Final US-DOCS\166080585.8 COSTAR GROUP, INC EXECUTIVE SEVERANCE PLAN I. PURPOSE The purpose of this CoStar Group, Inc. Executive Severance Plan (the “Plan”) is to encourage employees of CoStar Group, Inc. (together with any successor, the “Company”) and its subsidiaries to remain in the employ of the Employer by providing, among other things, severance protections to such employees in the event their employment is terminated under the circumstances described in this Plan. II. DEFINITIONS For purposes of this Plan, the following terms shall have the meanings set forth below: A. “Administrator” means the Committee or any other committee designated by the Board to administer the Plan. The Committee may from time to time delegate to a committee of one or more members of the Committee the authority to take any actions pursuant to this Plan. Any delegation hereunder shall be subject to the restrictions and limits that the Committee specifies and the time of such delegation, and the Committee may, at any time rescind the authority so delegated or appoint a new delegate. In its sole discretion, the Board may, at any time and from time to time, exercise any and all rights and duties of the Committee under the Plan except with respect to matters which under applicable securities laws and exchange listing rules are required to be determined in the sole discretion of the Committee. Any references in this Plan to the Administrator shall be construed as a reference to the committee to which the Committee has delegated such authority, if any. B. “Affiliate” means with respect to any person or entity, any other person or entity that, directly or indirectly, through one or more intermediaries, controls, or is controlled by, or is under common control with, such person or entity. For purposes of this definition, “control,” when used with respect to any person or entity, means the power to direct the management and policies of such person or entity, directly or indirectly, whether through ownership of voting securities, by contract or otherwise; and the terms “controlling” and “controlled” have meanings correlative to the foregoing. C. “Base Salary” means, with respect to any Participant, the Participant’s base salary at the rate in effect on the Participant’s Termination Date, disregarding for this purpose any decrease in base salary that provides a basis for Good Reason. D. “Board” means the Board of Directors of the Company. E. “Cause” means: (i) if the Participant is party to a written employment, consulting or similar agreement with the Company or any of its subsidiaries in which the term “cause” is defined, “Cause” as defined in such agreement, and (ii) if no such agreement exists, (A) the Administrator’s determination that the Participant willfully failed to substantially perform the Participant’s duties (other than a failure resulting from the Participant’s permanent and total disability (as determined under Section 22(e)(3) of the Code), which, if curable, has not been cured to the reasonable satisfaction of the Administrator within thirty (30) business days after the

2 US-DOCS\166080585.8 Participant receiving written notice from the Company; (B) the Administrator’s determination that the Participant willfully failed to carry out, or comply with any lawful and reasonable directive of the Board or the Participant’s immediate supervisor, which, if curable, has not been cured to the reasonable satisfaction of the Administrator within thirty (30) business days after the Participant receiving written notice from the Company; (C) the occurrence of any act or omission by the Participant that could reasonably be expected to result in (or has resulted in) the Participant’s conviction, plea of no contest, plea of nolo contendere, or imposition of unadjudicated probation for any felony or indictable offense or crime involving moral turpitude; (D) the Participant’s unlawful use (including being under the influence) or possession of illegal drugs on the premises of the Company or any of its subsidiaries or while performing the Participant’s duties and responsibilities for the Company or any of its subsidiaries; or (E) the Participant’s commission of an act of fraud, embezzlement, misappropriation, misconduct, or breach of fiduciary duty against the Company or any of its subsidiaries. F. “Change in Control” means the occurrence of any of the following events: (i) any “person” (as such term is used in Sections 13(d) and 14(d) of the Exchange Act) becomes the “beneficial owner” (as defined in Rule 13d-3 of the Exchange Act), directly or indirectly, of securities of the Company representing more than fifty percent (50%) total combined voting power of the Company’s securities outstanding immediately after such acquisition; (ii) the consummation of the sale or disposition by the Company in one transaction or a series of related transactions of all or substantially all of the Company’s assets; (iii) a majority of the individuals who constitute the Board (the “Incumbent Board”) cease for any reason to constitute at least a majority of the Board during any twelve month period; provided, however, that any individual becoming a member of the Board (a “Director”) subsequent to the date hereof whose election, or nomination for election by the Company’s stockholders, was approved by a vote of at least a majority of the Directors then comprising the Incumbent Board (either by a specific vote or by approval of the proxy statement of the Company in which such person is named as a nominee for director, without objection to such nomination) shall be deemed to have been a member of the Incumbent Board, but excluding, for this purpose, any such individual whose initial assumption of office occurs as a result of an actual or threatened election contest (within the meaning of Rule 14a-11 of the Exchange Act) with respect to the election or removal of Directors or other actual or threatened solicitation of proxies or consents by or on behalf of a “person” (as such term is used in Sections 13(d) and 14(d) of the Exchange Act) other than the Board; or (iv) the consummation of a reorganization, merger or consolidation of the Company with any other corporation, other than a reorganization, merger or consolidation which would result in the voting securities of the Company outstanding immediately prior thereto continuing to represent (either by remaining outstanding or by being converted into voting securities of the surviving entity or its direct or indirect parent) more than fifty percent (50%) of the total voting power represented

