1 ACTION BY WRITTEN CONSENT OF THE COMPENSATION, NOMINATING AND GOVERNANCE COMMITTEE OF THE BOARD OF DIRECTORS OF CENTRUS ENERGY CORP.12 The undersigned, being all of the members of the Compensation, Nominating and Governance Committee (the “Committee”) of the Board of Directors (the “Board”) of Centrus Energy Corp., a Delaware corporation (the “Company”), do hereby adopt the following recitals and resolutions by unanimous written consent in lieu of a meeting in accordance with the provisions of Section 141(f) of the Delaware General Corporation Law and the Bylaws of the Company as presently in effect effective as of August 12, 2025 (the “Effective Date”). Approval of Severance and Acceleration of RSU Vesting for Former Executive Officer WHEREAS, Mr. Harrill resigned as the Senior Vice President, Chief Financial Officer and Treasurer of the Company effective August 10, 2025; WHEREAS, in connection with his termination of employment, the Company intends for the Company and Mr. Harrill to enter into a Waiver and Release (the “Release”), a draft of which had been previously presented to the Board, pursuant to which the Company agrees to pay Mr. Harrill certain remuneration in consideration of a release of the Company as set forth therein and subject to the other terms and conditions thereof; WHEREAS, the Board on July 14, 2025 had authorized the Chair of the Board, and his delegees, to negotiate the terms of exit of Mr. Harrill from the Company, including the Release, subject to certain limitations on remuneration (the “Remuneration Limit”); WHEREAS, the Board on August 5, 2025 delegated to the Committee the authority to approve any remuneration to Mr. Harrill in conjunction with the Release that exceeds the Remuneration Limit; WHEREAS, following negotiations with Mr. Harrill, the Company has modified the Release as reflected in the draft attached hereto as Exhibit 1, pursuant to which the remuneration exceeds the Remuneration Limit (the “Increased Remuneration”); WHEREAS, the Committee previously approved the following awards of performance based restricted stock units (“RSUs”) to Kevin Harrill, the Company’s former Senior Vice President, Chief Financial Officer and Treasurer: (a) 1,951 RSUs granted on March 2, 2023 for the 2023-2025 performance period, (b) 2,586 RSUs granted on March 13, 2024 for the 2024-2026 performance period and (c) 1,185 RSUs granted on February 5, 2025 for the 2025-2027 performance period (collectively, the “Outstanding RSUs”), all of which are unvested; WHEREAS, pursuant to the award agreements between the Company and Mr. Harrill governing the Outstanding RSUs, upon Mr. Harrill’s resignation, the Outstanding RSUs are forfeited for no consideration; and WHEREAS, in connection with Mr. Harrill’s resignation, taking into account the facts and circumstances at hand, the Committee has determined it to be in the Company’s best interest to provide the Increased Remuneration and accelerate the vesting of all of the Outstanding RSUs as partial consideration 1 NTD: Present for consideration by the Committee only after final agreement with Kevin has been reached. 2 NTD: We assume that all of the other exit arrangements for Kevin have been previously approved, as needed, including cash severance, etc. Docusign Envelope ID: 20FC7414-496C-42A2-9DFB-E66E979A82E8

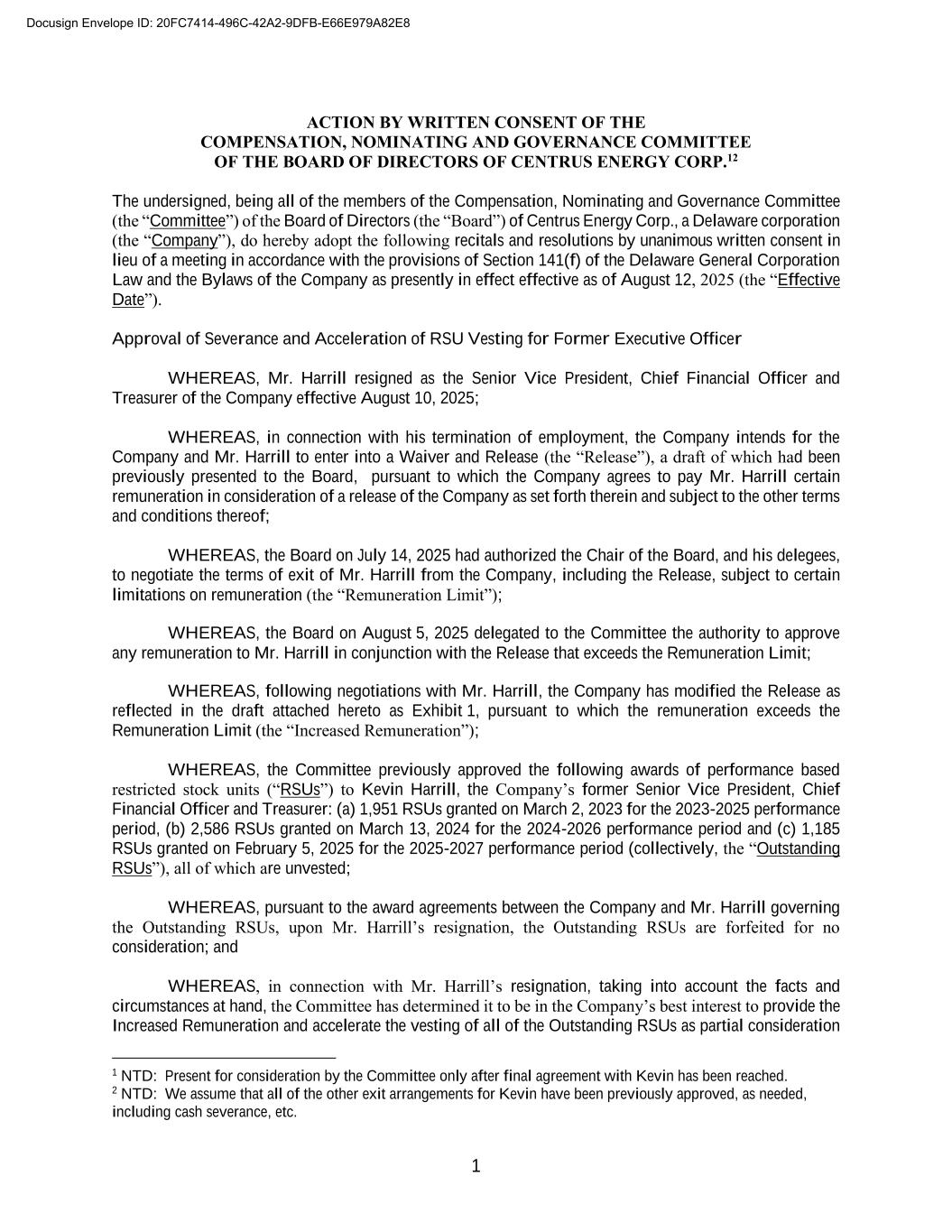

2 for Mr. Harrill’s (i) execution and delivery of the Release and (ii) continued employment in an advisory role with the Company until August 29, 2025, in order to facilitate a smooth transition of duties to his successor, such Increased Remuneration and acceleration of vesting subject to his continued employment through August 29, 2025 and his performance of satisfactory service as an advisor to the Company during the transition period. NOW, THEREFORE, BE IT RESOLVED, that the award agreements between the Company and Mr. Harrill governing the Outstanding RSUs are hereby amended as follows: Date of Grant Type and Number of Awards Amendment to Award Agreement March 2, 2023 1,951 Restricted Stock Units Section 4 is hereby amended by adding the following paragraph as a new third paragraph: “Notwithstanding the foregoing, the restrictions shall lapse on all of the then unvested Restricted Shares as of August 29, 2025 so long as Grantee has been continuously employed by the Company or any of its Affiliates through August 29, 2025 and Grantee has performed satisfactory service as an advisor to the Company.” March 13, 2024 2,586 Restricted Stock Units Section 4 is hereby amended by adding the following paragraph as a new third paragraph: “Notwithstanding the foregoing, the restrictions shall lapse on all of the then unvested Restricted Shares as of August 29, 2025 so long as Grantee has been continuously employed by the Company or any of its Affiliates through August 29, 2025 and Grantee has performed satisfactory service as an advisor to the Company.” February 5, 2025 1,185 Restricted Stock Units Section 3 is hereby amended by adding the following paragraph as a new second paragraph: “Notwithstanding the foregoing and Section 2, all of the then unvested RSUs shall vest as of August 29, 2025 so long as Grantee has been continuously employed by the Company or any of its Affiliates through August 29, 2025 and Grantee has performed satisfactory service as an advisor to the Company.” ; and be it FURTHER RESOLVED, that the Increased Remuneration is hereby approved; and be it FURTHER RESOLVED, that the Chair of the Committee and each of the officers of the Company be, and each of them hereby is, authorized, in the name and on behalf of the Company, to execute and deliver, or cause to be executed and delivered, any and all agreements, certificates, instruments and documents, and to take all such other action as any of them may determine to be necessary or advisable to carry out the purposes and intent of the foregoing resolutions, any such determination to be conclusively evidenced by the execution and delivery thereof or by the taking of such other action; and be it FURTHER RESOLVED, that any action taken by any of the officers of the Company prior to the adoption of these resolutions that is within the authority conferred herein be, and it hereby is, ratified, confirmed and approved. * * * Docusign Envelope ID: 20FC7414-496C-42A2-9DFB-E66E979A82E8

