.3 Fourth Quarter and Full Year 2025 Financial Results and Highlights © 2026 Cognizant February 4, 2026

© 2026 Cognizant 1 Forward-looking statements This earnings supplement includes statements that may constitute forward-looking statements made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, the accuracy of which is necessarily subject to risks, uncertainties and assumptions as to future events that may not prove to be accurate. These statements include, but are not limited to, express or implied forward-looking statements relating to our strategy, competitive position and opportunities in the marketplace, investment in and growth of our business, the pace and magnitude of change and client needs related to generative AI, the effectiveness of our recruiting and talent efforts and related costs, labor market trends, the anticipated amount of capital to be returned to shareholders and our anticipated financial performance and other statements regarding matters that are not historical facts. These statements are neither promises nor guarantees, but are subject to a variety of risks and uncertainties, many of which are beyond our control, which could cause actual results to differ materially from those contemplated in these forward-looking statements. Existing and prospective investors are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. Factors that could cause actual results to differ materially from those expressed or implied include general economic conditions, the competitive and rapidly changing nature of the markets we compete in, our ability to successfully use AI-based technologies and the impact those technologies may have on the demand and terms for our services, the competitive marketplace for talent and its impact on employee recruitment and retention, legal, reputational and financial risks resulting from cyberattacks, changes in the regulatory environment, including with respect to immigration, trade and taxes and the other factors discussed in our most recent Annual Report on Form 10-K and other filings with the Securities and Exchange Commission. Cognizant undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise, except as may be required under applicable securities law.

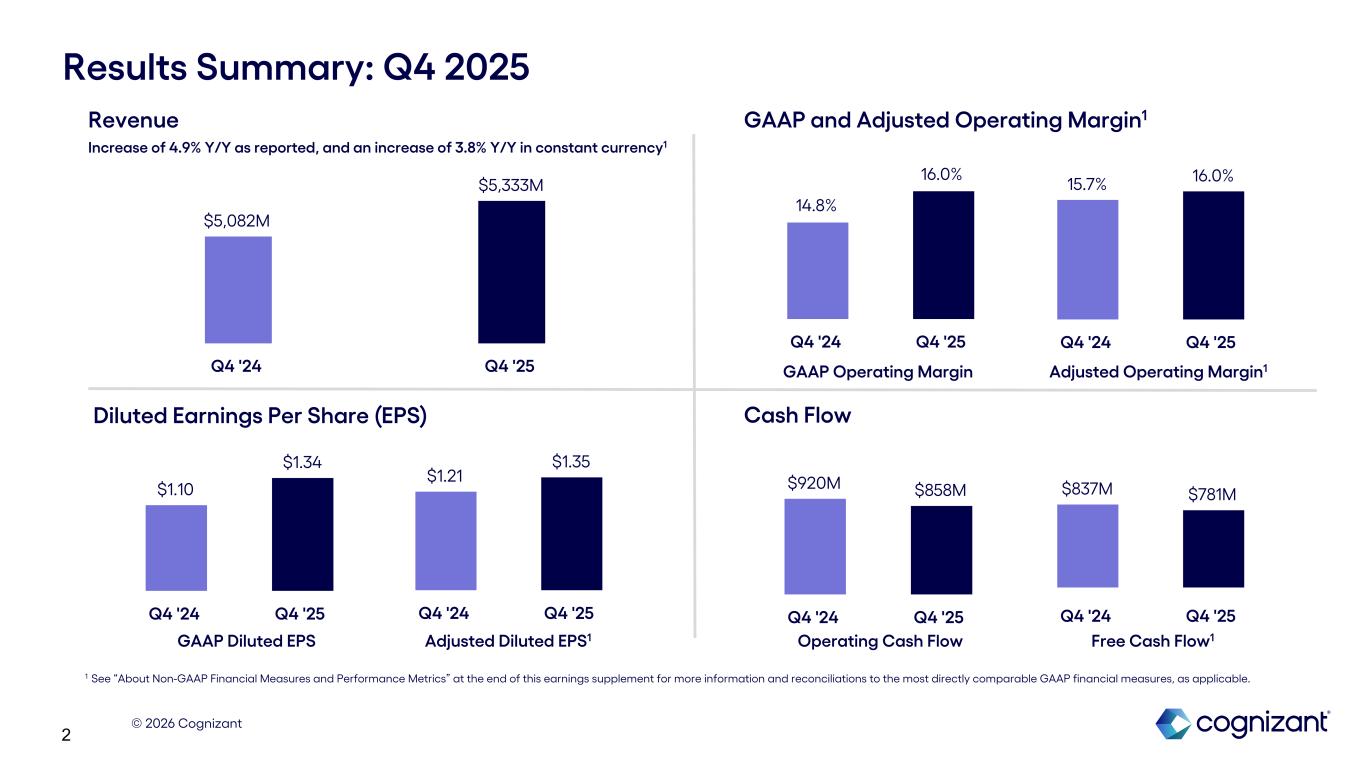

© 2026 Cognizant 2 $920M $858M Q4 '24 Q4 '25 Results Summary: Q4 2025 1 See “About Non-GAAP Financial Measures and Performance Metrics” at the end of this earnings supplement for more information and reconciliations to the most directly comparable GAAP financial measures, as applicable. Revenue Increase of 4.9% Y/Y as reported, and an increase of 3.8% Y/Y in constant currency1 GAAP and Adjusted Operating Margin1 Cash Flow $5,082M $5,333M Q4 '24 Q4 '25 14.8% 16.0% Q4 '24 Q4 '25 15.7% 16.0% Q4 '24 Q4 '25 $837M $781M Q4 '24 Q4 '25 $1.10 $1.34 Q4 '24 Q4 '25 $1.21 $1.35 Q4 '24 Q4 '25 Adjusted Operating Margin1 GAAP Diluted EPS Adjusted Diluted EPS1 Operating Cash Flow Free Cash Flow1 GAAP Operating Margin Adjusted Operating Margin1 Diluted Earnings Per Share (EPS)

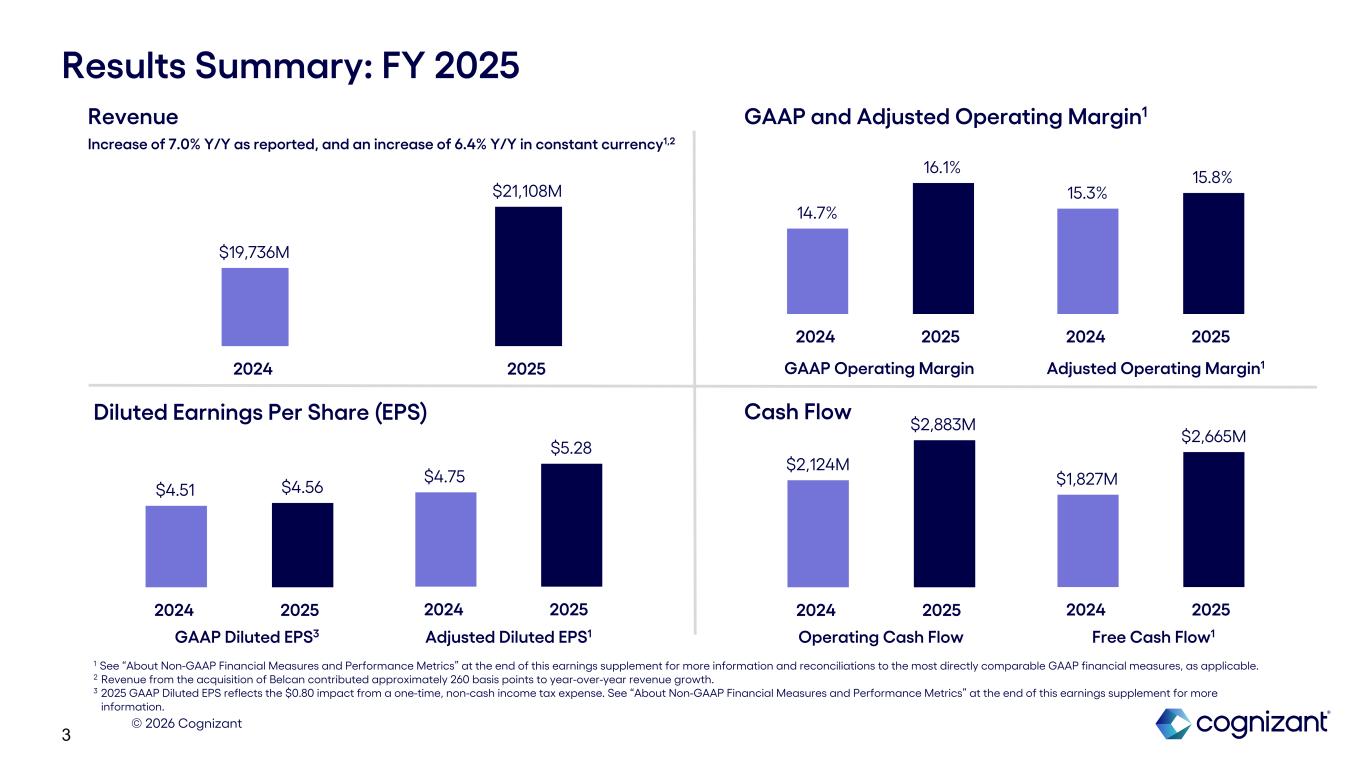

© 2026 Cognizant 3 Results Summary: FY 2025 Revenue Increase of 7.0% Y/Y as reported, and an increase of 6.4% Y/Y in constant currency1,2 GAAP and Adjusted Operating Margin1 $19,736M $21,108M 2024 2025 14.7% 16.1% 2024 2025 15.3% 15.8% 2024 2025 $2,124M $2,883M 2024 2025 $1,827M $2,665M 2024 2025 $4.51 $4.56 2024 2025 $4.75 $5.28 2024 2025 Adjusted Operating Margin1 GAAP Diluted EPS3 Adjusted Diluted EPS1 Operating Cash Flow Free Cash Flow1 GAAP Operating Margin Adjusted Operating Margin1 1 See “About Non-GAAP Financial Measures and Performance Metrics” at the end of this earnings supplement for more information and reconciliations to the most directly comparable GAAP financial measures, as applicable. 2 Revenue from the acquisition of Belcan contributed approximately 260 basis points to year-over-year revenue growth. 3 2025 GAAP Diluted EPS reflects the $0.80 impact from a one-time, non-cash income tax expense. See “About Non-GAAP Financial Measures and Performance Metrics” at the end of this earnings supplement for more information. Diluted Earnings Per Share (EPS) Cash Flow

