Filed by AngloGold Ashanti plc

This communication is filed pursuant to

Rule 425 under the United States Securities Act of 1933

Subject Company: AngloGold Ashanti Limited

Commission File Number: 333-272867

Date: July 7, 2023

This communication is filed pursuant to

Rule 425 under the United States Securities Act of 1933

Subject Company: AngloGold Ashanti Limited

Commission File Number: 333-272867

Date: July 7, 2023

Set forth below is the reorganization circular, distributed to AngloGold Ashanti Limited shareholders on July 7, 2023,

prepared in accordance with the South African Companies Act, No. 71 of 2008, the Companies Regulations, 2011 and the JSE Listing Requirements.

THIS CIRCULAR IS IMPORTANT AND REQUIRES YOUR IMMEDIATE ATTENTION

The interpretation clause and the definitions set out in the section headed “Interpretation and Definitions” commencing on page

19 of this Circular apply, unless the context clearly indicates otherwise, throughout this Circular, including this cover page.

This Circular should be read in conjunction with the Pre-listing Statement (which is available for inspection in terms of this Circular), in connection with the

secondary inward listing of the NewCo Ordinary Shares on the JSE, together with the Form F-4 (which is available for inspection in terms of the Circular), relating to the registration of the NewCo Ordinary Shares with the SEC.

ACTION REQUIRED BY SHAREHOLDERS:

| 1. |

This Circular should be read in its entirety with particular attention to the section headed “Action Required by AGA Shareholders” commencing on page 13 of this

Circular, which sets out in detail the action required to be taken by you.

|

| 2. |

If you are in any doubt as to what action you should take, please consult your CSDP, Broker, banker, accountant, legal adviser, financial adviser or other

professional adviser immediately.

|

| 3. |

If you have disposed of all of your AGA Ordinary Shares on or before Tuesday, 27 June 2023, please forward this Circular, together with the accompanying Form of Surrender and Transfer (blue), the Notice of Shareholders’ Meeting and Form of Proxy (yellow), and the Disclosure Package to the purchaser of such AGA Ordinary Shares, or to the

Broker or agent through whom the disposal of those AGA Ordinary Shares was effected for transmission to the purchaser or transferee.

|

This Circular and all transactions contemplated in this Circular shall be governed by and interpreted in accordance with the laws of South Africa. The release,

publication or distribution of this Circular in jurisdictions other than South Africa may be restricted by law and therefore any persons who are subject to the laws of any jurisdiction other than South Africa should inform themselves about, and

observe, any applicable requirements. Any failure to comply with the applicable requirements may constitute a violation of the securities laws of any such jurisdiction. AGA, the Independent Board and the AGA Board accepts no responsibility for

the failure by any of the AGA Shareholders to inform themselves about, or to observe, any applicable legal requirements in any relevant jurisdiction. AGA, the Independent Board and the AGA Board accepts no responsibility and is not liable for

any act or omission on the part of any CSDP, Broker or other nominee of its shareholders, including, without limitation, any failure on the part of the CSDP, Broker or other nominee to notify such shareholders of the details set out in this

Circular.

|

|

|

|

AngloGold Ashanti Limited

(Incorporated in the Republic of South Africa)

Registration number: 1944/017354/06

Ordinary share code: ANG ISIN: ZAE000043485

(“AGA” or the “Company”)

|

AngloGold Ashanti plc

(Incorporated in England and Wales)

Company number: 14654651

Ordinary share code: ANG ISIN: GB00BRXH2664

(“NewCo”)

|

|

COMBINED CIRCULAR TO AGA SHAREHOLDERS

|

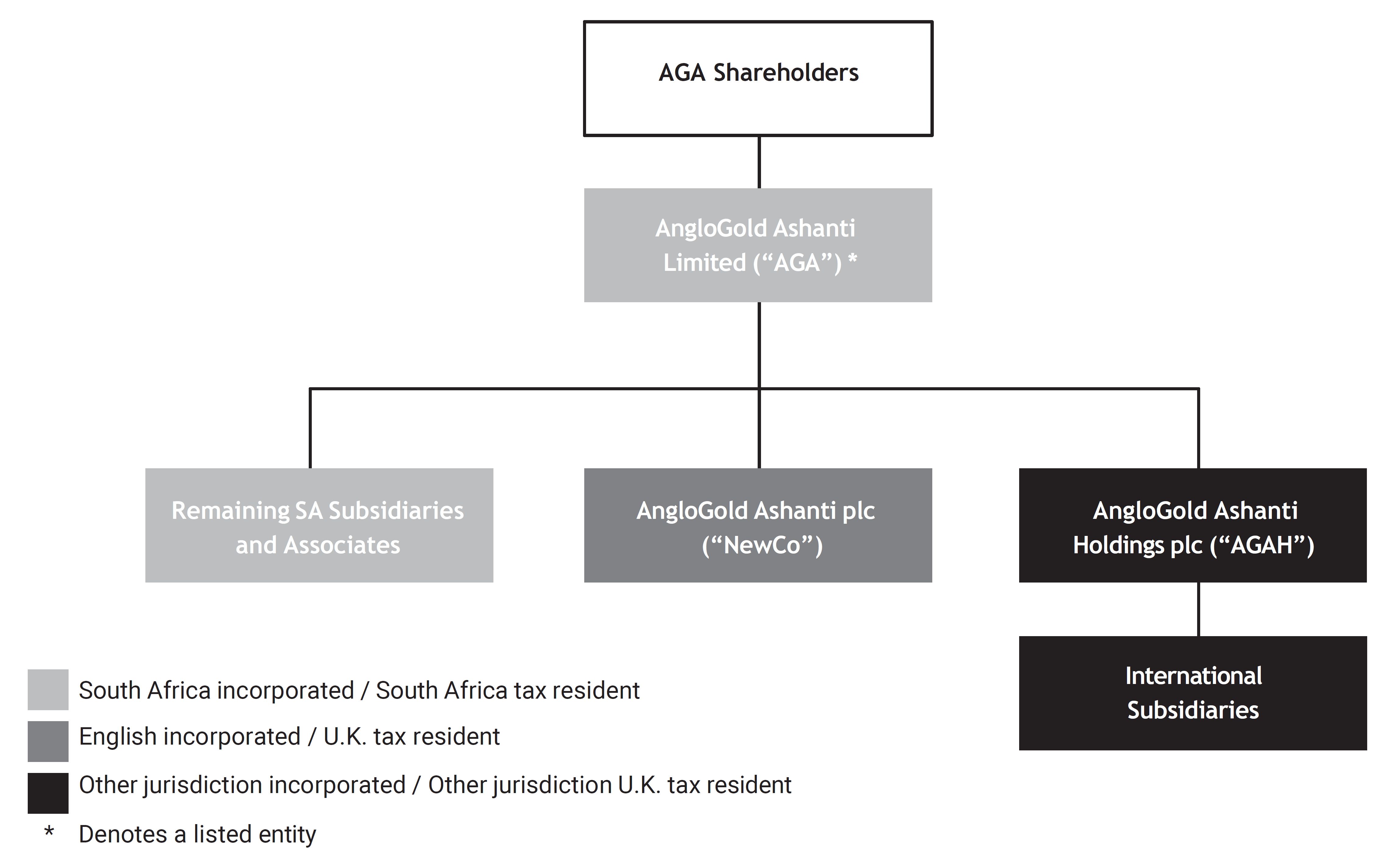

Relating to a series of inter-conditional transaction steps, to be implemented in the sequence in which they are set out below, that will result in a corporate

restructuring, a change in domicile and a change in primary listing location of the Group. The transaction steps comprise, among other things:

| ● |

the Spin-Off, in terms of which a distribution in specie will be effected by AGA to the AGA Shareholders recorded in the AGA Register as at the Reorganisation

Consideration Record Date, pursuant to which AGA will direct NewCo, its wholly-owned Subsidiary at that time, to issue 46,000 (forty six thousand) NewCo Ordinary Shares to such AGA Shareholders on a pro

rata basis, with the aggregate subscription price of USD 46,000 (forty six thousand Dollars) paid by AGA, resulting in NewCo ceasing to be a Subsidiary of AGA;

|

| ● |

the AGAH Sale, in terms of which NewCo has made an irrevocable offer to AGA to purchase 100% (one hundred percent) of the issued shares in AGAH. It is the present, non-binding intention of AGA to

accept the Irrevocable Offer to Purchase. The AGAH Sale, if completed, will constitute a disposal of all or the greater part of the assets or undertaking of AGA subject to approval under Chapter 5 of the Companies Act in terms of

Section 112 and Section 115 of the Companies Act;

|

| ● |

the Scheme, being a scheme of arrangement in terms of Section 114(1) read with Section 115 of the Companies Act between AGA and the AGA Shareholders, proposed by the AGA Board whereby NewCo will

acquire all of the issued AGA Ordinary Shares from the AGA Shareholders in consideration for the right and obligation to receive, ipso facto and without any action on the part of such AGA