3 IN WITNESS WHEREOF, the undersigned, constituting all of the members of the Compensation, Nominating and Governance Committee of the Board of Directors, have executed this Action by Written Consent, adopting the foregoing recitals and resolutions and consenting to the foregoing actions effective as of the Effective Date, and direct that this Action by Written Consent be filed with the minutes of the proceedings of the Committee. Said recitals, resolutions and actions shall have the same force and effect as if they were adopted at a meeting of the Committee held upon due notice at which the undersigned were personally present. This Action by Written Consent may be executed in one or more counterparts in writing or by electronic transmission, each of which shall be an original and all of which together shall be one and the same instrument. __________________________ Tina W. Jonas, Chair __________________________ Kirkland H. Donald __________________________ Mikel Williams Docusign Envelope ID: 20FC7414-496C-42A2-9DFB-E66E979A82E8

4 Exhibit 1 WAIVER AND RELEASE This is a Waiver and Release (“Release”) between Kevin J. Harrill (“Executive”) and Centrus Energy Corp. (the “Company”). The Company and Executive agree that they have entered into this Release voluntarily, and that it is intended to be a legally binding commitment between them. 1. In consideration for the promises made herein by Executive, the Company agrees as follows: (a) Severance Benefits. Provided that (i) Executive signs this Release; (ii) if Executive signs this Release during the period prior to Executive’s last day of employment, Executive signs the Bring Down Release Agreement in the form of Exhibit A on Executive’s last day of employment (as needed); (iii) Executive does not revoke this Release during the seven-day period after Executive signs it pursuant to Section 2(f)(iv) below; (iv) Executive does not revoke the Bring Down Release Agreement in Exhibit A during the seven-day period after Executive signs it pursuant to Section 2 of the Bring Down Release Agreement (if applicable); (v) Executive complies with, and agrees to, the terms set forth in Sections 3.5 (Restrictive Covenants; Confidentiality; Non-Competition and Non-Solicitation; Non-Disparagement: Nuclear, Workplace, Public Saved and Sarbanes- Oxley Concerns; No -Effect on Other Restrictive Covenants), 3.6 (Return of Consideration), 3.7 (Equitable Relief and Other Remedies), 3.8 (Survival of Provisions), 3.9 (Cooperation), Article 6 (General Provisions) and Article 7 (Definitions) of the Company’s Executive Severance Plan (the “Plan”), all of which are incorporated herein by reference as if set forth in specificity); and (vi) Executive remains employed with the Company through the “Separation Date” (as defined below) and works in good faith to facilitate an orderly transition of his duties, Executive shall receive the following severance benefits (the “Severance Benefits”): (i) The Company shall pay Executive the gross sum of $300,000.00, which is an amount equal to Executive’s annual base salary, plus Executive’s Pro-Rata Performance Bonus (as such term is defined in the Plan), plus the Final Average Bonus of $308,344.00 (as defined below), less all payroll and other deductions required by law or authorized by Executive (the “Severance Payment”). The Severance Payment shall be made within sixty (60) days after the Separation Date (as defined below) if all conditions to payment have been fully satisfied. The foregoing notwithstanding, the Pro-Rata Performance Bonus shall be paid upon the later of (i) the date annual bonuses for the annual bonus year to which such Pro-Rata Performance Bonus relates are paid to other executive employees of the Company, or (ii) the date on which this Release becomes effective and irrevocable, but in any event no later than March 15 of the calendar year after the year in which the Eligible Separation from Service occurs. The Pro-Rata Performance Bonus shall be calculated based on a proration period ending August 29, 2025, representing 66.3% of the calendar Docusign Envelope ID: 20FC7414-496C-42A2-9DFB-E66E979A82E8

5 year. Based on a target bonus of $240,000.00, the minimum payout shall be $159,120.00, and shall be increased up to the level of approved performance achievement as established under Attachment IV of the 2025 Employee Incentive Plan. For clarity, the Pro-Rata Performance Bonus shall be determined solely based on Company-wide performance metrics as approved under Attachment IV, and shall not be reduced or adjusted based on individual performance criteria or evaluations. (ii) The Company shall pay the premiums necessary for Executive to continue coverage for Executive and Executive’s eligible dependents in the Company’s group health plans on the same basis as applies to active employees from time to time, except at no cost to the Participant for a period commencing on September 1, 2025 and ending on the earlier to occur of (x) August 31, 2026 and (y) the date Executive (or Executive’s eligible dependents, as applicable) become eligible for healthcare benefit plan coverage, respectively (whether or not comparable to plans of the Company), from any successor employer (the “Severance Period”); provided, however, (A) Neither Executive nor Executive’s dependents shall be eligible for continued participation in any disability income plan, travel accident insurance plan, or tax-qualified retirement plan. (B) Nothing herein shall be deemed to restrict the right of the Company to amend or terminate any plan in a manner generally applicable to active employees. (C) The continuation of group health coverage during the Severance Period shall be applied toward the Company’s obligation to make continuation coverage available under Section 601 et seq. of ERISA (“COBRA”), and Executive and Executive’s eligible dependents shall be entitled to maintain such COBRA coverage, at their expense, for the balance of the period required by COBRA, if any, following such continuation of coverage. Notwithstanding the foregoing, in the event that the payment by the Company of (or reimbursements for) premiums benefits under this Release results or could reasonably be expected to result in taxes to the Company or its affiliates under Section 4980D of the Code, or other adverse tax, ERISA or other legal consequences under applicable law, the Company and Executive agree in good faith to amend or substitute such payment or reimbursement arrangement to avoid such taxes or adverse consequences in a substantially similar economic manner (including, as would not result in such taxes or adverse consequences, paying cash payments to Executive equal to the Company’s share of premiums that would have been paid on Executive’s behalf on the same schedule as such premiums would have been paid); provided, that if in the good faith determination of the Company’s accountants, no such substitute or amended arrangement could avoid such Docusign Envelope ID: 20FC7414-496C-42A2-9DFB-E66E979A82E8

