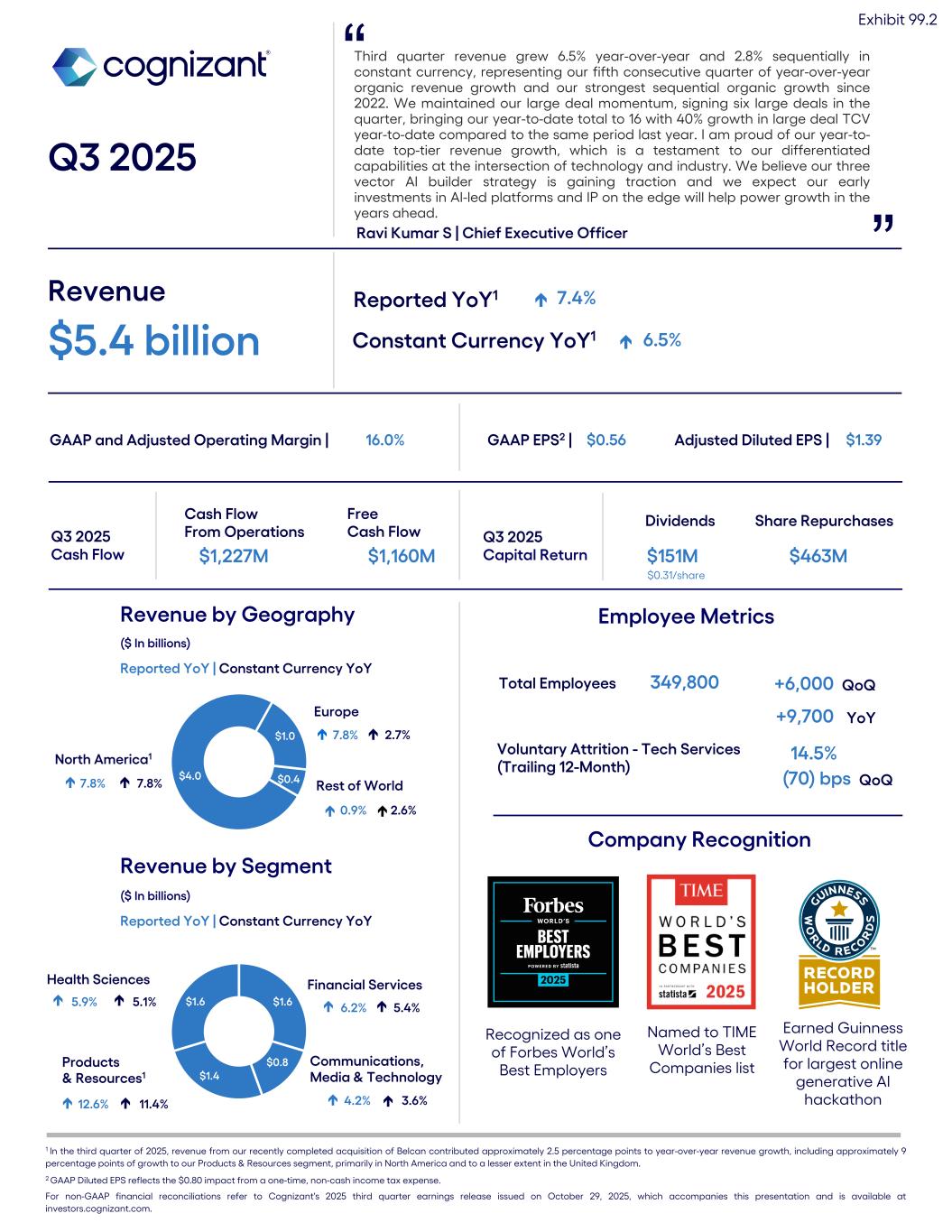

Third quarter revenue grew 6.5% year-over-year and 2.8% sequentially in constant currency, representing our fifth consecutive quarter of year-over-year organic revenue growth and our strongest sequential organic growth since 2022. We maintained our large deal momentum, signing six large deals in the quarter, bringing our year-to-date total to 16 with 40% growth in large deal TCV year-to-date compared to the same period last year. I am proud of our year-to- date top-tier revenue growth, which is a testament to our differentiated capabilities at the intersection of technology and industry. We believe our three vector AI builder strategy is gaining traction and we expect our early investments in AI-led platforms and IP on the edge will help power growth in the years ahead. Q3 2025 Ravi Kumar S | Chief Executive Officer ” Revenue $5.4 billion Reported YoY1 é 7.4% Constant Currency YoY1 é 6.5% GAAP and Adjusted Operating Margin | 16.0% GAAP Diluted EPS | $0.56 $4.0 $1.0 $0.4 Rest of World 0.9% Revenue by Geography ($ In billions) Reported YoY | Constant Currency YoY Q3 2025 Cash Flow Cash Flow From Operations $1,227M Free Cash Flow $1,160M Q3 2025 Capital Return Dividends $151M Share Repurchases $463M $0.31/share Revenue by Segment ($ In billions) Reported YoY | Constant Currency YoY Europe North America1 2.6% $1.6 $0.8 $1.4 $1.6 Products & Resources1 Health Sciences Financial Services Communications, Media & Technology 7.8% 2.7% 7.8% 7.8% 4.2% 3.6%12.6% 11.4% 6.2% 5.4%5.9% 5.1% Total Employees 349,800 ” +6,000 QoQ +9,700 YoY Voluntary Attrition - Tech Services (Trailing 12-Month) 14.5% é é é é é é é é é é é Adjusted Diluted EPS | $1.39 Employee Metrics Adjusted Operating Margin | 16.0% é é é 1 In the third quarter of 2025, revenue from our recently completed acquisition of Belcan contributed approximately 2.5 percentage points to year-over-year revenue growth, including approximately 9 percentage points of growth to our Products & Resources segment, primarily in North America and to a lesser extent in the United Kingdom. 2 GAAP Diluted EPS reflects the $0.80 impact from a one-time, non-cash income tax expense. For non-GAAP financial reconciliations refer to Cognizant's 2025 third quarter earnings release issued on October 29, 2025, which accompanies this presentation and is available at investors.cognizant.com. é Company Recognition Recognized as one of Forbes World’s Best Employers .2 (70) bps QoQ Earned Guinness World Record title for largest online generative AI hackathon Named to TIME World’s Best Companies list GAAP EPS2 | $0.56 Adjusted Diluted EPS | $1.39