Shareholders, the respective pro rata portions of the Scheme Consideration Shares;

|

| ● |

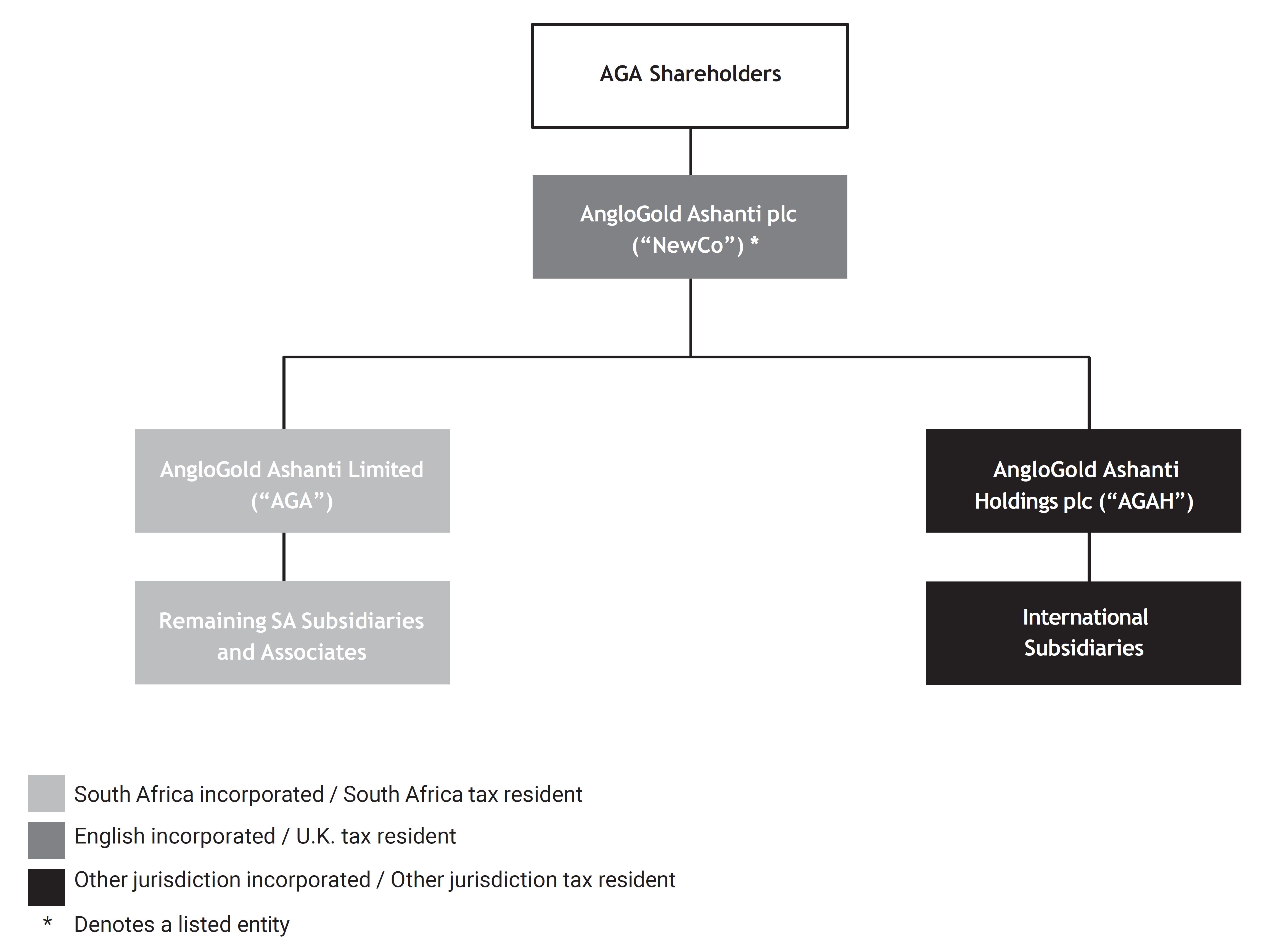

the Spin-Off, the AGAH Sale and the Scheme are three sequential, separate and inter-conditional transaction steps, referred to as the Reorganisation, which will result in, among other things:

|

1

| o |

AGA Shareholders recorded in the AGA Register as at the Reorganisation Consideration Record Date, receiving in aggregate one NewCo Ordinary Share for each AGA Ordinary Share (including AGA Ordinary

Shares represented by AGA ADSs);

|

| o |

NewCo becoming the listed parent company of the Group and each of AGA and AGAH becoming a direct, wholly-owned Subsidiary of NewCo;

|

| o |

the AGA Ordinary Shares being delisted from the JSE and the A2X in South Africa;

|

| o |

the AGA Ordinary Shares being delisted from the GhSE in Ghana;

|

| o |

the AGA GhDSs being delisted from the GhSE and replaced with the listing of NewCo GhDSs in Ghana;

|

| o |

the AGA ADSs being delisted from the NYSE and the AGA ADS Program being terminated; and

|

| o |

the NewCo Ordinary Shares having a primary listing on the NYSE, secondary inward listings on the JSE and the A2X in South Africa and a secondary listing on the GhSE in Ghana.

|

and incorporating, among other things:

| ● |

the Notice of Shareholders’ Meeting in terms of which the Shareholders’ Meeting is convened;

|

| ● |

a Form of Proxy (yellow) in respect of the Shareholders’ Meeting, for use by Certificated AGA Shareholders and Dematerialised AGA Shareholders with “own name”

registration only;

|

| ● |

a Form of Surrender and Transfer (blue), for use by Certificated AGA Shareholders only;

|

| ● |

the Independent Expert Report prepared by the Independent Expert in terms of Sections 114(2) and 114(3) of the Companies Act and Regulations 90 and 110(1);

|

| ● |

certain financial information in respect of AGA and NewCo; and

|

| ● |

extracts of Section 115 of the Companies Act dealing with the approval requirements for the AGAH Sale and the Scheme and Section 164 of the Companies Act dealing with Dissenting AGA Shareholders’

Appraisal Rights.

|

|

Legal Adviser

as to South African law

|

Legal Adviser

as to U.S. law

|

Legal Adviser

as to English law

|

|

|

|

|

Financial Adviser

|

Financial Adviser

|

Financial Adviser

|

|

|

|

|

|

Independent Expert

|

Independent Reporting Accountant

|

JSE Sponsor

|

|

|

|

|

|

|

|

Transaction Sponsor

|

Tax Adviser

as to South African tax

|

Legal Adviser

as to Ghanaian law

|

|

|

|

|

Date of issue of this Circular: Friday, 7 July 2023

This Circular is only available in English. Copies of this Circular may be obtained during normal business hours from the registered office of AGA

and the office of the Sponsors, whose addresses are set out in the “Corporate Information and Advisers” section of this Circular, during normal business hours in South Africa from the date of posting this Circular until the date of the

Shareholders’ Meeting. A copy of this Circular will also be made available on AGA’s website at https://www.anglogoldashanti.com

2

|

CORPORATE INFORMATION AND ADVISERS

|

The definitions and interpretations commencing on page 19 of this Circular apply, unless the context clearly indicates otherwise, to this section on Corporate Information and Advisers.

CORPORATE INFORMATION

|

AngloGold Ashanti Limited

Registration No. 1944/017354/06

|

AngloGold Ashanti plc

Company No. 14654651

|

|

|

Date and place of Incorporation

|

Date and place of Incorporation

|

|

|

29 May 1944, South Africa

|

10 February 2023, United Kingdom

|

|

|

Directors

|

Directors

|

|

|

Executive

|

Executive

|

|

|

Alberto Calderon

|

Alberto Calderon

|

|

|

Gillian Doran

|

Robert Hayes

|

|

|

Non-executive

|

Non-Executive

|

|

|

Maria Ramos (Chairperson)*

|

None

|

|

|

Kojo Busia*

|

||

|

Alan Ferguson*

|

Company Secretary

|

|

|

Albert Garner

|

Oakwood Corporate Secretary Limited

|

|

|

Rhidwaan Gasant*

|

Registration No. 07038430

|

|

|

Scott Lawson

|

3rd Floor

|

|

|

Maria Richter*

|

1 Ashley Road

|

|

|

Jochen Tilk*

|

Altrincham, Cheshire WA14 2DT

|

|

|

Jinhee Magie

|

United Kingdom

|

|

|

Diana Sands

|

Telephone: +44 (0)161 942 4700

|

|

|

* members of the Independent Board

|

Registered Office

|

|

|

4th Floor, Communications House

|

||

|

Company Secretary

|

South Street

|

|

|

LM Goliath

|

Staines-upon-Thames, Surrey TW18 4PR

|

|

|

(B.Com; MBA)

|

United Kingdom

|

|

|

Telephone: +44 (0) 203 968 3323

|

||

|

Registered Office

|

NewCo Transfer Agent

|

|

|

112 Oxford Road, Houghton Estate,

|

Computershare Trust Company, N.A.

