Filed by AngloGold Ashanti plc

This communication is filed pursuant to

Rule 425 under the United States Securities Act of 1933

Subject Company: AngloGold Ashanti Limited

Commission File Number: 333-272867

Date: July 7, 2023

This communication is filed pursuant to

Rule 425 under the United States Securities Act of 1933

Subject Company: AngloGold Ashanti Limited

Commission File Number: 333-272867

Date: July 7, 2023

Set forth below is the pre-listing statement, distributed to AngloGold Ashanti Limited shareholders on July 7, 2023,

prepared in accordance with the JSE Listing Requirements.

ELECTRONIC TRANSMISSION DISCLAIMER

STRICTLY NOT TO BE FORWARDED TO ANY OTHER PERSONS

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN PART, IN OR INTO ANY JURISDICTION WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OR REGULATIONS OF SUCH

JURISDICTION OR REQUIRE NEWCO (AS DEFINED BELOW) TO TAKE ANY FURTHER ACTION.

THE RELEASE, PUBLICATION OR DISTRIBUTION OF THIS PRE-LISTING STATEMENT (AS DEFINED BELOW) IN CERTAIN JURISDICTIONS MAY BE RESTRICTED BY LAW AND THEREFORE PERSONS IN ANY SUCH JURISDICTIONS

INTO WHICH THIS PRE-LISTING STATEMENT IS RELEASED, PUBLISHED OR DISTRIBUTED SHOULD INFORM THEMSELVES ABOUT AND OBSERVE SUCH RESTRICTIONS. ANY FAILURE TO COMPLY WITH THE APPLICABLE RESTRICTIONS MAY CONSTITUTE A VIOLATION OF THE SECURITIES LAWS

OF ANY SUCH JURISDICTION. THIS PRE-LISTING STATEMENT DOES NOT CONSTITUTE AN OFFER TO SELL OR ISSUE, OR THE SOLICITATION OF AN OFFER TO PURCHASE OR TO SUBSCRIBE FOR SHARES OR OTHER SECURITIES OR A SOLICITATION OF ANY VOTE OR APPROVAL IN ANY

JURISDICTION IN WHICH SUCH OFFER OR SOLICITATION WOULD BE UNLAWFUL.

AN OFFER OF SECURITIES IN THE UNITED STATES PURSUANT TO A BUSINESS COMBINATION TRANSACTION WILL ONLY BE MADE, AS MAY BE REQUIRED, THROUGH A PROSPECTUS WHICH IS PART OF AN EFFECTIVE

REGISTRATION STATEMENT FILED WITH THE U.S. SECURITIES AND EXCHANGE COMMISSION (THE “SEC”). IN CONNECTION WITH THE REORGANISATION, A REGISTRATION STATEMENT ON FORM F-4 UNDER THE UNITED STATES SECURITIES

ACT OF 1933, AS AMENDED, (THE “SECURITIES ACT”) HAS BEEN FILED WITH THE SEC. INVESTORS AND SHAREHOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT, AS WELL AS OTHER DOCUMENTS FILED WITH THE SEC, BECAUSE

THEY WILL CONTAIN IMPORTANT INFORMATION. COPIES OF ALL DOCUMENTS FILED WITH THE SEC REGARDING THE REORGANISATION AND DOCUMENTS INCORPORATED BY REFERENCE MAY BE OBTAINED AT THE SEC’S WEBSITE AT HTTPS://WWW.SEC.GOV. IN ADDITION, THE EFFECTIVE REGISTRATION STATEMENT ON FORM F-4 WILL BE MADE AVAILABLE FOR FREE TO SHAREHOLDERS.

THE JSE LISTINGS REQUIREMENTS AND OTHER SOUTH AFRICAN REGULATIONS GOVERNING THE PREPARATION AND DISSEMINATION OF FINANCIAL STATEMENTS DIFFER FROM STANDARDS AND REGULATIONS IN OTHER

JURISDICTIONS, INCLUDING THE UNITED STATES OF AMERICA, WHICH MAY RESULT IN DIFFERENCES IN THE PRESENTATION OF THE FINANCIAL STATEMENTS BETWEEN JURISDICTIONS.

ANY FORWARDING, REDISTRIBUTION OR REPRODUCTION OF THE DOCUMENT IN WHOLE OR IN PART IS UNAUTHORISED. FAILURE TO COMPLY WITH THIS DIRECTIVE MAY RESULT IN A VIOLATION OF THE APPLICABLE LAWS

OF APPLICABLE JURISDICTIONS. IF YOU HAVE GAINED ACCESS TO THIS TRANSMISSION CONTRARY TO ANY OF THE FOREGOING RESTRICTIONS, YOU ARE NOT AUTHORISED AND WILL NOT BE ABLE TO ACQUIRE ANY OF THE SECURITIES DESCRIBED IN THE DOCUMENT.

IMPORTANT: You must read the following disclaimer before continuing. This

electronic transmission disclaimer applies to the Pre-listing Statement and you are advised to read this disclaimer carefully before reading, accessing or making any other use of this Pre-listing Statement. In accessing this electronic

transmission and the Pre-listing Statement, you agree to be bound by the following terms and conditions (in addition to, and without derogating from, the terms and conditions set out in the Pre-listing Statement), including any modifications

to them from time to time, each time you receive any information as a result of such access.

You acknowledge that this electronic transmission and the delivery of the Pre-listing Statement is confidential and is intended for you only and you agree that you will not forward,

reproduce, copy or publish this electronic transmission or the Pre-listing Statement (in whole or in part) to any other person. NewCo (as defined below) has taken no action to authorise any distribution, copying, reproduction (electronically or

otherwise) of this electronic transmission or the Pre-listing Statement in whole or in part to any person in any jurisdiction.

These materials are not for distribution, directly or indirectly, in or into Canada or Japan

Neither this electronic transmission nor the Pre-listing Statement is an offer or an invitation to the public to subscribe for, or acquire, the NewCo Ordinary Shares (as defined below),

and the Pre-listing Statement is issued in compliance with the JSE Listings Requirements (as defined below) for the purpose of providing information to selected persons in South Africa (as defined below) and in other jurisdictions with regard

to AngloGold Ashanti plc (“NewCo”).

Nothing in this electronic transmission or the Pre-listing Statement constitutes an offer of securities for sale or subscription in the United States or in any other jurisdiction where it

is unlawful to do so. In the United States, the NewCo Ordinary Shares to be issued in connection with the Reorganisation will be registered with the SEC on a registration statement on Form F-4 under the Securities Act. This document is

available at https://www.sec.gov.

1

This Pre-listing Statement does not constitute an offer document or an offer of transferable securities to the public in the U.K. to which Section 85 of the Financial Services and Markets

Act 2000 of the U.K. (“FSMA”) applies and should not be considered as a recommendation that any person should subscribe for or purchase any of the NewCo Ordinary Shares. The NewCo Ordinary Shares will not

be offered or sold to any person in the U.K. except in circumstances which have not resulted and will not result in an offer to the public in the U.K. in contravention of Section 85(1) of FSMA. This Pre-listing Statement is not being

distributed by, nor has it been approved for the purposes of Section 21 of FSMA by, a person authorised under FSMA. The Pre-listing Statement is being communicated only to: (i) persons outside the United Kingdom; (ii) persons who are investment

professionals falling within Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (the “FPO”); or (c) high net worth companies, unincorporated associations and

other bodies within the categories described in Article 49(2)(a) to (d) of the FPO (together “relevant persons”). The NewCo Ordinary Shares are available only to, and any invitation, offer or agreement to

purchase will be engaged in only with, relevant persons who are AGA Shareholders as at the Reorganisation Consideration Record Date. No part of the Pre-listing Statement should be published, reproduced, distributed or otherwise made available

in whole or in part to any other person without the prior written consent of NewCo.

In relation to each Member State of the European Economic Area (each a “Member State”), an offer of NewCo Ordinary Shares may not be made to the

public in that Member State except that an offer to the public in that Member State of any NewCo Ordinary Shares may be made at any time under the following exemptions under the Prospectus Regulation: (i) to any legal entity which is a

qualified investor as defined under the Prospectus Regulation; (ii) to fewer than 150 natural or legal persons (other than qualified investors as defined under the Prospectus Regulation), subject to obtaining the prior consent of NewCo for any

such offer; or (iii) in any other circumstances falling within Article 1(4) of the Prospectus Regulation, provided that no such offer of NewCo Ordinary Shares shall result in a requirement for NewCo to publish a prospectus pursuant to Article 3

of the Prospectus Regulation. For the purposes of this paragraph, the expression an “offer to the public” in relation to any NewCo Ordinary Shares in any Member State means the communication in any form and by any means of sufficient

information on the terms of the offer and any NewCo Ordinary Shares to be offered so as to enable an investor to decide to purchase or subscribe for any NewCo Ordinary Shares and the expression “Prospectus Regulation” means the EU Prospectus

Regulation (Regulation 2017/1129).

