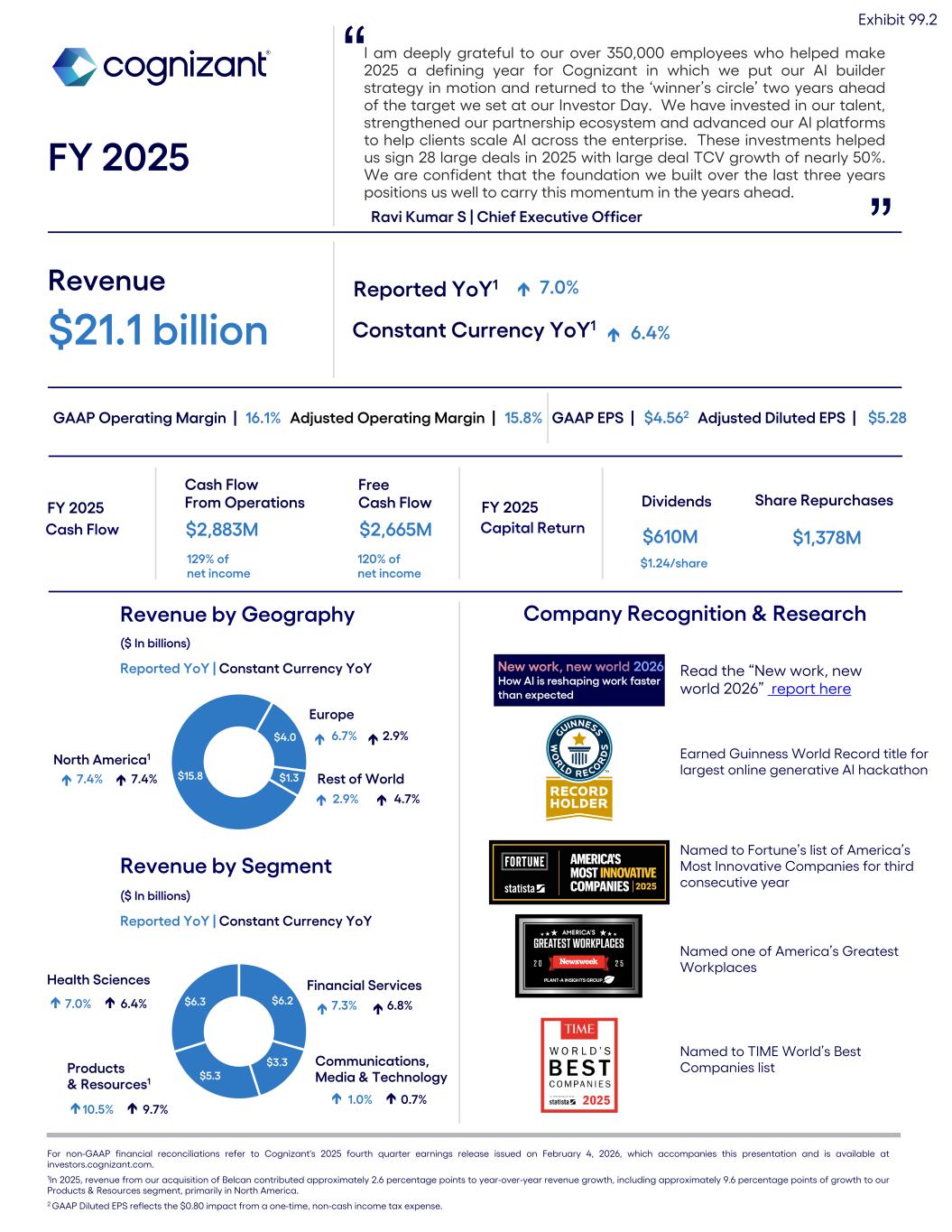

I am deeply grateful to our over 350,000 employees who helped make 2025 a defining year for Cognizant in which we put our AI builder strategy in motion and returned to the ‘winner’s circle’ two years ahead of the target we set at our Investor Day. We have invested in our talent, strengthened our partnership ecosystem and advanced our AI platforms to help clients scale AI across the enterprise. These investments helped us sign 28 large deals in 2025 with large deal TCV growth of nearly 50%. We are confident that the foundation we built over the last three years positions us well to carry this momentum in the years ahead. FY 2025 Ravi Kumar S | Chief Executive Officer ” Revenue $21.1 billion Reported YoY1 é 7.0% Constant Currency YoY1 é 6.4% GAAP Operating Margin | 16.1% GAAP EPS | $4.562 $15.8 $4.0 $1.3 Rest of World 2.9% Revenue by Geography ($ In billions) Reported YoY | Constant Currency YoY Cash Flow Cash Flow From Operations $2,883M Free Cash Flow $2,665M Capital Return Dividends $610M Share Repurchases $1,378M $1.24/share Revenue by Segment ($ In billions) Reported YoY | Constant Currency YoY Europe North America1 4.7% $6.2 $3.3 $5.3 $6.3 Products & Resources1 Health Sciences Financial Services Communications, Media & Technology 6.7% 2.9% 7.4% 7.4% 1.0% 0.7% 10.5% 9.7% 7.3% 6.8% 7.0% 6.4% ” For non-GAAP financial reconciliations