EPIC Crude Holdings, LP and Subsidiaries Consolidated Financial Statements For the Years Ended December 31, 2024 and 2023 (With Independent Auditors’ Report Thereon)

EPIC Crude Holdings, LP and Subsidiaries Table of Contents Page Independent Auditors’ Report 1 Consolidated Balance Sheets 3 Consolidated Statement of Operations 4 Consolidated Statement of Changes in Owners’ Equity 5 Consolidated Statement of Cash Flows 6 Notes to the Consolidated Financial Statements 7

KPMG LLP 17802 IH-10, Suite 101 Promenade Two San Antonio, TX 78257-2508 KPMG LLP, a Delaware limited liability partnership and a member firm of the KPMG global organization of independent member firms affiliated with KPMG International Limited, a private English company limited by guarantee. Independent Auditors’ Report The Board of Directors EPIC Crude Holdings, LP: Opinion We have audited the consolidated financial statements of EPIC Crude Holdings, LP and its subsidiaries (the Partnership), which comprise the consolidated balance sheets as of December 31, 2024 and 2023, and the related consolidated statements of operations, changes in owners’ equity, and cash flows for the years then ended, and the related notes to the consolidated financial statements. In our opinion, the accompanying consolidated financial statements present fairly, in all material respects, the financial position of the Partnership as of December 31, 2024 and 2023, and the results of its operations and its cash flows for the years then ended in accordance with U.S. generally accepted accounting principles. Basis for Opinion We conducted our audits in accordance with auditing standards generally accepted in the United States of America (GAAS). Our responsibilities under those standards are further described in the Auditors’ Responsibilities for the Audit of the Consolidated Financial Statements section of our report. We are required to be independent of the Partnership and to meet our other ethical responsibilities, in accordance with the relevant ethical requirements relating to our audits. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion. Responsibilities of Management for the Consolidated Financial Statements Management is responsible for the preparation and fair presentation of the consolidated financial statements in accordance with U.S. generally accepted accounting principles, and for the design, implementation, and maintenance of internal control relevant to the preparation and fair presentation of consolidated financial statements that are free from material misstatement, whether due to fraud or error. In preparing the consolidated financial statements, management is required to evaluate whether there are conditions or events, considered in the aggregate, that raise substantial doubt about the Partnership’s ability to continue as a going concern for one year after the date that the consolidated financial statements are available to be issued. Auditors’ Responsibilities for the Audit of the Consolidated Financial Statements Our objectives are to obtain reasonable assurance about whether the consolidated financial statements as a whole are free from material misstatement, whether due to fraud or error, and to issue an auditors’ report that includes our opinion. Reasonable assurance is a high level of assurance but is not absolute assurance and therefore is not a guarantee that an audit conducted in accordance with GAAS will always detect a material misstatement when it exists. The risk of not detecting a material misstatement resulting from fraud is higher than for one resulting from error, as fraud may involve collusion, forgery, intentional omissions, misrepresentations, or the override of internal control. Misstatements are considered material if there is a substantial likelihood that, individually or in the aggregate, they would influence the judgment made by a reasonable user based on the consolidated financial statements.

2 In performing an audit in accordance with GAAS, we: ● Exercise professional judgment and maintain professional skepticism throughout the audit. ● Identify and assess the risks of material misstatement of the consolidated financial statements, whether due to fraud or error, and design and perform audit procedures responsive to those risks. Such procedures include examining, on a test basis, evidence regarding the amounts and disclosures in the consolidated financial statements. ● Obtain an understanding of internal control relevant to the audit in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Partnership’s internal control. Accordingly, no such opinion is expressed. ● Evaluate the appropriateness of accounting policies used and the reasonableness of significant accounting estimates made by management, as well as evaluate the overall presentation of the consolidated financial statements. ● Conclude whether, in our judgment, there are conditions or events, considered in the aggregate, that raise substantial doubt about the Partnership’s ability to continue as a going concern for a reasonable period of time. We are required to communicate with those charged with governance regarding, among other matters, the planned scope and timing of the audit, significant audit findings, and certain internal control related matters that we identified during the audit. San Antonio, Texas April 24, 2025

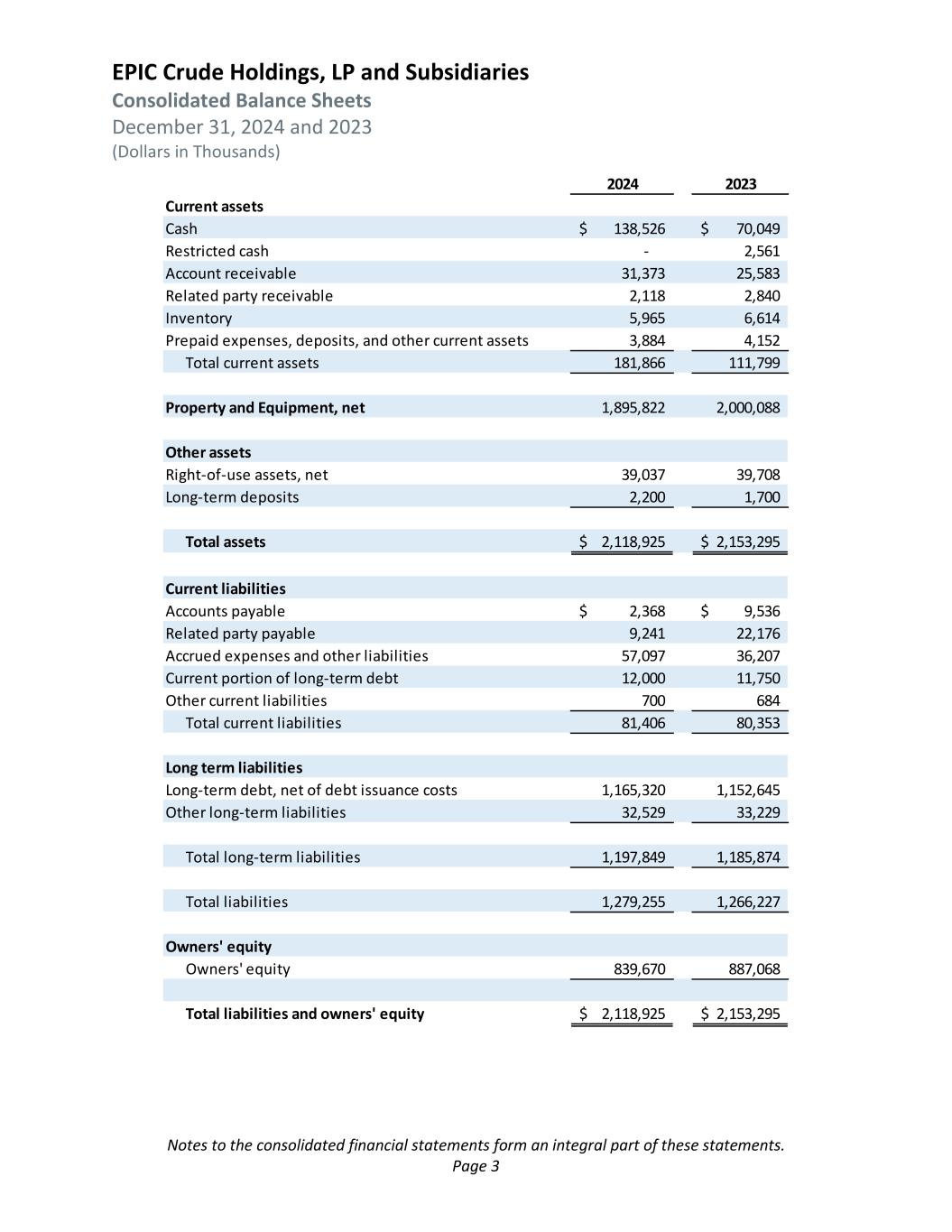

EPIC Crude Holdings, LP and Subsidiaries Consolidated Balance Sheets December 31, 2024 and 2023 (Dollars in Thousands) Notes to the consolidated financial statements form an integral part of these statements. Page 3 2024 2023 Current assets Cash 138,526$ 70,049$ Restricted cash - 2,561 Account receivable 31,373 25,583 Related party receivable 2,118 2,840 Inventory 5,965 6,614 Prepaid expenses, deposits, and other current assets 3,884 4,152 Total current assets 181,866 111,799 Property and Equipment, net 1,895,822 2,000,088 Other assets Right-of-use assets, net 39,037 39,708 Long-term deposits 2,200 1,700 Total assets 2,118,925$ 2,153,295$ Current liabilities Accounts payable 2,368$ 9,536$ Related party payable 9,241 22,176 Accrued expenses and other liabilities 57,097 36,207 Current portion of long-term debt 12,000 11,750 Other current liabilities 700 684 Total current liabilities 81,406 80,353 Long term liabilities Long-term debt, net of debt issuance costs 1,165,320 1,152,645 Other long-term liabilities 32,529 33,229 Total long-term liabilities 1,197,849 1,185,874 Total liabilities 1,279,255 1,266,227 Owners' equity Owners' equity 839,670 887,068 Total liabilities and owners' equity 2,118,925$ 2,153,295$

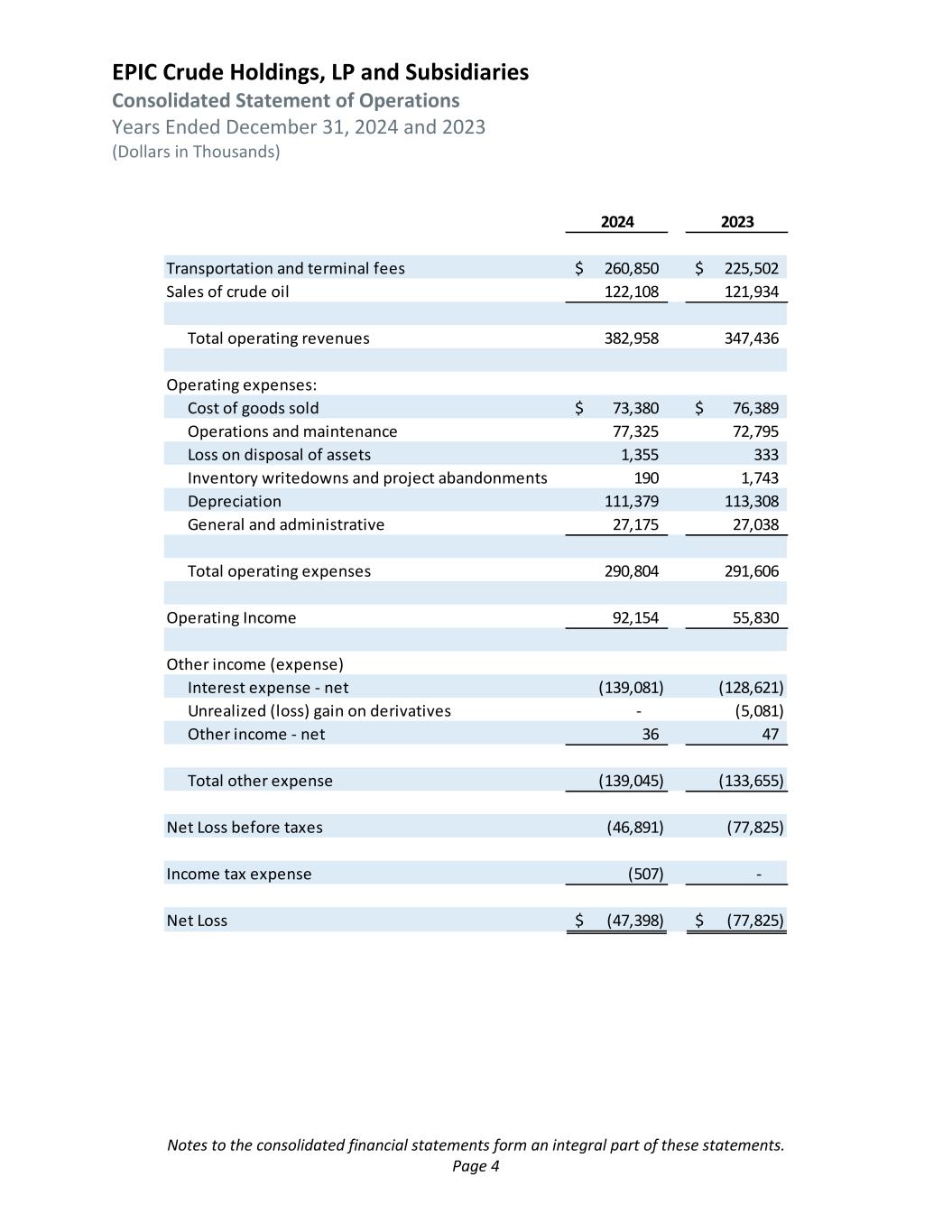

EPIC Crude Holdings, LP and Subsidiaries Consolidated Statement of Operations Years Ended December 31, 2024 and 2023 (Dollars in Thousands) Notes to the consolidated financial statements form an integral part of these statements. Page 4 2024 2023 Transportation and terminal fees 260,850$ 225,502$ Sales of crude oil 122,108 121,934 Total operating revenues 382,958 347,436 Operating expenses: Cost of goods sold 73,380$ 76,389$ Operations and maintenance 77,325 72,795 Loss on disposal of assets 1,355 333 Inventory writedowns and project abandonments 190 1,743 Depreciation 111,379 113,308 General and administrative 27,175 27,038 Total operating expenses 290,804 291,606 Operating Income 92,154 55,830 Other income (expense) Interest expense - net (139,081) (128,621) Unrealized (loss) gain on derivatives - (5,081) Other income - net 36 47 Total other expense (139,045) (133,655) Net Loss before taxes (46,891) (77,825) Income tax expense (507) - Net Loss (47,398)$ (77,825)$