|

|

|

Johannesburg, 2198

|

150 Royall Street

|

|

|

(Private Bag X 20, Rosebank, 2196)

|

Canton, Massachusetts 02021

|

|

|

South Africa

|

United States of America

|

|

|

Telephone: +27 11 637 6000

|

||

|

Fax: +27 11 637 6624

|

||

|

Transfer Secretaries

|

||

|

Computershare Investor Services Proprietary Limited

|

||

|

Registration No. 2004/003647/07

|

||

|

Rosebank Towers, 15 Biermann Avenue,

|

||

|

Rosebank, 2196

|

||

|

(Private Bag X9000, Saxonwold, 2132)

|

||

|

South Africa

|

||

|

Telephone: 0861 100 950 (in SA)

|

||

|

E-mail: queries@computershare.co.za

|

||

|

Website: www.computershare.com

|

||

|

JSE Sponsor

|

||

|

The Standard Bank of South Africa Limited

|

||

|

Registration No. 1962/000738/06

|

||

|

33 Baker, Rosebank, Johannesburg, 2196

|

||

|

South Africa

|

||

|

(PO Box 61344, Marshalltown, 2107)

|

||

|

Telephone: +27 11 721 0000

|

||

|

Transaction Sponsor

|

||

|

J.P. Morgan Equities South Africa Proprietary Limited

|

||

|

Registration No. 1995/011815/07

|

||

|

1 Fricker Road, Illovo, Johannesburg, 2196

|

||

| South Africa |

||

|

(Private Bag X9936, Sandton, 2196, South Africa)

|

3

ADVISERS

|

Legal Adviser as to South African law

|

Legal Adviser as to U.S. law

|

|

|

Edward Nathan Sonnenbergs Incorporated

|

Cravath, Swaine & Moore LLP

|

|

|

Registration No. 2006/018200/21

|

DOS ID No. 2886667

|

|

|

The MARC, Tower 1, 129 Rivonia Road, Sandton,

|

CityPoint, One Ropemaker Street, London, EC2Y 9HR

|

|

|

Johannesburg

|

United Kingdom

|

|

|

South Africa

|

||

|

(PO Box 783347, Sandton, 2146)

|

||

|

Independent Reporting Accountants

|

||

|

Legal Adviser as to English law

|

Ernst & Young Incorporated

|

|

|

Slaughter and May

|

Registration No. 2005/002308/21

|

|

|

SRA No. 55388

|

EY, 102 Rivonia Road, Sandton, Johannesburg

|

|

|

One Bunhill Row, London, EC1Y 8YY

|

South Africa

|

|

|

United Kingdom

|

(Private Bag X14, Sandton, 2146)

|

|

|

Legal Adviser as to Ghanaian law

|

Financial Adviser

|

|

|

Bentsi-Enchill, Letsa & Ankomah

4 Momotse Avenue

Adabraka, Accra

Ghana

|

JPMorgan Chase Bank, N.A., Johannesburg Branch

Registration No. 2001/016069/10

1 Fricker Road Illovo, Johannesburg, 2196, South Africa

(Private Bag X9936, Sandton, 2146, South Africa)

|

|

|

Independent Expert

|

Tax Adviser as to South African tax

|

|

|

Barclays Bank PLC

|

Bowman Gilfillan Incorporated

|

|

|

1 Churchill Place, London E14 5HP

|

Registration No. 1998/021409/21

|

|

|

United Kingdom

|

11 Alice Lane, Sandton

|

|

|

Johannesburg

|

||

|

Financial Adviser

|

South Africa

|

|

|

Centerview Partners UK LLP

|

(PO Box 785812, Sandton, 2146)

|

|

|

Company number OC345806

|

||

|

100 Pall Mall, London, SW1Y 5NQ

|

||

|

United Kingdom

|

||

|

Financial Adviser

|

||

|

Rothschild and Co South Africa Proprietary Limited

|

||

|

7th Floor, 144 Oxford, Rosebank

|

||

|

Johannesburg

|

||

|

South Africa

|

||

|

(PO Box 411332, Craighall, 2024)

|

4

|

IMPORTANT LEGAL NOTICES, DISCLAIMERS AND FORWARD-LOOKING STATEMENTS

|

The definitions and interpretations commencing on page 19 of this Circular apply, unless the context clearly indicates otherwise, to this section on Important Legal Notices, Disclaimers

and Forward-Looking Statements.

This Circular should be read in conjunction with the Pre-listing Statement (which is available for inspection in terms of this Circular), in connection with the secondary inward listing of

the NewCo Ordinary Shares on the JSE, together with the Form F-4 (which is available for inspection in terms of the Circular), relating to the registration of the NewCo Ordinary Shares with the SEC.

DISCLAIMER

The release, publication or distribution of this Circular may be restricted by law and therefore persons in any such jurisdictions into which this Circular is released, published or

distributed should inform themselves about and observe such restrictions. Any failure to comply with the applicable restrictions may constitute a violation of the securities laws or other legal requirements of any such jurisdiction. To the

fullest extent permitted by applicable law, AGA and NewCo, their respective boards of directors and advisers disclaim any responsibility or liability for the failure to become informed of or to observe or for any violation of such requirements

by any person.

This Circular is not intended to, and does not constitute an offer to sell or issue, or the solicitation of an offer to purchase or to subscribe for shares or other securities or a

solicitation of any vote or approval in any jurisdiction in which such solicitation would be unlawful or in which securities may not be offered or sold without registration or an exemption from registration. This Circular does not constitute a

prospectus or a prospectus-equivalent document. The Scheme contemplated in this Circular does not constitute an “offer to the public”, as envisaged in Chapter 4 of the Companies Act and, accordingly, this Circular does not, nor does it intend

to, constitute a ‘‘registered prospectus’’, as contemplated in Chapter 4 of the Companies Act.

To the extent that the distribution of this Circular in certain jurisdictions outside South Africa may be restricted or prohibited by the laws of such foreign jurisdiction, then this

Circular is deemed to have been provided for information purposes only and neither AGA nor NewCo, nor their respective boards of directors and advisers, accept any responsibility for any failure by AGA Shareholders to inform themselves about,

and to observe, any applicable legal requirements in any relevant foreign jurisdiction.

AGA Shareholders are advised to read this Circular, which contains the full terms and conditions of the Reorganisation with care. Any decision to approve the Reorganisation or other

response to the proposals should be made only on the basis of the information in the Disclosure Package.

AGA Shareholders must rely upon their own representatives, including their own legal advisers and accountants, and not those of AGA and/or NewCo, as to legal, tax, investment or any other

related matters concerning AGA and/or NewCo and/or the Reorganisation.

The Transaction Advisers are acting exclusively for AGA and/or NewCo (as the case may be), and no one else in connection with the Reorganisation and will not be responsible to anyone,

other than AGA and/or NewCo (as the case may be), for providing the protections afforded to clients of the Transaction Advisers, respectively, or for providing advice in relation to the Reorganisation.

No representation or warranty, express or implied, is made by any of the Transaction Advisers as to the accuracy, completeness or verification of the information set out in this Circular,

and nothing contained in this Circular is, or shall be relied upon as, a promise or representation in this respect, whether as to the past or the future. Each of the Transaction Advisers assumes no responsibility for this Circular’s accuracy,

completeness or verification and accordingly hereby disclaims, to the fullest extent permitted by applicable law, any and all liability whether arising in delict, tort, contract or otherwise which they might otherwise be found to have in

respect of this Circular or any such statement.

AGA Shareholders also acknowledge that: (a) they have not relied on the Transaction Advisers or any person affiliated with the Transaction Advisers in connection with any investigation of

the accuracy of any information contained in the Disclosure Package or their investment decision; (b) they have relied only on the information contained in the Disclosure Package; and (c) no person has been authorised to give any information or

to make any representation concerning the Company, NewCo or the NewCo Ordinary Shares (other than as contained in this Circular) and, if given or made, any such other information or representation should not be relied upon as having been

authorised by the Company or the Transaction Advisers.

The information contained in this Circular constitutes factual information as contemplated in section 1(3)(a) of the South African Financial Advisory and Intermediary Services Act, No. 37

of 2002 (as amended) and should not be construed as an express or implied recommendation, guidance or proposal that any particular transaction in respect of the Reorganisation is appropriate to the particular investment objectives, financial

situations or needs of an AGA Shareholder, and nothing in this Circular should be construed as constituting the canvassing for, or marketing or advertising of, financial services in South Africa or in any other jurisdiction.

5

APPLICABLE LAWS AND FOREIGN SHAREHOLDERS

This Circular has been prepared for the purposes of complying with the Companies Act, the Companies Regulations and the JSE Listings Requirements, and the information disclosed may not be

the same as that which would have been disclosed if this Circular had been prepared in accordance with the laws and regulations of any jurisdiction outside of South Africa.

The Reorganisation (comprising the Spin-Off, the AGAH Sale and the Scheme) is governed by the laws of South Africa and is subject to any applicable laws and regulations, including, but not

limited to, the Companies Act, the Companies Regulations, the JSE Listings Requirements and the Exchange Control Regulations.

The rights of the Foreign Shareholders in respect of the Reorganisation which is the subject of this Circular, may be affected by the laws of the relevant jurisdictions of any Foreign

Shareholders. Such Foreign Shareholders should inform themselves about and observe any applicable legal requirements of such jurisdictions. It is the responsibility of any Foreign Shareholder to satisfy themselves as to the full observance of

the laws and regulatory requirements of the relevant jurisdiction in connection with the Reorganisation, including the obtaining of any governmental, exchange control or other consents or the making of any filings which may be required, the

compliance with other necessary formalities, the payment of any transfer or other taxes or other requisite payments due in such jurisdiction.

Any Foreign Shareholder will be responsible for any transfer taxes, other taxes or other requisite payments by whomsoever payable on behalf of such Foreign Shareholder. Neither of AGA nor

NewCo, nor their respective boards of directors and advisers, accept any responsibility for any failure by Foreign Shareholders to inform themselves about, and to observe, any applicable legal requirements in any relevant foreign jurisdiction,

and AGA and/or NewCo any other person acting on their behalf shall be fully indemnified and held harmless by Foreign Shareholders for any such transfer or other taxes as such person may be required to pay.

