UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

|

☐ |

Preliminary Proxy Statement |

|

|

|

|

☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

|

|

|

☒ |

Definitive Proxy Statement |

|

|

|

|

☐ |

Definitive Additional Materials |

|

|

|

|

☐ |

Soliciting Material Pursuant to §240.14a-12 |

BSQUARE CORPORATION

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

Payment of Filing Fee (Check in the appropriate box):

|

☒ |

No fee required. |

|

|

|

|

☐ |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|

(1) |

Title of each class of securities to which transaction applies: |

|

|

|

||

|

(2) |

Aggregate number of securities to which transaction applies: |

|

|

|

||

|

(3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

|

|

|

||

|

(4) |

Proposed maximum aggregate value of transaction: |

|

|

|

||

|

(5) |

Total fee paid: |

|

|

|

|

☐ |

Fee paid previously with preliminary materials. |

|

|

|

|

☐ |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

(1) |

Amount Previously Paid: |

|

|

|

||

|

(2) |

Form, Schedule or Registration Statement No.: |

|

|

|

||

|

(3) |

Filing Party: |

|

|

|

||

|

(4) |

Date Filed: |

|

|

|

BSQUARE CORPORATION

1415 WESTERN AVENUE, SUITE 1400, SEATTLE, WASHINGTON 98101

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON JUNE 10, 2021

TO BSQUARE SHAREHOLDERS:

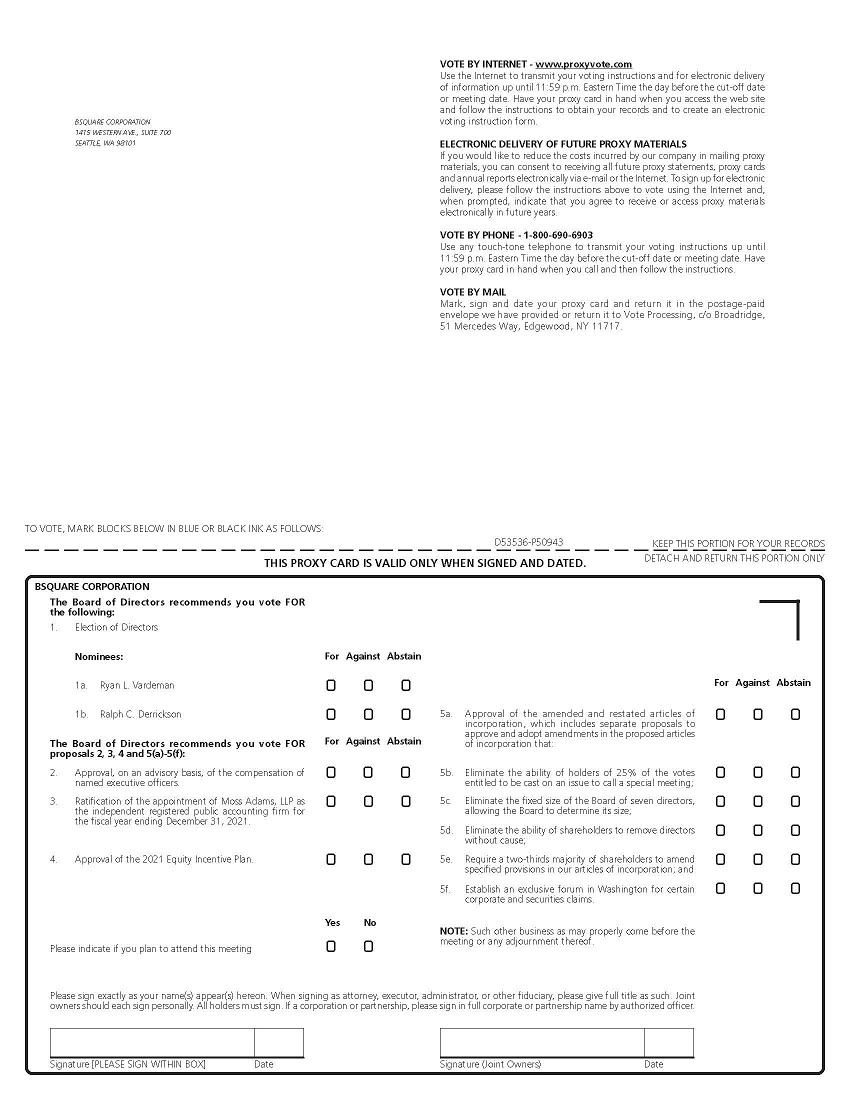

Notice is hereby given that the 2021 Annual Meeting of Shareholders of Bsquare Corporation, a Washington corporation (the “Company”), will be held on Thursday, June 10, 2021 at 10:00 a.m., local time. The meeting will be held at the Company’s headquarters, 1415 Western Avenue, Suite 700, Seattle, Washington 98101, for the following purposes:

|

1. |

To elect Ryan L. Vardeman and Ralph C. Derrickson as Class II Directors to serve for the ensuing three years and until their successors are duly elected and qualified; |

|

2. |

To approve the compensation of the Company’s named executive officers; |

|

3. |

To ratify the appointment of Moss Adams LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2021; |

|

|

|

||

|

4. |

To approve the 2021 Equity Incentive Plan; |

|

5 (a). |

To approve the amended and restated articles of incorporation, which includes separate proposals to approve and adopt amendments in the Proposed Articles that: |

|

(b). |

Eliminate the ability of holders of 25% of the votes entitled to be cast on an issue to call a special meeting; |

|

|

|

||

|

(c). |

Eliminate the fixed size of the Board of seven directors, allowing the Board to determine its size; |

|

|

|

||

|

(d). |

Eliminate the ability of shareholders to remove directors without cause; |

|

|

|

||

|

(e). |

Require a two-thirds majority of shareholders to amend specified provisions in our articles of incorporation; and |

|

|

|

||

|

(f). |

Establish an exclusive forum in Washington for certain corporate and securities claims; and |

|

6. |

To transact such other business as may properly come before the meeting or any adjournment or adjournments thereof. |

The foregoing items of business are more fully described in the Proxy Statement accompanying this Notice.

The Board of Directors has fixed the close of business on April 13, 2021 as the record date for the determination of shareholders entitled to vote at this meeting. Only shareholders of record at the close of business on April 13, 2021 are entitled to receive notice of, and to vote at, the meeting and any adjournment thereof.

