.2 EPIC Crude Holdings, LP and Subsidiaries Consolidated Financial Statements For the Nine Months Ended September 30, 2025 (unaudited)

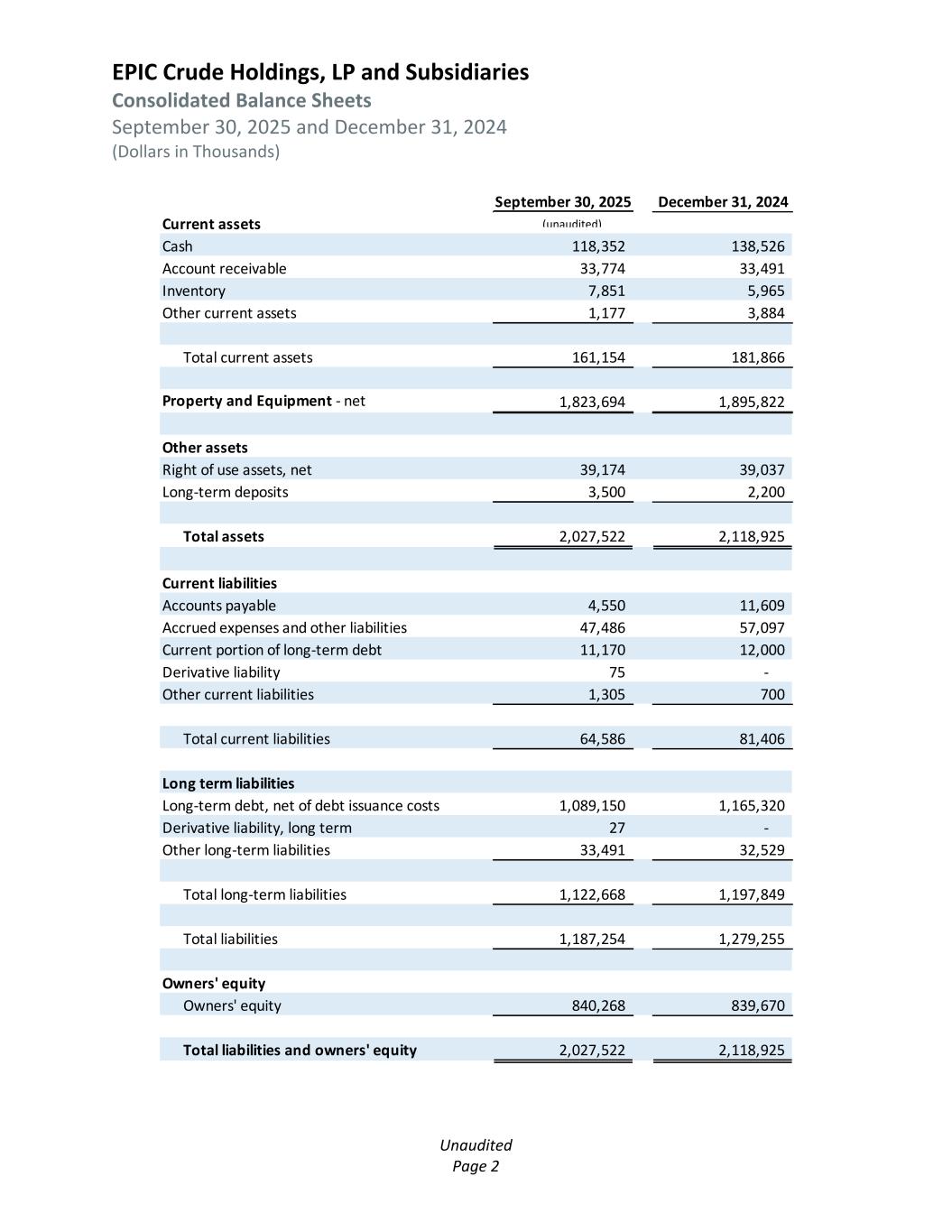

EPIC Crude Holdings, LP and Subsidiaries Consolidated Balance Sheets September 30, 2025 and December 31, 2024 (Dollars in Thousands) Unaudited Page 2 September 30, 2025 December 31, 2024 Current assets Cash 118,352 138,526 Account receivable 33,774 33,491 Inventory 7,851 5,965 Other current assets 1,177 3,884 Total current assets 161,154 181,866 Property and Equipment - net 1,823,694 1,895,822 Other assets Right of use assets, net 39,174 39,037 Long-term deposits 3,500 2,200 Total assets 2,027,522 2,118,925 Current liabilities Accounts payable 4,550 11,609 Accrued expenses and other liabilities 47,486 57,097 Current portion of long-term debt 11,170 12,000 