| · |

providing

us with a later dated proxy,

|

| · |

notifying

our clerk in writing of such revocation at the following address:

Implant

Sciences Corporation, 107 Audubon Road, #5, Wakefield, MA 01880,

Attn:

Clerk or Diane Ryan, or

|

| · |

attending

the annual meeting and voting in person. Attendance at the Annual

Meeting

will not in and of itself constitute revocation of a

proxy.

|

|

Name

|

Age

|

|

Position

|

Position

Since

|

|

|

|

|

|

|

|

Phillip

C. Thomas (1)

(2)

|

58

|

|

President

and Chief Executive Officer, Nominee for Director

|

2007

|

|

Stephen

N. Bunker (1)

|

64

|

|

Vice

President and Chief Scientist, Director

|

1987

|

|

Diane

J. Ryan (1)

|

47

|

|

Vice

President Finance and Chief Financial Officer

|

2003

|

|

Walter

Wriggins (1)

|

63

|

|

Vice

President and General Manager Core Systems

|

2004

|

|

Michael

Szycher (4)

(5) (6)

|

68

|

|

Nominee

for Director

|

1999

|

|

David

Eisenhaure (4)

(5) (6)

|

61

|

|

Nominee

for Director

|

2002

|

|

Michael

Turmelle (3)

(4) (5)(6)

|

48

|

|

Nominee

for Director

|

2005

|

|

Joseph

Levangie

|

62

|

|

Nominee

for Director

|

N/A

|

|

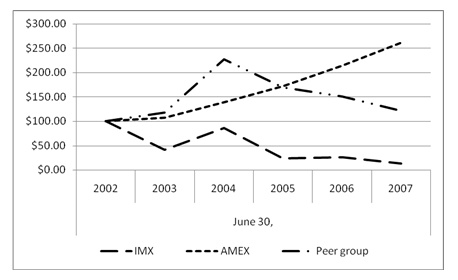

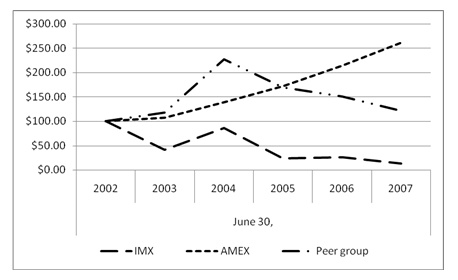

June

30,

|

||||||

|

2002

|

2003

|

2004

|

2005

|

2006

|

2007

|

|

|

IMX

|

100

|

42

|

85

|

23

|

26

|

13

|

|

AMEX

|

100

|

108

|

139

|

172

|

214

|

262

|

|

Peer

group

|

100

|

118

|

227

|

169

|

151

|

121

|

|

SUMMARY

COMPENSATION TABLE

|

|||||||||

|

|

|

|

|

|

|

|

Non-Qualified

|

|

|

|

Name

and Principal Position

|

Year

|

Salary($)

|

Bonus

($)

|

|

|

Non-Equity

|

Deferred

|

|

|

|

Stock

|

Option

|

Incentive

Plan

|

Compensation

|

Other

Annual

|

|

||||

|

Awards($)

|

Awards($)

|

Compensation

|

Earnings

|

Compensation($)(1)

|

Total

|

||||

|

Anthony

J. Armini (2)

|

2007

|

$242,790

|

-

|

-

|

-

|

-

|

-

|

$22,628

|

$265,418

|

|

President,

Chief Executive

|

2006

|

$214,712

|

-

|

-

|

$196,000

|

-

|

-

|

$12,353

|

$423,065

|

|

Officer

and Chairman

|

2005

|

$213,101

|

-

|

-

|

-

|

-

|

-

|

$15,417

|

$228,518

|

|

|

|

|

|

|

|

|

|

|

|

|

Stephen

N. Bunker

|

2007

|

$110,254

|

-

|

-

|

-

|

-

|

-

|

$1,102

|

$111,356

|

|

Vice

President,

|

2006

|

$55,814

|

-

|

-

|

$137,000

|

-

|

-

|

$1,100

|

$193,914

|

|

Chief

Scientist and Director

|

2005

|

$103,377

|

-

|

-

|

-

|

-

|

-

|

$1,077

|

$104,454

|

|

|

|

|

|

|

|

|

|

|

|

|

Phillip

C. Thomas(3)

|

2007

|

$57,692

|

-

|

-

|

$177,600

|

-

|

-

|

$2,489

|

$237,781

|

|

President

and Chief

|

2006

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

|

Executive

Officer

|

2005

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

Diane

J. Ryan

|

2007

|

$145,116

|

$18,750

|

-

|

$72,950

|

-

|

-

|

$1,220

|

$238,036

|

|

Vice

President Finance and

|

2006

|

$137,308

|

-

|

-

|

$213,500

|

-

|

-

|

$1,217

|

$352,025

|

|

Chief

Financial Officer

|

2005

|

$120,393

|

$25,000

|

-

|

-

|

-

|

-

|

$1,147

|

$146,540

|

|

|

|

|

|

|

|

|

|

|

|

|

Walter

J. Wriggins

(4)

