| 1) |

Title

of each class of securities to which transaction applies:

|

| 2) |

Aggregate

number of securities to which transaction applies:

|

| 3) |

Per

unit price or other underlying value of transaction computed pursuant

to

Exchange Act Rule 0-14 (Set forth the amount on which the filing

fee is

calculated and state how it was determined):

|

| 4) |

Proposed

maximum aggregate value of transaction:

|

| 5) |

Total

fee paid:

|

|

/

/

|

Check

box if any part of the fee is offset as provided by Exchange Act

Rule

0-14(a)(2) and identify the filing for which the offsetting fee was

paid

previously. Identify the previous filing by registration statement

number,

or the Form or Schedule and the date of its

filing.

|

| 1) |

Amount

Previously Paid:

|

| 2) |

Form,

Schedule or Registration Statement No.:

|

| 3) |

Filing

Party:

|

| 4) |

Date

Filed:

|

| · |

providing

us with a later dated proxy,

|

| · |

notifying

our clerk in writing of such revocation at the following address:

Implant

Sciences Corporation, 107 Audubon Road, #5, Wakefield, MA 01880,

Attn:

Clerk or Diane Ryan, or

|

| · |

attending

the annual meeting and voting in person. Attendance at the Annual

Meeting

will not in and of itself constitute revocation of a

proxy.

|

|

Name

|

Age

|

Position

|

Position

Since

|

|

Anthony

J. Armini (1)

|

68

|

President,

Chief Executive Officer and

Chairman

of the Board

|

1984

|

|

Stephen

N. Bunker (1)

|

63

|

Vice

President and Chief Scientist, Director and Clerk

|

1987

|

|

Diane

J. Ryan (1)

|

46

|

Vice

President Finance and Chief Financial Officer

|

2003

|

|

Walter

Wriggins

(1)

|

62

|

Vice

President and General Manager Core Systems

|

2004

|

|

John

Traub

(1)

|

59

|

Vice

President and President Accurel Systems

|

2005

|

|

R.

Erik Bates (1)

|

50

|

Vice

President, Security Systems Manufacturing

|

2005

|

|

Michael

Szycher (2)

|

67

|

Director

|

1999

|

|

David

B. Eisenhaure

(2) (4)

|

60

|

Director

|

2002

|

|

Michael

Turmelle (2)

(3) (4)

|

47

|

Director

|

2005

|

|

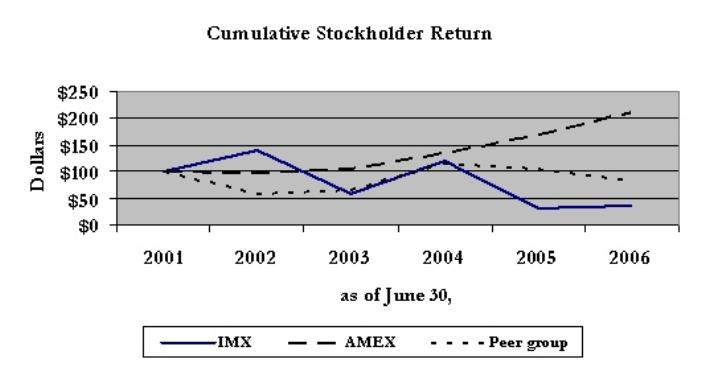

Value

of $100 investment on June 30, 2001 at each of the following measurement

points.

|

||||||

|

|

June

30,

|

|||||

|

|

2001

|

2002

|

2003

|

2004

|

2005

|

2006

|

|

IMX

|

100

|

139

|

58

|

119

|

32

|

36

|

|

AMEX

|

100

|

97

|

106

|

136

|

168

|

210

|

|

Peer

group

|

100

|

59

|

67

|

116

|

106

|

83

|

|

SUMMARY

COMPENSATION TABLE

|

|||||

|

Name

and Principal Position

|

Year

|

Salary($)

|

Bonus

($)

|

Other

Annual

Compensation($)(1)

|

Shares

Underlying

Options

Granted (#)

