2024–2025

The big picture Axon is a mission-driven company whose overarching goal is to protect life. Our vision is a world where bullets are obsolete, where social conflict is dramatically reduced, and where everyone has access to a fair and effective justice system. , AXON and Axon are trademarks of Axon Enterprise, Inc., some of which are registered in the US and other countries. For more information, visit www.axon.com/legal. All rights reserved. © 2025 Axon Enterprise, Inc.

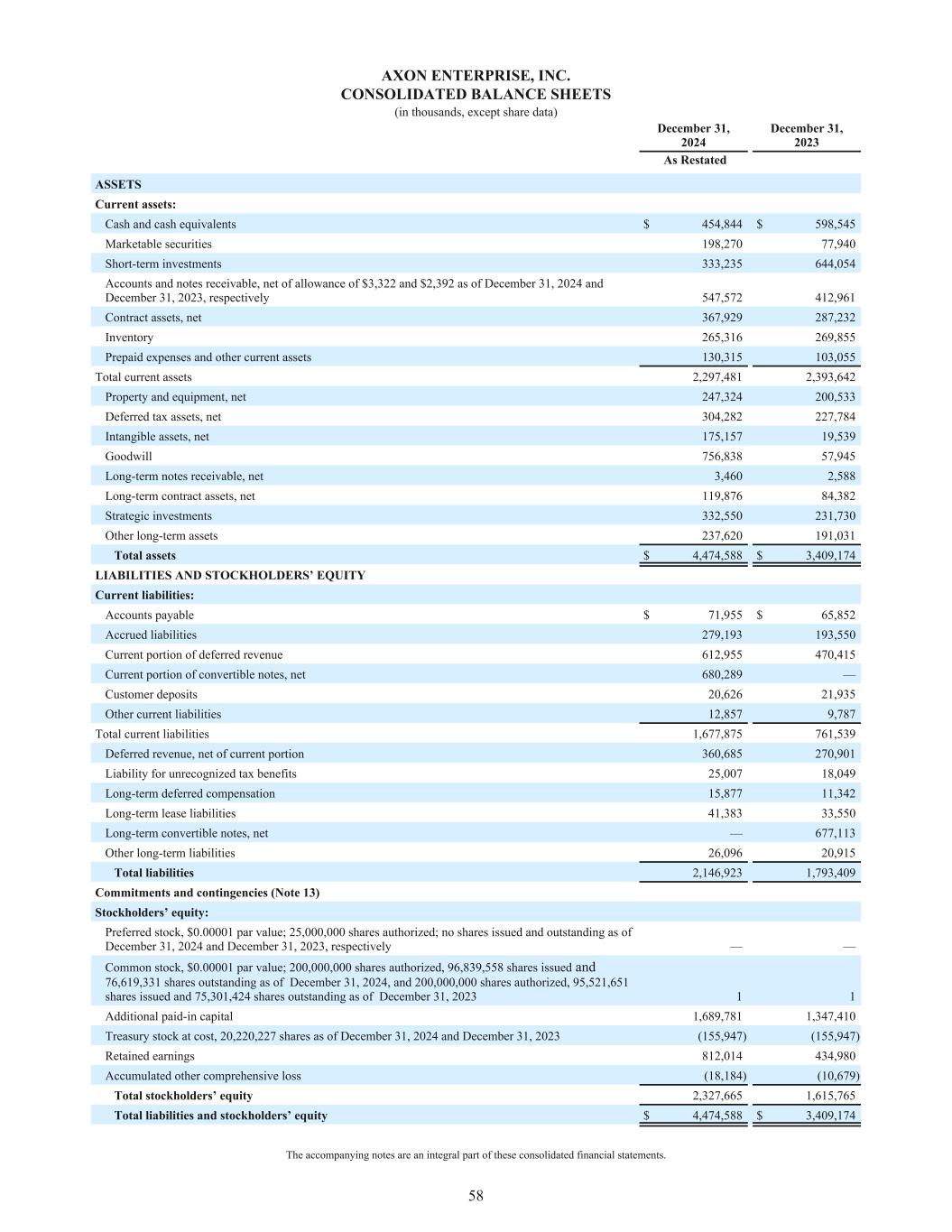

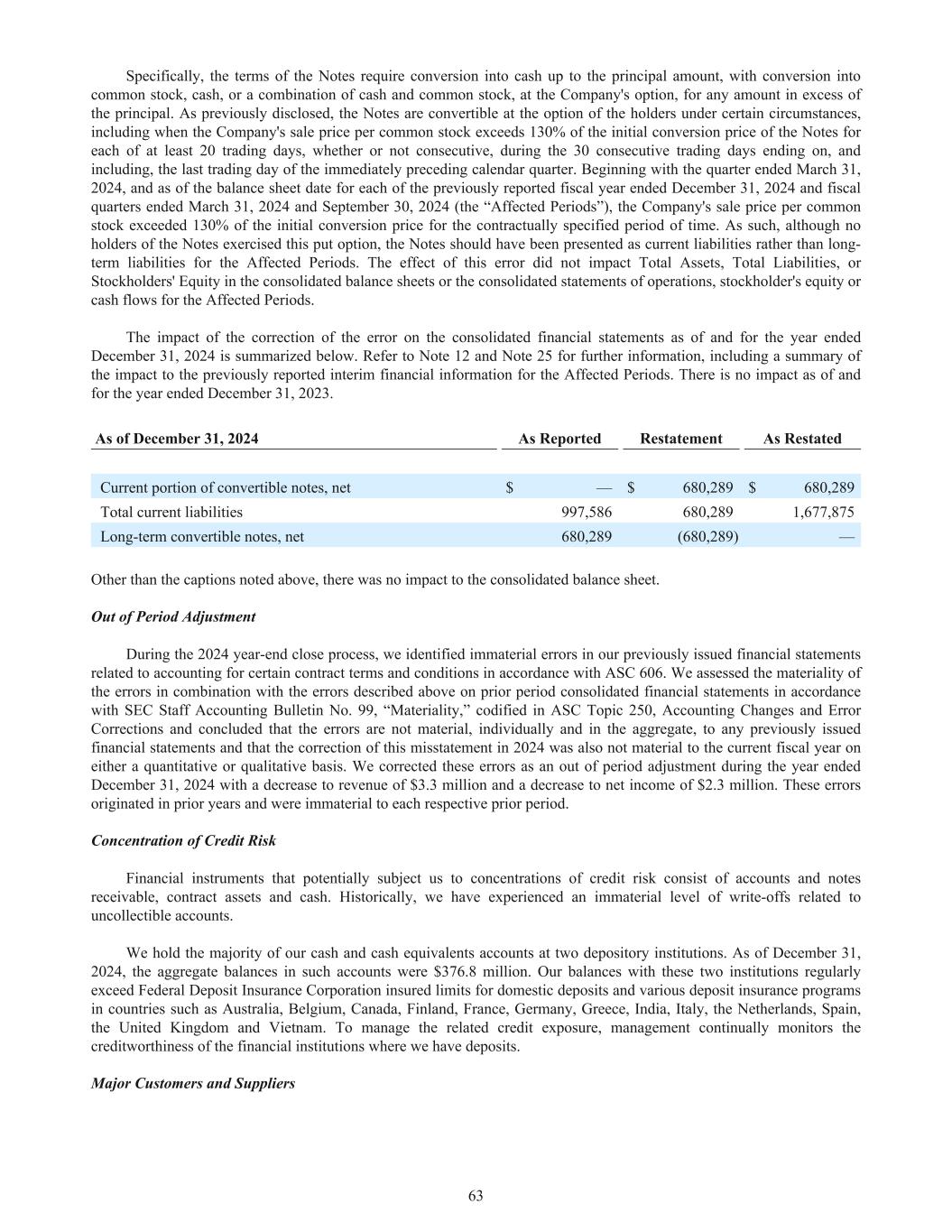

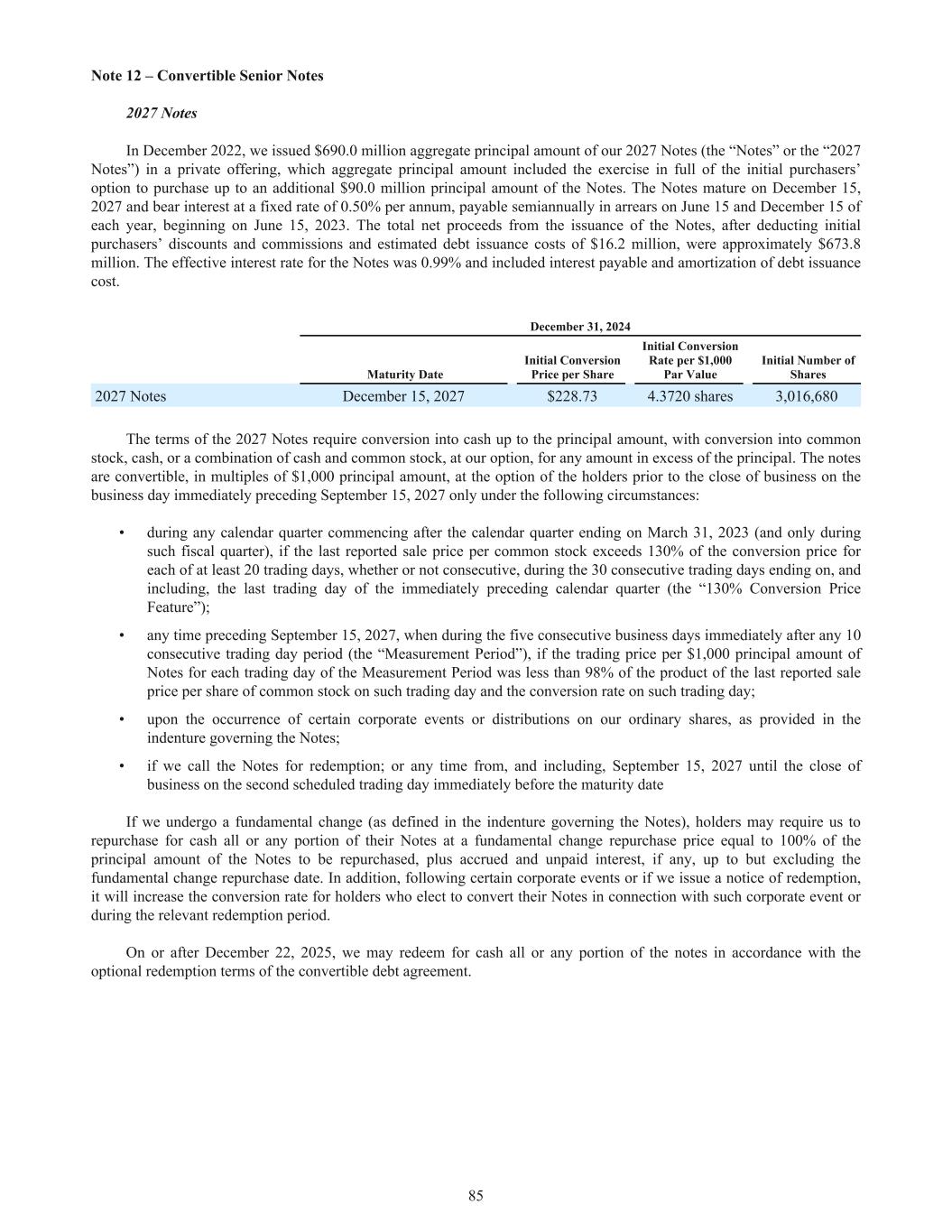

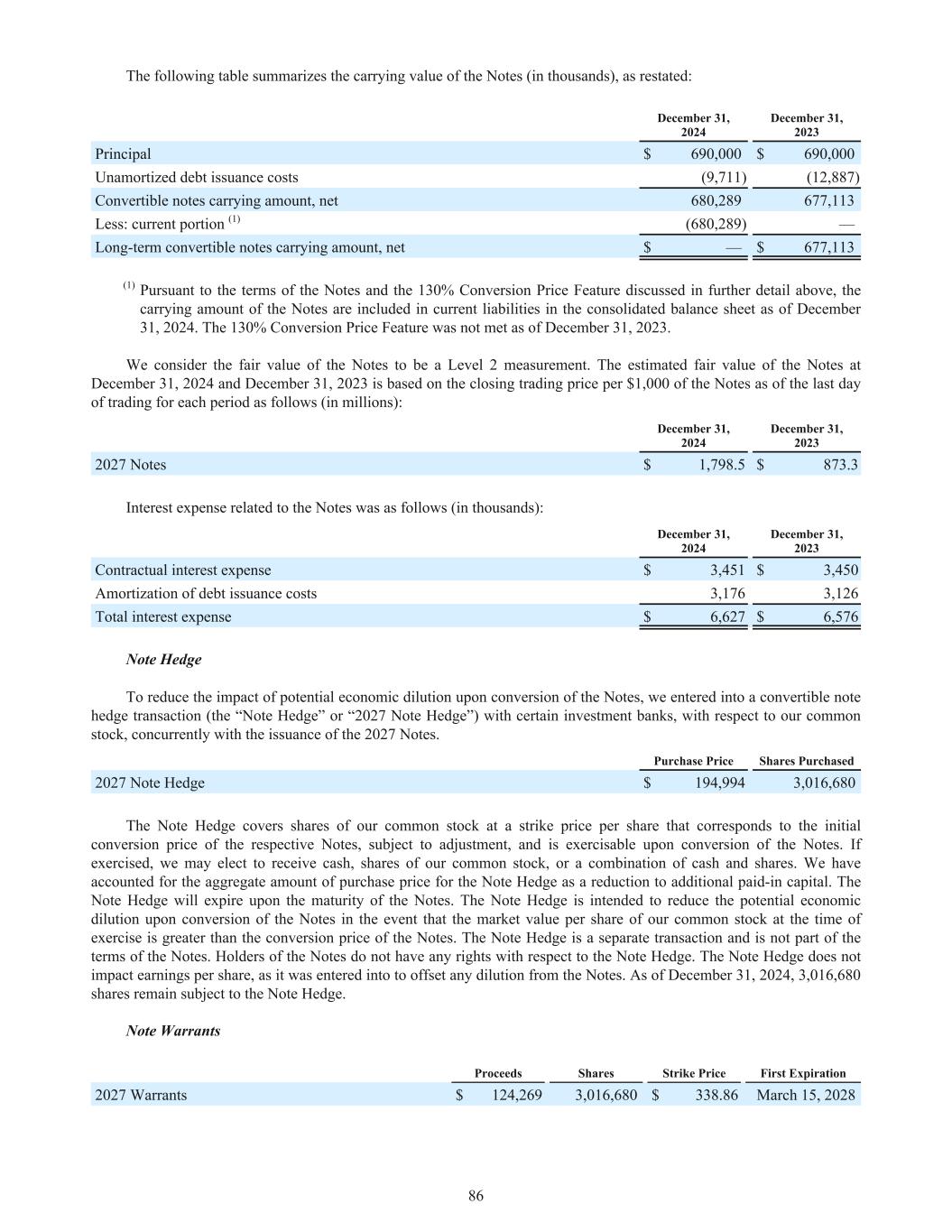

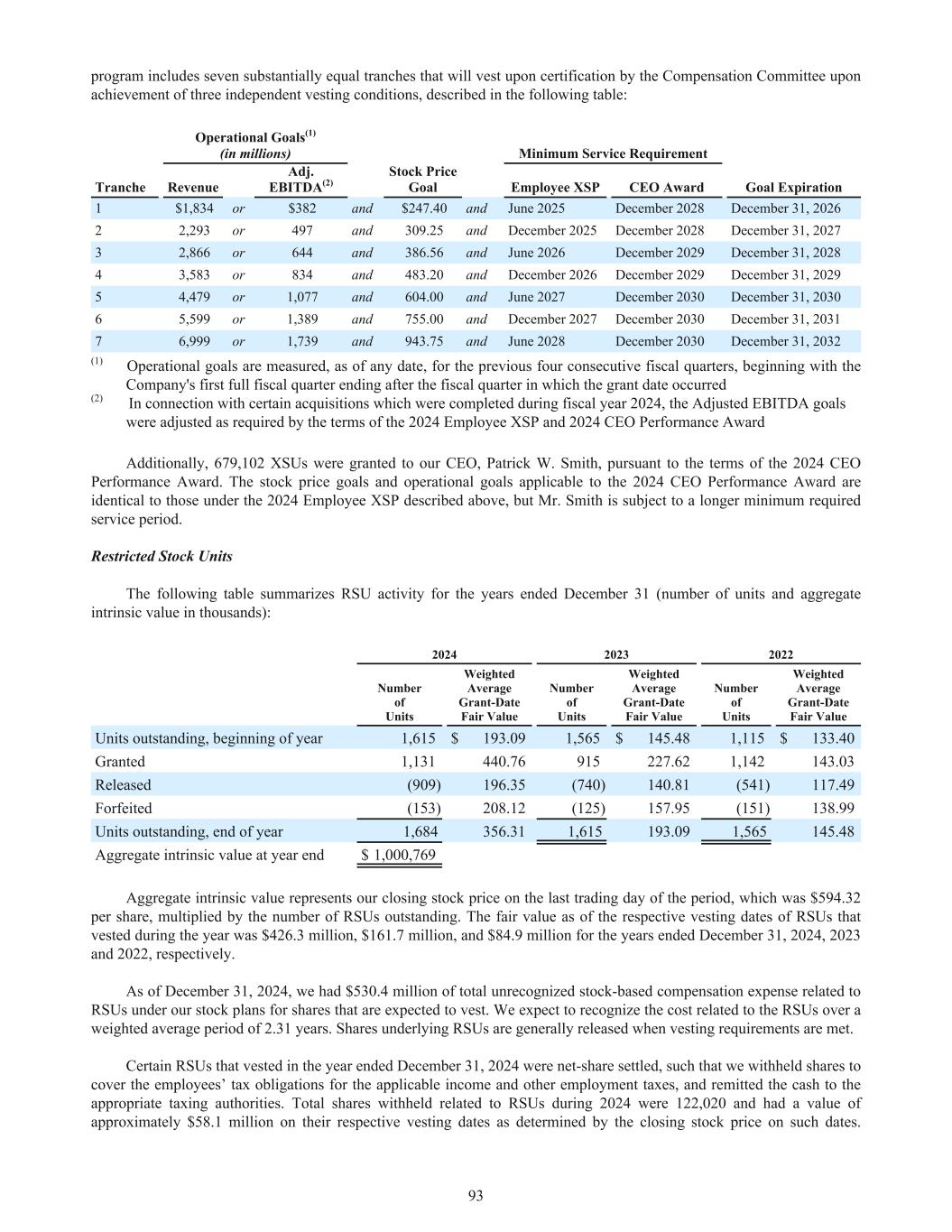

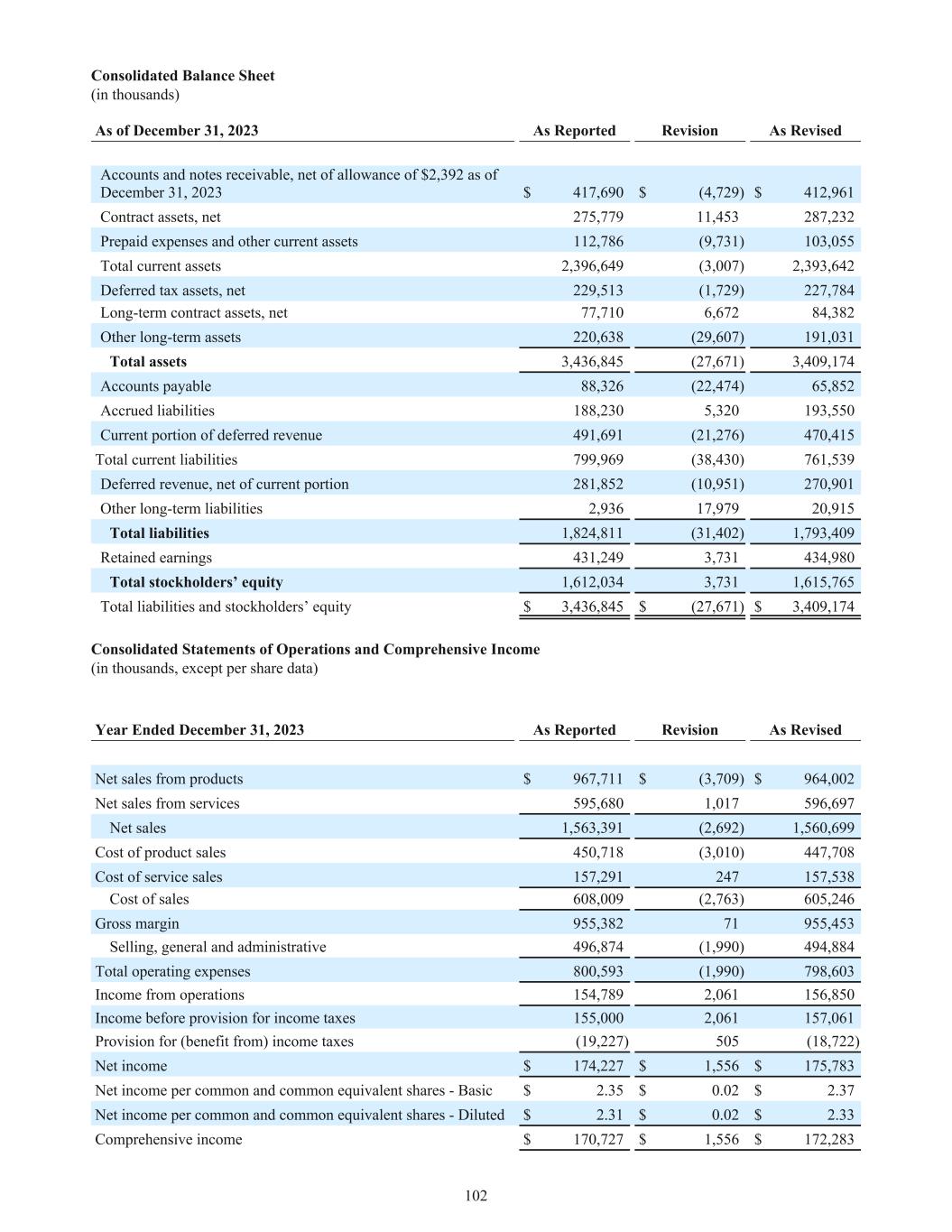

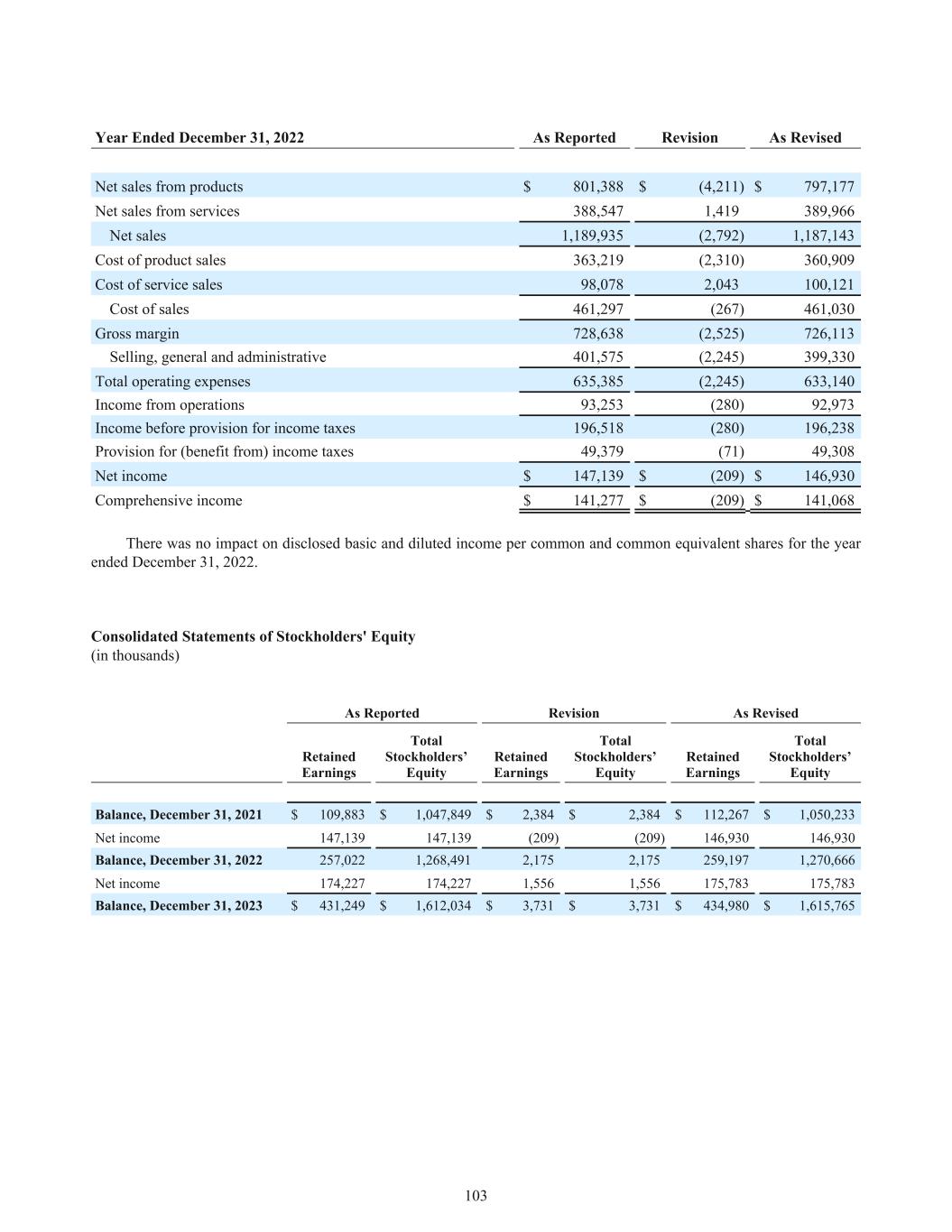

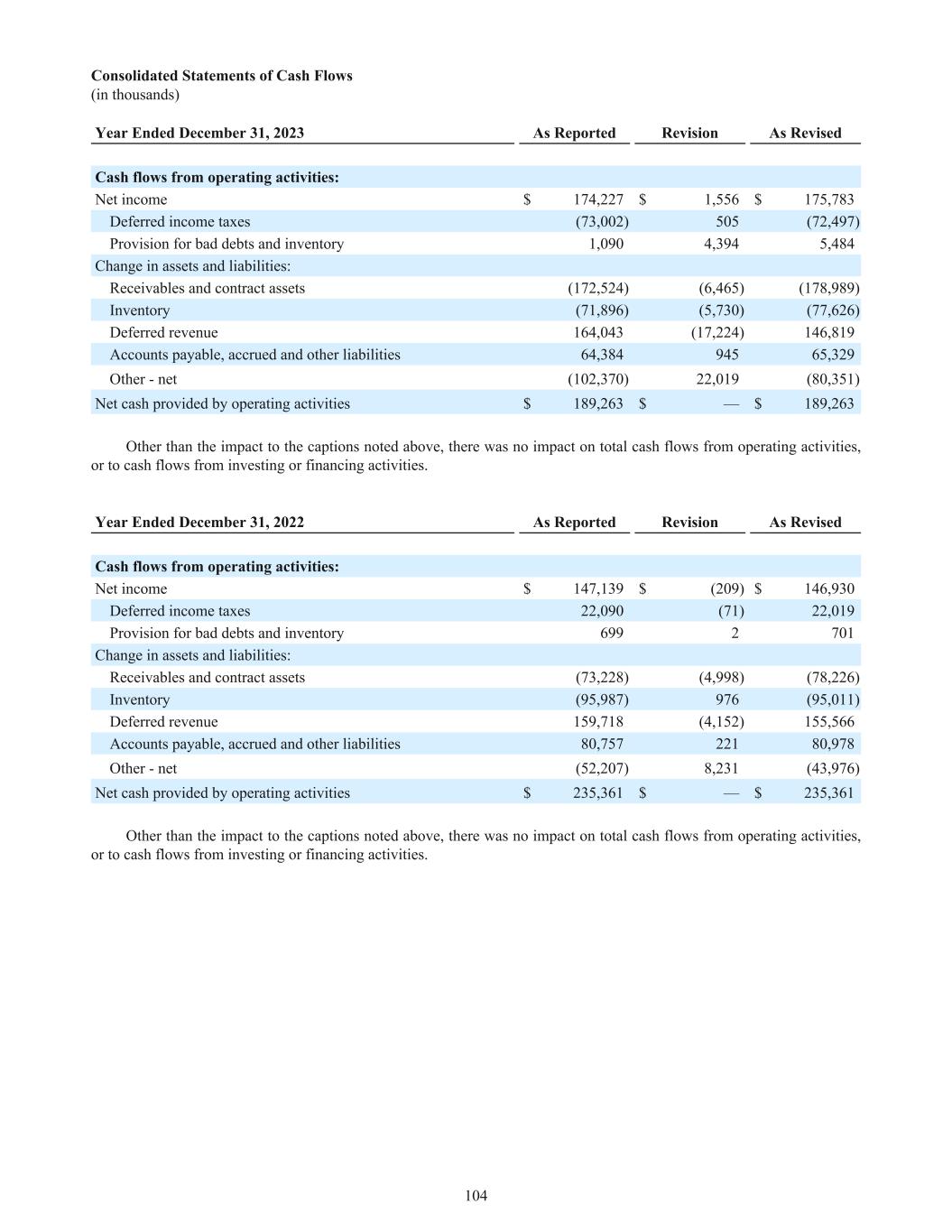

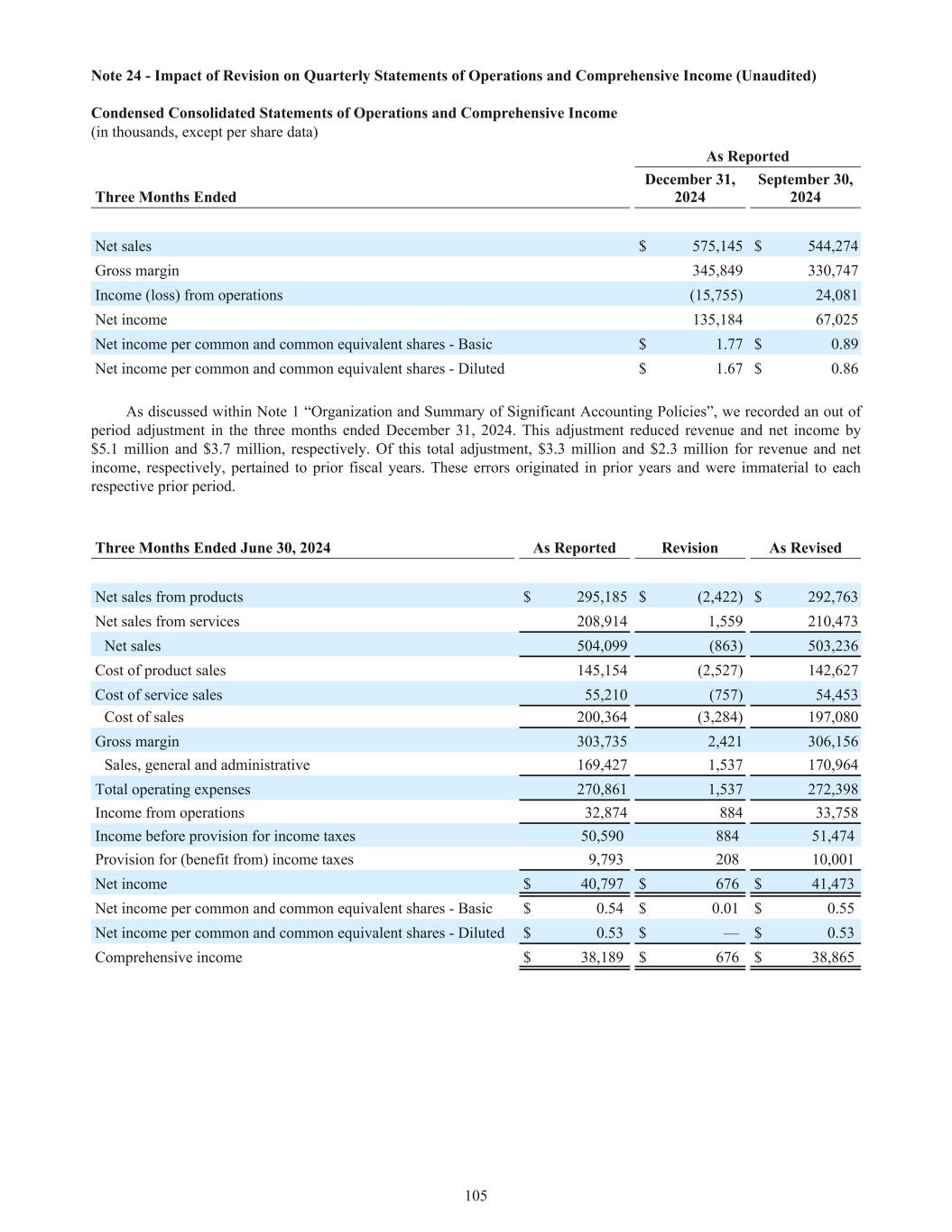

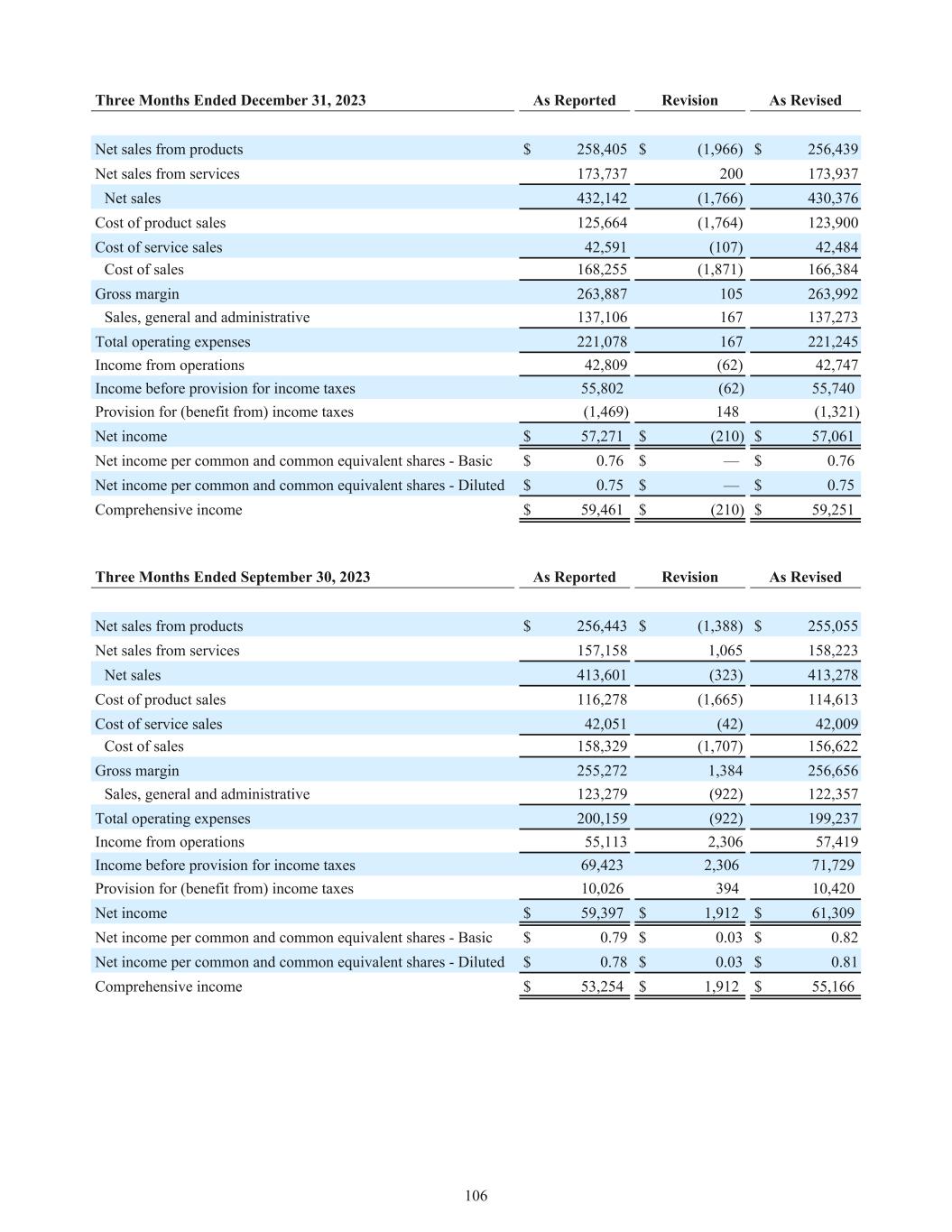

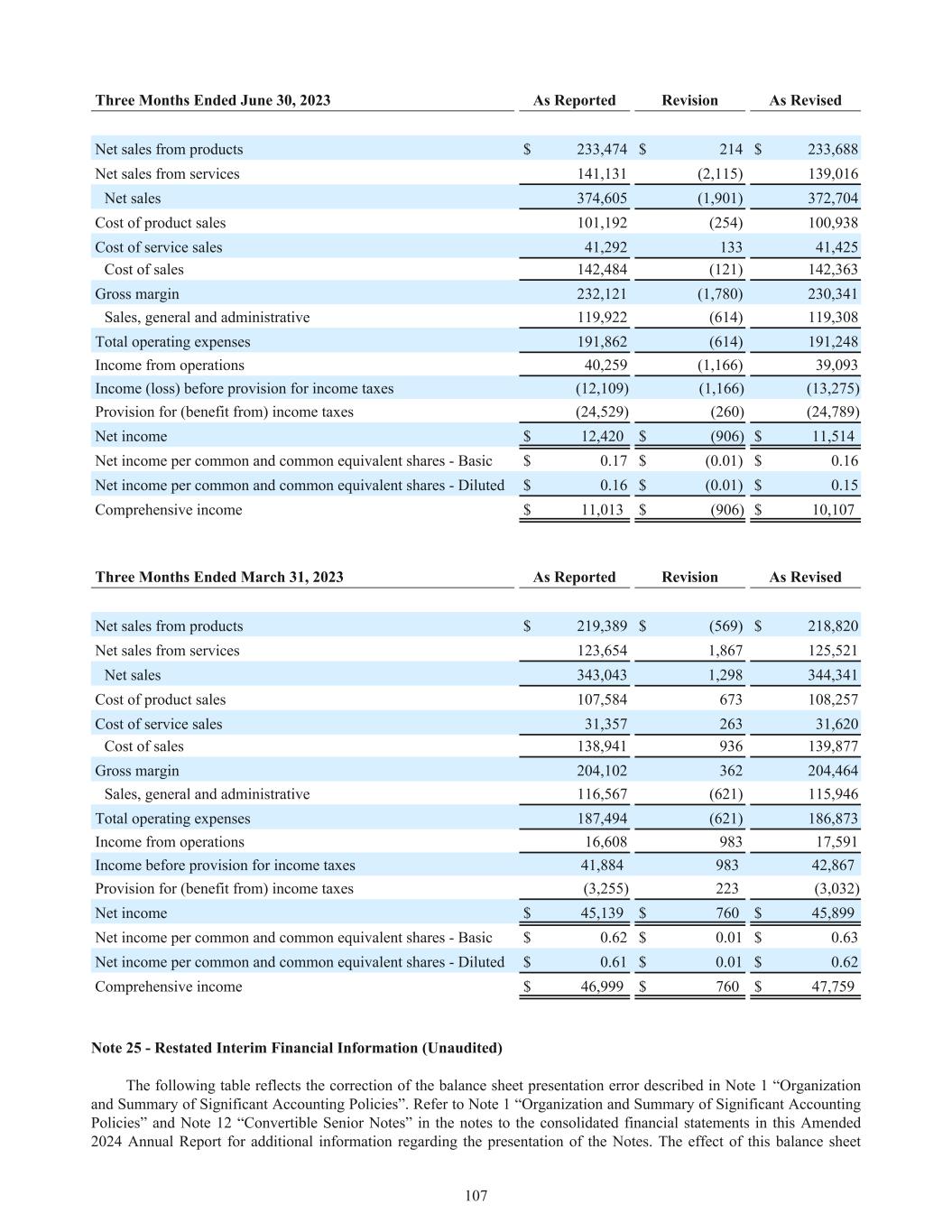