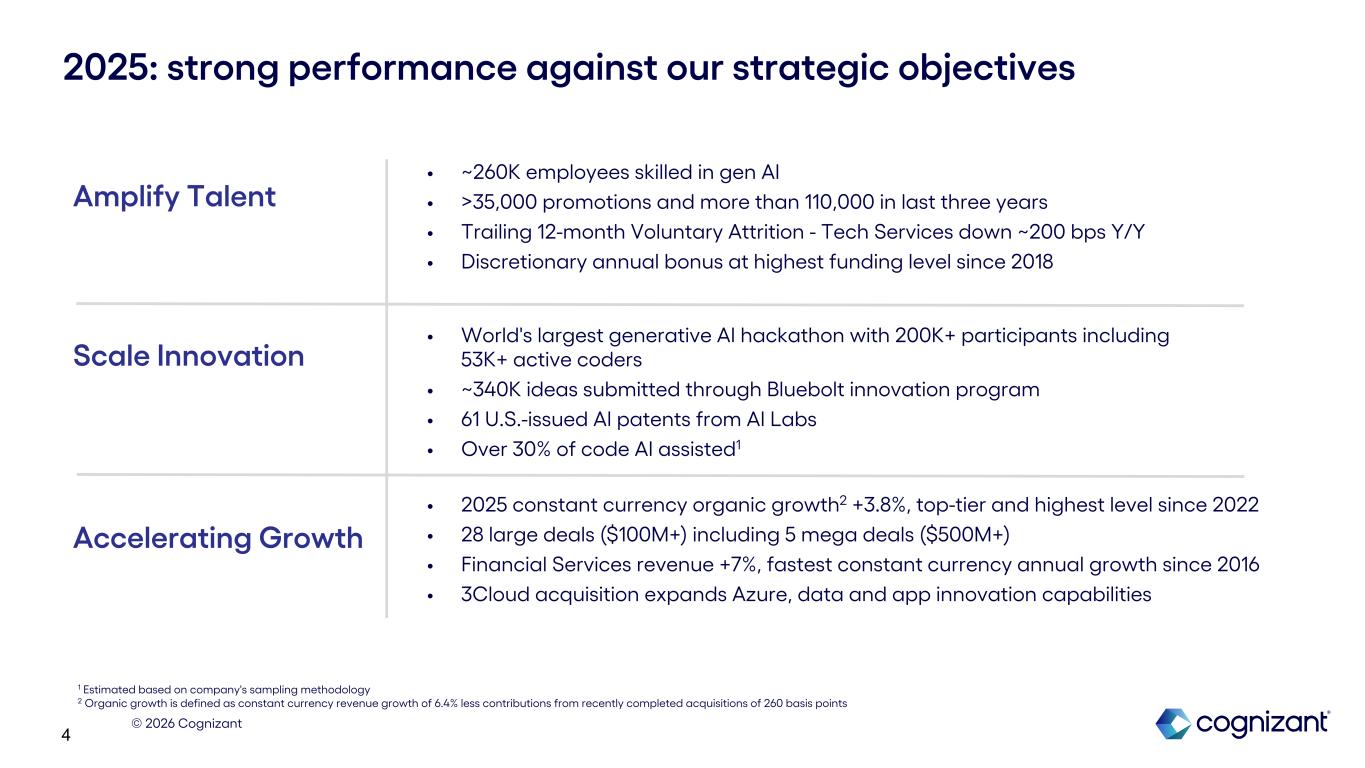

© 2026 Cognizant 4 • World's largest generative AI hackathon with 200K+ participants including 53K+ active coders • ~340K ideas submitted through Bluebolt innovation program • 61 U.S.-issued AI patents from AI Labs • Over 30% of code AI assisted1 2025: strong performance against our strategic objectives Amplify Talent Adjusted Operating Margin1 Scale Innovation Accelerating Growth • ~260K employees skilled in gen AI • >35,000 promotions and more than 110,000 in last three years • Trailing 12-month Voluntary Attrition - Tech Services down ~200 bps Y/Y • Discretionary annual bonus at highest funding level since 2018 • 2025 constant currency organic growth2 +3.8%, top-tier and highest level since 2022 • 28 large deals ($100M+) including 5 mega deals ($500M+) • Financial Services revenue +7%, fastest constant currency annual growth since 2016 • 3Cloud acquisition expands Azure, data and app innovation capabilities 1 Estimated based on company's sampling methodology 2 Organic growth is defined as constant currency revenue growth of 6.4% less contributions from recently completed acquisitions of 260 basis points

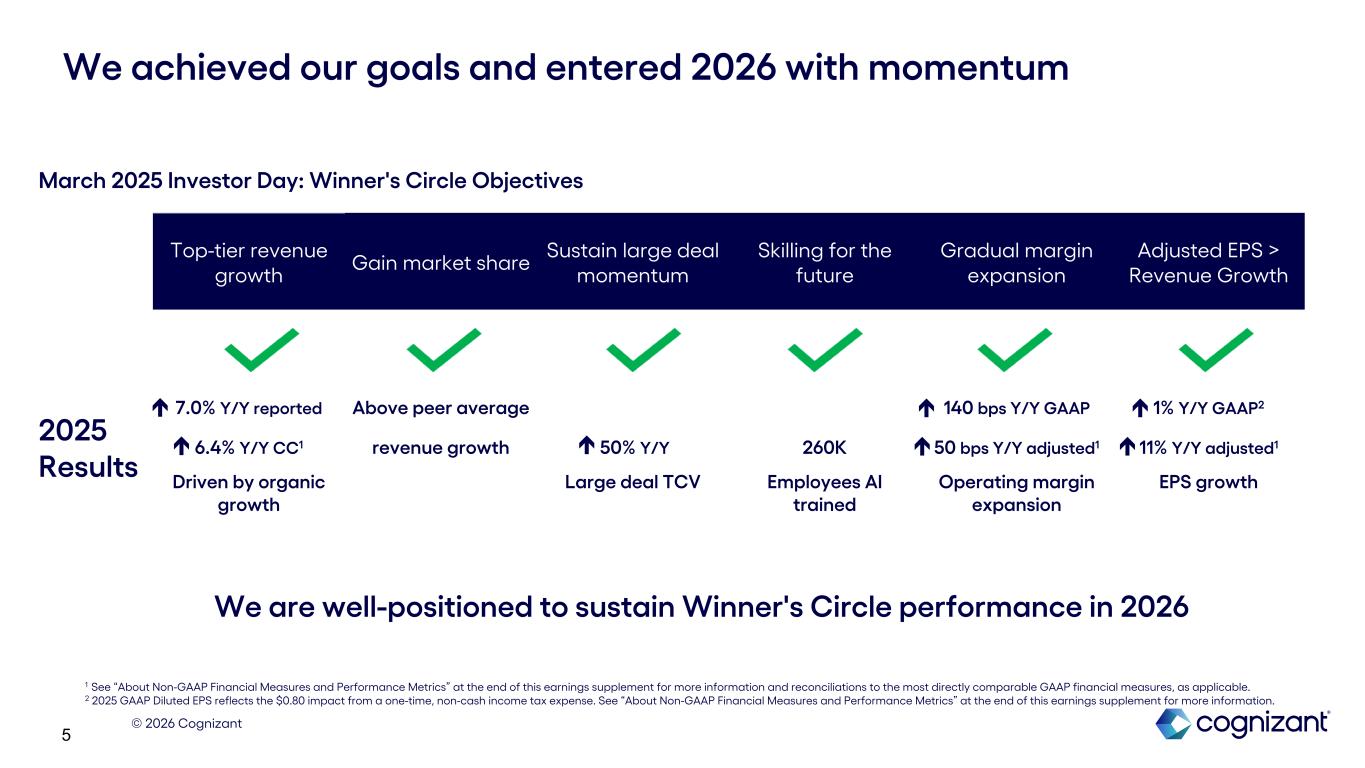

© 2026 Cognizant 5 March 2025 Investor Day: Winner's Circle Objectives Top-tier revenue growth Gain market share Sustain large deal momentum Skilling for the future Gradual margin expansion Adjusted EPS > Revenue Growth 2025 Results 7.0% Y/Y reported Above peer average 140 bps Y/Y GAAP 1% Y/Y GAAP2 6.4% Y/Y CC1 revenue growth 50% Y/Y 260K 50 bps Y/Y adjusted1 11% Y/Y adjusted1 Driven by organic growth Large deal TCV Employees AI trained Operating margin expansion EPS growth We achieved our goals and entered 2026 with momentum 1 See “About Non-GAAP Financial Measures and Performance Metrics” at the end of this earnings supplement for more information and reconciliations to the most directly comparable GAAP financial measures, as applicable. 2 2025 GAAP Diluted EPS reflects the $0.80 impact from a one-time, non-cash income tax expense. See “About Non-GAAP Financial Measures and Performance Metrics” at the end of this earnings supplement for more information. Adjusted Operating Margin1 We are well-positioned to sustain Winner's Circle performance in 2026 é é é é é é éé

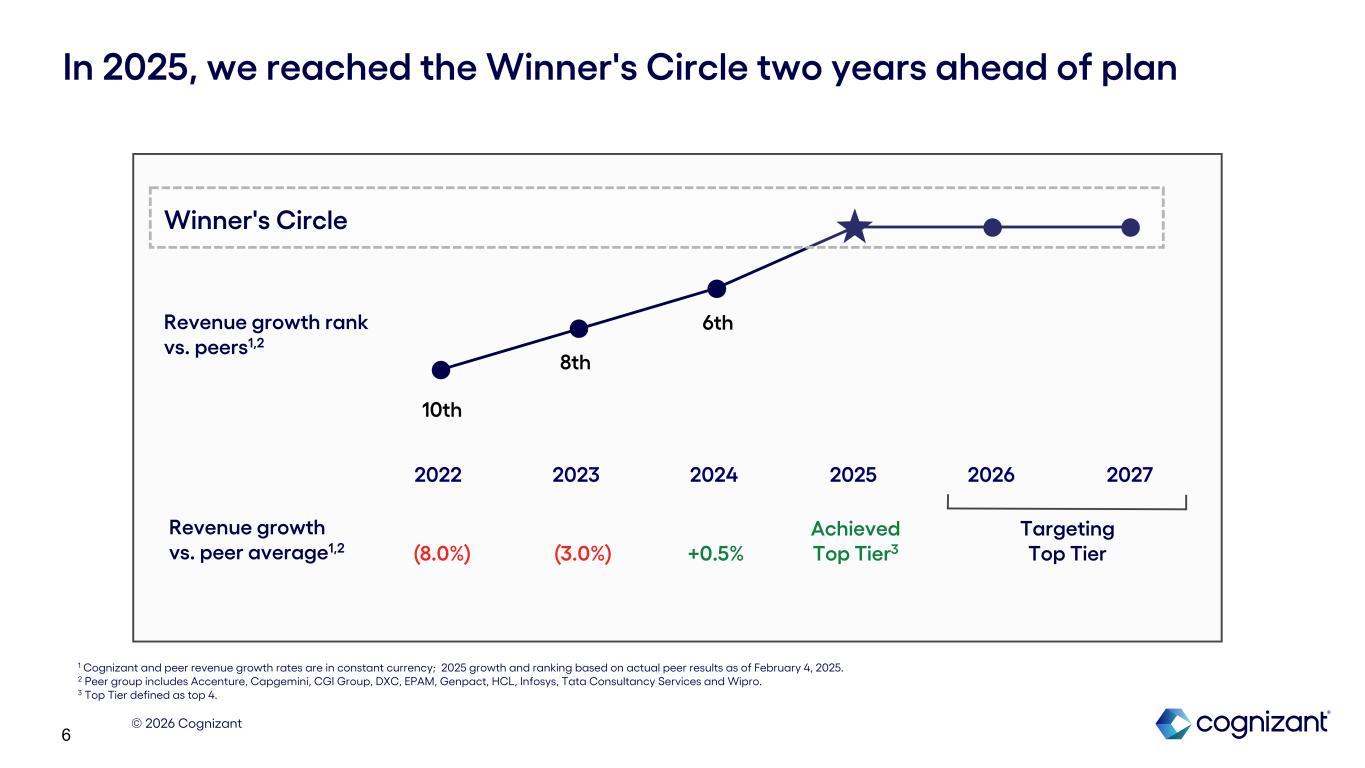

© 2026 Cognizant 6 In 2025, we reached the Winner's Circle two years ahead of plan 1 Cognizant and peer revenue growth rates are in constant currency; 2025 growth and ranking based on actual peer results as of February 4, 2025. 2 Peer group includes Accenture, Capgemini, CGI Group, DXC, EPAM, Genpact, HCL, Infosys, Tata Consultancy Services and Wipro. 3 Top Tier defined as top 4. 2022 2023 2024 2025 2026 2027 Adjusted Operating Margin1 Revenue growth rank vs. peers1,2 Revenue growth vs. peer average1,2 10th 8th 6th (8.0%) (3.0%) +0.5% Achieved Top Tier3 Targeting Top Tier Winner's Circle