The Pre-listing Statement is only being made available to AGA Shareholders and the NewCo Ordinary Shares which will be issued as part of the Reorganisation will only be issued to, and be

capable of being received by, Scheme Participants (as defined below). The Pre-listing Statement does not constitute an offer for the sale of or subscription for, or the advertisement or the solicitation of an offer to buy and/or to subscribe

for, NewCo Ordinary Shares to the public as defined in the Companies Act (as defined below) and will not be distributed to any person in South Africa in any manner that could be construed as an offer to the public in terms of the Companies Act.

Should any person who is not an AGA Shareholder receive the Pre-listing Statement, they will not be entitled to acquire any NewCo Ordinary Shares or otherwise act thereon. The Pre-listing Statement does not, nor is it intended to, constitute a

prospectus prepared and registered under the Companies Act. Accordingly, this Pre-listing Statement does not comply with the substance and form requirements for prospectuses set out in the Companies Act and the Companies Regulations of 2011(as

amended or restated from time to time) and has not been approved by, and/or registered with, the Companies and Intellectual Property Commission. The JSE has approved the Pre-listing Statement. Information made available in this Pre-listing

Statement should not be considered as “advice” as defined in the South African Financial Advisory and Intermediary Services Act No 37 of 2002 (as amended or restated from time to time), and nothing in the Pre-listing Statement should be

construed as constituting the canvassing for, or marketing or advertising of, financial services in South Africa.

The Pre-listing Statement is not a disclosure document for the purposes of Chapter 6D of the Australian Corporations Act 2001 (Cth) (the “Corporations Act”)

and does not purport to include the information required of a disclosure document under Chapter 6D of the Corporations Act. It has not been approved by any Australian regulatory authority, such as the Australian Securities and Investments

Commission (the “ASIC”) and has not been lodged with ASIC. NewCo Ordinary Shares which will be issued as part of the Reorganisation to Australian resident Scheme Participants (as defined below) will be

issued in reliance on exemptions in the Corporations Act and ASIC Legislative Instrument 2015/358 (as in respect of the Scheme, it will occur under a foreign compromise or arrangement that is made in accordance with laws in force in South

Africa, being an eligible foreign country). Australian resident Scheme Participants are advised to exercise caution in relation to the proposal set out in the Pre-listing Statement. Australian resident Scheme Participants should obtain

independent professional advice if they have any queries or concerns about any of the contents or subject matter of the Pre-Listing Statement.

If the Pre-listing Statement has been sent to you in an electronic form, you are reminded that documents transmitted via this medium may be altered or changed during the process of

electronic transmission, and consequently NewCo, the Sponsors, Financial Advisers, Legal Advisers, Tax Adviser and Independent Reporting Accountant, whose report and/or names are included in the Pre-listing Statement (collectively, the “Transaction Advisers”), any person who controls NewCo or the Transaction Advisers, any director, officer, employee or agent of any of them or any affiliate of any such person does not accept, and will not

assume, any liability or responsibility whatsoever in respect of any difference between the Pre-listing Statement distributed to you in electronic format and the hard copy version of the Pre-listing Statement. If verification is required,

please request a hard copy of the Pre-listing Statement. You are responsible for protecting against viruses, the unauthorised interception and other threats and destructive items. Your receipt of this electronic transmission or the Pre-listing

Statement via electronic communication is at your own risk and it is your responsibility to take precautions to ensure that it is free from viruses and other items of a destructive nature.

2

CONFIRMATION OF YOUR REPRESENTATION: This electronic transmission and the

Pre-listing Statement are delivered to you on the basis that you are deemed to have consented to delivery by electronic transmission of the Pre-listing Statement and deemed to have warranted and represented to NewCo and the Transaction

Advisers that: (i) you are an AGA Shareholder and (ii) you are a person into whose possession this electronic transmission and the Pre-listing Statement may be lawfully delivered in accordance with the laws of the jurisdiction in which you

are located, or to which you are subject.

You may not, nor are you authorised to, deliver this electronic transmission or the Pre-listing Statement, electronically or otherwise, to any other person. By accepting electronic

delivery of this document, you are deemed to have represented to NewCo and the Transaction Advisers that (i) you are acting on behalf of a person, or you are acting in an “offshore transaction” as defined in, and in reliance on, Regulation S

under the Securities Act; (ii) you are an AGA Shareholder; and (iii) if you are outside South Africa, the electronic mail address that you gave us and to which the document has been delivered is not located in Canada or Japan and you are a

person into whose possession this document may lawfully be delivered in accordance with the laws of the jurisdiction in which you are located.

None of the Transaction Advisers or any of their respective affiliates, or any of their respective directors, officers, employees or agents accepts any responsibility whatsoever for the

contents of the Pre-listing Statement or for any statement made or purported to be made by it, or on its behalf, in connection with NewCo or the NewCo Ordinary Shares. The Transaction Advisers and any of their respective affiliates and their

respective directors, officers, employees and agents accordingly disclaim all and any liability whether arising in tort, delict, contract, or otherwise which they might otherwise have in respect of such document or any such statement.

No representation or warranty express or implied, is made by any of the Transaction Advisers or any of their respective affiliates or their respective directors, officers, employees and

agents as to the accuracy, completeness, reasonableness or sufficiency of the information set out in this Pre-listing Statement. Thus, in addition to considering the contents of this Pre-listing Statement in full, each AGA Shareholder is

advised to seek appropriate professional advice, conduct its own research and consider all relevant factors in light of their individual circumstances in relation to any decision with respect to the Reorganisation and the acquisition of NewCo

Ordinary Shares and/or the information contained in this Pre-listing Statement.

The Transaction Advisers are acting exclusively for NewCo and/or AGA (as the case may be) and no one else in connection with the Reorganisation and the issue by NewCo of the NewCo Ordinary

Shares in terms thereof. Each Transaction Adviser will not regard any other person (whether or not a recipient of the Pre-listing Statement) as its client in relation to the Reorganisation and/ or the acquisition of any NewCo Ordinary Shares by

a Scheme Participant and will not be responsible to anyone other than NewCo for providing the protections afforded to its clients nor for giving advice in relation to the acquisition of the NewCo Ordinary Shares or any transaction or

arrangement referred to herein.

FAILURE TO COMPLY WITH THIS ELECTRONIC TRANSMISSION MAY RESULT IN THE VIOLATION OF THE APPLICABLE SECURITIES LAWS OR REGULATIONS OF CERTAIN JURISDICTIONS. IF YOU HAVE

GAINED ACCESS TO THIS ELECTRONIC TRANSMISSION OR THE PRE-LISTING STATEMENT CONTRARY TO ANY OF THE FOREGOING RESTRICTIONS, YOU ARE NOT AUTHORISED AND WILL NOT BE ABLE TO ACQUIRE ANY OF THE SECURITIES DESCRIBED IN THE PRE-LISTING STATEMENT.

3

AngloGold Ashanti plc

(previously known as AngloGold Ashanti (UK) Limited)

(Incorporated in England and Wales)

Registration No. 14654651

Ordinary share code: ANG GB00BRXH2664

LEI No.: 2138005YDSA7A82RNU96

(“NewCo” or the “Company”)

|

PRE-LISTING STATEMENT

|

This Pre-listing Statement:

| ● |

is issued in compliance with the JSE Listings Requirements for a listing by way of an introduction;

|

| ● |

has been prepared on the assumption that the shareholders’ resolutions proposed in the notice of the Shareholders’ Meeting,

forming part of the Circular to which this Pre-listing Statement is enclosed, will be passed at the Shareholders’ Meeting of the AGA

Shareholders and the Reorganisation shall become effective and be implemented; and

|

| ● |

should be read in conjunction with the Circular (to which this Pre-listing Statement is enclosed) detailing the Reorganisation

together with the Form F-4 (which is available for inspection in terms of the Circular) relating to the registration of the NewCo Ordinary Shares with the U.S. Securities and Exchange Commission (the “SEC”).

|

The interpretation clause and the definitions set out in the section headed “Definitions and Interpretation” commencing on page

17 of this Pre-listing Statement apply, unless the context clearly indicates otherwise, throughout this Pre-listing Statement, including this cover page, except where the context indicates a contrary intention.

