.2

Financial ResultsThird Quarter 2025October 23, 2025

Forward Looking Statements This presentation contains “forward-looking

statements” concerning the Corporation’s future economic, operational and financial performance. The words or phrases “expect,” “anticipate,” “intend,” “should,” “would,” “will,” “plans,” “forecast,” “believe” and similar expressions are

meant to identify “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and are subject to the safe harbor created by such

sections. The Corporation cautions readers not to place undue reliance on any such forward-looking statements, which speak only as of the date hereof, and advises readers that any such forward-looking statements are not guarantees of future

performance and involve certain risks, uncertainties, estimates and assumptions by us that are difficult to predict. Various factors, some of which are beyond our control, including, but not limited to, the uncertainties more fully discussed

in Part I, Item 1A, “Risk Factors” of the Corporation’s Annual Report on Form 10-K for the year ended December 31, 2024, and the following, could cause actual results to differ materially from those expressed in, or implied by, such

forward-looking statements: the effect of the current global interest rate environment (including the potential for ongoing reductions in interest rates) and inflation levels on the level, composition and performance of the Corporation’s

assets and liabilities, and corresponding effects on the Corporation’s net interest income, net interest margin, loan originations, deposit attrition, overall results of operations, and liquidity position; the effects of changes in the

interest rate environment, including any adverse change in the Corporation’s ability to attract and retain clients and gain acceptance from current and prospective customers for new products and services, including those related to the

offering of digital banking and financial services; volatility in the financial services industry, which could result in, among other things, bank deposit runoffs, liquidity constraints, and increased regulatory requirements and costs;

uncertainty as to the ability of FirstBank to retain its core deposits and generate sufficient cash flow through its wholesale funding sources, which may require us to sell investment securities at a loss; adverse changes in general political

and economic conditions in Puerto Rico, the U.S., and the U.S. and British Virgin Islands, including in the interest rate environment, unemployment rates, market liquidity, housing absorption rates, real estate markets and U.S. capital

markets; general competitive factors and other market risks as well as the implementation of existent or planned strategic growth opportunities, including risks, uncertainties, and other factors or events related to any business acquisitions,

dispositions, strategic partnerships, strategic operational investments including system conversions, and any anticipated efficiencies or other expected results related thereto; uncertainty as to the implementation of the debt restructuring

plan of Puerto Rico and the Fiscal Plan for Puerto Rico as certified on June 5, 2024 by the Financial Oversight and Management Board for Puerto Rico, or any revisions to it, on our clients and loan portfolios, and any potential impact from

future economic or political developments and tax regulations in Puerto Rico; the impact of government financial assistance for hurricane recovery and other disaster relief on economic activity in Puerto Rico; the timing of sales of

properties from our other real estate owned (“OREO”) portfolio; the impacts of applicable legislative, tax or regulatory changes on the Corporation’s financial condition or performance; and the effect of continued changes in the fiscal,

monetary, and trade policies and regulations of the U.S. federal government, the Puerto Rico government and other governments. The Corporation does not undertake and specifically disclaims any obligation to update any “forward-looking

statements” to reflect occurrences or unanticipated events or circumstances after the date of such statements, except as required by the federal securities laws. Non-GAAP Financial Measures In addition to the Corporation’s financial

information presented in accordance with GAAP, management uses certain “non-GAAP” financial measures” within the meaning of Regulation G promulgated by the SEC, to clarify and enhance understanding of past performance and prospects for the

future. Please refer to pages 16-19 for a reconciliation of GAAP to non-GAAP measures and calculations.

Agenda 1 3Q 2025 – Quarter Highlights Aurelio Alemán, President and Chief

Executive Officer 2 3Q 2025 – Results of Operations Orlando Berges, Executive Vice President and Chief Financial Officer 3 3Q 2025 – Questions and Answers

Third Quarter 2025 Financial Performance Highlights Balance Sheet Total loans

grew by $181.4 million reaching $13.1 billion (1.4% vs. prior quarter) mainly reflecting growth across commercial segments Core deposits, other than brokered and fully collateralized government deposits, increased by $138.7 million to $12.8

billion Fully collateralized government deposits increased by $66.5 million to $3.4 billion Non-performing assets (“NPA”) ratio decreased to 0.62% and annualized net charge-offs to average loans increased by 2 bps to 0.62% Allowance for

credit losses (“ACL”) coverage ratio on loans and leases decreased by 4 bps to 1.89% Asset Quality Total available liquidity sources of approximately $6.2 billion or 1.3x of uninsured deposits Repurchased $50.0 million in common stock and

declared $28.7 million in common stock dividends; CET1 remains strong and above well-capitalized levels at 16.7% On a non-GAAP basis, tangible book value per share grew by 5.6% to $11.79 and tangible common equity ratio reached

9.7% Liquidity and Capital Profitability Net income of $100.5 million ($0.63 per diluted share), compared to $80.2 million ($0.50 per diluted share) in 2Q 2025 Record net interest income of $217.9 million, compared to $215.9 million in 2Q

2025 and up 8% year-over-year On a non-GAAP basis, adjusted pre-tax, pre-provision income of $121.5 million, up 9% on a year-over-year basis Sustained track record of expense management discipline resulting in efficiency ratio of 50%, flat

vs. 2Q 2025

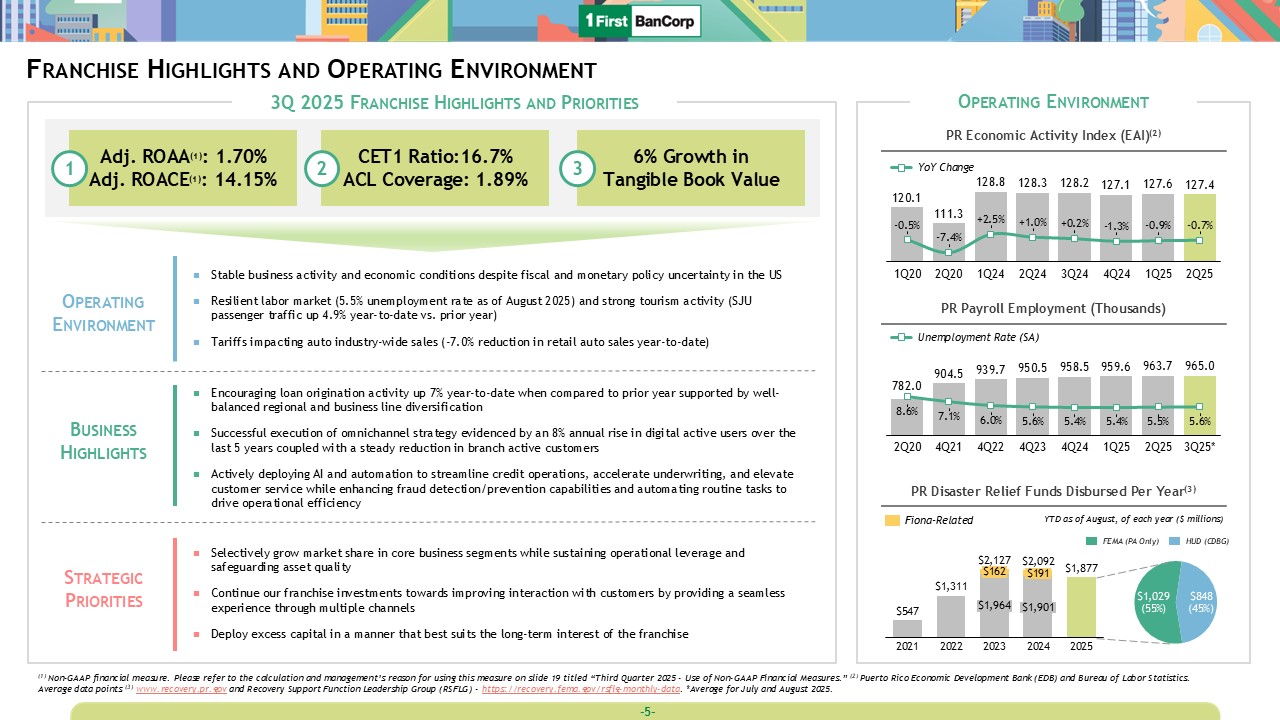

Franchise Highlights and Operating Environment Adj. ROAA(1): 1.70% Adj.