Derivative liability 75 - Other current liabilities 1,305 700 Total current liabilities 64,586 81,406 Long term liabilities Long-term debt, net of debt issuance costs 1,089,150 1,165,320 Derivative liability, long term 27 - Other long-term liabilities 33,491 32,529 Total long-term liabilities 1,122,668 1,197,849 Total liabilities 1,187,254 1,279,255 Owners' equity Owners' equity 840,268 839,670 Total liabilities and owners' equity 2,027,522 2,118,925 (unaudited)

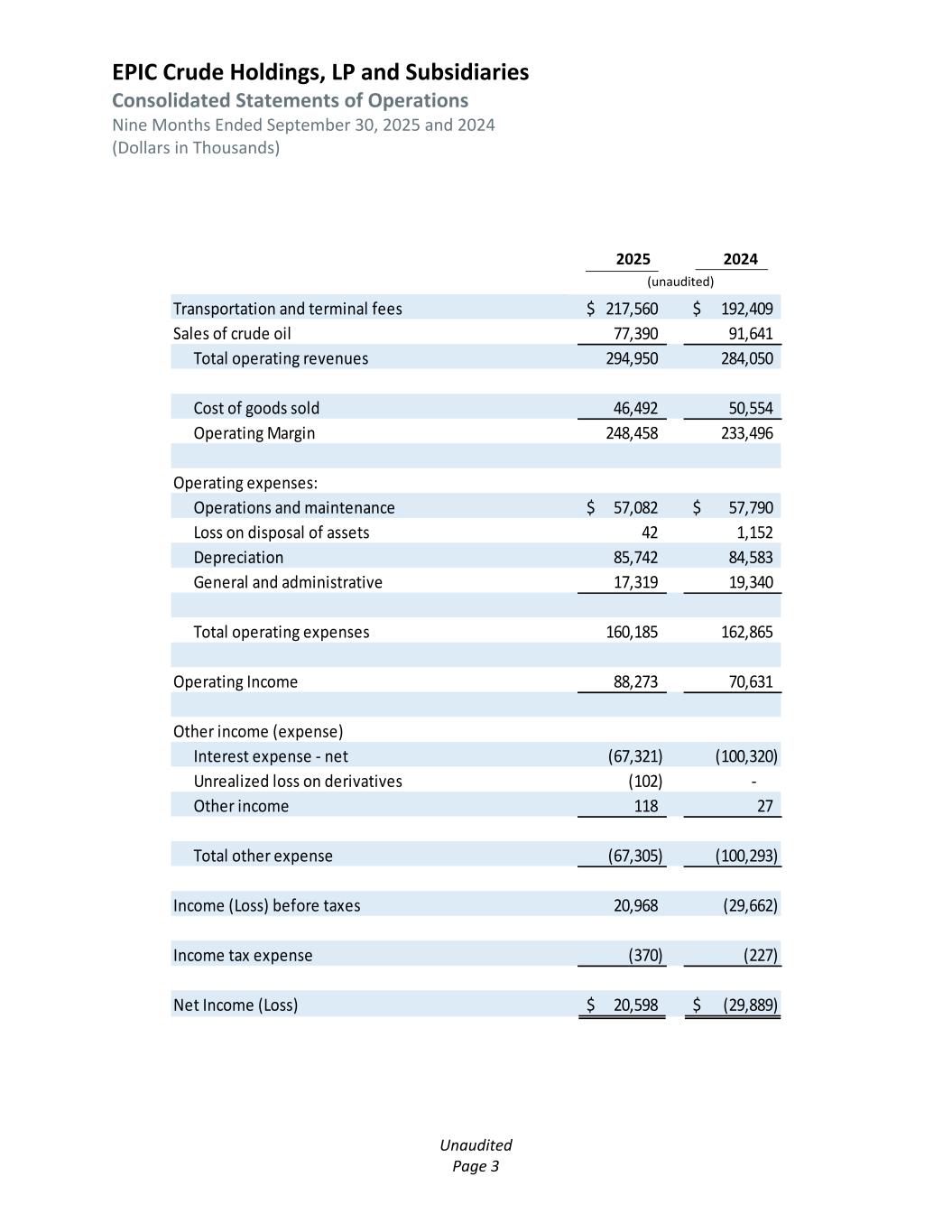

EPIC Crude Holdings, LP and Subsidiaries Consolidated Statements of Operations Nine Months Ended September 30, 2025 and 2024 (Dollars in Thousands) Unaudited Page 3 2025 2024 Transportation and terminal fees 217,560$ 192,409$ Sales of crude oil 77,390 91,641 Total operating revenues 294,950 284,050 Cost of goods sold 46,492 50,554 