Blackstone Mortgage Trust, Inc. Blackstone Mortgage Trust, Inc. Third Quarter 2025 Results OCTOBER 29, 2025

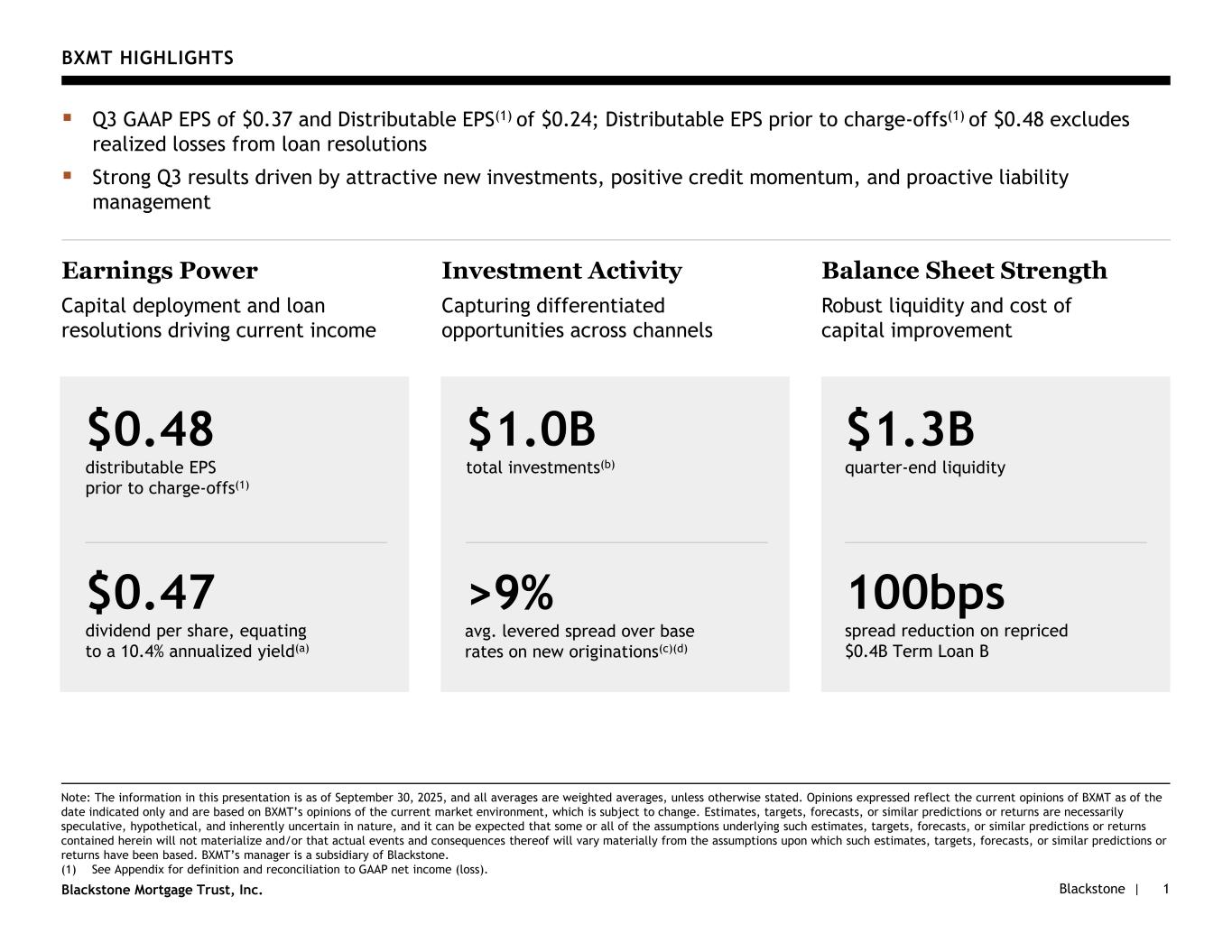

Blackstone |Blackstone Mortgage Trust, Inc. BXMT HIGHLIGHTS Note: The information in this presentation is as of September 30, 2025, and all averages are weighted averages, unless otherwise stated. Opinions expressed reflect the current opinions of BXMT as of the date indicated only and are based on BXMT’s opinions of the current market environment, which is subject to change. Estimates, targets, forecasts, or similar predictions or returns are necessarily speculative, hypothetical, and inherently uncertain in nature, and it can be expected that some or all of the assumptions underlying such estimates, targets, forecasts, or similar predictions or returns contained herein will not materialize and/or that actual events and consequences thereof will vary materially from the assumptions upon which such estimates, targets, forecasts, or similar predictions or returns have been based. BXMT’s manager is a subsidiary of Blackstone. (1) See Appendix for definition and reconciliation to GAAP net income (loss). 1 Q3 GAAP EPS of $0.37 and Distributable EPS(1) of $0.24; Distributable EPS prior to charge-offs(1) of $0.48 excludes realized losses from loan resolutions Strong Q3 results driven by attractive new investments, positive credit momentum, and proactive liability management Earnings Power Capital deployment and loan resolutions driving current income Investment Activity Capturing differentiated opportunities across channels Balance Sheet Strength Robust liquidity and cost of capital improvement $1.3B quarter-end liquidity 100bps spread reduction on repriced $0.4B Term Loan B $0.48 distributable EPS prior to charge-offs(1) $0.47 dividend per share, equating to a 10.4% annualized yield(a) $1.0B total investments(b) >9% avg. levered spread over base rates on new originations(c)(d)