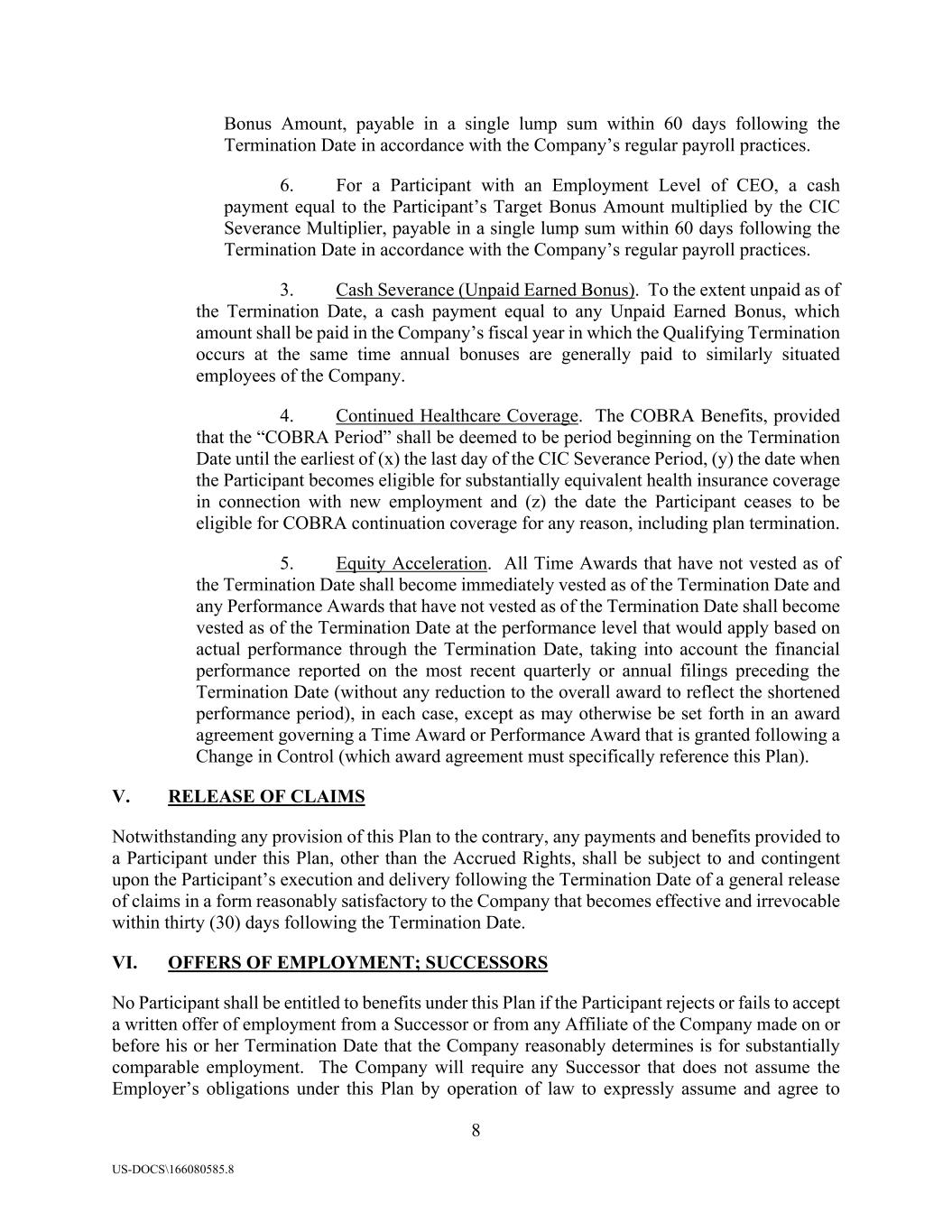

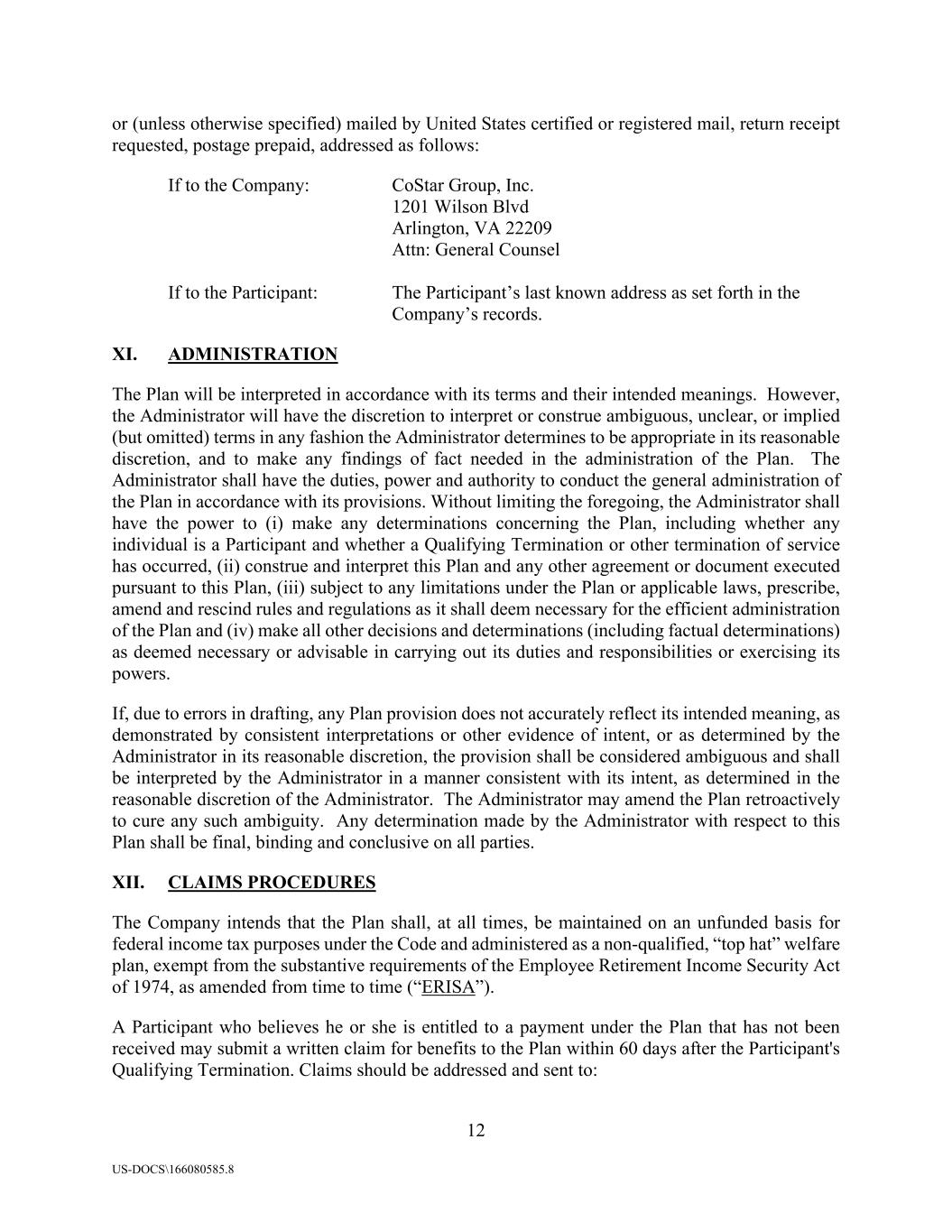

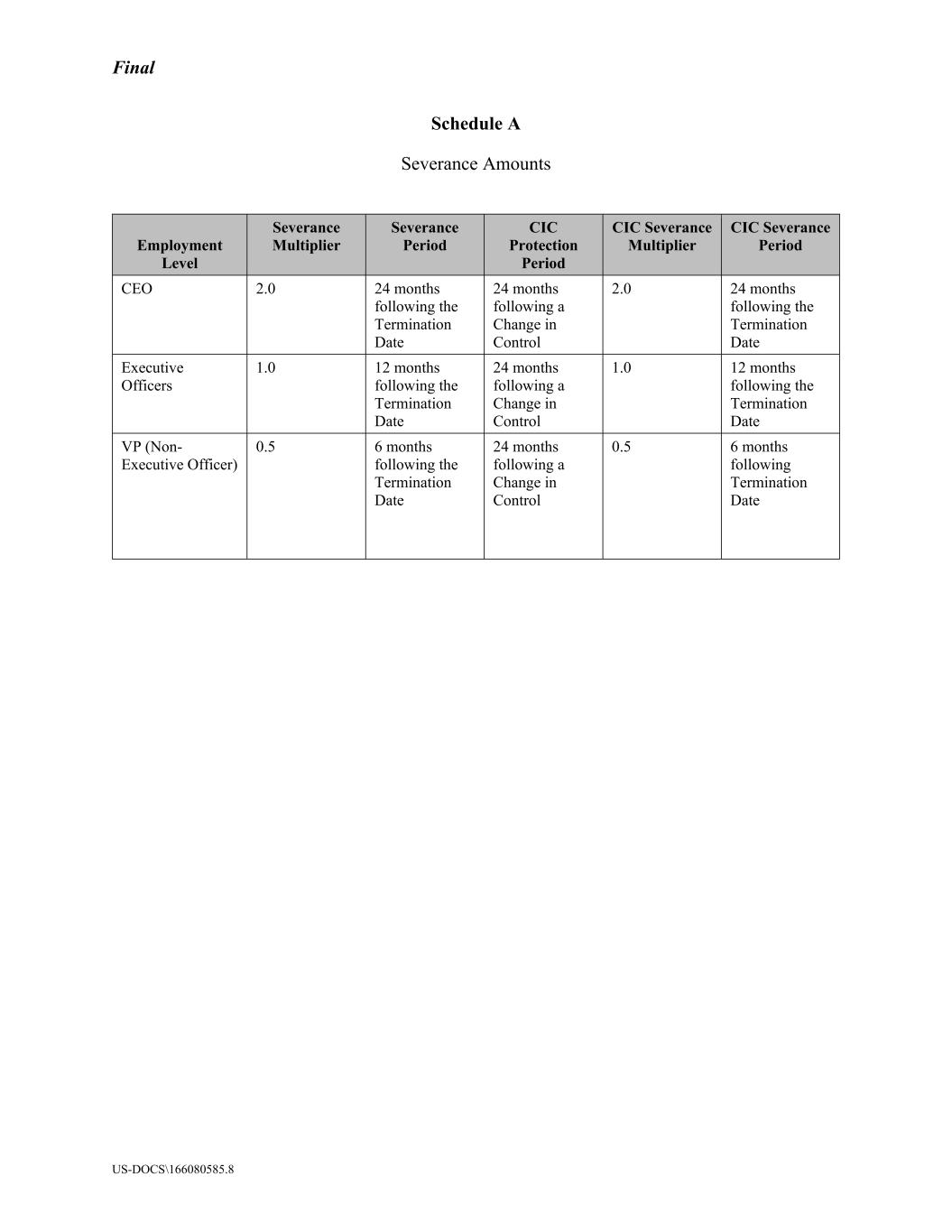

3 US-DOCS\166080585.8 by the voting securities of the Company or such surviving entity or its direct or indirect parent outstanding immediately after such merger or consolidation. Notwithstanding the foregoing, if a Change in Control constitutes a payment event with respect to any amount which constitutes or provides for the deferral of compensation and is subject to Section 409A, the transaction or event with respect to such amount must also constitute a “change in control event,” as defined in Treasury Regulation Section 1.409A-3(i)(5) to the extent required by Section 409A. The Administrator shall have full and final authority, which shall be exercised in its discretion, to determine conclusively whether a Change in Control has occurred pursuant to the above definition, the date of the occurrence of such Change in Control and any incidental matters relating thereto; provided that any exercise of authority in conjunction with a determination of whether a Change in Control is a “change in control event” as defined in Treasury Regulation Section 1.409A-3(i)(5) shall be consistent with such regulation. G. “CIC Protection Period” means, with respect to a Participant, the period of time set forth opposite the Participant’s Employment Level under the heading “CIC Protection Period” on Schedule A. H. “CIC Severance Multiplier” means, with respect to a Participant, the number set forth opposite the Participant’s Employment Level under the heading “CIC Severance Multiplier” on Schedule A. I. “CIC Severance Period” means, with respect to a Participant, the period of time set forth opposite the Participant’s Employment Level under the heading “CIC Severance Period” on Schedule A. J. “COBRA” means the Consolidated Omnibus Budget Reconciliation Act of 1985, as amended. K. “Code” means the Internal Revenue Code of 1986, as amended from time to time, or any successor statute thereto, and the regulations promulgated thereunder, as in effect from time to time. L. “Committee” means the Compensation Committee of the Board. M. “Effective Date” means January 6, 2026. N. “Employer” means, with respect to a Participant, the Company and its subsidiary that employs the Participant. O. “Employment Level” means, with respect to a Participant, the Participant’s employment level with the Employer as in effect at the time of the Participant’s Qualifying Termination. The Employment Level shall be determined by the Administrator. A Participant shall be designated with an Employment Level of either (i) CEO, (ii) Executive Officer, or (iii) VP (Non-Executive Officer).

