CRACKER BARREL INVESTOR PRESENTATION January 2026

Forward Looking Statements 2 All statements made by Cracker Barrel Old Country Store, Inc. (“the Company”) in this Presentation and in any commentary provided by the Company’s management in connection herewith other than statements of historical fact are “forward - looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and are provided under the safe harbor provisions of the Private Securities Litigation Refo rm Act of 1995, as amended. A reader or listener should not place undue reliance on forward - looking statements, all of which involve known and unknown risks and uncertainties and other important factors that could cause the Company's actual results, performance or achievements, or those of the industries and markets in which the Company participates, to differ materially from the Company's expectations o f future results, performance or achievements expressed or implied by these forward - looking statements. The Company's past results of operations do not necessarily indicate its future results, and the Company’s future results may di ffer materially from the Company’s past results and from the expectations and plans of the Company expressed in this presentation and management’s commentary due to various risks and uncertainties, including the risk factors discussed in the “Risk Factors” section of the Company’s Annual Report on Form 10 - K for the fiscal year 2025 filed on September 26, 2025, and other risk factors detailed from time to time in the Company’s filings with the Securities and Exchange Commission. This presentation and the forward - looking statements contained therein and in management’s commentary speak only as of January 12, 2026. Except as otherwise required by applicable laws, the Company undertakes no obligation to publicly update or revise any forward - looking or other statements included in this presentation or management’s commentary, whether as a result of new information, future events, changed circumstances or any other reason.