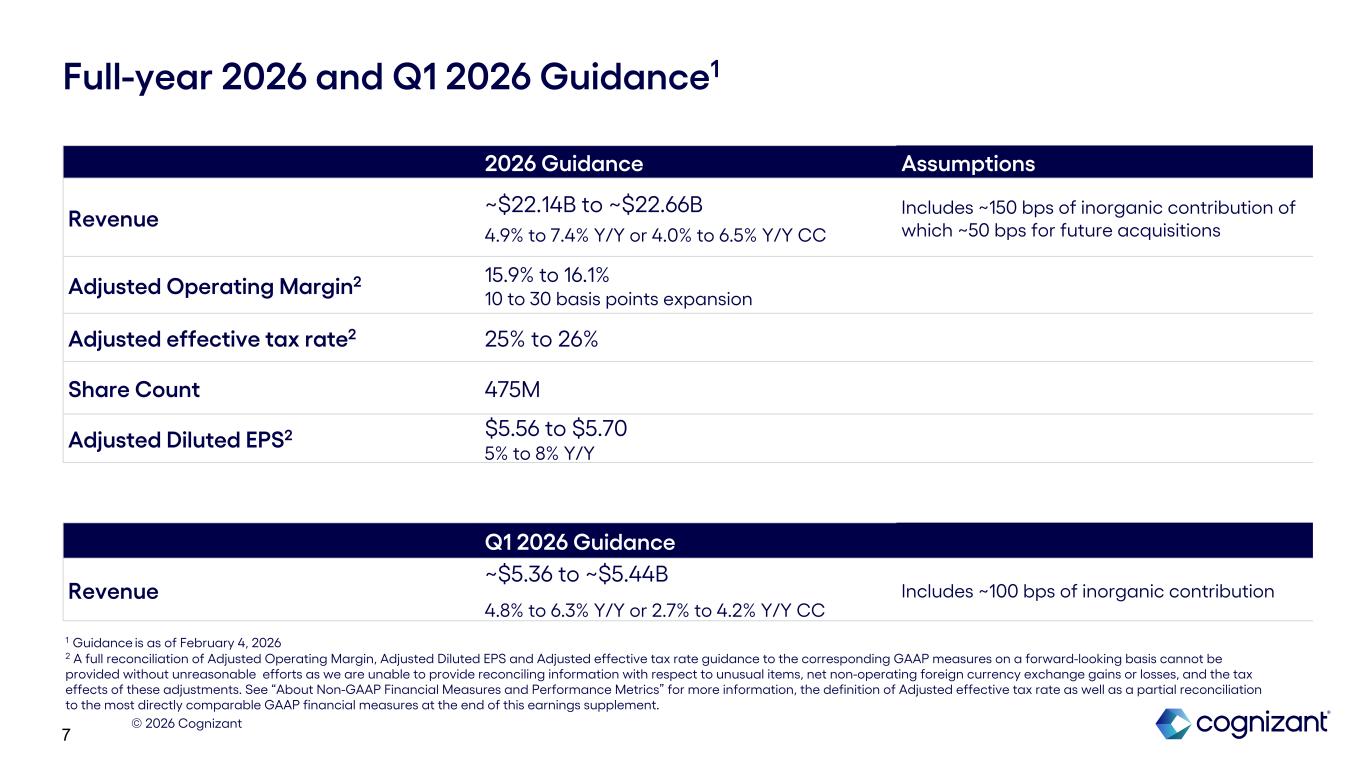

© 2026 Cognizant 7 Full-year 2026 and Q1 2026 Guidance1 1 Guidance is as of February 4, 2026 2 A full reconciliation of Adjusted Operating Margin, Adjusted Diluted EPS and Adjusted effective tax rate guidance to the corresponding GAAP measures on a forward-looking basis cannot be provided without unreasonable efforts as we are unable to provide reconciling information with respect to unusual items, net non-operating foreign currency exchange gains or losses, and the tax effects of these adjustments. See “About Non-GAAP Financial Measures and Performance Metrics” for more information, the definition of Adjusted effective tax rate as well as a partial reconciliation to the most directly comparable GAAP financial measures at the end of this earnings supplement. Q1 2026 Guidance Revenue ~$5.36 to ~$5.44B 4.8% to 6.3% Y/Y or 2.7% to 4.2% Y/Y CC Includes ~100 bps of inorganic contribution 2026 Guidance Assumptions Revenue ~$22.14B to ~$22.66B 4.9% to 7.4% Y/Y or 4.0% to 6.5% Y/Y CC Includes ~150 bps of inorganic contribution of which ~50 bps for future acquisitions Adjusted Operating Margin2 15.9% to 16.1% 10 to 30 basis points expansion Adjusted effective tax rate2 25% to 26% Share Count 475M Adjusted Diluted EPS2 $5.56 to $5.70 5% to 8% Y/Y

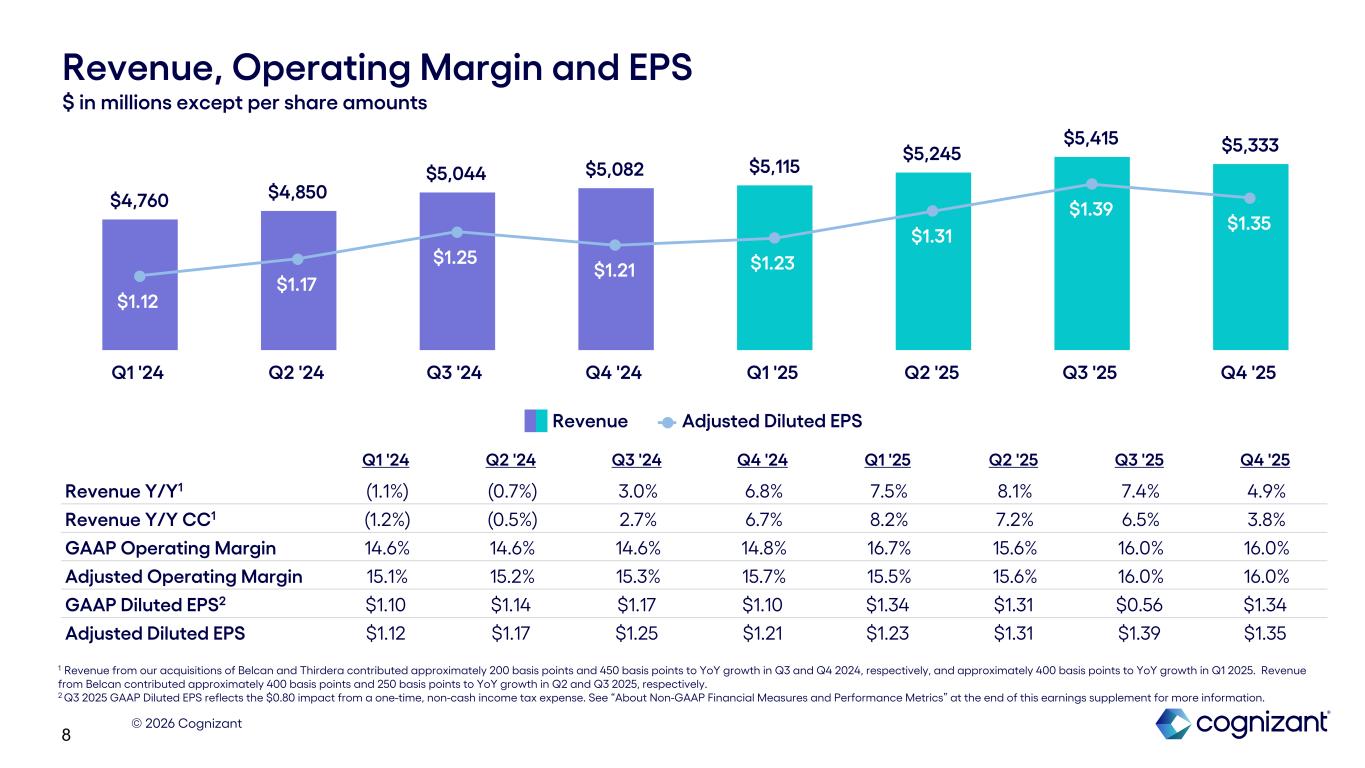

© 2026 Cognizant 8 $4,760 $4,850 $5,044 $5,082 $5,115 $5,245 $5,415 $5,333 $1.12 $1.17 $1.25 $1.21 $1.23 $1.31 $1.39 $1.35 Revenue Adjusted Diluted EPS Q1 '24 Q2 '24 Q3 '24 Q4 '24 Q1 '25 Q2 '25 Q3 '25 Q4 '25 $ in millions except per share amounts Q1 '24 Q2 '24 Q3 '24 Q4 '24 Q1 '25 Q2 '25 Q3 '25 Q4 '25 Revenue Y/Y1 (1.1%) (0.7%) 3.0% 6.8% 7.5% 8.1% 7.4% 4.9% Revenue Y/Y CC1 (1.2%) (0.5%) 2.7% 6.7% 8.2% 7.2% 6.5% 3.8% GAAP Operating Margin 14.6% 14.6% 14.6% 14.8% 16.7% 15.6% 16.0% 16.0% Adjusted Operating Margin 15.1% 15.2% 15.3% 15.7% 15.5% 15.6% 16.0% 16.0% GAAP Diluted EPS2 $1.10 $1.14 $1.17 $1.10 $1.34 $1.31 $0.56 $1.34 Adjusted Diluted EPS $1.12 $1.17 $1.25 $1.21 $1.23 $1.31 $1.39 $1.35 Revenue, Operating Margin and EPS 1 1 Revenue from our acquisitions of Belcan and Thirdera contributed approximately 200 basis points and 450 basis points to YoY growth in Q3 and Q4 2024, respectively, and approximately 400 basis points to YoY growth in Q1 2025. Revenue from Belcan contributed approximately 400 basis points and 250 basis points to YoY growth in Q2 and Q3 2025, respectively. 2 Q3 2025 GAAP Diluted EPS reflects the $0.80 impact from a one-time, non-cash income tax expense. See “About Non-GAAP Financial Measures and Performance Metrics” at the end of this earnings supplement for more information.

