United States

Securities and Exchange Commission

Washington, D.C. 20549

Schedule 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☑

File by a party other than the Registrant ☐

Check the appropriate box:

| ☐ |

Preliminary proxy statement

|

| ☐ |

Confidential, for use of the Commission only (as permitted by Rule 14a-6(e)(2))

|

| ☑ |

Definitive proxy statement

|

| ☐ |

Definitive additional materials

|

| ☐ |

Soliciting material under Rule 14a-12

|

|

COMMUNITY WEST BANCSHARES

|

|

(Name of the Registrant as Specified In Its Charter)

|

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

|

Payment of Filing Fee (check the appropriate box):

| ☑ |

No fee required.

|

| ☐ |

Fee paid previously with preliminary materials.

|

| ☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

445 Pine Avenue

Goleta, CA 93117-3709

(805) 692-5821

www.communitywest.com

|

April 14, 2023

To Our Shareholders:

You are cordially invited to attend the 2023 Annual Meeting of Shareholders (Meeting) of Community West Bancshares that will be held at La Cumbre Country Club, 4015 Via Laguna, Santa

Barbara, California 93110, on Thursday, May 25, 2022, at 6:30 P.M. Pacific Daylight Time (PDT). There will be refreshments at 5:30 P.M. with the business meeting starting promptly at 6:30 P.M. Please keep in mind that the La Cumbre

Country Club rules prohibit wearing any denim on its premises.

In addition, instead of mailing a printed paper copy of the Proxy Statement and Proxy Card, we have elected to provide our shareholders access to those documents electronically over the

Internet. We believe that this process provides shareholders with a convenient and quick way to access the proxy materials and vote, while allowing us to conserve natural resources and reduce the costs of printing and distributing the

proxy materials. A Notice Regarding Availability of Proxy Materials for the Community West Bancshares’ Shareholder Meeting (Notice) and our 2022 Annual Report to Shareholders will be mailed to our shareholders who owned our common stock

at the close of business on March 28, 2023. The Notice provides instructions on how to access the proxy materials through the Internet. Any shareholder who would like a paper or email copy printed set of the proxy materials may request

that the documents be mailed to the shareholder by following the directions included in the Notice.

As set forth in the Proxy Statement, the Meeting will be held to consider the election of the Board of Directors, the ratification of the selection of RSM US LLP as the Company’s

independent registered public accounting firm and to transact any other business that may properly come before the Meeting.

We will also review operating results for the past year and the progress of Community West Bancshares, and its wholly-owned subsidiary, Community West Bank, and present an opportunity to

ask questions of general interest to shareholders.

Your vote is important. Whether or not you attend the Meeting in person, I urge you to vote as soon as possible electronically via the Internet, by telephone or by mailing your executed

Proxy as explained in the Notice or Proxy Statement.

Thank you for your continued support of Community West Bancshares and, again, I look forward to seeing you at the Annual Meeting on Thursday, May 25, 2023.

|

Very truly yours,

|

|

|

|

|

William R. Peeples

Chairman of the Board of Directors

|

This Page Intentionally Left Blank

COMMUNITY WEST BANCSHARES

445 Pine Avenue

Goleta, California 93117-3709

Telephone: (805) 692-5821

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD MAY 25, 2023

NOTICE IS HEREBY GIVEN that the 2023 Annual Meeting of Shareholders (Meeting) of Community West Bancshares (Company) will be held at La Cumbre Country Club, 4015 Via Laguna, Santa

Barbara, CA 93110, on Thursday, May 25, 2023, at 6:30 P.M. Pacific Daylight Time (PDT). The Meeting proposals to be voted at the Meeting are listed below along with the Board of Director’s recommendations.

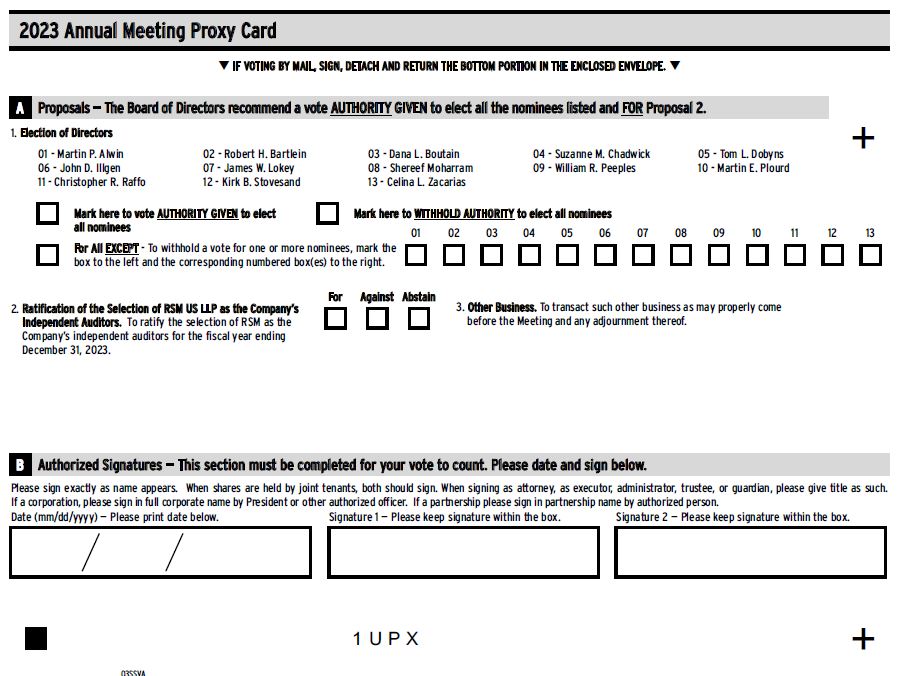

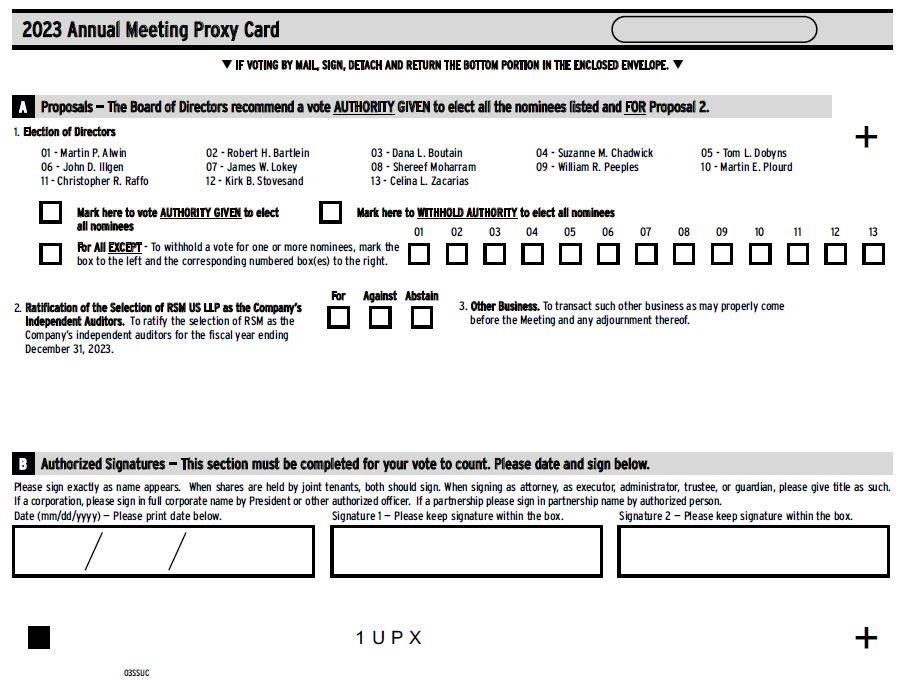

1. Election of Directors. To elect thirteen persons to the Board of Directors of the Company (Board) to serve until

the 2024 Annual Meeting of Shareholders and until their successors are elected and have qualified. The following persons are the Board of Directors’ nominees:

|

Martin P. Alwin

|

Shereef Moharram

|

|

Robert H. Bartlein

|

William R. Peeples

|

|

Dana L. Boutain

|

Martin E. Plourd

|

|

Suzanne M. Chadwick

|

Christopher R. Raffo

|

|

Tom L. Dobyns

|

Kirk B. Stovesand

|

|

John D. Illgen

|

Celina L. Zacarias

|

|

James W. Lokey

|

2. Shareholder Advisory (Non-Binding) Vote on Executive Compensation. To approve, in a non-binding advisory vote, the

compensation of the Company’s Named Executive Officers as disclosed in the accompanying Proxy Statement.

3. Ratification of the Independent Auditors. To ratify the selection of RSM US LLP as the Company’s independent

auditors for the fiscal year ending December 31, 2023.

4. Other Business. To transact such other business as may properly come

before the Meeting and any adjournment thereof, including, without limitation, to approve an adjournment(s) of the Meeting, if necessary, to solicit additional proxies for the thirteen nominees for election.

