UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ | Preliminary Proxy Statement |

☐ | Confidential, For Use of the Commission Only (as Permitted by Rule 14a-6(e)(2)) |

☒ | Definitive Proxy Statement |

☐ | Definitive Additional Materials |

☐ | Soliciting Material Pursuant to §240.14a-12 |

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☒ | No fee required. |

☐ | Fee paid previously with preliminary materials. |

☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

David Simon

Chairman of the Board,

Chief Executive Officer and

President

April 1, 2025

Dear Fellow Shareholders,

Please join me and the Board of Directors at our 2025 Annual Meeting of Shareholders on May 14, 2025, at 8:30 a.m. Eastern Daylight Time at our headquarters in Indianapolis, Indiana. The business to be conducted at the meeting is explained in the attached Notice of Annual Meeting and Proxy Statement.

I am very pleased with our 2024 results; it was another successful, record-breaking year for the Company. Our team has been hard at work continuing their efforts at redefining the shopping experience and differentiating our Company as we deliver our unique-to-market properties.

We are driving value through our investments in physical assets and ability to curate the right mix of experiences at our properties. We are excited for the opportunities that lay ahead across all of our operating platforms.

Recently, we held our National Conference, in our hometown of Indianapolis, Indiana. More than 1,000 employees participated for three days. The central theme of the conference was “Now. New. Next.” and it was truly inspirational to see the next generation of leadership engage on revolutionizing the Now, introducing the New and imagining the Next.

Whether or not you plan to attend the 2025 Annual Meeting in person, please read the Proxy Statement and vote your shares. Instructions for voting by mail, Internet and telephone are included in your Notice of Internet Availability of Proxy Materials or proxy card (if you receive your materials by mail). We are pleased to furnish proxy materials to our shareholders over the Internet. We believe that this e-proxy process expedites shareholders’ receipt of proxy materials, while also lowering the costs. We hope that after you have reviewed the Proxy Statement you will vote in accordance with the Board’s recommendations.

Our 2024 Annual Report to Shareholders accompanies, but is not part of, or incorporated into, this Proxy Statement.

Sincerely,

David Simon

WHEN |

Wednesday, May 14, 2025 |

8:30 a.m. Eastern Daylight Time |

WHERE |

Simon Property Group |

RECORD DATE |

Shareholders of record at the |

Notice of 2025 Annual Meeting of Shareholders

Dear Fellow Shareholders:

I invite you to attend the 2025 Annual Meeting of Shareholders of Simon Property Group at 8:30 a.m. Eastern Daylight Time on Wednesday, May 14, 2025. Our Annual Meeting will be held at Simon Property Group Headquarters, 225 W. Washington St., Indianapolis, IN 46204.

The following items of business will be conducted at our 2025 Annual Meeting of Shareholders:

ITEMS OF BUSINESS | ||

1 | Elect 13 directors to our Board of Directors, including 3 directors to be elected by the voting trustees who vote the Class B common stock, to serve until the next Annual Meeting of our Shareholders and until their successors are duly elected and qualified | |

2 | Advisory vote to approve the compensation of our Named Executive Officers | |

3 | Ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for 2025 | |

4 | To approve the Redomestication of the Company to the State of its headquarters, Indiana, by Conversion | |

5 | Other business as may properly come before the meeting or any adjournments or postponements of the meeting | |

By Order of the Board of Directors,

Steven E. Fivel

General Counsel and Secretary

April 1, 2025

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Shareholders to be held on May 14, 2025. This Proxy Statement and accompanying form of Proxy are first being made available to you on or about April 1, 2025. Proxy materials are available at proxyvote.com. Please be aware that our 2024 Annual Report to Shareholders accompanies, but is not a part of, or incorporated into, this Proxy Statement.

Table of Contents

61 | ||

61 | ||

63 | ||

64 | ||

66 | ||

66 | ||

68 | Estimated Post-Employment Payments Under Alternative Termination Scenarios | |

70 | ||

72 | ||

73 | ||

77 | ||

78 | Proposal 3: Ratification of Independent Registered Public Accounting Firm | |

79 | ||

82 | Proposal 4: Approval of the Redomestication of the Company to the State of Indiana by Conversion | |

82 | ||

87 | ||

91 | ||

94 | ||

109 | ||

112 | ||

113 | ||

114 | ||

115 | ||

115 | ||

116 | ||

116 | ||

117 | ||

117 | ||

118 | ||

A-1 | ||

B-1 | ||

C-1 | ||

D-1 | ||

E-1 | ||

F-1 |

Proxy Summary

This Proxy Statement and accompanying proxy card are being made available to shareholders on or about April 1, 2025, in connection with the solicitation by the Board of Directors (the “Board”) of Simon Property Group, Inc. (“Simon Property Group”, “Simon”, “SPG”, “we”, “us”, “our” or the “Company”) of proxies to be voted at the 2025 Annual Meeting of Shareholders (the “2025 Annual Meeting”) to be held at the corporate headquarters of the Company located at 225 W. Washington Street, Indianapolis, Indiana 46204 on May 14, 2025, at 8:30 a.m. Eastern Daylight Time. As required by rules adopted by the U.S. Securities and Exchange Commission (the “SEC”), the Company is making this Proxy Statement and its 2024 Annual Report to Shareholders (which includes our Form 10-K for the fiscal year ended December 31, 2024) (the “Annual Report”) available to shareholders electronically via the Internet. In addition, SPG is using the SEC’s “Notice and Access” rules to provide shareholders with more options for receipt of these materials. Accordingly, on April 1, 2025, the Company will begin mailing the Notice of Internet Availability of Proxy Materials (the “Notice”) to shareholders which will contain instructions on how to access this Proxy Statement and the Annual Report via the Internet, how to vote online, by QR code, or by telephone, and how to receive paper copies of the documents and a proxy card.

This proxy summary highlights information which may be contained elsewhere in this Proxy Statement. This summary does not contain all of the information that you should consider, and you should read the entire Proxy Statement carefully before voting. Page references are supplied to help you find further information in this Proxy Statement.

Proposals Submitted for Your Vote at the 2025 Annual Meeting

PROPOSAL |

| BOARD RECOMMENDATION |

Proposal 1 |

Vote “FOR” Each of the Directors | |

Proposal 2 |

Vote “FOR” this | |

Proposal 3 |

Vote “FOR” this | |

Proposal 4 |

Vote “FOR” this |

2025 PROXY STATEMENT | SIMON PROPERTY GROUP 1 |

2024 Financial and Business Highlights

This summary provides highlights of select Company financial and performance information. For more complete information regarding the Company’s 2024 performance, you should review the Company’s Annual Report on Form 10-K for the year ended December 31, 2024, filed with the SEC on February 21, 2025, and Current Report on Form 8-K furnished to the SEC on February 4, 2025. Simon Property Group had a very successful and productive year in 2024. ● Net Income attributable to common shareholders increased by 3.9% to $2.368 billion, or $7.26 per diluted share as compared to $2.280 billion, or $6.98 per diluted share, in 2023. ● Consolidated Net Income increased 4.3% to $2.729 billion. ● Generated funds from operations (“FFO”) of $4.877 billion or $12.99 per diluted share, and real estate FFO of $4.597 billion or $12.24 per diluted share. ● Portfolio net operating income (“NOI”), which includes NOI from international properties at constant currency, increased 4.6% compared to the prior year. ● Common stock cash dividends of $8.10 per share paid in 2024, an 8.7% increase over the amount in 2023, returning over $3 billion to shareholders in cash dividends. Please see “Where Do I Find Reconciliation of Non-GAAP Terms to GAAP Terms?” in the section of this Proxy Statement titled “Frequently Asked Questions and Answers” on page122. | |