4 US-DOCS\166080585.8 P. “Good Reason” shall mean (i) if the Participant is party to a written employment, consulting or similar agreement with the Company or any of its subsidiaries in which the term “Good Reason” is defined, “Good Reason” as defined in such agreement, and (ii) if no such agreement exists, the occurrence of any of the following events or conditions without the Participant’s written consent: (1) a decrease in the Participant’s Base Salary, other than a reduction in the Participant’s Base Salary of less than 10% that is implemented in connection with an extraordinary event (as determined by the Administrator) and a contemporaneous reduction in annual base salaries affecting other similarly situated employees of the Company; (2) a material decrease in the Participant’s authority or areas of responsibility as are commensurate with such Participant’s title or position; (3) a decrease in the Participant’s Target Bonus Amount, other than a reduction by less than 10% that is implemented in connection with an extraordinary event (as determined by the Administrator) and a contemporaneous reduction in target annual bonuses affecting other similarly situated employees of the Company; (4) a material breach by the Company or any of its subsidiaries of a written employment, consulting or similar agreement; (5) a failure of any successor to the Company to expressly agree to assume this Plan, unless assumption of the Plan occurs by operation of law; or (6) the relocation of the Participant’s primary office to a location more than 50 miles from the Participant’s then-current primary office location. The Participant must provide written notice to the Company of the occurrence of any of the foregoing events or conditions within sixty (60) days after the occurrence of such event or the date upon which the Participant reasonably became aware that such an event or condition had occurred. The Company or any successor, subsidiary or Affiliate shall have a period of thirty (30) days to cure such event or condition after receipt of written notice of such event from the Participant. Any termination for “Good Reason” following such cure period must occur no later than the date that is sixty (60) days following the date that notice was provided by the Participant. Q. “Performance Award” means each equity or equity-based award under any Company equity compensation plan that vests in whole or in part based upon the attainment of performance vesting conditions. R. “Pro-Rated Bonus Amount” means the product of (i) the Participant’s Target Bonus Amount times (ii) a fraction, the numerator of which is equal to the number of full calendar days elapsed in the fiscal year in which the Qualifying Termination occurs (up to and including the date of the Qualifying Termination) and the denominator of which is the number of full calendar days in the applicable fiscal year. S. “Qualifying Termination” means, with respect to a Participant, a termination of the Participant’s employment with the Employer by the Employer without Cause or by the Participant for Good Reason. T. “Section 409A” means Section 409A of the Code. U. “Severance Multiplier” means, with respect to a Participant, the number set forth opposite the Participant’s Employment Level under the heading “Severance Multiplier” on Schedule A.