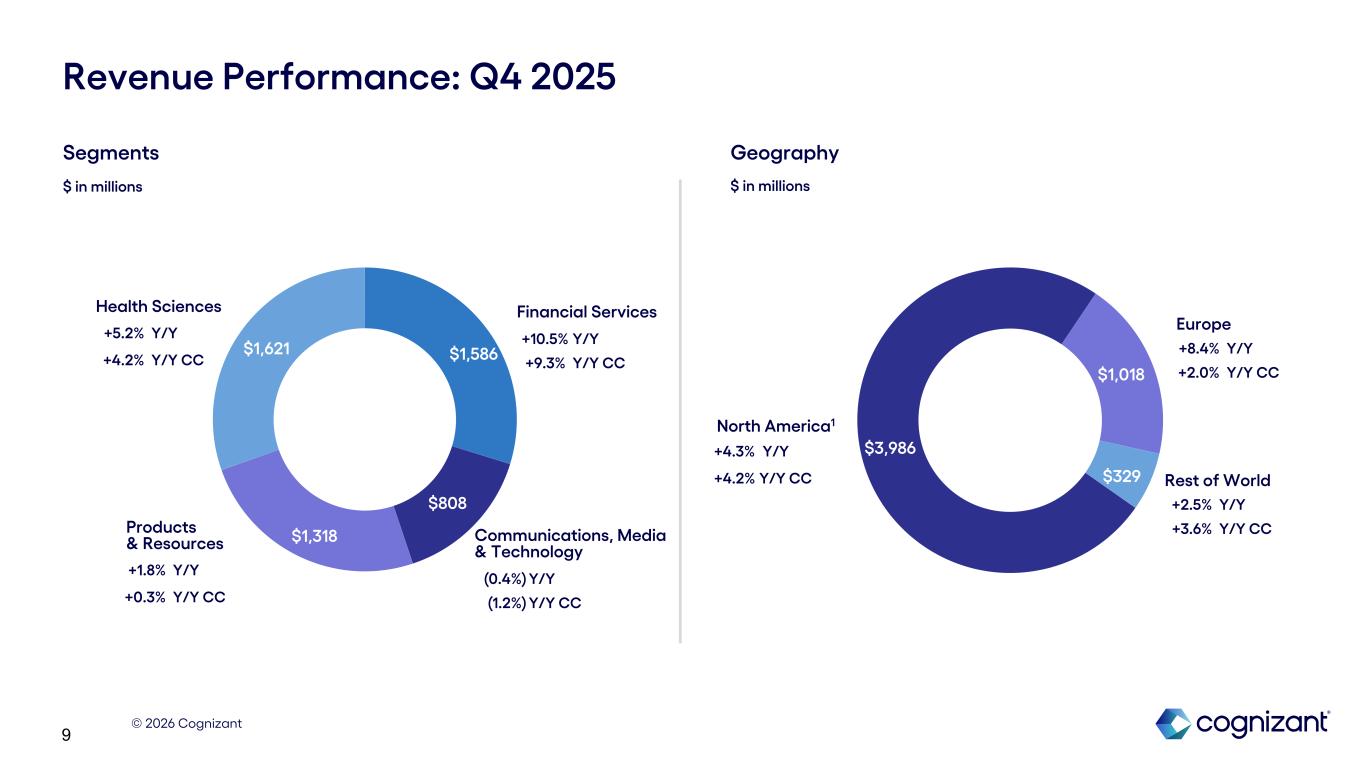

© 2026 Cognizant 9 $3,986 $1,018 $329 $1,586 $808 $1,318 $1,621 Revenue Performance: Q4 2025 Products & Resources Communications, Media & Technology Health Sciences Financial Services North America1 Europe Rest of World Segments $ in millions Geography $ in millions (0.4%) Y/Y (1.2%) Y/Y CC +1.8% Y/Y +0.3% Y/Y CC +5.2% Y/Y +4.2% Y/Y CC +10.5% Y/Y +9.3% Y/Y CC +8.4% Y/Y +2.0% Y/Y CC +2.5% Y/Y +3.6% Y/Y CC +4.3% Y/Y +4.2% Y/Y CC

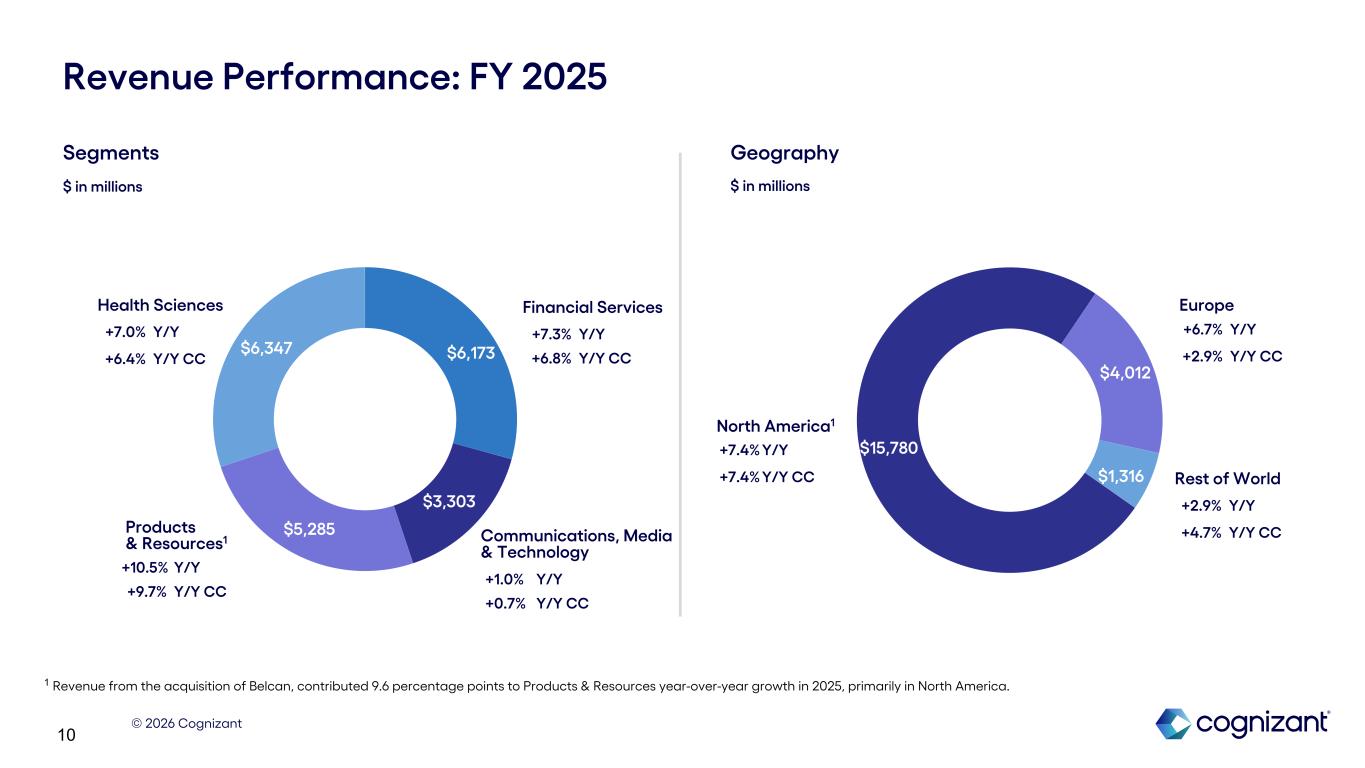

© 2026 Cognizant 10 +2.9% Y/Y +4.7% Y/Y CC $15,780 $4,012 $1,316 $6,173 $3,303 $5,285 $6,347 Revenue Performance: FY 2025 Products & Resources1 Communications, Media & Technology Health Sciences Financial Services North America1 Europe Rest of World Segments $ in millions Geography $ in millions +1.0% Y/Y +0.7% Y/Y CC +10.5% Y/Y +9.7% Y/Y CC +7.0% Y/Y +6.4% Y/Y CC +7.3% Y/Y +6.8% Y/Y CC +6.7% Y/Y +2.9% Y/Y CC +7.4% Y/Y +7.4% Y/Y CC 1 Revenue from the acquisition of Belcan, contributed 9.6 percentage points to Products & Resources year-over-year growth in 2025, primarily in North America.

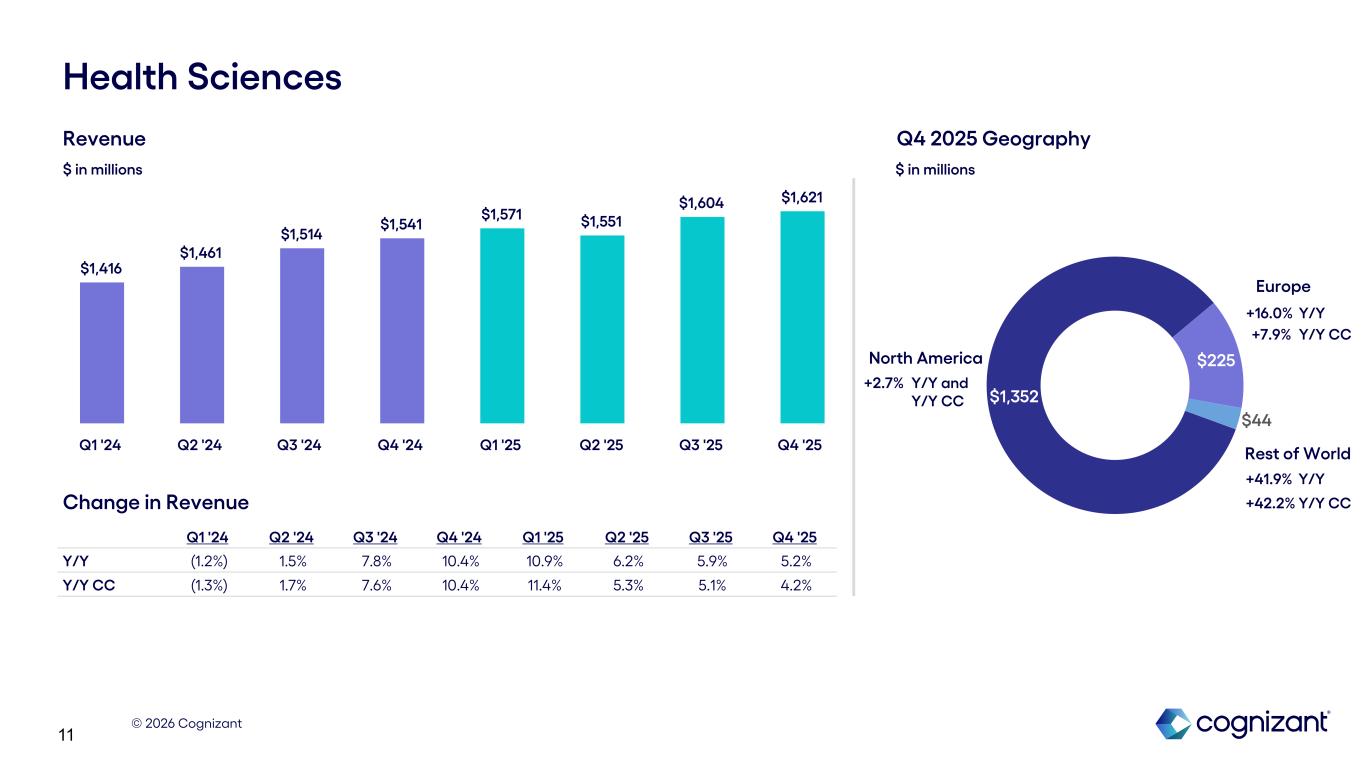

© 2026 Cognizant 11 $1,352 $225 $44 Health Sciences North America Europe Rest of World +41.9% Y/Y +42.2% Y/Y CC +16.0% Y/Y +7.9% Y/Y CC +2.7% Y/Y and Y/Y CC Revenue $ in millions Q1 '24 Q2 '24 Q3 '24 Q4 '24 Q1 '25 Q2 '25 Q3 '25 Q4 '25 Y/Y (1.2%) 1.5% 7.8% 10.4% 10.9% 6.2% 5.9% 5.2% Y/Y CC (1.3%) 1.7% 7.6% 10.4% 11.4% 5.3% 5.1% 4.2% $1,416 $1,461 $1,514 $1,541 $1,571 $1,551 $1,604 $1,621 Q1 '24 Q2 '24 Q3 '24 Q4 '24 Q1 '25 Q2 '25 Q3 '25 Q4 '25 Change in Revenue $ in millions Q4 2025 Geography