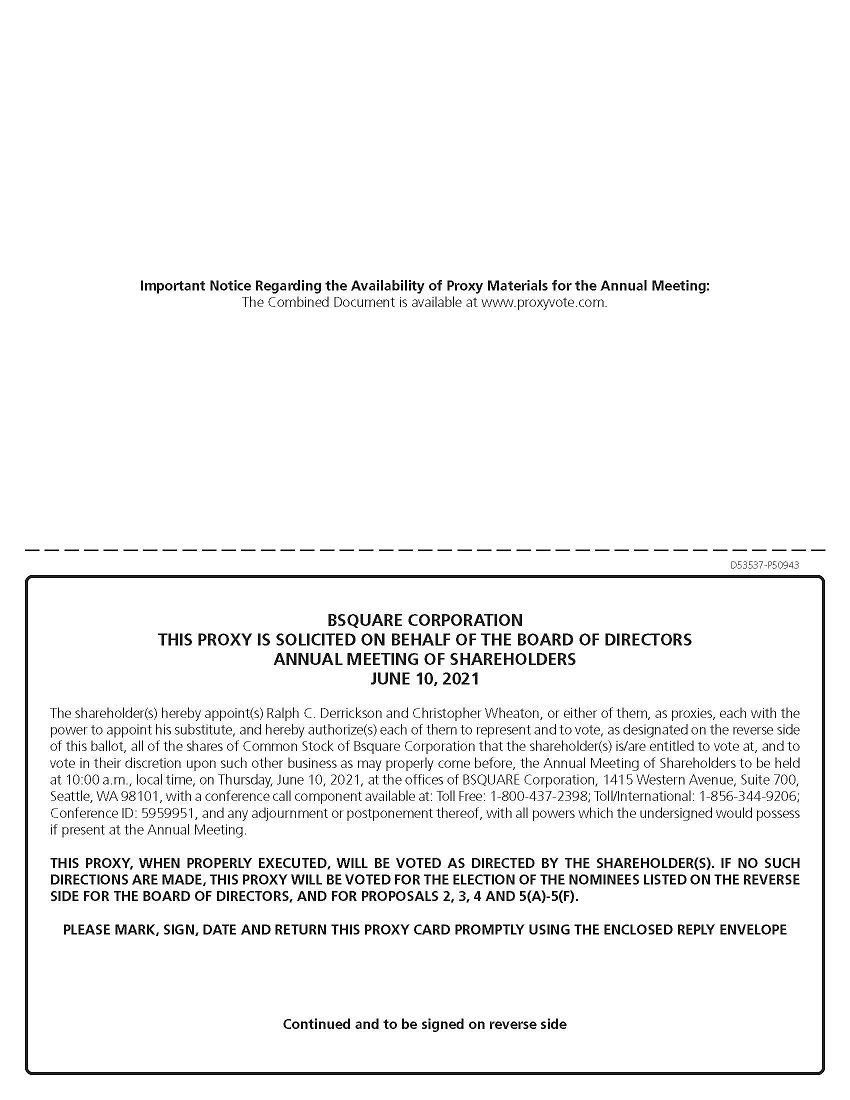

Given the COVID-19 pandemic, the Company is adding a conference call component to its 2021 Annual Meeting. You are encouraged to dial-in to the conference call at: Toll Free: 1-800-437-2398; Toll/International: 1-856-344-9206; Conference ID: 5959951, which will include the opportunity to ask questions. While the Company plans to conduct the formal business and voting in-person, it will comply and expects shareholders to comply with all applicable stay-at-home or similar orders, including all social distancing protocols. If this requires shifting the 2021 Annual Meeting entirely to a remote format (such as webcast or telephonic meeting), the Company will make appropriate updates. However, the Company is required to hold an annual shareholders’ meeting, and the Board of Directors believes that an in-person meeting with a conference call component is the best approach for the Company at this time. To ensure your representation at the meeting, you are urged to mark, sign, date and return the enclosed proxy card as promptly as possible in the postage-prepaid envelope enclosed for that purpose, or to follow the instructions for Internet or telephone voting in the accompanying notice or in the voter instruction form provided by your broker or other nominee. Any shareholder attending the meeting may vote in person even if the shareholder has previously returned a proxy. However, to simplify the voting process and to avoid handling your personal information, we do not plan to implement a voting feature into the conference call.

By Order of the Board of Directors

Christopher Wheaton

Chief Financial and Operating Officer, Secretary and Treasurer

Seattle, Washington

April 28, 2021

Important Notice Regarding the Availability of Proxy Materials for the Shareholder Meeting to Be Held on June 10, 2021: The proxy statement and annual report to shareholders are available at www.bsquare.com/proxy.

BSQUARE CORPORATION

1415 WESTERN AVENUE, SUITE 1400, SEATTLE, WASHINGTON 98101

PROXY STATEMENT

FOR THE 2021 ANNUAL MEETING OF SHAREHOLDERS

PROCEDURAL MATTERS

General

The enclosed proxy is solicited by the Board of Directors (the “Board”) of Bsquare Corporation, a Washington corporation. The Board has made these materials available to you over the internet, or has delivered printed versions of these materials to you by mail, in connection with the Board’s solicitation of proxies for use at the 2021 Annual Meeting of Shareholders (the “Annual Meeting”) to be held on Thursday, June 10, 2021 at 10:00 a.m. local time, and at any adjournment or postponement thereof for the purposes set forth in the proxy and in the accompanying Notice of Annual Meeting of Shareholders. The Annual Meeting will be held at our corporate headquarters, 1415 Western Avenue, Suite 700, Seattle, Washington 98101, with a conference call component available at: Toll Free: 1-800-437-2398; Toll/International: 1-856-344-9206; Conference ID: 5959951.

As used in this proxy statement, “we,” “us,” “our,” “Bsquare” and the “Company” refer to BSQUARE Corporation.

These proxy solicitation materials were first made available on or about May 1, 2021 to all shareholders entitled to vote at the Annual Meeting.

How to Vote my Shares and Participate

To ensure your vote is counted, we recommend you vote your shares in advance of the Annual Meeting. Please mark, sign, date and return the enclosed proxy card as promptly as possible in the postage-prepaid envelope enclosed for that purpose, or to follow the instructions for Internet or telephone voting in the accompanying Notice of Internet Availability of Proxy Materials or in the voter instruction form provided by your broker or other nominee. While we plan to conduct the formal business and voting in-person, we will comply and expect our shareholders to comply with all applicable stay-at-home or similar orders, including all social distancing protocols. This may require us to limit the number of in-person attendees. It may also require us to shift the meeting entirely to a remote format (such as webcast or telephonic meeting), and if that occurs, we will make appropriate updates. Accordingly, while in-person is permitted at the Annual Meeting, we urge you to vote your shares in advance.

We are also adding a conference call component to the Annual Meeting. In lieu of attending in-person, we encourage you to dial-in to the conference call at: Toll Free: 1-800-437-2398; Toll/International: 1-856-344-9206; Conference ID: 5959951. The conference call will be functionally similar to our earnings conference calls, including the opportunity to ask questions. However, to simplify the voting process and to avoid handling your personal information, we do not plan to implement a voting feature into the conference call. In turn, this means joining by conference call would not constitute attendance at the meeting for quorum purposes. Unless we change these plans, your only way to officially attend and to vote at the Annual Meeting will be to attend in-person and vote, or to vote through a proxy attending the meeting that you have instructed in advance (see “—Vote Without Attending the Annual Meeting”).

Voting Without Attending the Annual Meeting

To vote your shares without attending the meeting, please follow the instructions for Internet or telephone voting on the Notice of Internet Availability of Proxy Materials. If you request printed copies of the proxy materials by mail, you may also vote by signing and submitting your proxy card and returning it by mail, if you are the shareholder of record, or by signing the voter instruction form provided by your broker or other nominee and returning it by mail, if you are the beneficial owner but not the shareholder of record. We encourage all shareholders to vote in this manner in light of the uncertainties associated with COVID-19.

Record Date and Outstanding Shares

Only shareholders of record at the close of business on April 13, 2021 (the “record date”) are entitled to receive notice of and to vote at the Annual Meeting. Our only outstanding voting securities are shares of common stock, no par value. As of the record date, 13,407,029 shares of our common stock were issued and outstanding, held by 111 shareholders of record.

Revocability of Proxies

Any proxy may be revoked by the person giving it at any time prior to its use. To do so, the shareholder must either: (i) deliver a written instrument revoking the proxy to our Corporate Secretary, at the address referenced above or (ii) deliver a duly executed proxy bearing a later date (in either case no later than the close of business on June 9, 2021); or (iii) attend the Annual Meeting and vote in person.

Voting and Solicitation

Each holder of common stock is entitled to one vote for each share held.

This solicitation of proxies is made by our Board, and all related costs will be borne by us. We may reimburse brokerage firms and other persons representing beneficial owners of shares for their expenses in forwarding solicitation material to such beneficial owners. Proxies may also be solicited by certain of our directors, officers or administrative employees without the payment of any additional consideration. Solicitation of proxies may be made by mail, by telephone, by email, in person or otherwise.

Shareholders of Record and “Street Name” Holders

Where shares are registered directly in the holder’s name, that holder is the shareholder of record with respect to those shares. If shares are held by an intermediary, such as a broker or other nominee, then the broker or other nominee is considered the shareholder of record as to those shares. Those shares are said to be held in “street name” on behalf of the beneficial owner of the shares. Street name holders generally cannot directly vote their shares and must instead instruct the broker or other nominee on how to vote their shares using the voting instruction form provided by that broker or other nominee. Many brokers or other nominees also offer the option of giving voting instructions over the internet or by telephone. Instructions for giving your vote as a street-name holder are provided on your voting instruction form, and you should contact your broker or other nominee with any questions about its form or how to vote.

Quorum; Broker Non-Votes and Abstentions

At the Annual Meeting, an inspector of elections will determine the presence of a quorum and tabulate the results of the voting by shareholders. A quorum exists when holders of a majority of the total number of outstanding shares of common stock that are entitled to vote at the Annual Meeting are present at the Annual Meeting in person or represented by proxy. A quorum is necessary for the transaction of business at the Annual Meeting.

Broker non-votes can occur as to shares held in street name. This is the case when a broker or other nominee submits a proxy for the Annual Meeting but does not vote on a particular proposal because that broker or other nominee does not have discretionary voting power with respect to that proposal and has not received instructions from the beneficial owner. Under the current rules that govern brokers and other nominee holders of record, if you do not give instructions to your broker or other nominee, it will be able to vote your shares only with respect to proposals for which they have discretionary voting authority.