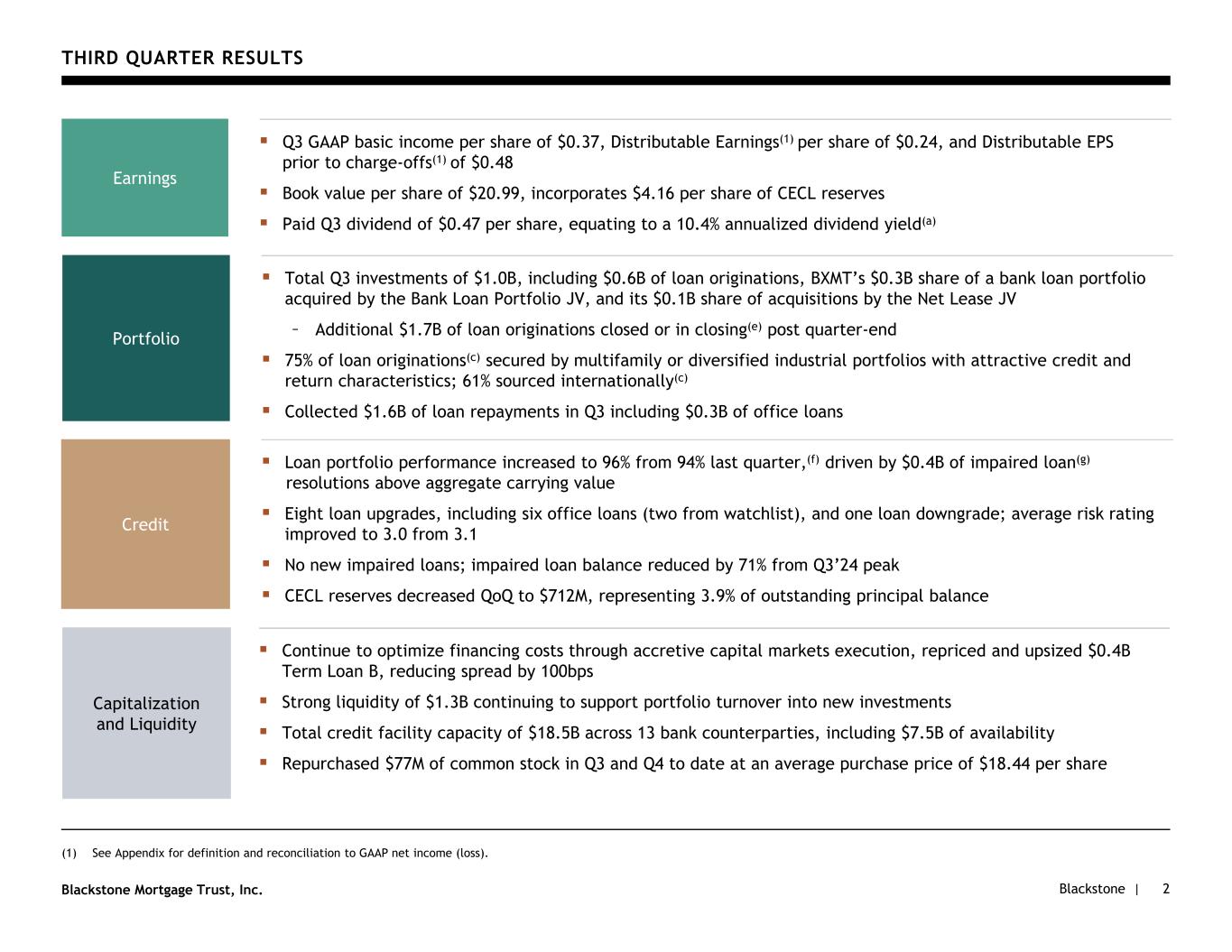

Blackstone |Blackstone Mortgage Trust, Inc. THIRD QUARTER RESULTS (1) See Appendix for definition and reconciliation to GAAP net income (loss). 2 Q3 GAAP basic income per share of $0.37, Distributable Earnings(1) per share of $0.24, and Distributable EPS prior to charge-offs(1) of $0.48 Book value per share of $20.99, incorporates $4.16 per share of CECL reserves Paid Q3 dividend of $0.47 per share, equating to a 10.4% annualized dividend yield(a) Earnings Total Q3 investments of $1.0B, including $0.6B of loan originations, BXMT’s $0.3B share of a bank loan portfolio acquired by the Bank Loan Portfolio JV, and its $0.1B share of acquisitions by the Net Lease JV – Additional $1.7B of loan originations closed or in closing(e) post quarter-end 75% of loan originations(c) secured by multifamily or diversified industrial portfolios with attractive credit and return characteristics; 61% sourced internationally(c) Collected $1.6B of loan repayments in Q3 including $0.3B of office loans Portfolio Loan portfolio performance increased to 96% from 94% last quarter,(f) driven by $0.4B of impaired loan(g) resolutions above aggregate carrying value Eight loan upgrades, including six office loans (two from watchlist), and one loan downgrade; average risk rating improved to 3.0 from 3.1 No new impaired loans; impaired loan balance reduced by 71% from Q3’24 peak CECL reserves decreased QoQ to $712M, representing 3.9% of outstanding principal balance Credit Continue to optimize financing costs through accretive capital markets execution, repriced and upsized $0.4B Term Loan B, reducing spread by 100bps Strong liquidity of $1.3B continuing to support portfolio turnover into new investments Total credit facility capacity of $18.5B across 13 bank counterparties, including $7.5B of availability Repurchased $77M of common stock in Q3 and Q4 to date at an average purchase price of $18.44 per share Capitalization and Liquidity

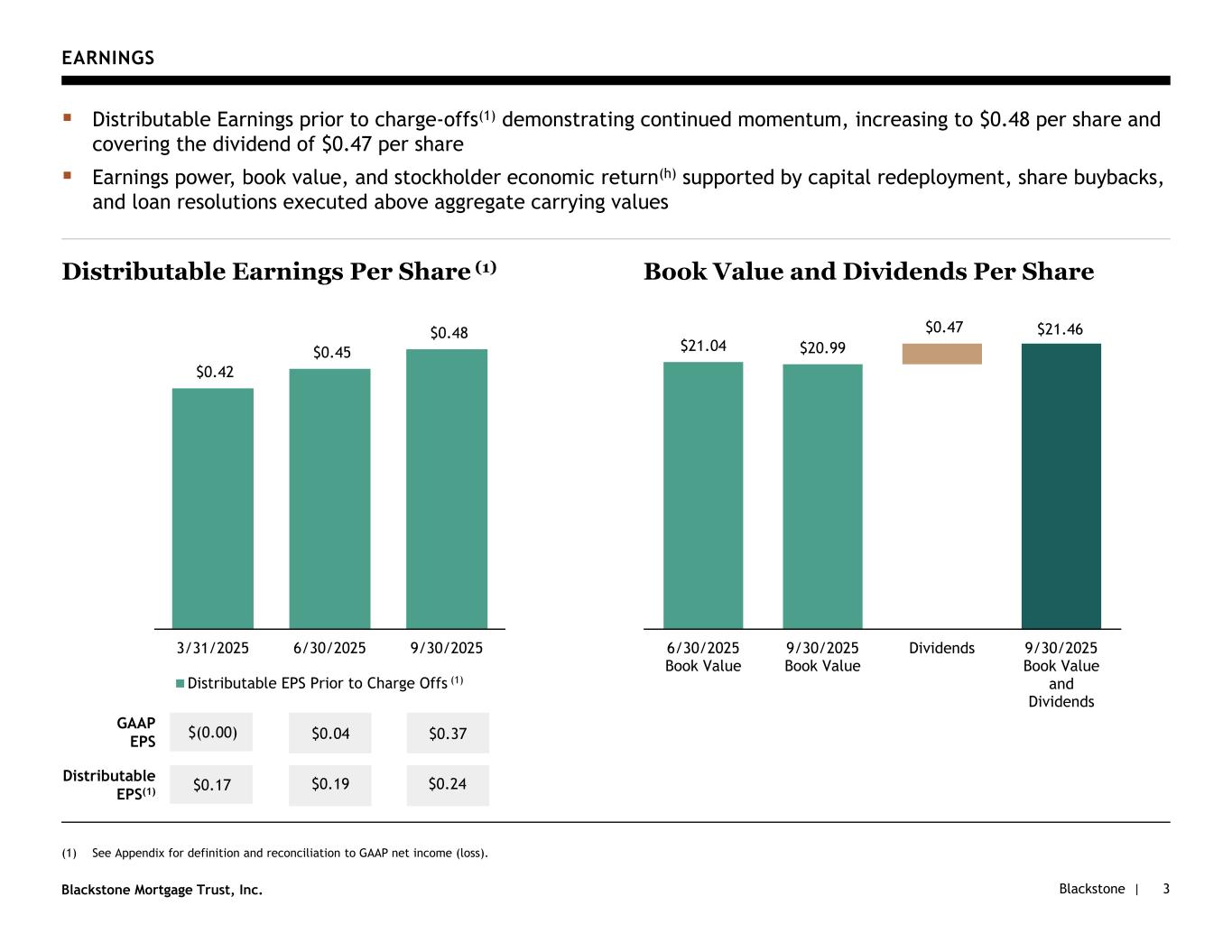

Blackstone |Blackstone Mortgage Trust, Inc. EARNINGS Distributable Earnings prior to charge-offs(1) demonstrating continued momentum, increasing to $0.48 per share and covering the dividend of $0.47 per share Earnings power, book value, and stockholder economic return(h) supported by capital redeployment, share buybacks, and loan resolutions executed above aggregate carrying values (1) See Appendix for definition and reconciliation to GAAP net income (loss). Book Value and Dividends Per Share 3 Distributable Earnings Per Share (1) GAAP EPS $(0.00) $0.42 $0.45 $0.48 3/31/2025 6/30/2025 9/30/2025 Distributable EPS Prior to Charge Offs (1) $0.04 $0.37 Distributable EPS(1) $0.17 $0.19 $0.24 $21.04 $20.99 $21.46$0.47 6/30/2025 Book Value 9/30/2025 Book Value Dividends 9/30/2025 Book Value and Dividends