|

|

Anthony

J. Armini

President,

Chief Executive Officer and

Chairman

of the Board

|

2006

2005

2004

|

$214,712

$213,101

$197,684

|

-

-

$59,700

|

$12,353

$15,417

$12,260

|

100,000

-

50,000

|

|

Stephen

N. Bunker

Vice

President,

Chief

Scientist and Director

|

2006

2005

2004

|

$55,814

$103,377

$114,228

|

-

-

$23,150

|

$1,100

$1,077

$1,049

|

50,000

30,000

50,000

|

|

Diane

J. Ryan

Vice

President Finance and

Chief

Financial Officer

|

2006

2005

2004

|

$137,308

$120,393

$93,102

|

-

$25,000

$25,050

|

$1,217

$1,147

$812

|

80,000

30,000

50,000

|

|

Walter

J. Wriggins

(2)

|

2006

2005

2004

|

$139,462

$101,124

-

|

-

-

-

|

$1,231

-

-

|

30,000

70,000

-

|

|

John

Traub (3)

|

2006

2005

2004

|

$170,000

$53,615

-

|

$20,000

-

-

|

$1,427

-

-

|

30,000

50,000

-

|

|

R.

Erik Bates (3)

|

2006

2005

2004

|

$134,366

$33,231

-

|

-

-

-

|

$1,206

-

-

|

30,000

30,000

-

|

|

Name

and Principal Position

|

Number

of

Securities

Underlying Options Granted

|

%

of Total Granted to Employees in Fiscal Year

|

Exercise

Price ($/sh)

|

Expiration

Date

|

|||||

|

Anthony

J. Armini

|

|

100,000

|

18%

|

$4.50

|

12/13/2010

|

||||

|

|

President,

Chief Executive Officer

|

|

|||||||

|

|

and

Chairman of the Board

|

|

|||||||

|

Stephen

N. Bunker

|

|

50,000

|

9%

|

$4.09

|

12/13/2015

|

||||

|

|

Vice

President and Chief Scientist

|

|

|||||||

|

Diane

J. Ryan

|

|

30,000

|

5%

|

$3.80

|

11/01/15

|

||||

|

|

Vice

President Finance and

|

|

50,000

|

9%

|

$4.09

|

12/13/15

|

|||

|

|

Chief

Financial Officer

|

|

|||||||

|

Walter

J. Wriggins

|

|

30,000

|

5%

|

$3.89

|

10/31/15

|

||||

|

|

Vice

President Business Development/Operations

|

||||||||

|

|

and

General Manager of Core Systems, Inc.

|

|

|||||||

|

John

Traub

|

|

30,000

|

5%

|

$4.20

|

03/02/16

|

||||

|

|

President

Accurel Systems International Corp.

|

|

|||||||

|

R.

Erik Bates

|

|

30,000

|

5%

|

$3.35

|

04/11/16

|

||||

|

|

Vice

President Operations

|

|

|

|

|

|

|

|

|

|

|

Security

Products Division

|

|

|

|

|

|

|

|

|

|

|

Name

and Principal Position

|

|

Number

of Securities Underlying Unexercised Options at June 30,

2006

|

Value

of Unexercised

In-the-Money

Options at

June

30, 2006

(1)(2)

|

|||

|

|

Exercisable

|

Unexercisable

|

Exercisable

|

Unexercisable

|

|||

|

|

|

|

|

|

|

|

|

|

Anthony

J. Armini

|

|

191,700

|

16,500

|

-

|

-

|

||

|

|

President,

Chief Executive Office

|

|

|||||

|

|

and

Chairman of the Board

|

|

|||||

|

Stephen

N. Bunker

|

|

133,500

|

16,500

|

-

|

-

|

||

|

|

Vice

President and Chief Scientist

|

|

|||||

|

Diane

J. Ryan

|

|

174,500

|

36,300

|

$7,852

|

-

|

||

|

|

Vice

President Finance and

|

|

|||||

|

|

Chief

Financial Officer

|

|

|||||

|

Walter

J. Wriggins

|

|

47,600

|

92,400

|

-

|

-

|

||

|

|

Vice

President Business Development/Operations

|

||||||

|

|

and

General Manager of Core Systems, Inc.

|

|

|||||

|

John

Traub

|

|

17,000

|

63,000

|

-

|

-

|

||

|

|

President

Accurel Systems International Corp.

|

|

|||||

|

R.