ROACE(1): 14.15% 1 CET1 Ratio:16.7% ACL Coverage: 1.89% 2 6% Growth in Tangible Book Value 3 PR Economic Activity Index (EAI)(2) 1Q20 2Q20 1Q24 2Q24 3Q24 4Q24 1Q25 2Q25 YoY Change PR Payroll Employment

(Thousands) 2Q20 4Q21 4Q22 4Q23 4Q24 1Q25 2Q25 3Q25* Unemployment Rate (SA) PR Disaster Relief Funds Disbursed Per Year(3) (1) Non-GAAP financial measure. Please refer to the calculation and management’s reason for using this

measure on slide 19 titled “Third Quarter 2025 - Use of Non-GAAP Financial Measures.” (2) Puerto Rico Economic Development Bank (EDB) and Bureau of Labor Statistics. Average data points (3) www.recovery.pr.gov and Recovery Support Function

Leadership Group (RSFLG) - https://recovery.fema.gov/rsflg-monthly-data. *Average for July and August 2025. YTD as of August, of each year ($ millions) 3Q 2025 Franchise Highlights and Priorities Operating Environment Operating

Environment Stable business activity and economic conditions despite fiscal and monetary policy uncertainty in the US Resilient labor market (5.5% unemployment rate as of August 2025) and strong tourism activity (SJU passenger traffic up

4.9% year-to-date vs. prior year) Tariffs impacting auto industry-wide sales (-7.0% reduction in retail auto sales year-to-date) Business Highlights Encouraging loan origination activity up 7% year-to-date when compared to prior year

supported by well-balanced regional and business line diversification Successful execution of omnichannel strategy evidenced by an 8% annual rise in digital active users over the last 5 years coupled with a steady reduction in branch active

customers Actively deploying AI and automation to streamline credit operations, accelerate underwriting, and elevate customer service while enhancing fraud detection/prevention capabilities and automating routine tasks to drive operational

efficiency 2022 $162 $1,964 2023 $191 $1,901 2024 2025 $1,311 $2,127 $2,092 $1,877 2021 $547 $1,029(55%) $848(45%) FEMA (PA Only) HUD (CDBG) Strategic Priorities Selectively grow market share in core business segments

while sustaining operational leverage and safeguarding asset quality Continue our franchise investments towards improving interaction with customers by providing a seamless experience through multiple channels Deploy excess capital in a

manner that best suits the long-term interest of the franchise Fiona-Related

Results of Operations

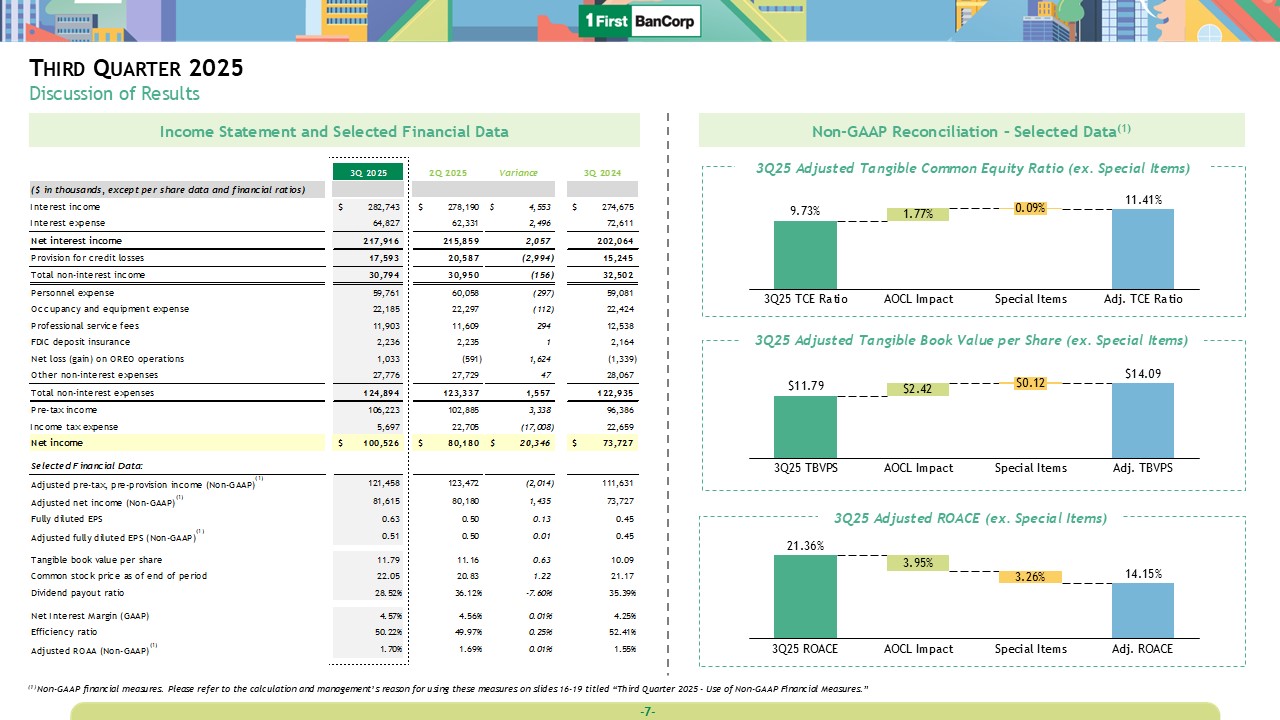

Third Quarter 2025 Discussion of Results 3Q25 Adjusted Tangible Common Equity

Ratio (ex. Special Items) 3Q25 Adjusted Tangible Book Value per Share (ex. Special Items) 3Q25 Adjusted ROACE (ex. Special Items) 3Q25 TCE Ratio AOCL Impact Adj. TCE Ratio Special Items 0.09% 3Q25 TBVPS AOCL Impact Adj.

TBVPS Special Items $0.12 3Q25 ROACE AOCL Impact Special Items Adj. ROACE (1) Non-GAAP financial measures. Please refer to the calculation and management’s reason for using these measures on slides 16-19 titled “Third Quarter 2025 -

Use of Non-GAAP Financial Measures.” Income Statement and Selected Financial Data Non-GAAP Reconciliation – Selected Data(1)