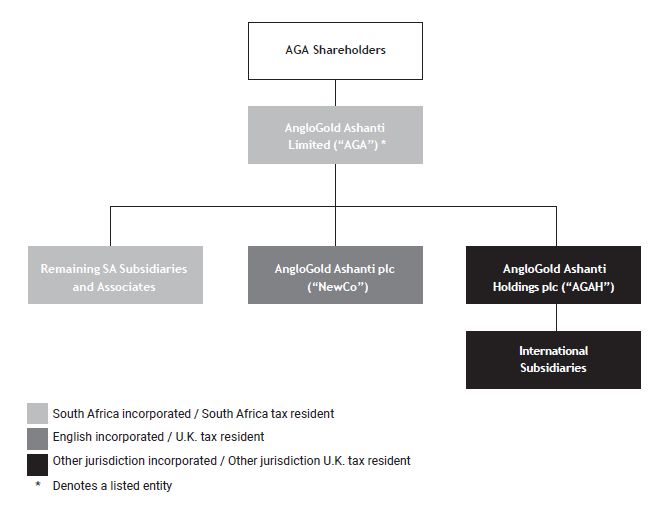

On 12 May 2023, AGA announced the Reorganisation, pursuant to which NewCo was incorporated and a proposal was made to implement 3 (three) sequential, separate and fully inter-conditional

steps. The expected steps consist of:

| ● |

the Spin-Off, in terms of which a distribution in specie will be effected by AGA to the AGA Shareholders recorded in the AGA Register as

at the Reorganisation Consideration Record Date, pursuant to which AGA will direct NewCo, its wholly-owned Subsidiary at that time, to issue 46,000 (forty six thousand) NewCo Ordinary Shares to such AGA Shareholders on a pro rata basis, with the aggregate subscription price of USD 46,000 (forty six thousand United States Dollars) paid by AGA resulting in NewCo ceasing to be a Subsidiary of AGA;

|

| ● |

the AGAH Sale, in terms of which NewCo has made an irrevocable offer to AGA to purchase 100% (one hundred percent) of the issued shares in AGAH. It is the present, non-binding

intention of AGA to accept the Irrevocable Offer to Purchase. The AGAH Sale, if completed, will constitute a disposal of all or a greater part of the assets or undertaking of AGA subject to approval under Chapter 5 of the Companies Act

in terms of Section 112 and Section 115 of the Companies Act; and

|

| ● |

the Scheme, being a scheme of arrangement in terms of Section 114(1) read with Section 115 of the Companies Act between AGA and the AGA Shareholders, proposed by the AGA Board

whereby NewCo will acquire all of the issued AGA Ordinary Shares from the AGA Shareholders in consideration for the right and obligation to receive, ipso facto and without any action on the

part of such AGA Shareholders, the respective pro rata portions of the Scheme Consideration Shares.

|

The implementation of the Reorganisation is subject to the fulfilment or waiver (to the extent permitted by applicable law and the Implementation Agreement), as the case may be, of the

Reorganisation Conditions including, amongst others, approval of the AGAH Sale and the Scheme by the AGA Shareholders in terms of the AGAH Sale Special Resolution and the Scheme Special Resolution respectively. If all of the Reorganisation

Conditions are not fulfilled or fulfilment is not waived (to the extent permitted by applicable law and the Implementation Agreement), as the case may be by the Longstop Date, the Reorganisation will not be implemented, and the AGA Shareholders

and AGA ADS Holders will retain their AGA Ordinary Shares and AGA ADSs, respectively.

This Pre-listing Statement has been prepared on the assumption that both the AGAH Sale Special Resolution and the Scheme Special Resolution, shall have been passed at the Shareholders

Meeting and that the Reorganisation shall have become effective and have been implemented; and accordingly, all disclosures in respect of NewCo are prepared on the basis that NewCo will have acquired all of the issued ordinary shares in both

AGA and AGAH.

4

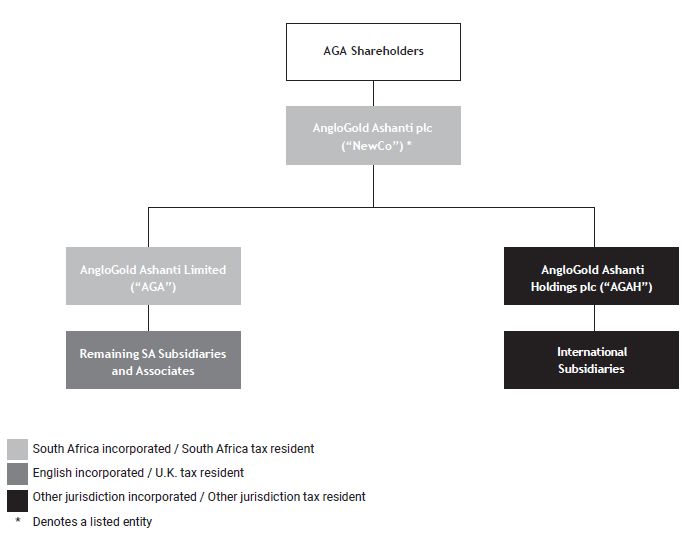

Upon completion of the Reorganisation NewCo will be the listed parent company of the Group and each of AGA and AGAH will be a direct, wholly-owned subsidiary of NewCo. In this regard, as

AGA has been listed on the Main Board of the JSE since 1998, and, as this Pre-listing Statement is addressed exclusively to the AGA Shareholders, the majority of information required to be disclosed in this Pre-listing Statement is already in

the public domain and is already known to the AGA Shareholders. Accordingly, this Pre-listing Statement does, where possible, incorporate the required information by reference to the relevant public documents in which the applicable information

regarding AGA may be located.

The NewCo Ordinary Shares are not currently listed on any securities exchange. If the Reorganisation becomes unconditional and is implemented:

| ● |

the NewCo Ordinary Shares will have a primary listing on the NYSE and secondary inward listings on the JSE under the ticker symbol “ANG” and ISIN No. GB00BRXH2664 and on the A2X,

and a secondary listing on the GhSE; and

|

| ● |

the AGA Shares currently listed on the JSE under the ticker symbol “ANG” will be delisted from the Main Board of the JSE.

|

As a result of the Reorganisation, each Scheme Participant will beneficially own one NewCo Ordinary Share for each AGA Share held on the Reorganisation Consideration Record Date, and the

existing AGA Shareholders will hold the same percentage of NewCo Ordinary Shares as they held of AGA Ordinary Shares on the Reorganisation Consideration Record Date (subject to any adjustments to reflect the exercise of Appraisal Rights as

contemplated in paragraph 14 (Dissenting AGA Shareholders’ Appraisal Rights)). NewCo will have sufficient authority to allot and issue the Spin-Off Shares and the Scheme Consideration Shares to the

Scheme Participants.

The issue of the NewCo Ordinary Shares pursuant to the Scheme to the Scheme Participants, as contemplated by and in terms of the Circular as read with this Pre-listing Statement, is

governed by Section 114 of the Companies Act and accordingly, the exchange by the Scheme Participants of their AGA Ordinary Shares in consideration for the issue of NewCo Ordinary Shares in terms of the Scheme does not constitute an offer as

contemplated in Section 95(1)(g) of the Companies Act. NewCo is therefore not required, in terms of the Companies Act, to prepare and file a prospectus with CIPC and this Pre-listing Statement does not constitute a prospectus within the meaning

given thereto in the Companies Act.

As there is no requirement for a company to set out an authorised share capital under English law, NewCo does not have an authorised share capital. NewCo will have sufficient authority to

allot and issue the requisite number of NewCo Ordinary Shares to satisfy the Reorganisation Consideration. The aggregate nominal value of the issued share capital of NewCo will, immediately following the implementation of the Reorganisation, be

approximately USD 419,612,543 and NewCo will, immediately following the implementation of the Reorganisation, have a stated capital in compliance with the JSE Listings Requirements. As at the date of listing, no NewCo Ordinary Shares will be

held as treasury shares. It is expected that NewCo will have 419,612,543 NewCo Ordinary Shares listed on the NYSE, and secondary listed on the JSE, A2X and GhSE following the implementation of the Reorganisation, being the same number of shares

that AGA will have listed on the JSE on the Reorganisation Consideration Record Date (subject to any adjustments to reflect the exercise of Appraisal Rights as contemplated in paragraph 14 (Dissenting AGA

Shareholders’ Appraisal Rights)). The subscribed capital is expected to be equal to the market value of AGA (standalone) on the date of implementation. All of the NewCo Ordinary Shares rank pari passu

in all respects, there being no conversion or exchange rights attaching thereto, and have equal voting rights and rights to participate in capital, dividend and profit distributions by NewCo.

The directors of NewCo and AGA, whose names are set out on page 7 of this Pre-listing Statement, collectively and individually, accept full responsibility for the accuracy of the

information given in this Pre-listing Statement (but only to the extent that they are required to accept such responsibility in terms of the Companies Act and/or the JSE Listings Requirements), and certify that, to the best of their knowledge

and belief, there are no facts that have been omitted, which would make any statement in this Pre- listing Statement false or misleading, and all reasonable enquiries to ascertain such facts have been made and this Pre-listing Statement

contains all information required by law and the JSE Listings Requirements.