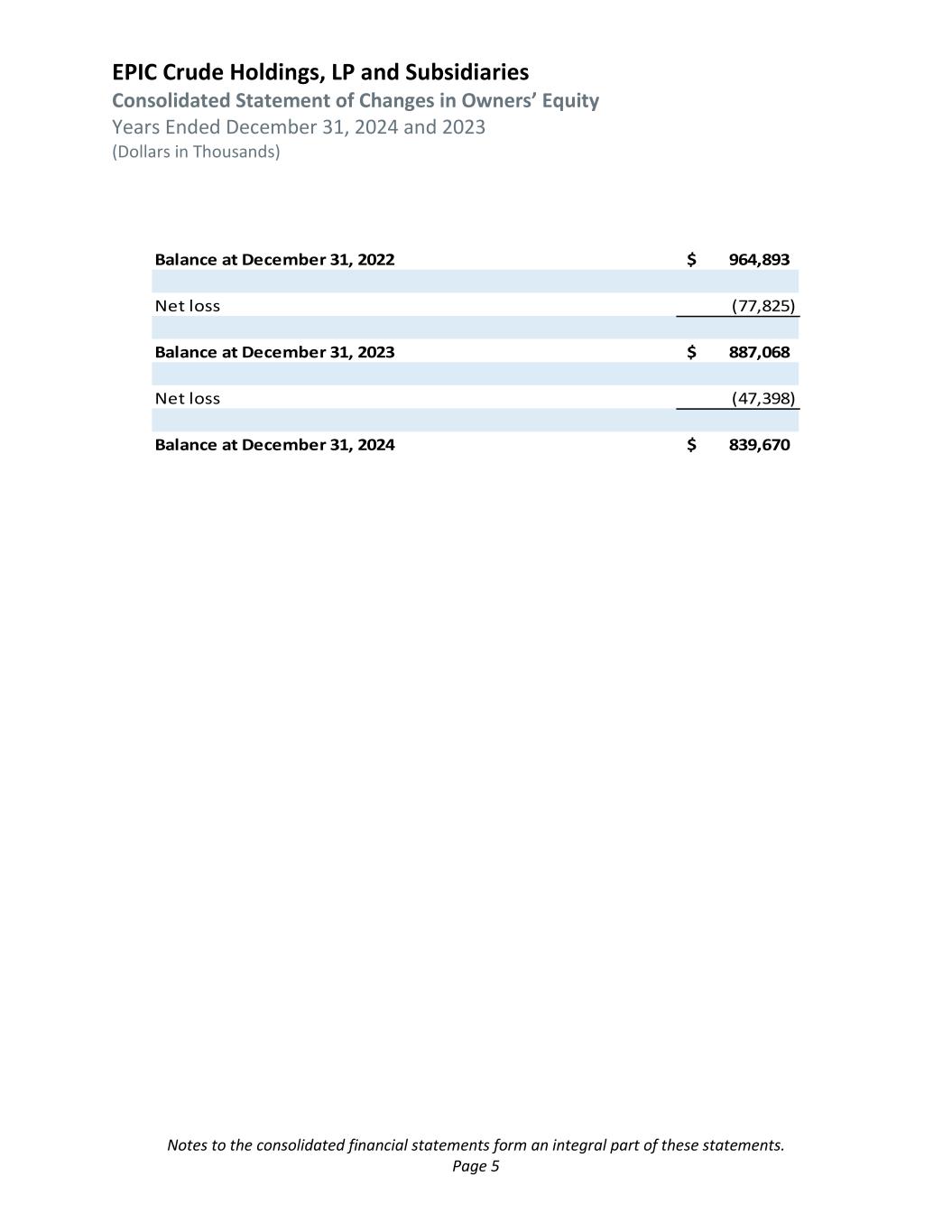

EPIC Crude Holdings, LP and Subsidiaries Consolidated Statement of Changes in Owners’ Equity Years Ended December 31, 2024 and 2023 (Dollars in Thousands) Notes to the consolidated financial statements form an integral part of these statements. Page 5 Balance at December 31, 2022 964,893$ Net loss (77,825) Balance at December 31, 2023 887,068$ Net loss (47,398) Balance at December 31, 2024 839,670$

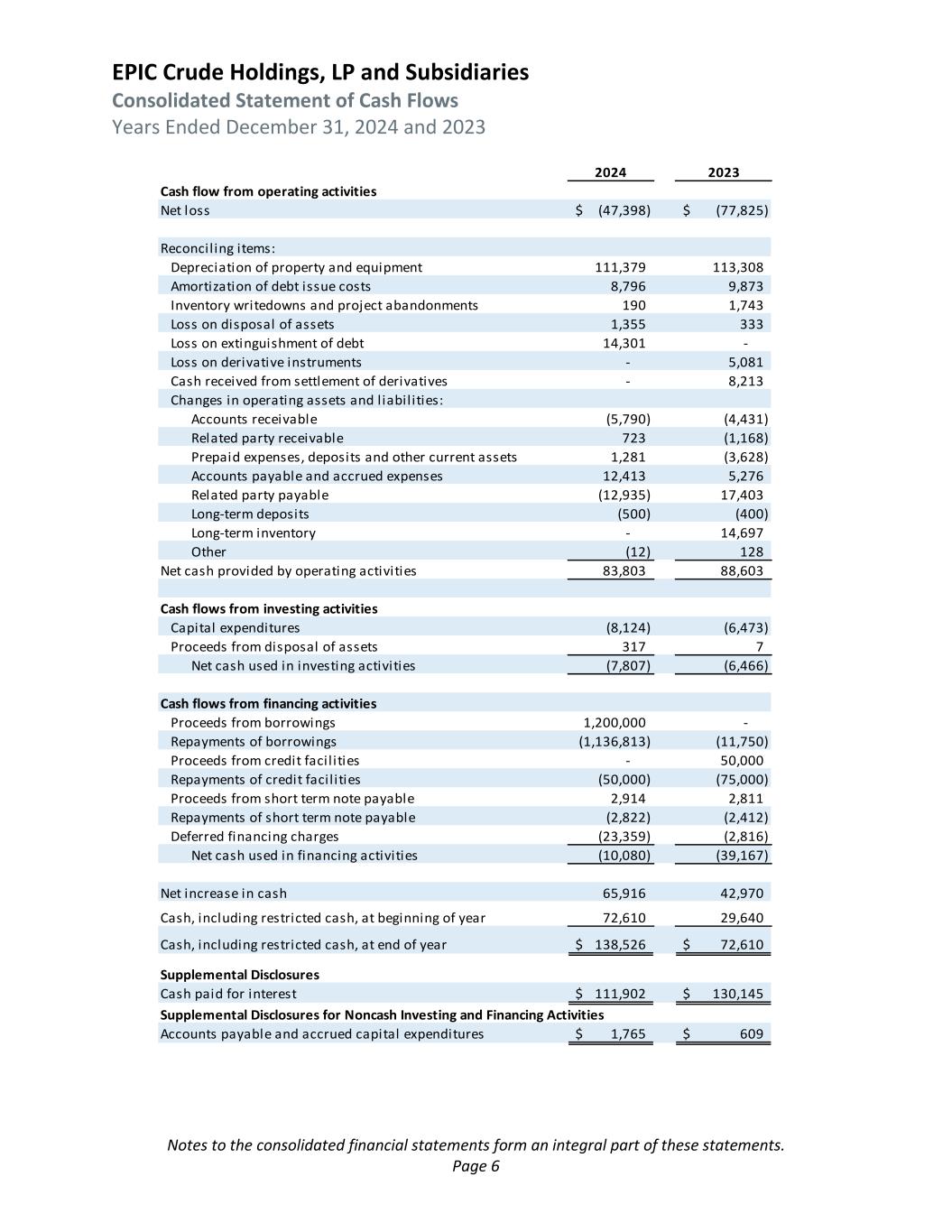

EPIC Crude Holdings, LP and Subsidiaries Consolidated Statement of Cash Flows Years Ended December 31, 2024 and 2023 Notes to the consolidated financial statements form an integral part of these statements. Page 6 2024 2023 Cash flow from operating activities Net loss (47,398)$ (77,825)$ Reconcil ing items: Depreciation of property and equipment 111,379 113,308 Amortization of debt issue costs 8,796 9,873 Inventory writedowns and project abandonments 190 1,743 Loss on disposal of assets 1,355 333 Loss on extinguishment of debt 14,301 - Loss on derivative instruments - 5,081 Cash received from settlement of derivatives - 8,213 Changes in operating assets and l iabil ities: Accounts receivable (5,790) (4,431) Related party receivable 723 (1,168) Prepaid expenses, deposits and other current assets 1,281 (3,628) Accounts payable and accrued expenses 12,413 5,276 Related party payable (12,935) 17,403 Long-term deposits (500) (400) Long-term inventory - 14,697 Other (12) 128 Net cash provided by operating activities 83,803 88,603 Cash flows from investing activities Capital expenditures (8,124) (6,473) Proceeds from disposal of assets 317 7 Net cash used in investing activities (7,807) (6,466) Cash flows from financing activities Proceeds from borrowings 1,200,000 - Repayments of borrowings (1,136,813) (11,750) Proceeds from credit facil ities - 50,000 Repayments of credit facil ities (50,000) (75,000) Proceeds from short term note payable 2,914 2,811 Repayments of short term note payable (2,822) (2,412) Deferred financing charges (23,359) (2,816) Net cash used in financing activities (10,080) (39,167) Net increase in cash 65,916 42,970 Cash, including restricted cash, at beginning of year 72,610 29,640 Cash, including restricted cash, at end of year 138,526$ 72,610$ Supplemental Disclosures Cash paid for interest 111,902$ 130,145$ Supplemental Disclosures for Noncash Investing and Financing Activities Accounts payable and accrued capital expenditures 1,765$ 609$