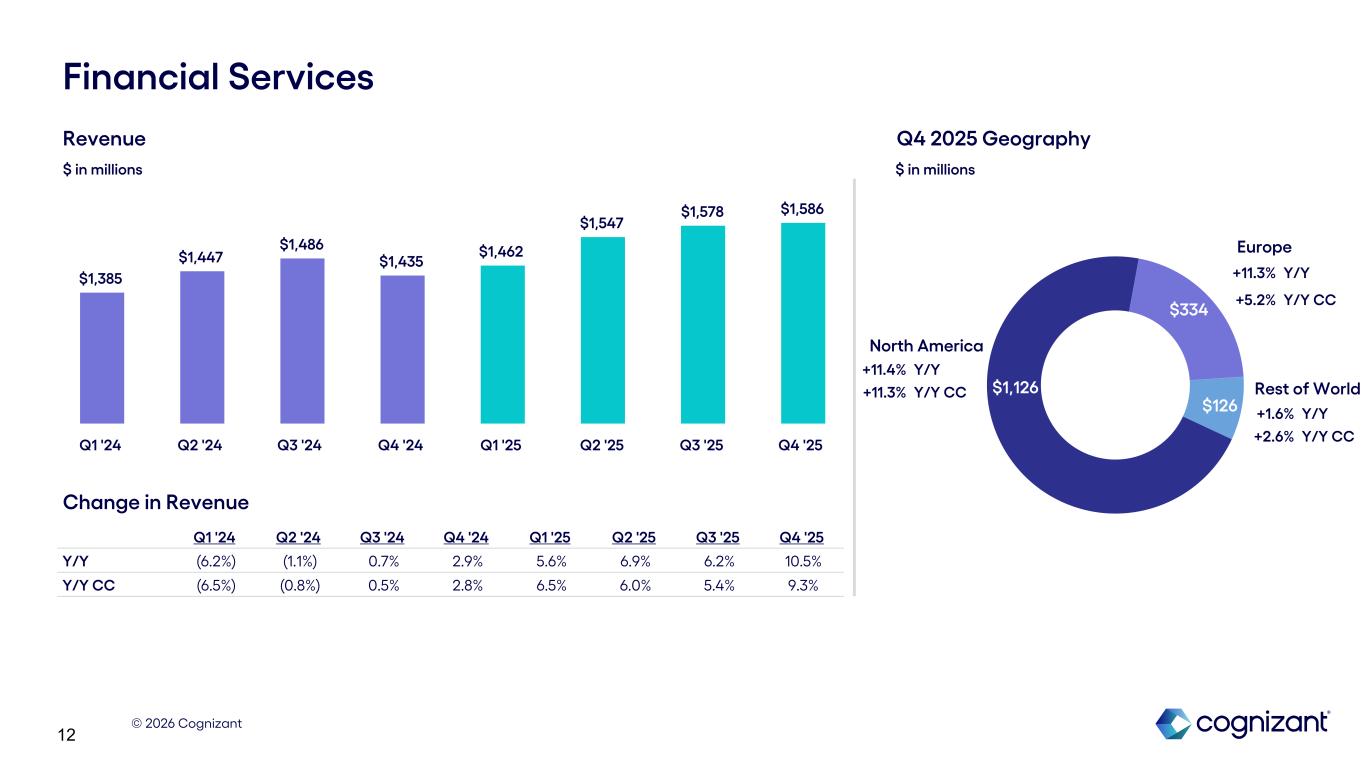

© 2026 Cognizant 12 $1,126 $334 $126 Financial Services North America Europe Rest of World Q1 '24 Q2 '24 Q3 '24 Q4 '24 Q1 '25 Q2 '25 Q3 '25 Q4 '25 Y/Y (6.2%) (1.1%) 0.7% 2.9% 5.6% 6.9% 6.2% 10.5% Y/Y CC (6.5%) (0.8%) 0.5% 2.8% 6.5% 6.0% 5.4% 9.3% +1.6% Y/Y +2.6% Y/Y CC +11.3% Y/Y +5.2% Y/Y CC Revenue Change in Revenue $ in millions $ in millions Q4 2025 Geography +11.4% Y/Y +11.3% Y/Y CC $1,385 $1,447 $1,486 $1,435 $1,462 $1,547 $1,578 $1,586 Q1 '24 Q2 '24 Q3 '24 Q4 '24 Q1 '25 Q2 '25 Q3 '25 Q4 '25

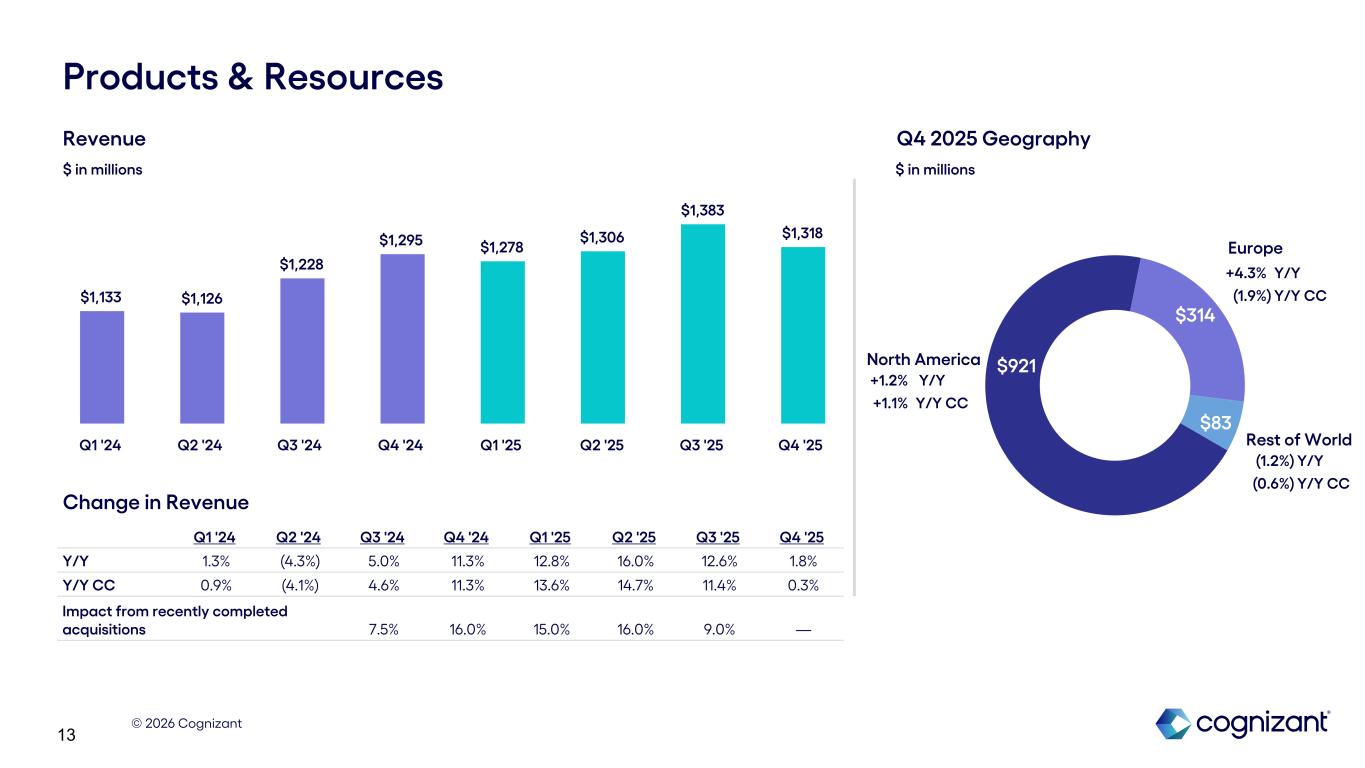

© 2026 Cognizant 13 $921 $314 $83 North America Europe Products & Resources +1.2% Y/Y +1.1% Y/Y CC +4.3% Y/Y (1.9%) Y/Y CC (1.2%) Y/Y (0.6%) Y/Y CC Rest of World Revenue $ in millions Q1 '24 Q2 '24 Q3 '24 Q4 '24 Q1 '25 Q2 '25 Q3 '25 Q4 '25 Y/Y 1.3% (4.3%) 5.0% 11.3% 12.8% 16.0% 12.6% 1.8% Y/Y CC 0.9% (4.1%) 4.6% 11.3% 13.6% 14.7% 11.4% 0.3% Impact from recently completed acquisitions 7.5% 16.0% 15.0% 16.0% 9.0% — $1,133 $1,126 $1,228 $1,295 $1,278 $1,306 $1,383 $1,318 Q1 '24 Q2 '24 Q3 '24 Q4 '24 Q1 '25 Q2 '25 Q3 '25 Q4 '25 Change in Revenue $ in millions Q4 2025 Geography

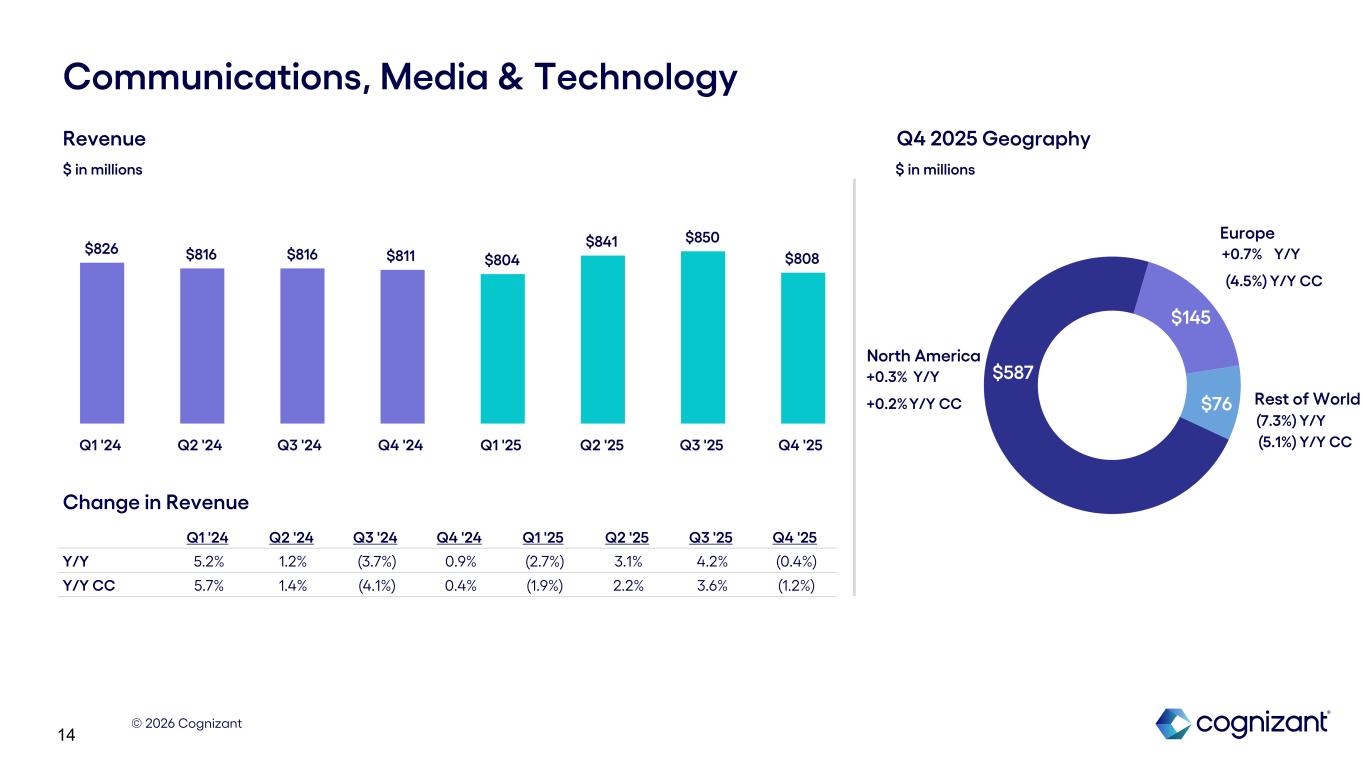

© 2026 Cognizant 14 $587 $145 $76 $826 $816 $816 $811 $804 $841 $850 $808 Q1 '24 Q2 '24 Q3 '24 Q4 '24 Q1 '25 Q2 '25 Q3 '25 Q4 '25 Communications, Media & Technology North America Rest of World (7.3%) Y/Y (5.1%) Y/Y CC +0.7% Y/Y (4.5%) Y/Y CC +0.3% Y/Y +0.2% Y/Y CC Europe Q1 '24 Q2 '24 Q3 '24 Q4 '24 Q1 '25 Q2 '25 Q3 '25 Q4 '25 Y/Y 5.2% 1.2% (3.7%) 0.9% (2.7%) 3.1% 4.2% (0.4%) Y/Y CC 5.7% 1.4% (4.1%) 0.4% (1.9%) 2.2% 3.6% (1.2%) Change in Revenue Revenue $ in millions $ in millions Q4 2025 Geography