5 US-DOCS\166080585.8 V. “Severance Period” means, with respect to a Participant, the period of time set forth opposite the Participant’s Employment Level under the heading “Severance Period” on Schedule A. W. “Successor” means any employer (whether or not the employer is an Affiliate of the Company) which acquires (through merger, consolidation, reorganization, transfer, sublease, assignment or otherwise) all or substantially all of the business or assets of the Company or of a division or business of the Company. X. “Target Bonus Amount” means, with respect to a Participant, the Participant’s target annual performance bonus amount, if any, in effect at the time of the Participant’s Qualifying Termination, disregarding for this purpose any decrease in target annual performance bonus that provides a basis for Good Reason. Y. “Termination Date” means, with respect to a Participant, the date on which a termination of the Participant’s employment is effective. Z. “Time Award” means each equity or equity-based award under any Company equity compensation plan that vests based solely on the Participant’s continued service to the Company or its subsidiaries. AA. “Unpaid Earned Bonus” means, to the extent unpaid, an amount of cash equal to any annual bonus earned by the Participant for the Company’s fiscal year prior to the fiscal year in which the Qualifying Termination occurs. III. ELIGIBILITY The participants in this Plan (“Participants”) are those regular U.S. full-time employees of the Company and its direct and indirect subsidiaries who have been designated as a Participant by the Committee, or with respect to individuals who are not executive officers of the Company, the Chief Executive Officer. IV. BENEFITS A. Accrued Rights; Death. Upon termination of a Participant’s employment with the Employer for any reason, the Participant will be entitled to receive payment of any earned but unpaid Base Salary and any other amounts or benefits, including accrued paid time off to the extent payable upon termination pursuant to the Employer’s policies, under the Employer’s employee benefit plans, programs or arrangements to which the Participant is entitled pursuant to the terms of such plans, programs or arrangements or applicable law, payable in accordance with the terms of such plans, programs or arrangements or as otherwise required by applicable law (collectively, “Accrued Rights”). In addition, in the event of a Participant’s death, all unvested Time Awards shall become immediately vested and any unvested Performance Awards shall become vested at the performance level that would apply based on actual performance through the Termination Date, taking into account the financial performance reported on the most recent quarterly or annual filings preceding the Termination Date (without any reduction to the overall award to reflect the shortened performance period).