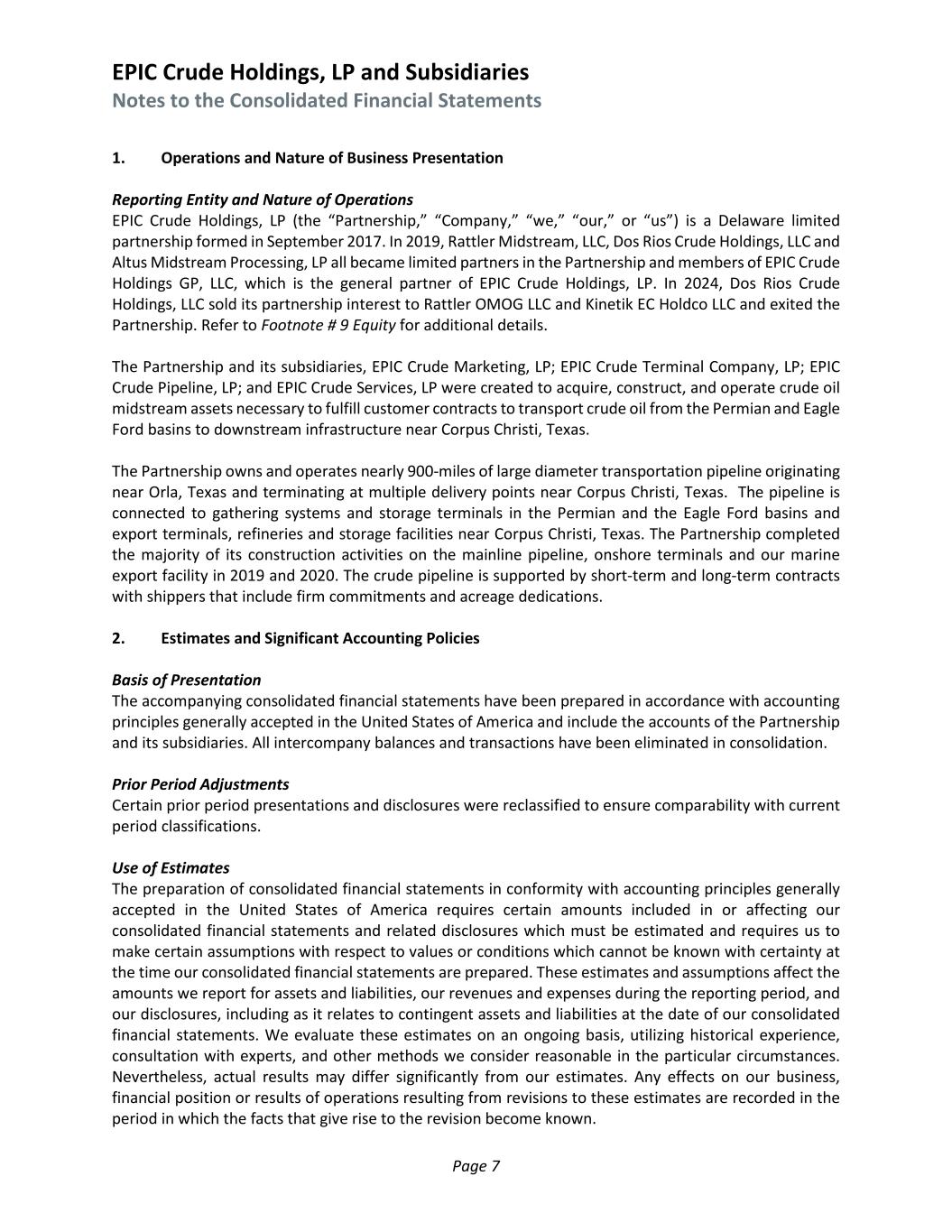

EPIC Crude Holdings, LP and Subsidiaries Notes to the Consolidated Financial Statements Page 7 1. Operations and Nature of Business Presentation Reporting Entity and Nature of Operations EPIC Crude Holdings, LP (the “Partnership,” “Company,” “we,” “our,” or “us”) is a Delaware limited partnership formed in September 2017. In 2019, Rattler Midstream, LLC, Dos Rios Crude Holdings, LLC and Altus Midstream Processing, LP all became limited partners in the Partnership and members of EPIC Crude Holdings GP, LLC, which is the general partner of EPIC Crude Holdings, LP. In 2024, Dos Rios Crude Holdings, LLC sold its partnership interest to Rattler OMOG LLC and Kinetik EC Holdco LLC and exited the Partnership. Refer to Footnote # 9 Equity for additional details. The Partnership and its subsidiaries, EPIC Crude Marketing, LP; EPIC Crude Terminal Company, LP; EPIC Crude Pipeline, LP; and EPIC Crude Services, LP were created to acquire, construct, and operate crude oil midstream assets necessary to fulfill customer contracts to transport crude oil from the Permian and Eagle Ford basins to downstream infrastructure near Corpus Christi, Texas. The Partnership owns and operates nearly 900-miles of large diameter transportation pipeline originating near Orla, Texas and terminating at multiple delivery points near Corpus Christi, Texas. The pipeline is connected to gathering systems and storage terminals in the Permian and the Eagle Ford basins and export terminals, refineries and storage facilities near Corpus Christi, Texas. The Partnership completed the majority of its construction activities on the mainline pipeline, onshore terminals and our marine export facility in 2019 and 2020. The crude pipeline is supported by short-term and long-term contracts with shippers that include firm commitments and acreage dedications. 2. Estimates and Significant Accounting Policies Basis of Presentation The accompanying consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America and include the accounts of the Partnership and its subsidiaries. All intercompany balances and transactions have been eliminated in consolidation. Prior Period Adjustments Certain prior period presentations and disclosures were reclassified to ensure comparability with current period classifications. Use of Estimates The preparation of consolidated financial statements in conformity with accounting principles generally accepted in the United States of America requires certain amounts included in or affecting our consolidated financial statements and related disclosures which must be estimated and requires us to make certain assumptions with respect to values or conditions which cannot be known with certainty at the time our consolidated financial statements are prepared. These estimates and assumptions affect the amounts we report for assets and liabilities, our revenues and expenses during the reporting period, and our disclosures, including as it relates to contingent assets and liabilities at the date of our consolidated financial statements. We evaluate these estimates on an ongoing basis, utilizing historical experience, consultation with experts, and other methods we consider reasonable in the particular circumstances. Nevertheless, actual results may differ significantly from our estimates. Any effects on our business, financial position or results of operations resulting from revisions to these estimates are recorded in the period in which the facts that give rise to the revision become known.

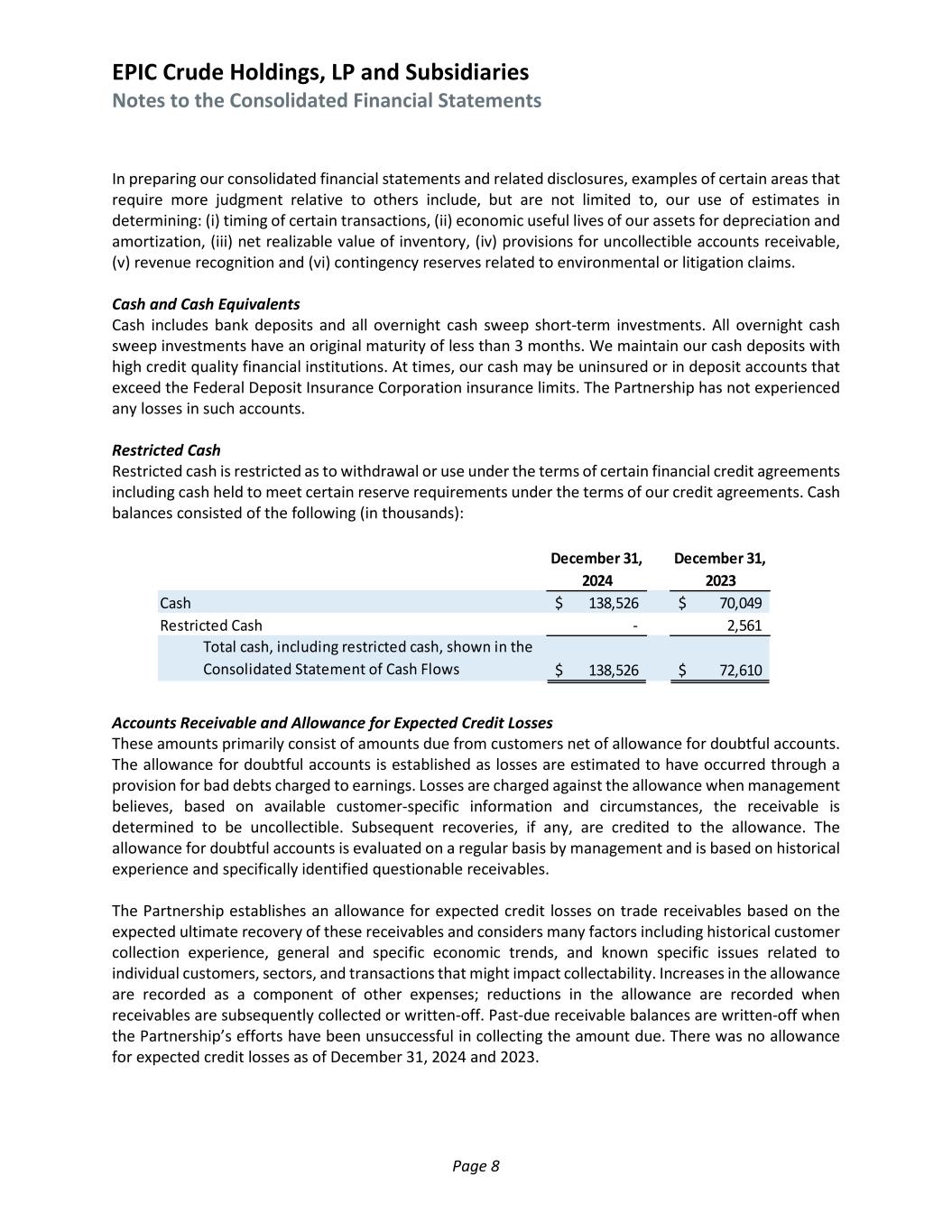

EPIC Crude Holdings, LP and Subsidiaries Notes to the Consolidated Financial Statements Page 8 In preparing our consolidated financial statements and related disclosures, examples of certain areas that require more judgment relative to others include, but are not limited to, our use of estimates in determining: (i) timing of certain transactions, (ii) economic useful lives of our assets for depreciation and amortization, (iii) net realizable value of inventory, (iv) provisions for uncollectible accounts receivable, (v) revenue recognition and (vi) contingency reserves related to environmental or litigation claims. Cash and Cash Equivalents Cash includes bank deposits and all overnight cash sweep short-term investments. All overnight cash sweep investments have an original maturity of less than 3 months. We maintain our cash deposits with high credit quality financial institutions. At times, our cash may be uninsured or in deposit accounts that exceed the Federal Deposit Insurance Corporation insurance limits. The Partnership has not experienced any losses in such accounts. Restricted Cash Restricted cash is restricted as to withdrawal or use under the terms of certain financial credit agreements including cash held to meet certain reserve requirements under the terms of our credit agreements. Cash balances consisted of the following (in thousands): December 31, 2024 December 31, 2023 Cash 138,526$ 70,049$ Restricted Cash - 2,561 Total cash, including restricted cash, shown in the Consolidated Statement of Cash Flows 138,526$ 72,610$ Accounts Receivable and Allowance for Expected Credit Losses These amounts primarily consist of amounts due from customers net of allowance for doubtful accounts. The allowance for doubtful accounts is established as losses are estimated to have occurred through a provision for bad debts charged to earnings. Losses are charged against the allowance when management believes, based on available customer-specific information and circumstances, the receivable is determined to be uncollectible. Subsequent recoveries, if any, are credited to the allowance. The allowance for doubtful accounts is evaluated on a regular basis by management and is based on historical experience and specifically identified questionable receivables. The Partnership establishes an allowance for expected credit losses on trade receivables based on the expected ultimate recovery of these receivables and considers many factors including historical customer collection experience, general and specific economic trends, and known specific issues related to individual customers, sectors, and transactions that might impact collectability. Increases in the allowance are recorded as a component of other expenses; reductions in the allowance are recorded when receivables are subsequently collected or written-off. Past-due receivable balances are written-off when the Partnership’s efforts have been unsuccessful in collecting the amount due. There was no allowance for expected credit losses as of December 31, 2024 and 2023.

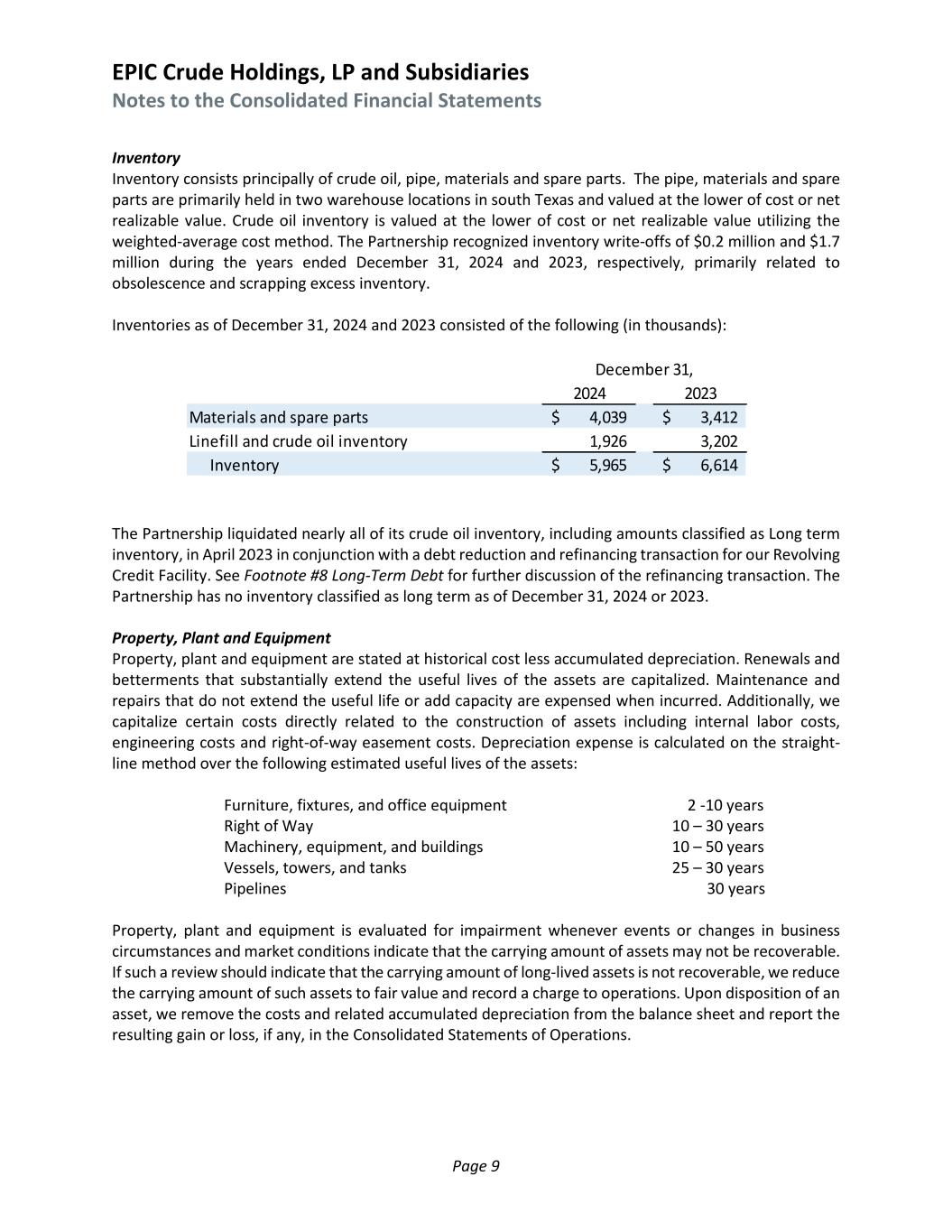

EPIC Crude Holdings, LP and Subsidiaries Notes to the Consolidated Financial Statements Page 9 Inventory Inventory consists principally of crude oil, pipe, materials and spare parts. The pipe, materials and spare parts are primarily held in two warehouse locations in south Texas and valued at the lower of cost or net realizable value. Crude oil inventory is valued at the lower of cost or net realizable value utilizing the weighted-average cost method. The Partnership recognized inventory write-offs of $0.2 million and $1.7 million during the years ended December 31, 2024 and 2023, respectively, primarily related to obsolescence and scrapping excess inventory. Inventories as of December 31, 2024 and 2023 consisted of the following (in thousands): 2024 2023 Materials and spare parts 4,039$ 3,412$ Linefill and crude oil inventory 1,926 3,202 Inventory 5,965$ 6,614$ December 31, The Partnership liquidated nearly all of its crude oil inventory, including amounts classified as Long term inventory, in April 2023 in conjunction with a debt reduction and refinancing transaction for our Revolving Credit Facility. See Footnote #8 Long-Term Debt for further discussion of the refinancing transaction. The Partnership has no inventory classified as long term as of December 31, 2024 or 2023. Property, Plant and Equipment Property, plant and equipment are stated at historical cost less accumulated depreciation. Renewals and betterments that substantially extend the useful lives of the assets are capitalized. Maintenance and repairs that do not extend the useful life or add capacity are expensed when incurred. Additionally, we capitalize certain costs directly related to the construction of assets including internal labor costs, engineering costs and right-of-way easement costs. Depreciation expense is calculated on the straight- line method over the following estimated useful lives of the assets: Furniture, fixtures, and office equipment 2 -10 years Right of Way 10 – 30 years Machinery, equipment, and buildings 10 – 50 years Vessels, towers, and tanks 25 – 30 years Pipelines 30 years Property, plant and equipment is evaluated for impairment whenever events or changes in business circumstances and market conditions indicate that the carrying amount of assets may not be recoverable. If such a review should indicate that the carrying amount of long-lived assets is not recoverable, we reduce the carrying amount of such assets to fair value and record a charge to operations. Upon disposition of an asset, we remove the costs and related accumulated depreciation from the balance sheet and report the resulting gain or loss, if any, in the Consolidated Statements of Operations.