If you have received this Circular and you are an AGA GhDS Holder or an AGA Ghana Shareholder, you will be sent a copy of AGA’s voting materials, as applicable, and an information wrapper

(the “Ghana Wrapper”), which provides important information with regards to how the Reorganisation will impact you and the specific details of how the Reorganisation will be implemented in Ghana. AGA’s

voting materials and the Ghana Wrapper will also be made available on AGA’s website at https://www.anglogoldashanti.com.

If you are a Foreign Shareholder, you are urged to read the important information relating to Foreign Shareholders contained in paragraph 7.6.12 (Foreign

Shareholders) in this Circular.

Any AGA Shareholder who is in doubt as to its position, including, without limitation, its tax status, should consult an appropriate independent professional adviser in the relevant

jurisdiction without delay.

FORWARD-LOOKING STATEMENTS

This Circular includes statements that are, or may be forward-looking statements. Forward-looking statements are not based on historical facts, but rather reflect AGA’s current

expectations concerning future results and events and generally may be identified by the use of forward-looking words or phrases such as “believe”, “aim”, “expect”, “anticipate”, “intend”, “foresee”, “forecast”, “likely”, “should”, “planned”,

“could”, “may”, “would”, “estimated”, “potential”, “outlook” or other similar words and phrases. Similarly, statements that describe AGA’s objectives, plans or goals are or may be forward-looking statements.

AGA Shareholders should consider any forward-looking statements or forecasts in light of the risks and uncertainties described in the information contained or incorporated by reference in

this Circular. These forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause the Group’s actual results, performance or achievements to differ materially from the anticipated results,

performance or achievements expressed or implied in these forward-looking statements. Although AGA and NewCo believe that the expectations reflected in such forward-looking statements and forecasts are reasonable, no assurance can be given that

such expectations will prove to have been correct. Accordingly, results could differ materially from those set out in the forward-looking statements as a result of, among other factors, risks and uncertainties related to the timing of the

Reorganisation, the possibility that the AGA Shareholders will not approve the Reorganisation, that the Reorganisation will not receive other necessary approvals or that the Reorganisation is otherwise not completed (whether following the

occurrence of a Material Adverse Effect or otherwise), the possibility that the expected benefits from the Reorganisation will not be realised or will not be realised within the expected time period, operational disruption due to the

Reorganisation, the incurrence of unexpected transaction costs and expenses or total transaction costs and expenses being higher than current estimates, the degree to which AGA is successful in implementing the Reorganisation (and deriving the

anticipated benefits from the Reorganisation) and other changes which AGA and/or NewCo may make to the Group’s corporate structure, changes in economic, social and political and market conditions, including related to inflation or international

conflicts, the success of business and operating initiatives, changes in the regulatory environment and other government actions, including environmental approvals, fluctuations in gold prices and exchange rates, the outcome of pending or

future litigation proceedings, any supply chain disruptions, any public health crises, pandemics or epidemics (including the COVID-19 pandemic), and other business and operational risks and other factors, including mining accidents. These

factors are not necessarily all of the important factors that could cause AGA’s actual results to differ materially from those expressed in any forward-looking statements. Other unknown or unpredictable factors could also have material adverse

effects on future results.

6

AGA Shareholders are therefore cautioned not to place undue reliance on the forward-looking statements and are advised to read the Disclosure Package in its entirety.

Forward-looking statements included in this Circular are made only as at the date on which the forward-looking statements are made, and neither NewCo nor AGA intends to update or release

any revisions to these forward-looking statements, except as is required by law. New factors may emerge from time to time that could cause the Group’s business, or other matters to which such forward-looking statements relate, not to develop as

expected and it is not possible to predict all of them. Further, the extent to which any factor or combination of factors may cause actual results or matters to differ materially from those contained in any forward-looking statement is not

known.

The forward-looking statements contained in this Circular have not been reviewed nor reported on by AGA’s or NewCo’s auditors or the Independent Reporting Accountant. Each of AGA and NewCo

qualifies all of its forward-looking statements by these factors and statements.

DATE OF INFORMATION PROVIDED

Unless the context clearly indicates otherwise, all information provided in this Circular is provided as at the Last Practicable Date.

NOTICE TO SHAREHOLDERS IN THE UNITED STATES

This Circular is not an offer of securities for sale in the United States. An offer of securities in the United States pursuant to a business combination transaction will only be made, as

may be required, through a prospectus which is part of an effective registration statement filed with the SEC. In connection with the Reorganisation a registration statement on Form F-4 under the Securities Act has been filed with the SEC.

Investors and shareholders are urged to read the registration statement, as well as other documents filed with the SEC, because they will contain important information. Copies of all documents filed with the SEC regarding the Reorganisation and

documents incorporated by reference may be obtained at the SEC’s website at https://www.sec.gov. In addition, the effective registration statement on Form F-4 will be made available

for free to AGA Shareholders. If you have received this Circular and you are a U.S. holder of AGA Ordinary Shares or an AGA ADS Holder, you should have been sent a copy of AGA’s voting materials and a form of notice. If you hold your AGA ADSs

indirectly through a Broker or other financial intermediary, you may receive a notice from your Broker or financial intermediary. If you did not receive AGA’s voting materials or a form of notice, you may contact the Broker or other financial

intermediary through which you hold your AGA Ordinary Shares or AGA ADSs to request a copy of these documents. If you are an AGA Shareholder with a registered address in the United States, you are advised that your CSDP or Broker should contact

you to ascertain how you wish to cast your vote at the Shareholders’ Meeting. If you have not been contacted by your CSDP or Broker, it is advisable for you to contact your CSDP or Broker and furnish them with your voting instructions. AGA ADS

Holders are advised that the notification of the upcoming vote will be made through customary U.S. market practices and pursuant to the terms of the AGA Deposit Agreement under which the AGA ADSs have been issued.

NOTICE TO SHAREHOLDERS IN AUSTRALIA

This Circular is not a disclosure document for the purposes of Chapter 6D of the Australian Corporations Act 2001 (Cth) (the “Corporations Act”) and does not purport to include the information required of a disclosure document under Chapter 6D of the Corporations Act. It has not been approved by any Australian regulatory authority,

such as the Australian Securities and Investments Commission (“ASIC”) and has not been lodged with ASIC. NewCo Ordinary Shares which will be issued as part of the Reorganisation to Australian resident

Scheme Participants (as defined below) will be issued in reliance on exemptions in the Corporations Act and ASIC Legislative Instrument 2015/358 (as in respect of the Scheme, it will occur under a foreign compromise or arrangement that is made

in accordance with laws in force in South Africa, being an eligible foreign country). Australian resident Scheme Participants are advised to exercise caution in relation to the proposal set out in this document. Australian resident Scheme

Participants should obtain independent professional advice if they have any queries or concerns about any of the contents or subject matter of this document.

7

NOTICE TO FORMER CDI HOLDERS WHO RETAIN A BENEFICIAL INTEREST IN AGA ORDINARY SHARES

FOLLOWING THE ASX DELISTING

AGA resolved to terminate its listing on the ASX regardless of whether the Reorganisation is implemented. AGA received approval to voluntarily delist from the ASX (which occurred on or

about 27 June 2023).

Prior to the ASX Delisting, AGA’s securities traded on ASX in form of a CHESS Depositary Interest (“CDI”). A CDI represented an uncertificated unit

of beneficial ownership in AGA Ordinary Shares at a ratio of five CDIs per AGA Ordinary Share. CDI holders did not hold direct legal title to the underlying AGA Ordinary Shares, which was held for and on behalf of CDI holders by CHESS

Depositary Nominees Pty Limited (“CDN”), a wholly owned subsidiary of ASX Limited that was created to fulfil the functions of a depositary nominee. CDN is authorised by its Australian Financial Services

Licence to operate custodial and depositary services, other than investor directed portfolio services, to wholesale and retail clients. As holders of CDIs are not the legal owners of the underlying ordinary shares, CDN is entitled to vote at

meetings of shareholders on the instruction of the registered holder of the CDIs.

As a result of the ASX Delisting CDIs are no longer traded or quoted on the ASX and holders of CDIs on and from the ASX Delisting will no longer hold CDIs in AGA. However, these holders (“Former CDI Holders”) continue to have a beneficial interest in the same AGA Ordinary Shares which were underlying their CDIs (“Beneficial Interest”). This is because

those AGA Ordinary Shares continue to be held by CDN in trust for their benefit until they are dealt with under one of the options described in previous communications made to Former CDI Holders, which include converting the Beneficial Interest

into AGA Ordinary Shares, participating in a voluntary sale facility or, following the closure of that facility, participating by default in a compulsory sale process (which will conclude prior to implementation of the Reorganisation such that

at implementation of the Reorganisation no Beneficial Interests will remain).

As a result, Former CDI Holders who retain a Beneficial Interest on the Shareholders’ Meeting Voting Record Date are entitled to vote at the Shareholders’ Meeting.

Former CDI Holders may attend the Shareholders’ Meeting, however, they are unable to vote in person at the meeting. Each Former CDI Holder will be entitled to one vote for every Beneficial

Interest that they hold. However, each Beneficial Interest represents one fifth of an AGA Ordinary Share (i.e., 0.2 (zero point two) AGA Ordinary Shares). In order to have votes cast at the Shareholders’ Meeting on their behalf, Former CDI

Holders must vote in accordance with the instructions contained in a beneficial interest voting instruction form (the “Beneficial Interest Voting Instruction Form”) which will be announced on the ASX and

dispatched to the Former CDI Holders. A blank Beneficial Interest Voting Instruction Form will also be made available on AGA’s website at https://www.anglogoldashanti.com.