The Proxy Statement that accompanies this Notice contains additional information regarding the proposals to be considered at the Meeting and shareholders are encouraged to read it in its

entirety.

The Board has fixed the close of business on March 28, 2023, as the record date for determination of shareholders entitled to notice of, and the right to vote at, the Meeting.

As set forth in the Proxy Statement, proxies are being solicited by and on behalf of the Board. All proposals set forth above are proposals of the Company. It is expected that these

proxy materials will be made available to shareholders via the Internet at: www.edocumentview.com/CWBC on or about April 14, 2023.

The Bylaws of the Company provide for the nomination of Directors in the following manner:

“Nominations for election of members of the board of directors may be made by the board of directors or by any shareholder of any outstanding class of capital stock of the corporation

entitled to vote for the election of directors. Notice of intention to make any nominations (other than for persons named in the notice of the meeting at which such nomination is to be made) shall be made in writing and shall be

delivered or mailed to the president of the corporation no more than sixty (60) days prior to any meeting of shareholders called for the election of directors and no more than ten (10) days after the date the notice of such meeting is

sent to shareholders pursuant to Section 2.4 of these Bylaws; provided, however, that if ten (10) days’ notice of such meeting is sent to shareholders, such notice of intention to nominate must be received by the president of the

corporation not later than the time fixed in the notice of the meeting for the opening of the meeting. Such notification shall contain the following information to the extent known to the notifying shareholder: (a) the name and address

of each proposed nominee; (b) the principal occupation of each proposed nominee; (c) the number of shares of capital stock of the corporation owned by each proposed nominee; (d) the name and residence address of the notifying shareholder;

(e) the number of shares of capital stock of the corporation owned by the notifying shareholder; (f) with the written consent of the proposed nominee, a copy of which shall be furnished with the notification, whether the proposed nominee

has ever been convicted of or pleaded nolo contendere to any criminal offense involving dishonesty or breach of trust, filed a petition in bankruptcy or been adjudged a bankrupt. The notice shall be signed by the nominating shareholder

and by the nominee. Nominations not made in accordance herewith shall be disregarded by the chairman of the meeting and, upon his instructions, the inspectors of election shall disregard all votes cast for each such nominee. The

restrictions set forth in this paragraph shall not apply to nomination of a person to replace a proposed nominee who has died or otherwise become incapacitated to serve as a director between the last day for giving notice hereunder and

the date of election of directors if the procedure called for in this paragraph was followed with respect to the nomination of the proposed nominee. A copy of the preceding paragraph shall be set forth in the notice to shareholders of

any meeting at which directors are to be elected.”

Since important matters are to be considered at the Meeting, it is very important that each shareholder vote.

We urge you to read the Proxy Statement fully, consider the proposals being presented at the Meeting, and cast your vote on such proposals electronically,

by telephone, or by requesting, completing, and returning a printed paper form of the Proxy as explained in the Notice in the Proxy Statement, and the Proxy, as promptly as possible, whether or not you plan to attend the Meeting. The

Proxy is solicited by the Board. Any shareholder who executes and delivers such a Proxy has the right to revoke it at any time before it is exercised by giving written notice of revocation to the Secretary of the Company, by submitting

a properly executed Proxy bearing a later date, or by voting online at www.investorvote.com/CWBC, by voting by telephone if you hold your shares in your name or electronically via the link

provided by your broker if you hold your shares in “street name”.

Please indicate on the proxy whether or not you expect to attend the Meeting so that the Company can arrange for adequate accommodations.

|

|

By Order of the Board of Directors,

|

| John D. Illgen, Secretary |

Dated: April 14, 2023

Goleta, California

PROXY MATERIALS AND ANNUAL REPORT ON FORM 10-K

Copies of the Company’s proxy materials described herein and the 2022 Annual Report on Form 10-K, as filed with the Securities and Exchange Commission, are available

upon request to: Richard Pimentel, Executive Vice President and Chief Financial Officer, Community West Bancshares, 445 Pine Avenue, Goleta, CA 93117-3474, telephone (800) 569-2100, e-mail: rpimentel@communitywestbank.com.

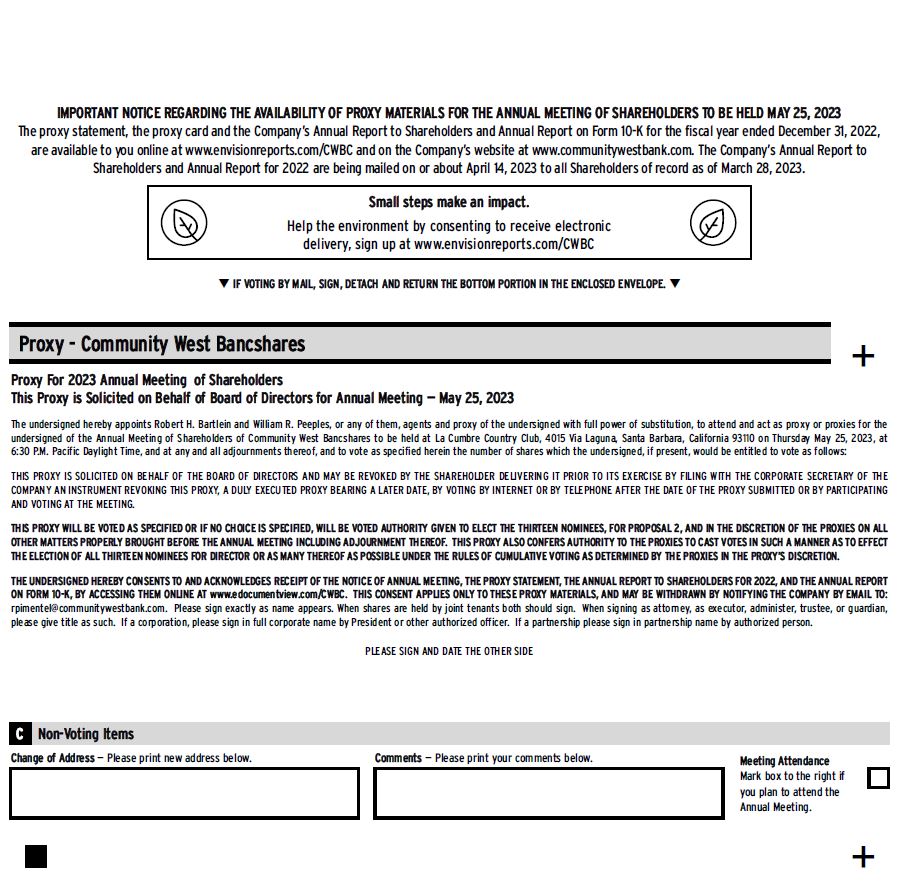

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF SHAREHOLDERS TO BE HELD ON MAY 25, 2023

This Proxy Statement, Proxy card and the Company’s Annual Report to Shareholders including the Annual Report on Form 10-K for the fiscal year ended December 31, 2022, are

available online at www.edocumentview.com/CWBC and on the Company’s website at www.communitywest.com.

COMMUNITY WEST BANCSHARES

445 Pine Avenue

Goleta, California 93117-3709

PROXY STATEMENT

ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD MAY 25, 2023

SOLICITATION AND VOTING OF PROXIES

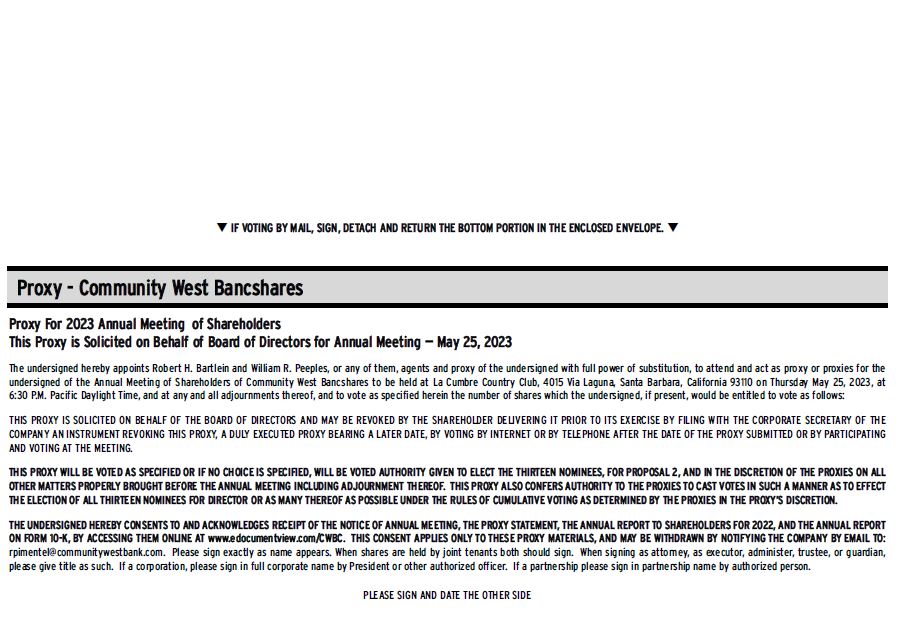

Community West Bancshares (Company or CWBC) is furnishing this Proxy Statement (Proxy Statement) to its shareholders in connection with the solicitation by the Board of Directors of the

Company (Board) of proxies in connection with the Annual Meeting of Shareholders (Meeting), to be held on Thursday, May 25, 2023 at 6:30 P.M. Pacific Daylight Time (PDT), at La Cumbre Country Club, 4015 via Laguna, Santa Barbara,

California 93110, and any and all adjournments and postponements thereof. The designated proxyholders (Proxyholders) are members of the Company’s Board. Only shareholders of record on March 28, 2023 (Record Date) are entitled to notice

of, to participate in, and to vote by proxy, telephone, or electronically either before or during the Meeting or any adjournment or postponement thereof.