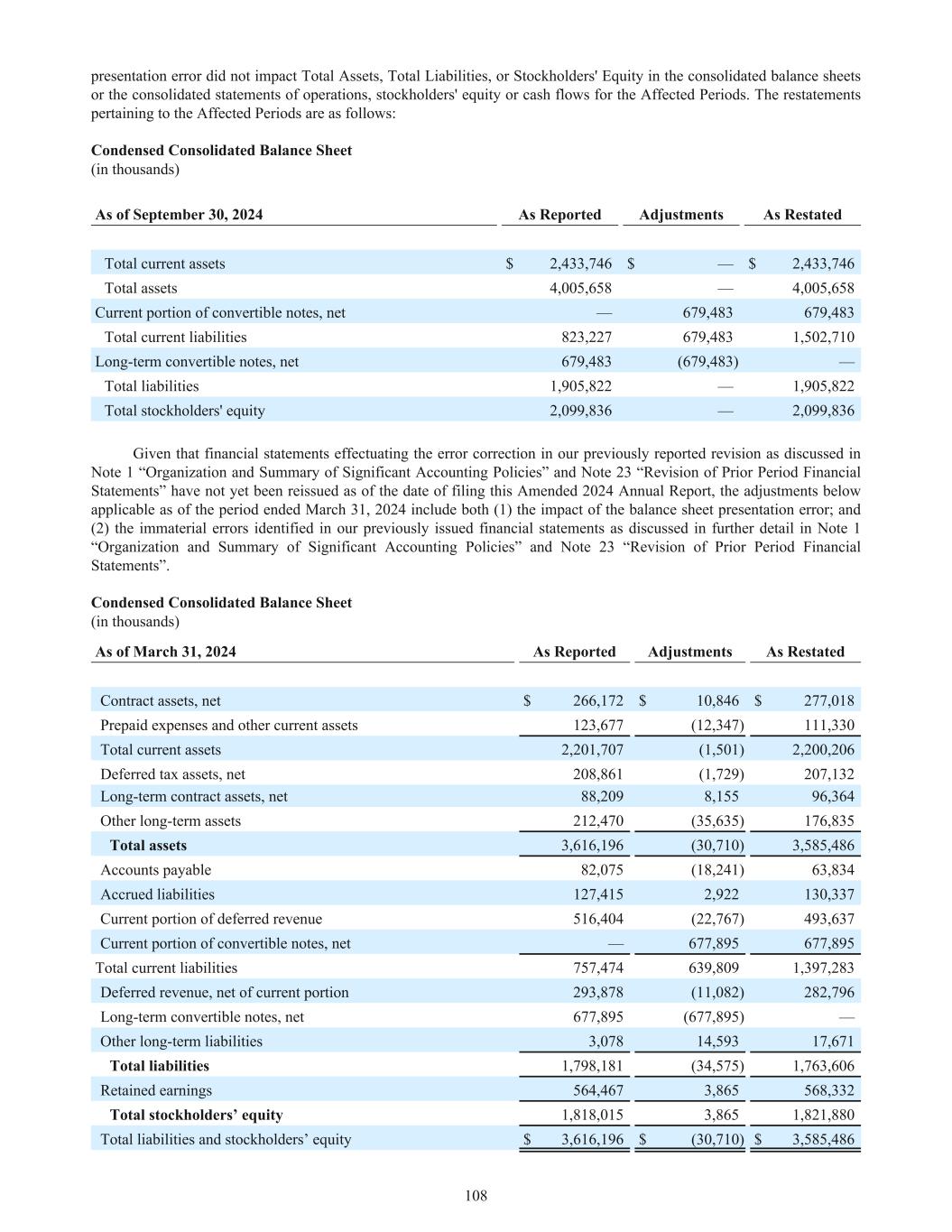

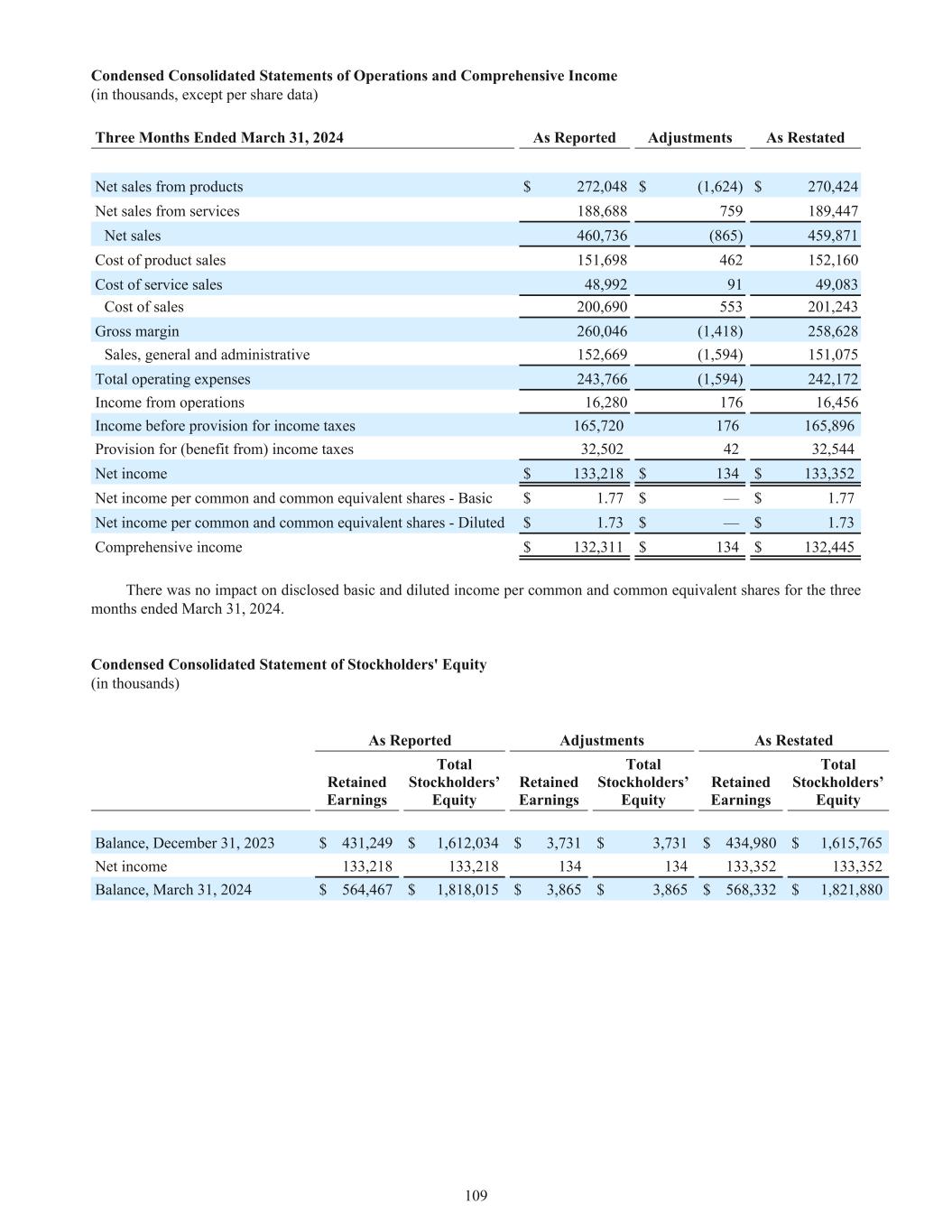

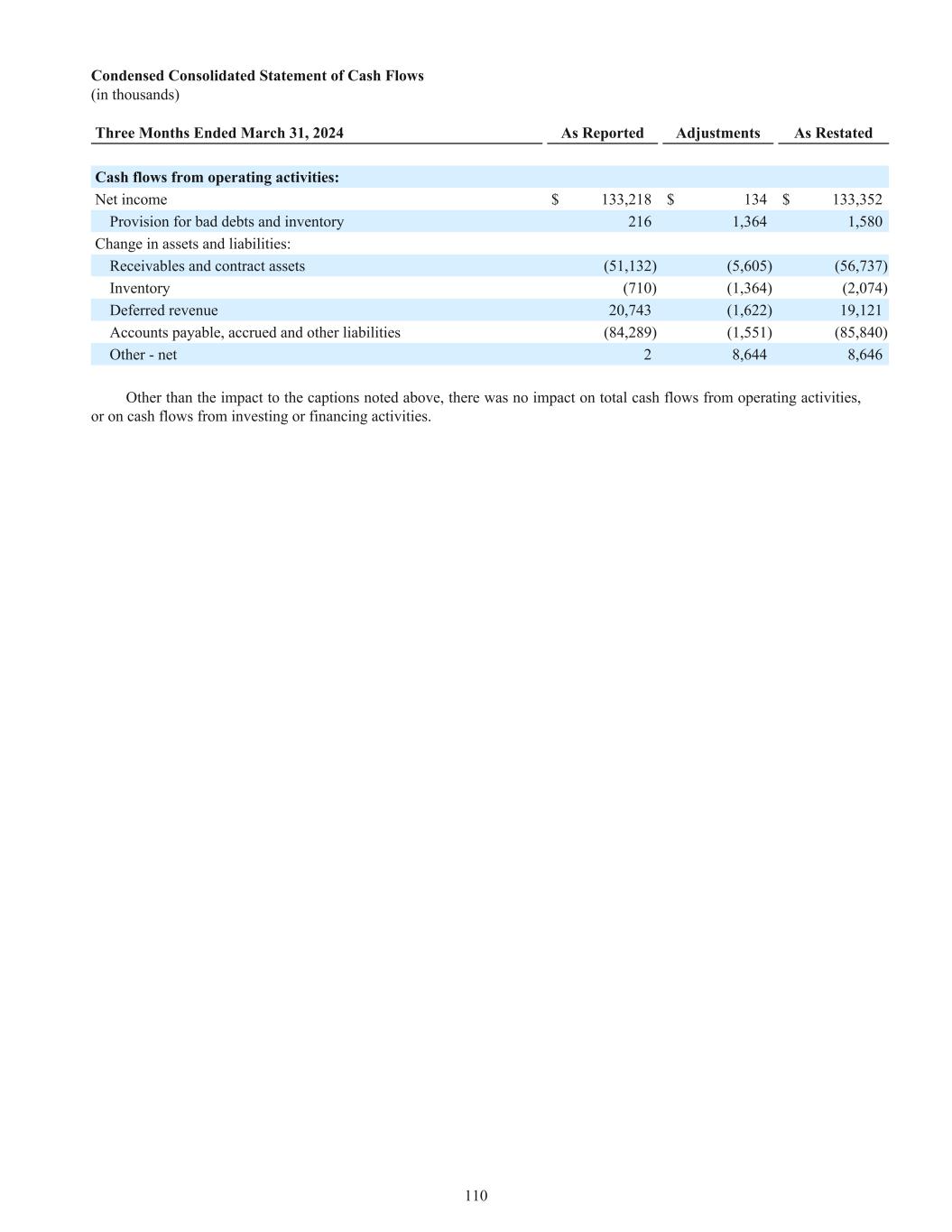

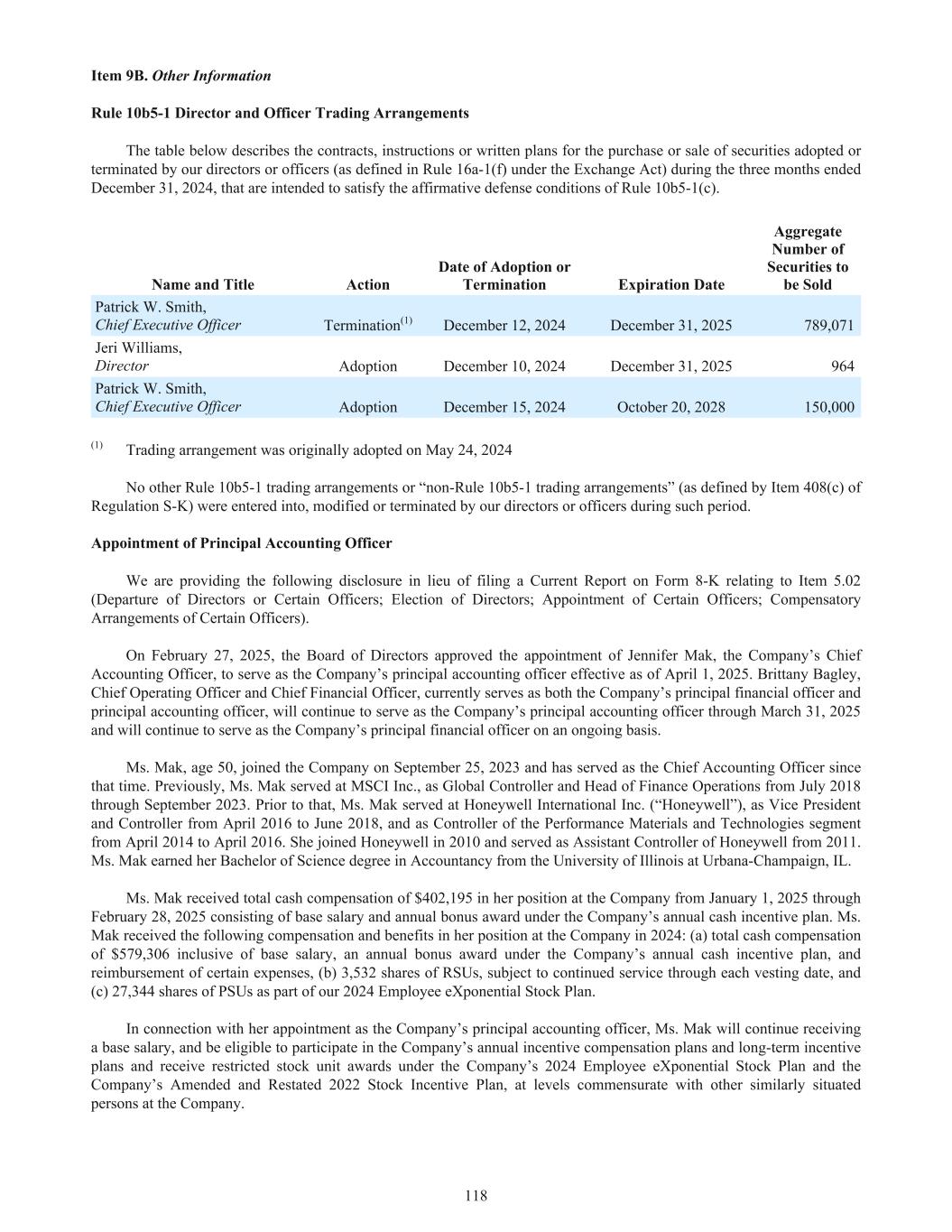

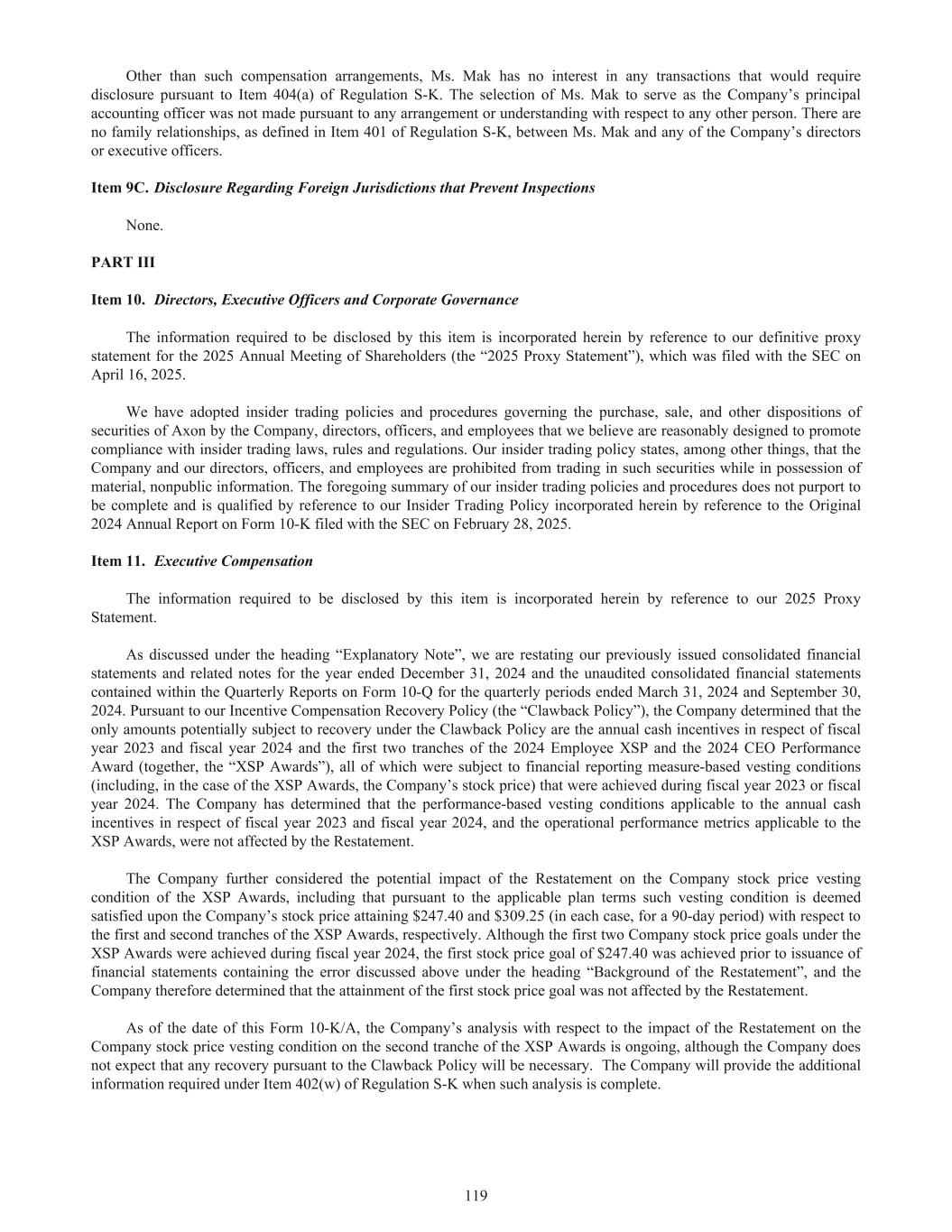

EXPLANATORY NOTE On May 7, 2025, Axon Enterprise, Inc. (the “Company”) filed an amendment (the “Form 10-K/A”) to our original Annual Report on Form 10-K for the fiscal year ended December 31, 2024 (the “Original Form 10-K”) with the Securities and Exchange Commission (the “SEC”) to include restated financial information for the fiscal year ended December 31, 2024 and the first and third quarters of 2024 (collectively with the year ended December 31, 2024 referred to as the “Affected Periods”) as well as related amended disclosure. Correspondingly, we have amended our Annual Report to Shareholders for the year ended December 31, 2024 on Form ARS (the “Annual Report”). This Annual Report includes disclosure from our Form 10-K/A