The election of directors (Proposal No. 1), approval of compensation of executive officers (Proposal No. 2), approval of the 2021 Equity Incentive Plan (Proposal No. 4), approval of the amended and restated articles of incorporation (Proposal No. 5), including each component thereof in Proposal Nos. 5(a)-5(f), and are proposals for which brokers and other nominees do not have discretionary voting authority. If you do not instruct your broker or other nominees how to vote on these proposals, your broker or other nominees will not vote on them and those non-votes will be counted as broker non-votes. The ratification of the appointment of Moss Adams LLP as our independent registered public accounting firm (Proposal No. 3) is considered discretionary and your brokerage firm will be able to vote on this proposal even if it does not receive instructions from you, as long as it holds your shares in its name.

Abstentions and broker non-votes are treated as shares present for determining whether there is a quorum for the transaction of business at the Annual Meeting. Abstentions and broker non-votes are not counted for determining the number of votes cast, and therefore will not affect the outcome of the vote on any of the proposals in this proxy statement.

Required Votes and Voting

Assuming that a quorum is present at the Annual Meeting, the following votes will be required:

|

● |

With regard to Proposal No. 1, the two nominees for election to the Board who receive the greatest number of votes cast “for” the election of the directors by the shares present, in person or represented by proxy, will be elected to the Board. Shareholders are not entitled to cumulate votes in the election of directors. |

|

● |

With regard to Proposal Nos. 2, 3, 4, and 5(a)-(f), approval of each of the proposals requires that the votes cast in favor of the proposal exceed the votes cast against it. |

All shares entitled to vote and represented by properly executed, unrevoked proxies received before the Annual Meeting will be voted at the Annual Meeting in accordance with the instructions given on those proxies. If no instructions are given on a properly executed proxy, the shares represented by that proxy will be voted as follows:

FOR the director nominees named in Proposal No. 1 of this proxy statement;

FOR Proposal No. 2, to approve the compensation of our named executive officers as disclosed in this proxy statement;

FOR Proposal No. 3, to ratify the appointment of Moss Adams LLP as our independent registered public accounting firm;

FOR Proposal No. 4, to approve the 2021 Equity Incentive Plan; and

FOR Proposal No. 5(a), to approve the amended and restated articles of incorporation, including as to the separate proposals to approve and adopt amendments in the Proposed Articles to vote:

FOR Proposal No. 5(b), to eliminate the ability of holders of 25% of the votes entitled to be cast on an issue to call a special meeting;

FOR Proposal No. 5(c), to eliminate the fixed size of the Board of seven directors, allowing the Board to determine its size;

FOR Proposal No. 5(d), to eliminate the ability of shareholders to remove directors without cause;

FOR Proposal No. 5(e), to require a two-thirds majority of shareholders to amend specified provisions in our articles of incorporation; and

FOR Proposal No. 5(f), to establish an exclusive forum in Washington for certain corporate and securities claims.

If any other matters are properly presented for consideration at the Annual Meeting, which may include, for example, a motion to adjourn the Annual Meeting to another time or place (including, without limitation, for the purpose of soliciting additional proxies), the persons named in the enclosed proxy and acting thereunder will have discretion to vote on those matters as they deem advisable. We do not currently anticipate that any other matters will be raised at the Annual Meeting.

Deadlines for Receipt of Shareholder Proposals

Shareholder proposals may be included in our proxy statement and form of proxy for an annual meeting so long as they are provided to us on a timely basis and satisfy the other conditions set forth in Rule 14a-8 under the Securities Exchange Act of 1934, as amended, regarding the inclusion of shareholder proposals in company-sponsored proxy materials. We currently anticipate holding our 2022 annual meeting of shareholders in June 2022, although the Board may decide to schedule the meeting for a different date. For a shareholder proposal to be considered pursuant to Rule 14a-8 for inclusion in our proxy statement and form of proxy for the annual meeting to be held in 2022, we must receive the proposal at our principal executive offices, addressed to our Secretary, no later than January 1, 2022. Submitting a shareholder proposal does not guarantee that it will be included in our proxy statement and form of proxy.

In addition, a shareholder proposal that is not intended for inclusion in our proxy statement and form of proxy under Rule 14a-8 (including director nominations) shall be considered “timely” within the provisions of our Bylaws and may be brought before the 2021 annual meeting of shareholders provided that we receive information and notice of the proposal in compliance with the requirements set forth in our Bylaws, addressed to our Secretary at our principal executive offices, no earlier than January 1, 2022 and no later than January 31, 2022. A copy of the full text of our Bylaws may be obtained by writing to our Secretary at our principal executive offices.

We strongly encourage any shareholder interested in submitting a proposal to contact our Secretary in advance of these deadlines to discuss any proposal he or she is considering, and shareholders may want to consult knowledgeable counsel with regard to the detailed requirements of applicable securities laws. All notices of shareholder proposals, whether or not intended to be included in our proxy materials, should be in writing and sent to our principal executive offices, located at: Bsquare Corporation, 1415 Western Avenue, Suite 1400, Seattle, Washington 98101, Attention: Secretary.

PROPOSAL NO. 1

ELECTION OF DIRECTORS

General

Our articles of incorporation currently provide that the Board has seven seats. The Board is divided into three classes, with each class having a three-year term. A director serves in office until his or her respective successor is duly elected and qualified, unless the director is removed, resigns or, by reason of death or other cause, is unable to serve in the capacity of director. Any additional directorships resulting from an increase in the number of directors will be distributed among the three classes so that, as nearly as possible, each class will consist of an equal number of directors. Set forth below is certain information furnished to us by the director nominees and by each of the incumbent directors whose terms will continue following the Annual Meeting. There are no family relationships among any of our directors or officers.

Nominees for Director

Two Class II directors are to be elected at the Annual Meeting for three-year terms ending in 2024. The Governance and Nominating Committee of the Board has nominated Ryan L. Vardeman and Ralph C. Derrickson for election as Class II directors. Unless otherwise instructed, the proxy holders will vote the proxies received by them for the election of Ryan L. Vardeman and Ralph C. Derrickson to the Board. Each of the nominees has indicated that he or she will serve if elected. We do not anticipate that any of the nominees will be unable or unwilling to stand for election, but if that occurs, all proxies received may be voted by the proxy holders for another person nominated by the Governance and Nominating Committee.

Vote Required for Election of Directors

If a quorum is present, the nominees for election to the Board receiving the greatest number of votes cast “for” the election of the directors by the shares present, in person or represented by proxy, will be elected to the Board.

Nominees and Continuing Directors

The names and certain information as of the record date about the nominees and each director continuing in office after the Annual Meeting are set forth below.

|

Name of Director Nominees |

Age |

Position |

Director Since |

Term Expires |

||||

|

Ralph C. Derrickson |

62 |

Director, President and Chief Executive Officer |

2019 |

2024 (Class II) |

||||

|

Ryan Vardeman |

43 |

Director |

2018 |

2024 (Class II) |

||||

|

Name of Continuing Directors |

Age |

Position |

Director Since |

Term Expires |

||||

|

Robert J. Chamberlain |

67 |

Director |

2015 |

2023 (Class I) |

||||

|

Andrew S.G. Harries |

59 |

Chairman of the Board |

2012 |

2023 (Class I) |

||||

|

Davin W. Cushman |

47 |

Director |

2018 |

2022 (Class III) |

||||

|

Mary Jesse |

56 |

Director |

2016 |

2022 (Class III) |

||||

|

Robert J. Peters |

43 |

Director |

2018 |

2022 (Class III) |

Director Nominees

Ryan L. Vardeman has been a director since June 2018. Mr. Vardeman is a principal and co-founder of Palogic Value Management, L.P., a Dallas, Texas based investment management company, a position he has held since January 2007. Mr. Vardeman has extensive corporate strategy, operating, financial and investment experience including capital structure analysis, a focus on small-cap equities, and investing in a broad range of industries with an emphasis on technology and software companies. Mr. Vardeman holds a B.S. in Electrical Engineering and Computer Science from Texas Tech University and an M.B.A. from the Owen Graduate School of Management at Vanderbilt University. The Board has concluded that Mr. Vardeman should serve as a director because of his extensive financial and operational experience and given his affiliation with one of our largest shareholders.