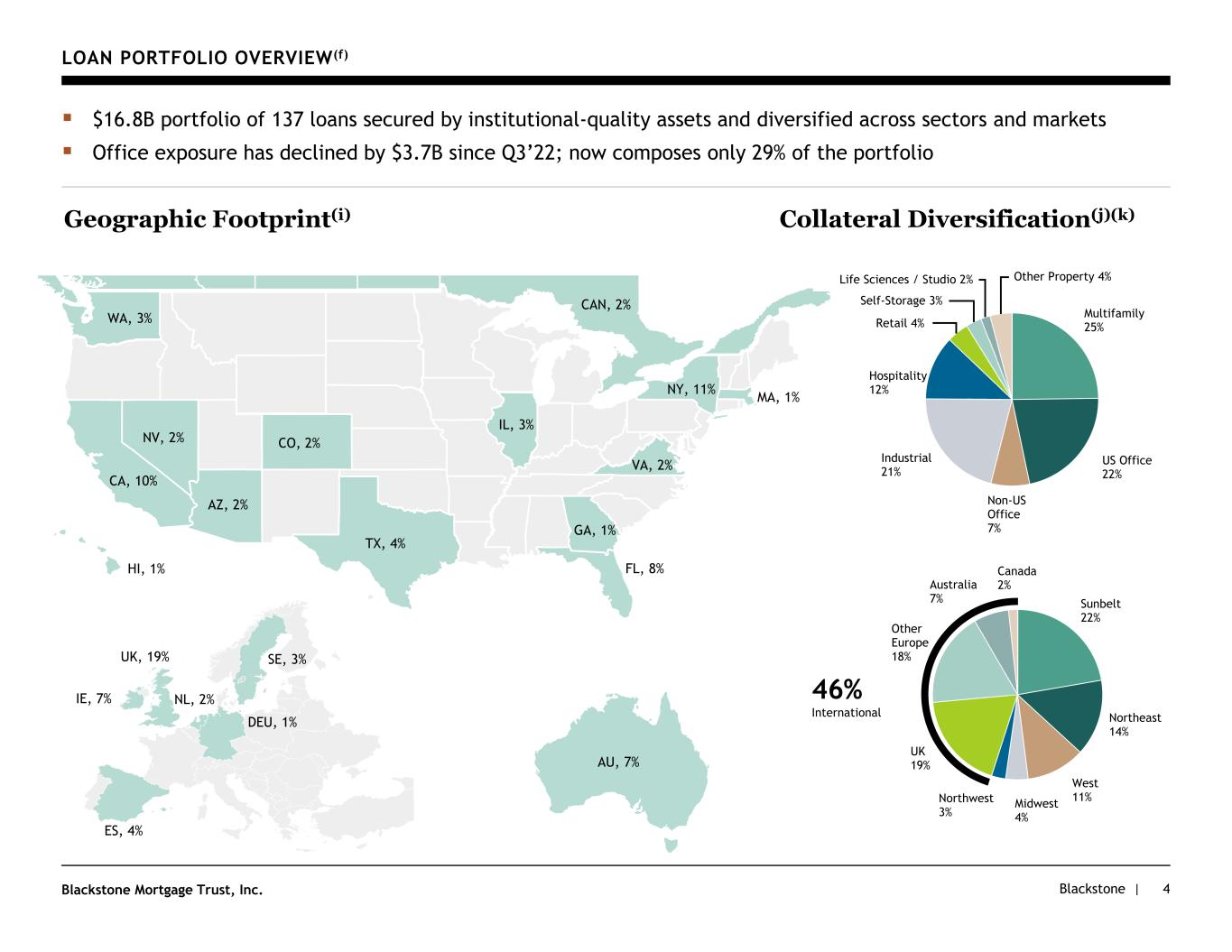

Blackstone |Blackstone Mortgage Trust, Inc. Sunbelt 22% Northeast 14% West 11%Midwest 4% Northwest 3% UK 19% Other Europe 18% Australia 7% Canada 2% LOAN PORTFOLIO OVERVIEW(f) WA, 2% 46% International AU, 7% ES, 4% IE, 7% UK, 19% SE, 3% DEU, 1% TX, 4% NY, 11% NV, 2% MA, 1% IL, 3% GA, 1% FL, 8% CA, 10% VA, 2% AZ, 2% CO, 2% HI, 1% Geographic Footprint(i) CAN, 2% NL, 2% $16.8B portfolio of 137 loans secured by institutional-quality assets and diversified across sectors and markets Office exposure has declined by $3.7B since Q3’22; now composes only 29% of the portfolio Collateral Diversification(j)(k) Multifamily 25% US Office 22% Non-US Office 7% Industrial 21% Hospitality 12% Retail 4% Self-Storage 3% Life Sciences / Studio 2% Other Property 4% WA, 3% 4

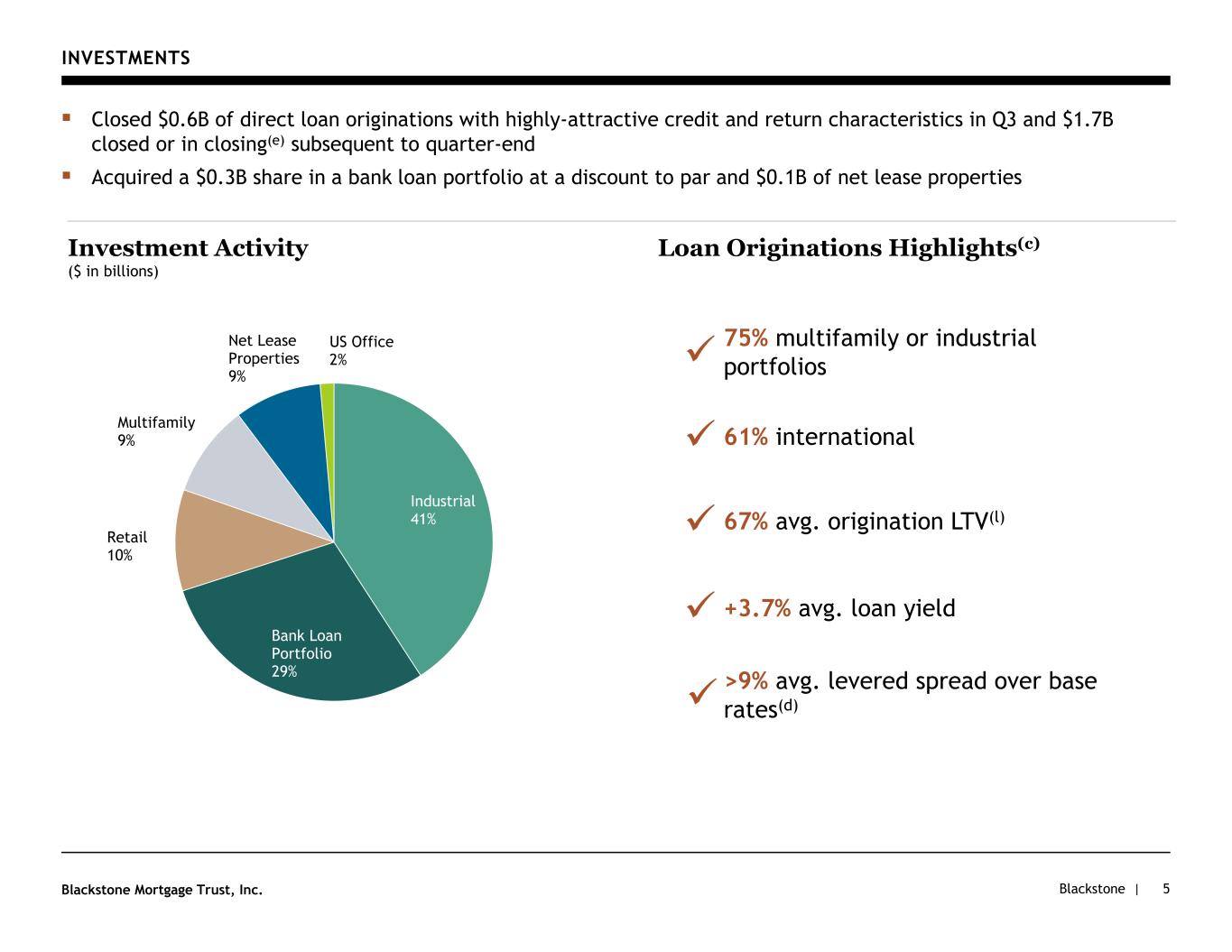

Blackstone |Blackstone Mortgage Trust, Inc. INVESTMENTS 5 Closed $0.6B of direct loan originations with highly-attractive credit and return characteristics in Q3 and $1.7B closed or in closing(e) subsequent to quarter-end Acquired a $0.3B share in a bank loan portfolio at a discount to par and $0.1B of net lease properties Loan Originations Highlights(c) 67% avg. origination LTV(l) +3.7% avg. loan yield 75% multifamily or industrial portfolios 61% international >9% avg. levered spread over base rates(d) Investment Activity ($ in billions) Industrial 41% Bank Loan Portfolio 29% Retail 10% Multifamily 9% Net Lease Properties 9% US Office 2%