CDN will follow the voting instructions properly received from registered holders of Beneficial Interests. If you hold your Beneficial Interest through a broker, dealer or other

intermediary, you will need to follow the instructions of your intermediary.

Should Former CDI Holders wish to convert their CDI or Beneficial Interest (as applicable) to AGA Ordinary Shares, the last date to do so is Friday, 1 September 2023. Therefore, whilst

Former CDI Holders who retain a Beneficial Interest as at the Shareholders’ Meeting Voting Record Date are able to vote at the Shareholders’ Meeting as described above, following Friday, 1 September 2023 Former CDI Holders who have not

converted their Beneficial Interest into AGA Ordinary Shares will be unable to be classified as a Scheme Participant (as their Beneficial Interests will have been sold as part of the compulsory sale process) and will therefore not be entitled

to participate in the Reorganisation as described in this Circular.

8

|

SUMMARY OF REORGANISATION

|

The definitions and interpretations commencing on page 19 of this Circular apply, unless the context clearly indicates otherwise, to this section Summary of the Reorganisation.

This Circular should be read in conjunction with the Pre-listing Statement (which is available for inspection in terms of this Circular), in connection with the secondary inward listing of

the NewCo Ordinary Shares on the JSE, together with the Form F-4 (which is available for inspection in terms of the Circular), relating to the registration of the NewCo Ordinary Shares with the SEC.

| 1. |

AGA, having disposed of its remaining South African operating assets in 2020, has undertaken a comprehensive review of its domicile and listing structure.

|

| 2. |

The review concluded that the most appropriate corporate structure for the Group is a UK corporate domicile with a U.S. primary listing on the NYSE and secondary inward listings on the JSE and the A2X

in South Africa and an additional listing on the GhSE in Ghana.

|

| 3. |

This change in corporate structure, domicile and listing structure is aligned with the transformation of AGA’s asset base into a diversified global portfolio of producing assets and projects.

|

| 4. |

The proposed Reorganisation is believed to have a number of benefits that will help facilitate implementation of the Company’s strategy and greater recognition of its full value, explained in more

detail in paragraph 6 of this Circular, including:

|

| 4.1. |

enhanced access to deeper pools of capital, including the opportunity to improve share trading liquidity;

|

| 4.2. |

improved competitive position in line with the Group’s global peers;

|

| 4.3. |

redomiciling to a leading, low-risk jurisdiction where the Group has a corporate presence;

|

| 4.4. |

minimal disruption for existing AGA Shareholders and other stakeholders; and

|

| 4.5. |

continuity of shareholding structure.

|

| 5. |

A number of inter-conditional transaction steps, implemented in sequence will be taken to implement the Reorganisation, including:

|

| 5.1. |

AGA will effect a distribution in specie to the AGA Shareholders as at the Reorganisation Consideration Record Date, pursuant to which AGA will direct NewCo,

a new UK incorporated company, and AGA’s wholly-owned Subsidiary at that time, to issue 46,000 (forty six thousand) NewCo Ordinary Shares (the “Spin-Off Shares”) to such AGA Shareholders on a pro rata basis, with the aggregate subscription price of USD 46,000 (forty six thousand Dollars) paid by AGA (the “Spin-Off” as more fully detailed in

paragraph 7.12.1.3 of this Circular), resulting in NewCo ceasing to be a Subsidiary of AGA;

|

| 5.2. |

NewCo has made an irrevocable offer to AGA to purchase 100% (one hundred percent) of the shares in AGAH. It is the present, non-binding intention of AGA to accept the Irrevocable Offer to Purchase. The

AGAH Sale, if completed, will result in NewCo holding all of the Group’s operations and assets located outside South Africa (the “AGAH Sale”, as more fully detailed in paragraph 7.12.1.4 of this

Circular); and

|

| 5.3. |

NewCo will then acquire all of the issued AGA Ordinary Shares from AGA Shareholders in consideration for a right and obligation to receive, ipso facto and

without any action on the part of such AGA Shareholders, the respective pro rata portions of the Scheme Consideration Shares, pursuant to a scheme of arrangement in terms of Section 114(1) read

with Section 115 of the Companies Act between AGA and the AGA Shareholders (the “Scheme”, as more fully detailed in paragraph 7.12.1.5 of this Circular).

|

| 6. |

If successfully completed, the aforementioned Reorganisation will result in:

|

| 6.1. |

NewCo owning all of AGA’s existing assets with:

|

| 6.1.1. |

the same shareholders as AGA immediately prior to implementation of the Reorganisation (subject to any adjustments to reflect the exercise of any Appraisal Rights by AGA Shareholders);

|

| 6.1.2. |

the business carried out by NewCo and its Subsidiaries immediately following the Reorganisation being the same as the business carried out by AGA and its Subsidiaries immediately prior to the

implementation of the Reorganisation;

|

| 6.1.3. |

a primary listing on the NYSE; and

|

| 6.1.4. |

secondary inward listings on the JSE and A2X in South Africa and a secondary listing on the GhSE in Ghana;

|

9

| 6.2. |

NewCo becoming the listed parent company of the Group and each of AGA and AGAH being a direct, wholly-owned Subsidiary of NewCo;

|

| 6.3. |

the AGA Ordinary Shares being delisted from the JSE in terms of paragraph 1.17(b) of the JSE Listings Requirements, the AGA ADSs being delisted from the NYSE and the AGA Ordinary Shares being delisted

from the GhSE;

|

| 6.4. |

the AGA ADS Program being terminated;

|

| 6.5. |

AGA GhDSs being delisted from the GhSE and the NewCo GhDSs being listed on the GhSE;

|

| 6.6. |

NewCo being subject to English company law;

|

| 6.7. |

no changes to the withholding tax rates for South African shareholders of NewCo and no South African withholding tax on dividends for other shareholders of NewCo; and

|

| 6.8. |

South African shareholders being able to hold NewCo Ordinary Shares on the South African register of NewCo without using their foreign investment allowance and to trade their NewCo Ordinary Shares on

the South African capital markets.

|

| 7. |

The Group will incur non-recurring costs in connection with the implementation of the Reorganisation and the NewCo Notes Distribution, consisting primarily of taxes payable in South Africa.

|

| 8. |

The costs of implementing the Reorganisation and the NewCo Notes Distribution will be tied to factors such as AGA’s market value and the prevailing ZAR/USD exchange rate at the time of implementation.

|

| 9. |

The total costs of the Reorganisation and NewCo Notes Distribution are currently estimated to be in the order of c. 5% (five percent) of the market capitalisation of AGA on the Operative Date.

|

The foregoing is only intended to serve as a summary of the key features of the Reorganisation and is not a comprehensive description of the Reorganisation.

Accordingly, for a full understanding of the Reorganisation, this Circular together with the Pre-listing Statement, should be read in its entirety.

10

|

TABLE OF CONTENTS

|

||

|

CLAUSE NUMBER AND DESCRIPTION

|

PAGE

|

|

|

CORPORATE INFORMATION AND ADVISERS

|

3

|

|

|

IMPORTANT LEGAL NOTICES, DISCLAIMERS AND FORWARD-LOOKING STATEMENTS

|

5

|

|

|

SUMMARY OF REORGANISATION

|

9

|

|

|

ACTION REQUIRED BY AGA SHAREHOLDERS

|

13

|

|

|

INTERPRETATION AND DEFINITIONS

|

19

|

|

|

SALIENT DATES AND TIMES

|

26

|

|

|

COMBINED CIRCULAR TO AGA SHAREHOLDERS

|

28

|

|

|

1.

|

INTRODUCTION

|

28

|

|

2.

|

PURPOSE OF THIS CIRCULAR

|

29

|

|

3.

|

BACKGROUND REGARDING AGA

|

29

|

|

4.

|

BACKGROUND REGARDING NEWCO

|

29

|

|

5.

|

BACKGROUND REGARDING AGAH

|

30

|

|

6.

|

RATIONALE FOR THE REORGANISATION AND PROSPECTS

|

30

|

|

7.

|

TERMS AND CONDITIONS OF THE REORGANISATION

|

33

|

|

8.

|

ACCOUNTING MATTERS AND TREATMENT

|

46

|

|

9.

|

EXCHANGE CONTROL REGULATIONS

|

47

|

|

10.

|

TAX IMPLICATIONS FOR AGA SHAREHOLDERS

|

47

|

|

11.

|

APPLICABLE LAWS

|

47

|

|

12.

|

SHARE CAPITAL OF AGA

|

47

|

|

13.

|

MAJOR AGA SHAREHOLDERS

|

47

|

|

14.

|

FINANCIAL INFORMATION

|

48

|

|

15.

|

INFORMATION RELATING TO AGA DIRECTORS

|

48

|

|

16.

|

BENEFICIAL INTERESTS

|

49

|

|

17.

|

CONTINUATION OF THE BUSINESS OF AGA

|

51

|

|

18.

|

OPINIONS AND RECOMMENDATIONS

|

52

|

|

19.

|

MATERIAL AGREEMENTS RELATING TO THE REORGANISATION

|

52

|

|

20.

|

MATERIAL CHANGES AND LITIGATION

|

52

|

|

21.