FFO PER DILUTED SHARE |

| DIVIDENDS PER SHARE |

| CONSOLIDATED REVENUE |

|

|

|

2 2025 PROXY STATEMENT | SIMON PROPERTY GROUP |

2024 Financial and Business Highlights

|

|

|

|

|

|

|

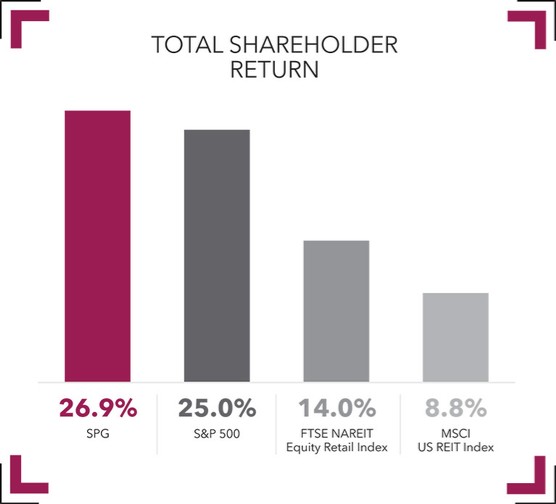

26.9% | $3B | 5,500 Leases | $58.26/sq. ft. | |||

2024 | Returned to | Were signed for more | U.S. Malls and Premium | |||

|

|

|

| |||

$739/sq. ft. | 96.5% | $11B | 17 | |||

In average Retailer Sales | Occupancy | Capital raised in 2024 for | New Development and |

2025 PROXY STATEMENT | SIMON PROPERTY GROUP 3 |

Board Shareholder Engagement

DIRECT ENGAGEMENT BY INDEPENDENT MEMBERS OF BOARD – | |||

● Leading up to our 2024 Annual Meeting, independent members of the Board engaged with twenty-one separate shareholders representing approximately 52% of our common shares outstanding as well as with other key stakeholders. ● Following the meeting, through the remainder of 2024 and into 2025, we reached out to twenty-five of our largest shareholders, offering to discuss the Company’s 2024 Annual Meeting results, governance and executive compensation matters and other topics of the shareholders’ choosing. This resulted in direct engagement with eight of our largest shareholders, representing more than 30% of our common shares outstanding by independent members of our Board or members of management. ● This ongoing exchange informs our Board’s meeting agendas and contributes to governance and disclosure enhancements that help us address the issues our shareholders and key stakeholders tell us matter most to them. | |||

IMPORTANCE OF BOARD ENGAGEMENT – | |||

● This Board engagement process is an important part of how we drive progress on our corporate governance objectives and our compensation, human capital and other sustainability initiatives. ● Importantly, this engagement process assists us in achieving our strategic objectives of creating long-term value, maintaining our culture of compliance and contributing to the continued growth and performance of the Company. ● Specifically, the engagement with shareholders by our independent members of the Board directly informed the work undertaken by independent members of the Board in designing and implementing the Amended and Restated Other Platform Investment Incentive Program (the “A&R OPI Program”) in response to shareholder feedback leading up to the 2023 Annual Meeting. See—A&R OPI Program – 2024 OPI Awards” on page 54 for details of our A&R OPI Program. | |||

Shareholder Engagements in 2024

ANNUAL OUTREACH |

|

| ENGAGEMENT |

|

| ENGAGEMENT SUCCESS RATIO |

|

|

|

4 2025 PROXY STATEMENT | SIMON PROPERTY GROUP |

Comprehensive Engagement Program

Board Activity | Shareholder Input | Year-Round Engagement | |||||

● Our Board assesses and monitors investor sentiment, shareholder voting results and trends in governance, executive compensation, human capital management, regulatory, sustainability and other matters. |

| ● The Board’s ongoing process of continually working to enhance governance and other practices is informed by Shareholder input and feedback. ● Senior Management and the Board review shareholder input to identify consistent themes and evaluate any issues or concerns. |

| ● Members of the Board participated in a series of meetings with shareholders of the Company leading up to and following our 2024 Annual Meeting. |

CORPORATE GOVERNANCE HIGHLIGHTS

Simon’s Board is committed to good corporate governance that promotes the long-term interests of shareholders, including oversight of management’s identification, assessment and mitigation of enterprise risks to which the Company is susceptible.

We believe that our Board membership is both balanced and broad in experience, qualifications, skills, professional background, perspectives, and expertise and that the range of tenures of our directors creates a synergy between institutional knowledge and new perspectives.

● 100% of Directors elected by vote of common shares are independent and 77% of our Board is independent. ● No hedging or pledging of our securities. ● Each Director attended at least 75% of applicable Board and Board committee meetings. ● All Directors are in compliance with our stock ownership guidelines. ● No related party transactions involving any independent directors. |

● Annual Board evaluation process involving Board and Board committee performance assessments; overseen by the chair of our Governance and Nominating Committee (“G&N Committee”) and our Lead Independent Director. ● Our mix of Director tenure, skills and background provides a balance of experience and institutional knowledge with fresh perspectives. ● Our average independent director tenure has been reduced from 11.4 years in 2021 to 9.2 years in 2025. | ||||

● Views active, objective, independent oversight of management as central to effective Board governance. ● Lead Independent Director role with significant authority and responsibilities. ● The Lead Independent Director is joined by independent directors with broad-based experience, and a Chair who, as CEO, serves as the primary voice to articulate the Company’s long-term objectives and strategic performance. |

● All Directors are required to stand for election annually. ● No shareholder rights plan. ● Independent Director approval required for material actions and transactions involving the Simon Family Group. | ||||

● Our Independent directors meet privately in executive session on a regular basis without our Chair and CEO or other members of management present, meeting 5 times in 2024. ● Our Board formally reviews CEO and senior management succession at least annually and assesses candidates during Board and committee meetings and in less formal settings. ● Board and Board committees charged with oversight of: o Cybersecurity o Enterprise risk management o Strategy o Succession planning |

● Financial governance: Evidenced by A-/A3 credit ratings by S&P/Moody’s. ● Operational governance: Annual enterprise level risk analyses with Board; rigorous investment and financial approval committee processes; field and property team-level management. ● Employee governance: Extensive employee learning and development platform requiring ethics, cybersecurity and other training. |

2025 PROXY STATEMENT | SIMON PROPERTY GROUP 5 |

BOARD REFRESHMENT AND COMPOSITION

Independent Director Nominee Tenure

0-7 Years | 8-12 Years | 12+ Years | ||||||

|

|

|

|

|

|

77% | 40% | |

of our Board is | of nominated independent directors | |

|

| |

8.5 years | 60% | |

is the median tenure of nominated | of nominated independent directors |

6 2025 PROXY STATEMENT | SIMON PROPERTY GROUP |

Corporate Governance

Board Leadership

Together, our CEO and Lead Independent Director deliver clear leadership, effective decision-making, and a cohesive corporate strategy for the Company. | |||

| David Simon Chairman of the Board, Chief Executive Officer and President Mr. David Simon has served since 2007 as the Chairman of the Board (“Chairman”) and Chief Executive Officer (“CEO”) and since February 15, 2019, also as our President. The Board believes that having Mr. David Simon fill these leadership roles is an appropriate and efficient leadership structure. | ||

| Larry C. Glasscock Lead Independent Director Larry C. Glasscock serves as our Lead Independent Director. The Lead Independent Director has robust and well-defined duties specified in the Governance Principles described below and such other duties as are assigned from time to time by the independent directors of the Board. We believe that our Lead Independent Director is performing his duties in an effective manner. | ||

Lead Independent Director Duties and Responsibilities

Under our Governance Principles, the Lead Independent Director is empowered to:

Preside at all Board meetings when Chairman is not present, including executive sessions of the independent directors | Serve as a liaison between the Chairman and the independent directors, including by facilitating communication and sharing of views between the independent directors and the Chairman | Approve materials sent to the Board and advise on such information | ||

Approve meeting agendas for the Board and coordinate with the Chairman with respect to developing such agendas | Approve Board meeting schedules to assure sufficient agenda item discussion time and coordinate with the Chairman to develop such schedules | Call meetings of the independent directors |

Ensure that he or she is available for consultation if requested by major shareholders, and direct communication | Retain outside advisors and consultants to report directly to the Board on Board-wide matters |

CORPORATE GOVERNANCE

Meetings and Committees of the Board

Meetings and Attendance

Our business, property and affairs are managed under the direction of our Board. Members of our Board are kept informed of our business through discussions with our Chairman and CEO, other executive officers, and our Lead Independent Director, by reviewing materials provided to them concerning the business, by visiting our offices and properties, and by participating in meetings of the Board and its committees. Directors are also expected to use reasonable efforts to attend the Annual Meeting of Shareholders.

All of our directors attended the 2024 Annual Meeting. During 2024, the Board met seven times, including four in-person meetings and three video conference meetings. Our independent directors meet privately in executive session on a regular basis without our Chair and CEO or other members of management present, and held 5 such executive sessions in 2024. All of our directors participated in at least 75% of the aggregate number of meetings of the Board and the committees on which they served in 2024.