EPIC Crude Holdings, LP and Subsidiaries Notes to the Consolidated Financial Statements Page 10 Lease Accounting At the inception of each lease arrangement, we determine if the arrangement is a lease or contains an embedded lease and review the facts and circumstances of the arrangement to classify lease assets as operating or finance leases. The Partnership has elected not to record any leases with terms of 12 months or less on the balance sheet. Balances related to operating leases are included in operating lease Right-of-Use (“ROU”) assets, accrued and other current liabilities, operating lease current liabilities and non-current operating lease liabilities in our Consolidated Balance Sheets. The ROU assets represent the Partnership’s right to use an underlying asset for the lease term and the lease liabilities represent the obligation of the Partnership to make minimum lease payments arising from the lease for the duration of the lease term. At the inception of a lease, all renewal options reasonably certain to be exercised are considered when determining the lease term. The exercise of lease renewal options is typically at the sole discretion of the Partnership and lease extensions are evaluated on a lease-by-lease basis. Leases containing early termination clauses typically require the agreement of both parties to the lease. The depreciable life of lease assets and leasehold improvements are limited by the expected lease term. To determine the present value of future minimum lease payments, we use the implicit rate when readily determinable. Presently, because many of our leases do not provide an implicit rate, the Partnership applies its incremental borrowing rate based on the information available at the lease commencement date to determine the present value of minimum lease payments. The ROU assets include any lease payments made and exclude lease incentives. Minimum rent payments are expensed on a straight-line basis over the term of the lease. In addition, some leases require additional contingent or variable lease payments, which are based on the factors specific to the individual agreement. The Partnership’s variable lease payments typically include payment of real estate taxes, maintenance expenses and insurance. For short-term leases (leases that have term of twelve months or less upon commencement), lease payments are recognized on a straight-line basis and no ROU assets are recorded. Debt Issuance Costs Debt issuance costs related to a recognized debt liability are presented in the balance sheet as a direct deduction from the carrying amount of that debt liability. Debt issuance costs are being amortized to interest expense using the effective interest method over the term of the related debt. The Partnership recorded losses on extinguishment of debt of $14.3 million during the year ended December 31, 2024. These have been recorded in Interest Expense, net on the Consolidated Statements of Operations. There were no losses on extinguishments of debt during the year ended December 31, 2023. Asset Retirement Obligations We have determined that we are obligated by contractual or regulatory requirements to remove facilities or perform other remediation upon retirement of certain assets. The fair value of any asset retirement obligation (“ARO”) is determined based on estimates and assumptions related to retirement costs, which the Partnership bases on historical retirement costs, future inflation rates and credit-adjusted risk-free interest rates.

EPIC Crude Holdings, LP and Subsidiaries Notes to the Consolidated Financial Statements Page 11 An ARO is required to be recorded when a legal obligation to retire an asset exists and such obligation can be reasonably estimated. We will record an asset retirement obligation in the periods in which management can reasonably estimate the settlement dates. Management was not able to reasonably measure the fair value of asset retirement obligations as of December 31, 2024 and 2023, in most cases because the settlement dates were indeterminable. Although some of our assets are subject to agreements or regulations that give rise to an ARO upon the discontinued use of these assets, AROs were not recorded because these assets have an indeterminate removal or abandonment date given the expected continued use of the assets with proper maintenance or replacement. The retirement obligations for these assets cannot be measured at this time. Individual component assets have been and will continue to be replaced, but the pipelines and the terminal facilities will continue in operation as long as supply and demand for crude oil exists. Based on the widespread use of crude oil in industrial and refining activities, management expects supply and demand to exist for the foreseeable future. We have in place a continuous repair and maintenance program that keeps the pipelines and the terminal facilities in good operational condition. Therefore, although some of the individual assets may be replaced, the pipelines and the facilities themselves will remain intact indefinitely. Revenue Recognition The Partnership accounts for revenue from contracts with customers in accordance with ASU No. 2014- 09, Revenue from Contracts with Customers, and a series of related accounting standard updates included in Accounting Standards Codification (“Topic 606”). The principles for recognizing revenue under Topic 606 is an entity should recognize revenue as that entity satisfies its performance obligations which are represented by a promise in contract to transfer to a customer either a distinct good or service or a series of distinct goods or services over a period of time. Topic 606 requires that a contract’s transaction price, which is the amount of consideration to which an entity expects to be entitled in exchange for transferring promised goods or services to a customer, is to be allocated to each performance obligation in the contract based on relative standalone selling prices and recognized as revenue when control of the goods or services transfers to the customer and the performance obligation is satisfied, whether that is a point in time or over a period of time. Our customer service contracts primarily include two distinct services: (i) transportation services, and (ii) terminaling services. We provide disaggregated data for these two distinct services in Footnote # 14 Revenue Recognition. The contract structure for these services is discussed in further detail below. For the majority of these contracts, our promise is to transfer a distinct good or service (or bundle of goods or services) over a period of time, which represents a single performance obligation. The transaction price includes fixed and/or variable consideration which is generally determinable at contract inception and/or upon our right to invoice for the standalone value of services provided to the customer during the preceding time period which is commonly at month end or upon completion of services if the services were transferred over a period of time that is less than one month. If upon evaluation, we determined the contract contained multiple performance obligations we would identify and allocate the total contract consideration we expect to be entitled to, to each distinct performance obligation. The transaction price is recognized as revenue over the service period specified in the contract, either based on the passage of time or a units-based method for quantifying the transfer of services and satisfaction of our performance obligation over the service period or at a point in time.

EPIC Crude Holdings, LP and Subsidiaries Notes to the Consolidated Financial Statements Page 12 We provide services on both a firm and interruptible basis. These particular type of services are distinct from one another in that the Partnership must stand ready to perform the services under firm customer contracts regardless of whether that customer actually requires us to perform the service. Firm service contracts are a promise to make capacity available to the customer at all times during the period(s) covered by the contract. As consideration for us making capacity available, firm service contracts are typically structured with a minimum volume commitment, which requires a customer to pay for a minimum quantity even if they choose not to use the capacity/service in the specified service period (referred to as “deficiency payments”). We typically recognize the portion of the transaction price associated with making capacity available that was unused by the customer (“volume shortfall”), which required a deficiency payment, as revenue depending on whether the contract allows the customer to deliver excess volumes in subsequent periods and “make-up” the volume shortfall. If contractually the customer cannot make up volume shortfalls in future periods, our performance obligation is satisfied, and revenue associated with any deficiency payments is immediately recognized. Consequently, if the customer can acquire the promised service in a future period and make-up the volume shortfall in a future period, we have a performance obligation to transfer services at the customer’s request in the future. As the Partnership’s performance obligation has not yet been satisfied, we defer any consideration received as deficiency payments as a liability, and will recognize a proportionate amount as revenue once either: (i) the customer makes-up the volume shortfall and we have fully satisfied our obligation thru performance or (ii) the customer becomes unable to exercise their right to make-up the volume shortfall (e.g., there is insufficient capacity to make-up the volumes or the service period expires). For interruptible service contracts, where the Partnership performs transportation or terminaling services over a period of time or on a units based method we recognize the transaction price as revenue as those units of service are transferred to the customer over the specified service period, generally a period of one month. The performance obligation with respect to interruptible service contracts is made on a case- by-case basis at the time the customer requests the service and/or product and we accept the customer’s request. Our crude oil sales contracts generally represent a separate performance obligation for each individual unit of crude oil, as our promise is to sell a distinct unit(s) at a point in time. The transaction price can be fixed or variable consideration, which amount is determinable each month end based on our contractual right for the value of commodity sold to the customer in that period. The transaction price is allocated to each performance obligation based on the product’s standalone selling price and recognized as revenue upon delivery of the commodity, which is the point in time when the customer obtains control of the crude oil and our performance obligation is satisfied. Our sales and purchases of crude oil were primarily accounted for on a gross basis as sales of crude oil, as applicable, and cost of sales. At times, the Partnership enters into purchase and sale contracts in contemplation of one another (“buy-sell” agreements) typically for the purpose of facilitating short-term transportation services. These contracts are not separable and distinct in nature as the performance obligation pertains to both sides of the buy-sell transaction, and neither the purchase nor sale of product can occur independently from the other. These transactions are accounted for on a net basis. Operating Costs and Expenses Operating expenses include all costs incurred to provide customers with transportation services and maintain Partnership assets, including compensation for operations personnel, vehicle expenses, fuel, cathodic protection, chemicals, utilities required for operations and maintenance and repair activities.