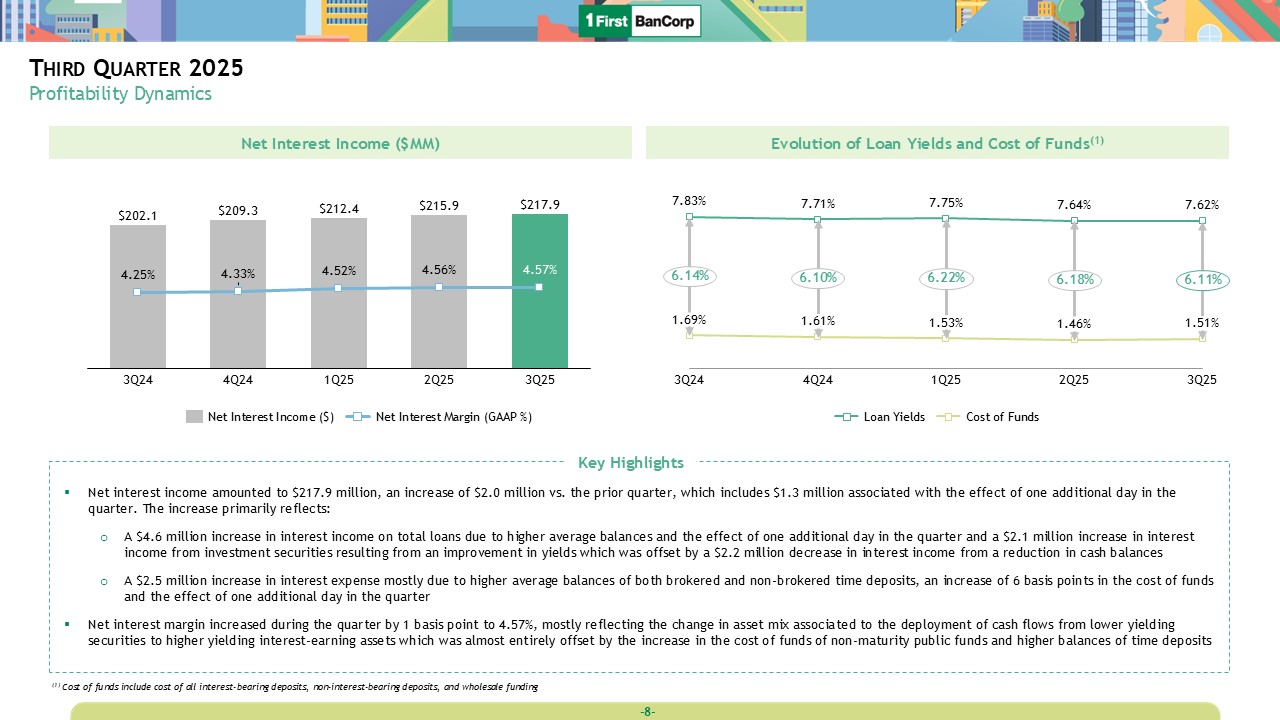

Third Quarter 2025 Profitability Dynamics Net Interest Income

($MM) 4.25% 3Q24 4.33% 4Q24 4.52% 1Q25 4.56% 2Q25 4.57% 3Q25 Net Interest Income ($) Net Interest Margin (GAAP %) Net interest income amounted to $217.9 million, an increase of $2.0 million vs. the prior quarter, which includes

$1.3 million associated with the effect of one additional day in the quarter. The increase primarily reflects: A $4.6 million increase in interest income on total loans due to higher average balances and the effect of one additional day in

the quarter and a $2.1 million increase in interest income from investment securities resulting from an improvement in yields which was offset by a $2.2 million decrease in interest income from a reduction in cash balances A $2.5 million

increase in interest expense mostly due to higher average balances of both brokered and non-brokered time deposits, an increase of 6 basis points in the cost of funds and the effect of one additional day in the quarter Net interest margin

increased during the quarter by 1 basis point to 4.57%, mostly reflecting the change in asset mix associated to the deployment of cash flows from lower yielding securities to higher yielding interest-earning assets which was almost entirely

offset by the increase in the cost of funds of non-maturity public funds and higher balances of time deposits Key Highlights Evolution of Loan Yields and Cost of Funds(1) (1) Cost of funds include cost of all interest-bearing deposits,

non-interest-bearing deposits, and wholesale funding 3Q24 4Q24 1Q25 2Q25 3Q25 6.14% 6.10% 6.22% 6.18% 6.11% Loan Yields Cost of Funds

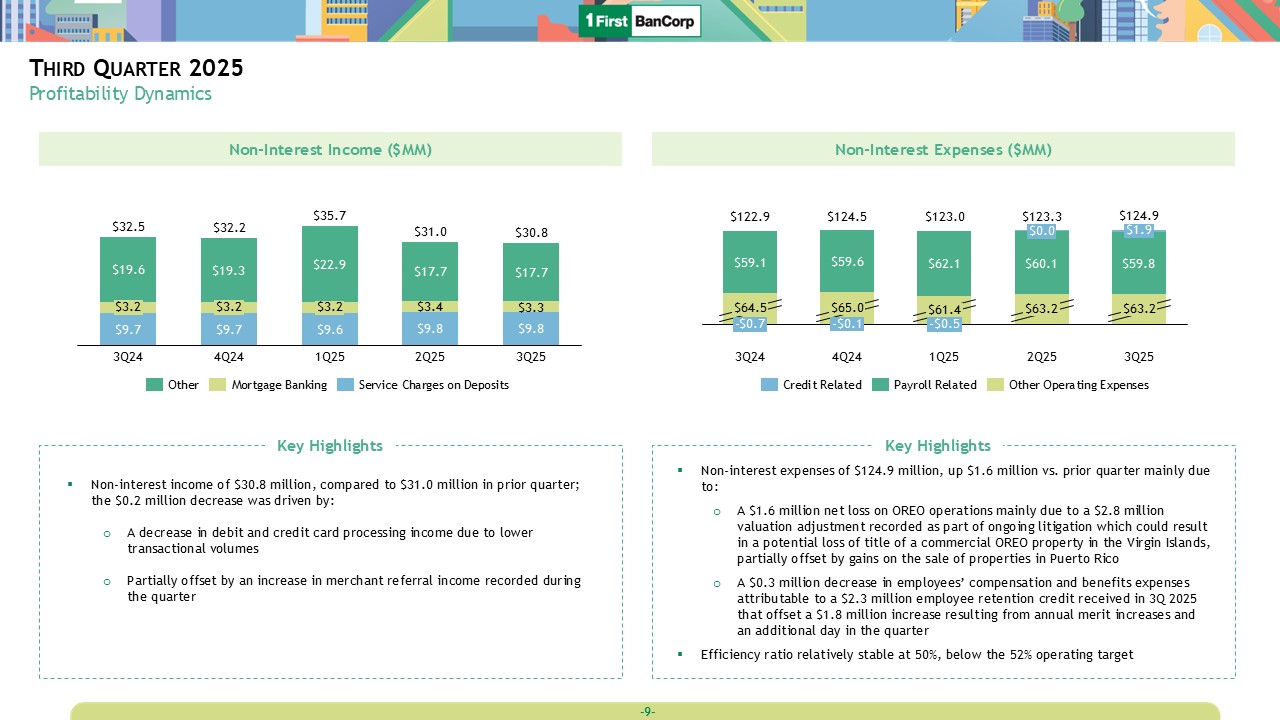

Third Quarter 2025 Profitability Dynamics Non-Interest Expenses

($MM) Non-Interest Income ($MM) 100 -20 0 80 120 140 $64.5 3Q24 -$0.1 $65.0 4Q24 -$0.5 $61.4 -$0.7 $0.0 $63.2 2Q25 $1.9 $63.2 1Q25 $122.9 $124.5 $123.0 $123.3 $124.9 3Q25 Credit Related Payroll Related Other