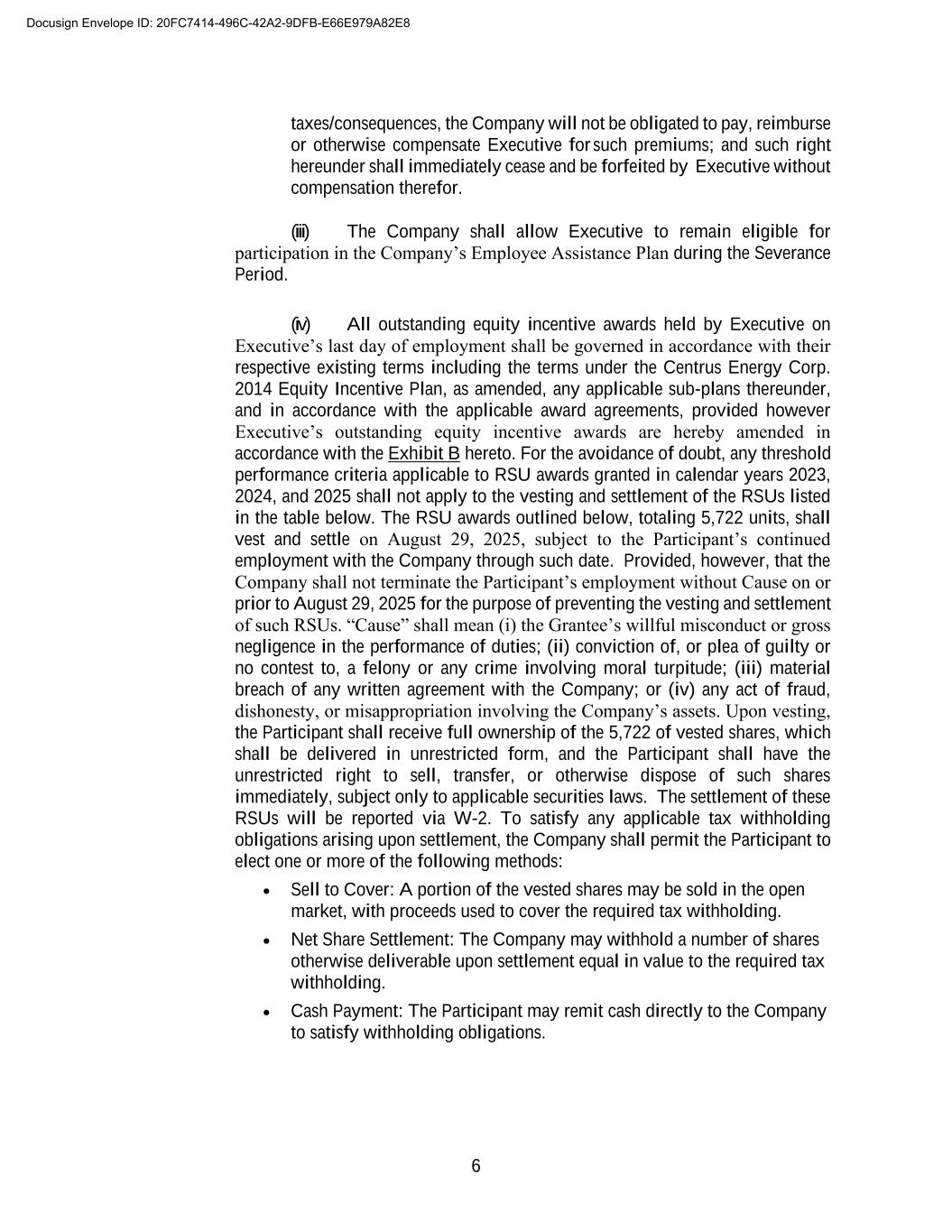

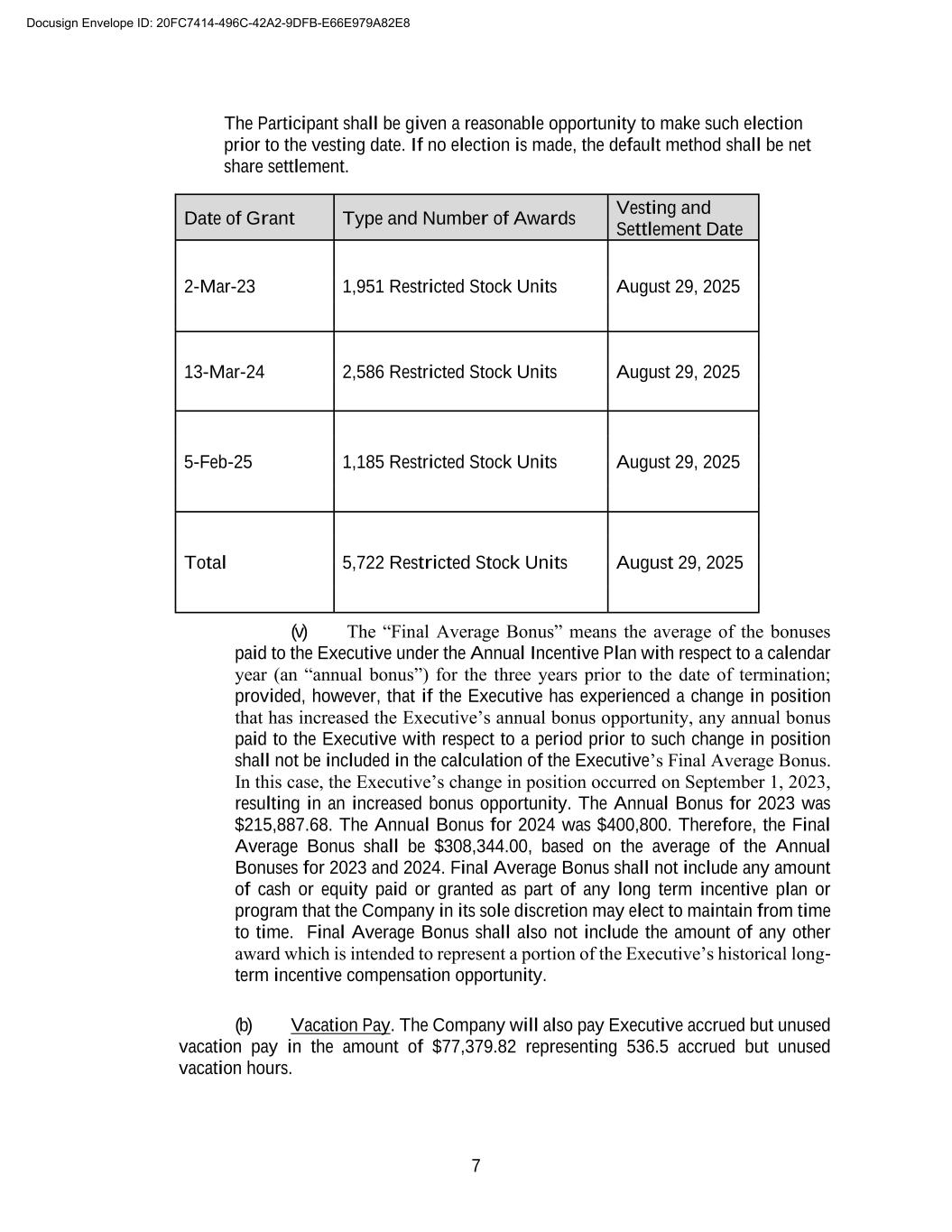

6 taxes/consequences, the Company will not be obligated to pay, reimburse or otherwise compensate Executive for such premiums; and such right hereunder shall immediately cease and be forfeited by Executive without compensation therefor. (iii) The Company shall allow Executive to remain eligible for participation in the Company’s Employee Assistance Plan during the Severance Period. (iv) All outstanding equity incentive awards held by Executive on Executive’s last day of employment shall be governed in accordance with their respective existing terms including the terms under the Centrus Energy Corp. 2014 Equity Incentive Plan, as amended, any applicable sub-plans thereunder, and in accordance with the applicable award agreements, provided however Executive’s outstanding equity incentive awards are hereby amended in accordance with the Exhibit B hereto. For the avoidance of doubt, any threshold performance criteria applicable to RSU awards granted in calendar years 2023, 2024, and 2025 shall not apply to the vesting and settlement of the RSUs listed in the table below. The RSU awards outlined below, totaling 5,722 units, shall vest and settle on August 29, 2025, subject to the Participant’s continued employment with the Company through such date. Provided, however, that the Company shall not terminate the Participant’s employment without Cause on or prior to August 29, 2025 for the purpose of preventing the vesting and settlement of such RSUs. “Cause” shall mean (i) the Grantee’s willful misconduct or gross negligence in the performance of duties; (ii) conviction of, or plea of guilty or no contest to, a felony or any crime involving moral turpitude; (iii) material breach of any written agreement with the Company; or (iv) any act of fraud, dishonesty, or misappropriation involving the Company’s assets. Upon vesting, the Participant shall receive full ownership of the 5,722 of vested shares, which shall be delivered in unrestricted form, and the Participant shall have the unrestricted right to sell, transfer, or otherwise dispose of such shares immediately, subject only to applicable securities laws. The settlement of these RSUs will be reported via W-2. To satisfy any applicable tax withholding obligations arising upon settlement, the Company shall permit the Participant to elect one or more of the following methods: • Sell to Cover: A portion of the vested shares may be sold in the open market, with proceeds used to cover the required tax withholding. • Net Share Settlement: The Company may withhold a number of shares otherwise deliverable upon settlement equal in value to the required tax withholding. • Cash Payment: The Participant may remit cash directly to the Company to satisfy withholding obligations. Docusign Envelope ID: 20FC7414-496C-42A2-9DFB-E66E979A82E8

7 The Participant shall be given a reasonable opportunity to make such election prior to the vesting date. If no election is made, the default method shall be net share settlement. (v) The “Final Average Bonus” means the average of the bonuses paid to the Executive under the Annual Incentive Plan with respect to a calendar year (an “annual bonus”) for the three years prior to the date of termination; provided, however, that if the Executive has experienced a change in position that has increased the Executive’s annual bonus opportunity, any annual bonus paid to the Executive with respect to a period prior to such change in position shall not be included in the calculation of the Executive’s Final Average Bonus. In this case, the Executive’s change in position occurred on September 1, 2023, resulting in an increased bonus opportunity. The Annual Bonus for 2023 was $215,887.68. The Annual Bonus for 2024 was $400,800. Therefore, the Final Average Bonus shall be $308,344.00, based on the average of the Annual Bonuses for 2023 and 2024. Final Average Bonus shall not include any amount of cash or equity paid or granted as part of any long term incentive plan or program that the Company in its sole discretion may elect to maintain from time to time. Final Average Bonus shall also not include the amount of any other award which is intended to represent a portion of the Executive’s historical long- term incentive compensation opportunity. (b) Vacation Pay. The Company will also pay Executive accrued but unused vacation pay in the amount of $77,379.82 representing 536.5 accrued but unused vacation hours. Date of Grant Type and Number of Awards Vesting and Settlement Date 2-Mar-23 1,951 Restricted Stock Units August 29, 2025 13-Mar-24 2,586 Restricted Stock Units August 29, 2025 5-Feb-25 1,185 Restricted Stock Units August 29, 2025 Total 5,722 Restricted Stock Units August 29, 2025 Docusign Envelope ID: 20FC7414-496C-42A2-9DFB-E66E979A82E8

