. PPNR is not a substitute for net income as reported under GAAP, and the calculation may differ from similarly-named measures at other institutions.

Douglas L. Kennedy President & Chief Executive Officer (908) 719-6554 dkennedy@peapackprivate.com Frank A. Cavallaro Senior EVP & Chief Financial Officer (908) 306-8933 fcavallaro@peapackprivate.com CONTACTS John P. Babcock Senior EVP & President of Peapack Private Wealth Management (908) 719-3301 jbabcock@peapackprivate.com Matthew P. Remo SVP | Managing Principal – Treasurer & Head of Corporate Finance (908) 872-9899 mremo@peapackprivate.com CORPORATE HEADQUARTERS 500 Hills Drive, Suite 300 P.O. Box 700 Bedminster, New Jersey 07921 (908) 234-0700 peapackprivate.com