As permitted by the Securities and Exchange Commission’s “notice and access” rules, the Company has furnished the Notice of Annual Meeting of Shareholders, this Proxy Statement, the form

of proxy (Proxy), and Annual Report to Shareholders for 2022, including consolidated financial statements for the year ended December 31, 2022 including the Annual Report on Form 10-K (collectively the “Proxy Materials”), by sending a

Notice of Internet Availability of Proxy Materials (Notice) to shareholders of record as of the Record Date, rather than mailing a paper copy of the Proxy Materials. The Proxy Materials are available beginning on April 14, 2023.

Instructions on how to access the Proxy Materials electronically over the Internet are provided in the Notice. To view these proxy materials electronically, please log on the Internet at www.edocumentview.com/CWBC and follow the

instructions provided. The Proxy Materials are also available on our website at: www.communitywest.com. Shareholders who would like to receive a copy of those documents in paper form by mail, including the Proxy Statement and

Proxy, may do so by following the instructions in the Notice for requesting those materials. The Company’s Annual Report to Shareholders for 2023, including consolidated financial statements for the year ended December 31, 2022 and the

Annual Report on Form 10-K is available by logging on to the Internet at www.edocumentview.com/CWBC and at our website at: www.communitywest.com.

Regardless of the number of shares of no-par value common stock of the Company (Common Stock) owned, it is important that the holders of a majority of shares be represented by proxy.

Shareholders are requested to vote by one of the methods described in the Notice, this Proxy Statement and on the Proxy. Proxies solicited by the Board will be voted in accordance with the directions

given therein. Where no instructions are indicated, signed or authorized Proxies will be voted “AUTHORITY GIVEN” for all thirteen (13) nominees for the election of the Directors named in this Proxy Statement; and, “FOR” ratification of

RSM US LLP (RSM) as the Company’s independent auditors for the fiscal year ending December 31, 2023. If any other business is properly presented at the Meeting, the Proxy will be voted in accordance with the recommendations of

the Board.

Other than the matters set forth on Notice and the attached Notice of Annual Meeting of Shareholders, the Board knows of no additional matters that will be presented for consideration at

the Meeting. An executed or authorized Proxy, confers to each of Robert H. Bartlein and William R. Peeples, as the designated Proxyholders, discretionary authority to vote the shares in such a manner as to effect the election of all

thirteen nominees for Director or as many thereof as possible under the rules of cumulative voting, if invoked, and in accordance with the recommendations of the Board on such other business, if any, which may properly come before the

Meeting and at any adjournments or postponements thereof, including whether or not to adjourn the Meeting. In addition, the Proxy being solicited confers, and the holders of each Proxy will have, discretionary authority to vote with

respect to any matter if the Company did not have notice of such matter by February 28, 2023, which is at least 45 days before the anniversary date on which the Company first mailed its proxy materials for the then-prior year’s Annual

Meeting of Shareholders.

When voting electronically either before or during the Meeting, please make sure you complete the voting on all proposals to assure that your vote is properly counted. If you complete

your electronic voting but you do not provide instructions on a proposal properly to come before the Meeting, your vote on that proposal will be cast in accordance with the recommendation of the Board.

1

You may revoke your Proxy at any time prior to its exercise by filing a written notice of revocation with the Secretary of the Company, by delivering to the Company a duly executed or

authorized Proxy bearing a later date, or by voting by telephone or electronically after the date of the Proxy via the Internet. However, if you are a shareholder whose shares are not registered in your own name, you will need to vote

electronically via the links provided to you by your brokerage firm or its agent.

The following matters will be considered and voted upon at the Meeting:

1. Election of Directors. To elect the following thirteen persons to the

Board of Directors of the Company to serve until the 2023 Annual Meeting of Shareholders and until their successors are elected and have qualified.

|

Martin P. Alwin

|

Shereef Moharram

|

|

Robert H. Bartlein

|

William R. Peeples

|

|

Dana L. Boutain

|

Martin E. Plourd

|

|

Suzanne M. Chadwick

|

Christopher R. Raffo

|

|

Tom L. Dobyns

|

Kirk B. Stovesand

|

|

John D. Illgen

|

Celina L. Zacarias

|

|

James W. Lokey

|

2. Ratification of the Company’s Independent Auditors. To ratify the appointment of RSM as the Company’s independent auditors for the fiscal year ending December 31, 2023.

3. Other Business. To transact such other business as may properly come

before the Meeting and any adjournment thereof, including, without limitation, approving an adjournment(s) of the Meeting, if necessary, to solicit additional proxies for the thirteen nominees for election.

This solicitation of proxies is being made by the Board. The expense of solicitation of proxies for the Meeting will be borne by the Company. Proxies may be solicited through the use of

the mail, personally or by telephone or electronic transmission by Directors, officers and employees of the Company, and its wholly-owned subsidiary, Community West Bank (CWB or Bank), without additional compensation therefor. In

addition, if the Board deems it advisable the services of individuals or companies that are not regularly employed by the Company or the Bank may be engaged or used in connection with the solicitation of proxies. The Company will also

request persons, firms and corporations holding shares in their names, or in the name of their nominees, that are beneficially owned by others, to send Proxy Materials to and obtain Proxies from such beneficial owners and will reimburse

such holders for their reasonable expenses in doing so. The total estimated cost of the solicitation is approximately $27,000 depending on whether an outside solicitor is engaged.

VOTING SECURITIES

The securities that may be voted at the Meeting consist of shares of Common Stock. The close of business on March 28, 2023 has been fixed by the Board as the date (Record Date) for the

determination of shareholders of record entitled to notice of and to vote at the Meeting and at any adjournments or postponements thereof. The total number of shares of Common Stock outstanding as of the Record Date was 8,835,143

shares. Each shareholder is entitled to one vote for each share held as of the Record Date, except that in the election of Directors, each shareholder has the right to cumulate votes provided that the candidates’ names have been properly

placed in nomination prior to commencement of voting and a shareholder has given notice of the shareholder’s intention to cumulate votes prior to commencement of voting. Cumulative voting entitles a shareholder to give one candidate a

number of votes equal to the number of Directors to be elected, multiplied by the number of shares of Common Stock held by that shareholder, or to distribute such votes among as many candidates as the shareholder deems fit. The

candidates receiving the highest number of votes, up to the number of Directors to be elected, will be elected. The Proxy confers on the Proxyholders discretionary authority to vote the shares in such a manner as to effect the election

of all thirteen (13) nominees for Director or as many thereof as possible under the rules of cumulative voting.

2

Of the shares of Common Stock issued and outstanding as of the Record Date, 1,614,388 (18.27%) shares were beneficially owned by Directors and executive officers of the Company. Such

persons have informed the Company that they will vote “AUTHORITY GIVEN” for all thirteen (13) nominees in the election of Directors; and “FOR” ratification

of the selection of RSM as the Company’s independent auditors for the fiscal year ending December 31, 2023. Under California law and the Company’s Bylaws, a quorum consists of the presence in person or by proxy of a majority of the

shares entitled to vote at the Meeting, and a matter (other than the election of Directors) voted on by shareholders will be approved if it receives the vote of a majority of the shares both present and voting, which shares also

constitute a majority of the required quorum, unless the vote of a greater number of shares is required. Abstentions and broker non-votes will be included in the number of shares present at the Meeting and entitled to vote for the

purpose of determining the presence of a quorum.

We urge you to fully review this Proxy Statement and all of the information contained in the Proxy Materials, including the Annual Report to Shareholders, before voting your shares on the

matters to be considered and voted upon at the Meeting.