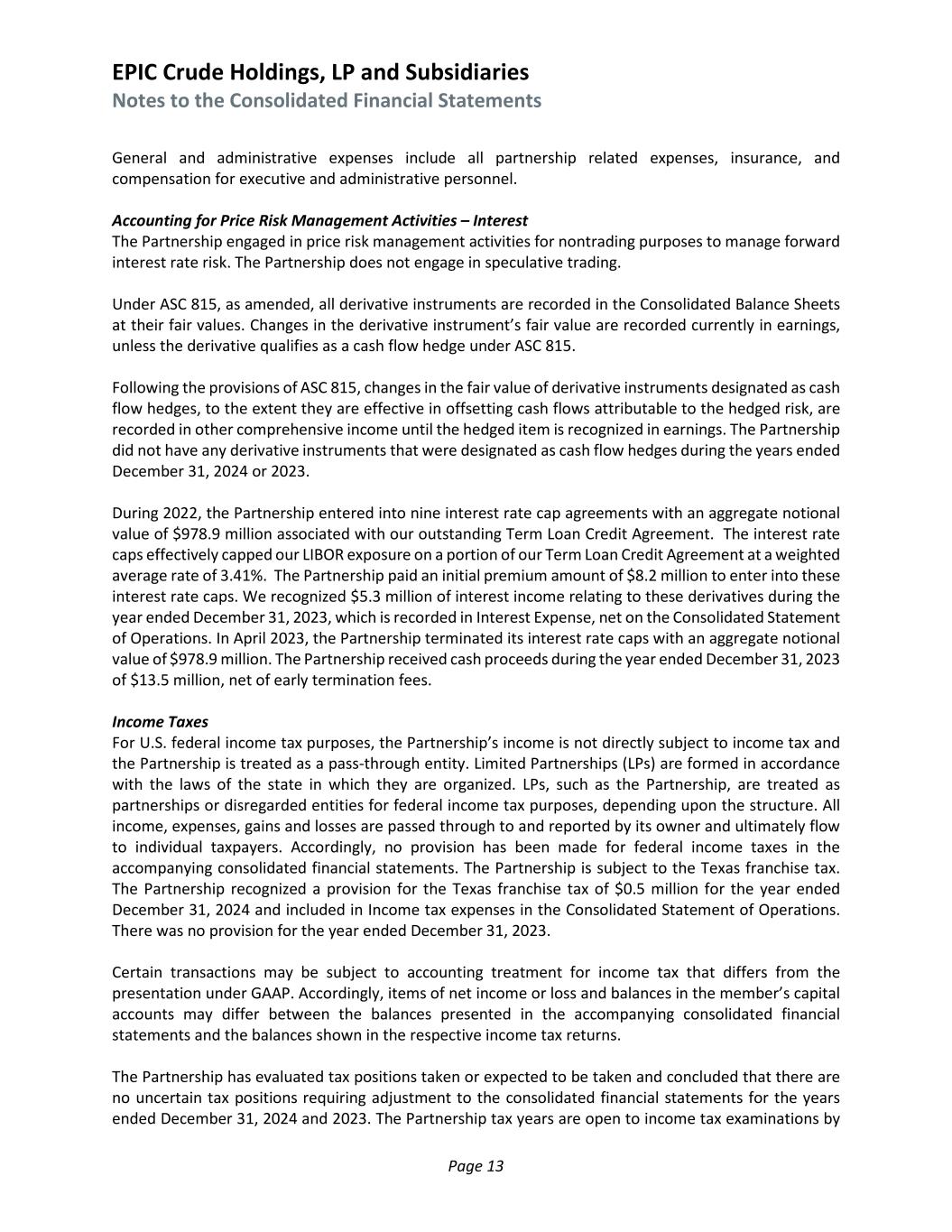

EPIC Crude Holdings, LP and Subsidiaries Notes to the Consolidated Financial Statements Page 13 General and administrative expenses include all partnership related expenses, insurance, and compensation for executive and administrative personnel. Accounting for Price Risk Management Activities – Interest The Partnership engaged in price risk management activities for nontrading purposes to manage forward interest rate risk. The Partnership does not engage in speculative trading. Under ASC 815, as amended, all derivative instruments are recorded in the Consolidated Balance Sheets at their fair values. Changes in the derivative instrument’s fair value are recorded currently in earnings, unless the derivative qualifies as a cash flow hedge under ASC 815. Following the provisions of ASC 815, changes in the fair value of derivative instruments designated as cash flow hedges, to the extent they are effective in offsetting cash flows attributable to the hedged risk, are recorded in other comprehensive income until the hedged item is recognized in earnings. The Partnership did not have any derivative instruments that were designated as cash flow hedges during the years ended December 31, 2024 or 2023. During 2022, the Partnership entered into nine interest rate cap agreements with an aggregate notional value of $978.9 million associated with our outstanding Term Loan Credit Agreement. The interest rate caps effectively capped our LIBOR exposure on a portion of our Term Loan Credit Agreement at a weighted average rate of 3.41%. The Partnership paid an initial premium amount of $8.2 million to enter into these interest rate caps. We recognized $5.3 million of interest income relating to these derivatives during the year ended December 31, 2023, which is recorded in Interest Expense, net on the Consolidated Statement of Operations. In April 2023, the Partnership terminated its interest rate caps with an aggregate notional value of $978.9 million. The Partnership received cash proceeds during the year ended December 31, 2023 of $13.5 million, net of early termination fees. Income Taxes For U.S. federal income tax purposes, the Partnership’s income is not directly subject to income tax and the Partnership is treated as a pass-through entity. Limited Partnerships (LPs) are formed in accordance with the laws of the state in which they are organized. LPs, such as the Partnership, are treated as partnerships or disregarded entities for federal income tax purposes, depending upon the structure. All income, expenses, gains and losses are passed through to and reported by its owner and ultimately flow to individual taxpayers. Accordingly, no provision has been made for federal income taxes in the accompanying consolidated financial statements. The Partnership is subject to the Texas franchise tax. The Partnership recognized a provision for the Texas franchise tax of $0.5 million for the year ended December 31, 2024 and included in Income tax expenses in the Consolidated Statement of Operations. There was no provision for the year ended December 31, 2023. Certain transactions may be subject to accounting treatment for income tax that differs from the presentation under GAAP. Accordingly, items of net income or loss and balances in the member’s capital accounts may differ between the balances presented in the accompanying consolidated financial statements and the balances shown in the respective income tax returns. The Partnership has evaluated tax positions taken or expected to be taken and concluded that there are no uncertain tax positions requiring adjustment to the consolidated financial statements for the years ended December 31, 2024 and 2023. The Partnership tax years are open to income tax examinations by

EPIC Crude Holdings, LP and Subsidiaries Notes to the Consolidated Financial Statements Page 14 U.S. federal, state or local tax authorities for tax years 2019 through 2023. Conclusions regarding the evaluation are subject to review and may change based on factors including, but not limited to, ongoing analysis of tax laws, regulations and interpretations thereof. The Partnership accounts for deferred income taxes using the asset and liability method. Under this method, deferred tax assets and liabilities are recognized for the future taxes attributable to the difference between financial statement carrying amounts of assets and liabilities and their respective tax basis. Deferred tax assets are also recognized for the future tax benefits attributable to the expected utilization of tax net operating loss carryforwards. In the event future utilization is determined to be unlikely, a valuation allowance is provided to reduce the tax benefits from such assets. There were no deferred tax assets or liabilities recorded as of December 31, 2024 or 2023. Contingencies Certain conditions may exist as of the date the consolidated financial statements are issued, which may result in a loss to the Partnership, but which will only be resolved when one or more future events occur or fail to occur. The Partnership’s management assesses such contingent liabilities, and such assessment inherently involves an exercise of judgment. In assessing loss contingencies related to legal proceedings that are pending against the Partnership or unasserted claims that may result in such proceedings, the Partnership evaluates the perceived merits of any legal proceedings or unasserted claims, as well as the perceived merits of the amount of relief sought or expected to be sought therein. If the assessment of a contingency indicates that it is probable that a material loss has been incurred and the amount of the liability can be estimated, then the estimated liability would be accrued in the Partnership’s consolidated financial statements based on the available facts and circumstances surrounding the matter in question. If the estimated loss has a range of possible outcomes and all outcomes are equally possible, we accrue the lowest amount within the possible range. If the assessment indicates that a potentially material loss contingency is not probable, but is reasonably possible, or is probable, but cannot be estimated, then the nature of the contingent liability, together with an estimate of the range of possible loss, if determinable and material, would be disclosed. Loss contingencies considered remote are generally not disclosed unless they involve guarantees, in which case the guarantees would be disclosed. Risks and Uncertainties The Partnership’s future financial condition and results of operations are highly dependent on throughput volumes being transported through the Partnership’s pipeline. Customer demand is based on the demand and prices received by customers for their oil, gas and natural gas liquids production. Commodity prices are subject to wide fluctuation in response to relatively minor changes in the supply of and demand for oil, natural gas and natural gas liquids, and market uncertainty, and a variety of additional factors beyond the Partnership’s control. These factors include the supply of oil and gas reserves in our areas of operations, the level of consumer demand, weather conditions, government regulations and taxes, the price and availability of alternative fuels, and overall economic conditions. A decline in oil, natural gas and natural gas liquids prices may adversely affect the Partnership’s cash flow, liquidity, and profitability as customers reduce the amount of drilling activity in our areas of operations, which could impact our throughput volumes.

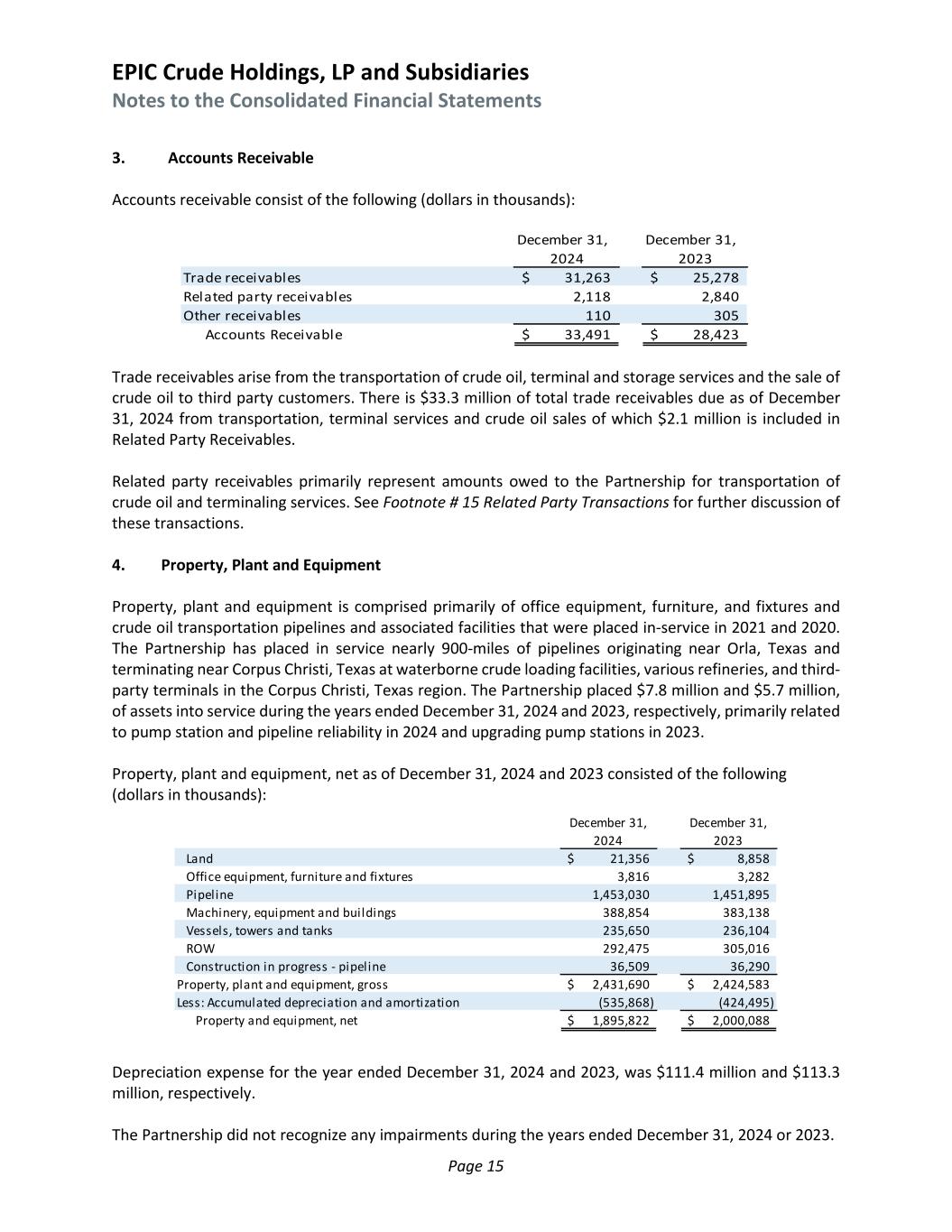

EPIC Crude Holdings, LP and Subsidiaries Notes to the Consolidated Financial Statements Page 15 3. Accounts Receivable Accounts receivable consist of the following (dollars in thousands): December 31, December 31, 2024 2023 Trade receivables 31,263$ 25,278$ Related party receivables 2,118 2,840 Other receivables 110 305 Accounts Receivable 33,491$ 28,423$ Trade receivables arise from the transportation of crude oil, terminal and storage services and the sale of crude oil to third party customers. There is $33.3 million of total trade receivables due as of December 31, 2024 from transportation, terminal services and crude oil sales of which $2.1 million is included in Related Party Receivables. Related party receivables primarily represent amounts owed to the Partnership for transportation of crude oil and terminaling services. See Footnote # 15 Related Party Transactions for further discussion of these transactions. 4. Property, Plant and Equipment Property, plant and equipment is comprised primarily of office equipment, furniture, and fixtures and crude oil transportation pipelines and associated facilities that were placed in-service in 2021 and 2020. The Partnership has placed in service nearly 900-miles of pipelines originating near Orla, Texas and terminating near Corpus Christi, Texas at waterborne crude loading facilities, various refineries, and third- party terminals in the Corpus Christi, Texas region. The Partnership placed $7.8 million and $5.7 million, of assets into service during the years ended December 31, 2024 and 2023, respectively, primarily related to pump station and pipeline reliability in 2024 and upgrading pump stations in 2023. Property, plant and equipment, net as of December 31, 2024 and 2023 consisted of the following (dollars in thousands): December 31, 2024 December 31, 2023 Land 21,356$ 8,858$ Office equipment, furniture and fixtures 3,816 3,282 Pipeline 1,453,030 1,451,895 Machinery, equipment and buildings 388,854 383,138 Vessels, towers and tanks 235,650 236,104 ROW 292,475 305,016 Construction in progress - pipeline 36,509 36,290 Property, plant and equipment, gross 2,431,690$ 2,424,583$ Less: Accumulated depreciation and amortization (535,868) (424,495) Property and equipment, net 1,895,822$ 2,000,088$ Depreciation expense for the year ended December 31, 2024 and 2023, was $111.4 million and $113.3 million, respectively. The Partnership did not recognize any impairments during the years ended December 31, 2024 or 2023.