Erik Bates

|

|

10,200

|

49,800

|

-

|

-

|

||

|

|

Vice

President Operations

|

|

|||||

|

|

Security

Products Division

|

|

|||||

|

|

|

|

|

|

|

|

|

|

(1)

As

of June 30, 2006, the market value of a share of common stock was

$3.30

(2)

Represents a 10 year option

|

|

|

|

||||

|

Plan

Category

|

Number

of securities to be issued upon exercise of outstanding options,

warrants

and rights

|

Weighted-average

exercise price of outstanding options, warrants and rights

|

Number

of securities remaining available for future issuance under equity

compensation plans

|

|||

|

Equity

Compensation Plans Approved by Security Holders

|

1,836,551

|

$5.41

|

649,147

|

|||

|

Equity

Compensation Plans Not Approved by Security Holders

|

-

|

-

|

-

|

|||

|

Total

|

1,836,551

|

$5.41

|

649,147

|

|

June

30,

|

|||

|

|

2006

|

2005

|

|

|

|

|

|

|

|

Audit

fees

|

$

191,000

|

|

$

297,500

|

|

Audit

related fees

|

56,000

|

|

17,650

|

|

Tax

fees

|

-

|

|

-

|

|

All

other fees

|

-

|

-

|

|

|

Total

|

$

247,000

|

|

$315,150

|

|

|

|

|

|

|

Name

of Beneficial Owner

|

Number

of Shares Beneficially Owned (1)

|

Percent

of Class (2)

|

|

|

|

|

|

Anthony

J. Armini (3)

|

1,382,138

|

11%

|

|

Stephen

N. Bunker(4)

|

768,548

|

6%

|

|

Diane

J. Ryan (5)

|

228,740

|

2%

|

|

Walter

J. Wriggins (6)

|

76,814

|

1%

|

|

John

Traub (7)

|

17,000

|

*

|

|

R.

Erik Bates (8)

|

10,200

|

*

|

|

Michael

Szycher (9)

|

71,000

|

1%

|

|

David

Eisenhaure (10)

|

66,000

|

1%

|

|

Michael

Turmelle

(11)

|

10,000

|

*

|

|

*

|

Less

than 1%

|

|

|

|

|||||

|

(1)

Unless

otherwise noted,

each person identified possesses sole voting and investment power

over the

shares.

|

|||||||||

| (2) The calculation of percentage of class is based on 11,800,466 shares of common stock issued and outstanding as of August 31, 2006 plus any shares issuable upon exercise of options, to such persons and included as being beneficially owned by him. | |||||||||

|

(3)

Includes 208,200 shares exercisable within 60 days of the date

hereof.

|

|||||||||

| (4) Includes 150,000 shares exercisable within 60 days of the date hereof. | |||||||||

|

(5)

Includes 200,900 shares exercisable within 60 days of the date

hereof.

|

|||||||||

|

(6)

Includes 76,814 shares exercisable within 60 days of the date

hereof.

|

|||||||||

|

(7)

Includes 10,200 shares exercisable within 60 days of the date

hereof.

|

|||||||||

|

(8)

Includes 10,200 shares exercisable within 60 days of the date

hereof.

|

|||||||||

|

(9) Includes

71,000 shares exercisable within 60 days of the date

hereof.

|

|||||||||

|

(10)

Includes 66,000 shares exercisable within 60 days of the date

hereof.

|

|||||||||

|

(11)

Includes 10,000 shares exercisable within 60 days of the date

hereof.

|

|||||||||

| (a) |

"Compensation"

means, for the purpose of any Offering (as hereinafter defined) pursuant

to this Plan, base pay in effect as of the Offering Commencement

Date (as

hereinafter defined). Compensation shall not include any deferred

compensation other than contributions by an individual through a

salary

reduction agreement to a cash or deferred plan pursuant to Section

401(k)

of the Code or to a cafeteria plan pursuant to Section 125 of the

Code.

|

| (b) |

"Board"

means the Board of Directors of the

Company.

|

| (c) |

"Common

Stock" means the common stock, $0.10 par value per share, of the

Company.

|

| (d) |

"Company"

shall also include any Parent or Subsidiary of Implant Sciences

Corporation designated by the Board of Directors of the Company (the

"Board").