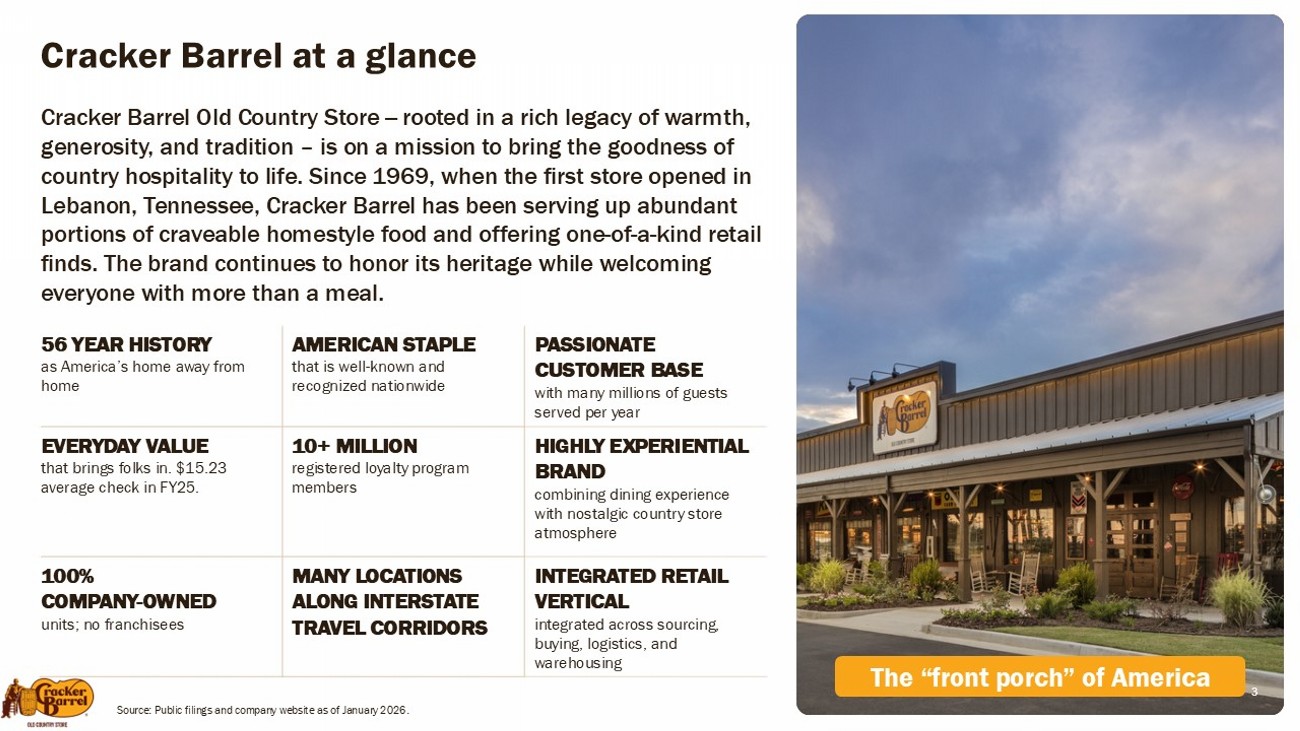

Cracker Barrel at a glance 3 The “front porch” of America Source: Public filings and company website as of January 2026. 3 PASSIONATE CUSTOMER BASE with many millions of guests served per year AMERICAN STAPLE that is well - known and recognized nationwide 56 YEAR HISTORY as America’s home away from home HIGHLY EXPERIENTIAL BRAND combining dining experience with nostalgic country store atmosphere 10+ MILLION registered loyalty program members EVERYDAY VALUE that brings folks in. $15.23 average check in FY25. INTEGRATED RETAIL VERTICAL integrated across sourcing, buying, logistics, and warehousing MANY LOCATIONS ALONG INTERSTATE TRAVEL CORRIDORS 100% COMPANY - OWNED units; no franchisees Cracker Barrel Old Country Store -- rooted in a rich legacy of warmth, generosity, and tradition – is on a mission to bring the goodness of country hospitality to life. Since 1969, when the first store opened in Lebanon, Tennessee, Cracker Barrel has been serving up abundant portions of craveable homestyle food and offering one - of - a - kind retail finds. The brand continues to honor its heritage while welcoming everyone with more than a meal.

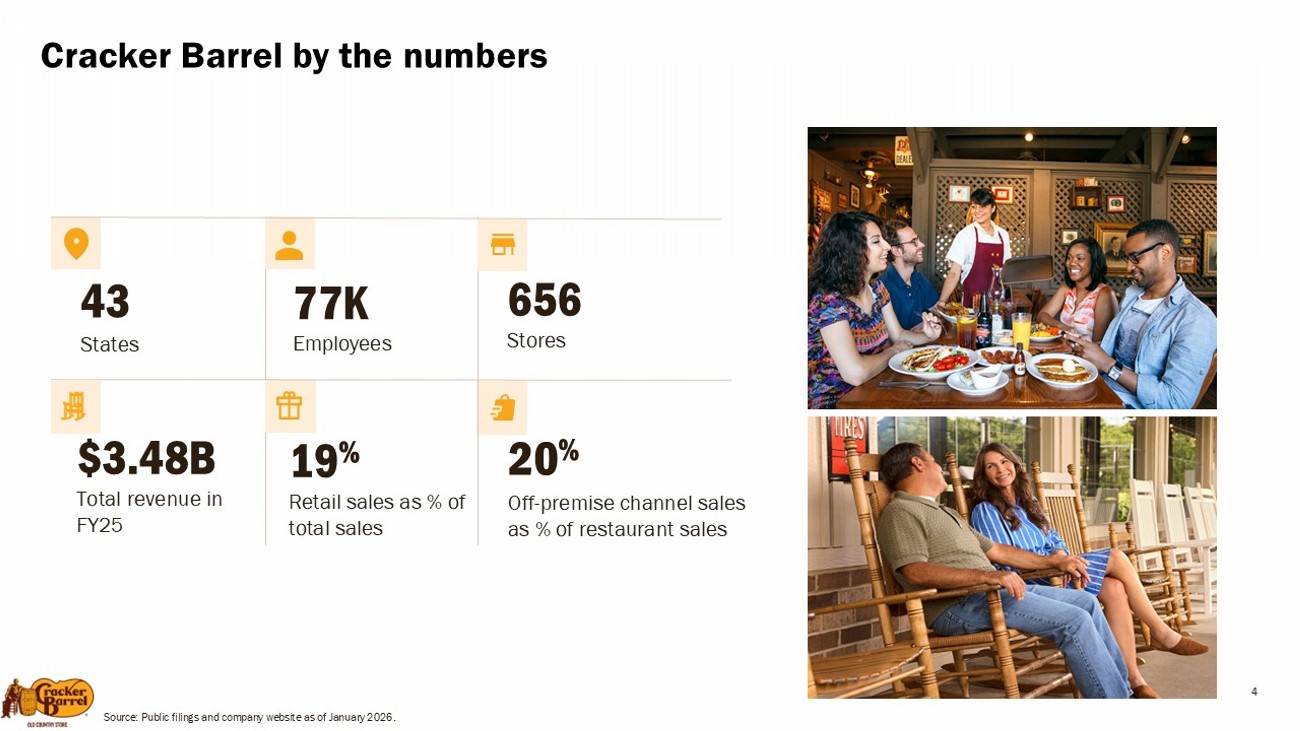

Cracker Barrel by the numbers 4 Source: Public filings and company website as of January 2026. 43 States 77K Employees 656 Stores 20 % Off - premise channel sales as % of restaurant sales 19 % Retail sales as % of total sales $3.48B Total revenue in FY25