in place of the Original Form 10-K. It also includes disclosure from our previously filed definitive proxy statement for the 2025 Annual Meeting of Shareholders (the “Proxy Statement”), which was filed with the SEC on April 16, 2025 and which we further supplemented with a proxy supplement filed with the SEC on May 12, 2025 (the “Proxy Supplement”). The Form 10-K/A, the Proxy Statement, the Proxy Supplement, the Company’s other proxy materials and this Annual Report are also available for viewing on the investor relations page of the Company’s website at http://investor.axon.com. Background on the Restatement As previously announced in the Current Report on Form 8-K filed with the SEC on May 7, 2025, on May 1, 2025, the Audit Committee of the Board of Directors, in consultation with management, concluded that the following previously issued consolidated financial statements of the Company (and related earnings releases, press releases, shareholder communications, investor presentations or other materials describing relevant portions of such financial statements) should no longer be relied upon and need to be restated because of an error in the balance sheet presentation of the Company’s $690.0 million aggregate principal amount of 0.50% convertible senior notes due 2027 (the “2027 Notes”) issued pursuant to an indenture, dated December 9, 2022, between current liabilities and long-term liabilities: • the audited consolidated financial statements as of and for the fiscal year ended December 31, 2024, contained within the original 2024 Annual Report on Form 10-K for such year (and the associated audit report of the Company’s independent registered public accounting firm); and • the unaudited condensed consolidated financial statements contained within the Quarterly Reports on Form 10- Q for the quarterly periods ended March 31, 2024 and September 30, 2024. The