|

| (e) |

"Employee"

means any person who is customarily employed at least 20 hours per

week

and more than five months in a calendar year by the

Company.

|

| (f) |

“Offering

commencement date” means January 1 or July

1.

|

| (g) |

“Offering

termination date” means June 30 for a January 1 offering commencement date

or December 31 for a July 1 offering commencement

date.

|

| (h) |

"Parent"

shall mean any present or future corporation which is or would constitute

a "parent corporation" as that term is defined in Section 424 of

the

Code.

|

| (i) |

"Plan

Administrator" shall consist of the Board or, if appointed by the

Board, a

committee consisting of at least two Outside Directors who shall

be

members of the Board, but who are not employees of the Company or

of any

parent or subsidiary of the

Company.

|

| (j) |

"Subsidiary"

shall mean any present or future corporation which is or would constitute

a "subsidiary corporation" as that term is defined in Section 424

of the

Code.

|

| (a) |

Participation

in the Plan is completely voluntary. Participation in any one or

more of

the Offerings under the Plan shall neither limit, nor require,

participation in any other

Offering.

|

| (b) |

Each

Employee shall be eligible to participate in the Plan on the first

Offering Commencement Date, as hereinafter defined, following the

completion of one year of continuous service with the Company.

Notwithstanding the foregoing, no Employee shall be granted an option

under the Plan:

|

| (i) |

if,

immediately after the grant, such Employee would own stock, and/or

hold

outstanding options to purchase stock, possessing 5% or more of the

total

combined voting power or value of all classes of stock of the Company

or

any Parent or Subsidiary; for purposes of this Paragraph the rules

of

Section 424(d) of the Code shall apply in determining stock ownership

of

any Employee; or

|

| (ii) |

which

permits such Employee's rights to purchase stock under all Section

423

employee stock purchase plans of the Company and any Parent or Subsidiary

to accrue at a rate that exceeds $25,000 of the fair market value

of the

stock (determined at the time such option is granted) for each calendar

year in which such option is outstanding; for purposes of this Paragraph,

the rules of Section 423(b)(8) of the Code shall

apply.

|

| (a) |

At

the time a participant files his authorization for a payroll deduction,

he

shall elect to have deductions made from his pay on each payday during

any

Offering in which he is a participant at a specified percentage of

his

Compensation as determined on the applicable Offering Commencement

Date;

said percentage shall be in increments of one percent up to a maximum

percentage of ten percent.

|

| (b) |

Payroll

deductions for a participant shall commence on the applicable Offering

Commencement Date when his authorization for a payroll deduction

becomes

effective and subject to the last sentence of Paragraph 5 shall end

on the

Offering Termination Date of the Offering to which such authorization

is

applicable unless sooner terminated by the participant as provided

in

Paragraph 10.

|

| (c) |

All

payroll deductions made for a participant shall be credited to his

account

under the Plan. A participant may not make any separate cash payment

into

such account.

|

| (d) |

A

participant may withdraw from the Plan at any time during the applicable

Offering period.

|

| (a) |

On

the Offering Commencement Date of each Offering, a participating

Employee

shall be deemed to have been granted an option to purchase a maximum

number of shares of the Common Stock equal to an amount determined

as

follows: 85% of the market value per share of the Common Stock on

the

applicable Offering Commencement Date shall be divided into an amount

equal to the percentage of the Employee's Compensation which he has

elected to have withheld (but no more than 10%) multiplied by the

Employee's Compensation over the Offering period. Such market value

per

share of the Common Stock shall be determined as provided in clause

(i) of

Paragraph 7(b).

|

| (b) |

The

option price of the Common Stock purchased with payroll deductions

made

during each such Offering for a participant therein shall be the

lower of:

|

| (i) |

85%

of the closing price per share on the Offering Commencement Date

as

reported by a nationally recognized stock exchange, or, if the Common

Stock is not listed on such an exchange, as reported by the National

Association of Securities Dealers Automated Quotation System ("Nasdaq")