Ralph C. Derrickson has been a director and our President and Chief Executive Officer since March 2019. Prior to that, since July 2018, Mr. Derrickson served as the Managing Director of RCollins Group, a strategic consulting company, and from October 2017 until July 2018, he served as the Senior Vice President of Corporate Development for Avizia, Inc., a telemedicine hardware, software and physician services company, until its acquisition by American Well in July 2018. From January 2006 until October 2017, Mr. Derrickson served as the President and Chief Executive Officer of Carena, Inc., a virtual care software and physician services company, until its acquisition by Avizia in October 2017. Prior to that, Mr. Derrickson was managing director of venture investments at Vulcan Inc., an investment management firm, was a founding partner of Watershed Capital, an early-stage venture capital firm, and held senior leadership positions at Metricom, Starwave Corporation (acquired by Walt Disney), NeXT Computer (acquired by Apple Computer) and Sun Microsystems. Since 2004, Mr. Derrickson has been a board member of Perficient, Inc. (NASDAQ: PRFT), a publicly traded digital transformation consulting company. Mr. Derrickson holds a B.T. in Systems Software Science from the Rochester Institute of Technology. The Board has concluded that Mr. Derrickson should serve as a director because of his experience as a chief executive officer, and in various other executive roles, which has provided him with broad leadership and executive experience, including operational, strategic planning, corporate development and mergers and acquisitions experience. As our President and Chief Executive Officer, Mr. Derrickson has first-hand knowledge of our business and provides valuable insight with respect to our operations and strategic opportunities.

Continuing Directors

Robert J. Chamberlain has been a director since August 2015. Since April 2018, Mr. Chamberlain has been the Chief Financial Officer of ZipWhip, a two-way business texting software company. From August 2014 to April 2016, Mr. Chamberlain served as the Chief Financial Officer of Big Fish Games Incorporated, a leading provider of casual games, which was acquired by Churchill Downs, Inc. in December 2014. From February 2013 to August 2014, Mr. Chamberlain served as the Senior Vice President and Chief Financial Officer of Audience Science Incorporated, a leading provider of enterprise advertising management systems. Prior to that, Mr. Chamberlain was the Chief Financial Officer of other technology companies in the Seattle area including PopCap Games Incorporated (acquired by Electronic Arts, Inc.), WatchGuard Technologies Incorporated, F5 Networks, Onyx Software Corp. (acquired by Consona Corporation) and Photodisc (acquired by Getty Images, Inc.). Earlier in his career, Mr. Chamberlain was an audit partner in the Seattle office of KPMG where he served middle market public and private companies. Mr. Chamberlain has a B.S. in Business Administration-Accounting from California State University Northridge. The Board has concluded that Mr. Chamberlain should serve as a director because he provides substantial financial expertise that includes extensive knowledge of the complex financial and operational issues facing publicly traded companies, and a deep understanding of accounting principles and financial reporting rules and regulations. He also brings professional service expertise, technology industry experience, and sales and marketing experience at KPMG.

Andrew S. G. Harries has been a director since November 2012, has served as the Chairman of the Board since July 2013 and served as the Executive Chairman from May 2018 to March 2019. Mr. Harries is a business advisor and corporate director and since 2016 has held the post of Tom Foord Professor of Practice in Innovation and Entrepreneurship at Simon Fraser University’s Beedie School of Business. Mr. Harries chaired the board of directors of Contractually, an online contract management company, from January 2014 until its acquisition by Coupa Software in December 2015, and co-founded Zeugma Systems Inc. where he served as the President and Chief Executive Officer from 2004 until Tellabs Inc. acquired substantially all of Zeugma in 2010. Mr. Harries was a co-founder of Sierra Wireless (NASDAQ: SWIR), a NASDAQ-listed wireless Internet of Things systems vendor, from 1993 to 2004, and previously served as Sierra’s Senior Vice President of Sales, Marketing and Operations. Prior to co-founding Sierra Wireless, Mr. Harries held a variety of positions at Motorola Inc. He holds three US patents and an M.B.A. from Simon Fraser University. The Board has concluded that Mr. Harries should serve as a director because of his embedded technology industry expertise and extensive management and sales and marketing experience. He also has experience as a public company board member.

Davin W. Cushman has been a director since November 2018. Mr. Cushman currently serves as CEO of Brightrose Software, a private, acquisition-focused growth company launched in 2021 from Cushman Management Company, a boutique advisory firm Mr. Cushman founded in 2010. Mr. Cushman started his career in 1996 with enterprise application pioneer Trilogy. Mr. Cushman’s professional experience also includes roles in operations and workforce strategy with Capital One. Mr. Cushman most recently completed a 10+ year stint in 2020 as CEO of Ignite Technologies and its affiliates, a privately held group formed through more than 40 mergers and acquisitions of small to mid-sized software companies. Mr. Cushman holds a B.A. in Politics from Princeton University and an M.B.A. from the Kellogg School of Management from Northwestern University. The Board has concluded that Mr. Cushman should serve as a director because of his nearly 20 years in various roles in the enterprise software industry, including leadership of companies that provide software and technical consulting services to the types of organizations Bsquare serves.

Mary Jesse has been a director since August 2016. Ms. Jesse is a technology executive, strategist, inventor and pioneer in the wireless industry. Ms. Jesse currently serves as Chief Executive Officer of MTI, a global hardware, software and services provider. She additionally serves on the MTI board. From 2019-2020, she served as a Senior Director for Alvarez & Marsal in their Corporate Performance Improvement (CPI) division. From January 2018 to August 2018, Ms. Jesse served as Chief Executive Officer and board member of Heyou Media, a technology-driven content company. From September 2015 to October 2017, she served as Chief Strategy Officer of VRstudios, a global virtual reality company based in Bellevue, Washington. From 2007 to October 2014, she was the founder and Chief Executive Officer of Ivy Corp., an enterprise messaging technology company. Prior to that, she served as the co-founder and Chief Technology Officer of RadioFrame Networks; Vice President of Strategic Technology of McCaw Cellular Communications, Inc.; and Vice President of Technology Development of AT&T Wireless. A licensed professional engineer, Ms. Jesse holds a B.S. in electrical engineering from the University of Utah and an M.S. in electrical engineering from Santa Clara University, in addition to having authored nineteen patents. She currently serves on the Washington Governors University business council in addition to serving as an advisor to multiple technology companies. Ms. Jesse volunteers her time to support STEM education, entrepreneurship and diversity in business and technology. The Board has concluded that Ms. Jesse should serve as a director because of her extensive technology product development experience and work with a wide range of emerging businesses.

Robert J. Peters has been a director since August 2018 and served as an observer to the Board from June to August 2018. Mr. Peters is a principal and co-founder of Palogic Value Management, L.P., the investment manager of Palogic Value Fund, LP, a Dallas, Texas based investment management company, a position he has held since January 2007. Mr. Peters routinely analyzes public companies’ business plans, financial statements, and competitive positioning. Prior to founding Palogic, Mr. Peters was an investment banker with Stephens Inc., based in Little Rock, Arkansas, where he served as an analyst and associate responsible for execution of a variety of corporate finance transactions including sell side mergers and acquisitions, buy side mergers and acquisitions, leveraged buyouts, private equity investments, initial public offerings, and private placements of debt and equity. Mr. Peters attended Texas Tech University and received an M.S. in Accounting and a B.A. in Business Administration – Accounting. The Board has concluded that Mr. Peters should serve as a director because of his significant experience in equity capital markets, assessing corporate strategy, and capital allocation and given his affiliation with one of our largest shareholders.

THE BOARD RECOMMENDS THAT SHAREHOLDERS VOTE FOR THE ELECTION OF EACH OF MESSRS. VARDEMAN AND DERRICKSON TO THE BOARD.

CORPORATE GOVERNANCE

Board Leadership Structure

The Board has adopted a structure under which the Chairman of the Board is an independent director. We believe that having a Chairman independent of management provides effective leadership for the Board and helps ensure critical and independent thinking with respect to our strategy and performance. In addition, the Board believes this governance structure promotes balance between the Board's independent authority to oversee our business and the Chief Executive Officer and his management team who manage the business on a day-to-day basis. Moreover, the current separation of the Chairman and Chief Executive Officer roles allows the Chief Executive Officer to focus his time and energy on operating and managing the business while leveraging the experience and perspectives of the Chairman. Our Chief Executive Officer has historically served as a member of and as the sole management representative on the Board. Mr. Derrickson is a director as well as our President and Chief Executive Officer. We believe it is important to enable our Chief Executive Officer to provide information and insight about us directly to the directors in their deliberations. Further, our Board believes that separating the Chief Executive Officer and Chairman of the Board roles as well as having the Chairman of the Board role represented by an independent director is the appropriate leadership structure for us at this time and demonstrates our commitment to effective corporate governance.