If your shares are held in "street name" by a brokerage firm, you will need to follow the directions your brokerage firm provides to you to properly vote your shares. Under the current

rules of the New York Stock Exchange (NYSE), if you do not give instructions to your brokerage firm at least ten (10) days before the Meeting, you still will be able to vote your shares with respect to certain "routine" matters, but you

will not be allowed to vote your shares with respect to certain "non-routine" matters. For example, the ratification of RSM as the Company's independent auditors (Proposal 2) is considered to be a routine matter under the NYSE rules and

your brokerage firm will be able to vote on this proposal if it does not receive instructions from you, so long as it holds your shares in its name. However, the election of Directors (Proposal 1) is a non-routine matter. Accordingly,

if you do not instruct your broker how to vote with respect to Proposals 1, your broker may not vote with respect to that proposal and those votes will be counted as "broker non-votes." "Broker non-votes" are shares that are held in

"street name" by a bank or brokerage firm that indicates on its proxy that it does not have or did not exercise discretionary authority to vote on a particular matter. Assuming that a quorum is present at the Meeting, the following table

sets forth the required vote to approve each matter to be considered and voted upon at the Meeting and the effect of “Withhold” votes, abstentions and broker non-votes.

|

Proposal

|

Required Vote

|

Effect of “Withhold” Votes, Abstentions, Broker Non-Votes

|

||||||

|

Proposal 1 – Election of Directors

|

The candidates receiving the highest number of votes, up to the number of Directors to be elected, will be elected.

|

Broker non-votes will have no effect on the voting for the election of Directors.

|

||||||

|

Proposal 2 – Ratification of the Company’s Independent Auditors

|

Affirmative vote of a majority of the shares represented and voting at the Meeting on this proposal, with affirmative votes constituting at least a majority of the required quorum.

|

Abstentions and broker non-votes will have no effect unless there are insufficient votes in favor of the proposal, such that the affirmative votes constitute less than a majority of the required

quorum. In such case, abstentions will have the same effect as a vote against the proposal.

|

Voting Methods

Your vote is important. Whether you hold shares directly as a shareholder of record or beneficially in "street name" (through a brokerage firm,

bank or other nominee, referred to herein as “broker”), you may vote your shares without participating in the Meeting by the methods set forth below.

If you are a shareholder whose shares are registered in your name as of the Record Date, you may vote your shares by one of the following methods:

Vote by Internet. You may direct your vote via the Internet by proxy without attending the Meeting. Our Internet voting procedures are designed

to authenticate shareholders by using individual control numbers. To vote via the Internet please go to www.investorvote.com/CWBC or scan the QR code provided in the shaded area on your Notice or Proxy. Follow the instructions

on your Notice or Proxy and use the Internet, which is available 24 hours a day, to transmit your voting instructions up until the voting is closed at 1:00 A.M. Pacific Daylight Time on May 25,

2023.

3

Vote by Telephone. You may also direct your vote by proxy without attending the Meeting by dialing toll free,

1-800-652-8683 and following the instructions for telephone voting shown on your Notice or Proxy. To transmit your voting instructions use any touch-tone telephone which is available 24 hours a day, up until voting is closed at 7:00 P.M.

Pacific Daylight Time on May 25, 2023.

Vote by Proxy. If you requested a paper copy of the Proxy you may vote by returning the completed and properly signed Proxy in the postage-paid

envelope enclosed with the paper copy of the proxy materials. Please mail your completed Proxy by regular mail to the following address: Community West Bancshares, c/o Computershare Investors Services, Post Office Box 43078, Providence,

RI 02940-3078 or by overnight delivery to Community West Bancshares, c/o Computershare Investors Services, 150 Royal St., Suite 101, Canton, MA 02021.

During the Meeting. Shares registered directly in your name as the shareholder of record may be voted by submitting a signed Proxy to the

Inspector of Elections.

If your shares are held in “street name” as of the Record Date, then you are the “beneficial owner” of those shares and you should receive a separate voting

instruction from your broker to direct your broker on how to vote your shares.

We encourage you to communicate your voting decisions to your broker to ensure your vote will be counted. Shares held through a broker may be voted only through the link provided to you

by your broker.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS, DIRECTORS AND EXECUTIVE OFFICERS

The following table sets forth certain information as of the Record Date, concerning the beneficial ownership of the Company’s outstanding Common Stock: (i) by persons (other than

depositories) known to the Company to own more than 5% of the Company’s outstanding Common Stock; (ii) by each of the Company’s Directors or nominees; (iii) by each of the Named Executive Officers (as hereinafter defined); and (iv) by all

current Directors and executive officers as a group. Management is not aware of any arrangement that may, at a subsequent date, result in a change in control of the Company.

Except as indicated, the address of each of the persons listed below is c/o Community West Bancshares, 445 Pine Avenue, Goleta, CA 93117.

4

|

Name and Title

|

Number of

Shares of

Common

Stock

Beneficially

Owned (1)

|

Number of

Shares

Subject to Vested

Stock Options

(2)

|

Percent of Class

Beneficially

Owned

(1) (2)

|

|||||||||

|

Martin P. Alwin, Director

|

4,186

|

-

|

*

|

|||||||||

|

Robert H. Bartlein, Director, Chairman of the Board, CWB

|

538,450

|

-

|

6.09

|

%

|

||||||||

|

Dana L. Boutain, Director

|

3,501

|

11,000

|

*

|

|||||||||

|

Suzanne M. Chadwick, Director

|

1,750

|

-

|

*

|

|||||||||

|

Tom L. Dobyns, Director

|

4,500

|

11,000

|

*

|

|||||||||

|

12,411

|

42,000

|

0.61

|

%

|

|||||||||

|

John D. Illgen, Director

|

27,000

|

21,000

|

0.54

|

%

|

||||||||

|

Investors of America, Limited Partnership (3)

|

568,696

|

-

|

6.44

|

%

|

||||||||

|

James W. Lokey, Director

|

13,054

|

11,000

|

*

|

|||||||||

|

Shereef Moharram, Director

|

15,925

|

21,000

|

*

|

|||||||||

|

William R. Peeples, Director, Chairman of the Board, CWBC

|

807,526

|

-

|

9.14

|

%

|

||||||||

|

PL Capital Advisors, LLC, Richard J. Lashley, John W. Palmer and Martin P. Alwin (6)

|

632,075

|

-

|

7.15

|

%

|

||||||||

|

Richard Pimentel, Executive Vice President and Chief Financial Officer, CWBC and CWB

|

-

|

4,000

|

*

|

|||||||||

|

Martin E. Plourd, Director, President and Chief Executive Officer, CWBC and Chief Executive Officer, CWB

|

96,550

|

140,130

|

2.64

|

%

|

||||||||

|

Christopher R. Raffo, Director (5)

|

1,739

|

20,000

|

*

|

|||||||||

|

Kirk B. Stovesand, Director

|

84,296

|

8,000

|

1.04

|

%

|

||||||||

|

Timothy J. Stronks, Executive Vice President and Chief Operating Officer and Chief Risk Officer, CWB

|

2,500

|

26,700

|

*

|

|||||||||

|

Philip J. Timyan (4)

|

506,311

|

-

|

5.73

|

%

|

||||||||

|

Celina L. Zacarias, Director

|

1,000

|

-

|

-

|

|||||||||

|

All Directors and Executive Officers as a Group (16 in number)

|

1,614,388

|

315,830

|

21.09

|

%

|

||||||||

* Less than 0.50%

(1) Includes shares beneficially owned, directly and indirectly, together with associates, except for shares subject to vested stock options’. Also includes shares held as

trustee and held by or as custodian for minor children. Unless otherwise noted, all shares are held as community property under California law or with sole investment and voting power.

(2) Shares subject to options held by Directors or executive officers that are exercisable within 60 days after the Record Date (vested) are treated as issued and outstanding for

the purpose of computing the percent of the class owned by such person and the percent of class owned by all Directors and executive officers as a group, but not for the purpose of computing the percent of class owned by any other person.

(3) Address is: 135 North Meramec, Clayton, MO 63105. These securities are owned by Investors of America, Limited Partnership and may be deemed to be indirectly owned by First

Bank, Inc. Members of the Dierberg Family and the Dierberg Family Trusts are shareholders of First Securities America, Inc., the General Partner of Investors of America, Limited Partnership, and First Bank, Inc. First Bank, Inc.

disclaims beneficial ownership of these securities.

(4) Address is: 105 Front Street #122, Key West, Florida 33040. Excludes 4,000 shares held by Mr. Timyan’s spouse, Anna S. Belyaev, of which Mr. Timyan disclaims beneficial

ownership. Information is pursuant to the most recent Schedule 13D filed by Mr. Timyan with the SEC on or about July 31, 2020.

(5) Mr. Raffo holds the option to purchase 20,000 shares of Company Common Stock from Philip J Timyan under the terms of an option agreement between Mr. Raffo and Mr. Timyan.

5

(6) Address is: 750 Eleventh Street South, Suite 202, Naples, FL 34102. Mr. Lashley, Mr. Palmer, and PL Capital Advisors, LLC disclaim beneficial ownership of such Common Stock,

except to the extent of their pecuniary interest therein. Information is pursuant to the most recent Schedule 13D/A filed by Mr. Lashley, Mr. Palmer, Mr. Alwin and PL Capital Advisors, LLC with the SEC on or about March 22, 2022.

PROPOSAL 1

ELECTION OF DIRECTORS

Directors and Executive Officers

The Company's Bylaws provide that the authorized number of Directors will be not less than eight (8) nor more than fifteen (15), with the exact number of Directors to be fixed from time

to time by resolution of a majority of the Board or by resolution of the shareholders. The Board of Directors last fixed the authorized number, within the range at thirteen (13).