8 (c) Unemployment Compensation. The Company will not contest the decision of the appropriate regulatory commission regarding unemployment compensation that may be due to Executive. (d) Agreement in Lieu of Plan Benefits. The parties acknowledge that Executive is not entitled to benefits described in the Plan, and that all payments and benefits under this Release are in lieu of, and not in addition to, any Plan or other benefits. 2. In consideration for and contingent upon Executive’s right to receive the benefits described above, Executive hereby agrees as follows: (a) General Waiver and Release. Except as provided in Section 2(f) below, Executive and any person acting through or under Executive hereby release, waive and forever discharge the Company, its past and present subsidiaries and affiliates, and their respective successors and assigns, and their respective present or past officers, trustees, directors, shareholders, executives and agents of each of them (collectively, the “Released Parties”), from any and all claims, demands, actions, liabilities and other claims for relief and remuneration whatsoever (including without limitation attorneys’ fees and expenses), whether known or unknown, absolute, contingent or otherwise (each, a “Claim”), arising or which could have arisen up to and including the date of Executive’s execution of this Release, including without limitation those arising out of or relating to Executive’s employment or cessation and termination of employment, or any other written or oral agreement, any change in Executive’s employment status, any benefits or compensation, any tortious injury, breach of contract, wrongful discharge (including any Claim for constructive discharge), infliction of emotional distress, slander, libel or defamation of character, and any Claims arising under the United States Constitution, the Maryland Constitution, Title VII of the Civil Rights Act of 1964 (as amended by the Civil Rights Act of 1991), the Americans With Disabilities Act, the Rehabilitation Act of 1973, the Fair Labor Standards Act, the Family and Medical Leave Act, the National Labor Relations Act, the Labor- Management Relations Act, the Equal Pay Act, the Older Workers Benefits Protection Act, the Workers Retraining and Notification Act, the Age Discrimination in Employment Act, the Employee Retirement Income Security Act of 1974, Section 211 of the Energy Reorganization Act of 1974, the Maryland Human Rights Act, the Virginia Human Rights Act (VHRA), the Virginians with Disabilities Act (VDA), the Virginia Equal Pay Act, the Virginia Genetic Testing Law, the Virginia Occupational Safety and Health Act (VOSH), the Virginia Fraud Against Taxpayers Act, the Virginia Minimum Wage Act, the Virginia Payment of Wage Law, the Virginia Fraud and Abuse Whistleblower Protection Act, the Virginia Right-to-Work Law, all including any amendments and their respective implementing regulations, or any other federal, state or local statute, law, ordinance, regulation, rule or executive order, any tort or contract claims, and any of the claims, matters and issues which could have been asserted by Executive against the Company or its subsidiaries and affiliates in any legal, administrative or other proceeding. Executive agrees that if any action is brought in Executive’s name before any court or administrative body, Executive will not accept any payment of monies in connection therewith. Docusign Envelope ID: 20FC7414-496C-42A2-9DFB-E66E979A82E8

9 (b) Miscellaneous. Executive agrees that this Release specifies payment from the Company to Executive, the total of which meets or exceeds any and all funds due to Executive by the Company, and that Executive will not seek to obtain any additional funds from the Company with the exception of non-reimbursed business expenses. (This covenant does not preclude Executive from seeking workers compensation, unemployment compensation, or benefit payments from Company’s insurance carriers that could be due Executive.) (c) Non-Competition, Non-Solicitation and Confidential Information. Executive warrants that Executive has complied, and will continue to comply, fully with the requirements of the Restrictive Covenants (as such term is used in Section 3.5 of the Plan, the requirements of which are incorporated herein by reference). (d) Waiver of Unknown Claims. In waiving and releasing any and all claims against the Released Parties, whether or not now known to or suspected by Executive, Executive understands that this means that, if Executive later discovers facts different from or facts in addition to those facts currently known by Executive, or believed by Executive to be true, the waivers and releases of this Release will remain effective in all respects – despite such different or additional facts and Executive’s later discovery of such facts, even if Executive would not have agreed to this Release if Executive had prior knowledge of such facts. (e) Excluded Claims. The waiver contained in Section 2(a) above does not apply to any Claims with respect to: (i) Any claims under employee benefit plans subject to the Employee Retirement Income Security Act of 1974 (“ERISA”) in accordance with the terms of the applicable employee benefit plan, (ii) Any Claim under or based on a breach of this Release, (iii) Rights or Claims that may arise under the Age Discrimination in Employment Act after the date that Executive signs this Release, (iv) Any right to indemnification or directors and officers liability insurance coverage to which Executive is otherwise entitled in accordance with the Company’s certificate of incorporation or by-laws or an individual indemnification agreement. (f) Waiver of Age Discrimination Claims. Executive expressly acknowledges and agrees that, by entering into this Release, Executive is waiving any and all rights or claims that Executive may have arising under the Age Discrimination in Employment Act, as amended (the “ADEA”), which have arisen on or before the date that Executive signs this Release. Executive further acknowledges and agrees that: Docusign Envelope ID: 20FC7414-496C-42A2-9DFB-E66E979A82E8

10 (i) In return for this Release, Executive will receive compensation beyond that to which Executive was already entitled to receive before entering into this Release. (ii) Executive is hereby advised in writing to consult with an attorney before signing this Supplemental Release. (iii) Executive is hereby informed that (x) Executive has twenty-one (21) days from the date this Release was first provided to him within which to consider signing it, (ii) the 21-day period to consider this Release will not re- start or be extended if any changes (whether material or immaterial) are made to this Release after the date it is first provided to Executive, and (iii) if Executive signs this Release before the end of such 21-day period, Executive acknowledges and agrees that Executive will have done so voluntarily and with full knowledge that Executive is waiving Executive’s right to have twenty-one (21) days to consider this Release. (iv) Executive is hereby informed that Executive has seven (7) days following the date that Executive signs this Release in which to revoke it, and that this Release will become null and void if Executive elects revocation during that time. Any revocation must be in writing and must be received by the Company (delivered to the Company’s outside counsel, Michele Kloeppel, mkloeppel@thompsoncoburn.com, with a copy to Richard Emery at generalcounsel@centrusenergy.com) during the 7-day revocation period. In the event that Executive exercises Executive’s right of revocation, neither the Company nor Executive will have any obligations under this Release and Executive will not be entitled to the Severance Benefits. (v) Nothing in this Release prevents or precludes Executive from challenging or seeking a determination in good faith of the validity of this waiver under the ADEA, nor does it impose any condition precedent, penalties or costs from doing so, unless specifically authorized by federal law. (g) No Pending Or Future Lawsuits Based On Released Claims. Executive represents and warrants that Executive does not have any lawsuits, claims, or actions pending in Executive’s name, or on behalf of any other person or entity, against the Company or any of the Released Parties. Executive agrees and covenants that neither Executive, nor any person, organization or other entity on Executive’s behalf, will file, charge, claim, sue or cause to permit to be filed, charged or claimed, any civil action, suit or legal proceeding for personal relief (including any action for damages, injunctive, declaratory, monetary or other relief) against the Released Parties involving any matter occurring at any time in the past up to and including the date of this Release or involving any continuing effects of any acts or practices which may have arisen or occurred prior to the date of this Release. Executive further agrees that if any person, organization, or other entity should bring a claim against the Released Parties involving any such matter, Executive will not accept any personal relief in such action. Docusign Envelope ID: 20FC7414-496C-42A2-9DFB-E66E979A82E8