Our Chairman of the Board is responsible for the effective functioning of our Board, enhancing its efficacy by guiding its processes and presiding at Board meetings and executive sessions of the independent directors. Our Chairman presides at shareholder meetings and ensures that directors receive appropriate information from our management to fulfill their responsibilities. Our Chairman also acts as a liaison between our Board and executive management, promoting clear and open communication between management and the Board.

Board Role in Risk Oversight

Our Board has responsibility for the oversight of risk management. Our Board, either as a whole or through its committees, regularly discusses with management our major risk exposures, their potential impact on us and the steps we take to manage them. While our Board is ultimately responsible for risk oversight, our Board committees assist the Board in fulfilling its oversight responsibilities in certain areas of risk. In particular, our Audit Committee focuses on financial, accounting and investment risks and oversees and approves company-wide risk management practices. Our Governance and Nominating Committee focuses on the management of risks associated with Board organization, membership, structure and corporate governance. In addition, our Compensation Committee assists the Board in fulfilling its oversight responsibilities with respect to the management of risks arising from our compensation policies and programs and related to succession planning for our executive officers.

Director Independence

The Board has determined, after consideration of all relevant factors, that each of Messrs. Chamberlain, Cushman, Harries, Peters and Vardeman and Ms. Jesse, together constituting a majority of our Board, qualifies as an “independent” director as defined under applicable rules of The NASDAQ Stock Market LLC (“NASDAQ”) and that none of such directors has any relationship with us that would interfere with the exercise of their independent business judgment. Mr. Derrickson does not qualify as an “independent” director under applicable NASDAQ rules because he serves as our President and Chief Executive Officer.

Standing Committees and Attendance

The Board held six meetings during 2020. All directors attended more than 75% of the aggregate of the meetings of the Board and committees thereof, if any, upon which such director served during the period for which he or she was a director or committee member during 2020.

The Board has an Audit Committee, a Compensation Committee and a Governance and Nominating Committee. Each of these committees operates under a written charter setting forth its functions and responsibilities, which is reviewed by the respective committee on an annual basis, and by the Board as appropriate. A current copy of each committee’s charter is available on our website at www.bsquare.com on the Corporate Governance page under Board Committees. Information about these standing committees and committee meetings is set forth below.

Audit Committee

The Audit Committee is currently comprised of Messrs. Chamberlain (Committee Chair) and Harries and Ms. Jesse. The Board has determined that, after consideration of all relevant factors, each of these directors qualifies as an “independent” director under applicable SEC and NASDAQ rules. Each member of the Audit Committee is able to read and understand fundamental financial statements, including our consolidated balance sheets, consolidated statements of operations and consolidated statements of cash flows. No member of the Audit Committee has participated in the preparation of our consolidated financial statements, or those of any of our current subsidiaries, at any time during the past three years. The Board has designated Mr. Chamberlain as an “audit committee financial expert” as defined under applicable SEC rules and has determined that Mr. Chamberlain possesses the requisite “financial sophistication” under applicable NASDAQ rules.

The Audit Committee is responsible for overseeing our independent auditors, including their selection, retention and compensation, reviewing and approving the scope of audit and other services by our independent auditors, reviewing the accounting policies, judgments and assumptions used in the preparation of our financial statements and reviewing the results of our audits. The Audit Committee is also responsible for reviewing the adequacy and effectiveness of our internal controls and procedures, including risk management, establishing procedures regarding complaints concerning accounting or auditing matters, reviewing and, if appropriate, approving related-party transactions, reviewing compliance with our Code of Business Conduct and Ethics, and reviewing our investment policy and compliance therewith. The Audit Committee held four meetings during 2020.

Compensation Committee

The Compensation Committee currently consists of Messrs. Cushman, Harries and Vardeman (Committee Chair). The Board has determined that, after consideration of all relevant factors, each of these directors qualifies as an “independent” and “non-employee” director under applicable NASDAQ and SEC rules. The Compensation Committee makes recommendations to the Board regarding our general compensation policies as well as the compensation plans and specific compensation levels for its executive officers. The Compensation Committee held six meetings during 2020.

One of the primary responsibilities of the Compensation Committee is to oversee, and make recommendations to the Board for its approval of, the compensation programs and performance of our executive officers, which includes the following activities:

|

● |

Establishing the objectives and philosophy of the executive compensation programs; |

|

● |

Designing and implementing the compensation programs; |

|

● |

Evaluating the performance of executives relative to their attainment of goals under the programs and reporting its evaluation to the Board; |

|

● |

Developing and maintaining a succession plan for the Chief Executive Officer; |

|

● |

Calculating and establishing payouts and awards under the programs as well as discretionary payouts and awards; |

|

● |

Reviewing base salary levels and equity ownership of the executives; and |

|

● |

Engaging consultants from time to time, as appropriate, to assist with program design and related matters. |

Additional information regarding the roles, responsibilities, scope and authority of the Compensation Committee, as well as the extent to which the Committee may delegate its authority, the role that our executive officers serve in recommending compensation and the role of compensation consultants in our compensation process is set forth below under “Executive Officer Compensation.”

The Compensation Committee also periodically reviews the compensation of the Board and proposes modifications, as necessary, to the full Board for its consideration.

Governance and Nominating Committee

The Governance and Nominating Committee (“GNC”) currently consists of Ms. Jesse (Committee Chair), Mr. Cushman and Mr. Peters. The Board has determined that, after consideration of all relevant factors, each of these directors qualifies as an “independent” director under applicable NASDAQ rules. The Governance and Nominating Committee held four meetings during 2020.

The primary responsibilities of the Governance and Nominating Committee are to:

|

● |

Develop and recommend to the Board criteria for selecting qualified director candidates; |

|

● |

Identify individuals qualified to become Board members; |

|

● |

Evaluate and select director nominees for each election of directors; |

|

● |

Consider the committee structure of the Board and the qualifications, appointment and removal of committee members; |

|

● |

Recommend codes of conduct and codes of ethics applicable to us; |

|

● |

Evaluate the composition and performance of the Board; |

|

● |

Ensure directors are keeping abreast of current governance standards; and |

|

● |

Provide oversight in the evaluation of the Board and each committee. |

Director Nomination Process

The Board has determined that director nomination responsibilities should be overseen by the GNC. One of the GNC’s goals is to assemble a Board that brings to us a variety of perspectives and skills derived from high quality business and professional experience. Although the GNC and the Board do not have a formal diversity policy, the Board instructed the GNC to consider such factors as it deems appropriate to develop a Board and committees that are diverse in nature and comprised of experienced and seasoned advisors. Factors considered by the GNC include judgment, knowledge, skill, diversity (including factors such as race, gender and experience), integrity, experience with businesses and other organizations of comparable size, including experience in software products and services, the Internet of Things industry, business, finance, administration or public service, the relevance of a candidate’s experience to our needs and experience of other Board members, familiarity with national and international business matters, experience with accounting rules and practices, the desire to balance the considerable benefit of continuity with the periodic injection of the fresh perspective provided by new members, and the extent to which a candidate would be a desirable addition to the Board and any committees of the Board. In addition, directors are expected to be able to exercise their best business judgment when acting on behalf of us and our shareholders, act ethically at all times and adhere to the applicable provisions of our Code of Business Conduct and Ethics. Other than consideration of the foregoing and applicable SEC and NASDAQ requirements, unless determined otherwise by the GNC, there are no stated minimum criteria, qualities or skills for director nominees. The GNC may also consider such other factors as it may deem are in the best interests of us and our shareholders. In addition, at least one member of the Board serving on the Audit Committee should meet the criteria for an “audit committee financial expert” having the requisite “financial sophistication” under applicable NASDAQ and SEC rules, and a majority of the members of the Board should meet the definition of “independent director” under applicable NASDAQ rules.

The GNC identifies director nominees by first evaluating the current members of the Board willing to continue in service. Current members of the Board with skills and experience that are relevant to our business and who are willing to continue in service are considered for re-nomination, balancing the value of continuity of service by existing members of the Board with that of obtaining a new perspective. The GNC also takes into account an incumbent director’s performance as a Board member. If any member of the Board does not wish to continue in service, if the GNC decides not to re-nominate a member for reelection, if the Board decided to fill a director position that is currently vacant or if the Board decides to recommend that the size of the Board be increased, the GNC identifies the desired skills and experience of a new nominee in light of the criteria described above. Current members of the Board and management are polled for suggestions as to individuals meeting the GNC’s criteria. Research may also be performed to identify qualified individuals. Nominees for director are selected by a majority of the members of the GNC, with any current directors who may be nominees themselves abstaining from any vote relating to their own nomination.