At the Meeting, thirteen (13) persons will be elected to serve as Directors of the Company until the 2024 Annual Meeting and until their successors are elected and have qualified. The

thirteen (13) persons named below are all currently Directors of the Company and have been nominated by the Board for re-election.

A Proxy that is submitted to the Company with the instruction “AUTHORITY GIVEN” or submitted without instructions will be voted in such a way as to effect the election of all thirteen

(13) nominees, or as many thereof as possible under the rules of cumulative voting if cumulative voting is invoked at the Meeting. In the event that any of the nominees should be unable to serve as a Director, it is intended that the

Proxy will be voted for the election of such substitute nominees, if any, as will be designated by the Board. Each nominee has consented to being named in the Proxy Statement and has agreed to serve as a member of the Board, if elected.

The Board has no reason to believe that any of the nominees will be unable or unwilling to serve. Additional nominations can only be made by complying with the notice provision set forth in the Bylaws of the Company, an extract of which

is included in the Notice of Annual Meeting of Shareholders accompanying this Proxy Statement. This Bylaw provision is designed to give the Board advance notice of competing nominations, if any, and the qualifications of nominees, and

may have the effect of precluding third-party nominations if the notice provisions are not followed.

None of the Directors or executive officers of the Company were selected pursuant to any arrangement or understanding, other than with the Directors and executive officers of the Company,

acting within their capacities as such. The Company knows of no family relationships between the Directors and executive officers of the Company, nor do any of the Directors or executive officers of the Company serve as Directors of any

other company which has a class of securities registered under, or which is subject to the periodic reporting requirements of the Exchange Act or any investment company registered under the Investment Company Act of 1940.

Pursuant to NASDAQ Stock Market LLC (NASDAQ) Listing Rules, the Board has made an affirmative determination that the following members of the Board are “independent” within the meaning of

such rules: Martin P. Alwin, Robert H. Bartlein, Dana L. Boutain, Suzanne M. Chadwick, Tom L. Dobyns, John D. Illgen, James W. Lokey, Shereef Moharram, William R. Peeples, Christopher R. Raffo, Kirk B. Stovesand, and Cecilia L. Zacarias.

As such, pursuant to NASDAQ Listing Rules, a majority of the members of the Board are “independent” as so defined. Also, pursuant to NASDAQ Listing Rules and Rule 10A-3 of the Securities Exchange Act of 1934 (Exchange Act), all of the

members of the Audit Committee are “independent” as so defined.

The following persons have been nominated for election by the Board:

|

Martin P. Alwin

|

Shereef Moharram

|

|

Robert H. Bartlein

|

William R. Peeples

|

|

Dana L. Boutain

|

Martin E. Plourd

|

|

Suzanne M. Chadwick

|

Christopher R. Raffo

|

|

Tom L. Dobyns

|

Kirk B. Stovesand

|

|

John D. Illgen

|

Celina L. Zacarias

|

|

James W. Lokey

|

THE BOARD OF DIRECTORS RECOMMENDS A VOTE OF “AUTHORITY GIVEN” FOR ALL THIRTEEN NOMINEES IN THE ELECTION OF DIRECTORS.

6

Board Diversity

In August 2021, the Securities and Exchange Commission (“SEC”) approved the Nasdaq proposed rule to amend its listing rules related to board diversity to advance board diversity and

enhance the transparency of those diversity statistics. Rule 5605(f) (Diverse Board Representation) requires Nasdaq-listed companies, subject to certain exceptions, (1) to have at least one director who self-identifies as a female, and

(2) to have at least one director who self-identifies as Black or African American, Hispanic or Latinx, Asian, Native American or Alaska Native, Native Hawaiian or Pacific Islander, two or more races or ethnicities, or as LGBTQ+, or (3)

to explain why the reporting company does not have at least two directors on its board who self-identify in the categories listed above. Smaller reporting companies, like the Company may satisfy the diversity objective by including two

directors who identify as female. In addition, Rule 5606 (Board Diversity Disclosure) requires each Nasdaq-listed company, again subject to certain exceptions, to provide statistical information about such company’s Board of Directors,

in a proposed uniform format, related to each director’s self-identified gender, race, and self-identification as LGBTQ+. Under an amendment adopted by Nasdaq, the requirement to have one diverse director (or provide explanation)

listing rules becomes effective for the Company on December 31, 2023 and the requirement for the Company to have two diverse directors (or provide an explanation) becomes effective December 31, 2025. The Company has nonetheless elected

to make the requested disclosures in the uniform format provided by Nasdaq, as set forth in the matrix below.

In addition, the State of California has enacted two statutes on the subject of board diversity that apply to all publicly held companies whose principal executive

offices are located in California. In 2018, SB 826 was adopted whereby such companies whose boards of directors have six or more members were required to have at least one female director by the end of 2019 and are required to have at

least three female directors by the end of 2021. In 2020, AB 979 was adopted which requires all publicly held corporations headquartered in California to diversify their boards of directors with directors from “underrepresented

communities.” Similar to Nasdaq proposed Rule 5605(f), AB 979 defines “director from an underrepresented community” as “an individual who self-identifies as Black, African American, Hispanic, Latino, Asian, Pacific Islander, Native

American, Native Hawaiian, or Alaska Native, or who self-identifies as gay, lesbian, bisexual, or transgender.” Covered companies must have at least one director from an underrepresented community on their boards by December 31, 2021,

and covered companies with nine or more directors must have at least three such directors on their boards by December 31, 2022. The same individual may count for the purposes of both gender and underrepresented community diversity.

The Company believes that it is presently in compliance with the diversity requirements imposed by the proposed Nasdaq listing rules. As well as the two State of

California statutes summarized above.

|

Board Diversity Matrix (As of March 28, 2023)

|

||||

|

Total Number of Directors

|

13

|

|||

|

Female

|

Male

|

Non-Binary

|

Did Not Disclose Gender

|

|

|

Directors

|

3

|

9

|

0

|

1

|

|

Number of Directors who identify in Any of the Categories Below:

|

||||

|

African American or Black

|

0

|

1

|

0

|

0

|

|

Alaskan Native or Native American

|

0

|

0

|

0

|

0

|

|

Asian

|

0

|

1

|

0

|

0

|

|

Hispanic or Latinx

|

1

|

0

|

0

|

0

|

|

Native Hawaiian or Pacific Islander

|

0

|

0

|

0

|

0

|

|

White

|

2

|

7

|

0

|

0

|

|

Two or More Races or Ethnicities

|

0

|

0

|

0

|

0

|

|

LGBTQ+

|

0

|

|||

|

Did not Disclose Demographic Background

|

1

|

|||

7

Information about the Nominees

Mr. Alwin was elected to the Boards of CWBC and CWB in May 2022. Mr. Alwin is the Senior Analyst at PL Capital Advisors, LLC.

He is also a Principal and Managing Member of RISE Commercial Self Storage Fund Managers, LLC. Prior to joining PL Capital, he was a Vice President of FIG Investment Banking for Piper Jaffray & Co. focused on mergers &

acquisitions, capital raising, balance sheet management, and other advisory services across the U.S. financial services industry. Mr. Alwin is a graduate of the University of Chicago Booth School of Business with a Masters of Business

Administration and has a Bachelor of Arts degree from Lawrence University.

Robert H. Bartlein (Age 75)

Mr. Bartlein has been a member of the Board of CWBC since its inception in 1997 and a founder and Director of CWB since 1989. Mr. Bartlein serves on CWBC’s Nominating and Corporate

Governance Committee and is Chairman of the Board of CWB, Chairman of CWB’s Credit Committee and a member of CWB’s Executive, Compensation, and Management Succession Committees. He is President and CEO of Bartlein & Company, Inc.,

founded in 1969, which is a property management company with three California offices. He is a graduate of the University of Wisconsin – Madison, with a degree in Finance, Investments and Banking, and did post-graduate study at the

University of Wisconsin - Milwaukee. Mr. Bartlein is past President and Director of the American Lung Association of Santa Barbara and Ventura Counties.

Dana L. Boutain (Age 58)

Mrs. Boutain was named to the Boards of CWBC and CWB in July 2017, and is a member of CWBC’s Audit Committee. Mrs. Boutain is a managing director in the Oxnard office of CBIZ MHM, LLC.

She assists clients with complex tax planning, from transaction structuring to multistate filing to taxation for international operations and subsidiaries. She has been in the industry for more than 30 years. Mrs. Boutain is a Certified

Public Accountant and holds a B.S. – Business Administration degree from the California State University – Bakersfield and holds a M.S. – Taxation degree from Golden Gate University.

Suzanne M. Chadwick (Age 75)

Ms. Chadwick was elected to the Board as of May 2021. Ms. Chadwick a resident of Oxnard, CA, was employed by Santa Barbara Bank and Trust for over 20 years. Having introduced Santa

Barbara Bank and Trust to Ventura County in 1995, she retired as Senior Vice President Private Client Manager in 2013. She cultivated high-value existing and new business relationships as well as being an active community volunteer. Ms.