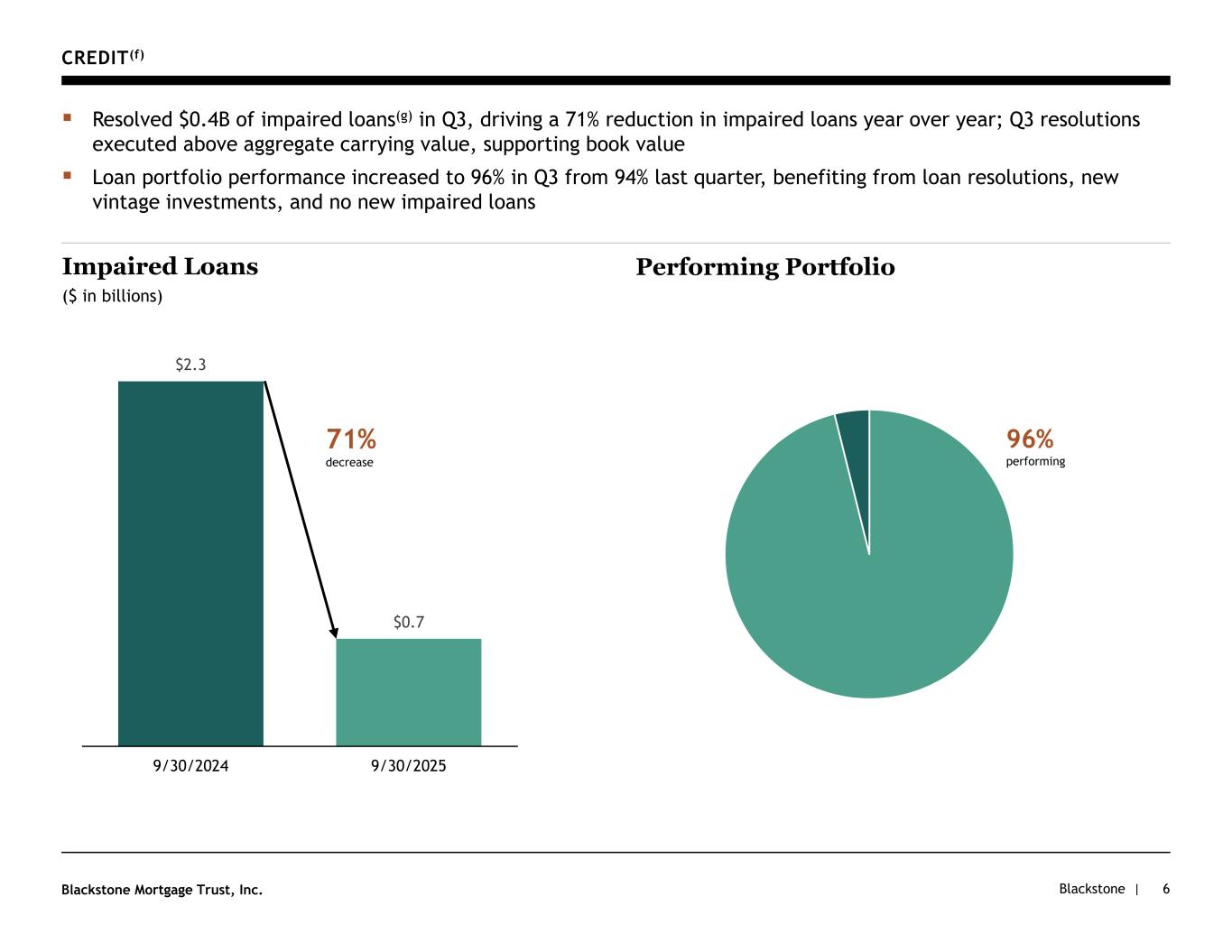

Blackstone |Blackstone Mortgage Trust, Inc. CREDIT(f) 6 Resolved $0.4B of impaired loans(g) in Q3, driving a 71% reduction in impaired loans year over year; Q3 resolutions executed above aggregate carrying value, supporting book value Loan portfolio performance increased to 96% in Q3 from 94% last quarter, benefiting from loan resolutions, new vintage investments, and no new impaired loans Impaired Loans ($ in billions) Performing Portfolio $2.3 $0.7 9/30/2024 9/30/2025 96% performing 71% decrease

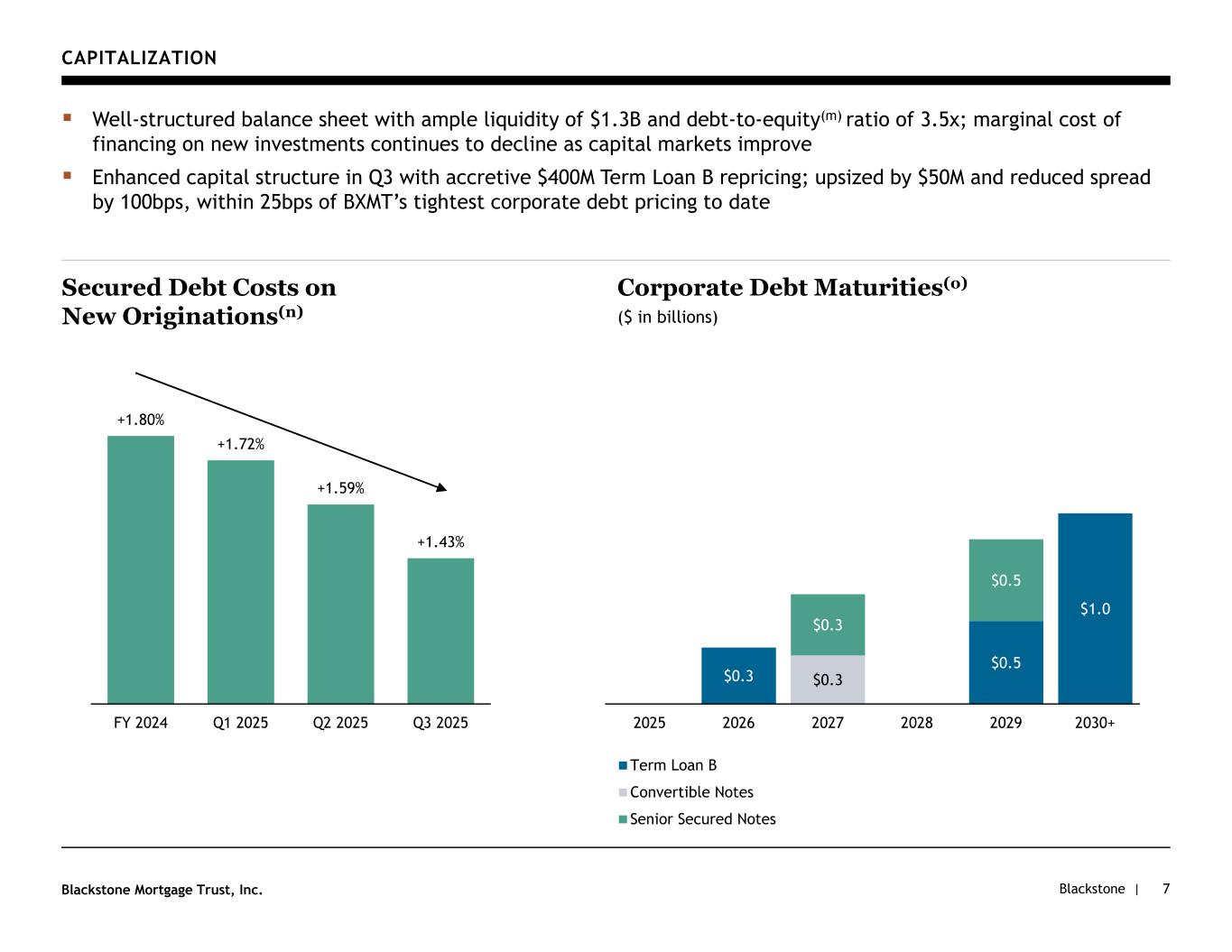

Blackstone |Blackstone Mortgage Trust, Inc. CAPITALIZATION 7 Well-structured balance sheet with ample liquidity of $1.3B and debt-to-equity(m) ratio of 3.5x; marginal cost of financing on new investments continues to decline as capital markets improve Enhanced capital structure in Q3 with accretive $400M Term Loan B repricing; upsized by $50M and reduced spread by 100bps, within 25bps of BXMT’s tightest corporate debt pricing to date Corporate Debt Maturities(o) ($ in billions) Secured Debt Costs on New Originations(n) $0.3 $0.5 $1.0 $0.3 $0.3 $0.5 2025 2026 2027 2028 2029 2030+ Term Loan B Convertible Notes Senior Secured Notes +1.80% +1.72% +1.59% +1.43% FY 2024 Q1 2025 Q2 2025 Q3 2025