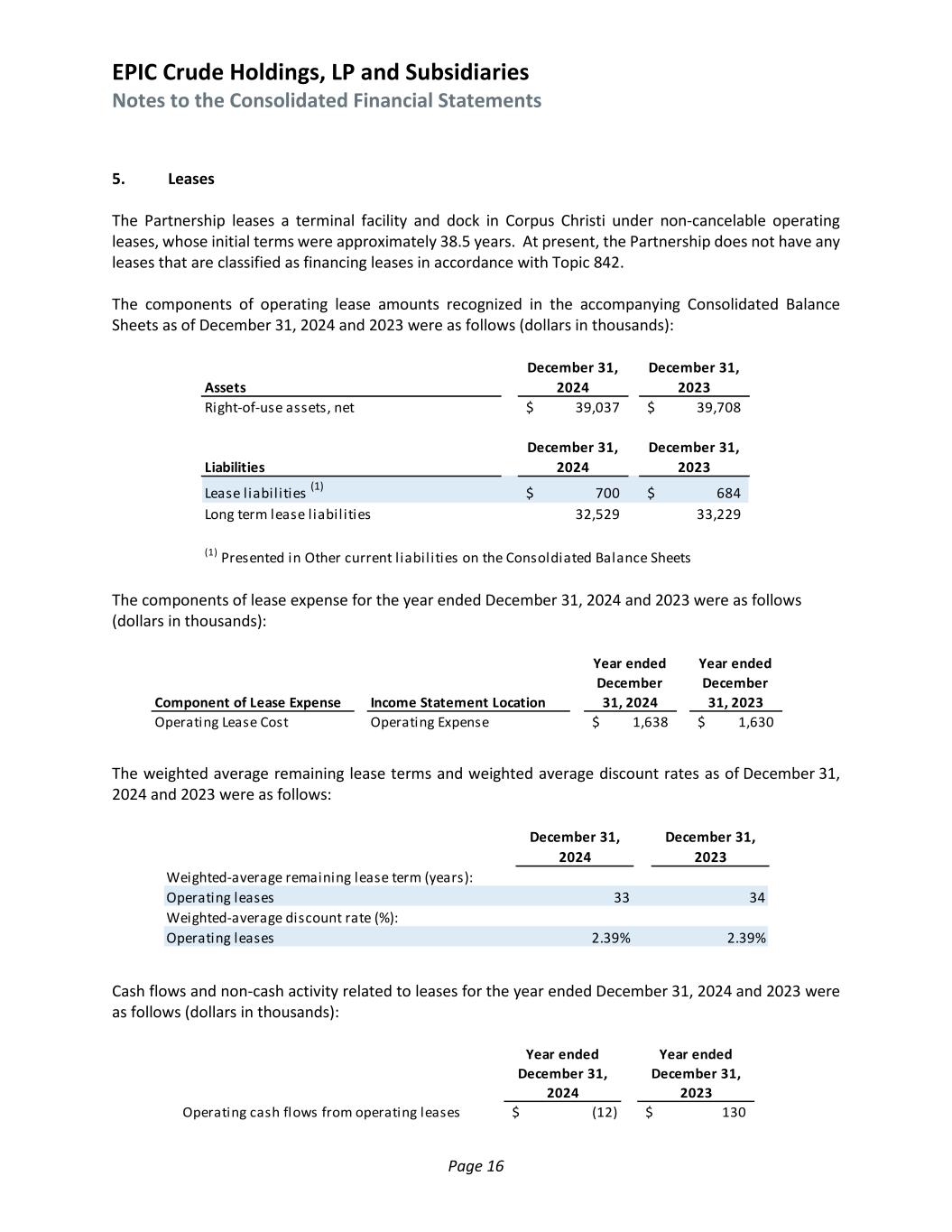

EPIC Crude Holdings, LP and Subsidiaries Notes to the Consolidated Financial Statements Page 16 5. Leases The Partnership leases a terminal facility and dock in Corpus Christi under non-cancelable operating leases, whose initial terms were approximately 38.5 years. At present, the Partnership does not have any leases that are classified as financing leases in accordance with Topic 842. The components of operating lease amounts recognized in the accompanying Consolidated Balance Sheets as of December 31, 2024 and 2023 were as follows (dollars in thousands): Assets December 31, 2024 December 31, 2023 Right-of-use assets, net 39,037$ 39,708$ Liabilities December 31, 2024 December 31, 2023 Lease l iabil ities (1) 700$ 684$ Long term lease l iabil ities 32,529 33,229 (1) Presented in Other current l iabil ities on the Consoldiated Balance Sheets The components of lease expense for the year ended December 31, 2024 and 2023 were as follows (dollars in thousands): Component of Lease Expense Income Statement Location Year ended December 31, 2024 Year ended December 31, 2023 Operating Lease Cost Operating Expense 1,638$ 1,630$ The weighted average remaining lease terms and weighted average discount rates as of December 31, 2024 and 2023 were as follows: December 31, 2024 December 31, 2023 Weighted-average remaining lease term (years): Operating leases 33 34 Weighted-average discount rate (%): Operating leases 2.39% 2.39% Cash flows and non-cash activity related to leases for the year ended December 31, 2024 and 2023 were as follows (dollars in thousands): Year ended December 31, 2024 Year ended December 31, 2023 Operating cash flows from operating leases (12)$ 130$

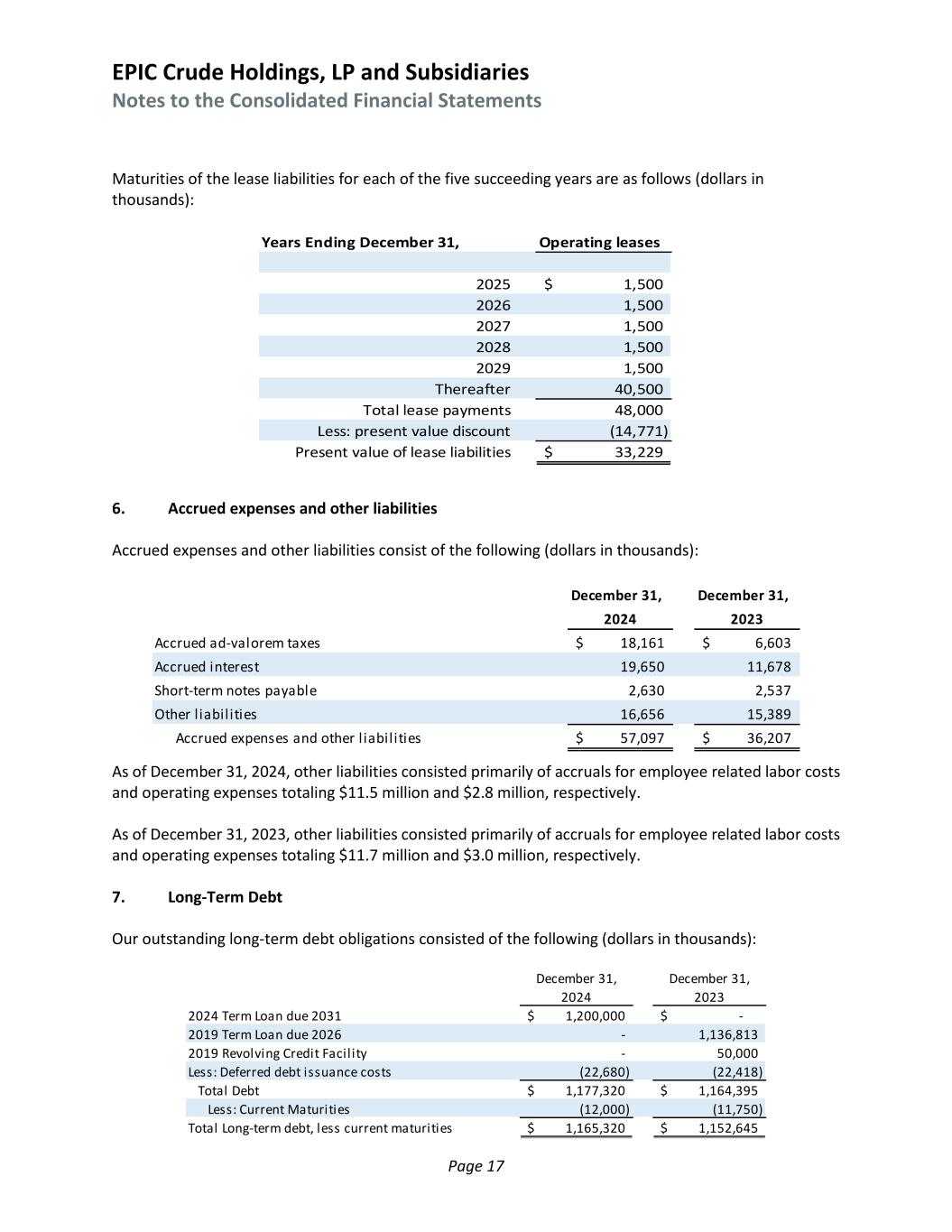

EPIC Crude Holdings, LP and Subsidiaries Notes to the Consolidated Financial Statements Page 17 Maturities of the lease liabilities for each of the five succeeding years are as follows (dollars in thousands): Years Ending December 31, Operating leases 2025 1,500$ 2026 1,500 2027 1,500 2028 1,500 2029 1,500 Thereafter 40,500 Total lease payments 48,000 Less: present value discount (14,771) Present value of lease liabilities 33,229$ 6. Accrued expenses and other liabilities Accrued expenses and other liabilities consist of the following (dollars in thousands): December 31, December 31, 2024 2023 Accrued ad-valorem taxes 18,161$ 6,603$ Accrued interest 19,650 11,678 Short-term notes payable 2,630 2,537 Other l iabil ities 16,656 15,389 Accrued expenses and other l iabil ities 57,097$ 36,207$ As of December 31, 2024, other liabilities consisted primarily of accruals for employee related labor costs and operating expenses totaling $11.5 million and $2.8 million, respectively. As of December 31, 2023, other liabilities consisted primarily of accruals for employee related labor costs and operating expenses totaling $11.7 million and $3.0 million, respectively. 7. Long-Term Debt Our outstanding long-term debt obligations consisted of the following (dollars in thousands): December 31, 2024 December 31, 2023 2024 Term Loan due 2031 1,200,000$ -$ 2019 Term Loan due 2026 - 1,136,813 2019 Revolving Credit Facil ity - 50,000 Less: Deferred debt issuance costs (22,680) (22,418) Total Debt 1,177,320$ 1,164,395$ Less: Current Maturities (12,000) (11,750) Total Long-term debt, less current maturities 1,165,320$ 1,152,645$

EPIC Crude Holdings, LP and Subsidiaries Notes to the Consolidated Financial Statements Page 18 Term Loan Credit Agreements Term Loan and Revolving Credit Facility Amendments and Refinancing In 2019, EPIC entered into a Term Loan Credit Agreement dated March 1, 2019 (“2019 Term Loan Credit Agreement”) which provides secured financing in an aggregate principal amount of up to $1 billion due 2026 (“2019 Term Loan”) and a $75 million secured revolving credit facility commitment due 2024 (“2019 Revolving Credit Facility”). The 2019 Term Loan proceeds were used to pay off outstanding indebtedness and fund continued project construction costs. The 2019 Term Loan Credit Agreement was amended twice in February 2020 to provide for an additional $175 million Incremental Term Loan, which are due in 2026. In May 2023, the Partnership amended the 2019 Revolving Credit Facility to extend the maturity date to 2026, reduce the availability to $50 million, and convert from LIBOR to SOFR-based borrowings. Subsequently, borrowings under the 2019 Revolving Credit Facility bear interest at SOFR plus the Benchmark Replacement Adjustment plus an applicable margin or a base rate, as defined in the 2019 Term Loan Credit Agreement, as amended. In August 2023, the Partnership amended the 2019 Term Loan to convert from LIBOR to SOFR-based borrowings. Subsequently, borrowings under the 2019 Term Loans bear interest at the SOFR plus the Benchmark Replacement Adjustment plus an applicable margin or a base rate as defined in the 2019 Term Loan Credit Agreements, as amended. On October 15, 2024, the Partnership entered into a new Credit Agreement (“2024 Credit Agreement”), which provided a Term Loan in the aggregate principal amount of $1.2 billion due October 15, 2031 (“2024 Term Loan”) and a revolving credit facility up to $125 million due October 10, 2029 (“2024 Revolving Credit Facility”). 2019 Term Loan and 2019 Revolving Credit Facility In October 2024, the Partnership paid off the balance of the 2019 Term Loan and the 2019 Revolving Credit Facility in conjunction with the issuance of the 2024 Credit Agreement. The Benchmark Replacement Adjustment ranges from 0.10% to 0.43%, as defined in the 2019 Term Loan Credit Agreements, as amended. The weighted average interest rate on the total amount outstanding under the 2019 Term Loan as of December 31, 2023 was 10.91%. As of December 31, 2023, we had $50.0 million borrowings and $0.0 million of letters of credit issued under the 2019 Revolving Credit Facility. The interest rate on the total amount outstanding on the 2019 Revolving Credit Facility as of December 31, 2023 was 10.23% 2024 Term Loan and 2024 Revolving Credit Facility Borrowings under the 2024 Term Loan bear interest at the SOFR plus an applicable margin. The interest rate on the total amount outstanding on the 2024 Term Loan as of December 31, 2024 was 7.66%. As of December 31, 2024, we had $0.0 million borrowings and $0.0 million of letters of credit issued under the 2024 Term Loan and Revolving Credit Facility. There was $125 million available under the 2024 Revolving Credit Facility as of December 31, 2024.