During 2024, the independent directors met in executive session without management present in connection with each regularly scheduled Board meeting, in person for four meetings. The Lead Independent Director presided over all of these meetings. The Board’s Lead Independent Director is appointed by the independent members of the Board, and the responsibilities of the Lead Independent Director are discussed in “Board Leadership” in the “Corporate Governance” section of this Proxy Statement on page 7.

2024 Committee Meeting Attendance

|

| COMPENSATION AND |

| GOVERNANCE AND | BOARD |

| |||

AUDIT | HUMAN CAPITAL | NOMINATING | OF DIRECTORS | >75% attendance at Board meetings in 2024 | |||||

Number of Meetings | 9 | 8 | 5 | 7 | |||||

G. Aeppel | 5 | 7 | |||||||

L. Glasscock | 9 | 5 | 7 | ||||||

A. Hubbard1 | 8 | 5 | 7 | ||||||

N. Jones | 72 | 7 | |||||||

R. Leibowitz | 9 | 8 | 7 | ||||||

R. Lewis | 9 | 6 | |||||||

G. Rodkin | 5 | 7 | |||||||

P. Roe | 5 | 7 | |||||||

S. Selig | 8 | 7 | 7 | ||||||

D. Smith | 8 | 7 | |||||||

M. Stewart | 9 | 6 | |||||||

D. Simon | 5 | ||||||||

R. Sokolov | 6 | ||||||||

E. Simon | 23 |

1 A. Hubbard will be retiring from the Board of Directors, effective May 14, 2025.

2 N. Jones was appointed to the Audit Committee on February 8, 2024.

3 E. Simon was appointed to the Board of Directors effective May 29, 2024.

CORPORATE GOVERNANCE

The Board Believes that its Members Should:

| ● | exhibit high standards of independent judgment and integrity; |

| ● | have broad and varied experiences and backgrounds; |

| ● | have a strong record of achievements; |

| ● | have an understanding of our business and the competitive environment in which we operate; and |

| ● | be committed to enhancing shareholder value on a long-term basis and have sufficient time to carry out their duties. |

In addition, the Board has determined that the Board, as a whole, should strive to have the right mix of experience, characteristics, talent and skills necessary to effectively perform its oversight responsibilities. Four of the independent director nominees are female and six are male. The Board believes that the professional skills and experiences set forth in the matrix below are important, and when carrying out its board refreshment strategy looks for independent director candidates who have skills and experience that complement those of the existing directors.

Director Characteristics, Skills and Experience Matrix

G. AEPPEL | L. GLASSCOCK | N. JONES | R. LEIBOWITZ | R. LEWIS | G. RODKIN | P. ROE | S. SELIG | D. SMITH | M. STEWART | D. SIMON | R. SOKOLOV | E. SIMON | ||||||||||||||

Skills and Experience | ||||||||||||||||||||||||||

Financial/Accounting Literacy | · | · | · | · | · | · | · | · | · | · | · | · | ||||||||||||||

Capital Markets Experience | · | · | · | · | · | · | · | · | · | · | ||||||||||||||||

Real Estate Development / Management Experience | · | · | · | · | · | · | · | · | ||||||||||||||||||

Executive Leadership | · | · | · | · | · | · | · | · | · | · | · | · | ||||||||||||||

Risk Management | · | · | · | · | · | · | · | · | · | · | · | |||||||||||||||

Marketing / Brand Management / Consumer Focus | · | · | · | · | · | · | · | |||||||||||||||||||

Retail Distribution | · | · | · | · | · | · | ||||||||||||||||||||

Technology | · | · | · | · | · | |||||||||||||||||||||

Human Capital Management | · | · | · | · | · | · | · | |||||||||||||||||||

International Business Experience | · | · | · | · | · | · | · | · | · | |||||||||||||||||

Public Policy / Government Experience | · | |||||||||||||||||||||||||

Corporate Governance | · | · | · | · | · | · | · | · | · | · | · | |||||||||||||||

Sustainability | · | · | · | · |

CORPORATE GOVERNANCE

Policies on Corporate Governance

The Board has adopted thoughtful and practical governance practices and processes and implemented a number of measures designed to enrich the quality of composition, enhance independent oversight, and increase its effectiveness. These measures align our corporate governance structure with achieving our strategic objectives, and facilitate our Board’s independent oversight of our culture of compliance and rigorous risk management. Good corporate governance is important to ensure that the Company is managed for the long-term benefit of its shareholders and to enhance the creation of long-term shareholder value. Each year, the G&N Committee reviews our Governance Principles, which are available at governanceprinciples.simon.com, and recommends to the Board any suggested modifications. Also, the Audit Committee obtains reports from management and the leader of the Company’s Audit Services function confirming that the Company and its subsidiaries are operating in conformity with the Company’s Code of Business Conduct and Ethics, which can be found at codeofconduct.simon.com, and advises the Board with respect to the Company’s policies and procedures regarding compliance with the Company’s Code of Business Conduct and Ethics. In addition, each of the Board’s standing committees reviews its written charter on an annual basis to consider whether any changes are required. These charters are located on our website at committeecomposition.simon.com. In addition to clicking on the preceding links, the current version of each of these documents is available by visiting www.simon.com and navigating to “Governance” by clicking on “Investors,” or by requesting a printed copy without charge upon written request to our Secretary at 225 W. Washington Street, Indianapolis, Indiana 46204.

We will also either disclose on Form 8-K and/or post on our Internet website any substantive amendment to, or waiver from, a provision of the Code of Business Conduct and Ethics that applies to any of our directors or executive officers.

| ● | Our Governance Principles provide that all candidates for election as members of the Board should possess high personal and professional ethics, integrity and values and be committed to representing the long-term interests of our shareholders and otherwise fulfilling the responsibilities of directors as described in our Governance Principles. |

| ● | Our Governance Principles further provide that if our directors simultaneously serve on more than four boards of public companies, including our Board, then the Board or G&N Committee must determine that serving on more than four public company boards does not impair the ability of the director to serve as an effective member of our Board. Currently, only one of our independent directors serves on more than one other public company board. We believe that each of our independent directors is able to devote the necessary time to meet their Board commitments to the Company. |

| ● | In recommending candidates to the Board for election as directors, the G&N Committee will consider the foregoing minimum qualifications as well as each candidate’s credentials, keeping in mind our desire, as stated in our Governance Principles, to have a Board representing varied experiences and backgrounds, as well as expertise in or knowledge of specific areas that are relevant to our business activities, including those set forth in our Director Skills and Experience Matrix on page 9. |

10 2025 PROXY STATEMENT | SIMON PROPERTY GROUP |

CORPORATE GOVERNANCE

Board Refreshment, Orientation and Education

Ongoing Evaluation and Continuous Review | 1 | ● Although we do not have term limits or a mandatory retirement age for our directors, we do believe that periodic board refreshment is beneficial. ● Evidencing our commitment to thoughtful refreshment, the G&N Committee regularly meets to evaluate the current composition of the Board and whether changes in such make-up may be advisable as well as identifying key characteristics to focus on in the event adding or replacing a director is necessary or advisable. ● Specific skills, experience and characteristics are discussed and evolve through the process so as to allow the G&N Committee to be prepared to make an informed recommendation for any opportunities to update the composition of the Board, all in furtherance of our Governance Principles. |

| ||

Search | 2 | ● The G&N Committee actively solicits recommendations and feedback from members of the Board as to general characteristics to target for possible new members of the Board as well as for any specific individuals who might make a compelling case should the opportunity arise. In addition, once there is a need for an addition to the Board or replacement of a departing member, the G&N Committee would engage a third-party search firm to assist in the process. ● When a possible need is identified, the G&N Committee is empowered to engage with third-party, executive search firms who work to tailor search parameters to the specific criteria from the G&N Committee, which they regularly review and update based on the circumstances driving the search. In addition, the G&N Committee regularly solicits information from all members of the Board on types of candidates to focus on as well as any specified individuals. The result is a dynamic process which is informed by the necessary experience and expertise of both current Board members and independent, third parties. |

| ||

Interview Process | 3 | ● All identified candidates are screened through a rigorous process, beginning with any applicable search firm, and interviewed by members of the G&N Committee, the Lead Independent Director, the Chief Executive Officer and other independent members of the Board and senior management. ● This process is intended to ensure that proposed candidates have the requisite tangible experience but also possess the interpersonal characteristics that are so important to maintaining the appropriate culture of our Board. |

| ||

Orientation and On-Boarding | 4 | ● All new directors participate in a director orientation program upon joining our Board, which includes a series of meetings with senior management representatives from all of our business and platform areas to review and discuss information about our company, industry, and operations. ● These meetings are informed by materials generated by management, specifically tailored to the individual characteristics, skills, experience and background of such candidate. ● This process provides invaluable exposure to, and familiarity with, members of senior management, which further enhances the ability to execute on the Board’s oversight mandate for the Company. ● Based on input from our directors, we believe this fulsome on-boarding approach, coupled with participation in regular Board and committee meetings, provides new directors with a strong foundation in our company’s businesses, connects directors with members of management with whom they will interact and oversee, and accelerates their effectiveness to engage fully in Board deliberations. |

| ||

Education | 5 | ● Director education is vital to the ability of directors to fulfill their roles and supports Board members in their continuous learning. ● The Board encourages directors to participate annually in external continuing director education programs. ● Our G&N Committee regularly updates members of the Board on current and ongoing educational offerings, and our company reimburses directors for their expenses associated with this participation. |