Blackstone |Blackstone Mortgage Trust, Inc. II. Appendix 8

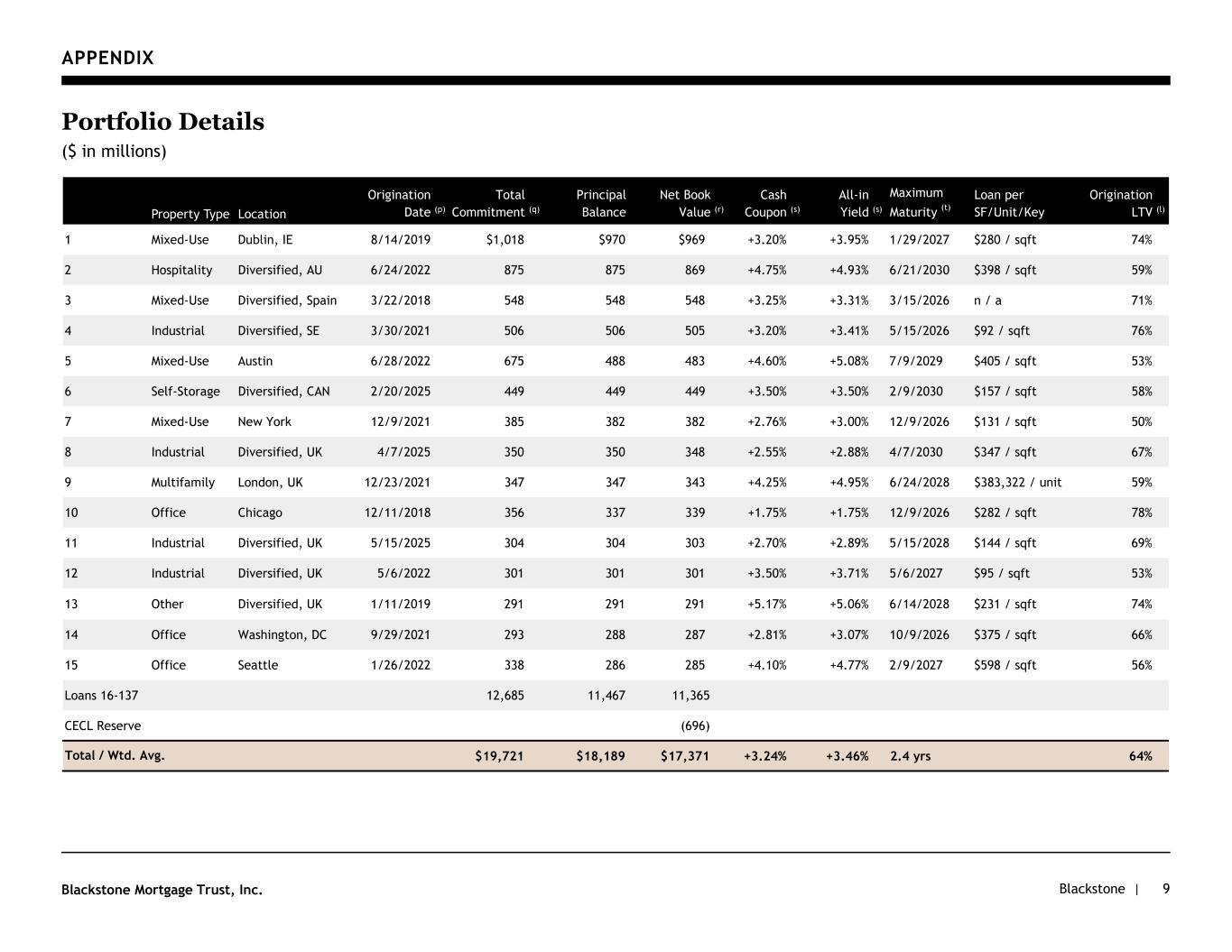

Blackstone |Blackstone Mortgage Trust, Inc. APPENDIX 9 Portfolio Details ($ in millions) Property Type Location Origination Date (p) Total Commitment (q) Principal Balance Net Book Value (r) Cash Coupon (s) All-in Yield (s) Maximum Maturity (t) Loan per SF/Unit/Key Origination LTV (l) 1 Mixed-Use Dublin, IE 8/14/2019 $1,018 $970 $969 +3.20% +3.95% 1/29/2027 $280 / sqft 74% 2 Hospitality Diversified, AU 6/24/2022 875 875 869 +4.75% +4.93% 6/21/2030 $398 / sqft 59% 3 Mixed-Use Diversified, Spain 3/22/2018 548 548 548 +3.25% +3.31% 3/15/2026 n / a 71% 4 Industrial Diversified, SE 3/30/2021 506 506 505 +3.20% +3.41% 5/15/2026 $92 / sqft 76% 5 Mixed-Use Austin 6/28/2022 675 488 483 +4.60% +5.08% 7/9/2029 $405 / sqft 53% 6 Self-Storage Diversified, CAN 2/20/2025 449 449 449 +3.50% +3.50% 2/9/2030 $157 / sqft 58% 7 Mixed-Use New York 12/9/2021 385 382 382 +2.76% +3.00% 12/9/2026 $131 / sqft 50% 8 Industrial Diversified, UK 4/7/2025 350 350 348 +2.55% +2.88% 4/7/2030 $347 / sqft 67% 9 Multifamily London, UK 12/23/2021 347 347 343 +4.25% +4.95% 6/24/2028 $383,322 / unit 59% 10 Office Chicago 12/11/2018 356 337 339 +1.75% +1.75% 12/9/2026 $282 / sqft 78% 11 Industrial Diversified, UK 5/15/2025 304 304 303 +2.70% +2.89% 5/15/2028 $144 / sqft 69% 12 Industrial Diversified, UK 5/6/2022 301 301 301 +3.50% +3.71% 5/6/2027 $95 / sqft 53% 13 Other Diversified, UK 1/11/2019 291 291 291 +5.17% +5.06% 6/14/2028 $231 / sqft 74% 14 Office Washington, DC 9/29/2021 293 288 287 +2.81% +3.07% 10/9/2026 $375 / sqft 66% 15 Office Seattle 1/26/2022 338 286 285 +4.10% +4.77% 2/9/2027 $598 / sqft 56% Loans 16-137 12,685 11,467 11,365 CECL Reserve (696) $19,721 $18,189 $17,371 +3.24% +3.46% 2.4 yrs 64%Total / Wtd. Avg.

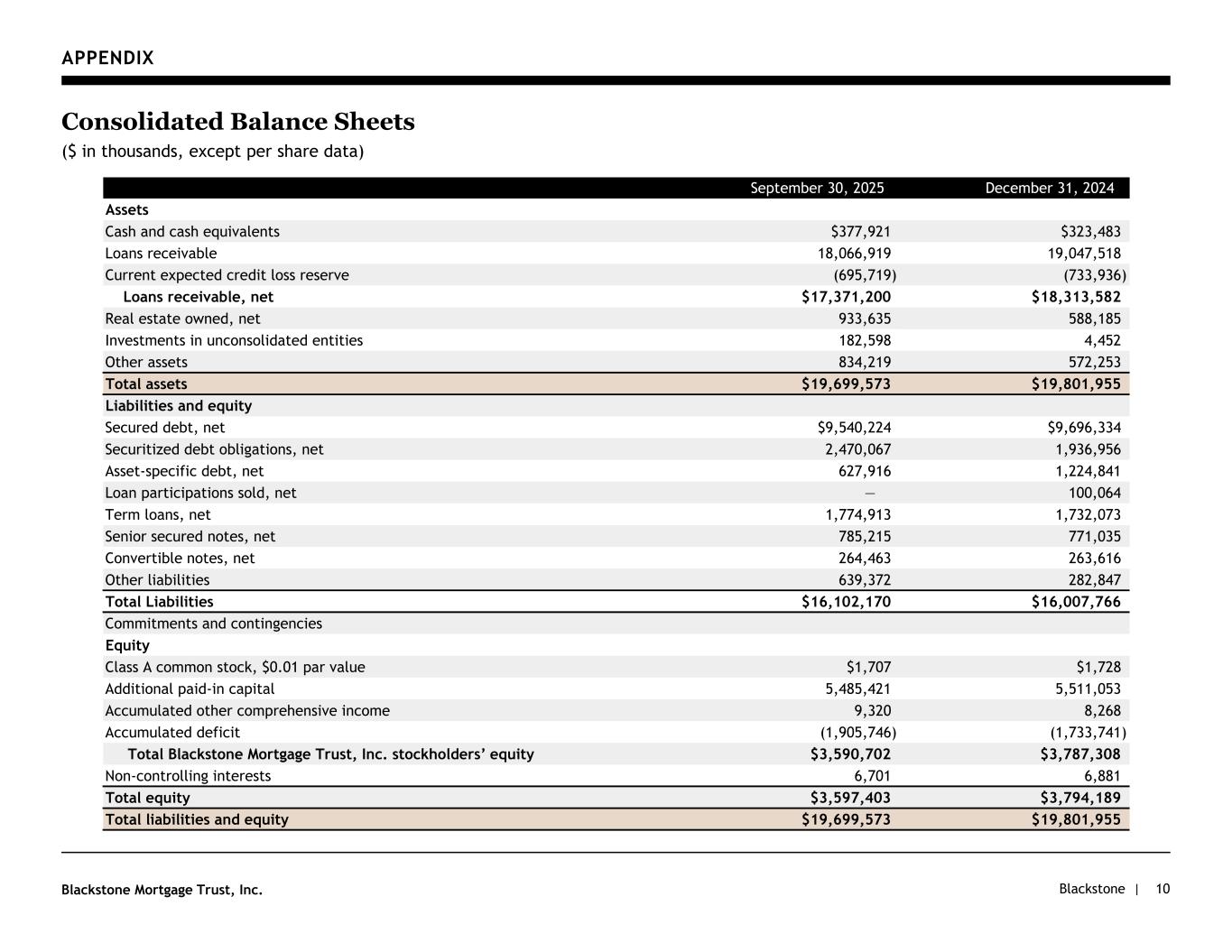

Blackstone |Blackstone Mortgage Trust, Inc. APPENDIX 10 Consolidated Balance Sheets ($ in thousands, except per share data) September 30, 2025 December 31, 2024 Assets Cash and cash equivalents $377,921 $323,483 Loans receivable 18,066,919 19,047,518 Current expected credit loss reserve (695,719) (733,936) Loans receivable, net $17,371,200 $18,313,582 Real estate owned, net 933,635 588,185 Investments in unconsolidated entities 182,598 4,452 Other assets 834,219 572,253 Total assets $19,699,573 $19,801,955 Liabilities and equity Secured debt, net $9,540,224 $9,696,334 Securitized debt obligations, net 2,470,067 1,936,956 Asset-specific debt, net 627,916 1,224,841 Loan participations sold, net — 100,064 Term loans, net 1,774,913 1,732,073 Senior secured notes, net 785,215 771,035 Convertible notes, net 264,463 263,616 Other liabilities 639,372 282,847 Total Liabilities $16,102,170 $16,007,766 Commitments and contingencies Equity Class A common stock, $0.01 par value $1,707 $1,728 Additional paid-in capital 5,485,421 5,511,053 Accumulated other comprehensive income 9,320 8,268 Accumulated deficit (1,905,746) (1,733,741) Total Blackstone Mortgage Trust, Inc. stockholders’ equity $3,590,702 $3,787,308 Non-controlling interests 6,701 6,881 Total equity $3,597,403 $3,794,189 Total liabilities and equity $19,699,573 $19,801,955