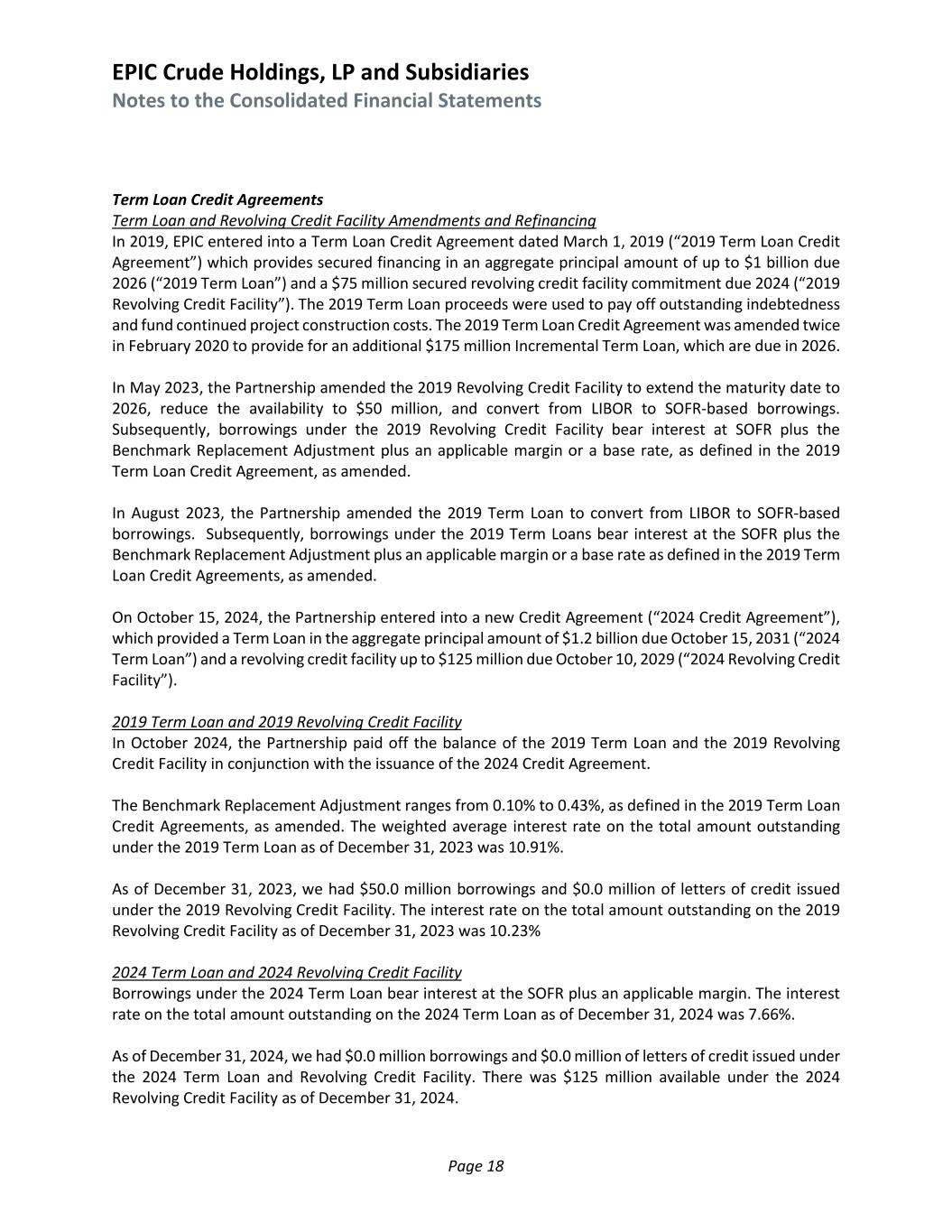

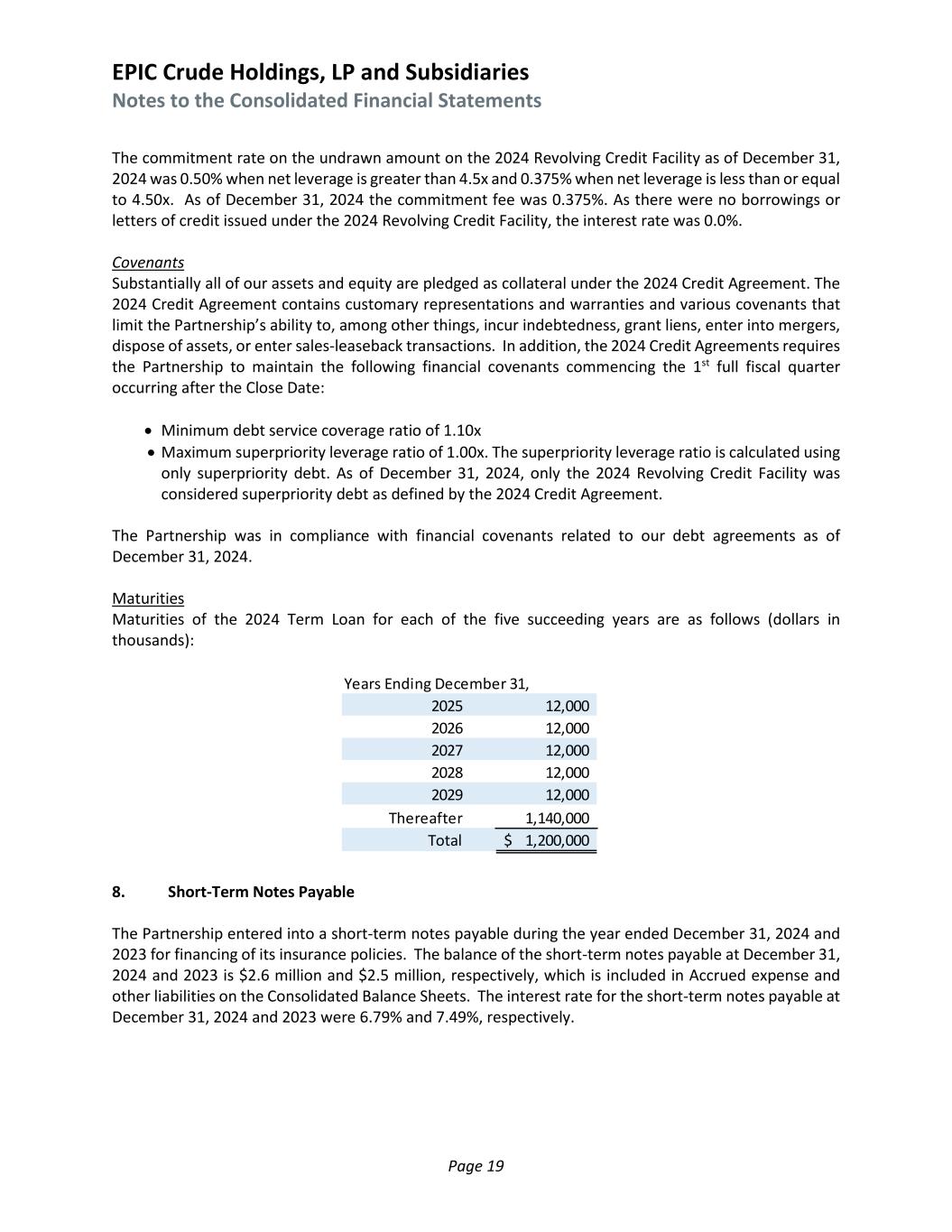

EPIC Crude Holdings, LP and Subsidiaries Notes to the Consolidated Financial Statements Page 19 The commitment rate on the undrawn amount on the 2024 Revolving Credit Facility as of December 31, 2024 was 0.50% when net leverage is greater than 4.5x and 0.375% when net leverage is less than or equal to 4.50x. As of December 31, 2024 the commitment fee was 0.375%. As there were no borrowings or letters of credit issued under the 2024 Revolving Credit Facility, the interest rate was 0.0%. Covenants Substantially all of our assets and equity are pledged as collateral under the 2024 Credit Agreement. The 2024 Credit Agreement contains customary representations and warranties and various covenants that limit the Partnership’s ability to, among other things, incur indebtedness, grant liens, enter into mergers, dispose of assets, or enter sales-leaseback transactions. In addition, the 2024 Credit Agreements requires the Partnership to maintain the following financial covenants commencing the 1st full fiscal quarter occurring after the Close Date: • Minimum debt service coverage ratio of 1.10x • Maximum superpriority leverage ratio of 1.00x. The superpriority leverage ratio is calculated using only superpriority debt. As of December 31, 2024, only the 2024 Revolving Credit Facility was considered superpriority debt as defined by the 2024 Credit Agreement. The Partnership was in compliance with financial covenants related to our debt agreements as of December 31, 2024. Maturities Maturities of the 2024 Term Loan for each of the five succeeding years are as follows (dollars in thousands): Years Ending December 31, 2025 12,000 2026 12,000 2027 12,000 2028 12,000 2029 12,000 Thereafter 1,140,000 Total 1,200,000$ 8. Short-Term Notes Payable The Partnership entered into a short-term notes payable during the year ended December 31, 2024 and 2023 for financing of its insurance policies. The balance of the short-term notes payable at December 31, 2024 and 2023 is $2.6 million and $2.5 million, respectively, which is included in Accrued expense and other liabilities on the Consolidated Balance Sheets. The interest rate for the short-term notes payable at December 31, 2024 and 2023 were 6.79% and 7.49%, respectively.

EPIC Crude Holdings, LP and Subsidiaries Notes to the Consolidated Financial Statements Page 20 9. Owners’ Equity Class A Equity Owners’ equity is composed of Class A units which represent limited partner interests in the Partnership. The holders of our Class A units are entitled to participate in our distributions (to the extent distributions are made) and are entitled to exercise the rights and privileges available to limited partners under our partnership agreement. No other class of units is issued and outstanding as of December 31, 2024. In 2019, EPIC Crude Parent, LP, sold: (i) a 10% equity stake in the Partnership to Rattler Midstream, LLC (a subsidiary of Diamondback Energy, Inc.), (ii) a 30% equity stake in the Partnership to Dos Rios Crude Holdings, LLC, and (iii) a 15% equity stake in the Partnership to Altus Midstream Processing, LP (a subsidiary of Kinetic Holdings, Inc.). The transactions noted herein reduced EPIC Crude Parent, LP’s overall ownership of the Partnership to 45%. In July 2024, Dos Rios Crude Holdings, LLC sold its 30% equity stake to subsidiaries of Diamondback Energy, Inc. and Kinetic Holdings, Inc., at which point each of these companies have equity stakes in the Partnership of 27.5%. General Partner Interests As defined by the partnership agreement, our general partner has a 0% economic ownership interest in the Partnership. However, the general partner continues to maintain all the rights afforded under the partnership agreement as it relates to managing the Partnership’s normal business activities. 10. Commitments and Contingent Liabilities The Partnership is subject to various regulatory, civil and legal claims and proceedings covering a wide range of matters that arise in the ordinary course of our business activities. Although no assurances can be given, management believes any liability that may ultimately result from the resolution of these matters will not have a material adverse effect on the consolidated financial condition or results of operations of the Partnership. When we determine a loss is probable of occurring and is reasonably estimable, we accrue a liability for that specific matter based on our best estimate at the time based on the available facts and circumstances surrounding the matter in question. If the estimated loss has a range of possible outcomes and all outcomes are equally possible, we accrue the lowest amount within the possible range. We disclose contingencies where an adverse result may be material, or in the decision of management, we conclude the matter should be disclosed. Litigation Claims The Partnership had $0.2 million of contingent liabilities recorded as of December 31, 2024 associated with the below litigation. There were no contingent liabilities recorded as of December 31, 2023. Mercado Lawsuit In August 2020, Nancy and Antonio Mercado (the “Mercados”) sued EPIC Crude Pipeline, LP in Duval County, Texas for breach of contract, negligence, and gross negligence relating to the construction of two pipelines across their property. At trial in January 2025, the Mercados amended their original petition to add new claims of trespass, fraud and unjust enrichment, and the jury found in favor of the Mercados on all claims and the Mercados entered a Motion for Judgment of $28.5 million. We will challenge the verdict by filing certain post-trial motions and commence the appeals process if the motions are denied by the