The JSE has conditionally approved the secondary inward listing, by way of an introduction, of the issued ordinary share capital of NewCo in the “Platinum

& Precious Metals” sector of the Main Board of the JSE under the abbreviated name “ANGGOLD” and share code ANG and ISIN No. GB00BRXH2664 with effect from the commencement of business on 20 September 2023, subject to NewCo obtaining

the requisite spread of shareholders required by the JSE Listings Requirements and the Reorganisation being approved by the AGA Shareholders. During the three years prior to the Last Practicable Date, AGA has complied with the spread of

shareholders requirements in terms of the JSE Listings Requirements and as such, on the Operative Date, it is expected that NewCo will also comply with the spread of shareholders requirements in terms of the JSE Listings Requirements.

5

Following the Listings, all the issued NewCo Ordinary Shares are expected to be listed on the JSE (as a secondary inward listing), the A2X (as a secondary inward listing), the GhSE (as a

secondary listing) and the NYSE (as a primary listing), in compliance with the JSE’s, A2X’s, GhSE’s and NYSE’s listing requirements and standards and the laws of South Africa, Ghana and the United States. NewCo has filed the Form F-4 (which

relates to the registration of the NewCo Ordinary Shares under the Securities Act) and will apply to list the NewCo Ordinary Shares on the NYSE.

The Sponsors, Financial Advisers, Legal Advisers, Tax Adviser and Independent Reporting Accountant whose report and/or names are included in this Pre-listing Statement, have given and have

not withdrawn their consent to the inclusion of their names and/or report in this Pre-listing Statement in the form and context in which they appear.

Certain information is incorporated by reference in this Pre-listing Statement to ensure that AGA Shareholders are aware of all information, which according to the particular nature of

NewCo and the Reorganisation, may be necessary to enable AGA Shareholders to make an informed assessment of the assets and liabilities, financial position, profit and losses and prospects of NewCo. In this regard, please refer to the section

entitled “Important Information — Documents Available for Inspection and Documents Included or Incorporated by Reference in this Pre-listing Statement” beginning on page 13 of this Pre-listing Statement.

This Pre-listing Statement is addressed exclusively to the AGA Shareholders and is therefore not an invitation to the general public to purchase or subscribe for the NewCo Ordinary Shares

and is issued in compliance with the JSE Listings Requirements.

|

Legal Adviser

as to South African law

|

Legal Adviser

as to U.S. law

|

Legal Adviser

as to English law

|

|

|

|

|

|

Tax Adviser

as to South African Tax

|

Transaction Sponsor

|

Independent Reporting Accountant

|

|

|

|

|

|

Financial Adviser

|

JSE Sponsor

|

|

|

|

|

Financial Adviser

|

Financial Adviser

|

|

|

|

Date of issue of this Pre-listing Statement: Friday, 7 July 2023

This Pre-listing Statement is only available in English. Copies of this Pre-listing Statement may be obtained during

normal business hours from the registered office of NewCo and the offices of the Sponsors, whose addresses are set out in the “Corporate Information and Advisers” section of this Pre-listing Statement, during normal business hours from the

date of posting this Pre-listing Statement until the 14th (fourteenth) day after the date of this Pre-listing Statement. A copy of this Pre-listing Statement will also be made available on AGA’s website at www.anglogoldashanti.com.

An abridged version of this document will be published on SENS on Friday July 7, 2023.

6

|

CORPORATE INFORMATION AND ADVISERS

|

The definitions and interpretations commencing on page 17 of this Pre-listing Statement apply, unless the context clearly indicates otherwise, to this section on Corporate Information and Advisers.

|

CORPORATE INFORMATION

|

|

|

AngloGold Ashanti plc

(previously known as AngloGold Ashanti (UK) Limited)

Company No. 14654651

Date and place of Incorporation

10 February 2023, the United Kingdom

Directors

Executive

Alberto Calderon

Robert Hayes

Non-executive

None

Registered Office

4th Floor, Communications House

South Street

Staines-upon-Thames, Surrey TW18 4PR

United Kingdom

Tel: +44 (0) 203 968 3323

Company Secretary

Oakwood Corporate Secretary Limited

Registration No. 07038430

3rd Floor

1 Ashley Road

Altrincham, Cheshire

'WA14 2DT

United Kingdom

+44 (0)161 942 4700

Transfer Secretaries

Computershare Trust Company, N.A.

150 Royall Street

Canton, Massachusetts 02021

United States of America

Transaction Sponsor

J.P. Morgan Equities South Africa Proprietary Limited

Registration No. 1995/011815/07

1 Fricker Road, Illovo, Johannesburg, 2196

South Africa

(Private Bag X9936, Sandton, 2196, South Africa)

JSE Sponsor

The Standard Bank of South Africa Limited

Registration No. 1962/000738/06

33 Baker, Rosebank

Johannesburg, 2196

South Africa

(PO Box 61344, Marshalltown, 2107)

Telephone: +27 11 721 0000

|

AngloGold Ashanti Limited

Registration No. 1944/017354/06 Date and place of Incorporation

29 May 1944, South Africa

Directors

Executive

Alberto Calderon

Gillian Doran

Non-executive

Maria Ramos (Chairperson)

Kojo Busia

Alan Ferguson

Albert Garner

Rhidwaan Gasant

Scott Lawson

Maria Richter

Jochen Tilk

Registered Office

112 Oxford Road, Houghton Estate, Johannesburg, 2198

(Private Bag X 20, Rosebank 2196)

South Africa

Telephone: +27 11 637 6000

Fax: +27 11 637 6624

Company Secretary

LM Goliath

(B.Com; MBA)

Transfer Secretaries

Computershare Investor Services Proprietary Limited

Registration No. 2004/003647/07

Rosebank Towers, 15 Biermann Avenue,

Rosebank, 2196

(Private Bag X9000, Saxonwold, 2123)

South Africa

Telephone: 0861 100 930 (in SA)

E-mail: queries@computershare.co.za

Website: www.computershare.com

Independent External Auditor

PricewaterhouseCoopers Incorporated

Registration No. 1998/012055/21

Waterfall City Heliport, 4 Lisbon Lane, Waterfall City,

Midrand, 2090

South Africa

|

7

|

ADVISERS

|

|

|

Legal Adviser as to South African law

Edward Nathan Sonnenbergs Incorporated

Registration No. 2006/018200/21

The MARC, Tower 1, 129 Rivonia Road, Sandton,

Johannesburg

South Africa

(PO Box 783347, Sandton, 2146)

Legal Adviser as to English law

Slaughter and May

SRA number: 55388

One Bunhill Row, London, EC1Y 8YY

United Kingdom

Financial Adviser

Centerview Partners UK LLP

Company number OC345806

Principal place of business:

100 Pall Mall, London, SW1Y 5NQ

United Kingdom

Financial Adviser

JPMorgan Chase Bank, N.A., Johannesburg Branch

Registration No. 2001/016069/10

1 Fricker Road, Illovo, Johannesburg, 2196

South Africa

(Private Bag X9936, Sandton, 2196, South Africa)

|

Legal Adviser as to U.S. law

Cravath, Swaine & Moore LLP

DOS ID Number: 2886667

CityPoint, One Ropemaker Street, London, EC2Y 9HR

United Kingdom

Independent Reporting Accountant

Ernst & Young Incorporated

Registration No. 2005/002308/21

EY, 102 Rivonia Road, Sandton, Johannesburg

(Private Bag X14, Sandton, 2146)

South Africa

Financial Adviser

Rothschild and Co South Africa Proprietary Limited

7th Floor, 144 Oxford,

Johannesburg

South Africa

(PO Box 411332, Craighall, 2024)

Tax Advisor as to South African tax law

Bowman Gilfillan Inc.

Registration No.1998/021409/21

11 Alice Lane, Sandhurst, Sandton, 2196

South Africa

|

8

|

NOTICE TO INVESTORS

|

The definitions and interpretations commencing on page 17 of this Pre-listing Statement apply, unless the context clearly indicates otherwise, to this section “Notice to Investors”.

DISCLAIMER

The release, publication or distribution of this Pre-listing Statement may be restricted by law and therefore persons in any such jurisdictions into which this Pre-listing Statement is

released, published or distributed should inform themselves about, and observe such restrictions. Any failure to comply with the applicable restrictions may constitute a violation of the securities laws or other legal requirements of any such

jurisdiction. To the fullest extent permitted by applicable law, AGA and NewCo, their respective boards of directors and the Transaction Advisers disclaim any responsibility or liability for the failure to become informed of or to observe or

for any violation of such requirements by any person.

This Pre-listing Statement is not intended to, and does not constitute an offer to sell or issue, or the solicitation of an offer to purchase or to subscribe for shares or other securities

or a solicitation of any vote or approval in any jurisdiction in which such solicitation would be unlawful or in which securities may not be offered or sold without registration or an exemption from registration. This Pre-listing Statement does

not constitute a prospectus or a prospectus-equivalent document.