11 (h) No Sex Discrimination, Sexual Assault, Sexual Harassment. Executive has not made any claims or allegations to the Company related to sexual harassment, sex discrimination, or sexual assault, and that none of the payments set forth in this Agreement are related to sexual harassment, sex discrimination, or sexual assault (i) No Liens. Executive represents and warrants that (a) Executive has the capacity to act on Executive’s own behalf and on behalf of all who might claim through him to bind them to the terms and conditions of this Release; and (b) there are no liens or claims of any lien or assignment in law or equity or otherwise of or against any of the Claims released herein. (j) Government Agency Claims Exception. Notwithstanding anything to the contrary herein, nothing in this Release restricts or prohibits Executive from initiating communications directly with, responding to inquiries from, providing testimony before, providing confidential information to, reporting possible violations of law or regulation to, or from filing a claim or assisting with an investigation directly with a self-regulatory authority or government agency or entity, including the U.S. Equal Employment Opportunity Commission, the Department of Labor, the National Labor Relations Board, the Department of Justice, the Securities and Exchange Commission, the Nuclear Regulatory Commission, Congress, and any agency Inspector General (collectively, the “Regulators”), or from making other disclosures that are protected under the whistleblower provisions of state or federal law or regulation. However, to the maximum extent permitted by law, Executive is waiving the right to receive any individual monetary relief from the Company or any others covered by the Release of Claims resulting from such claims or conduct, regardless of whether Executive or another party has filed them, and in the event Executive obtains such monetary relief, the Company will be entitled to an offset for the payments made pursuant to this Release. This Release does not limit Executive’s right to receive an award from any Regulator that provides awards for providing information relating to a potential violation of law. Executive does not need the prior authorization of the Company to engage in conduct protected by this paragraph, and Executive does not need to notify the Company that Executive has engaged in such conduct. (k) Bring Down Release. If Executive signs this Release during the period prior to Executive’s last day of employment, as a further condition to the payments and benefits herein, Executive agrees, within twenty-one (21) days following the Separation Date, to execute and not revoke a release of claims in the form attached hereto as Exhibit A. 3. Cessation of Service. Executive acknowledges and agrees that Executive’s employment with the Company and/or any of its parent, subsidiary, or affiliated entities will end on August 29, 2025 (the “Separation Date”). Executive acknowledges and agrees that Executive’s service as an officer or director with the Company and/or any of its parent, subsidiary, or affiliated entities ends on August 10, 2025. Docusign Envelope ID: 20FC7414-496C-42A2-9DFB-E66E979A82E8

12 4. Clawback Policy. Executive acknowledges and agrees that the Severance Benefits shall be subject to Section 3.6 of the Plan (the provisions of which are incorporated herein by reference), the Company’s Clawback Policy, effective as of August 3, 2023, and any other compensation clawback, recoupment, and/or anti-hedging policies that may be generally applicable to current or former executive officers of the Company, as in effect from time to time and as approved by the Board or a duly authorized committee thereof, to the extent required by applicable law. 5. Section 409A of the Internal Revenue Code. This Release is intended to comply with the requirements of section 409A of the Code (“Section 409A”), which relates to nonqualified deferred compensation arrangements, which can include severance benefits. Accordingly, this Release will be construed and interpreted to comply with Section 409A and, if necessary, any provision in this Release will be held null and void to the extent such provision (or part thereof) fails to comply with Section 409A or regulations issued under Section 409A. Executive and the Company also agree that any amounts payable under this Release will be excludible from the requirements of Section 409A to the maximum possible extent under applicable exceptions to those requirements for certain severance benefits. Executive and the Company agree that each payment of compensation under this Release will be treated as a separate payment of compensation for purposes of the Section 409A rules and exceptions. Further, any reimbursements or in-kind benefits provided under this Release that are subject to Section 409A will be made or provided in accordance with the requirements of Section 409A. Notwithstanding anything in this Release to the contrary, any right of the Company to offset or otherwise reduce any sums that may be due or become payable by the Company to Executive under this Release, by any overpayment or indebtedness of Executive, will be subject to limitations imposed by Section 409A. In addition, notwithstanding anything to the contrary herein, in the event that any aspect of the Severance Benefits is considered deferred compensation subject to additional taxes or penalties under Section 409A if paid on or commencing on the date specified in this Release, because Executive is a “Specified Employee” within the meaning of the Section 409A regulations, such payment or distribution shall be deferred and made on the earliest date on which Section 409A permits such payment or commencement without additional taxes or penalties under Section 409A (i.e., the first business day following the 6-month anniversary of the Participant’s separation from service, or Executive’s death if earlier). In the event payment is deferred under the preceding sentence, any amount that would have been paid prior to the deferred payment date but for Section 409A shall be paid in a single lump sum on such earliest payment date, without interest. 6. Voluntary Execution of Release. Executive acknowledges and agrees that (a) Executive has had the opportunity to have Executive’s own counsel provide Executive with legal and tax advice regarding the terms, conditions and releases contained in this Release; (b) Executive has read and understands the terms and consequences of this Release and of the releases it contains; (c) Executive is fully aware of the legal and binding effect of this Release; and (d) this Release has been mutually drafted by the parties and shall not be construed against either party as the drafter. Docusign Envelope ID: 20FC7414-496C-42A2-9DFB-E66E979A82E8

13 7. Governing Law. This Agreement and all matters arising out of or relating to this Agreement and Executive's employment or termination of employment with the Company, whether sounding in contract, tort, or statute, for all purposes shall be governed by and construed in accordance with the laws of Maryland without regard to any conflicts of laws principles that would require the laws of any other jurisdiction to apply. 8. Counterparts. This Agreement may be executed in counterparts, and each counterpart shall have the same force and effect as an original and shall constitute an effective, binding agreement on the part of each of the undersigned. Either party may execute this Release by signing on the designated signature block below, and by transmitting such signature page via facsimile, e-mail (via PDF format) or any electronic signing services (such as DocuSign) to the other party. Any signature made and transmitted by facsimile, e-mail (via PDF format) or any electronic signing services for the purpose of executing this Release shall be deemed an original signature for purposes of this Release, and shall be binding upon the party transmitting signature by facsimile, e-mail (via PDF format) or any electronic signing services. BY SIGNING BELOW, BOTH THE COMPANY AND EXECUTIVE AGREE THAT THEY UNDERSTAND AND ACCEPT EACH PART OF THIS RELEASE. EXECUTIVE Signed: ________________________________ Kevin J. Harrill ________________________________ DATE CENTRUS ENERGY CORP. Signed: ________________________________ Mikel Williams Chairman of the Board of Directors ________________________________ DATE Docusign Envelope ID: 20FC7414-496C-42A2-9DFB-E66E979A82E8

14 Exhibit A Bring Down Release of Claims Agreement This Bring Down Release Agreement (“Agreement”) between Kevin J. Harrill (“Executive”) and Centrus Energy Corp. (the “Company”) is hereby incorporated and made part of the Waiver and Release Agreement between the Company and Executive dated on or about _____________ (the “Severance Agreement,” hereby incorporated by reference). WHEREAS Executive’s employment ended on or about August 29, 2025, and WHEREAS Executive entered into the Severance Agreement which provides, inter alia, that Executive be presented with this Agreement on or about Executive’s Separation Date as a condition to the payments and benefits under the Severance Agreement, and to bring down the release of claims through the Separation Date, and WHEREAS the payments and other consideration provided to Executive under this Agreement and the Severance Agreement are inclusive of all compensation, severance pay and other benefits to which Executive is or may be entitled, and WHEREAS the Company and Executive intend the terms and conditions of this Agreement and the Severance Agreement to govern all issues related to Executive’s employment and the cessation of Executive’s employment with the Company. NOW, THEREFORE, in consideration of the covenants and mutual promises contained herein and in the Severance Agreement, the Company and Executive agree as follows: 1. Executive Representations. Executive hereby represents and acknowledges to the Company that (a) the Company has advised Executive to consult with an attorney of his choosing; (b) Executive has had at least twenty-one (21) days to consider any waiver of his rights under the Age Discrimination in Employment Act of 1967, as amended (“ADEA”) prior to signing this Agreement; (c) Executive agrees with the Company that changes to this Agreement, if any, whether material or immaterial, will not restart the running of this consideration period; (d) Executive has disclosed to the Company any information in his knowledge, possession, custody, or control concerning any conduct involving the Company or its affiliates that Executive has any reason to believe involves any false claims to the United States or is or may be unlawful or violates Company Policy in any respect; (e) consideration provided to Executive under this Agreement is sufficient to support the releases provided by the Executive under this Agreement and is in addition to anything of value to which he was already entitled; and (f) Executive has not filed any charges, claims or lawsuits against the Company involving any aspect of Executive’s employment which have not been terminated as of the Effective Date of this Agreement. Executive understands that the Company regards the representations made by him as material, and that the Company is relying on these representations in entering into this Agreement. Docusign Envelope ID: 20FC7414-496C-42A2-9DFB-E66E979A82E8