|

2007

|

$140,000

|

$20,000

|

-

|

$28,500

|

-

|

-

|

$4,450

|

$192,950

|

|

Vice

President and General

|

2006

|

$139,462

|

-

|

-

|

$77,400

|

-

|

-

|

$1,231

|

$218,093

|

|

Manager,

Core Systems

|

2005

|

$101,124

|

-

|

-

|

-

|

-

|

-

|

-

|

$101,124

|

|

|

|

|

|

|

|

|

|

|

|

|

(1)

Other annual compensation consists of life and disability insurance

premiums and 401(k) plan beneftis paid by us on behalf of these executive

officers. In addition, Dr. Armini, Mr. Thomas and Mr. Wriggins received

a

car allowance of $8,993, $2,250 and $3,600

respectively.

|

|||||||||

|

(2)

Dr. Armini stepped down and President and CEO on September 27, 2007.

He

remains Chairman of the Board.

|

|

||||||||

|

(3)

Joined the Company in March 2007. Promoted to CEO on September 27,

2007.

|

|

|

|

||||||

|

(4)

Joined the Company in October 2004.

|

|

|

|

|

|

|

|

||

|

Estimated

Future Payouts Under Non-Equity Incentive Plan Awards

|

Estimated

Future Payouts Under Equity Incentive Plan Awards

|

All

other Stock Awards: Number of Shares of Stocks or Units

|

All

other Option Awards: Number of Securities Underlying Options

(#)

|

Exercise

of Base Price of Option Awards ($/sh)

|

||||||

|

Name

|

Grant

Date

|

Threshold

($)

|

Target

($)

|

Maximum

($)

|

Threshold

($)

|

Target

($)

|

Maximum

($)

|

|||

|

(a)

|

(b)

|

(c)

|

(d)

|

(e)

|

(f)

|

(g)

|

(h)

|

(i)

|

(j)

|

(k)

|

|

Phillip

C. Thomas

|

3/12/2007

|

-

|

-

|

-

|

120,000

|

120,000

|

120,000

|

-

|

-

|

$2.12

|

|

Diane

J. Ryan

|

8/31/2006

|

-

|

-

|

-

|

20,000

|

20,000

|

20,000

|

-

|

-

|

$2.40

|

|

|

3/5/2007

|

-

|

-

|

-

|

25,000

|

25,000

|

25,000

|

-

|

-

|

$2.05

|

|

Walter

Wriggins

|

6/29/2007

|

-

|

-

|

-

|

25,000

|

25,000

|

25,000

|

-

|

-

|

$1.64

|

|

Name

|

Number

of Securities Underlying Unexercised Options (#)

Exercisable

|

Number

of Securities Underlying Unexercised Options (#)

Unexercisable

|

Equity

Incentive Plan Awards: Number of Securities Underlying Unexercised

Unearned Options (#)

|

Option

Exercise Price

|

Option

Expiration

|

Number

of Shares or Units of Stock that Have not Vested (#)

|

Market

Value of Shares or Units of Stock That Have Not Vested ($)

|

Equity

Incentive Plan Awards: Number of Unearned Shares, Units or Other

Rights

That Have Not Vested (#)

|

Equity

Incentive Plan Awards: Market or Payout Value of Unearned Shares,

Units or

Other Rights That have not Vested ($)

|

|

(a)

|

(b)

|

(c)

|

(d)

|

(e)

|

(f)

|

(g)

|

(h)

|

(i)

|

(j)