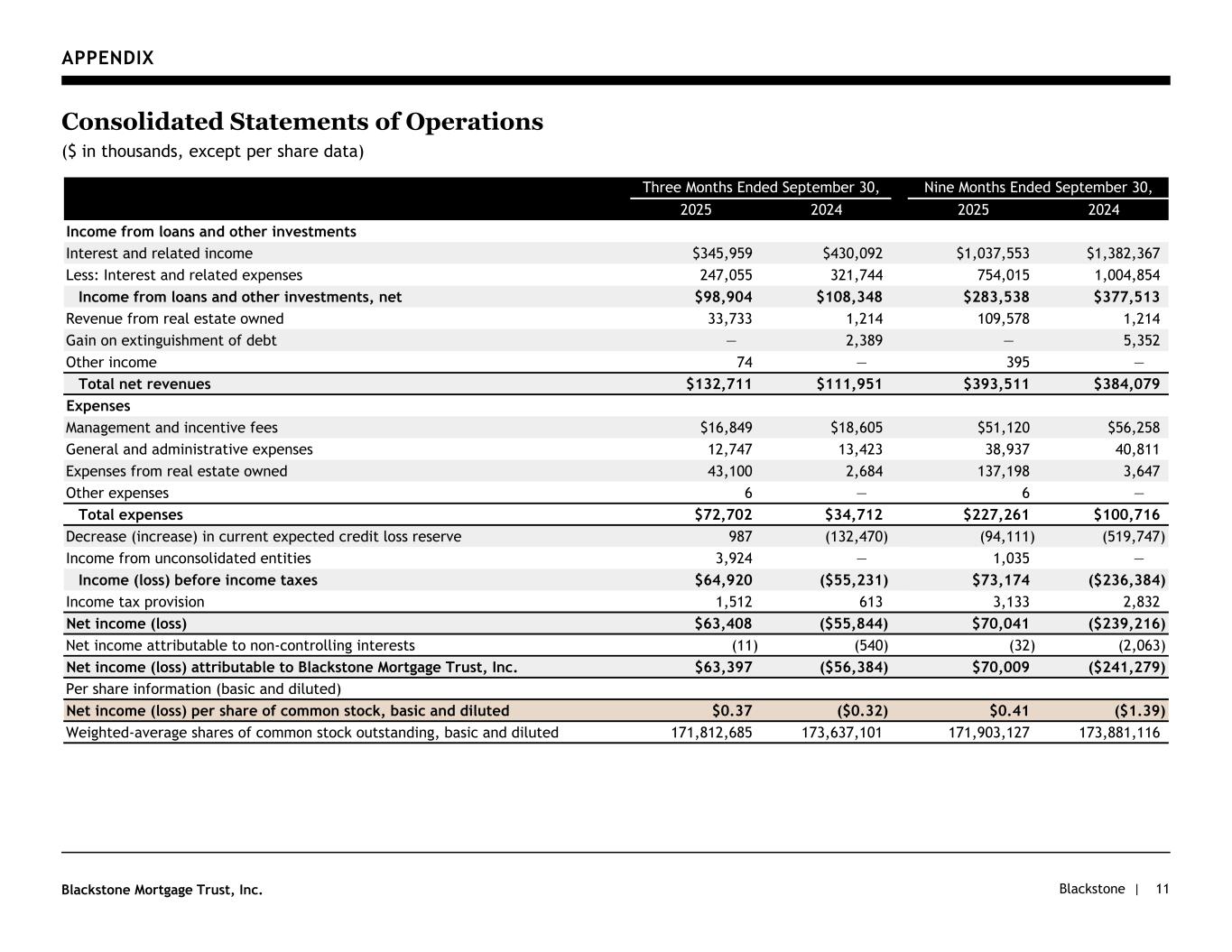

Blackstone |Blackstone Mortgage Trust, Inc. APPENDIX 11 Consolidated Statements of Operations ($ in thousands, except per share data) nice 2025 2024 2025 2024 Income from loans and other investments Interest and related income $345,959 $430,092 $1,037,553 $1,382,367 Less: Interest and related expenses 247,055 321,744 754,015 1,004,854 Income from loans and other investments, net $98,904 $108,348 $283,538 $377,513 Revenue from real estate owned 33,733 1,214 109,578 1,214 Gain on extinguishment of debt — 2,389 — 5,352 Other income 74 — 395 — Total net revenues $132,711 $111,951 $393,511 $384,079 Expenses Management and incentive fees $16,849 $18,605 $51,120 $56,258 General and administrative expenses 12,747 13,423 38,937 40,811 Expenses from real estate owned 43,100 2,684 137,198 3,647 Other expenses 6 — 6 — Total expenses $72,702 $34,712 $227,261 $100,716 Decrease (increase) in current expected credit loss reserve 987 (132,470) (94,111) (519,747) Income from unconsolidated entities 3,924 — 1,035 — Income (loss) before income taxes $64,920 ($55,231) $73,174 ($236,384) Income tax provision 1,512 613 3,133 2,832 Net income (loss) $63,408 ($55,844) $70,041 ($239,216) Net income attributable to non-controlling interests (11) (540) (32) (2,063) Net income (loss) attributable to Blackstone Mortgage Trust, Inc. $63,397 ($56,384) $70,009 ($241,279) Per share information (basic and diluted) Net income (loss) per share of common stock, basic and diluted $0.37 ($0.32) $0.41 ($1.39) Weighted-average shares of common stock outstanding, basic and diluted 171,812,685 173,637,101 171,903,127 173,881,116 Three Months Ended September 30, Nine Months Ended September 30,