2025 PROXY STATEMENT | SIMON PROPERTY GROUP 11 |

CORPORATE GOVERNANCE

Management Succession Planning

| ● | The Board is responsible for ensuring we have a high-performing management team in place. The Board, with the assistance of the Compensation and Human Capital Committee (the “Compensation Committee”), regularly conducts a detailed review of management development and succession planning activities to ensure top management positions, including the CEO position, can be filled without undue interruption. This formal process is undertaken at least annually. In addition, the Board assesses candidates during Board and committee meetings and in less formal settings to allow directors to personally evaluate candidates. |

| ● | Our succession planning process has two tiers to facilitate orderly succession: |

| o | Emergency Succession Plan: The first tier contemplates succession planning in the case of an emergency during which one or more members of our current management are unable to perform their duties. |

| ◾ | Our Board has established and actively implemented steps to address emergency CEO planning in extraordinary circumstances. |

| ◾ | Our emergency CEO succession planning is intended to enable the Company to respond to unexpected position vacancies, including those resulting from major medical conditions, accidents or catastrophes, by continuing the Company’s safe and sound operation and minimizing potential disruption or loss of continuity to our Company’s business and operations. |

| ◾ | In the event of any such vacancy, the Board is prepared to effectuate all actions necessary to allow seamless transition of management and operations and communicate the same to all relevant stakeholders. |

| o | Long-Term Succession Plan: The second tier involves long-term planning to identify and develop talent with potential to step in as our future management team. |

| ◾ | As part of our longer-term succession planning, we continually evaluate changes to our organizational architecture to prepare the Company for the next chapter in its evolution. |

| ◾ | Executive roles are evaluated and reorganized to drive our operational and strategic initiatives while allowing for growth opportunities for the next generation of potential leaders. |

| ● | Our CEO regularly consults with the independent members of the Board and provides recommendations and evaluations of potential CEO successors and reviews their development progress. Our Board reviews potential internal senior and middle management candidates with our CEO and our Chief Administrative Officer (“CAO”) annually, including the qualifications, experience, and development priorities for these individuals as well as identified succession plans for each role and individual. Further, our Board, through reports from the Compensation Committee, periodically reviews the overall composition of our senior management’s qualifications, tenure, and experience. |

| ● | Stability and orderly transitions in senior management have been a hallmark of our success. Mr. David Simon, our Chairman, CEO and President, Mr. John Rulli, our CAO and Mr. Steven Fivel, our General Counsel, were all with the Company at our IPO in 1993 and have been in their respective positions for substantial durations. In June 2018, the Company promoted Mr. Brian McDade to Executive Vice President and Chief Financial Officer (“CFO”) after 14 years with the Company, and more recently, Mr. Eli Simon was elevated to Executive Vice President and Chief Investment Officer on March 20, 2025, reflecting his expanded role in overseeing the Company’s investment strategy. |

| ● | The Company has long been focused on repeating this cycle with our next generation, purposefully building a deep bench of management talent behind our C-suite. Given the complex nature of our business, we prefer to promote individuals from within who gain a long-term understanding of our business and exceed performance |

12 2025 PROXY STATEMENT | SIMON PROPERTY GROUP |

CORPORATE GOVERNANCE

| expectations. Accordingly, we place a high emphasis on building talent from within and developing internal pathways to top leadership positions. |

| ● | Evidence of this approach is tangible and reflected in the strong success we have had in retaining and promoting from within (time period as of December 31, 2024 unless otherwise noted): |

| o | The average tenure of an employee of Simon is 8.8 years, which exceeds the average tenure of the workforce nationwide of 3.9 years (based on information from the U.S. Bureau of Labor Statistics, September 2024). |

| o | 48% of our corporate employees and 28% of our field employees operating at our properties have been with Simon for 10 years or more; there are 394 employees at Simon with 20 years or more of service. |

| o | In the period of January 1, 2024 through December 31, 2024, 132 corporate employees were promoted, a 17% increase from the prior year period. |

| ● | Also see “Compensation Discussion and Analysis “on page 40 of this Proxy for a discussion of how the Compensation Committee uses our Long-Term Incentive compensation program to retain a deep bench of talent and train our next potential leaders, as well as the Compensation Committee’s approach regarding the compensation of successor executives. |

Director Independence

The Board has adopted standards to assist it in making determinations of director independence. These standards incorporate, and are consistent with, the definition of “independent” contained in the NYSE Listed Company Manual and other applicable laws, rules and regulations in effect from time to time regarding director independence. These standards are included in our Governance Principles, which are available at governanceprinciples.simon.com. The Board has affirmatively determined that each person nominated by the Board for election as a director by the holders of voting shares of the Company’s common stock and listed in this Proxy Statement meets these standards and is independent.

Ten (10) of our director nominees are independent under the requirements of the NYSE. All of the members of the Audit Committee, G&N Committee and Compensation Committee are independent directors under the listing requirements and rules of the NYSE and other applicable laws, rules, and regulations. Mr. Allan Hubbard, who is currently on the Compensation Committee and G&N Committee and will be retiring from the Board effective May 14, 2025, is also independent under the listing requirements and rules of the NYSE and other applicable laws, rules and regulations.

Mr. David Simon, Mr. Richard S. Sokolov and Mr. Eli Simon, our Class B directors, are our employees and are not independent directors. Mr. Herbert Simon, who served as a Class B director until February 4, 2025, was also employed by the Company and not an independent director.

The Board’s Role in Oversight of Risk Management

Board of Directors’ Responsibilities

| ● | While risk management is primarily the responsibility of our management, the Board provides overall risk oversight focusing on the most significant risks we face. |

2025 PROXY STATEMENT | SIMON PROPERTY GROUP 13 |

CORPORATE GOVERNANCE

Audit Committee Responsibilities

| ● | The Board has delegated to the Audit Committee primary oversight of the Company’s Enterprise Risk Management Program and the Audit Committee provides regular reports to the full Board on it. |

| ● | In addition, as part of its oversight of risk management, the Audit Committee reviews the Company’s cybersecurity and other information security risks, controls and procedures, including those related to data privacy and network security, and any specific cybersecurity issues that could affect the adequacy of the Company’s internal controls. |

| ● | Our Company-wide Enterprise Risk Management Program identifies and assesses the major risks we face and includes the development of strategies for controlling, mitigating and monitoring those risks. As part of this process, every year in the third and fourth quarters, on behalf of the Audit Committee, the Company’s internal Audit Services function reviews and assesses the Company’s Enterprise Risk Management Program, including how risks are identified, managed, measured, monitored and reported. The identified risks and risk mitigation strategies are validated with management and presented to the Audit Committee and the Company’s independent auditors for their review during the first quarter of the following year. These risks and the Company’s mitigation efforts are monitored throughout the year. |

| ● | Our Audit Services leadership is responsible for supervising the Enterprise Risk Management Program described above and, in that role, reports directly to the Audit Committee. |

| ● | Other members of senior management who have responsibility for designing and implementing various aspects of our risk management process also regularly meet with the Audit Committee. |

| ● | The Audit Committee also discusses our identified financial and operational risks, and receives reports from, senior members of management, including our CEO and Chief Financial Officer. |