Operating Margin 248,458 233,496 Operating expenses: Operations and maintenance 57,082$ 57,790$ Loss on disposal of assets 42 1,152 Depreciation 85,742 84,583 General and administrative 17,319 19,340 Total operating expenses 160,185 162,865 Operating Income 88,273 70,631 Other income (expense) Interest expense - net (67,321) (100,320) Unrealized loss on derivatives (102) - Other income 118 27 Total other expense (67,305) (100,293) Income (Loss) before taxes 20,968 (29,662) Income tax expense (370) (227) Net Income (Loss) 20,598$ (29,889)$ 2025 2024 (unaudited)

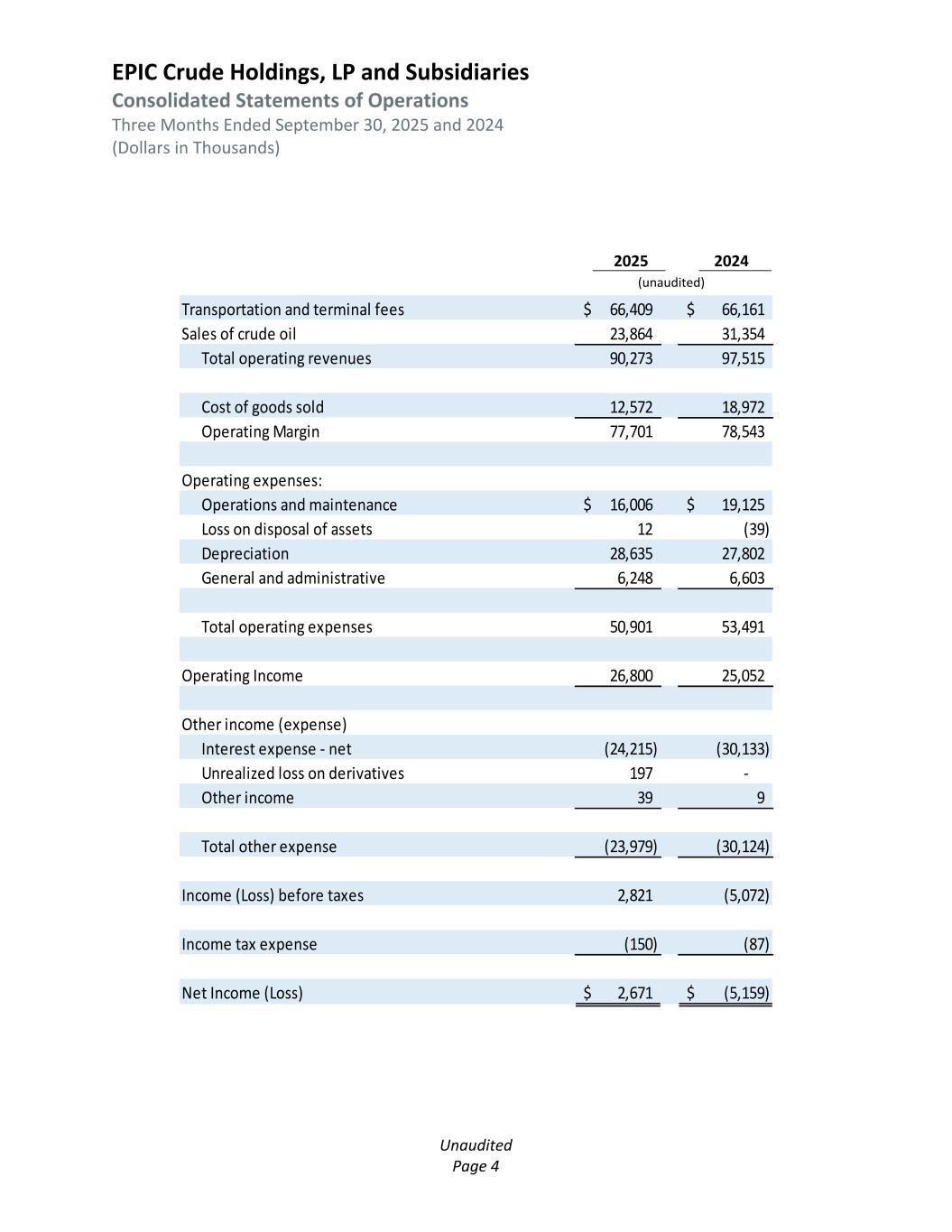

EPIC Crude Holdings, LP and Subsidiaries Consolidated Statements of Operations Three Months Ended September 30, 2025 and 2024 (Dollars in Thousands) Unaudited Page 4 2025 2024 Transportation and terminal fees 66,409$ 66,161$ Sales