|

DIRECTORS’ RESPONSIBILITY STATEMENT

|

52

|

|

22.

|

COSTS OF THE REORGANISATION AND EXPENSES

|

53

|

|

23.

|

CONSENTS

|

54

|

|

24.

|

DOCUMENTS AVAILABLE FOR INSPECTION

|

54

|

11

|

CLAUSE NUMBER AND DESCRIPTION

|

PAGE

|

|

Annexure A – Report of the Independent Expert

|

58

|

|

Annexure B – The Summary of Consolidated Financial Information of AGA

|

72

|

|

Annexure C – The Pro Forma Financial Information

|

73

|

|

Annexure D – The Independent Reporting Accountant’s Assurance Report on the Pro Forma Financial Information

|

79

|

|

Annexure E – Information on AGA Directors

|

81

|

|

Annexure F – Section 115 – Required Approval for the Transactions Contemplated in Part A of Chapter 5 of the Companies Act

|

86

|

|

Annexure G – Section 164 – Dissenting Shareholders’ Appraisal Rights

|

88

|

|

Annexure H – Tax Implications for AGA Shareholders

|

91

|

|

Annexure I – Extract of the Exchange Control Regulations

|

100

|

|

Annexure J – Notice of Shareholders’ Meeting

|

101

|

|

Annexure K – Form of Proxy

|

109

|

|

Annexure L – Form of Surrender and Transfer

|

111

|

12

|

ACTION REQUIRED BY AGA SHAREHOLDERS

|

The definitions and interpretations commencing on page 19 of this Circular apply, unless the context clearly indicates otherwise, to this section on Action Required by AGA Shareholders.

This Circular should be read in conjunction with the Pre-listing Statement (which is available for inspection in terms of this Circular), in connection with the secondary inward listing of

the NewCo Ordinary Shares on the JSE, together with the Form F-4 (which is available for inspection in terms of the Circular), relating to the registration of the NewCo Ordinary Shares with the SEC.

Please take careful note of the following provisions regarding the action required by AGA Shareholders. If you are in any doubt as to what actions to take, please consult your CSDP,

Broker, banker, accountant, legal adviser, financial adviser or other professional adviser immediately.

If you have disposed of all of your AGA Ordinary Shares on or before Tuesday, 27 June 2023, please forward this Circular, together with the accompanying Form of Surrender and Transfer (blue), the Notice of Shareholders’ Meeting and Form of Proxy (yellow) and the Disclosure Package to the purchaser of such AGA Ordinary Shares, or to the Broker or

agent through whom the disposal of those AGA Ordinary Shares was effected for transmission to the purchaser or transferee.

The Shareholders’ Meeting convened in terms of the Notice of Shareholders’ Meeting will be held entirely by way of electronic communication on Friday, 18 August 2023 at

2:00 p.m. (South Africa Standard Time), or such other postponed date and time or location as determined in accordance with the provisions of the AGA Memorandum of Incorporation, the Companies Act and the JSE Listings Requirements, at which AGA

Shareholders will be requested to consider and, if deemed fit, to pass, with or without modification, the resolutions set out in the Notice of Shareholders’ Meeting. The Notice of Shareholders’ Meeting is attached to, and forms part of, this

Circular.

| 1. |

IF YOU ARE A DEMATERIALISED AGA SHAREHOLDER WITHOUT “OWN NAME” REGISTRATION

|

| 1.1. |

To Participate in the Shareholders’ Meeting

|

| 1.1.1. |

Your CSDP or Broker with whom you have concluded a custody agreement in respect of your AGA Ordinary Shares should contact you in the manner stipulated in such custody agreement to ascertain:

|

| 1.1.1.1. |

if you wish to Participate in the Shareholders’ Meeting, in which case it must furnish you with a letter of representation which gives you the necessary authorisation to do so; or

|

| 1.1.1.2. |

if you do not wish to Participate in the Shareholders’ Meeting, in which case, you must not complete the attached Form of Proxy (yellow), you must instead provide your CSDP or Broker with your voting instructions in the manner stipulated in such custody agreement or advised by your CSDP or Broker. The forementioned instructions must be provided

to your CSDP or Broker by the cut-off time and date advised by the CSDP or Broker for instructions of this nature.

|

| 1.1.2. |

If your CSDP or Broker has not contacted you, you should contact your CSDP or Broker and furnish it with your voting instructions.

|

| 1.1.3. |

If your CSDP or Broker does not obtain voting instructions from you, it will be obliged to vote in accordance with the instructions contained in the custody agreement concluded between you and your

CSDP or Broker.

|

| 1.1.4. |

You must not complete the attached Form of Proxy (yellow).

|

| 1.1.5. |

It is requested that the necessary letter of representation (and supporting identification documents) of Dematerialised AGA Shareholders without “own name” registration be delivered to the Transfer

Secretaries, as follows:

|

| 1.1.5.1. |

by email at proxy@computershare.co.za;

|

| 1.1.5.2. |

by hand to Computershare Investor Services Proprietary Limited, 1st Floor, Rosebank Towers, 15 Biermann Avenue, Rosebank, Johannesburg 2196, South Africa; or

|

| 1.1.5.3. |

by post to Computershare Investor Services Proprietary Limited, Private Bag X9000, Saxonwold, 2132,

|

so as to reach the Transfer Secretaries by no later than 2:00 p.m. (South Africa Standard Time) on Wednesday, 16 August 2023, so as to assist AGA to timeously verify the identity of such

Dematerialised AGA Shareholders who wish to Participate by electronic communication at the Shareholders’ Meeting.

13

| 1.2. |

Surrender of Documents of Title

|

You must not complete the attached Form of Surrender and Transfer (blue).

| 1.3. |

Operation of the Reorganisation

|

Subject to paragraph 8 (Dissenting AGA Shareholders’ Appraisal Rights), should the Reorganisation become unconditional and be

implemented, then, irrespective of whether you voted in favour of Special Resolution Number 1 and/or Special Resolution Number 2, you will have your accounts at your CSDP or Broker debited with your AGA Ordinary Shares and credited with NewCo

Ordinary Shares. Should the Reorganisation not be implemented, you will retain your AGA Ordinary Shares and will not be entitled to receive any NewCo Ordinary Shares.

| 2. |

IF YOU ARE A DEMATERIALISED AGA SHAREHOLDER WITH “OWN NAME” REGISTRATION

|

| 2.1. |

To Participate in the Shareholders’ Meeting

|

| 2.1.1. |

You may Participate in the Shareholders’ Meeting (or if you are a company or other body corporate be represented by a duly authorised person) by electronic communication as outlined in paragraph 4.

|

| 2.1.2. |

Alternatively, if you do not wish to or are unable to Participate in the Shareholders’ Meeting and wish to be represented thereat, you may appoint one or more proxies, who need not also be AGA

Shareholders to Participate in your place by completing the Form of Proxy (yellow), in accordance with the instructions therein, and returning it together with proof of identification (i.e.

valid South African identity document, driver’s license or passport) and authority to do so (where acting in a representative capacity), to the Transfer Secretaries, as follows:

|

| 2.1.2.1. |

by email at proxy@computershare.co.za;

|

| 2.1.2.2. |

by hand to Computershare Investor Services Proprietary Limited, 1st Floor, Rosebank Towers, 15 Biermann Avenue, Rosebank, Johannesburg 2196, South Africa; or

|

| 2.1.2.3. |

by post to Computershare Investor Services Proprietary Limited, Private Bag X9000, Saxonwold, 2132,

|

so as to reach the Transfer Secretaries by no later than 48 (forty eight) hours before the Shareholders’ Meeting that is to be held on Friday, 18 August 2023 at 2:00 p.m. (South Africa Standard

Time) (or immediately before the conclusion or adjournment of the Shareholders’ Meeting), i.e., by 2:00 p.m. on Wednesday, 16 August 2023, so as to assist AGA to timeously verify the identity of the AGA Shareholders and their proxies who wish

to participate by electronic communication at the Shareholders’ Meeting.

| 2.2. |

The Form of Proxy (yellow) may, however, be handed to the chairman of the Shareholders’ Meeting, at any time before the commencement of the voting on the

applicable matter at the Shareholders’ Meeting.

|

| 2.3. |

Surrender of Documents of Title

|

You must not complete the attached Form of Surrender and Transfer (blue).

| 2.4. |

Operation of the Reorganisation

|

Subject to paragraph 8 (Dissenting AGA Shareholders’ Appraisal Rights), should the Reorganisation become unconditional and be

implemented, then irrespective of whether you voted in favour of Special Resolution Number 1 and/or Special Resolution Number 2, you will have your accounts at your CSDP or Broker debited with your AGA Ordinary Shares and credited with NewCo

Ordinary Shares. Should the Reorganisation not be implemented, you will retain your AGA Ordinary Shares and will not be entitled to receive any NewCo Ordinary Shares.

| 3. |

IF YOU ARE A CERTIFICATED SHAREHOLDER

|

| 3.1. |

To Participate in the Shareholders’ Meeting

|

| 3.1.1. |

You may Participate in the Shareholders’ Meeting (or if you are a company or other body corporate be represented by a duly authorised person) by electronic communication as outlined in paragraph 4.

|

| 3.1.2. |

Alternatively, if you do not wish to or are unable to Participate in the Shareholders’ Meeting and wish to be represented thereat, may appoint one or more proxies, who need not also be AGA Shareholders

to Participate in your place by completing the Form of Proxy (yellow), in accordance with the instructions therein, and returning it together with proof of identification (i.e. valid South