15 2. Effective Date of the Agreement. Executive shall have seven days from the date Executive signs this Agreement to revoke Executive’s consent to the waiver of Executive’s rights under the ADEA in writing addressed and delivered to the Company official identified below which action shall revoke this Agreement. In order to be valid, any written notice of revocation must be faxed, e-mailed, hand- delivered, or postmarked no later than the seventh (7th) calendar day after the date Executive signs this Agreement. If Executive revokes this Agreement, all of its provisions shall be void and unenforceable. If Executive does not revoke consent, the Agreement will take effect on the day after the end of this revocation period (the “Effective Date”). Notice of revocation should be delivered to the Company’s outside counsel, Michele Kloeppel, mkloeppel@thompsoncoburn.com, with a copy to Richard Emery at generalcounsel@centrusenergy.com. 3. Release of Claims. Executive and his heirs, assigns, and agents, release, waive, and discharge the Company and Released Parties as defined below from each and every claim, action or right of any sort, known or unknown, arising on or before the Effective Date. (a) General Waiver and Release. Except as provided in Section 2(f) of the Severance Agreement, Executive and any person acting through or under Executive hereby release, waive and forever discharge the Company, its past and present subsidiaries and affiliates, and their respective successors and assigns, and their respective present or past officers, trustees, directors, shareholders, executives and agents of each of them (collectively, the “Released Parties”), from any and all claims, demands, actions, liabilities and other claims for relief and remuneration whatsoever (including without limitation attorneys’ fees and expenses), whether known or unknown, absolute, contingent or otherwise (each, a “Claim”), arising or which could have arisen up to and including the date of Executive’s execution of this Release, including without limitation those arising out of or relating to Executive’s employment or cessation and termination of employment, or any other written or oral agreement, any change in Executive’s employment status, any benefits or compensation, any tortious injury, breach of contract, wrongful discharge (including any Claim for constructive discharge), infliction of emotional distress, slander, libel or defamation of character, and any Claims arising under the United States Constitution, the Maryland Constitution, Title VII of the Civil Rights Act of 1964 (as amended by the Civil Rights Act of 1991), the Americans With Disabilities Act, the Rehabilitation Act of 1973, the Fair Labor Standards Act, the Family and Medical Leave Act, the National Labor Relations Act, the Labor- Management Relations Act, the Equal Pay Act, the Older Workers Benefits Protection Act, the Workers Retraining and Notification Act, the Age Discrimination in Employment Act, the Employee Retirement Income Security Act of 1974, Section 211 of the Energy Reorganization Act of 1974, the Maryland Human Rights Act, the Virginia Human Rights Act (VHRA), the Virginians with Disabilities Act (VDA), the Virginia Equal Pay Act, the Virginia Genetic Testing Law, the Virginia Occupational Safety and Health Act (VOSH), the Virginia Fraud Against Taxpayers Act, the Virginia Minimum Wage Act, the Virginia Payment of Wage Law, the Virginia Fraud and Abuse Whistleblower Protection Act, the Virginia Right-to-Work Law, all including any amendments and their respective implementing regulations, or any other federal, state or local statute, law, ordinance, regulation, rule or executive order, any tort or contract claims, and any of the claims, matters and issues which could have been asserted by Executive against the Company or its subsidiaries and affiliates in any legal, administrative or other proceeding. Executive agrees that if any action is brought in Executive’s name before any court or administrative body, Executive will not accept any payment of monies in connection therewith. Docusign Envelope ID: 20FC7414-496C-42A2-9DFB-E66E979A82E8

16 (b) Miscellaneous. Executive agrees that this Release specifies payment from the Company to Executive, the total of which meets or exceeds any and all funds due to Executive by the Company, and that Executive will not seek to obtain any additional funds from the Company with the exception of non-reimbursed business expenses. (This covenant does not preclude Executive from seeking workers compensation, unemployment compensation, or benefit payments from Company’s insurance carriers that could be due Executive.) (c) Non-Competition, Non-Solicitation and Confidential Information. Executive warrants that Executive has complied, and will continue to comply, fully with the requirements of the Restrictive Covenants (as such term is used in Section 3.5 of the Plan, the requirements of which are incorporated herein by reference). (d) Waiver of Unknown Claims. In waiving and releasing any and all claims against the Released Parties, whether or not now known to or suspected by Executive, Executive understands that this means that, if Executive later discovers facts different from or facts in addition to those facts currently known by Executive, or believed by Executive to be true, the waivers and releases of this Release will remain effective in all respects – despite such different or additional facts and Executive’s later discovery of such facts, even if Executive would not have agreed to this Release if Executive had prior knowledge of such facts. (e) Excluded Claims. The waiver contained in Section 3(a) above does not apply to any Claims with respect to: (i) Any claims under employee benefit plans subject to the Employee Retirement Income Security Act of 1974 (“ERISA”) in accordance with the terms of the applicable employee benefit plan, (ii) Any Claim under or based on a breach of this Release, (iii) Rights or Claims that may arise under the Age Discrimination in Employment Act after the date that Executive signs this Release, (iv) Any right to indemnification or directors and officers liability insurance coverage to which Executive is otherwise entitled in accordance with the Company’s certificate of incorporation or by-laws or an individual indemnification agreement. (f) Waiver of Age Discrimination Claims. Executive expressly acknowledges and agrees that, by entering into this Release, Executive is waiving any and all rights or claims that Executive may have arising under the Age Discrimination in Employment Act, as amended (the “ADEA”), which have arisen on or before the date that Executive signs this Release. Executive further acknowledges and agrees that: (i) In return for this Release, Executive will receive compensation beyond that to which Executive was already entitled to receive before entering into this Release. Docusign Envelope ID: 20FC7414-496C-42A2-9DFB-E66E979A82E8

17 (ii) Executive is hereby advised in writing to consult with an attorney before signing this Supplemental Release. (iii) Executive is hereby informed that (x) Executive has twenty-one (21) days from the date this Release was first provided to him within which to consider signing it, (ii) the 21-day period to consider this Release will not re-start or be extended if any changes (whether material or immaterial) are made to this Release after the date it is first provided to Executive, and (iii) if Executive signs this Release before the end of such 21-day period, Executive acknowledges and agrees that Executive will have done so voluntarily and with full knowledge that Executive is waiving Executive’s right to have twenty-one (21) days to consider this Release. (iv) Executive is hereby informed that Executive has seven (7) days following the date that Executive signs this Release in which to revoke it, and that this Release will become null and void if Executive elects revocation during that time. Any revocation must be in writing and must be received by the Company (delivered to the Company’s outside counsel, Michele Kloeppel, mkloeppel@thompsoncoburn.com, with a copy to Richard Emery at generalcounsel@centrusenergy.com) during the 7-day revocation period. In the event that Executive exercises Executive’s right of revocation, neither the Company nor Executive will have any obligations under this Release and Executive will not be entitled to the Severance Benefits. (v) Nothing in this Release prevents or precludes Executive from challenging or seeking a determination in good faith of the validity of this waiver under the ADEA, nor does it impose any condition precedent, penalties or costs from doing so, unless specifically authorized by federal law. (g) No Pending Or Future Lawsuits Based On Released Claims. Executive represents and warrants that Executive does not have any lawsuits, claims, or actions pending in Executive’s name, or on behalf of any other person or entity, against the Company or any of the Released Parties. Executive agrees and covenants that neither Executive, nor any person, organization or other entity on Executive’s behalf, will file, charge, claim, sue or cause to permit to be filed, charged or claimed, any civil action, suit or legal proceeding for personal relief (including any action for damages, injunctive, declaratory, monetary or other relief) against the Released Parties involving any matter occurring at any time in the past up to and including the date of this Release or involving any continuing effects of any acts or practices which may have arisen or occurred prior to the date of this Release. Executive further agrees that if any person, organization, or other entity should bring a claim against the Released Parties involving any such matter, Executive will not accept any personal relief in such action. (h) No Sex Discrimination, Sexual Assault, Sexual Harassment. Executive has not made any claims or allegations to the Company related to sexual harassment, sex discrimination, or sexual assault, and that none of the payments set forth in this Agreement are related to sexual harassment, sex discrimination, or sexual assault (i) No Liens. Executive represents and warrants that (a) Executive has the capacity to act on Executive’s own behalf and on behalf of all who might claim through Docusign Envelope ID: 20FC7414-496C-42A2-9DFB-E66E979A82E8