effect of this error did not impact Total Assets, Total Liabilities, or Stockholders’ Equity (each as defined in the Form 10-K/A) in the consolidated balance sheets nor did it affect the statements of operations and comprehensive income, statements of cash flows, or statements of stockholders’ equity for the Affected Periods. Rather, the effect of the error impacts the presentation of the 2027 Notes from long-term liabilities to current liabilities in the consolidated balance sheets for the Affected Periods. Please see the “Explanatory Note” in the Form 10-K/A for additional information. Clawback Pursuant to our Incentive Compensation Recovery Policy (the “Clawback Policy”), the Company determined that the only amounts potentially subject to recovery under the Clawback Policy are the annual cash incentives in respect of fiscal year 2023 and fiscal year 2024 and the first two tranches of the 2024 Employee XSP and the 2024 CEO Performance Award (together, the “XSP Awards”), all of which were subject to financial reporting measure-based vesting conditions (including, in the case of the XSP Awards, the Company’s stock price) that were achieved during fiscal year 2023 or fiscal year 2024. The Company has determined that the performance-based vesting conditions applicable to the annual cash incentives in respect of fiscal year 2023 and fiscal year 2024, and the operational performance metrics applicable to the XSP Awards, were not affected by the restatement. The Company further considered the potential impact of the restatement on the Company stock price vesting condition of the XSP Awards, including that pursuant to the applicable plan terms such vesting condition is deemed satisfied upon the Company’s stock price attaining $247.40 and $309.25 (in each case, for a 90-day period), respectively. Although the first two Company stock price goals under the XSP Awards