Chadwick currently serves as Regent with California Lutheran University, where she has been active since 2013. She also serves on the Advisory Council for the Center for Nonprofit Leadership since 2016, Interface Children & Family

Services Advisory Board since 2008, KCLU Advisory Board since 1995 and Rotary Club of Oxnard.

Tom L. Dobyns (Age 70)

Mr. Dobyns was named to the Boards of CWBC and CWB in July 2017 and is a member of CWB’s Compensation and Asset/Liability Committees. Mr. Dobyns has more than 42 years of bank management

experience, including as Chief Executive Officer of Mission Community Bank (2011-2014); President and Chief Executive Officer of American Security Bank (2009-2011); President of the Retail Banking Group of Fullerton Community Bank

(2004-2007); Executive Vice President of First Interstate Bank (1981-1996), and a past member of the Board of Directors of the California Bankers Association. He currently has his own consulting company that assists both banks and

non-banks in leadership and executive coaching. He is a keynote speaker for organizations across the United States and abroad. Mr. Dobyns resides in Pismo Beach, CA and serves on several community-based non-profits. Currently he is the

Director of Advancement for Coastal Christian School in Pismo Beach.

John D. Illgen (Age 78)

Mr. Illgen has been a member of the Board of CWBC since its inception in 1997 and a founder and Director of CWB since 1989. He is Secretary of the Board of CWBC, a member of CWBC’s

Nominating and Corporate Governance, Audit Committees, Chairman of CWB’s Asset/Liability Committee, and a member of CWB’s Compensation Committee. Mr. Illgen was Sector Director and Vice President for Modeling and Simulation with Northrop

Grumman Information Systems until January 2018. He was Founder (1988), President and Chairman of Illgen Simulation Technologies, Inc. until its merger with Northrop Grumman Corporation in December 2003. Mr. Illgen is Chairman Emeritus

of the Board of Directors of the National Defense Industrial Association and appeared on television with the late General (Ret) Alexander Haig on “21st World Business Review” as an industry expert in information systems,

modeling and simulation and other technologies. Mr. Illgen is on the Advisory Board of the Santa Barbara Scholarship Foundation and is a Past President of Goleta Rotary Club. In 2012, Mr. Illgen received the International Award, “Modern

Day Technology Leader” from the BEYA for his contributions to the Modeling and Simulation domain. The National Defense Training Association (NTSA) awarded Mr. Illgen their highest honor by awarding Mr. Illgen the Governor’s Life-Time

Achievement Award for Modeling and Simulation in 2017. Mr. Illgen also received Board Member Emeritus from the National Defense Industrial Association (NDIA). Mr. Illgen will remain on all committees with the NDIA.

8

James W. Lokey (Age 75)

Mr. Lokey has been a member of the Board of CWBC and CWB since June 2015. He is a member of CWBC’s Audit Committee, Executive Committee and CWB’s Credit Committee. Mr. Lokey has more

than 42 years of bank management experience including as Chairman of the Board and Chief Executive Officer of Mission Community Bancorp (2010-2014); President of Rabobank, N.A. (2007-2009); President and Chief Executive Officer of

Mid-State Bank & Trust (2000-2007); President and Chief Executive Officer of Downey Savings (1997-1998); Executive Vice President of First Interstate Bank/Wells Fargo Bank (1973-1996) and Past Chairman of the California Bankers

Association. He has significant ties in the communities of the Central Coast, including serving as a member of the President’s Cabinet at Cal Poly State University in San Luis Obispo; a Director of Cal Poly Corporation and Chairman of

its investment committee; and Director of French Hospital Medical Center. Since retiring in 2014, Mr. Lokey has been active as a consultant and featured speaker regarding director education, enterprise risk management, and mergers and

acquisitions.

Shereef Moharram (Age 51)

Mr. Moharram was named to the Boards of CWBC and CWB in December 2011, and is a member of CWB’s Asset/Liability Committee. Mr. Moharram is a partner with the law firm Price Postel &

Parma LLP in Santa Barbara, where he specializes in real estate law. Mr. Moharram holds a B.A. in English Literature from the University of California, Santa Barbara, and a JD from the UCLA School of Law.

William R. Peeples (Age 80)

Mr. Peeples is Chairman of the Board of CWBC and a founder and Director of CWB since 1989. Mr. Peeples is Chairman of CWBC’s Nominating and Corporate Governance Committee and serves on

CWB’s Executive, Compensation and Management Succession Committees. Mr. Peeples served in various executive capacities, including as President and Chief Financial Officer of Inamed Corporation from 1985 to 1987. He also was a founder

and Chief Financial Officer of Nusil Corporation and Imulok Corporation from 1980 to 1985. Mr. Peeples has been active as a private investor and currently serves as Managing General Partner of two real estate partnerships. Mr. Peeples

holds a BBA from the University of Wisconsin – Whitewater, and an MBA from Golden Gate University, Air Force on-base program.

Martin E. Plourd (Age 65)

Mr. Plourd has been Chief Executive Officer and a member of the Board of CWB since November 2011 and President, Chief Executive Officer and member of the Board of CWBC since March 2012.

Mr. Plourd serves on CWB’s Credit, Asset/Liability and Management Succession Committees and is a member of the Management Disclosure Committee. He has been in banking for over 40 years and has been a bank executive for over 25 years.

From July 2009 to October 2011, he worked as a private consultant with banks on engagements concerning strategic planning, acquisitions and compliance issues. From July 2005 to July 2009, Mr. Plourd served first as Chief Operating

Officer and then as President and Director of Temecula Valley Bank. Prior to that, he spent 18 years with Rabobank/Valley Independent Bank in El Centro, including his last position as Executive Vice President and Community Banking

Officer. Mr. Plourd is an executive board member of the California Bankers Association , board member of the Goleta Valley Cottage Hospital Foundation, board member of the Scholarship Foundation of Santa Barbara, an Advisory board

member for the College of Agriculture at California State Polytechnic University, Pomona (Cal Poly), and is a member of the Goleta Rotary Club. Mr. Plourd is a graduate of Stonier Graduate School of Banking and Cal Poly.

Christopher R. Raffo (Age 65)

Mr. Raffo has been a member of the Board of CWBC and CWB since July 2020. Mr. Raffo has thirty-five years of Capital Markets experience in Community and Regional banks. Mr. Raffo served

as Managing Director for Caldwell Securities Incorporated a broker-dealer an investment advisory firm, where he led the Community Bank Services Group, and has held senior positions at Howe Barnes Investments, Podesta & Co, Hoefer

& Arnett and FIG Partners. Since 2017 he has been engaged with Kilowatt Labs, Inc.

9

Kirk B. Stovesand (Age 60)

Mr. Stovesand has been a member of the Board of CWBC and CWB since May 2003. Mr. Stovesand is Chairman of CWBC’s Audit Committee and serves on CWB’s Asset/Liability, and Credit

Committees and is Secretary of CWB’s Board. He is a partner of Walpole & Co., founded in 1974, which is a Certified Public Accounting and Consulting firm. Mr. Stovesand has served on the boards of both for-profit and not-for-profit

organizations. He is a graduate of the University of California Santa Barbara with a degree in Business Economics. Mr. Stovesand received a Masters Degree in Taxation from Golden Gate University and a Master Certificate in Global

Business Management from George Washington University. He is a Certified Financial Planner, certified in mergers and acquisitions, and a member of the American Institute of Certified Public Accountants.

Celina L. Zacarias (Age 61)

Ms. Zacarias was named to the Board s of both CWBC and CWB in December of 2021. Ms. Zacarias currently serves as Senior Director of Community & Government Relations at California

State University Channel Islands. Ms. Zacarias also currently serves as the Port of Hueneme Harbor Commissioner for the Oxnard Harbor District. Ms. Zacarias graduated from the University of California Santa Barbara with degrees in

Spanish literature and Hispanic civilization. Ms. Zacarias has 25 years of business experience from careers with GMAC Mortgage, Wells Fargo, and Cabrillo Economic Development Corporation. Ms. Zacarias received a Bachelor of Arts degree

in Spanish literature and Hispanic civilization form the University of California Santa Barbara.

Executive Officers (not members of the Board)

The following sets forth, as of the Record Date, the names and certain other information concerning current executive officers of the Company, other than for Martin E. Plourd, who is a current

director and nominee.

Mr. Filippin, President and Credit Officer of CWB, has been with the Company since June 2015 and has served as a Director of CWB since 2022. Prior to joining the Company, Mr. Filippin

served with Heritage Oaks Bank (and Mission Community Bank until it was merged into Heritage Oaks Bank in February 2014) as Market Area President from March 2012 to May 2015; Executive Vice President and Chief Credit Officer from August

2010 to March 2012; and, Senior Vice President and Credit Administrator from April 2009 to August 2010. Mr. Filippin is a founding member of the Paso Robles Optimist Club, served as President of the Paso Robles Kiwanis Club, and Chairman

of the Arroyo Grande Chamber of Commerce. He holds degrees in Agriculture Business Management from Cal Poly San Luis Obispo and from The Graduate School of Banking at the University of Wisconsin-Madison.