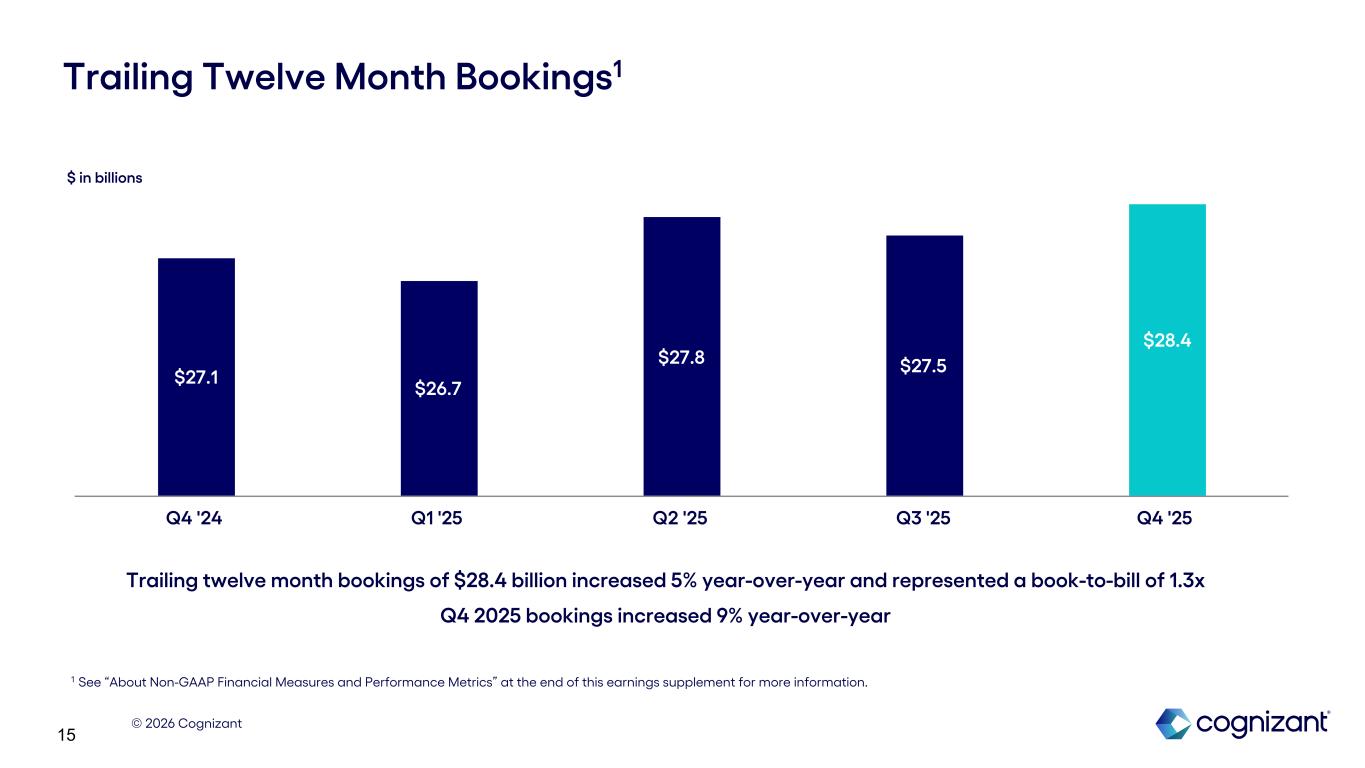

© 2026 Cognizant 15 $27.1 $26.7 $27.8 $27.5 $28.4 Q4 '24 Q1 '25 Q2 '25 Q3 '25 Q4 '25 Trailing Twelve Month Bookings1 Trailing twelve month bookings of $28.4 billion increased 5% year-over-year and represented a book-to-bill of 1.3x Q4 2025 bookings increased 9% year-over-year $ in billions 1 See “About Non-GAAP Financial Measures and Performance Metrics” at the end of this earnings supplement for more information.

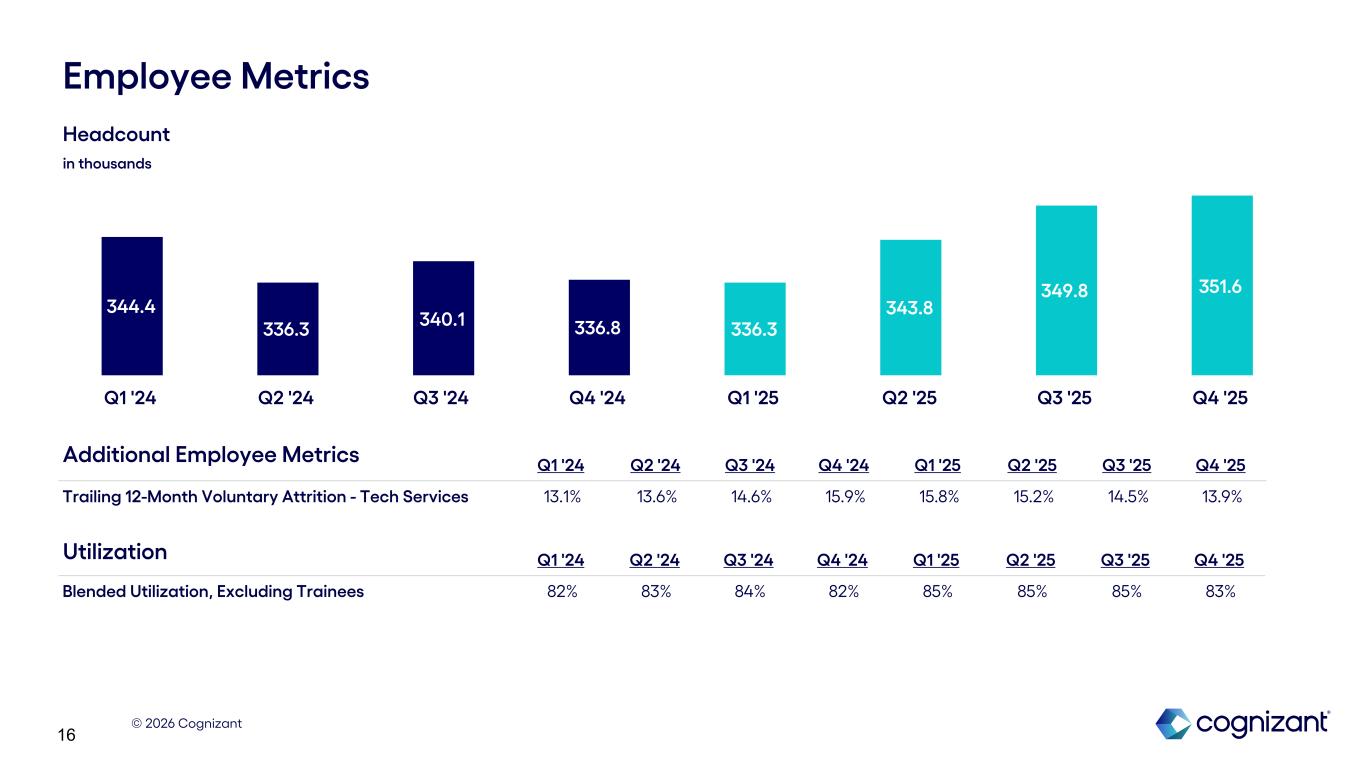

© 2026 Cognizant 16 Employee Metrics 344.4 336.3 340.1 336.8 336.3 343.8 349.8 351.6 Q1 '24 Q2 '24 Q3 '24 Q4 '24 Q1 '25 Q2 '25 Q3 '25 Q4 '25 Q1 '24 Q2 '24 Q3 '24 Q4 '24 Q1 '25 Q2 '25 Q3 '25 Q4 '25 Trailing 12-Month Voluntary Attrition - Tech Services 13.1% 13.6% 14.6% 15.9% 15.8% 15.2% 14.5% 13.9% Additional Employee Metrics Q1 '24 Q2 '24 Q3 '24 Q4 '24 Q1 '25 Q2 '25 Q3 '25 Q4 '25 Blended Utilization, Excluding Trainees 82% 83% 84% 82% 85% 85% 85% 83% Utilization Headcount in thousands