Operating Expenses $3.2 3Q24 $3.2 4Q24 $3.2 1Q25 2Q25 3Q25 $32.5 $32.2 $35.7 $31.0 $30.8 Other Mortgage Banking Service Charges on Deposits Non-interest expenses of $124.9 million, up $1.6 million vs. prior quarter mainly due

to: A $1.6 million net loss on OREO operations mainly due to a $2.8 million valuation adjustment recorded as part of ongoing litigation which could result in a potential loss of title of a commercial OREO property in the Virgin Islands,

partially offset by gains on the sale of properties in Puerto Rico A $0.3 million decrease in employees’ compensation and benefits expenses attributable to a $2.3 million employee retention credit received in 3Q 2025 that offset a $1.8

million increase resulting from annual merit increases and an additional day in the quarter Efficiency ratio relatively stable at 50%, below the 52% operating target Key Highlights Key Highlights Non-interest income of $30.8 million,

compared to $31.0 million in prior quarter; the $0.2 million decrease was driven by: A decrease in debit and credit card processing income due to lower transactional volumes Partially offset by an increase in merchant referral income

recorded during the quarter

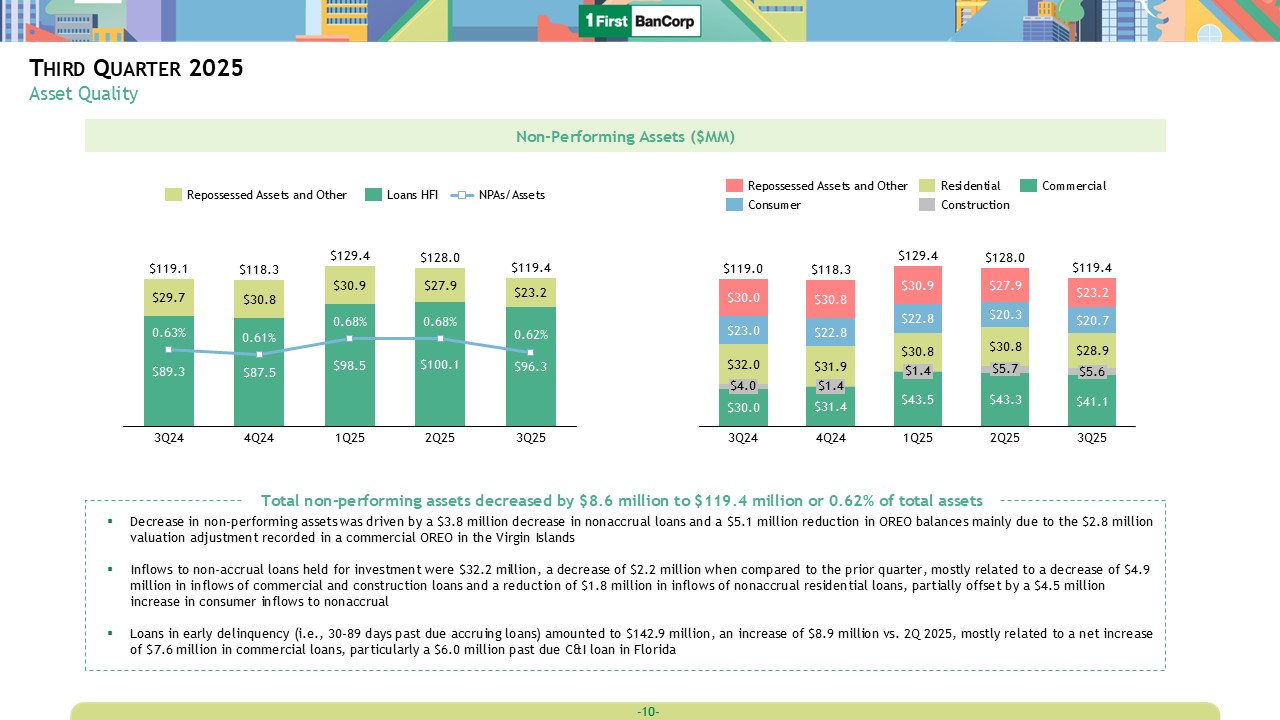

Third Quarter 2025 Asset Quality Non-Performing Assets ($MM) Decrease in

non-performing assets was driven by a $3.8 million decrease in nonaccrual loans and a $5.1 million reduction in OREO balances mainly due to the $2.8 million valuation adjustment recorded in a commercial OREO in the Virgin Islands Inflows to

non-accrual loans held for investment were $32.2 million, a decrease of $2.2 million when compared to the prior quarter, mostly related to a decrease of $4.9 million in inflows of commercial and construction loans and a reduction of $1.8

million in inflows of nonaccrual residential loans, partially offset by a $4.5 million increase in consumer inflows to nonaccrual Loans in early delinquency (i.e., 30-89 days past due accruing loans) amounted to $142.9 million, an increase

of $8.9 million vs. 2Q 2025, mostly related to a net increase of $7.6 million in commercial loans, particularly a $6.0 million past due C&I loan in Florida Total non-performing assets decreased by $8.6 million to $119.4 million or 0.62%

of total assets 0.63% 3Q24 0.61% 4Q24 0.68% 1Q25 0.68% 2Q25 $119.1 $118.3 $129.4 $128.0 3Q25 $119.4 0.62% Repossessed Assets and Other Loans

HFI NPAs/Assets $4.0 3Q24 $1.4 4Q24 $1.4 1Q25 $5.7 2Q25 $119.0 $118.3 $129.4 $128.0 3Q25 $119.4 $5.6 Repossessed Assets and Other Consumer Residential Construction Commercial

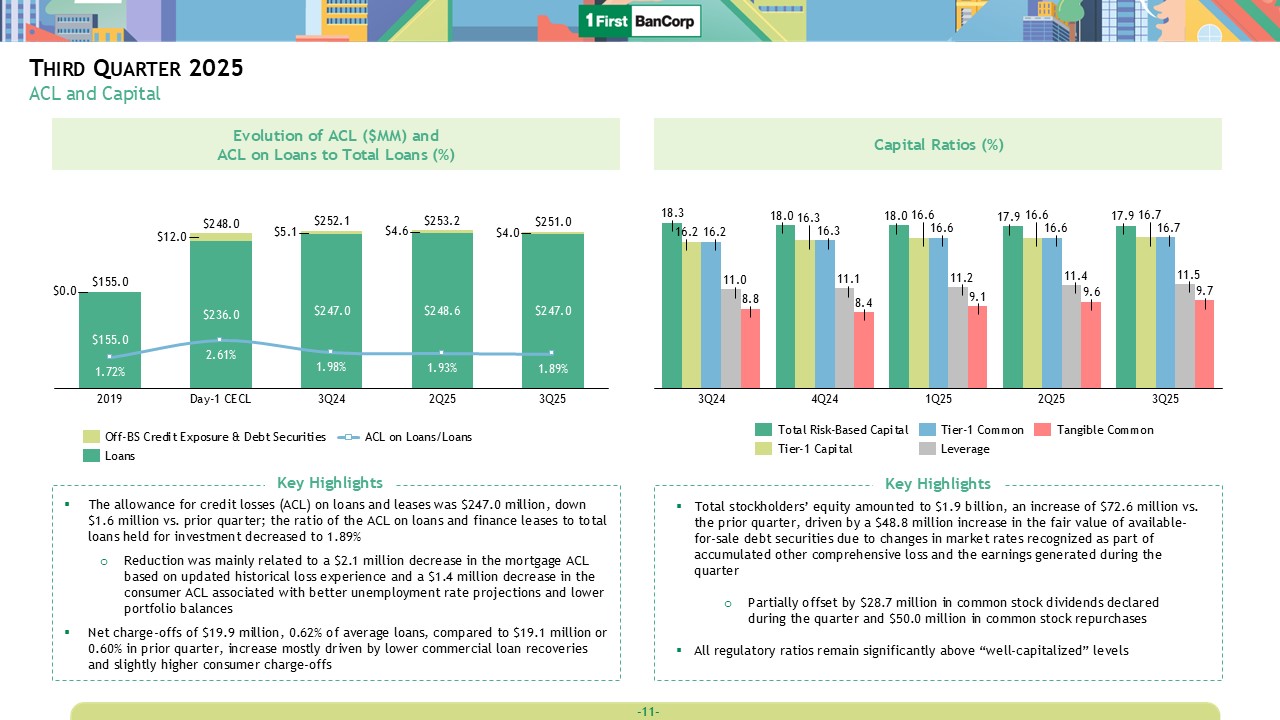

Third Quarter 2025 ACL and Capital Total stockholders’ equity amounted to $1.9

billion, an increase of $72.6 million vs. the prior quarter, driven by a $48.8 million increase in the fair value of available-for-sale debt securities due to changes in market rates recognized as part of accumulated other comprehensive loss

and the earnings generated during the quarter Partially offset by $28.7 million in common stock dividends declared during the quarter and $50.0 million in common stock repurchases All regulatory ratios remain significantly above