6 US-DOCS\166080585.8 B. Qualifying Termination outside of the CIC Protection Period. If a Participant experiences a Qualifying Termination other than during the CIC Protection Period, then subject to the terms of this Plan (including Sections V, VI and VII), the Participant will be entitled to receive the following payments and benefits: 1. Cash Severance (Base Salary). A cash payment equal to the Participant’s annual Base Salary multiplied by the Severance Multiplier, payable in regular installments over the Severance Period in accordance with the Company’s regular payroll practices. 2. Cash Severance (Pro-Rated Bonus). (a) For a Participant with an Employment Level of Executive Officer, a cash payment equal to the Participant’s Pro-Rated Bonus Amount, payable in a single lump sum within 60 days following the Termination Date in accordance with the Company’s regular payroll practices. (b) For a Participant with an Employment Level of CEO, a cash payment equal to the Participant’s Pro-Rated Bonus Amount multiplied by the Severance Multiplier, payable in a single lump sum within 60 days following the Termination Date in accordance with the Company’s regular payroll practices. (c) For the avoidance of doubt, a Participant with an Employment Level of VP (Non-Executive Officer) shall not be entitled to receive payments or benefits under this Section IV.B.2. 3. Cash Severance (Unpaid Earned Bonus). To the extent unpaid as of the Termination Date, a cash payment equal to any Unpaid Earned Bonus, which amount shall be paid in the Company’s fiscal year in which the Qualifying Termination occurs at the same time annual bonuses are generally paid to similarly situated employees of the Company. 4. Continued Healthcare Coverage. If the Participant timely elects continued coverage pursuant to COBRA for the Participant and the Participant’s covered dependents under the Company’s group health (medical, dental or vision) plans following such Qualifying Termination, then the Company shall pay the COBRA premiums necessary to continue the Participant’s and his or her covered dependents’ health insurance coverage in effect on the Termination Date until the earliest of (x) the last day of the Severance Period, (y) the date when the Participant becomes eligible for substantially equivalent health insurance coverage in connection with new employment and (z) the date the Participant ceases to be eligible for COBRA continuation coverage for any reason, including plan termination (such period from the Termination Date through the earlier of (x)-(z), the “COBRA Period”). Notwithstanding the foregoing, if at any time the Company determines that its payment of COBRA premiums on the Participant’s behalf would result in a violation of applicable law or result in an excise tax, then in lieu of paying COBRA premiums pursuant to this paragraph, the Company shall pay the Participant on the last day of each remaining month of the COBRA Period,

7 US-DOCS\166080585.8 a fully taxable cash payment equal to the COBRA premium for such month, subject to applicable tax withholding, such payment to be made without regard to the Participant’s payment of COBRA premiums. The benefits described in this paragraph are referred to as the “COBRA Benefits”. 5. Equity Acceleration. (a) For a Participant with an Employment Level of Executive Officer, (i) all Time Awards that have not vested as of the Termination Date shall become immediately vested as of the Termination Date as to the portion of the Time Awards that were scheduled to vest on or prior to the first anniversary of the Termination Date and (ii) any Performance Awards with a performance period that was scheduled to be completed on or prior to the first anniversary of the Termination Date and that have not vested as of the Termination Date shall become vested as of the Termination Date at the performance level that would apply based on actual performance through the Termination Date, taking into account the financial performance reported on the most recent quarterly or annual filings preceding the Termination Date (without any further reduction to the overall award to reflect the shortened performance period). (b) For a Participant with an Employment Level of CEO, (i) all Time Awards that have not vested as of the Termination Date shall become immediately vested as of the Termination Date as to the portion of the Time Awards that were scheduled to vest on or prior to the second anniversary of the Termination Date and (ii) any Performance Awards with a performance period that was scheduled to be completed on or prior to the second anniversary of the Termination Date and that have not vested as of the Termination Date shall become vested as of the Termination Date at the performance level that would apply based on actual performance through the Termination Date, taking into account the financial performance reported on the most recent quarterly or annual filings preceding the Termination Date (without any further reduction to the overall award to reflect the shortened performance period). C. Qualifying Termination During the CIC Protection Period. If a Participant experiences a Qualifying Termination during a CIC Protection Period, then subject to the terms of this Plan (including Sections V, VI and VII), the Participant will be entitled to receive the following payments and benefits: 1. Cash Severance (Base Salary). A cash payment equal to the Participant’s annual Base Salary multiplied by the CIC Severance Multiplier, payable in a single lump sum within 60 days following the Termination Date in accordance with the Company’s regular payroll practices. 2. Cash Severance (Target Bonus). (d) For a Participant with an Employment Level of Executive Officer or VP (Non-Executive Officer), a cash payment equal to the Participant’s Target