were achieved during fiscal year 2024, the first stock price goal of $247.40 with respect to the first tranche was achieved prior to issuance of financial statements

containing the error discussed above under the heading “Background on the Restatement”, and the Company therefore determined that the attainment of the first stock price goal was not affected by the restatement. The Company further considered the potential impact of the restatement on the Company stock price vesting condition of the second tranche of the XSP Awards, including that pursuant to the applicable plan terms such vesting condition is deemed satisfied upon the Company’s stock price attaining $309.25 for a 90-day period, and also noted the Company’s closing stock price of $601.82 on May 7, 2025 prior to the restatement announcement and $686.83 and $684.59 on the two days following the announcement of the restatement. As such, it was determined that the Company’s stock price was not affected by the restatement sufficiently to have caused the second tranche of the XSP Awards to fail the applicable Company stock price vesting condition, and therefore that the second tranche of the XSP Awards was not erroneously received. Additionally, the Company considered that under the terms of the XSP Awards, the applicable Company stock price vesting conditions can be met at any time through 2029, subject to other terms and conditions. As a result of the analysis described above, the Company determined that no recovery of incentive compensation was required in connection with the restatement pursuant to the terms of the Clawback Policy. The information provided above should be read in conjunction with the clawback disclosure provided in our Form 10-K/A, the Annual Report and the Company’s other proxy materials.

[This Page Intentionally Left Blank]

[This Page Intentionally Left Blank]

2024–2025 AXON.COM