“well-capitalized” levels Evolution of ACL ($MM) and ACL on Loans to Total Loans (%) Capital Ratios (%) The allowance for credit losses (ACL) on loans and leases was $247.0 million, down $1.6 million vs. prior quarter; the ratio of the

ACL on loans and finance leases to total loans held for investment decreased to 1.89% Reduction was mainly related to a $2.1 million decrease in the mortgage ACL based on updated historical loss experience and a $1.4 million decrease in the

consumer ACL associated with better unemployment rate projections and lower portfolio balances Net charge-offs of $19.9 million, 0.62% of average loans, compared to $19.1 million or 0.60% in prior quarter, increase mostly driven by lower

commercial loan recoveries and slightly higher consumer charge-offs Key Highlights Key Highlights $0.0 1.72% 2019 2.61% Day-1 CECL 1.98% 3Q24 1.93% 2Q25 1.89% 3Q25 $155.0 $248.0 $252.1 $253.2 $251.0 Off-BS Credit Exposure

& Debt Securities Loans ACL on Loans/Loans 16.2 3Q24 4Q24 1Q25 2Q25 3Q25 Total Risk-Based Capital Tier-1 Capital Tier-1 Common Leverage Tangible Common

3Q 2025 Financial Results Appendix and Non-GAAP Financial Measures

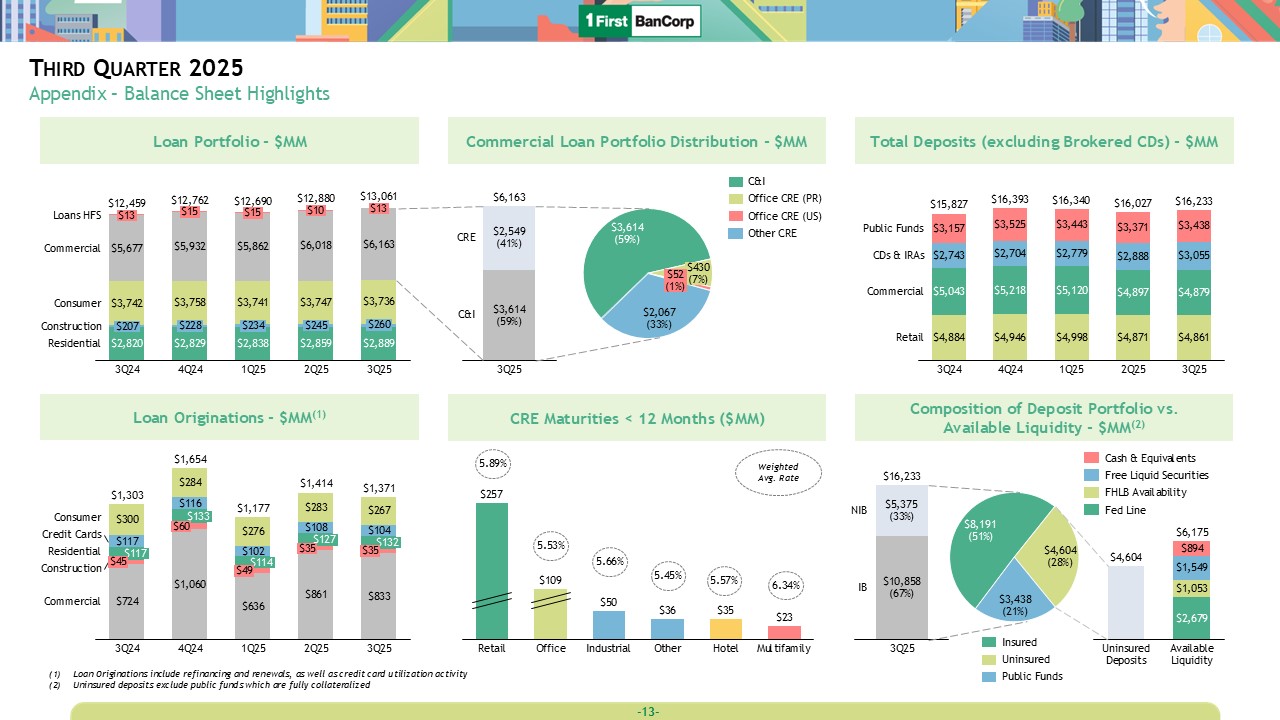

Third Quarter 2025 Appendix – Balance Sheet Highlights Loan Portfolio -

$MM Loan Originations - $MM(1) Total Deposits (excluding Brokered CDs) - $MM Composition of Deposit Portfolio vs. Available Liquidity - $MM(2) $13 $207 3Q24 $15 $228 4Q24 $15 $234 1Q25 $10 $245 2Q25 $13 $260 3Q25 Loans

HFS Commercial Consumer Construction Residential $12,459 $12,762 $12,690 $12,880 $13,061 $117 $45 3Q24 $133 $60 4Q24 $114 $49 1Q25 $127 $35 2Q25 $132 $35 3Q25 Consumer Credit

Cards Residential Construction Commercial $1,303 $1,654 $1,177 $1,414 $1,371 3Q24 4Q24 1Q25 2Q25 3Q25 Public Funds CDs & IRAs Commercial Retail $15,827 $16,393 $16,340 $16,027 $16,233 Loan Originations include

refinancing and renewals, as well as credit card utilization activity Uninsured deposits exclude public funds which are fully collateralized

$5,375(33%) $10,858(67%) 3Q25 NIB IB $16,233 $8,191(51%) $4,604(28%) $3,438(21%) Insured Uninsured Public Funds Uninsured Deposits Available Liquidity $6,175 Cash & Equivalents Free Liquid Securities FHLB

Availability Fed Line Commercial Loan Portfolio Distribution - $MM $2,549(41%) $3,614(59%) 3Q25 CRE C&I $6,163 $3,614(59%) $430(7%) $52(1%) $2,067(33%) C&I Office CRE (PR) Office CRE (US) Other CRE CRE Maturities <

12 Months ($MM) Retail Office Industrial Hotel Multifamily Other $257 $109 5.89% 5.53% 5.66% 5.45% 5.57% 6.34% Weighted Avg. Rate