To the extent that the distribution of this Pre-listing Statement in certain jurisdictions outside South Africa may be restricted or prohibited by the laws of such foreign jurisdiction,

then this Pre-listing Statement is deemed to have been provided for information purposes only and neither AGA nor NewCo, nor their respective boards of directors nor the Transaction Advisers, accept any responsibility for any failure by AGA

Shareholders to inform themselves about, and to observe, any applicable legal requirements in any relevant foreign jurisdiction. None of the NewCo or the Transaction Advisers, nor any of their respective representatives, is making any

representation to any AGA Shareholder regarding the legality of an investment in the NewCo Ordinary Shares by such AGA Shareholder under the law applicable to such AGA Shareholder.

The contents of this Pre-listing Statement should not be construed as legal, financial or tax advice. Each AGA Shareholder should consult his/her or its own legal, financial or tax adviser

as to the legal, financial, business, tax and related aspects of the acquisition of NewCo Ordinary Shares.

The Transaction Advisers are acting exclusively for AGA and/or NewCo (as the case may be), and no one else in connection with the Reorganisation and the contents of this Pre-listing

Statement and will not be responsible to anyone, other than AGA and/or NewCo (as the case may be), for providing the protections afforded to clients of the Transaction Advisers, respectively, or for providing advice in relation to the

Reorganisation and the contents of this Pre-listing Statement.

No representation or warranty, express or implied, is made by any of the Transaction Advisers as to the accuracy, completeness or verification of the information set out in this

Pre-listing Statement, and nothing contained in this Pre-listing Statement is, or shall be relied upon as, a promise or representation in this respect, whether as to the past or the future. Each of the Transaction Advisers assumes no

responsibility for this Pre-listing Statement’s accuracy, completeness or verification and accordingly hereby disclaims, to the fullest extent permitted by applicable law, any and all liability whether arising in delict, tort, contract or

otherwise which they might otherwise be found to have in respect of this Pre-listing Statement or any such statement.

Shareholders also acknowledge that: (a) they have not relied on the Transaction Advisers or any person affiliated with the Transaction Advisers in connection with any investigation of the

accuracy of any information contained in the Disclosure Package or their investment decision; (b) they have relied only on the information contained in the Disclosure Package and have made their own assessment of such information; and (c) no

person has been authorised to give any information or to make any representation concerning AGA, NewCo or the NewCo Ordinary Shares (other than as contained in this Pre-listing Statement) and, if given or made, any such other information or

representation should not be relied upon as having been authorised by AGA, NewCo or the Transaction Advisers.

The information contained in this Pre-listing Statement constitutes factual information as contemplated in Section 1(3)(a) of the South African Financial Advisory and Intermediary Services

Act, No. 37 of 2002 (as amended and restated from time to time) and should not be construed as an express or implied recommendation, guidance or proposal that any particular transaction in respect of the Reorganisation and/or the acquisition of

the NewCo Ordinary Shares is appropriate to the particular investment objectives, financial situations or needs of an AGA Shareholder, and nothing in this Pre-listing Statement should be construed as constituting the canvassing for, or

marketing or advertising of, financial services in South Africa or in any other jurisdiction.

9

APPLICABLE LAWS AND FOREIGN SHAREHOLDERS

This Pre-listing Statement has been prepared in accordance with the JSE Listings Requirements, and the information disclosed may not be the same as that which would have been disclosed if

this Pre-listing Statement had been prepared in accordance with the laws and regulations of any jurisdiction outside of South Africa.

The Reorganisation (comprising the Spin-off, the AGAH Sale and the Scheme) is governed by the laws of South Africa and is subject to any applicable laws and regulations, including, but not

limited to, the Companies Act, the Companies Regulations, the JSE Listings Requirements and the Exchange Control Regulations.

The rights of the Foreign Shareholders in respect of the Reorganisation pursuant to which this Pre-listing Statement has been issued, may be affected by the laws of the relevant

jurisdictions of any Foreign Shareholders. Such Foreign Shareholders should inform themselves about and observe any applicable legal requirements of such jurisdictions. It is the responsibility of any Foreign Shareholder to satisfy themselves

as to the full observance of the laws and regulatory requirements of the relevant jurisdiction in connection with the Reorganisation, including the obtaining of any governmental, exchange control or other consents or the making of any filings

which may be required, the compliance with other necessary formalities, the payment of any transfer or other taxes or other requisite payments due in such jurisdiction.

If you are a Foreign Shareholder, you are urged to read the important information relating to Foreign Shareholders contained in paragraph 11 on page 37 (Foreign

Shareholders) in this Pre-listing Statement.

Any AGA Shareholder who is in doubt as to their position, including, without limitation, their tax status, should consult an appropriate independent professional adviser in the relevant

jurisdiction without delay.

FORWARD-LOOKING STATEMENTS

This Pre-listing Statement includes statements that are, or may be forward-looking statements. Forward-looking statements are not based on historical facts, but rather reflect AGA’s

current expectations concerning future results and events and generally may be identified by the use of forward-looking words or phrases such as “believe”, “aim”, “expect”, “anticipate”, “intend”, “foresee”, “forecast”, “likely”, “should”,

“planned”, “could”, “may”, “would”, “estimated”, “potential”, “outlook” or other similar words and phrases. Similarly, statements that describe AGA’s objectives, plans or goals are or may be forward-looking statements.

AGA Shareholders should consider any forward-looking statements or forecasts in light of the risks and uncertainties described in the information contained or incorporated by reference in

this Pre-listing Statement. These forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause the Group’s actual results, performance or achievements to differ materially from the anticipated

results, performance or achievements expressed or implied in these forward-looking statements. Although AGA and NewCo believe that the expectations reflected in such forward-looking statements and forecasts are reasonable, no assurance can be

given that such expectations will prove to have been correct. Accordingly, results could differ materially from those set out in the forward-looking statements as a result of, among other factors, risks and uncertainties related to the timing

of the Reorganisation, the possibility that the AGA Shareholders will not approve the Reorganisation, that the Reorganisation will not receive other necessary approvals or that the Reorganisation is otherwise not completed (whether following

the occurrence of a Material Adverse Effect or otherwise), the possibility that the expected benefits from the Reorganisation will not be realised or will not be realised within the expected time period, operational disruption due to the

Reorganisation, the incurrence of unexpected transaction costs and expenses or total transaction costs and expenses being higher than current estimates, the degree to which AGA is successful in implementing the Reorganisation (and deriving the

anticipated benefits from the Reorganisation) and other changes which AGA and/or NewCo may make to the Group’s corporate structure, changes in economic, social and political and market conditions, including related to inflation or international

conflicts, the success of business and operating initiatives, changes in the regulatory environment and other government actions, including environmental approvals, fluctuations in gold prices and exchange rates, the outcome of pending or

future litigation proceedings, any supply chain disruptions, any public health crises, pandemics or epidemics (including the COVID-19 pandemic), and other business and operational risks and other factors, including mining accidents. These

factors are not necessarily all of the important factors that could cause AGA’s actual results to differ materially from those expressed in any forward-looking statements. Other unknown or unpredictable factors could also have material adverse

effects on future results.

AGA Shareholders are therefore cautioned not to place undue reliance on the forward-looking statements and are advised to read the Disclosure Package in its entirety.

10

Forward-looking statements included in this Pre-listing Statement are made only as at the date on which the forward-looking statement is made, and neither NewCo nor AGA intends to update

or release any revisions to these forward-looking statements, except as is required by law. New factors may emerge from time to time that could cause the Group’s business, or other matters to which such forward-looking statements relate, not to

develop as expected and it is not possible to predict all of them. Further, the extent to which any factor or combination of factors may cause actual results or matters to differ materially from those contained in any forward-looking statement

is not known.

The forward-looking statements contained in this Pre-listing Statement have not been reviewed nor reported on by AGA’s or NewCo’s auditors or the Independent Reporting Account. Each of AGA

and NewCo qualifies all of its forward-looking statements by these factors and statements.

DATE OF INFORMATION PROVIDED

Unless the context clearly indicates otherwise, all information provided in this Pre-listing Statement is provided as at the Last Practicable Date.

NOTICE TO SHAREHOLDERS IN THE UNITED STATES

This Pre-listing Statement is not an offer of securities for sale in the United States. An offer of securities in the United States pursuant to a business combination transaction will only

be made, as may be required, through a prospectus which is part of an effective registration statement filed with the SEC. In connection with the Reorganisation a registration statement on Form F-4 under the Securities Act has been filed with

the SEC. Investors and shareholders are urged to read the registration statement, as well as other documents filed with the SEC, because they will contain important information. Copies of all documents filed with the SEC regarding the

Reorganisation and documents incorporated by reference may be obtained at the SEC’s website at https://www.sec.gov. In addition, the effective registration statement on Form F-4 will

be made available for free to AGA Shareholders.

DATES AND TIMES

The dates and times referred to in this Pre-listing Statement are subject to change. Any such changes will be published through an announcement on SENS. All dates and times referred to in

this Pre-listing Statement are South African dates and times.