refer to Cognizant's 2025 fourth quarter earnings release issued on February 4, 2026, which accompanies this presentation and is available at investors.cognizant.com. 1In 2025, revenue from our acquisition of Belcan contributed approximately 2.6 percentage points to year-over-year revenue growth, including approximately 9.6 percentage points of growth to our Products & Resources segment, primarily in North America. 2 GAAP Diluted EPS reflects the $0.80 impact from a one-time, non-cash income tax expense. é é é é é é é é é é é éé é Adjusted Diluted EPS | $5.28 Company Recognition & Research Adjusted Operating Margin | 15.8% .2 FY 2025 FY 2025 Read the “New work, new world 2026” report here Earned Guinness World Record title for largest online generative AI hackathon Named to Fortune’s list of America’s Most Innovative Companies for third consecutive year Named to TIME World’s Best Companies list Named one of America’s Greatest Workplaces 129% of net income 120% of net income

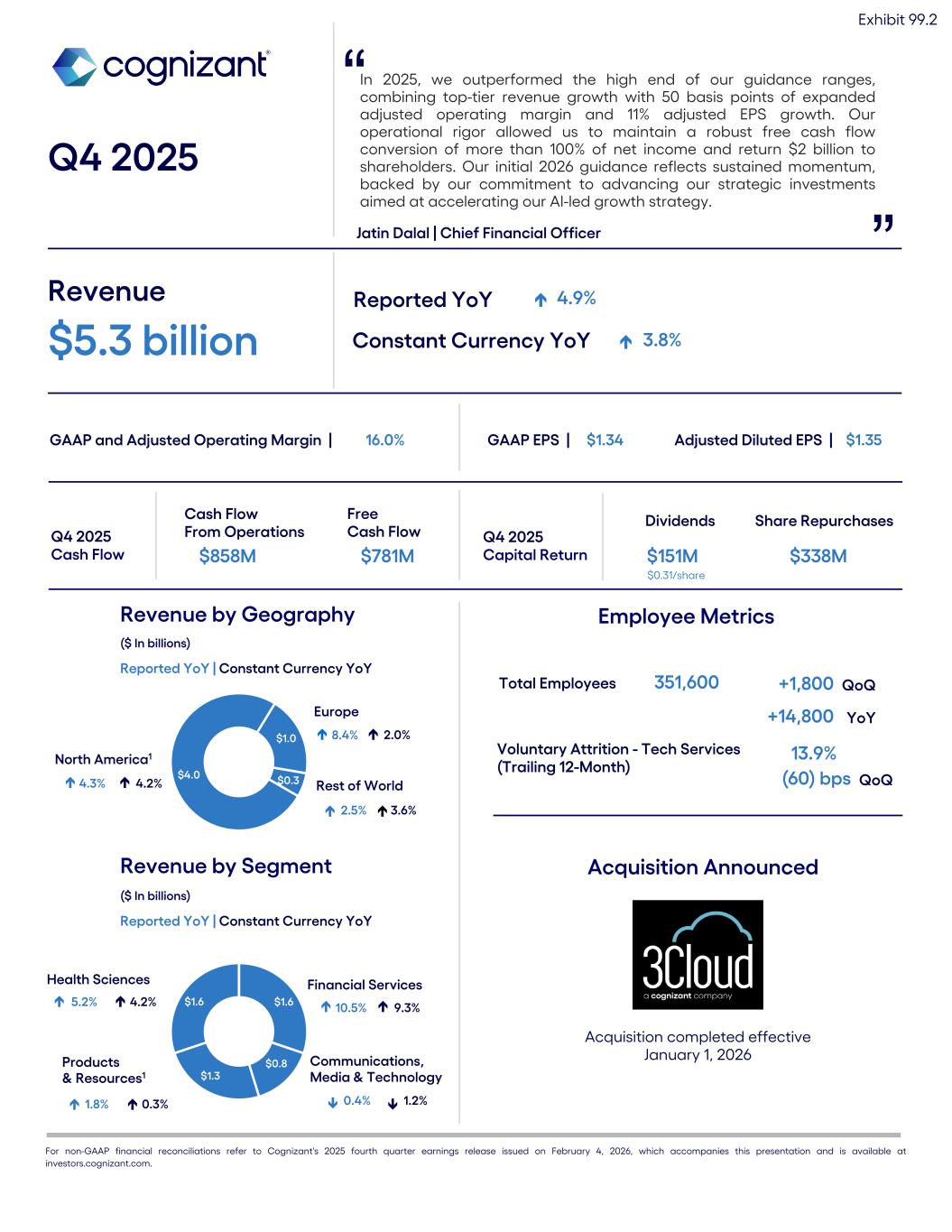

GAAP and Adjusted Operating Margin | 16.0% GAAP EPS | $1.34 Adjusted Diluted EPS | $1.35 In 2025, we outperformed the high end of our guidance ranges, combining top-tier revenue growth with 50 basis points of expanded adjusted operating margin and 11% adjusted EPS growth. Our operational rigor allowed us to maintain a robust free cash flow conversion of more than 100% of