of crude oil 23,864 31,354 Total operating revenues 90,273 97,515 Cost of goods sold 12,572 18,972 Operating Margin 77,701 78,543 Operating expenses: Operations and maintenance 16,006$ 19,125$ Loss on disposal of assets 12 (39) Depreciation 28,635 27,802 General and administrative 6,248 6,603 Total operating expenses 50,901 53,491 Operating Income 26,800 25,052 Other income (expense) Interest expense - net (24,215) (30,133) Unrealized loss on derivatives 197 - Other income 39 9 Total other expense (23,979) (30,124) Income (Loss) before taxes 2,821 (5,072) Income tax expense (150) (87) Net Income (Loss) 2,671$ (5,159)$ 2025 2024 (unaudited)

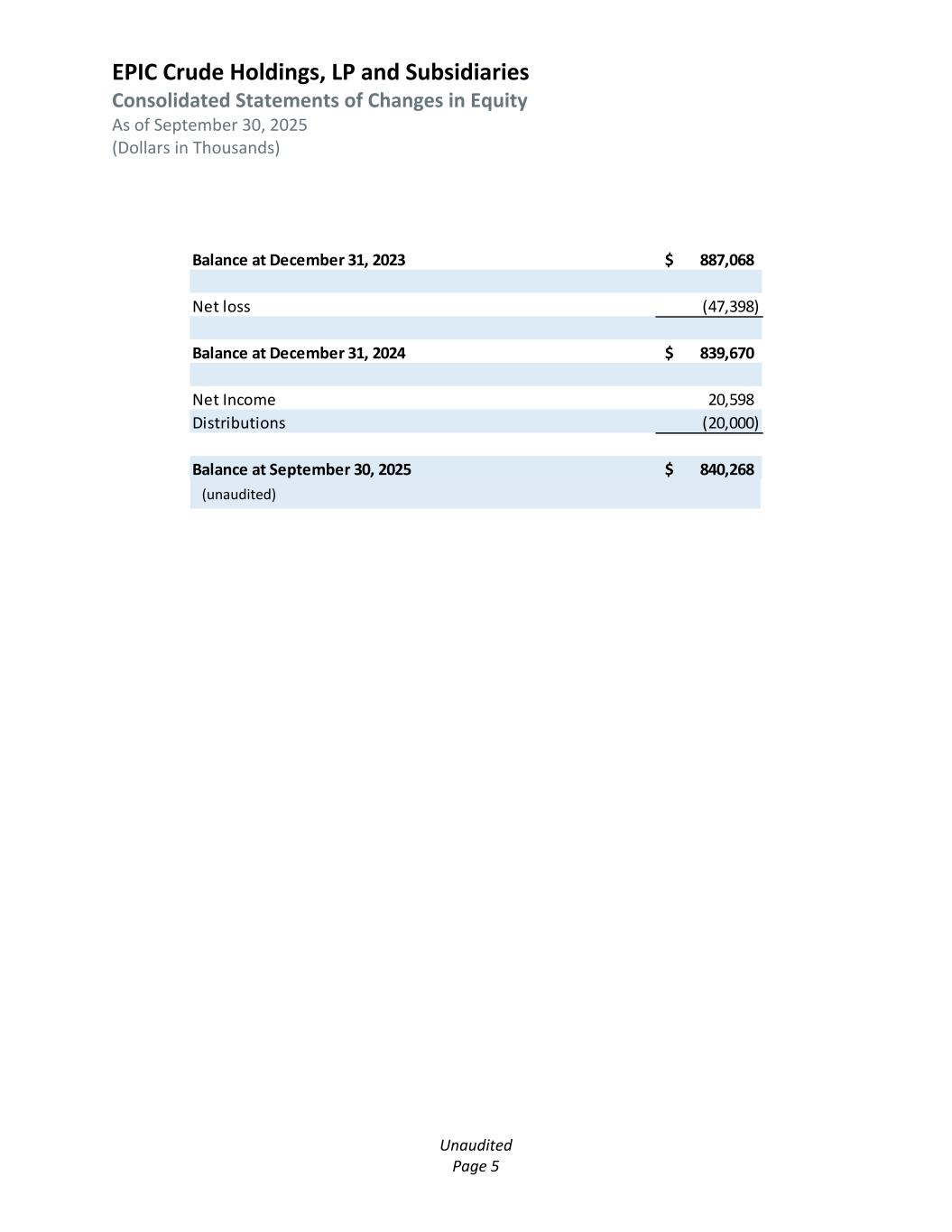

EPIC Crude Holdings, LP and Subsidiaries Consolidated Statements of Changes in Equity As of September 30, 2025 (Dollars in Thousands) Unaudited Page 