|

|

Anthony

J. Armini

|

48,000

|

-

|

-

|

$4.65

|

11/11/2007

|

-

|

-

|

-

|

-

|

|

|

10,200

|

-

|

-

|

$2.31

|

3/4/2008

|

-

|

-

|

-

|

-

|

|

|

50,000

|

-

|

-

|

$6.96

|

8/22/2008

|

-

|

-

|

-

|

-

|

|

|

100,000

|

-

|

-

|

$4.50

|

12/13/2010

|

-

|

-

|

-

|

-

|

|

Stephen

N. Bunker

|

50,000

|

-

|

-

|

$4.65

|

11/11/2007

|

-

|

-

|

-

|

-

|

|

|

50,000

|

-

|

-

|

$6.33

|

8/22/2013

|

-

|

-

|

-

|

-

|

|

|

50,000

|

-

|

-

|

$4.09

|

12/13/2015

|

-

|

-

|

-

|

-

|

|

Phillip

C. Thomas

|

-

|

120,000

|

-

|

$2.12

|

3/12/2017

|

-

|

-

|

-

|

-

|

|

Diane

J. Ryan

|

5,000

|

-

|

-

|

$10.90

|

4/4/2012

|

-

|

-

|

-

|

-

|

|

|

20,000

|

-

|

-

|

$4.23

|

11/11/2012

|

-

|

-

|

-

|

-

|

|

|

4,000

|

-

|

-

|

$2.10

|

3/4/2013

|

-

|

-

|

-

|

-

|

|

|

21,800

|

-

|

-

|

$3.16

|

5/21/2013

|

-

|

-

|

-

|

-

|

|

|

50,000

|

-

|

-

|

$6.33

|

8/22/2013

|

-

|

-

|

-

|

-

|

|

|

20,100

|

9,900

|

-

|

$9.15

|

7/28/2014

|

-

|

-

|

-

|

-

|

|

|

30,000

|

-

|

-

|

$3.80

|

11/1/2015

|

-

|

-

|

-

|

-

|

|

|

50,000

|

-

|

-

|

$4.09

|

12/13/2015

|

-

|

-

|

-

|

-

|

|

|

-

|

20,000

|

-

|

$2.40

|

8/31/2016

|

-

|

-

|

-

|

-

|

|

|

-

|

25,000

|

-

|

$2.05

|

3/5/2017

|

-

|

-

|

-

|

-

|

|

Walter

J. Wriggins

|

33,500

|

16,500

|

-

|

$9.92

|

10/15/2014

|

-

|

-

|

-

|

-

|

|

|

13,400

|

6,600

|

-

|

$3.58

|

4/22/2015

|

-

|

-

|

-

|

-

|

|

|

30,000

|

-

|

-

|

$3.89

|

10/31/2015

|

-

|

-

|

-

|

-

|

|

|

-

|

25,000

|

-

|

$1.64

|

6/29/2017

|

-

|

-

|

-

|

-

|

|

Name

|

Fees

Earned or

Paid

in Cash

($)

|

Stock

Awards

($)

|

Option

Awards

($)

|

Non-Equity

Incentive Plan Compensation

|

Change

in Pension Value and Nonqualified Deferred Compensation

Earnings

|

All

Other Compensation

($)

|

Total

($)

|

|

(a)

|

(b)

|

(c)

|

(d)

|

(e)

|

(f)

|

(g)

|

(h)

|

|

Michael

Szycher

|

13,500

|

-

|

16,200

|

-

|

-

|

-

|

29,700

|

|

David

Eisenhaure

|

12,000

|

-

|

16,200

|

-

|

-

|

-

|

28,200

|

|

Michael

Turmelle

|

13,500

|

-

|

16,200

|

-

|

-

|

-

|

29,700

|

|

|

June

30,

|

|

|

|

2007

|

2006

|

|

Audit

fees

|

$

196,000

|

$

173,500

|

|

Audit

related fees

|

95,000

|

65,500

|

|

Tax

fees

|

-

|

-

|

|

Other

fees

|

23,000

|

63,000

|

|

|

$

314,000

|

$

302,000

|

|

|

|

|

|

Name

of Beneficial Owner

|

|

Number

of Shares

Beneficially

Owned (1)

|

|

Percentage

of Class (2)

|

|

Officers

and Directors as a group

|

|

2,692,360

|

|

21%

|

|

Phillip

C. Thomas

|

|

-

|

|

-

|

|

Stephen

N. Bunker (3)

|

|

751,048

|

|

6%

|

|

Diane

J. Ryan (4)

|

|

245,309

|

|

2%

|

|

Walter

J. Wriggins (5)

|

|

106,114

|

|

1%

|

|

Michael

Szycher

(6)

|

|

81,000

|

|

1%

|

|

David

Eisenhaure (7)

|

|

76,000

|

|

1%

|

|

Michael

Turmelle (8)

|

|

20,000

|

|

-

|

|

Anthony

Armini (9)

|

|

1,412,889

|

|

11%

|

|

Joseph

Levangie

|

|

-

|

|

-

|

|

(1)

|

Unless

otherwise noted, each person identified possesses sole voting and

investment power over the shares.

|

|

(2)

|

The

calculation of percentage of class is based on 11,854,638 shares

of common

stock issued and outstanding as

of November 9, 2007 plus

any shares issuable upon exercise of options, to such persons and

included

as being beneficially owned by him.

|

|

(3)

|

Includes

150,000 shares exercisable within 60 days of the date

hereof.

|

|

(4)

|

Includes

217,467 shares exercisable within 60 days of the date

hereof.

|

|

(5)

|

Includes

76,900 shares exercisable within 60 days of the date

hereof.

|

|

(6)

|

Includes

79,000 shares exercisable within 60 days of the date

hereof.

|

|

(7)

|

Includes

75,000 shares exercisable within 60 days of the date

hereof.

|

|

(8)

|

Includes

20,000 shares exercisable within 60 days of the date

hereof

|

|

(9)

|

Includes

229,200 shares exercisable within 60 days of the date

hereof

|