Compensation and Human Capital Committee Responsibilities

| ● | The Compensation Committee is responsible for overseeing risks relating to our compensation policies and practices. Specifically, the Compensation Committee oversees the design of incentive compensation arrangements for our executive officers to implement our pay-for-performance philosophy without encouraging or rewarding excessive risk-taking by our executive officers. |

Governance and Nominating Committee

| ● | The G&N Committee assists and generally advises the Board on sustainability matters, including overseeing the Company’s sustainability strategy and related goals and policies, and periodically reviewing with management the Company’s progress towards the achievement of such strategy and goals. |

| ● | The G&N Committee also monitors and annually reviews, and if appropriate, recommends to the Board revisions to applicable stock ownership guidelines for members of the Board. |

Management Responsibilities

| ● | Our management regularly conducts additional reviews of risks, as needed, or as requested by the Board or applicable committee. |

14 2025 PROXY STATEMENT | SIMON PROPERTY GROUP |

CORPORATE GOVERNANCE

Majority Vote Standard for Election of Directors in Uncontested Elections

Our Amended and Restated By-Laws (the “By-Laws”) provide for a majority of votes cast standard for the election of directors in an uncontested election. The majority of votes cast standard for purposes of the election of director nominees means that in order for a director to be elected, the number of votes cast FOR a director’s election must exceed the number of votes cast AGAINST that director’s election, provided a quorum is present. Any incumbent director who, in an uncontested election, receives a greater number of AGAINST votes than FOR votes must promptly tender his or her resignation to the Board, subject to its acceptance. The G&N Committee will promptly consider the tendered resignation and recommend to the Board whether to accept or reject it or take a different action. Both the Board and G&N Committee may consider any factors they deem appropriate and relevant to their actions. The Board will act on the tendered resignation, taking into account the G&N Committee’s recommendation. The affected director cannot participate in any part of the process. We will publicly disclose the Board’s decision by a press release, a filing with the SEC or other broadly disseminated means of communication within 90 days after the shareholders’ vote has been certified. In a contested election (in which the number of nominees exceeds the number of directors to be elected), the standard for election of directors will be a plurality of the votes cast by the holders of shares entitled to vote on the election of directors, provided a quorum is present.

Nominations for Directors

The G&N Committee will consider director nominees recommended by shareholders. A shareholder who wishes to recommend a director candidate in this manner should send such recommendation to our Secretary at 225 W. Washington Street, Indianapolis, Indiana 46204, who will forward it to the G&N Committee. Any such recommendation shall include a description of the candidate’s qualifications for Board service, the candidate’s written consent to be considered for nomination and to serve if nominated and elected, the addresses and telephone numbers for contacting the shareholder and the candidate for more information and the other information required by Section 1.10 of our By-Laws. A shareholder who wishes to nominate an individual as a director candidate at an Annual Meeting of Shareholders, rather than either recommend the individual to the G&N Committee as a nominee or utilize the proxy access process described below and set forth in Section 1.11 of our By-Laws, shall comply with the advance notice requirements for shareholder nominations set forth in Section 1.10 of our By-Laws.

Communications with the Board

The Board has implemented a process by which our shareholders and other interested parties may communicate with one or more members of our Board, its committees, the Lead Independent Director or the independent directors as a group. Interested parties can send any such communication to Simon Property Group, Inc., Board of Directors, c/o Secretary, 225 W. Washington Street, Indianapolis, Indiana 46204. The Board has instructed our Secretary to promptly forward all such communications to the specified addressees thereof.

Transactions with Related Persons

Annually, each director and executive officer is obligated to complete a director and officer questionnaire, which requires disclosure of any transactions with us in which the director or executive officer, or any member of his or her immediate family, has or will have an interest. Pursuant to our Code of Business Conduct and Ethics at codeofconduct.simon.com, which is also available in the Governance section of our website at investors.simon.com, the Audit Committee must review and approve all related person transactions in which

2025 PROXY STATEMENT | SIMON PROPERTY GROUP 15 |

CORPORATE GOVERNANCE

any executive officer, director, director nominee or more than 5% shareholder of the Company, or any of their immediate family members, had, has or will have a direct or indirect material interest. Pursuant to the charter of the Audit Committee, which is available in the Governance section of our website at investors.simon.com, the Audit Committee may not approve a related person transaction unless (1) it is in, or not inconsistent with, our best interests and (2) where applicable, the terms of such transaction are at least as favorable to us as could be obtained from an unrelated third party. Our Restated Certificate of Incorporation (the “Charter”) requires that at least a majority of our directors be neither our employees nor members or affiliates of members of the Simon family. Our Charter further requires that transactions involving the Company, individually or in our capacity as general partner of our subsidiary, Simon Property Group, L.P. (the “Operating Partnership”), and any entity in which any of the Simons has an interest must, in addition to any other vote that may be required, be approved in advance by a majority of such independent directors. We currently have eleven independent directors serving on the Board.

Our General Counsel is charged with reviewing any conflict of interest involving any other employee.

Transactions with the Simons

Shopping Center Management and MSA Operations

Since 1993 we have managed two shopping centers owned by entities in which Mr. David Simon and Mr. Herbert Simon have ownership interests, for which we received a fee of $3,912,892 in 2024 pursuant to management agreements that provide for our receipt of a management fee and reimbursement of our direct and indirect costs.

We provide office space and support services to Melvin Simon & Associates, Inc. (“MSA”), a related party, for which we received a fee of $850,000 in 2024. MSA is owned 30.94% by trusts for the benefit of Mr. Herbert Simon, 3.04% by a trust for the benefit of Mr. David Simon, and by certain other shareholders. Please see footnote 4 to the Principal Shareholders Table on page 36 of this Proxy Statement for additional information on MSA.

Aircraft Reimbursement and Payments

DS Aviation, LLC (“DS Aviation”), an entity which is beneficially owned by Mr. David Simon, owns an aircraft (the “DS Aircraft”) which was used in 2024, in part, by the Company, for business purposes, pursuant to a lease agreement. The total amount paid in 2024 to DS Aviation was $3,518,175 under the lease.

In addition, Simon Hangar, LLC (“Hangar”), an entity which is beneficially owned by Mr. Herbert Simon, who retired from our Board effective February 4, 2025, received $58,000 relating to the Company’s business use of the DS Aircraft, pursuant to a management services agreement. The Company also reimbursed DS Aviation $21,760 for the temporary use of Mr. Herbert Simon’s aircraft for business purposes. The foregoing amounts charged to or reimbursed by the Company are less than the total actual cost per hour of operating the aircraft and are substantially less than the cost of chartering equivalent aircraft from unrelated third parties, based on a 2024 review and study of third-party market providers of such services and a review of actual costs incurred.

HS Arrow, LLC (“HS Arrow”), an entity beneficially owned by Mr. Herbert Simon, owns an aircraft (the “HS Aircraft”) which was used, in part, for Company related business in 2024. The Company reimbursed Mr. Herbert Simon a fixed annual amount of $250,000 for the Company’s business use of the HS Aircraft in 2024 pursuant to a reimbursement agreement. Such reimbursement includes all costs, fees, charges and expenses incurred by HS Arrow with respect to the Company use of the aircraft by Mr. Herbert Simon. This agreement terminated effective February 4, 2025, and all future reimbursements and payments have ceased.

These agreements were unanimously approved by the independent members of the Board of Directors upon the recommendation of the Company’s General Counsel and the Audit Committee of the Board of Directors.

16 2025 PROXY STATEMENT | SIMON PROPERTY GROUP |

CORPORATE GOVERNANCE

Terms of Employment of Mr. Eli Simon

Mr. Eli Simon is a Class B Director, Executive Vice President and Chief Investment Officer and the son of Mr. David Simon. In 2024, the Company paid Mr. Eli Simon a base salary of $575,000 and a bonus of $650,000. In 2024, Mr. Eli Simon was awarded a maximum opportunity of $500,000 under the 2024 Corporate Incentive Compensation Plan (“ICP”), and a maximum opportunity of $2,000,000 under the 3-year Senior Executive Long Term Incentive Program for the 2024-2026 performance period (“2024 LTIP”). Mr. Eli Simon’s 2024 LTIP Award consists of a 25% time-based component awarded as restricted stock units that will vest and settle as shares of the Company’s common stock on March 6, 2027, subject to his continued employment with the Company and a 75% component comprised of performance-based LTIP units that may be earned during the 3-year performance period through December 31, 2026. Any performance-based LTIP units that are earned will vest on January 1, 2028, subject to his continued employment with the Company. Additionally, on August 29, 2024, in connection with the Company’s sale of its interest in Authentic Brands Group, Mr. Eli Simon received an award of restricted stock under our Amended and Restated Other Platform Investments Incentive Program with a grant date value of $6,967,667 which vests ratably over four years, subject to his continued employment with the Company. The foregoing employment and compensation arrangements for Mr. Eli Simon have been reviewed and approved by the Compensation Committee and the independent directors of the Board.