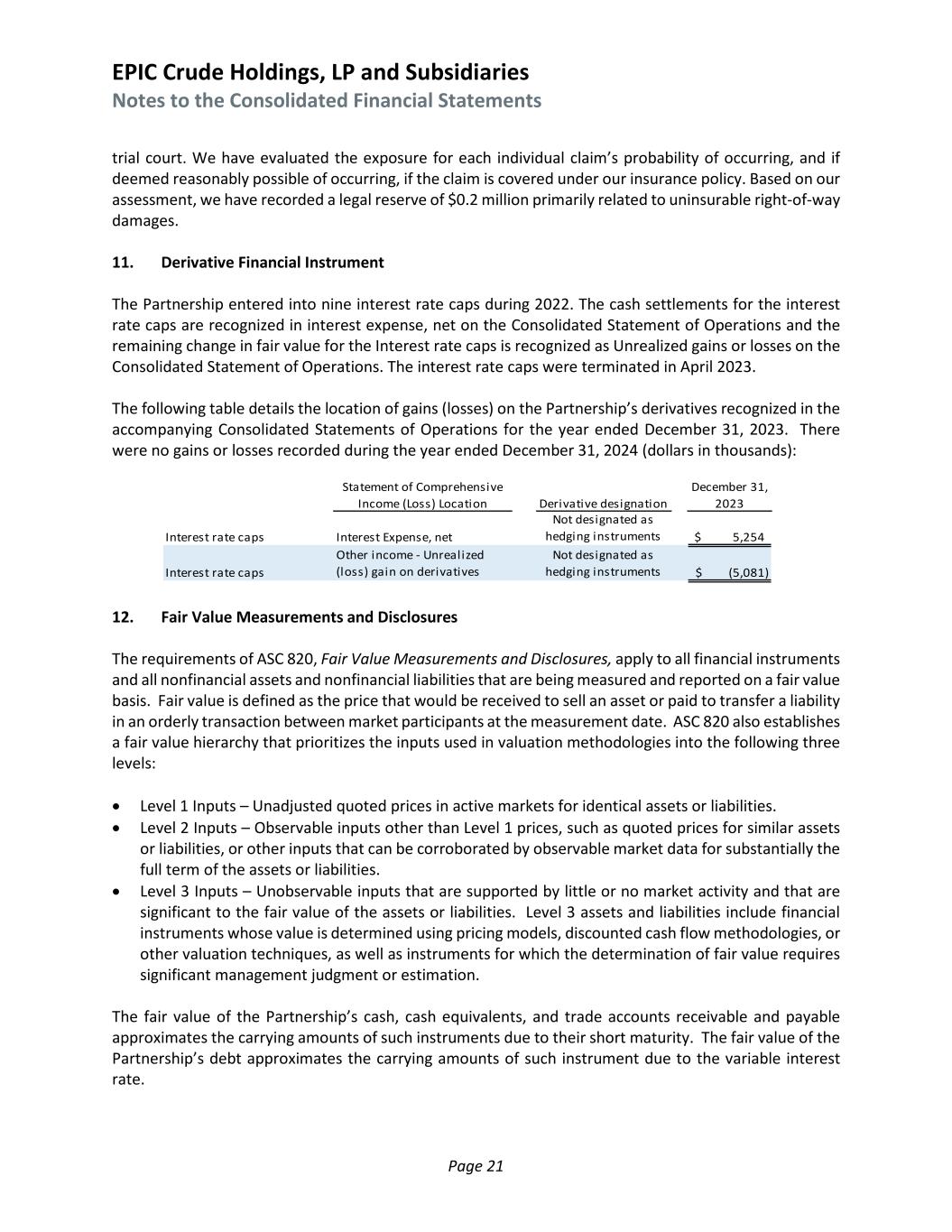

EPIC Crude Holdings, LP and Subsidiaries Notes to the Consolidated Financial Statements Page 21 trial court. We have evaluated the exposure for each individual claim’s probability of occurring, and if deemed reasonably possible of occurring, if the claim is covered under our insurance policy. Based on our assessment, we have recorded a legal reserve of $0.2 million primarily related to uninsurable right-of-way damages. 11. Derivative Financial Instrument The Partnership entered into nine interest rate caps during 2022. The cash settlements for the interest rate caps are recognized in interest expense, net on the Consolidated Statement of Operations and the remaining change in fair value for the Interest rate caps is recognized as Unrealized gains or losses on the Consolidated Statement of Operations. The interest rate caps were terminated in April 2023. The following table details the location of gains (losses) on the Partnership’s derivatives recognized in the accompanying Consolidated Statements of Operations for the year ended December 31, 2023. There were no gains or losses recorded during the year ended December 31, 2024 (dollars in thousands): December 31, 2023 Interest rate caps Interest Expense, net Not designated as hedging instruments 5,254$ Interest rate caps Other income - Unrealized (loss) gain on derivatives Not designated as hedging instruments (5,081)$ Derivative designation Statement of Comprehensive Income (Loss) Location 12. Fair Value Measurements and Disclosures The requirements of ASC 820, Fair Value Measurements and Disclosures, apply to all financial instruments and all nonfinancial assets and nonfinancial liabilities that are being measured and reported on a fair value basis. Fair value is defined as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. ASC 820 also establishes a fair value hierarchy that prioritizes the inputs used in valuation methodologies into the following three levels: • Level 1 Inputs – Unadjusted quoted prices in active markets for identical assets or liabilities. • Level 2 Inputs – Observable inputs other than Level 1 prices, such as quoted prices for similar assets or liabilities, or other inputs that can be corroborated by observable market data for substantially the full term of the assets or liabilities. • Level 3 Inputs – Unobservable inputs that are supported by little or no market activity and that are significant to the fair value of the assets or liabilities. Level 3 assets and liabilities include financial instruments whose value is determined using pricing models, discounted cash flow methodologies, or other valuation techniques, as well as instruments for which the determination of fair value requires significant management judgment or estimation. The fair value of the Partnership’s cash, cash equivalents, and trade accounts receivable and payable approximates the carrying amounts of such instruments due to their short maturity. The fair value of the Partnership’s debt approximates the carrying amounts of such instrument due to the variable interest rate.

EPIC Crude Holdings, LP and Subsidiaries Notes to the Consolidated Financial Statements Page 22 The Partnership obtains fair value measurements for derivative instruments from reputable pricing services. The fair value measurements are based on option pricing and discounted cash flow models which consider observable data that include forward market prices, volatilities and risk‐free interest rates. The general classification of such instruments pursuant to the valuation hierarchy is set forth below. As all of the interest rate caps were terminated during 2023, no fair value measurement was necessary at December 31, 2024 or 2023. 13. Major Customers At December 31, 2024, the Partnership’s trade receivables balance was related to over 25 customers. Of those, five customers made up approximately 77% of the trade receivables balance as of December 31, 2024 and 62% of total revenues for the year ended December 31, 2024. At December 31, 2023, the Partnership’s trade receivables balance was related to over 27 customers. Of those, five customers made up approximately 73% of the trade receivables balance as of December 31, 2023 and 72% of total revenues for the year ended December 31, 2023. 14. Revenue Recognition We provide pipeline transportation and terminaling services, which includes product storage and export dock loading, on a firm and interruptible basis. For our firm transportation service, we typically promise to transport on a stand-ready basis the customer’s minimum volume commitment amount. The customer is obligated to pay for its volume commitment amount, regardless of whether the customer flows volumes into our pipeline. The customer pays a transaction price typically based on a per-unit rate for quantities transported, including amounts attributable to deficiency quantities, or can be structured as a purchase and sale that contain fixed differential between the purchase and sale price to capture a margin relative to the service being performed. These transactions are included in our revenues on a net basis. Our firm terminal services generally follow the same recognition principles; however, the nature of the contracted service is different in that we are not transporting volume for the customer but are delivering/loading product onto an ocean-going vessel at our waterborne terminal facility or providing crude oil storage. Non-firm transportation and terminaling services are provided to our customers when and to the extent we determine the requested capacity is available in our pipeline system and/or terminal facilities. The customer pays a per-unit rate for actual quantities of product transported, loaded onto a vessel or stored within our facilities. Firm and interruptible services, ultimately have the same end goal by our customers which is transporting product from origin to destination and loading product across our dock and/or storing volumes for future consumption. Our sales and purchases of crude oil are primarily accounted for on a gross basis as sales of crude oil and cost of sales, except in circumstances where the Partnership is (i) not a principal in the transaction and does not have price risk or control of the goods prior to transfer to the customer or (ii) the purchase and sale are completely dependent on one another and carry the same performance obligation. In these instances, the revenue is recognized on a net basis. These customer contracts generally provide for the nomination of a specified quantity of products to be delivered and sold to the customer at specified delivery points. The customer pays a contractually agreed upon price typically based on a market indexed per-unit rate for the product and quantities sold and transferred to the customer during the period. Ultimately, the goal of purchasing and selling crude oil is to capture the marginal difference between the

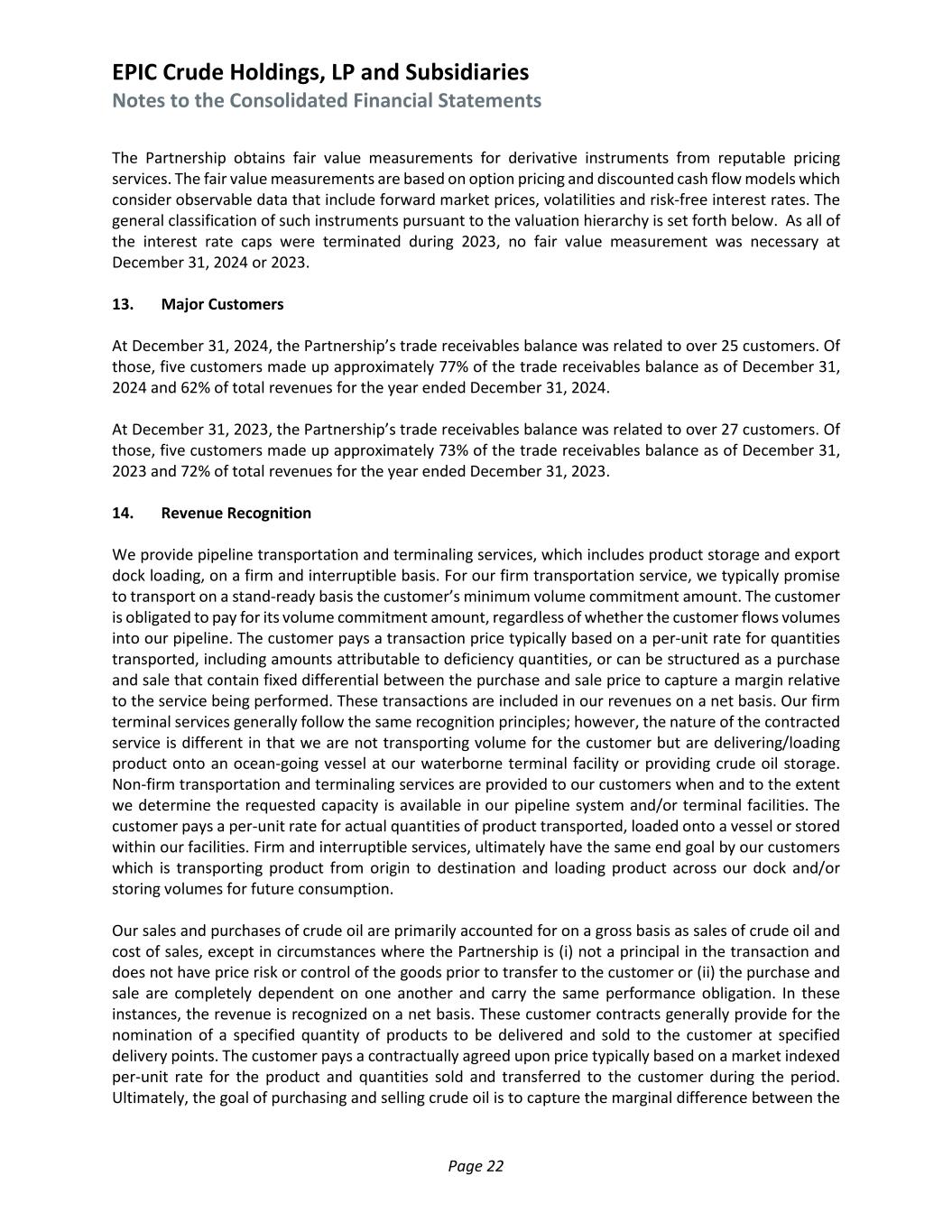

EPIC Crude Holdings, LP and Subsidiaries Notes to the Consolidated Financial Statements Page 23 purchase and sale transaction prices that represent the value of transporting crude oil and does not generally seek to capture arbitrage or market timing differentials. Additionally, our crude oil pipeline generates physical crude oil gains, either contractually or as the result of normal operations, that are sold to third party customers at prevailing market prices. Disaggregation of Revenues The following table present our revenues disaggregated by source of revenue for the years ended as indicated (dollars in thousands). Year ended December 31, 2024 Year ended December 31, 2023 Revenues from contracts with customers Services Pipeline transportation 245,384$ 207,538$ Terminaling and storage 15,466 17,964 Total services revenues 260,850 225,502 Crude oil sales 122,108 121,934 Total revenues from contracts with customers 382,958$ 347,436$ Other revenues (1) 36 47 Total revenues 382,994$ 347,483$ (1) Amounts recognized as revenue under guidance prescribed in Topics of Accounting Standards Codification (other than in Topic 606) and is composed of rental fees and an insurance settlement. The Partnership recorded revenues of $11.0 million and $5.6 million, associated with minimum volume commitments in which the customer did not fulfill their obligation to transport, load or store the entirety of their reserved capacity during the years ended December 31, 2024 and 2023, respectively. Of the total minimum volume commitment revenue, we recognized minimum volume commitments for pipeline transportation services of $8.8 million and $1.0 million for the years ended December 31, 2024 and 2023, respectively. We recognized minimum volume commitments for terminaling related services of $2.3 million and $4.6 million for the years ended December 31, 2024 and 2023, respectively. Contract Balances Contract assets and contract liabilities are the result of timing differences between revenue recognition, invoicing, and cash collections. We recognize contract assets in those instances where billing occurs subsequent to revenue recognition, and our right to invoice the customer is conditioned on something other than the passage of time. Conversely, we recognize contract liabilities when invoicing precedes the recognition of revenue as a future performance obligation exists. As of December 31, 2024 and 2023 we had no amounts recorded as deferred revenue for consideration received, or invoiced and due, for which we have an enforceable obligation to perform in the future. 15. Related Party Transactions The Partnership distinguishes the following related party transactions as either occurring with a) an entity in which a common control relationship exists due to our ownership or operating structure or b) the transaction is directly with an equity owner of the Partnership or with one of our equity owner partner’s directly, or indirectly, owned subsidiaries.

EPIC Crude Holdings, LP and Subsidiaries Notes to the Consolidated Financial Statements Page 24 The Partnership paid common control and equity partner affiliated related parties approximately $2.2 million and $2.3 million, for certain operating expenses and general and administrative expenses including leak detection and communication services and control room services during the years ended December 31, 2024 and 2023, respectively. In 2021, the Partnership made $1.3 million in payments to a common control related party to cover future payroll funding requirements of which $1 million is recorded as Long-term deposits and the $0.3 million is recorded as Prepaid expenses, deposits, and other current assets on the Consolidated Balance Sheets as of December 31, 2024, and 2023, respectively. The Partnership provided $23.9 million and $18.9 million for transportation and terminaling services to equity partner affiliates which are reflected in the Partnership’s revenues for the year ended December 31, 2024 and 2023, respectively. See Footnote # 14 Revenue Recognition for more disaggregated information related to the Partnership’s revenues. The Partnership paid $0.4 million and $0.0 million to common control related parties for capital projects during the year ended December 31, 2024 and 2023, respectively. The Partnership received $1.3 million and $0.0 million for contracts in aid of construction from a common control related party for the year ended December 31, 2024 and 2023, for costs incurred for property plant and equipment expansion projects. The Partnership sold property, plant, and equipment to a common control related party and an equity partner affiliate for $0.3 million during the year ended December 31, 2024. There were no property, plant, and equipment sales to related parties during the year ended December 31, 2023. The Partnership paid an equity partner affiliate approximately $0.0 million and $5.3 million for purchases of crude oil during the year ended December 31, 2024 and 2023, respectively. The Partnership paid a common control related party $72.1 million and $52.3 million for purchases of crude oil during the year ended December 31, 2024 and 2023, respectively. See Footnote # 14 Revenue Recognition for more disaggregated information related to the Partnership’s revenues. The Partnership paid a common control related party approximately $0.4 million and $0.5 million during 2024 and 2023, respectively, for project management, reimbursement of costs incurred to acquire multi- line rights-of-way easements, land purchases, and certain capital project related property, plant and equipment. Rights-of-way easements were assigned to the Partnership by the related party upon documentation of fully executed and properly recorded easements and submission for reimbursement of costs by the related party. 16. Subsequent Events The Partnership has evaluated subsequent events through April 24, 2025, the date the consolidated financial statements were available to be issued.