African identity document, driver’s license or passport) and authority to do so (where acting in a representative capacity), to the Transfer Secretaries, as follows:

|

14

| 3.1.2.1. |

by email at proxy@computershare.co.za;

|

| 3.1.2.2. |

by hand to Computershare Investor Services Proprietary Limited, 1st Floor, Rosebank Towers, 15 Biermann Avenue, Rosebank, Johannesburg 2196, South Africa; or

|

| 3.1.2.3. |

by post to Computershare Investor Services Proprietary Limited, Private Bag X9000, Saxonwold, 2132,

|

so as to reach the Transfer Secretaries by no later than 48 (forty eight) hours before the Shareholders’ Meeting that is to be held on Friday, 18 August 2023 at 2:00

p.m. (South Africa Standard Time) (or immediately before the conclusion or adjournment of the Shareholders’ Meeting), i.e., by 2:00 p.m. on Wednesday, 16 August 2023, so as to assist AGA to timeously verify the identity of the AGA Shareholders

and their proxies who wish to participate by electronic communication at the Shareholders’ Meeting.

| 3.1.3. |

The Form of Proxy (yellow) may, however, be handed to the chairman of the Shareholders’ Meeting, at any time before the commencement of the voting at the

Shareholders’ Meeting.

|

| 3.2. |

Surrender of Documents of Title and Operation of the Reorganisation

|

| 3.2.1. |

Should the Reorganisation become unconditional and be implemented:

|

| 3.2.1.1. |

you will be required to surrender your Documents of Title in respect of all your AGA Ordinary Shares in order to receive the Reorganisation Consideration which will be in Dematerialised form; and

|

| 3.2.1.2. |

you shall only be entitled to receive the Reorganisation Consideration owed to you once you have surrendered your Documents of Title in respect thereof. This is achieved by completing the attached Form

of Surrender and Transfer (blue) in accordance with its instructions and returning it, together with the relevant Documents of Title, to the Transfer Secretaries to be received by no later than

12:00 p.m. (South Africa Standard Time) on the Reorganisation Consideration Record Date. Should you wish to expedite receipt of your Reorganisation Consideration, you are entitled to surrender your Documents of Title in anticipation of

the Reorganisation being implemented, by completing the Form of Surrender and Transfer (blue) in accordance with the provisions contained in this paragraph 3.2.1.2 of this Circular. Documents

of Title surrendered by you prior to the Operative Date, will be held in trust by the Transfer Secretaries, at your risk, pending the Reorganisation becoming unconditional. Should you surrender your Documents of Title in anticipation of

the Reorganisation being implemented and the Reorganisation then is not implemented, the Transfer Secretaries shall, within 5 (five) Business Days of either the date upon which it becomes known that the Reorganisation will not be

implemented or on receipt by the Transfer Secretaries of the required Documents of Title, whichever is the later, return the Documents of Title to you by registered post at your own risk.

|

| 3.2.2. |

Once you have surrendered your Documents of Title, you will not be able to trade your AGA Ordinary Shares from the date that you surrender your Documents of Title in respect of those AGA Ordinary

Shares until the Operative Date or, if the Reorganisation is not implemented, between the date of surrender and the date on which your Documents of Title are returned to you as set out in paragraph 3.2.1.2 of this Circular.

|

| 3.2.3. |

If:

|

| 3.2.3.1. |

you fail to surrender your Documents of Title by not completing and returning the Form of Surrender and Transfer (blue) in accordance with the instructions

contained therein; or

|

| 3.2.3.2. |

you fail to provide any account details, or provide incorrect account details, of your CSDP or Broker, into which your Scheme Reorganisation Consideration will be transferred in Dematerialised form,

|

your Scheme Reorganisation Consideration will be transferred to an account in the name of Computershare Nominees, who will, subject to what is stated in paragraph 7.6

below of this Circular, hold the Reorganisation Consideration as the registered holder thereof, for and on your behalf, and you will become an Issuer Nominee Dematerialised NewCo Shareholder. For further detail in this regard, see paragraphs

7.6.5 and 7.6.6 below of this Circular.

| 3.2.4. |

You should note that if the Reorganisation becomes unconditional and is implemented, you will have to surrender your Documents of Title in respect of your AGA Ordinary Shares in exchange for your

Reorganisation Consideration, irrespective of whether you voted in favour of Special Resolution Number 1 and/or Special Resolution Number 2.

|

15

| 3.2.5. |

If the Reorganisation is not implemented, you will retain your AGA Ordinary Shares and will not be entitled to receive any NewCo Ordinary Shares.

|

| 3.2.6. |

If you wish to Dematerialise your AGA Ordinary Shares, please contact your CSDP or Broker. Although all NewCo Ordinary Shares will initially be issued in Dematerialised form, you do not need to

Dematerialise your AGA Ordinary Shares to participate in the Reorganisation or to receive any NewCo Ordinary Shares in terms of the Reorganisation.

|

| 3.2.7. |

No Dematerialisation or re-materialisation of AGA Ordinary Shares may take place:

|

| 3.2.7.1. |

from the Business Day following the Reorganisation Last Day to Trade up to and including the Shareholders’ Meeting Voting Record Date in respect of the Shareholders’ Meeting; and

|

| 3.2.7.2. |

if the Scheme becomes operative, on or after the Business Day following the Reorganisation Last Day to Trade.

|

| 3.2.8. |

If your share certificates relating to the Reorganisation Consideration to be surrendered have been lost or destroyed and you are a Certificated AGA Shareholder, you should nevertheless return the Form

of Surrender and Transfer (blue), duly signed and completed, to the Transfer Secretaries together with a duly completed indemnity form, which is obtainable from the Transfer Secretaries, as well

as satisfactory evidence that the Documents of Title have been lost or destroyed.

|

| 3.2.9. |

Under Strate directives, Dematerialised AGA Shareholders are required to elect to receive direct communication in the future, which includes but is not limited to the receipt of shareholder

communication documentation. Such election will facilitate the direct communication by NewCo to such holders. AGA Shareholders who are currently Certificated AGA Shareholders and will be Dematerialised NewCo Shareholders are encouraged

to make such election.

|

| 4. |

ELECTRONIC PARTICIPATION AT THE SHAREHOLDERS’ MEETING

|

| 4.1. |

AGA has appointed The Meeting Specialist Proprietary Limited (“TMS”) for purposes of hosting the Shareholders’ Meeting entirely by way of electronic

communication and, in particular, for TMS to provide AGA and the AGA Shareholders with access to its electronic communication platform (the “Platform”) for purpose of enabling all of the AGA

Shareholders, who are present at the Shareholders’ Meeting, to communicate concurrently with each other, without an intermediary, and to participate reasonably effectively in the Shareholders’ Meeting and exercise their voting rights at

the Shareholders’ Meeting.

|

| 4.2. |

Please also note that in order to attend and participate in the Shareholders’ Meeting, AGA Shareholders are required to be granted access to the Platform by TMS and any AGA Shareholder who wishes to

attend the Shareholders’ Meeting is encouraged to contact TMS on proxy@tmsmeetings.co.za or +27 084 433 4836 / 081 711 4255 / 061 440 0654 as soon as possible, but not later than 2:00 p.m. (South Africa Standard Time) on Friday, 4

August 2023 to enable TMS to verify its/his/her identity and thereafter to grant that AGA Shareholder access to the Platform. Notwithstanding the foregoing, any AGA Shareholder who wishes to attend the Shareholders’ Meeting is entitled

to contact TMS at any time prior to the conclusion of the Shareholders’ Meeting, in order to be verified and provided with access to the Platform by TMS. In order to avoid any delays in being provided with access to the Platform by TMS,

AGA Shareholders are encouraged to contact TMS at their earliest convenience.

|

| 4.3. |

Further details as to how you can Participate using electronic communication are set out in the Notice of Shareholders’ Meeting.

|

| 5. |

IF YOU ARE A HOLDER OF AGA ADSs

|

If you are in any doubt as to what action to take, please consult your Broker, legal adviser, accountant, banker, financial adviser or other

professional adviser immediately.

| 5.1. |

To Participate in the Shareholders’ Meeting

|

| 5.1.1. |

As a holder of AGA ADSs on the ADS Voting Record Date, you are entitled to instruct the ADS Depositary on how to vote the AGA Ordinary Shares that your AGA ADSs represent.

|

| 5.1.2. |

If you are a registered holder of AGA ADSs, you should receive a voting instruction card from the ADS Depositary, which you should mark, sign and return to the ADS Depositary, to be received prior to

12:00 p.m. (Eastern Standard Time) on Tuesday, 8 August 2023 (the “ADS Instruction Date”). If you hold AGA ADSs in a securities account through a broker or other securities intermediary, you

should receive voting materials from your intermediary, which you should use to give voting instructions to your intermediary, to be received prior to the cut-off date and time specified in those materials (which will be earlier than

the ADS Instruction Date above).

|

16

| 5.1.3. |

If you do not timely provide the ADS Depositary or relevant broker or securities intermediary with voting instructions, the AGA Ordinary Shares underlying your AGA ADSs will not be counted to establish

a quorum to open the Shareholders’ Meeting, voted in respect of the proposed resolutions, or taken into account in calculating whether the requisite majority required to approve Special Resolution Number 1 and Special Resolution Number