Terms of Employment of Mr. Sam Simon

Mr. Sam Simon was hired in September 2024 as Senior Vice President, Corporate Investments and is the son of Mr. David Simon. In 2024, the Company paid Mr. Sam Simon an annualized base salary of $250,000 and a sign-on bonus of $157,500. The foregoing employment and compensation arrangements for Mr. Sam Simon have been reviewed and approved by the independent directors of the Board.

2025 PROXY STATEMENT | SIMON PROPERTY GROUP 17 |

CORPORATE GOVERNANCE

Committee Function and Membership

Audit Committee

| 9 | Meetings |

| Function, Authority and Primary Responsibilities ● Assists the Board in monitoring the integrity of our financial statements, internal control over financial reporting, the qualifications, independence and performance of our independent registered public accounting firm, the performance of our internal audit function and our compliance with legal and regulatory requirements. ● Oversees the Company’s Enterprise Risk Management Program and cybersecurity preparedness. ● Sole authority to appoint or replace our independent registered public accounting firm and pre-approves the auditing services and permitted non-audit services to be performed by our independent registered public accounting firm, including the fees and terms thereof. ● Authority to retain legal, accounting or other advisors. ● Reviews and discusses with management and our independent registered public accounting firm our annual audited financial statements, our quarterly earnings releases and financial statements, significant financial reporting issues and judgments made in connection with the preparation of our financial statements and any major issues regarding the adequacy of our internal controls. ● Issues the report on its activities which appears in this Proxy Statement. ● Oversees and discusses with management the Company’s annual disclosure of its sustainability, including sustainability matters and efforts in the form of an annual sustainability report. ● The charter of the Audit Committee requires that each member meet the independence and experience requirements of the NYSE, the Securities Exchange Act of 1934, as amended (the “Exchange Act”) and the rules and regulations of the SEC. |

Members Committee Charter The Report of the Audit Committee is on page 79. All members are Independent All members are “audit committee financial experts” as defined by the rules of the SEC | ||||

18 2025 PROXY STATEMENT | SIMON PROPERTY GROUP |

CORPORATE GOVERNANCE

Compensation and Human Capital Committee

| 8 | Meetings |

| Function, Authority and Primary Responsibilities ● Sets remuneration levels for our executive officers. ● Reviews significant employee benefit programs. ● Establishes and administers our executive compensation program and our stock incentive plan. ● Reviews and discusses with management the Compensation Discussion and Analysis, and, if appropriate, recommends its inclusion in our Annual Report and Proxy Statement. ● Issues the report on its activities which appears in this Proxy Statement. ● Oversees human capital management, including but not limited to management succession planning and talent recruitment, development and retention. ● Periodically reviews and makes recommendations to the Board, as appropriate, with respect to certain of the Company’s human capital management strategies and policies, including with respect to matters such as management succession planning, workplace environment and culture, and talent recruitment, development and retention. ● Authorized to delegate authority to subcommittees of directors or designated executive officers for any matter that does not affect the compensation of executive officers. ● Authorized to retain the advice and assistance of compensation consultants and legal, accounting or other advisors. — Its current independent compensation consultant, Semler Brossy Consulting Group, LLC (“Semler Brossy”), has served the Committee since 2011. — Semler Brossy does not provide any other services to management of the Company. — Semler Brossy assists the Compensation Committee in the review and design of the Company’s executive compensation program. ● The charter of the Compensation Committee requires that each member meet the independence requirements of the NYSE and the rules and regulations of the SEC. |

Members Committee Charter The Compensation and Human Capital Committee Report is on page 39. All members are Independent Compensation and Human Capital Committee Interlocks and Insider Participation | ||||

1 A. Hubbard will be retiring from the Board of Directors, effective May 14, 2025.

2025 PROXY STATEMENT | SIMON PROPERTY GROUP 19 |

CORPORATE GOVERNANCE

Governance and Nominating Committee

| 5 | Meetings |

| Function, Authority and Primary Responsibilities ● Nominates persons to serve as directors in accordance with our Governance Principles and prescribes appropriate qualifications for Board members. ● Develops and recommends to the Board the Governance Principles applicable to the Company and the Board, leads the Board in its annual evaluation of the Board’s performance, oversees the assessment of the independence of each director, reviews compliance with stock ownership guidelines and makes recommendations regarding compensation for non-employee directors. ● Responsible for screening director candidates but may solicit advice from our CEO and other members of the Board. ● Authority to retain legal, accounting or other advisors, and has sole authority to approve the fees and other terms and conditions associated with retaining any such external advisors. ● Assists and generally advises the Board on sustainability matters, including overseeing the Company’s sustainability strategy and related goals and policies, and periodically reviewing with management the Company’s progress towards the achievement of such strategy and goals. ● The charter of the G&N Committee requires that each member meet the independence requirements of the NYSE and any other legal and regulatory requirements. |

Members Committee Charter All members are Independent | ||||

1 A. Hubbard will be retiring from the Board of Directors, effective May 14, 2025.

20 2025 PROXY STATEMENT | SIMON PROPERTY GROUP |

CORPORATE GOVERNANCE

Director Compensation

The Board believes that competitive compensation arrangements are necessary to attract and retain qualified independent directors. Compensation applicable to service on the Board by our non-employee directors for 2024 is listed below.

| ● | Annual Cash Retainer: $110,000, paid quarterly. |

| ● | Restricted Stock Awards: Valued on the grant date at $175,000. |

| — | Vests on the first anniversary of the grant date |

Committee chairpersons, committee members and our Lead Independent Director are entitled to the following additional retainers, paid 50% in cash and 50% in unvested restricted stock:

| ● | Lead Independent Director Retainer: $50,000 |

| ● | Committee Chairperson Retainer: |

| — | Audit Committee: $35,000 |

| — | Compensation and Human Capital Committee: $35,000 |

| — | Governance and Nominating Committee: $25,000 |

| ● | Committee Membership Retainer: |

| — | Audit Committee: $15,000 |

| — | Compensation and Human Capital Committee: $15,000 |

| — | Governance and Nominating Committee: $10,000 |

Our 2019 Stock Incentive Plan (the “2019 Plan”) provides that the aggregate grant date fair market value of equity awards that may be granted during any fiscal year to a non-employee director shall not exceed $750,000.

Director Stock Ownership Guidelines

We have a stringent stock retention policy that further aligns our directors’ financial interests with those of our shareholders. The Company believes that it is advisable for its independent directors to retain a fixed dollar amount of Company common stock as opposed to a fixed number of common shares. The stock ownership guidelines for each of the Company’s independent directors require that each independent director own $850,000 worth of common stock of the Company (or the equivalent amount of limited partnership units of the Operating Partnership) by no later than six years after the date he or she is elected to the Board. Stock options and unvested shares of restricted stock do not count toward this requirement. The ownership guidelines also require independent directors to hold shares acquired upon the vesting of restricted stock awards received as compensation for their service on the Board and its committees, together with all dividends paid on such awards which are required to be utilized to purchase additional shares of the Company’s common stock, in the director account of the Company’s deferred compensation plan until the director retires, dies or becomes disabled, or otherwise no longer serves as a director. The Company’s deferred compensation plan is described in “Other Elements of Compensation & Policies” in the “Compensation Discussion and Analysis” section of this Proxy Statement on page 57.

Any director who is prohibited by law or by applicable regulation of his or her employer from having an ownership interest in our securities will be exempt from this requirement until the restriction is lifted, at which time he or she

2025 PROXY STATEMENT | SIMON PROPERTY GROUP 21 |

CORPORATE GOVERNANCE

will have the following six-year period to comply with the ownership guidelines. The Board may grant exceptions on a case-by-case basis.

As of March 17, 2025, all independent directors of the Board have met or, within the applicable period, are expected to meet, these stock ownership guidelines.