18 him to bind them to the terms and conditions of this Release; and (b) there are no liens or claims of any lien or assignment in law or equity or otherwise of or against any of the Claims released herein. (j) Government Agency Claims Exception. Notwithstanding anything to the contrary herein, nothing in this Release restricts or prohibits Executive from initiating communications directly with, responding to inquiries from, providing testimony before, providing confidential information to, reporting possible violations of law or regulation to, or from filing a claim or assisting with an investigation directly with a self-regulatory authority or government agency or entity, including the U.S. Equal Employment Opportunity Commission, the Department of Labor, the National Labor Relations Board, the Department of Justice, the Securities and Exchange Commission, the Nuclear Regulatory Commission, Congress, and any agency Inspector General (collectively, the “Regulators”), or from making other disclosures that are protected under the whistleblower provisions of state or federal law or regulation. However, to the maximum extent permitted by law, Executive is waiving the right to receive any individual monetary relief from the Company or any others covered by the Release of Claims resulting from such claims or conduct, regardless of whether Executive or another party has filed them, and in the event Executive obtains such monetary relief, the Company will be entitled to an offset for the payments made pursuant to this Release. This Release does not limit Executive’s right to receive an award from any Regulator that provides awards for providing information relating to a potential violation of law. Executive does not need the prior authorization of the Company to engage in conduct protected by this paragraph, and Executive does not need to notify the Company that Executive has engaged in such conduct. 4. Breach by Executive. The Company’s obligations to Executive after the Effective Date are contingent on the Employee’s obligations under this Agreement and the Severance Agreement. Any material breach of this Agreement by Executive will result in the immediate cancellation of the Company’s obligations under this Agreement and of any benefits that have been granted to Executive by the terms of this Agreement except to the extent that such cancellation is prohibited by law or would result in the invalidation of the foregoing release. 5. Entire Agreement. This Agreement and the Severance Agreement sets forth the entire agreement and understanding between the parties hereto and may be changed only with the written consent of both parties and only if both parties make express reference to this Agreement. The parties have not relied on any oral statements that are not included in this Agreement. Any modifications to this Agreement must be in writing and signed by Executive and an authorized employee or agent of the Company. This Agreement supersedes all prior agreements and understandings concerning the subject matter of this Agreement; provided, however, that except as provided herein, all other terms and conditions of the Severance Agreement shall remain in full force and effect and are hereby ratified and confirmed including, inter alia, the Confidentiality, Non-Solicitation and Noncompetition sections and any and all sections of the Severance Agreement which remain operative following the Separation Date pursuant to the terms of the Severance Agreement. Docusign Envelope ID: 20FC7414-496C-42A2-9DFB-E66E979A82E8

TC Comments 8/11/25 Doc #34785839 20 EXECUTIVE Signed: ________________________________ Kevin J. Harrill ________________________________ DATE CENTRUS ENERGY CORP. Signed: ________________________________ Mikel Williams Chairman of the Board of Directors ________________________________ DATE Docusign Envelope ID: 20FC7414-496C-42A2-9DFB-E66E979A82E8