8 US-DOCS\166080585.8 Bonus Amount, payable in a single lump sum within 60 days following the Termination Date in accordance with the Company’s regular payroll practices. 6. For a Participant with an Employment Level of CEO, a cash payment equal to the Participant’s Target Bonus Amount multiplied by the CIC Severance Multiplier, payable in a single lump sum within 60 days following the Termination Date in accordance with the Company’s regular payroll practices. 3. Cash Severance (Unpaid Earned Bonus). To the extent unpaid as of the Termination Date, a cash payment equal to any Unpaid Earned Bonus, which amount shall be paid in the Company’s fiscal year in which the Qualifying Termination occurs at the same time annual bonuses are generally paid to similarly situated employees of the Company. 4. Continued Healthcare Coverage. The COBRA Benefits, provided that the “COBRA Period” shall be deemed to be period beginning on the Termination Date until the earliest of (x) the last day of the CIC Severance Period, (y) the date when the Participant becomes eligible for substantially equivalent health insurance coverage in connection with new employment and (z) the date the Participant ceases to be eligible for COBRA continuation coverage for any reason, including plan termination. 5. Equity Acceleration. All Time Awards that have not vested as of the Termination Date shall become immediately vested as of the Termination Date and any Performance Awards that have not vested as of the Termination Date shall become vested as of the Termination Date at the performance level that would apply based on actual performance through the Termination Date, taking into account the financial performance reported on the most recent quarterly or annual filings preceding the Termination Date (without any reduction to the overall award to reflect the shortened performance period), in each case, except as may otherwise be set forth in an award agreement governing a Time Award or Performance Award that is granted following a Change in Control (which award agreement must specifically reference this Plan). V. RELEASE OF CLAIMS Notwithstanding any provision of this Plan to the contrary, any payments and benefits provided to a Participant under this Plan, other than the Accrued Rights, shall be subject to and contingent upon the Participant’s execution and delivery following the Termination Date of a general release of claims in a form reasonably satisfactory to the Company that becomes effective and irrevocable within thirty (30) days following the Termination Date. VI. OFFERS OF EMPLOYMENT; SUCCESSORS No Participant shall be entitled to benefits under this Plan if the Participant rejects or fails to accept a written offer of employment from a Successor or from any Affiliate of the Company made on or before his or her Termination Date that the Company reasonably determines is for substantially comparable employment. The Company will require any Successor that does not assume the Employer’s obligations under this Plan by operation of law to expressly assume and agree to

9 US-DOCS\166080585.8 perform this Plan in the same manner and to the same extent that the Employer would be required to perform if no such succession had taken place. VII. TAX MATTERS A. Withholding The Employer may deduct and withhold from any amounts payable under this Plan such federal, state, local, foreign or other taxes as are required to be withheld pursuant to any applicable law or regulation. B. Section 409A The payments and benefits under this Plan are intended to comply with or be exempt from Section 409A and, accordingly, to the maximum extent permitted, this Plan shall be interpreted to be in compliance therewith. Notwithstanding any provision of this Plan to the contrary, in the event that the Administrator determines that any amounts payable hereunder would be immediately taxable to any Participant under Section 409A, the Administrator may (without any obligation to do so or to indemnify the Participant for failure to do so) (A) adopt such amendments to this Plan or adopt such other policies and procedures (including amendments, policies and procedures with retroactive effect) that it determines to be necessary or appropriate to preserve the intended tax treatment of the benefits provided by this Plan or the economic benefits of this Plan and (B) take such other actions it determines to be necessary or appropriate to exempt the amounts payable hereunder from Section 409A or to comply with the requirements of Section 409A and thereby avoid the application of penalty taxes thereunder. Notwithstanding any provision of this Plan to the contrary, no termination or other similar payments and benefits under this Plan will be payable to a Participant unless the Participant’s termination of employment constitutes a “separation from service” within the meaning of Section 409A (a “Separation from Service”). Notwithstanding any provision of this Plan to the contrary, if a Participant is deemed by the Company at the time of the Participant’s Separation from Service to be a “specified employee” for purposes of Section 409A, to the extent delayed commencement of any portion of the benefits to which the Participant is entitled under this Plan is required in order to avoid a prohibited distribution under Section 409A, such portion of the Participant’s benefits will not be provided to the Participant prior to the earlier of (i) the expiration of the six-month period measured from the date of the Participant’s Separation from Service or (ii) the date of the Participant’s death. As promptly as possible following the expiration of the applicable Section 409A period, all payments and benefits deferred pursuant to the preceding sentence will be paid in a lump sum to a Participant (or the Participant’s estate), and any remaining payments due to the Participant under this Plan will be paid as otherwise provided herein. A Participant’s right to receive any installment payments under this Plan shall be treated as a right to receive a series of separate payments and, accordingly, each such installment payment shall at all times be considered a separate and distinct payment as permitted under Section 409A. To the extent necessary to comply with Section 409A, if the designated payment period for any payment