Additionally, directors are subject to limitations on trading our securities, including prohibitions on hedging our securities, under our Insider Trading Policy.

2024 Independent Director Compensation

The following table sets forth information regarding the compensation we paid to our independent directors for 2024:

| FEES EARNED OR |

|

| ||||||

NAME(1) | PAID IN CASH | STOCK AWARDS(2) | TOTAL | ||||||

Glyn F. Aeppel | $ | 122,500 | $ | 194,110 | $ | 316,610 | |||

Larry C. Glasscock | $ | 147,500 | $ | 219,854 | $ | 367,354 | |||

Allan Hubbard (3) | $ | 122,500 | $ | 194,110 | $ | 316,610 | |||

Nina P. Jones | $ | 114,602 | $ | 246,106 | $ | 360,708 | |||

Reuben S. Leibowitz | $ | 135,000 | $ | 206,982 | $ | 341,982 | |||

Randall J. Lewis | $ | 117,500 | $ | 188,932 | $ | 306,432 | |||

Gary M. Rodkin | $ | 115,000 | $ | 186,269 | $ | 301,269 | |||

Peggy Fang Roe | $ | 115,000 | $ | 186,269 | $ | 301,269 | |||

Stefan M. Selig | $ | 125,000 | $ | 196,626 | $ | 321,626 | |||

Daniel C. Smith, Ph.D. | $ | 117,500 | $ | 188,932 | $ | 306,432 | |||

Marta R. Stewart | $ | 127,500 | $ | 199,289 | $ | 326,789 | |||

| 1. | As of December 31, 2024, the independent directors owned shares of restricted stock subject to vesting requirements in the following amounts: Glyn F. Aeppel—1,312; Larry C. Glasscock—1,486; Allan Hubbard—1,312; Nina P. Jones—1,673; Reuben S. Leibowitz—1,399; Randall J. Lewis—1,277; Gary M. Rodkin—1,259; Peggy Fang Roe—1,259; Stefan M. Selig—1,329; Daniel C. Smith, Ph.D.—1,277; and Marta R. Stewart—1,347. |

Mr. David Simon, Mr. Richard S. Sokolov and Mr. Eli Simon, who were also directors during 2024, are not included in this table because they are not independent directors and did not receive any compensation for their service as directors. In 2024, Mr. Herbert Simon, who retired from the Board of Directors effective February 4, 2025, received $100,000 in employment compensation for his service as our Chairman Emeritus. The compensation paid to Mr. David Simon as an executive officer of the Company is shown in the 2024 Summary Compensation Table on page 61 of this Proxy Statement. The compensation paid to Mr. Eli Simon, as an employee of the Company is described in “Corporate Governance–Transactions with the Simons on page 16 of this Proxy Statement.

| 2. | Represents the ASC 718 grant date fair value of the restricted stock awarded to the directors, determined based on the closing price of our common stock as reported by the NYSE on the date of grant. Restricted stock granted to directors must be held in the director deferred compensation account, and dividends on the restricted shares must be reinvested in additional shares of common stock which also must be held in the director deferred compensation account. One of our directors elected to defer his cash compensation in 2024. |

| 3. | A. Hubbard will be retiring from the Board of Directors, effective May 14, 2025. |

22 2025 PROXY STATEMENT | SIMON PROPERTY GROUP |

Proposal 1: Election of Directors

Based on the recommendation of the G&N Committee, the Board has nominated the following ten (10) persons listed as “Nominees for Director to be Elected by Holders of Voting Shares.”

| ● | All of the nominees are current directors. |

| ● | We expect each nominee for election as a director named in this Proxy Statement will be able to serve if elected. |

| ● | If any nominee is not able to serve, proxies will be voted in favor of the remainder of those nominated and may be voted for substitute nominees. |

| ● | The names, principal occupations and certain other information about the nominees for director, as well as key experiences, qualifications, attributes and skills that led the G&N Committee to conclude that such person is currently qualified to serve as a director, are set forth on the following pages. |

PROPOSAL 1: ELECTION OF DIRECTORS

Overview of Director Nominees1

DIRECTOR | COMMITTEES | |||||||

nAME AND pRImARY OCCUPATION | Age | Since | Ind | A | CHC | GN | Other Public Board(s) | |

| Glyn F. Aeppel President and Chief Executive Officer of Glencove Capital | 66 | 2016 | | C | • AvalonBay Communities, Inc. • Maui Land & Pineapple Company, Inc. | ||

| Larry C. Glasscock Former Chairman of Anthem, Inc. | 76 | 2010 | | · | · | • Sysco Corporation | |

| Nina P. Jones Retired Vice President and Portfolio Manager of T. Rowe Price | 45 | 2024 | | · | • Equity Residential | ||

| Reuben S. Leibowitz Managing Member of JEN Partners | 77 | 2005 | | · | C | ||

| Randall J. Lewis Managing Partner for Cleveland Avenue, LLC | 62 | 2023 | | · | • Guardian Pharmacy Services | ||

| Gary M. Rodkin Retired Chief Executive Officer of ConAgra Foods, Inc. | 72 | 2015 | | · | • McCormick & Company Incorporated | ||

| Peggy Fang Roe Executive Vice President and Chief Customer Officer of Marriott International | 53 | 2021 | | · | |||

| Stefan M. Selig Founder of BridgePark Advisors LLC | 62 | 2017 | | · | · | • Safehold Inc. | |

| Daniel C. Smith, Ph.D. Clare W. Barker Professor of Marketing, Kelley School of Business, Indiana University | 67 | 2009 | | · | |||

| Marta R. Stewart Retired Executive Vice President and Chief Financial Officer of Norfolk Southern Corporation | 67 | 2018 | | C | • Sherwin Williams Company | ||

IND = Independent = Lead C = Chair · = Member

A = Audit CHC = Compensation and Human Capital GN = Governance and Nominating

1 A. Hubbard will be retiring from the Board of Directors, effective May 14, 2025. At such time, the Board anticipates reducing the size of the Board by one, in accordance with the terms of the Company’s By-Laws.

Nominees for Director to be Elected by Holders of Voting Shares

Glyn F. Aeppel | Director since 2016 | |||

Independent Age: 66 Committees ● Governance and Nominating (Chair) |

| Career Highlights ● President and Chief Executive Officer of Glencove Capital, a lifestyle hospitality investment and advisory company that she founded in 2010. ● Chief Investment Officer of Andre Balazs Properties (October 2008 to May 2010). ● Executive Vice President of Acquisitions and Development for Loews Hotels and was a member of its executive committee (April 2006 to October 2008). ● Principal of Aeppel and Associates (April 2004 to April 2006). ● Executive positions with Le Meridien Hotels, Interstate Hotels & Resorts, Inc., FFC Hospitality, LLC, Holiday Inn Worldwide and Marriott Corporation (prior to April 2004). ● Board of directors of Maui Land & Pineapple Company, Inc. and also AvalonBay Communities, Inc. She also serves on the boards of Exclusive Resorts, LLC, Gilbane Inc., and Concord Hospitality Enterprises. ● Previously served on the boards of Key Hospitality Acquisition Corporation, Loews Hotels Corporation and Sunrise Senior Living, Inc. |

| Other Current Public Company Directorships ● AvalonBay Communities, Inc. ● Maui Land & Pineapple Company, Inc. Education ● Principia College, B.A. ● Harvard Business School, M.B.A. |

Director Qualifications Ms. Aeppel has more than 30 years of experience in property acquisitions, development and financing. Ms. Aeppel has experience in both public and private companies focusing on the acquisition, operation and branding of hotel properties, including serving as Chief Investment Officer at Andre Balazs Properties and Executive Vice President, Acquisitions and Development, of Loews Hotel Corporation. | ||||

Larry C. Glasscock | Director since 2010 | ||||

Lead Independent Age: 76 Committees ● Audit ● Governance and Nominating |

| Career Highlights ● Former Chairman of Anthem, Inc., a healthcare insurance company, now known as Elevance Health, Inc. (November 2005 to March 2010). ● President and Chief Executive Officer of WellPoint, Inc. (2004 to 2007). ● Previously served as Chairman, President and Chief Executive Officer of Anthem, Inc. from 2003 to 2004 and served as President and Chief Executive Officer of Anthem, Inc. from 2001 to 2003. ● Previously served as a director of Anthem, Inc., as a director for Sprint Nextel Corporation until 2013, and as a director and non-executive chairman of Zimmer Biomet Holdings, Inc. until 2021. ● Currently is a director of Sysco Corporation. ● Served as the Chief Executive Officer of the nation’s leading health benefits company for many years. He has experience in leading a large public company, setting and implementing strategic plans, developing and implementing turnaround and growth strategies, and developing talent and participating in successful leadership transitions. |

| Other Current Public Company Directorships ● Sysco Corporation Former Public Company Directorships within the Last Five Years ● Zimmer Biomet Holdings, Inc. Education ● Cleveland State University, B.B.A. | |