5 Balance at December 31, 2023 887,068$ Net loss (47,398) Balance at December 31, 2024 839,670$ Net Income 20,598 Distributions (20,000) Balance at September 30, 2025 840,268$ (unaudited)

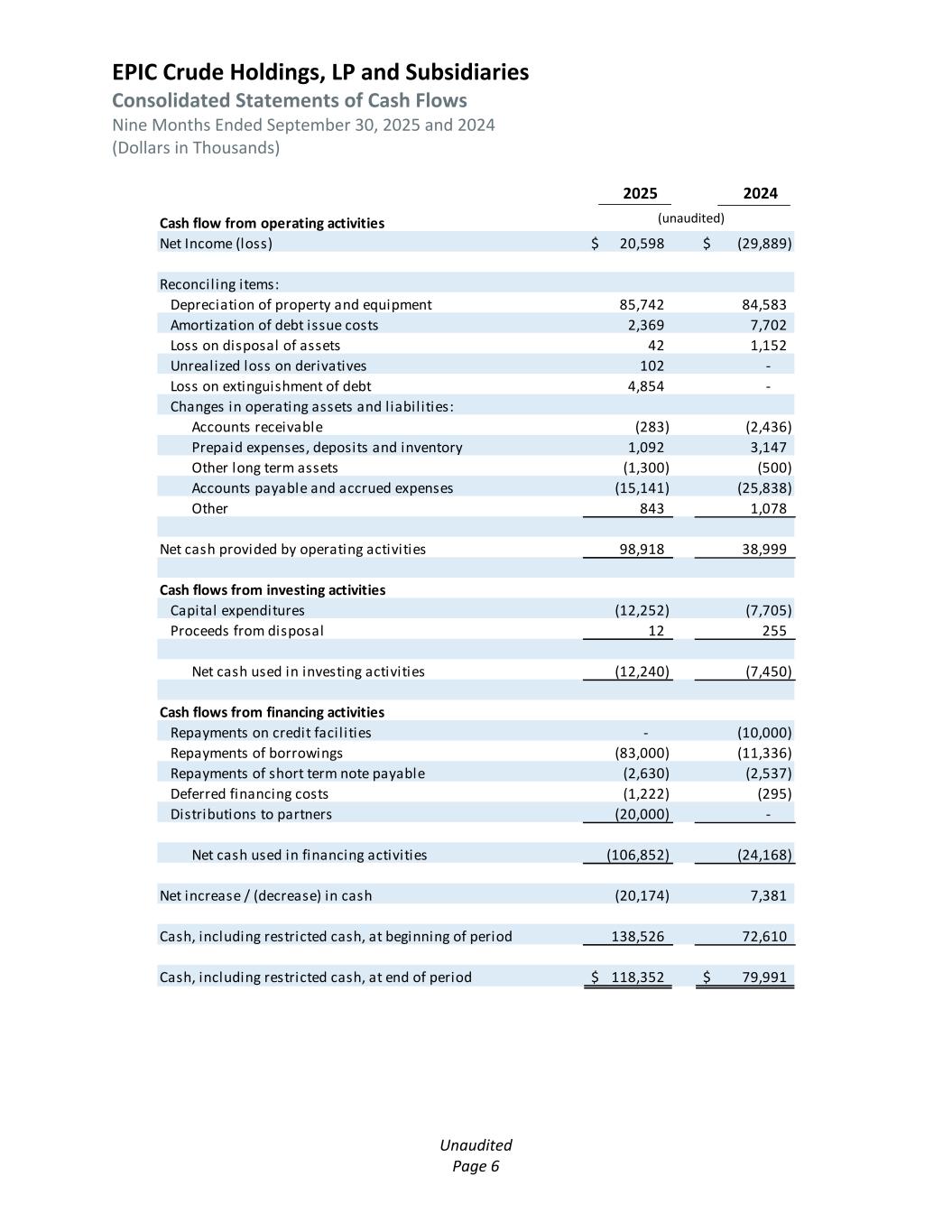

EPIC Crude Holdings, LP and Subsidiaries Consolidated Statements of Cash Flows Nine Months Ended September 30, 2025 and 2024 (Dollars in Thousands) Unaudited Page 6 2025 2024 Cash flow from operating activities Net Income (loss) 20,598$ (29,889)$ Reconciling items: Depreciation of property and equipment 85,742 84,583 Amortization of debt issue costs 2,369 7,702 Loss on disposal of assets 42 1,152 Unrealized loss on derivatives 102 - Loss on extinguishment of debt 4,854 - Changes in operating assets and liabil ities: Accounts receivable (283) (2,436) Prepaid expenses, deposits and inventory 1,092 3,147 Other long term assets (1,300) (500) Accounts payable and accrued expenses (15,141) (25,838) Other 843 1,078 Net cash provided by operating activities 98,918 38,999 Cash flows from investing activities Capital expenditures (12,252) (7,705) Proceeds from disposal 12 255 Net cash used in investing activities (12,240) (7,450) Cash flows from financing activities Repayments on credit facil ities - (10,000) Repayments of borrowings (83,000) (11,336) Repayments of short term note payable (2,630) (2,537) Deferred financing costs (1,222) (295) Distributions to partners (20,000) - Net cash used in financing activities (106,852) (24,168) Net increase / (decrease) in cash (20,174) 7,381 Cash, including restricted cash, at beginning of period 138,526 72,610 Cash, including restricted cash, at end of period 118,352$ 79,991$ (unaudited) 2025 2024