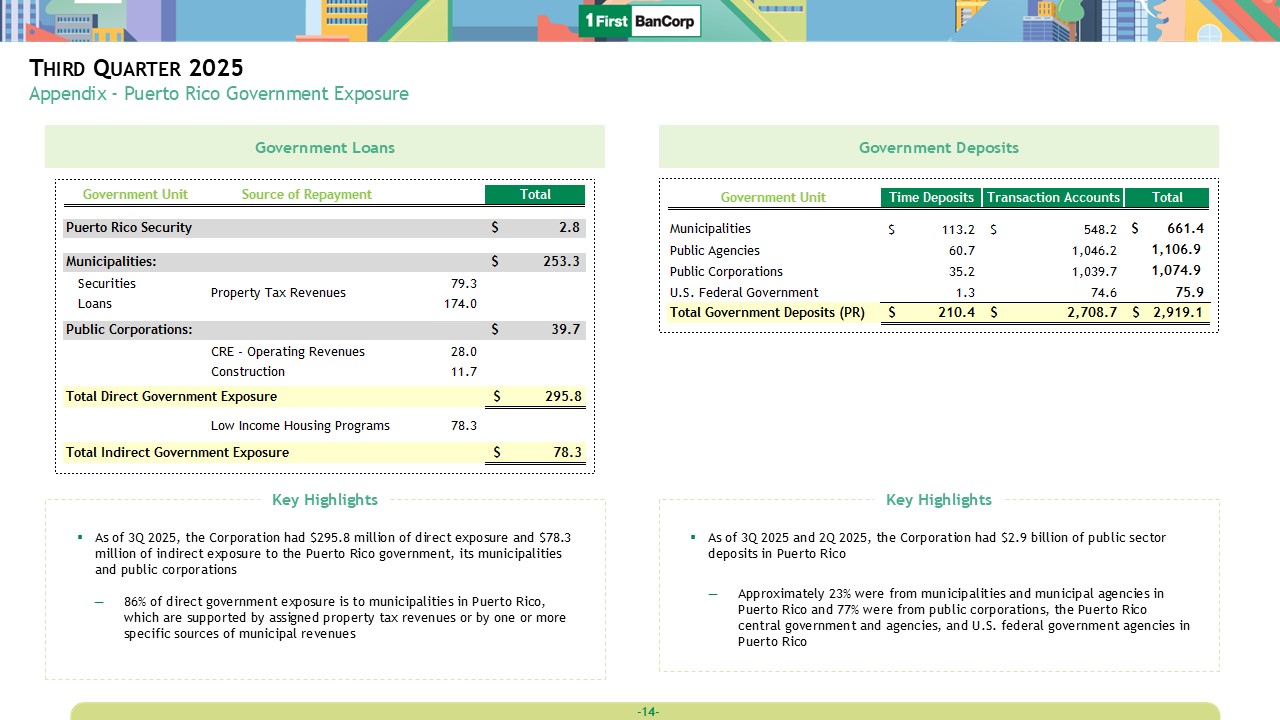

Third Quarter 2025 Appendix - Puerto Rico Government Exposure Government

Loans Key Highlights Government Deposits Key Highlights As of 3Q 2025, the Corporation had $295.8 million of direct exposure and $78.3 million of indirect exposure to the Puerto Rico government, its municipalities and public corporations

86% of direct government exposure is to municipalities in Puerto Rico, which are supported by assigned property tax revenues or by one or more specific sources of municipal revenues As of 3Q 2025 and 2Q 2025, the Corporation had $2.9

billion of public sector deposits in Puerto Rico Approximately 23% were from municipalities and municipal agencies in Puerto Rico and 77% were from public corporations, the Puerto Rico central government and agencies, and U.S. federal