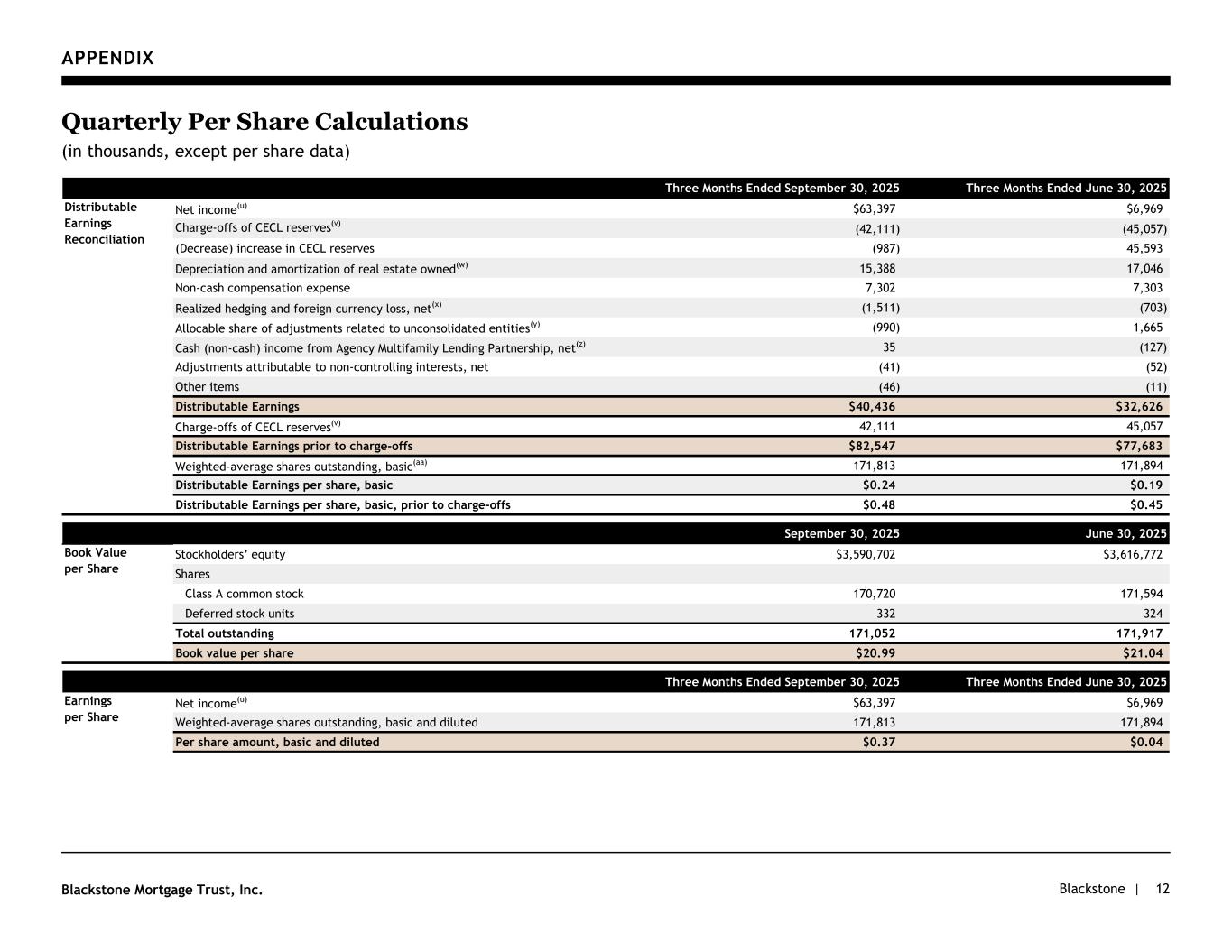

Blackstone |Blackstone Mortgage Trust, Inc. APPENDIX 12 Quarterly Per Share Calculations (in thousands, except per share data) Three Months Ended September 30, 2025 Three Months Ended June 30, 2025 Net income(u) $63,397 $6,969 Charge-offs of CECL reserves(v) (42,111) (45,057) (Decrease) increase in CECL reserves (987) 45,593 Depreciation and amortization of real estate owned(w) 15,388 17,046 Non-cash compensation expense 7,302 7,303 Realized hedging and foreign currency loss, net(x) (1,511) (703) Allocable share of adjustments related to unconsolidated entities(y) (990) 1,665 Cash (non-cash) income from Agency Multifamily Lending Partnership, net(z) 35 (127) Adjustments attributable to non-controlling interests, net (41) (52) Other items (46) (11) Distributable Earnings $40,436 $32,626 Charge-offs of CECL reserves(v) 42,111 45,057 Distributable Earnings prior to charge-offs $82,547 $77,683 Weighted-average shares outstanding, basic(aa) 171,813 171,894 Distributable Earnings per share, basic $0.24 $0.19 Distributable Earnings per share, basic, prior to charge-offs $0.48 $0.45 September 30, 2025 June 30, 2025 Stockholders’ equity $3,590,702 $3,616,772 Shares Class A common stock 170,720 171,594 Deferred stock units 332 324 Total outstanding 171,052 171,917 Book value per share $20.99 $21.04 Three Months Ended September 30, 2025 Three Months Ended June 30, 2025 Net income(u) $63,397 $6,969 Weighted-average shares outstanding, basic and diluted 171,813 171,894 Per share amount, basic and diluted $0.37 $0.04 Distributable Earnings Reconciliation Book Value per Share Earnings per Share

Blackstone |Blackstone Mortgage Trust, Inc. DEFINITIONS 13 Bank Loan Portfolio JV: A joint venture BXMT entered into with a Blackstone-advised investment vehicle in June 2025 to acquire portfolios of performing commercial mortgage loans. BXMT’s equity interest in the joint venture is included in investments in unconsolidated entities on BXMT’s balance sheet. Distributable Earnings: Blackstone Mortgage Trust, Inc. (“BXMT”) discloses Distributable Earnings in this presentation. Distributable Earnings is a financial measure that is calculated and presented on the basis of methodologies other than in accordance with generally accepted accounting principles in the United States of America (“GAAP”). Distributable Earnings is a non-GAAP measure, which is defined as GAAP net income (loss), including realized gains and losses not otherwise recognized in current period GAAP net income (loss), and excluding (i) non-cash equity compensation expense, (ii) depreciation and amortization, (iii) unrealized gains (losses), and (iv) certain non-cash items. Distributable Earnings may also be adjusted from time to time to exclude one-time events pursuant to changes in GAAP and certain other non-cash charges as determined by BXMT’s manager, subject to approval by a majority of its independent directors. Distributable Earnings mirrors the terms of BXMT’s management agreement between BXMT’s Manager and BXMT, for purposes of calculating its incentive fee expense. BXMT’s CECL reserves have been excluded from Distributable Earnings consistent with other unrealized gains (losses) pursuant to its existing policy for reporting Distributable Earnings. BXMT expects to only recognize such potential credit losses in Distributable Earnings if and when such amounts are realized and deemed non-recoverable upon a realization event. This is generally at the time a loan is repaid, or in the case of foreclosure, when the underlying asset is sold, but realization and non-recoverability may also be concluded if, in BXMT’s determination, it is nearly certain that all amounts due will not be collected. The timing of any such credit loss realization in BXMT’s Distributable Earnings may differ materially from the timing of CECL reserves or charge-offs in BXMT’s consolidated financial statements prepared in accordance with GAAP. The realized loss amount reflected in Distributable Earnings will equal the difference between the cash received, or expected to be received, and the book value of the asset, and is reflective of its economic experience as it relates to the ultimate realization of the loan. BXMT believes that Distributable Earnings provides meaningful information to consider in addition to net income (loss) and cash flow from operating activities determined in accordance with GAAP. BXMT believes Distributable Earnings is a useful financial metric for existing and potential future holders of its class A common stock as historically, over time, Distributable Earnings has been a strong indicator of its dividends per share. As a REIT, BXMT generally must distribute annually at least 90% of its net taxable income, subject to certain adjustments, and therefore BXMT believes its dividends are one of the principal reasons stockholders may invest in BXMT’s class A common stock. Distributable Earnings helps BXMT to evaluate its performance excluding the effects of certain transactions and GAAP adjustments that BXMT believes are not necessarily indicative of BXMT’s current loan portfolio and operations and is a performance metric BXMT considers when declaring its dividends. Furthermore, BXMT believes it is useful to present Distributable Earnings prior to charge-offs of CECL reserves to reflect BXMT’s direct operating results and help existing and potential future holders of BXMT’s class A common stock assess the performance of BXMT’s business excluding such charge-offs. BXMT utilizes Distributable Earnings prior to charge-offs of CECL reserves as an additional performance metric to consider when declaring BXMT’s dividends. Distributable Earnings mirrors the terms of BXMT’s Management Agreement for purposes of calculating BXMT’s incentive fee expense. Therefore, Distributable Earnings prior to charge-offs of CECL reserves is calculated net of the incentive fee expense that would have been recognized if such charge-offs had not occurred. Distributable Earnings and Distributable Earnings prior to charge-offs of CECL reserves are non-GAAP measures. BXMT defines Distributable Earnings as GAAP net income (loss), including realized gains and losses not otherwise recognized in current period GAAP net income (loss), and excluding (i) non-cash equity compensation expense, (ii) depreciation and amortization, (iii) unrealized gains (losses), and (iv) certain non-cash items. Distributable Earnings may also be adjusted from time to time to exclude one-time events pursuant to changes in GAAP and certain other non-cash charges as determined by BXMT’s Manager, subject to approval by a majority of BXMT’s independent directors. Distributable Earnings mirrors the terms of BXMT’s management agreement between its Manager and BXMT, or BXMT’s Management Agreement, for purposes of calculating BXMT’s incentive fee expense. Therefore, Distributable Earnings prior to charge-offs of CECL reserves is calculated net of the incentive fee expense that would have been recognized if such charge-offs had not occurred. Net Lease JV: A joint venture BXMT entered into with a Blackstone-advised investment vehicle in 2024 to acquire triple net lease properties. BXMT’s 75% equity interest in the joint venture is included in investments in unconsolidated entities on BXMT’s balance sheet. Net Loan Exposure: Represents the principal balance of loans that are included in BXMT’s consolidated financial statements, net of (i) asset-specific debt, (ii) participations sold, (iii) cost-recovery proceeds, and (iv) CECL reserves on its loans receivable. Does not include REO assets or investments in unconsolidated entities.

