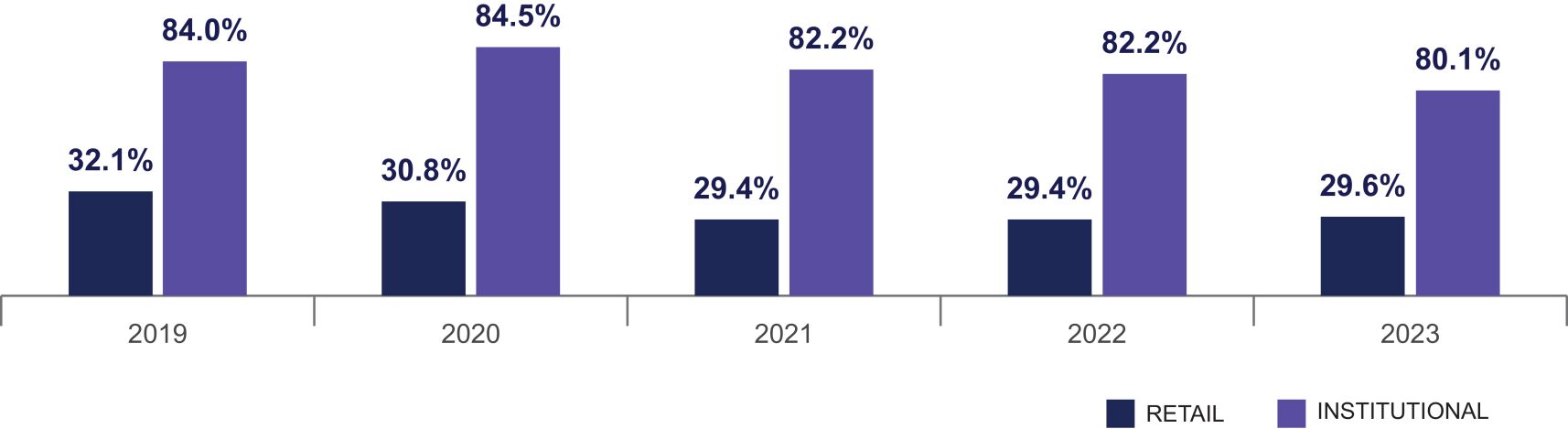

management’s role to communicate on behalf of the Company with its shareholders and the investment community. The Company maintains an effective investor relations process to respond to

shareholder questions and concerns. The Company also adopted the SPMF (which stands for Shareholder Partnership Management Framework, as defined under the heading CGI’s Shareholders earlier in this document), which structures the

processes and how information flows between CGI and the investment community, including both buy-side (institutional investor) and sell-side (investment dealer) research analysts. CGI obtained an ISO 9001

certification for the application of the SPMF in the Company’s operations.

The Board of Directors reviews and, where required, approves statutory

disclosure documents prior to their dissemination to the market and to the Company’s shareholders.

Codes of Ethics

CGI’s Codes of Ethics are attached as Appendix A to CGI’s 2025 Annual Information Form which is available on the Canadian Securities

Administrators’ website at www.sedarplus.ca and on CGI’s website at www.cgi.com. A copy of the 2025 Annual Information Form will be provided to shareholders by CGI upon request.

The Codes of Ethics are comprised of CGI’s Code of Ethics and Business Conduct, which applies to all CGI Partners, officers and directors (and which

incorporates CGI’s Anti-Corruption Policy); CGI’s Executive Code of Conduct, which supplements the Code of Ethics and Business Conduct for certain officers; and CGI’s Third Party Code of Ethics.

The Board of Directors monitors compliance with the Codes of Ethics and is, under its charter, responsible for any waivers of their provisions granted to

directors or officers. No such waivers have been granted to date. The Corporate Governance Committee is principally responsible for the annual review of the Codes of Ethics, overseeing compliance therewith, reviewing any request for a waiver from

their application, and making recommendations on these matters to the Board of Directors.

Under the terms of the Code of Ethics and Business Conduct, all

of CGI Partners are required to comply with its content and to assist with its application. In particular, the Code of Ethics and Business Conduct requires that incidents be reported to human resources, legal departments, management, CGI’s

Ethics Hotline, CGI’s Ethics Inbox or alternatively to any officer of the Company, especially when mandated by the Code of Ethics.

Similarly, under

the terms of the Third Party Code of Ethics, all of CGI’s business partners, including but not limited to, its primes, subcontractors, independent contractors, consultants, distributors, licensees, suppliers and other agents, must ensure that

they understand and adhere to the Company’s commitment to integrity and high standards of business conduct.

The Board of Directors has established

procedures approved by the Audit and Risk Management Committee for the receipt, retention, and treatment of ethical incidents relating to, among others, accounting, internal accounting control or auditing matters, discrimination and harassment,

corruption, bribery and data privacy, as well as any other potential breaches of the Codes of Ethics. In that regard, the Company adopted an Ethics Reporting Policy, which allows anyone who wishes to submit a report to do so via reporting hotline

and secure website managed by a third party that ensures that reporters who wish to preserve their anonymity are able to do so with confidence, as allowable by law. The Audit and Risk Management Committee is primarily responsible for the review and

oversight of these incident reports. A quarterly report is provided by management to the Audit and Risk Management Committee.

An integration program has

been designed for new CGI Partners to become familiar with CGI’s policies, including CGI’s Ethics and Compliance policies, and their responsibilities as CGI Partners. In order to ensure that all CGI Partners are aware of the importance

that the Company attaches to compliance with the Code of Ethics and Business Conduct, each new CGI Partner is informed of its content and the process for reporting

|

|

|

| 63 2025 MANAGEMENT PROXY CIRCULAR I |

|

© CGI Inc. |