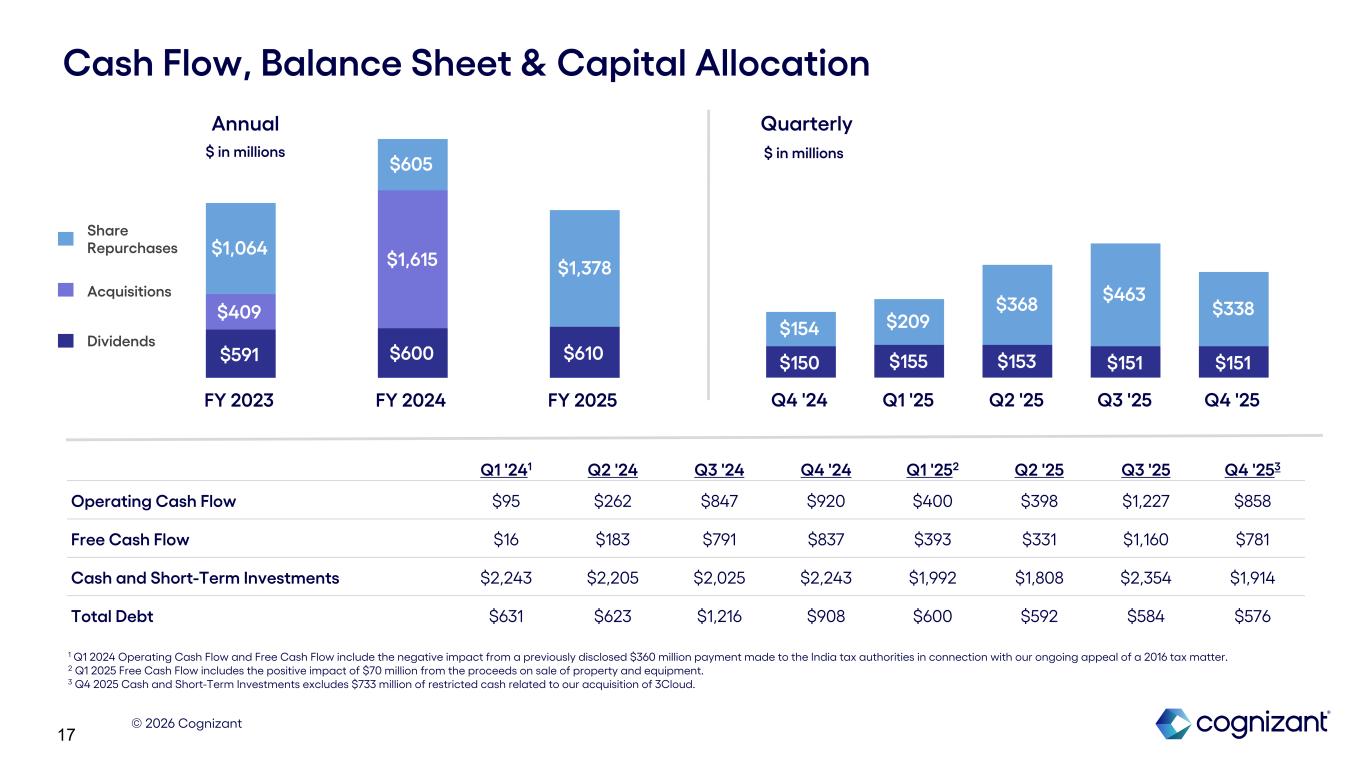

© 2026 Cognizant 17 $591 $600 $610 $409 $1,615$1,064 $605 $1,378 FY 2023 FY 2024 FY 2025 Acquisitions Share Repurchases $150 $155 $153 $151 $151 $154 $209 $368 $463 $338 Q4 '24 Q1 '25 Q2 '25 Q3 '25 Q4 '25 Cash Flow, Balance Sheet & Capital Allocation Q1 '241 Q2 '24 Q3 '24 Q4 '24 Q1 '252 Q2 '25 Q3 '25 Q4 '253 Operating Cash Flow $95 $262 $847 $920 $400 $398 $1,227 $858 Free Cash Flow $16 $183 $791 $837 $393 $331 $1,160 $781 Cash and Short-Term Investments $2,243 $2,205 $2,025 $2,243 $1,992 $1,808 $2,354 $1,914 Total Debt $631 $623 $1,216 $908 $600 $592 $584 $576 Annual Quarterly Dividends $ in millions $ in millions 1 Q1 2024 Operating Cash Flow and Free Cash Flow include the negative impact from a previously disclosed $360 million payment made to the India tax authorities in connection with our ongoing appeal of a 2016 tax matter. 2 Q1 2025 Free Cash Flow includes the positive impact of $70 million from the proceeds on sale of property and equipment. 3 Q4 2025 Cash and Short-Term Investments excludes $733 million of restricted cash related to our acquisition of 3Cloud.

APPENDIX: About Non-GAAP Financial Measures and Performance Metrics

© 2026 Cognizant 19 Non-GAAP Financial Measures To supplement our financial results presented in accordance with GAAP, this earnings supplement includes references to the following measures defined by the Securities and Exchange Commission as non-GAAP financial measures: Adjusted Operating Margin, Adjusted Diluted EPS, free cash flow, constant currency revenue growth and Adjusted effective tax rate. These non- GAAP financial measures are not based on any comprehensive set of accounting rules or principles and should not be considered a substitute for, or superior to, financial measures calculated in accordance with GAAP, and may be different from non-GAAP financial measures used by other companies. In addition, these non-GAAP financial measures should be read in conjunction with our financial statements prepared in accordance with GAAP. The reconciliations of our non-GAAP financial measures to the corresponding GAAP measures should be carefully evaluated. Our non-GAAP financial measures Adjusted Operating Margin and Adjusted Income from Operations exclude unusual items, such as the gain on sale of property in 2025 and equipment and NextGen charges in 2024. Our non-GAAP financial measure Adjusted Diluted EPS excludes unusual items, such as the one-time income tax expense related to the enactment of the OBBBA, the gain on sale of property and equipment and NextGen charges, and net non-operating foreign currency exchange gains or losses and the tax impact of all the applicable adjustments. The income tax impact of each item excluded from Adjusted Diluted EPS is calculated by applying the statutory rate and local tax regulations in the jurisdiction in which the item was incurred. Free cash flow is defined as cash flows from operating activities plus proceeds from sale of property and equipment, net of purchases of property and equipment. Constant currency revenue growth is defined as revenues for a given period restated at the comparative period’s foreign currency exchange rates measured against the comparative period's reported revenues. Adjusted effective tax rate reflects a tax rate commensurate with our non-GAAP Adjusted EPS. Management believes providing investors with an operating view consistent with how we manage the Company provides enhanced transparency into our operating results. For our internal management reporting and budgeting purposes, we use various GAAP and non-GAAP financial measures for financial and operational decision-making, to evaluate period-to-period comparisons, to determine portions of the compensation for our executive officers and for making comparisons of our operating results to those of our competitors. Accordingly, we believe that the presentation of our non-GAAP measures, which exclude certain costs, when read in conjunction with our reported GAAP results, can provide useful supplemental information to our management and investors regarding financial and business trends relating to our financial condition and results of operations. A limitation of using non-GAAP financial measures versus financial measures calculated in accordance with GAAP is that non-GAAP financial measures do not reflect all of the amounts associated with our operating results as determined in accordance with GAAP and may exclude costs that are recurring such as our net non-operating foreign currency exchange gains or losses. In addition, other companies may calculate non-GAAP financial measures differently than us, thereby limiting the usefulness of these non-GAAP financial measures as a comparative tool. We compensate for these limitations by providing specific information regarding the GAAP amounts excluded from our non-GAAP financial measures to allow investors to evaluate such non-GAAP financial measures. Performance Metrics Bookings are defined as total contract value (or TCV) of new contracts, including new contract sales as well as renewals and expansions of existing contracts. Bookings can vary significantly quarter to quarter depending in part on the timing of the signing of a small number of large contracts. Our book-to-bill ratio is defined as bookings for the trailing twelve months divided by revenue for the same period. Measuring bookings involves the use of estimates and judgments and there are no independent standards or requirements governing the calculation of bookings. The extent and timing of conversion of bookings to revenues may be impacted by, among other factors, the types of services and solutions sold, contract duration, the pace of client spending, actual volumes of services delivered as compared to the volumes anticipated at the time of sale, and contract modifications, including terminations, over the lifetime of a contract. The majority of our contracts are terminable by the client on short notice often without penalty, and some without notice. We do not update our bookings for subsequent terminations, reductions or foreign currency exchange rate fluctuations. Information regarding our bookings is not comparable to, nor should it be substituted for, an analysis of our reported revenues. However, management believes that it is a key indicator of potential future revenues and provides a useful indicator of the volume of our business over time. About Non-GAAP Financial Measures and Performance Metrics

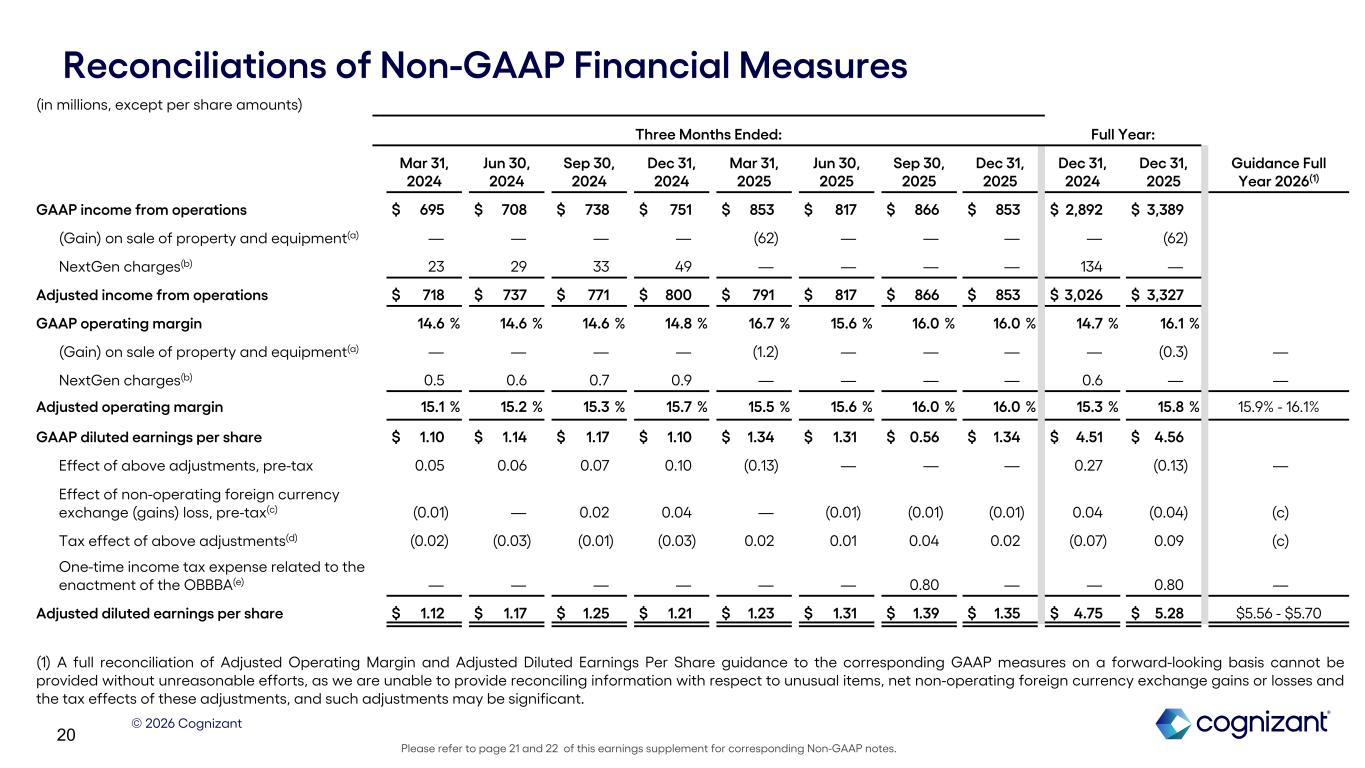

© 2026 Cognizant 20 Reconciliations of Non-GAAP Financial Measures Please refer to page 21 and 22 of this earnings supplement for corresponding Non-GAAP notes. (in millions, except per share amounts) Three Months Ended: Full Year: Mar 31, 2024 Jun 30, 2024 Sep 30, 2024 Dec 31, 2024 Mar 31, 2025 Jun 30, 2025 Sep 30, 2025 Dec 31, 2025 Dec 31, 2024 Dec 31, 2025 Guidance Full Year 2026(1) GAAP income from operations $ 695 $ 708 $ 738 $ 751 $ 853 $ 817 $ 866 $ 853 $ 2,892 $ 3,389 (Gain) on sale of property and equipment(a) — — — — (62) — — — — (62) NextGen charges(b) 23 29 33 49 — — — — 134 — Adjusted income from operations $ 718 $ 737 $ 771 $ 800 $ 791 $ 817 $ 866 $ 853 $ 3,026 $ 3,327 GAAP operating margin 14.6 % 14.6 % 14.6 % 14.8 % 16.7 % 15.6 % 16.0 % 16.0 % 14.7 % 16.1 % (Gain) on sale of property and equipment(a) — — — — (1.2) — — — — (0.3) — NextGen charges(b) 0.5 0.6 0.7 0.9 — — — — 0.6 — — Adjusted operating margin 15.1 % 15.2 % 15.3 % 15.7 % 15.5 % 15.6 % 16.0 % 16.0 % 15.3 % 15.8 % 15.9% - 16.1% GAAP diluted earnings per share $ 1.10 $ 1.14 $ 1.17 $ 1.10 $ 1.34 $ 1.31 $ 0.56 $ 1.34 $ 4.51 $ 4.56 Effect of above adjustments, pre-tax 0.05 0.06 0.07 0.10 (0.13) — — — 0.27 (0.13) — Effect of non-operating foreign currency exchange (gains) loss, pre-tax(c) (0.01) — 0.02 0.04 — (0.01) (0.01) (0.01) 0.04 (0.04) (c) Tax effect of above adjustments(d) (0.02) (0.03) (0.01) (0.03) 0.02 0.01 0.04 0.02 (0.07) 0.09 (c) One-time income tax expense related to the enactment of the OBBBA(e) — — — — — — 0.80 — — 0.80 — Adjusted diluted earnings per share $ 1.12 $ 1.17 $ 1.25 $ 1.21 $ 1.23 $ 1.31 $ 1.39 $ 1.35 $ 4.75 $ 5.28 $5.56 - $5.70 (1) A full reconciliation of Adjusted Operating Margin and Adjusted Diluted Earnings Per Share guidance to the corresponding GAAP measures on a forward-looking basis cannot be provided without unreasonable efforts, as we are unable to provide reconciling information with respect to unusual items, net non-operating foreign currency exchange gains or losses and the tax effects of these adjustments, and such adjustments may be significant.