We are taking decisive actions to return our performance to a positive trajectory 5 Evolving operations Connecting with guests Cost savings & cash management All our actions are underpinned by our priority of food and the guest experience ▪ Optimizing back - of - house ▪ Training and retraining ▪ Key leadership changes ▪ Menu ▪ Marketing ▪ Value ▪ Corporate restructuring ▪ Rationalized advertising spend ▪ Reduced capital spend

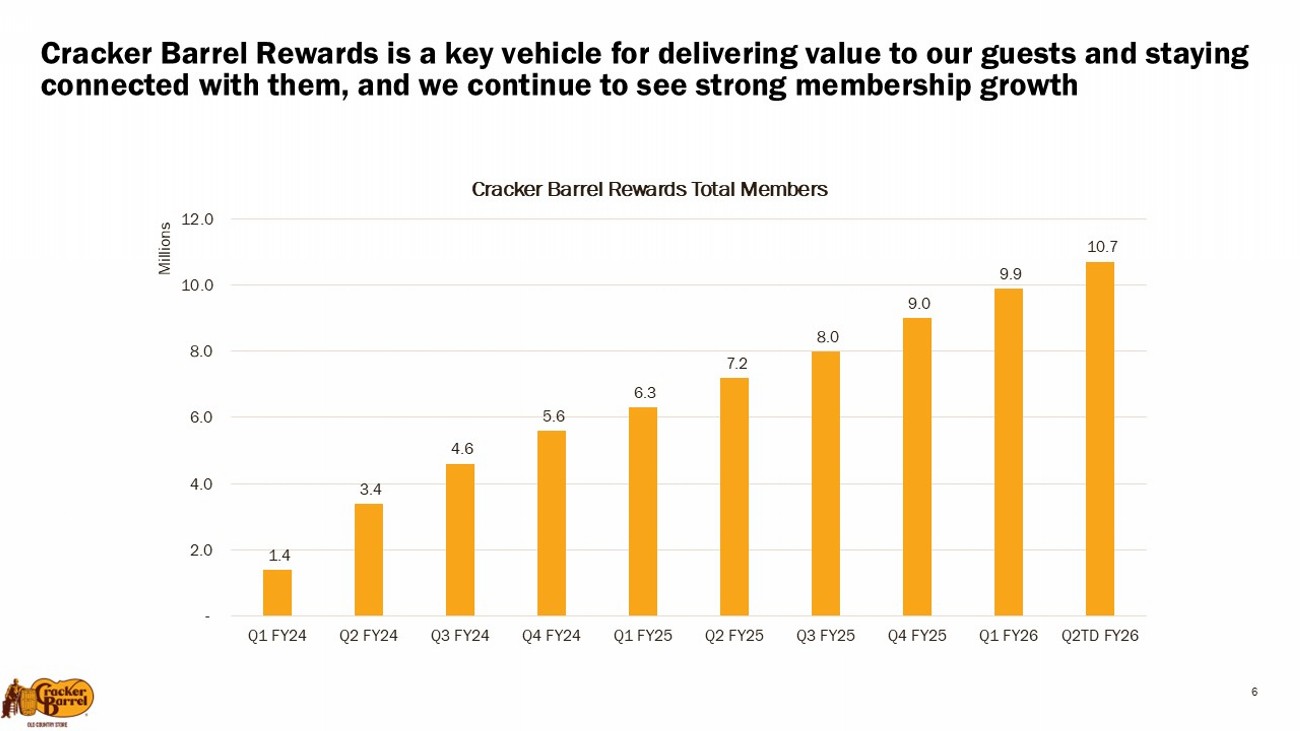

Cracker Barrel Rewards is a key vehicle for delivering value to our guests and staying connected with them, and we continue to see strong membership growth 6 1.4 3.4 4.6 5.6 6.3 7.2 8.0 9.0 9.9 10.7 - 2.0 4.0 6.0 8.0 10.0 12.0 Q1 FY24 Q2 FY24 Q3 FY24 Q4 FY24 Q1 FY25 Q2 FY25 Q3 FY25 Q4 FY25 Q1 FY26 Q2TD FY26 Millions Cracker Barrel Rewards Total Members