Richard Pimentel (Age 50)

Mr. Pimentel, Executive Vice President and Chief Financial Officer of CWBC and CWB, has been with the Company since January 2022. Mr. Pimentel previously served as Chief Financial

Officer of CalPrivate Bank and prior to that Senior Vice President, Corporate Finance Officer for Hanmi Bank. Mr. Pimentel has over 20 years of financial leadership experience with community banks. Mr. Pimentel is a graduate of Pacific

Coast Banking School and holds a Bachelor of Science degree in Finance, Real Estate, and Law from Cal Poly Pomona.

Timothy J. Stronks (Age 54)

Mr. Stronks, Executive Vice President and Chief Operating Officer and Chief Risk Officer of CWB, has been with the Company since July 2018. Mr. Stronks previously served as Senior Vice

President, Deputy Director of Operations with Rabobank and prior to that as Executive Vice President for Pacific Premier Bank and Executive Vice President, Chief Information Officer of Heritage Oaks Bank (which was acquired by Pacific

Premier Bank in March 2017). Mr. Stronks also previously held various positions at Business First National Bank (acquired by Heritage Oaks Bank) in Santa Barbara, CA and Santa Barbara Bank and Trust. Mr. Stronks is a Certified

Information Security Manager and serves on the board of the Science and Engineering Council of Santa Barbara. Mr. Stronks is a graduate of Pacific Coast Banking School, holds a Bachelor of Arts degree in International Political Science

and Slavic Languages and Literatures from the University of California at Santa Barbara, and an MBA in IT Management from Western Governors University.

10

Specific Experience, Qualifications, Attributes and Skills of Directors

The Nominating and Corporate Governance Committee (NCGC) has reviewed with the Board the specific experience, qualifications, attributes and skills of each Director, including each

nominee for election as a Director at the Meeting. The NCGC has concluded that each Director has the appropriate skills and characteristics required of Board membership, and each possesses an in-depth knowledge of the Company’s business

and strategy. The NCGC further believes that our Board is composed of well-qualified and well-respected Directors who are prominent in business, finance and the local community. The experience and key competencies of each Director, as

reviewed and considered by the NCGC, are set forth below.

Martin P. Alwin. As a registered investment advisor with over 15 years of experience in analyzing, understanding, monitoring and investing in

financial institutions across the United States, he brings a wealth of knowledge regarding the marketing, operations, and management of banking institutions and their market-related activities. He is very well acquainted with and is

regularly monitoring the activities of banks and their holding companies, nationally. He is well versed in mergers and acquisitions of those institutions, including evaluating potential strategic and financial benefits of such

transactions. His involvement in private and public equity transactions and his knowledge of how to price and effectuate such transactions including due diligence, client presentations, private offering memoranda, fairness opinions, as

well as public company registration statements and prospectuses makes him very well suited and well qualified to serve as a director of the Company and CWB

Robert H. Bartlein. As President of Bartlein & Company, Inc., Mr. Bartlein has substantial real estate experience with broad business

exposure. He is knowledgeable in real estate transactions, real estate law, credit analysis, accounting, income tax law and finance. Mr. Bartlein is particularly familiar with the Central Coast real estate market and is active in the

community. He is a founder and has served on the Bank Board since its inception.

Dana L. Boutain. Mrs. Boutain has a broad financial background and serves as a managing director of an accounting and consulting firm. Her

expertise is in consulting, transaction structuring and financial statement compilations and reviews, including assisting clients in developing banking relationships and banking transactions. She primarily services clients in

construction, manufacturing, government providers, oilfield services, transportation and real estate. Mrs. Boutain is active on boards of for-profit and not-for-profit organizations.

Suzanne M. Chadwick. Ms. Chadwick had an extensive career in banking cultivating business relationships and private client services. Ms.

Chadwick is extremely knowledgeable with the Ventura County banking market and the business community.

Tom L. Dobyns. Mr. Dobyns has extensive experience in bank management serving in various executive management capacities including as Chief

Executive Officer. Mr. Dobyns consults banks in leadership and executive coaching. Mr. Dobyns is active on several community-based not-for-profit boards.

John D. Illgen. As founder and Chief Executive Officer of Illgen Simulation Technologies, Inc., until sold to Northrop Grumman, Mr. Illgen has a

national reputation in technology, National Defense, models/ simulations, and broad business experience. He has strong expertise in cyber security, AI, modeling and simulation and has chaired sessions at symposiums on these subjects. He

continues to be published on technology and is a frequent symposium “Key Note” speaker. Mr. Illgen was Co-Host on World Business Review (International TV broadcast weekly) for technology with the Late Alexander Haig. Mr. Illgen is a

Co-founder and has served on the Bank Board since its inception.

James W. Lokey. Mr. Lokey has spent virtually his entire career serving the banking industry, including many years as Chairman and Chief Executive

Officer. He is extremely knowledgeable with the San Luis Obispo business community and banking market.

Shereef Moharram. Mr. Moharram is an attorney, specializing in real estate and is very active in the local community. The Company believes Mr.

Moharram’s legal and real estate background is pertinent in addressing numerous Board issues.

William R. Peeples. Mr. Peeples has substantial experience in finance, including positions as a Chief Financial Officer, and has

expertise in capital raising, venture capital, business combinations, real estate and broad business exposure. Mr. Peeples also served as interim President and Chief Executive Officer of CWBC. He is active in the local community. Mr.

Peeples is a founder and has served on the Bank Board since its inception.

Martin E. Plourd. As President, Chief Executive Officer and a Director of the Bank and the Company, and through numerous

executive positions Mr. Plourd has held in his banking career, he has a substantial financial services’ background, including management, lending, marketing and bank operations. This experience enables Mr. Plourd to provide the Company

with effective leadership in the conduct of its business and strategic initiatives. He is active in the community and also has served in executive positions in the banking industry.

11

Christopher R. Raffo. Mr. Raffo has thirty-five years of Capital Markets experience in Community and Regional banks. Mr. Raffo led the

Community Bank Services Group for Caldwell Securities Incorporated and has held senior sales positions at other investment advisory firms.

Kirk B. Stovesand. Mr. Stovesand has a broad financial background and serves as a partner of an accounting and consulting firm. He has a CPA, a

CFP and a Masters in taxation. Mr. Stovesand is active on boards of for-profit and not-for-profit organizations.

Celina L. Zacarias. Ms. Zacarias has 25 years of business experience and holds leadership positions in many professional, economic, and

charitable organizations. Ms. Zacarias business experience includes banking as well as education. Her leadership skills include promotion of culture diversity and goodwill regionally, thorough

out the state, nationally and internationally.

Material Litigation Involving Directors and Executive Officers

As of the date of this Proxy Statement, none of the Company’s Directors and/or Executive Officers is involved in any material proceeding as a party that is adverse to the Company or CWB

or has a material interest adverse to the Company or CWB. In addition, none of the Company’s Directors and/or Executive Officers have been convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors) during

the ten-year period prior to the date of this Proxy Statement.

Significant Employees

Although the Company and CWB considers each of their employees to be integral to the success of their respective operations in light of their individual contributions to the enterprise,

as of the date of this Proxy Statement, neither the Company nor CWB has identified any “significant employees” within the meaning of Item 401(c) of SEC Regulation S-K.

CERTAIN INFORMATION REGARDING THE BOARD OF DIRECTORS

Meetings and Committees

The Company’s Board met 13 times (12 regular meetings and one special meeting) during the

year ended December 31, 2022, and had the following standing committees of the Company or CWB that met during the year: Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee. In addition, the Company’s

Directors served on the Board of Directors of CWB, including the various committees established by CWB. During 2022, none of the Company’s Directors attended less than 83% of the Company’s Board meetings and meetings of committees on

which they served.

CWBC’s Audit Committee is composed of four independent Directors: Messrs. Stovesand, Illgen, Lokey, and Mrs. Boutain. This Committee is responsible for

review of all internal and external examination reports and selection of the Company’s independent auditors. The Audit Committee met 12 times during 2022.

CWBC’s Nominating and Corporate Governance Committee is composed of three independent Directors: Messrs. Peeples, Bartlein, and Illgen. The Committee is

responsible for recommendations regarding the Board’s composition and structure as well as policies and processes regarding overall corporate governance. The Committee met one time during 2022.

CWB’s Compensation Committee is composed of five independent Directors: Ms. Chadwick and Messrs. Bartlein, Dobyns, Illgen and Peeples. The Committee is

responsible for determining executive compensation. This Committee met three times, including at least once in each six-month period, during 2022.