It is the policy of the GNC to consider suggestions for persons to be nominated for director that are submitted by shareholders. The GNC will evaluate shareholder suggestions for director nominees in the same manner as it evaluates suggestions for director nominees made by management, then-current directors or other appropriate sources. Shareholders suggesting persons as director nominees should send information about a proposed nominee to our Secretary at our principal executive offices as referenced above not later than 90 days nor earlier than 120 days prior before the anniversary of the mailing date of the prior year’s proxy statement. This information should be in writing and should include a signed statement by the proposed nominee that he or she is willing to serve as a director of Bsquare Corporation, a description of the proposed nominee’s relationship to the shareholder and any information that the shareholder feels will fully inform the GNC about the proposed nominee and his or her qualifications. The GNC may request further information from the proposed nominee and the shareholder making the recommendation. In addition, a shareholder may nominate one or more persons for election as a director at our annual meeting of shareholders if the shareholder complies with the notice, information, consent and other provisions relating to shareholder nominees contained in our Bylaws.

Executive Officers

The names and certain information about the Executive Officers are set forth below.

|

Name |

Age |

Position |

|||

|

Ralph C. Derrickson |

62 |

Director, President and Chief Executive Officer |

|||

|

Christopher V. Wheaton |

49 |

Chief Financial Officer, Chief Operating Officer, Secretary and Treasurer |

|||

Mr. Derrickson’s biographical details are set out above under the heading titled “Directors.”

Christopher Wheaton joined us as Chief Financial Officer in September 2019. Prior to joining Bsquare, in November 2018, Mr. Wheaton was employed at IslandWood, a non-profit environmental education organization and served as its interim Chief Financial and Operating Officer from January 2019 to September 2019. From April 2015 to September 2018, Mr. Wheaton served as the Chief Operating and Financial Officer for Pacific Science Center Foundation, a non-profit educational organization. From July 2003 until April 2015, Mr. Wheaton co-founded and served as the Chief Operating and Financial Officer for EnerG2 Technologies, Inc., an advanced carbon materials manufacturing company. Prior to 2003, Mr. Wheaton was employed by several public and private companies in senior financial management positions. Since January 2020, Mr. Wheaton has been a board member of PEMCO, a mutual insurance company serving the property and casualty market in the Pacific Northwest. Mr. Wheaton received a B.A. from Northwestern University and an MBA from the Stanford Graduate School of Business.

Code of Ethics

We have adopted a Code of Business Conduct and Ethics in compliance with applicable rules of the SEC that applies to our principal executive officer, our principal financial officer and our principal accounting officer or controller, or persons performing similar functions, as well as to all members of our Board and all other employees. A copy of the Code of Business Conduct and Ethics is available on our website at www.bsquare.com on the Corporate Governance page. We will disclose, on our website, any amendment to, or waiver from, our Code of Business Conduct and Ethics that applies to our principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions and that relates to any element of the Code of Business Conduct and Ethics enumerated in applicable rules of the SEC.

2020 Director Compensation

When joining the Board, we historically granted directors a one-time grant of 25,000 stock options, which vest quarterly over two years, and an initial grant of restricted stock units, or RSUs. The Chairman of the Board historically received a one-time grant of 50,000 stock options when joining the Board (or 25,000 stock options if appointed as Chairman of the Board while already serving as a director), and an initial grant of restricted stock units. The number of shares underlying the initial restricted stock unit awards granted to new directors is determined by dividing $50,000 by our closing stock price on the date of grant (or $75,000 in the case of the Chairman of the Board (or $25,000 if appointed as Chairman of the Board while already serving as a director)) and is prorated based on the date on which such director is appointed. Thereafter, standing directors received annual grants of restricted stock units, the number of shares underlying which is determined by dividing $50,000 by our closing stock price on the date of grant ($75,000 in the case of the Chairman of the Board). Starting in 2021, we eliminated the option component of director compensation and established a floor price of $3.25 for all RSUs awarded to directors to better align director compensation with value creation for shareholders. The annual restricted stock unit awards are granted on the earlier of (i) the day of the annual meeting of our shareholders or (ii) the last trading day of our second fiscal quarter. The restricted stock unit awards vest quarterly over one year. All equity awards cease vesting as of the date a director’s service on the Board terminates for any reason, provided that the Board may accelerate the vesting of any outstanding stock award for a director whose service on the Board terminates for any reason other than removal for cause.

We also pay annual cash director fees of $30,000 to non-Chair directors and $40,000 to the Chairman of the Board, and annual Board Committee fees to directors who serve on the Audit Committee of $10,000 and $5,000 to directors who serve on other committees. The Chairs of the Governance and Nominating Committee and the Compensation Committee receive additional annual Board Committee fee compensation of $3,000. The Board may also determine to pay these cash amounts in RSUs, subject to a floor price of $3.25 per RSU. All cash amounts are payable in quarterly increments. Directors are also reimbursed for reasonable expenses incurred for Board-related activities. Notwithstanding the foregoing, directors who are also our employees, including Mr. Derrickson, our President and Chief Executive Officer, do not receive additional compensation for services provided as a director.

The table below presents the 2020 compensation of our non-employee directors. The compensation of Ralph C. Derrickson, a director and President and Chief Executive Officer, is described in the Summary Compensation Table in the section titled “Executive Officer Compensation.”

Director Compensation Table

|

Fees Earned or |

||||||||||||||||

|

Paid in Cash(1) |

Stock Awards(2) |

Option Awards(3) |

Total |

|||||||||||||

|

Name |

($) |

($) |

($) |

($) |

||||||||||||

|

Robert J. Chamberlain (4) |

$ | 40,000 | $ | 50,000 | $ | - | $ | 90,000 | ||||||||

|

Davin W. Cushman (5) |

46,889 | 50,000 | - | 96,889 | ||||||||||||

|

Andrew S.G. Harries (6) |

55,000 | 75,000 | - | 130,000 | ||||||||||||

|

Mary Jesse (7) |

48,000 | 50,000 | - | 98,000 | ||||||||||||

|

Robert J. Peters (8) |

35,000 | 50,000 | - | 85,000 | ||||||||||||

|

Ryan L. Vardeman (9) |

35,000 | 50,000 | - | 85,000 | ||||||||||||

(1) Fees paid earned or paid in cash are composed of payments for services performed in each prior quarter.

(2) The amounts in this column reflect the aggregate grant-date fair value of restricted stock unit awards, determined in accordance with the Financial Accounting Standards Board Accounting Standards Codification Topic 718 for stock-based compensation (“Topic 718”) without regard to forfeitures. The amounts included reflect only the awards treated as granted in 2020. Assumptions used in the calculation of these award amounts are set forth in Note 11 (Shareholders’ Equity) to the financial statements included in Part II, Item 8 of our Annual Report on Form 10-K.

(3) The amounts in this column reflect the aggregate grant-date fair value of stock option awards, determined in accordance with Topic 718 without regard to forfeitures. The amounts included reflect only the awards treated as granted in 2020. Assumptions used in the calculation of these award amounts are set forth in Note 11 (Shareholders’ Equity) to the financial statements included in Part II, Item 8 of our Annual Report on Form 10-K.

(4) Mr. Chamberlain held 25,000 vested stock options and 25,338 unreleased restricted stock units as of December 31, 2020.

(5) Mr. Cushman held 25,000 vested stock options and 25,338 unreleased restricted stock units as of December 31, 2020.

(6) Mr. Harries held 25,000 vested stock options and 38,007 unreleased restricted stock units as of December 31, 2020.

(7) Ms. Jesse held 25,000 vested stock options and 25,338 unreleased restricted stock units as of December 31, 2020.

(8) Mr. Peters held 25,000 vested stock options and 25,338 unreleased restricted stock units as of December 31, 2020.

(9) Mr. Vardeman held 25,000 vested stock options and 25,338 unreleased restricted stock units as of December 31, 2020.

2020 Executive Officer Compensation

The following table sets forth the compensation earned during the past two fiscal years by Ralph C. Derrickson, our President and Chief Executive Officer, and Christopher Wheaton, our Chief Financial Officer, Chief Operating Officer, Secretary and Treasurer. We did not have any other executive officers during 2020. We refer to these persons as our “named executive officers.”