11

|

TABLE OF CONTENTS

|

|

CLAUSE NUMBER AND DESCRIPTION

|

PAGE

|

|

PRE-LISTING STATEMENT

|

4

|

|

CORPORATE INFORMATION AND ADVISERS

|

7

|

|

NOTICE TO INVESTORS

|

9

|

|

IMPORTANT INFORMATION

|

13

|

|

IMPORTANT FINANCIAL AND OTHER INFORMATION

|

16

|

|

DEFINITIONS AND INTERPRETATION

|

17

|

|

SALIENT DATES AND TIMES

|

24

|

|

EXECUTIVE SUMMARY

|

26

|

|

PER SHARE MARKET INFORMATION AND DIVIDENDS

|

40

|

|

INFORMATION ABOUT NEWCO, THE GROUP AND THE COMPANIES INVOLVED IN THE REORGANISATION

|

41

|

|

MINERAL RESOURCE AND MINERAL RESERVE STATEMENT

|

49

|

|

NEWCO DIRECTORS AND NEWCO MANAGEMENT

|

50

|

|

REMUNERATION OF NEWCO DIRECTORS AND NEWCO MANAGEMENT

|

58

|

|

MATERIAL U.S. FEDERAL INCOME TAX CONSEQUENCES

|

64

|

|

MATERIAL U.K. TAX CONSEQUENCES

|

69

|

12

|

IMPORTANT INFORMATION

|

ABOUT THIS PRE-LISTING STATEMENT

This Pre-listing Statement has been prepared in accordance with the JSE Listings Requirements in respect of the secondary inward listing of the NewCo Ordinary Shares on the JSE.

A separate Circular has been prepared to provide AGA Shareholders with information regarding the Reorganisation and the manner in which they may have their vote in relation to the

Reorganisation recorded. The Circular additionally provides AGA Shareholders with the Independent Expert Report prepared in respect of the Reorganisation and informs AGA Shareholders of their Appraisal Rights and the manner in which such rights

may be exercised. Further, the Shareholders’ Meeting, convened in terms of the notice of the Shareholders’ Meeting attached to the Circular, is convened to consider and approve the AGAH Sale Special Resolution and the Scheme Special Resolution.

This Pre-listing Statement should be read in conjunction with the Circular, which contains the full description of the Reorganisation and has been posted to the AGA Shareholders together with this Pre-listing Statement, and the documents that

are incorporated in this Pre-listing Statement by reference.

The NewCo Ordinary Shares which are the subject matter of this Pre-listing Statement will be beneficially acquired by the Scheme Participants, by virtue of their participation in the

Reorganisation and accordingly, this Pre-listing Statement is addressed exclusively to the Scheme Participants, who shall become beneficial owners of the NewCo Ordinary Shares, in the same proportions in which they held their shares in AGA as

at the Reorganisation Consideration Record Date (subject to any adjustments to reflect the exercise of Appraisal Rights as contemplated in paragraph 14 (Dissenting AGA Shareholders’ Appraisal Rights)),

upon the completion of the Reorganisation. Any AGA Shareholder which does not exercise its Appraisal Rights (as further described in the Circular) before the Reorganisation Consideration Record Date, and which is eligible to receive the NewCo

Ordinary Shares, shall automatically be entitled to receive the NewCo Ordinary Shares in exchange for its Scheme Shares and become a Scheme Participant upon the approval of the AGAH Sale Special Resolution and the Scheme Special Resolution. The

NewCo Ordinary Shares which are the subject matter of this Pre-listing Statement are only being made available to Scheme Participants, who will be the only persons who are entitled to receive the NewCo Ordinary Shares, and therefore the NewCo

Ordinary Shares may not be acquired by any person who is not a Scheme Participant. Accordingly, there are no minimum subscription requirements for the NewCo Ordinary Shares in terms of the Pre-listing Statement and as the NewCo Ordinary Shares

will be issued to the Scheme Participants on a one-for-one basis in consideration for their AGA Shares and over subscription in respect of the NewCo Ordinary Shares is not possible.

A separate registration statement on Form F-4 has been filed with the SEC by NewCo, which includes a prospectus under the Securities Act with respect to NewCo Ordinary Shares being issued

to AGA Shareholders with a registered address in the United States and in respect of the AGA Shares represented by the AGA ADSs.

DOCUMENTS AVAILABLE FOR INSPECTION AND DOCUMENTS INCLUDED OR INCORPORATED BY REFERENCE IN THIS PRE-LISTING STATEMENT

Documents Available for Inspection

Copies of the following documents will be available for inspection in hard copy form at the registered office of NewCo and at the registered offices of the Sponsors between the hours 09:00

and 16:00 on all South African business days (which excludes Saturdays, Sundays and South African public holidays) and/or in the electronic form by email request sent to companysecretary@anglogoldashanti.com from the date of issue of this

Pre-listing Statement up to and including the 14th (fourteenth) day after the date of this Pre-Listing Statement:

| ● |

NewCo Articles of Association;

|

| ● |

AGA Memorandum of Incorporation;

|

| ● |

the Implementation Agreement;

|

| ● |

the Irrevocable Offer to Purchase;

|

| ● |

the Mineral Resource and Mineral Reserve Report as at 31 December 2022;

|

| ● |

copies or summaries of service agreements with NewCo’s and AGA’s directors, managers, secretaries entered into within the three years preceding the Last Practicable Date;

|

| ● |

written consents of the Financial Advisers, Sponsors, Independent Reporting Accountant and Legal Advisers to the inclusion of their names in this Pre-listing Statement in the context and form in which

they appear;

|

| ● |

the audited financial statements of AGA for the three years ended 2022, 2021, 2020, prepared in accordance with IFRS, as issued by IASB;

|

| ● |

the reviewed condensed consolidated interim financial statements of AGA for the three financial periods ended 30 June 2022, 2021 and 2020, prepared in accordance with IFRS;

|

| ● |

pro forma financial information of NewCo to illustrate the effects of the Reorganisation as of and for the 12 (twelve) months ended 31 December 2022;

|

13

| ● |

Independent Reporting Accountant’s assurance report on the pro forma financial information incorporated by reference in this Pre-listing Statement;

|

| ● |

the NewCo Share Plan;

|

| ● |

a signed copy of the Form F-4;

|

| ● |

a signed copy of the Circular; and

|

| ● |

a signed copy of this Pre-listing Statement.

|

Information Included or Incorporated by Reference in this Pre-listing Statement

The following table sets out the information included or incorporated by reference in this Pre-listing Statement:

|

Document

|

Location

|

|

Circular (including pro-forma financial information of NewCo to illustrate the effects of the Reorganisation and the relevant Independent Reporting Accountant’s assurance report)

|

https://www.anglogoldashanti.com

|

|

AGA Integrated Report for 2022 / AGA Annual Financial Report

|

Integrated Report 2022 | AngloGold Ashanti

|

|

AGA Audited annual financial statements of AGA for the 3 (three) financial years ended 31 December 2020, 2021 and 2022

|

Annual reports – AngloGold Ashanti

|

|

AGA Mineral Resource and Mineral Reserve Report

|

Annual reports – AngloGold Ashanti

|

|

AGA – Q1 2023 Market Update Report

|

https://www.anglogoldashanti.com

|

These documents may also be accessed:

| ● |

on AGA’s website at https://www.anglogoldashanti.com; and

|

| ● |

at NewCo’s registered address, AGA’s registered address and at the offices of the Sponsors, which documents will be available at no charge, during business hours for a period of 14

(fourteen) days after the date of this Pre-listing Statement.

|

Any document that is incorporated in this Pre-listing Statement by reference and any document that is made available for inspection in terms of this Pre-listing Statement, will be

incorporated herein and made available for inspection subject to all of the disclaimers contained in this Pre-listing Statement together with any disclaimer, limitation and/or qualification set out in any such document, provided that if there

is a conflict between the disclaimers contained in this Pre-listing Statement and any of the disclaimers, limitations and/or qualifications set out any document incorporated herein by reference or made available for inspection in terms hereof,

the most onerous provision shall prevail to the extent of the conflict.

DOCUMENTS FILED WITH THE SEC

In terms of applicable U.S. securities laws, NewCo has filed a registration statement on Form F-4 with the SEC with respect to the NewCo Ordinary Shares being issued to AGA Shareholders

with a registered address in the United States and in respect of the AGA Shares represented by AGA ADSs. Among other things, the Form F-4 is required by applicable U.S. securities laws to contain certain financial information, presented in a

format compliant with U.S. securities laws, including the unaudited pro forma financial information required by the rules and regulations of the SEC, for the year ended 31 December 2022.

The Form F-4 and any amendments thereto will be available for inspection and copying as set forth below. The Form F-4, including the attached exhibits, contains additional relevant

information about NewCo and the NewCo Ordinary Shares.