Director Qualifications Mr. Glasscock also has experience leading acquisitions of companies. In addition, he worked in financial services for over 20 years and can identify meaningful metrics to assess a company’s performance. He also serves, and has served for over 15 years, as a director of other public companies. The Board has determined that Mr. Glasscock is an “audit committee financial expert.” | |||||

PROPOSAL 1: ELECTION OF DIRECTORS

Nina P. Jones | Director since 2024 | |||

Independent Age: 45 Committees ● Audit |

| Career Highlights ● Has over 15 years of real estate investing experience at T. Rowe Price, a global investment manager with over $1 trillion in assets under management. ● She most recently served as Vice President, Portfolio Manager, of the T. Rowe Price U.S. Real Estate Equity Strategy until her retirement in December 2023. ● Previously served as portfolio manager of the U.S. Real Estate Equity Strategy (2019 to 2023). ● Previously served as portfolio manager of the Global Real Estate Equity Strategy (2015 to 2021). ● Previously served as global team leader for real estate at T. Rowe Price influencing over $50 billion of assets under management across the platform including as an advisory committee member of the Mid-Cap Value, Institutional Large-Cap Value, Global Growth, Global Stock, and Financial Services strategies. ● Previously served as a Senior Associate in Audit and Risk Advisory for KPMG, earning the CPA designation. |

| Other Current Public Company Directorships ● Equity Residential Education ● University of Maryland, B.S. ● Columbia University, M.B.A. |

Director Qualifications Ms. Jones currently is a Trustee of Equity Residential, where she is a member of the audit committee and a member of the corporate governance committee. Ms. Jones is a certified public accountant and has significant experience reviewing financial statements during her tenure with KPMG. She also has extensive experience analyzing and investing in real estate companies. The Board has determined that Ms. Jones is an "audit committee financial expert." | ||||

Reuben S. Leibowitz | Director since 2005 | ||||

Independent Age: 77 Committees ● Audit ● Compensation and Human Capital (Chair) |

| Career Highlights ● Managing Member of JEN Partners, a private equity firm (Since 2005). ● Managing Director of Warburg Pincus (1984 to 2005). ● Director of Chelsea Property Group, Inc (1993 to 2004). ● He led a major private equity firm’s real estate activities for many years and in that role was also responsible for implementing long-term corporate strategies. ● He practiced 15 years as a CPA, including a number of years specializing in tax issues, and is an attorney. He has an in-depth understanding of our Premium Outlets® platform, having served as a director of Chelsea Property Group, the publicly-held company we acquired in 2004. |

| Other Current Public Company Directorships ● None Education ● Brooklyn College, B.S. ● New York University, M.B.A., L.L.M. ● Brooklyn Law School, J.D. | |

Director Qualifications Mr. Leibowitz practiced 15 years as a CPA, including a number of years specializing in tax issues, and is an attorney. He has an in-depth understanding of our Premium Outlets® platform, having served as a director of Chelsea Property Group, the publicly-held company we acquired in 2004. The Board has determined that Mr. Leibowitz is an “audit committee financial expert.” | |||||

26 2025 PROXY STATEMENT | SIMON PROPERTY GROUP |

PROPOSAL 1: ELECTION OF DIRECTORS

Randall J. Lewis | Director since 2023 | |||

Independent Age: 62 Committees ● Audit |

| Career Highlights ● Mr. Lewis joined Cleveland Avenue in 2020 and is responsible for leading transaction sourcing, due diligence, financial evaluation and portfolio management of the firm’s portfolio investments. ● He is the Managing Partner for Cleveland Avenue, LLC, a venture capital investment firm that invests in agrifood and beverage, related technologies, and life-style related technology investments. He is also a Certified Public Accountant. ● He served his alma mater, Purdue University, as Executive Director for the Krannert Professional Development Center from 2013 to 2020. ● Mr. Lewis currently serves on the board of directors for Guardian Pharmacy Services, where he is a member and serves as the chair of the audit committee. ● He has over 35 years of finance, risk management, and operations experience. This includes his years with GE, Wells Fargo and Elevance Health, Inc. (formerly Anthem). While working for these Fortune 500 companies, he held various senior executive roles, including Executive Vice President and Chief Compliance Officer, Executive Vice President and Chief Auditor, Managing Director of Corporate Development, and Chief Executive Officer for a start-up logistics firm which was sold. |

| Other Current Public Company Directorships ● Guardian Pharmacy Services Education ● Purdue University, B.S., M.B.A. |

Director Qualifications Mr. Lewis’s experience has provided him extensive exposure and a high level of familiarity with applicable regulations regarding preparation and review of financial statements. The Board has determined that Mr. Lewis is an “audit committee financial expert.” | ||||

Gary M. Rodkin | Director since 2015 | |||

Independent Age: 72 Committees ● Governance and Nominating |

| Career Highlights ● He is a member of the board of directors of Rutgers University and the Chairman of Feeding America, a national network of food banks. ● Previously served as Chief Executive Officer and member of the board of ConAgra Foods, Inc. (2005 to May 2015). ● Mr. Rodkin was Chairman and Chief Executive Officer of PepsiCo Beverages and Foods North America (February 2003 to June 2005). ● Mr. Rodkin joined PepsiCo in 1998, after it acquired Tropicana, where Mr. Rodkin had served as President since 1995. From 1979 to 1995, Mr. Rodkin held marketing and general management positions of increasing responsibility at General Mills, with his last three years at the company as President, Yoplait Colombo. ● Currently serves on the board of directors of McCormick & Company, Incorporated, where he is a member of the audit committee. ● He served as a director of ConAgra Foods, Inc. from 2005 to 2015 and Avon Products, Inc. from 2008 to 2016. |

| Other Current Public Company Directorships ● McCormick & Company Incorporated Education ● Rutgers University, B.S. ● Harvard Business School, M.B.A. |

Director Qualifications Mr. Rodkin has extensive experience in the leadership and management of a large, packaged food company and expertise in branding and marketing of food and food service operations globally as the former Chief Executive Officer of ConAgra Foods, Inc. | ||||

2025 PROXY STATEMENT | SIMON PROPERTY GROUP 27 |

PROPOSAL 1: ELECTION OF DIRECTORS

Peggy Fang Roe | Director since 2021 | |||

Independent Age: 53 Committees ● Governance and Nominating |

| Career Highlights ● She has served as Executive Vice President and Chief Customer Officer for Marriott International since 2023. ● Ms. Roe is responsible for Marriott’s Global Customer Group overseeing the management of Marriott’s Portfolio of 30+ Brands and Experiences, Customer Experience Design and Innovation, Global Marketing, Data and Martech, The Marriott Bonvoy Loyalty Program, Partnerships, New Businesses, and the Worldwide Customer Engagement Centers. ● Ms. Roe joined Marriott International in 2003 and has served in several positions before being named Executive Vice President and Chief Customer Officer, including Global Officer, Customer Experience, Loyalty & New Ventures, Chief Sales and Marketing Officer Asia Pacific, Global Operations, Global Brand Marketing and Brand Management. ● She is the Executive Sponsor of the Women’s Associate Resource Group at Marriott International and served as a board member of the Hong Kong chapter of the Asian University of Women in Bangladesh. ● Ms. Roe currently serves as the Board Chair for the Marriott – Alibaba joint venture and serves on the Board of Directors of the Association of National Advertisers. |

| Other Current Public Company Directorships ● None Education ● University of Michigan, B.A. ● Harvard Business School, M.B.A. |

Director Qualifications Ms. Roe has more than 20 years of experience in the hotel industry and serves as EVP and Chief Customer Officer for the largest global hospitality company in the world. In that role, Ms. Roe gained experience in globalization, leadership, and management. | ||||

Stefan M. Selig | Director since 2017 | |||

Independent Age: 62 Committees ● Audit ● Compensation and Human Capital |