National Market System or, if the Common Stock is not listed on the

Nasdaq

National Market System but is otherwise publicly traded over-the-counter,

85% of the mean of the bid and asked prices per share on the Offering

Commencement Date or, if the Common Stock is not traded over-the-counter,

85% of the fair market value on the Offering Commencement Date as

determined by the Plan Administrator; and

|

| (ii) |

85%

of the closing price per share on the Offering Termination Date as

reported by a nationally recognized stock exchange, or, if the Common

Stock is not listed on such an exchange, as reported by the Nasdaq

National Market System or, if the Common Stock is not listed on the

Nasdaq

National Market System but is otherwise publicly traded over-the-counter,

85% of the mean of the bid and asked prices per share on the Offering

Termination Date or, if the Common Stock is not traded over-the-counter,

85% of the fair market value on the Offering Termination Date as

determined by the Plan

Administrator.

|

| (a) |

Unless

a participant gives written notice to the Treasurer of the Company

as

hereinafter provided, his option for the purchase of Common Stock

with

payroll deductions made during any Offering will be deemed to have

been

exercised automatically on the Offering Termination Date applicable

to

such Offering for the purchase of the number of full shares of Common

Stock which the accumulated payroll deductions in his account at

that time

will purchase at the applicable option price (but not in excess of

the

number of shares for which options have been granted the Employee

pursuant

to Paragraph 7(a) and any pro rata allocation to such participant

under

Paragraph 12(a)), and any excess in his account at that time, other

than

amounts representing fractional shares, will be returned to

him.

|

| (b) |

Fractional

shares will not be issued under the Plan and any accumulated payroll

deductions which would have been used to purchase fractional shares

shall

be automatically carried forward to the next Offering unless the

participant elects, by written notice to the Treasurer of the Company,

to

have the excess cash returned to

him.

|

| (a) |

Prior

to the Offering Termination Date for an Offering, any participant

may

withdraw the payroll deductions credited to his account under the

Plan for

such Offering by giving written notice to the Treasurer of the Company.

All of the participant's payroll deductions credited to such account

will

be paid to him promptly after receipt of notice of withdrawal, without

interest, and no future payroll deductions will be made from his

pay

during such Offering. The Company will treat any attempt to borrow

by a

participant on the security of accumulated payroll deductions as

an

election to withdraw such

deductions.

|

| (b) |

Except

as set forth in Paragraph 6(d), a participant's election not to

participate in, or withdrawal from, any Offering will not have any

effect

upon his eligibility to participate in any succeeding Offering or

in any

similar plan which may hereafter be adopted by the

Company.

|

| (c) |

Upon

termination of the participant's employment for any reason, including

retirement but excluding death, the payroll deductions credited to

his

account will be returned to him, or, in the case of his death, to

the

person or persons entitled thereto under Paragraph

14.

|

| (d) |

Upon

termination of the participant's employment because of death, his

beneficiary (as defined in Paragraph 14) shall have the right to

elect, by

written notice given to the Company's Treasurer prior to the expiration

of

a period of 90 days commencing with the date of the death of the

participant, either:

|

| (i) |

to

withdraw all of the payroll deductions credited to the participant's

account under the Plan; or

|

| (ii) |

to

exercise the participant's option for the purchase of stock on the

Offering Termination Date next following the date of the participant's

death for the purchase of the number of full shares which the accumulated

payroll deductions in the participant's account at the date of the

participant's death will purchase at the applicable option price

(subject

to the limitation contained in Paragraph 7(a)), and any excess in

such

account will be returned to said beneficiary. In the event that no

such

written notice of election shall be duly received by the Company's

Treasurer, the beneficiary shall automatically be deemed to have

elected

to withdraw the payroll deductions credited to the participant's

account

at the date of the participant's death and the same will be paid

promptly

to said beneficiary.

|

| (a) |

The

maximum number of shares of Common Stock available for issuance and

purchase by Employees under the Plan, subject to adjustment upon

changes

in capitalization of the Company as provided in Paragraph 17, shall

be

500,000 shares of Common Stock. If the total number of shares for

which

options are exercised on any Offering Termination Date in accordance

with

Paragraph 8 exceeds the maximum number of shares for the applicable

Offering, the Company shall make a pro rata allocation of the shares

available for delivery and distribution in an equitable manner, and

the

balances of payroll deductions credited to the account of each participant

under the Plan shall be returned to the participant.

|

| (b) |

The

participant will have no interest in stock covered by his option

until

such option has been exercised.

|