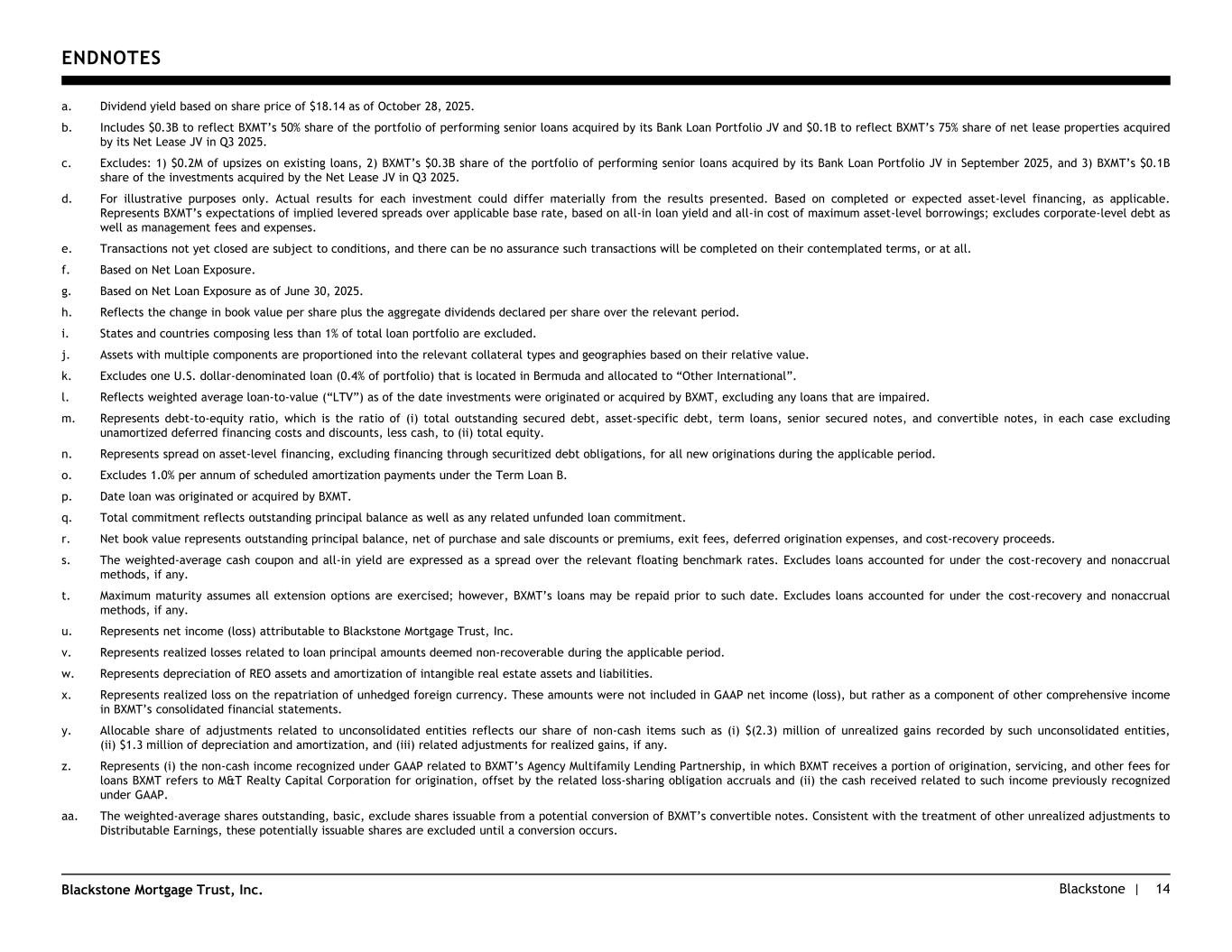

Blackstone |Blackstone Mortgage Trust, Inc. ENDNOTES 14 a. Dividend yield based on share price of $18.14 as of October 28, 2025. b. Includes $0.3B to reflect BXMT’s 50% share of the portfolio of performing senior loans acquired by its Bank Loan Portfolio JV and $0.1B to reflect BXMT’s 75% share of net lease properties acquired by its Net Lease JV in Q3 2025. c. Excludes: 1) $0.2M of upsizes on existing loans, 2) BXMT’s $0.3B share of the portfolio of performing senior loans acquired by its Bank Loan Portfolio JV in September 2025, and 3) BXMT’s $0.1B share of the investments acquired by the Net Lease JV in Q3 2025. d. For illustrative purposes only. Actual results for each investment could differ materially from the results presented. Based on completed or expected asset-level financing, as applicable. Represents BXMT’s expectations of implied levered spreads over applicable base rate, based on all-in loan yield and all-in cost of maximum asset-level borrowings; excludes corporate-level debt as well as management fees and expenses. e. Transactions not yet closed are subject to conditions, and there can be no assurance such transactions will be completed on their contemplated terms, or at all. f. Based on Net Loan Exposure. g. Based on Net Loan Exposure as of June 30, 2025. h. Reflects the change in book value per share plus the aggregate dividends declared per share over the relevant period. i. States and countries composing less than 1% of total loan portfolio are excluded. j. Assets with multiple components are proportioned into the relevant collateral types and geographies based on their relative value. k. Excludes one U.S. dollar-denominated loan (0.4% of portfolio) that is located in Bermuda and allocated to “Other International”. l. Reflects weighted average loan-to-value (“LTV”) as of the date investments were originated or acquired by BXMT, excluding any loans that are impaired. m. Represents debt-to-equity ratio, which is the ratio of (i) total outstanding secured debt, asset-specific debt, term loans, senior secured notes, and convertible notes, in each case excluding unamortized deferred financing costs and discounts, less cash, to (ii) total equity. n. Represents spread on asset-level financing, excluding financing through securitized debt obligations, for all new originations during the applicable period. o. Excludes 1.0% per annum of scheduled amortization payments under the Term Loan B. p. Date loan was originated or acquired by BXMT. q. Total commitment reflects outstanding principal balance as well as any related unfunded loan commitment. r. Net book value represents outstanding principal balance, net of purchase and sale discounts or premiums, exit fees, deferred origination expenses, and cost-recovery proceeds. s. The weighted-average cash coupon and all-in yield are expressed as a spread over the relevant floating benchmark rates. Excludes loans accounted for under the cost-recovery and nonaccrual methods, if any. t. Maximum maturity assumes all extension options are exercised; however, BXMT’s loans may be repaid prior to such date. Excludes loans accounted for under the cost-recovery and nonaccrual methods, if any. u. Represents net income (loss) attributable to Blackstone Mortgage Trust, Inc. v. Represents realized losses related to loan principal amounts deemed non-recoverable during the applicable period. w. Represents depreciation of REO assets and amortization of intangible real estate assets and liabilities. x. Represents realized loss on the repatriation of unhedged foreign currency. These amounts were not included in GAAP net income (loss), but rather as a component of other comprehensive income in BXMT’s consolidated financial statements. y. Allocable share of adjustments related to unconsolidated entities reflects our share of non-cash items such as (i) $(2.3) million of unrealized gains recorded by such unconsolidated entities, (ii) $1.3 million of depreciation and amortization, and (iii) related adjustments for realized gains, if any. z. Represents (i) the non-cash income recognized under GAAP related to BXMT’s Agency Multifamily Lending Partnership, in which BXMT receives a portion of origination, servicing, and other fees for loans BXMT refers to M&T Realty Capital Corporation for origination, offset by the related loss-sharing obligation accruals and (ii) the cash received related to such income previously recognized under GAAP. aa. The weighted-average shares outstanding, basic, exclude shares issuable from a potential conversion of BXMT’s convertible notes. Consistent with the treatment of other unrealized adjustments to Distributable Earnings, these potentially issuable shares are excluded until a conversion occurs.

Blackstone |Blackstone Mortgage Trust, Inc. FORWARD-LOOKING STATEMENTS & IMPORTANT DISCLOSURE INFORMATION 15 References herein to “Blackstone Mortgage Trust,” “Company,” “we,” “us,” or “our” refer to Blackstone Mortgage Trust, Inc. and its subsidiaries unless the context specifically requires otherwise. Opinions expressed reflect the current opinions of BXMT as of the date appearing in this document only and are based on the BXMT's opinions of the current market environment, which is subject to change. There can be no assurances that any of the trends described herein will continue or will not reverse. Past events and trends do not imply, predict or guarantee, and are not necessarily indicative of, future events or results. This presentation may contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which reflect BXMT’s current views with respect to, among other things, its operations and financial performance, its business plans and the impact of the current macroeconomic environment, including interest rate changes. You can identify these forward-looking statements by the use of words such as “outlook,” “objective,” “indicator,” “believes,” “expects,” “potential,” “continues,” “may,” “will,” “should,” “seeks,” “predicts,” “intends,” “plans,” “estimates,” “anticipates” or the negative version of these words or other comparable words. Such forward-looking statements are subject to various risks and uncertainties. Accordingly, there are or will be important factors that could cause actual outcomes or results to differ materially from those indicated in these statements. BXMT believes these factors include but are not limited to those described under the section entitled “Risk Factors” in its Annual Report on Form 10-K for the fiscal year ended December 31, 2024, as such factors may be updated from time to time in its periodic filings with the Securities and Exchange Commission (“SEC”) which are accessible on the SEC’s website at www.sec.gov. These factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included in this presentation and in the filings. BXMT assumes no obligation to update or supplement forward-looking statements that become untrue because of subsequent events or circumstances.