Board Leadership Structure and Role in Risk Oversight

The position of Chairman of the Board is separate from the position of Chief Executive Officer for each of the Company and CWB. William R. Peeples, a non-employee independent Director,

has been elected as the Chairman of the Company and Robert H. Bartlein, a non-employee independent Director, has been elected as the Chairman of CWB. Martin E. Plourd is serving as President and Chief Executive Officer of the Company and

Chief Executive Officer of CWB. Separating these positions allows the Chief Executive Officer to focus on day-to-day business, while allowing the Chairman of the Boards of each of the Company and CWB to lead the respective Boards in

their fundamental role of providing advice to and independent oversight of management. The Board recognizes the time, effort and energy that the Chief Executive Officer is required to devote to his position in the current business

environment, as well as the commitment required for those individuals to serve as the Company and CWB Chairman, particularly as the Board’s oversight responsibilities continue to grow. While the Company’s bylaws and corporate governance

guidelines do not require that the Company’s Chairman and Chief Executive Officer positions be separate, the Board believes that having separate positions and having independent outside Directors serve as the Chairman of each of the

Company and CWB is the appropriate leadership structure for the Company at this time and demonstrates the Company’s commitment to good corporate governance.

12

Risk is inherent with every business, and how well a business manages risk can ultimately determine its success. The Company faces a number of risks, including interest rate risk,

economic risks, environmental, cybersecurity, and regulatory risks, and others, such as the impact of competition. Management is responsible for the day-to-day identification and management of risks the Company faces, while the Board, as

a whole and through its committees, has responsibility for the oversight of risk management. In its risk oversight role, the Board has the responsibility to satisfy itself that the risk management processes designed and implemented by

management are adequate and functioning as designed.

The Board believes that establishing the right “tone at the top” and that full and open communication between management and the Board of Directors is essential for effective risk

management and oversight. The Company’s Chairman and CWB’s Chairman meet regularly with the Chief Executive Officer and other senior officers to discuss strategy and risks facing the Company. Senior management is available to address any

questions or concerns raised by the Board on risk management and any other matters. Periodically, the Board of Directors receives presentations from senior management on strategic matters involving the Company’s operations. The Board

holds strategic planning sessions with senior management to discuss strategies, key challenges and risks and opportunities for the Company.

While the Board is ultimately responsible for risk oversight at the Company, the Board’s various standing committees assist the Board in fulfilling its oversight responsibilities in

certain areas of risk. The Audit Committee assists the Board in fulfilling its oversight responsibilities with respect to risk management in the areas of financial reporting, internal controls, compliance with legal and regulatory

requirements, and cybersecurity and discusses policies with respect to risk assessment and risk management. Risk assessment reports are regularly provided by management to the Audit Committee or the Board. The Compensation Committee of

the Board assists the Board in fulfilling its oversight responsibilities with respect to the management of risks arising from compensation policies and programs. The Nominating and Corporate Governance Committee of the Board assists the

Board in fulfilling its oversight responsibilities with respect to the management of risks associated with Board organization, membership and structure, succession planning for the Company’s Directors and executive officers and corporate

governance.

Shareholder Communication with Directors

Shareholders may communicate directly with the Board by writing to:

William R. Peeples, Chairman of the Board of Directors

Community West Bancshares

445 Pine Avenue

Goleta, CA 93117-3709

Audit Committee Report

The Report of the Audit Committee of the Board will not be deemed filed under the Securities Act of 1933, as amended (Securities Act) or under the Exchange Act.

The Board maintains a separately designated standing Audit Committee within the meaning of Section 3(a)(58) of the Exchange Act. The Audit Committee is comprised of four of the Company’s

Directors, each of whom meet the independence and experience requirements of the NASDAQ Listing Rules and Rule 10A-3(b)(1) of the Exchange Act. The Audit Committee assists the Board in monitoring the accounting, auditing and financial

reporting practices of the Company. The Audit Committee operates under a written Charter, which is assessed annually for adequacy. The Audit Committee Charter was last ratified on February 23, 2023 and is included as Appendix A of this

proxy statement.

Based on the attributes, education and experience requirements under the NASDAQ Listing Rules, the requirements set forth in section 407 of the Sarbanes-Oxley Act of 2002 (“SOX”) and

associated regulations, the Board has identified Kirk B. Stovesand as an “Audit Committee Financial Expert” as defined under Item 407 (d) (5) of Regulation S-K, and has determined him to be independent.

13

Management is responsible for the preparation of the Company’s financial statements and financial reporting process, including its system of internal controls. In fulfilling its

oversight responsibilities, the Audit Committee:

| • |

Reviewed and discussed with management the audited financial statements contained in the Company’s Annual Report on Form 10-K for fiscal 2022; and

|

| • |

Obtained from management their representation that the Company’s financial statements have been prepared in accordance with accounting principles generally accepted in the United States.

|

The Company’s 2022 independent auditor, RSM US LLP (RSM), was responsible for performing an audit of the Company’s financial statements in accordance with the standards of the Public

Company Accounting Oversight Board (United States) (PCAOB) and expressing an opinion on whether the Company’s financial statements present fairly, in all material respects, the Company’s financial position and results of operations for

the periods presented and conform with accounting principles generally accepted in the United States. In fulfilling its oversight responsibilities, the Audit Committee:

| • |

Discussed with RSM the matters required to be discussed by PCAOB Auditing Standards No. 1301, Communications with Audit Committees (AS 1301); and

|

| • |

Received and discussed with RSM the written disclosures and the letter from RSM required by applicable requirements of the PCAOB regarding RSM’s communications with the Audit Committee concerning independence and reviewed and

discussed with RSM whether the rendering of the non-audit services provided by them to the Company during fiscal 2022 was compatible with their independence.

|

In performing its functions, the Audit Committee acts only in an oversight capacity. It is not the responsibility of the Audit Committee to determine that the Company’s financial

statements are complete and accurate, are presented in accordance with accounting principles generally accepted in the United States or present fairly the results of operations of the Company for the periods presented or that the Company

maintains appropriate internal controls. Further, it is not the duty of the Audit Committee to determine that the audit of the Company’s financial statements has been carried out in accordance with PCAOB standards or that the Company’s

auditors are independent.

Based upon the reviews and discussions described above, and the report of RSM, the Audit Committee recommended to the Board, and the Board has approved, that the audited financial

statements be included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2022 for filing with the SEC.

|

THE AUDIT COMMITTEE

|

|

|

Kirk B. Stovesand, Chairman

|

|

|

Dana L. Boutain

|

|

|

John D. Illgen

|

|

|

James W. Lokey

|

Dated: February 23, 2023

Nominating and Corporate Governance Committee

The Company’s Nominating and Corporate Governance Committee (NCGC) was established in February 2004 and the committee charter (Charter) is annually assessed and was last ratified on

February 23, 2023. A copy of the Charter, as amended, is included as Appendix B to this Proxy Statement. The NCGC, consisting of three independent Directors, makes recommendations to the Board regarding the Board’s composition and

structure, nominations for elections of Directors, and policies and processes regarding principles of corporate governance to ensure the Board’s compliance with its fiduciary duties to the Company and its shareholders. The NCGC reviews

the qualifications of, and recommends to the Board, candidates as additions, or to fill Board vacancies, if any were to occur during the year.

The NCGC will consider, as part of its nomination process, any Director candidate recommended by a shareholder of the Company who follows the procedures in this Proxy Statement shown

under the heading “2023 Shareholder Proposals” set forth below. The NCGC will follow the processes in the Charter when identifying and evaluating overall Board composition and individual nominees to the Board.

14

Additional information regarding (i) the NCGC’s policy with regard to the consideration of any Director candidates recommended by security holders and related procedures to be followed by

security holders in submitting such recommendations, (ii) minimum qualifications of Director candidates, and (iii) the NCGC’s process for identifying and evaluating nominees for Directors, is incorporated herein by reference to the

Charter.

The NCGC determines the required selection criteria and qualifications of Director nominees based upon the Company’s needs at the time nominees are considered. In general, Directors

should possess the highest personal and professional ethics, integrity and values and be committed to representing the long-term interests of the Company’s shareholders. In addition to the foregoing considerations, the NCGC will consider

criteria such as strength of character and leadership skills; general business acumen and experience; broad knowledge of the industry; number of other board seats; and, willingness to commit the necessary time to ensure an active board

whose members work well together and possess the collective knowledge and expertise required by the Board. The NCGC considers these same criteria for candidates regardless of whether the candidate was identified by the NCGC, by

shareholders, or any other source.

The goal of the NCGC is to seek to achieve a balance of knowledge, diversity, and experience on the Company’s Board. To this end, the NCGC seeks

nominees with the highest professional and personal ethics and values, an understanding of the Company’s business and industry, diversity of business experience, expertise and backgrounds, a high level of education, broad-based business

acumen and the ability to think strategically. The composition of the current Board reflects diversity in business and professional experience, skills, and gender. The NCGC reviews the effectiveness of the Charter in achieving the goals

of the NCGC as stated therein annually.

The Compensation Committee (CC) assists the Board by reviewing and approving the Company’s overall compensation and benefit programs and administering the compensation of the Company’s

executive and senior officers. The CC is comprised of five of the Company’s Directors, each of whom meet the current independence and experience requirements of the applicable provision of the NASDAQ Listing Rules and requirements of the

SEC. At the November 2021 meeting, the CC utilized the services of outside compensation consultants NFP and Blanchard Consulting Group to educate the CC on best practices, equity incentive plans and trends in executive and director