Summary Compensation Table

|

All other |

||||||||||||||||||||

|

Option |

compen- |

|||||||||||||||||||

|

Salary |

awards(1) |

sation(2) |

Total |

|||||||||||||||||

|

Name and principal position |

Year |

($) |

($) |

($) |

($) |

|||||||||||||||

|

Ralph C. Derrickson |

2020 |

325,000 | - | 34,673 | 359,673 | |||||||||||||||

|

President and Chief Executive Officer |

2019 |

256,250 | 1,108,125 | 9,111 | 1,373,486 | |||||||||||||||

|

Christopher Wheaton |

2020 |

275,000 | 34,500 | 18,723 | 328,223 | |||||||||||||||

|

Chief Financial Officer, Chief Operating Officer, Secretary and Treasurer |

2019 |

72,981 | 164,050 | 3,938 | 240,969 | |||||||||||||||

|

(1) |

The amounts in this column reflect the aggregate grant-date fair value of stock option awards, determined in accordance with Topic 718 without regard to forfeitures. The amounts included for a particular year reflect only the awards treated as granted in that year. Assumptions used in the calculation of these award amounts are set forth in Note 11 (Shareholders’ Equity) to the financial statements included in Part II, Item 8 of our 2020 10-K. |

|

(2) |

Represents 401(k) matching employer contributions, premiums paid by us under a group medical or life insurance plan, and any other allowances for parking and mobile telephone / data service, which includes personal use. |

Employment Agreements with Named Executive Officers

We have agreements with our named executive officers, which include provisions regarding post-termination compensation. We do not have a formal severance policy or plan applicable to our executive officers as a group.

Under our agreement with Mr. Derrickson entered into in February 2019, Mr. Derrickson is entitled to receive an annual salary of at least $325,000 and is eligible to receive an annual bonus equal to 50% of his annual salary at 100% achievement. His 2021 salary is set at $345,000, and we have agreed that bonuses will be paid in the form of performance-based RSUs, as described further in the Determination of Compensation section below. In the event Mr. Derrickson’s employment is terminated by us when neither cause nor long term disability exists (as such terms are defined in the agreement), subject to execution of a release by Mr. Derrickson of any employment-related claims, he shall be entitled to receive severance equal to nine months of his then annual base salary, continued COBRA coverage at our expense for a period of nine months following his termination date and a pro rata portion of his annual bonus as determined by the Compensation Committee. In the event that, within twelve months after a change of control of Bsquare (as defined in the agreement), Mr. Derrickson’s employment is terminated when neither cause nor long term disability exists or Mr. Derrickson terminates his employment for good reason (as defined in the agreement), subject to execution of a release by Mr. Derrickson of any employment-related claims, he shall be entitled to receive a one-time lump sum severance payment equal to twelve months of his then annual base salary, 100% of his target annual bonus as determined by the Compensation Committee, and continued COBRA coverage at our expense for a period of twelve months following his termination date (provided that, during the first twelve months after a change of control of Bsquare, such severance payments shall be in lieu of the severance payments described in the preceding sentence, and after expiration of the twelve-month period following a change of control, Mr. Derrickson shall only be entitled to the severance payments described in the preceding sentence). In addition, immediately prior to a change of control of Bsquare, all of Mr. Derrickson’s unvested stock options and restricted stock units shall become fully vested and immediately exercisable.

Under our agreement with Mr. Wheaton entered into in August 2019, Mr. Wheaton is entitled to receive an annual salary of at least $275,000 and is eligible to receive an annual bonus of $100,000 at 100% achievement. His 2021 salary is set at $300,000, and we have agreed that bonuses will be paid in the form of performance-based RSUs, as described further in the Determination of Compensation section below. In the event that, within twelve months after a change of control of Bsquare (as defined in the agreement), Mr. Wheaton’s employment is terminated when neither cause nor long term disability exists or Mr. Wheaton terminates his employment for good reason (as defined in the agreement), subject to execution of a release by Mr. Wheaton of any employment-related claims, he shall be entitled to receive a one-time lump sum severance payment equal to six months of his then annual base salary, 100% of his target annual bonus as determined by the Compensation Committee, and continued COBRA coverage at our expense for a period of six months following his termination date. In addition, immediately prior to a change of control of Bsquare, all of Mr. Wheaton’s unvested stock options shall become fully vested and immediately exercisable.

Determination of Compensation

The Compensation Committee’s philosophy regarding total executive compensation has been to provide a comprehensive and competitive compensation package consisting of base salary and performance-based incentives that help align executive compensation with shareholder interests and promote growth in shareholder value. The Compensation Committee believes total executive compensation is below market peer median levels. We also periodically review the level of incentive-based compensation for each member of our executive team. We intend to maintain competitive levels of compensation for our management team. In 2021, we decided to eliminate future cash bonuses in exchange for an award of performance-based RSUs with vesting based on stock performance and service conditions.

Total Compensation

For purposes of evaluating executive officer total compensation including base salary, discretionary bonus, equity awards and incentive compensation, the Compensation Committee primarily considers two factors:

|

● |

Competitive level: The Compensation Committee has the authority to engage its own advisers to assist in carrying out its responsibilities. Historically the Compensation Committee has engaged a compensation consultant to review and assess the market competitiveness of our executive compensation programs. |

|

● |

Company and individual performance objectives: In addition to considering compensation levels of executives at similarly sized regional public companies, the Compensation Committee reviews our financial and non-financial performance objectives applicable to each executive. Our performance objectives are typically determined through collaboration with the Chief Executive Officer, the Board and the Compensation Committee. The Compensation Committee determines the financial and non-financial performance objectives applicable to the Chief Executive Officer (without his participation). These objectives and associated awards have historically been addressed through annual cash or equity bonuses with respect to our executive officers. |

Base Salary and Discretionary Bonus

The Compensation Committee’s goal is to provide a competitive base salary for our executive officers. The Compensation Committee has not established any formal guidelines for purposes of setting base salaries (such as payment at a particular percentile of a benchmark group), but instead considers the general market compensation data along with our performance and the individual’s performance and experience in determining what represents a competitive salary. The Compensation Committee also considers these factors in its recommendations to the Board regarding whether and in what amounts to award discretionary cash or equity bonuses.

Short-Term Incentive Plan Compensation (STI)

We have historically awarded short-term incentive compensation to our named executive officers, including annual cash or equity bonuses, the terms of which vary from year to year.

In March 2020, upon the recommendation of the Compensation Committee, our Board adopted the Bsquare Corporation Executive Bonus Plan (“EBP”), which formalized the Company’s historical practice of awarding annual bonuses to certain key executives of the Company based on achievement of specified performance goals. Awards may be in the form of cash or equity granted under the equity incentive plans. The Board designated the Committee as the administrator of the EBP (the “Administrator”). The Administrator may establish performance goals that relate to financial, operational or other performance of the Company, or to any other performance goal established by the Administrator in connection with a potential bonus payment (the “Performance Goals”). Pursuant to the EBP, the Administrator established Performance Goals for 2020 relating to segment revenues and contribution margin and working capital levels. Following completion of the 2020 Performance Period, the amounts payable to each Covered Executive under the EBP will be based entirely on the determination of the Administrator regarding the level of achievement of the Performance Goals. The Administrator has authority to revise or refine the Performance Goals in its discretion. The EBP was also reassessed and restructured to more tightly align compensation with both short- and long-term shareholder interests and to be responsive to prior shareholder advisory votes on executive compensation.

Long-Term Equity Incentive Awards (LTI)

Longer-term incentives in the form of grants of stock options, restricted stock, RSUs and other forms of equity instruments to executive officers are governed by the fourth amended and restated stock plan (the “Current Stock Plan”) or our 2011 Inducement Award Plan (the “Inducement Plan”), as applicable.

Historically, we granted stock options at the time we hired an executive officer under the Inducement Plan. We stopped using our Inducement Plan in 2019 and formally terminated it in 2021, in favor of using shareholder-approved Current Stock Plan for all equity incentive awards, including those to new hires

Further, the Compensation Committee periodically reviews the equity ownership of the executive officers and may determine that additional awards of equity instruments under the Current Stock Plan are warranted based on a number of factors, including competitive factors, company and individual performance, the vested status of currently outstanding equity awards, the executive’s equity ownership in relation to that of other executives and other factors. The Compensation Committee maintains no formal guidelines for these periodic reviews. Stock options are awarded with exercise prices equal to the closing market price per share of our common stock on the grant date. Our only equity award to executive officers in 2020 was an August 2020 award to Mr. Wheaton of options to acquire 25,000 shares of our common stock, which vests 25% on the one-year anniversary and the balance in equal monthly installments for three years thereafter.