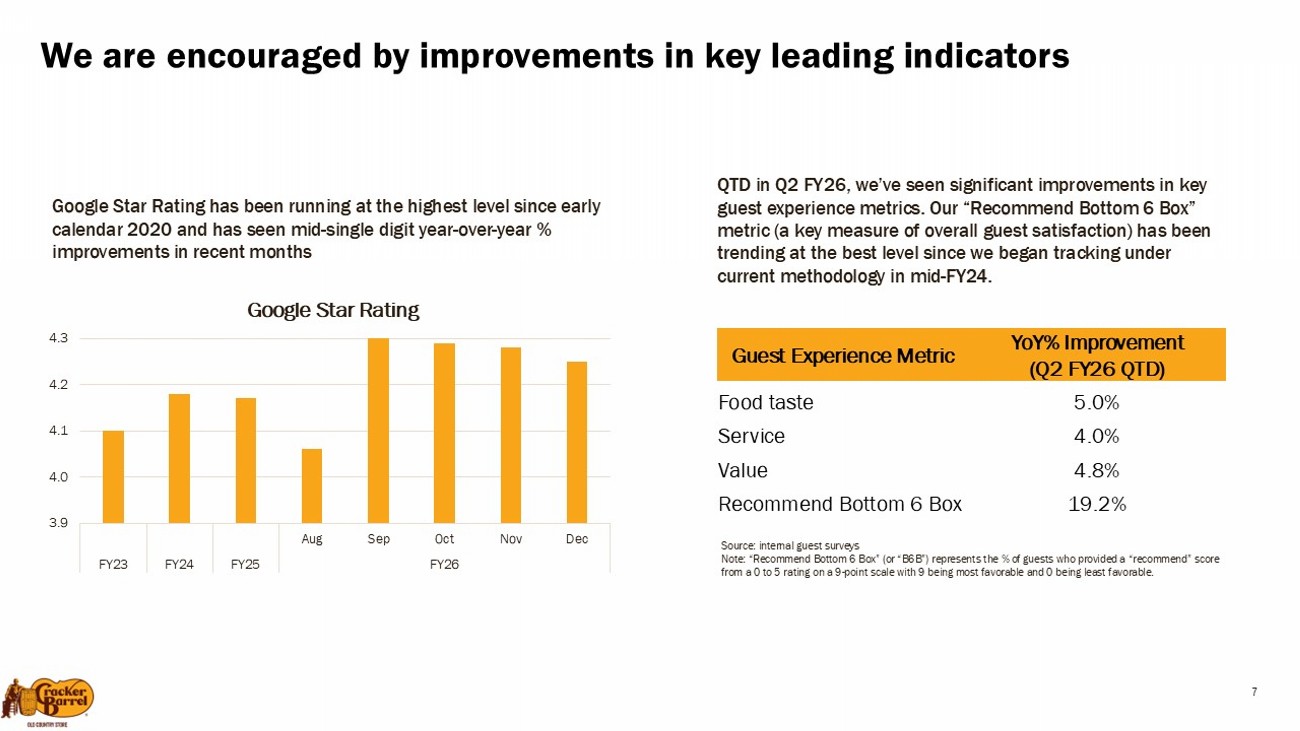

We are encouraged by improvements in key leading indicators 7 YoY% Improvement (Q2 FY26 QTD) Guest Experience Metric 5.0% Food taste 4.0% Service 4.8% Value 19.2% Recommend Bottom 6 Box Google Star Rating has been running at the highest level since early calendar 2020 and has seen mid - single digit year - over - year % improvements in recent months QTD in Q2 FY26, we’ve seen significant improvements in key guest experience metrics. Our “Recommend Bottom 6 Box” metric (a key measure of overall guest satisfaction) has been trending at the best level since we began tracking under current methodology in mid - FY24. Source: internal guest surveys Note: “Recommend Bottom 6 Box” (or “B6B”) represents the % of guests who provided a “recommend” score from a 0 to 5 rating on a 9 - point scale with 9 being most favorable and 0 being least favorable. 3.9 4.0 4.1 4.2 4.3 Aug Sep Oct Nov Dec FY23 FY24 FY25 FY26 Google Star Rating