government agencies in Puerto Rico

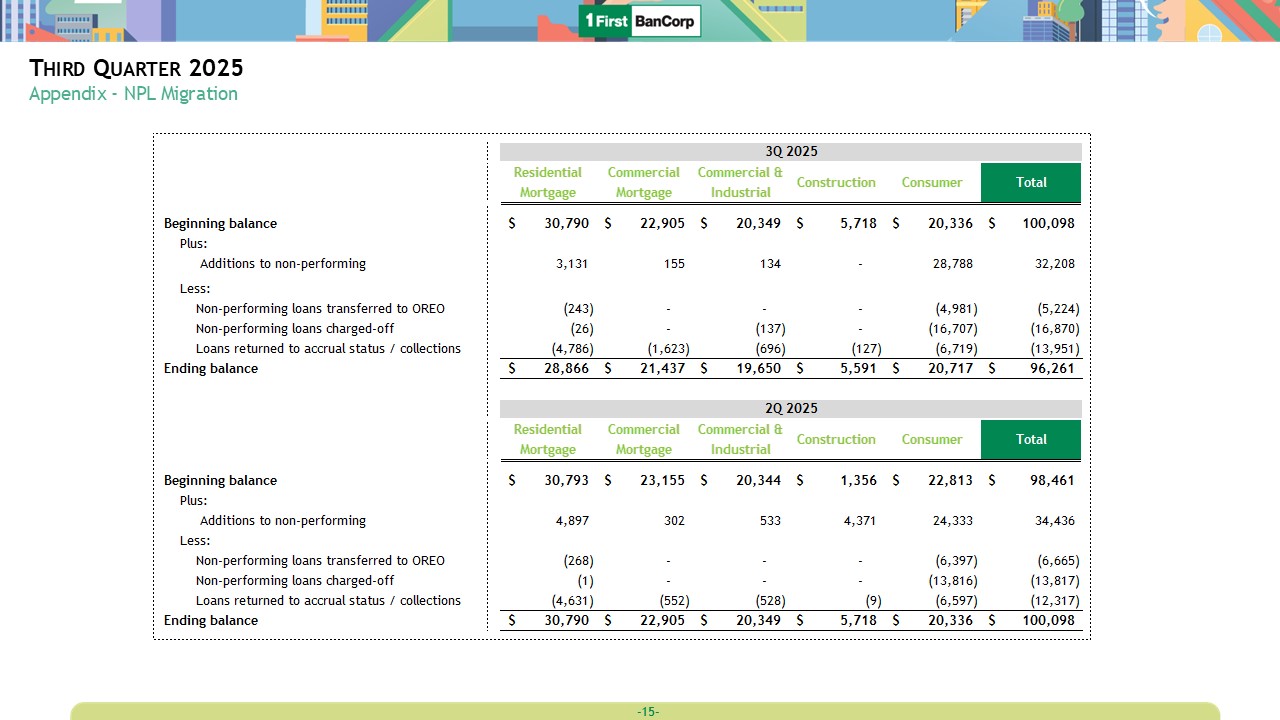

Third Quarter 2025 Appendix - NPL Migration

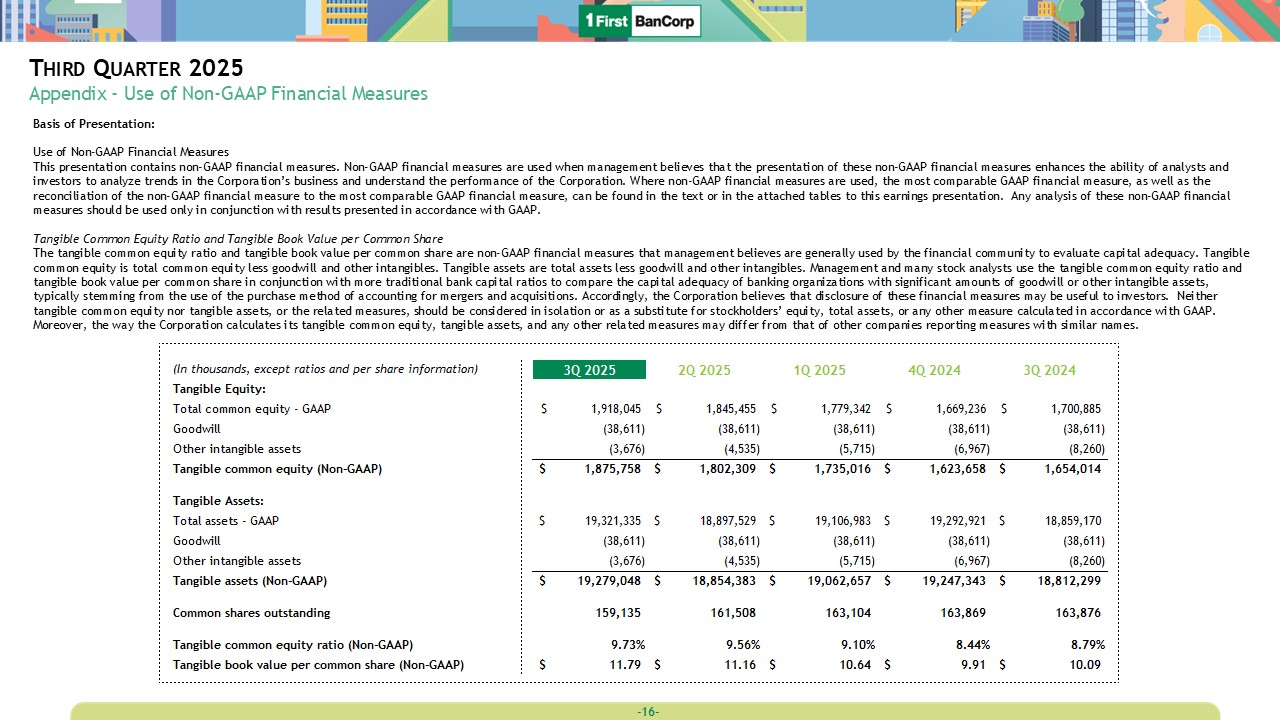

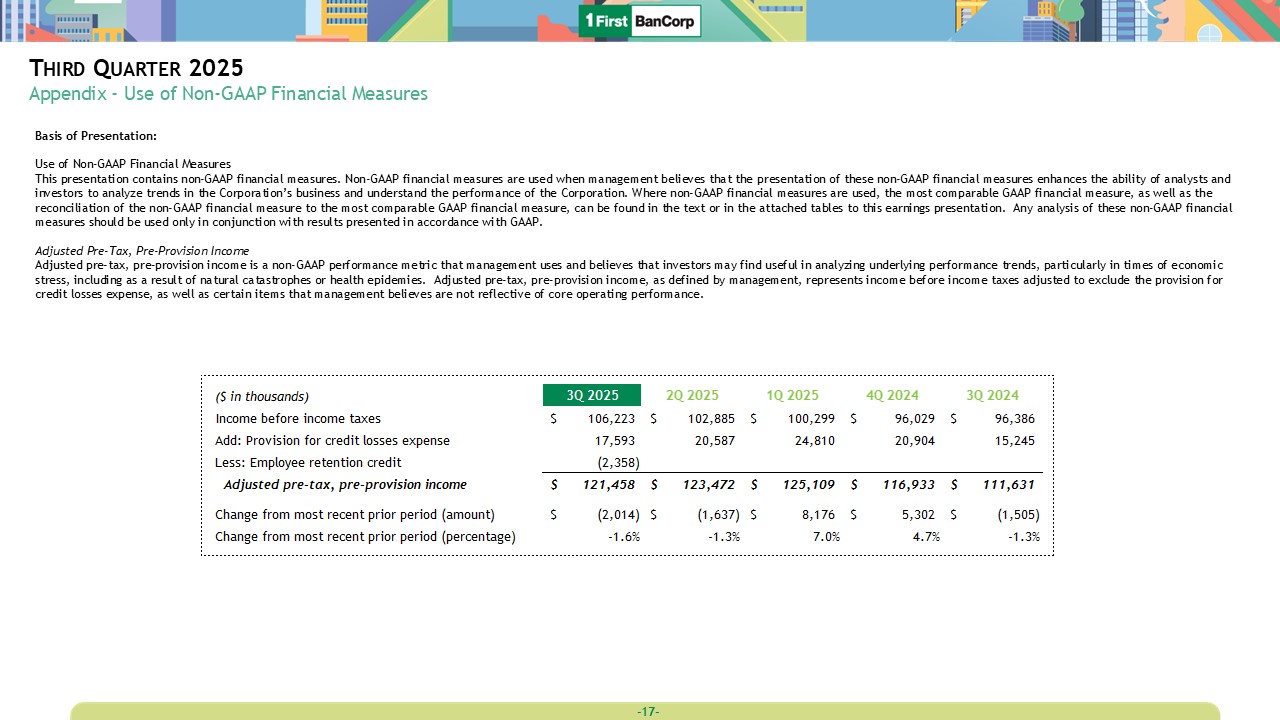

Third Quarter 2025 Appendix - Use of Non-GAAP Financial Measures Basis of

Presentation: Use of Non-GAAP Financial Measures This presentation contains non-GAAP financial measures. Non-GAAP financial measures are used when management believes that the presentation of these non-GAAP financial measures enhances the

ability of analysts and investors to analyze trends in the Corporation’s business and understand the performance of the Corporation. Where non-GAAP financial measures are used, the most comparable GAAP financial measure, as well as the

reconciliation of the non-GAAP financial measure to the most comparable GAAP financial measure, can be found in the text or in the attached tables to this earnings presentation. Any analysis of these non-GAAP financial measures should be used

only in conjunction with results presented in accordance with GAAP. Tangible Common Equity Ratio and Tangible Book Value per Common Share The tangible common equity ratio and tangible book value per common share are non-GAAP financial

measures that management believes are generally used by the financial community to evaluate capital adequacy. Tangible common equity is total common equity less goodwill and other intangibles. Tangible assets are total assets less goodwill

and other intangibles. Management and many stock analysts use the tangible common equity ratio and tangible book value per common share in conjunction with more traditional bank capital ratios to compare the capital adequacy of banking

organizations with significant amounts of goodwill or other intangible assets, typically stemming from the use of the purchase method of accounting for mergers and acquisitions. Accordingly, the Corporation believes that disclosure of these

financial measures may be useful to investors. Neither tangible common equity nor tangible assets, or the related measures, should be considered in isolation or as a substitute for stockholders’ equity, total assets, or any other measure

calculated in accordance with GAAP. Moreover, the way the Corporation calculates its tangible common equity, tangible assets, and any other related measures may differ from that of other companies reporting measures with similar names.

Third Quarter 2025 Appendix - Use of Non-GAAP Financial Measures Basis of

Presentation: Use of Non-GAAP Financial Measures This presentation contains non-GAAP financial measures. Non-GAAP financial measures are used when management believes that the presentation of these non-GAAP financial measures enhances the

ability of analysts and investors to analyze trends in the Corporation’s business and understand the performance of the Corporation. Where non-GAAP financial measures are used, the most comparable GAAP financial measure, as well as the

reconciliation of the non-GAAP financial measure to the most comparable GAAP financial measure, can be found in the text or in the attached tables to this earnings presentation. Any analysis of these non-GAAP financial measures should be used

only in conjunction with results presented in accordance with GAAP. Adjusted Pre-Tax, Pre-Provision Income Adjusted pre-tax, pre-provision income is a non-GAAP performance metric that management uses and believes that investors may find

useful in analyzing underlying performance trends, particularly in times of economic stress, including as a result of natural catastrophes or health epidemies. Adjusted pre-tax, pre-provision income, as defined by management, represents

income before income taxes adjusted to exclude the provision for credit losses expense, as well as certain items that management believes are not reflective of core operating performance.