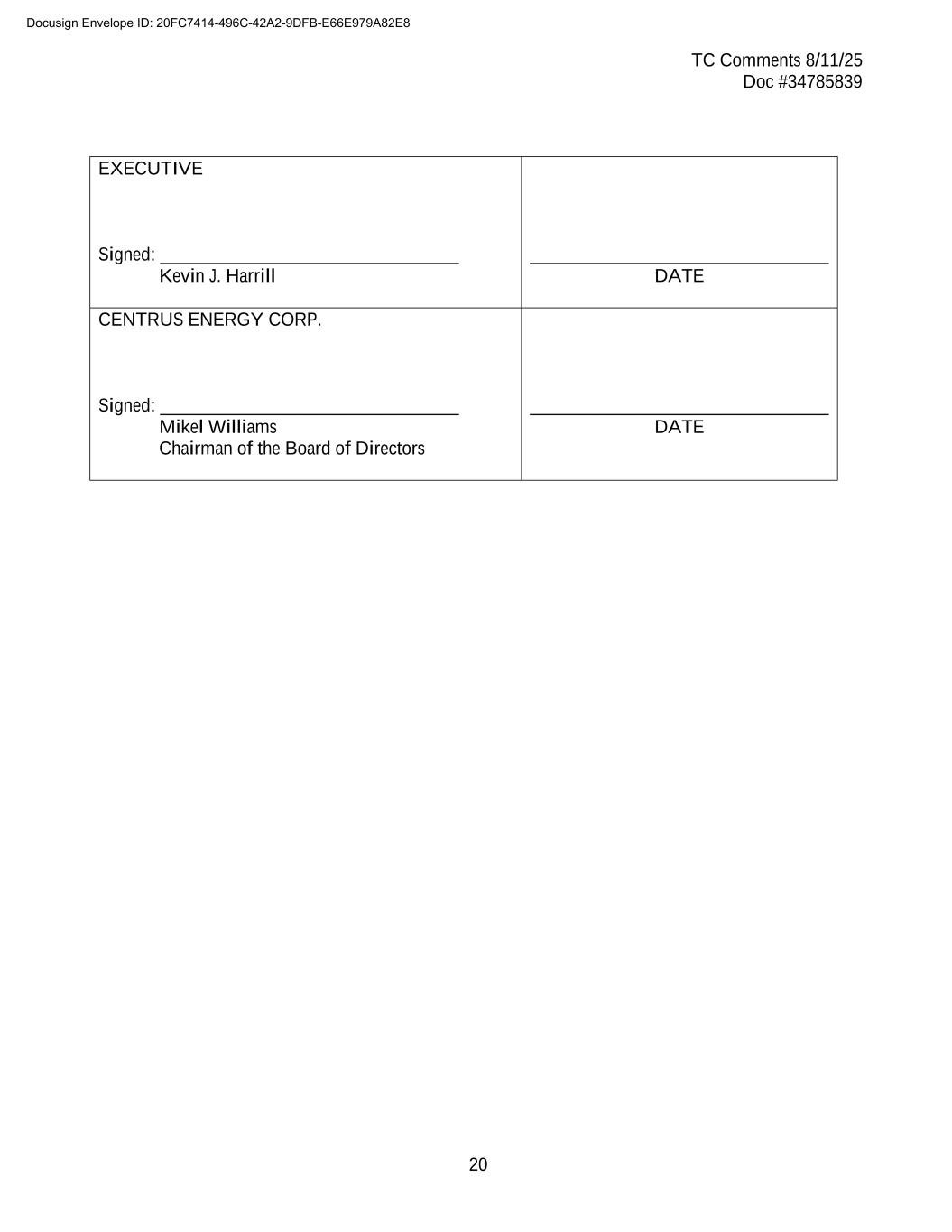

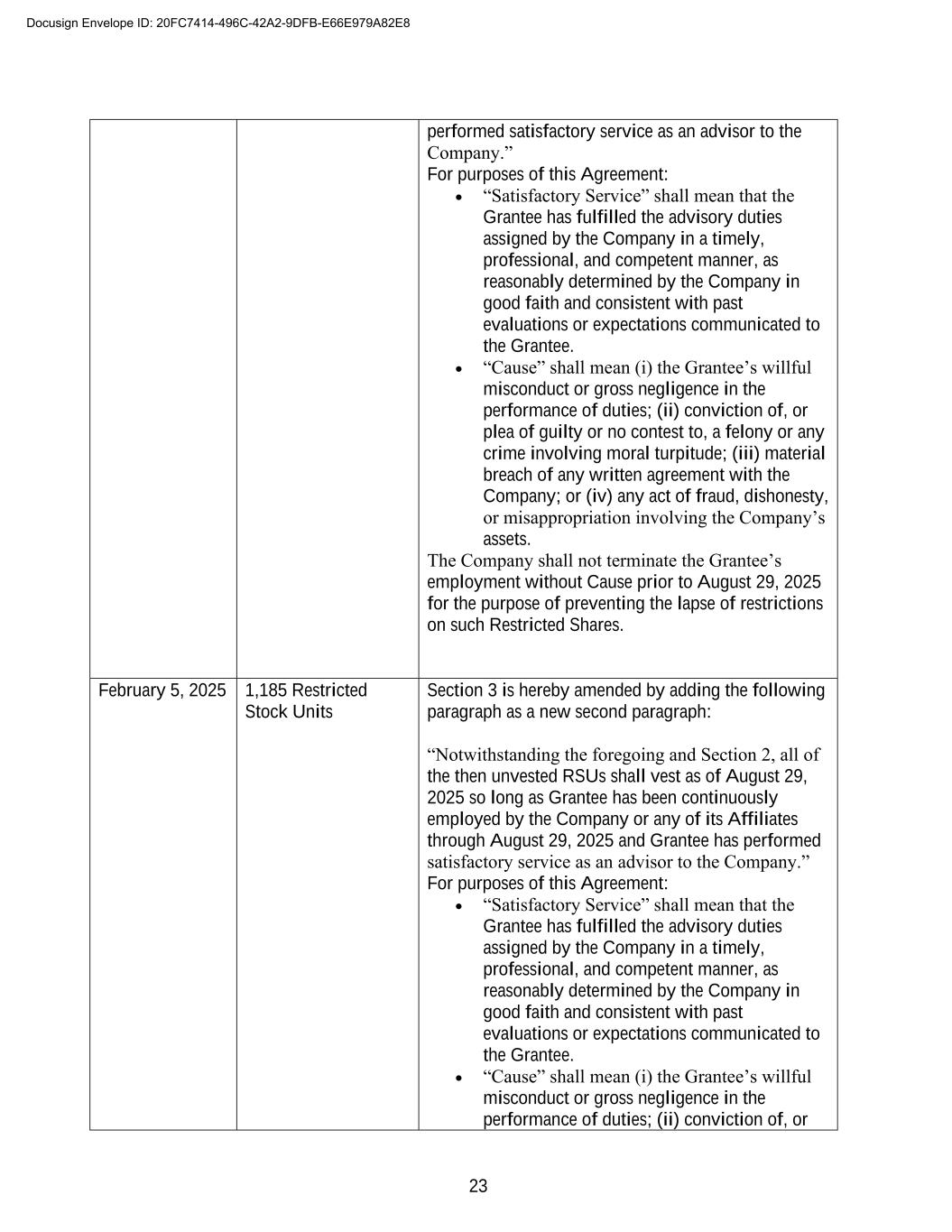

22 Exhibit B Schedule of Amendments to Award Agreements Date of Grant Type and Number of Awards Amendment March 2, 2023 1,951 Restricted Stock Units Section 4 is hereby amended by adding the following paragraph as a new third paragraph: “Notwithstanding the foregoing, the restrictions shall lapse on all of the then unvested Restricted Shares as of August 29, 2025 so long as Grantee has been continuously employed by the Company or any of its Affiliates through August 29, 2025 and Grantee has performed satisfactory service as an advisor to the Company.” For purposes of this Agreement: • “Satisfactory Service” shall mean that the Grantee has fulfilled the advisory duties assigned by the Company in a timely, professional, and competent manner, as reasonably determined by the Company in good faith and consistent with past evaluations or expectations communicated to the Grantee. • “Cause” shall mean (i) the Grantee’s willful misconduct or gross negligence in the performance of duties; (ii) conviction of, or plea of guilty or no contest to, a felony or any crime involving moral turpitude; (iii) material breach of any written agreement with the Company; or (iv) any act of fraud, dishonesty, or misappropriation involving the Company’s assets. The Company shall not terminate the Grantee’s employment without Cause prior to August 29, 2025 for the purpose of preventing the lapse of restrictions on such Restricted Shares. March 13, 2024 2,586 Restricted Stock Units Section 4 is hereby amended by adding the following paragraph as a new third paragraph: “Notwithstanding the foregoing, the restrictions shall lapse on all of the then unvested Restricted Shares as of August 29, 2025 so long as Grantee has been continuously employed by the Company or any of its Affiliates through August 29, 2025 and Grantee has Docusign Envelope ID: 20FC7414-496C-42A2-9DFB-E66E979A82E8

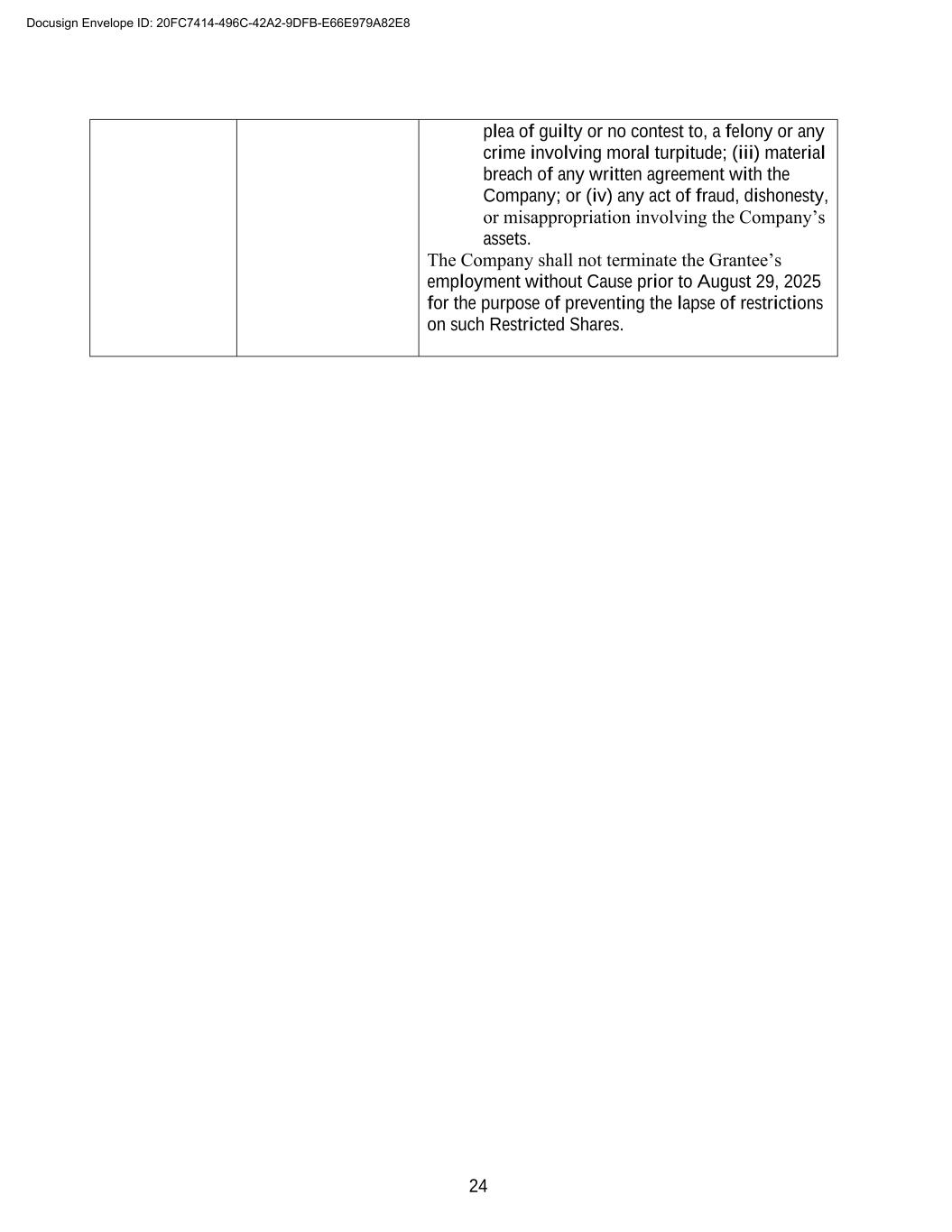

23 performed satisfactory service as an advisor to the Company.” For purposes of this Agreement: • “Satisfactory Service” shall mean that the Grantee has fulfilled the advisory duties assigned by the Company in a timely, professional, and competent manner, as reasonably determined by the Company in good faith and consistent with past evaluations or expectations communicated to the Grantee. • “Cause” shall mean (i) the Grantee’s willful misconduct or gross negligence in the performance of duties; (ii) conviction of, or plea of guilty or no contest to, a felony or any crime involving moral turpitude; (iii) material breach of any written agreement with the Company; or (iv) any act of fraud, dishonesty, or misappropriation involving the Company’s assets. The Company shall not terminate the Grantee’s employment without Cause prior to August 29, 2025 for the purpose of preventing the lapse of restrictions on such Restricted Shares. February 5, 2025 1,185 Restricted Stock Units Section 3 is hereby amended by adding the following paragraph as a new second paragraph: “Notwithstanding the foregoing and Section 2, all of the then unvested RSUs shall vest as of August 29, 2025 so long as Grantee has been continuously employed by the Company or any of its Affiliates through August 29, 2025 and Grantee has performed satisfactory service as an advisor to the Company.” For purposes of this Agreement: • “Satisfactory Service” shall mean that the Grantee has fulfilled the advisory duties assigned by the Company in a timely, professional, and competent manner, as reasonably determined by the Company in good faith and consistent with past evaluations or expectations communicated to the Grantee. • “Cause” shall mean (i) the Grantee’s willful misconduct or gross negligence in the performance of duties; (ii) conviction of, or Docusign Envelope ID: 20FC7414-496C-42A2-9DFB-E66E979A82E8

24 plea of guilty or no contest to, a felony or any crime involving moral turpitude; (iii) material breach of any written agreement with the Company; or (iv) any act of fraud, dishonesty, or misappropriation involving the Company’s assets. The Company shall not terminate the Grantee’s employment without Cause prior to August 29, 2025 for the purpose of preventing the lapse of restrictions on such Restricted Shares. Docusign Envelope ID: 20FC7414-496C-42A2-9DFB-E66E979A82E8