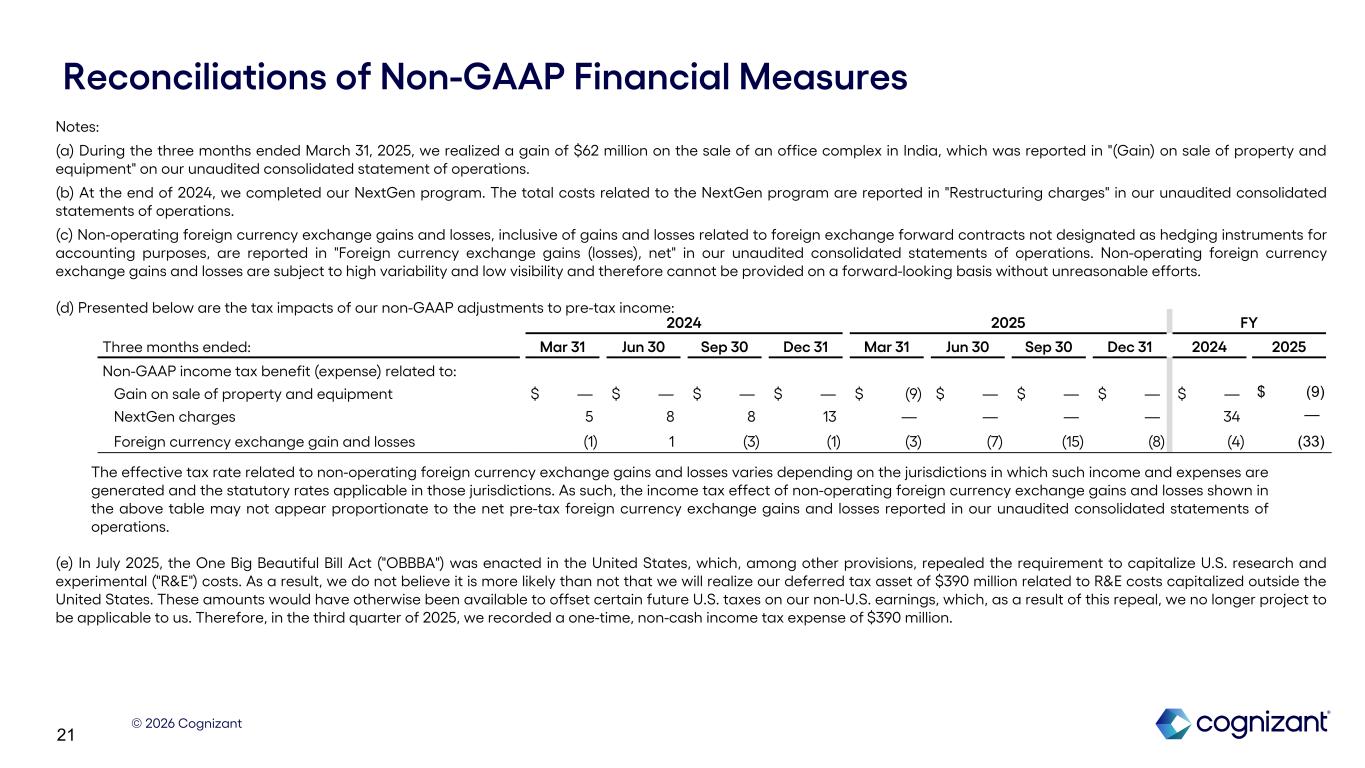

© 2026 Cognizant 21 Reconciliations of Non-GAAP Financial Measures Notes: (a) During the three months ended March 31, 2025, we realized a gain of $62 million on the sale of an office complex in India, which was reported in "(Gain) on sale of property and equipment" on our unaudited consolidated statement of operations. (b) At the end of 2024, we completed our NextGen program. The total costs related to the NextGen program are reported in "Restructuring charges" in our unaudited consolidated statements of operations. (c) Non-operating foreign currency exchange gains and losses, inclusive of gains and losses related to foreign exchange forward contracts not designated as hedging instruments for accounting purposes, are reported in "Foreign currency exchange gains (losses), net" in our unaudited consolidated statements of operations. Non-operating foreign currency exchange gains and losses are subject to high variability and low visibility and therefore cannot be provided on a forward-looking basis without unreasonable efforts. 2024 2025 FY Three months ended: Mar 31 Jun 30 Sep 30 Dec 31 Mar 31 Jun 30 Sep 30 Dec 31 2024 2025 Non-GAAP income tax benefit (expense) related to: Gain on sale of property and equipment $ — $ — $ — $ — $ (9) $ — $ — $ — $ — $ (9) NextGen charges 5 8 8 13 — — — — 34 — Foreign currency exchange gain and losses (1) 1 (3) (1) (3) (7) (15) (8) (4) (33) (d) Presented below are the tax impacts of our non-GAAP adjustments to pre-tax income: The effective tax rate related to non-operating foreign currency exchange gains and losses varies depending on the jurisdictions in which such income and expenses are generated and the statutory rates applicable in those jurisdictions. As such, the income tax effect of non-operating foreign currency exchange gains and losses shown in the above table may not appear proportionate to the net pre-tax foreign currency exchange gains and losses reported in our unaudited consolidated statements of operations. (e) In July 2025, the One Big Beautiful Bill Act ("OBBBA") was enacted in the United States, which, among other provisions, repealed the requirement to capitalize U.S. research and experimental ("R&E") costs. As a result, we do not believe it is more likely than not that we will realize our deferred tax asset of $390 million related to R&E costs capitalized outside the United States. These amounts would have otherwise been available to offset certain future U.S. taxes on our non-U.S. earnings, which, as a result of this repeal, we no longer project to be applicable to us. Therefore, in the third quarter of 2025, we recorded a one-time, non-cash income tax expense of $390 million.

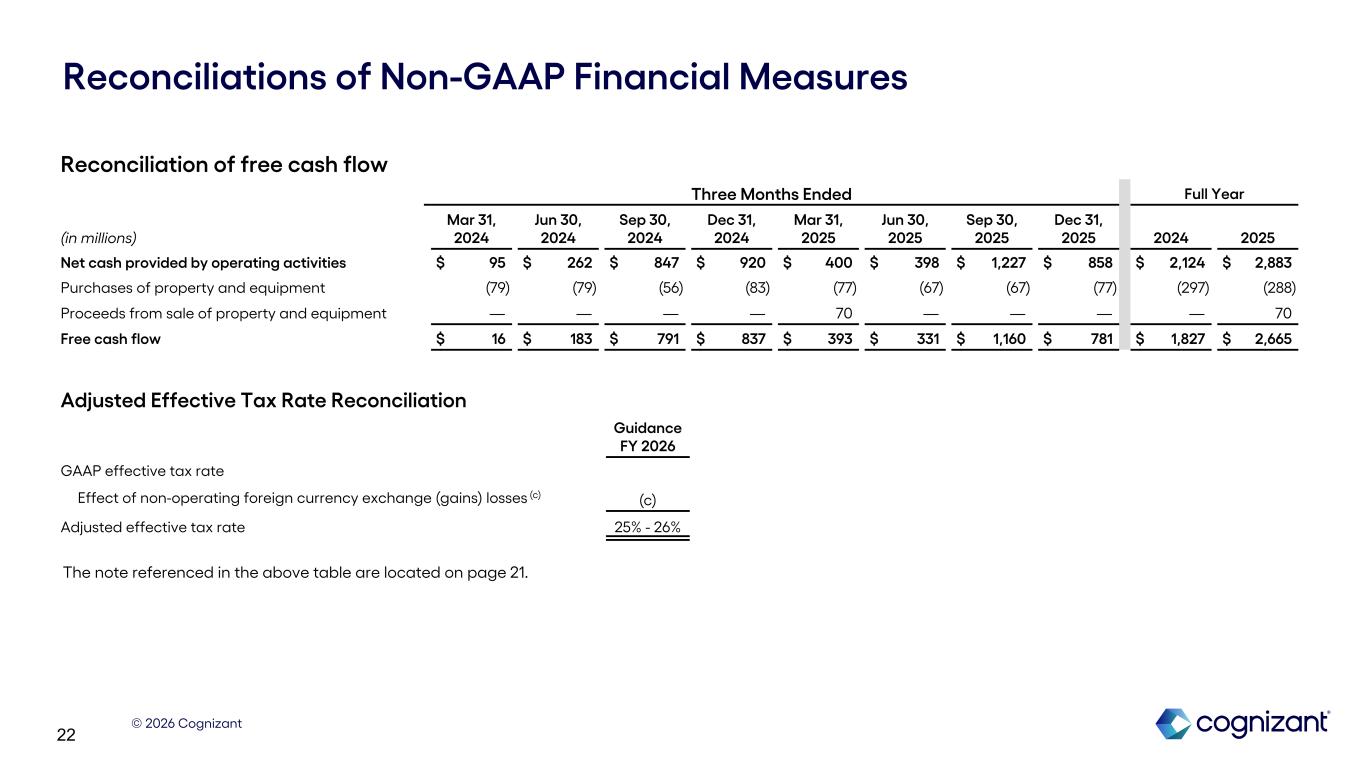

© 2026 Cognizant 22 Reconciliations of Non-GAAP Financial Measures Reconciliation of free cash flow Three Months Ended Full Year (in millions) Mar 31, 2024 Jun 30, 2024 Sep 30, 2024 Dec 31, 2024 Mar 31, 2025 Jun 30, 2025 Sep 30, 2025 Dec 31, 2025 2024 2025 Net cash provided by operating activities $ 95 $ 262 $ 847 $ 920 $ 400 $ 398 $ 1,227 $ 858 $ 2,124 $ 2,883 Purchases of property and equipment (79) (79) (56) (83) (77) (67) (67) (77) (297) (288) Proceeds from sale of property and equipment — — — — 70 — — — — 70 Free cash flow $ 16 $ 183 $ 791 $ 837 $ 393 $ 331 $ 1,160 $ 781 $ 1,827 $ 2,665 Adjusted Effective Tax Rate Reconciliation Guidance FY 2026 GAAP effective tax rate Effect of non-operating foreign currency exchange (gains) losses (c) (c) Adjusted effective tax rate 25% - 26% The note referenced in the above table are located on page 21. Net Interest FY 2024 Guidance FY 2025 Interest income $105 ~$115 Interest expense (37) (~50) Net Interest Income $68 ~ Adjusted Net Income Reconciliation (in millions) Q3 2025 YTD 2025 GAAP net income $ 274 $ 1,582 Non-operating foreign currency exchange gains / losses (c) 11 12 (Gain) on sale of property and equipment (a) — (53) One-time income tax expense related to the enactment of the OBBBA(e) 390 390 Adjusted Net Income $ 675 $ 1,931