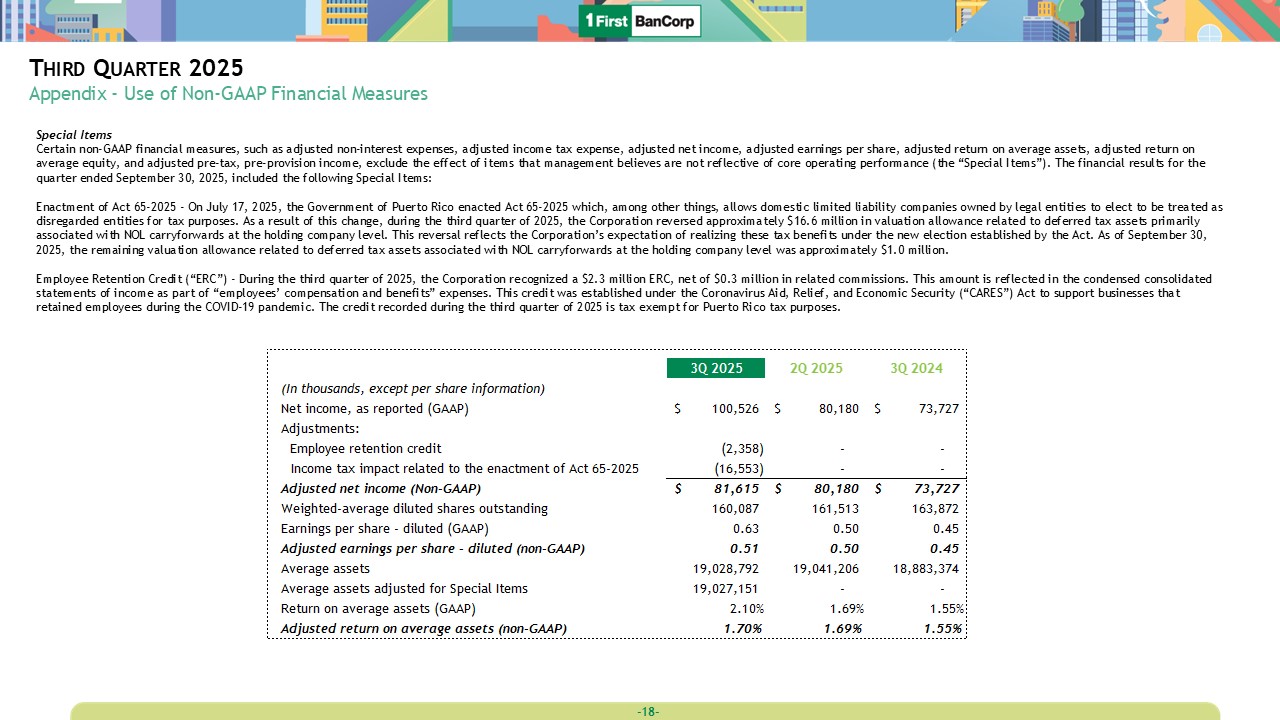

Third Quarter 2025 Appendix - Use of Non-GAAP Financial Measures Special

Items Certain non-GAAP financial measures, such as adjusted non-interest expenses, adjusted income tax expense, adjusted net income, adjusted earnings per share, adjusted return on average assets, adjusted return on average equity, and

adjusted pre-tax, pre-provision income, exclude the effect of items that management believes are not reflective of core operating performance (the “Special Items”). The financial results for the quarter ended September 30, 2025, included the

following Special Items: Enactment of Act 65-2025 - On July 17, 2025, the Government of Puerto Rico enacted Act 65-2025 which, among other things, allows domestic limited liability companies owned by legal entities to elect to be treated as

disregarded entities for tax purposes. As a result of this change, during the third quarter of 2025, the Corporation reversed approximately $16.6 million in valuation allowance related to deferred tax assets primarily associated with NOL

carryforwards at the holding company level. This reversal reflects the Corporation’s expectation of realizing these tax benefits under the new election established by the Act. As of September 30, 2025, the remaining valuation allowance

related to deferred tax assets associated with NOL carryforwards at the holding company level was approximately $1.0 million. Employee Retention Credit (“ERC”) - During the third quarter of 2025, the Corporation recognized a $2.3 million

ERC, net of $0.3 million in related commissions. This amount is reflected in the condensed consolidated statements of income as part of “employees’ compensation and benefits” expenses. This credit was established under the Coronavirus Aid,

Relief, and Economic Security (“CARES”) Act to support businesses that retained employees during the COVID-19 pandemic. The credit recorded during the third quarter of 2025 is tax exempt for Puerto Rico tax purposes.

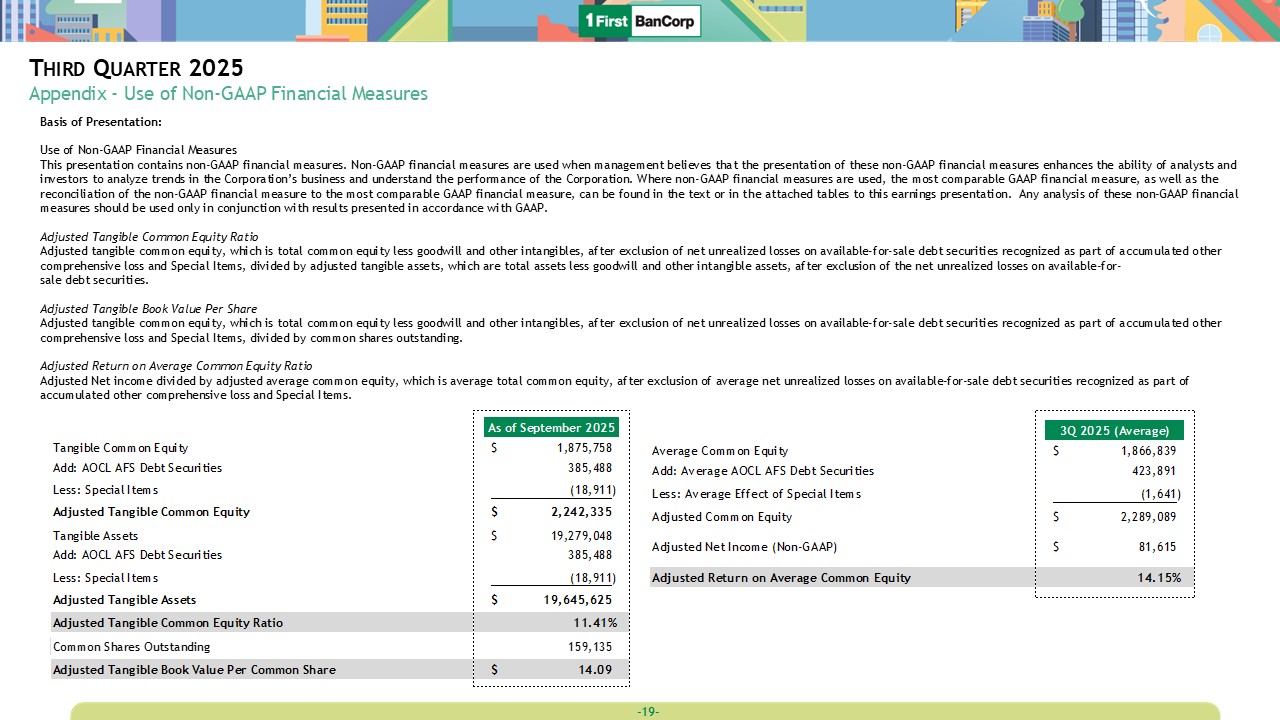

Third Quarter 2025 Appendix - Use of Non-GAAP Financial Measures Basis of

Presentation: Use of Non-GAAP Financial Measures This presentation contains non-GAAP financial measures. Non-GAAP financial measures are used when management believes that the presentation of these non-GAAP financial measures enhances the

ability of analysts and investors to analyze trends in the Corporation’s business and understand the performance of the Corporation. Where non-GAAP financial measures are used, the most comparable GAAP financial measure, as well as the

reconciliation of the non-GAAP financial measure to the most comparable GAAP financial measure, can be found in the text or in the attached tables to this earnings presentation. Any analysis of these non-GAAP financial measures should be used

only in conjunction with results presented in accordance with GAAP. Adjusted Tangible Common Equity Ratio Adjusted tangible common equity, which is total common equity less goodwill and other intangibles, after exclusion of net unrealized

losses on available-for-sale debt securities recognized as part of accumulated other comprehensive loss and Special Items, divided by adjusted tangible assets, which are total assets less goodwill and other intangible assets, after exclusion

of the net unrealized losses on available-for- sale debt securities. Adjusted Tangible Book Value Per Share Adjusted tangible common equity, which is total common equity less goodwill and other intangibles, after exclusion of net

unrealized losses on available-for-sale debt securities recognized as part of accumulated other comprehensive loss and Special Items, divided by common shares outstanding. Adjusted Return on Average Common Equity Ratio Adjusted Net income

divided by adjusted average common equity, which is average total common equity, after exclusion of average net unrealized losses on available-for-sale debt securities recognized as part of accumulated other comprehensive loss and Special

Items.