2 has been achieved.

|

| 5.1.4. |

If you wish to attend, speak and vote at the Shareholders’ Meeting, you must:

|

| 5.1.4.1. |

surrender your AGA ADSs to the ADS Depositary for cancellation;

|

| 5.1.4.2. |

withdraw the AGA Ordinary Shares represented by your AGA ADSs from the custodian bank holding such AGA Ordinary Shares; and

|

| 5.1.4.3. |

be recorded in the AGA Register as an AGA Shareholder on the Shareholders’ Meeting Voting Record Date. You should note that the ADS Depositary may charge a fee for the surrender of your AGA ADSs and

the delivery of the AGA Ordinary Shares represented by your AGA ADSs. The amount of any such charge should be confirmed directly with the ADS Depositary.

|

| 5.1.5. |

For more information on how to provide instructions in connection with the Shareholders’ Meeting, holders of AGA ADSs should refer to the notice and instructions provided by the ADS Depositary.

|

| 6. |

FOREIGN SHAREHOLDERS

|

If you are a Foreign Shareholder, your attention is drawn to paragraph 7.6.12 (Foreign Shareholders) of this Circular for

further details concerning the Reorganisation. The availability, and implications, of the Reorganisation may be affected by the laws of the relevant jurisdiction of a Foreign Shareholder. It is the responsibility of Foreign Shareholders to

satisfy themselves as to the full observance of the laws and regulatory requirements of the relevant jurisdiction in connection with the Reorganisation, including the obtaining of any governmental, exchange control or other consents, the making

of any filings which may be required, the compliance with other necessary formalities and the payment of any transfer or other taxes or other requisite payments due in such jurisdiction. If you are in any doubt as to what action to take, please

consult your CSDP, Broker, legal adviser, accountant, banker, financial adviser or other professional adviser immediately.

| 7. |

APPROVAL OF THE AGAH SALE AND THE SCHEME

|

| 7.1. |

The AGAH Sale must be approved by AGA Shareholders by voting in favour of Special Resolution Number 1, being a special resolution to be adopted in accordance with Section 112(2) read with Section

115(2)(a) of the Companies Act, at the Shareholders’ Meeting and at which Shareholders’ Meeting sufficient AGA Shareholders are present (not being less than 3 (three) AGA Shareholders) to exercise, in aggregate, at least 25% (twenty

five percent) of all the voting rights that are entitled to be exercised on Special Resolution Number 1. In order to be approved, Special Resolution Number 1 will require votes in favour representing at least 75% (seventy five percent)

of the voting rights exercised at the Shareholders’ Meeting.

|

| 7.2. |

The Scheme must be approved by AGA Shareholders by voting in favour of Special Resolution Number 2, being a special resolution to be adopted in accordance with Section 114 read with Section 115(2)(a)

of the Companies Act, at the Shareholders’ Meeting and at which Shareholders’ Meeting sufficient AGA Shareholders are present (not being less than 3 (three) AGA Shareholders) to exercise, in aggregate, at least 25% (twenty five percent)

of all the voting rights that are entitled to be exercised on Special Resolution Number 2. In order to be approved, Special Resolution Number 2 will require votes in favour representing at least 75% (seventy five percent) of the voting

rights exercised at the Shareholders’ Meeting.

|

| 7.3. |

AGA Shareholders are advised that, in accordance with Section 115(3) of the Companies Act, AGA may, in certain circumstances, not implement Special Resolution Number 1 and Special Resolution Number 2,

despite the fact that they will have been adopted at the Shareholders’ Meeting, without the approval of a court or other competent authority. Please also see 7.14 (Court Approval) below. A copy

of Section 115 of the Companies Act pertaining to the required approval for the AGAH Sale and the Scheme is set out in Annexure F attached to this Circular.

|

| 7.4. |

No approval of the Spin-Off is being sought from AGA Shareholders or AGA ADS Holders.

|

17

| 8. |

DISSENTING AGA SHAREHOLDERS’ APPRAISAL RIGHTS

|

| 8.1. |

If an AGA Shareholders wishes to exercise his/her/its Appraisal Rights, that AGA Shareholder must give AGA written notice in terms of Section 164 of the Companies Act objecting to Special Resolution

Number 1 and/or Special Resolution Number 2, at any time before Special Resolution Number 1 and Special Resolution Number 2 are to be voted on at the Shareholders’ Meeting.

|

| 8.2. |

Within 10 (ten) Business Days after AGA has adopted Special Resolution Number 1 and Special Resolution Number 2, AGA must send a notice stating that Special Resolution Number 1 and/or Special

Resolution Number 2 has been adopted, to each AGA Shareholder who gave AGA written notice of objection and has not withdrawn that notice and has voted against Special Resolution Number 1 and/or Special Resolution Number 2, as

applicable.

|

| 8.3. |

An AGA Shareholder who has given AGA written notice in terms of Section 164 of the Companies Act objecting to Special Resolution Number 1 and/or Special Resolution Number 2, and who has not withdrawn

that notice and has voted against Special Resolution Number 1 and/or Special Resolution Number 2, as the case may be, and has complied with all of the procedural requirements set out in Section 164 of the Companies Act may, if Special

Resolution Number 1 and Special Resolution Number 2 have been adopted, demand in writing within:

|

| 8.3.1. |

20 (twenty) Business Days after receipt of the notice from AGA referred to above; or

|

| 8.3.2. |

20 (twenty) Business Days after learning that Special Resolution Number 1 and Special Resolution Number 2 have been adopted, if the AGA Shareholder does not receive the notice from AGA referred to

above,

|

that AGA pays that AGA Shareholder the fair value (in terms of, and subject to, the requirements set out in Section 164 of the Companies Act) for all of the AGA Ordinary

Shares held by that AGA Shareholder.

| 8.4. |

A copy of Section 164 of the Companies Act referred to in this paragraph 8 is attached as Annexure G to this Circular.

|

| 8.5. |

AGA ADS Holders do not have dissenting shareholders’ Appraisal Rights, except if they surrender their AGA ADSs to the ADS Depositary, pay the ADS Depositary’s fee for surrender of the AGA ADSs and

become a registered holder of AGA Ordinary Shares prior to the Shareholders’ Meeting Voting Record Date.

|

| 9. |

OTHER

|

The contents of this Circular do not purport to constitute personal legal advice or to comprehensively deal with the legal, regulatory and/or tax implications of the

Reorganisation or any other matter for each AGA Shareholder. AGA Shareholders are, accordingly, advised to consult their professional advisers about their personal legal, regulatory and tax positions regarding the Reorganisation or any other

matter and in particular the disposal of Scheme Shares and the receipt of the Reorganisation Consideration, as applicable.

18

|

INTERPRETATION AND DEFINITIONS

|

The headings in this Circular are for the purpose of convenience and reference only and shall neither be used in the interpretation of, nor modify, nor amplify the terms of this Circular. Unless a contrary

intention clearly appears:

| 1. |

the following terms shall have the meanings assigned to them hereunder and cognate expressions shall have corresponding meanings, namely:

|

| 1.1. |

“ADS Depositary” means The Bank of New York Mellon which acts as the depositary in respect of the AGA ADS Program;

|

| 1.2. |

“AGA” or “Company” means AngloGold Ashanti Limited (Registration No. 1944/017354/06), a public company duly incorporated

in accordance with the company laws of South Africa;

|

| 1.3. |

“AGA ADS Holder” means a registered holder of AGA ADSs;

|

| 1.4. |

“AGA ADS Program” means the American Depositary Share Program of AGA governed by the AGA Deposit Agreement;

|

| 1.5. |

“AGA ADSs” means American depositary shares representing AGA Ordinary Shares deposited or subject to deposit with the ADS Depositary under the AGA Deposit

Agreement at a ratio of 1 (one) AGA Ordinary Share to 1 (one) such American depositary share, which are listed and traded on the NYSE;

|

| 1.6. |

“AGA Board” means the directors of the Company, comprising, as at the Last Practicable Date, those persons whose names appear in section headed “Corporate

Information and Advisers”;

|

| 1.7. |

“AGA Ghana Shareholder” means the holders of the AGA Ordinary Shares on the Ghana branch of the AGA Register;

|

| 1.8. |

“AGA GhDSs” means Ghanaian depositary shares representing AGA Ordinary Shares at a ratio of 1 (one) AGA Ordinary Share to 100 (one hundred) such Ghanaian

depositary shares, which are listed and traded on the GhSE;

|

| 1.9. |

“AGA GhDS Holder” means a holder of AGA GhDS;

|

| 1.10. |

“AGA Deposit Agreement” means the amended and restated deposit agreement (dated as of

3 June 2008) entered into between AGA, the ADS Depositary and all owners and beneficial owners from time to time of AGA ADSs issued thereunder;

|

| 1.11. |

“AGA Ordinary Shares” means the ordinary shares, with a par value of R0.25 (twenty five cents) each, in the issued share capital of AGA, which are listed for

trading with ISIN No. ZAE 000043485 on, inter alia, the Main Board of the JSE;

|

| 1.12. |

“AGA Register” means collectively AGA’s: (a) “securities register” as defined in section 1 of the Companies Act; and (b) “uncertificated securities register” as

defined in section 1 of the Companies Act (which the Companies Act stipulates forms part of the “securities register”);

|

| 1.13. |

“AGA Shareholders” means the holders of AGA Ordinary Shares, who are recorded as such in the AGA Register;