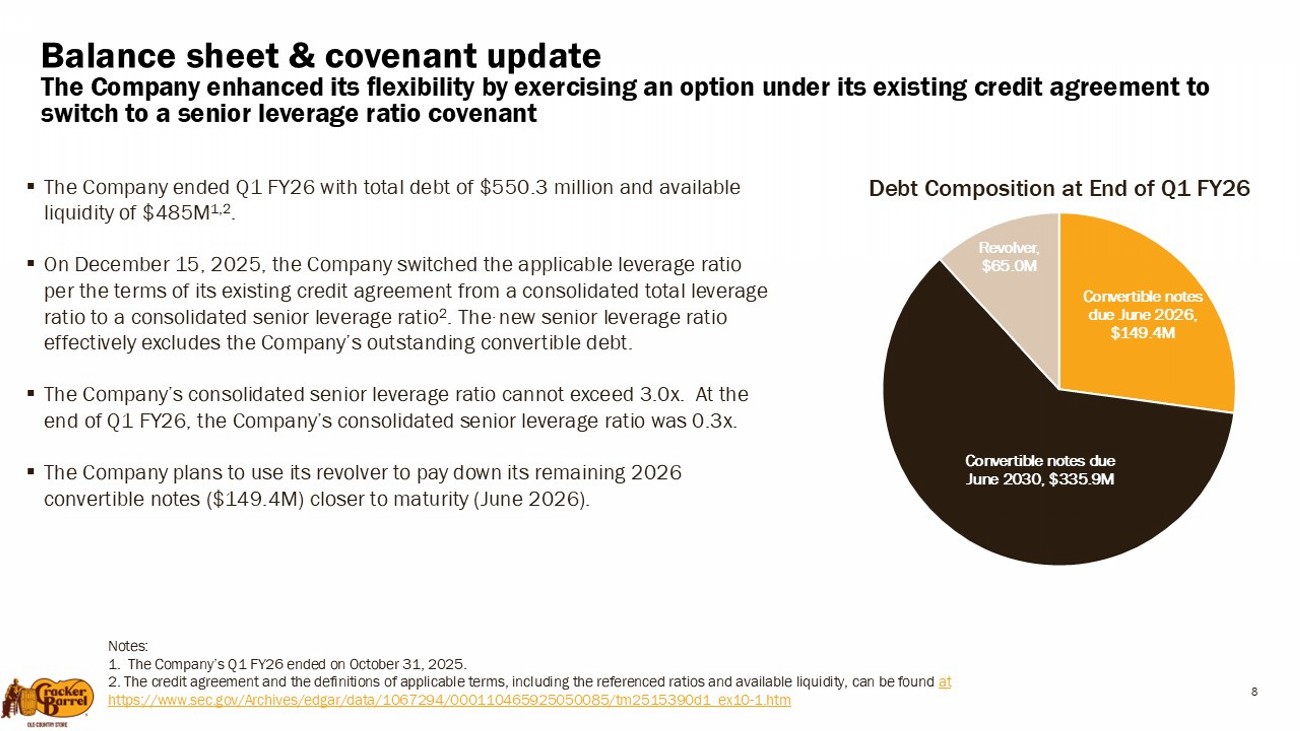

Balance sheet & covenant update The Company enhanced its flexibility by exercising an option under its existing credit agreement to switch to a senior leverage ratio covenant ▪ The Company ended Q1 FY26 with total debt of $550.3 million and available liquidity of $485M 1,2 . ▪ On December 15, 2025, the Company switched the applicable leverage ratio per the terms of its existing credit agreement from a consolidated total leverage ratio to a consolidated senior leverage ratio 2 . The . new senior leverage ratio effectively excludes the Company’s outstanding convertible debt. ▪ The Company’s consolidated senior leverage ratio cannot exceed 3.0x. At the end of Q1 FY26, the Company’s consolidated senior leverage ratio was 0.3x. ▪ The Company plans to use its revolver to pay down its remaining 2026 convertible notes ($149.4M) closer to maturity (June 2026). 8 Convertible notes due June 2026, $ 149.4 M Convertible notes due June 2030, $ 335.9 M Revolver , $ 65.0 M Debt Composition at End of Q1 FY26 Notes: 1. The Company’s Q1 FY26 ended on October 31, 2025. 2. The credit agreement and the definitions of applicable terms, including the referenced ratios and available liquidity, can be found at https://www.sec.gov/Archives/edgar/data/1067294/000110465925050085/tm2515390d1_ex10 - 1.htm

9