AGA files annual reports and other information with the SEC under the Exchange Act. The SEC maintains an internet site that contains reports, proxy and information statements, and other

information regarding issuers that file electronically with the SEC (http://www.sec.gov), on which AGA’s annual and other reports are made available. You may also inspect certain

reports and other information concerning AGA at the offices of the NYSE located at 11 Wall Street, New York, New York 10005.

The information in the documents filed with the SEC have been prepared in accordance with applicable U.S. securities laws. Such information does not comply with the JSE Listings Requirements and has not been

reviewed by the JSE. In addition, the documents filed with the SEC and referred to herein do not form a part of, and are not being incorporated by reference into, this Pre-listing Statement.

14

By order of the Board

Signed at , London, England on behalf of each of the directors of NewCo in terms of a resolution of the

NewCo Board authorising him to do so on their behalf.

Alberto Calderon

Principal Executive Officer

ANGLOGOLD ASHANTI PLC

23 June 2023

15

|

IMPORTANT FINANCIAL AND OTHER INFORMATION

|

PRESENTATION OF FINANCIAL INFORMATION

NewCo was incorporated, as a private limited company under the laws of England and Wales on 10 February, 2023, and on 22 June 2023 NewCo was re-registered as a public limited company,

solely for the purposes of carrying out the Reorganisation. As such, NewCo has not yet commenced operations, has no material assets or liabilities and has not carried on any activities other than in connection with the Reorganisation. The

functional currency of NewCo is U.S. Dollars and the annual financial statements will be prepared in accordance with FRS 102. These financial statements will be made available to NewCo Shareholders and will be submitted to the JSE and the NYSE.

As NewCo was incorporated solely for the purpose of the Reorganisation and has not carried on any activities other than in connection with the Reorganisation, NewCo does not have audited

financial statements for the three financial years preceding the Reorganisation. However, as following the implementation of the Reorganisation, AGA will become a wholly-owned subsidiary of NewCo, this Pre-listing Statement incorporates by

reference the consolidated financial statements of AGA as at, and for, the years ended 31 December 2020, 2021 and 2022, which have been prepared using the historical results of operations, assets and liabilities attributable to AGA and all of

its subsidiaries, as contained in the Annual Financial Statements for those years. The consolidated financial statements of AGA as at and for the years ended 31 December 2020, 2021 and 2022 have been prepared according to the historical cost

convention, except for the revaluation of certain assets and liabilities to fair value. The consolidated financial statements of AGA are presented in U.S. Dollars and prepared in accordance with IFRS as issued by IASB. AGA’s Annual Financial

Statements are distributed to AGA Shareholders and AGA ADS Holders and are submitted to the JSE and the NYSE.

Ernst & Young Inc. was appointed by the AGA Board as the Group’s independent external auditor for the financial year ending 31 December 2022. Ernst & Young Inc. was also appointed

by the AGA Board as the Independent Reporting Accountant for the purpose of preparing the assurance report on the pro forma financial information to illustrate the effect of the Reorganisation as of

and for the year ended 31 December 2022, as required in terms of the JSE Listings Requirements and the Takeover Regulations, which assurance report is set out in Annexure D to the Circular and is

incorporated in this Pre-listing Statement by reference.

Ernst & Young Inc. will resign as independent external auditor of the Group on conclusion of its responsibilities relating to the 31 December 2022 financial year audit, which is

expected to conclude during June 2023. Accordingly, PricewaterhouseCoopers Inc. was appointed by the AGA Board as the Group’s independent external auditor for the financial year ending 31 December 2023. See the section entitled “Report of the Audit Committee – Auditors” in the Annual Financial Report for 2022, which is incorporated by reference in this Pre-listing Statement.

16

|

DEFINITIONS AND INTERPRETATION

|

The headings in this Pre-listing Statement are for the purpose of convenience and reference only and shall neither be used in the interpretation of, nor modify, nor amplify the terms of

this Pre-listing Statement. Unless a contrary intention clearly appears:

| 1. |

the following terms shall have the meanings assigned to them hereunder and cognate expressions shall have corresponding meanings, namely:

|

| 1.1. |

“ADS Depositary” means The Bank of New York Mellon, which acts as the depositary in respect of the AGA ADS Program;

|

| 1.2. |

“AGA” or “Company” means AngloGold Ashanti Limited (Registration No.1944/017354/06), a public

company duly incorporated in accordance with the company laws of South Africa;

|

| 1.3. |

“AGA ADS Holder” means a registered holder of AGA ADSs;

|

| 1.4. |

“AGA ADS Program” means the American Depositary Share Program of AGA governed by the AGA Deposit Agreement;

|

| 1.5. |

“AGA ADSs” means American depositary shares representing AGA Shares deposited or subject to deposit with the ADS Depositary under the AGA Deposit Agreement at a

ratio of 1 (one) AGA Share to 1 (one) such American depositary share, which are listed and traded on the NYSE;

|

| 1.6. |

“AGA Board” means the directors of AGA, comprising, as at the Last Practicable Date, those persons whose names appear in section headed “Corporate Information and Advisers” in this Pre-listing Statement;

|

| 1.7. |

“AGA Deposit Agreement” means the amended and restated deposit agreement (dated as of 3 June 2008) entered into between AGA, the ADS Depositary and all owners

and beneficial owners from time to time of AGA ADSs issued thereunder, as amended from time to time;

|

| 1.8. |

“AGA Director” means a member on the AGA Board, as constituted from time to time;

|

| 1.9. |

“AGA GhDSs” means Ghanaian depositary shares representing AGA Ordinary Shares at a ratio of 1 (one) AGA Ordinary Share to 100 (one hundred) such Ghanaian

depositary shares, which are listed and traded on the GhSE;

|

| 1.10. |

“AGA MOI” means the memorandum of incorporation of AGA which is in force and effect from time to time;

|

| 1.11. |

“AGA Register” means collectively AGA’s: (a) “securities register” as defined in Section 1 of the Companies Act; and (b) “uncertificated securities register” as

defined in Section 1 of the Companies Act (which the Companies Act stipulates forms part of the “securities register”);

|

| 1.12. |

“AGA Shareholders” means the holders of AGA Shares, who are recorded as such in the AGA Register;

|

| 1.13. |

“AGA Shares” or “AGA Ordinary Shares” means the ordinary shares, with a par value of R0.25 (twenty five cents) each, in

the issued share capital of AGA, which are listed for trading with ISIN No. ZAE 000043485 on, inter alia, the Main Board of the JSE;

|

| 1.14. |

“AGAH” means AngloGold Ashanti Holdings plc (Registration No. 001177V), a company duly incorporated in accordance with the company laws of the Isle of Man, which

as of the Last Practicable Date is a wholly-owned subsidiary of AGA and which acts as a holding company for certain of AGA’s operations and assets located outside South Africa;

|

| 1.15. |

“AGAH Sale” means the irrevocable offer by NewCo to AGA to purchase 100% (one hundred percent) of the shares in AGAH, and the present, non-binding intention of

AGA to accept the Irrevocable Offer to Purchase, which if completed will constitute a disposal of all or the greater part of the assets or undertaking of AGA subject to approval under Chapter 5 of the Companies Act in terms of Section

112 and Section 115(2)(b) of the Companies Act;

|

| 1.16. |

“AGAH Sale Shares” means 100% (one hundred percent) of the issued share capital of AGAH;

|

| 1.17. |

“AGAH Sale Special Resolution” means the special resolution to be passed by the AGA Shareholders in accordance with Section 112(2)(a) of the

Companies Act;

|

| 1.18. |

“Annual Financial Statements” means the document entitled “Annual Financial Statements” submitted by AGA with the JSE on 17 March 2023;

|

| 1.19. |

“Annexures” means the annexures to this Pre-listing Statement;

|

| 1.20. |

“Appraisal Rights” means the dissenting shareholders’ appraisal rights remedy afforded to shareholders in terms of Section 164 of the Companies Act;

|

17

| 1.21. |

“Associate/s” means an associate in relation to either an individual or to a company;

|

| 1.22. |

“ASX” means the Australian Securities Exchange;

|

| 1.23. |

“AUD” or “Australian Dollars” means the Australian Dollar, being the lawful currency of Australia;

|

| 1.24. |

“A2X” means A2X Solutions Proprietary Limited (Registration No. 2021/439627/07), a private company duly incorporated in accordance with the company laws of South

Africa, or where the context requires, the South African securities exchange known as the A2X Markets which is operated by A2X Solutions Proprietary Limited and which is licensed to operate as a securities exchange under the Financial

Markets Act;

|

| 1.25. |

“A2X Listing” means the proposed secondary inward listing of NewCo Ordinary Shares on the A2X;

|

| 1.26. |

“Bowmans” means Bowman Gilfillan Inc. (Registration No.1998/021409/21) a personal

liability company incorporated under the laws of South Africa;

|

| 1.27. |

“Broker” means any person registered as a “broker member equities” in terms of the rules of the JSE in accordance with the provisions of the