Other Compensation and Perquisites

Executive officers, including the named executive officers, are eligible to participate in standard benefit plans available to all employees including our 401(k)-retirement plan, medical, dental, disability, vacation and sick leave and life and accident insurance. The same terms apply to all employees for these benefits except where the value of the benefit may be greater for executives because they are more highly compensated than most other employees (e.g., disability benefits). We do not provide any pension or deferred compensation benefits to our executive officers.

Outstanding Equity Awards at Fiscal Year End

The following table presents the outstanding equity awards held by the named executive officers as of December 31, 2020:

|

Option Awards |

|||||||||||||||

|

Number of Securities |

|||||||||||||||

|

Underlying |

Option |

Option |

|||||||||||||

|

Grant |

Unexercised Options |

Exercise |

Expiration |

||||||||||||

|

Name |

Date |

Exercisable (#) |

Unexercisable (#) |

Price ($) (1) |

Date (2) |

||||||||||

|

Ralph C. Derrickson |

03/11/2019 |

164,063 | 210,937 | $ | 1.97 |

03/11/2029 |

|||||||||

|

03/11/2019 |

— | 187,500 | $ | 1.97 |

03/11/2029 |

||||||||||

|

Christopher Wheaton |

09/09/2019 |

40,367 | 88,806 | $ | 1.27 |

09/09/2029 |

|||||||||

| 08/26/2020 | — | 25,000 | $ | 1.38 | 08/26/2030 | ||||||||||

|

(1) |

The option exercise price is the closing price of our common stock on the grant date. |

|

(2) |

All options outstanding expire ten years from the grant date. |

Employee Benefit Plans

401(k) Plan

We maintain a tax-qualified 401(k) employee savings and retirement plan for eligible U.S. employees. Eligible employees may elect to defer a percentage of their eligible compensation in the 401(k) plan, subject to the statutorily prescribed annual limit. We may make matching contributions on behalf of all participants in the 401(k) plan in the amount equal to one-half of the first 6% of an employee’s contributions. Company matching contributions and employee contributions are fully vested at all times. We intend the 401(k) plan to qualify under Sections 401(k) and 501 of the Internal Revenue Code of 1986, as amended, so that contributions by employees or us to the 401(k) plan and income earned, if any, on plan contributions are not taxable to employees until withdrawn from the 401(k) plan (except as regards Roth contributions), and so that we will be able to deduct our contributions when made. The trustee of the 401(k) plan, at the direction of each participant, invests the assets of the 401(k) plan in any of a number of investment options.

Equity Compensation Plan Information

The following table presents certain information regarding our common stock that may be issued upon the exercise of options and vesting of restricted stock units granted to employees, consultants or directors as of December 31, 2020:

|

Number of securities |

||||||||||||||

|

Number of securities |

remaining available for future |

|||||||||||||

|

to be issued upon |

Weighted-average |

issuance under equity |

||||||||||||

|

exercise of |

exercise price of |

compensation plans (excluding |

||||||||||||

|

outstanding options, |

outstanding options, |

securities reflected |

||||||||||||

|

warrants and rights |

warrants and rights |

in column (a)) |

||||||||||||

|

(a) |

(b) |

(c) |

||||||||||||

|

Equity compensation plans approved by security holders |

1,215,140 | (1) | $ | 1.84 | 954,355 | |||||||||

|

Equity compensation plans not approved by security holders |

736,448 | (2) | 1.93 | 287,770 | (3) | |||||||||

|

(1) |

Amount includes 164,697 restricted stock units granted and unvested as of December 31, 2020. |

|

(2) |

Amount includes no restricted stock units granted and unvested as of December 31, 2020. |

|

(3) |

Indicates shares of our common stock reserved for future issuance under the Inducement Plan. The Inducement Plans allow us to grant options, restricted stock, restricted stock units and certain other equity-based compensation in connection with hiring new employees. The number of shares reserved for issuance may be modified by the Board, subject to SEC and NASDAQ limitations. There were 791,673 options and no restricted stock units granted under the Inducement Plan during 2019. Following these awards, we determined to stop using the Inducement Plan in 2019, and we formally terminated the Inducement Plan in 2021. |

STOCK OWNERSHIP

Security Ownership of Principal Shareholders, Directors and Management

The following table sets forth certain information regarding the beneficial ownership of our common stock as of March 15, 2021 by:

|

● |

each person who is known by us to own beneficially more than five percent (5%) of the outstanding shares of common stock; |

|

● |

each of our directors; |

|

● |

each of the named executive officers; and |

|

● |

all of our directors and executive officers as a group. |

Beneficial ownership is determined in accordance with the rules of the SEC. The number of shares listed below under the heading “Total Common Stock Equivalents” is the aggregate beneficial ownership for each shareholder and includes common stock owned plus settled RSUs; the number of shares listed under the heading "Deemed Outstanding Shares" includes vested stock options plus unvested options and restricted stock units that may be exercised or settled for common stock within 60 days after March 31, 2020. Deemed Outstanding Shares are considered beneficially owned by the holder for the purpose of computing share and percentage ownership of that holder presented below, but are not treated as outstanding for the purpose of computing the percentage ownership of any other holder presented below.

This table is based on information supplied by officers, directors, and filings made with the SEC. Percentage ownership is based on 13,298,150 shares of common stock outstanding as of March 31, 2020.

Unless otherwise noted below, the address for each shareholder listed below is c/o Bsquare Corporation, 1415 Western Avenue, Suite 700, Seattle, Washington 98101. Unless otherwise noted, each of the shareholders listed below has sole investment and voting power with respect to the common stock indicated, except to the extent shared by spouses under applicable law.

|

Number of |

Percentage |

|||||||||||

|

Total |

Shares Underlying |

of |

||||||||||

|

Common |

Options and RSUs |

Common |

||||||||||

|

Stock |

(Deemed |

Stock |

||||||||||

|

Name and Address of Beneficial Owner |

Equivalents |

Outstanding Shares) |

Equivalents |

|||||||||

|

5% Owners: |

||||||||||||

|

Palogic Value Management, L.P (1) |

1,585,711 | — | 11.9 | % | ||||||||

|

5310 Harvest Hill Road, Suite 110 |

||||||||||||

|

Dallas, TX 75230 |

||||||||||||

|

Renaissance Technologies LLC (2) |

1,134,531 | — | 8.5 | % | ||||||||

|

800 Third Avenue |

||||||||||||

|

New York, NY 10022 |

||||||||||||

|

Directors and Named Executive Officers: |

||||||||||||

|

Ryan L. Vardeman (5) |

1,653,992 | 33,446 | 12.7 | % | ||||||||

|

Andrew S.G Harries |

298,290 | 37,669 | 2.5 | % | ||||||||

|

Ralph C. Derrickson |

35,000 | 257,813 | 2.2 | % | ||||||||

|

Robert J. Chamberlain |

93,871 | 33,446 | 1.0 | % | ||||||||

|

Davin W. Cushman |

86,700 | 33,446 | 0.9 | % | ||||||||

|

Mary Jesse |

86,440 | 33,446 | 0.9 | % | ||||||||

|

Robert J. Peters (6) |

71,046 | 33,446 | 0.8 | % | ||||||||

|

Christopher Wheaton |

15,000 | 53,823 | 0.5 | % | ||||||||

|

All executive officers and directors as a group |

2,340,339 | 516,535 | 20.7 | % | ||||||||

(1) The indicated ownership is based solely on SEC Form 4, filed with the SEC on August 28, 2020, according to which Palogic Value Management, L.P., Palogic Value Fund, L.P., Palogic Capital Management, LLC and Mr. Vardeman then had shared voting and dispositive power such shares.

(2) The indicated ownership is based solely on a Schedule 13G/A filed with the SEC on February 11, 2021, according to which each of Renaissance Technologies LLC and Renaissance Technologies Holdings Corporation has sole voting power and dispositive power over such shares.

(3) Mr. Vardeman is a principal of and may be deemed to beneficially own securities beneficially owned by Palogic Capital Management.

(4) Mr. Peters is a principal of Palogic Capital Management but does not have dispositive or voting power over shares beneficially owned by Palogic Capital Management.

Pursuant to our Insider Trading Policy, we strongly discourage all employees from engaging in any form of hedging transactions, such as prepaid variable forwards, equity swaps, collars and exchange funds. We believe facing the full risks and rewards of ownership is important to aligning the objectives of employees with our other shareholders. Any employee wishing to enter into such a hedging transaction must obtain pre-clearance at least two weeks in advance and set forth a justification for the proposed transaction.