10 US-DOCS\166080585.8 under this Plan begins in one taxable year and ends in the next taxable year, the payment will commence or otherwise be made in the later taxable year. C. Potential Reduction of Certain “Parachute Payments” 1. Notwithstanding any other provisions of this Plan, in the event that any payment or benefit by the Company or otherwise to or for the benefit of a Participant, whether paid or payable or distributed or distributable pursuant to the terms of this Plan (all such payments and benefits, including the payments and benefits under Section IV of the Plan, being hereinafter referred to as the “Total Payments”), would be subject (in whole or in part) to the excise tax imposed by Section 4999 of the Code (the “Excise Tax”), then the Total Payments shall be reduced (in the order provided in subsection B below) to the minimum extent necessary to avoid the imposition of the Excise Tax on the Total Payments, but only if (i) the net amount of such Total Payments, as so reduced (and after subtracting the net amount of federal, state and local income and employment taxes on such reduced Total Payments and after taking into account the phase out of itemized deductions and personal exemptions attributable to such reduced Total Payments), is greater than or equal to (ii) the net amount of such Total Payments without such reduction (but after subtracting the net amount of federal, state and local income and employment taxes on such Total Payments and the amount of the Excise Tax to which the Participant would be subject in respect of such unreduced Total Payments and after taking into account the phase out of itemized deductions and personal exemptions attributable to such unreduced Total Payments). 2. The Total Payments shall be reduced in the following order: (i) reduction on a pro-rata basis of any cash severance payments that are exempt from Section 409A, (ii) reduction on a pro-rata basis of any non-cash severance payments or benefits that are exempt from Section 409A, and (iii) reduction of any payments or benefits otherwise payable to the Participant on a pro-rata basis or such other manner that complies with Section 409A; provided, in case of clauses (ii) and (iii), that reduction of any payments attributable to the acceleration of vesting of Company equity awards shall be first applied to Company equity awards that would otherwise vest last in time. 3. All determinations regarding the application of Section VII.C shall be made by an accounting firm or consulting group with experience in performing calculations regarding the applicability of Section 280G of the Code and the Excise Tax selected by the Company (the “Independent Advisors”). For purposes of determinations, no portion of the Total Payments shall be taken into account which, in the opinion of the Independent Advisors, (i) does not constitute a “parachute payment” within the meaning of Section 280G(b)(2) of the Code (including by reason of Section 280G(b)(4)(A) of the Code) or (ii) constitutes reasonable compensation for services actually rendered, within the meaning of Section 280G(b)(4)(B) of the Code, in excess of the “base amount” (as defined in Section 280G(b)(3) of the Code) allocable to such reasonable compensation. The costs of obtaining such determination and all related fees and expenses (including related fees and expenses incurred in any later audit) shall be borne by the Company.

11 US-DOCS\166080585.8 4. In the event it is later determined that a greater reduction in the Total Payments should have been made to implement the objective and intent of Section VII.C, the excess amount shall be returned promptly by the Participant to the Company. VIII. DURATION; TERMINATION; AMENDMENT; MODIFICATION This Plan will become effective on the Effective Date. The Board or the Administrator may amend, modify or terminate this Plan at any time; provided that, except as otherwise provided in Section VII: A. No amendment, modification or termination may affect any right of any Participant to claim benefits under this Plan as in effect prior to such amendment, modification or termination with respect to a Termination Date that occurs prior to the date of such amendment, modification or termination; and B. During the CIC Protection Period for a given Participant, this Plan may not be amended or modified in any manner that decreases the payments or benefits payable to the Participant or otherwise adversely affects the Participant’s economic rights or terminated. IX. RELATION TO OTHER PLANS Nothing in this Plan will prevent or limit a Participant’s continuing or future participation in any plan, contract, agreement, practice, policy or program provided by the Company or any Affiliate thereof for which the Participant may qualify (an “Other Arrangement”), nor will anything in this Plan limit or otherwise affect any rights the Participant may have under any Other Arrangement with the Company or any Affiliate thereof, provided that the benefits received under this Plan and an Other Arrangement shall not be duplicative. Therefore, notwithstanding any provision herein to the contrary, the payments and benefits payable hereunder shall be reduced (on a dollar for dollar basis) by the amount of such severance payments and benefits payable under an Other Arrangement to the extent duplicative, such that a Participant who is entitled to receive payments and benefits hereunder receives, in the aggregate, not more than the amount of payments and benefits that would be provided hereunder if there were no such Other Arrangement. Any such reduction in payments and benefits provided hereunder shall be implemented in such manner as is determined by the Company in compliance with all applicable laws, including Section 409A, if applicable, without changing the time or form of payment of any severance payments and benefits payable under an Other Arrangement. Vested benefits and other amounts a Participant is otherwise entitled to receive under any incentive compensation (including any equity award agreement), deferred compensation, retirement, pension or other plan, practice, policy or program of, or any contract or agreement with, the Company or any Affiliate thereof shall be payable in accordance with the terms of each such plan, practice, policy, program, contract or agreement, as the case may be. X. NOTICES All notices or other communications required or permitted by this Plan will be made in writing and all such notices or communications will be deemed to have been duly given when delivered

12 US-DOCS\166080585.8 or (unless otherwise specified) mailed by United States certified or registered mail, return receipt requested, postage prepaid, addressed as follows: If to the Company: CoStar Group, Inc. 1201 Wilson Blvd Arlington, VA 22209 Attn: General Counsel If to the Participant: The Participant’s last known address as set forth in the Company’s records. XI. ADMINISTRATION The Plan will be interpreted in accordance with its terms and their intended meanings. However, the Administrator will have the discretion to interpret or construe ambiguous, unclear, or implied (but omitted) terms in any fashion the Administrator determines to be appropriate in its reasonable discretion, and to make any findings of fact needed in the administration of the Plan. The Administrator shall have the duties, power and authority to conduct the general administration of the Plan in accordance with its provisions. Without limiting the foregoing, the Administrator shall have the power to (i) make any determinations concerning the Plan, including whether any individual is a Participant and whether a Qualifying Termination or other termination of service has occurred, (ii) construe and interpret this Plan and any other agreement or document executed pursuant to this Plan, (iii) subject to any limitations under the Plan or applicable laws, prescribe, amend and rescind rules and regulations as it shall deem necessary for the efficient administration of the Plan and (iv) make all other decisions and determinations (including factual determinations) as deemed necessary or advisable in carrying out its duties and responsibilities or exercising its powers. If, due to errors in drafting, any Plan provision does not accurately reflect its intended meaning, as demonstrated by consistent interpretations or other evidence of intent, or as determined by the Administrator in its reasonable discretion, the provision shall be considered ambiguous and shall be interpreted by the Administrator in a manner consistent with its intent, as determined in the reasonable discretion of the Administrator. The Administrator may amend the Plan retroactively to cure any such ambiguity. Any determination made by the Administrator with respect to this Plan shall be final, binding and conclusive on all parties. XII. CLAIMS PROCEDURES The Company intends that the Plan shall, at all times, be maintained on an unfunded basis for federal income tax purposes under the Code and administered as a non-qualified, “top hat” welfare plan, exempt from the substantive requirements of the Employee Retirement Income Security Act of 1974, as amended from time to time (“ERISA”). A Participant who believes he or she is entitled to a payment under the Plan that has not been received may submit a written claim for benefits to the Plan within 60 days after the Participant's Qualifying Termination. Claims should be addressed and sent to:

13 US-DOCS\166080585.8 CoStar Group, Inc. 1201 Wilson Blvd Arlington, VA 22209 Attn: General Counsel If the Participant's claim is denied, in whole or in part, the Participant will be furnished with written notice of the denial within 90 days after the Administrator's receipt of the Participant's written claim, unless special circumstances require an extension of time for processing the claim, in which case a period not to exceed 180 days will apply. If such an extension of time is required, written notice of the extension will be furnished to the Participant before the termination of the initial 90- day period and will describe the special circumstances requiring the extension, and the date on which a decision is expected to be rendered. Written notice of the denial of the Participant's claim will contain the following information: (i) the specific reason or reasons for the denial of the Participant’s claim; (ii) references to the specific Plan provisions on which the denial of the Participant's claim was based; (iii) a description of any additional information or material required by the Administrator to reconsider the Participant's claim (to the extent applicable) and an explanation of why such material or information is necessary; and (iv) a description of the Plan's review procedures and time limits applicable to such procedures, including a statement of the Participant's right to bring a civil action under Section 502(a) of ERISA following a benefit claim denial on review. If the Participant's claim is denied and he or she wishes to submit a request for a review of the denied claim, the Participant or his or her authorized representative must follow the procedures described below: (i) Upon receipt of the denied claim, the Participant (or his or her authorized representative) may file a request for review of the claim in writing with the Administrator. This request for review must be filed no later than 60 days after the Participant has received written notification of the denial. (ii) The Participant has the right to submit in writing to the Administrator any comments, documents, records or other information relating to his or her claim for benefits. (iii) The Participant has the right to be provided with, upon request and free of charge, reasonable access to and copies of all pertinent documents, records and other information that is relevant to his or her claim for benefits. The review of the denied claim will take into account all comments, documents, records and other information that the Participant submitted relating to his or her claim, without regard to whether such information was submitted or considered in the initial denial of his or her claim. The Administrator will provide the Participant with written notice of its decision within 60 days after the Administrator's receipt of the Participant's written claim for review. There may be special circumstances which require an extension of this 60-day period. In any such case, the Administrator will notify the Participant in writing within the 60-day period and the final decision will be made no later than 120 days after the Administrator's receipt of the Participant's written claim for review. The Administrator's decision on the Participant's claim for review will be

14 US-DOCS\166080585.8 communicated to the Participant in writing and will clearly state: (i) the specific reason or reasons for the denial of the Participant's claim; (ii) reference to the specific Plan provisions on which the denial of the Participant's claim is based; (iii) a statement that the Participant is entitled to receive, upon request and free of charge, reasonable access to, and copies of, the Plan and all documents, records and other information relevant to his or her claim for benefits; and (iv) a statement describing the Participant's right to bring an action under Section 502(a) of ERISA. The exhaustion of these claims procedures is mandatory for resolving every claim and dispute arising under the Plan. As to such claims and disputes: (i) no claimant shall be permitted to commence any legal action to recover benefits or to enforce or clarify rights under the Plan under Section 502 or Section 510 of ERISA or under any other provision of law, whether or not statutory, until these claims procedures have been exhausted in their entirety; and (ii) in any such legal action, all explicit and implicit determinations by the Administrator (including, but not limited to, determinations as to whether the claim, or a request for a review of a denied claim, was timely filed) shall be afforded the maximum deference permitted by law. XIII. MISCELLANEOUS All payments provided under this Plan shall be paid in cash from the general funds of the Company, and no special or separate fund or other segregation of assets shall be required to be made to assure payment. To the extent that any person acquires a right to receive payments from the Company under this Plan, such right shall be no greater than the right of an unsecured creditor of the Company. Nothing in this Plan shall interfere with or limit in any way the right of the Company or its subsidiaries and/or its Affiliates to terminate any Participant’s employment or service for the Company at any time or for any reason, nor shall this Plan itself confer upon any Participant any right to continue his or her employment or service for any specified period of time. Benefits arising under this Plan shall not constitute an employment contract with the Company or any subsidiary and/or its Affiliates. No payment under the Plan will be taken into account in determining any benefits under any pension, retirement, savings, profit sharing, group insurance, welfare or other benefit plan of the Company except as expressly provided in writing in such other plan or an agreement thereunder. This Plan and any documents hereunder shall be interpreted and construed in accordance with the laws of the Delaware and applicable federal law. * * * * *

Final US-DOCS\166080585.8 Schedule A Severance Amounts Employment Level Severance Multiplier Severance Period CIC Protection Period CIC Severance Multiplier CIC Severance Period CEO 2.0 24 months following the Termination Date 24 months following a Change in Control 2.0 24 months following the Termination Date Executive Officers 1.0 12 months following the Termination Date 24 months following a Change in Control 1.0 12 months following the Termination Date VP (Non- Executive Officer) 0.5 6 months following the Termination Date 24 months following a Change in Control 0.5 6 months following Termination Date