net income and return $2 billion to shareholders. Our initial 2026 guidance reflects sustained momentum, backed by our commitment to advancing our strategic investments aimed at accelerating our AI-led growth strategy. Q4 2025 Jatin Dalal | Chief Financial Officer ” Revenue $5.3 billion Reported YoY é 4.9% Constant Currency YoY é 3.8% GAAP Diluted EPS | $1.34 $4.0 $1.0 $0.3 Rest of World 2.5% Revenue by Geography ($ In billions) Reported YoY | Constant Currency YoY Q4 2025 Cash Flow Cash Flow From Operations $858M Free Cash Flow $781M Q4 2025 Capital Return Dividends $151M Share Repurchases $338M $0.31/share Revenue by Segment ($ In billions) Reported YoY | Constant Currency YoY Europe North America1 3.6% $1.6 $0.8 $1.3 $1.6 Products & Resources1 Health Sciences Financial Services Communications, Media & Technology 8.4% 2.0% 4.3% 4.2% 0.4% 1.2%1.8% 0.3% 10.5% 9.3%5.2% 4.2% Total Employees 351,600 ” +1,800 QoQ +14,800 YoY Voluntary Attrition - Tech Services (Trailing 12-Month) 13.9% é é é é é é é é é é é Adjusted Diluted EPS | $1.35 Employee Metrics Adjusted Operating Margin | 16.0% é é é For non-GAAP financial reconciliations refer to Cognizant's 2025 fourth quarter earnings release issued on February 4, 2026, which accompanies this presentation and is available at investors.cognizant.com. é Acquisition Announced .2 (60) bps QoQ Acquisition completed effective January 1, 2026