Financial Markets Act;

|

| 1.28. |

“Business Day” means any day other than a Saturday, Sunday or proclaimed public holiday in South Africa from time to time;

|

| 1.29. |

“Category 1 Transaction” or “Category 1” means a category 1 transaction as that term is defined in the JSE Listings Requirements;

|

| 1.30. |

“Category 2 Transaction” or “Category 2” means a category 2 transaction as that term is defined in the JSE Listings Requirements;

|

| 1.31. |

“Cede” means Cede & Co., a New York general partnership organised and maintained by DTC;

|

| 1.32. |

“CIPC” means the Companies and Intellectual Property Commission established in terms of Section 185 of the Companies Act, or its successor

body;

|

| 1.33. |

“Circular” means the bound document, dated 7 July 2023, including the Annexures thereto incorporating the Notice of Shareholders’ Meeting,

Forms of Proxy (yellow), Form of Surrenders and Transfer (blue);

|

| 1.34. |

“City Takeover Code” means the U.K. City Code on Takeovers and Mergers;

|

| 1.35. |

“CMA” means South Africa, the Republic of Namibia and the Kingdoms of Lesotho and Eswatini;

|

| 1.36. |

“Code” means the U.S. Internal Revenue Code of 1986;

|

| 1.37. |

“Companies Act” means the South African Companies Act, No. 71 of 2008;

|

| 1.38. |

“Companies Regulations” or “Regulations” means the Companies Regulations, 2011, promulgated under the Companies Act;

|

| 1.39. |

“Computershare” means Computershare Investor Services Proprietary Limited (Registration No. 2004/003647/07), a limited liability private company incorporated and

registered under the laws of South Africa;

|

| 1.40. |

“Computershare Nominees” means Computershare Nominees Proprietary Limited (Registration No. 1999/008543/07), a limited liability private company incorporated and

registered under the laws of South Africa, being the nominee of Computershare’s CSDP;

|

| 1.41. |

“Cravath, Swaine & Moore” means Cravath, Swaine & Moore LLP, DOS ID No. 2886667;

|

| 1.42. |

“Credit Support Agreement” means an agreement titled “Credit Support Agreement” concluded or to be concluded between AGAH and AGA, in terms of which, inter alia, AGAH undertakes to provide and/or provides credit support to AGA by way of a loan facility to enable AGA to meet the requirements of the solvency and liquidity test (as set out in Section

4 of the Companies Act);

|

| 1.43. |

“CS Depositary” means Computershare Trust Company, N.A., a national association organised under the laws of the United States;

|

| 1.44. |

“CS Depositary Nominee” means GTU Ops Inc., a Delaware corporation , operating as nominee to hold NewCo Ordinary Shares for the CS Depositary;

|

| 1.45. |

“CSDP” means a central securities depository participant authorised by a licenced central securities depository to perform custody and administration services or

settlement services or both, in terms of the central securities depository rules published in terms of the FMA;

|

| 1.46. |

“Disclosure Package” means this Pre-listing Statement and the Circular, which shall be posted together;

|

| 1.47. |

“DTC” means The Depository Trust Company, a limited purpose trust company established under the New York Banking Law;

|

18

| 1.48. |

“ENSafrica” means Edward Nathan Sonnenbergs Inc. (Registration No. 2006/018200/21), a personal liability company incorporated and registered under the laws of

South Africa;

|

| 1.49. |

“Entitlements” means the trading entitlements to the NewCo Ordinary Shares available for trading on the JSE and A2X;

|

| 1.50. |

“Exchange Act” means the U.S. Securities Exchange Act of 1934;

|

| 1.51. |

“Exchange Control Regulations” means the Exchange Control Regulations of South Africa, promulgated in terms of Section 9 of the South African Currency and

Exchanges Act, No. 9 of 1933;

|

| 1.52. |

“EY” means Ernst & Young Inc. (Registration No. 2005/002308/21), a personal liability company incorporated and registered under the laws of South Africa;

|

| 1.53. |

“Financial Advisers” means AGA’s and/or NewCo’s (as the case may be) appointed financial advisers in respect of the Reorganisation, being Centerview Partners UK

LLP (Company number OC345806), JPMorgan Chase Bank, N.A., Johannesburg Branch (Registration No. 2001/016069/10) and Rothschild and Co South Africa Proprietary Limited (Registration No. 1999/021764/07), a limited liability private

company incorporated and registered under the laws of South Africa;

|

| 1.54. |

“Financial Markets Act” or “FMA” means the South African Financial Markets Act, No. 9 of 2012 and the regulations

promulgated thereunder;

|

| 1.55. |

“Form F-4” means the Registration Statement on Form F-4 (SEC File no. 333-272867)

initially filed by NewCo with the SEC on 23 June 2023;

|

| 1.56. |

“Foreign Shareholder” means an AGA Shareholder who is a non-resident of South Africa as contemplated in the Exchange Control Regulations;

|

| 1.57. |

“Founder Share” means the 1 (one) NewCo Ordinary Share which AGA holds in NewCo as at the Last Practicable Date, which NewCo Ordinary Share

was issued to AGA upon the incorporation of NewCo;

|

| 1.58. |

“Fulfilment Date” means the date on which the last of the

Reorganisation Conditions has been fulfilled or waived, as the case may be;

|

| 1.59. |

“GBP” or “Pounds” means the British Pound Sterling, being the lawful currency of the United Kingdom;

|

| 1.60. |

“GhSE” means the Ghana Stock Exchange;

|

| 1.61. |

“GhSE Listing” means the proposed secondary listing of NewCo Ordinary Shares on the GhSE;

|

| 1.62. |

“Group” means AGA and its Subsidiaries prior to the implementation of the Reorganisation and subsequent to the implementation of the

Reorganisation, NewCo and its Subsidiaries, as the context requires;

|

| 1.63. |

“HMRC” means His Majesty’s Revenue and Customs, being the tax authority of the United Kingdom;

|

| 1.64. |

“IASB” means the International Accounting Standards Board;

|

| 1.65. |

“IFRS” means the International Financial Reporting Standards, as issued by the IASB;

|

| 1.66. |

“Implementation Agreement” means the agreement titled “Implementation Agreement” entered into on 12 May 2023 between AGA and NewCo, and as amended on 23 June

2023, in terms of which, inter alia, NewCo undertakes to co-operate with AGA to implement the Reorganisation;

|

| 1.67. |

“Income Tax Act” or “ITA” means the South Africa Income Tax Act, No. 58 of 1962, together with the regulations

promulgated thereunder;

|

| 1.68. |

“Independent External Auditor” means AGA’s appointed independent external auditor, being PwC for the financial year ending 31 December 2023, and EY for financial

years ended 31 December 2022, 2021, 2020 and 2019;

|

| 1.69. |

“Independent Expert Report” shall be given the meaning which is attributed thereto in the Circular;

|

| 1.70. |

“Independent Reporting Accountant” means each of AGA’s and NewCo’s appointed independent reporting accountant, being EY;

|

| 1.71. |

“Irrevocable Offer to Purchase” means the document titled “Irrevocable Offer to Purchase”, signed by NewCo and delivered to AGA on 12 May 2023, in terms of

which, inter alia, NewCo irrevocably offers, in favour of AGA, to purchase all (and not part only) of the AGAH Sale Shares in consideration for the issue by NewCo to AGA of the NewCo Notes;

|

| 1.72. |

“IRS” means the United States Internal Revenue Service;

|

| 1.73. |

“Integrated Reports” means collectively or separately and individually as the context

may require the Integrated Report published by AGA for its financial years ended on 31 December 2022, 2021 and 2020;

|

19

| 1.74. |

“JSE” means the JSE Limited (Registration No. 2005/022939/06), a public company duly incorporated in South Africa and which is licensed to

operate as a securities exchange under the Financial Markets Act;

|

| 1.75. |

“JSE Listing” means the proposed secondary inward listing of the NewCo Ordinary Shares on the JSE by way of an introduction;

|

| 1.76. |

“JSE Listings Requirements” means the listings requirements of the JSE, as published from time to time by the JSE;

|

| 1.77. |

“JSE Sponsor” means The Standard Bank of South Africa Limited (Registration No. 1962/000738/06) a public company incorporated and registered under the laws of

South Africa;

|

| 1.78. |

“King IV” means the King IV Report on Corporate Governance for South Africa, 2016;

|

| 1.79. |

“Last Practicable Date” means 15 June 2023, being the last practicable date, before the issue of this Pre-listing Statement;

|

| 1.80. |

“Legal Advisers” means each of AGA’s and NewCo’s appointed legal advisers, being ENSafrica, Cravath, Swaine & Moore, or Slaughter and May, as the context may

require;

|

| 1.81. |

“Listings” means the NYSE Listing, the JSE Listing, the A2X Listing and the GhSE Listing;

|

| 1.82. |

“Longstop Date” means 29 February 2024 or such later date that the AGA and NewCo may agree to in writing prior to such date, being the date by which all the